On January 20, 2022, the Company announced that it believed it should file an application with the ASC against 22NW, Messrs. English, Broderick, Mitchell and Noll, and 726 (collectively, the “Respondents”) for breaching take-over bid and AMR obligations under applicable Canadian securities laws (the “ASC Application”).

The ASC Application outlined the basis on which the Company believed that the Respondents failed to comply with certain disclosure and take-over bid provisions under Alberta securities laws as a result of 726 and 22NW acting jointly or in concert and breaches of NI 62-103 by 22NW and 726. In the ASC Application, the Company outlined the conduct of 22NW and 726 and their respective principals and certain 22NW employees which formed the basis of its allegations including:

| | o | 22NW and 726 regularly participating in joint meetings and calls with the Company; |

| | o | 22NW and 726’s share purchases appear coordinated on at least one occasion; |

| | o | Mr. English’s assertion to the Company on September 10, 2021 that 22NW and 726 could jointly block any hostile bid; |

| | o | 22NW and 726 acting in what appeared to be coordinated attempts, within two minutes of each other, in seeking to hamper a financing within ten minutes of the signing of the term sheet for the Convertible Debenture Financing; |

| | o | the Company’s belief based on a conversation with Mr. Noll earlier in the day on November 17, 2021, that 726 supported the Requisition prior to its announcement; |

| | o | communication from another institutional shareholder who knows both 22NW and 726 reasonably well, who emailed the Company on three separate occasions in November and December 2021 to express his view that the Company should agree to reconstitute the Board to meet 22NW’s demands, noting in one email that this was appropriate since 726 and 22NW “own nearly a third of your company, and therefore deserve several seats at the table”; and |

| | o | failures by 726 and 22NW to timely file AMRs, and failure by 22NW to comply with disclosure requirements in one AMR, all as required under Canadian securities laws. |

The relief sought by the Company is set out below:

| | o | an order from the ASC enforcing compliance with the take-over bid provisions of the Securities Act (Alberta) and preventing 22NW and 726 from obtaining any economic benefit from having breached such provisions, including restraining voting by the Respondents to 19.99% of the issued and outstanding Common Shares; |

| | o | an order that 22NW and 726 cease trading in securities of the Company until they make public disclosure in compliance with their AMR obligations; |

| | o | an order prohibiting Mr. English, Mr. Noll and certain employees of 22NW from becoming or acting as a director or officer of an issuer in Alberta for two years; |

| | o | an order reprimanding the Respondents; and |

| | o | an order that the exemptions contained in Alberta securities laws not apply to the Respondents for two years. |

On February 25, 2022, the Company filed its preliminary proxy statement in connection with the Meeting.

On March 3, 2022, the ASC held a hearing in respect of the ASC Application.

On March 4, 2022, the ASC rendered its decision, concluding that the Respondents were not acting jointly or in concert, and declined to grant any of the relief sought by the Company. The ASC found the 22NW AMR Compliance Failure was to be an ordinary course compliance failure, and no remedy against 726 or 22NW was warranted.

On March 7, 2022, the Company filed Amendment No. 1 to its preliminary proxy statement in connection with the Meeting.

On March 11, 2022 at 10:00 a.m. MST, counsel to 22NW sent a letter to counsel to the Board and the Special Committee, requesting confirmation that the Board will not seek to adjourn the Meeting. In the letter, 22NW indicated that it intends to initiate legal action if such confirmation was not received by 5:00 p.m. MST on Monday, March 14, 2022.

On March 11, 2022 at 12:37 p.m. MST, 22NW, through its counsel, delivered the 22NW Supplement Notice to the Company to advise that it intends to nominate one person to the Board in addition to those set out in the Requisition (the “22NW Supplemental Nominee”).

On March 14 and 15, 2022, counsel to the Board and the Special Committee responded to counsel to 22NW’s letter of March 11, 2022.

On March 15, 2022, the Company filed Amendment No. 2 to its preliminary proxy statement in connection with the Meeting.

On March 22, 2022, 22NW filed Amendment No. 1 to its definitive proxy statement in connection with the Meeting.

On March 24, 2022, the Company filed its definitive proxy statement in connection with the Meeting.

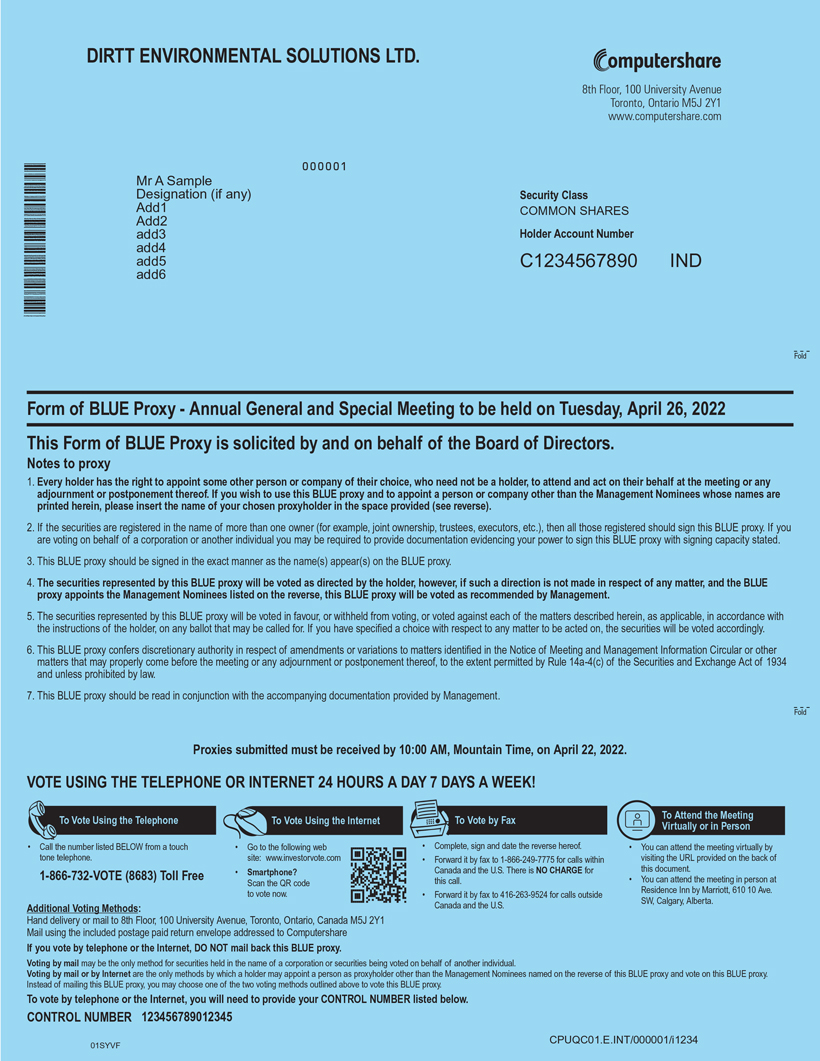

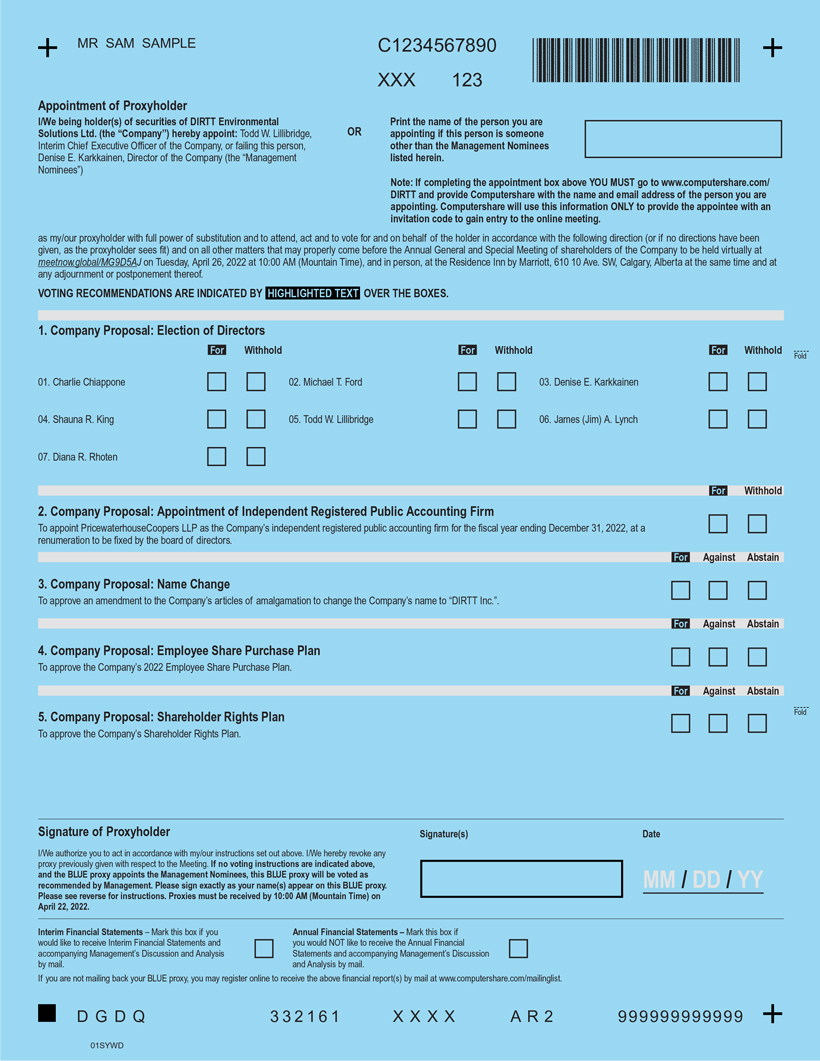

OUR BOARD STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM 22NW, EVEN TO VOTE “WITHHOLD” WITH RESPECT TO THE 22NW NOMINEES AND THE 22NW SUPPLEMENTAL NOMINEE, AS DOING SO WILL CANCEL ANY PROXY YOU MAY HAVE PREVIOUSLY SUBMITTED TO HAVE YOUR SHARES VOTED FOR THE BOARD’S PROPOSED SLATE ON THE BLUE PROXY CARD, AS ONLY YOUR LATEST PROXY CARD OR VOTING INSTRUCTION FORM WILL BE COUNTED.

CERTAIN EFFECTS OF THE 22NW SOLICITATION

22NW is seeking to nominate seven members of the Board, which if elected, would replace all of the current directors. Our Board is currently comprised of seven members, if four or more members of the Board are removed and at least four out of the seven candidates from 22NW’s slate (including the 22NW Nominees and 22NW Supplemental Nominee) are elected to the Board, a “change of control” may be deemed to have occurred under certain of our plans and agreements. Should a change of control occur as a result of 22NW’s proxy solicitation, certain of our material agreements could be impacted.

Pursuant to the Company’s Amended and Restated Incentive Stock Option Plan, amended and restated on August 2, 2017 (the “Option Plan”), a “change of control” may be deemed to have occurred if during any 12-month period, a majority of the members of the Board are replaced by directors whose appointment or election is not endorsed by a majority of the Board before the date of appointment or election. The Option Plan contains a “double-trigger” accelerated vesting provision for unvested Options (as defined in the Option Plan) granted thereunder. Pursuant to the Option Plan, if the employment or engagement of an Option Holder or Agent (each as defined in the Option Plan) is terminated by the Company without Cause (as defined in the Option Plan) or if the Option Holder or Agent resigns with Good Reason (as defined in the Option Plan), then all unvested Options held by such Option Holder or Agent shall immediately vest and the expiration date of such Options shall be the day following the date of such termination or resignation. Pursuant to the Option Plan, the committee of the Board appointed in accordance with the Option Plan (the “Committee”) may accelerate the vesting of one or more Option at any time, including upon the occurrence of a change of control. In addition, under the Option Plan, in the event of a change of control, the Board has the power to change or modify the terms of the Options as long as such changes are not adverse to the Option Holder or to assist the Option Holder to tender into a takeover bid and to terminate any Options not exercised following the successful completion of a change of control. As of the date of this Proxy Statement, the Board has not made a determination as to whether it will endorse the 22NW Nominees and the 22NW Supplemental Nominee for the limited purpose of Section 1.1(j)(iv) of the Option Plan.

Pursuant to the Company’s Long Term Incentive Plan, with an effective date of May 22, 2020 (the “LTI Plan”), a “change of control” may be deemed to have occurred if during any 12-month period, a majority of the members of the Board are replaced by directors whose appointment or election is not endorsed by a majority of the Board before the date of appointment or election. The LTI Plan contains a “double-trigger” accelerated vesting provision for unvested Awards (as defined in the LTI Plan) granted thereunder. Pursuant to the LTI Plan, if a Participant’s (as defined in the LTI Plan) service, consulting relationship or employment is terminated by the Company without Cause (as defined in the LTI Plan) or if the Participant resigns with Good Reason (as defined in the LTI Plan), then the vesting and exercisability of all Awards then held by such Participant will be accelerated in full and the expiration date of certain Awards shall be the earlier of the date such Awards would otherwise expire and the 60th day following such termination or resignation. As of the date of this Proxy Statement, the Board has not made a determination as to whether it will endorse the 22NW Nominees and the 22NW Supplemental Nominee for the limited purpose of Section 2 of the LTI Plan.

xv