Exhibit 99.1

Forward-Looking Statements and Terminology Used * This presentation includes forward-looking statements, which give the Company's current expectations or forecasts of future events based on currently available information. Forward-looking statements are statements that are not historical facts, such as expectations regarding completion of the proposed acquisition, drilling plans, including the acceleration thereof, production rates and guidance, proven reserves, resource potential, incremental transportation capacity, exit rate guidance, net present value, development plans, progress on infrastructure projects, exposures to weak natural gas prices, changes in the Company's liquidity, changes in acreage positions, expected expenses, expected capital expenditures, and projected debt balances. The assumptions of management and the future performance of the Company are subject to a wide range of business risks and uncertainties, including the risk that the transaction with Comstock may not close, and there is no assurance that these statements and projections will be met. Factors that could affect the Company's business include, but are not limited to: the risks associated with drilling and completion of oil and natural gas wells; the Company's ability to find, acquire, market, develop, and produce new reserves; the risk of drilling dry holes; oil liquids and natural gas price volatility; derivative transactions (including the costs associated therewith and the abilities of counterparties to perform thereunder); uncertainties in the estimation of proved, probable, and possible reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's assumptions regarding items of income and expense and the level of capital expenditures; uncertainties in the timing of exploitation expenditures; operating hazards attendant to the oil and natural gas business; drilling and completion losses that are generally not recoverable from third parties or insurance; potential mechanical failure or underperformance of significant wells; midstream and pipeline construction difficulties and operational upsets; climatic conditions; availability and cost of material, equipment and services; the risks associated with operating in a limited number of geographic areas, as well as in new areas as a result of the Comstock transaction; actions or inactions of third-party operators of the Company's properties; the Company's ability to retain and hire skilled personnel; diversion of management's attention from existing operations while pursuing acquisitions or dispositions; the Company’s ability to integrate the newly acquired assets and operations, including the assets to be acquired from Comstock; availability and cost of capital; the strength and financial resources of the Company's competitors; regulatory developments; environmental risks; uncertainties in the capital markets; general economic and business conditions (including the effects of the worldwide economic recession); changes in commodity prices that were not anticipated in the acquisition of the assets and operations from Comstock; industry trends; and other factors detailed in the Company's most recent Form 10-K, Form 10-Q and other filings with the Securities and Exchange Commission. If one or more of these risks or uncertainties materialize (or the consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. The Company undertakes no obligation to publicly update or revise any forward-looking statements except as required by law. References to quantities of oil or natural gas may include amounts that the Company believes will ultimately be produced, but are not yet classified as “proved reserves” under SEC definitions. We use the term "net risked resources" to describe the Company's internal estimates of volumes of natural gas and oil that are not classified as proved developed reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. Estimates of net risked resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the Company. Estimates of net risked resources may change significantly as development provides additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates.

Grow new Permian Basin position Double rig count by year end Assess horizontal application Develop inventory of 145 MMBoe Begin testing lower well spacing Leverage high-return Eagle Ford Maintain position as a leading Eagle Ford player Develop inventory of approximately 500 MMBoe with 15 years of drilling opportunities Expand production base with about 12 percent of inventory developed Successfully execute business plan Grow total production and liquids volumes Lower overall cost structure and improve margins Capture firm transportation and processing capacity Apply cross-basin knowledge Test future growth opportunities Evaluate previously untested Eagle Ford acreage Continue testing optimal Eagle Ford and Wolfbone well spacing Pursue new growth targets through blend of acquisitions and new ventures Evaluate Gaines County Wolfcamp potential Maintain financial strength and flexibility Sizable liquidity Active hedging program Company Strategy *

GROW NEW PERMIAN BASIN POSITION *

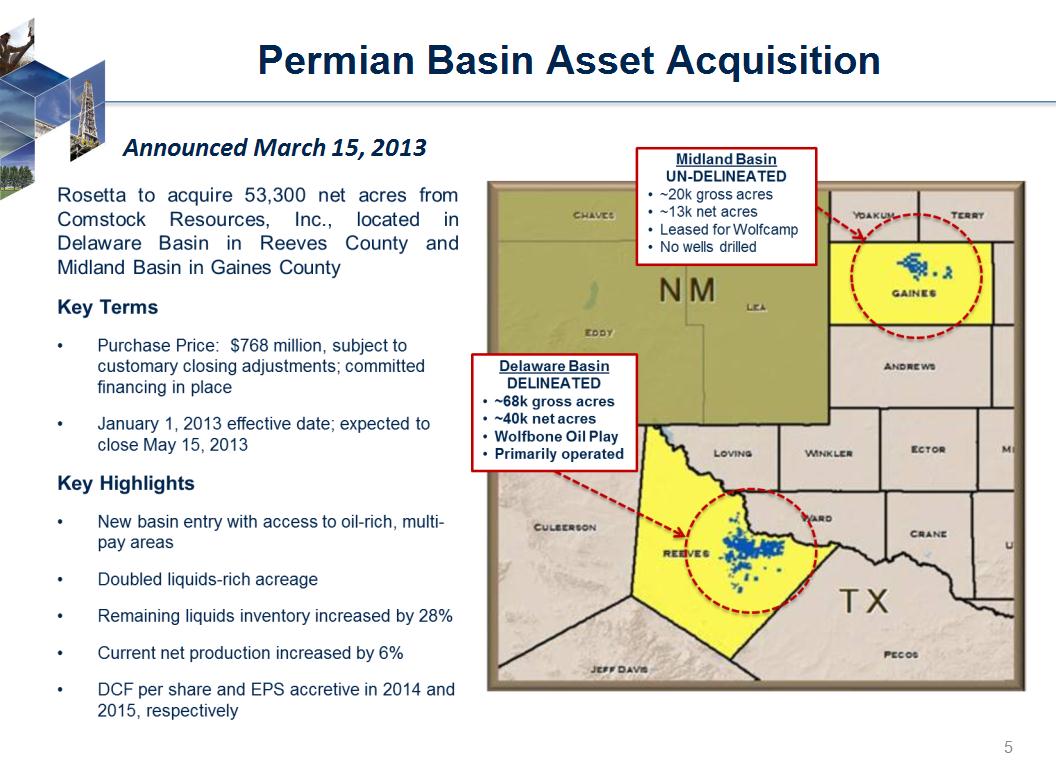

* Permian Basin Asset Acquisition Announced March 15, 2013

Asset Potential Stacked Zones Provide Collection of Vertical/Horizontal Development Opportunities *

Reeves County, Vertical Wolfbone * Central East

*

*

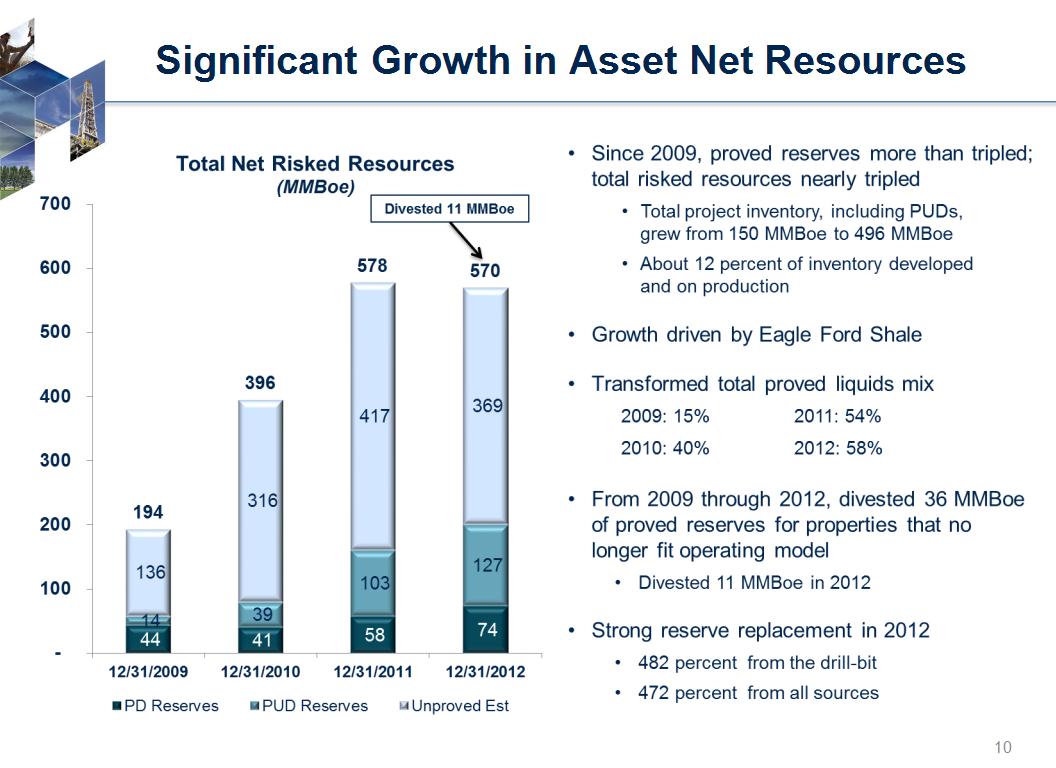

Significant Growth in Asset Net Resources *

Quarterly Production Performance *

*

Top 20 Eagle Ford Operators % of Eagle Ford Shale Production Gross Boe/d per Well * Data Source: IHS, Inc., reported November 2012 production (as of 2/24/2013); gross 8/8ths production. Top 20 Eagle Ford Operators include APC, BHP, CHK, COP, CRK, CRZO, EP, EOG, GeoSouthern, Hunt, Lewis, MRO, MTDR, MUR, PXD, PXP, RDS, ROSE, SM, TLM.

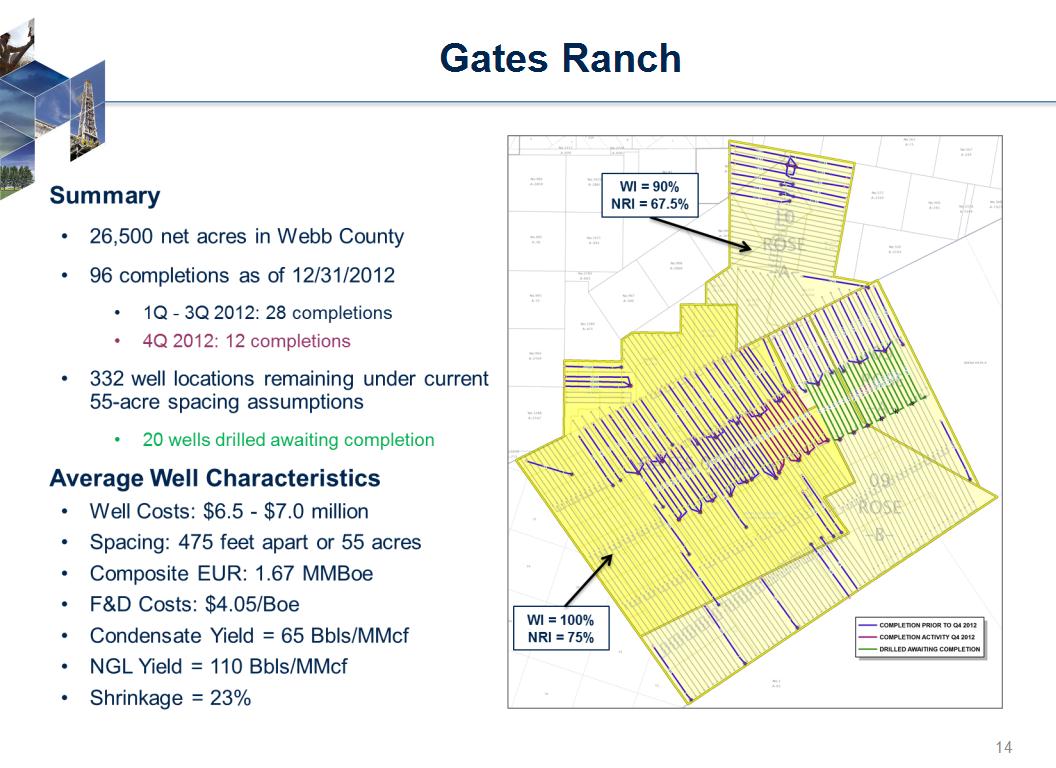

Gates Ranch *

Well Performance on 55 acres Compared to similar offsetting wells spaced at 100 acres *

Eagle Ford Multiple Takeaway Options *

*

* South Texas Shale Activity

* Briscoe Ranch

* Karnes Trough Area

* Central Dimmit County Area

* Lopez Farm-In

Eagle Ford Inventory +/- 900 net wells remaining as of 12/31/2012 * Denotes roughly 12,000 net acres in the liquids window of the play. *

Commodity Derivatives Position – February 28, 2013 *

Developing Premium Asset Base Focused on liquids-rich targets in Eagle Ford with significant project inventory Acquired oil-rich assets in Permian’s Delaware Basin adding substantial project inventory Executing Business Plan Grew proved reserves 25 percent versus 12/31/2011; more than double year-end 2010 Increased Gates Ranch recoveries Ensured sufficient firm take-away capacity Recorded strong 2012 production growth and exit rates Testing Growth Opportunities Increased Gates Ranch inventory Added discovery in another Eagle Ford area Pursuing new growth targets through blend of acquisitions and new ventures Maintaining Financial Strength and Flexibility Approximately $440 million in liquidity as of late February 2013 Active hedging program Summary *

REDEFINED BUILDING VALUE IN UNCONVENTIONAL RESOURCES

APPENDIX *

Reeves County Asset Snapshot 145 MMBOE Resource (40-acre vertical development only) *

Eagle Ford Growth Profile *

Gates Ranch Well Performance – North & South Areas North Type Curve – 1.4 MMBoe (22% Oil / 34% NGLs) *

* Briscoe Ranch

* Karnes Trough Area – Klotzman

Karnes Trough Area – Adele Dubose *

* Central Dimmit – Lasseter & Eppright

Typical Well Economics * Reserves and Economic metrics are “Unrisked” Note: Oil Price assumptions, $/Bbl - $91.72 in 2013, $89.88 in 2014, $95 thereafter. Gas Price assumptions, $/MMBtu - $3.71 in 2013, $4.10 in 2014, $4.60 thereafter

Debt and Capital Structure *

Liquidity *

* * Excludes recently announced Permian transaction

*

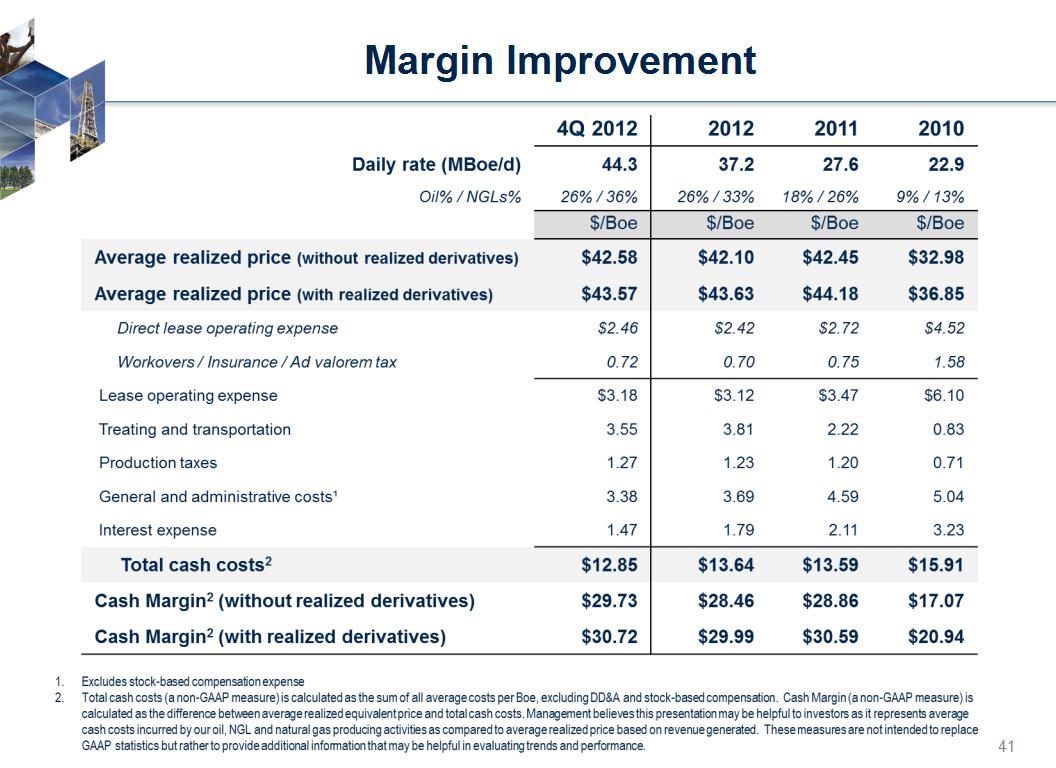

Margin Expansion *

Margin Improvement *