UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| |

| o | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | | Definitive Proxy Statement |

| |

| o | | Definitive Additional Materials |

| |

| o | | Soliciting Material Pursuant to §240.14a-12 |

MOLECULAR INSIGHT PHARMACEUTICALS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

MOLECULAR INSIGHT PHARMACEUTICALS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 12, 2008

To the Stockholders of Molecular Insight Pharmaceuticals, Inc.:

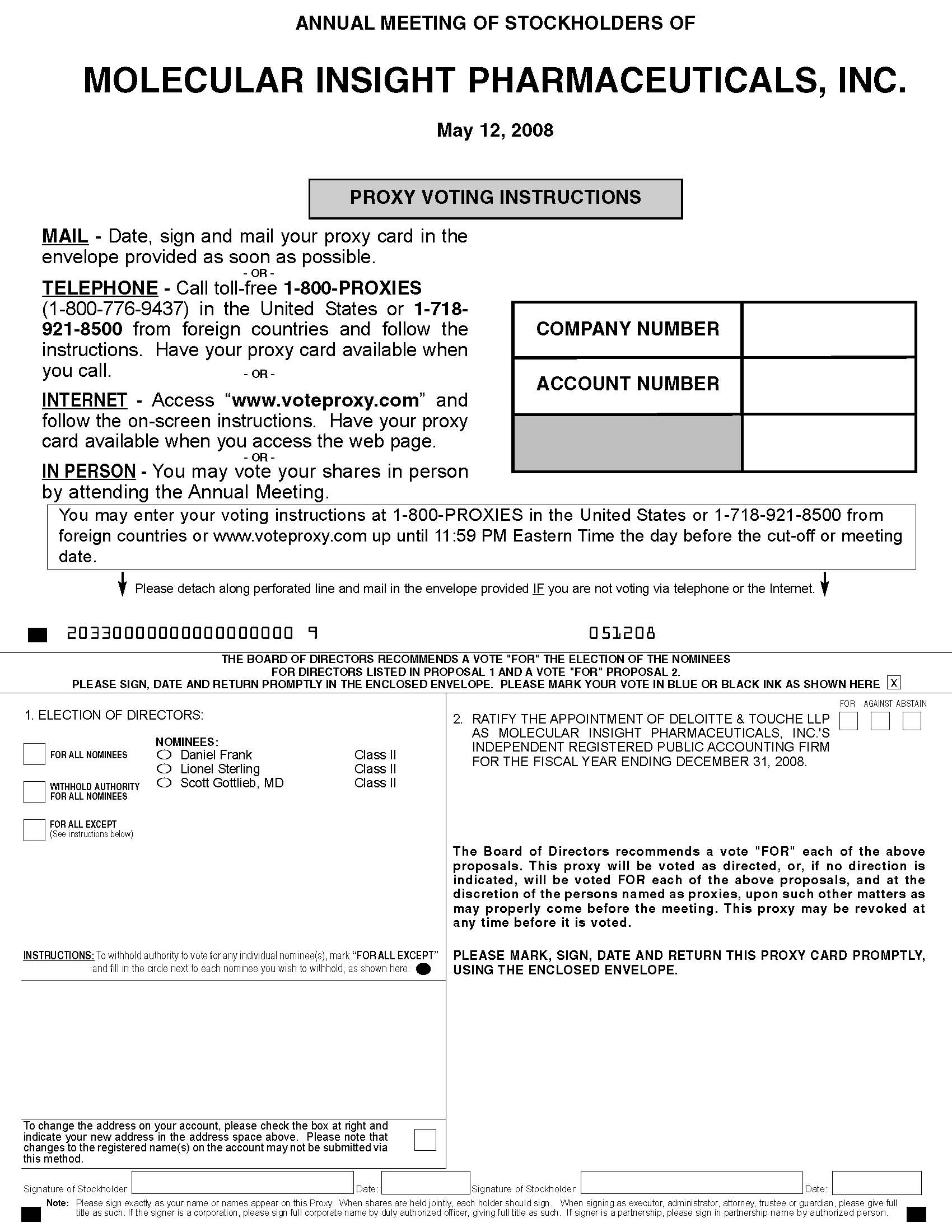

Notice is hereby given that the 2008 annual meeting of stockholders (the “Annual Meeting”) of Molecular Insight Pharmaceuticals, Inc., a Massachusetts corporation (the “Company”), will be held at 10:00 a.m., local time, on Monday, May 12, 2008, at the offices of Foley & Lardner LLP, 111 Huntington Avenue, Boston,MA 02199-7610, to consider and act upon the following proposals:

1. To elect three directors to be Class II directors of the Company’s Board of Directors, each to serve for a term of three years or until his or her successor is elected and qualified;

2. To ratify the selection of Deloitte & Touche LLP, independent registered public accounting firm, as auditors for the fiscal year ending December 31, 2008; and

3. To transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

The Board of Directors has fixed the close of business on April 1, 2008 as the record date. Only the holders of record of the Company’s common stock on the record date are entitled to notice of and to vote at the Annual Meeting. Information relating to the matters to be considered and voted on at the Annual Meeting is set forth in the proxy statement accompanying this notice. Copies of our Annual Report onForm 10-K for the 2007 fiscal year and our 2007 Annual Review are also enclosed.

All stockholders are cordially invited to attend the Annual Meeting in person. To ensure your representation at the Annual Meeting, you are urged to complete, sign, date and return the enclosed proxy card as promptly as possible in the enclosed postage-prepaid envelope, even if you plan to attend the Annual Meeting. You may revoke your proxy in the manner described in the accompanying proxy statement at any time before it has been voted at the Annual Meeting. Any stockholder attending the Annual Meeting may vote in person even if he or she has returned a proxy.

By Order of the Board of Directors,

David S. Barlow

Chairman of the Board and Chief Executive Officer

April 11, 2008

TABLE OF CONTENTS

MOLECULAR INSIGHT PHARMACEUTICALS, INC.

160 Second Street

Cambridge, Massachusetts 02142

(617) 492-5554

PROXY STATEMENT

FOR

2008 ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of the accompanying proxies on behalf of the Board of Directors of Molecular Insight Pharmaceuticals, Inc. (the “Company”) for use at the Company’s 2008 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Monday, May 12, 2008, at the offices of Foley & Lardner LLP, 111 Huntington Avenue, Boston, MA02199-7610, at 10:00 a.m., local time, and any adjournments or postponements of the Annual Meeting.

This Proxy Statement and the accompanying proxy cards, together with the Company’s Annual Report onForm 10-K for the 2007 fiscal year and our 2007 Annual Review, are first being mailed to stockholders entitled to vote at the Annual Meeting on or about April 11, 2008.

ABOUT THE MEETING

Why am I receiving these materials?

At the Annual Meeting, stockholders will act upon matters described in the notice of meeting contained in this Proxy Statement, including the election of directors. We sent you this proxy statement and the enclosed proxy card because the Board of Directors of the Company is soliciting your proxy to vote at the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign, and return the enclosed proxy card, or, if your shares are held by a broker, you may vote your shares by telephone or over the Internet, if authorized by your broker.

Who is entitled to vote?

Only holders of the Company’s common stock outstanding as of the close of business on April 1, 2008 (the “Record Date”) will be entitled to vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of common stock he or she held on the Record Date. As of the close of business on April 1, 2008, 24,966,062 shares of our common stock were issued and outstanding.

Who can attend the Annual Meeting?

All stockholders, or individuals holding their duly appointed proxies, may attend the Annual Meeting. Appointing a proxy in response to this solicitation will not affect a stockholder’s right to attend the Annual Meeting and to vote in person. Please note that if you hold your shares in “street name” (in other words, through a broker, bank, or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the Record Date to gain admittance to the Annual Meeting.

What constitutes a quorum?

A majority of the shares of common stock outstanding on the Record Date must be represented, in person or by proxy, to provide a quorum at the Annual Meeting. If you vote, your shares will be part of the quorum. Shares represented by a proxy card either marked “ABSTAIN” or returned without voting instructions are counted as present for the purpose of determining whether the quorum requirement is satisfied. Also, in those instances where shares are held by brokers who have returned a proxy but are prohibited from exercising discretionary authority for beneficial owners who have not given voting instructions (“broker non-votes”),

those shares will be counted as present for quorum purposes. However, broker non-votes will not be counted as votes for or against any proposal.

What is the effect of not voting?

It will depend on how your share ownership is registered. If you own shares as a registered holder and do not vote, your unvoted shares will not be represented at the meeting and will not count toward the quorum requirement. If a quorum is obtained, your unvoted shares will not affect whether a proposal is approved or rejected.

If you own shares in street name and do not vote, your broker may represent your shares at the meeting for purposes of obtaining a quorum. In the absence of your voting instructions, your broker may or may not vote your shares in its discretion depending on the proposals before the meeting. Your broker may vote your shares in its discretion on routine matters such as Proposal 1, the election of directors. Any shares not voted, whether due to abstention or because they constitute broker nonvotes, will not affect the election of directors. Once a share is represented at the Annual Meeting, it will be deemed present for quorum purposes throughout the Annual Meeting (including any adjournment or postponement of that meeting unless a new record date is or must be set for such adjournment or postponement).

How do I vote?

Stockholders who own shares registered directly with the Company’s transfer agent on the close of business on April 1, 2008 can appoint a proxy by mailing their signed proxy card in the enclosed envelope. Street name holders may vote by telephone or Internet if their bank or broker makes those methods available, in which case the bank or broker will enclose the instructions with the Proxy Statement. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that the stockholders’ instructions have been properly recorded.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you can change your vote at any time before the proxy is exercised by appointing a new proxy bearing a later date, by providing written notice to the Secretary of the Company that you are revoking your proxy, or by voting in person at the Annual Meeting. Presence at the Annual Meeting of a stockholder who has appointed a proxy does not in itself revoke a proxy. Unless so revoked, the shares represented by proxies received by the Board will be voted at the Annual Meeting. When a stockholder specifies a choice by means of the proxy, then the shares will be voted in accordance with such specifications. A written notice to the Company’s Secretary revoking your proxy must be sent to: Corporate Secretary, Molecular Insight Pharmaceuticals, Inc., 160 Second Street, Cambridge, Massachusetts 02142.

What am I voting on?

You are voting on two proposals:

1. Election of three directors, with the following as the Board’s nominees:

| | |

| | • | Daniel Frank (nominated as a Class II director with a term to end at the 2011 Annual Meeting of Stockholders); |

| |

| | • | Lionel Sterling (nominated as a Class II director with a term to end at the 2011 Annual Meeting of Stockholders); and |

| |

| | • | Scott Gottlieb, MD (nominated as a Class II director with a term to end at the 2011 Annual Meeting of Stockholders); and |

2. Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2008.

2

What are the Board’s recommendations?

The Board recommends a vote:

| | |

| | • | For election of the nominated slate of directors; and |

| |

| | • | For the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2008. |

If you sign and return your proxy card, unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Withhold” votes, and with respect to proposals other than the election of directors, “Against” votes, abstentions, and broker non-votes. Abstentions will be counted towards the vote total for each proposal and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give the broker or nominee specific instructions, your broker or nominee can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the Nasdaq Global Market on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

What vote is required to approve the proposals?

Directors are elected by a plurality of the votes cast by stockholders entitled to vote at the Annual Meeting. On all other matters being submitted to stockholders, the affirmative vote of a majority of shares present, in person or represented by proxy, and voting on each such matter at the Annual Meeting is required for approval.

Are there any other items that are to be discussed during the Annual Meeting?

No. The Company is not aware of any other matters that you will be asked to vote on at the Annual Meeting. If other matters are properly brought before the Annual Meeting, the Board or proxy holders will use their discretion on these matters as they may arise.

Who will count the vote?

American Stock Transfer & Trust Company, the Company’s transfer agent, will count the vote. Foley & Lardner LLP, the Company’s outside counsel, will serve as the inspector of the election.

Who pays to prepare, mail, and solicit the proxies?

Proxies may be solicited by personal meeting, Internet, advertisement, telephone, and facsimile machine, as well as by use of the mails. Solicitations may be made by directors, officers, and other employees of the Company, as well as the Company’s investor relations firm, none of whom will receive additional compensation for such solicitations. The cost of soliciting proxies will be borne by the Company. It is anticipated that banks, brokerage houses, and other custodians, nominees, or fiduciaries will be requested to forward solicitation materials to their principals and to obtain authorization for the execution of proxies and that they will be reimbursed by the Company for their out-of-pocket expenses incurred in providing those services. All expenses of solicitation of proxies will be borne by the Company.

3

Delivery of Proxy Materials to Households

Pursuant to SEC rules, services that deliver the Company’s communications to stockholders that hold their stock through a bank, broker, or other holder of record may deliver to multiple stockholders sharing the same address a single copy of the Company’s annual report to stockholders and this proxy statement. Upon written or oral request, the Company will promptly deliver a separate copy of the annual report to stockholders and this proxy statement to any stockholder at a shared address to which a single copy of each document was delivered. Stockholders may notify the Company of their requests by calling the Company’s Secretary at(617) 492-5554 or by sending a written request addressed to the Company, Attention: Secretary, Molecular Insight Pharmaceuticals, Inc., 160 Second Street, Cambridge, Massachusetts 02142.

How can I contact the members of the Board?

Stockholders may communicate with the full Board or individual directors by submitting such communications in writing to Molecular Insight Pharmaceuticals, Inc., Attn: Board of Directors (or the individual director(s)), Molecular Insight Pharmaceuticals, Inc., 160 Second Street, Cambridge, Massachusetts 02142. Such communications will be delivered directly to the directors.

4

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board of Directors recommends the following nominees for election as directors and recommends that each stockholder vote “FOR” the nominees. Executed proxies in the accompanying form will be voted at the annual meeting in favor of the election as directors of the nominees named below, unless authority to do so is withheld.

Our Board of Directors presently consists of seven members and is divided into three classes (designated “Class I,” “Class II,” and “Class III”), with the number of directors in each class being as nearly equal as possible. Our Board of Directors was first divided into three classes in February 2007 at the time of our initial public offering. Our articles of incorporation and bylaws provide that the directors in each respective class will serve three-year terms expiring at the third annual meeting of stockholders after their elections or until their respective successors have been duly elected and qualified, provided that the initial term of the Class I directors is scheduled to expire at our first annual stockholder meeting following our initial public offering, the initial term of the Class II directors is scheduled to expire at our second annual stockholder meeting following our initial public offering, and the initial term of the Class III directors is scheduled to expire at our third annual stockholder meeting following our initial public offering. Accordingly, at the Annual Meeting, three Class II directors are required to be elected. Our Board of Directors, upon the recommendation of the Governance and Nominating Committee, has nominated Daniel Frank, Lionel Sterling and Scott Gottlieb, M.D. to stand for election as Class II directors.

The persons nominated for election have agreed to serve if elected, and the Board of Directors has no reason to believe that any of these nominees will be unavailable or will decline to serve. In the event, however, that any of the nominees are unable or decline to serve as a director at the time of the annual meeting, the persons designated as proxies will vote for any nominee who is designated by our current Board of Directors to fill the vacancy.

The three nominees for director named above currently are directors of the Company and are proposed to be elected at the Annual Meeting to serve until the 2011 annual meeting of stockholders (as Class II directors). The remaining four directors will continue to serve as members of the Board for the terms described below under “Directors and Executive Officers.” Directors are elected by a plurality of the votes cast (assuming a quorum is present or represented by proxy at the Annual Meeting), meaning that the three nominees receiving the highest number of affirmative votes of the votes represented at the Annual Meeting will be elected as directors. Proxies solicited by the Board will be voted “FOR” the nominees named above unless a stockholder specifies otherwise.

Biographical information and the age (as of the Record Date) for each director nominee to be elected at the Annual Meeting, and each other director and executive officer of the Company can be found below under “Directors and Executive Officers.”

PROPOSAL 2 — RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors recommends the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008 and recommends that each stockholder vote “FOR” the ratification. Executed proxies in the accompanying form will be voted at the annual meeting in favor of the ratification of the independent registered public accounting firm, unless authority to do so is withheld.

At the Annual Meeting, the stockholders will be asked to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008. The Audit Committee of our Board of Directors has recommended, and the Board of Directors has already selected, Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2008. Deloitte & Touche LLP also served as our independent registered public accounting firm during the fiscal year ended December 31, 2007. Unless a stockholder directs otherwise, proxies will be voted for the approval of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the 2008 fiscal year. If the stockholders do not approve the appointment of

5

Deloitte & Touche LLP, the Board will consider the selection of other independent public accountants for the 2008 fiscal year, but will not be required to do so.

The affirmative vote of the majority of all shares of common stock eligible to vote on a matter is required to ratify the selection of Deloitte & Touche LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

In the event the stockholders fail to ratify the appointment, the Board of Directors will reconsider its selection. Even if the selection is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent registered public accounting firm for such fiscal year if the Board of Directors feels that such a change would be in the best interests of our company and its stockholders.

Representatives of Deloitte & Touche LLP will be present at the Annual Meeting and will be available to respond to appropriate questions and may make a statement if they so desire.

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the director nominees to be elected at the Annual Meeting, and each other director and executive officer of the Company, their ages, and the positions currently held by each such person with the Company as of April 1, 2008.

| | | | | | | |

Name | | Age | | Position |

| |

| David S. Barlow | | | 51 | | | Chairman of the Board of Directors, Chief Executive Officer |

| John W. Babich, Ph.D. | | | 51 | | | President and Chief Scientific Officer |

| John E. McCray | | | 57 | | | Chief Operating Officer |

| Norman LaFrance, M.D., FACP, FACNP | | | 60 | | | Senior Vice President, Clinical Development and Chief Medical Officer |

| Donald E. Wallroth | | | 59 | | | Chief Financial Officer |

| John A. Barrett, Ph.D. | | | 54 | | | Vice President of Research |

| Joshua Hamermesh | | | 35 | | | Vice President of Commercial and Business Development |

| Priscilla Harlan | | | 55 | | | Vice President, Corporate Communications and Investor Relations |

| James F. Kronauge, Ph.D. | | | 52 | | | Vice President of Process Development |

| James Wachholz | | | 54 | | | Vice President, Regulatory Affairs and Quality Assurance |

| David M. Stack | | | 56 | | | Director |

| Harry Stylli, Ph.D. | | | 46 | | | Director |

| Daniel Frank(1) | | | 51 | | | Director |

| Lionel Sterling(1) | | | 70 | | | Director |

| Scott Gottlieb, MD(1) | | | 35 | | | Director |

David S. Barlowhas served as the Chairman of our Board of Directors since early 2000 and as our Chief Executive Officer since January 2003. Mr. Barlow is a Trustee of McLean Hospital, Bates College, and Newton Country Day School. He is also a member of the President’s Council at Massachusetts General Hospital (MGH), Boston, Massachusetts.

John W. Babich, Ph.D., a founder of our Company in 1997, serves as our President and Chief Scientific Officer and is a member of our Board of Directors.

6

John E. McCrayhas served as our Chief Operating Officer since joining Molecular Insight in March 2003. Prior to joining our Company, from 2000 to 2003, Mr. McCray served as the Chief Operating Officer at Pan Pacific Pharmaceuticals.

Norman LaFrance, M.D., FACP, FACNPhas served as our Senior Vice President, Clinical Development and Chief Medical Officer since April 2007. From 2005 to 2007 he worked at Bausch & Lomb, where he served as Vice President, Global Pharmaceutical R&D. Dr. LaFrance was with Celltech Americas as Senior Vice President, Medical and Regulatory Affairs from 2002 to 2005.

Donald E. Wallrothhas served as our Chief Financial Officer since August 2007. Prior to joining Molecular Insight, Mr. Wallroth worked in the National Life Sciences practice of Tatum LLC, a national financial executive services firm from 2006 to August 2007, where he was deployed as the CFO for prominent New England-based companies. From 2004 to 2005, he was a Partner with Keen Partners, an investment banking firm which focused on raising capital for emerging companies. From 2002 to 2004, he was the Chief Operating Officer of GoldK where he managed its financial and business operations.

John A. Barrett, Ph.D. has served as our Vice President of Research since August 2005. He came to Molecular Insight from Infinity Pharmaceuticals, where he worked from 2003 to 2005 and served as the Senior Director Pharmacology/Toxicology, ADME, and Bioanalytical Chemistry. Prior to Infinity Pharmaceuticals, Dr. Barrett was Senior Director of Pharmacology/Toxicology at EPIX Medical, Inc. from 2000 to 2003.

Joshua Hamermeshhas served as our Vice President of Commercial and Business Development since May 2005. From 1999 to 2005, he worked at Genzyme Corporation, where he was the Business Director, Cardiac Cell Therapy and Chief Operating Officer of the company’s MG Biotherapeutics unit. Mr. Hamermesh held several cardiovascular product marketing and business development positions at Genzyme, including Director, Cardiovascular Business Development and Marketing Manager, Genzyme Surgical Products.

Priscilla Harlanhas served as our Vice President, Corporate Communications since July 2005. From 2000 to 2005, Ms. Harlan worked at Complete Healthcare Communications, Inc., a medical communications consultancy, where she was an Account Director for pharmaceutical clients.

James F. Kronauge, Ph.D. joined Molecular Insight in December 1999, and after serving in a variety of research positions, became our Vice President of Process Development in August 2005.

James Wachholzhas served as our Vice President, Regulatory Affairs and Quality Assurance since May 2005. Prior to joining our Company, from 2003 to May 2005, he worked at Accentia Biopharmaceuticals, where he served as Chief Regulatory Officer. From 1998 to 2003, Mr. Wachholz worked at Sepracor Inc., where he served as the Executive Director of Regulatory Affairs.

David M. Stackhas served as a member of the Board of Directors since 2006. Mr Stack is the President and Chief Executive Officer of Pacira Pharmaceuticals, Inc, has been Executive Partner of MPM Capital since 2005 and a Managing Partner of Stack Pharmaceuticals, Inc since 1998. From 2001 until 2004, he was the President and the Chief Executive Officer of The Medicines Company. He currently serves as Director ofBio-Imaging Technologies, Inc, PepTx., Inc., Pacira Pharmaceuticals, Inc., and Elixir Pharmaceuticals Inc.

Harry Stylli, MBA, Ph.D. has served as a member of our Board of Directors since 2004. Dr. Stylli has been President, Chief Executive Officer and a member of the Board of Directors of Sequenom, Inc. since 2005. From 2003 until 2005, he was President and Chief Executive Officer of Xencor, Inc. From 2002 to 2003, he served as co-founder, President and Chief Executive Officer of CovX Pharmaceuticals Inc. From 1995 to 2002 he held various senior roles at Aurora Biosciences Corp., a company he co-founded. In 2001, following the merger between Aurora Biosciences Corp. and Vertex Pharmaceuticals Incorporated, Dr. Stylli served as President of Aurora Biosciences Corp. and Panvera Corporation. Harry Stylli is currently an advisor to Nanosyn, a chemistry company. Since July 2007, he has also been serving as a member of the Board of Directors of Micropharma Limited, a privately held biotechnology company.

Daniel Frankhas served as a member of our Board of Directors since 2004. Since 2001, he has worked at Cerberus Capital Management, L.P., a private investment firm. Mr. Frank is also currently a member of the Board of Directors for Aton Pharma, Inc. and Reva Medical Inc.

7

Lionel Sterlingjoined our Board of Directors as of the listing of our common stock on the Nasdaq Global Market in February 2007. In 1987, Mr. Sterling founded Equity Resources Inc., a private investment firm, where he has served as President since 1987. He is currently a member of the Board of Directors of Third Wave Technologies.

Scott Gottlieb, MDhas served as a member of our Board of Directors since August, 2007. Dr. Gottlieb is also currently a practicing physician, who joined the American Enterprise Institute in 2007 after several years at the U.S. Food and Drug Administration (FDA). Dr. Gottlieb was the Deputy Commissioner for Medical and Scientific Affairs at the FDA from 2005 to 2007. Prior to his appointment as Deputy Commissioner, he served at the FDA in a number of senior capacities in 2003 and 2004, including Senior Advisor for Medical Technology for the FDA Commissioner and Director of Medical Policy Development.

Executive officers of he Company are elected by the Board of Directors on an annual basis and serve until their successors have been duly elected and qualified.

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Meetings and Independence

During the fiscal year ended December 31, 2007 (“Fiscal 2007”), the Board of Directors of the Company held 12 meetings, out of which 4 were in-person and 8 were telephonic, and took action by written consent on three occasions. Each current director attended at least 75% of the total meetings of the Board and the total number of meetings held by all committees of the Board on which he served during Fiscal 2007. It is the Company’s current policy to strongly encourage directors to attend the Annual Meeting, but they are not required to attend. The annual meeting of stockholders for Fiscal 2007 was held on May 14, 2007. Two directors attended our annual meeting for Fiscal 2007.

In addition to the regular meetings of the Board in 2007, the independent members of the Board held one meeting without the management directors, which was attended by all the independent members of the Board.

Our Board of Directors presently has seven members, and biographical information regarding these directors (three of whom are director nominees) is set forth above. The Board has determined that five of its members are “independent directors” as defined under the rules of the Nasdaq Stock Market, Inc. andRule 10A-3(b)(i) under the Securities Exchange Act of 1934. These five “independent directors” are Messrs. Frank, Stylli, Stack, Sterling and Gottlieb. Mr. Frank is the designated lead independent director and in such capacity is responsible for calling meetings of the independent directors and establishing agenda for such meetings.

Board Committees

The Board of Directors has established three standing committees: an Audit Committee, a Compensation Committee, and a Governance and Nominating Committee. In addition, the Board of Directors has established a Scientific Advisory Board. The following is a summary description of the respective responsibilities of the Board’s standing committees:

Audit Committee.

The Audit Committee performs the following functions, among others:

| | |

| | • | appointing and replacing our independent registered public accounting firm; |

| |

| | • | reviewing compliance with legal and regulatory requirements; |

| |

| | • | evaluating our audit and internal control functions; |

| |

| | • | reviewing the proposed scope and results of the audit; and |

| |

| | • | reviewing and pre-approving the independent registered public accounting firm’s audit and non-audit services rendered. |

8

The Audit Committee consists of three independent directors, Messrs. Sterling, Stylli and Stack. Each member of the Audit Committee is able to read and understand fundamental financial statements, including our balance sheet, income statement and cash flows statements.

Our Board of Directors has determined that Mr. Sterling is an “audit committee financial expert” as that term is defined in Securities and Exchange Commission regulations. The Audit Committee met seven times in Fiscal 2007. The Audit Committee’s report on its activities during 2007 appears later in this proxy statement under the caption “Audit Committee Report”. The Board of Directors has approved and adopted a written charter for the Audit Committee, and the chairperson of the Audit Committee is Mr. Sterling. A copy of the Audit Committee’s charter is posted on the Company’s websitewww.molecularinsight.com in the “Corporate Governance” subsection in the “Investor Relations” section of the website.

Compensation Committee.

The Compensation Committee performs the following functions, among others, as set forth in its committee charter, a copy of which is available at our website atwww.molecularinsight.com, including:

| | |

| | • | recommending and approving salaries, incentive compensation and equity-based plans for our executive officers and managers; |

| |

| | • | reviewing corporate goals and objectives relative to executive compensation; |

| |

| | • | evaluating our Chief Executive Officer’s performance in light of corporate objectives; |

| |

| | • | setting our Chief Executive Officer’s compensation based on the achievement of corporate objectives; |

| |

| | • | developing plans for Chief Executive Officer succession; and |

| |

| | • | preparing and issuing reports required under the committee charter. |

The Compensation Committee consists of three independent directors, Messrs. Frank, Sterling and Stack. The chairperson of the Compensation Committee is Mr. Frank. The Compensation Committee met six times and took action by written consent once in Fiscal 2007.

A copy of the Compensation Committee’s charter is posted on the Company’s website atwww.molecularinsight.comin the “Corporate Governance” subsection in the “Investor Relations” section of the website.

Governance and Nominating Committee.

The Governance and Nominating Committee performs the following functions, among others, as set forth in its committee charter:

| | |

| | • | developing criteria for director selection; |

| |

| | • | identifying and recommending to the full Board of Directors the director-nominees to stand for election at annual meetings of the stockholders; |

| |

| | • | recommending members of the Board of Directors to serve on the various committees of the Board of Directors; |

| |

| | • | evaluating and ensuring the independence of each member of each committee of the Board of Directors; |

| |

| | • | recommending to the Board of Directors our corporate governance principles; and |

| |

| | • | recommending to the Board of Directors a code of conduct for our directors, officers and employees. |

The Governance and Nominating Committee will consider nominees recommended by stockholders who submit such recommendations in writing to our Secretary in accordance with our Bylaws, and include the candidate’s name, biographical data and qualifications. Stockholders recommending nominees must disclose the stockholder’s name and address, class and number of shares of our stock that are owned, the length of such ownership and any relationship between the stockholder and the nominee. Stockholders must also comply

9

with such other procedural requirements as we may establish from time to time. Each nominee is evaluated by our Governance and Nominating Committee, which shall take into account all factors it considers appropriate, which may include judgment, skill, diversity, experiences with businesses and other organizations of comparable size, the interplay of the candidate’s experiences with the experience of other directors, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. At a minimum, a nominee should have distinguished him or herself in a career in industry, government or academia; should be capable of offering sound advice and counsel to us and our Chief Executive Officer; must possess the highest personal and professional ethics, integrity and values; and must be eligible to serve a minimum of three years. The Governance and Nominating Committee considers not only the individual talents and skills of each nominee, but also the range of talents and skills represented by all members of our Board of Directors. Our Governance and Nominating Committee may, but need not, use the services of an executive search firm to help it to identify, evaluate and attract the best candidates for nomination as a director.

The Governance and Nominating Committee consists of three independent directors, Messrs. Frank, Sterling and Gottlieb, and the chairperson of the Governance and Nominating Committee is Mr. Frank. The Governance and Nominating Committee met three times during Fiscal 2007. A copy of the Governance and Nominating Committee’s charter is posted on the Company’s website atwww.molecularinsight.comin the “Corporate Governance” subsection in the “Investor Relations” section of the website.

Scientific Advisory Board.

In addition to the foregoing, our Board of Directors has established a group of respected scientists in the biochemistry, organic and inorganic chemistry, cardiology, radiation oncology, nuclear medicine and radiology fields to advise it on scientific, technical and commercialization issues. The scientific advisory board does not have any authority with respect to the governance of our company but provides advice on the scientific results and strategy of our products and research and development efforts. The advisors are currently William C. Eckelman, Ph.D., who serves as Chairman; Ronald L. Van Heertum, M.D.; Ross J. Baldessarini, M.D.; Peter Conti, M.D., Ph.D.; Alan Davison, Ph.D., F.R.S.; Duncan H. Hunter, Ph.D.; Alan P. Kozikowski, Ph.D.; Rob Mairs, Ph.D.; H. William Strauss, M.D.; Vladimir Torchilin, Ph.D.; John F. Valliant, Ph.D.; Barry Zarett, M.D.; and Jon A. Zubieta, Ph.D.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics that is applicable to all of the employees and directors of the Company and its subsidiaries. The text of the Code of Business Conduct and Ethics is posted on the website atwww.molecularinsight.comin the “Corporate Governance” subsection in the “Investor Relations” section of our website.

Communications with the Board of Directors

Stockholders may communicate with the full Board of Directors or individual directors by submitting such communications in writing to Molecular Insight Pharmaceuticals, Inc., Attention: Board of Directors (or the individual director(s)), 160 Second Street, Cambridge, Massachusetts 02142. Such communications will be delivered directly to the directors.

10

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act of 1934, as amended, an officer, director, or greater-than-10% stockholder of the Company must file a Form 4 reporting the acquisition or disposition of Company’s equity securities with the Securities and Exchange Commission no later than the end of the second business day after the day the transaction occurred unless certain exceptions apply. Such persons must also file initial reports of ownership on Form 3 upon becoming an officer, director, or greater-than-10% stockholder. Transactions not reported on Form 4 or Form 3 must be reported on Form 5 within 45 days after the end of the Company’s fiscal year. Based on information available to us, we believe that during fiscal year 2007 all applicable Section 16(a) filing requirements were met, except that, due to unwitting oversights: (i) Harry Stylli was late in filing a report of an open market purchase of an aggregate of 7,500 shares of the Company’s common stock. None of the shares purchased by Mr. Stylli on the open market was sold during the fiscal year 2007; and (ii) Messrs. Barlow, Babich and McCray were late in reporting employee stock option awards that they received in fiscal year 2007. None of the options covered by such awards begin to vest until November 2008. Forms 5 have been filed to report the aforementioned transactions involving Messrs. Stylli, Barlow, Babich and McCray, albeit after the lapse of the 45 days period following the end of the fiscal year 2007.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of March 14, 2008 with respect to (i) each person known by the Company to beneficially own more than 5% of the Company’s common stock, (ii) each of the Company’s named executive officers, (iii) each of the Company’s directors and director nominees, and (iv) all directors and executive officers of the Company as a group. The number and percentage of shares beneficially owned is determined under rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares of which the individual has the right to acquire beneficial ownership within 60 days of March 14, 2008 through the exercise of any stock option, warrant, or other right. Unless otherwise indicated in the footnotes, each person has sole voting and investment power with respect to the shares shown as beneficially owned. A total of 24,953,562 shares of the Company’s common stock were issued and outstanding as of March 14, 2008.

| | | | | | | | | |

| | | Number of Shares of

| | |

| | | Common Stock

| | |

Beneficial Owner | | Beneficially Owned | | Percent |

| |

5% Stockholders | | | | | | | | |

| Cerberus Partners, L.P.(1) | | | 4,009,709 | | | | 15.9 | % |

299 Park Avenue, 22nd Floor

New York, NY 10171 | | | | | | | | |

| Highland Capital Management, L.P.(2) | | | 2,488,692 | | | | 9.97 | |

13455 Noel Road Ste. 1300

Dallas, TX 75240 | | | | | | | | |

| Standard Pacific Capital Holdings, LLLP(3) | | | 1,755,729 | | | | 7.04 | |

6501 Red Hook Plaza, Ste. 201

St. Thomas, USVI 00802 | | | | | | | | |

| QVT Financial LP(4) | | | 1,893,763 | | | | 7.1 | |

1177 Avenue of the Americas, 9th Floor

New York, NY 10036 | | | | | | | | |

| James Poitras | | | 1,259,483 | | | | 5.05 | |

3100 Springhead Court

Narcoosee, FL 33844 | | | | | | | | |

Named Executive Officers, Directors, and Director Nominees | | | | | | | | |

| David S. Barlow(5) | | | 2,645,478 | | | | 10.57 | |

| John Babich(6) | | | 679,369 | | | | 2.67 | |

| John McCray(7) | | | 283,434 | | | | 1.13 | |

| Robert Gallahue (former Chief Financial Officer)(8) | | | 89,583 | | | | * | |

| Donald E. Wallroth | | | — | | | | — | |

| Norman D. LaFrance(9) | | | 22,750 | | | | * | |

| David Stack(10) | | | 8,333 | | | | * | |

| Daniel Frank(11) | | | 147,446 | | | | * | |

| Scott Gottlieb | | | — | | | | — | |

| Harry Stylli(12) | | | 15,833 | | | | * | |

| Lionel Sterling(13) | | | 268,561 | | | | 1.07 | |

| Executive Officers and Directors (including Director Nominees) as a Group (14) (16 persons) | | | 4,338,335 | | | | 16.74 | |

| | |

| * | | Less than 1.0% |

| |

| (1) | | This information is based on Schedule 13D/A filed with the SEC on February 12, 2008 by Stephen Feinberg, as per which Schedule, Mr. Feinberg has sole voting and investment power over all of the shares of common stock held by Cerberus Partners, L.P., a Delaware limited partnership, and affiliates. |

12

| | |

| | As per the aforementioned Schedule, as of December 31, 2007, Cerberus Partners, L.P. owned (i) 3,753,299 shares of common stock and (ii) a warrant to acquire an additional 256,410 shares of common stock. We have not made any independent determination as to the beneficial ownership of such stockholder and are not restricted in any determination we may make by reason of inclusion of such stockholder or its shares in this table. |

| |

| (2) | | This information is based on a Schedule 13G/A dated February 14, 2008 and filed with the SEC on the same date for Highland Capital Management, L.P., along with Strand Advisors, Inc. and James D. Dondero. We have not made any independent determination as to the beneficial ownership of such stockholders and are not restricted in any determination we may make by reason of inclusion of such stockholders or their shares in this table. |

| |

| (3) | | This information is based on a Schedule 13G/A dated February 14, 2008 and filed with the SEC on the same date for Standard Pacific Capital Holdings, L.L.L.P., along with Beaver Creek, Ltd. and Andrew Midler. We have not made any independent determination as to the beneficial ownership of such stockholders and are not restricted in any determination we may make by reason of inclusion of such stockholders or their shares in this table. |

| |

| (4) | | This information is based on a Schedule 13G/A dated February 8, 2008 and filed with the SEC on February 11, 2008 for QVT Financial LP, along with QVT Fund LP, QVT Financial GP LLC and QVT Associates GP LLC. We have not made any independent determination as to the beneficial ownership of such stockholders and are not restricted in any determination we may make by reason of inclusion of such stockholders or their shares in this table. |

| |

| (5) | | Includes 81,250 shares of common stock issuable upon the exercise of options which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

| |

| (6) | | Includes 505,834 shares of common stock issuable upon the exercise of options which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

| |

| (7) | | Includes 88,130 shares of common stock issuable upon the exercise of options which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

| |

| (8) | | Mr. Gallahue resigned from his employment with the Company on April 11, 2007 (see “Executive Employment Agreements”). The figure of 89,583 constitutes entirely of shares of common stock issuable upon exercise of options which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

| |

| (9) | | Includes 18,750 shares of common stock issuable upon the exercise of option which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

| |

| (10) | | Includes 8,333 shares of common stock issuable upon the exercise of options which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

| |

| (11) | | Includes 4,166 shares of common stock issuable upon the exercise of options which are currently exercisable or which are exercisable within 60 days of March 14, 2008. Mr. Frank is a Managing Director of Cerberus Capital Management, L.P., an entity affiliated with Cerberus Partners, L.P. Mr. Frank has no voting or investment power over shares of common stock held by Cerberus Partners, L.P. and he disclaims beneficial ownership of those shares held by Cerberus Partners, L.P. Accordingly, no shares of our common stock that are held in the name of Cerberus Partners, L.P. are attributed to Mr. Frank. As discussed in footnote 1 to this table, shares of our common stock that are held in the name of Cerberus Partners, L.P. are attributed to Stephen Feinberg. |

| |

| (12) | | Includes 8,333 shares of common stock issuable upon the exercise of options which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

| |

| (13) | | Includes 33,333 shares of common stock issuable upon exercise of options which are currently exercisable or which are exercisable within 60 days of March 14, 2008. |

| |

| (14) | | Includes a total of 958,703 shares of common stock issuable upon exercise of options which are currently exercisable or which will be exercisable within 60 days of March 14, 2008. |

13

REPORT OF AUDIT COMMITTEE

The Audit Committee is composed of three independent directors and operates under a written charter adopted by the Board of Directors. A copy of the Audit Committee Charter is posted on the Company’s website atwww.molecularinsight.comin the “Corporate Governance” subsection in the “Investor Relations” section of the website. The Audit Committee reviews and reassesses this charter annually and recommends any changes to the Board for approval.

During fiscal year 2007, the Audit Committee met seven times.

In the exercise of the Committee’s duties and responsibilities, the Committee members have reviewed and discussed the audited financial statements for fiscal year 2007 with the management and the independent auditors. The Committee also discussed all the matters required to be discussed by Statement of Auditing Standard No. 61 with our independent auditors, Deloitte & Touche LLP. The Committee received a written disclosure letter from Deloitte & Touche LLP as required by Independence Standards Board Standard No. 1 and has discussed with Deloitte & Touche LLP their independence. Based on its review and discussions and subject to the limitations on the role and responsibilities of the Committee in its charter, the Committee recommended to the Board that the audited financial statements for fiscal year 2007 be included in the Company’s Annual Report to shareholders onForm 10-K filed with the Securities and Exchange Commission.

THE AUDIT COMMITTEE

David M. Stack

Harry Stylli, Ph.D.

Lionel Sterling

April 11, 2008

14

INDEPENDENT PUBLIC ACCOUNTANTS FEES AND SERVICES

The consolidated financial statements as of and for the years ended December 31, 2007, 2006 and 2005 have been audited by Deloitte & Touche LLP, independent registered public accounting firm. We expect that representatives of Deloitte & Touche LLP will be present at the Annual Meeting and will be available to respond to appropriate questions from stockholders and may make a statement if they so desire.

Audit and Related Fees

During Fiscal 2007, the Company engaged Deloitte & Touche LLP to perform the Fiscal 2007 audit and to prepare the Fiscal 2007 income tax returns.

Audit Fees. The aggregate audit fees billed by Deloitte & Touche LLP for the fiscal years ended December 31, 2007 and 2006 were $711,820 and $634,020, respectively. Audit fees consist of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements and review of the interim condensed consolidated financial statements, as well as other professional services rendered in connection with the Company’s initial public offering included in the Company’s registration statement onForm S-1 filed in February 2007 and services that are normally provided by Deloitte & Touche LLP in connection with statutory and regulatory filings or engagements, except those not required by statute or regulation.

Audit-Related Fees. There were no fees billed by Deloitte & Touche LLP during Fiscal 2007 or Fiscal 2006 for assurance and related services related to the performance of the audit or review of the Company’s consolidated financial statements and not described above under “Audit Fees.”

Tax Fees. During Fiscal 2007, Deloitte & Touche LLP billed $17,500 to the Company for preparing the Company’s 2006 tax returns, and during Fiscal 2006, Deloitte & Touche LLP billed $25,000 to the Company for preparing the Company’s 2005 tax returns.

All Other Fees. There were no fees billed by Deloitte & Touche LLP during Fiscal 2007 or Fiscal 2006 for professional services other than the services described under “Audit Fees,” “Audit-Related Fees” and “Tax Fees” above.

The Audit Committee does not believe the provision of non-audit services by the independent accountant impairs the ability of such accountant to maintain independence with regard to the Company.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the Company’s independent auditors in order to assure that the provision of such services does not impair the auditor’s independence. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Management is required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. Such services and fees of our auditors were pre-approved by the Audit Committee for fiscal year 2007.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Compensation Discussion and Analysis

Overview

We describe our executive compensation program below and provide an analysis of the 2007 compensation paid to and earned by our “named executive officers” — our Chairman and CEO, CFO and three other most highly-compensated executive officers, as well as our former CFO, who resigned in 2007. In 2007, our

15

named executive officers were Messrs. Barlow, McCray, Wallroth and Gallahue (our former CFO), and Drs. Babich and LaFrance. This Compensation Discussion and Analysis should be read in conjunction with the detailed tabular and narrative information regarding executive compensation in this proxy statement.

Objectives

We utilize a compensation package that combines cash and equity, fixed and performance-based payments and short and long-term components in the proportions we believe are most appropriate to attract and retain talented senior management to lead our Company and motivate and reward our senior management for the achievement of annual and longer term business objectives. Our executive compensation program is intended to meet the following objectives:

| | |

| | • | Focus our senior management on the achievement of our annual and longer term performance goals and milestones by basing a significant portion of their compensation on company and individual performance. |

| | |

| | • | We place a substantial portion of executive officers’ total compensation at risk based on the achievement of annual and longer term financial, research and development and operating objectives and results through the use of annual and long-term incentive compensation. For our named executive officers in 2007, annual and long-term incentive compensation represented approximately 61% of their total compensation on average (annualized for 2007 new hires). We believe this approach clearly links our executive officer team’s compensation to our results and each executive officer’s contribution to our success. |

| | |

| | • | Align the interests of our executive officers with those of our shareholders through the use of equity compensation. |

| | |

| | • | We grant equity awards to our executive officers that make up a significant portion of their total direct compensation. In 2007 we granted stock options with an exercise price set at a premium of approximately 65% above the fair market value on the grant date to our continuing executive officers, our CEO, our President and CSO, and our COO. The premium exercise price represented the approximate average stock price since our IPO in February, 2007. We felt that this pricing strategy linked our executives with shareholders who have purchased shares at various prices after our IPO, in some cases at prices well in excess of the fair market value at the time our Committee was considering the 2007 equity awards. We believe that this significant weighting of long-term equity compensation in the total compensation package and the premium exercise price stock option grant to certain executives in 2007 creates alignment with our shareholders. |

| | |

| | • | Foster a performance-oriented culture built on shared values, a collegial team-based approach and a commitment to achieving our business and scientific objectives. |

| | |

| | • | Our compensation programs are intended to focus our executives’ actions on achieving the goals and milestones that will enable us to build a successful company that creates long-term shareholder value. We evaluate and reward our executive officers based on their contribution to the achievement of these short and longer term goals and objectives. |

| | |

| | • | Provide competitive compensation opportunities that allow us to attract and retain the best talent to lead the company in a competitive market for executive talent. |

| | |

| | • | We position our compensation at approximately mid-market for salary and target bonus and at approximately the 75th percentile for equity compensation. To the extent that we achieve or exceed our annual goals and create shareholder value, our total direct compensation can be positioned at or above the 75th percentile. |

| | |

| | • | Respond to changes at our Company, within the industry and the competitive employment markets as we evolve the Company. |

16

| | |

| | • | By necessity, we will continue to refine and adjust our compensation practices driven by our stage of development and growth as a company. |

Administration of Our Executive Compensation Program

Our Compensation Committee approves, administers and interprets our executive compensation and benefit policies, including our equity incentive plans. Our Compensation Committee is appointed by our Board of Directors, and consists entirely of directors who are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code and “non-employee directors” for purposes ofRule 16b-3 under the Exchange Act. Our Compensation Committee is comprised of Messrs. Frank, Stack and Sterling, and is chaired by Mr. Frank.

Our Compensation Committee reviews and makes recommendations to our Board to ensure that our executive compensation and benefit program is consistent with our compensation philosophy and corporate governance guidelines and is responsible for establishing the executive compensation packages offered to our named executive officers.

Our Compensation Committee has taken the following steps to ensure that our executive compensation and benefit program is both consistent with our compensation philosophy and meets our compensation objectives:

| | |

| | • | Engaged and directed W.T. Haigh & Company, Inc. as our independent executive compensation and benefits consultant to assess the competitiveness of our overall executive compensation program; |

| |

| | • | With the assistance of W.T. Haigh & Company, Inc., developed appropriate executive compensation structures based on targeting a competitive level of pay as measured against our peer group; |

| |

| | • | Maintained a practice of reviewing the performance and determining the total compensation earned, paid or awarded to our Chief Executive Officer; |

| |

| | • | Reviewed on an annual basis the performance of our other named executive officers and other key employees with assistance from our Chief Executive Officer, and determined what we believe to be appropriate total compensation based on competitive levels as measured against our peer group and consistent with the company’s and each executive’s performance; and |

| |

| | • | Maintained the practice of holding executive sessions (without management present) at every Compensation Committee meeting and communicating with other committee members and management informally throughout the year. |

Process for Determining Executive Compensation

Throughout the year, the Compensation Committee meets in person or via telephone to establish, review and modify, as necessary, our compensation program, the compensation for our named executive officers, to review ongoing company and executive officer performance and to keep appraised of trends in compensation practices generally. While the Compensation Committee is ultimately responsible for making all compensation decisions affecting our named executive officers, our CEO, Mr. Barlow, plays an important role in the process underlying such decisions. Generally, after the end of our fiscal year, our executive officers including Mr. Barlow complete a self-assessment of their performance for the year. Mr. Barlow receives these self-assessments and prepares an overall review of company performance and his assessment of the executive officers’ performance, including his own, for the Compensation Committee.

Mr. Barlow engages in active dialogue with the Compensation Committee regarding his evaluation of the Company’s performance as well as that of the executive officers. His recommendations for payouts of that year’s incentive cash bonus, as well as recommendations for the coming year for long-term equity awards and base salary, are also discussed with the Compensation Committee prior to final compensation determinations. The Compensation Committee uses Mr. Barlow’s assessments and recommendations as part of its own assessment process to determine final compensation actions for the executive officers, including Mr. Barlow. Mr. Barlow does not participate in the portion of Compensation Committee meetings regarding the review of his own performance or the determination of the actual amounts of his compensation.

17

In 2007, compensation decisions were made at various points during the year and early 2008 due to unique factors, including (i) the completion of our IPO in 2007 during a time of the year when our performance management and compensation process usually takes place, (ii) the hiring of two senior executive officers, Dr. LaFrance and Mr. Wallroth, during April and August 2007, respectively, and (iii) the Compensation Committee’s desire to consider a number of equity grant alternatives prior to making equity awards. These compensation decisions and their specific timing are described in greater detail below with respect to each primary element of our direct compensation program.

The review of performance for 2007 and the related cash incentive awards, the setting of 2008 base salaries and the approvals of 2008 equity awards were all completed prior to the end of March 2008. Going forward, we expect all compensation actions and approval of the Company’s and executive officers’ annual performance goals to occur within the first 60 days of the new fiscal year. This approach allows the Compensation Committee to consider and approve all elements of executive compensation at the same time, set the year’s performance objectives early in the year and increases the administrative efficiencies and overall coherence of our compensation strategy.

Factors Considered to Determine Total Direct Compensation

In determining the primary elements of executive total direct compensation and the amounts that may be earned, the Compensation Committee considers the following:

Goal Setting. Generally at the start of each new fiscal year, each executive officer works with the CEO to develop individual performance goals for the upcoming fiscal year and to provide input on overall company goals for the fiscal year. The CEO then discusses the Company’s overall performance goals, each executive officer’s individual goals and his own individual performance goals with the Compensation Committee. The Compensation Committee reviews, modifies and ultimately approves the coming year’s performance objectives for the Company and the named executive officers.

Our Company’s Performance. As noted above, our compensation program is designed to motivate our executives to achieve our short-term, long-term and strategic performance goals. These goals include key research, clinical, manufacturing, business development and financial objectives, among other thing. As described above, the Compensation Committee generally selects and approves the applicable corporate performance goals for the year during the first quarter.

In 2007, the corporate goals included:

| | |

| | • | Successful completion of our IPO and raising additional capital later in the year; |

| |

| | • | Specific research, development and manufacturing milestones; and |

| |

| | • | Organization and staffing. |

Executive Performance. The following are criteria considered by the Compensation Committee to evaluate individual executive performance for 2007, not all of which are applicable to all executive officers:

| | |

| | • | Role in the research, development, acquisition, licensing and manufacture of key products and technology; |

| |

| | • | Participation in the achievement of certain research, development and manufacturing milestones; |

| |

| | • | Contribution to the management team and development and application of leadership skills; |

| |

| | • | Role in meeting our organization and staffing goals, including personnel recruitment, influence on employee retention and executing management development; |

| |

| | • | Involvement in accessing capital to fund our research, development, operations and other business activities; and |

| |

| | • | Responsibility for full compliance with all applicable financial, legal and regulatory requirements. |

18

Market Benchmarks. Our market for experienced management is highly competitive. We aim to attract and retain the most highly qualified executives to manage each of our business functions. In doing so, we aim to draw upon a pool of talent that is highly sought after by both large, established pharmaceutical and biotechnology companies in our geographic area and by other development stage life science companies. We believe that the executive compensation practices of our industry in general and of our select peer group in particular provide useful information to help us establish compensation practices that allow us to attract, retain and motivate a talented executive team. Accordingly, each year we review the total cash and equity compensation levels and the levels of the principal elements of our compensation structure — base salary, performance bonus and equity awards — for our named executive officers against comparable compensation paid within our peer group.

As described below, in considering how this data relates to our existing compensation structure, we take into account our relative company size, stage of development, performance and geographic location as compared to these peer companies, as well as what we know about the scope of responsibilities that executives are accountable for at these companies.

We believe we must offer a compensation package that is competitive within our peer group, yet fully aligned with our current stage of development and our annual and longer term performance. We believe that our total target cash and equity compensation levels should be positioned at approximately the 50th and 75th percentiles, respectively, of our peer group, with the opportunity to be positioned above this range for above target performance.

In 2007, Haigh & Company worked with our Compensation Committee to develop a select peer group of 25 companies based on, among other things, market capitalization, number of employees and stage of development. The Compensation Committee intends to review and modify this peer group periodically, to ensure that the peer companies remain aligned with our stage of development. For 2007, the peer group consisted of the following companies:

AMAG Pharmaceuticals, Inc.

Alnylam Pharmaceuticals, Inc.

Altus Pharmaceuticals, Inc.

Ariad Pharmaceuticals, Inc.

Arqule, Inc.

CombinatoRx, Inc.

Curagen Corporation

Cytokinetics, Inc.

Genomic Health, Inc.

Geron Corporation

Idenix Pharmaceuticals, Inc.

Indevus Pharmaceuticals, Inc.

Momenta Pharmaceuticals, Inc.

Neurogen Corporation

Novacea, Inc.

Osiris Therapeutics, Inc.

Pain Therapeutics, Inc.

Panacos Pharmaceuticals, Inc.

Penwest Pharmaceutical Co.

Progenics Pharmaceuticals, Inc.

Renovis, Inc.

Sirtris Pharmaceuticals, Inc.

Synta Pharmaceuticals Corp.

Sunesis Pharmaceutical, Inc.

Viacell, Inc. (acquired by Perkin Elmer, Inc. in late 2007)

19

In 2007 and early 2008, Haigh & Company compiled executive compensation data for this peer group for use by the Compensation Committee as described above. We also use compensation data from national surveys such as the 2007 Radford Global Life Sciences Survey Executive Report to provide additional context to the peer group data.

Mix of Pay. In setting total compensation, and in setting the amounts of each primary element of total direct compensation, our Compensation Committee does not rely on a specific target pay mix. Instead, the Compensation Committee is guided by the general principle that a material percentage of an executive’s total compensation should be “at risk” — that is, payable only upon achievement of performance objectives or, as is the case with stock option awards, with value dependent on the appreciation of our stock price — as the executive has increasing responsibility for and impact on Company performance results. Based on this principle, performance-based compensation, in the form of target cash bonus and equity awards, represented approximately 60% of the total direct compensation for our named executive officers in 2007 (on an annualized basis for executives hired during the year).

We believe this pay mix is reasonable in light of compensation practices of peer companies and therefore allows us to remain competitive in seeking and retaining top executive talent. We also believe this pay mix appropriately aligns the interests of our executives with those of our shareholders, by placing a substantial portion of their compensation at risk based on the Company’s performance and the market performance of our stock.

Assessment of 2007 Performance

Our business strategy is to become a leader in the discovery, development and commercialization of innovative and targeted radiotherapeutics and molecular imaging pharmaceuticals. We intend to build our product portfolio in each of these areas through our internal research efforts, our use of proprietary technologies and our acquisition or in-licensing of complimentary products and technologies. In order to enable these strategic initiatives to continue, we must continue to focus on effective financing strategies, which involve raising additional capital through the issuance of equity and debt instruments. We must also focus on continually strengthening our management and scientific teams, in order to provide the human resources necessary to carry out our business objectives.

In 2007, we continued to make significant progress highlighted by the following specific achievements:

Financing

| | |

| | • | Successfully completed our IPO, raising $70 million; and |

| |

| | • | Raised an additional $150 million in November through a bond offering. |

Research, Development and Manufacturing

| | |

| | • | We acquired a GMP manufacturing facility in October which will provide us with in-house manufacturing capacity; |

| |

| | • | We strengthened other manufacturing supply arrangements; |

| |

| | • | Met or exceeded certain important Phase I and II clinical trial schedules; and |

| |

| | • | In-licensed two high-potential radiotherapeutic drug candidates. |

Organization

| | |

| | • | We continued to develop and expand our management team with the hiring of our CFO, CMO, VP Manufacturing and VP Human Resources, as well as the hiring of key scientific and clinical operations personnel. |

20

Based on the Compensation Committee’s review of performance for 2007, the Compensation Committee set the overall bonus pool funding for the senior executive team at 113% of target.

Components of our Executive Total Direct Compensation Program and 2007 Compensation Actions

When we and the Compensation Committee consider executive total direct compensation, our focus is on our three primary direct compensation elements which consist of:

| | | | | | | | | | | | | |

| 1. Base Salary | | + | | 2. Annual Cash

Performance Awards | | + | | 3. Long-Term

Equity Incentives | | = | | Total Direct

Compensation |

Base Salary. Base salary is used to recognize the experience, skills, knowledge and responsibilities required of each executive officer, as well as competitive market conditions. For newly hired personnel, we considered the base salary of the individual at his or her prior employment, market salary levels for similar positions and the individuals experience and potential to take on roles of increasing responsibility. Base salaries for our senior executives are generally positioned between the 40th and 60th percentiles versus our peer group.

The base salary of our named executive group is reviewed on an annual basis and adjustments are made to reflect performance-based factors, as well as competitive conditions. Increases are considered within the context of our overall annual merit increase budget before more specific individual and market competitive factors are considered. We do not apply specific formulas to determine increases. Generally, executive salaries are adjusted effective January 1 of each year.

For Messrs. Barlow, McCray, Gallahue (our former CFO) and Dr. Babich, salaries were not adjusted in 2007 as their salaries were increased in September of 2006. For Dr. LaFrance and Mr. Wallroth, their 2007 salaries were set at $325,000 and $275,000 respectively, upon their hiring.

Annual Cash Bonus. Annual performance bonuses for our officers are based on the achievement of Company annual goals and objectives, departmental or functional area goals, as well as individual performance objectives. Awards under the program are based on a thorough quantitative and qualitative review of all the facts and circumstances related to Company, department/function and individual performance when determining each individual’s annual bonus as described in detail above. An individual may receive an award from zero to 150% of his or her target bonus based on the review of results. For 2007, the target bonuses for Messrs. Barlow, McCray and Wallroth and Dr. Babich were 50% of their base salary and the target bonus for Dr. LaFrance was 30% of his base salary. In March of 2008, cash bonuses for 2007 performance were paid as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | 2007 Actual

| |

| | | | | | Bonus Target | | | Bonus Award | |

Executive | | 2007 Salary | | | % Salary | | | $ Value | | | % Salary | | | $ Value | |

| |

| David Barlow | | $ | 400,000 | | | | 50 | % | | $ | 200,000 | | | | 52.5 | % | | $ | 210,000 | |

| John Babich | | $ | 325,750 | | | | 50 | % | | $ | 162,500 | | | | 60.0 | % | | $ | 195,000 | |

| John McCray | | $ | 275,897 | | | | 50 | % | | $ | 137,500 | | | | 60.0 | % | | $ | 165,000 | |

| Norman LaFrance* | | $ | 325,000 | | | | 30 | % | | $ | 97,500 | | | | 31.5 | % | | $ | 64,000 | * |

| Donald Wallroth* | | $ | 275,000 | | | | 50 | % | | $ | 137,500 | | | | 60.0 | % | | $ | 68,800 | * |

| | |

| * | | Dr. LaFrance’s and Mr. Wallroth’s salaries stated above are the respective annual salaries for them for Fiscal 2007, assuming a full year of employment. Dr. LaFrance commenced his employment with the Company during April 2007 and Mr. Wallroth during August 2007. The actual salaries received by them are according lower. The 2007 Actual Bonus Awards are based on the actual salaries received. Please see the Summary Compensation Table below. |

Mr. Gallahue resigned during 2007 and did not receive any performance incentives for that year.

21

Long-term Compensation. For 2007, our long-term equity compensation consisted solely of stock options. Our option grants are designed to align management’s performance objectives with the interests of our stockholders and to encourage our employees to act as owners of the Company. Additionally, stock options provide a means of ensuring the retention of our key executives and employees as the options vest over multi-year periods.

In general, stock options are granted annually, and are subject to vesting based on the executive’s continued employment. Most options vest in four annual installments on the first four anniversaries of the date of the grant.