Exhibit 99.2

REDEFINED BUILDING VALUE IN UNCONVENTIONAL RESOURCES Rosetta Resources Inc. Permian Basin Acquisition Conference Call Oil-Rich Inventory Growth Transaction March 15, 2013

Overview Jim Craddock Operational Comments John Clayton Financial Comments John Hagale Closing Remarks Jim Craddock * Acquisition Call Agenda

Rosetta to acquire 53,300 net acres from Comstock Resources, Inc., located in Delaware Basin in Reeves County and Midland Basin in Gaines County Key Terms Purchase Price: $768 million, subject to customary closing adjustments; committed financing in place January 1, 2013 effective date; expected to close May 15, 2013 Key Highlights New basin entry with access to oil-rich, multi-pay areas Doubled liquids-rich acreage Remaining liquids inventory increased by 28% Current net production increased by 6% DCF per share and EPS accretive in 2014 and 2015, respectively * Permian Basin Asset Acquisition

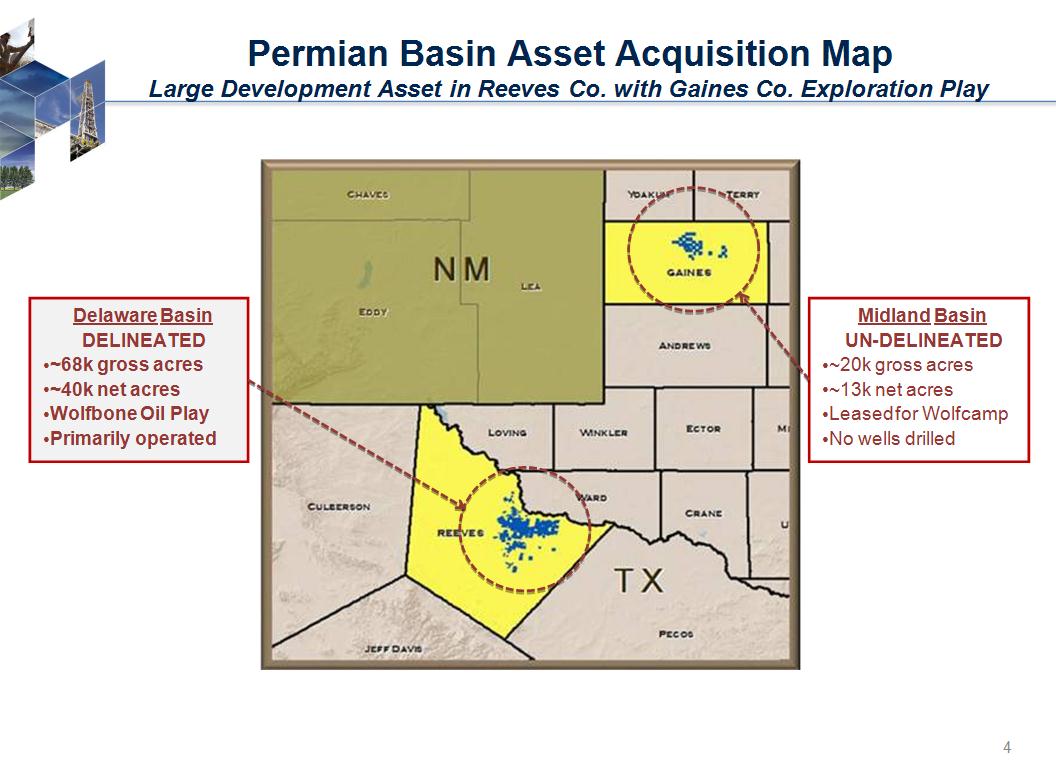

* Delaware Basin DELINEATED ~68k gross acres ~40k net acres Wolfbone Oil Play Primarily operated Midland Basin UN-DELINEATED ~20k gross acres ~13k net acres Leased for Wolfcamp No wells drilled Permian Basin Asset Acquisition Map Large Development Asset in Reeves Co. with Gaines Co. Exploration Play

Delineated Delaware Basin position with 145 MMBOE of oil-rich, repeatable inventory (40-acre spacing) provides long-term production/reserve growth Single well economics compete with ROSE’s existing portfolio Significant upside potential Vertical down-spacing Early stage horizontal Wolfcamp play evolving Potential development of western Reeves County acreage Multiple stacked zones Gaines County new ventures play Adds core position for further Wolfbone growth and A&D/New Ventures Permian Basin expansion opportunities * Permian Entry in Core of Wolfbone Vertical Oil Play

Reeves County Acreage Overview (Entire Asset) Overview (Entire Asset) Gross / Net Acreage (all Reeves Co.) ~68K / ~40K Average Working Interest ~60% overall ~76% for operated acreage Undrilled inventory (vertical Wolfbone 40-acres only) ~1,300 gross locations Est. Current Production (74 producing wells) ~3,300 BOEPD Total Resource (vertical Wolfbone 40-acres only, PD+Undeveloped) 145 MMBOE Oil % / Liquid % (PD+Undeveloped) 67.1% / 82.5% Reeves County Asset Snapshot 145 MMBOE Resource (40-acre vertical development only) *

HIGHLIGHTS Reeves County Vertical Wolfbone 40-acre development Down-spacing potential Reeves County Horizontal Wolfcamp Early stage - operators testing upper and middle Wolfcamp Completed 2 horizontals in acquired area Reeves County Avalon / Bone Spring Additional horizontal upside potential Reeves County Other Formations May ultimately recognize upside in deeper, gas-prone formations Likely requires higher gas price environment Gaines County Exploration Play Gaines County Exploration Play Exploration play; no wells drilled to date Wolfcamp is a likely target Asset Potential Stacked Zones Provide Collection of Vertical/Horizontal Development Opportunities Base Case Upside Reeves County *

22% 6% Note: Based on ROSE Base Case estimates (Reeves Co. only for all metrics) Based on proved undeveloped plus non-proved; Acquired Permian inventory per ROSE Base Case @ 03/05/13 Strip-LT pricing ROSE inventory estimate as of 12/31/2012 ROSE production is January 2013 average Pro Forma Overview Acquisition Provides 140+ MMBOE of Net Risked Undeveloped Resource 50% * Rosetta Acquisition Liquids-Focused Assets (000s Net Acres) Current Net Production (Mboe/d) Net Resource (Undeveloped)1 (MMboe) 2 3

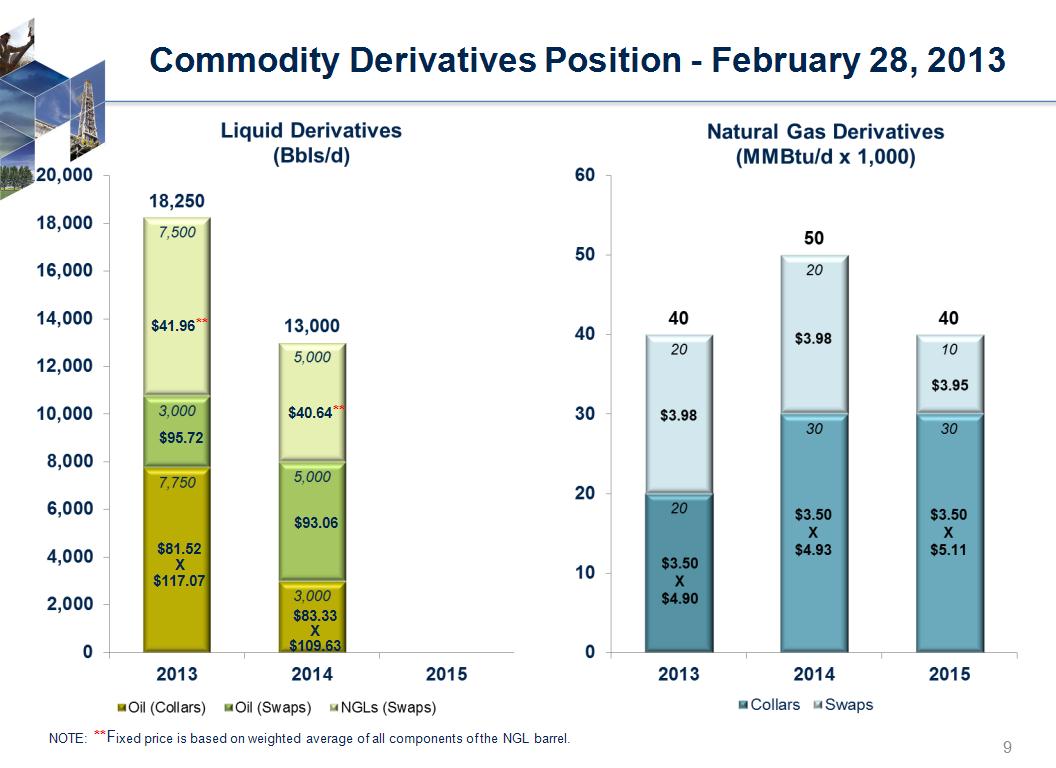

Commodity Derivatives Position – February 28, 2013 NOTE: **Fixed price is based on weighted average of all components of the NGL barrel. $40.64** $41.96** $81.52 X $117.07 $83.33 X $109.63 $95.72 $93.06 *

Permian Basin Wolfbone Acquisition Oil-Rich Inventory Growth Transaction Focus Acquisition Attributes Diversify the Asset Base Provides Rosetta focus Basin entry in core of Wolfbone oil play Clean asset deal that adds a new core operating area Pursue Oil-Rich, Inventory Growth 145 MMBOE of oil-weighted, repeatable vertical inventory (40-acres); approximately 1,300 gross drilling locations Vertical down-spacing upside Evolving early-stage horizontal play; multiple stacked zones Position for Future Growth Targets Establishes core position in Delaware Basin for further Wolfbone growth A&D / New Ventures Permian expansion opportunities Maintain Financial Strength and Flexibility Single well economics that compete with ROSE’s existing portfolio 5+ years of production growth at attractive margins Accretive to cash flow per share in 2014 *

This press release includes forward-looking statements, which give the Company's current expectations or forecasts of future events based on currently available information. Forward-looking statements are statements that are not historical facts, such as expectations regarding completion of the proposed acquisition, drilling plans, including the acceleration thereof, production rates and guidance, proven reserves, resource potential, incremental transportation capacity, exit rate guidance, net present value, development plans, progress on infrastructure projects, exposures to weak natural gas prices, changes in the Company's liquidity, changes in acreage positions, expected expenses, expected capital expenditures, and projected debt balances. The assumptions of management and the future performance of the Company are subject to a wide range of business risks and uncertainties, including the risk that the transaction with Comstock may not close, and there is no assurance that these statements and projections will be met. Factors that could affect the Company's business include, but are not limited to: the risks associated with drilling and completion of oil and natural gas wells; the Company's ability to find, acquire, market, develop, and produce new reserves; the risk of drilling dry holes; oil liquids and natural gas price volatility; derivative transactions (including the costs associated therewith and the abilities of counterparties to perform thereunder); uncertainties in the estimation of proved, probable, and possible reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's assumptions regarding items of income and expense and the level of capital expenditures; uncertainties in the timing of exploitation expenditures; operating hazards attendant to the oil and natural gas business; drilling and completion losses that are generally not recoverable from third parties or insurance; potential mechanical failure or underperformance of significant wells; midstream and pipeline construction difficulties and operational upsets; climatic conditions; availability and cost of material, equipment and services; the risks associated with operating in a limited number of geographic areas, as well as in new areas as a result of the Comstock transaction; actions or inactions of third-party operators of the Company's properties; the Company's ability to retain and hire skilled personnel; diversion of management's attention from existing operations while pursuing acquisitions or dispositions; the Company’s ability to integrate the newly acquired assets and operations, including the assets to be acquired from Comstock; availability and cost of capital; the strength and financial resources of the Company's competitors; regulatory developments; environmental risks; uncertainties in the capital markets; general economic and business conditions (including the effects of the worldwide economic recession); changes in commodity prices that were not anticipated in the acquisition of the assets and operations from Comstock; industry trends; and other factors detailed in the Company's most recent Form 10-K, Form 10-Q and other filings with the Securities and Exchange Commission. If one or more of these risks or uncertainties materialize (or the consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. The Company undertakes no obligation to publicly update or revise any forward-looking statements except as required by law. * Forward-Looking Statements and Terminology Used

References to quantities of oil or natural gas may include amounts that the Company believes will ultimately be produced, but are not yet classified as “proved reserves” under SEC definitions. We use the term "net risked resources" to describe the Company's internal estimates of volumes of natural gas and oil that are not classified as proved developed reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. Estimates of net risked resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the Company. Estimates of net risked resources may change significantly as development provides additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates. * Forward-Looking Statements and Terminology Used (cont.)