Exhibit 99.1

ANNUAL INFORMATION FORM

For the year ended March 31, 2012

Dated as at June 19, 2012

SILVERCORP METALS INC.

(“Silvercorp” or the “Company”)

Suite 1378 - 200 Granville Street

Vancouver, BC, Canada V6C 1S4

Tel: (604) 669-9397

Fax: (604) 669-9387

Email: corp@silvercorp.ca

Website: www.silvercorp.ca

| | |

| ITEM 1 | GENERAL | 3 |

| 1.1 | Date of Information | 3 |

| 1.2 | Forward Looking Statements | 3 |

| 1.3 | Currency | 6 |

| ITEM 2 | CORPORATE STRUCTURE | 7 |

| 2.1 | Names, Address and Incorporation | 7 |

| 2.2 | Intercorporate Relationships | 7 |

| ITEM 3 | GENERAL DEVELOPMENT OF THE BUSINESS | 9 |

| 3.1 | Business of Silvercorp | 9 |

| 3.2 | The Company’s Strategic Vision | 9 |

| 3.3 | Three Year History of Project Development | 10 |

| 3.4 | Other Matters | 14 |

| ITEM 4 | DESCRIPTION OF THE BUSINESS | 14 |

| 4.1 | General | 14 |

| 4.2 | Chinese Mining Law | 16 |

| 4.3 | Risk Factors | 17 |

| ITEM 5 | MINERAL PROPERTIES | 27 |

| 5.1 | Ying Mine, Henan Province, China. | 27 |

| 5.2 | GC Project | 46 |

| ITEM 6 | DIVIDENDS | 67 |

| ITEM 7 | DESCRIPTION OF CAPITAL STRUCTURE | 67 |

| ITEM 8 | MARKET FOR SECURITIES | 69 |

| ITEM 9 | ESCROWED SECURITIES | 70 |

| ITEM 10 | DIRECTORS & OFFICERS | 70 |

| ITEM 11 | AUDIT COMMITTEE | 73 |

| ITEM 12 | PROMOTERS | 75 |

| ITEM 13 | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 75 |

| ITEM 14 | INTEREST OF MANAGEMENT AND OTHERS IN MATERIALTRANSACTIONS | 75 |

| ITEM 15 | TRANSFER AGENTS AND REGISTRARS | 75 |

| ITEM 16 | MATERIAL CONTRACTS | 75 |

| ITEM 17 | INTERESTS OF EXPERTS | 75 |

| ITEM 18 | ADDITIONAL INFORMATION | 77 |

| ITEM 19 | SCHEDULE “A” | 78 |

2

ITEM 1 GENERAL

1.1Date of Information

All information in this Annual Information Form is as of March 31, 2012, unless otherwise indicated.

1.2Forward Looking Statements

Certain of the statements and information in this Annual Information Form (“AIF”) for Silvercorp Metals Inc. (“Silvercorp” or the “Company”) constitute “forward-looking statements” within the meaning of the United StatesPrivate Securities Litigation Reform Actof 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. All statements and information concerning mineral resource and mineral reserve estimates may also be deemed to constitute “forward-looking statements” to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Forward-looking statements or information relate to, among other things:

the price of silver and other metals;

the accuracy of mineral resource and mineral reserve estimates at the Company’s material properties;

estimated production from the Company’s mines in the Ying Mining District (defined herein);

timing of receipt of regulatory approvals;

availability of funds from production to finance the Company’s operations; and

access to and availability of funding for future construction and development of the Company’s properties.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to:

fluctuating commodity prices;

estimation of mineral resources, reserves and mineralization and precious and base metal recovery;

interpretations and assumptions of mineral resource and mineral reserve estimates;

3

exploration and development programs;

feasibility and engineering reports;

permits and licences;

title to properties;

First Nations title claims and rights;

property interests;

joint venture partners;

acquisition of commercially mineable mineral rights;

financing;

recent market events and conditions;

economic factors affecting the Company;

timing, estimated amount, capital and operating expenditures and economic returns of future production;

integration of future acquisitions into the Company’s existing operations;

competition;

operations and political conditions;

regulatory environment in China and Canada;

environmental risks;

foreign exchange rate fluctuations;

insurance;

risks and hazards of mining operations;

dependence on management and key personnel;

conflicts of interest;

internal control over financial reporting as per the requirements of theSarbanes-Oxley Act; and

bringing actions and enforcing judgments under U.S. securities laws.

4

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this AIF under the heading “Risk Factors” and elsewhere. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this AIF, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.

Cautionary Note to U.S. Investors – Information Concerning Preparation of Mineral Resource and Mineral Reserve Estimates

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource and mineral reserve estimates included in this AIF have been prepared in accordance with National Instrument 43-101Standards of Disclosure for Mineral Projects(“NI 43-101”) and the Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Mineral Reserves” (the “CIM Guidelines”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (“SEC”), and mineral resource and mineral reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable.

Disclosure of “contained metal” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under

5

SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

1.3Currency

All sums of money which are referred to herein are expressed in lawful money of the United States, unless otherwise specified. The symbol “C$” denotes lawful money of Canada and “RMB” denotes lawful money of the People’s Republic of China.

The following table sets forth, for each of the periods indicated, the year-end exchange rate, the average noon rate and the high and low noon exchange rates for one Canadian dollar expressed in U.S. dollars, as quoted by the Bank of Canada:

| | | | | | | |

| | Year Ended March 31, | |

| | 2012 | | 2011 | | 2010 | |

| High | 1.0583 | | 1.0324 | | 0.9775 | |

| Low | 0.9430 | | 0.9278 | | 0.8170 | |

| Average | 1.0070 | | 0.9840 | | 0.9171 | |

| Period End | 1.0009 | | 1.0290 | | 0.9775 | |

The exchange rate for one Canadian dollar expressed in U.S. dollars based upon the noon buying rate on June 19, 2012 provided by the Bank of Canada was $0.9825.

The following table sets forth, for each of the periods indicated, the year-end exchange rate, the average noon rate and the high and low noon exchange rates for one Canadian dollar expressed in Chinese Renminbi, as quoted by the Bank of Canada:

| | | | | | | |

| | Year Ended March 31, | |

| | 2012 | | 2011 | | 2010 | |

| High | 6.8681 | | 6.8540 | | 6.6723 | |

| Low | 6.0132 | | 6.3371 | | 5.5808 | |

| Average | 6.4390 | | 6.6004 | | 6.2625 | |

| Period End | 6.3052 | | 6.7340 | | 6.6723 | |

6

The exchange rate for one Canadian dollar expressed in Chinese Renminbi based upon the noon buying rate on June 19, 2012 provided by the Bank of Canada was RMB 6.2422.

ITEM 2 CORPORATE STRUCTURE

2.1Names, Address and Incorporation

Silvercorp was formed as Spokane Resources Ltd. pursuant to an amalgamation of Julia Resources Corporation and MacNeill International Industries Inc. under theCompany Act(British Columbia) on October 31, 1991. By a special resolution dated October 5, 2000, Spokane Resources Ltd. consolidated its share capital on a ten for one basis and altered its Memorandum and Articles of Incorporation by changing its name to “SKN Resources Ltd.” At the Company’s Annual and Special General Meeting held October 20, 2004, the shareholders (a) approved an increase to the Company’s authorized capital to an unlimited number of common shares and adopted new Articles consistent with the transition to theBusiness Corporations Act(British Columbia); and (b) passed a special resolution to change the Company’s name. On May 2, 2005, the Company filed a Notice of Alteration with the British Columbia Registrar of Companies changing its name from “SKN Resources Ltd.” to “Silvercorp Metals Inc.” The head office, principal address and registered and records office of the Company is located at 1378-200 Granville Street, Vancouver, British Columbia, V6C 1S4. The Company’s shares are listed for trading on the Toronto Stock Exchange (the “TSX”) and on the New York Stock Exchange (the “NYSE”), each under the symbol “SVM”, and the Company is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, Nova Scotia and New Brunswick.

2.2Intercorporate Relationships

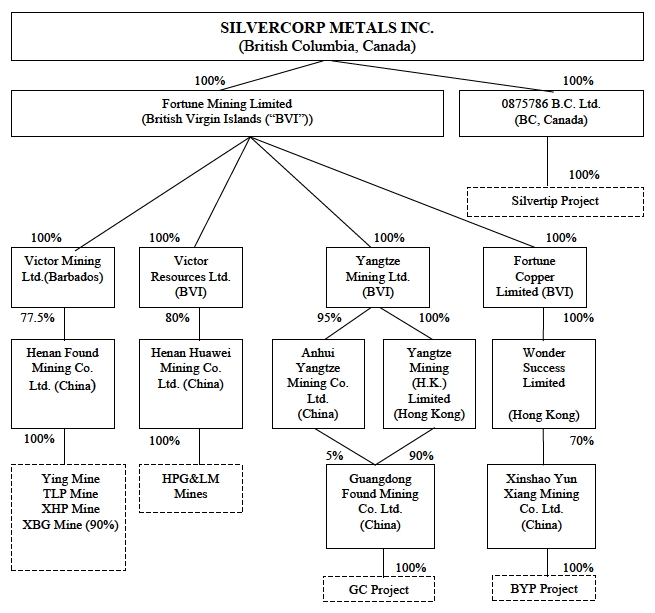

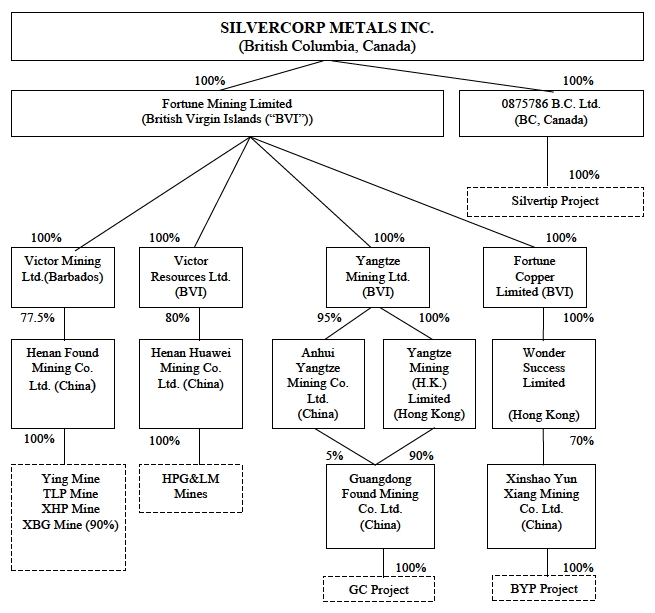

The corporate structure of the Company and its subsidiaries as at the date of this AIF is as follows:

7

The Company has acquired a number of mineral property interests in China and one property in British Columbia during the past several years.

The Company is the sole shareholder of Fortune Mining Limited (“Fortune”), which was incorporated on August 23, 2002, to be the holding company of several other subsidiaries which are parties to agreements relating to mineral properties in China. Fortune beneficially owns 100% of the following material subsidiary companies:

| | |

| a) | Victor Mining Ltd. (“Victor Mining”) was incorporated on October 23, 2003, under the laws of the BVI and continued into Barbados on August 27, 2009. Victor Mining is a party to a cooperative agreement under which it has earned a 77.5% interest in Henan Found Mining Co. Ltd. (“Henan Found”), the Chinese company holding, among other assets: (i) the Ying silver, lead and zinc project (the “Ying Mine”); and (ii) the silver and lead project in Tieluping (the “TLP Mine”) and (iii) the XHP and XBG mines (the “X Mines”). |

8

| b) | Victor Resources Ltd. (“Victor Resources”) was incorporated on May 30, 2003, under the laws of the BVI and is a party to a cooperative agreement under which it earned a 70% interest in Henan Huawei Mining Co. Ltd. (“Henan Huawei”), the Chinese company holding the project in Houpinggou and the project in Longmeng (collectively, the “HPG&LM Mines”) in the Henan Province. In May 2010, Victor Resources acquired shares from the minority shareholder of Henan Huawei and increased its ownership interest to 80%. |

| | |

| c) | Yangtze Mining Ltd. (“Yangtze Mining”) was incorporated on February 11, 2002. It holds a 100% interest in Yangtze Mining (H.K.) Ltd. and a 95% interest in Anhui Yangtze Mining Co. Ltd. (“Anhui Yangtze”), the Chinese company that held the silver, lead and zinc exploration permits on the project in Gaocheng (the “GC Project”) in the Guangdong Province. |

| | |

| d) | Fortune Copper Limited was incorporated on August 23, 2002. It holds a 100% interest in Wonder Success Limited, a Hong Kong Company which has a 70% equity interest in Xinshao Yun Xiang Mining Co. Ltd. (“Yunxiang”), which owns the BYP Project in Hunan Province. |

| | |

| e) | Guangdong Found Mining Company Limited (“Guangdong Found”) was incorporated in December 2008 as the designated joint venture operating company of the GC Project. Anhui Yangtze owns 5% of Guangdong Found and Yangtze HK owns 90% of Guangdong Found, respectively. Guangdong Found has a 100% beneficial interest in the GC Project. |

The Company’s operations in China are largely conducted through equity joint ventures, over which the Company has control. See “Item 4 General Description of Business, 4.2 Chinese Mining Law”.

The Company is also the sole shareholder of 0875786 B.C. Ltd. which was incorporated on March 10, 2010, and holds a 100% interest in the Silvertip Project in British Columbia, Canada.

ITEM 3 GENERAL DEVELOPMENT OF THE BUSINESS

3.1Business of Silvercorp

Silvercorp operates, develops, acquires and explores for silver mineral properties in China and Canada. Silvercorp is China’s largest primary silver producer. Currently, the Company is operating and developing four silver, lead and zinc mines in an area encompassing the Ying Mine, the TLP Mine, and the HPG and LM Mines (collectively, the “Ying Mining District”). The Company’s other material property is the GC Project (defined herein) in Guangdong Province, at which the Company is constructing a 1,600 tonne per day operation, with initial production expected to commence in Fiscal 2013. In February, 2010, Silvercorp acquired the advanced exploration-stage Silvertip silver, lead and zinc project in northern British Columbia, Canada. In January, 2011 Silvercorp acquired the BYP gold–lead zinc mine in Hunan Province, China. In August and December, 2011 Silvercorp, through Henan Found, acquired a 90% interest in the XBG Mine, and 100% interest in the XHP mine (collectively, the “X Mines”). Both mines are located approximately a three hour drive from the Ying Mining District.

3.2The Company’s Strategic Vision

Silvercorp has built a record of success by formulating and executing a distinct long-term strategy characterized by three key steps. First, Silvercorp focuses on the acquisition and selective exploration of projects with significant resource and cash flow potential. It seeks out higher grade, underground, precious metals projects that may be too small for large companies and too large for juniors. Second, Silvercorp focuses on quickly developing high-margin operations with reasonable development capital profiles to generate cash flow before the project’s full resource potential is fully drilled. Third, the cash

9

flow Silvercorp generates from its early operations are used to fund further exploration, resource expansion and production growth.

This strategy, with its focus on early production, provides earlier benefits to: (i) local communities through increased employment opportunities, (ii) local governments through payment of taxes, (iii) local joint venture partners through profit sharing, and (iv) Company shareholders through less dilution. The early benefits help build a base of strong stakeholder support necessary for further project growth.

3.3Three Year History of Project Development

Since 2003, when the Company changed its focus to mineral exploration in China, Silvercorp has been actively acquiring mineral properties in China and more recently, has pursued growth opportunities in other jurisdictions. Production at the Ying Mine commenced on April 1, 2006, and since that time, three of the Company’s other properties in Henan Province, China have commenced production.

The year ended March 31, 2012, was Silvercorp’s sixth consecutive year of production growth with annual production of 5.6 million ounces of silver. The Company also produced 72.8 million pounds of lead and 13.7 million pounds of zinc during the same period.

The following table summarizes the total metal production in each period under review.

| | | |

| | | Years Ended March 31, | |

| | 2012 | 2011 | 2010 |

| Silver (‘000s ounces) | 5,618 | 5,300 | 4,624 |

| Gold (‘000s ounces) | 8.8 | 3.2 | 1.6 |

| Lead (‘000s pounds) | 72,804 | 69,011 | 62,374 |

| Zinc (‘000s pounds) | 13,749 | 16,343 | 14,740 |

Henan Found

Ying Mine

In fiscal 2012, the total ore mined was 293,367 tonnes, of which 12,365 tonnes were direct smelting ore, a decrease of 7% compared to total ore production of 316,522 tonnes in fiscal 2011. The decrease was due to labour shortages which impacted our mining contractors at the Ying mine from July 2011 to November 2011. The Company has worked with its mining contractors to introduce new measures to maintain a stable mining labour force and it is also in the process of establishing its own mining crews to carry out mining operations at the Ying mine. As a result, the labour shortages were mostly resolved by the end of 2011, and the average daily mining production at the Ying mine was back to normal thereafter.

In fiscal 2012, silver head grade at the Ying mine was 440 g/t, compared to 470 g/t in fiscal 2011. Head grades for lead and zinc were 8.3% and 2.4%, respectively, comparable to head grades for lead and zinc of 8.1% and 2.8%, respectively, in fiscal 2011. Head grades were changing along with the mining sequence.

In fiscal 2012, the Ying mine produced 3.94 million ounces of silver, 52.2 million pounds of lead and 10.8 million pounds of zinc, a decrease of 7%, 1% and 19%, respectively, compared to 4.2 million ounces

10

of silver, 52.9 million pounds of lead and 13.4 million pounds of zinc produced in fiscal 2011. The decrease was a result of lower ore production and lower head grades.

In fiscal 2012, total mining costs per tonne and cash mining costs per tonne were $69.50 (FY 2011 - $59.14) and $50.52 (FY 2011 - $46.05), respectively. The increase of cash mining costs was mainly due to (i) higher mining contractor costs as the mine paid approximately $1.80 per tonne more as compensation for increases in miners’ salary and benefits, (ii) higher labour costs of approximately $1.00 per tonne due to the Company’s own employees’ pay raises, and (iii) the impact of the US dollar deprecation versus the Chinese RMB of $2.40 per tonne, which was offset by a $1.10 per tonne decrease in mining preparation costs. The increase of non-cash mining costs was a result of higher assets base subject to depletion.

Including by-product credits, in fiscal 2012, Ying mine’s total and cash cost per ounce of silver were negative $6.61 and negative $8.27, respectively, compared to negative $7.20 and negative $8.30 in fiscal 2011. The increase in cost was mainly due to lower by-product credits from lower production and a higher production costs noted above.

In fiscal 2012, the Company completed 464 m of the development of a 5,200 m access ramp at the Ying mine, with dimensions of 4 m by 4.5 m, starting from the 580 m elevation and going down to zero metre elevation. The access ramp will provide access to the S7-1 vein in which resources were expanded by recent drilling, and provide access to future expected mining operations below zero metre elevation. The access ramp is expected to be completed in two and half years. Inclusive of this development work, in fiscal 2012, the Ying mine incurred $15.5 million in exploration and development expenditures (FY 2011 – $11.3 million).

TLP Mine

The TLP Mine is located in Henan Province, China. Silvercorp acquired the TLP Mine in 2007.

In fiscal 2012, the TLP mine produced 1.03 million ounces of silver, 13.1 million pounds of lead and 2.1 million pounds of zinc, an increase of 57%, 34% and a decrease of 15%, respectively compared to 660,000 ounces of silver, 9.8 million pounds of lead and 2.4 million pounds of zinc produced in fiscal 2011.

The increases are attributable to increased production as more ore was mined while mine development progressed. In fiscal 2012, the total ore mined was 275,739 tonnes, of which 52 tonnes were direct smelting ore, an increase of 36% compared to total ore production of 202,417 tonnes in fiscal 2011. In fiscal 2012, silver head grade improved to 147 g/t from 122 g/t a year ago.

In fiscal 2012, total mining costs per tonne and cash mining costs per tonne were $55.82 (FY 2011 - $39.89) and $48.62 (FY 2011 - $35.68), respectively. The increase was mainly due to (i) higher mining contractor costs as the mine paid $4.00 per tonne more for increases in miners’ salaries and benefits, (ii) higher labour costs of approximately $3.70 per tonne due to an increased number of employees and employee pay raises, and (iii) the impact of US dollar depreciation versus the Chinese RMB of $2.30 per tonne. The increase of non-cash mining costs was a result of a higher asset base subject to depletion.

In fiscal 2012, the Company incurred $4.7 million (FY 2011 - $3.9 million) in exploration and development expenditures.

11

X Mines

Since acquisition of the X Mines in fiscal 2012, the Company has mined 3,890 tonnes of ore and processed 11,667 tonnes of existing stockpile ore to yield 5,800 ounces of silver, 100 ounces of gold, and 444,000 pounds of lead.

The Company plans to commence a comprehensive exploration program that includes surface and underground mapping and sampling, and surface and underground diamond drilling to explore the existing veins and discover additional new veins, with a goal of defining a NI 43-101 compliant mineral resource.

In fiscal 2012, the X Mines incurred approximately $2.1 million in exploration and mine development.

Henan Huawei

HPG and LM Mines

The HPG and LM mines are located in Henan Province, China. Silvercorp acquired the HPG and LM mines in 2007.

In fiscal 2012, the total ore mined was 93,466 tonnes, of which 182 tonnes were direct smelting ore, an increase of 27% compared to total ore production of 73,390 tonnes in fiscal 2011.

In fiscal 2012, HPG and LM mines produced 635,000 ounces of silver, 7.0 million pounds of lead and 591,000 pounds of zinc, an increase of 62%, 12% and 9%, respectively, compared to 391,000 ounces of silver, 6.2 million pounds of lead and 544,000 pounds of zinc produced in fiscal 2011.

The increases are attributable to higher grades and higher ore production. In fiscal 2012, silver head grade increased to 227 g/t from 185 g/t a year ago. In addition, in fiscal 2012, ore processed increased by 25% to 93,396 tonnes from 74,478 tonnes a year ago.

In fiscal 2012, total mining costs per tonne and cash mining costs per tonne were $75.81 (FY 2011 - $63.98) and $63.77 (FY 2011 - $55.67), respectively. The increase of cash mining costs was mainly due to (i) higher mining contractor costs as the mine paid approximately $4.20 per tonne more for raises in miners’ salary and benefits, (ii) higher labour costs of approximately $3.50 per tonne due to the increased number of employees and employee pay raises, and (iii) the impact of US dollar depreciation versus the Chinese RMB of $3.00 per tonne. The increase of non-cash mining costs was a result of a higher asset base subject to depletion.

In fiscal 2012, the Company completed 339 m of a 4,800 m access ramp with dimensions of 4 m by 4.5 m at the southwest corner of the TLP Mining Permit, adjacent to the LM Mining Permit, from about 980 m elevation to 500 m elevation. The access ramp will provide access to newly-discovered mineralized veins at the LM mine. Currently, the Company is producing approximately 60,000 tonnes per year from the LM mine. Once the access ramp is completed in two and half years, the mining capacity is expected to increase to approximately 200,000 tonnes per year.

In fiscal 2012, HPG and LM mines incurred $8.5 million (FY 2011 – $4.4 million) in exploration and development expenditures.

12

Guangdong Found

GC Project

The Company acquired the GC Project in 2008. In December 2010, the GC Project received its mining permit. Since then, the Company has been in the project development phase.

As of March 31, 2012, 717 m of the 2,210 m main access ramp, 42 m of the 618 m main shaft and 400 m of a water diversion tunnel were completed. In addition, GC Project also began to develop a new 3.7 m by 4 m, 4,500 m long exploration ramp.

The construction of a 1,600 t/d floatation mill capable of producing silver, lead, zinc, and pyrite floatation concentrates and an optional tin gravity concentrate is underway. Milling equipment was sourced and the final purchase contract was signed. In accordance with plans, the mill should be completed by July 2012 with an estimated cost of approximately RMB 100 million, or US$17 million. The Company is using the same mill contractor for GC as for the two mills at the Ying Mining District.

In fiscal 2012, the drilling program discovered four new high-grade silver, lead, zinc veins and a number of vein structures and isolated mineralized pockets, increasing the total number of mineralized veins at the GC property to 33 veins. The program also successfully extended the existing veins further to down dip and striking directions.

In fiscal 2012, GC incurred approximately $5.9 million (FY 2011 - $0.7 million) in capital expenditures for mine development and exploration.

Yunxiang

BYP Project

In January 2011, the Company completed the acquisition of a 70% equity interest in Xinshao Yunxiang Mining Co., Ltd., which owns a mining permit in the BYP Gold-Lead-Zinc mine in Hunan Province, China.

In fiscal 2012, the BYP mine mined 91,128 tonnes of ore, milled 83,760 tonnes, yielding 5,100 ounces of gold and 249,000 pounds of zinc. Total mining costs per tonne and cash mining costs per tonne were $38.00 and $16.79 respectively. Total and cash cost per ounce of gold was $843.60 and $473.93, respectively.

The Company will continue to utilize the existing 500 t/d floatation mill to mine and process gold mineralization. Construction of an 800 t/d backfill facility to fill up gold mineralization stopes is underway, which will cost approximately $1.5 million and will be completed in July 2012. In fiscal 2012, the Company also started to sink a 180 m deep, 3.5 m diameter shaft from 380 m to 200 m elevations. The shaft will mainly be utilized to mine the #3 gold mineralization body. The cost of the shaft is approximately $1.0 million and is expected to be completed in October 2012.

In fiscal 2012, the BYP mine incurred approximately $4.0 million in exploration and mine development.

0875786 B.C. Ltd.

Silvertip Project

The Silvertip Project was acquired in February 2010. The Company is nearing completion of a Small Mine Permit application which will be submitted to the British Columbia Ministry of Energy and Mines.

13

In fiscal 2012, the Company conducted a drill program. Drilling intersected high grade lower zone mineralization to the north of the Silver Creek zone and indicates that more detailed work may outline additional resources.

In fiscal 2012, the Silvertip project incurred approximately $5.2 million in exploration expenditures (FY 2011 - $7.2 million).

3.4Other Matters

2011 Normal Course Issuer Bid

On June 17, 2011, the Company commenced a normal course issuer bid (the “NCIB”) whereby it intended to acquire up to 10,000,000 of its common shares, being approximately 6% of the common shares then outstanding. Up to March 31, 2012 the Company acquired 4,468,012 common shares at an average cost of $7.90 per share through the combined facilities of the TSX and NYSE. All common shares purchased under the NCIB were cancelled.

Financings

On December 14, 2010, the Company closed a bought deal financing of 9,200,000 common shares at a price of $12.70 per common share, for gross proceeds of $116.8 million to a syndicate of underwriters led by CIBC World Markets and BMO Capital Markets.

ITEM 4 DESCRIPTION OF THE BUSINESS

4.1General

Silvercorp’s principal products and source of sales are silver-bearing lead and zinc concentrates and direct smelting ores. In fiscal 2012, the Ying Mine accounted for 70% of Silvercorp’s production of silver. At present, Silvercorp sells all its products to local smelters or companies in the mineral products trading business.

For each of the Company’s two most recently completed financial years, revenues for each category of products that accounted for 10% or more of total consolidated revenues for the applicable financial year are as follows:

| | | | |

| | Years ended March 31 | |

| In 000s’US$ | 2012 | | 2011 | |

| Silver (Ag) | 156,085 | | 95,834 | |

| Lead (Pb) | 61,526 | | 57,623 | |

Additional information is provided in the Company’s most recent financial statements and the management’s discussion and analysis for its most recently completed fiscal year.

The mining industry is intensely competitive and Silvercorp competes with many companies possessing similar or greater financial and technical resources. Silvercorp’s competitive position is largely dependent on its high profitability, arising from its relatively higher grade resource, particularly at the Ying Mine, and its low production costs in China compared to the costs of other producers outside China. Within China, the Company’s competitive advantage arises from the high grade nature of its concentrates and its proximity to local smelters.

14

During fiscal 2012, the Company revisited the reclamation costs for the existing mines and the timing to settle the reclamation liabilities as a result of new environmental regulations in China and the extension of mine lives due to the revised mining plan and updated reserves and resources at the existing mines. The remaining mine lives range from 8 to 23 years, and the cash outflow is expected to occur each year until the reclamation work is completed instead of at the end of the mine lives as estimated in previous years. Although the ultimate reclamation costs to be incurred for the existing mines are uncertain, the Company has increased the estimated undiscounted future value of these costs to $5.3 million as at March 31, 2012.

For the year ended March 31, 2012, Silvercorp had on average over 1,400 employees and approximately 2,900 contractors. The majority of the employees and contractors were working in the Ying Mining District.

2013 Outlook

Production in China

From the four mines at the Ying Mining District, production is expected to increase to 695,000 tonnes of ore at a grade of 295g/t silver, 0.5g/t gold, 5.1% lead and 1.5% zinc, yielding 5.9 million ounces of silver, 3,350 ounces of gold, and 87 million pounds of lead and zinc. The cash and total production costs are expected to be approximately $68 and $85 per tonne of ore.

The GC Project in Guangdong Province is expected to commence initial production in fiscal 2013. It is expected to mine 160,000 tonnes and to mill 153,000 tonnes of ore, yielding approximately 630,000 ounces of silver and 12 million pounds of lead and zinc. The cash and total production costs are expected to be approximately $40 and $65 per tonne of ore, respectively.

The BYP Project in Hunan Province is expected to mine and mill 175,000 tonnes of ore, yielding approximately 13,590 ounces of gold at cash and total production costs of $35 and $60 per tonne of ore, respectively.

At the newly-acquired X Mines, the Company will focus on exploration during fiscal 2013, with only a minimal amount of by-product ore expected to be produced.

Capital Expenditures Budget

The total capital expenditures for fiscal 2013 is estimated at $79.9 million for mine development, mill construction, and other capital items (e.g. surface infrastructures and facilities, land use rights, reporting and permitting), plus exploration expenditures of $9.8 million to complete a 206,000 m surface and underground drilling program, for a total of $89.7 million. The budget estimate is based on contracts on hand, designs by qualified Chinese engineering firms, and the Company’s past operating experience in China.

Ying Mining District

The capital expenditures for the Ying, TLP, LM and HPG mines and central mills for fiscal 2013 are budgeted at $46.6 million, including 4,900 m ramps ($4.8 million), 4,500 m vertical shafts, declines, and raises ($5.7 million), 100,000 m of horizontal tunnels ($19.3 million), mill equipment, tailing and surface facilities ($11.2 million), and 144,200 m surface and underground drilling program ($5.6 million).

15

GC Project

The capital expenditures for the GC Project for fiscal 2013 are budgeted at $32.2 million, of which $12.8 million is for mine development, $17.5 million is for mill and infrastructure and $1.9 million is for a 26,400 m underground drilling program. A substantial portion of GC mine’s operation will be built in fiscal 2013, including 1500 m ramp ($1.7 million), 800 m vertical shafts ($3.0 million), 9,400 m horizontal tunnels ($6.3 million), 1,600 t/d mill ($7.7 million), land use rights ($3.5 million), and power grid, office, labs and other surface facilities ($8.1 million).

BYP Project

The capital expenditures for the BYP Project for fiscal 2013 are budgeted at $3.4 million, including 180 m shaft ($0.6 million), 3,400 m horizontal tunnels ($1.4 million), backfilling facility ($0.8 million), surface facilities ($0.4 million), and 1,800 m surface drilling program ($0.2 million).

X Mines

During the fiscal 2013, the Company’s focus on these two newly-acquired projects will be a 33,600 m surface and underground drilling program, budgeted at approximately $2.1 million. In addition, $3.9 million of capital expenditures is budgeted for mine development, exploration tunneling and upgrading existing mills. The Company is also planning to prepare an initial NI 43-101 resource report for the properties during fiscal 2013.

Silvertip Project

The Company has budgeted $1.5 million to complete and submit an application for a Small Mine Permit.

In addition to the aggressive exploration program carried out by the Company to grow the resources and reserves in its operating projects, Silvercorp continually seeks acquisition opportunities in China and other jurisdictions.

Growth by Exploration and Acquisition

Silvercorp continues to pursue future growth opportunities by carrying out aggressive exploration programs within existing exploration and mining permit areas at its projects. In addition, the Company continues to pursue in China and other jurisdictions future growth opportunities by evaluating the acquisition of exploration, development or production assets or the acquisition of or merger with other entities. The Company often engages in discussions with respect to such possible opportunities. At any time, discussions and activities can be in progress on a number of initiatives, each at different stages of development. Although the Company may from time to time be a party to a number of letters of intent in respect to certain opportunities and other acquisitions, the Company currently does not have any binding agreements or binding commitments to enter into any such transactions. There is no assurance that any potential transaction will be successfully completed.

4.2Chinese Mining Law

Currently, all of the Company’s producing properties are located in China. Under the laws of China, mineral resources are owned by the State, and in the past, it has been state-owned enterprises which have been the principal force in the development of mineral resources. A new Mineral Resources Law became effective on January 1, 1997, and three regulations were promulgated on February 12, 1998. The new law provides for equal legal status for domestic enterprises and enterprises with foreign investment, security

16

and transferability of mineral titles as well as the exclusivity of mining rights. The right to explore and exploit minerals is granted by way of exploration and mining rights. The holder of an exploration right has the privileged priority to obtain the mining right to the mineral resources in the exploration area provided the holder meets the conditions and requirements specified in the law. The Company’s interests in mineral properties are held though joint venture companies established under and governed by the laws of China. The Company’s joint venture partners in China include state-sector entities and, like other state-sector entities, their actions and priorities may be dictated by government policies instead of purely commercial considerations.

Additionally, companies with a foreign ownership component operating in China may be required to work within a framework which is different from that imposed on domestic Chinese companies. The Chinese government currently allows foreign investment in certain mining projects under central government guidelines.

4.3Risk Factors

An investment in the common shares of the Company involves a significant degree of risk and ought to be considered a highly speculative investment. The following risk factors, as well as risks not currently known to the Company, could materially adversely affect the Company’s future business, operations and financial condition and could cause them to differ materially from the estimates described in the forward-looking statements and information relating to the Company.

Fluctuating commodity prices

The Company’s sales price for lead and zinc pounds is fixed against the Shanghai Metals Exchange as quoted at www.shmet.com, while gold ounces are fixed against the Shanghai Gold Exchange as quoted at www.sge.com.cn and silver ounces are fixed against the Shanghai White Platinum & Silver Exchange as quoted at www.ex-silver.com. These metal prices traditionally move in tandem with and at marginally higher prices than those quoted on the North American and European market places.

The Company’s revenues, if any, are expected to be in large part derived from the mining and sale of silver, lead, zinc, and gold contained in metal concentrates. The prices of those commodities has fluctuated widely, particularly in recent years, and are affected by numerous factors beyond the Company’s control including international and regional economic and political conditions, expectations of inflation; currency exchange fluctuations; interest rates; global or regional supply and demand for jewellery and industrial products containing silver and other metals; sale of silver and other metals by central banks and other holders, speculators and producers of silver and other metals; availability and costs of metal substitutes; and increased production due to new mine developments and improved mining and production methods. The price of base and precious metals may have a significant influence on the market price of the Company’s shares and the value of the properties. The effect of these factors on the price of base and precious metals, and therefore the viability of the Company’s exploration projects, cannot be accurately predicted.

If silver and other metals prices were to decline significantly or for an extended period of time, the Company may be unable to continue operations, develop the properties or fulfil obligations under agreements with the Company’s joint venture partners or under its permits or licenses.

Estimation of mineral resources, reserves and mineralization and metal recovery

There is a degree of uncertainty attributable to the estimation of mineral resources, reserves and mineralization and corresponding grades being mined or dedicated to future production. Until resources, reserves or mineralization are actually mined and processed, quantity of mineralization and grades must be considered as estimates only. In addition, the quantity of resources, reserves and mineralization may

17

vary depending on metal prices. Any material change in quantity of resources, mineralization, or grade may affect the economic viability of the Company’s properties. In addition, there can be no assurance that precious or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Interpretations and assumptions of mineral resource and mineral reserve estimates

Unless otherwise indicated, mineral resource and mineral reserve estimates presented in this AIF and in the Company’s other filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by Company personnel and independent geologists/mining engineers. These estimates are imprecise and depend upon geologic interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. The mineral resource and mineral reserve estimates contained in this AIF have been determined based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. There can be no assurance that:

these estimates will be accurate;

mineral reserve, resource or other mineralization figures will be accurate; or

the mineralization could be mined or processed profitably.

The interpretation of drill results, the geology, grade and continuity of the Company’s mineral deposits contains inherent uncertainty. Any material reductions in estimates of mineralization, or of the Company’s ability to extract this mineralization, could have a material adverse effect on its results of operations or financial condition.

Exploration and development programs

The long-term operation of the Company’s business and its profitability is dependent, in part, on the cost and success of its exploration and development programs. Mineral exploration and development involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. There can be no assurance that the Company’s mineral exploration and development programs will result in any discoveries of bodies of commercial mineralization. There can also be no assurance that even if commercial quantities of mineralization are discovered that a mineral property will be brought into commercial production.

Development of the Company’s mineral properties will follow only upon obtaining satisfactory exploration results. Discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent upon a number of factors, some of which are the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metal prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. Most of the above factors are beyond the control of the Company. As a result, there can be no assurance that the Company’s exploration and development programs will yield reserves to replace or expand current resources. Unsuccessful exploration or development programs could have a material adverse impact on the Company’s operations and profitability.

18

Feasibility and engineering reports

There is a potential for delays in exploration or the completion of feasibility studies that may adversely impact the Company. The Company has received mining permits from the Department of Land and Resources of Henan Province and has commenced mining operations in the Ying Mining District in accordance with the mining permits. While the Company is preparing a feasibility study on the GC Project, to date, the Company has not completed a formal feasibility study of any of its material properties in China, which might otherwise be prepared for a mineral property located in North America.

Permits and licenses

All mineral resources and mineral reserves of the Company are owned by their respective governments, and mineral exploration and mining activities may only be conducted by entities that have obtained or renewed exploration or mining permits and licenses in accordance with the relevant mining laws and regulations. No guarantee can be given that the necessary exploration and mining permits and licenses will be issued to the Company or, if they are issued, that they will be renewed or that the Company will be in a position to comply with all conditions that are imposed.

Nearly all mining projects require government approval. There can be no certainty that approvals necessary to develop and operate mines on the Company’s properties will be granted to the Company in a timely manner, or at all.

Title to properties

While the Company has investigated title to all of its mineral claims and to the best of its knowledge, title to all of its properties is in good standing, the properties may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. There may be valid challenges to the title of the Company’s properties which, if successful, could impair development and/or operations. The Company cannot give any assurance that title to its properties will not be challenged. Title insurance is generally not available for mineral properties and the Company’s ability to ensure that it has obtained secure claim to individual mineral properties or mining concessions may be severely constrained. The Company’s mineral properties in China have not been surveyed, and the precise location and extent thereof may be in doubt.

First Nations title claims and rights

Governments in many jurisdictions must consult with multiple First Nations and other aboriginal peoples with respect to grants of mineral rights and the issuance or amendment of project authorizations. Consultation and other rights of aboriginal people may require accommodations, including undertakings regarding employment, contracting, profit sharing, and other matters in impact and benefit agreements. This may affect our ability, the timing and costs of developing the Silvertip Project. The risk of unforeseen First Nations title claims also could affect future operations, development projects and future acquisitions. In particular, there can be no guarantee that the unsettled nature of land claims in British Columbia will not create delays in project approval or unexpected interruptions in project progress, or result in additional costs to advance the Silvertip Project. These requirements may affect our ability to expand or transfer existing operations or to develop existing or new projects.

Property interests

The agreements pursuant to which the Company holds its rights in certain of the properties provide that the Company must make a series of cash payments over certain time periods or make certain minimum exploration expenditures. If the Company fails to make such payments or expenditures in a timely manner, the Company may lose interest in those projects.

19

Joint venture partners

The Company’s interests in various properties may, in certain circumstances, pursuant to option agreements currently in place, become subject to the risks normally associated with the conduct of joint ventures. The existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on the Company’s profitability or the viability of its interests held through joint ventures, which could have a material adverse impact on the Company’s business prospects, results of operations and financial conditions: (i) disagreements with joint venture partners on how to conduct exploration; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) disputes or litigation between joint venture partners regarding budgets, development activities, reporting requirements and other joint venture matters.

Acquisition of commercially mineable mineral rights

Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of recovery of mineral reserves will be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited.

The Company’s future growth and productivity will depend, in part, on its ability to identify and acquire additional mineral rights, and on the costs and results of continued exploration and development programs. Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

establish mineral reserves through drilling and metallurgical and other testing techniques;

determine metal content and metallurgical recovery processes to extract metal from the ore; and

construct, renovate or expand mining and processing facilities.

In addition, if the Company discovers a mineral deposit, it would take several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change.

The Company’s success at completing any acquisitions will depend on a number of factors, including, but not limited to:

identifying acquisitions that fit the Company’s business strategy;

negotiating acceptable terms with the seller of the business or property to be acquired; and

obtaining approval from regulatory authorities in the jurisdictions of the business or property to be acquired.

As a result of these uncertainties, there can be no assurance that the Company will successfully acquire additional mineral rights.

Financing

The Company has limited financial resources. If the Company’s exploration programs are successful in establishing ore of commercial tonnage and grade, additional funds will be required for the development of the ore body and to place it in commercial production. Therefore, the Company’s ability to continue its

20

exploration and development activities, if any, will depend in part on the Company’s ability to obtain suitable financing.

The Company intends to fund its plan of operations from working capital, proceeds of production, external financing, strategic alliances, sale of property interests and other financing alternatives. The sources of external financing that the Company may use for these purposes include project or bank financing, or public or private offerings of equity or debt. One source of future funds presently available to the Company is through the sale of equity capital. There is no assurance this source of financing will continue to be available, as required or at all. If it is available, future equity financings may result in substantial dilution to shareholders. Another alternative for the financing of further exploration would be the offering by the Company of an interest in the properties to be earned by another party or parties carrying out further exploration or development thereof. There can be no assurance the Company will be able to conclude any such agreements, on favourable terms or at all. The failure to obtain financing could have a material adverse effect on the Company’s growth strategy and results of operations and financial condition.

Recent market events and condition

Over the past several years market events and conditions, including disruptions in the Canadian, United States and international credit markets and other financial systems, along with the uncertainty of the Canadian, United States and global economic conditions, could, among other things, impede access to capital or increase the cost of capital, which would have an adverse effect on the Company’s ability to fund its working capital and other capital requirements.

Over the past several years, worldwide securities markets, particularly those in the United States and Canada, have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly those considered exploration- or development-stage companies, have experienced unprecedented declines in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. Most significantly, the share prices of natural resource companies have in the past experienced an extraordinary decline in value and in the number of buyers willing to purchase such securities. In addition, significantly higher redemptions by holders of mutual funds has forced many of such funds (including those holding the Company’s securities) to sell such securities at any price.

Therefore, there can be no assurance that significant fluctuations in the trading price of the Company’s common shares will not occur, or that such fluctuations will not materially adversely impact on the Company’s ability to raise equity funding without significant dilution to its existing shareholders, or at all.

Economic factors affecting the Company

The recent unprecedented events in global financial markets have had a profound impact on the global economy. Many industries, including the mining industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets, and a lack of market liquidity. A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates, and tax rates may adversely affect the Company’s growth and profitability. Specifically:

the volatility of silver, lead and zinc prices would impact the Company’s revenues, profits, losses and cash flow;

21

volatile energy prices, commodity and consumables prices and currency exchange rates would impact the Company’s production costs; and

the devaluation and volatility of global stock markets would impact the valuation of the Company’s equity and other securities.

These factors could have a material adverse effect on the Company’s financial condition and results of operations.

Timing, estimated amount, capital and operating expenditures and economic returns of future production

There are no assurances if and when a particular mineral property of the Company can enter into production. The amount of future production is based on the estimates prepared by or for the Company. The capital and operating costs to take the Company’s projects into production may be significantly higher than anticipated. Capital and operating costs of production and economic returns are based on estimates prepared by or for the Company may differ significantly from their actual values. There can be no assurance that the Company’s actual capital and operating costs will not be higher than currently anticipated.

In addition, the construction and development of mines and infrastructure are complex. Resources invested in construction and development may yield outcomes that may differ significantly from those anticipated by the Company.

Integration of future acquisitions into existing operations

The Company acquired the XBG and XHP mines in 2012 and may make selected acquisitions in the future. If the Company does make further acquisitions, any positive effect on the Company’s results will depend on a variety of factors, including, but not limited to:

integrating the operations of an acquired business or property in a timely and efficient manner;

maintaining the Company’s financial and strategic focus while integrating the acquired business or property;

implementing uniform standards, controls, procedures and policies at the acquired business, as appropriate; and

to the extent that the Company makes an acquisition outside of markets in which it has previously operated, conducting and managing operations in a new operating environment.

Acquiring additional businesses or properties could place pressure on the Company’s cash flow if such acquisitions involve cash consideration or existing shareholders may experience dilution if such acquisitions involve share consideration.

The integration of the Company’s existing operations with any acquired business will require significant expenditures of time, attention and funds. Achievement of the benefits expected from consolidation would require the Company to incur significant costs in connection with, among other things, implementing financial and planning systems. The Company may not be able to integrate the operations of a recently acquired business or restructure the Company’s previously existing business operations without encountering difficulties and delays. In addition, this integration may require significant attention

22

from the Company’s management team, which may detract attention from the Company’s day-to-day operations.

Over the short-term, difficulties associated with integration could have a material adverse effect on the Company’s business, operating results, financial condition and the price of the Company’s common shares. In addition, the acquisition of mineral properties may subject the Company to unforeseen liabilities, including environmental liabilities, which could have a material adverse effect on the Company. There can be no assurance that any future acquisitions will be successfully integrated into the Company’s existing operations.

Competition

The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of ore are discovered, a ready market will exist for the sale of such ore, or concentrate, by the Company. Marketability of natural resources which may be discovered by the Company will be affected by numerous factors beyond the control of the Company, such as market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations including regulations relating to prices, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of such factors cannot be predicted but they may result in the Company not receiving an adequate return on its capital.

The Company may be at a competitive disadvantage in acquiring additional mining properties because it must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than the Company. The Company may also encounter increasing competition from other mining companies in its efforts to hire experienced mining professionals. Competition for exploration resources at all levels is currently very intense, particularly affecting the availability of manpower and drill rigs. Increased competition could adversely affect the Company’s ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

Operations and political conditions

The majority of the properties in which the Company has an interest are located in China, which has different regulatory and legal standards than those in North America. Even if the Company’s mineral properties are proven to host economic reserves of metals, factors such as political instability, terrorism, opposition and harassment from local miners, or governmental expropriation or regulation may prevent or restrict mining of any such deposits or repatriation of profits.

The majority of the Company’s operations are located in China. These operations are subject to the risks normally associated with conducting business in China. Some of these risks are more prevalent in countries which are less developed or have emerging economies, including uncertain political and economic environments, as well as risks of war and civil disturbances or other risks which may limit or disrupt a project, restrict the movement of funds or result in the deprivation of contract rights or the taking of property by nationalization or expropriation without fair compensation, risk of adverse changes in laws or policies, increases in foreign taxation or royalty obligations, delays in obtaining or the inability to obtain necessary governmental permits, limitations on ownership and repatriation of earnings, and foreign exchange controls and currency devaluations.

In addition, the Company may face import and export regulations, including export restrictions, disadvantages of competing against companies from countries that are not subject to similar laws, restrictions on the ability to pay dividends offshore, and risk of loss due to disease and other potential endemic health issues. Although the Company is not currently experiencing any significant or

23

extraordinary problems in China arising from such risks, there can be no assurance that such problems will not arise in the future. The Company currently does not carry political risk in insurance coverage.

The Company’s interests in its mineral properties are held through joint venture companies established under and governed by the laws of China. The Company’s joint venture partners in China include state-sector entities and, like other state-sector entities, their actions and priorities may be dictated by government policies instead of purely commercial considerations. Additionally, companies with a foreign ownership component operating in China may be required to work within a framework which is different from that imposed on domestic Chinese companies. The Chinese government currently allows foreign investment in certain mining projects under central government guidelines. There can be no assurance that these guidelines will not change in the future.

Regulatory environment in China and Canada

The Company conducts operations primarily in China and is developing the Silvertip Project in northern British Columbia, Canada. The laws of China differ significantly from those of Canada and all such laws are subject to change. Mining operations, development and exploration activities are subject to extensive laws and regulations governing prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, environmental protection, mine safety, consultation with First Nations in Canada and other matters. Mining is subject to potential risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production.

Failure to comply with applicable laws and regulations may result in enforcement actions there under and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws and regulations.

New laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations could have a material adverse impact on future cash flow, results of operations and the financial condition of the Company.

Further, all phases of the Company’s operations are subject to environmental regulations in the various jurisdictions in which it operates. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environment assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulations, if any, will not adversely affect the Company’s operations.

Environmental risks

The Company’s activities are subject to extensive laws and regulations governing environmental protection and employee health and safety, including environmental laws and regulations in China. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species, and reclamation of lands disturbed by mining operations. There are also laws and regulations prescribing reclamation activities on some mining properties. Environmental legislation in many countries is evolving and the trend has been toward stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on behalf of the Company and may cause material

24

changes or delays in the Company’s intended activities. There can be no assurance that the Company has been or will be at all times in complete compliance with current and future environmental and health and safety laws and permits will not materially adversely affect the Company’s business, results of operations or financial condition. It is possible that future changes in these laws or regulations could have a significant adverse impact on some portion of the Company’s business, causing the Company to re-evaluate those activities at that time. The Company’s compliance with environmental laws and regulations entail uncertain costs.

Foreign exchange rate fluctuations

In the past, the Company has raised its equity and maintained its accounts in Canadian dollars but now reports in US dollars. Going forward, operations carried out in non-US currency, including the Canadian dollar or the Chinese Renminbi, could subject the Company to foreign currency fluctuations that may materially and adversely affect the Company’s financial position.

Insurance

The Company’s mining activities are subject to the risks normally inherent in the industry, including, but not limited, to environmental hazards, flooding, fire, periodic or seasonal hazardous climate and weather conditions, unexpected rock formation, industrial accidents and metallurgical and other processing problems. These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties; personal injury; environmental damage; delays in mining; increased production costs; monetary losses; and possible legal liability. The Company may become subject to liability which it cannot insure or against which it may elect not to insure due to high premium costs or other reasons. Where considered practical to do so the Company maintains insurance against risks in the operation of its business in amounts which the Company believes to be reasonable. Such insurance, however, contains exclusions and limitations on coverage. The Company cannot provide any assurance that such insurance will continue to be available, will be available at economically acceptable premiums or will be adequate to cover any resulting liability. In some cases, coverage is not available or considered too expensive relative to the perceived risk.

Risks and hazards of mining operations

Mining is inherently dangerous and the Company’s operations are subject to a number of risks and hazards including, without limitation:

environmental hazards;

discharge of pollutants or hazardous chemicals;

industrial accidents;

failure of processing and mining equipment;

labour disputes;

supply problems and delays;

encountering unusual or unexpected geologic formations or other geological or grade problems;

encountering unanticipated ground or water conditions;

cave-ins, pit wall failures, flooding, rock bursts and fire;

25

periodic interruptions due to inclement or hazardous weather conditions;

equipment breakdown;

other unanticipated difficulties with or interruptions in development, construction or production; and

other acts of God or unfavourable operating conditions.

Such risks could result in damage to, or destruction of, mineral properties or processing facilities, personal injury or death, loss of key employees, environmental damage, delays in mining, monetary losses and possible legal liability. Satisfying such liabilities may be very costly and could have a material adverse effect on the Company’s future cash flow, results of operations and financial condition.

Dependence on management and key personnel

The executive directors and the China operational management team all have extensive experience in the mineral resources industry in China. Most of the non-executive directors also have extensive experience in mining and/or exploration (or as advisors to companies in the field). The Company’s success depends to a significant extent upon its ability to retain, attract and train key management personnel, both in Canada and in China.

The Company depends on the services of a number of key personnel, including its directors and executive officers, the loss of any one of whom could have an adverse effect on the Company’s operations.

The Company’s ability to manage growth effectively will require it to continue to implement and improve management systems and to recruit and train new employees. The Company cannot be assured that it will be successful in attracting and retraining skilled and experienced personnel.

Conflicts of interest

Conflicts of interest may arise as a result of the directors, officers and promoters of the Company also holding positions as directors and/or officers of other companies. Some of those persons who are directors and officers of the Company have and will continue to be engaged in the identification and evaluation of assets and businesses and companies on their own behalf and on behalf of other companies, and situations may arise where the directors and officers may be in direct competition with the Company. Conflicts, if any, will be subject to the procedures and remedies under theBusiness Corporations Act(British Columbia).

Internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act

Management of the Company is responsible for establishing and maintaining an adequate system of internal control over financial reporting, and used the framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) to evaluate the effectiveness of internal controls in fiscal year 2012. Based on this evaluation, management concluded that our internal control over financial reporting was effective as at March 31, 2012 and provided a reasonable assurance of the reliability of our financial reporting and preparation of the financial statements.

The Company's consolidated audited financial statements for fiscal 2012 included an unqualified report of its independent auditors that the Company had maintained effective internal control over financial reporting as at March 31, 2012. Nonetheless the Company may in the future fail to achieve and maintain the adequacy of its internal control over financial reporting, as such standards are modified, supplemented or amended from time to time, and the Company may not be able to ensure that it can conclude on an ongoing basis that it has effective internal controls over financial reporting in accordance with Section

26

404 of Sarbanes-Oxley Act ("SOX"). The Company’s failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of its financial statements, which in turn could harm the Company’s business and negatively impact the trading price of its common shares. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm the Company’s operating results or cause it to fail to meet its reporting obligations. Future acquisitions of companies may provide the Company with challenges in implementing the required processes, procedures and controls in its acquired operations. Acquired companies may not have disclosure control and procedures or internal control over financial reporting that are as thorough or effective as those required by securities laws currently applicable to the Company.

No evaluation can provide complete assurance that the Company’s internal control over financial reporting will detect or uncover all failures of persons within the Company to disclose material information otherwise required to be reported. The effectiveness of the Company’s control and procedures could also be limited by simple errors or faulty judgments. In addition, should the Company expand in the future, the challenges involved in implementing appropriate internal controls over financial reporting will increase and will require that the Company continue to improve its internal controls over financial reporting. Although the Company intends to devote substantial time and incur substantial costs, as necessary, to ensure compliance, the Company cannot be certain that it will be successful in complying with Section 404 on an ongoing basis.

Bringing actions and enforcing judgments under U.S. securities laws

Investors in the U.S. or in other jurisdictions outside of Canada may have difficulty bringing actions and enforcing judgments against the Company, its directors, its executive officers and some of the experts named in this AIF based on civil liabilities provisions of the federal securities laws, other laws in the state(s) in the U.S. or the equivalent laws of other jurisdictions of residence.

ITEM 5 MINERAL PROPERTIES

The Company has interests in mineral properties located in China and Canada. As at March 31, 2012, these properties were carried on the Company’s balance sheet as assets with a book value of approximately $258.5 million. The book value consists of acquisition costs plus cumulative expenditures on properties, net of amortization and impairment charges for which the Company has future exploration plans.

For the purposes of NI 43-101, the following properties have been determined to be material to the Company as of March 31, 2012:

| (a) | the Ying Mine, Ying Mining District, Henan Province, China; and |

| | |

| (b) | the GC Project, Guangdong Province, China. |

5.1 Ying Mine, Henan Province, China.