Half-Year Report JANUARY – JUNE 2024

Contents MorphoSys Group: Half-Year Report January – June 2024 3 Summary 6 Interim Group Management Report 6 Operating Business Performance 11 Strategy and Group Management 11 General Business and Market Environment 12 Intellectual Property 12 Human Resources 12 Financial Analysis 19 Interim Consolidated Financial Statements 19 Consolidated Statement of Profit or Loss (IFRS) 20 Consolidated Statement of Comprehensive Income (IFRS) 21 Consolidated Balance Sheet (IFRS) 23 Consolidated Statement of Changes in Stockholder’s Equity (IFRS) 25 Consolidated Statement of Cash Flows (IFRS) 27 Notes to the Consolidated Financial Statements 2 Group Interim Statement MorphoSys – II/2024

Summary of the Second Quarter of 2024 Corporate Developments • On February 5, 2024, MorphoSys announced that it entered into a Business Combination Agreement with Novartis BidCo AG (formerly trading as Novartis data42 AG) and Novartis AG according to which Novartis BidCo AG intended to submit a voluntary public takeover offer for all of MorphoSys’ outstanding common shares in exchange for payment of € 68.00 per share. The corresponding voluntary public takeover offer was then published on April 11, 2024, by Novartis BidCo AG at an offer price of € 68.00 per MorphoSys share following approval by the German Federal Financial Supervisory Authority (BaFin) on April 11, 2024. • Separately, MorphoSys entered into a purchase agreement (the "Purchase Agreement") with Incyte Corporation ("Incyte") to sell and transfer to Incyte all rights worldwide related to tafasitamab for a purchase price of US$ 25.0 million. MorphoSys and Incyte have been collaborating on the development and commercialization of tafasitamab since 2020. Prior to this agreement, tafasitamab was co-marketed in the U.S. by MorphoSys and Incyte as Monjuvi® (tafasitamab-cxix) and outside the U.S. by Incyte as Minjuvi®. • On March 22, 2024, MorphoSys announced the receipt of the last outstanding antitrust clearance in the U.S. in connection with takover offer of Novartis BidCo AG, following the receipt of antitrust clearance in Germany and Austria. • The acceptance period of the takeover offer of Novartis BidCo AG ended on May 13, 2024, and the additional acceptance period ended on May 30, 2024. Until expiration of the acceptance period on May 13, 2024, 25,610,813 MorphoSys shares were tendered, with the transfer of these MorphoSys shares to Novartis BidCo AG being completed on May 23, 2024. As a result, Novartis BidCo AG became the majority shareholder of MorphoSys, making MorphoSys a part of the Novartis Group. Together with the MorphoSys shares tendered during the additional acceptance period, ultimately 29,336,378 MorphoSys shares (corresponding to approximately 77.78% of the share capital of MorphoSys and approximately 77.89% of the voting share capital of MorphoSys) were tendered and transferred to Novartis BidCo AG in the course of the takeover offer. Through further acquisitions until June 16, 2024, Novartis BidCo AG has increased its stake in MorphoSys to 34,337,809 MorphoSys shares (corresponding to approximately 91.04% of the share capital, or approximately 91.17% of the voting share capital of MorphoSys). • On May 22, 2024, Biogen Inc. (Biogen) and Human Immunology Biosciences (HI-Bio), in which MorphoSys holds an investment in associates announced that the companies have entered into an agreement which stipulates that Biogen will acquire HI-Bio for US$ 1.15 billion (€ 1.07 billion) upfront and up to US$ 650 million (€ 607 million) in potential milestone payments. HI-Bio is investigating felzartamab which was originally developed by MorphoSys. The acquisition has been completed in July 2024. More details can be found in the section "Subsequent Events". • Following the closing of the takeover offer by Novartis BidCo AG to the shareholders of MorphoSys AG and the resignation of Marc Cluzel, M.D., Ph.D., George Golumbeski, Ph.D., Krisja Vermeylen, Michael Brosnan and Andrew Cheng, M.D., Ph.D. as members of the Supervisory Board, the Munich Local Court appointed Heinrich Moisa, Romain Lege and Silke Mainka as new members of the Supervisory Board. The newly composed Supervisory Board held its first meeting on June 6, 2024, and resolved to appoint Arkadius Pichota, Ph.D., and Lukas Gilgen as new members of the management board. Arkadius Pichota, Ph.D., who previously served as President, General Manager and Chairman of the Board of the Novartis company Navigate BioPharma Services, Inc., has been appointed as the new CEO, and Lukas Gilgen, who previously Group Interim Statement 3 MorphoSys – II/2024

served as Transaction Lead Enterprise Projects with Novartis International AG, has been appointed as the new CFO. At the same time, the membership of Jean-Paul Kress, M.D., and Lucinda Crabtree, Ph.D., on the Management Board ended on June 6, 2024. Heinrich Moisa, Romain Lege, Silke Mainka and Christian Diehl were proposed to the Annual General Meeting of MorphoSys convoked for August 27, 2024, for election as members of the Supervisory Board. • On June 20, 2024, MorphoSys announced that the company has entered into a delisting agreement with Novartis AG and Novartis BidCo AG in which it was agreed that Novartis BidCo AG publishes a public delisting purchase offer for all outstanding ordinary shares of MorphoSys not held by Novartis companies. Furthermore, on June 20, 2024 Novartis BidCo Germany AG, a subsidiary of Novartis BidCo AG informed MorphoSys of its intention to merge MorphoSys into Novartis BidCo Germany, Munich by initiating a squeeze-out of MorphoSys’ minority shareholders following the transfer of Novartis BidCo AG’s stake in MorphoSys of 34,337,809 MorphoSys shares (corresponding to approximately 91.04% of the share capital of MorphoSys) to Novartis BidCo Germany AG on June 19, 2024. R&D Highlights of the Second Quarter of 2024 • On May 31, 2024, MorphoSys presented new efficacy and safety data from the Phase 3 MANIFEST-2 trial of pelabresib, an investigational BET inhibitor, in combination with the JAK inhibitor ruxolitinib in JAK inhibitor-naïve patients with myelofibrosis during an oral presentation at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting. • On June 1, 2024, new data from the Phase 2 study of tulmimetostat, an investigational next-generation dual inhibitor of EZH2 and EZH1, in patients with advanced solid tumors or hematologic malignancies have been showcased in a poster presentation at ASCO 2024. Financial Results for the First Half-Year of 2024 • The financial results presented for the first half-year of 2024 related to continued business operations of MorphoSys and the figures in connection with "Discontinued Operations and Assets Held for Sale". Due to the announcement on February 5, 2024, to sell and transfer tafasitamab to Incyte, the entire tafasitamab business has been classified as discontinued operations in accordance with IFRS 5. Furthermore, on May 22, 2024 Biogen Inc. headquartered in Cambridge, Massachusetts, USA, announced that it had entered into an agreement to acquire Human Immunology Bioscience (HI-Bio). The share in HI-Bio is now classified as "held for sale" by MorphoSys and presented separately. Consequently, the figures reported for the first half-year of 2023 were adapted due to these changes in presentation. • Group revenues from continued operations amounted to € 62.2 million (H1 2023: € 50.9 million) and mainly included revenues from royalties and to a smaller extent from milestones. • Research and development expenses in the first half-year of 2024 amounted to € 134.8 million (H1 2023: € 105.0 million). In the first half-year of 2024 the combined expenses for selling and general and administration totaled € 233.3 million (H1 2023: € 35.5 million). • Cash and other financial assets totaled € 512.3 million as of June 30, 2024 (December 31, 2023: € 680.5 million). • As a consequence of the sale and transfer of tafasitamab to Incyte on February 5, 2024, MorphoSys' 2024 financial guidance published on January 30, 2024, could not be maintained and therefore was revoked. For the time being, MorphoSys will no longer make a forecast for revenues from product sales, as no such revenues are expected to be realized this year. • As a consequence of the Novartis takeover, MorphoSys is now including the effects from the implementation of the takeover in its guidance. Consequently, the Group now expects R&D expenses of € 205 million to € 225 million for the 2024 which mainly represent our investments in the development of pelabresib and tulmimetostat. Selling, administrative and general expenses are now expected to be between € 260 million and € 270 million. 4 Group Interim Statement MorphoSys – II/2024

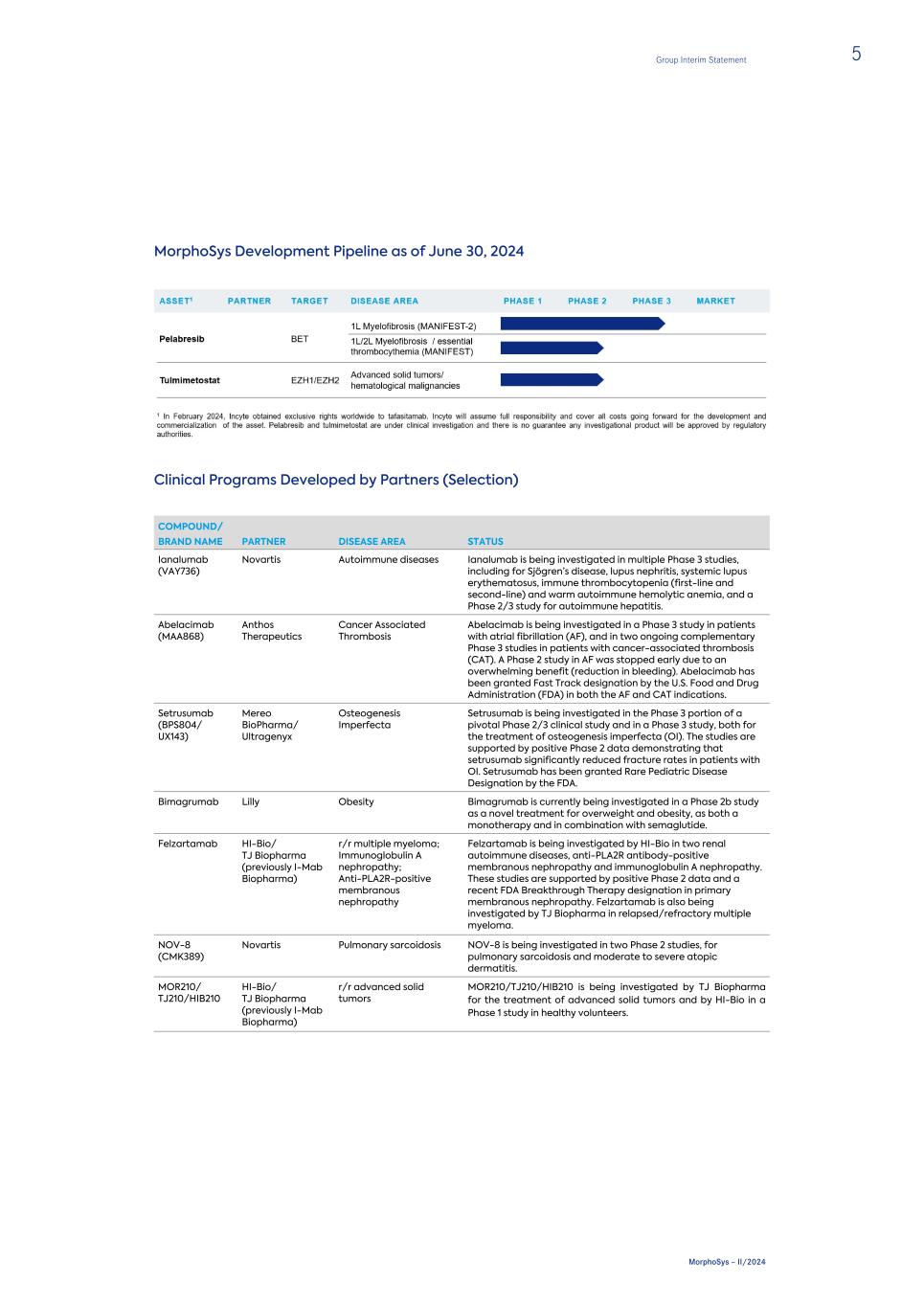

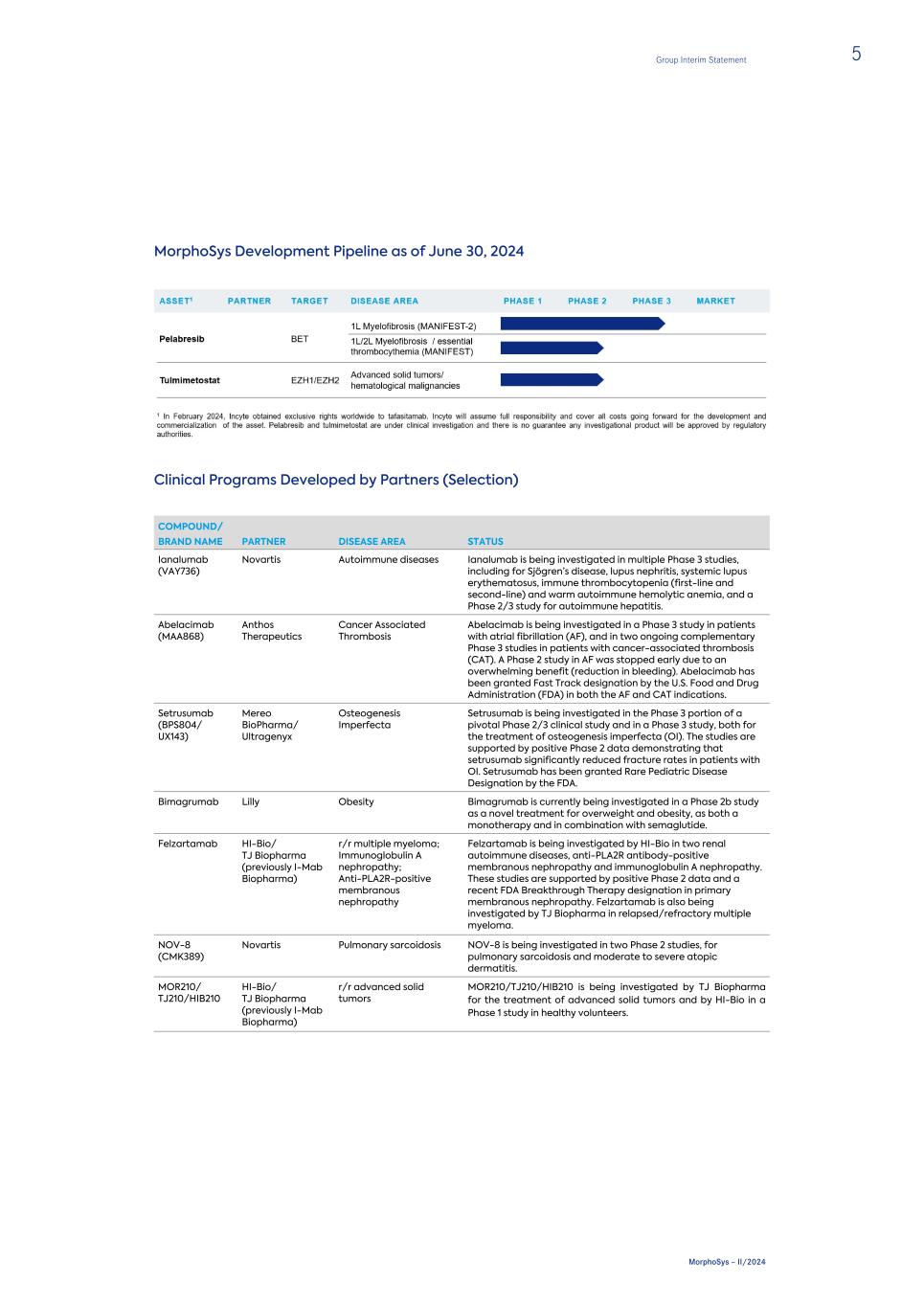

MorphoSys Development Pipeline as of June 30, 2024 Clinical Programs Developed by Partners (Selection) COMPOUND/ BRAND NAME PARTNER DISEASE AREA STATUS Ianalumab (VAY736) Novartis Autoimmune diseases Ianalumab is being investigated in multiple Phase 3 studies, including for Sjögren’s disease, lupus nephritis, systemic lupus erythematosus, immune thrombocytopenia (first-line and second-line) and warm autoimmune hemolytic anemia, and a Phase 2/3 study for autoimmune hepatitis. Abelacimab (MAA868) Anthos Therapeutics Cancer Associated Thrombosis Abelacimab is being investigated in a Phase 3 study in patients with atrial fibrillation (AF), and in two ongoing complementary Phase 3 studies in patients with cancer-associated thrombosis (CAT). A Phase 2 study in AF was stopped early due to an overwhelming benefit (reduction in bleeding). Abelacimab has been granted Fast Track designation by the U.S. Food and Drug Administration (FDA) in both the AF and CAT indications. Setrusumab (BPS804/ UX143) Mereo BioPharma/ Ultragenyx Osteogenesis Imperfecta Setrusumab is being investigated in the Phase 3 portion of a pivotal Phase 2/3 clinical study and in a Phase 3 study, both for the treatment of osteogenesis imperfecta (OI). The studies are supported by positive Phase 2 data demonstrating that setrusumab significantly reduced fracture rates in patients with OI. Setrusumab has been granted Rare Pediatric Disease Designation by the FDA. Bimagrumab Lilly Obesity Bimagrumab is currently being investigated in a Phase 2b study as a novel treatment for overweight and obesity, as both a monotherapy and in combination with semaglutide. Felzartamab HI-Bio/ TJ Biopharma (previously I-Mab Biopharma) r/r multiple myeloma; Immunoglobulin A nephropathy; Anti-PLA2R-positive membranous nephropathy Felzartamab is being investigated by HI-Bio in two renal autoimmune diseases, anti-PLA2R antibody-positive membranous nephropathy and immunoglobulin A nephropathy. These studies are supported by positive Phase 2 data and a recent FDA Breakthrough Therapy designation in primary membranous nephropathy. Felzartamab is also being investigated by TJ Biopharma in relapsed/refractory multiple myeloma. NOV-8 (CMK389) Novartis Pulmonary sarcoidosis NOV-8 is being investigated in two Phase 2 studies, for pulmonary sarcoidosis and moderate to severe atopic dermatitis. MOR210/ TJ210/HIB210 HI-Bio/ TJ Biopharma (previously I-Mab Biopharma) r/r advanced solid tumors MOR210/TJ210/HIB210 is being investigated by TJ Biopharma for the treatment of advanced solid tumors and by HI-Bio in a Phase 1 study in healthy volunteers. Group Interim Statement 5 MorphoSys – II/2024

Interim Group Management Report: January 1 – June 30, 2024 Operating Business Performance MorphoSys AG (hereinafter also referred as "MorphoSys") focuses on advancing product candidates at various stages of development, positioning itself for long-term sustainable growth. The key measures of value for MorphoSys’ development activities include: • Advancement of development programs and product approvals • Clinical trial results • Regulatory interactions with (or feedback from) health authorities regarding the approval of new drug candidates or of marketed drugs for additional indications • Strong patent protection to secure MorphoSys’ market position Research and Development MorphoSys’ research and development activities are currently focused on the following clinical candidates: • Pelabresib1 (CPI-0610) is an investigational selective small-molecule BET inhibitor designed to promote anti-tumor activity by specifically inhibiting the function of BET proteins. The clinical development of pelabresib is currently focused on myelofibrosis (MF). MF is a form of bone marrow cancer that disrupts the body's normal production of blood cells and is characterized by four hallmarks: an enlarged spleen, anemia, bone marrow fibrosis and disease-associated symptoms. • Tulmimetostat (CPI‑0209) is an investigational small-molecule, second-generation dual EZH2 and EZH1 inhibitor with an epigenetic mechanism of action. Tulmimetostat was designed to improve on first generation EZH2 inhibitors through increased potency, longer residence time on target and a longer half- life, offering the potential for enhanced anti-tumor activity. Tulmimetostat is being investigated in a basket study of solid tumors and lymphomas. In addition to MorphoSys’ own pipeline, the following programs, among others, are being further developed by MorphoSys’ partners: • Ianalumab (VAY736) – a fully human IgG1/k mAb with a dual mode of action targeting B-cell lysis and BAFF-R blockade, developed by Novartis; • Abelacimab (MAA868) – an antibody directed against Factor XI, developed by Anthos Therapeutics; • Setrusumab (BPS804) – an antibody directed against sclerostin, developed by Ultragenyx and Mereo BioPharma; • Bimagrumab - an antibody binding to activin type II receptors, developed by Lilly; • Felzartamab – a therapeutic human monoclonal antibody directed against CD38, developed by HI-Bio and TJ Biopharma (previously I-Mab Biopharma); • MOR210/TJ210/HIB210 – a human antibody directed against C5aR1, the receptor of the complement factor C5a, developed by HI-Bio and TJ Biopharma (previously I-Mab Biopharma). In addition to the late-stage partnered programs listed above, there are several additional partnered programs in early to mid-stage research and development. 6 Group Interim Statement MorphoSys – II/2024 1The development of pelabresib was funded in part by The Leukemia and Lymphoma Society®.

Development of Tafasitamab On February 5, 2024, Incyte obtained exclusive rights worldwide to tafasitamab. Incyte assumes full responsibility and covers all costs going forward for the development and commercialization of the asset. From January 1, 2024 until February 5, 2024, Monjuvi® sales amounted to € 5.9 million and are classified under discontinued operations. Proprietary Clinical Development Studies of Pelabresib There are currently two ongoing trials evaluating pelabresib in myelofibrosis (MF), the Phase 2 MANIFEST trial and the Phase 3 MANIFEST-2 trial. MANIFEST is a global, multicenter, open-label Phase 2 study that evaluates pelabresib as a monotherapy or in combination with ruxolitinib (marketed as Jakafi®/Jakavi®), the current standard of care. MANIFEST‑2 is a global, multicenter, double-blind, randomized Phase 3 clinical study evaluating pelabresib plus ruxolitinib versus placebo plus ruxolitinib in JAK-inhibitor-naïve patients with primary MF or post- essential thrombocythemia (post-ET) or post-polycythemia vera (post-PV) MF who have splenomegaly and symptoms requiring therapy. On November 20, 2023, MorphoSys announced topline results from the Phase 3 MANIFEST-2 study. MANIFEST-2 met its primary endpoint, as the combination therapy demonstrated a statistically significant and clinically meaningful improvement in the proportion of patients achieving at least a 35% reduction in spleen volume (SVR35) at week 24. The key secondary endpoints assessing symptom improvement – proportion of patients achieving at least a 50% reduction in total symptom score (TSS50) and absolute change in total symptom score (TSS) from baseline at week 24 – showed a positive trend favoring the pelabresib and ruxolitinib combination. 430 JAK inhibitor-naïve adult patients with myelofibrosis were randomized for this study. On December 10, 2023, detailed findings of the MANIFEST-2 study were presented during an oral presentation at the 65th American Society for Hematology (ASH) Annual Meeting and Exposition: In the MANIFEST-2 study, pelabresib and ruxolitinib demonstrated a near doubling in the proportion of patients achieving a ≥35% reduction in spleen volume (SVR35) at 24 weeks, the primary endpoint, versus placebo plus ruxolitinib (p<0.001). For the first key secondary endpoint assessing symptom reduction, absolute change in total symptom score (TSS) at 24 weeks, there was a strong numerical improvement for patients receiving pelabresib and ruxolitinib versus placebo plus ruxolitinib. The response rate for the second key secondary endpoint, proportion of patients achieving ≥50% reduction in symptom score (TSS50) at 24 weeks, was also numerically greater for patients receiving pelabresib and ruxolitinib. The proportion of patients achieving both SVR35 and TSS50 at 24 weeks was doubled with pelabresib and ruxolitinib versus placebo plus ruxolitinib (40.2% vs. 18.5%, respectively). Group Interim Statement 7 MorphoSys – II/2024

Detailed results at 24 weeks are included in the table below: Endpoint Pelabresib + ruxolitinib (n = 214) Placebo + ruxolitinib (n = 216) Difference SVR35 65.9% 35.2% 30.4%* p-value: p<0.001 Absolute change in TSS -15.99 -14.05 -1.94** (Mean baseline: 28.26) (Mean baseline: 27.36) p-value: 0.0545 TSS50 52.3% 46.3% 6.0%* p-value: 0.216 *Difference calculated using Cochran–Mantel–Haenszel (CMH) common risk difference **Least square mean estimate Patients receiving pelabresib in combination with ruxolitinib reported fewer anemia adverse events (43.9%, grade ≥3: 23.1%) compared with placebo plus ruxolitinib (55.6%, grade ≥3: 36.4%). Additionally, by week 24, fewer patients in the pelabresib and ruxolitinib arm required red blood cell transfusions compared with the placebo arm (30.8% vs. 41.2%, respectively). A greater proportion of patients achieved a hemoglobin response — defined as a ≥1.5 g/dL mean increase in hemoglobin levels over baseline in the absence of transfusions during the previous 12 weeks — with pelabresib and ruxolitinib versus placebo plus ruxolitinib (9.3% vs. 5.6%, respectively). Average hemoglobin levels were greater in patients receiving pelabresib and ruxolitinib than in those receiving placebo plus ruxolitinib, starting at week 9 and continuing to week 24. Bone marrow fibrosis, or the replacement of bone marrow with fibrous scar tissue, is a central pathological feature of myelofibrosis. In MANIFEST-2, fibrosis was improved by at least one grade in a greater proportion of patients receiving pelabresib and ruxolitinib (38.5% vs. 24.2% with placebo plus ruxolitinib) and worsened by at least one grade in a smaller proportion of patients receiving pelabresib and ruxolitinib (16.3% vs. 28.3% with placebo plus ruxolitinib) at 24 weeks. Bone marrow fibrosis is graded on a scale from 0 (normal) to 3 (most severe) based on fiber density; studies suggest a correlation between the grade of bone marrow fibrosis and patient prognosis. Overall, grade ≥3 treatment-emergent adverse events (TEAEs) were reported less frequently with pelabresib and ruxolitinib than with placebo plus ruxolitinib (49.1% vs. 57.5%, respectively). In the pelabresib and ruxolitinib arm, the most common (≥10%) hematologic TEAEs were anemia (43.9%; grade ≥3: 23.1%), thrombocytopenia (32.1%; grade ≥3: 9.0%), and platelet count decrease (20.8%; grade ≥3: 4.2%). In the placebo plus ruxolitinib arm, the most common hematologic TEAEs were anemia (55.6%; grade ≥3: 36.4%), thrombocytopenia (23.4%; grade ≥3: 5.6%), and platelet count decrease (15.9%; grade ≥3: 0.9%). The most common (≥10%) non-hematologic TEAEs in the pelabresib and ruxolitinib arm were diarrhea (23.1%; grade ≥3: 0.5%), dysgeusia (18.4%; grade ≥3: 0.5%), constipation (18.4%; grade ≥3: 0%), nausea (14.2%; grade ≥3: 0.5%), cough (12.7%; grade ≥3: 0), asthenia (11.8%; grade ≥3: 0.5%), fatigue (11.8%; grade ≥3: 0.5%), dizziness (11.3%; grade ≥3: 0%), headache (11.3%; grade ≥3: 0.5%), and COVID-19 (11.3%; grade ≥3: 0%). The most common non- hematologic TEAEs in the placebo plus ruxolitinib arm were constipation (24.3%; grade ≥3: 0%), diarrhea (18.7%; grade ≥3: 1.4%), fatigue (16.8%; grade ≥3: 0.9%), COVID-19 (15.9%; grade ≥3: 1.9%), nausea (15.0%; grade ≥3: 0%), asthenia (13.6%; grade ≥3: 0%), dyspnea (13.1%; grade ≥3: 0.9%), cough (11.2%; grade ≥3: 0%), and headache (10.7%; grade ≥3: 0%). Discontinuation rates due to adverse events were 10.7% with pelabresib and ruxolitinib and 6.5% with placebo plus ruxolitinib. 8 Group Interim Statement MorphoSys – II/2024

In May and June 2024, MorphoSys presented new efficacy and safety data from the MANIFEST-2 study during oral presentations at the American Society of Clinical Oncology (ASCO) and at the European Hematology Association (EHA) Annual Meetings. The updated data showed that the combination of pelabresib and ruxolitinib demonstrated rapid, deep and sustained SVR35 responses (a ≥35% reduction in spleen volume). More than twice as many patients receiving pelabresib and ruxolitinib achieved SVR35 (64.0%) at 12 weeks (the first post-treatment measurement of spleen volume) compared with those receiving placebo plus ruxolitinib (31.5%). Additionally, a higher proportion of responders maintained their SVR35 response in the pelabresib and ruxolitinib arm compared with the placebo plus ruxolitinib arm. The new insights from MANIFEST-2 build on MorphoSys’ understanding of the previously observed improvements in reducing spleen volume. The safety profile of the combination of pelabresib and ruxolitinib was generally comparable to the established safety profile of ruxolitinib, with fewer grade ≥3 events versus placebo plus ruxolitinib (49.1% vs. 57.0%, respectively). Leukemic transformation to accelerated or blast phase occurred in 3.3% of patients receiving pelabresib and ruxolitinib compared with 2.3% of patients receiving placebo plus ruxolitinib. As the trial is ongoing, MorphoSys continues to monitor the long-term efficacy and safety of the combination. Study of Tulmimetostat Patient enrollment in a Phase 1/2 clinical trial of tulmimetostat is ongoing. This Phase 1/2, open-label, multi- center, first-in-human study is designed to evaluate the safety and tolerability and preliminary clinical activity in patients with advanced solid tumors or lymphomas. The Phase 1 evaluated the dose escalation period in patients with advanced tumors and aimed to determine maximum tolerated dose (MTD) and/or recommended Phase 2 dose (RP2D) as a monotherapy in patients with advanced tumors or lymphomas. Patients are currently enrolled in two Phase 2 dose optimization cohorts in gynecological tumor indications. Safety and efficacy data from the ongoing Phase 2 study of tulmimetostat monotherapy in multiple advanced malignancies were presented during the ASCO Annual Meeting in June 2023. The data demonstrated disease stabilization or better across all solid tumor cohorts studied, including those with heavily pre-treated patients. Safety findings from the trial were consistent with the mechanism of EZH2 inhibition. In September 2023, the FDA granted Fast Track designation for tulmimetostat, for the treatment of patients with advanced, recurrent, or metastatic endometrial cancer harboring AT-rich interacting domain-containing protein 1A (ARID1A) mutations and who have progressed on at least one prior line of treatment. During the IGCS (International Gynecologic Cancer Society) 2023 Annual Global Meeting held in Seoul, South Korea, in November 2023, MorphoSys showcased in a featured poster abstract session, updated preliminary Phase 2 clinical data and first biomarker findings in a subset of patients with ARID1A-mutated ovarian clear- cell or endometrial carcinomas. Updated efficacy and safety data from the Phase 2 study of tulmimetostat in patients with advanced solid tumors or hematologic malignancies were further highlighted in a poster presentation at ASCO 2024. The presentation featured new information on the two dose optimization cohorts (M2 and M3) that are enrolling patients with ARID1A mutated ovarian clear cell carcinoma and endometrial cancer, showing preliminary signs of tulmimetostat’s anti-tumor activity with disease response and stabilization in heavily pre-treated patients with advanced/recurrent gynecological and other solid and hematological malignancies. Preliminary safety data from the M2 and M3 cohorts indicate improved tolerability with a trend towards decrease in incidence and severity of TEAEs and number of treatment discontinuations in 200mg and 300mg arms compared with 350mg. Group Interim Statement 9 MorphoSys – II/2024

Clinical Development Through Partners Studies of Ianalumab Ianalumab (VAY736) is a fully human IgG1/k mAb with a dual mode of action targeting B-cell lysis and BAFF-R blockade that is being investigated by Novartis in multiple indications within the immunology and hematology field. Ianalumab is currently in Phase 3 clinical development in lupus nephritis (LN), Sjögren’s disease, systemic lupus erythematosus (SLE), immune thrombocytopenia (1L and 2L ITP), and warm autoimmune hemolytic anemia (wAIHA). Ianalumab is also in Phase 2/3 clinical development in autoimmune hepatitis (AIH). MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Study of Abelacimab Abelacimab (MAA868) is an antibody directed against Factor XI that is being investigated by Anthos Therapeutics in two complementary Phase 3 clinical studies in cancer-associated thrombosis (CAT) for the prevention of venous thromboembolism (VTE) and in one Phase 3 study in high-risk patients with atrial fibrillation (AF). A Phase 2 study in AF was stopped early due to an overwhelming benefit (reduction in bleeding). The FDA granted fast track designation to abelacimab for both indications under study. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Study of Setrusumab Setrusumab (BPS804/UX143) is a fully human monoclonal antibody inhibiting sclerostin that is currently being investigated by Ultragenyx and Mereo BioPharma in the Phase 3 portion of the pivotal Phase 2/3 clinical study and a Phase 3 study for the treatment of osteogenesis imperfecta (OI). On April 30, 2024, Ultragenyx announced that all patients have been enrolled across the Phase 3 Orbit and Cosmic studies evaluating setrusumab in pediatric and young adult patients with OI. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Study of Bimagrumab Bimagrumab is a fully human monoclonal antibody against activin type II receptors that is currently in clinical development. Versanis Bio was investigating bimagrumab in a global Phase 2b study in patients with obesity and announced completion of enrollment in June 2023. Versanis Bio was acquired by Eli Lilly and Company, the transaction was completed in August 2023. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Studies of Felzartamab Felzartamab is an investigational therapeutic human monoclonal antibody directed against CD38. Human Immunology Biosciences, Inc. (HI-Bio) obtained exclusive rights to develop and commercialize felzartamab across all indications worldwide, with the exception of Greater China. During a transition phase MorphoSys evaluated felzartamab for patients with two renal autoimmune diseases, anti-PLA2R antibody-positive membranous nephropathy (M-PLACE and New-PLACE trial) and immunoglobulin A nephropathy (IGNAZ trial) together with HI-Bio. On May 25, 2023, HI-Bio announced that the FDA has granted orphan drug designation (ODD) for felzartamab in development for the treatment of membranous nephropathy (MN). On May 22, 2024, Biogen and HI-Bio announced that the companies have entered into an agreement which stipulates that Biogen will acquire HI-Bio for US$ 1.15 billion (€ 1.07 billion) upfront and up to US$ 650 million (€ 607 million) in potential milestone payments. The acquisition has been completed in July 2024. More details can be found in the section "Subsequent Events". On May 24, 2024, HI-Bio presented positive interim results from the Phase 2 IGNAZ study of felzartamab in IgA nephropathy at the 61st European Renal Association (ERA) Congress. On May 25, 2024, HI-Bio announced positive results from a 10 Group Interim Statement MorphoSys – II/2024

Phase 2 investigator-sponsored clinical trial of felzartamab for late antibody-mediated rejection (AMR) in kidney transplant recipients. TJ Biopharma (previously I-Mab Biopharma) holds the exclusive rights to develop and commercialize felzartamab in Greater China for all indications and is studying felzartamab in relapsed/refractory multiple myeloma. MorphoSys will be eligible to receive payments on achievement of development, regulatory, and commercial milestones in addition to royalties on net sales of felzartamab. Studies of MOR210/TJ210/HIB210 MOR210/TJ210/HIB210 is an investigational human antibody directed against C5aR1, the receptor of the complement factor C5a. HI-Bio obtained exclusive worldwide rights to develop and commercialize MOR210 across all indications worldwide, with the exception of Greater China and South Korea. On July 11, 2023, HI-Bio announced that the first participants have been dosed in a Phase 1 healthy volunteer study of HIB210. TJ Biopharma (previously I-Mab Biopharma) holds the exclusive rights for MOR210 in Greater China and South Korea and is currently investigating MOR210 for the treatment of advanced solid tumors and exploring autoimmune disease. MorphoSys will be eligible to receive payments on achievement of development, regulatory, and commercial milestones in addition to royalties on net sales of MOR210/TJ210/HIB210. Other Programs In addition to the late-stage partnered programs listed above, there are several additional partnered programs in early to mid-stage research and development. Strategy and Group Management The Company aims to realize intermediate- and long-term growth through its focus on proprietary drug development. The Company prioritizes the lead development candidates pelabresib and tulmimetostat. MorphoSys is also pursuing the development of further clinical candidates as described in the Annual Report 2023 starting on page 33. The group management has been adjusted to reflect these operations. General Business and Market Environment Economic Trends In early 2024, the International Monetary Fund (IMF) projected a stabilization for the world economy — with the inflation falling faster than expected and the growth recovery. Meanwhile, the momentum on global disinflation has slowed. This reflects different sectoral dynamics: the persistence of higher-than-average inflation in services prices, tempered to some extent by stronger disinflation in the prices of goods. In its updated World Economic Outlook from July 16, 2024, the IMF projects a stable global growth with an estimated 3.2% in 2024 and 3.3% in 2025. The global inflation will continue to decline. Advanced economies are expected to see a stable growth, from 1.7% in 2024 to 1.8% in 2025. At the end of the first half of the year, the SDAX index closed 2.6 % higher, the TecDAX 0.3 % lower and the Nasdaq Biotech Index 4.0 % higher. The MorphoSys share started 2024 at € 34.00 and reached a high of € 69.35 on May 17, 2024. The paper closed the first half of 2024 at € 67.60 on June 28, 2024. Sector Developments In the first half of 2024, numerous medical conferences were held where companies in the sector presented their research results. The world’s largest oncology conference, the American Society of Clinical Oncology Group Interim Statement 11 MorphoSys – II/2024

(ASCO) Annual Meeting, was held in Chicago on May 31 — June 4, 2024 and the leading European conference in the field of hematology, the Annual Meeting of the European Hematology Association (EHA) was held on June 13 — 16, 2024. MorphoSys presented clinical results of pelabresib and tulmimetostat in oral presentations, posters and publications at these medical conferences. Intellectual Property In the first six months of 2024, we continued to reinforce the patent protection of our development programs and technology portfolio, which represent the core value drivers of our Company. Currently, the Company has more than 100 different proprietary patent families worldwide, in addition to the numerous patent families we are pursuing in collaboration with our partners. Human Resources On June 30, 2024, the MorphoSys Group had 446 employees (December 31, 2023: 524). During the first half- year of 2024, the MorphoSys Group employed an average of 475 people (H1 2023: 591). The decrease is caused by the decision to terminate the US sales force, which is related to the sale of tafasitamab to Incyte announced on February 5, 2024. Financial Analysis MorphoSys reports the key financial figures – research and development expenses as well as combined expenses for selling and general and administration – relevant for internal management purposes in its half- year financial statements. Their presentation is supplemented accordingly if other areas of the statement of profit or loss or balance sheet are affected by material business transactions during the quarter. Revenues Group revenues in the first half-year of 2024 amounted to € 62.2 million (H1 2023: € 50.9 million) and mainly included revenues from royalties in the amount of € 61.2 million (H1 2023: € 45.5 million). Additional group revenues were attributable to licenses, milestones, and other sources, amounting to € 1.0 million (H1 2023: € 5.4 million). On a regional basis, MorphoSys generated 100% or € 62.2 million of its revenues with biopharmaceutical companies in North America. In the same period last year, 98% (€ 49.8 million) of revenues were generated with customers in North America, and 2% (€ 1.2 million) with customers located in Europe. In the first half- year of 2024, 100% of the Group's revenues were generated with the customer Janssen (H1 2023: 98% with Janssen and HI-Bio). 12 Group Interim Statement MorphoSys – II/2024

Cost of Sales Cost of sales in the first half-year of 2024 amounted to € 4.1 million (H1 2023: € 2.8 million). The year-on-year increase resulted primarily from higher personnel costs from accelerated vesting of certain share-based payment programs. Operating Expenses Research and Development Expenses Research and development expenses amounted to € 134.8 million in the first half-year of 2024 (H1 2023: € 105.0 million) and consisted primarily of personnel expenses of € 90.3 million (H1 2023: € 42.7 million) and costs for external research and development services of € 34.5 million (H1 2023: € 51.9 million). In the first half-year of 2024, the increase in personnel expenses mainly resulted from effects of both an accelerated vesting of certain share-based payment programs, according to the terms and conditions of the share-based compensation plans, and the recognition of remuneration-related provisions following the acquisition by Novartis. In the first half-year of 2023, personnel expenses included a one-time effect resulting from severances in connection with the restructuring of the research area. Furthermore, the first half-year of 2023 comprised costs for external research and development services incurred due to the positive development of the patient recruitment in the major ongoing clinical studies of MorphoSys. The € 17.4 million decrease in expenses for external research and development services in the first half-year of 2024 is attributable to the regular progress of the clinical trial phase for the testing of pelabresib. Combined Expenses for Selling and General and Administration The combined expenses for selling and general and administration amounted to € 233.3 million in the first half-year of 2024 (H1 2023: € 35.5 million). This sum consisted mainly of personnel expenses of € 129.0 million (H1 2023: € 22.2 million) and expenses for external services of € 101.9 million (H1 2023: € 5.4 million). Selling expenses amounted to € 27.7 million in the first half-year of 2024 (H1 2023: € 8.1 million). This item consisted mainly of personnel expenses of € 22.7 million (H1 2023: € 2.2 million) and expenses for external services of € 5.2 million (H1 2023: € 1.5 million). The increase in selling expenses was mainly due to the effects of accelerated vesting of certain share-based payment programs, according to the terms and conditions of the share-based compensation plans, and the recognition of remuneration-related provisions following the acquisition by Novartis. In comparison to the same period of the previous year, general and administrative expenses increased to € 205.6 million (H1 2023: € 27.4 million). This line item mainly comprised personnel expenses amounting to € 106.4 million (H1 2023: € 20.0 million) and expenses for external services of € 96.6 million (H1 2023: € 3.9 million). The increase in general and administrative expenses was mainly due to the effects of accelerated vesting of certain share-based payment programs and the recognition of remuneration-related provisions following the acquisition by Novartis in accordance with terms and conditions of the share-based Group Interim Statement 13 MorphoSys – II/2024

compensation plans and individual employee contract terms. The increase in expenses resulting from external services was attributable to transaction costs in connection with the acquisition by Novartis. Finance Income / Finance Expenses Finance income totaled € 17.3 million in the first half-year of 2024 (H1 2023: € 57.6 million) and resulted from income from the investment of cash and cash equivalents and corresponding currency translation gains from investing of funds amounting to € 17.2 million (H1 2023: € 12.1 million). In the same period last year, finance income included measurement effects from deviations between underlying planning assumptions and actual numbers of financial liabilities from future payments to Royalty Pharma. (H1 2024: € 0.0 million; H1 2023: € 28.8 million) as well as effects from the repurchase of own convertible bonds (H1 2024: € 0.0 million; H1 2023 € 16.4 million). Finance expenses totaled € 100.7 million in the first half-year of 2024 (H1 2023: € 51.6 million). This increase was due to the measurement effects from financial liabilities from future payments to Royalty Pharma of € 80.0 million (H1 2023: € 43.8 million) mainly resulting from differences between underlying planning assumptions and actual figures, foreign currency effects and the application of the effective interest method. Furthermore, interest expenses on the convertible bond increased to € 17.5 million (H1 2023: € 5.7 million). It was expected that the bondholders will exercise their contractual right of termination due to the change of control by Novartis on May 23, 2024. Payment of the nominal amount plus interest up to the payment date is expected in the third quarter of 2024. As of June 30, 2024, the convertible bonds were written up to the nominal amount plus interest up to the payment date, resulting in additional interest expenses of € 14.9 million. The other interest expenses for convertible bonds were attributable to the regular application of the effective interest method until the change of control. Also included were finance expenses from the investment of liquid funds and foreign currency translation losses from financing activities in the amount of € 2.9 million (H1 2023: € 1.5 million). Financial Position Cash and Investments On June 30, 2024, the Group had cash and investments of € 512.3 million, compared to € 680.5 million on December 31, 2023. Cash and investments are presented in the balance sheet items "Cash and Cash Equivalents" and current and non-current "Other Financial Assets". The decrease in cash and investments resulted mainly from financing the operating activities in the first half- year of 2024 and from the settlement of transaction costs in connection with the acquisition by Novartis. Balance Sheet In contrast to the Consolidated Statement of Profit or Loss, as permitted, the previous year's balances within the Consolidated Balance Sheet were not split into Discontinued Operations and Assets Held for Sale. As a result, the balance sheet compared to the previous year balances show significant variances. 14 Group Interim Statement MorphoSys – II/2024

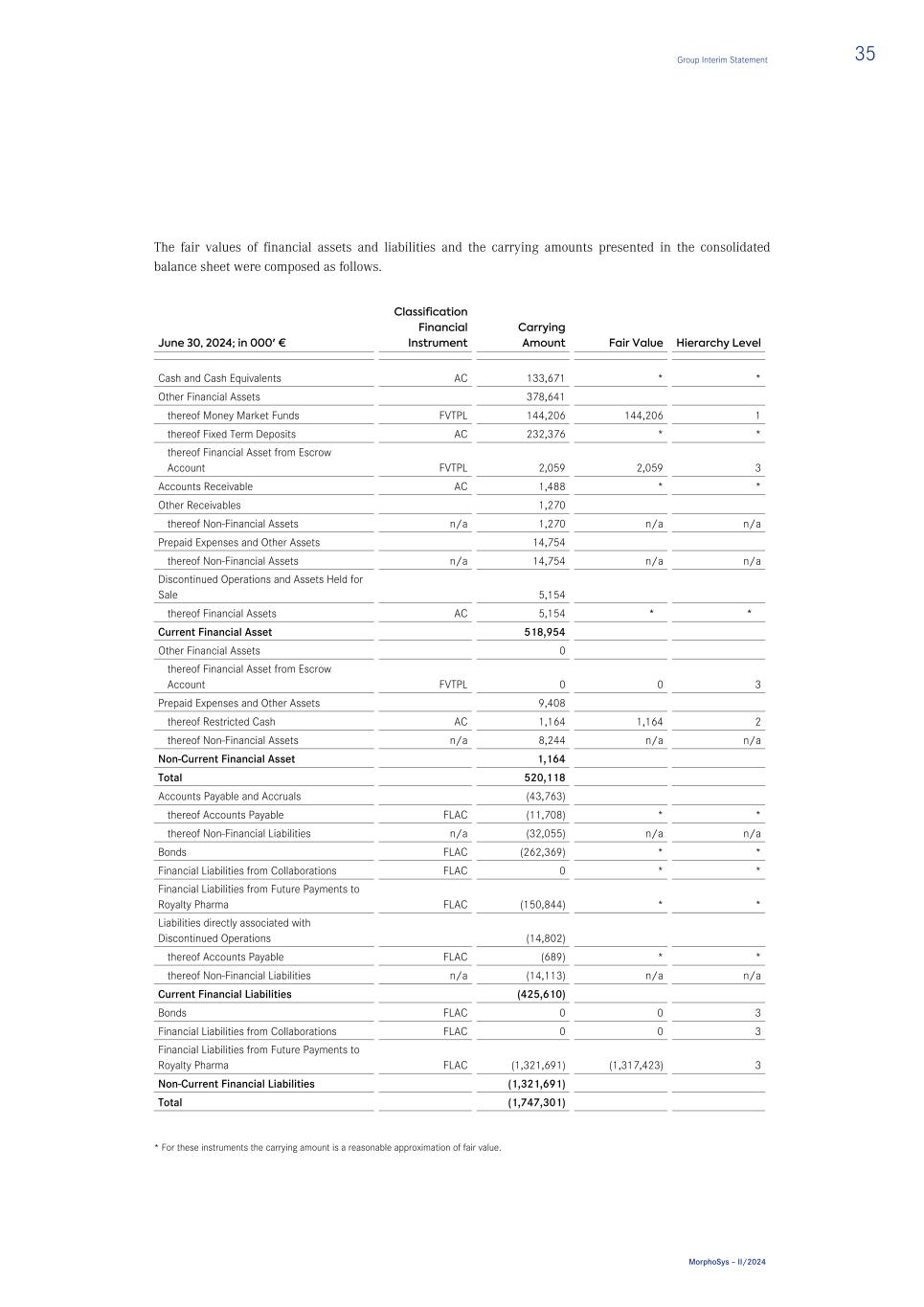

Assets Total assets as of June 30, 2024, amounted to € 1,705.0 million, a decrease of € 321.3 million compared to December 31, 2023 (€ 2,026.3 million). Current assets decreased by € 275.1 million from € 814.0 million as of December 31, 2023 to € 539.0 million as of June 30, 2024, mainly due to a € 142.2 million decrease in "Other Financial Assets" and a € 24.8 million decrease in “Cash and Cash Equivalents”. The changes were mainly due to the financing of operating activities in the first half-year of 2024 and from the settlement of transaction costs in connection with the acquisition by Novartis. The decrease in "Inventories" by € 62.1 million, in “Accounts Receivable” by € 30.6 million and in the balance sheet item “Prepaid Expenses and Other Assets” by € 15.6 million were due to the sale of tafasitamab to Incyte. Refer to note "11. Discontinued Operations and Assets Held for Sale " of the Notes to the Consolidated Financial Statement for more details. As of June 30, 2024, the balance sheet item "Discontinued Operations and Assets Held for Sale" consisted of accounts receivables in connection with tafasitamab in the amount of € 5.2 million as well as the Investment in Associates that shows a carrying amount of 0 €. In comparison to December 31, 2023, Non-Current Assets decreased by € 46.2 million to € 1,166.1 million. P&L-neutral fluctuations in currency exchange rates resulted in an increase in Goodwill by € 11.0 million and in Intangible Assets by € 24.8 million but were more than offset by effects stemming from discontinued operations, predominantely due to the transfer of intangible assets in the amount of € 74.8 million and Right- of-Use Assets for technical equipment in the amount of € 3.7 million to Incyte. Please refer to note "11. Discontinued Operations and Assets Held for Sale " of the Notes to the Consolidated Financial Statement for more details. Liabilities Current Liabilities increased by € 431.4 million from € 264.3 million as of December 31, 2023, to € 695.7 million as of June 30, 2024. The increase mainly resulted from effects related to the Novartis acquisition. Due to the change of control, bondholders can exercise their right of redemption and therefore a repayment of the nominal amount plus accrued interest in the third quarter is expected. This caused a reclassification of the non-current portion of the convertible bonds to current financial liabilities resulting in an increase in the line item "Bonds" in the amount of € 260.7 million. Furthermore, due to the effects of accelerated vesting of certain share-based payment programs and the recognition of current remuneration- related provisions the "Personnel-Related Provisions (Novartis Transaction)" increased to € 204.9 million. In addition, current "Financial Liabilities from Future Payments to Royalty Pharma" increased by € 31.0 million due to adjustments in planning assumptions. The effect was partially offset by a decrease in "Accounts Payable and Accruals" of € 66.0 million, the "Contract Liability" of € 19.4 million as well as the "Financial Liabilities from Collaborations" in the amount of € 5.5 million that are due to the sale of tafasitamab to Incyte. Refer to note "11. Discontinued Operations and Assets Held for Sale " of the Notes to the Consolidated Financial Statement for more details. As of June 30, 2024 the item "Liabilities directly associated with Discontinued Operations" in the amount of € 14.8 million contained accruals and accounts payables in connection with tafasitamab mainly as a result from the agreed transition activities. Group Interim Statement 15 MorphoSys – II/2024

Non-Current Liabilities decreased by € 368.9 million to € 1,344.0 million, compared to December 31, 2023. The decrease mainly resulted from effects related to the Novartis acquisition. Due to the change-of-control events, bondholders can exercise their right of redemption and therefore it is expected that the nominal amount plus accrued interest are repaid in the third quarter. This caused a reclassification of the non-current portion of the convertible bonds to current financial liabilities resulting in a decrease in the non-current line item "Bonds" in the amount of € 244.0 million. The item "Personnel-Related Provisions (Novartis Transaction)" decreased by € 16.6 million. By contrast, the "Financial Liabilities from Future Payments to Royalty Pharma" increased in the amount of € 5.3 million due to adjustments in planning assumptions. The decrease in "Financial Liabilities from Collaborations" by € 108.9 million was due to the sale of tafasitamab to Incyte. Stockholder’s Equity As of June 30, 2024, the Company’s common stock excluding treasury shares amounted to € 37,716,423 (December 31, 2023: € 37,655,137). As of June 30, 2024, the value of treasury shares was € 1,995,880 (December 31, 2023: € 1,995,880). The number of MorphoSys shares held by the Company as of June 30, 2024, still amounted to 53,685 shares (December 31, 2023: 53,685 shares). As of June 30, 2024, additional paid-in capital amounted to € 927,779,776 (December 31, 2023: € 938,088,474). The decrease totaling € 10,308,698 was attributable to the reclassification of personnel expenses from share-based payment programs previously recorded in additional paid-in capital to the balance sheet item Personnel-Related Provisions (Novartis Transaction)" in the amount of € 13,650,010 resulting from the execution of the Novartis Business Combination Agreement according to which all share-payment programs shall be settled in cash. In contrast, cash contributions to additional paid-in capital in the amount of € 3,341,313 from the exercising of stock option programs were recorded. On June 30, 2024, the other comprehensive income reserve mainly contained foreign currency translation differences from the consolidation of € 109,072,358 (December 31, 2023: € 88,435,451). The currency translation differences from the consolidation included exchange rate differences from the translation of the financial statements of Group companies prepared in foreign currencies and differences between the exchange rates used in the balance sheet and income statement. The consolidated net loss for the first six months of financial year 2024 of € 390,208,995 from continued operations, and € 3,946,859 from discontinued operations is reported under “accumulated deficit.” As a result, the accumulated deficit increased from € 1,013,133,943 on December 31, 2023 to € 1,407,289,797 on June 30, 2024. The development of the equity of the parent company MorphoSys AG (including the assessment with regard to the provision of section 92 German Stock Corporation Act) as well as of MorphoSys Group is closely monitored by the Management Board. In addition, the company is thoroughly monitoring the liquidity situation of MorphoSys Group. On June 20, 2024, Novartis BidCo AG, Basel, Switzerland, and MorphoSys AG concluded a Shareholder Loan Facility Agreement with a volume of up to € 500.0 million. With this agreement MorphoSys has access to sufficient liquid funds to ensure business operations for the forecast period which is subject to the going-concern assessment (at least twelve months from the issuance date of the interim consolidated financial statements) without requiring additional proceeds from external refinancing. At the 16 Group Interim Statement MorphoSys – II/2024

time of this report, the Management Board is not aware of any imminent risks that could affect the company as a going concern. Risks and Opportunities As already explained in the risk and opportunity report for the 2023 financial year, the risk situation changed in the first half of the year due to the completion of the takeover by Novartis and the sale of the tafasitamab business to Incyte. As a result, all risks relating to tafasitamab no longer apply as at the half-year reporting date compared to the presentation in the annual report as of December 31, 2023. In addition, the risk mentioned in the subsequent event report that the takeover by Novartis cannot be completed as planned has become obsolete due to the completion of the takeover on May 23, 2024. As a result of the takeover by Novartis, the financing of the MorphoSys Group companies is also secured, so that the risk of long-term corporate financing is no longer relevant. Taking into account the current developments on the relevant markets, the other risks and opportunities and their assessments remain unchanged in all material aspects compared to the situation described on pages 64 to 76 of the 2023 Annual Report. Outlook Expected Development of Financial Position As a consequence of the sale and transfer of tafasitamab to Incyte on February 5, 2024, MorphoSys' 2024 financial guidance published on January 30, 2024, could not be maintained and therefore was revoked. For the time being, MorphoSys will no longer make a forecast for revenues from product sales, as no such revenues are expected to be realized this year. As a consequence of the Novartis takeover, MorphoSys is now including the effects from the implementation of the takeover in its guidance. Consequently, the Group now expects R&D expenses of € 205 million to € 225 million for the 2024 which mainly represent our investments in the development of pelabresib and tulmimetostat. Selling, administrative and general expenses are now expected to be between € 260 million and € 270 million. The overall forecast is subject to a number of uncertainties, including inflation and foreign currency effects. The development of the equity of the parent company MorphoSys AG (including the assessment with regard to the provision of Section 92 German Stock Corporation Act) as well as of MorphoSys Group is closely monitored by the Management Board. In addition, the company is closely monitoring the liquidity situation of MorphoSys Group as well as for MorphoSys AG. On June 20, 2024, Novartis BidCo AG, Basel, Switzerland, and MorphoSys AG concluded a Shareholder Loan Facility Agreement with a volume of up to € 500.0 million. With this agreement MorphoSys has access to sufficient liquid funds to ensure business operations for the forecast period (at least twelve months from the issuance date of the interim consolidated financial statements), which is subject to the going-concern assessment, without requiring additional proceeds from external refinancing. At the time of this report, the Management Board is not aware of any imminent risks, neither individually nor collectively, that could affect the company as a going concern. Group Interim Statement 17 MorphoSys – II/2024

As of June 30, 2024, MorphoSys had cash and investments of € 512.3 million (December 31, 2023: € 680.5 million). 18 Group Interim Statement MorphoSys – II/2024

Consolidated Statement of Profit or Loss (IFRS) – (unaudited) in € Note Q2 2024 1 Q2 2023 1 H1 2024 H1 2023 Product Sales 2 0 0 0 0 Royalties 2 34,121,668 24,667,068 61,161,409 45,528,281 Licenses, Milestones and Other 2 522,110 1,893,878 1,022,110 5,379,373 Revenues 2 34,643,778 26,560,946 62,183,519 50,907,653 Cost of Sales (1,293,718) (1,721,614) (4,117,928) (2,759,521) Gross Profit 33,350,060 24,839,332 58,065,591 48,148,132 Operating Expenses Research and Development (49,658,680) (39,544,306) (134,810,150) (104,958,212) Selling (9,216,250) (4,672,196) (27,667,880) (8,093,955) General and Administrative (20,058,598) (16,776,815) (205,592,501) (27,370,642) Total Operating Expenses (78,933,528) (60,993,317) (368,070,531) (140,422,810) Operating Profit / (Loss) (45,583,468) (36,153,984) (310,004,940) (92,274,678) Other Income 1,227,852 603,682 2,064,511 2,711,622 Other Expenses (199,317) (533,830) (619,506) (2,366,521) Finance Income 7,714,167 6,800,000 17,277,381 57,579,480 Finance Expenses (43,828,838) (26,373,312) (100,662,941) (51,562,680) Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets 45,000 45,967 154,000 590,967 Income Tax Benefit / (Expenses) 3 0 0 1,582,500 0 Consolidated Net Profit / (Loss) from Continued Operations (80,624,603) (55,611,478) (390,208,995) (85,321,810) Consolidated Net Profit / (Loss) from Discontinued Operations and Assets held for Sale 11 1,431,545 (18,355,682) (3,946,859) (33,076,989) Consolidated Net Profit / (Loss) (79,193,058) (73,967,160) (394,155,854) (118,398,799) Earnings per Share from Continued Operations, Basic and Diluted (in €) (2.14) (1.63) (10.37) (2.50) Earnings per Share (Total operations), Basic and Diluted (in €) (2.10) (2.16) (10.47) (3.47) Earnings per Share from Discontinued Operations and Assets held for Sale, Basic and Diluted (in €) 0.04 (0.54) (0.10) (0.97) Shares Used in Computing Earnings per Share, Basic and Diluted 37,662,738 34,166,655 37,640,439 34,166,401 1 The three month period is not part of the auditor’s review. Group Interim Statement 19 MorphoSys – II/2024

Consolidated Statement of Comprehensive Income (IFRS) – (unaudited) in € Q2 2024 1 Q2 2023 1 H1 2024 H1 2023 Consolidated Net Profit / (Loss) (79,193,058) (73,967,160) (394,155,854) (118,398,799) Items that will not be reclassified to Profit or Loss Change in Fair Value of Shares through Other Comprehensive Income 0 359,458 0 359,458 Items that may be reclassified to Profit or Loss Foreign Currency Translation Differences from Consolidation 6,142,825 99,042,501 20,636,907 (16,311,587) Other Comprehensive Income 6,142,825 99,401,959 20,636,907 (15,952,129) Total Comprehensive Income (73,050,233) 25,434,799 (373,518,947) (134,350,928) 1 The three month period is not part of the auditor’s review. 20 Group Interim Statement MorphoSys – II/2024

Consolidated Balance Sheet (IFRS) – (unaudited) in € Note 06/30/2024 12/31/2023 ASSETS Current Assets Cash and Cash Equivalents 5 133,670,902 158,499,651 Other Financial Assets 5 378,640,705 520,845,412 Accounts Receivable 5 1,487,592 32,093,682 Financial Assets from Collaborations 5 0 3,410,247 Income Tax Receivables 3,981,640 5,284,542 Other Receivables 5 1,269,509 1,496,489 Inventories 0 62,068,115 Prepaid Expenses and Other Assets 14,753,615 30,323,373 Discontinued Operations and Assets Held for Sale 11 5,153,976 0 Total Current Assets 538,957,939 814,021,511 Non-Current Assets Property, Plant and Equipment 2,986,905 3,890,162 Right-of-Use Assets 6,343,401 11,100,166 Intangible Assets 793,986,754 844,109,432 Goodwill 353,328,541 342,296,501 Other Financial Assets 5 0 1,133,982 Investment in Associates 11, 13 0 2,417,968 Prepaid Expenses and Other Assets 5 9,407,666 7,341,491 Total Non-Current Assets 1,166,053,267 1,212,289,702 TOTAL ASSETS 1,705,011,206 2,026,311,213 Group Interim Statement 21 MorphoSys – II/2024

in € Note 06/30/2024 12/31/2023 LIABILITIES AND STOCKHOLDERS’ EQUITY Current Liabilities Accounts Payable and Accruals 5 43,762,504 109,804,500 Lease Liabilities 3,777,981 3,628,433 Tax Liabilities 3 329,723 329,723 Provisions 14,887,312 4,127,121 Personnel-Related Provisions (Novartis Transaction) 204,912,015 0 Contract Liability 0 19,443,663 Bonds 14 262,369,281 1,638,125 Financial Liabilities from Collaborations 4, 5 0 5,526,679 Financial Liabilities from Future Payments to Royalty Pharma 4, 5 150,843,882 119,811,363 Liabilities directly associated with Discontinued Operations 11 14,802,019 0 Total Current Liabilities 695,684,717 264,309,607 Non-Current Liabilities Lease Liabilities 7,489,131 8,796,915 Provisions 122,041 3,794,171 Personnel-Related Provisions (Novartis Transaction) 7,980,649 24,568,963 Deferred Tax Liability 3 6,760,763 6,549,655 Bonds 14 0 244,020,955 Financial Liabilities from Collaborations 4, 5 0 108,868,561 Financial Liabilities from Future Payments to Royalty Pharma 4, 5 1,321,691,025 1,316,353,147 Total Non-Current Liabilities 1,344,043,609 1,712,952,367 Total Liabilities 2,039,728,326 1,977,261,974 Stockholders’ Equity Common Stock 6 37,716,423 37,655,137 Treasury Stock (53,685 and 53,685 shares for 2024 and 2023, respectively), at Cost (1,995,880) (1,995,880) Additional Paid-in Capital 6 927,779,776 938,088,474 Other Comprehensive Income Reserve 6 109,072,358 88,435,451 Accumulated Deficit 6 (1,407,289,797) (1,013,133,943) Total Stockholders’ Equity (334,717,120) 49,049,239 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY 1,705,011,206 2,026,311,213 22 Group Interim Statement MorphoSys – II/2024

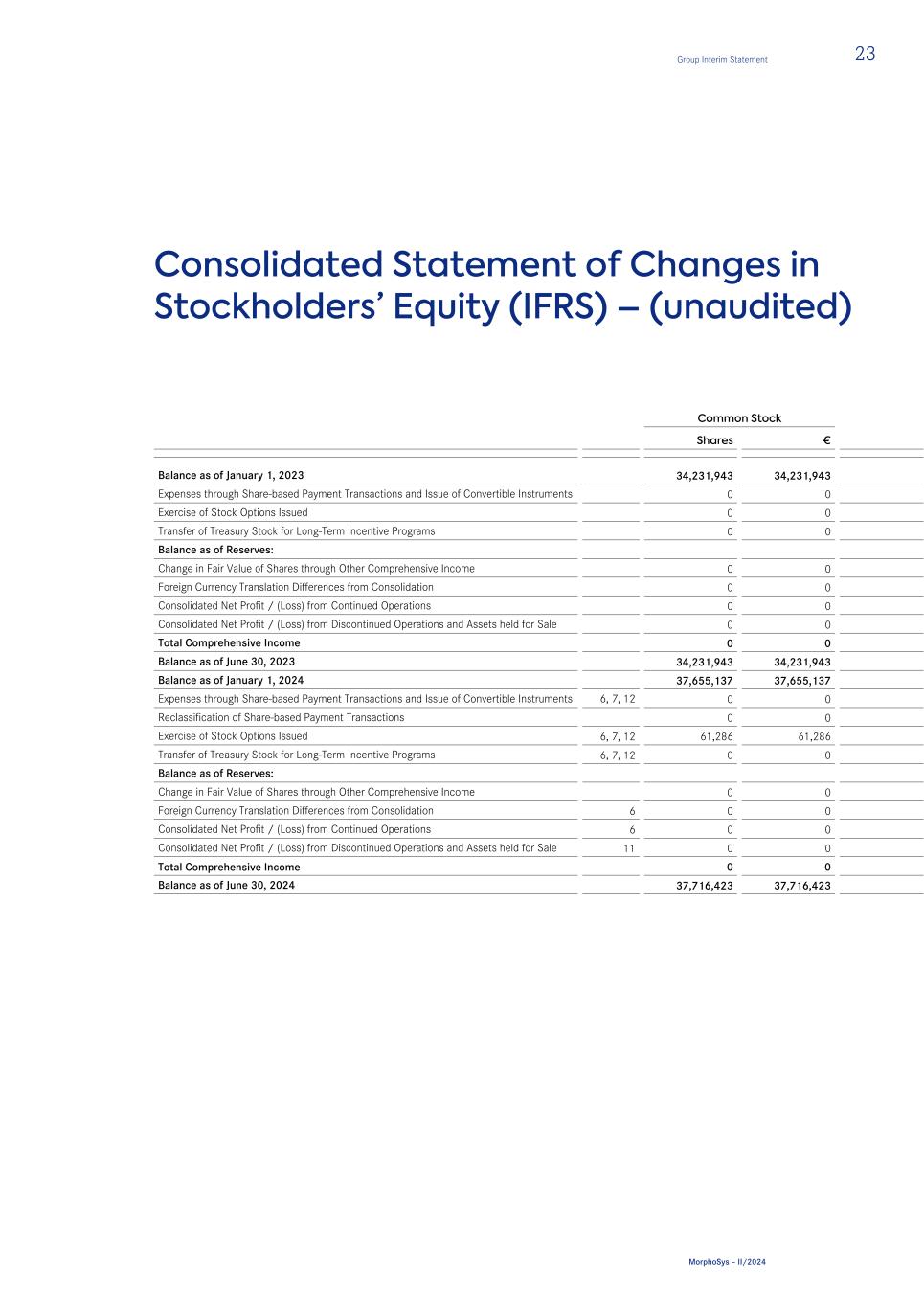

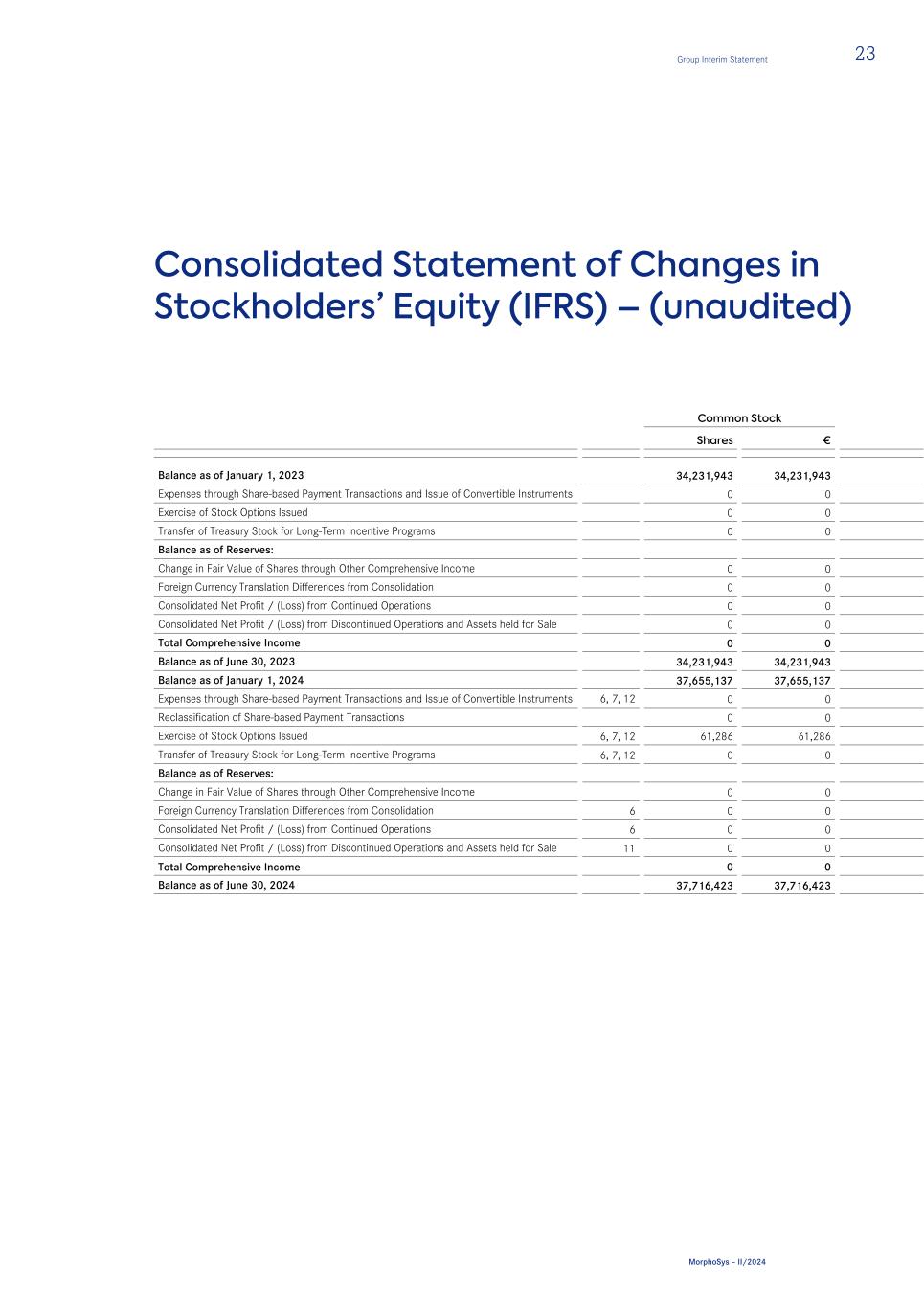

Consolidated Statement of Changes in Stockholders’ Equity (IFRS) – (unaudited) Common Stock Shares € Balance as of January 1, 2023 34,231,943 34,231,943 Expenses through Share-based Payment Transactions and Issue of Convertible Instruments 0 0 Exercise of Stock Options Issued 0 0 Transfer of Treasury Stock for Long-Term Incentive Programs 0 0 Balance as of Reserves: Change in Fair Value of Shares through Other Comprehensive Income 0 0 Foreign Currency Translation Differences from Consolidation 0 0 Consolidated Net Profit / (Loss) from Continued Operations 0 0 Consolidated Net Profit / (Loss) from Discontinued Operations and Assets held for Sale 0 0 Total Comprehensive Income 0 0 Balance as of June 30, 2023 34,231,943 34,231,943 Balance as of January 1, 2024 37,655,137 37,655,137 Expenses through Share-based Payment Transactions and Issue of Convertible Instruments 6, 7, 12 0 0 Reclassification of Share-based Payment Transactions 0 0 Exercise of Stock Options Issued 6, 7, 12 61,286 61,286 Transfer of Treasury Stock for Long-Term Incentive Programs 6, 7, 12 0 0 Balance as of Reserves: Change in Fair Value of Shares through Other Comprehensive Income 0 0 Foreign Currency Translation Differences from Consolidation 6 0 0 Consolidated Net Profit / (Loss) from Continued Operations 6 0 0 Consolidated Net Profit / (Loss) from Discontinued Operations and Assets held for Sale 11 0 0 Total Comprehensive Income 0 0 Balance as of June 30, 2024 37,716,423 37,716,423 Group Interim Statement 23 MorphoSys – II/2024

Treasury Stock Additional Paid- in Capital Other Comprehensive Income Reserve Accumulated Deficit Total Stockholders’ Equity Shares € € € € € 65,980 (2,450,303) 833,708,724 115,326,601 (823,407,416) 157,409,549 0 0 2,338,789 0 0 2,338,789 0 0 0 0 0 0 (4,149) 153,347 (153,347) 0 0 0 0 0 6,271,775 359,458 0 6,631,233 0 0 0 (16,311,588) 0 (16,311,588) 0 0 0 0 (85,321,810) (85,321,810) 0 0 0 0 (33,076,989) (33,076,989) 0 0 6,271,775 (15,952,130) (118,398,799) (128,079,154) 61,831 (2,296,956) 842,165,941 99,374,471 (941,806,215) 31,669,184 53,685 (1,995,880) 938,088,474 88,435,451 (1,013,133,943) 49,049,239 0 0 0 0 0 0 0 0 (13,650,010) 0 0 (13,650,010) 0 0 3,341,313 0 0 3,402,599 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 20,636,907 0 20,636,907 0 0 0 0 (390,208,995) (390,208,995) 0 0 0 0 (3,946,859) (3,946,859) 0 0 0 20,636,907 (394,155,854) (373,518,947) 53,685 (1,995,880) 927,779,776 109,072,358 (1,407,289,797) (334,717,120) 24 Group Interim Statement MorphoSys – II/2024

Consolidated Statement of Cash Flows (IFRS) – (unaudited) H1 (in €) Note 2024 2023 Operating Activities: Consolidated Net Profit / (Loss) from Continued Operations (390,208,995) (85,321,810) Adjustments to Reconcile Consolidated Net Profit / (Loss) to Net Cash Provided by / (Used in) Operating Activities: Impairments of Assets 379,225 0 Depreciation and Amortization of Tangible and Intangible Assets and of Right-of-Use Assets 2,248,312 5,121,631 Net (Gain) / Loss of Other Financial Assets (13,216,494) (10,461,167) (Income) from Reversals of Impairments / Impairments on Financial Assets (154,000) (590,967) Net (Gain) / Loss on Derivative Financial Instruments (100,682) 0 Non Cash Effective Net Change in Financial Liabilities from Future Payments to Royalty Pharma 18,862,937 (30,584,264) Interest Expense from Convertible Bond and Gain on Repurchase of Convertible Bond 17,529,263 (10,656,108) Net (Gain) / Loss on Sale of Property, Plant and Equipment (224,696) 0 Share-based Payment 10 141,973,192 12,807,771 Share of Loss of Associates accounted for using the Equity Method 0 0 Other Cash and Non-Cash Expenses (+) / Income (-) (1,489,755) (183,783) Income Tax (Benefit) / Expenses 3 (1,582,500) 0 Changes in Operating Assets and Liabilities: Accounts Receivable 294,477 7,038,682 Income Tax Receivables, Other Receivables, Inventories and Prepaid Expenses and Other Assets (2,669,731) 2,071,632 Accounts Payable and Accruals, Lease Liabilities, Tax Liabilities and Provisions 20,534,889 (29,692,055) Income Taxes Paid (-) / Received (+) 2,885,401 (132,740) Net Cash Provided by / (Used in) Operating Activities (204,939,157) (140,583,177) Group Interim Statement 25 MorphoSys – II/2024

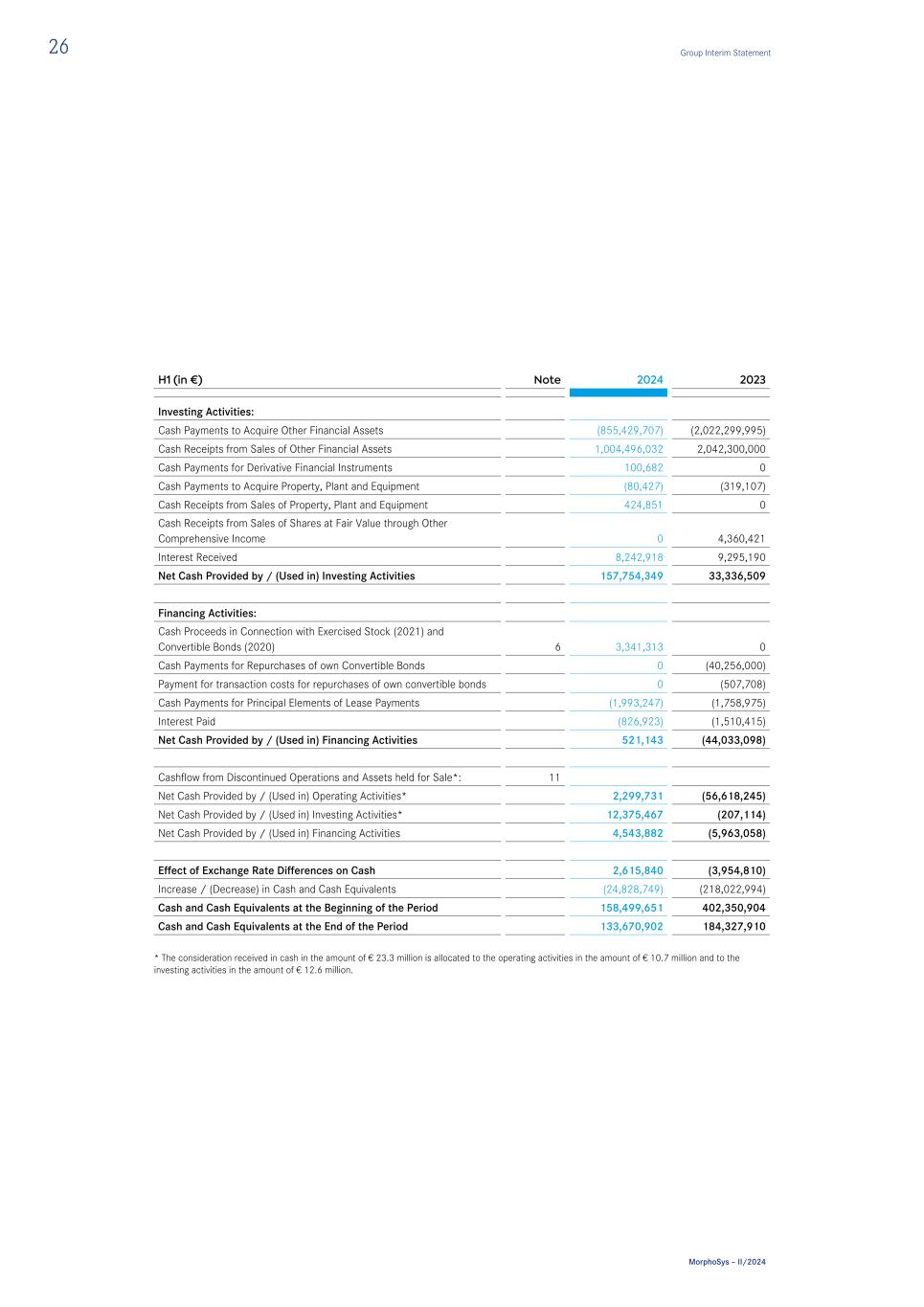

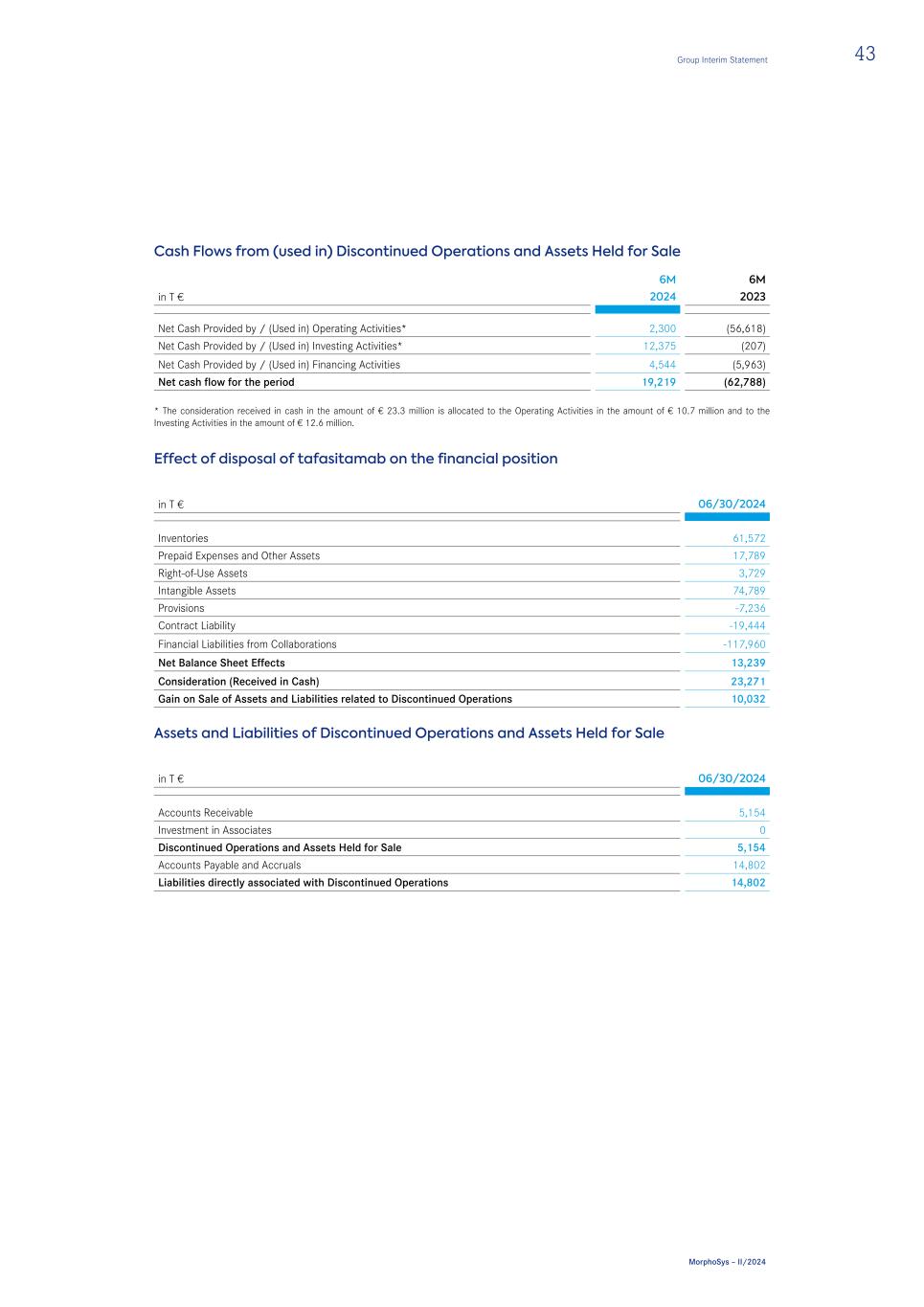

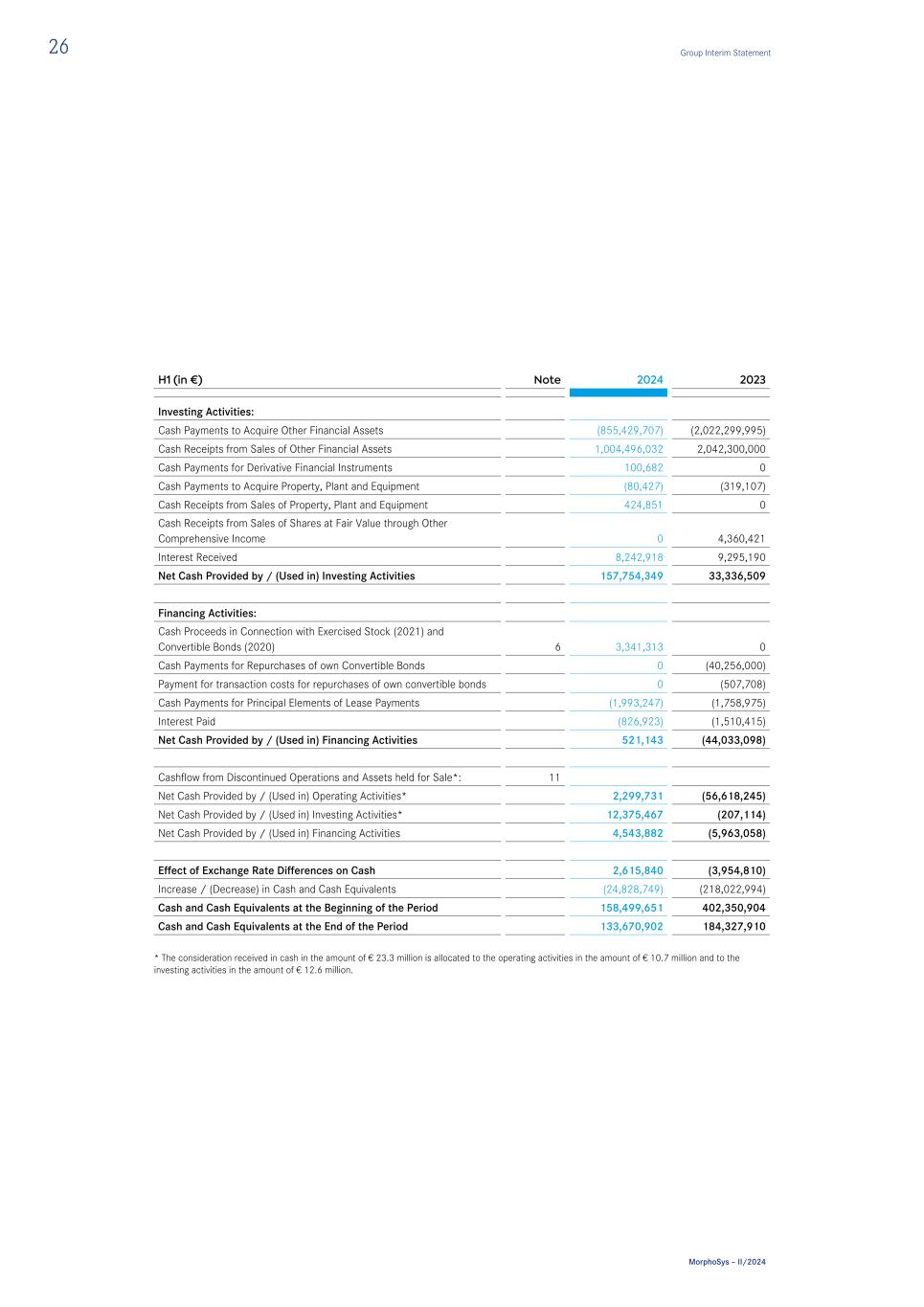

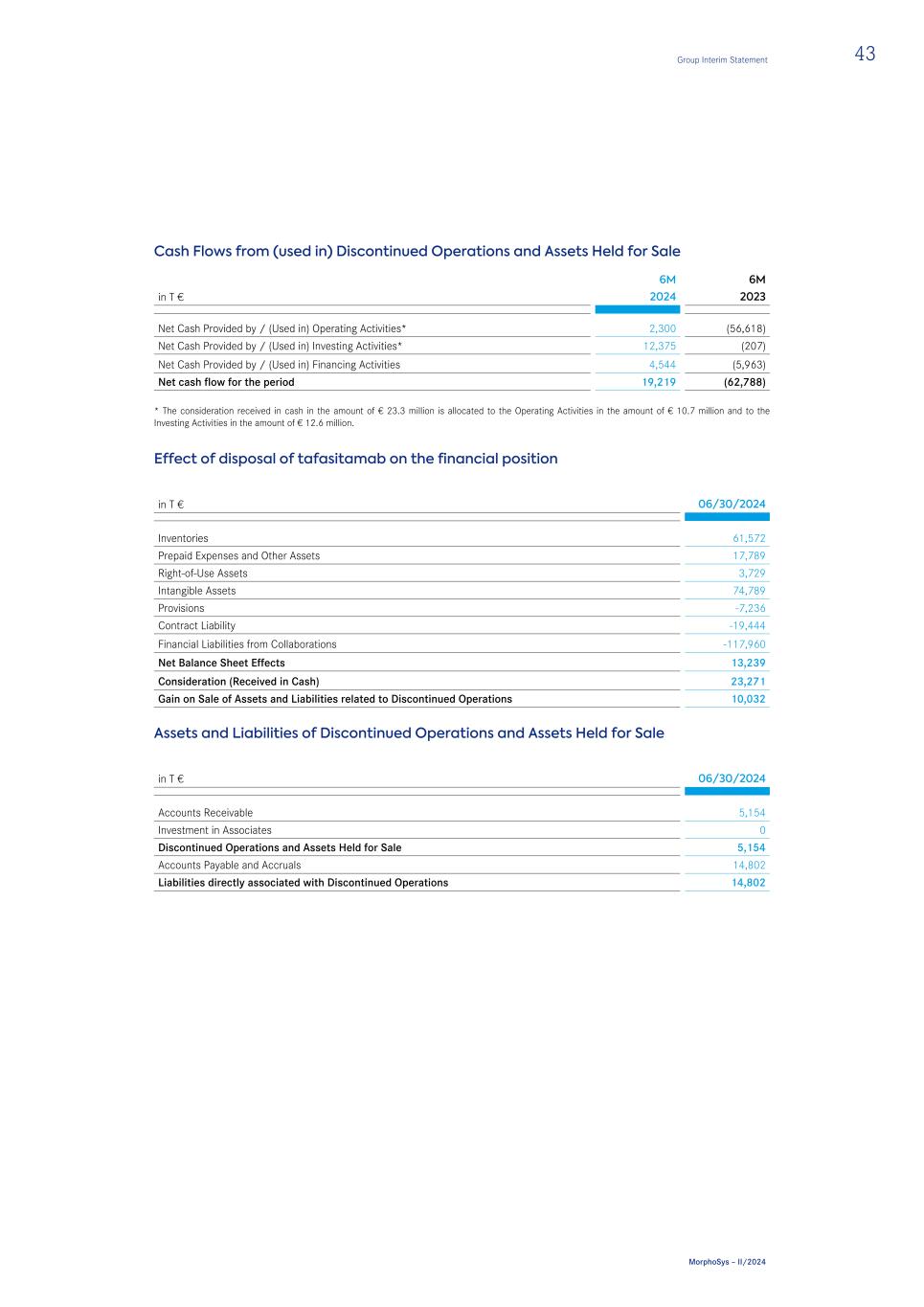

H1 (in €) Note 2024 2023 Investing Activities: Cash Payments to Acquire Other Financial Assets (855,429,707) (2,022,299,995) Cash Receipts from Sales of Other Financial Assets 1,004,496,032 2,042,300,000 Cash Payments for Derivative Financial Instruments 100,682 0 Cash Payments to Acquire Property, Plant and Equipment (80,427) (319,107) Cash Receipts from Sales of Property, Plant and Equipment 424,851 0 Cash Receipts from Sales of Shares at Fair Value through Other Comprehensive Income 0 4,360,421 Interest Received 8,242,918 9,295,190 Net Cash Provided by / (Used in) Investing Activities 157,754,349 33,336,509 Financing Activities: Cash Proceeds in Connection with Exercised Stock (2021) and Convertible Bonds (2020) 6 3,341,313 0 Cash Payments for Repurchases of own Convertible Bonds 0 (40,256,000) Payment for transaction costs for repurchases of own convertible bonds 0 (507,708) Cash Payments for Principal Elements of Lease Payments (1,993,247) (1,758,975) Interest Paid (826,923) (1,510,415) Net Cash Provided by / (Used in) Financing Activities 521,143 (44,033,098) Cashflow from Discontinued Operations and Assets held for Sale*: 11 Net Cash Provided by / (Used in) Operating Activities* 2,299,731 (56,618,245) Net Cash Provided by / (Used in) Investing Activities* 12,375,467 (207,114) Net Cash Provided by / (Used in) Financing Activities 4,543,882 (5,963,058) Effect of Exchange Rate Differences on Cash 2,615,840 (3,954,810) Increase / (Decrease) in Cash and Cash Equivalents (24,828,749) (218,022,994) Cash and Cash Equivalents at the Beginning of the Period 158,499,651 402,350,904 Cash and Cash Equivalents at the End of the Period 133,670,902 184,327,910 * The consideration received in cash in the amount of € 23.3 million is allocated to the operating activities in the amount of € 10.7 million and to the investing activities in the amount of € 12.6 million. 26 Group Interim Statement MorphoSys – II/2024

Notes to the Consolidated Financial Statements (unaudited) MorphoSys AG ("the Company" or "MorphoSys") is a biopharmaceutical company dedicated to the development and commercialization of therapeutic antibodies for patients suffering from various cancers. The Company has a proprietary portfolio of compounds and a pipeline of compounds developed with partners from the pharmaceutical and biotechnology industry. MorphoSys was founded as a German limited liability company in July 1992. In June 1998, MorphoSys became a German stock corporation. In March 1999, the Company completed its initial public offering on Germany’s "Neuer Markt": the segment of the Deutsche Börse designated, at that time, for high-growth companies. On January 15, 2003, MorphoSys AG was admitted to the Prime Standard segment of the Frankfurt Stock Exchange. On April 18, 2018, MorphoSys completed an IPO on the Nasdaq Global Market through the issue of American Depositary Shares (ADS). Each ADS represents 1/4 of a MorphoSys ordinary share. MorphoSys AG’s registered office is located in Planegg (district of Munich), and the registered business address is Semmelweisstrasse 7, 82152 Planegg, Germany. The MorphoSys AG consolidated and separate financial statements can be viewed at this address. The Company is registered in the Commercial Register B of the District Court of Munich under the number HRB 121023. On February 5, 2024, MorphoSys announced that it entered into a Business Combination Agreement with Novartis BidCo AG (formerly trading as Novartis data42 AG) and Novartis AG according to which Novartis BidCo AG intended to submit a voluntary public takeover offer for all of MorphoSys’ outstanding common shares in exchange for payment of € 68.00 per share. The corresponding voluntary public takeover offer was then published on April 11, 2024, by Novartis BidCo AG at an offer price of € 68.00 per MorphoSys share following approval by the German Federal Financial Supervisory Authority (BaFin) on April 11, 2024. The acceptance period of the takeover offer ended on May 13, 2024, and the additional acceptance period ended on May 30, 2024. Until expiration of the acceptance period on May 13, 2024, 25,610,813 MorphoSys shares were tendered, with the transfer of these MorphoSys shares to Novartis BidCo AG being completed on May 23, 2024. As a result, Novartis BidCo AG became the majority shareholder of MorphoSys, making MorphoSys a part of the Novartis Group. Together with the MorphoSys shares tendered during the additional acceptance period, ultimately 29,336,378 MorphoSys shares (corresponding to approximately 77.78% of the share capital of MorphoSys and approximately 77.89% of the voting share capital of MorphoSys) were tendered and transferred to Novartis BidCo AG in the course of the takeover offer. Through further acquisitions until June 16, 2024, Novartis BidCo AG has increased its stake in MorphoSys to 34,337,809 MorphoSys shares (corresponding to approximately 91.04% of the share capital, or approximately 91.17% of the voting share capital of MorphoSys). On June 20, 2024, MorphoSys announced that the company has entered into a delisting agreement with Novartis AG and Novartis BidCo AG in which it was agreed that Novartis BidCo AG publishes a public delisting purchase offer for all outstanding ordinary shares of MorphoSys not held by Novartis companies. Furthermore, on June 20, 2024, Novartis BidCo Germany AG, a subsidiary of Novartis BidCo AG, informed MorphoSys of its intention to merge MorphoSys into Novartis BidCo Germany AG by initiating a squeeze-out of MorphoSys’ minority shareholders, following the transfer of Novartis BidCo AG’s stake in MorphoSys of 34,337,809 MorphoSys shares (corresponding to approximately 91.04% of the share capital of MorphoSys) to Novartis BidCo Germany AG on June 19, 2024. Group Interim Statement 27 MorphoSys – II/2024

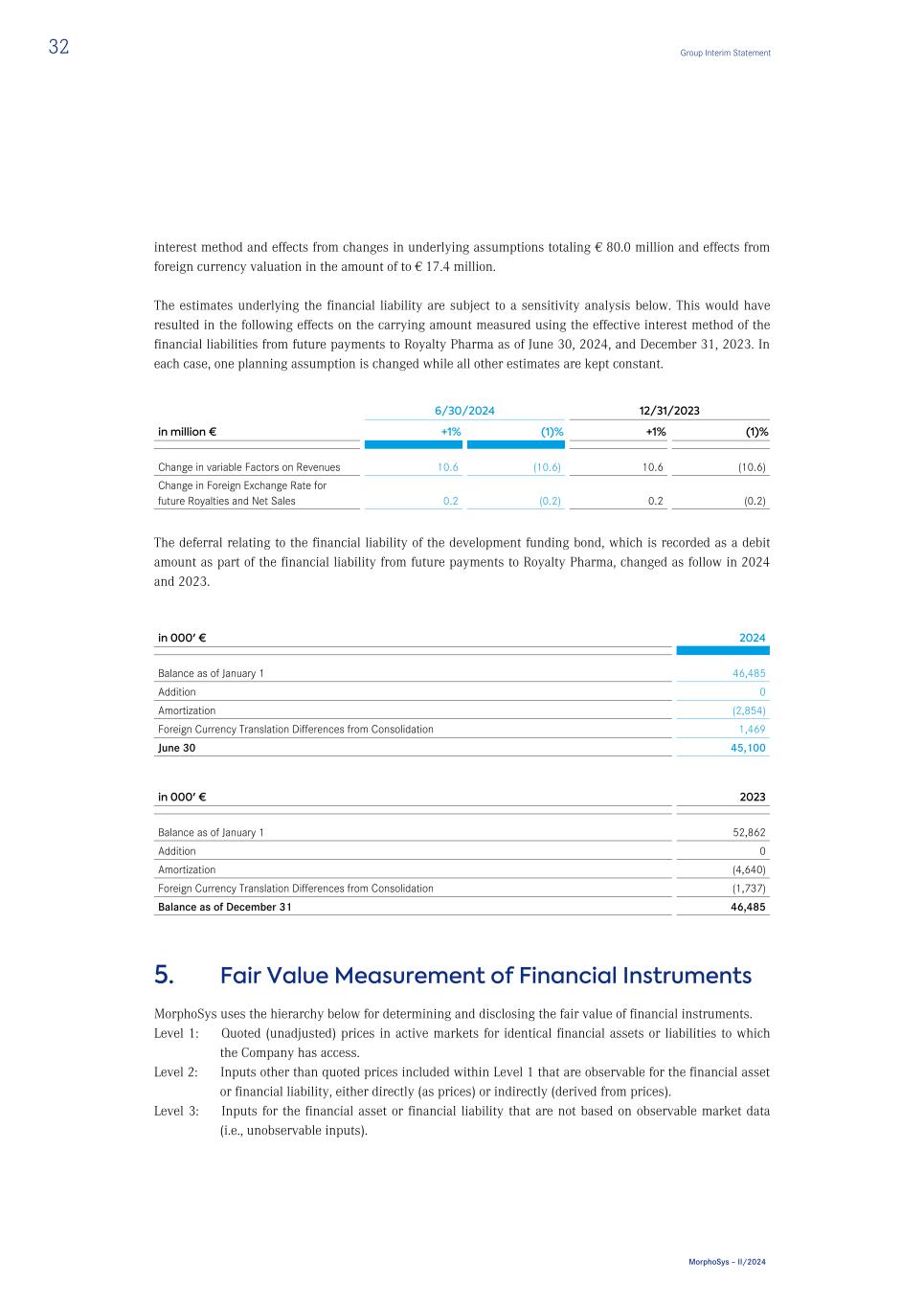

These interim consolidated financial statements were prepared in accordance with the International Financial Reporting Standards (IFRS) of the International Accounting Standards Board (IASB), taking into account the recommendations of the International Financial Reporting Standards Interpretations Committee (IFRS IC) as applicable in the European Union (EU). These interim consolidated financial statements comply with both the IFRSs published by the International Accounting Standards Board (IASB) and those adopted by the EU. These interim consolidated financial statements comply with IAS 34 "Interim Financial Reporting." The condensed interim consolidated financial statements do not contain all of the information and disclosures required for the financial year-end consolidated financial statements and therefore should be read in conjunction with the consolidated financial statements dated December 31, 2023. The condensed interim consolidated financial statements were approved for publication on August 28, 2024. The interim consolidated financial statements as of June 30, 2024, include MorphoSys AG as the parent company. MorphoSys AG has one wholly owned subsidiary, MorphoSys US Inc. (Boston, Massachusetts, USA). MorphoSys US Inc. in turn has a wholly owned subsidiary - Constellation Pharmaceuticals, Inc. (Cambridge, Massachusetts, USA). Constellation Pharmaceuticals, Inc. also has a wholly owned subsidiary, Constellation Securities Corp. (Cambridge, Massachusetts, USA). Constellation Pharmaceuticals, Inc. and Constellation Securities Corp. are collectively referred to as “Constellation”, and all entities constitute the “MorphoSys Group” or the “Group”. 1. Summary of Material Accounting Policies Basis of Application The accounting and valuation principles applied to the consolidated financial statements for the financial year ending December 31, 2023, were the same as those applied to the first six months of 2024. The consolidated financial statements as of December 31, 2023, are available on the Company’s website at: https://www.morphosys.com/en/investors/financial-information. Changes in Accounting Policies and Disclosures New or Revised Standards and Interpretations Adopted for the First Time in the Financial Year Standard/Interpretation Mandatory Application for financial years starting on Adopted by the European Union Impact on MorphoSys IAS 1 (A) Classification of Liabilities as Current or Non- current, Non-current Liabilities with Covenants 1/1/2024 yes yes IAS 7 (A) and IFRS 7 (A) Supplier Finance Arrangements 1/1/2024 yes none IFRS 16 (A) Lease Liability in a Sale and Leaseback 1/1/2024 yes none (A) Amendments Standards with the remark "none" do not have a material impact on the consolidated financial statements. The impact on the consolidated financial statements of the amendments to IAS 1 is not considered material and therefore not explained separately. 28 Group Interim Statement MorphoSys – II/2024

New or Revised Standards and Interpretations not yet Mandatorily Applicable The following new and revised standards that were not yet mandatory in the reporting period and not yet adopted by the European Union were not applied in advance. Standards with the remark "yes" are likely to have an impact on the consolidated financial statements and are currently being assessed by the Group. Standards with the remark "none" are not expected to have a material impact on the consolidated financial statements. Standard/Interpretation Mandatory Application for financial years starting on Adopted by the European Union Possible Impact on MorphoSys IFRS 18 Presentation and Disclosure in Financial Statements 1/1/2027 no yes IFRS 19 Subsidiaries without Public Accountability: Disclosures 1/1/2027 no none IFRS 9/IFRS 7 (A) Classification and Measurement of Financial Instruments 1/1/2026 no none IAS 21 (A) The Effects of Changes in Foreign Exchange Rates: Lack of Exchangeability 1/1/2025 no none (A) Amendments Change in Presentation Provisions As of June 30, 2024, the current and non-current item "Personnel-Related Provisions (Novartis Transaction)" was presented separately in the balance sheet. This item exclusively comprises provisions for share-based payment programs and provisions for other amounts related to the change of control. The takeover by Novartis made it necessary to recognize significant amounts for these matters in the first six months of the 2024 financial year (see also sections 7 to 10 of the notes to the half-year financial statements); previously, any current and non-current amounts were reported in the balance sheet item "Provisions". To improve the comparability of the balance sheet item, any amounts as at December 31, 2023 have also been adjusted. Assets held for sale and discontinued operations The sale of tafasitamab to Incyte on February 5, 2024 was classified as "Discontinued Operations" in accordance with IFRS 5. In addition, the shares in the associated company Human Immunology Biosciences Inc. (HI-Bio) are classified as an "asset held for sale" after the acquisition of the company by Biogen Inc. was announced on May 22, 2024. Therefore, the Consolidated Statement of Profit or Loss as well as the Consolidated Statement of Cash Flows have been split into "Continued Operations" and "Discontinued Operations" and prior year amounts have been reclassified respectively. Balance sheet items related to "Discontinued Operations and Assets Held for Sale" were shown separately as of June 30, 2024. A corresponding allocation of the previous year's balances in the Consolidated Balance Sheet was not carried out as permitted. Group Interim Statement 29 MorphoSys – II/2024

2. Revenues in 000' € H1 2024 H1 2023 Product Sales, Net 0 0 Royalties 61,161 45,528 License Fees 0 152 Milestone Payments 1,000 1,500 Service Fees 22 3,728 Other 0 0 Licenses, Milestones and Other 1,022 5,379 Total 62,184 50,908 The following overview shows the Group’s regional distribution of revenue on the basis of the customer location: in 000' € H1 2024 H1 2023 Europe (excluding Germany) 0 1,151 USA 62,184 49,756 Total 62,184 50,908 The following overview shows the timing of the satisfaction of performance obligations: in 000' € H1 2024 H1 2023 At a Point in Time 62,161 49,908 Over Time 22 1,000 Total 62,184 50,908 Of the total revenues generated in the first half-year of 2024, a total of € 62.2 million were recognized from performance obligations that were fulfilled in previous periods and related to milestone payments and royalties (H1 2023: € 47.0 million). 3. Income Taxes In the first half-year of 2024, the Group recognized tax income in the amount of € 1.6 million (H1 2023: tax expenses of € 0.0 million). In 2023, there were neither tax expenses nor tax income and no deferred taxes. In the first half of 2024, tax income for previous years was recognized in profit or loss. No deferred taxes were recognized as of June 30, 2024, as the conditions for non-recognition of deferred taxes still continue to exist. The effective group tax rate for the first half-year of 2024 is 0.4% (H1 2023: —%). The change was mainly due to the recognition of tax income from previous years. 30 Group Interim Statement MorphoSys – II/2024

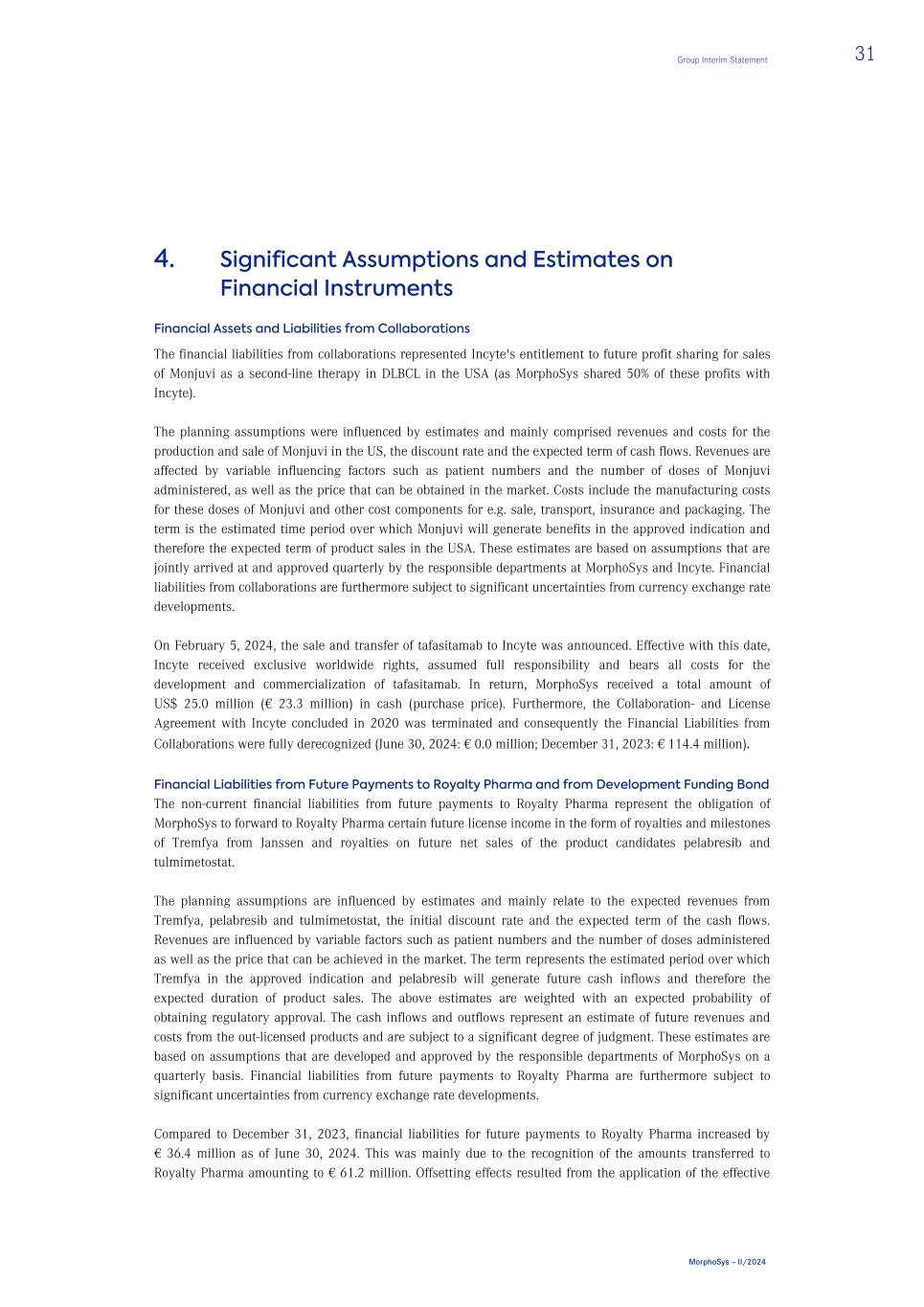

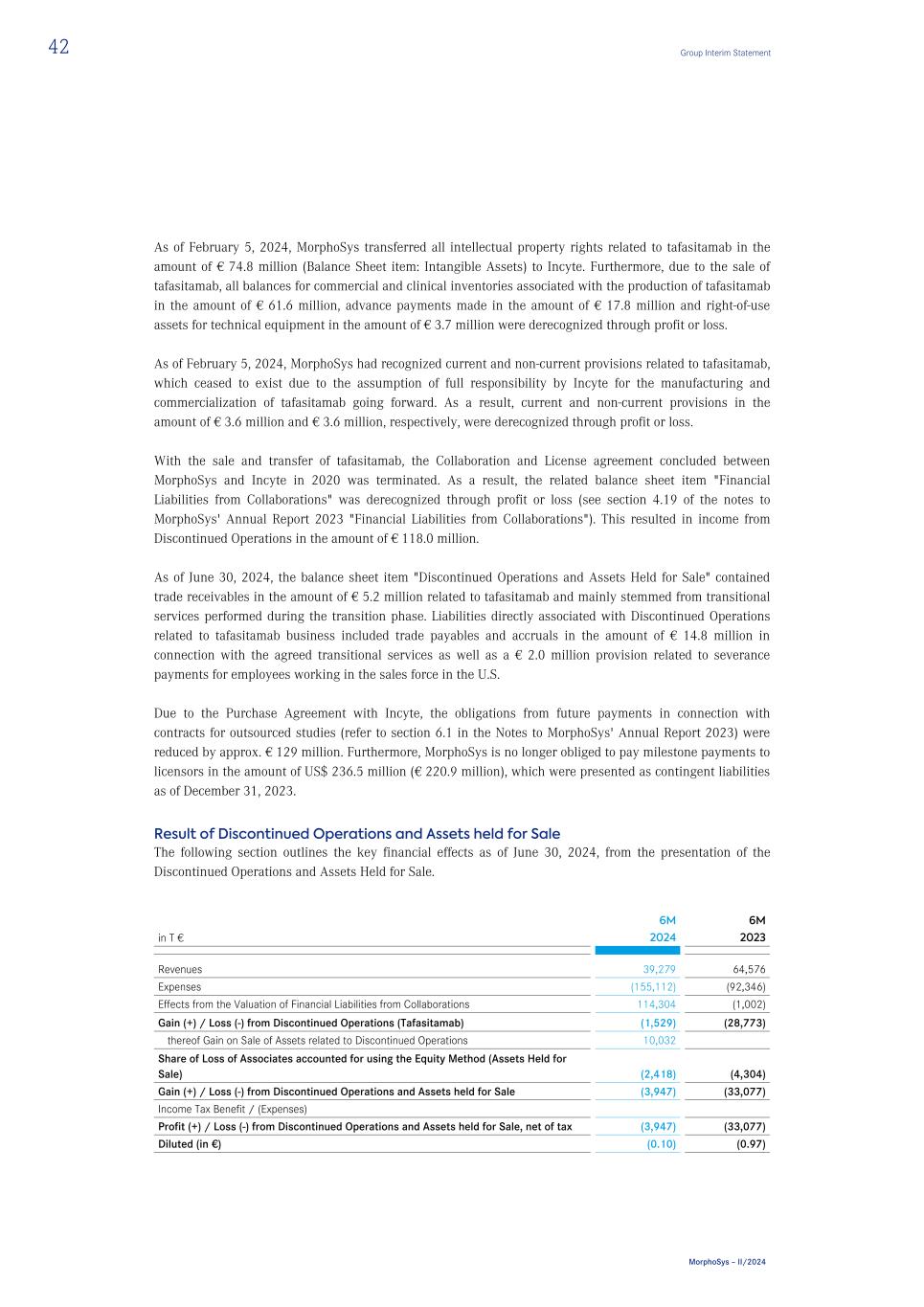

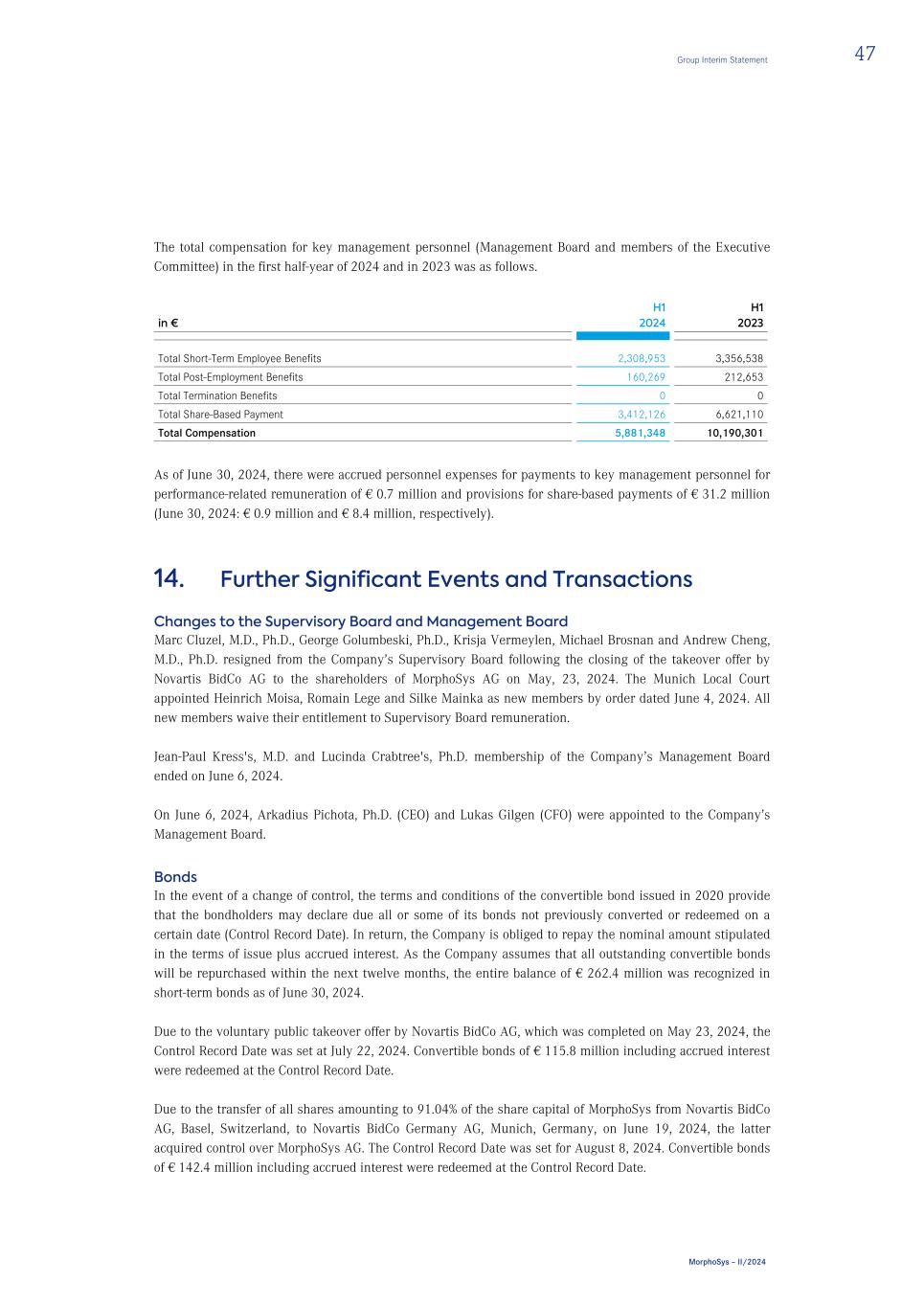

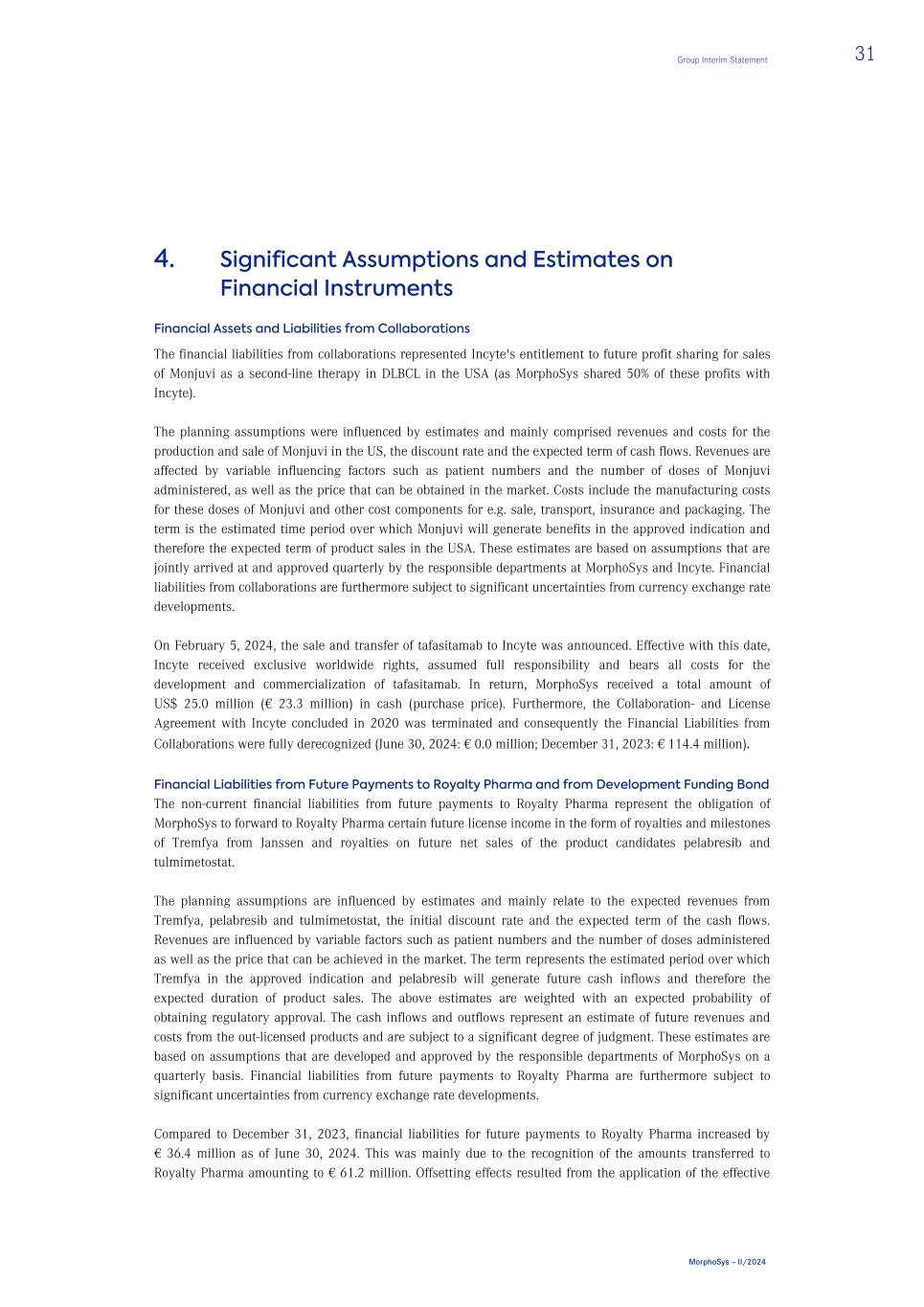

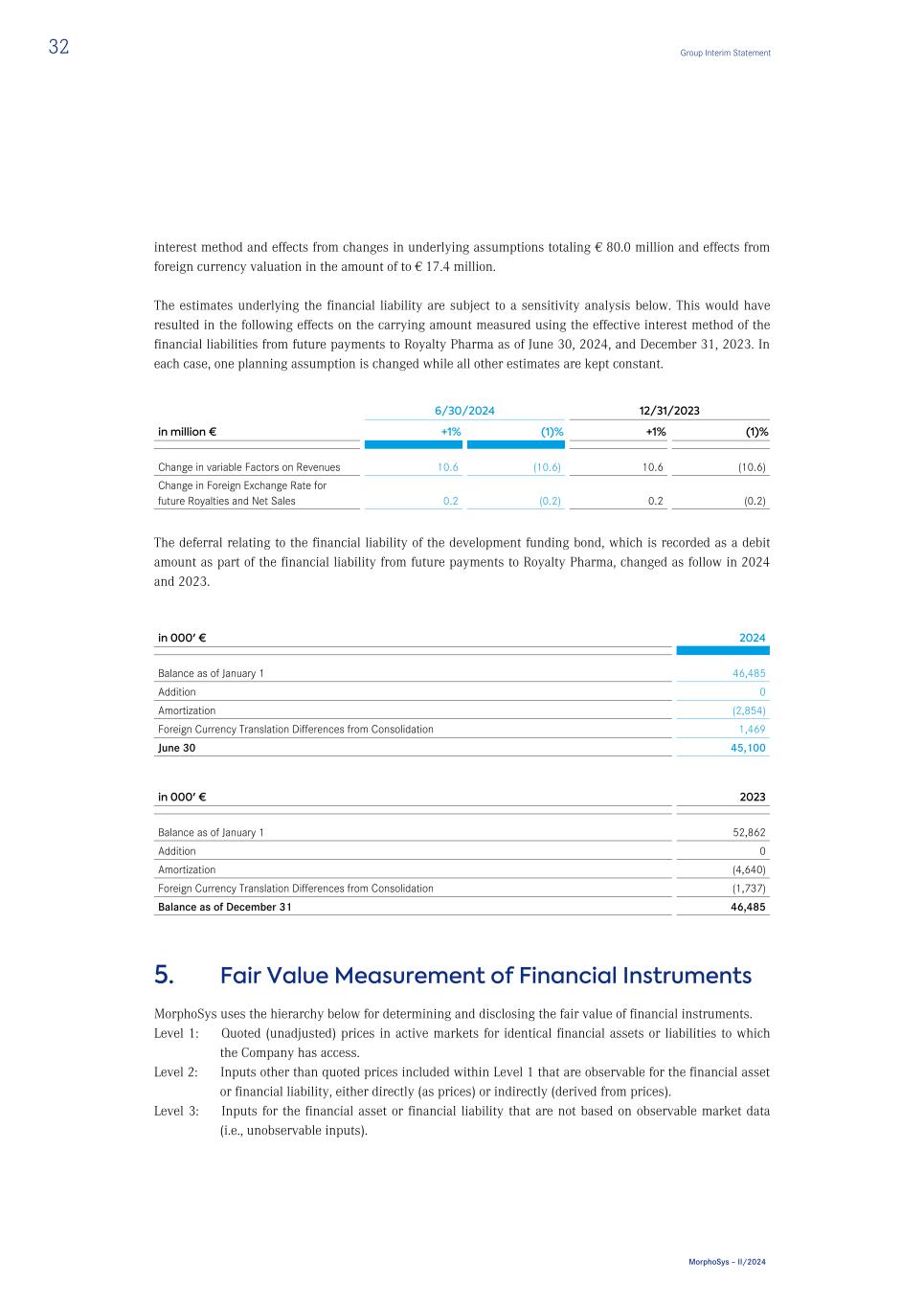

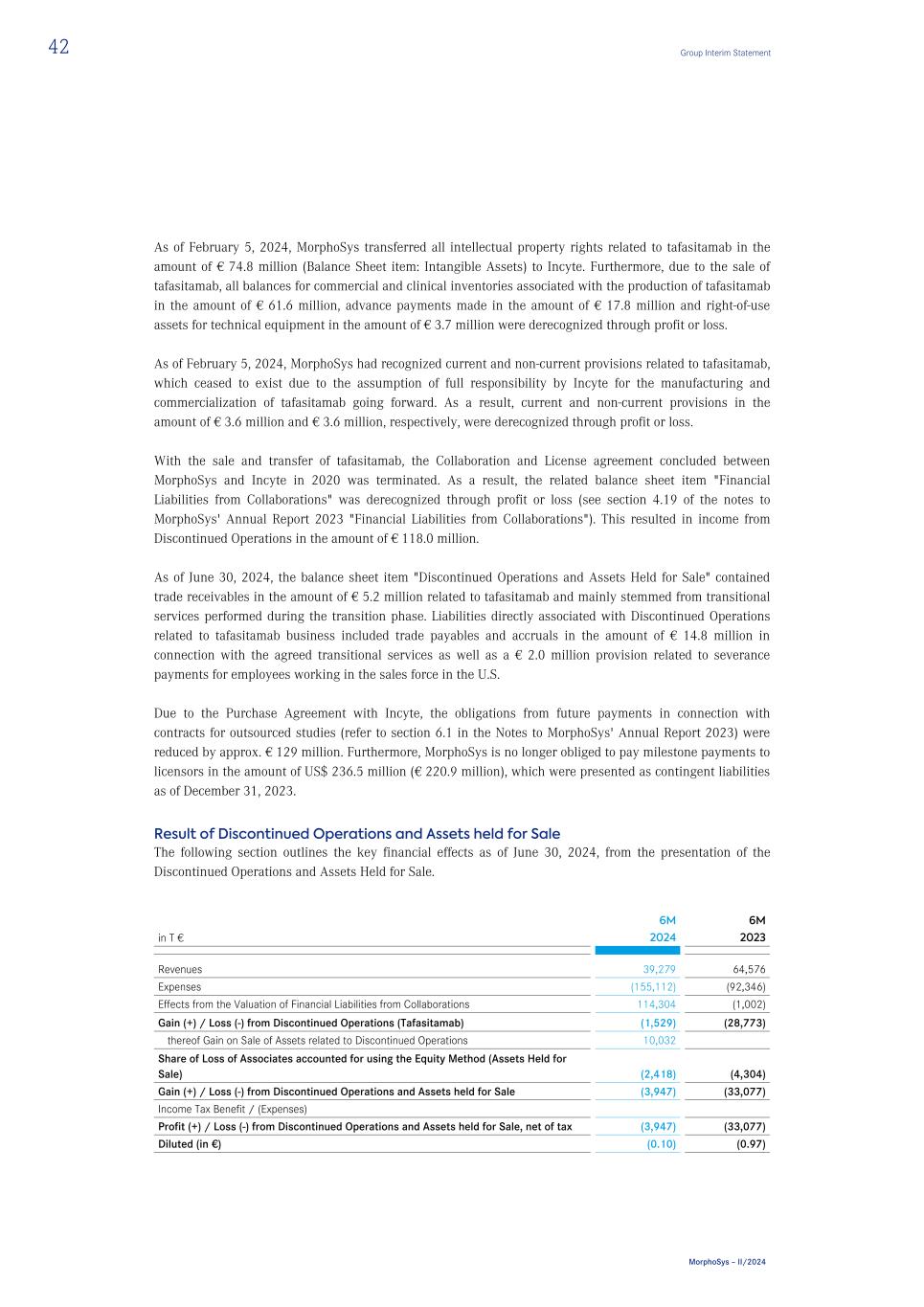

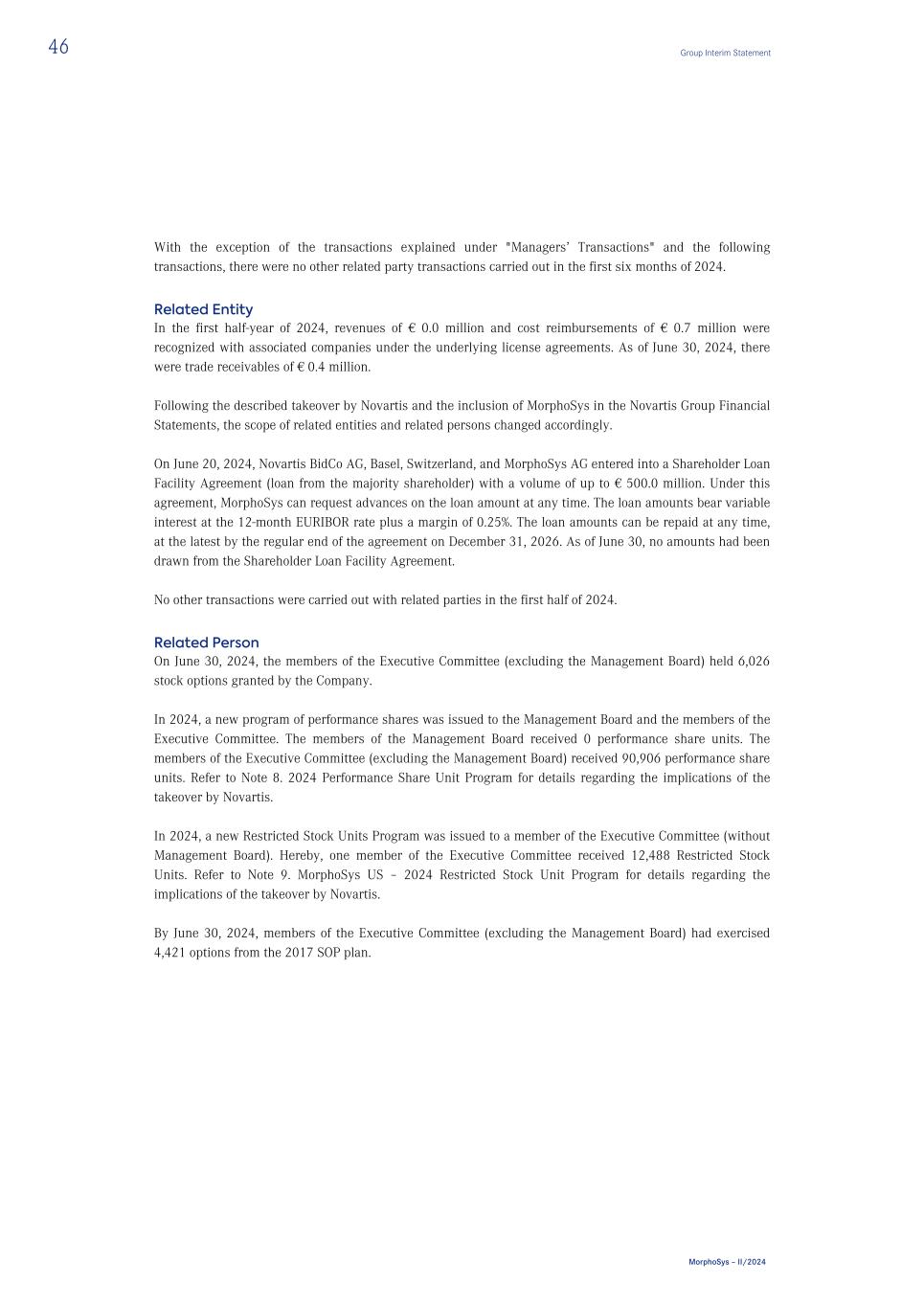

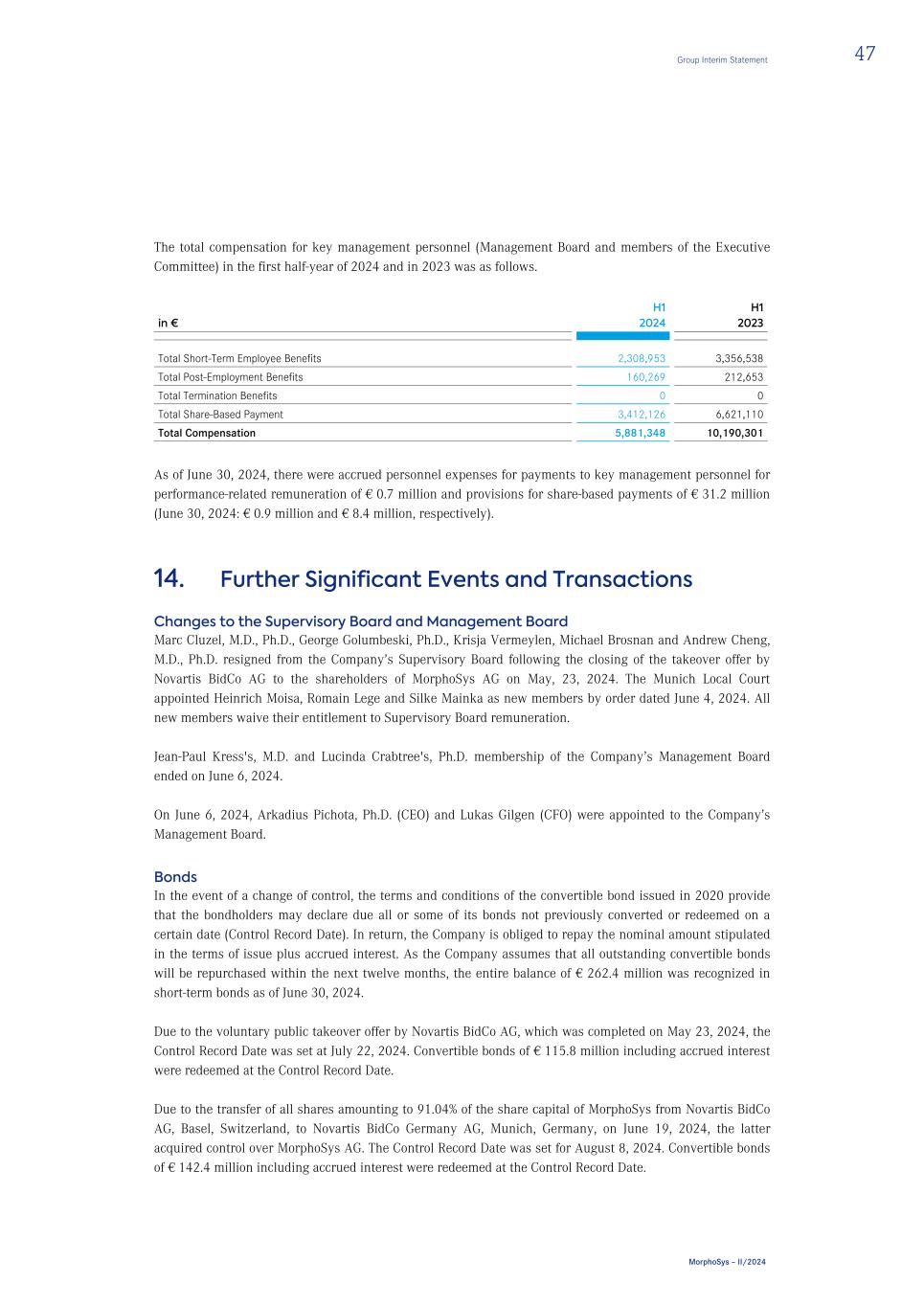

4. Significant Assumptions and Estimates on Financial Instruments Financial Assets and Liabilities from Collaborations The financial liabilities from collaborations represented Incyte's entitlement to future profit sharing for sales of Monjuvi as a second-line therapy in DLBCL in the USA (as MorphoSys shared 50% of these profits with Incyte). The planning assumptions were influenced by estimates and mainly comprised revenues and costs for the production and sale of Monjuvi in the US, the discount rate and the expected term of cash flows. Revenues are affected by variable influencing factors such as patient numbers and the number of doses of Monjuvi administered, as well as the price that can be obtained in the market. Costs include the manufacturing costs for these doses of Monjuvi and other cost components for e.g. sale, transport, insurance and packaging. The term is the estimated time period over which Monjuvi will generate benefits in the approved indication and therefore the expected term of product sales in the USA. These estimates are based on assumptions that are jointly arrived at and approved quarterly by the responsible departments at MorphoSys and Incyte. Financial liabilities from collaborations are furthermore subject to significant uncertainties from currency exchange rate developments. On February 5, 2024, the sale and transfer of tafasitamab to Incyte was announced. Effective with this date, Incyte received exclusive worldwide rights, assumed full responsibility and bears all costs for the development and commercialization of tafasitamab. In return, MorphoSys received a total amount of US$ 25.0 million (€ 23.3 million) in cash (purchase price). Furthermore, the Collaboration- and License Agreement with Incyte concluded in 2020 was terminated and consequently the Financial Liabilities from Collaborations were fully derecognized (June 30, 2024: € 0.0 million; December 31, 2023: € 114.4 million). Financial Liabilities from Future Payments to Royalty Pharma and from Development Funding Bond The non-current financial liabilities from future payments to Royalty Pharma represent the obligation of MorphoSys to forward to Royalty Pharma certain future license income in the form of royalties and milestones of Tremfya from Janssen and royalties on future net sales of the product candidates pelabresib and tulmimetostat. The planning assumptions are influenced by estimates and mainly relate to the expected revenues from Tremfya, pelabresib and tulmimetostat, the initial discount rate and the expected term of the cash flows. Revenues are influenced by variable factors such as patient numbers and the number of doses administered as well as the price that can be achieved in the market. The term represents the estimated period over which Tremfya in the approved indication and pelabresib will generate future cash inflows and therefore the expected duration of product sales. The above estimates are weighted with an expected probability of obtaining regulatory approval. The cash inflows and outflows represent an estimate of future revenues and costs from the out-licensed products and are subject to a significant degree of judgment. These estimates are based on assumptions that are developed and approved by the responsible departments of MorphoSys on a quarterly basis. Financial liabilities from future payments to Royalty Pharma are furthermore subject to significant uncertainties from currency exchange rate developments. Compared to December 31, 2023, financial liabilities for future payments to Royalty Pharma increased by € 36.4 million as of June 30, 2024. This was mainly due to the recognition of the amounts transferred to Royalty Pharma amounting to € 61.2 million. Offsetting effects resulted from the application of the effective Group Interim Statement 31 MorphoSys – II/2024