UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21832 |

|

Eaton Vance Tax-Managed Diversified Equity Income Fund |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Maureen A. Gemma The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2007 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Annual Report October 31, 2007

EATON VANCE

TAX-MANAGED

DIVERSIFIED

EQUITY INCOME

FUND

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e. fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and it's underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to Portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

|

Michael A. Allison, CFA |

Eaton Vance Mgmt. |

Co-Portfolio Manager |

|

|

Walter A. Row, CFA |

Eaton Vance Mgmt. |

Co-Portfolio Manager |

|

|

Ronald M. Egalka |

Rampart Investment Mgmt. |

Co-Portfolio Manager |

The Fund

Performance for the Past Year

· Based on share price, Eaton Vance Tax-Managed Diversified Equity Income Fund (the Fund), a diversified, closed-end investment management company traded on the New York Stock Exchange under the symbol ETY, had a total return of - -3.63% for the period from inception on November 30, 2006, to October 31, 2007. This return resulted from a decrease in share price to $17.13 on October 31, 2007, from $19.10 (offering price of $20 per share, less all commissions) on November 30, 2006, plus the reinvestment of $1.388 per share in distributions .(1)

· Based on net asset value (NAV), the Fund had a total return of 10.26% for the same period. This return resulted from an increase in NAV to $19.60 on October 31, 2007, from $19.10 (offering price of $20 per share, less all commissions) on November 30, 2006, plus the reinvestment of $1.388 per share in distributions.(1)

· For comparison, management used a blended index consisting of an 80% weighting in the S&P 500 Index, an unmanaged market index commonly used to measure the performance of U.S. stocks, and a 20% weighting in the FTSE Eurotop 100 Index, a tradable index designed to represent the performance of the 100 most highly-capitalized blue chip companies in Europe. This blended index had a total return of 14.94% for the period from November 30, 2006 to October 31, 2007. On an individual basis, the S&P 500 Index had a total return of 12.42% and the FTSE Eurotop 100 Index had a total return of 24.69% for the same period. The CBOE S&P 500 BuyWrite Index (BXM), a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index, had a total return of 7.53% for the same period. The Lipper Closed-End Value Funds Classification had an average total return of 8.98% at NAV and 3.29% at share price for the same period.(2)

Management Discussion

· Major equity market indices posted strong returns during the 11-month period ended October 31, 2007, despite an increase in volatility to its highest level in nearly four years. Corporate earnings growth proved better than expected, and merger and buyout activity continued at a robust clip, fueling the equity markets. During the summer, however, a sub-prime mortgage crisis, coupled with rising food and commodity prices, led to investor fears of both a slowing economy and rising inflation. The Federal Reserve addressed the issues by lowering interest rates, which provided a boost to the equity markets. On average during the course of the period, large-capitalization stocks generally outperformed small- and mid-cap stocks, and growth style investments remained ahead of their value counterparts.

· During the period ended October 31, 2007, the Fund underperformed the blended index. It is important to remember that the

blended index does not include the hedging characteristics that are utilized by the Fund in the execution of its covered call option writing strategy. While writing covered call options offers downside protection in a falling market, it does provide a drag on performance in market conditions such as those experienced in the period ended October 31, 2007. The Fund’s most significant positive performance came from stocks held in the industrials, information technology, and health care sectors. Conversely, stock selection in utilities and financials made negative contributions to the Fund’s relative returns.(2),(3)

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Share price and net asset value on November 30, 2006, were calculated assuming a purchase price of $20.00 per share less the sales charge of $0.90 per share paid by the shareholder.

(2) It is not possible to invest directly in an Index or a Lipper Classification. The Index’s total return does not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. The Lipper total return is the average total return, at net asset value and at share price, of the funds that are in the same Lipper Classification as the Fund.

(3) Holdings and sector weightings are subject to change due to active management.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

1

· For the same period, the Fund outperformed the BXM Index. The Fund’s limited over-write of stock index call options with respect to a portion of its common stock portfolio value (approximately 50%) allowed it to benefit from the generally positive market environment.

· At October 31, 2007, the Fund had written options on 50% of its equity holdings. Option premiums available from writing call options vary with investors’ expectation of the future volatility of the underlying asset. The expectation of volatility, or “implied volatility,” is the primary variable that drives the pricing of options. The implied volatility of equity options increased during 2007, spurred, in part, by difficulties in sub-prime mortgages and turmoil in the international markets. The Fund was able to “monetize” some of this volatility in the form of higher premiums during the 11-month period ended October 31, 2007.

· During the period covered in this report, the Fund’s dividend capture strategy proved productive, with a number of extraordinary, non-recurring dividend opportunities providing strong levels of qualified dividend income.*

* There can be no assurance that the dividend capture strategy will continue to be successful in the future. The use of this strategy exposes the Fund to increased trading costs and the potential for capital loss or gain. The amount of monthly dividend distributions may vary depending on a number of factors. As portfolio and market conditions change, the rate of distributions on Fund common shares may change.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

2

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

FUND PERFORMANCE

Performance(1)

Symbol | | ETY | |

Total Cumulative Returns (by share price, New York Stock Exchange) | | | |

Life of Fund (11/30/06) | | -3.63 | % |

| | | |

Total Cumulative Returns (at net asset value) | | | |

Life of Fund (11/30/06) | | 10.26 | % |

(1) Share price and net asset value on 11/30/06 are calculated assuming an offering price of $20.00, less the sales load of $0.90 per share paid by the shareholder.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. The Fund’s performance at market share price will differ from its results at NAV. Although share price performance generally reflects investment results over time, during shorter periods, returns at share price can also be affected by factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for the Fund’s shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. For performance as of the most recent month end, please refer to www.eatonvance.com.

Top Ten Equity Holdings(2)

By total investments

General Electric Co. | | 2.5 | % |

Exxon Mobil Corp. | | 2.5 | |

Anadarko Petroeum Corp. | | 2.5 | |

Verizon Communications, Inc. | | 2.3 | |

AT&T, Inc. | | 2.3 | |

McDonald’s Corp. | | 2.2 | |

Pfizer, Inc. | | 2.2 | |

Southern Copper Corp. | | 2.1 | |

Microsoft Corp. | | 1.9 | |

American International Group, Inc. | | 1.6 | |

(2) Top Ten Equity Holdings represented 22.1% of the Fund’s total investments as of October 31, 2007. Holdings are subject to change due to active management.

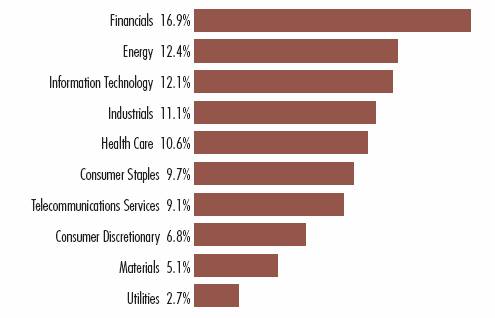

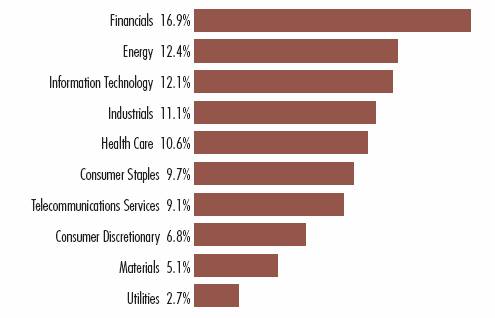

Common Stock Sector Allocation(3)

By total investments

(3) As a percentage of the Fund’s total investments as of October 31, 2007. Fund information may not be representative of the Fund’s current or future investments and may change due to active management.

3

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

PORTFOLIO OF INVESTMENTS

| Common Stocks — 94.7%(1) | |

| Security | | Shares | | Value | |

| Aerospace & Defense — 3.5% | |

| Boeing Co. | | | 243,855 | | | $ | 24,041,664 | | |

| Honeywell International, Inc. | | | 318,095 | | | | 19,216,119 | | |

| Raytheon Co. | | | 338,352 | | | | 21,522,571 | | |

| United Technologies Corp. | | | 499,830 | | | | 38,281,980 | | |

| | | $ | 103,062,334 | | |

| Air Freight & Logistics — 0.8% | |

| FedEx Corp. | | | 220,636 | | | $ | 22,800,524 | | |

| | | $ | 22,800,524 | | |

| Beverages — 2.6% | |

| Coca-Cola Co. | | | 633,605 | | | $ | 39,131,445 | | |

| PepsiCo, Inc. | | | 510,203 | | | | 37,612,165 | | |

| | | $ | 76,743,610 | | |

| Biotechnology — 1.5% | |

| Amgen, Inc.(2) | | | 302,040 | | | $ | 17,551,544 | | |

| Celgene Corp.(2) | | | 178,162 | | | | 11,758,692 | | |

| Gilead Sciences, Inc.(2) | | | 304,411 | | | | 14,060,744 | | |

| | | $ | 43,370,980 | | |

| Capital Markets — 4.5% | |

| Bank of New York Mellon Corp. | | | 654,360 | | | $ | 31,965,486 | | |

| Goldman Sachs Group, Inc. | | | 135,503 | | | | 33,593,904 | | |

| Lehman Brothers Holdings, Inc. | | | 273,719 | | | | 17,337,361 | | |

| Merrill Lynch & Co., Inc. | | | 356,681 | | | | 23,548,080 | | |

| Morgan Stanley | | | 383,836 | | | | 25,816,809 | | |

| | | $ | 132,261,640 | | |

| Chemicals — 1.3% | |

| Dow Chemical Co. | | | 258,649 | | | $ | 11,649,551 | | |

| Du Pont E.I. de Nemours and Co. | | | 245,478 | | | | 12,153,616 | | |

| Monsanto Co. | | | 159,802 | | | | 15,601,469 | | |

| | | $ | 39,404,636 | | |

| Commercial Banks — 2.9% | |

| Marshall & Ilsley Corp. | | | 649,313 | | | $ | 27,725,665 | | |

| Wachovia Corp. | | | 573,042 | | | | 26,205,211 | | |

| Wells Fargo & Co. | | | 873,179 | | | | 29,696,818 | | |

| | | $ | 83,627,694 | | |

| Security | | Shares | | Value | |

| Communications Equipment — 4.1% | |

| Cisco Systems, Inc.(2) | | | 1,177,355 | | | $ | 38,923,356 | | |

| Corning, Inc. | | | 504,116 | | | | 12,234,895 | | |

| Motorola, Inc. | | | 787,475 | | | | 14,796,655 | | |

| Nokia Oyj ADR | | | 906,326 | | | | 35,999,269 | | |

| QUALCOMM, Inc. | | | 452,566 | | | | 19,338,145 | | |

| | | $ | 121,292,320 | | |

| Computer Peripherals — 5.0% | |

| Apple, Inc.(2) | | | 176,579 | | | $ | 33,541,181 | | |

| Dell, Inc.(2) | | | 630,205 | | | | 19,284,273 | | |

| EMC Corp.(2) | | | 1,304,899 | | | | 33,131,386 | | |

| Hewlett-Packard Co. | | | 563,667 | | | | 29,130,311 | | |

| IBM Corp. | | | 278,079 | | | | 32,290,533 | | |

| | | $ | 147,377,684 | | |

| Consumer Finance — 1.0% | |

| American Express Co. | | | 471,302 | | | $ | 28,725,857 | | |

| | | $ | 28,725,857 | | |

| Containers & Packaging — 0.9% | |

| Temple-Inland, Inc. | | | 507,571 | | | $ | 27,241,336 | | |

| | | $ | 27,241,336 | | |

| Distributors — 0.8% | |

| Genuine Parts Co. | | | 502,283 | | | $ | 24,647,027 | | |

| | | $ | 24,647,027 | | |

| Diversified Financial Services — 3.0% | |

| Bank of America Corp. | | | 539,278 | | | $ | 26,036,342 | | |

| Citigroup, Inc. | | | 429,420 | | | | 17,992,698 | | |

| JPMorgan Chase & Co. | | | 929,131 | | | | 43,669,157 | | |

| | | $ | 87,698,197 | | |

| Diversified Telecommunication Services — 4.4% | |

| AT&T, Inc. | | | 1,551,359 | | | $ | 64,831,293 | | |

| Verizon Communications, Inc. | | | 1,413,136 | | | | 65,103,176 | | |

| | | $ | 129,934,469 | | |

| Electric Utilities — 2.1% | |

| American Electric Power Co., Inc. | | | 309,756 | | | $ | 14,933,337 | | |

| Duke Energy Corp. | | | 768,569 | | | | 14,733,468 | | |

See notes to financial statements

4

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Electric Utilities (continued) | |

| Exelon Corp. | | | 190,453 | | | $ | 15,765,699 | | |

| FPL Group, Inc. | | | 233,557 | | | | 15,979,970 | | |

| | | $ | 61,412,474 | | |

| Electrical Equipment — 0.9% | |

| Emerson Electric Co. | | | 490,302 | | | $ | 25,628,086 | | |

| | | $ | 25,628,086 | | |

| Energy Equipment & Services — 3.4% | |

| Diamond Offshore Drilling, Inc. | | | 192,801 | | | $ | 21,830,857 | | |

| Halliburton Co. | | | 448,036 | | | | 17,661,579 | | |

| Schlumberger, Ltd. | | | 352,024 | | | | 33,994,958 | | |

| Transocean, Inc.(2) | | | 225,051 | | | | 26,864,338 | | |

| | | $ | 100,351,732 | | |

| Food & Staples Retailing — 2.1% | |

| Walgreen Co. | | | 716,975 | | | $ | 28,428,059 | | |

| Wal-Mart Stores, Inc. | | | 747,078 | | | | 33,775,396 | | |

| | | $ | 62,203,455 | | |

| Food Products — 1.0% | |

| Kraft Foods, Inc., Class A | | | 865,522 | | | $ | 28,917,090 | | |

| | | $ | 28,917,090 | | |

| Health Care Equipment & Supplies — 0.7% | |

| Medtronic, Inc. | | | 416,089 | | | $ | 19,739,262 | | |

| | | $ | 19,739,262 | | |

| Health Care Providers & Services — 1.5% | |

| UnitedHealth Group, Inc. | | | 442,210 | | | $ | 21,734,621 | | |

| WellPoint, Inc.(2) | | | 276,083 | | | | 21,874,056 | | |

| | | $ | 43,608,677 | | |

| Hotels, Restaurants & Leisure — 2.2% | |

| McDonald's Corp. | | | 1,079,018 | | | $ | 64,417,375 | | |

| | | $ | 64,417,375 | | |

| Household Products — 1.2% | |

| Procter & Gamble Co. | | | 510,772 | | | $ | 35,508,869 | | |

| | | $ | 35,508,869 | | |

| Security | | Shares | | Value | |

| Industrial Conglomerates — 2.5% | |

| General Electric Co. | | | 1,763,332 | | | $ | 72,578,745 | | |

| | | $ | 72,578,745 | | |

| Insurance — 4.6% | |

| American International Group, Inc. | | | 735,490 | | | $ | 46,424,129 | | |

| Berkshire Hathaway, Inc., Class A(2) | | | 204 | | | | 27,030,000 | | |

| MetLife, Inc. | | | 458,969 | | | | 31,600,016 | | |

| Travelers Cos., Inc. | | | 552,830 | | | | 28,863,254 | | |

| | | $ | 133,917,399 | | |

| Internet Software & Services — 1.3% | |

| eBay, Inc.(2) | | | 299,153 | | | $ | 10,799,423 | | |

| Google Inc., Class A(2) | | | 40,029 | | | | 28,300,503 | | |

| | | $ | 39,099,926 | | |

| IT Services — 0.6% | |

| Automatic Data Processing, Inc. | | | 336,066 | | | $ | 16,655,431 | | |

| | | $ | 16,655,431 | | |

| Machinery — 2.7% | |

| Caterpillar, Inc. | | | 247,470 | | | $ | 18,463,737 | | |

| Danaher Corp. | | | 483,008 | | | | 41,379,295 | | |

| ITT Industries, Inc. | | | 291,331 | | | | 19,495,870 | | |

| | | $ | 79,338,902 | | |

| Media — 1.5% | |

| Time Warner Inc. | | | 1,157,715 | | | $ | 21,139,876 | | |

| Walt Disney Co. | | | 619,493 | | | | 21,453,043 | | |

| | | $ | 42,592,919 | | |

| Metals & Mining — 2.7% | |

| Alcoa, Inc. | | | 251,584 | | | $ | 9,960,211 | | |

| Freeport-McMoRan Copper & Gold, Inc., Class B | | | 89,158 | | | | 10,492,113 | | |

| Southern Copper Corp. | | | 426,559 | | | | 59,590,292 | | |

| | | $ | 80,042,616 | | |

| Multiline Retail — 0.7% | |

| Target Corp. | | | 319,597 | | | $ | 19,610,472 | | |

| | | $ | 19,610,472 | | |

See notes to financial statements

5

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Multi-Utilities — 0.5% | |

| Dominion Resources, Inc. | | | 168,487 | | | $ | 15,438,464 | | |

| | | $ | 15,438,464 | | |

| Oil, Gas & Consumable Fuels — 8.8% | |

| Anadarko Petroleum Corp. | | | 1,205,201 | | | $ | 71,130,963 | | |

| Chevron Corp. | | | 320,462 | | | | 29,325,478 | | |

| ConocoPhillips | | | 428,881 | | | | 36,437,730 | | |

| Devon Energy Corp. | | | 342,347 | | | | 31,975,210 | | |

| Exxon Mobil Corp. | | | 779,389 | | | | 71,695,994 | | |

| Valero Energy Corp. | | | 244,902 | | | | 17,248,448 | | |

| | | $ | 257,813,823 | | |

| Pharmaceuticals — 6.7% | |

| Abbott Laboratories | | | 445,257 | | | $ | 24,319,937 | | |

| Bristol-Myers Squibb Co. | | | 590,485 | | | | 17,708,645 | | |

| Johnson & Johnson | | | 488,743 | | | | 31,851,381 | | |

| Merck & Co., Inc. | | | 492,770 | | | | 28,708,780 | | |

| Pfizer, Inc. | | | 2,551,679 | | | | 62,796,820 | | |

| Schering-Plough Corp. | | | 498,418 | | | | 15,211,717 | | |

| Wyeth | | | 351,063 | | | | 17,072,194 | | |

| | | $ | 197,669,474 | | |

| Retail-Food and Drug — 1.0% | |

| CVS Caremark Corp. | | | 734,283 | | | $ | 30,671,001 | | |

| | | $ | 30,671,001 | | |

| Road & Rail — 0.6% | |

| CSX Corp. | | | 381,513 | | | $ | 17,080,337 | | |

| | | $ | 17,080,337 | | |

| Semiconductors & Semiconductor Equipment — 2.3% | |

| Applied Materials, Inc. | | | 802,297 | | | $ | 15,580,608 | | |

| Intel Corp. | | | 1,285,946 | | | | 34,591,947 | | |

| Texas Instruments, Inc. | | | 485,599 | | | | 15,830,527 | | |

| | | $ | 66,003,082 | | |

| Software — 2.7% | |

| Microsoft Corp. | | | 1,510,088 | | | $ | 55,586,339 | | |

| Oracle Corp.(2) | | | 1,027,978 | | | | 22,790,272 | | |

| | | $ | 78,376,611 | | |

| Security | | Shares | | Value | |

| Specialty Retail — 1.0% | |

| Home Depot, Inc. | | | 525,680 | | | $ | 16,564,177 | | |

| Lowe's Companies, Inc. | | | 506,358 | | | | 13,615,967 | | |

| | | $ | 30,180,144 | | |

| Textiles, Apparel & Luxury Goods — 0.5% | |

| Nike, Inc., Class B | | | 231,971 | | | $ | 15,370,398 | | |

| | | $ | 15,370,398 | | |

| Thrifts & Mortgage Finance — 0.6% | |

| Fannie Mae | | | 330,088 | | | $ | 18,828,220 | | |

| | | $ | 18,828,220 | | |

| Tobacco — 1.6% | |

| Altria Group, Inc. | | | 627,274 | | | $ | 45,747,093 | | |

| | | $ | 45,747,093 | | |

| Wireless Telecommunication Services — 0.4% | |

| SprintNextel Corp. | | | 652,403 | | | $ | 11,156,091 | | |

| | | $ | 11,156,091 | | |

Total Common Stocks

(identified cost $2,582,352,423) | | $ | 2,778,146,476 | | |

| Other Investments — 0.0% | |

| Description | | Shares | | Value | |

| Cairn Energy PLC, Class B, Deferred Shares(2)(3) | | | 1,033,567 | | | $ | 0 | | |

| Kelda Group PLC, Deferred Shares(2)(3) | | | 773,591 | | | | 0 | | |

Total Other Investments

(identified cost $0) | | $ | 0 | | |

| Put Options Purchased — 0.4% | |

| Type of contract | | Number of

Contracts | | Value | |

| S&P 500 Index, Expires 03/22/08, Strike 1,425 | | | 100 | | | $ | 338,000 | | |

| S&P 500 Index, Expires 03/22/08, Strike 1,455 | | | 480 | | | | 1,824,000 | | |

| S&P 500 Index, Expires 03/22/08, Strike 1,460 | | | 687 | | | | 2,686,170 | | |

| S&P 500 Index, Expires 03/22/08, Strike 1,465 | | | 730 | | | | 2,938,250 | | |

| S&P 500 Index, Expires 03/22/08, Strike 1,470 | | | 997 | | | | 4,127,580 | | |

Total Put Options Purchased

(identified cost $24,606,632) | | $ | 11,914,000 | | |

See notes to financial statements

6

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

| Short-Term Investments — 3.0% | |

| Description | | Interest

(000's omitted) | | Value | |

| Investment in Cash Management Portfolio, 4.83%(4) | | | 89,219 | | | $ | 89,218,917 | | |

Total Short-Term Investments

(identified cost $89,218,917) | | $ | 89,218,917 | | |

Total Investments — 98.1%

(identified cost $2,696,177,972) | | $ | 2,879,279,393 | | |

| Covered Call Options Written — (0.8%) | |

| Type of Contract | | Number of

Contracts | | Premiums

Received | | Value | |

S&P 500 Index, Expires 11/17/07,

Strike 1,535 | | | 3,954 | | | $ | 12,416,570 | | | $ | (12,099,240 | ) | |

S&P 500 Index, Expires 11/17/07,

Strike 1,545 | | | 2,635 | | | | 8,529,444 | | | | (6,324,000 | ) | |

S&P 500 Index, Expires 11/17/07,

Strike 1,550 | | | 1,971 | | | | 5,909,255 | | | | (3,942,000 | ) | |

S&P 500 Index, Expires 11/17/07,

Strike 1,560 | | | 870 | | | | 2,190,686 | | | | (1,305,000 | ) | |

Total Covered Call Options Written

(premiums received $29,045,955) | | $ | (23,670,240 | ) | |

| Other Assets, Less Liabilities — 2.7% | | $ | 78,100,861 | | |

| Net Assets — 100.0% | | $ | 2,933,710,014 | | |

ADR - American Depository Receipt

(1) A portion of each common stock has been segregated as collateral for options written.

(2) Non-income producing security.

(3) Security valued at fair value using methods determined in good faith by or at the direction of the Trustees.

(4) Affiliated investment company available to Eaton Vance portfolios and funds which invests in high quality U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of October 31, 2007.

See notes to financial statements

7

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of October 31, 2007

| Assets | |

| Unaffiliated investments, at value (identified cost, $2,606,959,055) | | $ | 2,790,060,476 | | |

| Affiliated investment, at value (identified cost, $89,218,917) | | | 89,218,917 | | |

| Foreign currency, at value (identified cost, $1,330,408) | | | 1,337,037 | | |

| Receivable for investments sold | | | 99,090,318 | | |

| Dividends receivable | | | 3,329,268 | | |

| Interest receivable from affiliated investment | | | 439,091 | | |

| Tax reclaims receivable | | | 3,367,167 | | |

| Total assets | | $ | 2,986,842,274 | | |

| Liabilities | |

| Payable for investments purchased | | $ | 26,487,448 | | |

| Written options outstanding, at value (premiums received $29,045,955) | | | 23,670,240 | | |

| Payable to affiliate for investment advisory fee | | | 2,421,520 | | |

| Payable to affiliate for Trustees' fees | | | 3,152 | | |

| Other accrued expenses | | | 549,900 | | |

| Total liabilities | | $ | 53,132,260 | | |

| Net Assets | | $ | 2,933,710,014 | | |

| Sources of Net Assets | |

Common Shares, $0.01 par value, unlimited number of shares

authorized, 149,711,079 shares issued and outstanding | | $ | 1,497,111 | | |

| Additional paid-in capital | | | 2,842,655,923 | | |

| Accumulated net realized loss (computed on the basis of identified cost) | | | (99,126,430 | ) | |

| Net unrealized appreciation (computed on the basis of identified cost) | | | 188,683,410 | | |

| Net Assets | | $ | 2,933,710,014 | | |

| Net Asset Value | |

| ($2,933,710,014 ÷ 149,711,079 shares issued and outstanding) | | $ | 19.60 | | |

Statement of Operations

For the Period Ended

October 31, 2007(1)

| Investment Income | |

| Dividends (net of foreign taxes, $15,249,893) | | $ | 218,115,990 | | |

| Interest | | | 995,928 | | |

| Interest income allocated from affiliated investment | | | 3,745,058 | | |

| Expenses allocated from affiliated investment | | | (348,413 | ) | |

| Total investment income | | $ | 222,508,563 | | |

| Expenses | |

| Investment adviser fee | | $ | 26,343,276 | | |

| Trustees' fees and expenses | | | 20,967 | | |

| Custodian fee | | | 851,955 | | |

| Printing and postage | | | 365,950 | | |

| Legal and accounting services | | | 192,145 | | |

| Transfer and dividend disbursing agent fees | | | 65,062 | | |

| Organization expenses | | | 15,000 | | |

| Miscellaneous | | | 236,868 | | |

| Total expenses | | $ | 28,091,223 | | |

Deduct —

Expense reimbursement from investment adviser | | $ | 15,000 | | |

| Total expense reductions | | $ | 15,000 | | |

| Net expenses | | $ | 28,076,223 | | |

| Net investment income | | $ | 194,432,340 | | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) —

Investment transactions (identified cost basis) | | $ | (79,790,432 | ) | |

| Written options | | | (19,335,998 | ) | |

| Foreign currency transactions | | | (1,870,955 | ) | |

| Net realized loss | | $ | (100,997,385 | ) | |

Change in unrealized appreciation (depreciation) —

Investments (identified cost basis) | | $ | 183,101,421 | | |

| Written options | | | 5,375,715 | | |

| Foreign currency | | | 206,274 | | |

| Net change in unrealized appreciation (depreciation) | | $ | 188,683,410 | | |

| Net realized and unrealized gain | | $ | 87,686,025 | | |

| Net increase in net assets from operations | | $ | 282,118,365 | | |

(1) For the period from the start of business, November 30, 2006, to October 31, 2007.

See notes to financial statements

8

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | | Period Ended

October 31, 2007(1) | |

From operations —

Net investment income | | $ | 194,432,340 | | |

Net realized loss from investment transactions,

written options and foreign currency transactions | | | (100,997,385 | ) | |

Net change in unrealized appreciation (depreciation)

of investments, written options and foreign currency | | | 188,683,410 | | |

| Net increase in net assets from operations | | $ | 282,118,365 | | |

Distributions to shareholders —

From net investment income | | $ | (192,561,385 | ) | |

| From tax return of capital | | | (14,497,588 | ) | |

| Total distributions to shareholders | | $ | (207,058,973 | ) | |

Capital share transactions —

Proceeds from sale of shares | | $ | 2,841,125,000 | (2) | |

| Reinvestment of distributions to shareholders | | | 18,767,049 | | |

| Offering costs | | | (1,341,427 | ) | |

| Total increase in net assets from capital share transactions | | $ | 2,858,550,622 | | |

| Net increase in net assets | | $ | 2,933,610,014 | | |

| Net Assets | |

| At beginning of period | | $ | 100,000 | | |

| At end of period | | $ | 2,933,710,014 | | |

(1) For the period from the start of business, November 30, 2006, to October 31, 2007.

(2) Proceeds from sales of shares net of sales load paid of $133,875,000.

See notes to financial statements

9

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Period Ended

October 31, 2007(2) | |

| Net asset value — Beginning of period | | $ | 19.100 | (3) | |

| Income from operations | |

| Net investment income(1) | | $ | 1.314 | | |

| Net realized and unrealized gain | | | 0.583 | | |

| Total income from operations | | $ | 1.897 | | |

| Less distributions | |

| From net investment income | | $ | (1.290 | ) | |

| From tax return of capital | | | (0.098 | ) | |

| Total distributions | | $ | (1.388 | ) | |

| Offering costs charged to paid-in capital(1) | | $ | (0.009 | ) | |

| Net asset value — End of period | | $ | 19.600 | | |

| Market value — End of period | | $ | 17.130 | | |

| Total Investment Return on Net Asset Value(4) | | | 10.26 | %(5)(7) | |

| Total Investment Return on Market Value(4) | | | (3.63 | )%(5)(7) | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000's omitted) | | $ | 2,933,710 | | |

| Expenses | | | 1.06 | %(6) | |

| Net investment income | | | 7.27 | %(6) | |

| Portfolio Turnover | | | 221 | % | |

(1) Computed using average shares outstanding.

(2) For the period from the start of business, November 30, 2006, to October 31, 2007.

(3) Net asset value at beginning of period reflects a deduction of the sales load of $0.90 per share by the shareholder from the $20.00 offering price.

(4) Returns are historical and are calculated by determining the percentage change in market value or net asset value with all distributions reinvested.

(5) Total investment return on net asset value is calculated assuming a purchase at the offering price of $20.00 less the sales load of $0.90 per share paid by the shareholder on the first day and a sale at the net asset value on the last day of the period reported with all distributions reinvested. Total investment return on market value is calculated assuming a purchase at the offering price of $20.00 less the sales load of $0.90 per share paid by the shareholder on the first day and a sale at the current market price on the last day of the period reported with all distributions reinvested.

(6) Annualized.

(7) Not Annualized.

See notes to financial statements

10

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Eaton Vance Tax-Managed Diversified Equity Income Fund (the Fund) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a diversified, closed-end management investment company. The Fund was organized under the laws of the Commonwealth of Massachusetts by an Agreement and Declaration of Trust dated October 5, 2005. The Fund's primary investment objective is to provide current income and gains, with a secondary objective of capital appreciation. The Fund pursues its investment objectives by investing primarily in a diversified portfolio of common stocks. Under normal market conditions, the Fund will seek to generate current earnings in part by writing (selling) stock index call options on the S&P 500 Index and investing in dividend-paying common stock. The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally ac cepted in the United States of America.

A Investment Valuation — Securities listed on a U.S. securities exchange generally are valued at the last sale price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ Global or Global Select Market generally are valued at the official NASDAQ closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices or, in the case of preferred equity securities that are not listed or traded in the over-the-counter market, by an independent pricing service. Exchange-traded options are valued at the last sale price for the day of valuation as quoted on the principal exchange or board of trade on which the options are traded or, in the absence of sales on such date, at the mean between the latest bid and asked prices. Futures positions on securities and currencies generally are valued at closing settlement prices. Short-term debt securities with a remaining maturity of 60 days or less are valued at amortized cost. If short-term debt securities are acquired with a remaining maturity of more than 60 days, they will be valued by a pricing service. Other fixed income and debt securities, including listed securities and securities for which price quotations are available, will normally be valued on the basis of valuations furnished by a pricing service. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by an independent quotation service. The daily valuation of exchange traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Trustees have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair valued securities. Investments held by the Fund for which valuations or market quotations are unavailable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Fund considering relevant factors, data and information including the market value of freely tradable securities of the same class in the principal market on which such securities are normally traded.

The Fund may invest in Cash Management Portfolio (Cash Management), an affiliated investment company managed by Boston Management and Research (BMR), a subsidiary of Eaton Vance Management (EVM). Cash Management values its investment securities utilizing the amortized cost valuation technique permitted by Rule 2a-7 of the 1940 Act. This technique involves initially valuing a portfolio security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

B Income — Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Fund is informed of the ex-dividend date. Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

C Federal Taxes — The Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its taxable income, including any net realized capital gain on investments. Accordingly, no provision for federal income or excise tax is necessary. At October 31, 2007, the Fund, for federal income tax purposes, had a capital loss carryforward of $101,048,122 which will reduce the taxable income arising from future net realized gain on investments, if any, to the extent permitted by the Internal Revenue Code and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income or ex cise tax. Such capital loss carryforward will expire on October 31, 2015.

11

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS CONT'D

D Organization and Offering Costs — Costs incurred by a Fund in connection with its organization are expensed. Costs incurred by the Fund in connection with the offering were recorded as a reduction of capital paid in excess of par.

E Written Options — Upon the writing of a call or a put option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the option written in accordance with the Fund's policies on investment valuations discussed above. Premiums received from writing options which expire are treated as realized gains. Premiums received from writing options which are exercised or are closed are added to or offset against the proceeds or amount paid on the transaction to determine the realized gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund, as writer of an option, may have no control over whether the underlying securities may be sold (call) or purchased (put) and, as a result, bears the market risk of an unfavorable change in the price of the securities underlying the written option.

F Purchased Options — Upon the purchase of a call or put option, the premium paid by the Fund is included in the Statement of Assets and Liabilities as an investment. The amount of the investment is subsequently marked-to-market to reflect the current market value of the option purchased, in accordance with the Fund's policies on investment valuations discussed above. If an option which the Fund has purchased expires on the stipulated expiration date, the Fund will realize a loss in the amount of the cost of the option. If the Fund enters into a closing sale transaction, the Fund will realize a gain or loss, depending on whether the sales proceeds from the closing sale transaction are greater or less than the cost of the option. If the Fund exercises a put option, it will realize a gain or loss from the sale of the underlying security, and the proceeds from such sale will be decreased by the premium originally paid. If the Fund exercises a call option, the cost of the security which the Fund purchases upon exercise will be increased by the premium originally paid.

G Foreign Currency Translation — Investment valuations, other assets, and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuation s in foreign currency exchange rates is not separately disclosed.

H Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

I Indemnifications — Under the Fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund, and shareholders are indemnified against personal liability for obligations of the Fund. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

J Other — Investment transactions are accounted for on a trade date basis. Realized gains and losses are computed on the specific identification of the securities sold.

K Expense Reduction — State Street Bank and Trust Company (SSBT) serves as custodian of the Fund. Pursuant to the custodian agreement, SSBT receives a fee reduced by credits, which are determined based on the average daily cash balance the Fund maintains with SSBT. All credit balances, if any, used to reduce the Fund's custodian fees are reported as a reduction of expenses in the Statement of Operations.

2 Distributions to Shareholders

The Fund intends to make regular quarterly distributions sourced from the Fund's cash available for distribution. "Cash available for distribution" will consist of the Fund's dividends and interest income after payment of Fund expenses, net option premiums, and net realized and unrealized gains on stock investments. The Fund's annual distributions will likely differ from annual net investment income. The investment income of the Fund will consist of all dividend and interest income accrued on portfolio investments, short-term capital gain (including short-term gains on option positions and gains on the sale of portfolio

12

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS CONT'D

investments held for one year or less) in excess of long-term capital loss and income from certain hedging transactions, less all expenses of the Fund. If the Fund's total quarterly distributions in any year exceed the amount of its net investment income for the year, any such excess would be characterized as a return of capital for federal income tax purposes to the extent not designated as a capital gain dividend. Distributions in any year may include a substantial return of capital component. At least annually, the Fund intends to distribute all or substantially all of its net realized capital gains, if any. The final determination of tax characteristics of the Fund's distributions will occur after the end of the year, at which time it will be reported to shareholders. As portfolio and market conditions change, the rate of distributions and the Fund's distribution policy could change. Distributions are recorded on the ex-divi dend date. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital.

The tax character of the distributions paid for the period from the start of business, November 30, 2006, to October 31, 2007 was as follows:

| | | Period Ended

October 31, 2007 | |

| Distributions declared from: | |

| Ordinary income | | $ | 192,561,385 | | |

| Tax return of capital | | $ | 14,497,588 | | |

During the period from the start of business, November 30, 2006, to October 31, 2007, undistributed net investment income was decreased by $1,870,955 and accumulated net realized loss was decreased by $1,870,955 due to differences between book and tax accounting for foreign currency transactions. These reclassifications had no effect on the net assets or the net asset value per share of the Fund.

As of October 31, 2007, the components of distributable earnings (accumulated losses) and unrealized appreciation (depreciation) on a tax basis were as follows:

| Capital loss carryforward | | $ | (101,048,122 | ) | |

| Unrealized appreciation | | $ | 190,605,102 | | |

The differences between components of distributable earnings (accumulated losses) on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to differences in book and tax policies for wash sales and options.

3 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by EVM, as compensation for management and investment advisory services rendered to the Fund. Under the advisory agreement, EVM receives a monthly advisory fee in the amount of 1.00% annually of average daily gross assets of the Fund. EVM serves as the administrator of the Fund, but currently receives no compensation for providing administrative services to the Fund. The portion of the advisory fee payable by Cash Management on the Fund's investment of cash therein is credited against the Fund's advisory fee. For the period from the start of business, November 30, 2006, to October 31, 2007, the Fund's advisory fee totaled $26,678,388, of which $335,112 was allocated from Cash Management and $26,343,276 was paid or accrued directly by the Fund. Pursuant to a sub-advisory agreement, EVM has delegated the investment management of the Fund's option strategy to Rampart Investment Management Compan y (Rampart). EVM pays Rampart a fee at an annual rate equal to 0.05% of the value of the Fund's average daily gross assets that is subject to written call options for sub-advisory services provided to the Fund.

EVM has agreed to reimburse the Fund for costs incurred in the Fund's organization. For the period from the start of business, November 30, 2006, to October 31, 2007, EVM reimbursed the Fund $15,000 in organization expenses.

Except for Trustees of the Fund who are not members of EVM's organization, officers and Trustees receive remuneration for their services to the Funds out of the investment adviser fee. Certain officers and one Trustee of the Funds are officers of EVM.

Certain officers and Trustees of the Fund are officers of the above organization.

4 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations, aggregated $8,750,102,395 and $6,099,442,044, respectively, for the period from the start of business, November 30, 2006, to October 31, 2007.

13

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS CONT'D

5 Federal Income Tax Basis of Unrealized Appreciation (Depreciation)

The cost and unrealized appreciation (depreciation) in value of investments owned by the Fund at October 31, 2007, as determined on a federal income tax basis, were as follows:

| Aggregate cost | | $ | 2,688,880,565 | | |

| Gross unrealized appreciation | | $ | 235,147,692 | | |

| Gross unrealized depreciation | | | (44,748,864 | ) | |

| Net unrealized appreciation | | $ | 190,398,828 | | |

The net unrealized appreciation on foreign currency transactions at October 31, 2007 on a federal income tax basis was $206,274.

6 Shares of Beneficial Interest

The Agreement and Declaration of Trust permits the Fund to issue an unlimited number of full and fractional $0.01 par value shares of beneficial interest. In addition, the Fund has issued common shares pursuant to the Fund's dividend reinvestment plan. Transactions in shares for the period from the start of business, November 30, 2006 to October 31, 2007 were as follows:

| | | Period Ended

October 31, 2007(1) | |

| Sales | | | 148,755,000 | | |

Issued to shareholders electing to receive

payments of distributions in Fund shares | | | 956,079 | | |

| Net increase | | | 149,711,079 | | |

(1) For the period from the start of business, November 30, 2006, to October 31, 2007.

7 Financial Instruments

The Fund may trade in financial instruments with off-balance sheet risk in the normal course of its investing activities to assist in managing exposure to various market risks. These financial instruments may include written options, forward foreign currency exchange contracts and financial futures contracts and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. The notional or contractual amounts of these instruments represent the investment the Fund has in particular classes of financial instruments and does not necessarily represent the amounts potentially subject to risk. The measurement of the risks associated with these instruments is meaningful only when all related and offsetting transactions are considered. A summary of obligations under these financial instruments at October 31, 2007 is included in the Portfolio of Investments.

Written options activity for the period from the start of business, November 30, 2006, to October 31, 2007 was as follows:

| | | Number of

Contracts | | Premiums

Received | |

| Outstanding, beginning of period | | | — | | | $ | — | | |

| Options written | | | 119,155 | | | | 226,437,073 | | |

Options terminated in closing

purchase transactions | | | (103,015 | ) | | | (196,730,832 | ) | |

| Options expired | | | (6,710 | ) | | | (660,286 | ) | |

| Outstanding, end of period | | | 9,430 | | | $ | 29,045,955 | | |

All of the assets of the Fund are subject to segregation to satisfy the requirements of the escrow agent. At October 31, 2007, the Fund had sufficient cash and/or securities to cover commitments under these contracts.

8 Risks Associated with Foreign Investments

Investing in securities issued by companies whose principal business activities are outside the United States may involve significant risks not present in domestic investments. For example, there is generally less publicly available information about foreign companies, particularly those not subject to the disclosure and reporting requirements of the U.S. securities laws. Foreign issuers are generally not bound by uniform accounting, auditing, and financial reporting requirements and standards of practice comparable to those applicable to domestic issuers. Investments in foreign securities also involve the risk of possible adverse changes in investment or exchange control regulations, expropriation or confiscatory taxation, limitation on the removal of funds or other assets of the Fund, political or financial instability or diplomatic and other developments which could affect such investments. Foreign stock markets, while growin g in volume and sophistication, are generally not as developed as those in the United States, and securities of some foreign issuers (particularly those located in developing countries) may be less liquid and more volatile than securities of comparable U.S. companies. In general, there is less overall governmental supervision and regulation of foreign securities markets, broker-dealers and issuers than in the United States.

14

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS CONT'D

9 Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48 (FIN 48), "Accounting for Uncertainty in Income Taxes — an interpretation of FASB Statement No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109, "Accounting for Income Taxes". This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective on the last business day of the first required financial reporting period for fiscal years beginning after December 15, 2006. Management is currently evaluating the impact of applying the various provisions of FIN 48.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157 (FAS 157), "Fair Value Measurements". FAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact the adoption of FAS 157 will have on the Fund's financial statement disclosures.

15

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees and Shareholders

of Eaton Vance Tax-Managed

Diversified Equity Income Fund:

We have audited the accompanying statement of assets and liabilities of Eaton Vance Tax-Managed Diversified Equity Income Fund (the "Fund"), including the portfolio of investments, as of October 31, 2007, and the related statement of operations, the statement of changes in net assets and the financial highlights for the period from the start of business, November 30, 2006, to October 31, 2007. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and si gnificant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2007, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007, the results of its operations, the changes in its net assets, and the financial highlights for the period from the start of business, November 30, 2006, to October 31, 2007, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

December 14, 2007

16

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

OTHER MATTERS (Unaudited)

The Fund held its Annual Meeting of Shareholders on August 17, 2007. The following action was taken by the shareholders:

Item 1: The election of Benjamin C. Esty, Thomas E. Faust Jr., Allen R. Freedman and James B. Hawkes as Class I Trustees of the Fund for a three-year term expiring in 2010 and the election of Heidi L. Steiger as Class II Trustee of the Fund for a one-year term expiring in 2008.

| | | Number of Shares | |

| Nominees for Class I Trustee | | For | | Withheld | |

| Benjamin C. Esty | | | 140,038,241 | | | | 1,267,332 | | |

| Thomas E. Faust Jr. | | | 140,031,203 | | | | 1,274,370 | | |

| Allen R. Freedman | | | 139,988,517 | | | | 1,317,056 | | |

| James B. Hawkes | | | 140,016,489 | | | | 1,289,084 | | |

| | | Number of Shares | |

| Nominee for Class II Trustee | | For | | Withheld | |

| Heidi L. Steiger | | | 140,038,337 | | | | 1,267,236 | | |

17

Eaton Vance Tax-Managed Diversified Equity Income Fund as of October 31, 2007

FEDERAL TAX INFORMATION (Unaudited)

The Form 1099-DIV you receive in January 2008 will show the tax status of all distributions paid to your account in calendar 2007. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code regulations, shareholders must be notified within 60 days of the Fund's fiscal year-end regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately $227,712,327, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund's dividend distribution that qualifies under tax law. For the Fund's fiscal 2007 ordinary income dividends, 45.1% qualifies for the corporate dividends received deduction.

18

Eaton Vance Tax-Managed Diversified Equity Income Fund

DIVIDEND REINVESTMENT PLAN

The Fund offers a dividend reinvestment plan (the Plan) pursuant to which shareholders automatically have dividends and capital gains distributions reinvested in common shares (the Shares) of the Fund unless they elect otherwise through their investment dealer. On the distribution payment date, if the net asset value per Share is equal to or less than the market price per Share plus estimated brokerage commissions then new Shares will be issued. The number of Shares shall be determined by the greater of the net asset value per Share or 95% of the market price. Otherwise, Shares generally will be purchased on the open market by the Plan Agent. Distributions subject to income tax (if any) are taxable whether or not shares are reinvested.

If your shares are in the name of a brokerage firm, bank, or other nominee, you can ask the firm or nominee to participate in the Plan on your behalf. If the nominee does not offer the Plan, you will need to request that your shares be re-registered in your name with the Fund's transfer agent, PFPC Inc. or you will not be able to participate.

The Plan Agent's service fee for handling distributions will be paid by the Fund. Each participant will be charged their pro rata share of brokerage commissions on all open-market purchases.

Plan participants may withdraw from the Plan at any time by writing to the Plan Agent at the address noted on the following page. If you withdraw, you will receive shares in your name for all Shares credited to your account under the Plan. If a participant elects by written notice to the Plan Agent to have the Plan Agent sell part or all of his or her Shares and remit the proceeds, the Plan Agent is authorized to deduct a $5.00 fee plus brokerage commissions from the proceeds.

If you wish to participate in the Plan and your shares are held in your own name, you may complete the form on the following page and deliver it to the Plan Agent.

Any inquires regarding the Plan can be directed to the Plan Agent, PFPC Inc., at 1-800-331-1710.

19

Eaton Vance Tax-Managed Diversified Equity Income Fund

APPLICATION FOR PARTICIPATION IN DIVIDEND REINVESTMENT PLAN

This form is for shareholders who hold their common shares in their own names. If your common shares are held in the name of a brokerage firm, bank, or other nominee, you should contact your nominee to see if it will participate in the Plan on your behalf. If you wish to participate in the Plan, but your brokerage firm, bank, or nominee is unable to participate on your behalf, you should request that your common shares be re-registered in your own name which will enable your participation in the Plan.

The following authorization and appointment is given with the understanding that I may terminate it at any time by terminating my participation in the Plan as provided in the terms and conditions of the Plan.

Please print exact name on account:

Shareholder signature Date

Shareholder signature Date

Please sign exactly as your common shares are registered. All persons whose names appear on the share certificate must sign.

YOU SHOULD NOT RETURN THIS FORM IF YOU WISH TO RECEIVE YOUR DIVIDENDS AND DISTRIBUTIONS IN CASH. THIS IS NOT A PROXY.

This authorization form, when signed, should be mailed to the following address:

Eaton Vance Tax-Managed Diversified Equity Income Fund

c/o PFPC, Inc.

P.O. Box 43027

Providence, RI 02940-3027

800-331-1710

Number of Employees

The Fund is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company and has no employees.

Number of Shareholders

As of October 31, 2007, our records indicate that there are 82 registered shareholders and approximately 109,378 shareholders owning the Fund shares in street name, such as through brokers, banks, and financial intermediaries.

If you are a street name shareholder and wish to receive our reports directly, which contain important information about the Fund, please write or call:

Eaton Vance Distributors, Inc.

The Eaton Vance Building

255 State Street

Boston, MA 02109

1-800-225-6265

New York Stock Exchange symbol

The New York Stock Exchange symbol is ETY.

20

Eaton Vance Tax-Managed Diversified Equity Income Fund

BOARD OF TRUSTEES' ANNUAL APPROVAL OF THE INVESTMENT ADVISORY AGREEMENTS

Overview of the Contract Review Process

The Investment Company Act of 1940, as amended (the "1940 Act"), provides, in substance, that each investment advisory agreement between a fund and its investment adviser will continue in effect from year to year only if its continuance is approved at least annually by the fund's board of trustees, including by a vote of a majority of the trustees who are not "interested persons" of the fund ("Independent Trustees"), cast in person at a meeting called for the purpose of considering such approval.

At a meeting of the Boards of Trustees (each a "Board") of the Eaton Vance group of mutual funds (the "Eaton Vance Funds") held on April 23, 2007, the Board, including a majority of the Independent Trustees, voted to approve continuation of existing advisory and sub-advisory agreements for the Eaton Vance Funds for an additional one-year period. In voting its approval, the Board relied upon the affirmative recommendation of the Special Committee of the Board, which is a committee comprised exclusively of Independent Trustees. Prior to making its recommendation, the Special Committee reviewed information furnished for a series of meetings of the Special Committee held in February, March and April 2007. Such information included, among other things, the following:

Information about Fees, Performance and Expenses

• An independent report comparing the advisory and related fees paid by each fund with fees paid by comparable funds;

• An independent report comparing each fund's total expense ratio and its components to comparable funds;

• An independent report comparing the investment performance of each fund to the investment performance of comparable funds over various time periods;

• Data regarding investment performance in comparison to relevant peer groups of funds and appropriate indices;

• Comparative information concerning fees charged by each adviser for managing other mutual funds and institutional accounts using investment strategies and techniques similar to those used in managing the fund;

• Profitability analyses for each adviser with respect to each fund;

Information about Portfolio Management

• Descriptions of the investment management services provided to each fund, including the investment strategies and processes employed;

• Information concerning the allocation of brokerage and the benefits received by each adviser as a result of brokerage allocation, including information concerning the acquisition of research through "soft dollar" benefits received in connection with the funds' brokerage, and the implementation of a soft dollar reimbursement program established with respect to the funds;

• Data relating to portfolio turnover rates of each fund;

• The procedures and processes used to determine the fair value of fund assets and actions taken to monitor and test the effectiveness of such procedures and processes;

Information about each Adviser

• Reports detailing the financial results and condition of each adviser;

• Descriptions of the qualifications, education and experience of the individual investment professionals whose responsibilities include portfolio management and investment research for the funds, and information relating to their compensation and responsibilities with respect to managing other mutual funds and investment accounts;

• Copies of the Codes of Ethics of each adviser and its affiliates, together with information relating to compliance with and the administration of such codes;

• Copies of or descriptions of each adviser's proxy voting policies and procedures;

• Information concerning the resources devoted to compliance efforts undertaken by each adviser and its affiliates on behalf of the funds (including descriptions of various compliance programs) and their record of compliance with investment policies and restrictions, including policies with respect to market-timing, late trading and selective portfolio disclosure, and with policies on personal securities transactions;

• Descriptions of the business continuity and disaster recovery plans of each adviser and its affiliates;

Other Relevant Information

• Information concerning the nature, cost and character of the administrative and other non-investment management services provided by Eaton Vance Management and its affiliates;

• Information concerning management of the relationship with the custodian, subcustodians and fund accountants by each adviser or the funds' administrator; and

• The terms of each advisory agreement.

21

Eaton Vance Tax-Managed Diversified Equity Income Fund

BOARD OF TRUSTEES' ANNUAL APPROVAL OF THE INVESTMENT ADVISORY AGREEMENTS CONT'D

In addition to the information identified above, the Special Committee considered information provided from time to time by each adviser throughout the year at meetings of the Board and its committees. Over the course of the twelve-month period ended April 30, 2007, the Board met ten times and the Special Committee, the Audit Committee and the Governance Committee, each of which is a Committee comprised solely of Independent Trustees, met twelve, fourteen and eight times, respectively. At such meetings, the Trustees received, among other things, presentations by the portfolio managers and other investment professionals of each adviser relating to the investment performance of each fund and the investment strategies used in pursuing the fund's investment objective.

For funds that invest through one or more underlying portfolios, the Board considered similar information about the portfolio(s) when considering the approval of advisory agreements. In addition, in cases where the fund's investment adviser has engaged a sub-adviser, the Board considered similar information about the sub-adviser when considering the approval of any sub-advisory agreement.

The Special Committee was assisted throughout the contract review process by Goodwin Procter LLP, legal counsel for the Independent Trustees. The members of the Special Committee relied upon the advice of such counsel and their own business judgment in determining the material factors to be considered in evaluating each advisory and sub-advisory agreement and the weight to be given to each such factor. The conclusions reached with respect to each advisory and sub-advisory agreement were based on a comprehensive evaluation of all the information provided and not any single factor. Moreover, each member of the Special Committee may have placed varying emphasis on particular factors in reaching conclusions with respect to each advisory and sub-advisory agreement.

Results of the Process

The Board noted that the initial approval of the investment advisory agreement and sub-advisory agreement for the Fund had occurred in November 2005 and November 2006, respectively, and that the Fund had commenced operations in November 2006. The Board, and the Special Committee of the Board also reviewed extensive information about the Adviser and Sub-adviser to the Fund in connection with their services to other Eaton Vance Funds. Based on its consideration of the information presented in connection with the other advisory contract renewals, the foregoing, and such other information as it deemed relevant, including the factors and conclusions described below, the Special Committee concluded that the continuance of the investment advisory agreement of the Eaton Vance Tax-Managed Diversified Equity Income Fund (the "Fund") with Eaton Vance Management (the "Adviser"), and the sub-advisory agreement with Rampart Investment Managem ent Company, Inc. ("Rampart," the "Sub-adviser") including their fee structures, is in the interests of shareholders and, therefore, the Special Committee recommended to the Board approval of the respective agreements. The Board accepted the recommendation of the Special Committee as well as the factors considered and conclusions reached by the Special Committee with respect to the agreements. Accordingly, the Board, including a majority of the Independent Trustees, voted to approve continuation of the investment advisory agreement and the sub-advisory agreement for the Fund.

Nature, Extent and Quality of Services

In considering whether to approve the investment advisory and sub-advisory agreements of the Fund, the Board evaluated the nature, extent and quality of services provided to the Fund by the Adviser and the Sub-adviser.

The Board considered the Adviser's and the Sub-adviser's management capabilities and investment process with respect to the types of investments held by the Fund, including the education, experience and number of its investment professionals and other personnel who provide portfolio management, investment research, and similar services to the Fund and whose responsibilities include supervising the Sub-adviser and coordinating their activities in implementing the Fund's investment strategy. In particular, the Board evaluated the abilities and experience of such investment personnel in analyzing factors such as tax efficiency and special considerations relevant to investing in stocks and selling call options on various indexes, including the S & P 500 Index. With respect to Rampart, the Board considered Rampart's business reputation and its options strategy and its past experience in implementing this strategy.

The Board reviewed the compliance programs of the Adviser and Sub-adviser and relevant affiliates thereof. Among other matters, the Board considered compliance and reporting matters relating to personal trading by investment personnel, selective disclosure of portfolio holdings, late trading, frequent trading, portfolio valuation, business continuity and the allocation of investment opportunities. The Board also evaluated the responses of the Adviser and its affiliates to requests from regulatory authorities such as the Securities and Exchange Commission and the National Association of Securities Dealers.