Q3 Results & Business Update November 11, 2021

2© MorphoSys - Q3 2021 results This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including the expectations regarding Monjuvi's ability to treat patients with relapsed or refractory diffuse large B- cell lymphoma, the further clinical development of tafasitamab, including ongoing confirmatory trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi. The words "anticipate," "believe," "estimate," "expect," "intend," "may," "plan," "predict," "project," "would," "could," "potential," "possible," "hope" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys' results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are MorphoSys' expectations regarding risks and uncertainties related to the impact of the COVID-19 pandemic to MorphoSys' business, operations, strategy, goals and anticipated milestones, including its ongoing and planned research activities, ability to conduct ongoing and planned clinical trials, clinical supply of current or future drug candidates, commercial supply of current or future approved products, and launching, marketing and selling current or future approved products, the global collaboration and license agreement for tafasitamab, the further clinical development of tafasitamab, including ongoing confirmatory trials, and MorphoSys' ability to obtain and maintain requisite regulatory approvals and to enroll patients in its planned clinical trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi, MorphoSys' reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys' Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi®, tafasitamab/Minjuvi® and guselkumab/Tremfya®). There is no guarantee any investigational product will be approved by regulatory authorities. Monjuvi® is a registered trademark of MorphoSys AG. Tremfya® is a registered trademark of Janssen Biotech, Inc. Forward-Looking Statements

3© MorphoSys - Q3 2021 results Agenda Quarterly Highlights & Outlook Jean-Paul Kress, M.D., CEO Pipeline Update Malte Peters, M.D., CR&DO Q&A Jean-Paul Kress, Sung Lee, Malte Peters, Joe Horvat Financial Results Sung Lee, CFO

4 Highlights & Outlook Jean-Paul Kress, M.D., CEO © MorphoSys - Q3 2021 results

5© MorphoSys - Q3 2021 results Q3 Business Update Building momentum in the commercial execution for r/r DLBCL, 22% Q-Q growth Monjuvi Launch Expanding reach of tafasitamab with recent approval of Minjuvi in Europe and Canada Tafasitamab MANIFEST phase 2 additional data to be presented at the ASH conference. Arm 3 data confirms data presented at ASH 2020 and further underpins MorphoSys‘ confidence in the ongoing phase 3 study (MANIFEST-2) Pelabresib Potential in solid cancer and hematology-oncology as well as autoimmune indications Mid-stage programs: CPI-0209 & felzartamab Progressing our vision as an emerging hematology oncology leader

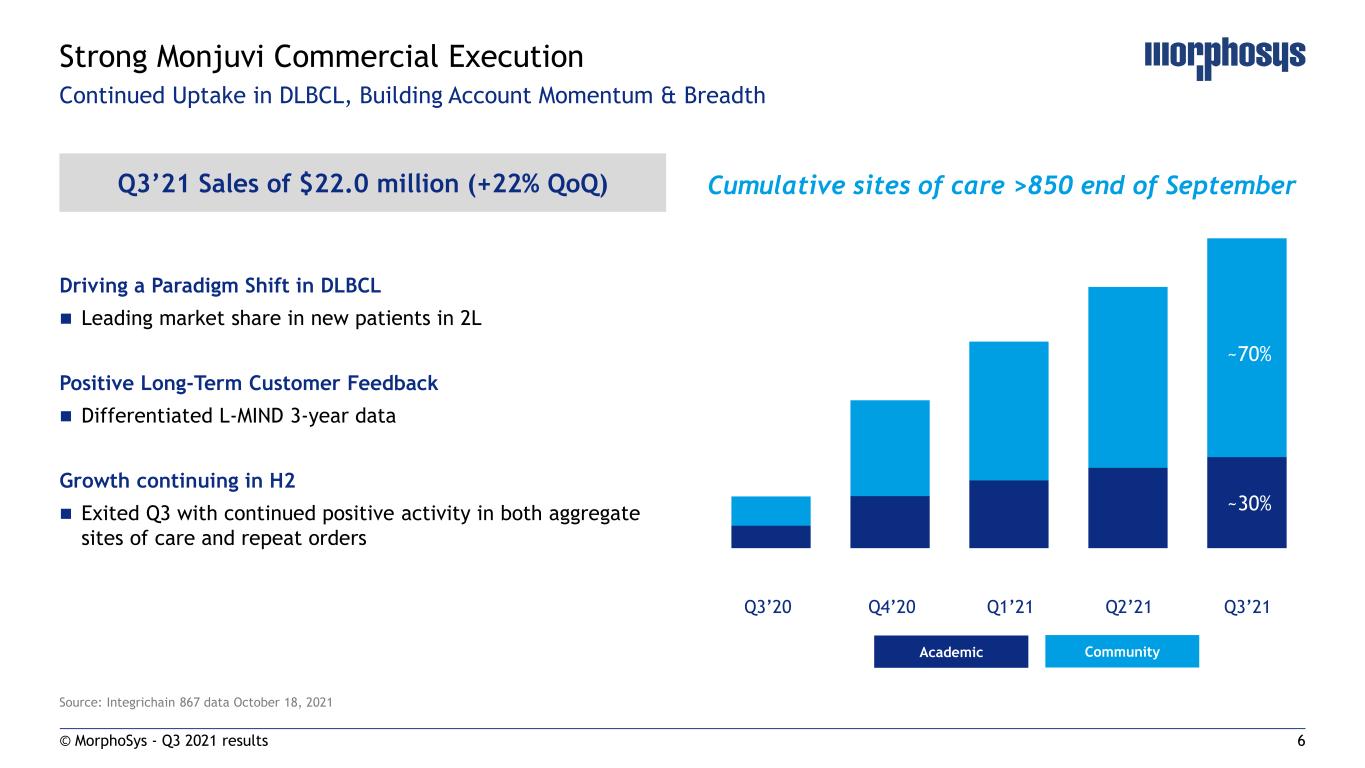

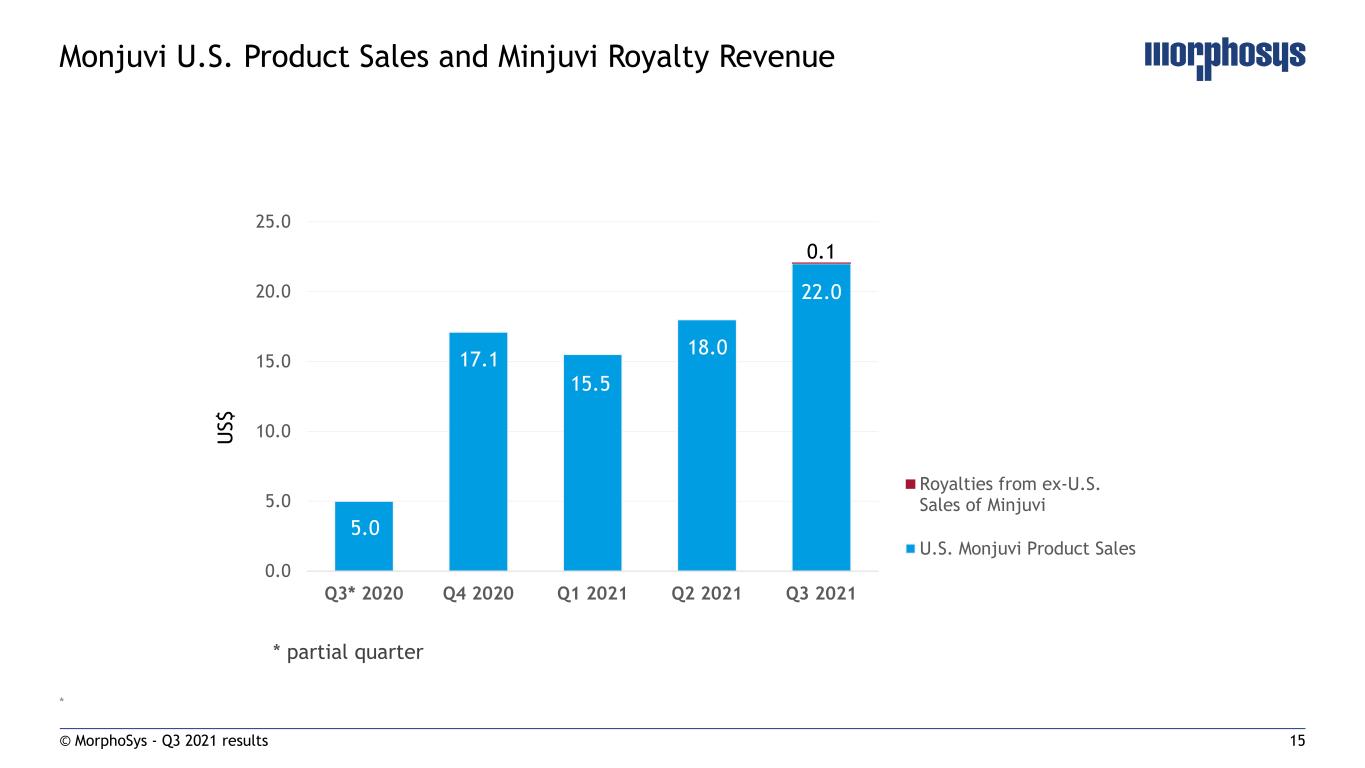

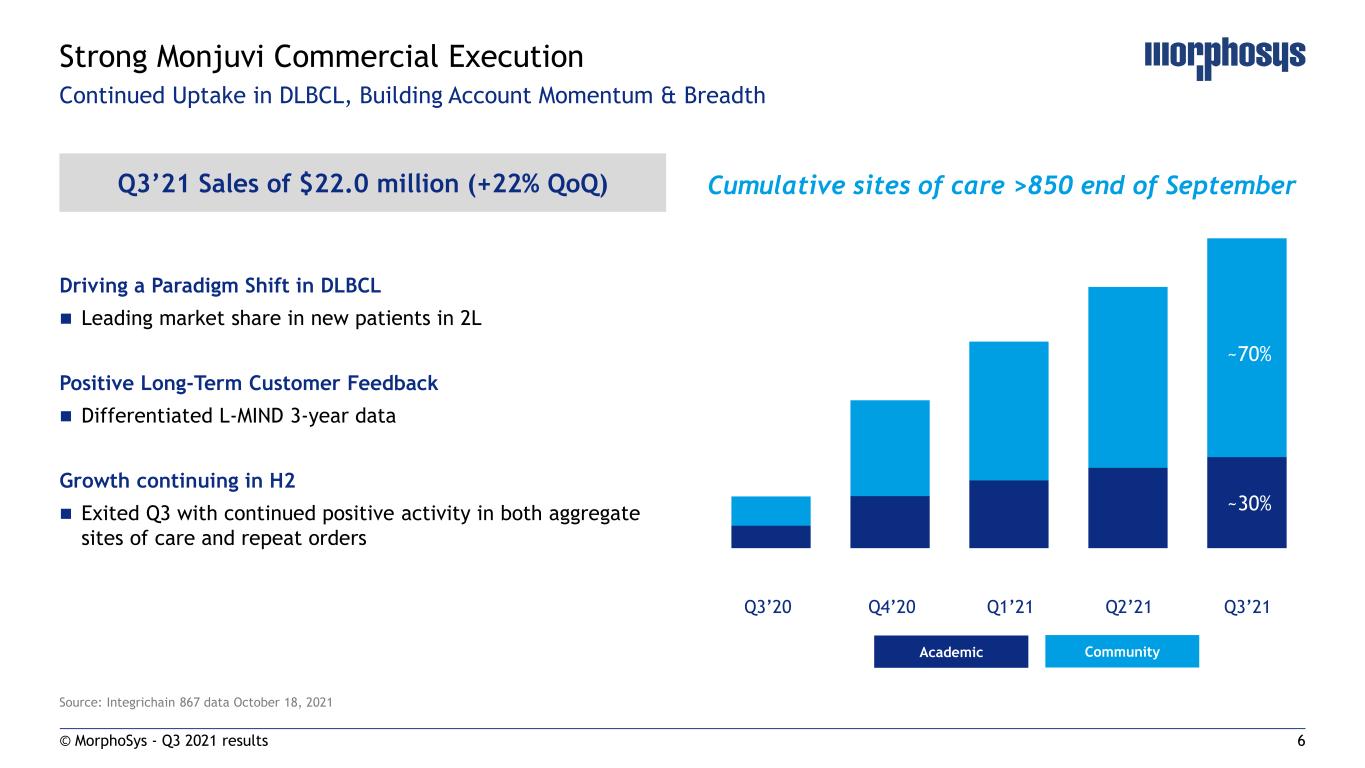

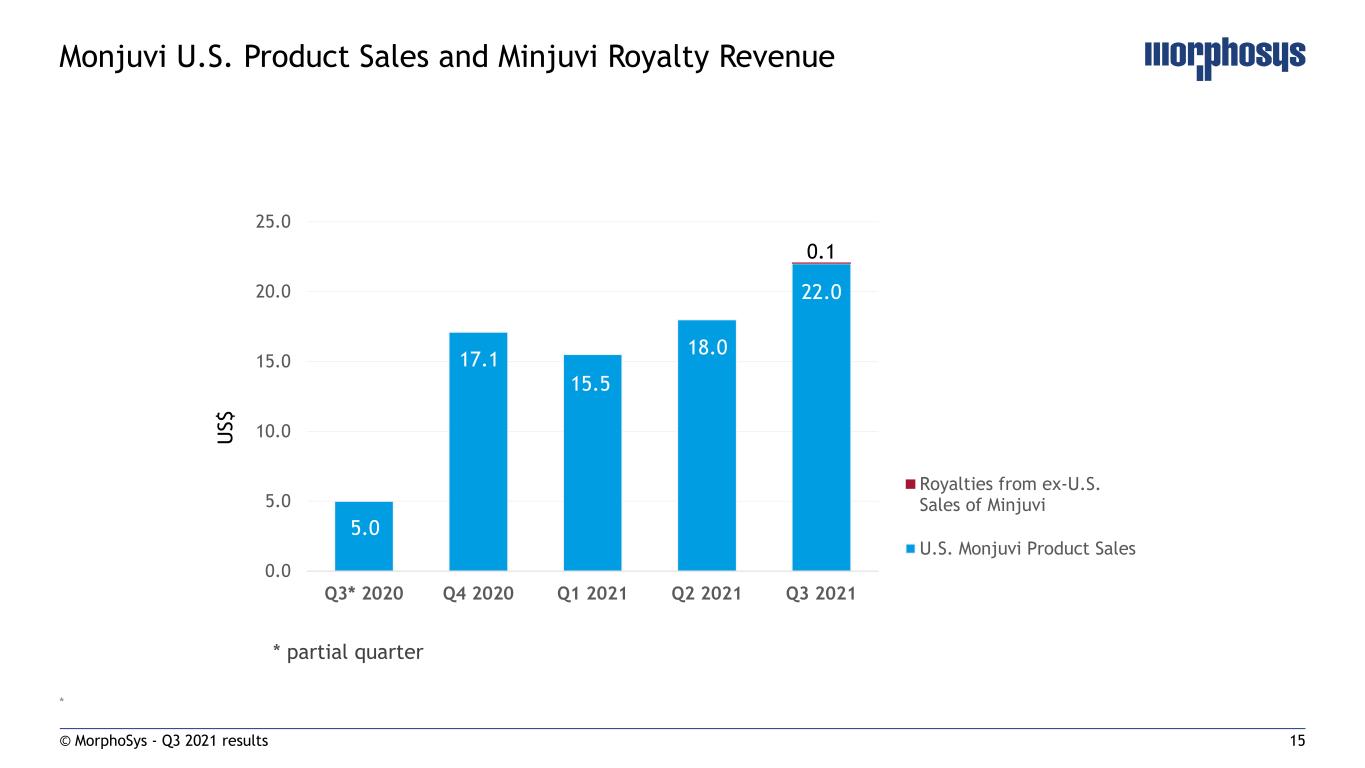

6 Driving a Paradigm Shift in DLBCL Leading market share in new patients in 2L Positive Long-Term Customer Feedback Differentiated L-MIND 3-year data Growth continuing in H2 Exited Q3 with continued positive activity in both aggregate sites of care and repeat orders Source: Integrichain 867 data October 18, 2021 Q3’21 Sales of $22.0 million (+22% QoQ) © MorphoSys - Q3 2021 results Strong Monjuvi Commercial Execution Q3’20 Q4’20 Q1’21 Q2’21 Q3’21 Cumulative sites of care >850 end of September CommunityAcademic ~30% ~70% Continued Uptake in DLBCL, Building Account Momentum & Breadth

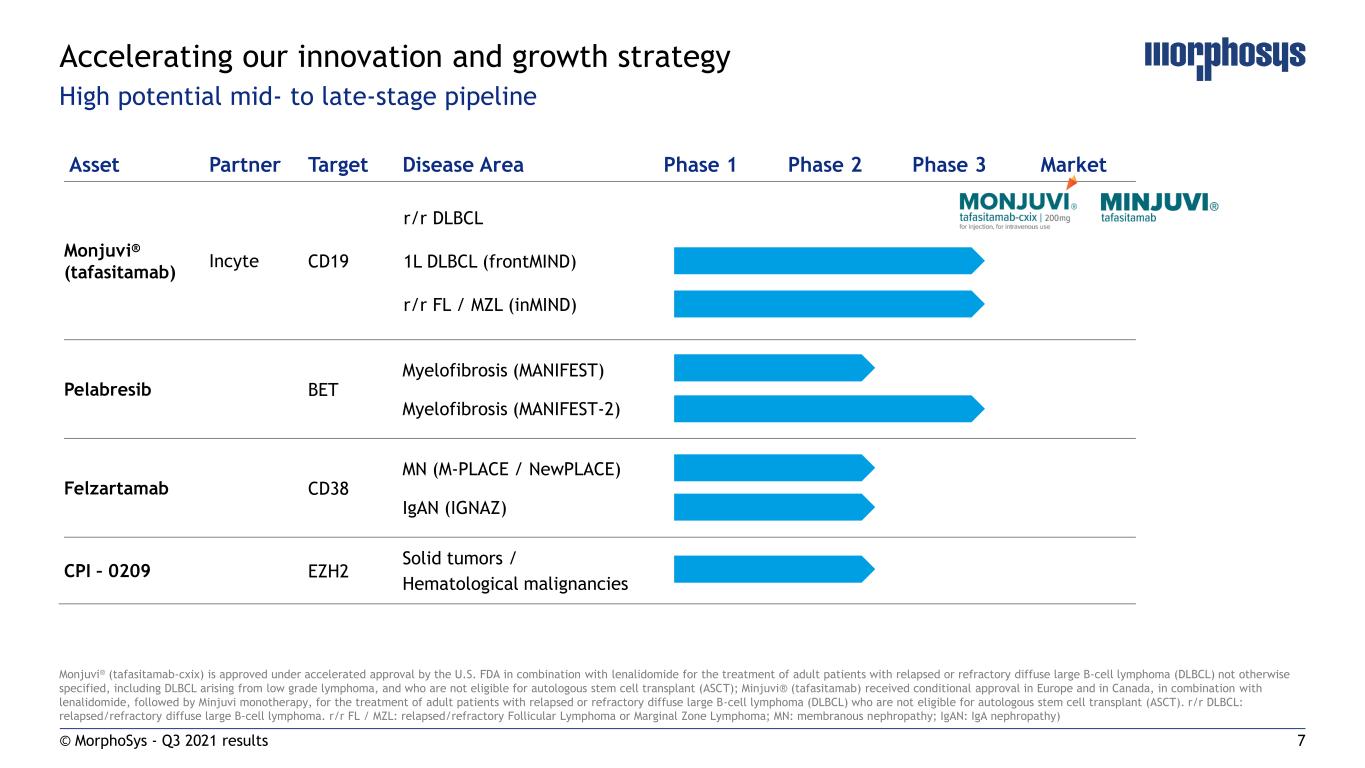

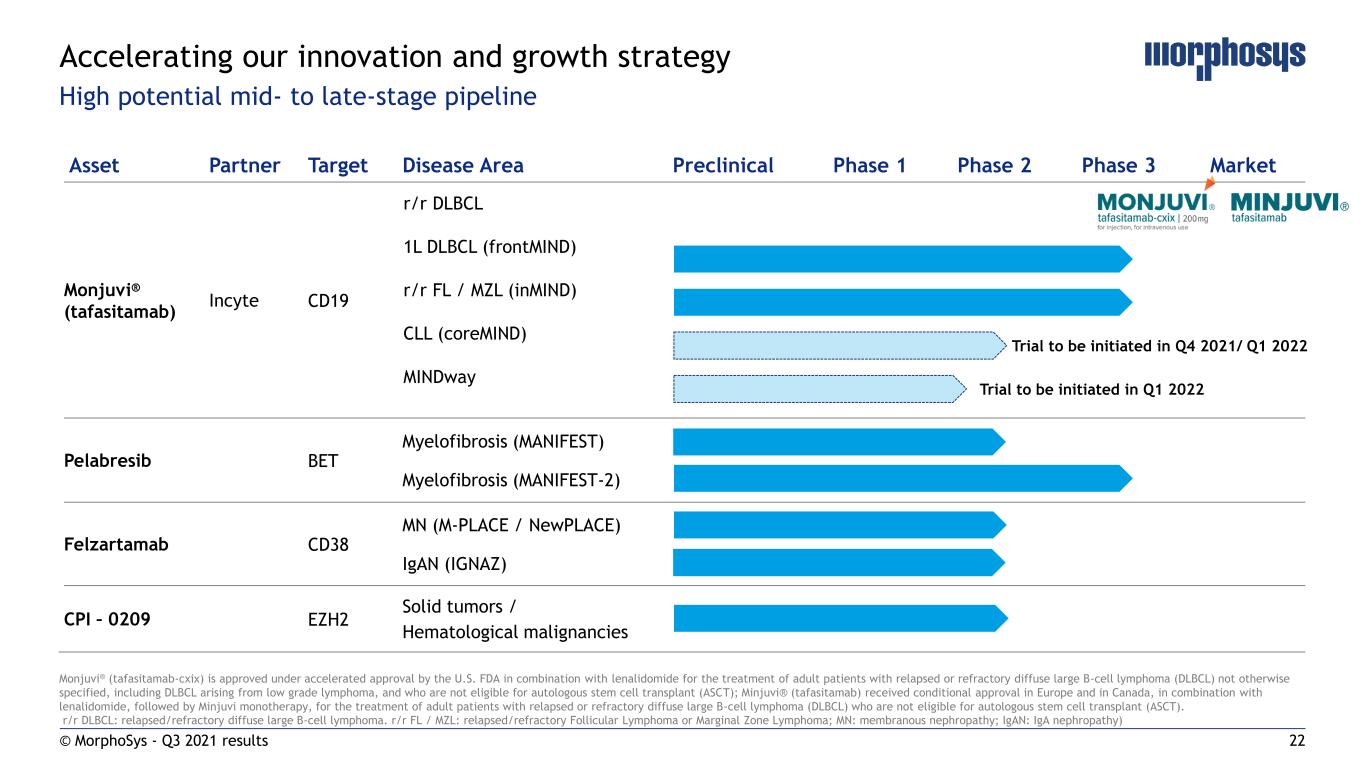

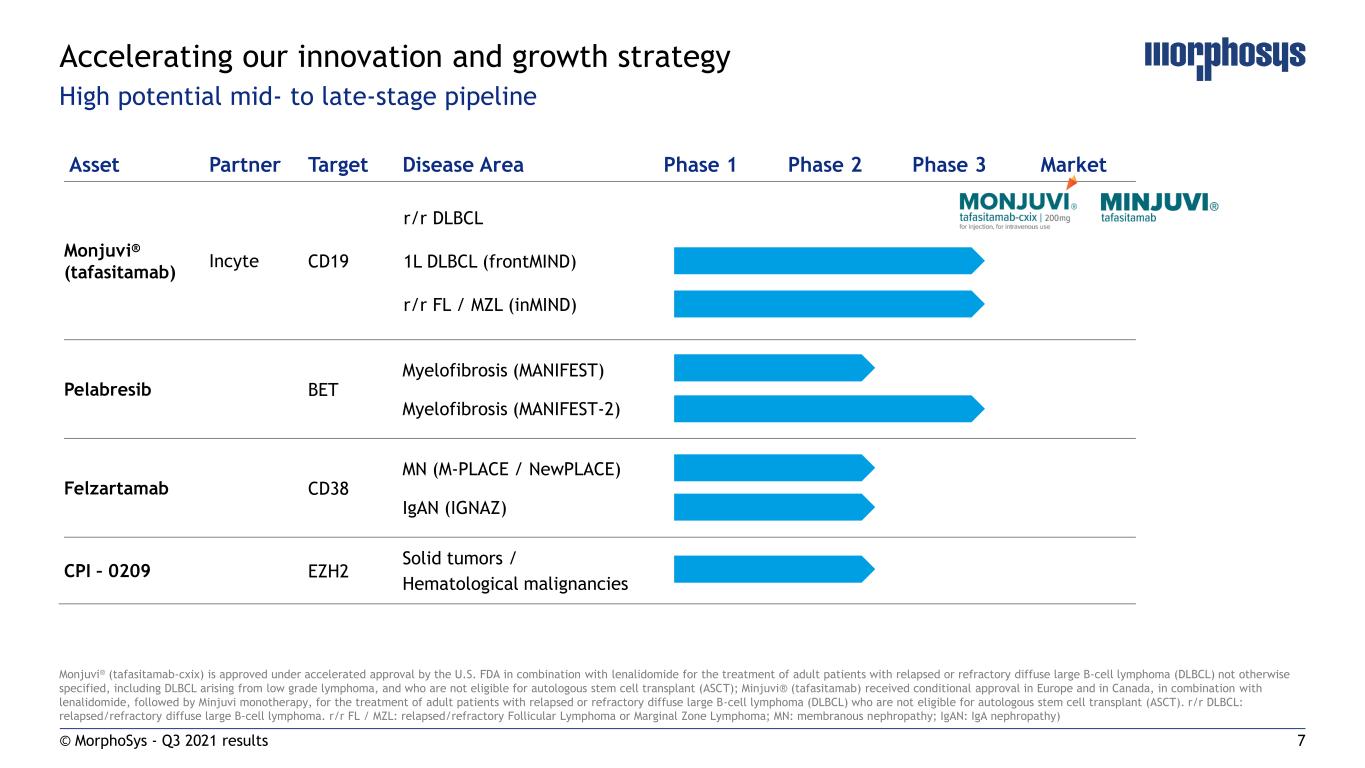

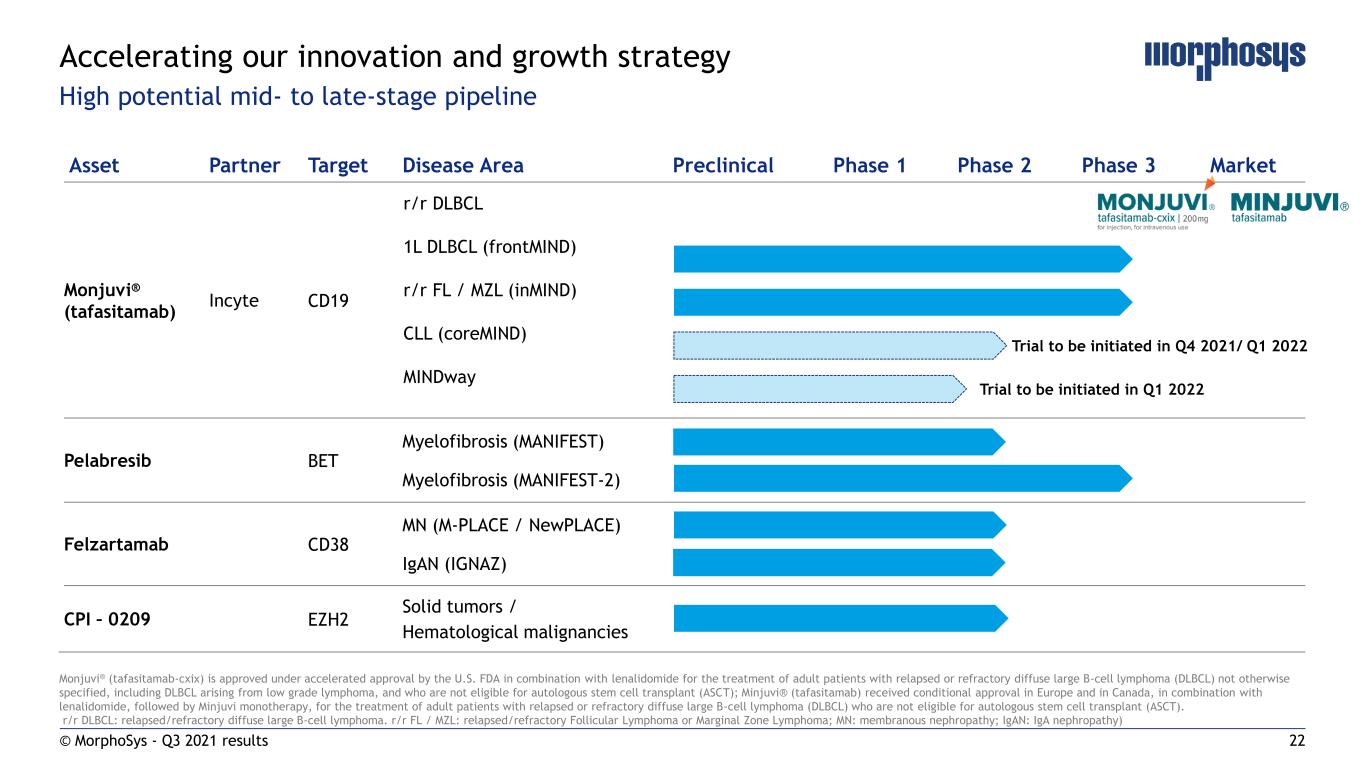

7 Asset Partner Target Disease Area Phase 1 Phase 2 Phase 3 Market Monjuvi® (tafasitamab) Incyte CD19 r/r DLBCL 1L DLBCL (frontMIND) r/r FL / MZL (inMIND) Pelabresib BET Myelofibrosis (MANIFEST) Myelofibrosis (MANIFEST-2) Felzartamab CD38 MN (M-PLACE / NewPLACE) IgAN (IGNAZ) CPI – 0209 EZH2 Solid tumors / Hematological malignancies Monjuvi® (tafasitamab-cxix) is approved under accelerated approval by the U.S. FDA in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT); Minjuvi® (tafasitamab) received conditional approval in Europe and in Canada, in combination with lenalidomide, followed by Minjuvi monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT). r/r DLBCL: relapsed/refractory diffuse large B-cell lymphoma. r/r FL / MZL: relapsed/refractory Follicular Lymphoma or Marginal Zone Lymphoma; MN: membranous nephropathy; IgAN: IgA nephropathy) Accelerating our innovation and growth strategy High potential mid- to late-stage pipeline © MorphoSys - Q3 2021 results

8 Pipeline Update Malte Peters, M.D., CR&DO © MorphoSys - Q3 2021 results

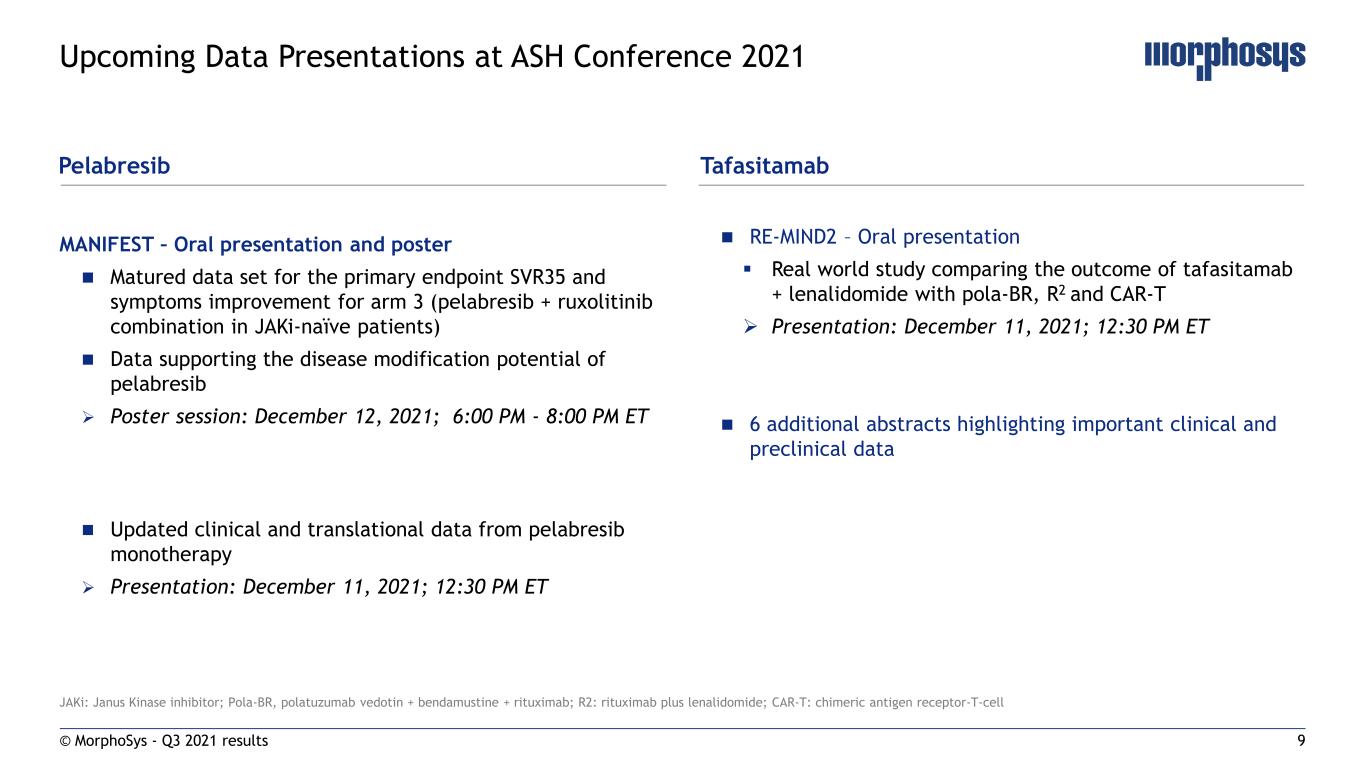

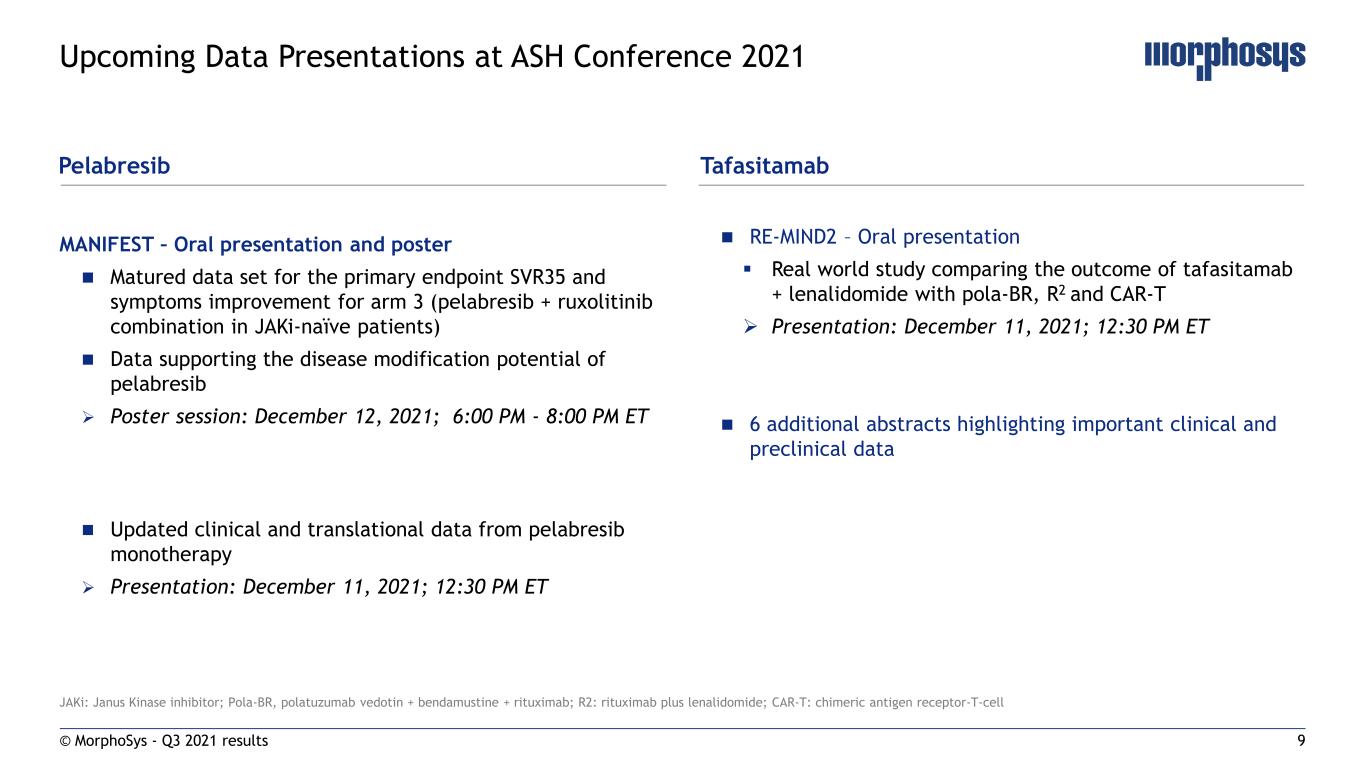

9 JAKi: Janus Kinase inhibitor; Pola-BR, polatuzumab vedotin + bendamustine + rituximab; R2: rituximab plus lenalidomide; CAR-T: chimeric antigen receptor-T-cell MANIFEST – Oral presentation and poster Matured data set for the primary endpoint SVR35 and symptoms improvement for arm 3 (pelabresib + ruxolitinib combination in JAKi-naïve patients) Data supporting the disease modification potential of pelabresib Poster session: December 12, 2021; 6:00 PM - 8:00 PM ET Updated clinical and translational data from pelabresib monotherapy Presentation: December 11, 2021; 12:30 PM ET RE-MIND2 – Oral presentation Real world study comparing the outcome of tafasitamab + lenalidomide with pola-BR, R2 and CAR-T Presentation: December 11, 2021; 12:30 PM ET 6 additional abstracts highlighting important clinical and preclinical data © MorphoSys - Q3 2021 results Upcoming Data Presentations at ASH Conference 2021 Pelabresib Tafasitamab

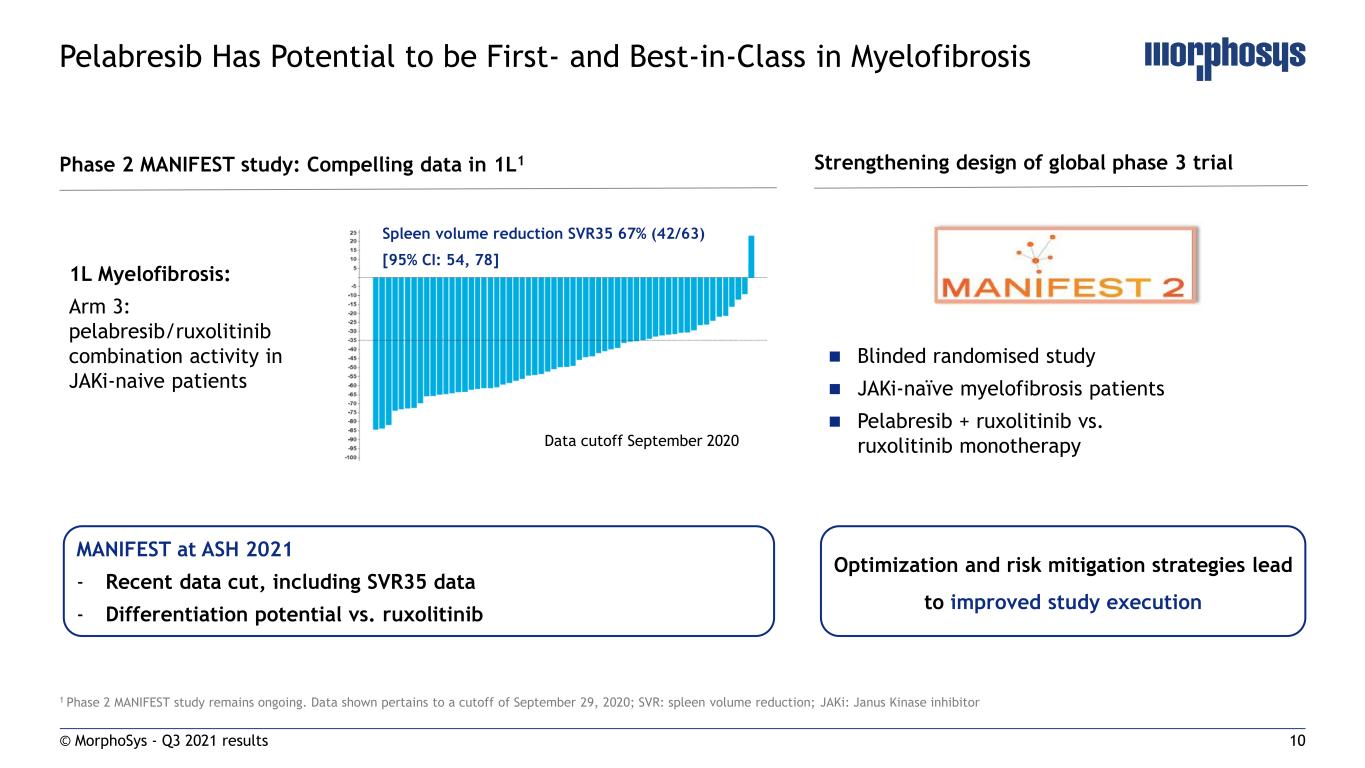

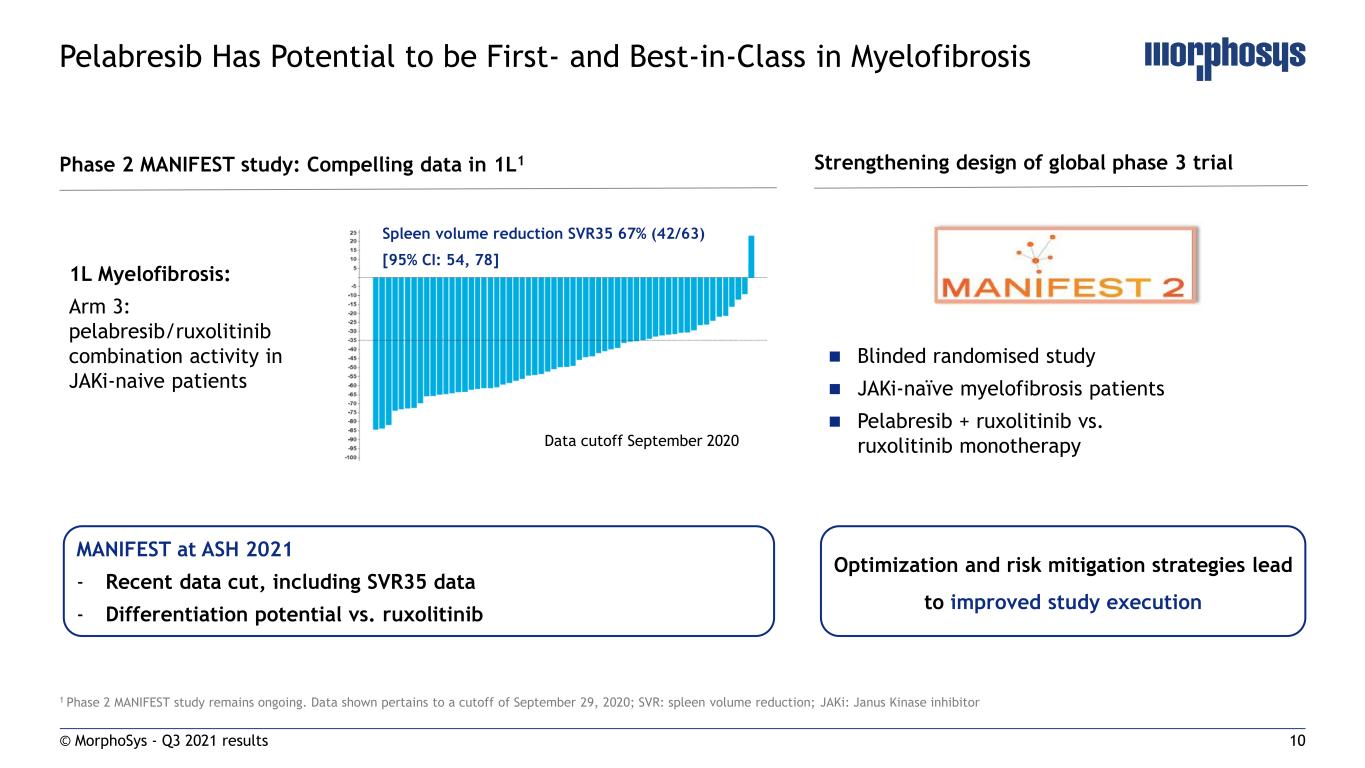

10 1 Phase 2 MANIFEST study remains ongoing. Data shown pertains to a cutoff of September 29, 2020; SVR: spleen volume reduction; JAKi: Janus Kinase inhibitor Pelabresib Has Potential to be First- and Best-in-Class in Myelofibrosis 1L Myelofibrosis: Arm 3: pelabresib/ruxolitinib combination activity in JAKi-naive patients Spleen volume reduction SVR35 67% (42/63) [95% CI: 54, 78] Blinded randomised study JAKi-naïve myelofibrosis patients Pelabresib + ruxolitinib vs. ruxolitinib monotherapy Phase 2 MANIFEST study: Compelling data in 1L1 Strengthening design of global phase 3 trial © MorphoSys - Q3 2021 results MANIFEST at ASH 2021 - Recent data cut, including SVR35 data - Differentiation potential vs. ruxolitinib Data cutoff September 2020 Optimization and risk mitigation strategies lead to improved study execution

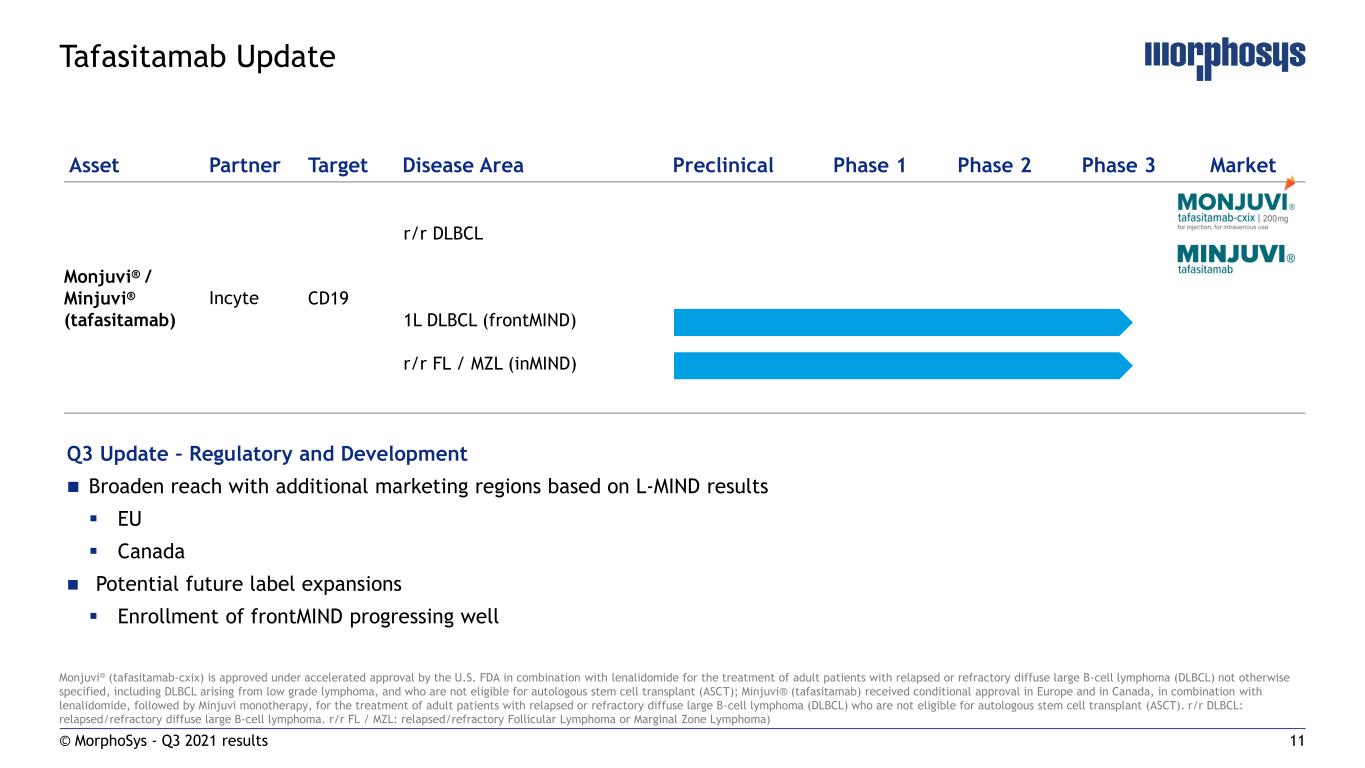

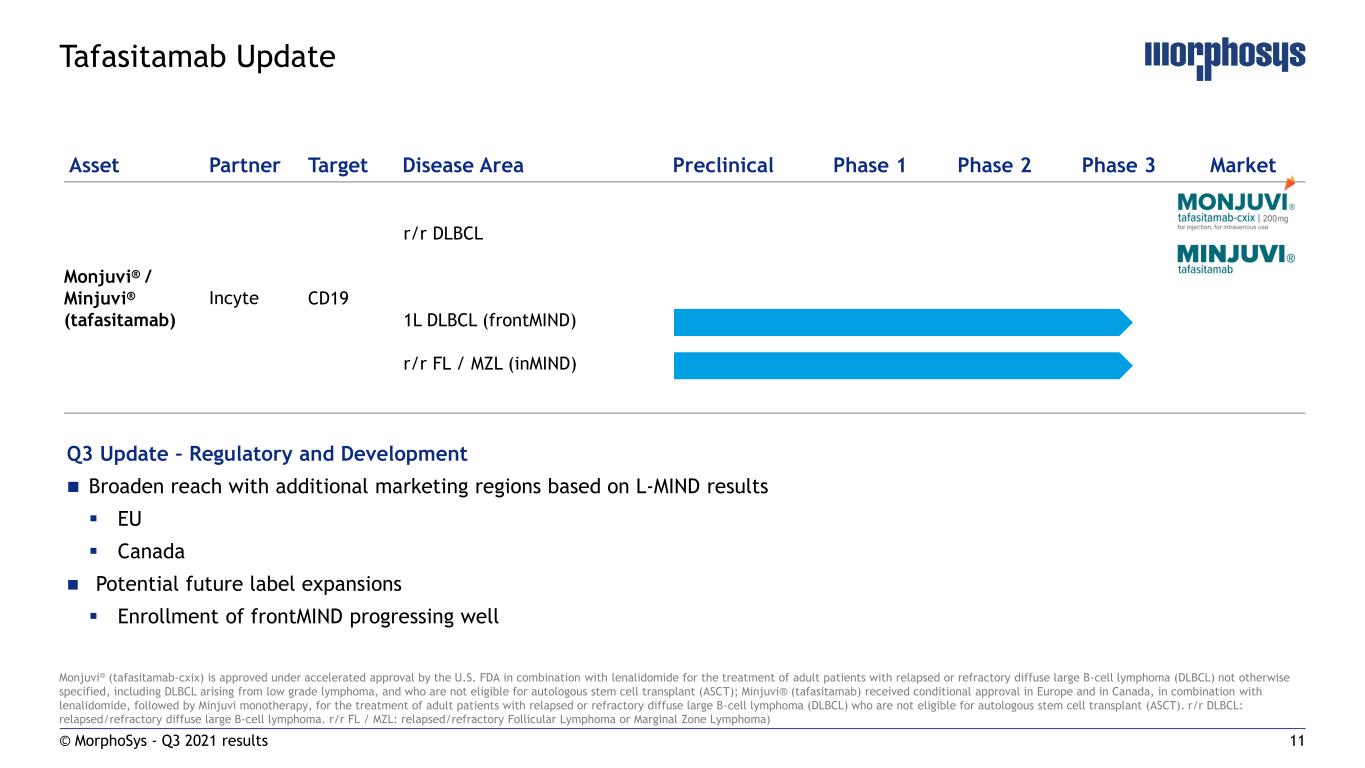

11 Asset Partner Target Disease Area Preclinical Phase 1 Phase 2 Phase 3 Market Monjuvi® / Minjuvi® (tafasitamab) Incyte CD19 r/r DLBCL 1L DLBCL (frontMIND) r/r FL / MZL (inMIND) Monjuvi® (tafasitamab-cxix) is approved under accelerated approval by the U.S. FDA in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT); Minjuvi® (tafasitamab) received conditional approval in Europe and in Canada, in combination with lenalidomide, followed by Minjuvi monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT). r/r DLBCL: relapsed/refractory diffuse large B-cell lymphoma. r/r FL / MZL: relapsed/refractory Follicular Lymphoma or Marginal Zone Lymphoma) Tafasitamab Update © MorphoSys - Q3 2021 results Q3 Update – Regulatory and Development Broaden reach with additional marketing regions based on L-MIND results EU Canada Potential future label expansions Enrollment of frontMIND progressing well

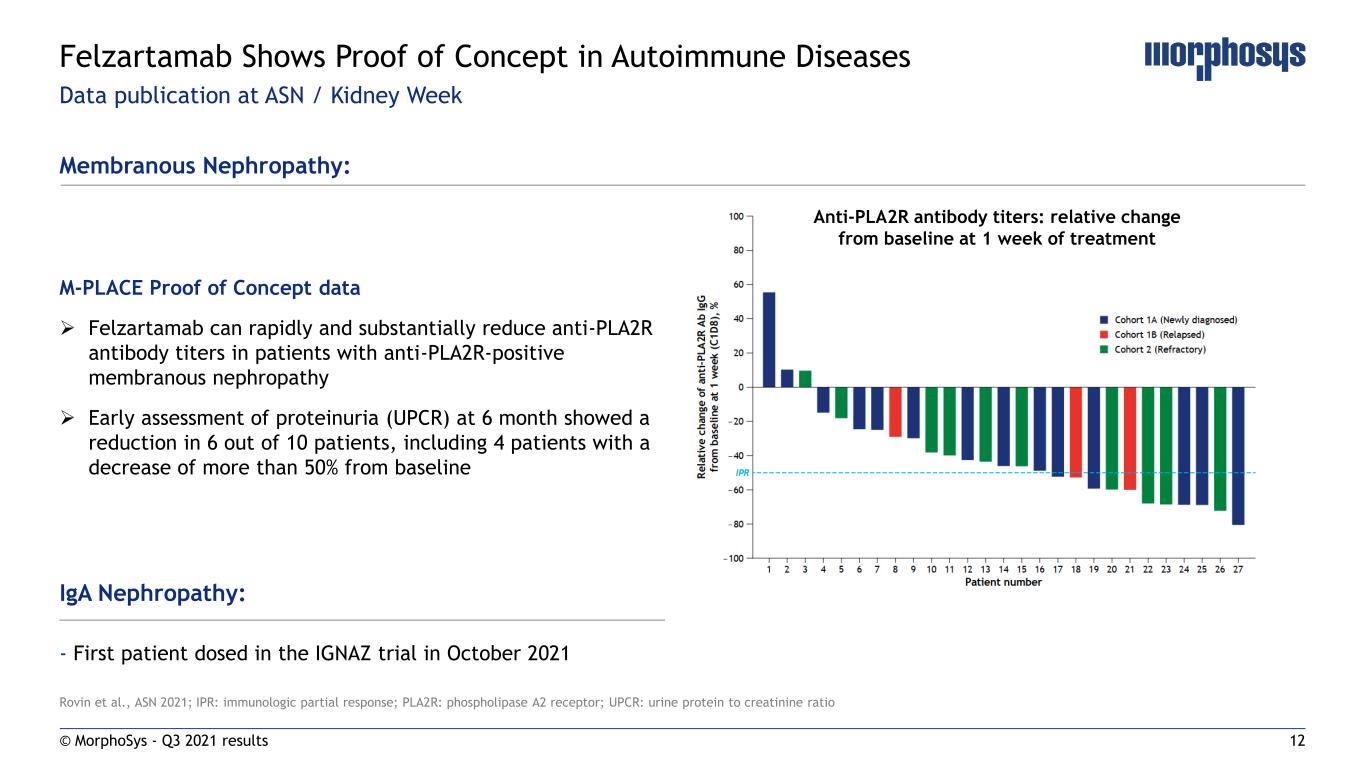

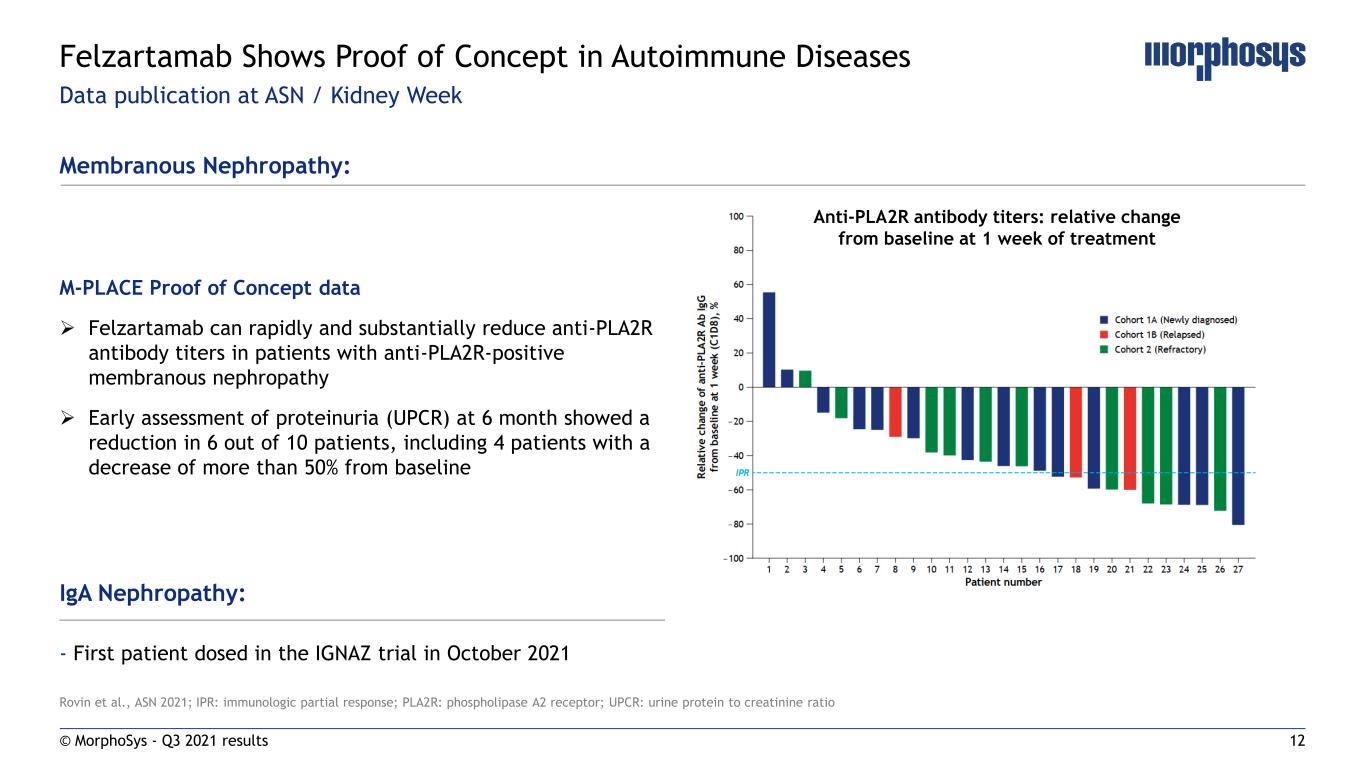

12 Rovin et al., ASN 2021; IPR: immunologic partial response; PLA2R: phospholipase A2 receptor; UPCR: urine protein to creatinine ratio Data publication at ASN / Kidney Week © MorphoSys - Q3 2021 results Felzartamab Shows Proof of Concept in Autoimmune Diseases Membranous Nephropathy: M-PLACE Proof of Concept data Felzartamab can rapidly and substantially reduce anti-PLA2R antibody titers in patients with anti-PLA2R-positive membranous nephropathy Early assessment of proteinuria (UPCR) at 6 month showed a reduction in 6 out of 10 patients, including 4 patients with a decrease of more than 50% from baseline IgA Nephropathy: - First patient dosed in the IGNAZ trial in October 2021 Anti-PLA2R antibody titers: relative change from baseline at 1 week of treatment

13 Broadening proprietary development pipeline © MorphoSys - Q3 2021 results Upcoming Key Clinical Milestones 2021 – H1 22 2022 – 23 2024 - 25 Primary analysis data Myelofibrosis H1 2024 Pelabresib — MANIFEST-2 Primary analysis data in 1L 1L DLBCL H2 2025 Tafasitamab — frontMIND Phase 2 PoC data IgA Nepropathy Q4 2022 Felzartamab — IGNAZ Start of parsaclisib combo study r/r B-cell malignancies Q4 2021 Tafasitamab — topMIND Phase 2 Study Start CLL Q4 2021/Q1 2022 Tafasitamab — coreMIND Start of combo study r/r B-cell malignancies Q1 2022 Tafasitamab — Plamotamab Primary analysis data r/r FL H2 2023 Tafasitamab — inMIND Phase 1/2 PoC data solid cancer/lymphoma H1 2022 CPI-0209 Pivotal Studies Data update phase 2 studies Membranous Nephropathy H2 2022 Felzartamab — M-PLACE NewPLACE Data update phase 2 study Myelofibrosis Q4 2021 Pelabresib — MANIFEST Upcoming at ASH DLBCL: diffuse large B-cell lymphoma. r/r FL: relapsed/refractory Follicular Lymphoma; CLL: chronic lymphocytic leukemia

14 Financial Results Q3/9M 2021 & Guidance Sung Lee, CFO © MorphoSys - Q3 2021 results

15 * © MorphoSys - Q3 2021 results Monjuvi U.S. Product Sales and Minjuvi Royalty Revenue 0.0 5.0 10.0 15.0 20.0 25.0 Q3* 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Royalties from ex-U.S. Sales of Minjuvi U.S. Monjuvi Product Sales * partial quarter U S $ 5.0 17.1 15.5 18.0 22.0 0.1

16 Monjuvi was approved in the U.S. on July 31, 2020; * Differences due to rounding ** Includes expenses from Constellation from July 15 through September 30, 2021 © MorphoSys - Q3 2021 results Q3 2021: Profit or Loss Statement* In € million Q3 2021** Q3 2020 Revenues 41.2 22.0 87% Monjuvi Product Sales 18.6 4.4 >100% Royalties 17.0 10.2 67% Licenses, Milestones and Other 5.6 7.4 (24%) Cost of Sales (7.5) (3.7) >(100%) Gross Profit 33.8 18.3 85% Total Operating Expenses (116.1) (80.3) (45%) R&D Expenses (64.4) (34.2) (88%) Selling Expenses (32.4) (32.9) 2% G&A Expenses (19.4) (13.3) (46%) Operating Profit / (Loss) (82.4) (62.0) (33%) Consolidated Net Profit / (Net Loss) (112.8) (65.3) (73%) Earnings per Share, basic and diluted (in €) (3.30) (2.00) (65%) Earnings per Share, basic (in €) - - - Earnings per Share, diluted (in €) - - - On September 30, 2021 MorphoSys’ position in cash and investments amounted to € 1,130.9 million (December 31, 2020: € 1,244.0 million)

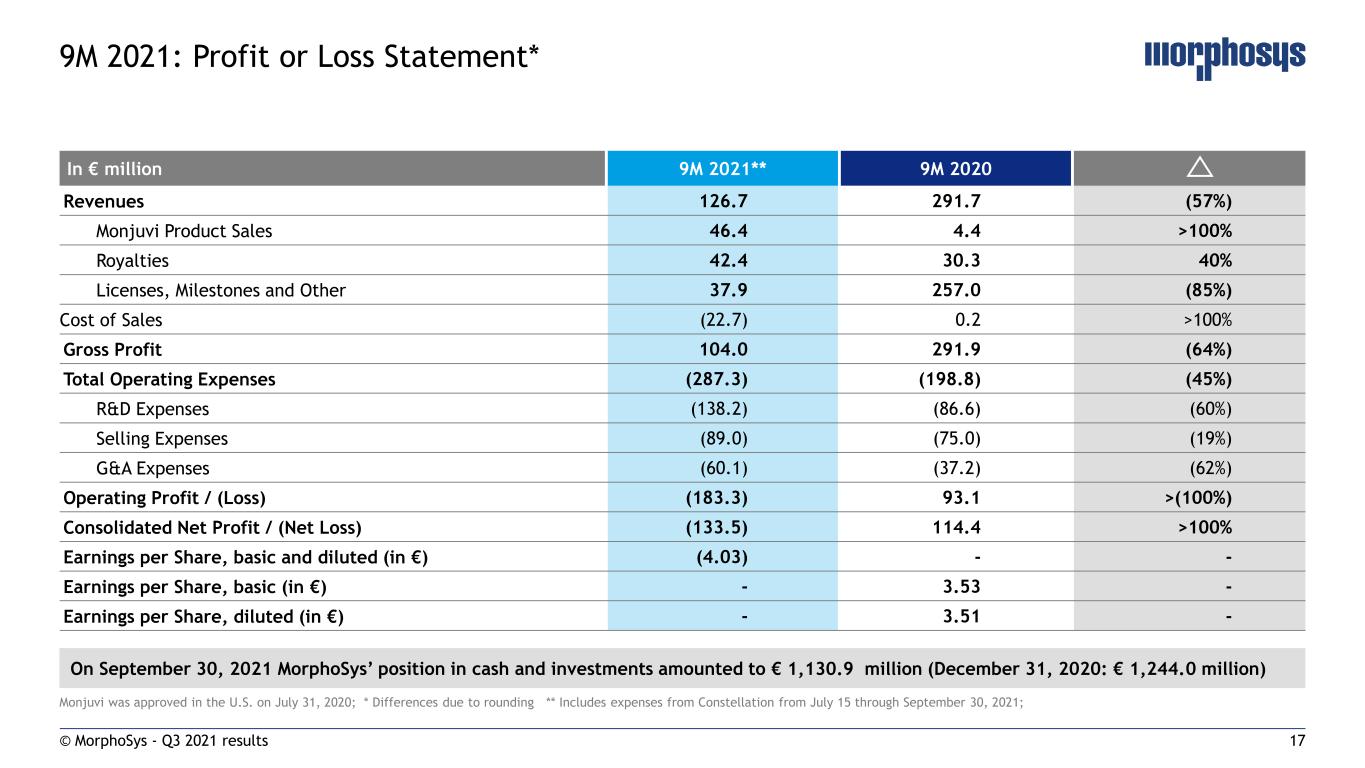

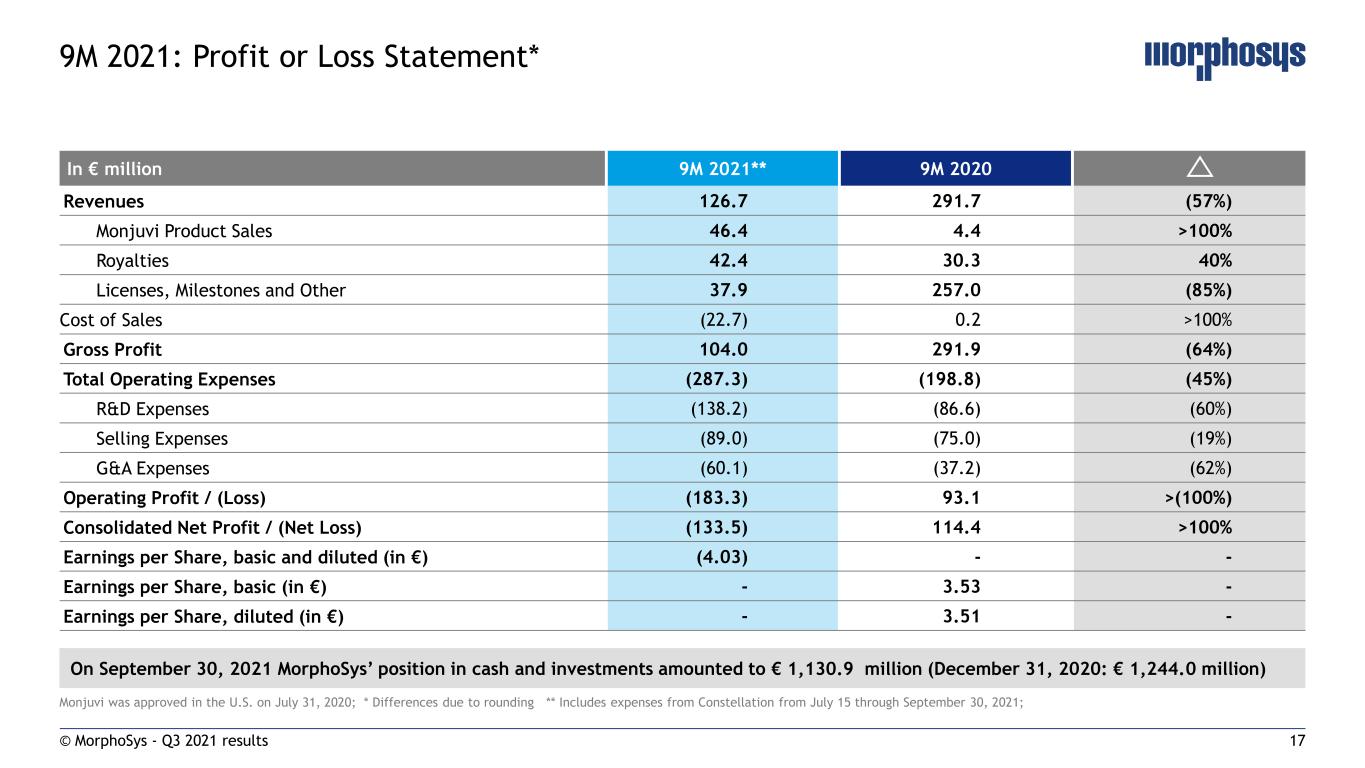

17 Monjuvi was approved in the U.S. on July 31, 2020; * Differences due to rounding ** Includes expenses from Constellation from July 15 through September 30, 2021; © MorphoSys - Q3 2021 results 9M 2021: Profit or Loss Statement* In € million 9M 2021** 9M 2020 Revenues 126.7 291.7 (57%) Monjuvi Product Sales 46.4 4.4 >100% Royalties 42.4 30.3 40% Licenses, Milestones and Other 37.9 257.0 (85%) Cost of Sales (22.7) 0.2 >100% Gross Profit 104.0 291.9 (64%) Total Operating Expenses (287.3) (198.8) (45%) R&D Expenses (138.2) (86.6) (60%) Selling Expenses (89.0) (75.0) (19%) G&A Expenses (60.1) (37.2) (62%) Operating Profit / (Loss) (183.3) 93.1 >(100%) Consolidated Net Profit / (Net Loss) (133.5) 114.4 >100% Earnings per Share, basic and diluted (in €) (4.03) - - Earnings per Share, basic (in €) - 3.53 - Earnings per Share, diluted (in €) - 3.51 - On September 30, 2021 MorphoSys’ position in cash and investments amounted to € 1,130.9 million (December 31, 2020: € 1,244.0 million)

18© MorphoSys - Q3 2021 results Accounting for Royalty Pharma and Constellation Transactions Overview of major deal effects on consolidated financial statements Acquisition financing from Royalty Pharma (RP) Constellation: Purchase Price Allocation Net assets acquired of EUR 161.7m as of July 15, 2021 Purchase price allocation under IFRS 3 identified the following items In-process R&D (intangible assets): Lead compounds of Constellation; EUR 706.5m as of September 30, 2021 Goodwill of EUR 569.3m as of September 30, 2021, comprising non- separable intangible assets (IPR&D), workforce, know-how and technology platform Deferred taxes (net liability) of EUR 28.6m as of September 30, 2021 Regular testing for impairment in future periods MorphoSys owes the following future cash flows to RP: 100% of Tremfya royalties 80% of royalties and 100% of milestone payments for otilimab 60% of gantenerumab royalties 3% on future net sales of pelabresib and CPI-0209 RP financial liabilities are in the scope of IFRS 9 Initial recognition at fair value on July 15, 2021, subsequent measurement on a quarterly basis Subsequent measurement at amortized cost based on effective interest rate (EIR) method; EUR 1,210.6m as of September 2021 presented as “Financial Liabilities from Future Payments to Royalty Pharma” on the balance sheet Cash transfers from licensees to RP (e.g., Tremfya royalties) reduce the financial liabilities Balance of financial liabilities can be affected by changes in the lifetime forecast for royalty/milestone/net sales streams Finance Income/Expense can be recognized quarterly due to: Application of interest charges Foreign exchange rate changes Changes in lifetime forecast Changes to the financial liabilities and/or recognition of finance income/expense have NO cash impact on MorphoSys

19 *Operating Expenses is comprised of R&D and SG&A, inclusive of Incyte’s share of Monjuvi selling costs in the U.S. © MorphoSys - Q3 2021 results Financial Guidance FY2021 Updated Guidance Provided on 7/26/21 and Reiterated on 11/10/21 2021 Updated Guidance Insights Group Revenues 155 to 180 • Includes full year Tremfya royalties • Range excludes any royalty revenue from potential sales of tafasitimab outside of the U.S • No significant milestone payments anticipated in Q4 2021 Operating Expenses* 435 to 465 • Reflects the acquisition of Constellation which was accomplished on July 15, 2021 • Range includes one-time transaction costs of € 36m related to the agreements with Constellation and Royalty Pharma R&D Expense 52 to 57% OpEx (excl. one-time transaction costs) • R&D percentage range applies to OpEx EXCLUDING € 36m of one-time transaction costs In € million

20© MorphoSys - Q3 2021 results Q & A

The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicine Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi®, tafasitamab/Minjuvi® and guselkumab/Tremfya®). HuCAL®, HuCAL GOLD®, HuCAL PLATINUM®, CysDisplay®, RapMAT®, arYla®, Ylanthia®, 100 billion high potentials®, Slonomics®, ENFORCER® and Monjuvi® are trademarks of the MorphoSys Group. Tremfya® is a trademark of Janssen Biotech, Inc. XmAb® is a trademark of Xencor, Inc. www.morphosys.com Thank You

22 Asset Partner Target Disease Area Preclinical Phase 1 Phase 2 Phase 3 Market Monjuvi® (tafasitamab) Incyte CD19 r/r DLBCL 1L DLBCL (frontMIND) r/r FL / MZL (inMIND) CLL (coreMIND) MINDway Pelabresib BET Myelofibrosis (MANIFEST) Myelofibrosis (MANIFEST-2) Felzartamab CD38 MN (M-PLACE / NewPLACE) IgAN (IGNAZ) CPI – 0209 EZH2 Solid tumors / Hematological malignancies Monjuvi® (tafasitamab-cxix) is approved under accelerated approval by the U.S. FDA in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT); Minjuvi® (tafasitamab) received conditional approval in Europe and in Canada, in combination with lenalidomide, followed by Minjuvi monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT). r/r DLBCL: relapsed/refractory diffuse large B-cell lymphoma. r/r FL / MZL: relapsed/refractory Follicular Lymphoma or Marginal Zone Lymphoma; MN: membranous nephropathy; IgAN: IgA nephropathy) Accelerating our innovation and growth strategy High potential mid- to late-stage pipeline Trial to be initiated in Q4 2021/ Q1 2022 Trial to be initiated in Q1 2022 © MorphoSys - Q3 2021 results

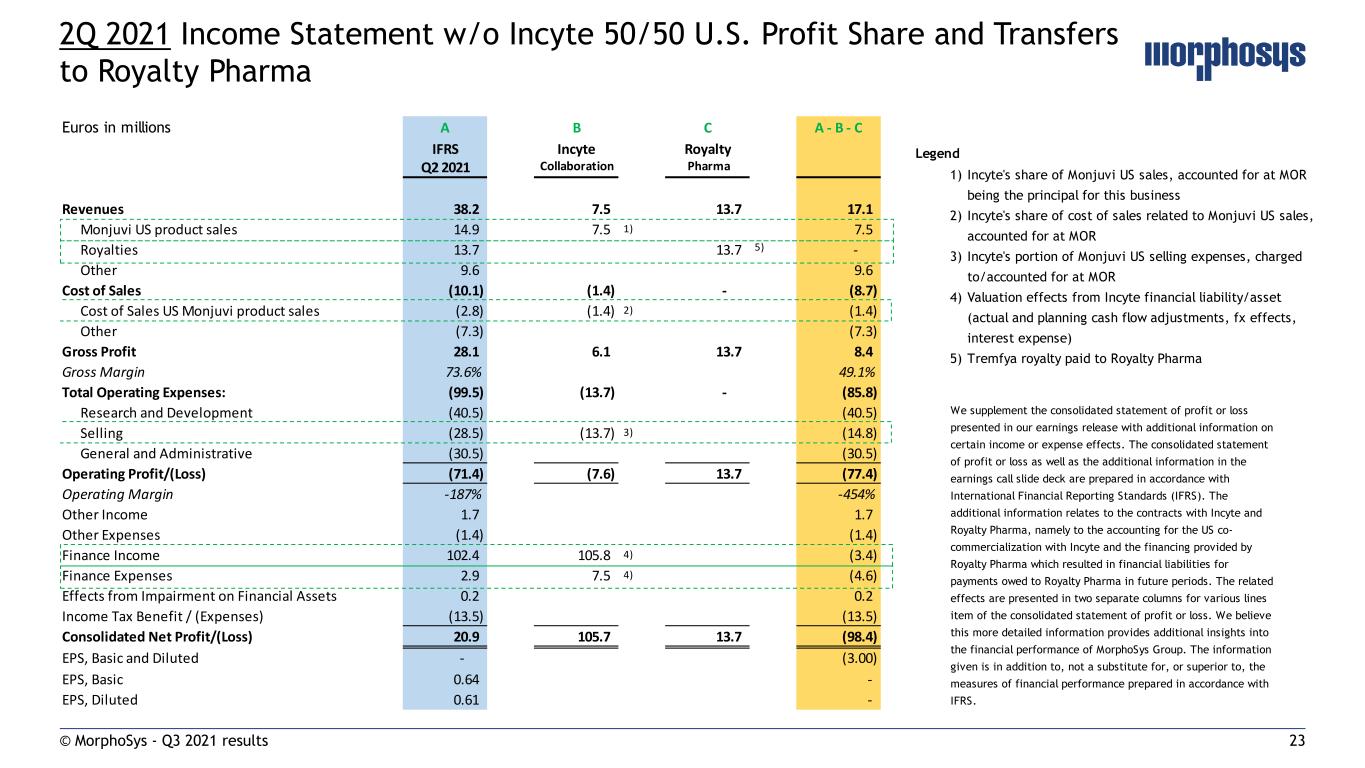

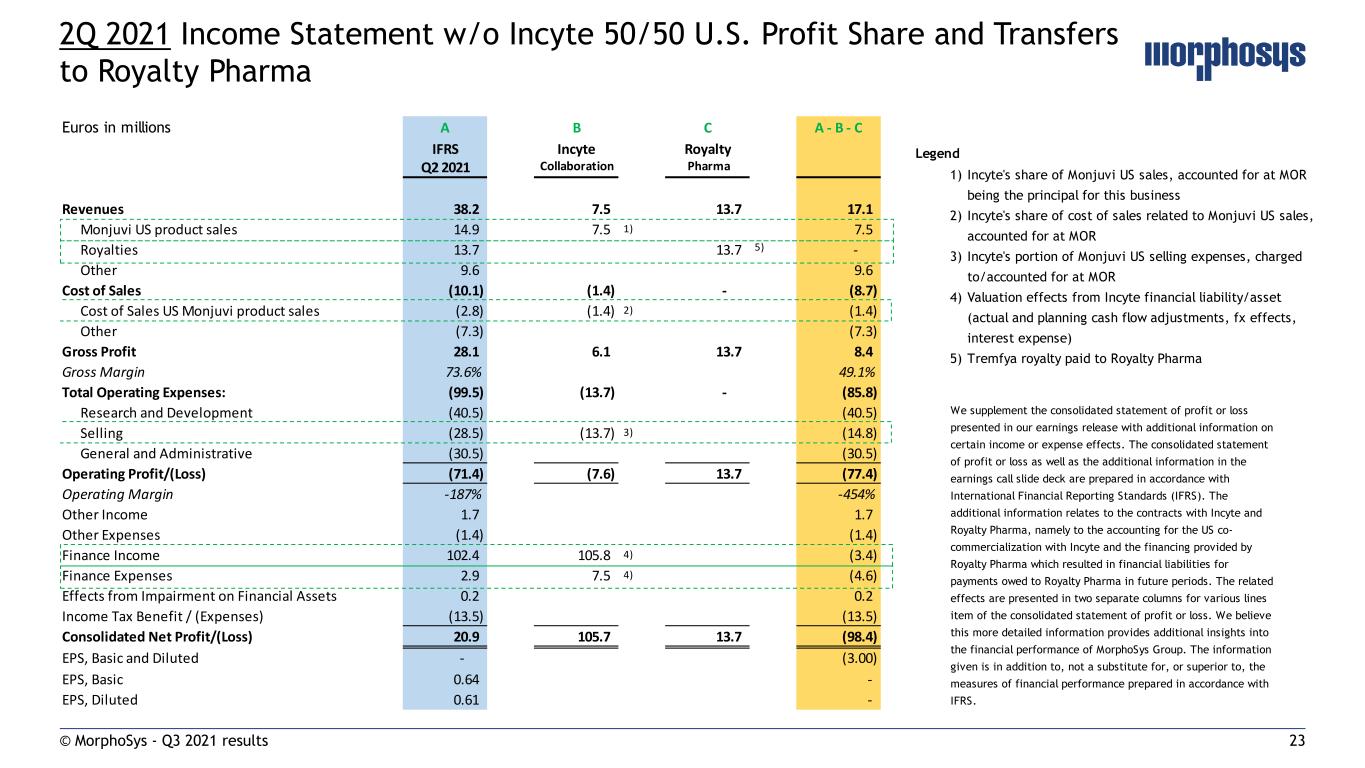

23© MorphoSys - Q3 2021 results 2Q 2021 Income Statement w/o Incyte 50/50 U.S. Profit Share and Transfers to Royalty Pharma Euros in millions A B C A - B - C IFRS Incyte Royalty Q2 2021 Collaboration Pharma Revenues 38.2 7.5 13.7 17.1 Monjuvi US product sales 14.9 7.5 1) 7.5 Royalties 13.7 13.7 5) - Other 9.6 9.6 Cost of Sales (10.1) (1.4) - (8.7) Cost of Sales US Monjuvi product sales (2.8) (1.4) 2) (1.4) Other (7.3) (7.3) Gross Profit 28.1 6.1 13.7 8.4 Gross Margin 73.6% 49.1% Total Operating Expenses: (99.5) (13.7) - (85.8) Research and Development (40.5) (40.5) Selling (28.5) (13.7) 3) (14.8) General and Administrative (30.5) (30.5) Operating Profit/(Loss) (71.4) (7.6) 13.7 (77.4) Operating Margin -187% -454% Other Income 1.7 1.7 Other Expenses (1.4) (1.4) Finance Income 102.4 105.8 4) (3.4) Finance Expenses 2.9 7.5 4) (4.6) Effects from Impairment on Financial Assets 0.2 0.2 Income Tax Benefit / (Expenses) (13.5) (13.5) Consolidated Net Profit/(Loss) 20.9 105.7 13.7 (98.4) EPS, Basic and Diluted - (3.00) EPS, Basic 0.64 - EPS, Diluted 0.61 - Legend 1) Incyte's share of Monjuvi US sales, accounted for at MOR being the principal for this business 2) Incyte's share of cost of sales related to Monjuvi US sales, accounted for at MOR 3) Incyte's portion of Monjuvi US selling expenses, charged to/accounted for at MOR 4) Valuation effects from Incyte financial liability/asset (actual and planning cash flow adjustments, fx effects, interest expense) 5) Tremfya royalty paid to Royalty Pharma We supplement the consolidated statement of profit or loss presented in our earnings release with additional information on certain income or expense effects. The consolidated statement of profit or loss as well as the additional information in the earnings call slide deck are prepared in accordance with International Financial Reporting Standards (IFRS). The additional information relates to the contracts with Incyte and Royalty Pharma, namely to the accounting for the US co- commercialization with Incyte and the financing provided by Royalty Pharma which resulted in financial liabilities for payments owed to Royalty Pharma in future periods. The related effects are presented in two separate columns for various lines item of the consolidated statement of profit or loss. We believe this more detailed information provides additional insights into the financial performance of MorphoSys Group. The information given is in addition to, not a substitute for, or superior to, the measures of financial performance prepared in accordance with IFRS.

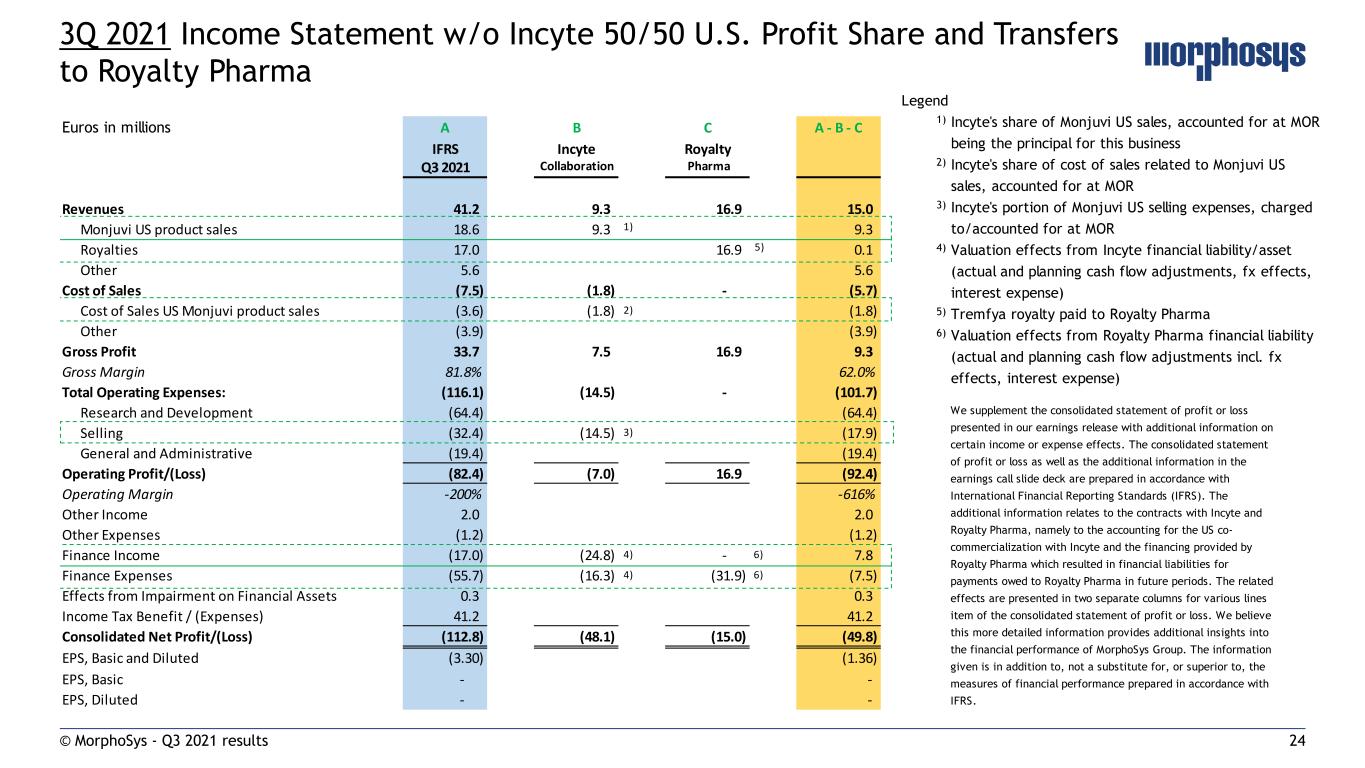

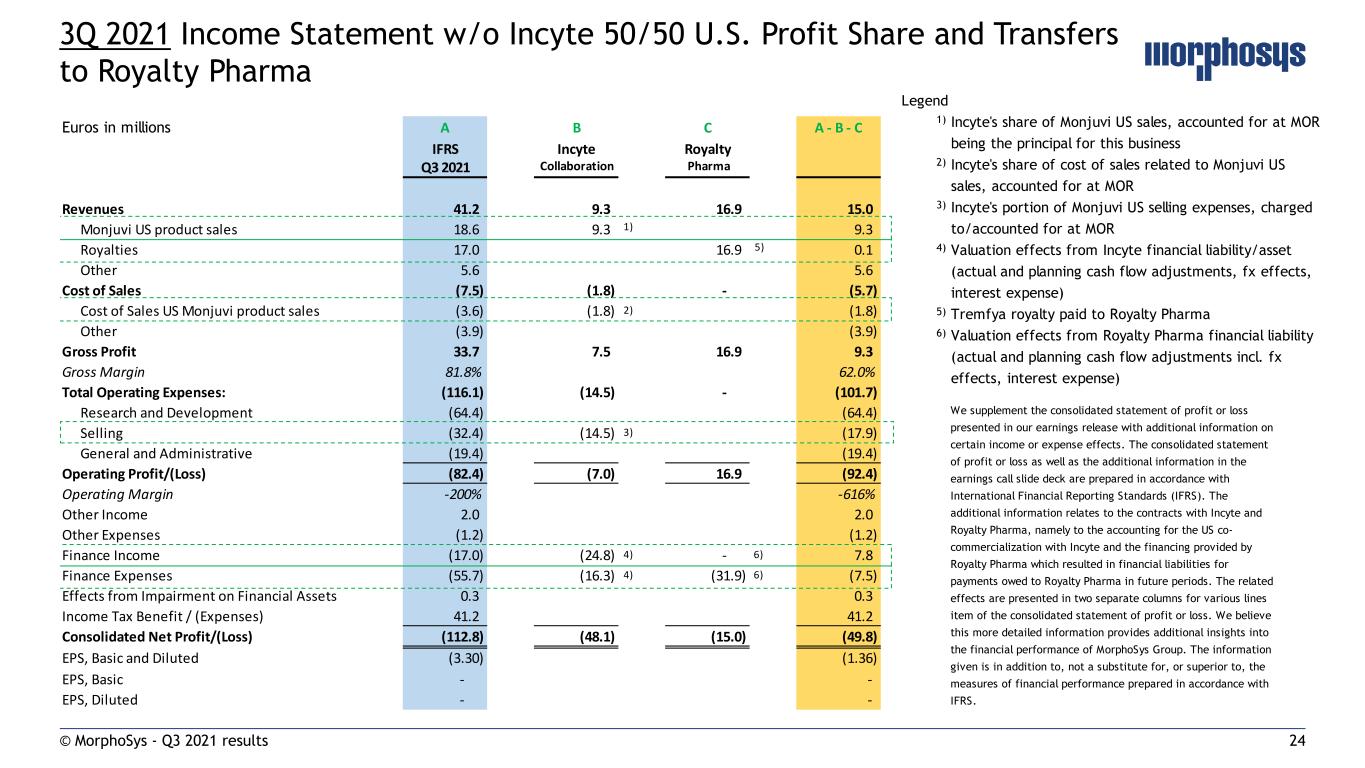

24© MorphoSys - Q3 2021 results 3Q 2021 Income Statement w/o Incyte 50/50 U.S. Profit Share and Transfers to Royalty Pharma Euros in millions A B C A - B - C IFRS Incyte Royalty Q3 2021 Collaboration Pharma Revenues 41.2 9.3 16.9 15.0 Monjuvi US product sales 18.6 9.3 1) 9.3 Royalties 17.0 16.9 5) 0.1 Other 5.6 5.6 Cost of Sales (7.5) (1.8) - (5.7) Cost of Sales US Monjuvi product sales (3.6) (1.8) 2) (1.8) Other (3.9) (3.9) Gross Profit 33.7 7.5 16.9 9.3 Gross Margin 81.8% 62.0% Total Operating Expenses: (116.1) (14.5) - (101.7) Research and Development (64.4) (64.4) Selling (32.4) (14.5) 3) (17.9) General and Administrative (19.4) (19.4) Operating Profit/(Loss) (82.4) (7.0) 16.9 (92.4) Operating Margin -200% -616% Other Income 2.0 2.0 Other Expenses (1.2) (1.2) Finance Income (17.0) (24.8) 4) - 6) 7.8 Finance Expenses (55.7) (16.3) 4) (31.9) 6) (7.5) Effects from Impairment on Financial Assets 0.3 0.3 Income Tax Benefit / (Expenses) 41.2 41.2 Consolidated Net Profit/(Loss) (112.8) (48.1) (15.0) (49.8) EPS, Basic and Diluted (3.30) (1.36) EPS, Basic - - EPS, Diluted - - Legend 1) Incyte's share of Monjuvi US sales, accounted for at MOR being the principal for this business 2) Incyte's share of cost of sales related to Monjuvi US sales, accounted for at MOR 3) Incyte's portion of Monjuvi US selling expenses, charged to/accounted for at MOR 4) Valuation effects from Incyte financial liability/asset (actual and planning cash flow adjustments, fx effects, interest expense) 5) Tremfya royalty paid to Royalty Pharma 6) Valuation effects from Royalty Pharma financial liability (actual and planning cash flow adjustments incl. fx effects, interest expense) We supplement the consolidated statement of profit or loss presented in our earnings release with additional information on certain income or expense effects. The consolidated statement of profit or loss as well as the additional information in the earnings call slide deck are prepared in accordance with International Financial Reporting Standards (IFRS). The additional information relates to the contracts with Incyte and Royalty Pharma, namely to the accounting for the US co- commercialization with Incyte and the financing provided by Royalty Pharma which resulted in financial liabilities for payments owed to Royalty Pharma in future periods. The related effects are presented in two separate columns for various lines item of the consolidated statement of profit or loss. We believe this more detailed information provides additional insights into the financial performance of MorphoSys Group. The information given is in addition to, not a substitute for, or superior to, the measures of financial performance prepared in accordance with IFRS.

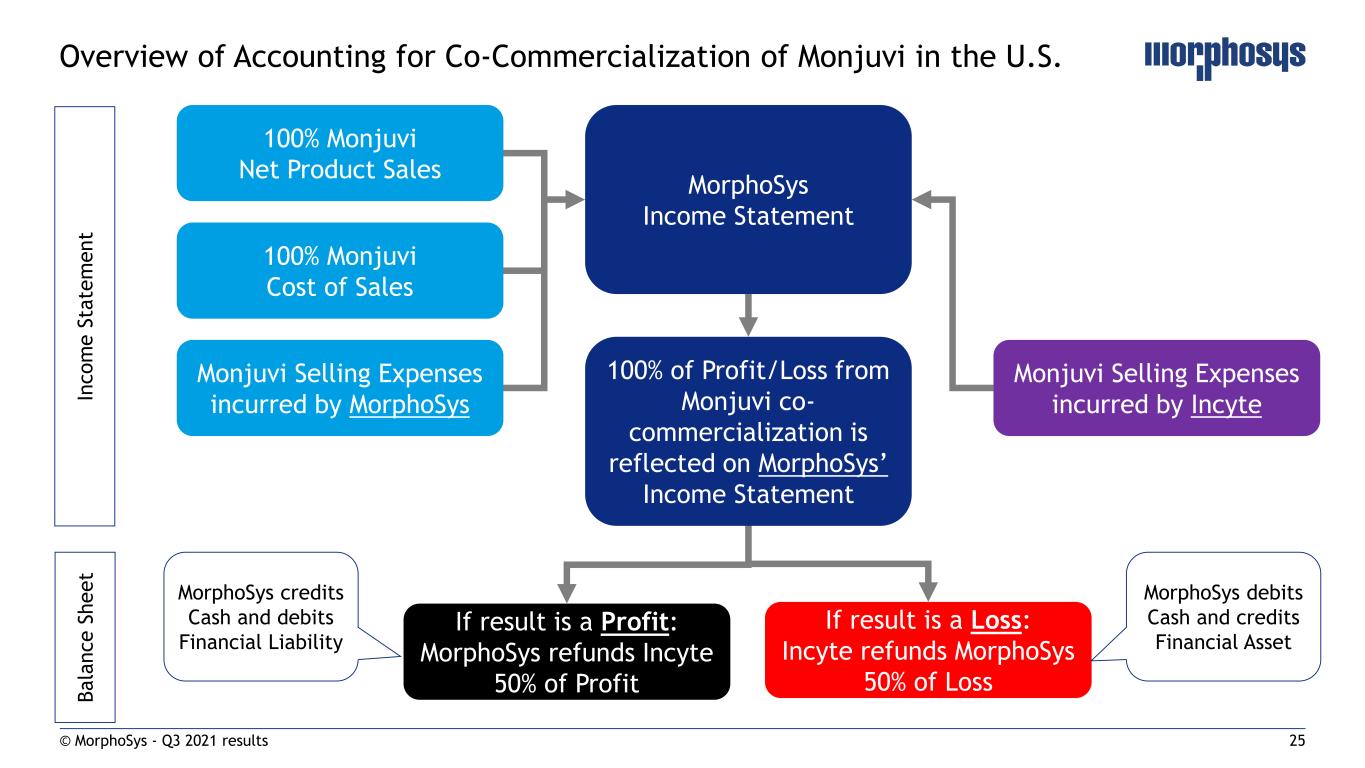

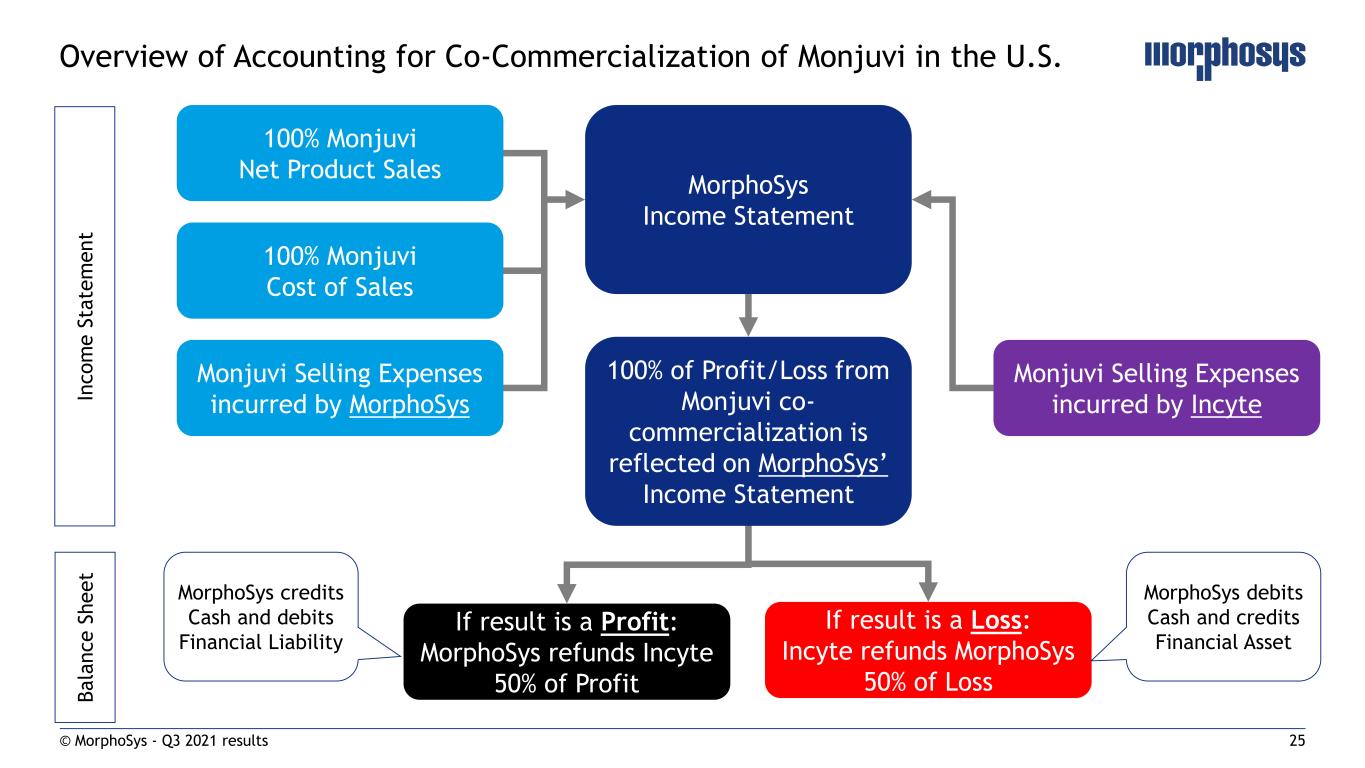

25© MorphoSys - Q3 2021 results Overview of Accounting for Co-Commercialization of Monjuvi in the U.S. 100% of Profit/Loss from Monjuvi co- commercialization is reflected on MorphoSys’ Income Statement 100% Monjuvi Net Product Sales 100% Monjuvi Cost of Sales Monjuvi Selling Expenses incurred by MorphoSys Monjuvi Selling Expenses incurred by Incyte MorphoSys Income Statement If result is a Loss: Incyte refunds MorphoSys 50% of Loss If result is a Profit: MorphoSys refunds Incyte 50% of Profit In c o m e S ta te m e n t B a la n c e S h e e t MorphoSys credits Cash and debits Financial Liability MorphoSys debits Cash and credits Financial Asset