United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21822

(Investment Company Act File Number)

Federated Managed Pool Series

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 12/31/13

Date of Reporting Period: 12/31/13

Item 1. Reports to Stockholders

| Ticker | FCSPX |

| 1 | Please see the footnotes to the line graphs below for definitions of, and further information about the BUSC. |

| 2 | Please see the footnotes to the line graphs below for definitions of, and further information about the BUSC-Baa. |

| 3 | Duration is a measure of a security's price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations. |

| 4 | High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default. |

| 5 | The Fund's use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional instruments. |

| 6 | Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. |

| Average Annual Total Returns for the Period Ended 12/31/2013 | |

| 1 Year | -1.02% |

| 5 Years | 10.37% |

| Start of Performance* | 7.12% |

| * | The Fund's start of performance date was June 20, 2006. |

| Federated Corporate Bond Strategy Portfolio | BUSC | BUSC-Baa | |

| 6/20/2006 | 10,000 | 10,000 | 10,000 |

| 12/31/2006 | 10,678 | 10,616 | 10,675 |

| 12/31/2007 | 11,234 | 11,159 | 11,182 |

| 12/31/2008 | 10,251 | 10,815 | 10,212 |

| 12/31/2009 | 12,900 | 12,550 | 12,991 |

| 12/31/2010 | 14,133 | 13,613 | 14,294 |

| 12/31/2011 | 15,139 | 14,750 | 15,649 |

| 12/31/2012 | 16,960 | 16,132 | 17,421 |

| 12/31/2013 | 16,787 | 15,807 | 17,062 |

| 1 | The Fund's performance assumes the reinvestment of all dividends and distributions. The BUSC and BUSC-Baa have been adjusted to reflect reinvestment of dividends on securities in an index. |

| 2 | The BUSC is composed of all publicly issued, fixed-rate, nonconvertible, investment-grade corporate debt and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities. Issues are rated at least “Baa” by Moody's Investors Service or “BBB” by Standard & Poor's, if unrated by Moody's. The index is not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 3 | The BUSC-Baa is a component of the BUSC comprised of corporate bonds or securities represented by the following sectors: industrial, utility and finance, including both U.S. and non-U.S. corporations and non-corporate bonds or securities represented by the following sectors: sovereign, supranational, foreign agencies and foreign local governments. The index is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| Security Type | Percentage of Total Net Assets |

| Corporate Debt Securities | 92.8% |

| Foreign Government Debt Securities | 4.3% |

| U.S. Treasury Security | 1.0% |

| Derivative Contracts2 | 0.2% |

| Cash Equivalents3 | 0.7% |

| Other Assets and Liabilities—Net4 | 1.0% |

| TOTAL | 100.0% |

| 1 | See the Fund's Prospectus and Statement of Additional Information for a description of these security types. |

| 2 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund's performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract's significance to the portfolio. More complete information regarding the Fund's direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

| 3 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 4 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—92.8% | |||

| Basic Industry - Chemicals—2.4% | |||

| $15,000 | Albemarle Corp., Sr. Note, 5.10%, 2/1/2015 | $15,656 | |

| 525,000 | Dow Chemical Co., Note, 8.55%, 5/15/2019 | 678,286 | |

| 250,000 | Eastman Chemical Co., Sr. Unsecd. Note, 5.50%, 11/15/2019 | 275,565 | |

| 120,000 | 1,2 | Incitec Pivot Finance LLC, Company Guarantee, Series 144A, 4.00%, 12/7/2015 | 124,842 |

| 85,000 | 1,2 | Incitec Pivot Finance LLC, Company Guarantee, Series 144A, 6.00%, 12/10/2019 | 93,090 |

| TOTAL | 1,187,439 | ||

| Basic Industry - Metals & Mining—7.3% | |||

| 250,000 | Alcoa, Inc., Note, 5.55%, 2/1/2017 | 269,193 | |

| 150,000 | Alcoa, Inc., Sr. Unsecd. Note, 5.40%, 4/15/2021 | 153,234 | |

| 110,000 | Allegheny Technologies, Inc., Sr. Note, 9.375%, 6/1/2019 | 134,472 | |

| 200,000 | 1,2 | Anglo American Capital PLC, Company Guarantee, Series 144A, 2.625%, 4/3/2017 | 201,628 |

| 235,000 | Anglogold Ashanti Holdings PLC, Sr. Note, 6.50%, 4/15/2040 | 183,331 | |

| 90,000 | Anglogold Ashanti Holdings PLC, Sr. Unsecd. Note, 8.50%, 7/30/2020 | 93,384 | |

| 85,000 | ArcelorMittal, Sr. Unsecd. Note, 5.00%, 2/25/2017 | 91,587 | |

| 600,000 | ArcelorMittal, Sr. Unsecd. Note, 5.75%, 8/5/2020 | 639,000 | |

| 310,000 | ArcelorMittal, Sr. Unsecd. Note, 7.25%, 3/1/2041 | 297,600 | |

| 40,000 | Carpenter Technology Corp., Sr. Unsecd. Note, 4.45%, 3/1/2023 | 38,393 | |

| 150,000 | Carpenter Technology Corp., Sr. Unsecd. Note, 5.20%, 7/15/2021 | 153,645 | |

| 130,000 | 1,2 | Gerdau S.A., Company Guarantee, Series 144A, 5.75%, 1/30/2021 | 133,250 |

| 250,000 | 1,2 | Gold Fields Orogen Holding BVI Ltd., Company Guarantee, Series 144A, 4.875%, 10/7/2020 | 203,190 |

| 200,000 | 1,2 | Hyundai Steel Co., Sr. Unsecd. Note, Series 144A, 4.625%, 4/21/2016 | 211,111 |

| 280,000 | 1,2 | Newcrest Finance Property Ltd., Sr. Unsecd. Note, Series 144A, 4.20%, 10/1/2022 | 223,789 |

| 225,000 | Reliance Steel & Aluminum Co., Sr. Unsecd. Note, 4.50%, 4/15/2023 | 220,781 | |

| 250,000 | Southern Copper Corp., Note, 6.75%, 4/16/2040 | 243,885 | |

| 100,000 | Xstrata Canada Corp., 6.00%, 10/15/2015 | 108,333 | |

| TOTAL | 3,599,806 | ||

| Basic Industry - Paper—1.7% | |||

| 245,000 | International Paper Co., Sr. Unsecd. Note, 7.50%, 8/15/2021 | 300,425 | |

| 150,000 | Plum Creek Timberlands LP, Sr. Unsecd. Note, 3.25%, 3/15/2023 | 134,929 | |

| 140,000 | Plum Creek Timberlands LP, Sr. Unsecd. Note, 4.70%, 3/15/2021 | 145,172 | |

| 100,000 | Weyerhaeuser Co., Sr. Unsecd. Note, 7.375%, 10/1/2019 | 121,317 | |

| 100,000 | Weyerhaeuser Co., Sr. Unsecd. Note, 7.375%, 3/15/2032 | 122,386 | |

| TOTAL | 824,229 | ||

| Capital Goods - Aerospace & Defense—0.2% | |||

| 100,000 | Embraer SA, Sr. Unsecd. Note, 5.15%, 6/15/2022 | 100,250 | |

| Capital Goods - Building Materials—1.1% | |||

| 260,000 | Masco Corp., Sr. Unsecd. Note, 5.95%, 3/15/2022 | 276,250 | |

| 30,000 | Masco Corp., Sr. Unsecd. Note, 7.125%, 3/15/2020 | 34,395 | |

| 200,000 | Valmont Industries, Inc., Sr. Unsecd. Note, 6.625%, 4/20/2020 | 224,446 | |

| TOTAL | 535,091 | ||

| Capital Goods - Construction Machinery—0.3% | |||

| 120,000 | AGCO Corp., Sr. Unsecd. Note, 5.875%, 12/1/2021 | 128,179 | |

| Capital Goods - Diversified Manufacturing—0.9% | |||

| 100,000 | Harsco Corp., 5.75%, 5/15/2018 | 105,010 | |

| 200,000 | 1,2 | Hutchison Whampoa International Ltd., Company Guarantee, Series 144A, 3.50%, 1/13/2017 | 209,164 |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—continued | |||

| Capital Goods - Diversified Manufacturing—continued | |||

| $136,000 | 1,2 | Textron Financial Corp., Jr. Sub. Note, Series 144A, 6.00%, 2/15/2067 | $122,400 |

| TOTAL | 436,574 | ||

| Capital Goods - Packaging—1.1% | |||

| 65,000 | Packaging Corp. of America, Sr. Unsecd. Note, 3.90%, 6/15/2022 | 63,167 | |

| 80,000 | Packaging Corp. of America, Sr. Unsecd. Note, 4.50%, 11/1/2023 | 80,238 | |

| 120,000 | Rock-Tenn Co., Sr. Unsecd. Note, 4.00%, 3/1/2023 | 114,650 | |

| 40,000 | Rock-Tenn Co., Sr. Unsecd. Note, 4.45%, 3/1/2019 | 42,218 | |

| 220,000 | Sonoco Products Co., Sr. Unsecd. Note, 5.75%, 11/1/2040 | 232,982 | |

| TOTAL | 533,255 | ||

| Communications - Media & Cable—2.5% | |||

| 250,000 | 1,2 | Cox Communications, Inc., Series 144A, 3.25%, 12/15/2022 | 226,298 |

| 245,000 | DIRECTV Holdings LLC, Company Guarantee, 6.375%, 3/1/2041 | 254,082 | |

| 40,000 | Time Warner Cable, Inc., Company Guarantee, 5.50%, 9/1/2041 | 33,151 | |

| 90,000 | Time Warner Cable, Inc., Company Guarantee, 6.75%, 6/15/2039 | 84,769 | |

| 420,000 | Time Warner Cable, Inc., Company Guarantee, 8.25%, 4/1/2019 | 492,319 | |

| 50,000 | Time Warner Cable, Inc., Company Guarantee, 8.75%, 2/14/2019 | 59,676 | |

| 100,000 | Time Warner Cable, Inc., Sr. Unsecd. Note, 5.85%, 5/1/2017 | 109,114 | |

| TOTAL | 1,259,409 | ||

| Communications - Media Noncable—3.2% | |||

| 100,000 | Grupo Televisa S.A., 6.625%, 3/18/2025 | 112,742 | |

| 200,000 | Interpublic Group of Cos., Inc., Sr. Unsecd. Note, 2.25%, 11/15/2017 | 197,273 | |

| 70,000 | Interpublic Group of Cos., Inc., Sr. Unsecd. Note, 4.00%, 3/15/2022 | 67,009 | |

| 100,000 | News America Holdings, Inc., Sr. Deb., 6.75%, 1/9/2038 | 113,596 | |

| 350,000 | News America, Inc., Company Guarantee, 5.65%, 8/15/2020 | 392,304 | |

| 30,000 | 1,2 | News America, Inc., Sr. Unsecd. Note, Series 144A, 4.00%, 10/1/2023 | 29,661 |

| 155,000 | Omnicom Group, Inc., Sr. Unsecd. Note, 3.625%, 5/1/2022 | 150,149 | |

| 200,000 | 1,2 | Pearson Funding Five PLC, Sr. Unsecd. Note, Series 144A, 3.25%, 5/8/2023 | 180,357 |

| 100,000 | 1,2 | Pearson Funding Two PLC, Sr. Unsecd. Note, Series 144A, 4.00%, 5/17/2016 | 105,582 |

| 280,000 | WPP Finance 2010, Sr. Unsecd. Note, 5.125%, 9/7/2042 | 255,045 | |

| TOTAL | 1,603,718 | ||

| Communications - Telecom Wireless—0.5% | |||

| 70,000 | American Tower Corp., Sr. Unsecd. Note, 5.00%, 2/15/2024 | 70,542 | |

| 180,000 | Telefonaktiebolaget LM Ericsson, Sr. Unsecd. Note, 4.125%, 5/15/2022 | 175,009 | |

| TOTAL | 245,551 | ||

| Communications - Telecom Wirelines—9.4% | |||

| 300,000 | CenturyLink, Inc., Sr. Note, Series Q, 6.15%, 9/15/2019 | 318,000 | |

| 485,000 | CenturyLink, Inc., Sr. Unsecd. Note, 7.65%, 3/15/2042 | 435,287 | |

| 250,000 | CenturyLink, Inc., Sr. Unsecd. Note, Series S, 6.45%, 6/15/2021 | 261,250 | |

| 100,000 | Rogers Communications, Inc., Company Guarantee, 6.80%, 8/15/2018 | 119,248 | |

| 325,000 | Telecom Italia Capital SA, Company Guarantee, 6.00%, 9/30/2034 | 283,156 | |

| 425,000 | Telefonica Emisiones S.A.U., Company Guarantee, 5.462%, 2/16/2021 | 448,956 | |

| 40,000 | Telefonica SA, Company Guarantee, 7.045%, 6/20/2036 | 44,173 | |

| 1,800,000 | Verizon Communications, Inc., Sr. Unsecd. Note, 5.15%, 9/15/2023 | 1,933,308 | |

| 700,000 | Verizon Communications, Inc., Sr. Unsecd. Note, 6.55%, 9/15/2043 | 819,153 | |

| TOTAL | 4,662,531 | ||

| Consumer Cyclical - Automotive—3.5% | |||

| 50,000 | 1,2 | American Honda Finance Corp., Series 144A, 7.625%, 10/1/2018 | 61,212 |

| 200,000 | Ford Motor Co., Sr. Unsecd. Note, 4.75%, 1/15/2043 | 180,417 | |

| 200,000 | Ford Motor Credit Co., Sr. Unsecd. Note, 2.375%, 1/16/2018 | 202,096 |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—continued | |||

| Consumer Cyclical - Automotive—continued | |||

| $470,000 | Ford Motor Credit Co., Sr. Unsecd. Note, 4.25%, 9/20/2022 | $472,313 | |

| 270,000 | 1,2 | Harley-Davidson Financial Services, Inc., Sr. Unsecd. Note, Series 144A, 2.70%, 3/15/2017 | 276,903 |

| 250,000 | 1,2 | Hyundai Capital America, Sr. Unsecd. Note, Series 144A, 2.875%, 8/9/2018 | 251,094 |

| 200,000 | 1,2 | RCI Banque SA, Sr. Unsecd. Note, 3.50%, 4/3/2018 | 203,934 |

| 100,000 | 1,2 | RCI Banque SA, Sr. Unsecd. Note, Series 144A, 4.60%, 4/12/2016 | 106,034 |

| TOTAL | 1,754,003 | ||

| Consumer Cyclical - Entertainment—1.8% | |||

| 240,000 | Carnival Corp., Sr. Unsecd. Note, 3.95%, 10/15/2020 | 240,376 | |

| 440,000 | Time Warner, Inc., Company Guarantee, 6.20%, 3/15/2040 | 484,833 | |

| 95,000 | Viacom, Inc., Sr. Unsecd. Note, 2.50%, 12/15/2016 | 98,310 | |

| 70,000 | Viacom, Inc., Sr. Unsecd. Note, 4.25%, 9/1/2023 | 69,879 | |

| TOTAL | 893,398 | ||

| Consumer Cyclical - Lodging—1.4% | |||

| 250,000 | Choice Hotels International, Inc., Company Guarantee, 5.70%, 8/28/2020 | 264,375 | |

| 150,000 | Hyatt Hotels Corp., Sr. Unsecd. Note, 3.375%, 7/15/2023 | 137,565 | |

| 280,000 | Wyndham Worldwide Corp., Sr. Unsecd. Note, 4.25%, 3/1/2022 | 273,355 | |

| 20,000 | Wyndham Worldwide Corp., Sr. Unsecd. Note, 5.625%, 3/1/2021 | 21,362 | |

| 1,000 | Wyndham Worldwide Corp., Sr. Unsecd. Note, 6.00%, 12/1/2016 | 1,104 | |

| TOTAL | 697,761 | ||

| Consumer Cyclical - Retailers—0.3% | |||

| 80,000 | Advance Auto Parts, Inc., Company Guarantee, 4.50%, 1/15/2022 | 81,203 | |

| 50,000 | CVS Caremark Corp., Sr. Unsecd. Note, 4.00%, 12/5/2023 | 49,912 | |

| TOTAL | 131,115 | ||

| Consumer Non-Cyclical - Food/Beverage—2.7% | |||

| 80,000 | 1,2 | Bacardi Ltd., Sr. Note, Series 144A, 7.45%, 4/1/2014 | 81,340 |

| 60,000 | ConAgra Foods, Inc., 6.625%, 8/15/2039 | 68,101 | |

| 170,000 | ConAgra Foods, Inc., Sr. Unsecd. Note, 3.20%, 1/25/2023 | 157,887 | |

| 100,000 | 1,2 | Grupo Bimbo SAB de CV, Sr. Unsecd. Note, Series 144A, 4.50%, 1/25/2022 | 99,273 |

| 250,000 | 1,2 | Kerry Group Financial Services, Sr. Unsecd. Note, Series 144A, 3.20%, 4/9/2023 | 226,447 |

| 300,000 | Kraft Foods, Inc., Sr. Unsecd. Note, 6.50%, 2/9/2040 | 358,576 | |

| 180,000 | 1,2 | Pernod-Ricard SA, Sr. Unsecd. Note, 4.25%, 7/15/2022 | 179,599 |

| 165,000 | Tyson Foods, Inc., Sr. Unsecd. Note, 4.50%, 6/15/2022 | 168,049 | |

| TOTAL | 1,339,272 | ||

| Consumer Non-Cyclical - Health Care—0.2% | |||

| 35,000 | CareFusion Corp., Sr. Unsecd. Note, 6.375%, 8/1/2019 | 39,636 | |

| 40,000 | Laboratory Corp. of America Holdings, Sr. Unsecd. Note, 3.75%, 8/23/2022 | 38,758 | |

| TOTAL | 78,394 | ||

| Consumer Non-Cyclical - Pharmaceuticals—0.1% | |||

| 40,000 | Dentsply International, Inc., Sr. Unsecd. Note, 2.75%, 8/15/2016 | 41,182 | |

| Consumer Non-Cyclical - Tobacco—1.3% | |||

| 140,000 | Altria Group, Inc., 9.25%, 8/6/2019 | 184,537 | |

| 235,000 | Altria Group, Inc., Sr. Unsecd. Note, 4.00%, 1/31/2024 | 229,777 | |

| 200,000 | Lorillard Tobacco Co., Sr. Unsecd. Note, 7.00%, 8/4/2041 | 217,544 | |

| TOTAL | 631,858 | ||

| Energy - Independent—4.3% | |||

| 50,000 | Petroleos Mexicanos, 6.50%, 6/2/2041 | 52,500 | |

| 1,665,000 | Petroleos Mexicanos, Company Guarantee, 5.50%, 1/21/2021 | 1,798,200 | |

| 240,000 | Petroleos Mexicanos, Company Guarantee, Series WI, 6.00%, 3/5/2020 | 267,840 |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—continued | |||

| Energy - Independent—continued | |||

| $14,364 | 1,2 | Tengizchevroil LLP, Series 144A, 6.124%, 11/15/2014 | $14,681 |

| TOTAL | 2,133,221 | ||

| Energy - Integrated—3.7% | |||

| 250,000 | Hess Corp., Sr. Unsecd. Note, 5.60%, 2/15/2041 | 260,587 | |

| 245,000 | Husky Energy, Inc., Sr. Unsecd. Note, 3.95%, 4/15/2022 | 241,899 | |

| 100,000 | Husky Oil Ltd., Deb., 7.55%, 11/15/2016 | 115,711 | |

| 100,000 | Petro-Canada, Bond, 5.35%, 7/15/2033 | 101,907 | |

| 500,000 | Petrobras Global Finance BV, Sr. Unsecd. Note, 4.375%, 5/20/2023 | 449,764 | |

| 730,000 | Petrobras International Finance Co., Company Guarantee, 6.75%, 1/27/2041 | 680,981 | |

| TOTAL | 1,850,849 | ||

| Energy - Oil Field Services—1.7% | |||

| 35,000 | Nabors Industries, Inc., Company Guarantee, 5.00%, 9/15/2020 | 36,429 | |

| 100,000 | Nabors Industries, Inc., Sr. Unsecd. Note, 4.625%, 9/15/2021 | 100,146 | |

| 200,000 | 1,2 | Nabors Industries, Inc., Sr. Unsecd. Note, Series 144A, 5.10%, 9/15/2023 | 198,455 |

| 90,000 | Noble Holding International Ltd., Company Guarantee, 4.90%, 8/1/2020 | 95,008 | |

| 100,000 | Noble Holding International Ltd., Sr. Unsecd. Note, 3.05%, 3/1/2016 | 103,019 | |

| 150,000 | Weatherford International Ltd., 7.00%, 3/15/2038 | 166,061 | |

| 165,000 | Weatherford International Ltd., Sr. Unsecd. Note, 5.95%, 4/15/2042 | 165,358 | |

| TOTAL | 864,476 | ||

| Energy - Refining—1.3% | |||

| 150,000 | Marathon Petroleum Corp., Sr. Unsecd. Note, 6.50%, 3/1/2041 | 170,993 | |

| 350,000 | Valero Energy Corp., 9.375%, 3/15/2019 | 451,335 | |

| TOTAL | 622,328 | ||

| Financial Institution - Banking—7.4% | |||

| 200,000 | Associated Banc-Corp., Sr. Unsecd. Note, 5.125%, 3/28/2016 | 213,881 | |

| 350,000 | Bank of America Corp., Sr. Unsecd. Note, 5.00%, 5/13/2021 | 382,577 | |

| 125,000 | Bank of America Corp., Sr. Unsecd. Note, Series MTN, 2.00%, 1/11/2018 | 124,843 | |

| 350,000 | Citigroup, Inc., Sr. Unsecd. Note, 4.45%, 1/10/2017 | 379,474 | |

| 170,000 | Citigroup, Inc., Sr. Unsecd. Note, 4.50%, 1/14/2022 | 180,205 | |

| 270,000 | City National Corp., Sr. Unsecd. Note, 5.25%, 9/15/2020 | 290,037 | |

| 310,000 | Fifth Third Bancorp, Sr. Unsecd. Note, 3.625%, 1/25/2016 | 325,828 | |

| 350,000 | Goldman Sachs Group, Inc., Sr. Unsecd. Note, 5.375%, 3/15/2020 | 389,338 | |

| 480,000 | Goldman Sachs Group, Inc., Sr. Unsecd. Note, 5.75%, 1/24/2022 | 540,488 | |

| 110,000 | HSBC Holdings PLC, Sr. Unsecd. Note, 5.10%, 4/5/2021 | 122,293 | |

| 40,000 | Huntington Bancshares, Inc., Sub. Note, 7.00%, 12/15/2020 | 46,399 | |

| 30,000 | JPMorgan Chase & Co., Sub. Note, 3.375%, 5/1/2023 | 27,970 | |

| 175,000 | Morgan Stanley, Sub. Note, 4.10%, 5/22/2023 | 169,414 | |

| 200,000 | Morgan Stanley, Sub. Note, 5.00%, 11/24/2025 | 200,678 | |

| 250,000 | 1,2 | RBS Citizens Financial Group, Inc., Sub. Note, Series 144A, 4.15%, 9/28/2022 | 241,944 |

| 50,000 | Wilmington Trust Corp., Sub. Note, 8.50%, 4/2/2018 | 59,170 | |

| TOTAL | 3,694,539 | ||

| Financial Institution - Brokerage—3.0% | |||

| 190,000 | 1,2 | Cantor Fitzgerald LP, Bond, Series 144A, 7.875%, 10/15/2019 | 200,450 |

| 10,000 | Eaton Vance Corp., Sr. Unsecd. Note, 3.625%, 6/15/2023 | 9,584 | |

| 2,000 | Eaton Vance Corp., Sr. Unsecd. Note, 6.50%, 10/2/2017 | 2,271 | |

| 150,000 | Janus Capital Group, Inc., Sr. Note, 6.70%, 6/15/2017 | 167,106 | |

| 70,000 | Jefferies Group LLC, Sr. Unsecd. Note, 6.50%, 1/20/2043 | 69,425 | |

| 250,000 | Jefferies Group LLC, Sr. Unsecd. Note, 6.875%, 4/15/2021 | 286,008 | |

| 200,000 | Legg Mason, Inc., Sr. Unsecd. Note, 5.50%, 5/21/2019 | 218,922 |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—continued | |||

| Financial Institution - Brokerage—continued | |||

| $500,000 | Raymond James Financial, Inc., Sr. Unsecd. Note, 5.625%, 4/1/2024 | $524,720 | |

| TOTAL | 1,478,486 | ||

| Financial Institution - Finance Noncaptive—0.9% | |||

| 250,000 | Discover Bank, Sr. Unsecd. Note, 2.00%, 2/21/2018 | 245,671 | |

| 100,000 | HSBC Finance Capital Trust IX, Note, 5.911%, 11/30/2035 | 103,500 | |

| 70,000 | 1,2 | Macquarie Group Ltd., Sr. Unsecd. Note, Series 144A, 6.00%, 1/14/2020 | 77,336 |

| TOTAL | 426,507 | ||

| Financial Institution - Insurance - Life—5.6% | |||

| 75,000 | AXA-UAP, Sub. Note, 8.60%, 12/15/2030 | 92,531 | |

| 255,000 | American International Group, Inc., Sr. Unsecd. Note, 4.125%, 2/15/2024 | 253,615 | |

| 575,000 | American International Group, Inc., Sr. Unsecd. Note, 6.40%, 12/15/2020 | 679,744 | |

| 120,000 | Hartford Financial Services Group, Inc., Sr. Unsecd. Note, 5.125%, 4/15/2022 | 130,745 | |

| 120,000 | Hartford Financial Services Group, Inc., Sr. Unsecd. Note, 6.625%, 4/15/2042 | 144,294 | |

| 110,000 | Lincoln National Corp., Sr. Note, 7.00%, 6/15/2040 | 137,845 | |

| 200,000 | Lincoln National Corp., Sr. Unsecd. Note, 6.25%, 2/15/2020 | 230,619 | |

| 100,000 | MetLife, Inc., Jr. Sub. Note, 10.75%, 8/1/2039 | 148,000 | |

| 50,000 | 1,2 | Penn Mutual Life Insurance Co., Sr. Note, Series 144A, 7.625%, 6/15/2040 | 62,715 |

| 150,000 | Prudential Financial, Inc., Sr. Note, Series MTND, 7.375%, 6/15/2019 | 184,267 | |

| 650,000 | Prudential Financial, Inc., Sr. Unsecd. Note, 5.375%, 6/21/2020 | 735,120 | |

| TOTAL | 2,799,495 | ||

| Financial Institution - Insurance - P&C—2.9% | |||

| 500,000 | CNA Financial Corp., Sr. Unsecd. Note, 5.875%, 8/15/2020 | 570,441 | |

| 50,000 | CNA Financial Corp., Sr. Unsecd. Note, 7.35%, 11/15/2019 | 60,725 | |

| 75,000 | Horace Mann Educators Corp., Sr. Note, 6.85%, 4/15/2016 | 81,561 | |

| 60,000 | 1,2 | Liberty Mutual Group, Inc., Company Guarantee, Series 144A, 5.00%, 6/1/2021 | 62,945 |

| 310,000 | 1,2 | Liberty Mutual Group, Inc., Series 144A, 4.95%, 5/1/2022 | 320,641 |

| 55,000 | 1,2 | Liberty Mutual Group, Inc., Sr. Unsecd. Note, Series 144A, 4.25%, 6/15/2023 | 53,122 |

| 195,000 | 1,2 | Nationwide Mutual Insurance Co., Sub. Note, Series 144A, 9.375%, 8/15/2039 | 275,947 |

| TOTAL | 1,425,382 | ||

| Financial Institution - REITs—4.0% | |||

| 100,000 | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 3.90%, 6/15/2023 | 93,215 | |

| 60,000 | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 4.60%, 4/1/2022 | 60,393 | |

| 70,000 | Boston Properties LP, Sr. Unsecd. Note, 3.80%, 2/1/2024 | 67,152 | |

| 200,000 | Boston Properties LP, Sr. Unsecd. Note, 5.875%, 10/15/2019 | 229,822 | |

| 325,000 | Equity One, Inc., Bond, 6.00%, 9/15/2017 | 364,059 | |

| 230,000 | Health Care REIT, Inc., Sr. Unsecd. Note, 6.125%, 4/15/2020 | 258,924 | |

| 200,000 | Healthcare Trust of America, 3.70%, 4/15/2023 | 184,353 | |

| 200,000 | Liberty Property LP, 6.625%, 10/1/2017 | 229,130 | |

| 100,000 | Post Apartment Homes LP, Sr. Unsecd. Note, 3.375%, 12/1/2022 | 92,151 | |

| 100,000 | ProLogis LP, Sr. Unsecd. Note, 3.35%, 2/1/2021 | 97,139 | |

| 73,000 | ProLogis, Inc., Sr. Unsecd. Note, 6.875%, 3/15/2020 | 86,038 | |

| 45,000 | Tanger Properties LP, Sr. Unsecd. Note, 3.875%, 12/1/2023 | 43,393 | |

| 110,000 | Tanger Properties LP, Sr. Unsecd. Note, 6.125%, 6/1/2020 | 126,101 | |

| 70,000 | UDR, Inc., Company Guarantee, 4.625%, 1/10/2022 | 71,951 | |

| TOTAL | 2,003,821 | ||

| Technology—2.6% | |||

| 120,000 | Agilent Technologies, Inc., Sr. Unsecd. Note, 3.20%, 10/1/2022 | 109,871 | |

| 50,000 | Agilent Technologies, Inc., Sr. Unsecd. Note, 3.875%, 7/15/2023 | 47,407 | |

| 100,000 | BMC Software, Inc., 7.25%, 6/1/2018 | 101,500 |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—continued | |||

| Technology—continued | |||

| $150,000 | Fidelity National Information Services, Inc., Sr. Unsecd. Note, 3.50%, 4/15/2023 | $136,775 | |

| 320,000 | Fiserv, Inc., Sr. Note, 6.80%, 11/20/2017 | 368,875 | |

| 100,000 | Ingram Micro, Inc., Sr. Unsecd. Note, 5.00%, 8/10/2022 | 99,641 | |

| 130,000 | Juniper Networks, Inc., Sr. Unsecd. Note, 5.95%, 3/15/2041 | 128,376 | |

| 220,000 | Verisk Analytics, Inc., Sr. Unsecd. Note, 4.125%, 9/12/2022 | 213,010 | |

| 75,000 | Verisk Analytics, Inc., Sr. Unsecd. Note, 4.875%, 1/15/2019 | 79,462 | |

| TOTAL | 1,284,917 | ||

| Transportation - Airlines—0.6% | |||

| 75,000 | Southwest Airlines Co., Deb., 7.375%, 3/1/2027 | 84,275 | |

| 220,000 | Southwest Airlines Co., Sr. Unsecd. Note, 5.125%, 3/1/2017 | 239,029 | |

| TOTAL | 323,304 | ||

| Transportation - Railroads—1.3% | |||

| 200,000 | Burlington Northern Santa Fe Corp., Sr. Unsecd. Note, 3.05%, 3/15/2022 | 189,628 | |

| 200,000 | Canadian Pacific Railway Co., Sr. Unsecd. Note, 4.45%, 3/15/2023 | 206,529 | |

| 100,000 | Canadian Pacific RR, 7.125%, 10/15/2031 | 120,278 | |

| 55,000 | Kansas City Southern de Mexico SA de CV, Sr. Unsecd. Note, 3.00%, 5/15/2023 | 50,005 | |

| 100,000 | Union Pacific Corp., Sr. Unsecd. Note, 4.163%, 7/15/2022 | 102,911 | |

| TOTAL | 669,351 | ||

| Transportation - Services—1.9% | |||

| 330,000 | 1,2 | Enterprise Rent-A-Car USA Finance Co., Sr. Unsecd. Note, Series 144A, 5.625%, 3/15/2042 | 337,120 |

| 420,000 | 1,2 | Penske Truck Leasing Co. LP & PTL Finance Corp., Series 144A, 3.75%, 5/11/2017 | 442,016 |

| 100,000 | Ryder System, Inc., Sr. Unsecd. Note, 3.50%, 6/1/2017 | 104,676 | |

| 70,000 | Ryder System, Inc., Sr. Unsecd. Note, Series MTN, 2.45%, 11/15/2018 | 69,292 | |

| TOTAL | 953,104 | ||

| Utility - Electric—5.1% | |||

| 95,000 | American Electric Power Co., Inc., Sr. Unsecd. Note, Series F, 2.95%, 12/15/2022 | 87,886 | |

| 200,000 | Appalachian Power Co., Sr. Unsecd. Note, 7.00%, 4/1/2038 | 241,617 | |

| 75,000 | Cleveland Electric Illuminating Co., Sr. Unsecd. Note, 5.95%, 12/15/2036 | 76,383 | |

| 100,000 | Commonwealth Edison Co., 1st Mtg. Bond, 6.15%, 9/15/2017 | 115,606 | |

| 50,000 | Dominion Resources, Inc., Sr. Unsecd. Note, 8.875%, 1/15/2019 | 63,567 | |

| 300,000 | Dominion Resources, Inc., Unsecd. Note, Series B, 5.95%, 6/15/2035 | 331,211 | |

| 100,000 | 1,2 | Enel Finance International SA, Company Guarantee, Series 144A, 3.875%, 10/7/2014 | 102,185 |

| 160,000 | Exelon Generation Co. LLC, Sr. Unsecd. Note, 5.75%, 10/1/2041 | 153,291 | |

| 100,000 | Exelon Generation Co. LLC, Sr. Unsecd. Note, 6.25%, 10/1/2039 | 101,359 | |

| 250,000 | FirstEnergy Corp., Sr. Unsecd. Note, Series A, 2.75%, 3/15/2018 | 245,772 | |

| 35,710 | 1,2 | Great River Energy, 1st Mtg. Note, Series 144A, 5.829%, 7/1/2017 | 37,921 |

| 200,000 | National Rural Utilities Cooperative Finance Corp., Sr. Unsecd. Note, 10.375%, 11/1/2018 | 270,623 | |

| 50,000 | PPL Energy Supply LLC, Sr. Unsecd. Note, 6.00%, 12/15/2036 | 47,360 | |

| 200,000 | 1,2 | PPL WEM Holdings PLC, Sr. Unsecd. Note, Series 144A, 5.375%, 5/1/2021 | 212,716 |

| 50,000 | PSEG Power LLC, Sr. Unsecd. Note, 2.45%, 11/15/2018 | 49,382 | |

| 30,000 | Progress Energy, Inc., 7.05%, 3/15/2019 | 35,980 | |

| 80,000 | TECO Finance, Inc., Company Guarantee, 5.15%, 3/15/2020 | 87,757 | |

| 250,000 | UIL Holdings Corp., Sr. Unsecd. Note, 4.625%, 10/1/2020 | 254,679 | |

| TOTAL | 2,515,295 | ||

| Utility - Natural Gas Distributor—0.6% | |||

| 40,000 | 1,2 | Florida Gas Transmission Co. LLC, Sr. Unsecd. Note, Series 144A, 5.45%, 7/15/2020 | 43,302 |

| 100,000 | National Fuel Gas Co., Sr. Unsecd. Note, 3.75%, 3/1/2023 | 94,406 | |

| 90,000 | National Fuel Gas Co., Sr. Unsecd. Note, 4.90%, 12/1/2021 | 93,665 |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—continued | |||

| Utility - Natural Gas Distributor—continued | |||

| $75,000 | Sempra Energy, Sr. Unsecd. Note, 6.50%, 6/1/2016 | $84,433 | |

| TOTAL | 315,806 | ||

| Utility - Natural Gas Pipelines—4.0% | |||

| 80,000 | Enbridge Energy Partners LP, Sr. Unsecd. Note, 5.50%, 9/15/2040 | 77,350 | |

| 400,000 | Energy Transfer Partners LP, Sr. Unsecd. Note, 4.90%, 2/1/2024 | 406,211 | |

| 200,000 | Enterprise Products Operating LLC, Company Guarantee, 5.25%, 1/31/2020 | 223,038 | |

| 325,000 | Kinder Morgan Energy Partners LP, Sr. Unsecd. Note, 5.80%, 3/15/2035 | 333,249 | |

| 370,000 | Kinder Morgan Energy Partners LP, Sr. Unsecd. Note, 6.375%, 3/1/2041 | 399,237 | |

| 240,000 | Spectra Energy Capital LLC, Company Guarantee, 5.65%, 3/1/2020 | 261,403 | |

| 200,000 | 1,2 | Texas Eastern Transmission LP, Sr. Unsecd. Note, Series 144A, 2.80%, 10/15/2022 | 178,902 |

| 120,000 | Williams Partners LP, 5.25%, 3/15/2020 | 131,248 | |

| TOTAL | 2,010,638 | ||

| TOTAL CORPORATE BONDS (IDENTIFIED COST $44,927,037) | 46,054,534 | ||

| FOREIGN GOVERNMENTS/AGENCIES—4.3% | |||

| Sovereign—4.3% | |||

| 600,000 | Brazil, Government of, Sr. Unsecd. Note, 4.875%, 1/22/2021 | 633,000 | |

| 200,000 | Brazil, Government of, Sr. Unsecd. Note, 6.00%, 1/17/2017 | 221,600 | |

| 250,000 | Colombia, Government of, Sr. Unsecd. Note, 4.375%, 7/12/2021 | 258,125 | |

| 300,000 | Panama, Government of, Sr. Unsecd. Note, 5.20%, 1/30/2020 | 326,625 | |

| 190,000 | Peru, Government of, 6.55%, 3/14/2037 | 218,500 | |

| 206,000 | United Mexican States, 6.75%, 9/27/2034 | 243,080 | |

| 210,000 | United Mexican States, Note, 5.625%, 1/15/2017 | 234,675 | |

| TOTAL FOREIGN GOVERNMENTS/AGENCIES (IDENTIFIED COST $2,054,060) | 2,135,605 | ||

| U.S. TREASURY—1.0% | |||

| 500,000 | United States Treasury Note, 1.25%, 11/30/2018 (IDENTIFIED COST $495,573) | 489,018 | |

| INVESTMENT COMPANY—0.7% | |||

| 371,042 | 3,4 | Federated Prime Value Obligations Fund, Institutional Shares, 0.06% (AT NET ASSET VALUE) | 371,042 |

| TOTAL INVESTMENTS—98.8% (IDENTIFIED COST $47,847,712)5 | 49,050,199 | ||

| OTHER ASSETS AND LIABILITIES - NET—1.2%6 | 585,080 | ||

| TOTAL NET ASSETS—100% | $49,635,279 |

| Description | Number of Contracts | Notional Value | Expiration Date | Unrealized Appreciation |

| 7U.S. Treasury Long Bond Short Futures | 10 | $1,283,125 | March 2014 | $15,134 |

| 7U.S. Treasury Notes 5-Year Short Futures | 7 | $835,188 | March 2014 | $10,211 |

| 7U.S. Treasury Notes 10-Year Short Futures | 25 | $3,076,172 | March 2014 | $50,334 |

| UNREALIZED APPRECIATION ON FUTURES CONTRACTS | $75,679 | |||

| 1 | Denotes a restricted security that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) is subject to a contractual restriction on public sales. At December 31, 2013, these restricted securities amounted to $6,412,596, which represented 12.9% of total net assets. |

| 2 | Denotes a restricted security that may be resold without restriction to “qualified institutional buyers” as defined in Rule 144A under the Securities Act of 1933 and that the Fund has determined to be liquid under criteria established by the Fund's Board of Trustees (the “Trustees”). At December 31, 2013, these liquid restricted securities amounted to $6,412,596, which represented 12.9% of total net assets. |

| 3 | Affiliated holding. |

| 4 | 7-day net yield. |

| 5 | Also represents cost for federal tax purposes. |

| 6 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

| 7 | Non-income-producing security. |

| Valuation Inputs | ||||

| Level 1— Quoted Prices and Investments in Investment Companies | Level 2— Other Significant Observable Inputs | Level 3— Significant Unobservable Inputs | Total | |

| Debt Securities: | ||||

| Corporate Bonds | $— | $46,054,534 | $— | $46,054,534 |

| Foreign Governments/Agencies | — | 2,135,605 | — | 2,135,605 |

| U.S. Treasury | — | 489,018 | — | 489,018 |

| Investment Company | 371,042 | — | — | 371,042 |

| TOTAL SECURITIES | $371,042 | $48,679,157 | $— | $49,050,199 |

| OTHER FINANCIAL INSTRUMENTS* | $75,679 | $— | $— | $75,679 |

| * | Other financial instruments include futures contracts. |

| MTN | —Medium Term Note |

| REIT(s) | —Real Estate Investment Trust(s) |

| Year Ended December 31 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $11.41 | $10.73 | $10.78 | $10.37 | $8.76 |

| Income From Investment Operations: | |||||

| Net investment income | 0.50 | 0.54 | 0.57 | 0.57 | 0.59 |

| Net realized and unrealized gain (loss) on investments and futures contracts | (0.62) | 0.73 | 0.18 | 0.41 | 1.61 |

| TOTAL FROM INVESTMENT OPERATIONS | (0.12) | 1.27 | 0.75 | 0.98 | 2.20 |

| Less Distributions: | |||||

| Distributions from net investment income | (0.50) | (0.54) | (0.57) | (0.57) | (0.59) |

| Distributions from net realized gain on investments and futures contracts | (0.09) | (0.05) | (0.23) | — | — |

| TOTAL DISTRIBUTIONS | (0.59) | (0.59) | (0.80) | (0.57) | (0.59) |

| Net Asset Value, End of Period | $10.70 | $11.41 | $10.73 | $10.78 | $10.37 |

| Total Return1 | (1.02)% | 12.03% | 7.12% | 9.56% | 25.84% |

| Ratios to Average Net Assets: | |||||

| Net expenses2 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Net investment income | 4.57% | 4.81% | 5.19% | 5.28% | 6.01% |

| Expense waiver/reimbursement3 | 0.41% | 0.61% | 0.80% | 0.85% | 1.68% |

| Supplemental Data: | |||||

| Net assets, end of period (000 omitted) | $49,635 | $50,650 | $36,321 | $46,004 | $30,886 |

| Portfolio turnover | 31% | 30% | 80% | 31% | 42% |

| 1 | Based on net asset value. |

| 2 | The Adviser has contractually agreed to reimburse all operating expenses, excluding extraordinary expenses, incurred by the Fund. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

December 31, 2013

| Assets: | ||

| Total investment in securities, at value including $371,042 of investment in an affiliated holding (Note 5) (identified cost $47,847,712) | $49,050,199 | |

| Restricted cash (Note 2) | 68,175 | |

| Income receivable | 685,610 | |

| Receivable for shares sold | 144,891 | |

| Receivable for daily variation margin | 9,641 | |

| TOTAL ASSETS | 49,958,516 | |

| Liabilities: | ||

| Payable for shares redeemed | $74,398 | |

| Income distribution payable | 196,450 | |

| Payable to adviser (Note 5) | 1,278 | |

| Payable for Directors'/Trustees' fees (Note 5) | 226 | |

| Payable for auditing fees | 27,250 | |

| Payable for portfolio accounting fees | 11,512 | |

| Accrued expenses (Note 5) | 12,123 | |

| TOTAL LIABILITIES | 323,237 | |

| Net assets for 4,638,928 shares outstanding | $49,635,279 | |

| Net Assets Consist of: | ||

| Paid-in capital | $48,322,573 | |

| Net unrealized appreciation of investments and futures contracts | 1,278,166 | |

| Accumulated net realized gain on investments and futures contracts | 29,061 | |

| Undistributed net investment income | 5,479 | |

| TOTAL NET ASSETS | $49,635,279 | |

| Net Asset Value, Offering Price and Redemption Proceeds Per Share: | ||

| $49,635,279 ÷ 4,638,928 shares outstanding, no par value, unlimited shares authorized | $10.70 |

Year Ended December 31, 2013

| Investment Income: | ||

| Interest | $2,315,260 | |

| Dividends received from an affiliated holding (Note 5) | 513 | |

| TOTAL INCOME | 2,315,773 | |

| Expenses: | ||

| Administrative fee (Note 5) | $39,564 | |

| Custodian fees | 10,934 | |

| Transfer agent fee | 7,252 | |

| Directors'/Trustees' fees (Note 5) | 1,431 | |

| Auditing fees | 27,250 | |

| Legal fees | 8,672 | |

| Portfolio accounting fees | 70,931 | |

| Share registration costs | 19,934 | |

| Printing and postage | 13,084 | |

| Insurance premiums (Note 5) | 4,134 | |

| Miscellaneous (Note 5) | 6,420 | |

| TOTAL EXPENSES | 209,606 | |

| Reimbursement of other operating expenses (Note 5) | (209,606) | |

| Net expenses | — | |

| Net investment income | 2,315,773 | |

| Realized and Unrealized Gain (Loss) on Investments and Futures Contracts: | ||

| Net realized gain on investments | 293,556 | |

| Net realized gain on futures contracts | 124,342 | |

| Net change in unrealized appreciation of investments | (3,434,474) | |

| Net change in unrealized appreciation of futures contracts | 75,679 | |

| Net realized and unrealized loss on investments and futures contracts | (2,940,897) | |

| Change in net assets resulting from operations | $(625,124) |

| Year Ended December 31 | 2013 | 2012 |

| Increase (Decrease) in Net Assets | ||

| Operations: | ||

| Net investment income | $2,315,773 | $2,128,843 |

| Net realized gain on investments and futures contracts | 417,898 | 275,539 |

| Net change in unrealized appreciation/depreciation of investments and futures contracts | (3,358,795) | 2,581,154 |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | (625,124) | 4,985,536 |

| Distributions to Shareholders: | ||

| Distributions from net investment income | (2,315,638) | (2,126,552) |

| Distributions from net realized gain on investments | (413,001) | (224,716) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (2,728,639) | (2,351,268) |

| Share Transactions: | ||

| Proceeds from sale of shares | 10,808,752 | 17,707,480 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 25,499 | 14,995 |

| Cost of shares redeemed | (8,495,455) | (6,027,291) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | 2,338,796 | 11,695,184 |

| Change in net assets | (1,014,967) | 14,329,452 |

| Net Assets: | ||

| Beginning of period | 50,650,246 | 36,320,794 |

| End of period (including undistributed net investment income of $5,479 and $5,344, respectively) | $49,635,279 | $50,650,246 |

| ■ | Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

| ■ | Fixed-income securities and repurchase agreements acquired with remaining maturities of 60 days or less are valued at their amortized cost (adjusted for the accretion of any discount or amortization of any premium), unless the issuer's creditworthiness is impaired or other factors indicate that amortized cost is not an accurate estimate of the investment's fair value, in which case it would be valued in the same manner as a longer-term security. |

| ■ | Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs. |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the purchase price of the security, information obtained by contacting the issuer, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded and public trading in similar securities of the issuer or comparable issuers. |

| ■ | With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts; |

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and |

| ■ | Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

| Fair Value of Derivative Instruments | ||

| Asset | ||

| Statement of Assets and Liabilities Location | Fair Value | |

| Derivatives not accounted for as hedging instruments under ASC Topic 815 | ||

| Interest rate contracts | Receivable for daily variation margin | $75,679* |

| * | Includes cumulative appreciation of futures contracts as reported in the footnotes to the Portfolio of Investments. Only the current day's variation margin is reported within the Statement of Assets and Liabilities. |

| Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

| Futures | |

| Interest rate contracts | $124,342 |

| Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income | |

| Futures | |

| Interest rate contracts | $75,679 |

| Year Ended December 31 | 2013 | 2012 |

| Shares sold | 972,845 | 1,594,588 |

| Shares issued to shareholders in payment of distributions declared | 2,370 | 1,321 |

| Shares redeemed | (773,953) | (543,924) |

| NET CHANGE RESULTING FROM FUND SHARE TRANSACTIONS | 201,262 | 1,051,985 |

| 2013 | 2012 | |

| Ordinary income | $2,315,638 | $2,126,552 |

| Long-term capital gains | $413,001 | $224,716 |

| Undistributed ordinary income | $5,479 |

| Undistributed long-term capital gains | $104,740 |

| Net unrealized appreciation | $1,202,487 |

| Administrative Fee | Average Daily Net Assets of the Investment Complex |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |

| Federated Prime Value Obligations Fund, Institutional Shares | |

| Balance of Shares Held 12/31/2012 | 700,268 |

| Purchases/Additions | 17,233,180 |

| Sales/Reductions | (17,562,406) |

| Balance of Shares Held 12/31/2013 | 371,042 |

| Value | $371,042 |

| Dividend Income | $513 |

| Purchases | $13,866,828 |

| Sales | $11,120,523 |

February 24, 2014

| Beginning Account Value 7/1/2013 | Ending Account Value 12/31/2013 | Expenses Paid During Period1 | |

| Actual | $1,000 | $1,026.90 | $0.00 |

| Hypothetical (assuming a 5% return before expenses) | $1,000 | $1,025.21 | $0.00 |

| 1 | Expenses are equal to the Fund's annualized net expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half-year period). The Adviser has contractually agreed to reimburse all operating expenses, excluding extraordinary expenses, incurred by the Fund. |

| Name | For | Withheld |

| John T. Collins | 7,690,221.700 | 4,178,181.407 |

| Maureen Lally-Green | 7,690,221.700 | 4,178,181.407 |

| Thomas M. O'Neill | 7,690,221.700 | 4,178,181.407 |

| P. Jerome Richey | 7,690,221.700 | 4,178,181.407 |

| 1 | The following Trustees continued their terms: John F. Donahue, J. Christopher Donahue, Maureen Lally-Green (having been previously appointed by the Board), Peter E. Madden, Charles F. Mansfield, Jr., Thomas M. O'Neill (having been previously appointed by the Board), and John S. Walsh. |

| Name Birth Date Positions Held with Trust Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held and Previous Position(s) |

| John F. Donahue* Birth Date: July 28, 1924 Trustee Began serving: November 2005 | Principal Occupations: Director or Trustee of the Federated Fund Family; Chairman and Director, Federated Investors, Inc.; Chairman of the Federated Fund Family's Executive Committee. Previous Positions: Chairman of the Federated Fund Family; Trustee, Federated Investment Management Company; Chairman and Director, Federated Investment Counseling. |

| J. Christopher Donahue* Birth Date: April 11, 1949 President and Trustee Began serving: October 2005 | Principal Occupations: Principal Executive Officer and President of certain of the Funds in the Federated Fund Family; Director or Trustee of the Funds in the Federated Fund Family; President, Chief Executive Officer and Director, Federated Investors, Inc.; Chairman and Trustee, Federated Investment Management Company; Trustee, Federated Investment Counseling; Chairman and Director, Federated Global Investment Management Corp.; Chairman, Federated Equity Management Company of Pennsylvania and Passport Research, Ltd. (investment advisory subsidiary of Federated); Trustee, Federated Shareholder Services Company; Director, Federated Services Company. Previous Positions: President, Federated Investment Counseling; President and Chief Executive Officer, Federated Investment Management Company, Federated Global Investment Management Corp. and Passport Research, Ltd. |

| * | Family relationships and reasons for “interested” status: John F. Donahue is the father of J. Christopher Donahue; both are “interested” due to their beneficial ownership of shares of Federated Investors, Inc. and the positions they hold with Federated and its subsidiaries. |

| Name Birth Date Positions Held with Trust Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held, Previous Position(s) and Qualifications |

| John T. Collins Birth Date: January 24, 1947 Trustee Began serving: October 2013 | Principal Occupations: Director or Trustee of the Federated Fund Family; Chairman and CEO, The Collins Group, Inc. (a private equity firm). Other Directorships Held: Chairman Emeriti, Bentley University; Director, Sterling Suffolk Downs, Inc.; Former Director, National Association of Printers and Lithographers. Previous Positions: Director and Audit Committee Member, Bank of America Corp. Qualifications: Business management and director experience. |

| Name Birth Date Positions Held with Trust Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held, Previous Position(s) and Qualifications |

| Maureen Lally-Green Birth Date: July 5, 1949 Trustee Began serving: August 2009 | Principal Occupations: Director or Trustee of the Federated Fund Family; Associate General Secretary and Director, Office for Church Relations, Diocese of Pittsburgh; Adjunct Professor of Law, Duquesne University School of Law; Superior Court of Pennsylvania (service began 1998 and ended July 2009). Other Directorships Held: Director, Consol Energy (service started June 2013); Director, Auberle (service ended December 2013); Member, Pennsylvania State Board of Education; Director, Saint Vincent College; Director, Ireland Institute of Pittsburgh (service ended December 2013); Director and Chair, UPMC Mercy Hospital; Regent, St. Vincent Seminary; Director, Epilepsy Foundation of Western and Central Pennsylvania; Director, Saint Thomas More Society (service ended December 2013); Director, Our Campaign for the Church Alive!, Inc.; Director, Pennsylvania Bar Institute (2013-present); Director, Cardinal Wuerl North Catholic High School (2013-present). Previous Position: Professor of Law, Duquesne University School of Law, Pittsburgh (1983-1998). Qualifications: Legal and director experience. |

| Peter E. Madden Birth Date: March 16, 1942 Trustee Began serving: November 2005 | Principal Occupation: Director or Trustee, and Chairman of the Board of Directors or Trustees, of the Federated Fund Family. Previous Positions: Representative, Commonwealth of Massachusetts General Court; President, Chief Operating Officer and Director, State Street Bank and Trust Company and State Street Corporation (retired); Director, VISA USA and VISA International; Chairman and Director, Massachusetts Bankers Association; Director, Depository Trust Corporation; Director, The Boston Stock Exchange. Qualifications: Business management, mutual fund services and director experience. |

| Charles F. Mansfield, Jr. Birth Date: April 10, 1945 Trustee Began serving: November 2005 | Principal Occupations: Director or Trustee of the Federated Fund Family; Management Consultant. Previous Positions: Chief Executive Officer, PBTC International Bank; Partner, Arthur Young & Company (now Ernst & Young LLP); Chief Financial Officer of Retail Banking Sector, Chase Manhattan Bank; Senior Vice President, HSBC Bank USA (formerly Marine Midland Bank); Vice President, Citibank; Assistant Professor of Banking and Finance, Frank G. Zarb School of Business, Hofstra University; Executive Vice President, DVC Group, Inc. (marketing, communications and technology). Qualifications: Banking, business management, education and director experience. |

| Thomas M. O'Neill Birth Date: June 14, 1951 Trustee Began serving: October 2006 | Principal Occupations: Director or Trustee, Vice Chairman of the Audit Committee of the Federated Fund Family; Sole Proprietor, Navigator Management Company (investment and strategic consulting). Other Directorships Held: Board of Overseers, Children's Hospital of Boston; Visiting Committee on Athletics, Harvard College; Board of Directors, Medicines for Humanity; Board of Directors, The Golisano Children's Museum of Naples, Florida. Previous Positions: Chief Executive Officer and President, Managing Director and Chief Investment Officer, Fleet Investment Advisors; President and Chief Executive Officer, Aeltus Investment Management, Inc.; General Partner, Hellman, Jordan Management Co., Boston, MA; Chief Investment Officer, The Putnam Companies, Boston, MA; Credit Analyst and Lending Officer, Fleet Bank; Director and Consultant, EZE Castle Software (investment order management software); Director, Midway Pacific (lumber). Qualifications: Business management, mutual fund, director and investment experience. |

| P. Jerome Richey Birth Date: February 23, 1949 Trustee Began serving: October 2013 | Principal Occupations: Director or Trustee of the Federated Fund Family; General Counsel, University of Pittsburgh. Other Directorships Held: Board Chairman, Epilepsy Foundation of Western Pennsylvania; Board Member, World Affairs Council of Pittsburgh. Previous Positions: Chief Legal Officer and Executive Vice President, CONSOL Energy Inc.; Shareholder, Buchanan Ingersoll & Rooney PC (a law firm). Qualifications: Business management, legal and director experience. |

| John S. Walsh Birth Date: November 28, 1957 Trustee Began serving: November 2005 | Principal Occupations: Director or Trustee, Chairman of the Audit Committee of the Federated Fund Family; President and Director, Heat Wagon, Inc. (manufacturer of construction temporary heaters); President and Director, Manufacturers Products, Inc. (distributor of portable construction heaters); President, Portable Heater Parts, a division of Manufacturers Products, Inc. Previous Position: Vice President, Walsh & Kelly, Inc. Qualifications: Business management and director experience. |

| Name Birth Date Address Positions Held with Trust Date Service Began | Principal Occupation(s) for Past Five Years and Previous Position(s) |

| John W. McGonigle Birth Date: October 26, 1938 EXECUTIVE VICE PRESIDENT AND SECRETARY Officer since: October 2005 | Principal Occupations: Executive Vice President and Secretary of the Federated Fund Family; Vice Chairman, Executive Vice President, Secretary and Director, Federated Investors, Inc. Previous Positions: Trustee, Federated Investment Management Company and Federated Investment Counseling; Director, Federated Global Investment Management Corp., Federated Services Company and Federated Securities Corp. |

| Lori A. Hensler Birth Date: January 6, 1967 TREASURER Officer since: April 2013 | Principal Occupations: Principal Financial Officer and Treasurer of the Federated Fund Family; Senior Vice President, Federated Administrative Services; Financial and Operations Principal for Federated Securities Corp. and Edgewood Services, Inc.; and Assistant Treasurer, Federated Investors Trust Company. Ms. Hensler has received the Certified Public Accountant designation. Previous Positions: Controller of Federated Investors, Inc.; Senior Vice President and Assistant Treasurer, Federated Investors Management Company; Treasurer, Federated Investors Trust Company; Assistant Treasurer, Federated Administrative Services, Federated Administrative Services, Inc., Federated Securities Corp., Edgewood Services, Inc., Federated Advisory Services Company, Federated Equity Management Company of Pennsylvania, Federated Global Investment Management Corp., Federated Investment Counseling, Federated Investment Management Company, Passport Research, Ltd., and Federated MDTA, LLC; Financial and Operations Principal for Federated Securities Corp., Edgewood Services, Inc. and Southpointe Distribution Services, Inc. |

| Peter J. Germain Birth Date: September 3, 1959 CHIEF LEGAL OFFICER Officer since: October 2005 | Principal Occupations: Mr. Germain is Chief Legal Officer of the Federated Fund Family. He is General Counsel and Vice President, Federated Investors, Inc.; President, Federated Administrative Services and Federated Administrative Services, Inc.; Vice President, Federated Securities Corp.; Secretary, Federated Private Asset Management, Inc.; and Secretary, Retirement Plan Service Company of America. Mr. Germain joined Federated in 1984 and is a member of the Pennsylvania Bar Association. Previous Positions: Deputy General Counsel, Special Counsel, Managing Director of Mutual Fund Services, Federated Investors, Inc.; Senior Vice President, Federated Services Company; and Senior Corporate Counsel, Federated Investors, Inc. |

| Richard B. Fisher Birth Date: May 17, 1923 VICE CHAIRMAN Officer since: October 2005 | Principal Occupations: Vice Chairman or Vice President of some of the Funds in the Federated Fund Family; Vice Chairman, Federated Investors, Inc.; Chairman, Federated Securities Corp. Previous Positions: President and Director or Trustee of some of the Funds in the Federated Fund Family; Executive Vice President, Federated Investors, Inc.; Director and Chief Executive Officer, Federated Securities Corp. |

| Brian P. Bouda Birth Date: February 28, 1947 CHIEF COMPLIANCE OFFICER AND SENIOR VICE PRESIDENT Officer since: October 2005 | Principal Occupations: Senior Vice President and Chief Compliance Officer of the Federated Fund Family; Vice President and Chief Compliance Officer of Federated Investors, Inc. and Chief Compliance Officer of certain of its subsidiaries. Mr. Bouda joined Federated in 1999 and is a member of the American Bar Association and the State Bar Association of Wisconsin. Previous Positions: Served in Senior Management positions with a large regional banking organization. |

| Robert J. Ostrowski Birth Date: April 26, 1963 Chief Investment Officer Officer since: September 2006 | Principal Occupations: Robert J. Ostrowski joined Federated in 1987 as an Investment Analyst and became a Portfolio Manager in 1990. He was named Chief Investment Officer of Federated's taxable fixed-income products in 2004 and also serves as a Senior Portfolio Manager. Mr. Ostrowski became an Executive Vice President of the Fund's Adviser in 2009 and served as a Senior Vice President of the Fund's Adviser from 1997 to 2009. Mr. Ostrowski has received the Chartered Financial Analyst designation. He received his M.S. in Industrial Administration from Carnegie Mellon University. |

| Jerome Conner Birth Date: June 3, 1968 Vice President Officer since: June 2012 Portfolio Manager since: February 2010 | Principal Occupations: Jerome Conner, CFA, has been the Fund's Portfolio Manager since February 2010. He is Vice President of the Trust with respect to the Fund. Mr. Conner joined Federated in 2002 as an Investment Analyst, responsible for research and competitive analysis in the domestic fixed income area concentrating on high-grade corporate and commercial mortgage-backed securities. He became an Assistant Vice President of the Fund's Adviser in 2004 and a Vice President and Senior Investment Analyst in 2007. Previous associations: Associate, Riggs Capital Partners; Associate, Allied Capital; Relationship Manager, Mellon Bank Corporate Banking Department; Officer, U.S. Marine Corps.; B.S., U.S. Naval Academy; M.S., Boston University. |

Federated Investors Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

2014 ©Federated Investors, Inc.

| Ticker | FHYSX |

| 1 | Please see the footnotes to the line graphs below for definitions of, and further information about, the BHY2%ICI. |

| 2 | High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and a higher risk of default. |

| 3 | Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. |

| 4 | Credit Suisse High Yield Bond Index serves as a benchmark to evaluate the performance of low-quality bonds. Low-quality is defined as those bonds in the range from “BB” to “CCC” and defaults. The index is unmanaged, and it is not possible to invest directly in an index. |

| 5 | Duration is a measure of a security's price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities with shorter durations. |

| Average Annual Total Returns for the Period Ended 12/31/2013 | |

| 1 Year | 7.83% |

| 5 Years | 18.24% |

| Start of Performance* | 19.19% |

| * | The Fund's start of performance date was December 24, 2008. |

| Federated High-Yield Strategy Portfolio | BHY2%ICI | |

| 12/24/2008 | 10,000 | 10,000 |

| 12/31/2008 | 10,448 | 10,519 |

| 12/31/2009 | 15,901 | 16,700 |

| 12/31/2010 | 18,296 | 19,195 |

| 12/31/2011 | 19,411 | 20,147 |

| 12/31/2012 | 22,393 | 23,326 |

| 12/31/2013 | 24,146 | 25,062 |

| 1 | The Fund's performance assumes the reinvestment of all dividends and distributions. The BHY2%ICI has been adjusted to reflect reinvestment of dividends on securities in the index. |

| 2 | The BHY2%ICI is an issuer-constrained version of the Barclays U.S. Corporate High-Yield Index that measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. The index follows the same rules as the uncapped index but limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro-rata basis. The BHY2%ICI is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The index is unmanaged and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| Index Classification | Percentage of Total Net Assets2 |

| Technology | 13.7% |

| Health Care | 9.7% |

| Energy | 8.6% |

| Media—Non-cable | 7.2% |

| Food & Beverage | 5.6% |

| Automotive | 5.2% |

| Retailers | 4.8% |

| Packaging | 4.7% |

| Financial Institutions | 4.4% |

| Consumer Products | 3.7% |

| Building Materials | 3.6% |

| Industrial—Other | 3.6% |

| Wireless Communications | 3.6% |

| Utility—Natural Gas | 3.3% |

| Gaming | 2.9% |

| Chemicals | 2.6% |

| Other3 | 10.6% |

| Cash Equivalents4 | 1.0% |

| Other Assets and Liabilities—Net5 | 1.2% |

| TOTAL | 100.0% |

| 1 | Index classifications are based upon, and individual portfolio securities are assigned to, the classifications and sub-classifications of the BHY2%ICI. Individual portfolio securities that are not included in the BHY2%ICI are assigned to an index classification by the Fund's Adviser. |

| 2 | As of the date specified above, the Fund owned shares of one or more affiliated investment companies. For purposes of this table, the affiliated investment company (other than an affiliated money market mutual fund) is not treated as a single portfolio security, but rather the Fund is treated as owning a pro rata portion of each security and each other asset and liability owned by the affiliated investment company. Accordingly, the percentages of total net assets shown in the table will differ from those presented on the Portfolio of Investments. |

| 3 | For purposes of this table, index classifications which constitute less than 2.5% of the Fund's total net assets have been aggregated under the designation “Other.” |

| 4 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 5 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

| Shares | Value | ||

| INVESTMENT COMPANY—100.6% | |||

| 3,450,484 | 1 | High Yield Bond Portfolio | $22,842,206 |

| TOTAL INVESTMENTS—100.6% (IDENTIFIED COST $22,975,672)2 | 22,842,206 | ||

| OTHER ASSETS AND LIABILITIES - NET—(0.6)%3 | (147,064) | ||

| TOTAL NET ASSETS—100% | $22,695,142 |

| 1 | Due to this affiliated holding representing greater than 75% of the Fund's total net assets, a copy of the affiliated holding's most recent Annual Report is included with this Report. |

| 2 | The cost of investments for federal tax purposes amounts to $22,981,425. |

| 3 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

| Year Ended December 31 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $14.05 | $13.32 | $13.79 | $14.18 | $10.41 |

| Income From Investment Operations: | |||||

| Net investment income | 1.06 | 1.22 | 1.22 | 1.40 | 1.27 |

| Net realized and unrealized gain (loss) on investments | 0.001 | 0.76 | (0.41) | 0.62 | 3.92 |

| TOTAL FROM INVESTMENT OPERATIONS | 1.06 | 1.98 | 0.81 | 2.02 | 5.19 |

| Less Distributions: | |||||

| Distributions from net investment income | (1.06) | (1.22) | (1.22) | (1.40) | (1.27) |

| Distributions from net realized gain on investments | (0.13) | (0.03) | (0.06) | (1.01) | (0.15) |

| TOTAL DISTRIBUTIONS | (1.19) | (1.25) | (1.28) | (2.41) | (1.42) |

| Net Asset Value, End of Period | $13.92 | $14.05 | $13.32 | $13.79 | $14.18 |

| Total Return2 | 7.83% | 15.44% | 6.09% | 15.07% | 52.35% |

| Ratios to Average Net Assets: | |||||

| Net expenses3 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Net investment income | 7.41% | 8.89% | 8.98% | 9.68% | 9.42% |

| Expense waiver/reimbursement4 | 0.77% | 2.08% | 3.07% | 2.92% | 7.69% |

| Supplemental Data: | |||||

| Net assets, end of period (000 omitted) | $22,695 | $13,084 | $8,900 | $9,720 | $9,156 |

| Portfolio turnover | 20% | 35% | 82% | 125% | 40% |

| 1 | Represents less than $0.01. |

| 2 | Based on net asset value. |

| 3 | The Adviser has contractually agreed to reimburse all operating expenses, excluding extraordinary expenses, incurred by the Fund. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

December 31, 2013

| Assets: | ||

| Total investment in an affiliated holding (Note 5) (identified cost $22,975,672) | $22,842,206 | |

| Receivable for investments sold | 65,000 | |

| Receivable for shares sold | 69,447 | |

| TOTAL ASSETS | 22,976,653 | |

| Liabilities: | ||

| Payable for shares redeemed | $57,519 | |

| Bank overdraft | 2,809 | |

| Income distribution payable | 177,275 | |

| Payable to adviser (Note 5) | 617 | |

| Payable for Directors'/Trustees' fees (Note 5) | 219 | |

| Payable for auditing fees | 24,850 | |

| Payable for portfolio accounting fees | 7,042 | |

| Accrued expenses (Note 5) | 11,180 | |

| TOTAL LIABILITIES | 281,511 | |

| Net assets for 1,630,552 shares outstanding | $22,695,142 | |

| Net Assets Consist of: | ||

| Paid-in capital | $22,669,816 | |

| Net unrealized depreciation of investments | (133,466) | |

| Accumulated net realized gain on investments | 158,792 | |

| TOTAL NET ASSETS | $22,695,142 | |

| Net Asset Value, Offering Price and Redemption Proceeds Per Share: | ||

| $22,695,142 ÷ 1,630,552 shares outstanding, no par value, unlimited shares authorized | $13.92 |

Year Ended December 31, 2013

| Investment Income: | ||

| Dividends received from an affiliated holding (Note 5) | $1,384,717 | |

| Expenses: | ||

| Administrative fee (Note 5) | $14,580 | |

| Custodian fees | 4,472 | |

| Transfer agent fee | 3,495 | |

| Directors'/Trustees' fees (Note 5) | 1,294 | |

| Auditing fees | 24,850 | |

| Legal fees | 8,672 | |

| Portfolio accounting fees | 42,286 | |

| Share registration costs | 21,172 | |

| Printing and postage | 16,840 | |

| Insurance premiums (Note 5) | 4,069 | |

| Miscellaneous (Note 5) | 1,444 | |

| TOTAL EXPENSES | 143,174 | |

| Reimbursement of other operating expenses (Note 5) | (143,174) | |

| Net expenses | — | |

| Net investment income | 1,384,717 | |

| Realized and Unrealized Gain (Loss) on Investments: | ||

| Net realized gain on sale of investments in an affiliated holding (Note 5) | 74,852 | |

| Realized gain distribution from affiliated investment company shares (Note 5) | 218,884 | |

| Net change in unrealized appreciation of investments | (257,790) | |

| Net realized and unrealized gain on investments | 35,946 | |

| Change in net assets resulting from operations | $1,420,663 |

| Year Ended December 31 | 2013 | 2012 |

| Increase (Decrease) in Net Assets | ||

| Operations: | ||

| Net investment income | $1,384,717 | $964,579 |

| Net realized gain on investments | 293,736 | 203,010 |

| Net change in unrealized appreciation/depreciation of investments | (257,790) | 349,872 |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 1,420,663 | 1,517,461 |

| Distributions to Shareholders: | ||

| Distributions from net investment income | (1,418,167) | (964,579) |

| Distributions from net realized gain on investments | (183,767) | (27,656) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (1,601,934) | (992,235) |

| Share Transactions: | ||

| Proceeds from sale of shares | 12,033,682 | 6,261,431 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 5,211 | — |

| Cost of shares redeemed | (2,246,575) | (2,602,941) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | 9,792,318 | 3,658,490 |

| Change in net assets | 9,611,047 | 4,183,716 |

| Net Assets: | ||

| Beginning of period | 13,084,095 | 8,900,379 |

| End of period | $22,695,142 | $13,084,095 |

| ■ | Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs. |

| ■ | Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market. |

| ■ | Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Board of Trustees (the “Trustees”). |

| ■ | Fixed-income securities and repurchase agreements acquired with remaining maturities of 60 days or less are valued at their amortized cost (adjusted for the accretion of any discount or amortization of any premium), unless the issuer's creditworthiness is impaired or other factors indicate that amortized cost is not an accurate estimate of the investment's fair value, in which case it would be valued in the same manner as a longer-term security. |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the purchase price of the security, information obtained by contacting the issuer, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded and public trading in similar securities of the issuer or comparable issuers. |

| ■ | With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts; |

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and |

| ■ | Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

| Year Ended December 31 | 2013 | 2012 |

| Shares sold | 859,798 | 451,098 |

| Shares issued to shareholders in payment of distributions declared | 375 | — |

| Shares redeemed | (160,867) | (188,202) |

| NET CHANGE RESULTING FROM FUND SHARE TRANSACTIONS | 699,306 | 262,896 |

| Increase (Decrease) | ||

| Undistributed Net Investment Income (Loss) | Accumulated Net Realized Gain (Loss) | |

| $33,450 | $(33,450) | |

| 2013 | 2012 | |

| Ordinary income1 | $1,471,738 | $991,868 |

| Long-term capital gains | $130,196 | $367 |

| 1 | For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

| Undistributed income2 | $13,913 |

| Undistributed long-term capital gains | $150,632 |

| Net unrealized depreciation | $(139,219) |

| 2 | For tax purposes, short-term capital gains are considered ordinary income in determining distributable earnings. |

| Administrative Fee | Average Daily Net Assets of the Investment Complex |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |

| High Yield Bond Portfolio | |

| Balance of Shares Held 12/31/2012 | 1,961,758 |

| Purchases/Additions | 2,031,838 |

| Sales/Reductions | (543,112) |

| Balance of Shares Held 12/31/2013 | 3,450,484 |

| Value | $22,842,206 |

| Dividend Income | $1,384,717 |

| Capital Gain Distributions | $218,884 |

| Purchases | $13,497,427 |

| Sales | $3,616,000 |

February 24, 2014

| Beginning Account Value 7/1/2013 | Ending Account Value 12/31/2013 | Expenses Paid During Period1 | |

| Actual | $1,000 | $1,058.90 | $0.00 |

| Hypothetical (assuming a 5% return before expenses) | $1,000 | $1,025.21 | $0.00 |

| 1 | Expenses are equal to the Fund's annualized net expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half-year period). The Adviser has contractually agreed to reimburse all operating expenses, excluding extraordinary expenses incurred by the Fund. |

High Yield Bond Portfolio

| 1 | Please see the footnotes to the line graphs below for definitions of, and further information about, the BHY2%ICI. |

| 2 | High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and a higher risk of default. |

| 3 | Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. |

| 4 | Credit Suisse High Yield Bond Index serves as a benchmark to evaluate the performance of low-quality bonds. Low-quality is defined as those bonds in the range from “BB” to “CCC” and defaults. The index is unmanaged, and it is not possible to invest directly in an index. |

| 5 | Duration is a measure of a security's price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities with shorter durations. |

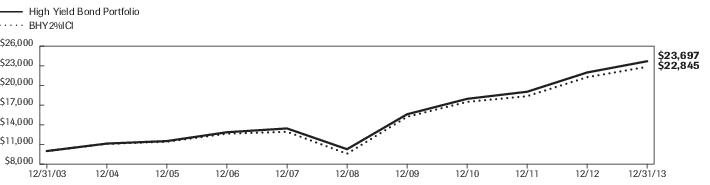

| Average Annual Total Returns for the Period Ended 12/31/2013 | |

| 1 Year | 7.80% |

| 5 Years | 18.17% |

| 10 Years | 9.01% |

| High Yield Bond Portfolio | BHY2%ICI | |

| 12/31/2003 | 10,000 | 10,000 |

| 12/31/2004 | 11,140 | 11,114 |

| 12/31/2005 | 11,524 | 11,421 |

| 12/31/2006 | 12,869 | 12,650 |

| 12/31/2007 | 13,446 | 12,937 |

| 12/31/2008 | 10,282 | 9,589 |

| 12/31/2009 | 15,607 | 15,223 |

| 12/31/2010 | 17,958 | 17,497 |

| 12/31/2011 | 19,042 | 18,365 |

| 12/31/2012 | 21,981 | 21,263 |

| 12/31/2013 | 23,697 | 22,845 |

| 1 | The Fund's performance assumes the reinvestment of all dividends and distributions. The BHY2%ICI has been adjusted to reflect reinvestment of dividends on securities in the index. |

| 2 | The BHY2%ICI is an issuer-constrained version of the Barclays U.S. Corporate High-Yield Index that measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. The index follows the same rules as the uncapped index but limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro-rata basis. The BHY2%ICI is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The index is unmanaged and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| Index Classification | Percentage of Total Net Assets |

| Technology | 13.1% |

| Health Care | 10.2% |

| Energy | 7.5% |

| Media–Non-Cable | 7.4% |

| Food & Beverage | 5.6% |

| Retailers | 5.4% |

| Packaging | 5.0% |

| Automotive | 4.9% |

| Financial Institutions | 4.6% |

| Wireless Communications | 4.1% |

| Gaming | 3.7% |

| Building Materials | 3.6% |

| Industrial–Other | 3.6% |

| Consumer Products | 3.5% |

| Utility–Natural Gas | 3.1% |

| Other2 | 11.8% |

| Cash Equivalents3 | 1.8% |

| Other Assets and Liabilities—Net4 | 1.1% |

| TOTAL | 100.0% |

| 1 | Index classifications are based upon, and individual portfolio securities are assigned to, the classifications and sub-classifications of the Barclays U.S. Corporate High Yield 2% Issuer Capped Index (BHY2%ICI). Individual portfolio securities that are not included in the BHY2%ICI are assigned to an index classification by the Fund's Adviser. |

| 2 | For purposes of this table, index classifications which constitute less than 2.5% of the Fund's total net assets have been aggregated under the designation “Other.” |

| 3 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 4 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

| Principal Amount or Shares | Value | ||

| CORPORATE BONDS—96.7% | |||

| Aerospace/Defense—0.8% | |||

| $5,625,000 | B/E Aerospace, Inc., Sr. Unsecd. Note, 5.25%, 4/1/2022 | $5,737,500 | |

| 1,725,000 | TransDigm, Inc., 5.50%, 10/15/2020 | 1,694,813 | |

| 1,000,000 | TransDigm, Inc., 7.50%, 7/15/2021 | 1,080,000 | |

| 9,675,000 | TransDigm, Inc., Company Guarantee, 7.75%, 12/15/2018 | 10,424,812 | |

| TOTAL | 18,937,125 | ||

| Automotive—4.7% | |||

| 5,875,000 | Affinia Group, Inc., Sr. Unsecd. Note, 7.75%, 5/1/2021 | 6,198,125 | |

| 3,400,000 | 1,2 | Allison Transmission, Inc., Sr. Unsecd. Note, Series 144A, 7.125%, 5/15/2019 | 3,680,500 |

| 2,000,000 | American Axle & Manufacturing Holdings, Inc., 6.25%, 3/15/2021 | 2,135,000 | |

| 1,300,000 | American Axle & Manufacturing Holdings, Inc., Sr. Note, 5.125%, 2/15/2019 | 1,342,250 | |

| 4,125,000 | American Axle & Manufacturing Holdings, Inc., Sr. Note, 6.625%, 10/15/2022 | 4,362,187 | |

| 6,875,000 | American Axle & Manufacturing Holdings, Inc., Sr. Note, 7.75%, 11/15/2019 | 7,854,687 | |

| 5,225,000 | Chrysler Group LLC, Note, Series WI, 8.25%, 6/15/2021 | 5,969,562 | |

| 1,525,000 | Cooper-Standard Automotive, Inc., Company Guarantee, 8.50%, 5/1/2018 | 1,622,219 | |

| 5,175,000 | 3,4 | Exide Technologies, Sr. Secd. Note, 8.625%, 2/1/2018 | 3,726,000 |