Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Rosetta Resources similar filings

- 27 Feb 14 Forward-Looking Statements and Terminology Used

- 25 Feb 14 Fourth Quarter & Full Year 2013 Earnings Review

- 24 Feb 14 Results of Operations and Financial Condition

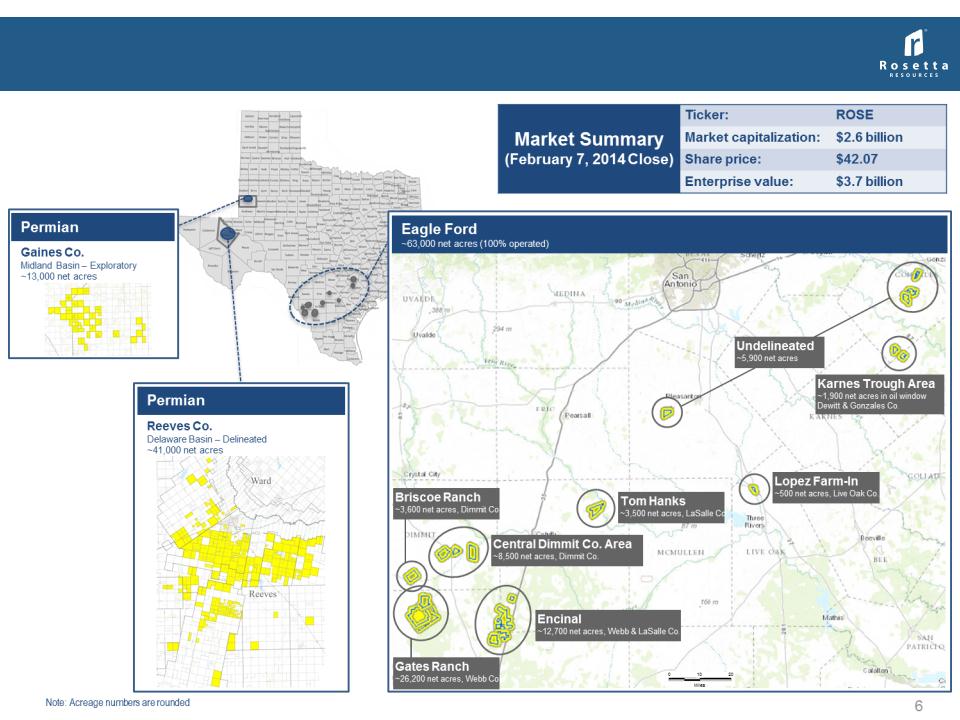

- 12 Feb 14 Regulation FD Disclosure

- 30 Jan 14 Results of Operations and Financial Condition

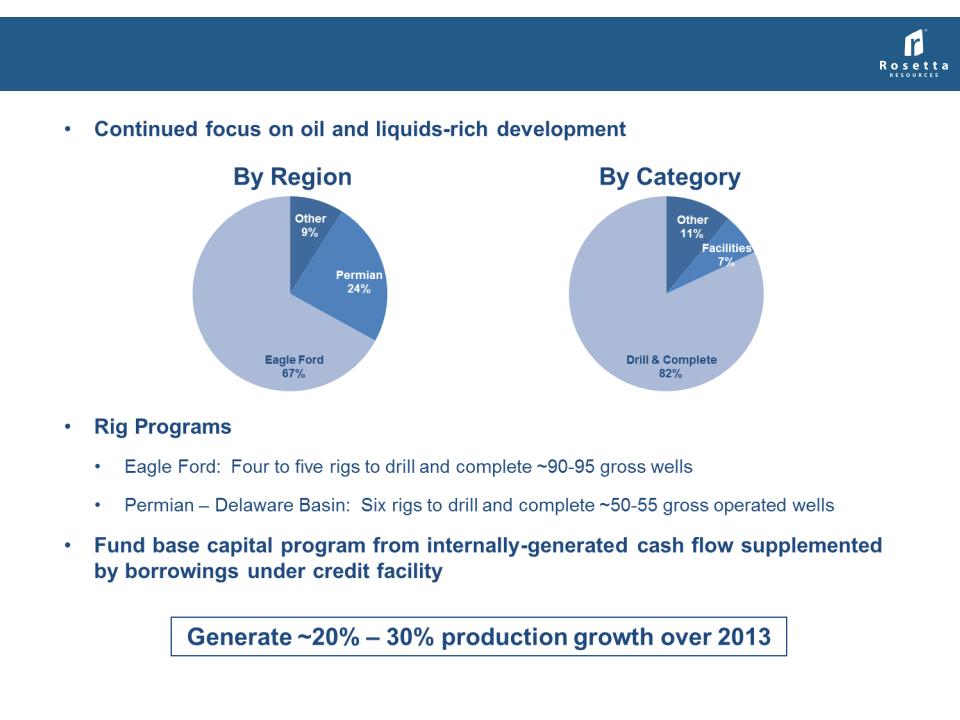

- 18 Dec 13 Rosetta Resources Inc. Announces 2014 Capital Budget and Guidance and Provides Operations Update

- 9 Dec 13 Departure of Directors or Certain Officers

Filing view

External links