Q3 2023 Results & Business Update November 16, 2023

This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including the expectations regarding Monjuvi's ability to treat patients with relapsed or refractory diffuse large B-cell lymphoma ("DLBCL"), the further clinical development of tafasitamab, including ongoing confirmatory trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi. The words "anticipate", "believe", "estimate", "expect", "intend", "may", "plan", "predict", "project", "would", "could", "potential", "possible", "hope" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys' results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are MorphoSys' expectations regarding risks and uncertainties related to the impact of the COVID-19 pandemic to MorphoSys' business, operations, strategy, goals and anticipated milestones, including its ongoing and planned research activities, ability to conduct ongoing and planned clinical trials, clinical supply of current or future drug candidates, commercial supply of current or future approved products, and launching, marketing and selling current or future approved products, the global collaboration and license agreement for tafasitamab, the further clinical development of tafasitamab, including ongoing confirmatory trials, and MorphoSys' ability to obtain and maintain requisite regulatory approvals and to enroll patients in its planned clinical trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi, MorphoSys' reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys' Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi® and tafasitamab/Minjuvi® in relapsed or refractory DLBCL). The safety and efficacy of these investigational products have not been established and there is no guarantee any investigational product will be approved by regulatory authorities. Monjuvi® and Minjuvi® are registered trademarks of MorphoSys AG. Forward-Looking Statements 2© MorphoSys – Q3 2023 Results

3 Agenda 01 Q3 2023 Highlights & Outlook Jean-Paul Kress, M.D., Chief Executive Officer (CEO) 02 Development Update Tim Demuth, M.D., Ph.D., Chief Research & Development Officer (CR&DO) 03 Financial Results & Guidance Lucinda Crabtree, Ph.D., Chief Financial Officer (CFO) 04 Q&A Jean-Paul Kress, Tim Demuth, Lucinda Crabtree © MorphoSys – Q3 2023 Results

Q3 2023 Highlights & Outlook 01 © MorphoSys – Q3 2023 Results Jean-Paul Kress, M.D. CEO

5 MANIFEST-2 Topline Results BY END OF NOVEMBER DECEMBER 10 MANIFEST-2 Detailed Results: Oral Presentation at ASH 2023 © MorphoSys – Q3 2023 Results

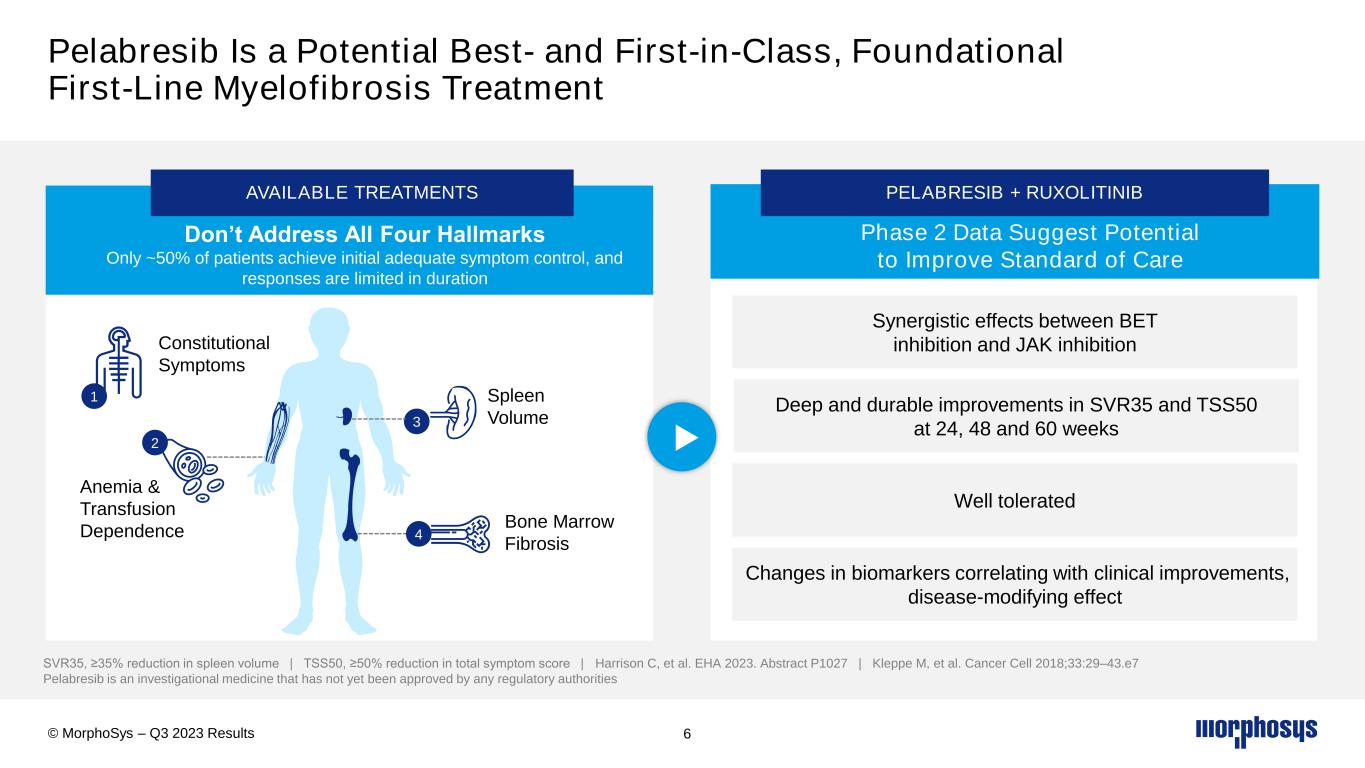

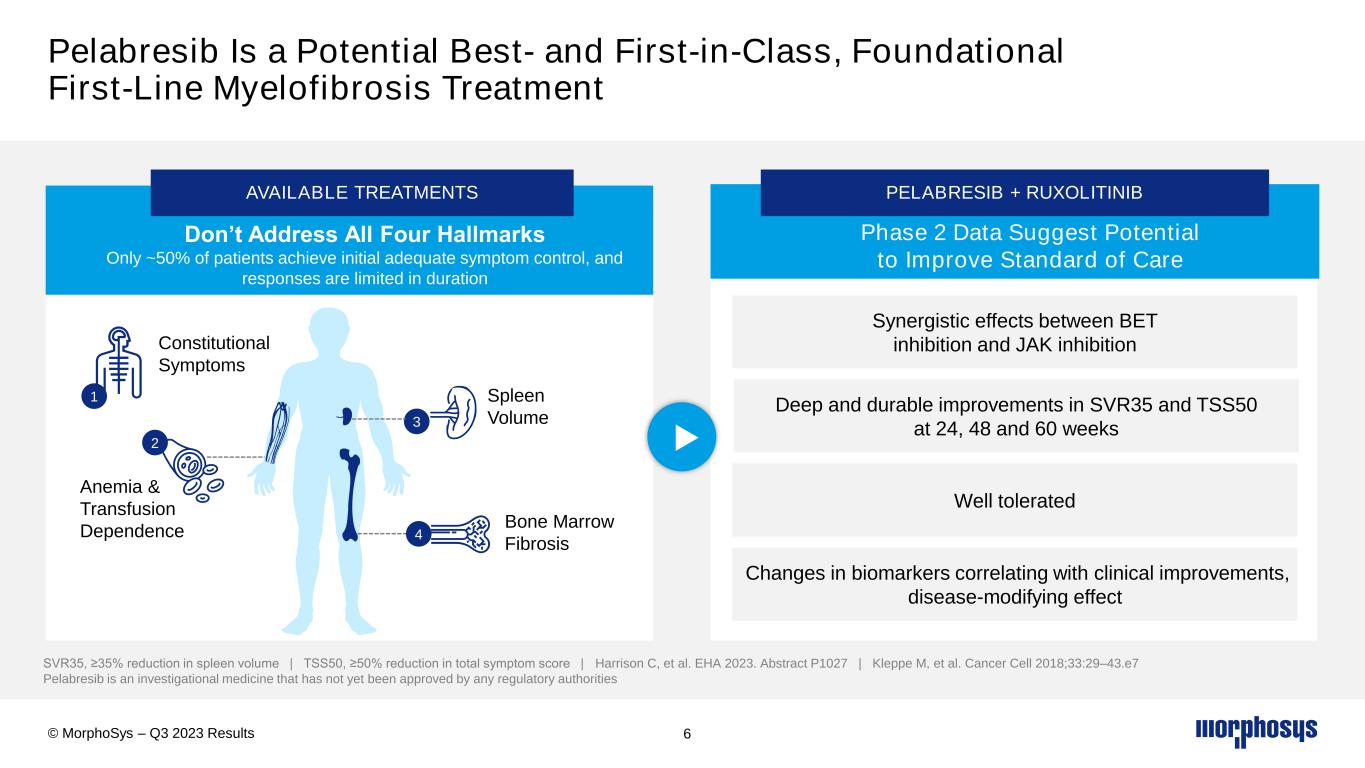

6 Spleen Volume Anemia & Transfusion Dependence Bone Marrow Fibrosis Constitutional Symptoms Don’t Address All Four Hallmarks Only ~50% of patients achieve initial adequate symptom control, and responses are limited in duration AVAILABLE TREATMENTS 1 2 3 SVR35, ≥35% reduction in spleen volume | TSS50, ≥50% reduction in total symptom score | Harrison C, et al. EHA 2023. Abstract P1027 | Kleppe M, et al. Cancer Cell 2018;33:29–43.e7 Pelabresib is an investigational medicine that has not yet been approved by any regulatory authorities 4 Phase 2 Data Suggest Potential to Improve Standard of Care PELABRESIB + RUXOLITINIB Pelabresib Is a Potential Best- and First-in-Class, Foundational First-Line Myelofibrosis Treatment Synergistic effects between BET inhibition and JAK inhibition Changes in biomarkers correlating with clinical improvements, disease-modifying effect Deep and durable improvements in SVR35 and TSS50 at 24, 48 and 60 weeks Well tolerated © MorphoSys – Q3 2023 Results

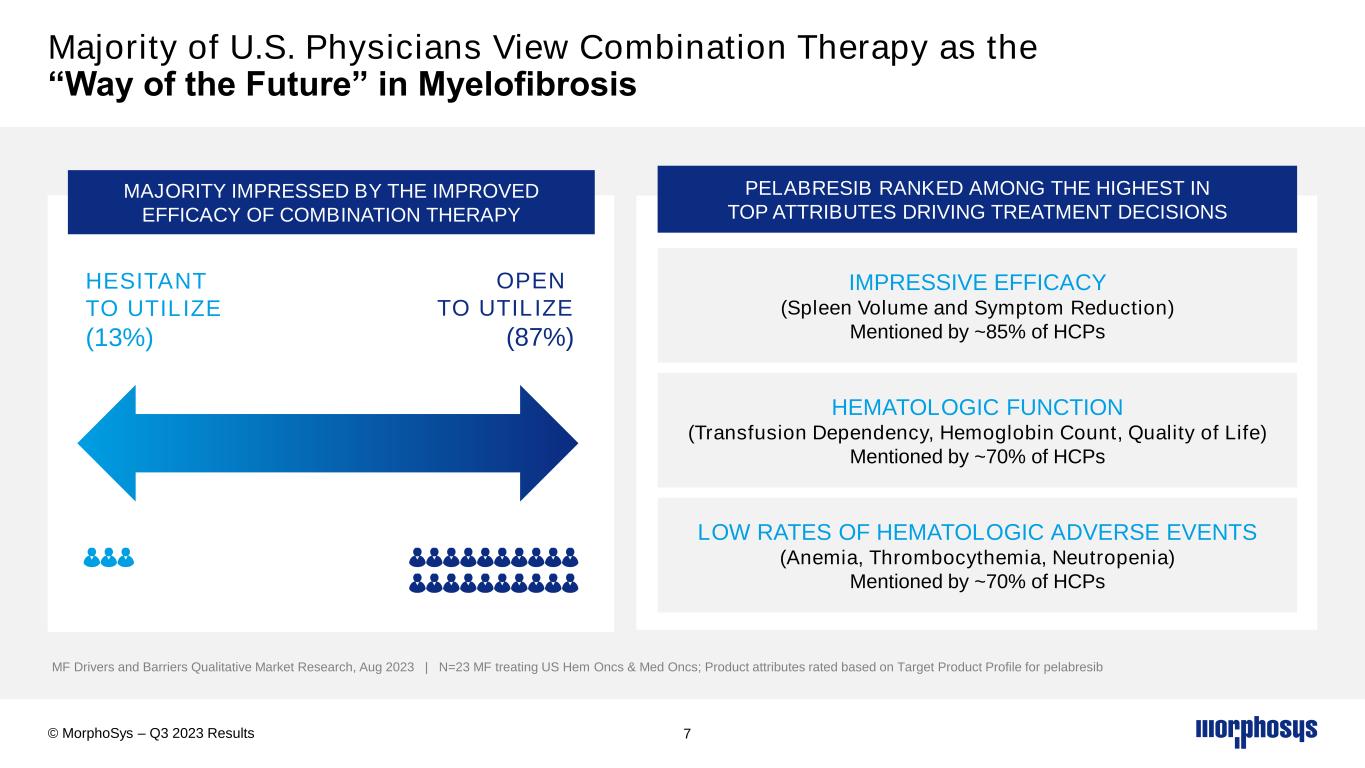

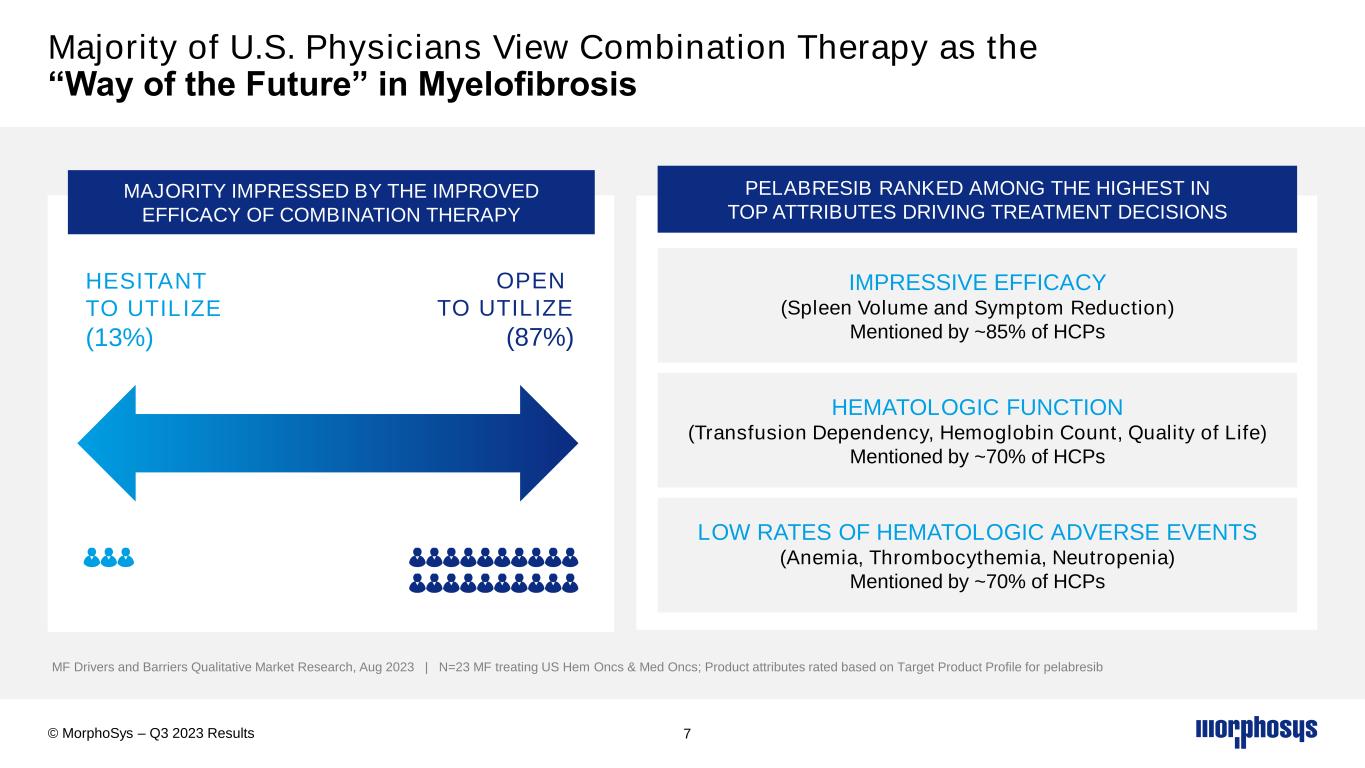

Majority of U.S. Physicians View Combination Therapy as the “Way of the Future” in Myelofibrosis 7 MF Drivers and Barriers Qualitative Market Research, Aug 2023 | N=23 MF treating US Hem Oncs & Med Oncs; Product attributes rated based on Target Product Profile for pelabresib © MorphoSys – Q3 2023 Results OPEN TO UTILIZE (87%) HESITANT TO UTILIZE (13%) MAJORITY IMPRESSED BY THE IMPROVED EFFICACY OF COMBINATION THERAPY PELABRESIB RANKED AMONG THE HIGHEST IN TOP ATTRIBUTES DRIVING TREATMENT DECISIONS IMPRESSIVE EFFICACY (Spleen Volume and Symptom Reduction) Mentioned by ~85% of HCPs HEMATOLOGIC FUNCTION (Transfusion Dependency, Hemoglobin Count, Quality of Life) Mentioned by ~70% of HCPs LOW RATES OF HEMATOLOGIC ADVERSE EVENTS (Anemia, Thrombocythemia, Neutropenia) Mentioned by ~70% of HCPs

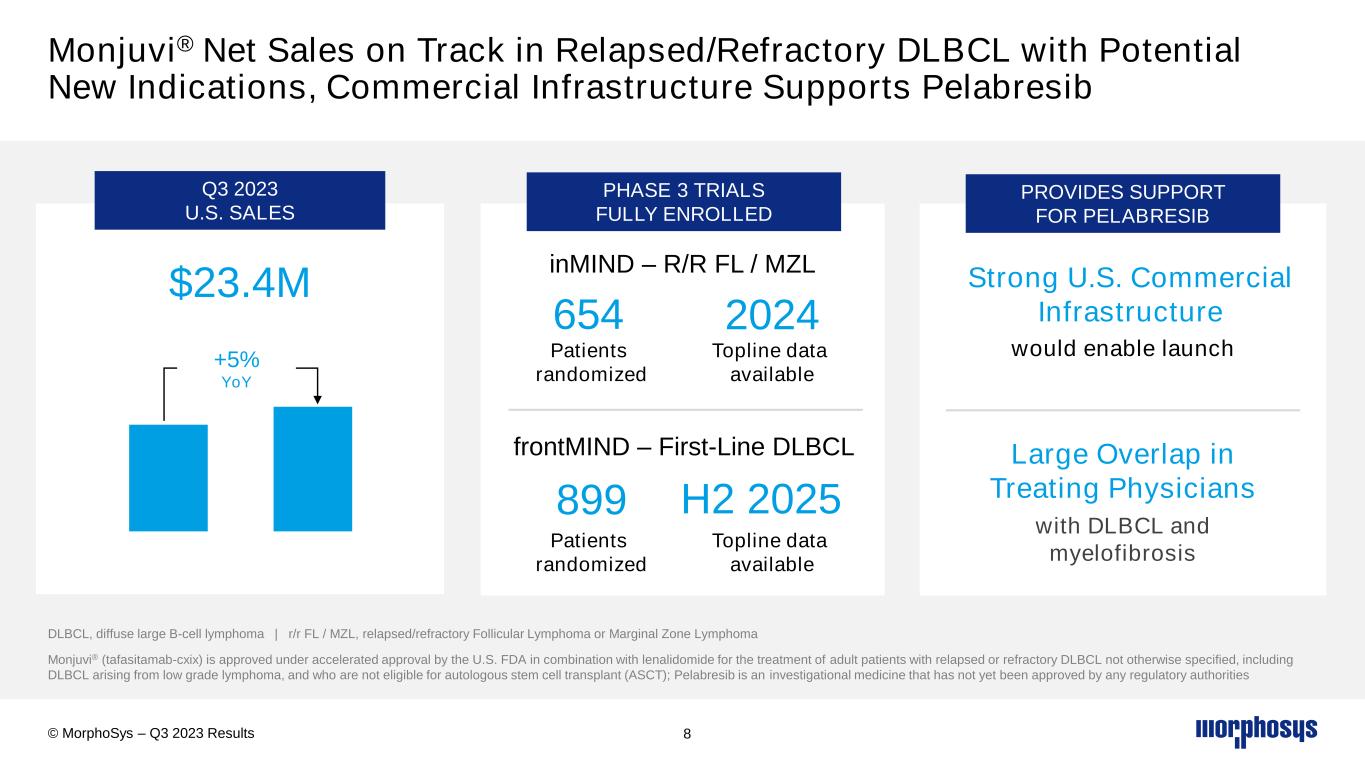

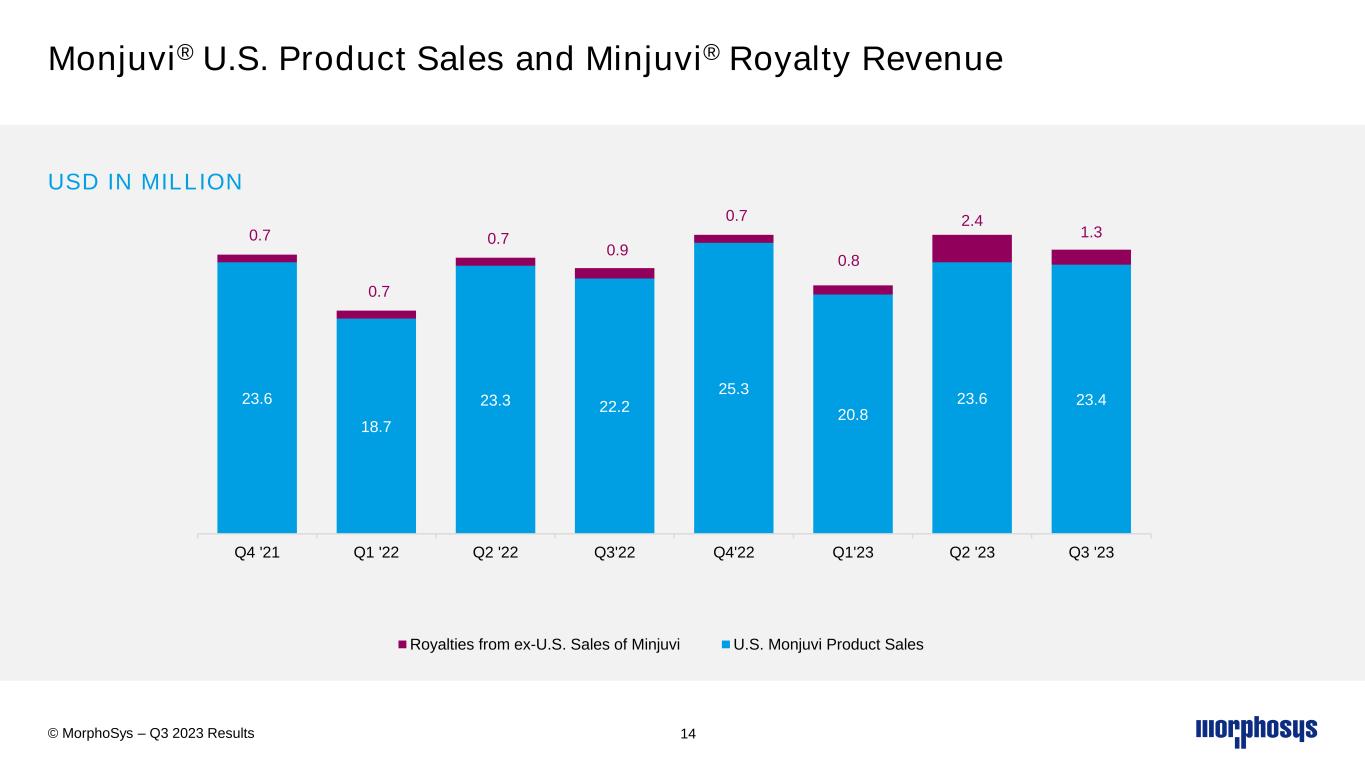

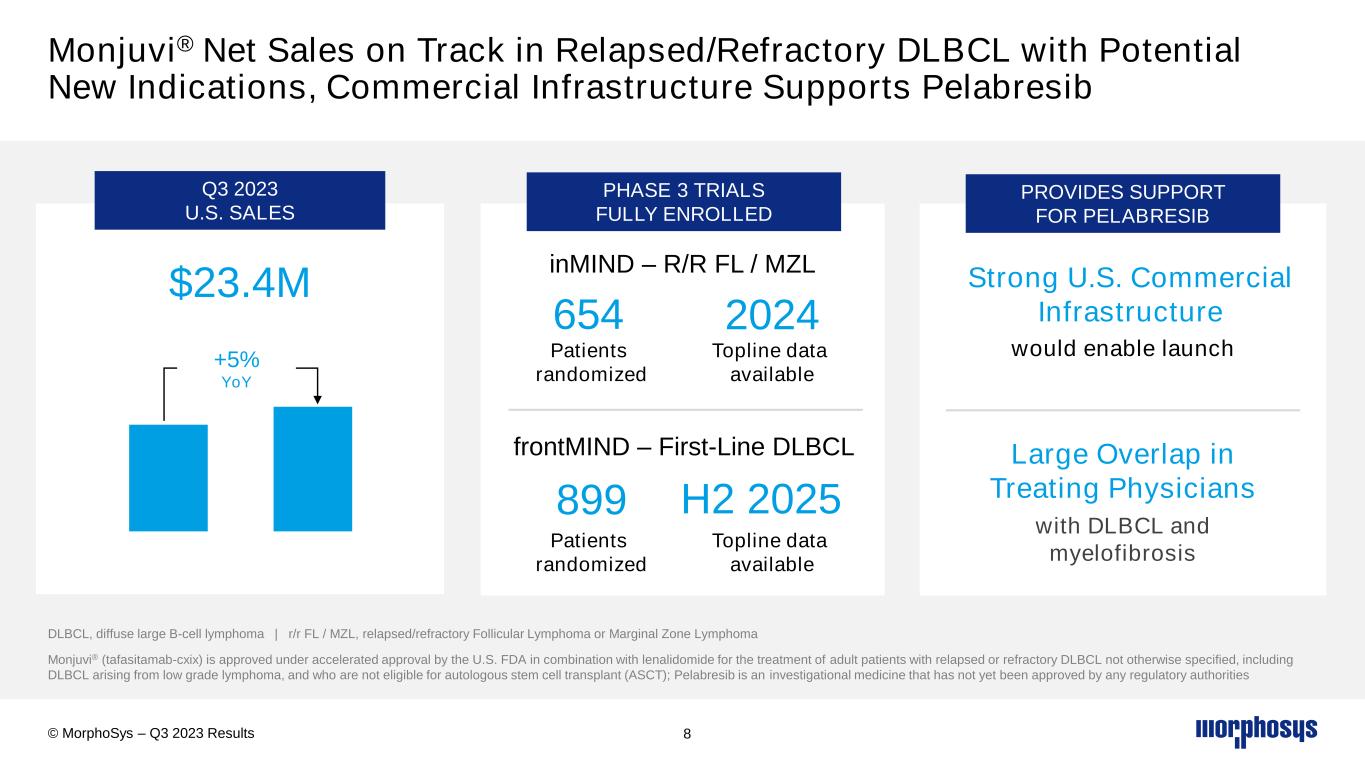

Monjuvi® Net Sales on Track in Relapsed/Refractory DLBCL with Potential New Indications, Commercial Infrastructure Supports Pelabresib 8 Monjuvi® (tafasitamab-cxix) is approved under accelerated approval by the U.S. FDA in combination with lenalidomide for the treatment of adult patients with relapsed or refractory DLBCL not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT); Pelabresib is an investigational medicine that has not yet been approved by any regulatory authorities $23.4M +5% YoY Q3 2023 U.S. SALES PHASE 3 TRIALS FULLY ENROLLED 654 PROVIDES SUPPORT FOR PELABRESIB Strong U.S. Commercial Infrastructure Large Overlap in Treating Physicians with DLBCL and myelofibrosis © MorphoSys – Q3 2023 Results inMIND – R/R FL / MZL 2024 H2 2025 frontMIND – First-Line DLBCL 899 DLBCL, diffuse large B-cell lymphoma | r/r FL / MZL, relapsed/refractory Follicular Lymphoma or Marginal Zone Lymphoma Patients randomized Topline data available Patients randomized Topline data available would enable launch

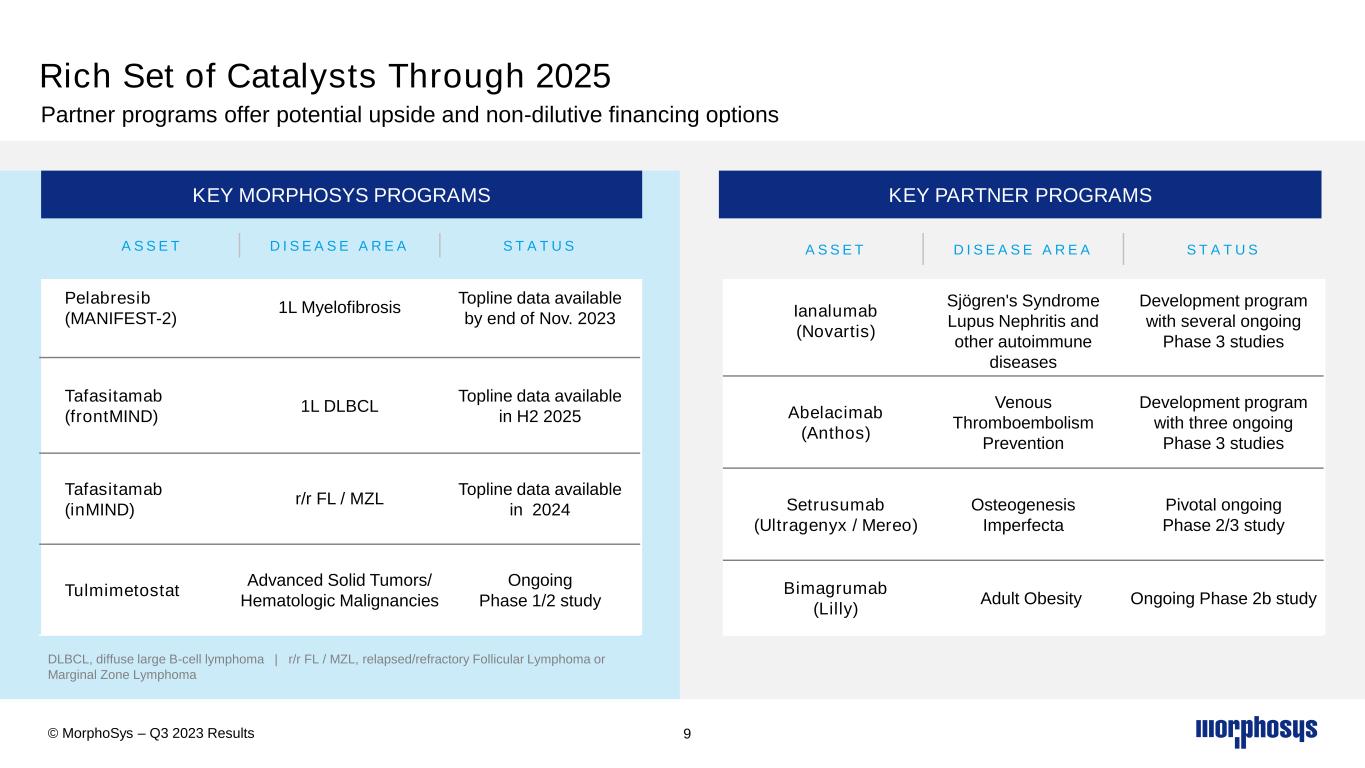

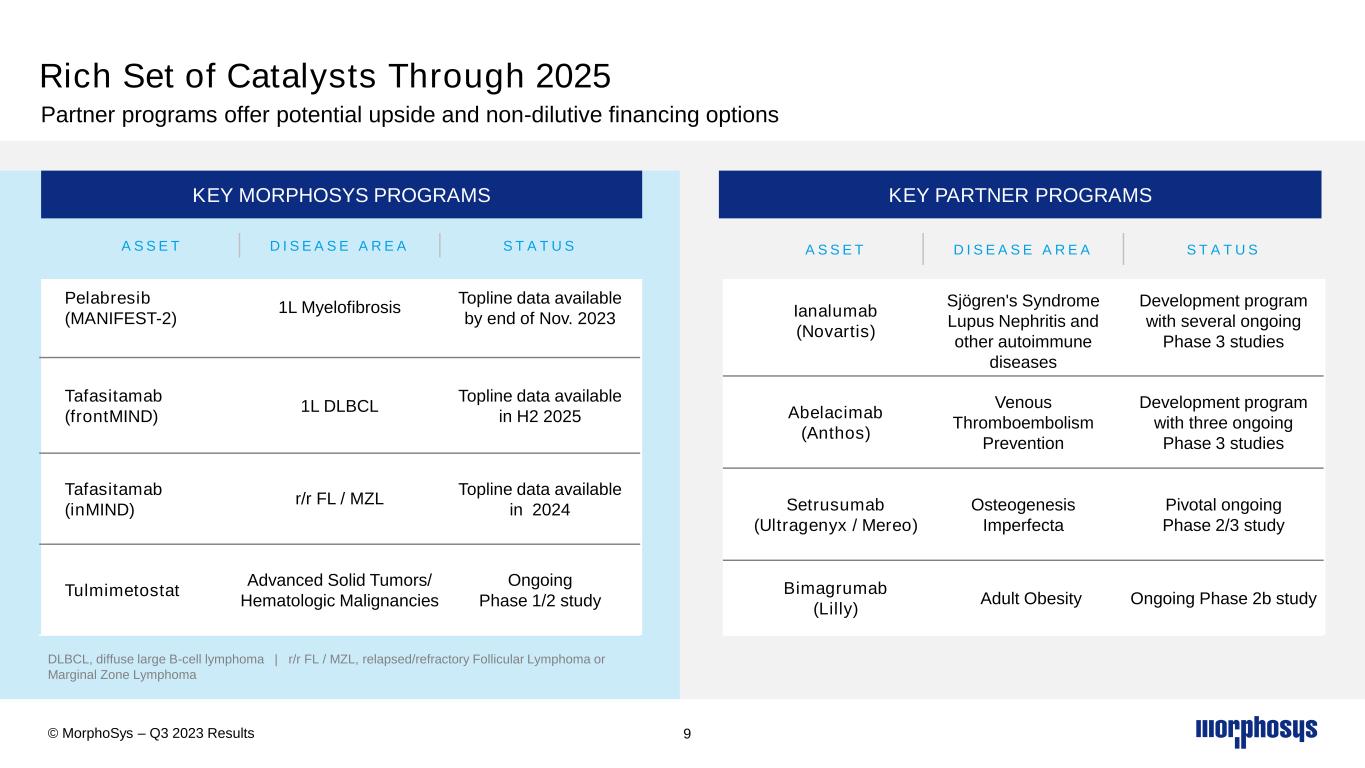

DLBCL, diffuse large B-cell lymphoma | r/r FL / MZL, relapsed/refractory Follicular Lymphoma or Marginal Zone Lymphoma 9 A S S E T D I S E A S E A R E A S T A T U S Pelabresib (MANIFEST-2) 1L Myelofibrosis Topline data available by end of Nov. 2023 Tafasitamab (frontMIND) 1L DLBCL Topline data available in H2 2025 Tafasitamab (inMIND) r/r FL / MZL Topline data available in 2024 Tulmimetostat Advanced Solid Tumors/ Hematologic Malignancies Ongoing Phase 1/2 study A S S E T D I S E A S E A R E A S T A T U S Ianalumab (Novartis) Sjögren's Syndrome Lupus Nephritis and other autoimmune diseases Development program with several ongoing Phase 3 studies Abelacimab (Anthos) Venous Thromboembolism Prevention Development program with three ongoing Phase 3 studies Setrusumab (Ultragenyx / Mereo) Osteogenesis Imperfecta Pivotal ongoing Phase 2/3 study Bimagrumab (Lilly) Adult Obesity Ongoing Phase 2b study KEY MORPHOSYS PROGRAMS KEY PARTNER PROGRAMS Rich Set of Catalysts Through 2025 Partner programs offer potential upside and non-dilutive financing options © MorphoSys – Q3 2023 Results

Development Update 02 © MorphoSys – Q3 2023 Results Tim Demuth, M.D., Ph.D. CR&DO

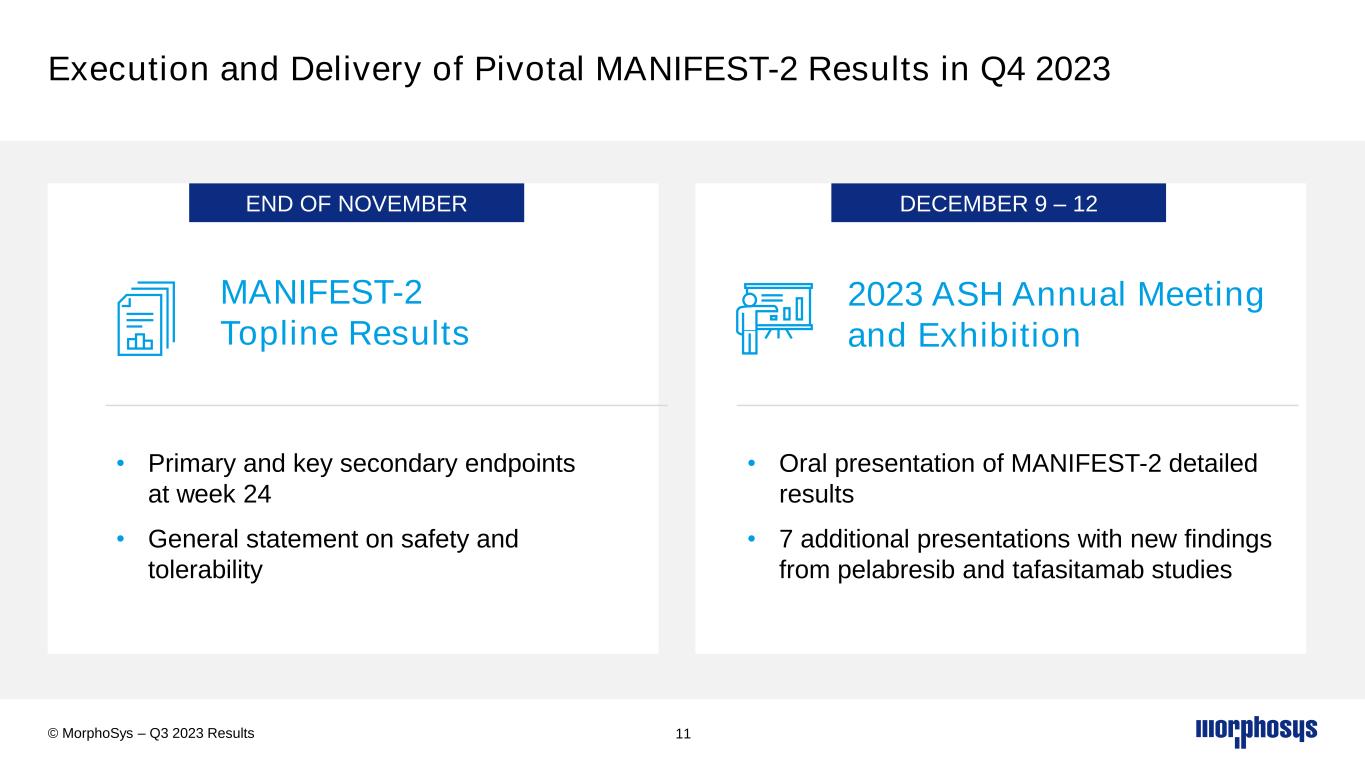

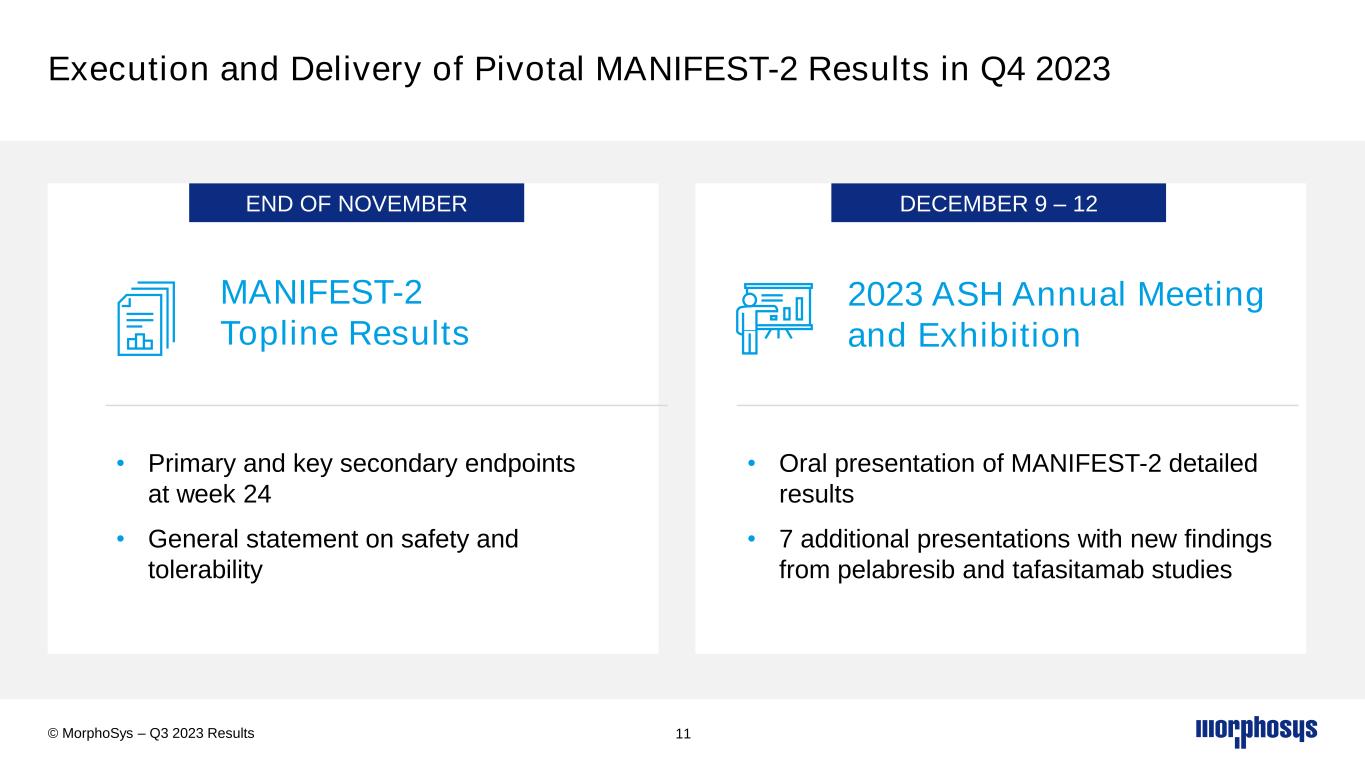

Execution and Delivery of Pivotal MANIFEST-2 Results in Q4 2023 11 • Oral presentation of MANIFEST-2 detailed results • 7 additional presentations with new findings from pelabresib and tafasitamab studies MANIFEST-2 Topline Results 2023 ASH Annual Meeting and Exhibition • Primary and key secondary endpoints at week 24 • General statement on safety and tolerability END OF NOVEMBER DECEMBER 9 – 12 © MorphoSys – Q3 2023 Results

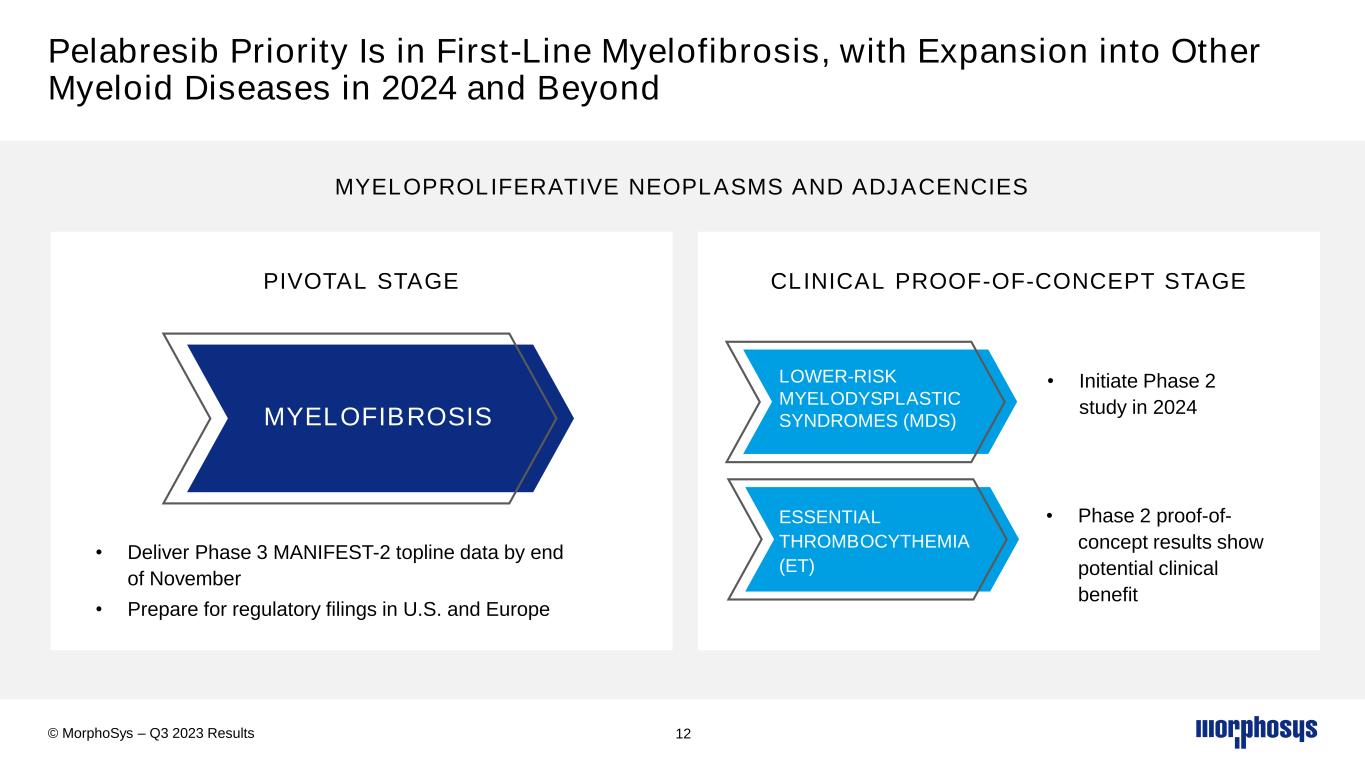

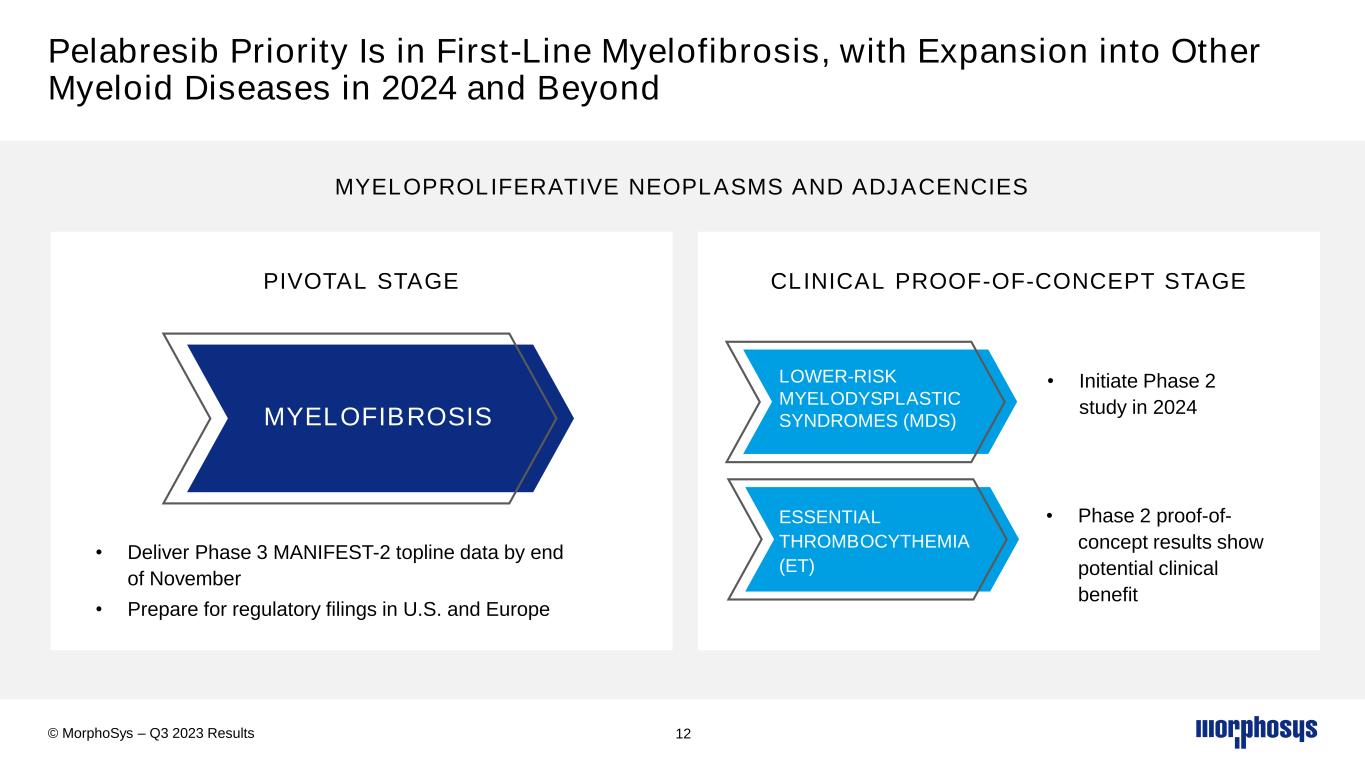

Pelabresib Priority Is in First-Line Myelofibrosis, with Expansion into Other Myeloid Diseases in 2024 and Beyond v v PIVOTAL STAGE CLINICAL PROOF-OF-CONCEPT STAGE 12 MYELOPROLIFERATIVE NEOPLASMS AND ADJACENCIES • Initiate Phase 2 study in 2024 • Phase 2 proof-of- concept results show potential clinical benefit LOWER-RISK MYELODYSPLASTIC SYNDROMES (MDS) ESSENTIAL THROMBOCYTHEMIA (ET) MYELOFIBROSIS • Deliver Phase 3 MANIFEST-2 topline data by end of November • Prepare for regulatory filings in U.S. and Europe © MorphoSys – Q3 2023 Results

03 Financial Results & Guidance © MorphoSys – Q3 2023 Results Lucinda Crabtree, Ph.D. CFO

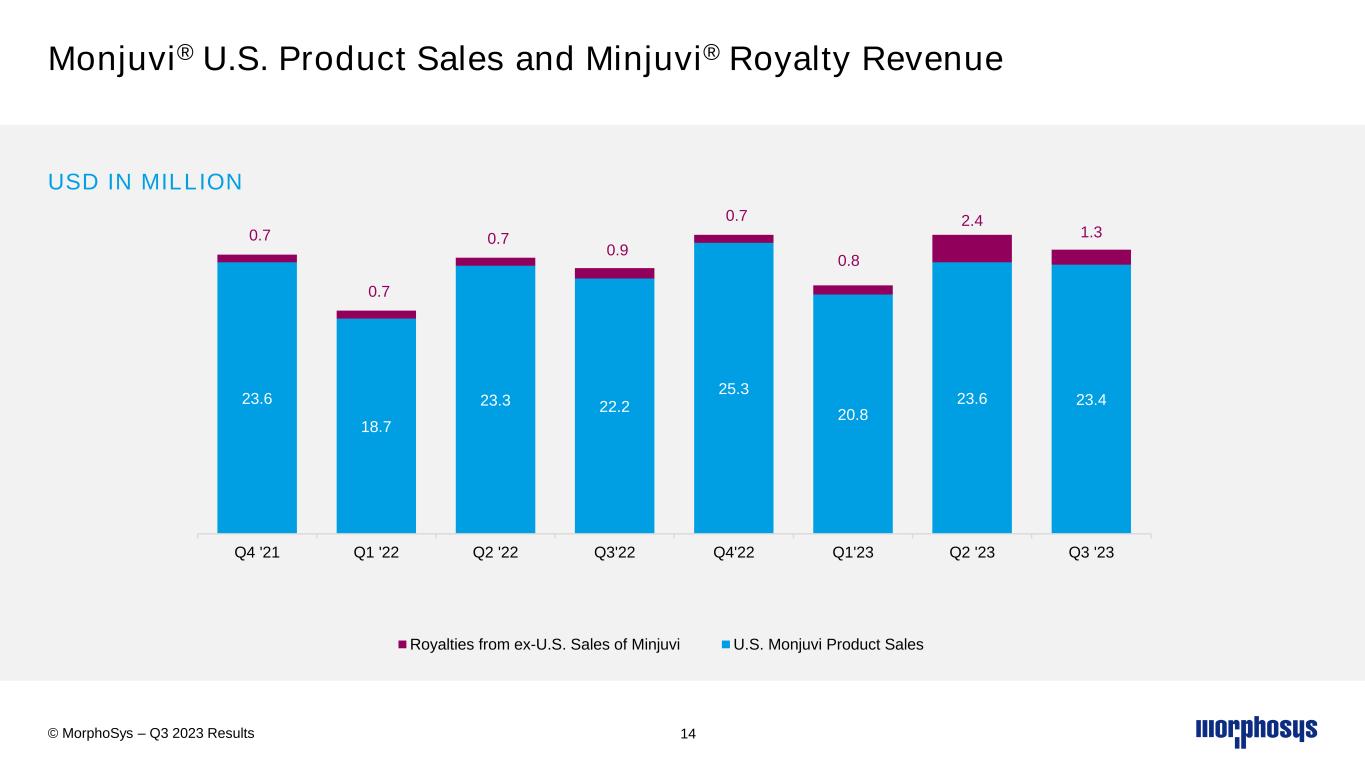

Monjuvi® U.S. Product Sales and Minjuvi® Royalty Revenue 14 23.6 18.7 23.3 22.2 25.3 20.8 23.6 23.4 0.7 0.7 0.7 0.9 0.7 0.8 2.4 1.3 Q4 '21 Q1 '22 Q2 '22 Q3'22 Q4'22 Q1'23 Q2 '23 Q3 '23 Royalties from ex-U.S. Sales of Minjuvi U.S. Monjuvi Product Sales USD IN MILLION © MorphoSys – Q3 2023 Results

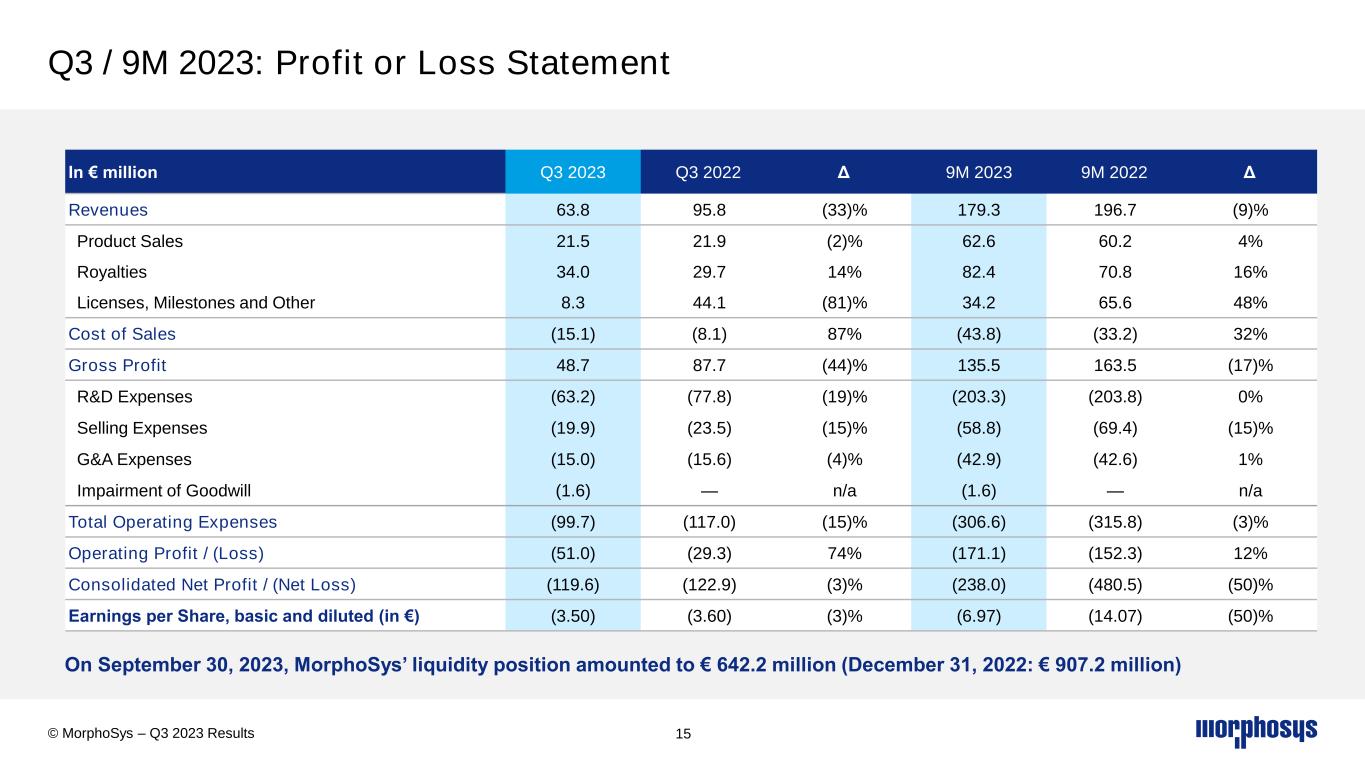

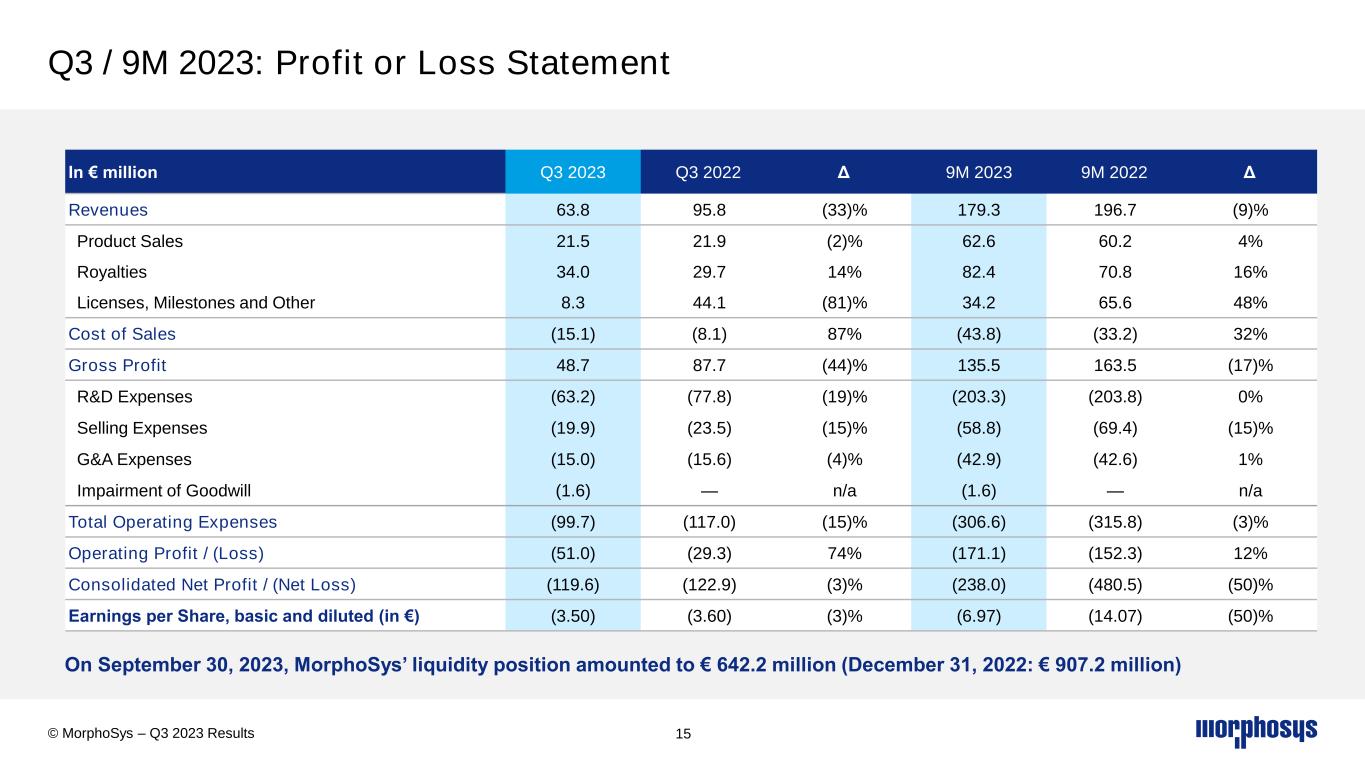

On September 30, 2023, MorphoSys’ liquidity position amounted to € 642.2 million (December 31, 2022: € 907.2 million) In € million Q3 2023 Q3 2022 Δ 9M 2023 9M 2022 Δ Revenues 63.8 95.8 (33)% 179.3 196.7 (9)% Product Sales 21.5 21.9 (2)% 62.6 60.2 4% Royalties 34.0 29.7 14% 82.4 70.8 16% Licenses, Milestones and Other 8.3 44.1 (81)% 34.2 65.6 48% Cost of Sales (15.1) (8.1) 87% (43.8) (33.2) 32% Gross Profit 48.7 87.7 (44)% 135.5 163.5 (17)% R&D Expenses (63.2) (77.8) (19)% (203.3) (203.8) 0% Selling Expenses (19.9) (23.5) (15)% (58.8) (69.4) (15)% G&A Expenses (15.0) (15.6) (4)% (42.9) (42.6) 1% Impairment of Goodwill (1.6) — n/a (1.6) — n/a Total Operating Expenses (99.7) (117.0) (15)% (306.6) (315.8) (3)% Operating Profit / (Loss) (51.0) (29.3) 74% (171.1) (152.3) 12% Consolidated Net Profit / (Net Loss) (119.6) (122.9) (3)% (238.0) (480.5) (50)% Earnings per Share, basic and diluted (in €) (3.50) (3.60) (3)% (6.97) (14.07) (50)% Q3 / 9M 2023: Profit or Loss Statement 15© MorphoSys – Q3 2023 Results

Financial Guidance Full-Year 2023 16 Monjuvi U.S. Net Product Sales US$ 85M – 95M Gross Margin for Monjuvi U.S. Net Product Sales Approx. 75% R&D Expenses € 290M – 315M SG&A Expenses € 140M – 155M © MorphoSys – Q3 2023 Results

Q&A Tim Demuth, M.D., Ph.D. CR&DO 04 Jean-Paul Kress, M.D. CEO © MorphoSys – Q3 2023 Results Lucinda Crabtree, Ph.D. CFO

Thank you! www.MorphoSys.com © MorphoSys – Q3 2023 Results