UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

DIRTT ENVIRONMENTAL SOLUTIONS LTD.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

RULES RELATED TO THE MEETING OF SHAREHOLDERS

OF

DIRTT ENVIRONMENTAL SOLUTIONS LTD.

In order to facilitate free and fair voting at the annual and special meeting (the “Meeting”) of shareholders (the “Shareholders”) of DIRTT ENVIRONMENTAL SOLUTIONS LTD. (the “Company”) scheduled to be held on April 26, 2022, and any adjournment(s) or postponement(s) thereof, the Company hereby adopts the following rules:

Chair

| 1. | In accordance with the by-laws of the Company, Mr. Todd W. Lillibridge, or such other director as he may designate, will preside over the Meeting as the chair (the “Chair”). |

| 2. | The Chair retains the discretion to proceed as the Chair determines to be appropriate, including in accordance with the by-laws of the Company and applicable laws, for the proper conduct of the Meeting. The Chair shall be entitled to enforce these rules as against any person present in person or by proxy, actually or by conference telephone, at the Meeting. |

Secretary

| 3. | The Chair will appoint Mr. Charles Kraus, Senior Vice President, General Counsel & Corporate Secretary of the Company, or such other person as the Chair may designate, to act as the Secretary of the Meeting. |

Scrutineer

| 4. | The Chair will appoint a representative of Computershare Trust Company of Canada (“Computershare”) to act as the scrutineer of the Meeting (the “Scrutineer”), and, as such, to determine the presence of a quorum and to tabulate the results of any votes held by ballot at the Meeting and to report thereon to the Chair. |

Persons Entitled to be Present

| 5. | The following persons are entitled to be present at the Meeting, subject to any restrictions imposed by law as a result of the COVID-19 pandemic: |

| | i. | registered Shareholders (as of the record date) and their duly appointed proxyholders; |

| | ii. | directors of the Company; |

| | iii. | representatives of Computershare; |

| | iv. | representatives of the auditor of the Company; |

| | v. | representatives of McMillan LLP, legal counsel to the Company; |

| | vi. | representatives of Kingsdale Advisors; |

| | viii. | director nominees of 22NW Fund, LP (“22NW”) other than Aron English who are not otherwise registered Shareholders or duly appointed proxyholders; |

| | ix. | one (1) representative of each of Wildeboer Dellelce LLP and Olshan Frome Wolosky LLP, legal counsel to 22NW (collectively, “22NW Counsel”); |

| | x. | one (1) representative of Saratoga Proxy Consulting LLC (“Saratoga”); |

| | xi. | any person invited to be present at the Meeting by the Chair; |

| | xii. | any other person who is entitled or required under the articles or by-laws of the Company to attend at the Meeting; |

| | xiii. | any person who establishes to the satisfaction of the Chair or his designee that he or she is a beneficial owner of common shares of the Company (“Common Shares”) and who is represented for the purposes of voting by a registered Shareholder or a duly appointed proxyholder; and |

| | xiv. | any other person on the invitation of the Chair. |

Delivery of Proxies

| 6. | The deadline for the delivery to Computershare of proxies to be used at the Meeting is 10:00 a.m. (Mountain Time) on Friday, April 22, 2022 or, if the Meeting is adjourned or postponed, 48 hours (excluding Saturdays, Sundays or statutory holidays) before any reconvened meeting (the “Proxy Deposit Deadline”). The Chair retains its discretion to waive compliance with the Proxy Deposit Deadline. In the event of any such waiver, the Chair shall promptly advise Computershare, McMillan LLP, 22NW Counsel, Kingsdale Advisors and Saratoga thereof. |

Ballots and Voting

| 7. | The Chair shall provide McMillan LLP and Wildeboer Dellelce LLP by 7:00 a.m. (Mountain Time) on April 25, 2022 with the form of ballot(s) for each of the resolutions to be presented to the Shareholders for consideration, discussion and determination at the Meeting. Only registered Shareholders and duly appointed proxyholders who attend the Meeting in person will be able to vote by paper ballot at the Meeting. If registered or beneficial holders of Common Shares wish to appoint a person other than the management nominees identified on the BLUE proxy or voting instruction form to attend and participate at the Meeting as their proxyholders and vote their Common Shares, including if they are beneficial Shareholders and wish to appoint themselves as proxyholders to attend, participate and vote at the Meeting, they must submit their BLUE proxy card or voting instruction form, as applicable, appointing that person as proxyholder and, if the proxyholder will be attending virtually, register that proxyholder online. |

- 2 -

| 8. | Registering a proxyholder is an additional step to be completed after a Shareholder has submitted his, her or its form of proxy or voting instruction form. To register a proxyholder, Shareholders must visit www.computershare.com/DIRTT by the voting deadline of April 22, 2022 at 10:00 a.m. (Mountain Time) and provide Computershare with their proxyholders’ contact information (including e-mail address), so that Computershare may provide the proxyholder with an invitation code via email. Without this invitation code, proxyholders will not be able to participate or vote at the Meeting virtually. |

Revocation of Proxies

| 9. | Any registered Shareholder may revoke a previously delivered proxy by depositing an instrument in writing executed by such registered Shareholder or such Shareholder’s attorney authorized in writing as set out in the management information circular of the Company dated March 24, 2022. |

| 10. | Instruments revoking proxies will also be received at any time up to the time of commencement of the Meeting by depositing such instruments with the Scrutineer. |

| 11. | Any revocation instrument in the form of a later dated proxy received after the Proxy Deposit Deadline (if unwaived) but prior to the relevant vote at the Meeting will be accepted only as a revocation of the prior proxy, but will not be counted as a proxy for voting purposes. |

| 12. | Any registered Shareholder present in person at the Meeting may revoke a proxy by so declaring to the Scrutineer or the Chair and signing an instrument of revocation. If a registered Shareholder present in person at the Meeting votes on any ballot, then any proxy with respect to the Common Shares of such Shareholder will be thereby revoked. |

| 13. | If a revocation is made on the day of the Meeting, or any adjournment or postponement thereof, such revocation will not be effective with respect to any matter on which a vote has already been cast pursuant to the proxy. |

Business and Discussion at the Meeting

| 14. | The business of the Meeting will consist solely of the items set out in the Notice of the Meeting dated March 24, 2022 (the “Notice”). |

| 15. | Subject to paragraphs 16 to 19 below, the Chair shall allow Shareholders and proxyholders to discuss motions under consideration at the Meeting; however, the time allotted for such discussion will be limited, within reason, by the Chair. Only registered Shareholders (as of the record date) and duly appointed proxyholders will be permitted to ask questions/speak at the Meeting. All discussion and questions must be directed to the Chair who will then direct questions to the appropriate person, as applicable. The Chair will ask any person who wishes to speak to provide his or her name and confirm that he or she is a registered Shareholder or duly appointed proxyholder. The Chair may require the assistance of the Scrutineer to confirm that such person is a registered Shareholder or duly appointed proxyholder. |

- 3 -

Discussion on Resolutions

| 16. | Subject only to paragraph 17, there will be no on-site solicitation activity permitted at the Meeting. |

| 17. | Subject to paragraphs 18 and 19, following the introduction of each resolution by the Chair, any Shareholder or proxyholder will be permitted to speak when called upon by the Chair to the resolution for a maximum of three minutes. Following such statement, a representative of the Company shall be entitled to speak to the matter for a maximum of three minutes. |

| 18. | The time limits set out in paragraph 17 will be enforced by the Chair. No rebuttal or follow-up questions or comments will be permitted. In order to ensure that the Meeting is conducted in the best interests of Shareholders and to avoid disruption or acrimony, the Chair will ask persons present at the Meeting to be constructive, courteous and respectful in their comments. The Chair will be entitled to truncate the time allocated under paragraph 16 in the event of a deviation or breach by any person present at the Meeting from or of any of these rules. The Chair may also permit any speaker to exceed the time allotted where he deems this appropriate in the interests of fair and open discussion. |

| 19. | The Chair may impose such other restrictions or time limits on debate as are, in his view, reasonable or appropriate in the circumstances in order to give effect to these rules and to seek to ensure that the Meeting is conducted, and the business is dealt with, efficiently and fairly. |

Voting

| 20. | Ballots will be conducted for each resolution to be considered at the Meeting. As noted above, ballots may be deposited with Computershare in advance of the Meeting by email or otherwise, and all valid ballots will be deemed voted at the Meeting as directed by the Chair of the Meeting. Voting will be solely by ballot. |

| 21. | Ballots may be provided in advance of the Meeting as provided in paragraph 7 above. Ballots may also be distributed upon request by the Scrutineer at the registration desk to any (a) registered Shareholder (as of the record date) who either has not previously deposited a proxy or who indicates that he or she has previously deposited a proxy but wishes to revoke the vote indicated in such proxy or (b) duly appointed proxyholder. |

| 22. | Polls will remain open on each item of business until, in the opinion of the Chair, every registered Shareholder or proxyholder in attendance and duly and appropriately registered at the Meeting has had an opportunity to vote. The Chair will call for a brief recess of the Meeting for an appropriate period of time following the discussion of, and voting on, each resolution in order to permit the Scrutineer to tally the votes and to complete the tabulation of voting and determination of a result. The Chair will be available at this time to make any determinations at the request of the Scrutineer as to the validity of any proxy, voting instruction form, ballot or other voting documentation, and at the request of the Scrutineer, the Chair shall rule upon the validity thereof. |

- 4 -

| 23. | The Scrutineer will present a final report as to the result of each ballot to the Chair. The Chair will receive the Scrutineer’s report and announce the result of each item. |

Review of Proxies

| 24. | Prior to 7:00 a.m. (Mountain Time) on the business day prior to the Meeting, the Scrutineer will send by e-mail any proxies which are deemed problematic, unclear or otherwise questionable by the Scrutineer to the Chair (with copies to Kingsdale Advisors) and, upon request, to 22NW. Any argument 22NW wishes to make with respect thereto should be sent in writing to the Scrutineer and the Chair. The information provided by the Scrutineer shall be maintained in strict confidence by 22NW and Aron English (and their representatives) and by the Company (and its representatives) and will not be publicly disclosed or released in any manner (including but not limited to further solicitation) and access to this information by any person will be subject to his or her acknowledgement of, and agreement with, this condition. The Meeting will commence promptly at 10:00 a.m. (Mountain Time) on April 26, 2022 unless otherwise determined by the Chair. |

| 25. | If any person present at the Meeting wishes to object to any ruling by the Chair at the Meeting, including any determination made by the Chair regarding the validity of proxies, then such person (including such person’s representative) may register an objection to such ruling to permit such objection to appear on the record of the Meeting. |

| 26. | The Scrutineer shall follow the presumptions set forth in the STAC “Proxy Protocol January 2016”, subject to the instructions of the Chair, to validate all proxies and other voting documents. |

Safekeeping of Ballots and Proxies

| 27. | In the event that 22NW wishes to review the proxies, ballots and other voting documentation used in respect of the Meeting, the Company will arrange a virtual meeting following conclusion of the Meeting at a mutually convenient time during normal business hours. Entitled to be present at this meeting will be the Scrutineer, the Chair, and two representatives of each of counsel to the Company and 22NW, Aron English, Kingsdale Advisors, Saratoga and any other person with the consent of the Chair. |

| 28. | The Company will, for at least three months after the Meeting, keep each ballot cast and each proxy voted at the Meeting. At the end of such three month period, the Company may destroy such ballots and proxies. |

General

| 29. | The Meeting will be recorded unless the Chair determines it is impracticable to do so. Such recording will be made available upon request, as soon as reasonably possible following the Meeting. |

- 5 -

| 30. | In the case of any dispute as to the admission or rejection of a vote given on a poll, the Chair will determine the dispute, and his determination made in good faith will be final and conclusive. |

| 31. | In addition to these rules, guidelines may be issued from time to time by the Chair prior to the commencement of the Meeting or during the course of the Meeting. |

Dated this 11th day of April, 2022.

Important Additional Information Regarding Proxy Solicitation

The Company has filed a definitive proxy statement (the “Definitive Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the Meeting. The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from Shareholders in respect of the Meeting. Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the SEC on February 25, 2022, and the Definitive Proxy Statement, as filed with the SEC on March 24, 2022. To the extent holdings of such participants in the Company’s securities are not reported, or have changed since the amounts described, in the Definitive Proxy Statement, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Details concerning the nominees of the Company’s Board for election at the Meeting are included in the Definitive Proxy Statement and accompanying BLUE proxy card. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT, ACCOMPANYING BLUE PROXY CARD AND ANY SUPPLEMENTS THERETO BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and Shareholders can obtain a copy of the Definitive Proxy Statement and other relevant documents filed by the Company free of charge from the SEC’s website, www.sec.gov. Shareholders can also obtain, without charge, a copy of the Definitive Proxy Statement and other relevant filed documents by directing a request by mail to DIRTT Environmental Solutions Ltd., 7303 30th Street S.E., Calgary, Alberta, Canada T2C 1N6 or at ir@dirtt.com or from the investor relations section of the Company’s website, www.dirtt.com/investors.

Special Note Regarding Forward-Looking Statements

This document contains forward-looking information within the meaning of applicable securities legislation, which reflects the Company’s current expectations regarding future events. In some cases, forward-looking information can be identified by such terms as “plans”, “anticipated”, “believe”, and “will”. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control that could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking information. The Company’s estimates, beliefs and assumptions, may prove to be incorrect. The risks and uncertainties that may affect forward-looking information include, but are not limited to, market conditions, the effect of the COVID-19 pandemic on the

- 6 -

Company’s operations, business and financial results, and other factors discussed under “Risks Factors” in the Company’s management’s discussion and analysis in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC and applicable securities commissions or similar regulatory authorities in Canada on February 23, 2022, which is available on SEDAR (www.sedar.com) and on the SEC’s website (www.sec.gov). The Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable law. This forward-looking information speaks only as of the date of this document.

- 7 -

Investor Q&A: Setting the Record Straight on 22NW’s Repeated Misrepresentations

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS Certain statements contained in this presentation (this “presentation”) are “forward-looking statements” within the meaning of “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934 and “forward-looking information” within the meaning of applicable Canadian securities laws. All statements, other than statements of historical fact included in this presentation, regarding without limitation our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, the words “anticipate,” “believe,” “expect,” “estimate,” “intend,” “plan,” “project,” “outlook,” “may,” “will,” “should,” “would,” “could,” “can,” the negatives thereof, variations thereon and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements necessarily involve unknown risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed or implied in such statements. Due to the risks, uncertainties and assumptions inherent in forward-looking information, you should not place undue reliance on forward-looking statements. Factors that could have a material adverse effect on our business, financial condition, results of operations and growth prospects include, but are not limited to: the severity and duration of the coronavirus (“COVID-19”) pandemic and related economic repercussions; global economic, political and social conditions and financial markets; competition in the interior construction industry; our reliance on our network of distribution partners for sales, marketing and installation of our solutions; our ability to implement our strategic plans and to maintain and manage growth effectively; our ability to introduce new designs, solutions and technology and gain client and market acceptance; product liability, product defects and warranty claims brought against us; defects in our designing and manufacturing software; infringement on our patents and other intellectual property; cyber-attacks and other security breaches of our information and technology systems; material fluctuations of commodity prices, including raw materials; shortages of supplies of certain key components and materials; our exposure to currency exchange rate, tax rate and other fluctuations that result from general economic conditions and changes in laws; legal and regulatory proceedings brought against us; the availability of capital or financing on acceptable terms, which may impair our ability to make investments in the business; and other risks described under the section titled “Risk Factors” in our Form 10-K for the year ended December 31, 2021, filed with the U.S. Securities and Exchange Commission (the “SEC”) and applicable securities commissions or similar regulatory authorities in Canada. Our past results of operations are not necessarily indicative of our future results. You should not rely on any forward-looking statements, which represent our beliefs, assumptions and estimates only as of the dates on which they were made, as predictions of future events. We undertake no obligation to update these forward-looking statements, even though circumstances may change in the future, except as required under applicable securities laws. We qualify all of our forward looking statements by these cautionary statements. Currency and Presentation of Financial Information Unless otherwise indicated, all financial information relating to the Company in this presentation has been prepared in U.S. dollars using accounting principles generally accepted in the United States (“GAAP") and the rules and regulations of the SEC. Our consolidated financial statements are prepared in accordance with GAAP. These GAAP financial statements include non-cash charges and other charges and benefits that we believe are unusual or infrequent in nature or that we believe may make comparisons to our prior or future performance difficult. Advisories

As a result, we also provide financial information that is not prepared in accordance with GAAP and should not be considered as an alternative to the information prepared in accordance with GAAP. Management uses these non-GAAP financial measures in its review and evaluation of the financial performance of the Company. We believe that these non-GAAP financial measures also provide additional insight to investors and securities analysts as supplemental information to our GAAP results and as a basis to compare our financial performance from period to period and to compare our financial performance with that of other companies. We believe that these non-GAAP financial measures facilitate comparisons of our core operating results from period to period and to other companies by removing the effects of our capital structure (net interest income on cash deposits, interest expense on outstanding debt and debt facilities, or foreign exchange movements), asset base (depreciation and amortization), tax consequences and stock-based compensation. In addition, management bases certain forward-looking estimates and budgets on non-GAAP financial measures, primarily Adjusted EBITDA. Government subsidies, depreciation and amortization, stock-based compensation and impairment expenses are excluded from our non-GAAP financial measures because management considers them to be outside of the Company’s core operating results, even though some of those expenses may recur, and because management believes that each of these items can distort the trends associated with the Company’s ongoing performance. We remove the impact of all foreign exchange from Adjusted EBITDA. Foreign exchange gains and losses can vary significantly period-on-period due to the impact of changes in the U.S. and Canadian dollar exchange rates on foreign currency denominated monetary items on the balance sheet and are not reflective of the underlying operations of the Company. Additionally, in Q1 2020, and Q1 2021 we have excluded from Adjusted Gross Profit costs associated with under-utilized capacity. Fixed production overheads are allocated to inventory on the basis of normal capacity of the production facilities. In certain periods where production levels are abnormally low, unallocated overheads are recognized as an expense in the period in which they are incurred. We believe that excluding these amounts provides investors and management with greater visibility to the underlying performance of the business operations, enhances consistency and comparativeness with results in prior periods that do not, or future periods that may not, include such items, and facilitates comparison with the results of other companies in our industry. Important Additional Information Regarding Proxy Solicitation DIRTT has filed a definitive proxy statement (the “Definitive Proxy Statement”) with the SEC in connection with the solicitation of proxies for the shareholders meeting scheduled to be held on April 26, 2022 (the “Meeting”). DIRTT, its directors and certain of its executive officers are participants in the solicitation of proxies from shareholders in respect of the Meeting. Information regarding the names of DIRTT’s directors and executive officers and their respective interests in DIRTT by security holdings or otherwise is set forth in DIRTT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the SEC on February 25, 2022, and the Definitive Proxy Statement, as filed with the SEC on March 24, 2022. To the extent holdings of such participants in DIRTT’s securities are not reported, or have changed since the amounts described, in the Definitive Proxy Statement, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Details concerning the nominees of DIRTT’s Board for election at the Meeting are included in the Definitive Proxy Statement and accompanying BLUE proxy card. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT, ACCOMPANYING BLUE PROXY CARD AND ANY SUPPLEMENTS THERETO BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and shareholders can obtain a copy of the Definitive Proxy Statement and other relevant documents filed by DIRTT free of charge from the SEC’s website, www.sec.gov. DIRTT’s shareholders can also obtain, without charge, a copy of the Definitive Proxy Statement and other relevant filed documents by directing a request by mail to DIRTT Environmental Solutions Ltd., 7303 30th Street S.E., Calgary, Alberta, Canada T2C 1N6 or at ir@dirtt.com or from the investor relations section of DIRTT’s website, www.dirtt.com/investors. Advisories

Question: 22NW started this costly and distracting proxy fight four months ago; have they provided any details of their plan for DIRTT?

No. 22NW has no articulated plan – only that they will eventually “come up with a plan”. To date: 22NW has failed to present DIRTT shareholders with a detailed business plan with any strategic initiatives; 22NW has not articulated a transition plan; and 22NW has not identified a new management team. As of April 8, 2022, 22NW’s most-recent articulation of its “plan” is another series of vague, imprecise platitudes. DIRTT shareholders deserve better. They deserve a clear plan and a qualified Board to execute it. No Articulated Plan from 22NW

Question: What are the issues with 22NW’s ‘plan to have a plan’?

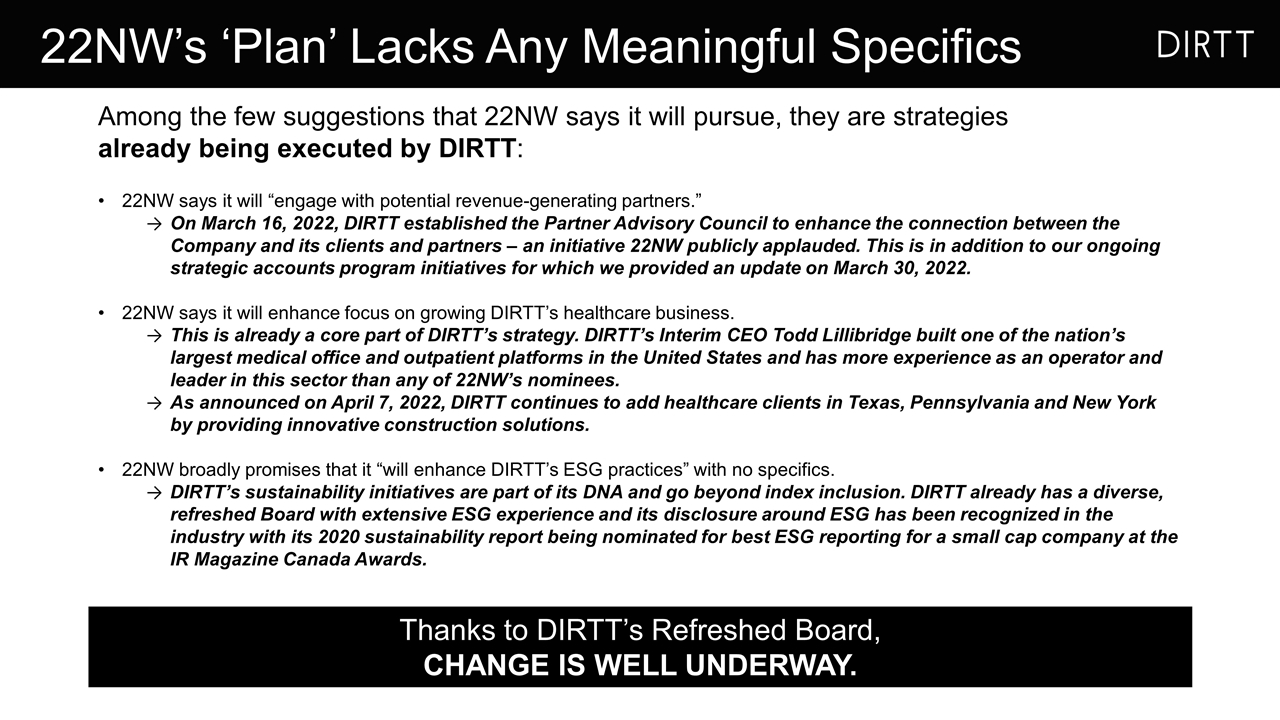

Among the few suggestions that 22NW says it will pursue, they are strategies already being executed by DIRTT: 22NW says it will “engage with potential revenue-generating partners.” On March 16, 2022, DIRTT established the Partner Advisory Council to enhance the connection between the Company and its clients and partners – an initiative 22NW publicly applauded. This is in addition to our ongoing strategic accounts program initiatives for which we provided an update on March 30, 2022. 22NW says it will enhance focus on growing DIRTT’s healthcare business. This is already a core part of DIRTT’s strategy. DIRTT’s Interim CEO Todd Lillibridge built one of the nation’s largest medical office and outpatient platforms in the United States and has more experience as an operator and leader in this sector than any of 22NW’s nominees. As announced on April 7, 2022, DIRTT continues to add healthcare clients in Texas, Pennsylvania and New York by providing innovative construction solutions. 22NW broadly promises that it “will enhance DIRTT’s ESG practices” with no specifics. DIRTT’s sustainability initiatives are part of its DNA and go beyond index inclusion. DIRTT already has a diverse, refreshed Board with extensive ESG experience and its disclosure around ESG has been recognized in the industry with its 2020 sustainability report being nominated for best ESG reporting for a small cap company at the IR Magazine Canada Awards. Thanks to DIRTT’s Refreshed Board, CHANGE IS WELL UNDERWAY. 22NW’s ‘Plan’ Lacks Any Meaningful Specifics

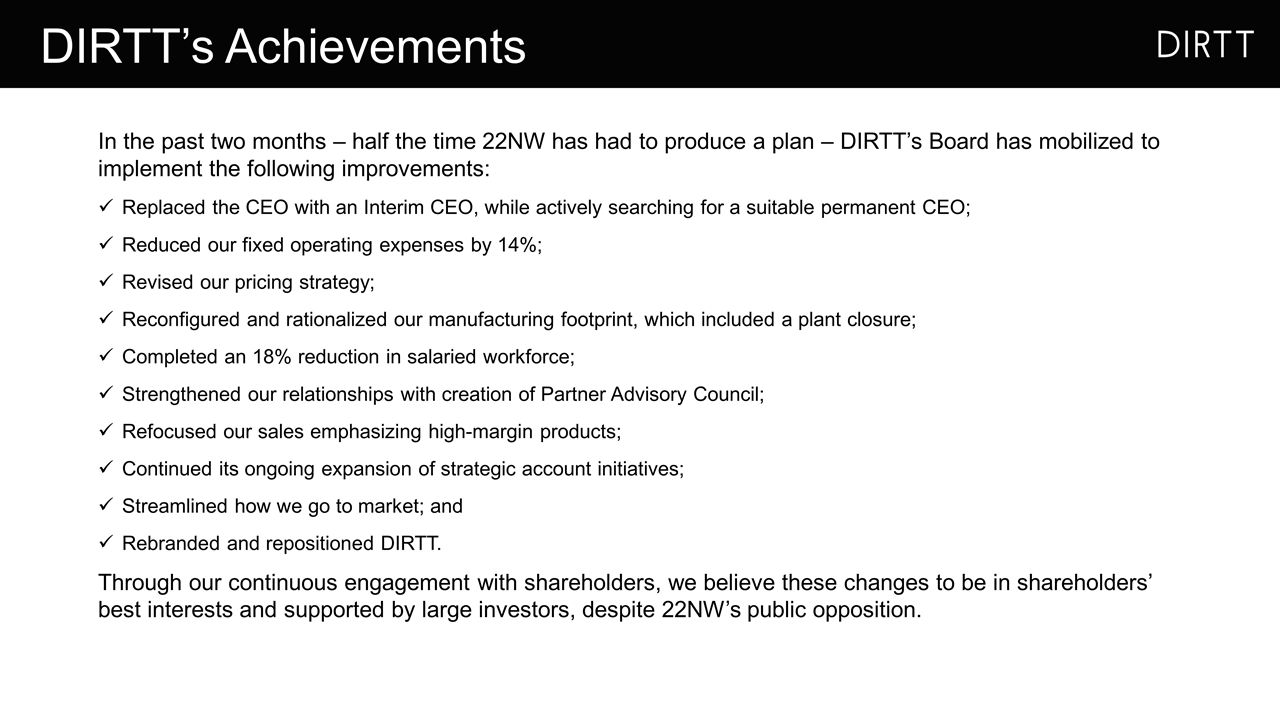

In the past two months – half the time 22NW has had to produce a plan – DIRTT’s Board has mobilized to implement the following improvements: Replaced the CEO with an Interim CEO, while actively searching for a suitable permanent CEO; Reduced our fixed operating expenses by 14%; Revised our pricing strategy; Reconfigured and rationalized our manufacturing footprint, which included a plant closure; Completed an 18% reduction in salaried workforce; Strengthened our relationships with creation of Partner Advisory Council; Refocused our sales emphasizing high-margin products; Continued its ongoing expansion of strategic account initiatives; Streamlined how we go to market; and Rebranded and repositioned DIRTT. Through our continuous engagement with shareholders, we believe these changes to be in shareholders’ best interests and supported by large investors, despite 22NW’s public opposition. DIRTT’s Achievements

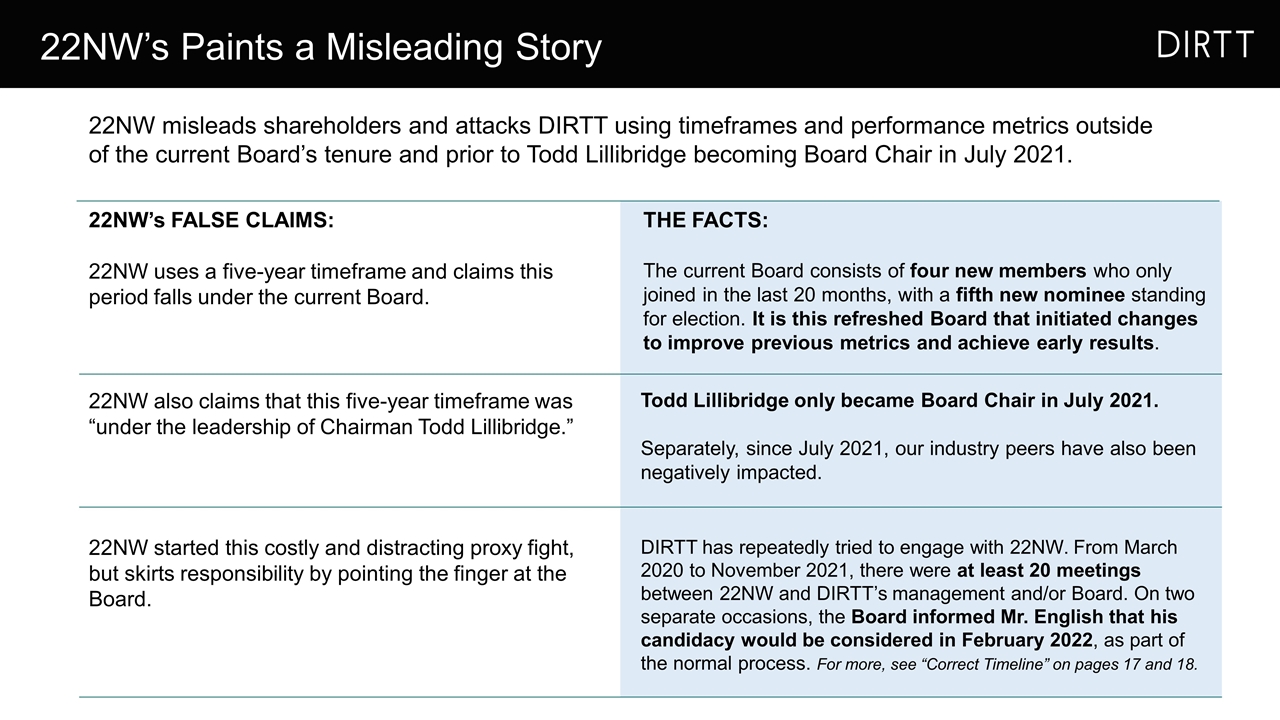

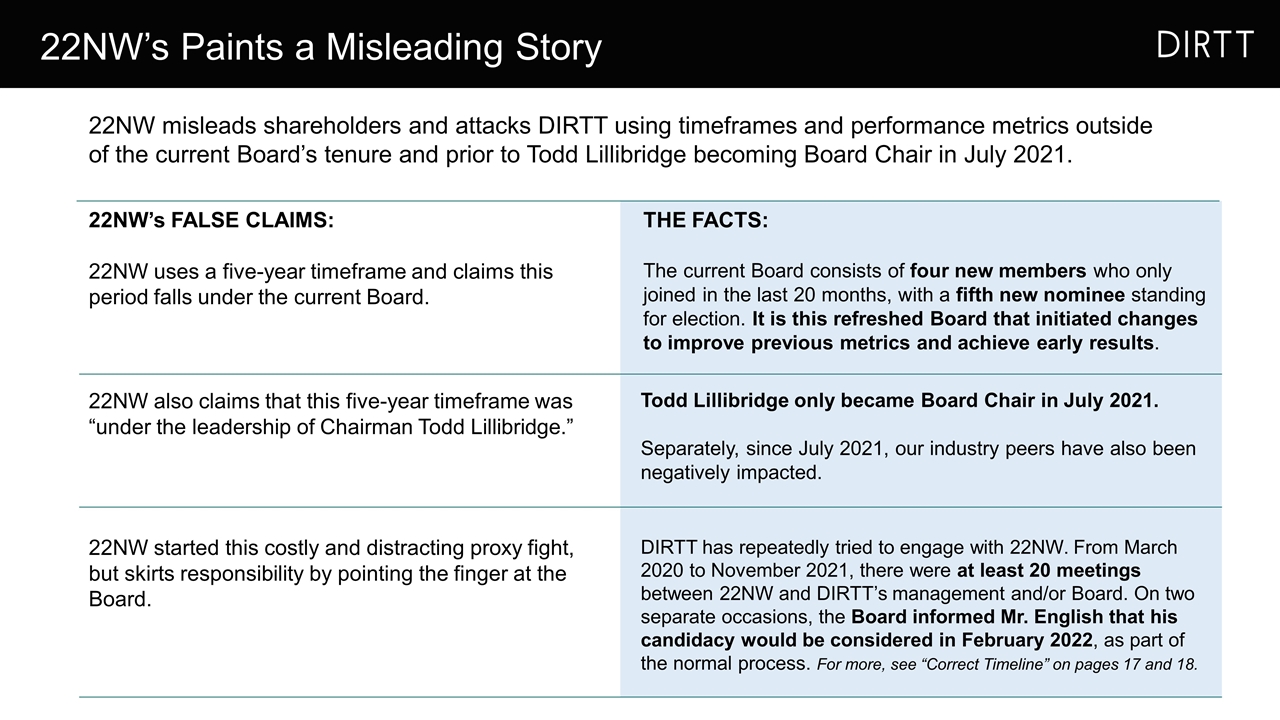

22NW misleads shareholders and attacks DIRTT using timeframes and performance metrics outside of the current Board’s tenure and prior to Todd Lillibridge becoming Board Chair in July 2021. 22NW’s Paints a Misleading Story 22NW’s FALSE CLAIMS: 22NW uses a five-year timeframe and claims this period falls under the current Board. THE FACTS: The current Board consists of four new members who only joined in the last 20 months, with a fifth new nominee standing for election. It is this refreshed Board that initiated changes to improve previous metrics and achieve early results. 22NW also claims that this five-year timeframe was “under the leadership of Chairman Todd Lillibridge.” Todd Lillibridge only became Board Chair in July 2021. Separately, since July 2021, our industry peers have also been negatively impacted. 22NW started this costly and distracting proxy fight, but skirts responsibility by pointing the finger at the Board. DIRTT has repeatedly tried to engage with 22NW. From March 2020 to November 2021, there were at least 20 meetings between 22NW and DIRTT’s management and/or Board. On two separate occasions, the Board informed Mr. English that his candidacy would be considered in February 2022, as part of the normal process. For more, see “Correct Timeline” on pages 17 and 18.

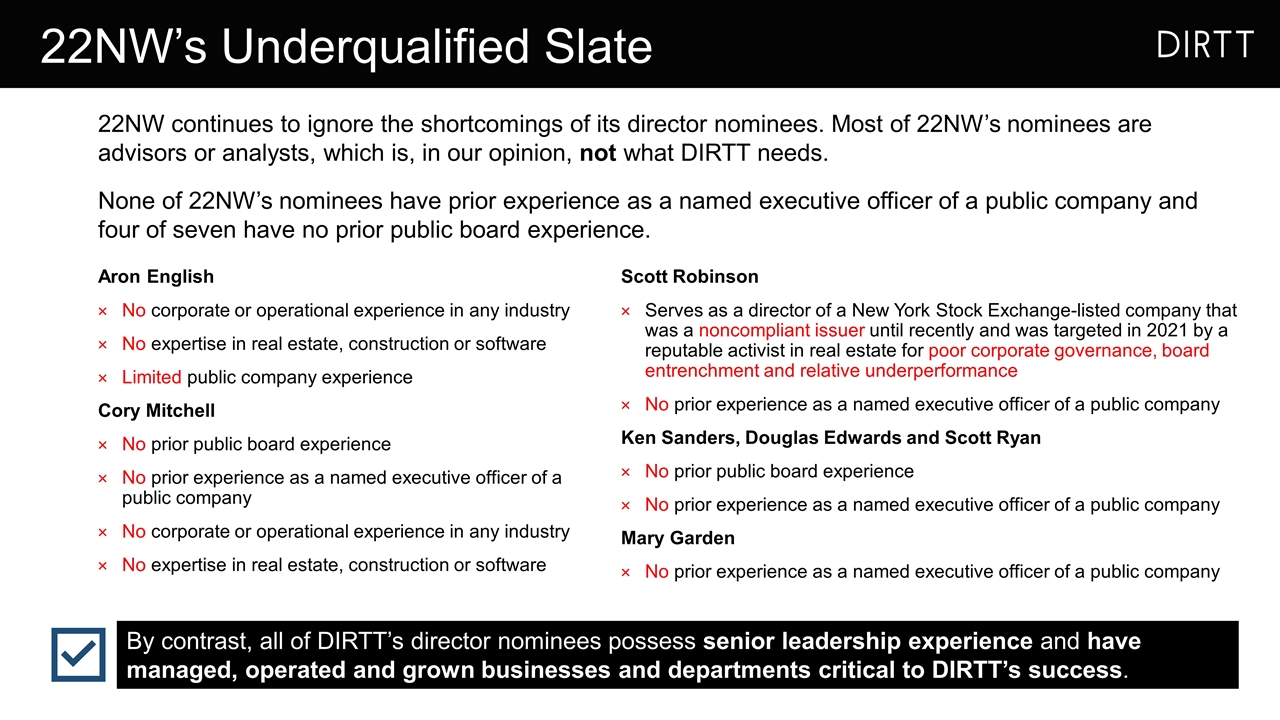

Question: How underqualified are the 22NW board nominees?

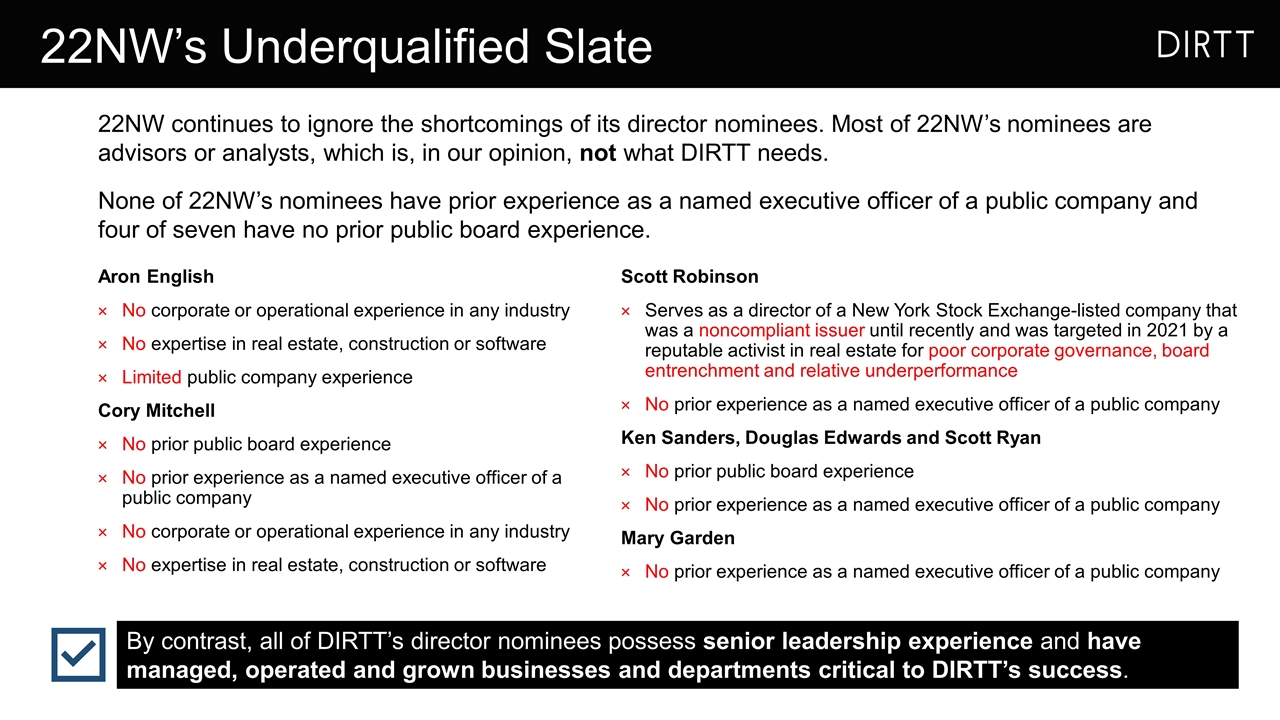

22NW continues to ignore the shortcomings of its director nominees. Most of 22NW’s nominees are advisors or analysts, which is, in our opinion, not what DIRTT needs. None of 22NW’s nominees have prior experience as a named executive officer of a public company and four of seven have no prior public board experience. Aron English No corporate or operational experience in any industry No expertise in real estate, construction or software Limited public company experience Cory Mitchell No prior public board experience No prior experience as a named executive officer of a public company No corporate or operational experience in any industry No expertise in real estate, construction or software Scott Robinson Serves as a director of a New York Stock Exchange-listed company that was a noncompliant issuer until recently and was targeted in 2021 by a reputable activist in real estate for poor corporate governance, board entrenchment and relative underperformance No prior experience as a named executive officer of a public company Ken Sanders, Douglas Edwards and Scott Ryan No prior public board experience No prior experience as a named executive officer of a public company Mary Garden No prior experience as a named executive officer of a public company 22NW’s Underqualified Slate By contrast, all of DIRTT’s director nominees possess senior leadership experience and have managed, operated and grown businesses and departments critical to DIRTT’s success.

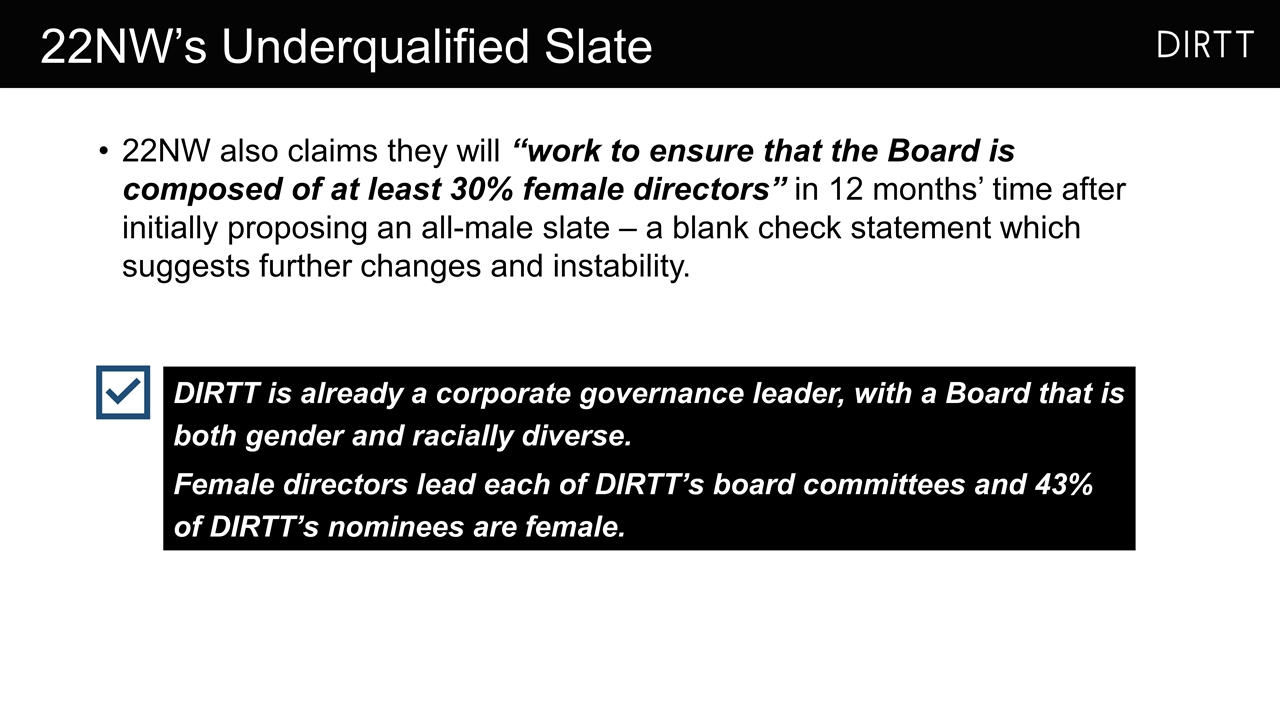

22NW also claims they will “work to ensure that the Board is composed of at least 30% female directors” in 12 months’ time after initially proposing an all-male slate – a blank check statement which suggests further changes and instability. DIRTT is already a corporate governance leader, with a Board that is both gender and racially diverse. Female directors lead each of DIRTT’s board committees and 43% of DIRTT’s nominees are female. 22NW’s Underqualified Slate

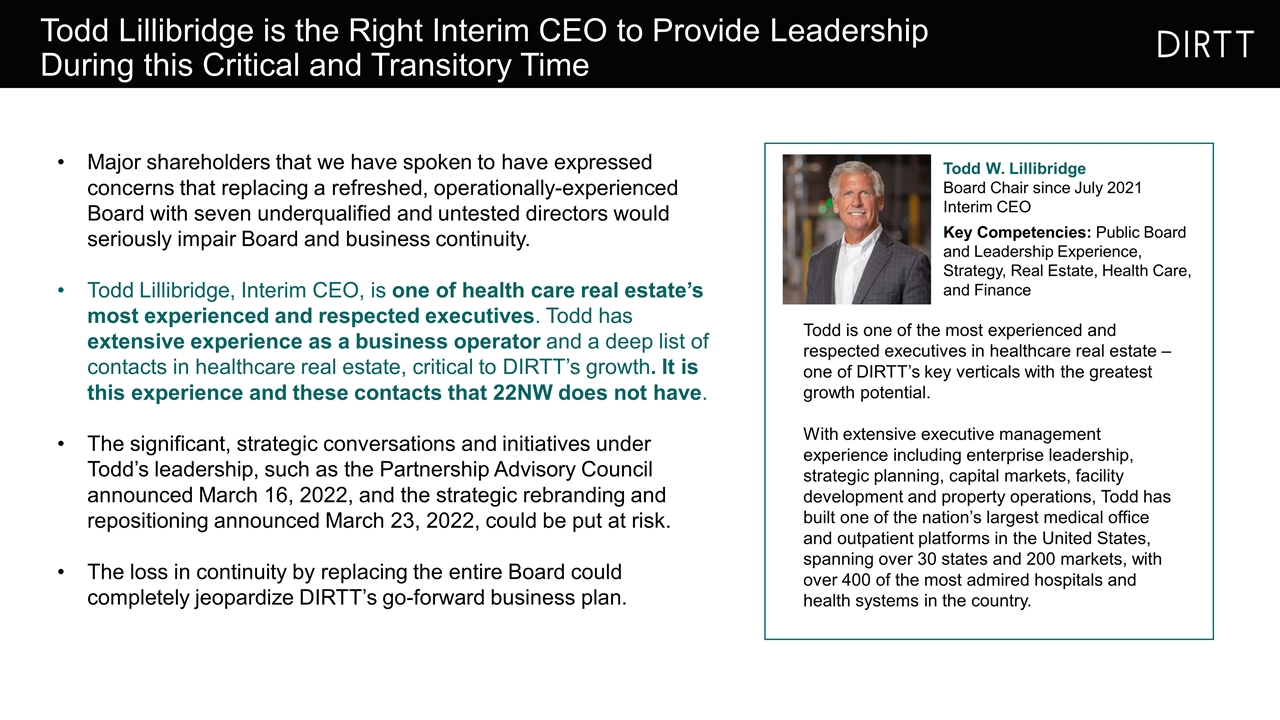

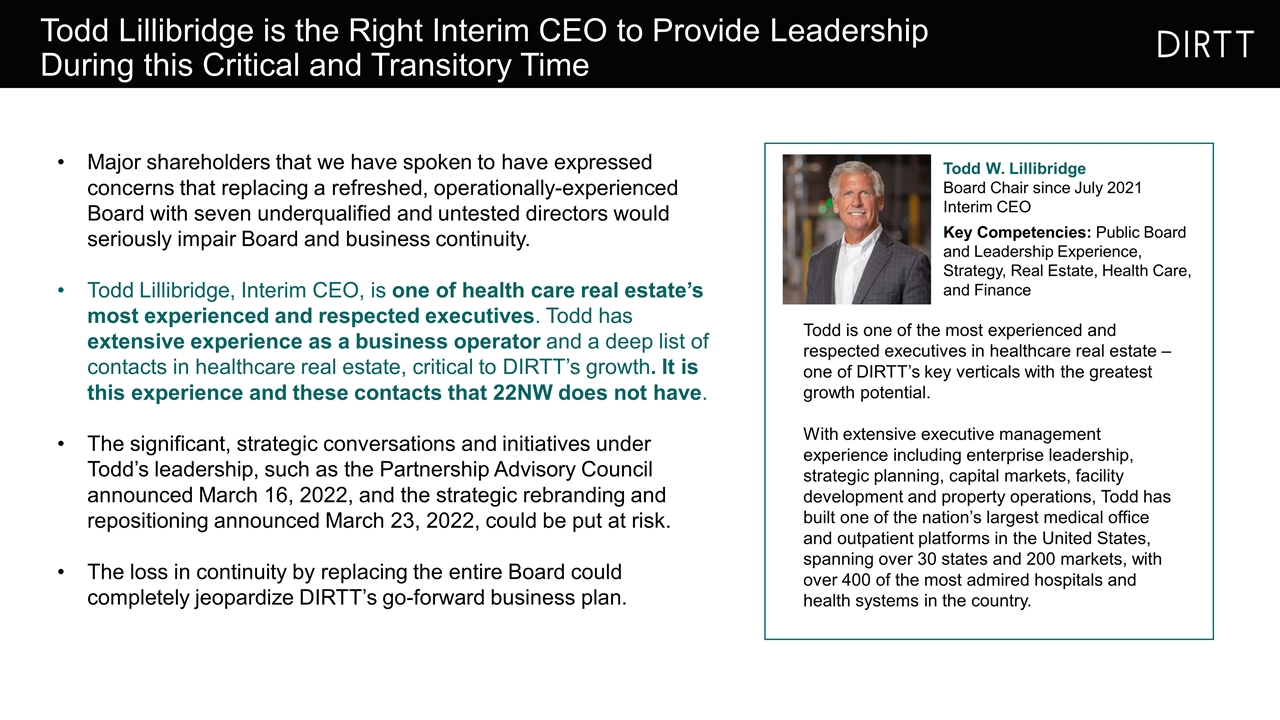

Todd Lillibridge is the Right Interim CEO to Provide Leadership During this Critical and Transitory Time Major shareholders that we have spoken to have expressed concerns that replacing a refreshed, operationally-experienced Board with seven underqualified and untested directors would seriously impair Board and business continuity. Todd Lillibridge, Interim CEO, is one of health care real estate’s most experienced and respected executives. Todd has extensive experience as a business operator and a deep list of contacts in healthcare real estate, critical to DIRTT’s growth. It is this experience and these contacts that 22NW does not have. The significant, strategic conversations and initiatives under Todd’s leadership, such as the Partnership Advisory Council announced March 16, 2022, and the strategic rebranding and repositioning announced March 23, 2022, could be put at risk. The loss in continuity by replacing the entire Board could completely jeopardize DIRTT’s go-forward business plan. Key Competencies: Public Board and Leadership Experience, Strategy, Real Estate, Health Care, and Finance Todd W. Lillibridge Board Chair since July 2021 Interim CEO Todd is one of the most experienced and respected executives in healthcare real estate – one of DIRTT’s key verticals with the greatest growth potential. With extensive executive management experience including enterprise leadership, strategic planning, capital markets, facility development and property operations, Todd has built one of the nation’s largest medical office and outpatient platforms in the United States, spanning over 30 states and 200 markets, with over 400 of the most admired hospitals and health systems in the country.

Question: Has DIRTT tried to negotiate with 22NW, and if so, what has been 22NW’s response?

DIRTT’s Board has continually made good-faith offers to meet with 22NW in order to discuss possible resolutions, while 22NW has refused those requests, and instead, chosen to negotiate through press releases. On April 4, 2022, based on feedback received as part of its commitment to shareholder engagement and openness to efficiently resolve this proxy fight for the best interest of all shareholders, DIRTT offered to expand its Board size to eight members and include Mr. Aron English and another 22NW nominee. 22NW’s continuous refusal to engage for over four months left us with no choice but to negotiate by issuing our most recent press release. We have received no response.

These are the facts: November 5 and 12, 2021: DIRTT’s Board informed Mr. English that his candidacy would be considered in February 2022 as part of its normal course of review and director selection process. Mr. English was not willing to participate in the Board’s regular process and demanded a seat immediately with no conditions. November 17, 2021: 22NW starts a costly and distracting proxy fight and publicly announces requisition of meeting to replace six directors on DIRTT’s board. December 9, 2021: 22NW issues a press release stating they are proposing to withdraw the Requisition if three incumbent directors retire from the Board and be replaced by Mr. English and two of his other nominees. 22NW’s Canadian counsel contacted the Board’s counsel to inform them of the proposal in the form of a term sheet a mere nine minutes prior to issuing the news release. December 10, 2021: Counsel to the Board and the Special Committee sent an email to 22NW’s counsel notifying them that the Special Committee would be issuing a press release stating that the Special Committee remains committed to negotiating a settlement with 22NW that benefits all shareholders. In the email, it was stated that if 22NW “is prepared to enter in negotiations on a without prejudice basis (which would include the timing of such negotiations), the Special Committee would be prepared to do so.” Correct Timeline of the Engagement: DIRTT has Repeatedly Tried to Engage with 22NW

Correct Timeline of the Engagement: DIRTT has Repeatedly Tried to Engage with 22NW January 4, 2022: Counsel to the Board and the Special Committee again emails 22NW’s counsel and references the December 10th email asking for negotiations: “As noted below, the Special Committee is prepared to have discussions with 22NW on a without prejudice basis. Please let us know if 22NW wishes to negotiate on a without prejudice basis.” January 6, 2022: 22NW issues a press release stating that they are only prepared to have discussions with the Special Committee regarding a potential settlement if the complaints to the Alberta Securities Commission are withdrawn. 22NW’s counsel also emailed counsel to the Board and the Special Committee to relay the same message. January 7, 2022: Counsel to the Board and the Special Committee replies to 22NW’s counsel noting that the Special Committee is raising concerns about 22NW’s activities and disclosures because they raise fundamental issues with respect to: the protection of DIRTT’s minority shareholders, the equal treatment of its shareholders, and ensuring that shareholders have accurate and complete information to make informed decisions. Counsel to the Board and the Special Committee also stated: “Nevertheless, the Special Committee has asked me to relay to you that it remains committed to engaging in discussions with 22NW on a without prejudice basis and does not wish to engage in negotiations via press releases. The Special Committee proposes an in-person meeting in Vancouver during the week of January 17 or 24. If you could propose dates and times during this period that you and your client are available to meet, I am certain that we can arrange for a meeting very quickly.” In their April 8 presentation, 22NW acknowledged each of these offers to negotiate a settlement. Despite the Board’s repeated attempts to engage with 22NW, 22NW refused each of these offers.

January 12, 2022: Five days after receiving the January 7 offer from the Special Committee to meet to negotiate on a without prejudice basis, counsel to 22NW responded that they expected to be able to reply the next day. January 14, 2022: 22NW’s counsel sends to the Board and the Special Committee a collection of non-binding, so-called proxies executed by 22NW, 726, Mr. English, employees of 22NW and certain other Company shareholders. 22NW claims these non-binding proxies represent support for the 22NW Nominees by persons holding approximately 50.4% of the issued and outstanding Common Shares. The so-called proxies were accompanied by a letter which requested that the 22NW Nominees immediately replace six of the current directors as set out in the Requisition and that an accompanying draft cooperation agreement be signed. The letter states that the draft agreement was to be a “market-standard agreement,” but had a standstill provision which would not apply to the Company’s 2023 and later annual general meetings. 22NW’s January 14, 2022 email and press release were not an attempt to negotiate, and once again was a ploy in that it was publicly announced. To date, Mr. English continues to refuse to engage with the Company. Correct Timeline of the Engagement: DIRTT has Repeatedly Tried to Engage with 22NW

Question: Has DIRTT engaged with its shareholders to get their input and feedback?

Since becoming Board Chair in July 2021, Todd Lillibridge has engaged with shareholders holding over 80% of the Company’s shares (including 22NW) and solicited their input and feedback on the future direction of DIRTT. Aside from 22NW’s attempts to impede DIRTT’s progress, shareholders have expressed their support for the recent changes, which is consistent with their earlier feedback. Yes, DIRTT values shareholder engagement.

Question: Is the Board aligned and committed to the best interest of DIRTT’s shareholders?

In fact, DIRTT’s refreshed Board – with four new directors joining in the last 20 months and another standing for election for the first time – is further deepening its commitment to the Company by increasing their collective share ownership. The Board currently owns 635,000 shares and 361,000 DSUs – with Mr. Lillibridge personally owning more than twice the shares personally owned by Mr. English. All directors have also elected to receive 100% of their compensation in deferred share units rather than cash. This is in line with the Company’s Director Ownership Guidelines, which provides that directors have five years within which to attain the requisite investment. This is common practice in the marketplace. Yes.