UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Rosetta Resources Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

ROSETTA RESOURCES INC.

717 Texas, Suite 2800

Houston, Texas 77002

May 5, 2006

Dear Rosetta Stockholder:

I am pleased to invite you to Rosetta’s Annual Meeting of Stockholders. The meeting will be held at the Hilton Americas—Houston (1600 Lamar, Houston, Texas 77010) on Wednesday, June 14, 2006, at 10:00 a.m., local Houston time. If you cannot be present at the Annual Meeting, I ask that you participate by completing the enclosed proxy and returning it at your earliest convenience.

At the meeting, you and the other stockholders will elect five directors to Rosetta’s Board of Directors as described in the accompanying Proxy Statement. You will also have the opportunity to hear what has happened in our business in the past year and to ask questions. The past ten months have been exciting for everyone here at Rosetta. We completed our acquisition of Calpine Corporation’s domestic oil and natural gas business in July 2005 and became a public company in February 2006. Everybody in our organization has worked extremely hard to build a foundation for a great company. We are excited about Rosetta’s future and appreciate your support as a stockholder.

I encourage you to read the enclosed Notice of Annual Meeting and Proxy Statement, which contains information about the Board of Directors and its committees and personal information about each of the nominees for the Board.

We hope you can join us on June 14th. Whether or not you can attend personally, it is important that your shares are represented at the meeting. Pleasemark your votes on the enclosed proxy card,sign and datethe proxy card, andreturn it to us in the enclosed envelope. Your vote is important, so please return your proxy promptly.

Sincerely,

B.A. (Bill) Berilgen

Chairman of the Board, President and

Chief Executive Officer

ROSETTA RESOURCES INC.

717 Texas, Suite 2800

Houston, TX 77002

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 14, 2006

To the Stockholders of

Rosetta Resources Inc.:

The annual meeting of stockholders of ROSETTA RESOURCES INC., a Delaware corporation (the “Company”), will be held on Wednesday, June 14, 2006, at 10:00 a.m., local Houston Time, at the Hilton Americas—Houston (1600 Lamar, Houston, Texas 77010), for the following purposes:

| | 1. | To elect the members of the Board of Directors of the Company to serve until the next annual meeting of the Company’s stockholders; and |

| | 2. | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on April 27, 2006 as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof. Only stockholders of record at the close of business on the record date are entitled to notice of, and to vote at, the meeting. A complete list of the stockholders will be available for examination at the offices of the Company in Houston, Texas during ordinary business hours for a period of 10 days prior to the meeting.

A record of the Company’s activities during 2005 and its financial statements for the fiscal year ended December 31, 2005 are contained in the Company’s 2005 Annual Report on Form 10-K. The Annual Report does not form any part of the material for solicitation of proxies.

All stockholders are cordially invited to attend the meeting.Stockholders are urged, whether or not they plan to attend the meeting, to complete, date and sign the accompanying proxy card and to return it promptly in the postage-paid return envelope provided.If a stockholder who has returned a proxy attends the meeting in person, the stockholder may revoke the proxy and vote in person on all matters submitted at the meeting.

By Order of the Board of Directors of

ROSETTA RESOURCES INC.

Michael J. Rosinski

Executive Vice President, Chief Financial Officer,

Secretary, and Treasurer

Houston, Texas

May 5, 2006

TABLE OF CONTENTS

i

GENERAL INFORMATION

| Q: | Who is soliciting my proxy? |

| A: | We, the Board of Directors of Rosetta Resources Inc., are sending you this proxy statement in connection with our solicitation of proxies for use at Rosetta’s 2006 Annual Meeting of Stockholders. Certain directors, officers and employees of Rosetta or American Stock Transfer & Trust Company also may solicit proxies on our behalf by mail, phone, fax or in person. |

| Q: | Who is paying for this solicitation? |

| A: | Rosetta will pay for the solicitation of proxies, including the cost of preparing and mailing this proxy statement. Rosetta also will reimburse banks, brokers, custodians, nominees and fiduciaries for their reasonable charges and expenses to forward our proxy materials to the beneficial owners of Rosetta stock. No additional fee beyond the $2,500 monthly fee paid to AST to act as Rosetta’s transfer agent, together with AST’s out-of-pocket expenses, will be paid to AST. |

| A: | The election of B.A. Berilgen, Richard W. Beckler, Donald D. Patteson, Jr., D. Henry Houston, and G. Louis Graziadio to the Board of Directors. |

| A: | Stockholders as of the close of business on April 27, 2006 are entitled to vote at the annual meeting. |

| A: | You may vote your shares either in person or by proxy. To vote by proxy, you should mark, date, sign and mail the enclosed proxy card in the prepaid envelope. Giving a proxy will not affect your right to vote your shares if you attend the annual meeting and want to vote in person – by voting in person you automatically revoke your proxy. You also may revoke your proxy at any time before the meeting by giving the Secretary written notice of your revocation or by submitting a later-dated proxy. If you return your proxy card but do not mark your voting preference, the individuals named as proxies will vote your sharesFOR the election of the nominees for director. |

| Q: | How does the Board recommend I vote on the proposals? |

| A: | The Board recommends a voteFOR each of the director nominees. |

| Q: | Is my vote confidential? |

| A: | Proxy cards, ballots and voting tabulations that identify individual stockholders are mailed or returned directly to Rosetta and handled in a manner intended to protect your voting privacy. Your vote will not be disclosedexcept: (1) as needed to permit Rosetta to tabulate and certify the vote; (2) as required by law; or (3) in limited circumstances, such as a proxy contest in opposition to the Board (which is not currently anticipated). Additionally, all comments written on the proxy card or elsewhere will be forwarded to management, but your identity will be kept confidential unless you ask that your name be disclosed. |

| Q: | How many shares can vote? |

| A: | As of the record date, April 27, 2006, Rosetta had outstanding 50,650,350 shares of common stock. Each share of common stock is entitled to one (1) vote. |

| Q: | What happens if I withhold my vote for an individual director? |

| A: | Because the individual directors are elected by a plurality of the votes cast at the meeting, a withheld vote will not have an effect on the outcome of the election of an individual director. |

ii

| Q: | Can I vote on other matters? |

| A: | We do not expect any other matter to come before the meeting. If any other matter is presented at the annual meeting, your signed proxy gives the individuals named as proxies authority to vote your shares on such matters at their discretion. |

| Q: | When are stockholder proposals due for the annual stockholders meeting in 2007? |

| A: | To be considered for inclusion in the proxy statement for Rosetta’s 2007 annual meeting, a stockholder proposal must be received at Rosetta’s offices no later than January 5, 2007. A stockholder proposal submitted outside the processes of Rule 14a-8 of the SEC, if received by Rosetta after February 28, 2007, will be considered untimely for presentation at Rosetta’s 2007 annual meeting of stockholders. |

| Q: | How can I communicate directly with a Rosetta director? |

| A: | Stockholders and other interested parties may contact any member of our Board or Committee thereof via U.S. mail, by addressing any correspondence to the Board, the applicable Committee, the non-management directors as a group or any individual director by either name or title, in care of Rosetta Resources Inc., 717 Texas, Suite 2800, Houston, Texas 77002; Attn: Corporate Secretary. In the case of communications addressed to the non-management directors, the Corporate Secretary will send appropriate stockholder communications to the chairman of the audit committee. In the case of communications addressed to a committee of the Board, the Corporate Secretary will send appropriate stockholder communications to the chairman of such committee. |

iii

ROSETTA RESOURCES INC.

717 Texas, Suite 2800

Houston, TX 77002

PROXY STATEMENT

For Annual Meeting of Stockholders

To Be Held on June 14, 2006

INTRODUCTION

The accompanying proxy, mailed together with this proxy statement, is solicited by and on behalf of the Board of Directors (the “Board of Directors” or “Board”) of Rosetta Resources Inc., a Delaware corporation (the “Company”), for use at the annual meeting of stockholders of the Company to be held at 10:00 a.m., local Houston time on Wednesday, June 14, 2006, at the Hilton Americas—Houston (1600 Lamar, Houston, Texas 77010), and at any adjournment or postponement thereof. The approximate date on which this proxy statement and the accompanying proxy will first be mailed to stockholders of the Company is May 5, 2006.

Shares represented by valid proxies will be voted at the meeting in accordance with the directions given. If no directions are given, the shares will be voted in accordance with the recommendations of the Board of Directors unless otherwise indicated. Any stockholder of the Company returning a proxy has the right to revoke the proxy at any time before it is voted by communicating the revocation in writing to Michael J. Rosinski, Secretary, Rosetta Resources Inc., 717 Texas, Suite 2800, Houston, Texas 77002, or by executing and delivering a proxy bearing a later date. No revocation by written notice or by delivery of another proxy shall be effective until the notice of revocation or other proxy, as the case may be, has been received by the Company at or prior to the meeting.

Only holders of record of the Company’s common stock at the close of business on April 27, 2006, the record date for the meeting, are entitled to notice of and to vote at the meeting. On that date, Rosetta had outstanding 50,650,350 shares of common stock, each of which is entitled to one vote.

Voting Procedures and Tabulation

Holders of record of common stock of the Company may vote by signing, dating and returning the proxy card in the accompanying postage-paid envelope. Stockholders whose shares of common stock of the Company are held in the name of a bank, broker or other holder of record (that is, “street name”) will receive separate instructions from such holder of record regarding the voting of proxies.

Rosetta will appoint one or more inspectors of election to act at the meeting and to make a written report thereof. Prior to the meeting, the inspectors will sign an oath to perform their duties in an impartial manner and according to the best of their ability. The inspectors will ascertain the number of shares outstanding and the voting power of each, determine the shares represented at the meeting and the validity of proxies and ballots, count all votes and ballots, and perform certain other duties as required by law.

The inspectors will tabulate the number of votes cast for, or withheld from, each matter submitted at the meeting for a stockholder vote. Votes that are withheld will be excluded entirely from the vote and will have no effect. Under the NASDAQ Marketplace Rules, brokers who hold shares in street name have the discretionary authority to vote on certain “routine” items when they have not received instructions from beneficial owners. For purposes of the 2006 annual meeting, routine items include the election of directors. In instances where brokers are prohibited from exercising discretionary authority and no instructions are received from beneficial owners with respect to such item (so-called “broker non-votes”), the shares they hold will not be considered part of the voting power present and, therefore, will have no effect on the vote.

1

CORPORATE GOVERNANCE AND COMMITTEES OF THE BOARD

Board of Directors

Our Board of Directors currently consists of four directors. Three of our four Board members (all members other than Mr. Berilgen) meet the independence criteria under SEC rules and under the NASDAQ Marketplace Rules. Our Board will continue to evaluate possible candidates to increase the size of our Board. Each of our Board members serves a one-year term or until such Board member’s successor is duly elected to serve on our Board.

In addition, our bylaws provide that the authorized number of directors, which shall constitute the whole Board of Directors, may be changed by resolution duly adopted by the Board of Directors. Any additional directorships resulting from an increase may be filled by the affirmative vote of a majority of our directors then in office, even if less than a quorum.

During 2005, our Board met four times and acted by unanimous written consent two times. Each of the directors attended all of the meetings of the Board. Each director attended at least 75% of the meetings of the Board of Directors and its committees of which such director was a member during the past fiscal year.

Committees of the Board

Our Board of Directors has established three committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Although we are not required to have a separate Compensation Committee, we have determined that it is in the best interests of the Company to maintain an independent Compensation Committee.

Messrs. Beckler, Patteson, and Houston serve on our Audit Committee, all of whom are “independent” under the listing standards of The NASDAQ National Market and Securities and Exchange Commission rules. Mr. Houston, chairman of the Audit Committee, is an “Audit Committee financial expert,” as defined under the rules of the SEC. The Audit Committee recommends to the Board of Directors the independent registered public accounting firm to audit our financial statements and oversees the annual audit. The Audit Committee also approves any other services provided by public accounting firms. The Audit Committee provides assistance to the Board of Directors in fulfilling its oversight responsibility to the stockholders, the investment community and others relating to the integrity of our financial statements, our compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence and the performance of our internal audit function. The Audit Committee oversees our system of disclosure controls and procedures and system of internal controls regarding financial, accounting, legal compliance and ethics that management and the Board of Directors have established. In doing so, it will be the responsibility of the Audit Committee to maintain free and open communication between the Audit Committee and our independent registered public accounting firm, the internal accounting function and management of the Company. Additionally, the Audit Committee will provide oversight to the process of determining our estimated reserves and will utilize independently engaged experts as necessary.

Our Audit Committee met three times during 2005. Each member of the Audit Committee was present at all meetings. See the report of the Audit Committee in this proxy statement. A copy of our Audit Committee’s adopted charter is attached hereto as Appendix A.

Messrs. Beckler, Patteson, and Houston serve on the Compensation Committee of our Board. The Chairman is Mr. Patteson. The Compensation Committee reviews the compensation and benefits of our executive officers, establishes and reviews general policies related to our compensation and benefits and administers our 2005 Long-Term Incentive Plan, as amended. Under the Compensation Committee charter, the Compensation Committee will determine the compensation of our CEO. Our Compensation Committee met once during 2005. Each member of the Compensation Committee was present at all meetings. See the report of the Compensation Committee in this Proxy Statement. A copy of our Compensation Committee’s adopted charter is attached hereto as Appendix B.

2

Messrs. Beckler, Patteson, and Houston, all of whom are “independent” under the listing standards of The NASDAQ National Market and Securities and Exchange Commission rules, serve on the Nominating and Corporate Governance Committee of our Board of Directors. The Chairman is Mr. Beckler. The Nominating and Corporate Governance Committee assists our Board of Directors by identifying individuals qualified to become members of our Board of Directors, consistent with its approved criteria, recommending director nominees for election at the annual meeting of our shareholders or for appointment to fill vacancies, and advising our Board of Directors about the appropriate composition of our Board of Directors and its committees. The Committee also develops and recommends to our Board of Directors corporate governance principles and practices and assists in its implementing them. The Nominating and Corporate Governance Committee is to conduct a regular review of our corporate governance principles and practices and to recommend to our Board of Directors any additions, amendments or other changes. The Nominating and Corporate Governance Committee is to evaluate and make an annual report concerning the performance of our Board of Directors, the Nominating and Corporate Governance Committee’s performance and our senior management’s performance with respect to corporate governance matters. Our Nominating and Corporate Governance Committee was established effective on December 29, 2005. Our Nominating and Corporate Governance Committee did not meet in 2005. A copy of our Nominating and Corporate Governance Committee’s adopted charter is attached hereto as Appendix C.

Corporate Governance Guidelines and Code of Ethics

We are committed to integrity, reliability and transparency in our disclosures to the public. On August 1, 2005, our Board of Directors adopted Guidelines for Publicity and Public Affairs Activities. On August 1, 2005, our Board of Directors also adopted a Code of Business Conduct and Ethics. Additionally, on September 27, 2005, our Board of Directors adopted the following as a part of our corporate governance: a Mission Statement and Values, a Code of Business Conduct and Ethics, Environmental, Health and Safety Mission Statement, Policy and Process. All of the foregoing are attached as Appendix D and are posted on our website atwww.rosettaresources.com along with our committee charters. These documents will also be available in print to any shareholder requesting a copy in writing from our corporate secretary at our executive offices set forth in this proxy statement.

Director Independence.The standards applied by the Board of Directors in affirmatively determining whether a director is “independent” in compliance with the listing standards of the NASDAQ, generally provide that a director is not independent if: (a) the director is, or in the past three years has been, an employee of Rosetta or any of its subsidiaries; (b) a member of the director’s immediate family is, or in the past three years has been, an executive officer of Rosetta or any of its subsidiaries; (c) the director or a member of the director’s immediate family has received more than $60,000 per year in direct compensation from Rosetta or any of its subsidiaries other than for service as a director (or for a family member, as a non-executive employee); (d) the director or a member of the director’s immediate family is, or in the past three years has been, employed in a professional capacity by PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, or has worked for such firm in any capacity on Rosetta’s audit; (e) the director or a member of the director’s immediate family is, or in the past three years has been, employed as an executive officer of a company where a Rosetta executive officer serves on the compensation committee; or (f) the director or a member of the director’s immediate family is an executive officer of a company that makes payments to, or receives payments from, Rosetta or any of its subsidiaries in an amount which, in any twelve-month period during the past three years, exceeds the greater of $200,000 or two percent of the consolidated gross revenues of the company receiving the payment.

The Board of Directors, applying the standards referenced above, affirmatively determined that three of its members, constituting a majority of the Board, are independent for Board membership purposes. The Board of Directors also determined that all members of the Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee are independent.

3

Independent Directors.At various times in 2005 our non management independent directors met outside of the presence of management directors and other members of our management, both with the independent auditors and then without anyone else present.

Executive Sessions. Beginning in 2006, we established a procedure by which our non-management directors will meet at least quarterly in executive session, outside of the presence of management directors or other members of management, both with the independent auditors and then without anyone else present.

Board Composition. The Nominating and Corporate Governance Committee is responsible for reviewing the requisite skills and characteristics of new Board members as well as the composition of the Board as a whole. Nominees for directorship will be selected by the Committee in accordance with the policies and principles in its charter. The Committee believes that the minimum qualifications for serving as a director are that a nominee demonstrate an ability to make a meaningful contribution to the Board’s oversight of our business and affairs and have a reputation for ethical conduct. Nominees for director will include individuals who, taking into account their diversity, age, skills, and experience in the context of the needs of the Board, as well as other relevant factors such as conflicts of interest and other commitments, would enhance the Board’s ability to manage and direct our affairs and business. We have not established term limits as we do not wish to risk losing the contribution of directors who will be able to develop, over a period of time, increasing insight into our business and operations.

The Committee identifies candidates by asking our current directors and executive officers to notify the Committee if they become aware of individuals who meet the criteria described above. The Committee has the sole authority to engage firms that specialize in identifying director candidates, although we have not heretofore engaged such a firm. The Committee will also consider candidates recommended by stockholders. After the Committee has identified a potential candidate, it collects and reviews available information regarding the individual, and if the Committee determines that the candidate warrants further consideration, the Committee Chair or another Committee member will contact the person. Generally, if the individual expresses a willingness to be considered for election to the Board, the Committee will request information from the candidate, review the individual’s qualifications, engage a third part to conduct a background investigation, and conduct one or more interviews with the candidate. When the Committee has completed this process, it tenders its recommendation to the full Board for consideration.

Responsibility of Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee shall prepare and recommend to the Board for adoption appropriate corporate governance principles and practices. Each year, this Committee shall:

| | • | | Review the advisability or need for any changes in the number and composition of the Board; |

| | • | | Review the advisability or need for any changes in the number, charters, titles of, or composition of the committees of the Board; |

| | • | | Recommend to the Board the composition of each committee of the Board and the individual director to serve as chairperson of each committee; |

| | • | | Require each chairman of each committee to report to the Board about the committee’s annual evaluation of its performance and evaluation of its charter; |

| | • | | Receive comments from all directors and report to the Board with an assessment of the Board’s performance, to be discussed with the full Board following the end of each fiscal year; |

| | • | | Develop, review and reassess the adequacy of the Company’s corporate governance principles and practices and recommend any proposed changes to the Board for its approval; |

| | • | | Make a report to the Board on succession planning and work with the Board to evaluate potential successors to the Chief Executive Officers; and |

| | • | | Evaluate the performance of the Nominating and Corporate Governance Committee and make a report to the full Board. |

4

Board’s Interaction With Stockholders. Our Chief Executive Officer and other corporate officers are responsible for establishing effective communications with our stockholders. It is our policy that management speaks for Rosetta. This policy does not preclude independent directors from meeting with stockholders, but where appropriate, management should be present at such meetings. Stockholders may submit communications to directors by writing to our corporate secretary at our executive offices set forth in this proxy statement.

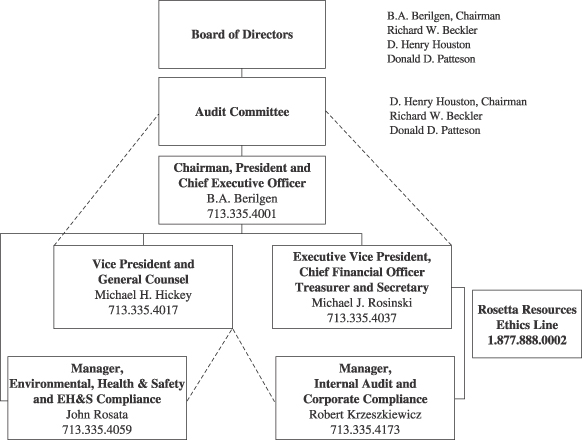

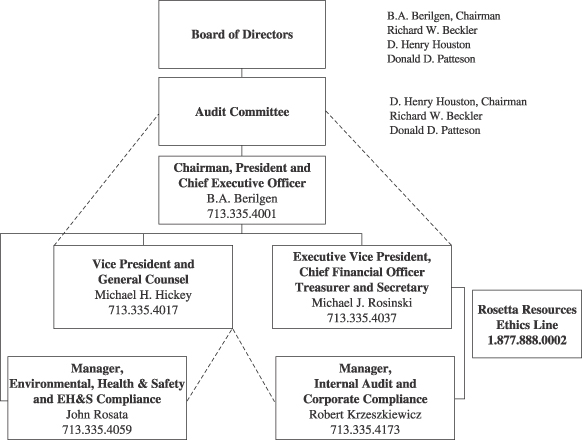

Business Conduct and Ethics. Our code of business conduct and ethics requires all of our directors, officers and employees to adhere to certain basic principles to uphold our mission to maximize value creation through excellence and innovative leadership. Our code requires them to comply with the law, avoid conflicts of interest, compete fairly and honestly, maintain a safe and healthy work environment, and preserve company assets. Our guiding values are honesty, integrity and quality in all that we do. We do not presently believe that there would be any occasion requiring any changes in or waivers under the code, but in the event of exceptional circumstances in which such a change or waiver becomes necessary, it would require Board approval and, where appropriate, prompt public disclosure. Our code includes specific compliance procedures and a mechanism for reporting violations to a supervisor, our manager of our internal audit department, or to our chief counsel. We have established an “ethics hotline” for employees to use and a procedure for maintaining secrecy of names with respect to an employee reporting a violation of our code of business conduct and ethics. You can access our code of business conduct and ethics on our website atwww.rosettaresources.com.

5

VOTING SECURITIES

Only holders of record of common stock of the Company, par value $0.001 per share, at the close of business on April 27, 2006, the record date for the annual meeting, are entitled to notice of, and to vote at, the meeting. A majority of the shares of common stock entitled to vote, present in person or represented by proxy, is necessary to constitute a quorum. Abstentions and broker non-votes on filed proxies and ballots are counted as present for establishing a quorum. On the record date for the annual meeting, there were issued and outstanding 50,650,350 shares of common stock. Each share of common stock is entitled to one vote.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following tabulation sets forth as of March 1, 2006 information with respect to the only persons who were known to the Company to be beneficial owners of more than five percent of the outstanding shares of common stock of the Company.

| | | | | | |

Name and Address of Beneficial Owner | | Amount and

Nature of

Beneficial Ownership | | | Percent of Class | |

First Pacific Advisors, Inc. 11400 West Olympic Blvd., Suite 1200 Los Angeles, California 90064 | | 8,320,400 | (1) | | 16.4 | % |

Capital Research and Management Company 5300 Robin Hood Rd. Norfolk, Virginia 23513-2407 | | 4,500,000 | (2) | | 8.9 | % |

Caisse De Depot Et Placement Du Quebec 1000 Place Jean-Paul-Riopelle Montreal, Quebec Canada H2Z 2B3 | | 3,125,000 | | | 6.2 | % |

Deephaven Capital Management, LLC 390 Greenwich Street, Suite 5 New York, New York 10013-2375 | | 2,772,100 | (3) | | 5.5 | % |

U.S. Trust Excelsior Value and Restructuring Fund 499 Washington Blvd., 7th Floor Jersey City, New Jersey 07310-1995 | | 2,750,000 | | | 5.4 | % |

Wellington Management Company, LLP 200 State Street Boston, Massachusetts 02109-2605 | | 2,543,600 | (4) | | 5.0 | % |

| (1) | First Pacific Advisors, Inc. may be deemed to share voting and dispositive control over the shares of common stock owned by AR Inc. Master Trust (102,900 shares), Detroit Diesel Empl. Pension (70,900 shares), Goldman Sachs GMS Funds LLC (550,700 shares), Lannan Foundation (174,800 shares), Masters Select Fund (177,100 shares), Pennsylvania Public School Employee Retirement Fund (1,204,100 shares), Rensselaer Polytechnic Institute (74,500 shares), Southern Farm Bureau Life Insurance (1,000,800 shares), FPA Capital Fund, Inc. (4,387,600 shares) and General Electric Pension Trust (577,000 shares). |

| (2) | Capital Research and Management Company may be deemed to share voting and dispositive control over the shares of common stock owned by the American Funds Insurance Series, Asset Allocation Fund (2,520,000 shares) and the American Funds Insurance Series, Growth Fund (1,980,000 shares). |

| (3) | Deephaven Capital Management, LLC may be deemed to share voting and dispositive control over the shares of common stock owned by Deephaven Distressed Opportunities Trading LTD. (1,350,000 shares), Deephaven Event Trading LTD. (1,350,000 shares), and MA Deep Event, Ltd. (72,100 shares). |

6

| (4) | Wellington Management Company, LLP may be deemed to share voting and dispositive control over the shares of common stock owned by Bay Pond Investors (Bermuda) L.P. (11,800 shares), Bay Pond Partners, L.P. (199,000 shares), Placer Creek Investors Bermuda L.P. (120,700 shares), Placer Creek Partners, L.P. (165,600 shares), Quissett Investors Bermuda L.P. (106,600 shares), Quissett Partners, L.P. (20,700 shares), Raytheon Company Combined DB/DC Master Trust (127,800 shares), Spendrift Investors Bermuda L.P. (1,068,100 shares), Spendrift Partners, L.P. (680,800 shares), and Trident Selections (42,500 shares). |

PROPOSAL I

ELECTION OF DIRECTORS

As of the date of this proxy statement, the Company’s Board of Directors consists of four directors, three of whom are independent. After the date of this proxy statement, the Company’s Board of Directors intends to expand the size of the Board by one member and to elect G. Louis Graziadio, III. Information regarding the business experience of each nominee is provided below. All directors are elected annually to serve until the next annual meeting and until successors are elected. You are being asked to elect five members to our Board of Directors.

Directors are elected by plurality vote of the shares present at the annual meeting, meaning that the director nominee with the most affirmative votes for a particular slot is elected for that slot. The proxyholders will vote in favor of the five persons listed below unless contrary instructions are given.

If you sign your proxy card but do not give instructions with respect to the voting of directors, your shares will be voted for the five persons recommended by the Board of Directors. If you wish to give specific instructions with respect to the voting of directors, you must do so with respect to the slate of four persons who will be voted upon at the annual meeting prior to the annual meeting.

The Board of Directors expects that all of the nominees will be available to serve as directors as indicated. In the event that any nominee should become unavailable, however, the proxyholders will vote for a nominee or nominees who would be designated by the Board of Directors unless the Board of Directors chooses to reduce the number of directors serving on the Board of Directors.

Company Nominees for Director

B. A. (Bill) Berilgen, age 58, has served as Chairman of the Board, President and Chief Executive Officer of Rosetta Resources Inc. since its formation in June 2005. Prior to joining Rosetta, Mr. Berilgen served as Executive Vice President of Calpine Corporation and as President—Calpine Power Fuels Company from January 2003 to June 2005. Previously he served as Senior Vice President—Natural Gas of Calpine Corporation from October 1999 to January 2003. Additionally, since October 1999, Mr. Berilgen served as Executive Vice President of Rosetta Resources Operating LP (formerly known as Calpine Natural Gas L.P.), then a subsidiary of Calpine and the operator of Calpine’s domestic oil and natural gas business. On December 20, 2005, Calpine Corporation and certain subsidiaries filed for bankruptcy protection in the Southern District of New York. Mr. Berilgen was President and Chief Executive Officer of Sheridan Energy, a publicly traded oil and gas company from 1997 to 1999, when Sheridan was acquired by Calpine. Mr. Berilgen previously worked as Vice President of Operations for Forest Oil and has also held positions with Aminoil, ANR Production Company and Mobil during his 35-year career in exploration and production. He holds a Bachelors degree in Petroleum Engineering and a Masters degree in Industrial Engineering, both from the University of Oklahoma.

Richard W. Beckler, age 65, has served as Director of Rosetta Resources Inc. since July 2005. Since 2003, Mr. Beckler has served as a partner in the global litigation group of the law firm of Howrey, Simon, Arnold & White. From 1979 to 2003, he served as a partner for the law firm of Fulbright & Jaworski, and at the end of his tenure was a partner heading the litigation group in Washington, D.C. Mr. Beckler also served as a section chief in the Criminal Fraud Section of the U.S. Department of Justice, and as an assistant district attorney in the Manhattan District Attorney’s office.

7

Donald D. Patteson, Jr., age 61, has served as Director of Rosetta Resources Inc. since July 2005. Mr. Patteson is the founder and Chief Executive Officer of Sovereign Business Forms, Inc. a consolidator in the wholesale manufacturing of custom business forms and related products segment of the printing industry. Prior to founding Sovereign in August 1996, he served as Managing Director of Sovereign Capital Partners, an investment firm specializing in leveraged buyouts. Mr. Patteson also previously served as President and Chief Executive Officer of WBC Holdings, Inc., President and Chief Executive Officer of Temple Marine Drilling, Inc./R.C. Chapman Drilling Co., Inc., President, Chief Executive Officer and Director of Temple Drilling. Mr. Patteson also worked with Atwood Oceanics, Houston Offshore International, Western Oceanic and Arthur Andersen’s management consulting practice earlier in his career.

D. Henry Houston, age 66, has served as Director of Rosetta Resources Inc. since July 2005. Since 2002, Mr. Houston has been Executive Vice President, Chief Operating Officer, and Chief Financial Officer of Remote Knowledge, Inc., a publicly owned development stage company offering monitoring and communication services to link owners with remote assets (e.g., oil and gas production facilities). From 1995 to 2002, he served as Executive Vice President and Chief Financial Officer of T.D. Rowe Amusements, a private company operating approximately 25,000 vending and amusement devices. Mr. Houston also previously worked as an oil and gas consultant and served as President of KP Explorations, Inc., Chairman of the Board of Magee Poole Drilling, President of Black Hawk Oil Company, Chief Financial Officer of C&K Petroleum, and Vice President, Chief Financial Officer, and Director Southdown Inc. Earlier in his career, he worked with Price Waterhouse and with Detsco, Inc. Mr. Houston serves on the Board of Directors of Remote Knowledge, Inc.

G. Louis Graziadio, III,age 55, is a nominee for election as a director of Rosetta Resources Inc. at the 2006 shareholders meeting. Mr. Graziadio is President and Chief Executive Officer of Second Southern Corp., the managing partner of Ginarra Partners, L.L.C., a closely-held California company involved in a wide range of investments and business ventures including, since 1983, investments in oil and gas. He is also Chairman of the Board and Chief Executive Officer of Boss Holdings, Inc., a distributor of work and hunting gloves, rainwear, rain boots, industrial apparel, pet products, and ad specialty merchandise. Mr. Graziadio is also currently a director of True Religion Apparel, Inc. and of Acacia Research Corporation. From 1984 through 2000, Mr. Graziadio served as a director of Imperial Bancorp, parent company of Imperial Bank, a Los Angeles-based commercial bank acquired by Comerica Bank in January, 2001. Mr. Graziadio, and companies with which he is affiliated, are significant shareholders in numerous private and public companies. Since 1978, Mr. Graziadio has been active in restructurings of both private and public companies, as well as corporate spin-offs and IPOs.

Stockholder Recommended Directors

Currently, Rosetta’s Nominating and Corporate Governance Committee does not have a policy to consider nominees for director. The Committee intends to consider this policy for 2006 and future years.

The Board of Directors unanimously recommends a vote FOR the election of each of the Board’s nominees.

INFORMATION CONCERNING THE BOARD OF DIRECTORS

Compensation of Directors

Effective after the 2006 shareholders meeting, we will pay each of our non-employee directors an annual retainer of $35,000. In addition, the chairperson of the Audit Committee is paid an annual retainer of $15,000, the chairperson of the Compensation Committee is paid an annual retainer of $10,000, and the chairperson of the Nominating & Corporate Governance Committee is paid an annual retainer of $5,000. Non-employee directors are paid an attendance fee of $1,500 for each Board meeting attended in person, an attendance fee of $1,000 for each committee meeting attended in person (except for attendance at meetings of the Audit Committee, for which

8

the director is paid $1,250), and an attendance fee of $1,000 for each Board or committee meeting attended telephonically. We will reimburse all directors for reasonable expenses incurred while attending Board and committee meetings.

Any non-employee director may elect to receive a grant of shares of our common stock in lieu of the annual retainer fees as a Board member and chairperson. The number of shares is determined by dividing the fee amount by the fair market value (the average of the high and low trading price) of our common stock on the day that said fees are to be paid, which will generally be within ten business days after the annual shareholders meeting.

Upon joining our Board in July 2005, Messrs. Patteson, Beckler and Houston, as non-employee directors, each received fully vested options to purchase 10,000 shares of our common stock for a ten-year term at an exercise price of $16, which was the price of our common stock on the date of grant. Also, Messrs. Patteson, Beckler and Houston each received a grant of 1,800 shares of restricted stock, with vesting to occur in three installments: 25% one year after the date of grant, an additional 25% two years after grant and the remaining 50% three years after the date of grant.

Subsequent to each shareholders meeting at which a director is elected or reelected, beginning with the shareholders meeting in June 2006, he/she will receive an additional grant of (i) a fully vested option to purchase 5,000 shares of our common stock for a ten-year term at the fair market value on the date of the shareholders meeting, and (ii) a grant of 3,500 shares of restricted stock, with vesting to occur in three installments: 25% one year after the date of grant, an additional 25% two years after grant and the remaining 50% three years after the date of grant.

Mr. Berilgen receives no separate compensation for service on our Board of Directors, nor will any other of our officers who serve as directors in the future receive separate compensation.

Compensation Committee Interlocks and Insider Participation

At December 31, 2005, the members of the Compensation Committee were Messrs. Beckler, Patteson, and Houston. No member of the Compensation Committee was an officer or employee of Rosetta at any time during 2005.

During 2005, no executive officer or employee of Rosetta served as (i) a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served on the Compensation Committee of the Board of Directors; (ii) a director of another entity, one of whose executive officers served on the Compensation Committee of the Board of Directors; or (iii) a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served as a director of Rosetta.

9

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following tabulation sets forth, as of April 27, 2006, the shares of common stock beneficially owned by each nominee director, each named executive officer listed in the Summary Compensation Table included elsewhere in this proxy statement, and all nominee directors and named executive officers as a group.

| | | | | |

| | | Common Stock

Beneficially Owned(1) |

Name | | Number of Shares | | | Percent

of Class |

Director | | | | | |

B.A. Berilgen | | 125,000 | (2) | | * |

Richard W. Beckler | | 12,800 | (3) | | * |

D. Henry Houston | | 13,300 | (3) | | * |

Donald D. Patteson, Jr. | | 12,800 | (3) | | * |

G. Louis Graziadio | | — | | | — |

| | |

Named Executive Officers (excluding any director named above) | | | | | |

Michael J. Rosinski | | 37,700 | (4) | | * |

Charles F. Chambers | | 38,000 | (5) | | * |

Michael H. Hickey | | 24,562 | (6) | | * |

Edward E. Seeman | | 38,000 | (7) | | * |

All directors and named executive officers as a group (9 persons) | | 302,162 | | | * |

| (1) | Unless otherwise indicated, all shares are directly held with sole voting and investment power. |

| (2) | Represents (i) 20,000 regular restricted shares of common stock, which will vest 25% on the first anniversary of the date of grant, 25% on the second anniversary of the grant, and the remaining 50% on the third anniversary of the grant, provided the executive is continuously employed by Rosetta or an affiliate until such dates, (ii) 80,000 unrestricted shares of common stock, and (iii) 25,000 shares of common stock underlying fully vested options. |

| (3) | Represents (i) 10,000 shares of common stock underlying fully vested options; (ii) 1,800 restricted shares of common stock, which will vest 25% on the first anniversary of the date of grant, 25% on the second anniversary of the date of grant, and the remaining 50% on the third anniversary of the date of grant; and (iii) in the case of Messrs. Beckler and Patteson, 1,000 shares of common stock requested in lieu of cash compensation for Board service; and in the case of Mr. Houston, 1,500 shares of common stock requested in lieu of cash compensation for Board service. |

| (4) | Represents (i) 6,000 regular restricted shares of common stock (ii) 24,000 unrestricted shares of common stock, and (iii) 7,700 shares of common stock underlying fully vested options. |

| (5) | Represents (i) 6,000 regular restricted shares of common stock (ii) 24,000 unrestricted shares of common stock, and (iii) 8,000 shares of common stock underlying fully vested options. |

| (6) | Represents (i) 6,000 regular restricted shares of common stock (ii) 12,000 unrestricted shares of common stock, and (iii) 6,562 shares of common stock underlying fully vested options. |

| (7) | Represents (i) 6,000 regular restricted shares of common stock (ii) 24,000 unrestricted shares of common stock, and (iii) 8,000 shares of common stock underlying fully vested options. |

10

Executive Officers who are not Directors

Michael J. Rosinski, age 61, has served as Executive Vice President, Chief Financial Officer, and Treasurer of Rosetta Resources Inc. since July 2005. Prior to joining Rosetta, Mr. Rosinski served as Executive Vice President and Chief Financial Officer of Rosetta Resources Operating LP (formerly known as Calpine Natural Gas L.P.). Prior to that Mr. Rosinski served as Chief Financial Officer of Power Medical Products from July 2004 through May 2005, and was Senior Vice President and Chief Operating Officer of Municipal Energy Resources Corporation from 1997 to 2004. Previously, he held positions as Senior Vice President and Chief Financial Officer of Santa Fe Energy, and held a number of positions at Tenneco. Mr. Rosinski holds a Masters degree in Business Administration from Tulane University and a Bachelors degree in Mechanical Engineering from Georgia Tech. He has over 35 years of experience in energy financing, financial management and controls, planning and investor relations in energy and related industries.

Charles F. Chambers, age 55, has served as Executive Vice President, Corporate Development of Rosetta Resources Inc. since June 2005. Prior to joining Rosetta and since February 2005, Mr. Chambers served as Vice President of Business Development and Land for Rosetta Resources Operating LP (formerly known as Calpine Natural Gas L.P.). Prior to that in March 2002, he founded Buena Vista Oil & Gas for the purpose of acquiring domestic oil and gas assets, and he served as its President. Mr. Chambers served as Vice President, Business Development for Rosetta Resources Operating LP from October 1999 until March 2002. Mr. Chambers served as Vice President, Corporate Development of Sheridan Energy from 1997 until 1999 when Sheridan was acquired by Calpine. Prior to these assignments, Mr. Chambers was land manager at C&K Petroleum Inc. and later founded Chambers Oil & Gas, Inc., an independent operator active in the Texas-Louisiana Gulf Coast. Mr. Chambers has 32 years of experience in the oil and gas industry.

Michael H. Hickey, age 51, has served as Vice President and General Counsel of Rosetta Resources Inc. since August 2005. Mr. Hickey has previous experience in the role as general counsel having served as Vice President Law and Secretary of Technip Offshore Inc., from April 2004 through July 2005. He is knowledgeable concerning Rosetta’s oil and natural gas business, having been promoted to Vice President and Managing Counsel for Calpine’s North American E&P and midstream group, where he contributed to the growth of these oil and natural gas assets from September 2000 to March 2004. He served as Vice President, General Counsel and Secretary of Kosa B.V. from December 1998 until August 2000. He holds a Bachelors of Arts degree and J.D. both from the University of Tennessee and has been a practicing lawyer for 26 years.

Edward E. Seeman, age 58, has served as Vice President, Northern Division of Rosetta Resources Inc. since July 2005. Prior to joining Rosetta, Mr. Seeman served as Director, Reservoir Engineering since April 2001 for Rosetta Resources Operating LP (formerly known as Calpine Natural Gas L.P.). Previously, he held a number of positions with Forest Oil Corporation beginning in 1974. He holds a Bachelors degree in Petroleum Engineering from the University of Oklahoma and has over 31 years of reservoir engineering experience in the oil and gas industry.

EXECUTIVE COMPENSATION

The following report of the Compensation Committee of the Board of Directors shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules, except for the required disclosure in this proxy statement, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), and the information shall not be deemed to be incorporated by reference into any filing made by the Company under the Securities Act of 1933 or the Exchange Act.

11

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

To the Stockholders of

Rosetta Resources Inc.:

The purpose of the Compensation Committee is to assist the Board of Directors of the Company in discharging its responsibilities relating to compensation of the Company’s executive officers and the members of the Board. The Compensation Committee has overall responsibility for approval, evaluation and oversight of all compensation plans, policies and programs of the Company. In addition, it is the responsibility of the Compensation Committee to produce a committee report on executive compensation as required by the SEC to be included in the Company’s annual proxy statement or annual report on Form 10-K. The Board of Directors has delegated to the Compensation Committee authority to determine and approve the bonus, equity-based compensation and other benefits applicable to executive officers of the Company. The Compensation Committee held one meeting during 2005.

Executive Compensation

Historical Compensation

Calpine paid compensation of certain of our officers as employees of Calpine, including our Chief Executive Officer, Mr. Berilgen, during the first half of 2005, 2004 and 2003, prior to the closing of our private placement of equity in July 2005. We have entered into an agreement with a private employer organization to provide payroll services and employee benefits coverage. Compensation information regarding our named executive officers for fiscal year 2005 is provided below.

2005 Long-Term Incentive Plan

We adopted our 2005 Long-Term Incentive Plan in July 2005, and reserved 3,000,000 shares for issuance under the Plan. As of April 27, 2006, we had issued 636,400 shares of restricted stock and 847,500 stock options from the Long-Term Incentive Plan to employees and service providers (totals are net after cancellation of grants due to termination of service).

Employment Agreements and Other Arrangements

We have entered into employment agreements with our top five executives effective July 2005. The agreements are substantially similar in form, with differences in base salary, performance bonus targets and equity grants (detailed in the table below), termination provisions and contract term.

Each contract provides for an initial term beginning on its effective date and continuing through the contract term, although it may be terminated earlier under certain circumstances. At the end of the initial term, each agreement will be automatically extended for an additional year, and thereafter automatically extended for an additional year, unless we or the executive gives written notice to the other six months before the end of the initial term or any subsequent additional term. Mr. Berilgen’s initial term is three years. Messrs. Rosinski’s, and Chambers’ initial terms are both two years. Messrs Hickey’s and Seeman’s initial term is one year.

Each executive has been granted an award of regular restricted shares of our common stock, which will vest 25% on the first anniversary of the date of grant, 25% on the second anniversary of the grant, and the remaining 50% on the third anniversary of the grant, provided that the executive is continuously employed by Rosetta or an affiliate until such date. Additionally, each executive has been granted an award of bonus restricted shares of our common stock, which vested in full on the day following the date on which our initial registration statement became effective under the Securities Act. Also, each executive has been granted a non-qualified option to purchase shares of our common stock, which will become exercisable 25% on the date of grant, 25% on the first anniversary of the date of grant, 25% on the second anniversary of the grant, and the remaining 25% on the third anniversary of the grant.

12

Each agreement provides that, if the executive’s employment is terminated by us without cause, by the executive for good reason, or for our failure to renew the employment agreement, he will remain on the payroll and continue to draw his regular salary for a period of time, and we will pay him a lump sum amount equal to a certain multiple of his annual target bonus. Also, the executive’s equity-based awards will become immediately exercisable in full. For Mr. Berilgen, he would continue to draw his regular salary for three years and would receive a lump sum payment of three times his target bonus. For each of Messrs. Rosinski, Chambers, Hickey, and Seeman, each would continue to draw his regular salary for one year and would receive a lump sum payment of his target bonus.

Each agreement provides that if, subsequent to certain corporate changes (as defined in the agreement), the executive’s employment is terminated within two years of the corporate change for any reason other than death, inability to perform, or for cause, or for failure to renew the employment agreement, or is terminated by the executive for good reason, he will receive a lump-sum payment equal to a multiple of the sum of his annual salary and annual target bonus. Also, the executive will be entitled to reimbursement for certain health insurance benefits for a period of time, and all of his equity-based awards will become immediately vested. Mr. Berilgen would receive a lump sum payment equal to three times the sum of (a) his regular salary, plus (b) his target bonus amount. Additionally, he would receive reimbursement for the cost of COBRA (or other similar) health insurance coverage, less the amount charged at the time of termination to other employees, for a period of three years. Messrs. Rosinski, Chambers, Hickey and Seeman each would receive a lump sum payment equal to two times the sum of (a) his regular salary, plus (b) his target bonus amount. Additionally, each would receive reimbursements for the cost of COBRA (or other similar) health insurance coverage, less the amount charged at the time of termination to other employees, for one year.

Under the employment agreement, if benefits to which the executive becomes entitled are considered “excess parachute payments” under Section 280G of the Tax Code, then he will be entitled to an additional “gross-up” payment from us in an amount such that, after payment by the executive of all taxes, including any excise tax imposed upon the gross-up payment, he retains an amount equal to the excise tax imposed upon the payment.

Each executive is also entitled to all of the employee benefits, fringe benefits and perquisites we provide to other employees.

Summary

The members of the Compensation Committee believe that linking executive compensation to corporate performance results in a better alignment of compensation with corporate goals and stockholder interests. As performance goals are met or exceeded, resulting in increased value to stockholders, executive officers are rewarded commensurately. The Compensation Committee believes that compensation levels during 2005 adequately reflect the compensation goals and policies of the Company.

April 28, 2006

Compensation Committee

Donald D. Patteson, Jr.Chair

Richard W. Beckler

D. Henry Houston

13

The following “Summary Compensation Table,” “Option Grants in 2005” table, “Aggregated Option Exercises in 2005 and 12/31/05 Option Values” table, and “Long Term Incentive Plan Grants in 2005” table are attachments to this Report of the Compensation Committee on Executive Compensation.

The following table sets forth certain summary information concerning the compensation awarded to, earned by or paid to the Chief Executive Officer of the Company and each of the four most-highly compensated executive officers of the Company other than the Chief Executive Officer (collectively, the “named executive officers”) from the period beginning July 1, 2005 and ending December 31, 2005. Calpine Corporation paid all the compensation of certain of our named executive officers as employees of Calpine during 2003, 2004, and the first six months of 2005. Rosetta has not included this information in the table below because prior compensation is not reflective of the executive’s current compensation as a Rosetta executive.

Summary Compensation Table

| | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Annual Compensation (1) | | Long Term Compensation (1) | | All Other Compensation ($) |

| | | Salary ($) | | Bonus ($) | | Other Annual Compen- sation ($) | | Shares

Underlying

Stock

Options (2) | | Shares of

Restricted

Stock (3) | | Performance

Unit Payouts | |

B.A. Berilgen President and Chief Executive Officer | | 2005 | | 195,564 | | — | | — | | 100,000 | | 100,000 | | — | | 976 |

| | | | | | | | |

Michael J. Rosinski Executive Vice President and Chief Financial Officer | | 2005 | | 112,372 | | — | | — | | 30,800 | | 30,000 | | — | | 1,819 |

| | | | | | | | |

Charles F. Chambers Executive Vice President, Corporate Development | | 2005 | | 97,709 | | — | | — | | 32,000 | | 30,000 | | — | | 390 |

| | | | | | | | |

Michael H. Hickey Vice President and General Counsel | | 2005 | | 88,938 | | — | | — | | 26,250 | | 18,000 | | — | | — |

| | | | | | | | |

Edward E. Seeman Vice President – Northern Division | | 2005 | | 87,941 | | — | | — | | 32,000 | | 30,000 | | — | | — |

| (1) | Represents compensation of the named executive officers of the Company for the period beginning July 1, 2005 and ending December 31, 2005. |

| (2) | Options represent the right to purchase shares of common stock at a fixed price per share equal to fair market value on the date of grant, which will become exercisable 25% on the date of grant, 25% on the first anniversary of the date of grant, 25% on the second anniversary of the grant, and the remaining 25% on the third anniversary of the grant. The vesting of the options will accelerate in the event of a change in control of the Company. Vesting of these options is not contingent on performance criteria. |

| (3) | Consists of restricted shares of the Company’s common stock issued pursuant to the 2005 Long-Term Incentive Plan. Vesting of these restricted shares at the end of the three-year restricted period ending 2008 is dependent upon the continued employment of the restricted stockholder with the Company. In addition, the lapse of restrictions on restricted shares will accelerate in the event of a change in control of the Company. The grantee has the right to receive dividends or distributions on the shares of restricted stock, although such dividends or distributions are subject to the same restrictions as the shares of restricted stock. |

14

The following table sets forth certain information with respect to options to purchase common stock granted during the year ended December 31, 2005 to each of the named executive officers.

Option Grants in 2005

| | | | | | | | | | | | | | |

| | | Individual Grants | | | | |

| | | Number of

Shares Underlying

Options Granted (1) | | % of Total Options Granted to Employees in 2005 | | | Exercise or Base Price ($/sh) | | Expiration Date | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation

for Option Term |

Name | | | | | | 5%($) | | 10%($) |

B.A. Berilgen | | 100,000 | | 14.20 | % | | $ | 16.00 | | 7/7/15 | | 1,680,000 | | 1,760,000 |

Michael J. Rosinski | | 30,800 | | 4.40 | % | | $ | 16.00 | | 7/7/15 | | 517,440 | | 542,080 |

Charles F. Chambers | | 32,000 | | 4.50 | % | | $ | 16.00 | | 7/7/15 | | 537,600 | | 563,200 |

Michael H. Hickey | | 26,250 | | 3.70 | % | | $ | 16.00 | | 7/7/15 | | 441,000 | | 462,000 |

Edward E. Seeman | | 32,000 | | 4.50 | % | | $ | 16.00 | | 7/7/15 | | 537,600 | | 563,200 |

| (1) | Options represent the right to purchase shares of common stock at the price per share (equal to fair market value on the date of grant) indicated in the table, which will become exercisable 25% on the date of grant, 25% on the first anniversary of the date of grant, 25% on the second anniversary of the grant, and the remaining 25% on the third anniversary of the grant. |

The following table sets forth certain information with respect to the exercise of options to purchase common stock during the year ended December 31, 2005, and the unexercised options held at December 31, 2005 and the value thereof, by each of the named executive officers.

Aggregated Option Exercises in 2005

and 12/31/05 Option Values

| | | | | | | | | | | | |

Name | | Shares Acquired on Exercise | | Value Realized ($) | | Number of Securities

Underlying Unexercised

Options at December 31, 2005 (number of shares) | | Value of Unexercised In-the-Money Options at December 31, 2005 ($) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

B.A. Berilgen | | — | | — | | 25,000 | | 75,000 | | 50,000 | | 150,000 |

Michael J. Rosinski | | — | | — | | 7,700 | | 23,100 | | 15,400 | | 46,200 |

Charles F. Chambers | | — | | — | | 8,000 | | 24,000 | | 16,000 | | 48,000 |

Michael H. Hickey | | — | | — | | 6,562 | | 19,688 | | 13,124 | | 39,376 |

Edward E. Seeman | | — | | — | | 8,000 | | 24,000 | | 16,000 | | 48,000 |

15

The following table sets forth certain information with respect to shares of restricted common stock of the Company granted during the year ended December 31, 2005 to each of the named executive officers.

Long Term Incentive Plan Grants in 2005

| | | | | | | | | | | | | | | | |

| | | Number of

Restricted

Shares Granted | | % of Total Restricted

Shares Granted to Employees

in 2005 | | | Performance Period | | Estimated Payout at Maturity |

Name | | | | | Threshold

Payout | | Target Payout | | Maximum

Payout |

B.A. Berilgen | | 80,000

20,000 | | 17 | % | | | | $

| 1,280,000

320,000 | | $

| 1,280,000

320,000 | | $

| 1,280,000

320,000 |

Michael J. Rosinski | | 24,000

6,000 | | 5 | % | | | |

| 384,000

96,000 | |

| 384,000

96,000 | |

| 384,000

96,000 |

Charles F. Chambers | | 24,000

6,000 | | 5 | % | | | |

| 384,000

96,000 | |

| 384,000

96,000 | |

| 384,000

96,000 |

Michael H. Hickey | | 12,000

6,000 | | 3 | % | | | |

| 192,000

96,000 | |

| 192,000

96,000 | |

| 192,000

96,000 |

Edward E. Seeman | | 24,000

6,000 | | 5 | % | | | |

| 384,000

96,000 | |

| 384,000

96,000 | |

| 384,000

96,000 |

Description of 2005 Long-Term Incentive Plan

The Company has established the Rosetta Resources Inc. 2005 Long-Term Incentive Plan and Amendment No. 1 to the Plan (together, the “Plan”). The Board of Directors believes that equity-based incentive compensation plans provide an important means of attracting, retaining and motivating employees, non-employee directors and other service providers. The Plan is intended to promote and advance the interests of Rosetta by providing employees, non-employee directors and other service providers of Rosetta and its affiliates added incentive to continue in the service of Rosetta through a more direct interest in the future success of Rosetta’s operations. The Board of Directors believes that employees, non-employee directors and other service providers who have an investment in Rosetta are more likely to meet and exceed performance goals. The Board of Directors believes that the various equity-based incentive compensation vehicles provided for under the Plan, including stock options, restricted and unrestricted stock, restricted stock units, stock appreciation rights, performance awards and other incentive awards, are needed to maintain and promote Rosetta’s competitive ability to attract, retain and motivate employees, non-employee directors and other service providers. The following is a summary of the Plan.

Purposes. The Plan allows for the grant of stock options, stock awards, restricted stock, restricted stock units, stock appreciation rights, performance awards and other incentive awards to employees, non-employee directors and other service providers of Rosetta and its affiliates who are in a position to make a significant contribution to the success of Rosetta and its affiliates. The purposes of the Plan are to attract and retain service providers, further align employee and shareholder interests, and closely link compensation with company performance. The Plan will provide an essential component of the total compensation package, reflecting the importance that we place on aligning the interests of service providers with those of our stockholders.

Administration. The Plan provides for administration by the Compensation Committee or another committee of our Board of Directors (the “Committee”). However, each member of the Committee must (1) meet independence requirements of the exchange on which our common stock is listed (if any), (2) be a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 and (3) be an “outside director” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). With respect to awards granted to non-employee directors, the Committee is the Board of Directors. Among the powers granted to the Committee are (1) the authority to operate, interpret and administer the Plan, (2) determine eligibility for and the amount and nature of awards, (3) establish rules and regulations for the Plan’s operation,

16

accelerate the exercise, vesting or payment of an award if the acceleration is in our best interest, (4) require participants to hold a stated number or percentage of shares acquired pursuant to an award for a stated period of time and (5) establish other terms and conditions of awards made under the Plan. The Committee also has authority with respect to all matters relating to the discharge of its responsibilities and the exercise of its authority under the Plan. The Plan provides for indemnification of Committee members for personal liability incurred related to any action, interpretation or determination made in good faith with respect to the Plan and awards made under the Plan.

Eligibility.Employees, non-employee directors and other service providers of Rosetta and our affiliates who, in the opinion of the Committee, are in a position to make a significant contribution to the success of Rosetta and our affiliates are eligible to participate in the Plan. The Committee determines the type and size of award and sets the terms, conditions, restrictions and limitations applicable to the award within the confines of the Plan’s terms.

Available Shares. The maximum number of shares available for grant under the plan is 3,000,000 shares of common stock plus any shares of common stock that become available under the Plan for any reason other than exercise. The number of shares available for award under the Plan is subject to adjustment for certain corporate changes in accordance with the provisions of the Plan. Shares of common stock issued pursuant to the Plan may be shares of original issuance or treasury shares or a combination of those shares.

The maximum number of shares of common stock available for grant of awards under the Plan to any one participant is (i) 300,000 shares during the fiscal year in which the participant begins work for Rosetta and (ii) 200,000 shares during each fiscal year thereafter.

Stock Options. The Plan provides for the grant of incentive stock options intended to meet the requirements of Section 422 of the Code and nonqualified stock options that are not intended to meet those requirements. Incentive stock options may be granted only to employees of Rosetta and its affiliates. All options will be subject to terms, conditions, restrictions and limitations established by the Committee, as long as they are consistent with the terms of the Plan.

The Committee will determine when an option will vest and become exercisable. No option will be exercisable more than ten years after the date of grant (or, in the case of an incentive stock option granted to a 10% shareholder, five years after the date of grant). Unless otherwise provided in the option award agreement, options terminate within a certain period of time following a participant’s termination of employment or service for any reason other than cause (12 months) or for cause (30 days).

Generally, the exercise price of a stock option granted under the Plan may not be less than the fair market value of the common stock on the date of grant. However, the exercise price may be less if the option is granted in connection with a transaction and complies with special rules under Section 409A of the Code. Incentive stock options must be granted at 100% of fair market value (or, in the case of an incentive stock option granted to a 10 percent shareholder, 110 percent of fair market value).

The exercise price of a stock option may be paid (i) in cash, (ii) in the discretion of the Committee, with previously acquired non-forfeitable, unrestricted shares of common stock that have been held for six months and that have an aggregate fair market value at the time of exercise equal to the total exercise price, or (iii) a combination of those shares and cash. In addition, in the discretion of the Committee, the exercise price may be paid by delivery to us or our designated agent of an executed irrevocable option exercise form together with irrevocable instructions to a broker-dealer to sell or margin a sufficient portion of the shares of common stock with respect to which the option is exercised and deliver the sale or margin loan proceeds directly to Rosetta to pay the exercise price and any required withholding taxes.

Stock Appreciation Rights (SARs). A stock appreciation right entitles the participant to receive an amount in cash and/or shares of Common Stock, as determined by the Committee, equal to the amount by which our

17

common stock appreciates in value after the date of the award. The Committee will determine when the SAR will vest and become exercisable. Generally, the exercise price of a SAR will not be less than the fair market value of the common stock on the date of grant. However, the exercise price may be less if the stock is granted in connection with a transaction and complies with special rules under Section 409A of the Code. No SAR will be exercisable later than ten years after the date of the grant. The Committee will set other terms, conditions, restrictions and limitations on SARs, including rules as to exercisability after termination of employment or service.

Stock Awards.Stock awards are shares of common stock awarded to participants that are subject to no restrictions. Stock awards may be issued for cash consideration or for no cash consideration.

Restricted Stock and Restricted Stock Units (RSUs). Restricted stock is shares of common stock that must be returned to us if certain conditions are not satisfied. The Committee will determine the restriction period and may impose other terms, conditions and restrictions on restricted stock, including vesting upon achievement of performance goals pursuant to a performance award and restrictions under applicable securities laws. The Committee also may require the participant to pay for restricted stock. Subject to the terms and conditions of the award agreement related to restricted stock, a participant holding restricted stock will have the right to receive dividends on the shares of restricted stock during the restriction period, vote the restricted stock and enjoy all other shareholder rights related to the shares of common stock. Upon expiration of the restriction period, the participant is entitled to receive shares of common stock not subject to restriction.

Restricted Stock Units Are Fictional Shares Of Common Stock. The Committee will determine the restriction period and may impose other terms, conditions and restrictions on RSUs. Upon the lapse of restrictions, the participant is entitled to receive one share of common stock or an amount of cash equal to the fair market value of one share of common stock as provided in the award agreement. An award of RSUs may include the grant of a tandem cash dividend right or dividend unit right. A cash dividend right is a contingent right to receive an amount in cash equal to the cash distributions made with respect to a share of common stock during the period the RSU is outstanding. A dividend unit right is a contingent right to have additional RSUs credited to the participant equal to the number of shares of common stock (at fair market value) that may be purchased with the cash dividends. Restricted stock unit awards are considered nonqualified deferred compensation subject to Section 409A of the Code and will be designed to comply with that section.

Performance Awards. A performance award is an award payable in cash or common stock (or a combination thereof) upon the achievement of certain performance goals over a performance period. Performance awards may be combined with other awards to impose performance criteria as part of the terms of the other awards. For each performance award, the Committee will determine (i) the amount a participant may earn in the form of cash or shares of common stock or a formula for determining the amount payable to the participant, (ii) the performance criteria and level of achievement versus performance criteria that will determine the amount payable or number of shares of common stock to be granted, issued, retained and/or vested, (iii) the performance period over which performance is to be measured, which may not be shorter than one year, (iv) the timing of any payments to be made, (v) restrictions on the transferability of the award and (vi) other terms and conditions that are not inconsistent with the Plan. The maximum amount that may be paid in cash pursuant to a performance award each fiscal year is $1 million. If an award provides for a performance period longer than one fiscal year, the limit will be multiplied by the number of full fiscal years in the performance period. The performance measure(s) to be used for purposes of performance awards may be described in terms of objectives that are related to the individual participant or objectives that are company-wide or related to a subsidiary, division, department, region, function or business unit of Rosetta in which the participant is employed, and may consist of a combination of certain criteria, including, but not limited to earnings or earnings per share, return on equity, return on assets or net assets, revenues, individual business objectives, stock price among other items.

Performance awards may be designed to comply with the performance-based compensation requirements of Section 162(m) of the Code. Section 162(m) of the Code limits Rosetta’s income tax deduction for compensation

18