Exhibit 99.1

22NW EXPOSING DIRTT’S MISREPRESENTATIONS A ND OMISSIONS APRIL 2022

22NW RECAP: CASE FOR CHANGE AT DIRTT & 22NW’S PROPOSED SOLUTION

3 22NW DIRTT HAS SIGNIFICANTLY UNDERPERFORMED UNDER THE CURRENT BOARD Source : Company filings, Bloomberg (share price depreciation reflects share price and performance up until December 22 , 2021 , which is the day before 22 NW filed its preliminary proxy statement) . DIRTT’s share price has fallen 60% over the past five years. Recent convertible offerings have diluted shareholders by 20%. DIRTT has reported a negative combined cash flow in 9 out of the last 10 quarters. DIRTT’s stock has underperformed its peer group and relevant indices. Executive compensation and RSUs have increased despite poor results. Total revenues have fallen ~38% since 2017. We have significant concerns regarding DIRTT’s poor corporate governance, high cash burn and perpetual financial underperformance.

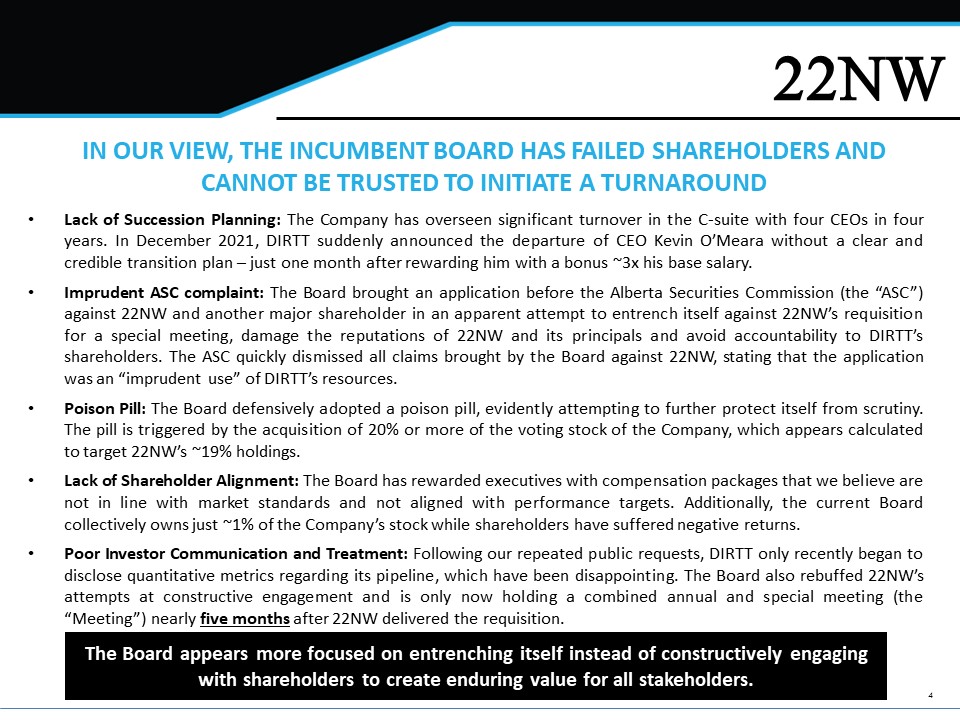

4 22NW IN OUR VIEW, THE INCUMBENT BOARD HAS FAILED SHAREHOLDERS AND CANNOT BE TRUSTED TO INITIATE A TURNAROUND • Lack of Succession Planning : The Company has overseen significant turnover in the C - suite with four CEOs in four years . In December 2021 , DIRTT suddenly announced the departure of CEO Kevin O’Meara without a clear and credible transition plan – just one month after rewarding him with a bonus ~ 3 x his base salary . • Imprudent ASC complaint : The Board brought an application before the Alberta Securities Commission (the “ASC”) against 22 NW and another major shareholder in an apparent attempt to entrench itself against 22 NW’s requisition for a special meeting, damage the reputations of 22 NW and its principals and avoid accountability to DIRTT’s shareholders . The ASC quickly dismissed all claims brought by the Board against 22 NW, stating that the application was an “imprudent use” of DIRTT’s resources . • Poison Pill : The Board defensively adopted a poison pill, evidently attempting to further protect itself from scrutiny . The pill is triggered by the acquisition of 20 % or more of the voting stock of the Company, which appears calculated to target 22 NW’s ~ 19 % holdings . • Lack of Shareholder Alignment : The Board has rewarded executives with compensation packages that we believe are not in line with market standards and not aligned with performance targets . Additionally, the current Board collectively owns just ~ 1 % of the Company’s stock while shareholders have suffered negative returns . • Poor Investor Communication and Treatment : Following our repeated public requests, DIRTT only recently began to disclose quantitative metrics regarding its pipeline, which have been disappointing . The Board also rebuffed 22 NW’s attempts at constructive engagement and is only now holding a combined annual and special meeting (the “Meeting”) nearly five months after 22 NW delivered the requisition . The Board appears more focused on entrenching itself instead of constructively engaging with shareholders to create enduring value for all stakeholders.

5 22NW OUR HIGHLY QUALIFIED NOMINEES HAVE A VISION TO FIX DIRTT Ken Sanders x Extensive C - suite and board experience in the architecture, engineering and planning sectors x Deep knowledge of technology, including hands - on experience using DIRTT’s product in the field x Experience leading global operations in finance, research and business development Mary Garden Scott Robinson Douglas Edwards x Public board experience, including Horizon North Logistics (TSX : HNL) and Dexterra Group (TSX : DXT), where she is Audit Committee Chair x Significant experience advising C - suite executives and leaders x Long history of value creation as a fiduciary managing multibillion - dollar private equity real estate portfolios x Successful track record investing in the real estate sector x C - suite experience in modular construction and public board experience in the real estate industry, including at Monmouth Real Estate (NYSE : MNR) x Sorely needed finance, operational and industry - specific experience x Seasoned executive with experience in the real estate and telecommunications sectors x Valuable operational and management experience x Important perspectives on industry trends’ impact on DIRTT’s value proposition Our nominees have an actionable plan to turn around poor performance and governance at DIRTT – and will always act in the best interest of all shareholders. Scott Ryan x Lawyer and seasoned arbiter specializing in contract disputes x Valuable legal and construction industry knowledge that can aid in DIRTT’s numerous ongoing lawsuits x Experience as general counsel of Building Group (NYSE: TPC) Cory Mitchell x Successful track record investing across the construction and building products sectors x Capital allocation and capital markets expert with relevant shareholder perspectives x Extensive knowledge of DIRTT’s assets, governance and financials Aron English x Significant, long - term shareholder of DIRTT with successful track record investing across industries x Experience building and managing incoming management teams for public companies x Chair of Anebulo Pharmaceuticals, Inc. (NASDAQ: ANEB) Audit Committee

6 22NW • 22 NW previously received executed non - binding indications of support from approximately 50 . 4 % of DIRTT’s shareholders for the election of our nominees to the Board at the Meeting . • Instead of listening to shareholders’ opinions and perspectives, the Board sought a hearing before the ASC in which it attempted to enjoin 22 NW’s ability to vote certain of its shares, among other items . • Ultimately, the Company was unsuccessful in its apparent attempt to intimidate shareholders and was admonished by the ASC for its ill - conceived pursuit . • Link to the ASC’s ruling here . WE BELIEVE SHAREHOLDERS STAND WITH 22NW – NOT WITH THE INCUMBENTS

7 22NW In the following slides, we set the record straight regarding the many misleading components of DIRTT’s April 5 th presentation. We believe the Board’s attempts to shirk responsibility for DIRTT’s underperformance and rewrite history only reinforce the need for meaningful change atop the Company. The reality is that the Company has perpetually underperformed and destroyed shareholder value over the past five years under the leadership of Chairman Todd Lillibridge . The Board seems to be doubling down on the same losing strategy when it is clear to us that the Company’s declining stock value has shown the Board to be a poor steward of shareholder capital with an inability to effectively oversee management or plan for the future. 22NW intends to remain a long - term, significant shareholder of DIRTT. We have no intention to take the Company private or pursue short - term initiatives that would hurt minority shareholders. IN OUR VIEW, THE BOARD’S RECENT INVESTOR PRESENTATION VALIDATES OUR ENTIRE CAMPAIGN FOR WHOLESALE CHANGE

22NW REBUTTAL: EXPOSING DIRTT'S DISTORTIONS AND MISREPRESENTATIONS

9 22NW x THE REALITY : We are seeking to remove and replace seven members of the Board, thus disrupting the dismal status quo . x THE REALITY : We believe continuing with the current Board would be a serious risk given its history of shareholder - unfriendly actions and utter mismanagement of the Company . x THE REALITY : The Board’s recent purported settlement offer is an apparent sham given that it was never communicated directly to 22 NW and the Board has refused to cease its mudslinging attacks on its largest shareholder . x THE REALITY : 22 NW is not, and has never been, working in concert with other DIRTT shareholders . In fact, the ASC concluded in its ruling that 22 NW was not acting jointly or in concert with 726 . x THE REALITY : 22 NW repeatedly offered to engage in financing discussions with DIRTT and advocated for a rights offering to minimize dilution, third - party fees and cash outflow . IN OUR VIEW, THE BOARD HAS MISREPRESENTED ITS ENGAGEMENT WITH SHAREHOLDERS AND ITS PURPORTED WILLINGNESS TO AVOID A FIGHT x MYTH : The Board says we are seeking to "stay the course" and "keep the status quo . " x MYTH : In its press release, the Board argued "a wholesale change could create significant risk” (while also saying it has “championed change” and our campaign is about maintaining the status quo) . x MYTH : In an apparent attempt to rewrite history, the Board claimed it tried to work with 22 NW on a settlement and that we refused to negotiate . x MYTH : The Board claimed 22 NW was working with 726 BC LLC (“ 726 ”), another shareholder, continuing to misconstrue and contradict our intentions . x MYTH : The Board claimed 22 NW offered no alternative to the Company’s onerous November financing . Source : Company filings .

10 22NW • Mr . Lillibridge has overseen strategic and operational missteps across DIRTT, specifically in healthcare . • Since Mr . Lillibridge joined the Board in 2017 , DIRTT’s total revenue and healthcare revenue have declined by ~ 39 % and ~ 70 % , respectively . • Despite touting Mr . Lillibridge’s healthcare executive background, we believe the Company’s paltry $ 305 million pipeline illustrates his inability to strategically position DIRTT within the industry . • In our extensive interviews, several distribution partners and former employees have been very critical of Mr . Lillibridge’s ability to lead, as well as his business decisions . THE BOARD CLAIMS MR. LILLIBRIDGE IS CRITICAL TO THE COMPANY’S SUCCESS DESPITE DIRTT’S POOR PERFORMANCE DURING HIS TENURE $56,000 $58,000 $60,000 $62,000 $64,000 $66,000 $68,000 $70,000 $72,000 $74,000 $0 $10 $20 $30 $40 $50 $60 $70 DIRTT vs. Healthcare Industry Construction Spending (in millions) DIRTT healthcare revenue (TTM) Healthcare Indstry Construction Spending (TTM) Source : Company presentation, Company filings .

11 22NW THE BOARD IS UNWILLING TO TAKE RESPONSIBILITY FOR ITS MISSTEPS AND UNDERPERFORMANCE Source : Company presentation . The Facts: • DIRTT has consistently made excuses that shift blame for execution and leadership failures away from the Board . • DIRTT’s revenue problem existed long before COVID - 19 disruptions and its competitors are rebounding at a faster rate . • The Board’s defeatist attitude toward the current environment and its actions toward 22 NW reflect a culture of blame shifting and a lack of accountability . • We believe that poor leadership is the true root of DIRTT’s issues spanning over four years . • Some of the purported headwinds cited by the Board – including labor shortages, supply chain issues and uncertain workplace configurations – should act as tailwinds and increase the value - proposition for a solution like DIRTT’s . The Board has blamed its underperformance on COVID - 19 and made excuses for poor results.

12 22NW DIRTT SAYS IT HAS “MOMENTUM” DESPITE ITS SUSTAINED TAILSPIN UNDER THE INCUMBENT BOARD Source : S&P Capital IQ . The Board cannot run from the fact that DIRTT has delivered negative performance for years and plummeted ~40% following Chairman Lillibridge’s appointment as interim CEO. -45% -40% -35% -30% -25% -20% -15% -10% -5% 0% 1/18/2022 1/20/2022 1/22/2022 1/24/2022 1/26/2022 1/28/2022 1/30/2022 2/1/2022 2/3/2022 2/5/2022 2/7/2022 2/9/2022 2/11/2022 2/13/2022 2/15/2022 2/17/2022 2/19/2022 2/21/2022 2/23/2022 2/25/2022 2/27/2022 3/1/2022 3/3/2022 3/5/2022 3/7/2022 3/9/2022 3/11/2022 3/13/2022 3/15/2022 3/17/2022 3/19/2022 3/21/2022 3/23/2022 3/25/2022 3/27/2022 3/29/2022 3/31/2022 4/2/2022 4/4/2022 DIRTT Total Shareholder Return Since Mr. Lillibridge’s Appointment as Interim CEO DIRTT Steelcase S&P 600 Building Products Index

13 22NW WE BELIEVE THE BOARD WASTED COMPANY RESOURCES BY BRINGING A MERITLESS APPLICATION BEFORE THE ASC AGAINST ITS OWN SHAREHOLDERS Source : Company presentation . The Facts: • The ASC dismissed all of the Company’s requested relief against 22 NW . • Despite this ruling, the Board continued its reckless entrenchment campaign in an apparent attempt to mislead shareholders about the outcome of the application . • DIRTT issued a press release on March 7 th falsely claiming that the “ASC Agrees 22 NW Broke the Law” and issued another press release days later, which corrected and retracted these inaccurate statements . • In its ruling, the ASC noted that “we express our dismay that this application was brought at all” and “this was an ill conceived application and an imprudent use of DIRTT's resources . ” In our view, the apparent misconduct surrounding the ASC complaint raises serious questions about the Board’s integrity and how seriously it takes its fiduciary duties.

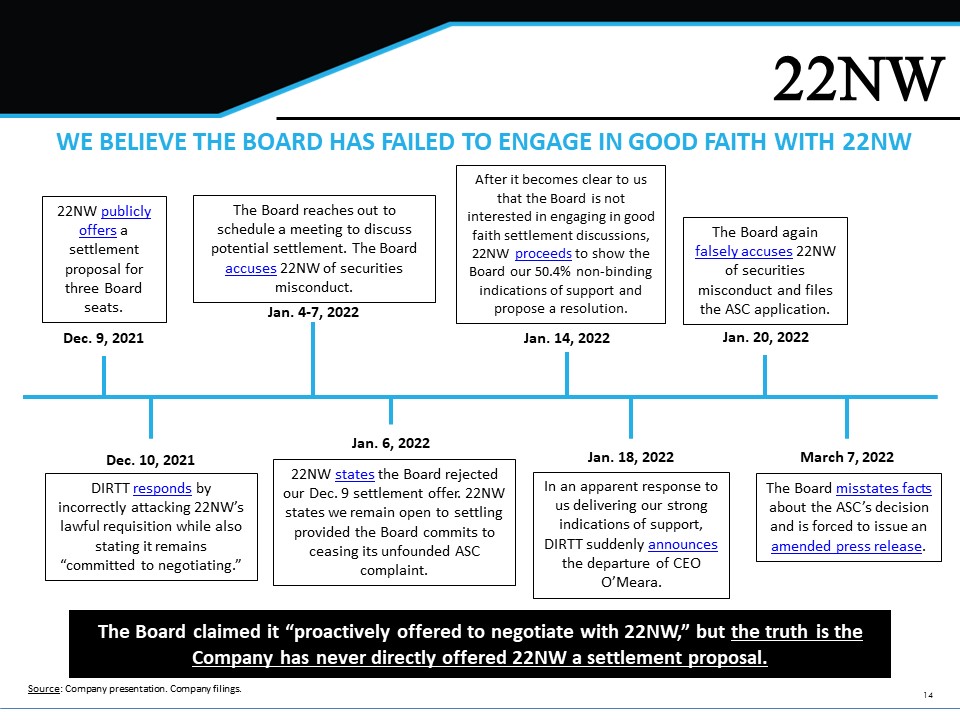

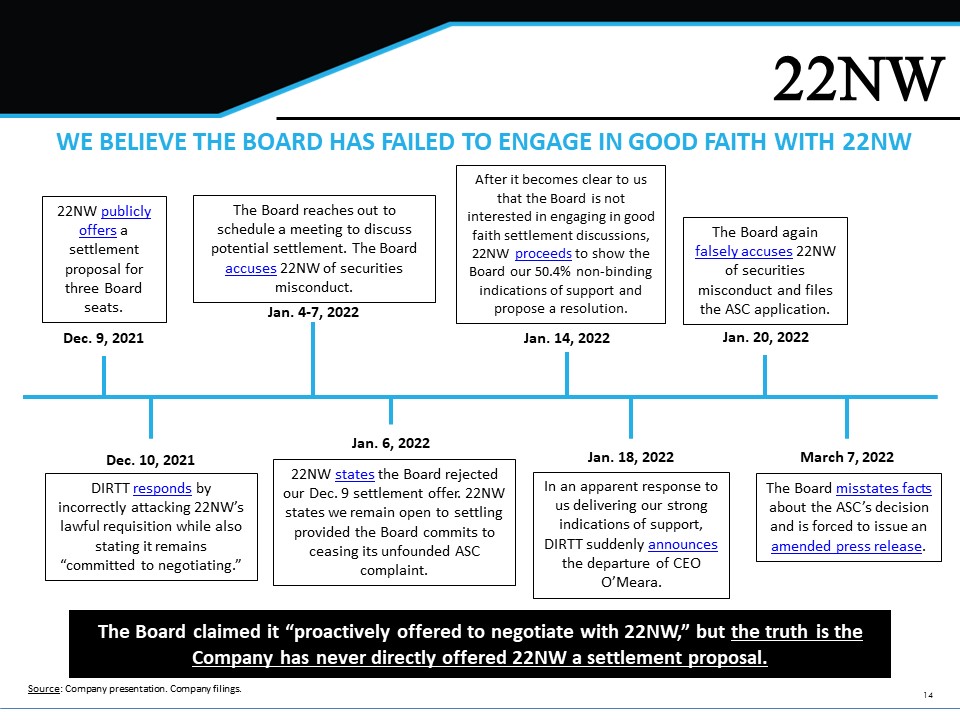

14 22NW WE BELIEVE THE BOARD HAS FAILED TO ENGAGE IN GOOD FAITH WITH 22NW Source : Company presentation . Company filings . The Board claimed it “proactively offered to negotiate with 22NW,” but the truth is the Company has never directly offered 22NW a settlement proposal. Dec. 9, 2021 Dec. 10, 2021 Jan. 4 - 7, 2022 Jan. 6, 2022 Jan. 14, 2022 Jan. 18, 2022 Jan. 20, 2022 March 7, 2022 22NW publicly offers a settlement proposal for three Board seats. DIRTT responds by incorrectly attacking 22NW’s lawful requisition while also stating it remains “committed to negotiating.” The Board reaches out to schedule a meeting to discuss potential settlement. The Board accuses 22NW of securities misconduct. 22NW states the Board rejected our Dec. 9 settlement offer. 22NW states we remain open to settling provided the Board commits to ceasing its unfounded ASC complaint. In an apparent response to us delivering our strong indications of support, DIRTT suddenly announces the departure of CEO O’Meara. After it becomes clear to us that the Board is not interested in engaging in good faith settlement discussions, 22NW proceeds to show the Board our 50.4% non - binding indications of support and propose a resolution. The Board misstates facts about the ASC’s decision and is forced to issue an amended press release . The Board again falsely accuses 22NW of securities misconduct and files the ASC application.

15 22NW THE BOARD CLAIMS IT IS COMMITTED TO THE BEST INTERESTS OF ALL STAKEHOLDERS Source : Company presentation . The Board collectively owns roughly 1 % of the Company’s stock, demonstrating a lack of alignment with shareholders . The Board has overseen a ~ 10 % year - over - year increase in total executive compensation and paid Mr . O’Meara a 2021 year - end bonus 3 x his base salary just weeks before firing him for alleged “performance” reasons . The Board chose to pursue a costly and distracting proxy contest rather than engage and collaborate with a meaningful shareholder to deliver value . The Board submitted a costly complaint to the ASC against 22 NW and DIRTT’s second - largest shareholder in an apparent and failed attempt to intimidate shareholders from voicing their concerns and seeking change . The Board has never directly sent 22 NW a settlement proposal, despite its claims . In fact, 22 NW delivered resolution proposals to the Company on December 9 , 2021 , and again on January 14 , 2022 . DIRTT categorically rebuffed our proposals and filed the ASC application shortly after .

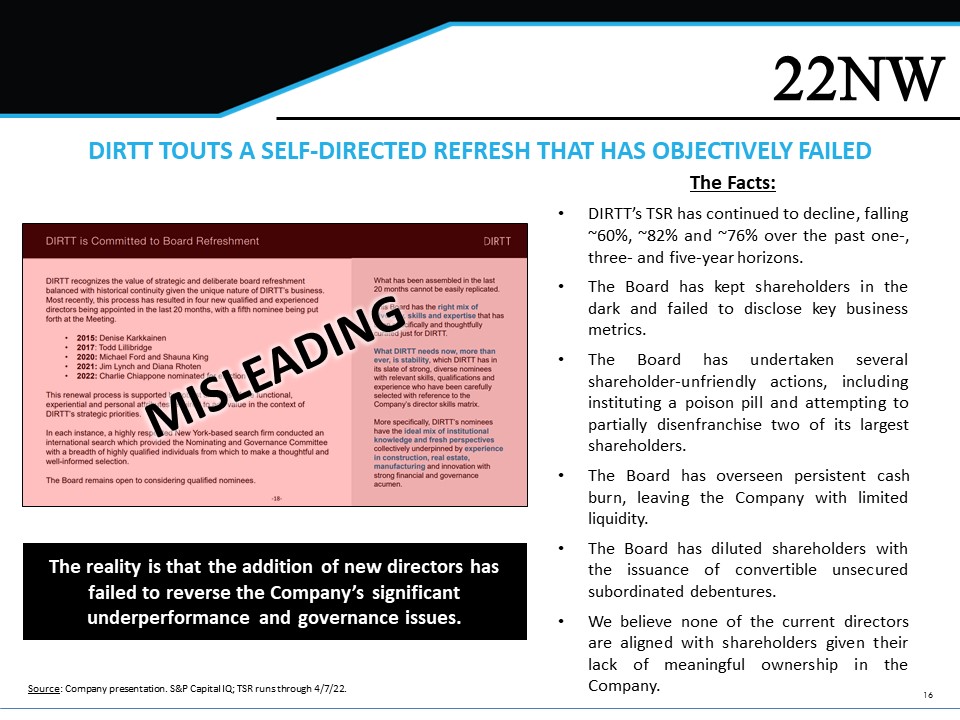

16 22NW The Facts: • DIRTT’s TSR has continued to decline, falling ~ 60 % , ~ 82 % and ~ 76 % over the past one - , three - and five - year horizons . • The Board has kept shareholders in the dark and failed to disclose key business metrics . • The Board has undertaken several shareholder - unfriendly actions, including instituting a poison pill and attempting to partially disenfranchise two of its largest shareholders . • The Board has overseen persistent cash burn, leaving the Company with limited liquidity . • The Board has diluted shareholders with the issuance of convertible unsecured subordinated debentures . • We believe none of the current directors are aligned with shareholders given their lack of meaningful ownership in the Company . DIRTT TOUTS A SELF - DIRECTED REFRESH THAT HAS OBJECTIVELY FAILED The reality is that the addition of new directors has failed to reverse the Company’s significant underperformance and governance issues. Source : Company presentation . S&P Capital IQ ; TSR runs through 4 / 7 / 22 .

17 22NW DIRTT APPEARS TO IGNORE REALITY BY PROCLAIMING THAT ITS STRATEGY, REBRAND AND REPOSITIONING ARE WORKING The Facts: • Despite the Company’s “new” marketing initiatives, we believe it is doubling down on its same losing strategy . • In our view, this highlights the Board’s lack of understanding of how DIRTT is successfully positioned in the market . • The reality is that DIRTT is not a commodity product that competes on price – it is a premium method of construction that is unrivaled in the industry . • Current and former employees, who used to successfully sell for DIRTT, have reported that the Company’s messaging is confusing in the marketplace and heavily dilutes DIRTT’s strong brand reputation . • We believe the current Board clearly misunderstands the Company’s value proposition and has poorly marketed the business . The Board’s strategy has failed to deliver value for shareholders. We believe boardroom change is needed to fix DIRTT’s balance sheet and replace the status quo. Source : Company presentation .

18 22NW UNLIKE THE CURRENT BOARD, OUR SLATE HAS THE RIGHT SKILLS, PERSPECTIVES AND EXPERIENCE TO TURN AROUND DIRTT AND CREATE MEANINGFUL VALUE Source : Company presentation, Company filings . Our highly qualified nominees possess the necessary skillsets and experience to ameliorate DIRTT’s weak operational performance . 22 NW’s candidates will bring sorely needed shareholder perspectives to the Board and align the Board’s interests with those of shareholders . Our slate has an actionable plan to make a positive impact within the first 90 days of serving on the Board . If elected, our nominees are committed to entering the boardroom with open minds, working with certain members of the Board to ensure a smooth transition through consulting or other arrangements and exploring all potential paths to value creation for all stakeholders .

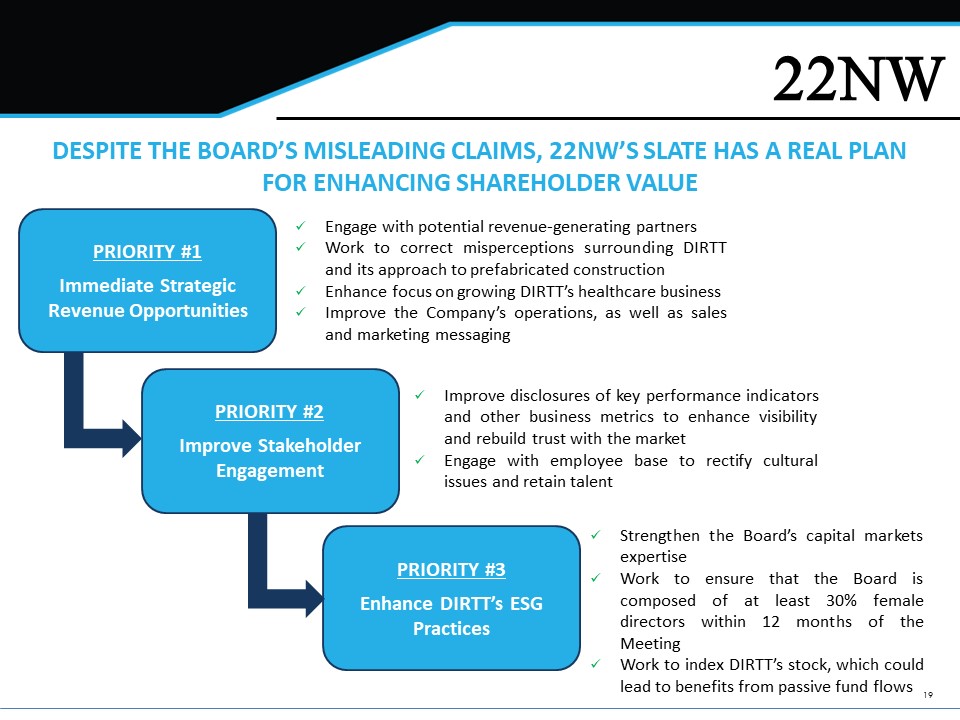

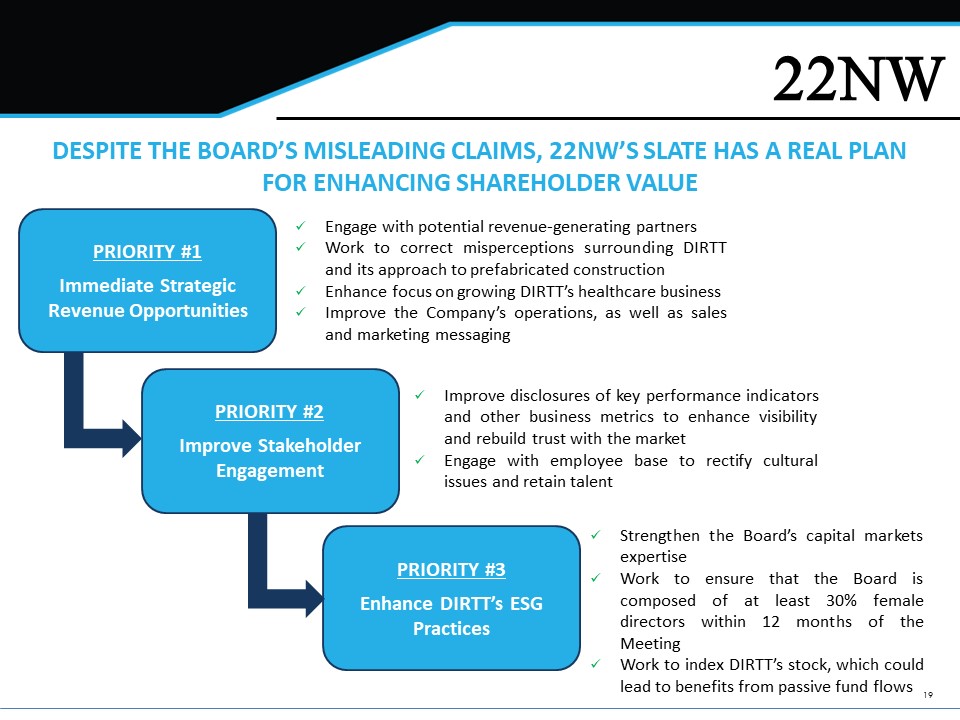

19 22NW DESPITE THE BOARD’S MISLEADING CLAIMS, 22NW’S SLATE HAS A REAL PLAN FOR ENHANCING SHAREHOLDER VALUE PRIORITY #1 Immediate Strategic Revenue Opportunities PRIORITY #2 Improve Stakeholder Engagement PRIORITY #3 Enhance DIRTT’s ESG Practices x Engage with potential revenue - generating partners x Work to correct misperceptions surrounding DIRTT and its approach to prefabricated construction x Enhance focus on growing DIRTT’s healthcare business x Improve the Company’s operations, as well as sales and marketing messaging x Improve disclosures of key performance indicators and other business metrics to enhance visibility and rebuild trust with the market x Engage with employee base to rectify cultural issues and retain talent x Strengthen the Board’s capital markets expertise x Work to ensure that the Board is composed of at least 30 % female directors within 12 months of the Meeting x Work to index DIRTT’s stock, which could lead to benefits from passive fund flows

20 22NW VOTE ON THE WHITE PROXY CARD FOR 22NW’S SLATE THE 22NW NOMINEES ARE COMMITTED TO BUILDING A BETTER DIRTT CONTACT INFO@SARATOGAPROXY.COM WITH QUESTIONS ON HOW TO VOTE

21 22NW Disclaimer – Important Information The materials contained herein (the “Materials”) represent the opinions of 22 NW Fund, LP and the other participants named in its proxy solicitation (collectively, “ 22 NW”) and are based on publicly available information with respect to DIRTT Environmental Solutions, Ltd . (the “Company”) . 22 NW recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with the 22 NW’s conclusions . 22 NW reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such changes . 22 NW disclaims any obligation to update the information or opinions contained herein . Certain financial projections and statements made herein have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”), SEDAR or other regulatory authorities and from other third party reports . There is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein . The estimates, projections and potential impact of the opportunities identified by 22 NW herein are based on assumptions that 22 NW believes to be reasonable as of the date of the Materials, but there can be no assurance or guarantee that actual results or performance of the Company will not differ, and such differences may be material . The Materials are provided merely as information and are not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security . Certain members of 22 NW currently beneficially own, and/or have an economic interest in, securities of the Company . It is possible that there will be developments in the future (including changes in price of the Company’s securities) that cause one or more members of 22 NW from time to time to sell all or a portion of their holdings of the Company in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities . To the extent that 22 NW discloses information about its position or economic interest in the securities of the Company in the Materials, it is subject to change and 22 NW expressly disclaims any obligation to update such information .

22 22NW Disclaimer – Continued The Materials contain forward - looking statements . All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opportunity,” “estimate,” “plan,” “may,” “will,” “projects,” “targets,” “forecasts,” “seeks,” “could,” and similar expressions are generally intended to identify forward - looking statements . The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of the Materials and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such projected results and statements . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of 22 NW . Although 22 NW believes that the assumptions underlying the projected results or forward - looking statements are reasonable as of the date of the Materials, any of the assumptions could be inaccurate and therefore, there can be no assurance that the projected results or forward - looking statements included herein will prove to be accurate . In light of the significant uncertainties inherent in the projected results and forward - looking statements included herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected results and forward - looking statements will be achieved . 22 NW will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward - looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events . Unless otherwise indicated herein, 22 NW has not sought or obtained consent from any third party to use any statements, photos or information indicated herein as having been obtained or derived from statements made or published by third parties . Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein . No warranty is made as to the accuracy of data or information obtained or derived from filings made with the SEC or SEDAR by the Company or from any third - party source . All trade names, trademarks, service marks, and logos herein are the property of their respective owners who retain all proprietary rights over their use .