Exhibit 10.4

Territory License Agreement

between

Molecular Insight Pharmaceuticals, Inc

and

BIOMEDICA Life Sciences, S.A.

TABLE OF CONTENTS

| | |

Article I | | 3 |

Definitions | | 3 |

Article II | | 9 |

License | | 9 |

Article III | | 11 |

Manufacture and Supply | | 11 |

Article IV | | 12 |

Development and Commercialization | | 12 |

Article V | | 15 |

Consideration | | 15 |

Article VI | | 21 |

Call Back Option and Right of First Discussions | | 21 |

Article VII | | 23 |

Intellectual Property | | 23 |

Article VIII | | 28 |

Representations and Warranties | | 28 |

Article IX | | 30 |

Confidentiality | | 30 |

Article X | | 31 |

Announcement and Publicity | | 31 |

Article XI | | 32 |

Term and Termination | | 32 |

Article XII | | 34 |

Indemnification and Insurance | | 34 |

Article XIII | | 36 |

Information on Clinical Safety and Pharmacovigilance | | 36 |

Article XIV | | 37 |

Governing Law and Jurisdiction | | 37 |

Article XV | | 37 |

Miscellaneous Provisions | | 37 |

2

TERRITORY LICENSE AGREEMENT

Molecular Insight Pharmaceuticals, Inc. / BIOMEDICA Life Sciences S.A.

This territory license agreement (“Agreement”), dated this 1st day of September, 2009 (the “Effective Date”) is entered into by and between Molecular Insight Pharmaceuticals, Inc. (referred to herein as “MIP”), a corporation organized and existing under the laws of The Commonwealth of Massachusetts and having its principal office at 160 Second Street, Cambridge, MA 02142 USA, and BIOMEDICA Life Sciences S.A., a corporation organized and existing under the laws of Greece, with offices at 4 Papanikoli Str., 15232 Halandri, Athens, Greece (referred to herein as “BIOMEDICA”), with Greek Tax ID of 094413470, from the tax office of FAEE Athens; each a “Party” and collectively the “Parties” hereto.

RECITALS

WHEREAS, MIP has experience with and has developed and controls certain intellectual property and technical information with respect to a pharmaceutical product known as Onalta™. In particular, MIP has licensed exclusive and non-exclusive worldwide rights from Novartis AG to certain intellectual property relating to radiolabeled somatostatin analogues;

WHEREAS, BIOMEDICA has expertise in the health care market, radiopharmaceuticals in particular, and is engaged in the innovation and R&D in the subject areas.

WHEREAS, BioMedica wishes to obtain, and MIP desires to grant, a territory license from MIP for the development, exploitation and commercialization of Onalta™;

WHEREAS, the Parties have executed a Letter of Intent (LOI) on March 26, 2009, in furtherance of this purpose.

NOW, THEREFORE, in consideration of the mutual promises, covenants and agreements hereinafter set forth, the sufficiency of which is hereby acknowledged, the Parties to this Agreement mutually agree as follows:

1. DEFINITIONS

| 1.1. | “Accounting Standards” shall mean, with respect to MIP, U.S. GAAP (United States Generally Accepted Accounting Principles) and, with respect to BIOMEDICA, IFRS (International Financial Reporting Standards). |

| 1.2. | “Affiliate” shall mean any entity that directly or indirectly controls or is controlled by or is under common Control with a Party to this Agreement. For purposes of this definition, “control” or “controlled” means ownership directly or through one or more Affiliates, of fifty percent (50%) or more of the shares of stock entitled to vote for the election of directors, in the case of a |

3

| | corporation, or fifty percent (50%) or more of the equity interest in the case of any other type of legal entity, status as a general partner in any partnership, or any other arrangement whereby a Party controls or has the right to control the board of directors or equivalent governing body of a corporation or other entity, or the ability to cause the direction of the management or policies of a corporation or other entity. |

| 1.3. | “Agreement” shall mean this Agreement together with all exhibits, schedules, and appendices attached to this Agreement, all as respectively amended, modified or supplemented by the Parties in accordance with the terms of this Agreement. |

| 1.4. | “BIOMEDICA Field” shall mean human oncology therapeutic use, and use of the Indium 111 labeled Compound for dosimetry purposes in relation to therapy administration of the Product. |

| 1.5. | “BIOMEDICA New Intellectual Property” shall exclude technology developed jointly by the Parties. |

| 1.6. | “Calendar Year” shall mean the calendar year, starting on January 1 and ending on December 31, in which the first sale of the Compound or the Product occurs and each successive calendar year. |

| 1.7. | “Change of Control” shall mean any of the following events: (a) any Third Party (or group of Third Parties acting in concert) becomes the beneficial owner, directly or indirectly, of fifty percent (50%) or more of the voting power of the stock then outstanding of a Party; (b) a Party consolidates with or merges into another corporation or entity, or any corporation or entity consolidates with or merges into the Party, in either event pursuant to a transaction in which fifty percent (50%) or more of the total voting power of the stock outstanding of the surviving entity normally entitled to vote is not held by the Parties holding more than fifty percent (50%) of the outstanding shares of a Party prior to such consolidation or merger; (c) any Third Party (or group of Third Parties acting in concert) obtains the power to direct or cause the direction of the management and policies of a Party by any lawful means whatsoever; or (d) a Party conveys, transfers or leases all or substantially all of its assets. |

| 1.8. | “Commercialization” or “Commercialize” shall mean activities conducted by a Party either by itself or through a Third Party and directed to marketing, promoting, distributing, importing, exporting, offering for sale or selling a Product, which may include pre-launch market preparation, whether undertaken by a Party alone or with a partner or a sub-licensee. When used as a verb, “Commercialize” means to engage in Commercialization. |

| 1.9. | “Commercially Reasonable Effort” shall mean the efforts and resources customarily used in the industry by a company of similar size for a product with an equivalent sales and profit potential to the Product. |

4

| 1.10. | “Compound” shall mean a lyophilized kit comprising the DOTA-chelated somatostatin peptide analogue known as edotreotide plus excipients provided. |

| 1.11. | “Confidential Information” shall mean and include any and all Know-How, data and information, not in the public domain. It shall also include, but not be limited to, information relating to the Product and/or Compound, or the business, research and development activities, results of clinical trials, regulatory proceedings, finances, contractual relationships and operations of the Parties. |

| 1.12. | “Controlled” or “Controls”, when used in reference to intellectual property, shall mean the legal authority or right of a Party hereto (or any of its Affiliates) to grant a license or sub-license of intellectual property rights to another Party, or to otherwise disclose proprietary or trade secret information to such other Party, without breaching the terms of any agreement with a Third Party, infringing upon the intellectual property rights of a Third Party, or misappropriating the proprietary or trade secret information of a Third Party. |

| 1.13. | “Development” shall mean all activities conducted by a Party either by itself or through a Third Party, as are necessary for an application for a Marketing Authorization. |

| 1.14. | “Development Costs” shall mean, with respect to the Compound or Product, expenses and other costs, including regulatory expenses, incurred by or on behalf of a Party in connection with the Development of the Compound or Product, including, the costs of clinical trials, the preparation, collation and/or validation of data from such clinical trials and the preparation of medical writing and publishing. |

| 1.15. | “Effective Date” shall mean the date first above written. |

| 1.16. | “EMEA” shall mean the European Medicines Agency or its successor agency. |

| 1.17. | “First Commercial Sale” shall mean the first sale of the Compound or the Product to a Third Party by BIOMEDICA or an Affiliate or sub-licensee of BIOMEDICA in a country in the Territory following applicable EMEA approval for or consent to compassionate use of the Compound or the Product and/or Marketing Authorization in one indication of the Product in the Territory. |

| 1.18. | “Good Clinical Practice” or “GCP” shall mean the generally accepted standard of Good Clinical Practice within the pharmaceutical industry for the design, conduct, performance, monitoring, auditing, recording, analyses and reporting of clinical trials that provides assurance that the data and reported results are clinical and accurate and that the rights, integrity and confidentiality of the trial subjects are protected. |

| 1.19. | “Good Manufacturing Practices” or “GMP” shall mean the then current Good Manufacturing Practices as such term is defined from time to time by the FDA or other relevant Governmental Authority having jurisdiction over the development, manufacture or sale of the Product in the Territory pursuant to its regulations, guidelines or otherwise. |

5

| 1.20. | “Initial Period” is the time from the effective date until the filing of a marketing application |

| 1.21. | “Interim Period” is the time from the filing of the marketing application to the final action by the EMEA. |

| 1.22. | “Marketing Authorization” shall mean, with respect to a country in the Territory, the approval by the appropriate authority necessary for the Commercialization of the Product in that country. For the sake of clarity, Marketing Authorization shall not include the reimbursement approval. |

| 1.23. | “NDA” or “New Drug Application” shall mean a new drug application and all amendments and supplements thereto filed with the EMEA, or any such Regulatory Authority requiring such filing, including all documents, data and other information concerning a pharmaceutical product that are necessary for gaining Marketing Authorization to market and sell such pharmaceutical product. |

| 1.24. | “NDA Acceptance” shall mean the date upon which the Product NDA submitted by BIOMEDICA is deemed filable by the EMEA or the equivalent dossier is accepted for review by any other country’s respective Regulatory Authority. |

| 1.25. | “Net Sales” shall mean with respect to the Compound and the Product the gross amount invoiced by or on behalf of BIOMEDICA and its Affiliates and sub-licensees for the Compound or Product sold to Third Parties other than sub-licensees in bona fide, arms-length transactions, less the following customary deductions, determined in accordance with the BIOMEDICA’s Accounting Standards as generally and consistently applied by BIOMEDICA, to the extent included in the gross invoiced sales price of any Compound or Product or otherwise directly paid or incurred by BIOMEDICA, its Affiliates or sub-licensees with respect to the sale of such Compound or Product: i) normal and customary trade and quantity discounts actually allowed and properly taken directly with respect to sales of the Compound or Product; ii) amounts actually repaid or credited by reasons of defects, rejection recalls, returns, rebates and allowances of goods; iii) chargebacks and other amounts paid on sale or dispensing of such Compound or Product; iv) amounts payable resulting from governmental mandated rebate programs; v) tariffs, duties, mandatory transaction or sales related type fees imposed by any governmental entity (even if paid to a third party), excise, sales, value- added and other taxes (other than taxes based on income); vi) retroactive price reductions specifically identifiable to the Compound or Product that are actually allowed or granted; vii) customary cash discounts for timely payment; viii) delayed ship order credits; ix) discounts pursuant to indigent patient programs and patient discount programs and coupon discounts; and x) all freight, postage and insurance included in the invoice price. |

| | 1.25.1. | Sales from BIOMEDICA to its Affiliates shall be disregarded for purposes of calculating Net Sales. Any of the items set forth above that would otherwise be deducted from the invoice price in the calculation of Net Sales but which are separately charged to Third Parties shall not be deducted from the invoice price in the calculation of Net Sales. |

6

| | 1.25.2. | In the case of any sale or other disposal of the Compound or the Product between or among BIOMEDICA and its Affiliates or sub-licensees, for resale, Net Sales shall be calculated as above only on the value charged or invoiced on the first arm’s-length sale thereafter to a Third Party; |

| | 1.25.3. | In the case of any sale which is not invoiced or is delivered before invoice, Net Sales shall be calculated at the time of shipment or when the Compound or the Product is paid for, if paid for before shipment or invoice; |

| | 1.25.4. | In the case of any sale or other disposal for value, such as barter or counter-trade, of any Compound or Product, or part thereof, other than in an arm’s length transaction exclusively for money, Net Sales shall be calculated as above on the value of the non-cash consideration received or the fair market price (if higher) of the Compound or Product in the country of sale or disposal; |

| | 1.25.5. | In the event the Compound and the Product is sold in a finished dosage form containing the Compound in combination with one or more other active ingredients (a “Combination Product”), the Net Sales of the Compound or Product, for the purposes of determining royalty payments, shall be determined by multiplying the Net Sales (as defined above in this Article) of the Combination Product by the fraction, A/(A+B) where A is the weighted (by sales volume) average sale price in a particular country of the Compound or Product when sold separately in finished form and B is the weighted average sale price in that country of the other product(s) sold separately in finished form. In the event that such average sale price cannot be determined for both the Compound, Product and the other product(s) in combination, Net Sales for purposes of determining royalty payments shall be agreed by the Parties based on the relative value contributed by each component, such agreement shall not be unreasonably delayed or withheld. |

| 1.26. | “Know-How” shall mean proprietary or non proprietary information relating to the Compound and/or the Product excluding the regulatory CMC information for the chemical manufacturing process. The information shall include the relevant specifications, technical data, inventions, discoveries, formulation, processes, trade secrets, expertise developments and regulatory information of the Product controlled by MIP as well as, chemical, stability, pharmacological, safety, clinical data, analytical and quality control data, whether or not protected under patent, trademark, copyright or other legal principles, to which MIP has rights at the Effective Date. For the sake of clarity, any information related to the manufacture of the Tyr-3 octreotide will not be disclosed to BIOMEDICA. |

7

| 1.27. | “Novartis License Agreement” shall mean the license agreement entered into by and between Novartis and MIP dated November 3, 2006 and any amendments thereto. |

| 1.28. | “Novartis” shall mean Novartis Pharma AG, a corporation organized and existing under the laws of Switzerland, and having its principal offices at Lichtstrasse 35, CH-4056 Basel, Switzerland. |

| 1.29. | “Novartis Patents” shall mean those patents and patent applications owned or Controlled by MIP during the term of this Agreement with a claim encompassing Compound, Product, or any other formulations of Compound, processes, uses and intermediates for the foregoing and shall include any patents or patent applications and any continuations, continuations-in-part, divisions, provisionals, substitutions, patents of addition, reissues, examination, renewals or extensions thereof (including any supplemental patent certificates) and any confirmation patent or registration patent and all foreign counterparts of any of the foregoing. |

| 1.30. | “Onalta” and “www.onalta.com” shall mean the trademarks owned and selected by MIP for the Product. |

| 1.31. | “Peptide” shall mean the DOTA-chelated somatostatin peptide analogue known as edotreotide. |

| 1.32. | “Product” shall mean the yttrium radiolabeled Compound for therapeutic use and indium-111 radiolabeled Compound for dosimetry purposes, both in a form ready for use in human clinical trials and/or by the ultimate consumer with the trademark of Onalta. |

| 1.33. | “Regulatory Authority” shall mean the EMEA or additional governmental or regulatory agencies in the Territory responsible for applicable Marketing Authorization. |

| 1.34. | “Royalty Term” shall have the meaning as set forth in article 5.6. |

| 1.35. | “Sub-licensee” shall mean a Third Party to whom BIOMEDICA may grant a right or license to use Novartis Patents or Know-How to make, use or sell any Product in the Territory. |

| 1.36. | “Term” shall have the meaning as set forth in article 11.1. |

| 1.37. | “Territory” shall mean those countries as of the Effective Date belonging to the European Union, the European Free Trade Association (Switzerland, Iceland, Lichtenstein and Norway), Eastern Europe, Russia and the other former Commonwealth of Independent States (CIS), the Middle East and Arabic States, Turkey, and the North Africa region. “Territory” shall specifically exclude the State of Israel unless and until such rights become available pursuant to article 2.4. |

8

| 1.38. | “Trademark” shall mean MIP’s “Onalta” related trademarks, logos, and tradenames. |

| 1.39. | “Valid Claim” shall mean an issued claim of a Novartis Patent which claim has not been held invalid or unenforceable by final decision of a court or other governmental agency of competent jurisdiction, unappealable or unappealed within the time allowed for appeal, and which is not admitted to be invalid or unenforceable through reissue, disclaimer or otherwise. |

The following Schedules attached to this Agreement are hereby incorporated by reference:

Exhibit A: BIOMEDICA Business Plan

Exhibit B: Intellectual Property

Exhibit C: Examples of Contingent Milestone Payment Calculations

Exhibit D: Examples of Permitted Disclosures

2. LICENSE

| 2.1 | Grant to BIOMEDICA.Subject to the terms and conditions of this Agreement, MIP hereby grants to BIOMEDICA exclusively within the Territory, a royalty-bearing license under its rights in the Novartis Patents and Know-How necessary for BIOMEDICA to (i) develop, (ii) market, (iii) advertise, (iv) manufacture, (vi) have manufactured, (vii) import, (viii) export, (ix) distribute, and (x) commercialize the Compound and the Product, including securing all regulatory approvals and performing clinical studies. Such rights granted are expressly conditioned on and subject to the Novartis License Agreement. In addition, MIP hereby grants to BIOMEDICA a non-exclusive, non-transferable license to use the trademark ONALTA in connection with sale or distribution of the Product throughout the Territory subject to the terms and conditions set forth below. For the avoidance of doubt, the rights granted herein are for the Compound when used as a therapeutic Product, and BIOMEDICA shall not be granted any rights to use, sell or otherwise promote the Compound or Product as a diagnostic product. |

| 2.2 | MIP agrees that in the event that it grants future sublicenses under the Novartis License Agreement on more favorable terms than the terms set forth in this Agreement, MIP will offer such terms to BIOMEDICA provided such terms are not unfairly discriminatory to BIOMEDICA. More favorable payment terms to a third party licensee which are either not under MIP’s control (such as government imposed terms), or reasonable in light of the size and limited economic opportunity in the subject country or region, shall not constitute unfair discrimination. |

9

| 2.3 | Sub-license. BIOMEDICA shall have the right to grant, under the license granted in article 2.1, additional sub-licenses to Third Parties with respect to the Product, provided that the terms and conditions of sub-license agreements shall be consistent with the terms of this agreement. BIOMEDICA shall undertake to enforce the provisions of such sub-license agreements and shall remain responsible for the performance of sub-licensee’s obligations. BIOMEDICA shall cause each sub-licensee to execute any and all additional documents reasonably requested by MIP to reflect the conditions set forth in this agreement. |

| | 2.3.1 | BIOMEDICA’s right to grant Third Party sublicenses hereunder is expressly conditioned upon prior written notice and approval by MIP and by Novartis, which approval from MIP shall not be unreasonably withheld. |

| 2.4 | Limitations of Rights. It is acknowledged and agreed that no other license rights are granted by MIP to BIOMEDICA other than the license expressly granted by the provisions of Article 2.1, and that MIP expressly retains all other rights under any MIP Know-How and MIP Patents. |

| 2.5 | MIP-NOVARTIS Change in Payment Terms. To the extent that MIP and NOVARTIS, or in the event of material breach by Novartis enter into a new agreement reducing the payments to be paid to Novartis under the Novartis License Agreement and/or amending the payment structure, MIP agrees to extend the benefit of any such reduction or amendment to BIOMEDICA to the extent fair and reasonable. |

| 2.6 | Additional Countries. If exclusive sublicense rights to the Novartis Patents become available in ******, then MIP shall notify BIOMEDICA in writing of the existence of such rights, and the Parties shall undertake to include ****** within the Territory under this Agreement. Other than ******, if after the Effective Date but within the Term of this Agreement, if MIP desires to sublicense rights to the Novartis Patents for any country not included in the Territory, then MIP shall give BIOMEDICA reasonable notice of its intent and an opportunity to participate in negotiations for sublicense rights in such country. |

| 2.7 | Transfer of MIP Information and MIP Files. MIP shall use reasonable efforts to transfer to BIOMEDICA within ninety (90) days of the Effective Date or such longer period as reasonably required by MIP, instructions and training manuals for the radiolabeling and patient administration of the Compound, existing as of the Effective Date, on an “as is” basis. For the sake of clarity MIP shall not be requested to perform clinical trials or animal studies with the Compound or Product, and all data and files shall be transferred as is with no further obligations on MIP. The MIP information provided hereunder shall remain the property of MIP, but BIOMEDICA shall be free to use it in connection with the sublicense granted above. |

10

*Confidential Treatment Requested*

| 2.8 | Liaison. The primary contact persons (the “Contact”) at BIOMEDICA and MIP are set forth in Section 15.8, and these designated persons shall act as liaisons for the purpose of this Agreement, which role shall include but not be limited to receiving the reports set forth in Articles 4.2 and 5.8 and other notices under this Agreement. The Parties may change their respective Contact at any time by providing written notice to the other Party. |

3. MANUFACTURE AND SUPPLY

| 3.1 | Purchase of Compound and Product. During the Term of this Agreement BIOMEDICA shall purchase all of its requirements for the Compound and the Product exclusively and solely from MIP, a MIP designated third party manufacturer, and/or a BIOMEDICA designated third party manufacturer approved by MIP. BIOMEDICA shall not, without the written authorization from MIP, supply or otherwise distribute the Compound or Product to any third party outside of the Territory. |

| | 3.1.1 | Supply agreement. The Parties agree to begin good faith negotiations on a definitive supply agreement for the Compound and the Product immediately upon execution of this Agreement. It is the goal of the Parties to finalize the supply agreement within 14 days of the Effective Date of this Agreement. The Parties acknowledge that the effective date of the supply agreement shall be concurrent with the date MIP enters into a manufacturing agreement with an MIP designated third party, manufacturer. The Parties understand and acknowledge that the supply agreement will include an advance payment by BIOMEDICA for inventory on the following schedule: |

| | 3.1.2 | The acquisition of product from inventory will be at the agreed-to price for both the Compound and the Product (section 3.4). For the sake of clarity, the Parties agree that the supply agreement referenced above in Section 3.1.1 will include a minimum purchase requirement by BioMedica, with the amount(s) and frequency of such minimum purchase to be |

11

*Confidential Treatment Requested*

| | negotiated by the Parties acting in good faith. The inventory payments referred to in section 3.1.1 will be credited against purchases once purchases exceed milestones that will be defined in the supply agreement between MIP and BIOMEDICA. |

| 3.2 | Responsibility for Manufacturing Product. MIP, or the MIP designated third party manufacturer shall supply BIOMEDICA’s requirements for the Product for a period of ten years following the Effective Date of this Agreement upon terms to be agreed in the supply agreement. |

| 3.3 | Responsibility for Manufacturing Compound. MIP, or the MIP designated third party manufacturer shall supply BIOMEDICA’s requirements for the Compound for a period of five years following the Effective Date of this Agreement upon terms to be agreed in the supply agreement. |

| 3.4 | ****** License Termination: Immediately upon execution of this Agreement, MIP and BIOMEDICA jointly agree to develop and implement a Peptide distribution plan to be effective concurrent with MIP’s termination of the ****** Agreement (90 day notice required) in order to be able to seamlessly supply peptide within the Territory. |

| 3.5 | Pricing Commitment: MIP will provide the Compound for radiolabeling during the interim period until the Product, Onalta™, is available. BIOMEDICA will purchase the Compound at an agreed upon single unit dose price of ******. BIOMEDICA will be responsible for Y-90 isotope purchase for the production at radiopharmacies until the Product, Onalta™, is available. BIOMEDICA will purchase the Product at an agreed upon unit price of ******. |

| 3.6 | Training and Support: MIP will provide reasonable levels of technical support to BIOMEDICA at BIOMEDICA’s request on a time and materials basis. The Parties will enter into good faith discussions regarding the details of such support and associated costs upon request by BIOMEDICA. Such support will take place as soon as reasonably possible and primarily focused on training BIOMEDICA’s personnel. |

4. DEVELOPMENT AND COMMERCIALIZATION

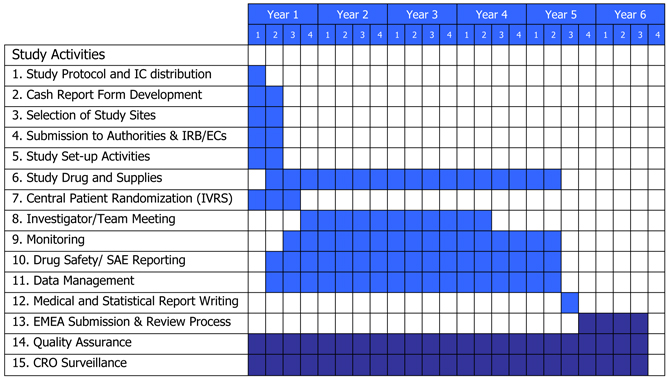

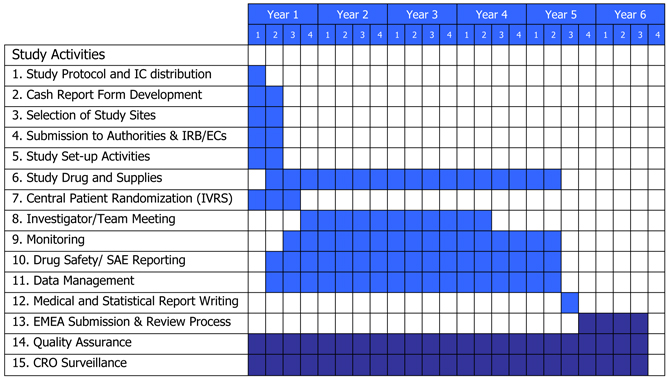

| 4.1 | Development Costs. BIOMEDICA shall be solely responsible for all Development and Commercialization activities to be conducted pursuant to this Agreement from the Effective Date and all costs related thereto. BIOMEDICA has developed a Business Plan (the “Business Plan”) attached hereto Exhibit A that describes in detail the Development and Commercialization activities that BIOMEDICA will undertake in connection with the Compound and the Product. BIOMEDICA commits to implement the Development and Commercialization activities substantially in accordance with the “Business Plan” Development milestones and timelines shown on page 20 of Exhibit A. |

12

*Confidential Treatment Requested*

| 4.2 | Reports: BIOMEDICA shall provide to MIP reports detailing its Development and Commercialization activities as set forth below. If BIOMEDICA should elect a third party manufacturer of the Product pursuant to article 3.3, then the report shall include all manufacturing information, including but not limited to lot numbers, Product specifications, and GMP compliance. |

| | 4.2.1 | During the Initial Period, no later than thirty (30) days after the end of each calendar quarter, BIOMEDICA shall provide written reports to MIP containing specific and detailed information regarding BIOMEDICA’s performance under each of the Timelines and Milestones set forth in the Business development Plan, including but not limited to (i) a summary of the regulatory activities for the Product, including any material changes in such activities since the prior reporting period, (ii) a summary of the clinical study results for the Compound and the Product, including any material changes in the clinical activities since the prior reporting period, (iii) other development activities for the Licensed Product (which may include material changes in the projected timelines) as deemed appropriate by BIOMEDICA in its reasonable discretion, and (iv) a summary of material planned regulatory and clinical activities for the four (4) calendar quarters following such reporting period; the relevant reporting period shall be the three (3)-month period ending March 31, June 30, September 30 or December 31 of each calendar year preceding such report, as applicable; |

| | 4.2.2 | During the Interim Period, no later than sixty (60) days after the end of each six (6)-month period ending June 30 and December 31 of each calendar year (semi-annual), BIOMEDICA shall provide written reports to MIP containing the information specified in clause (i) above for the six (6)-month reporting period ending June 30 or December 31 of each calendar year preceding such report and a summary of material planned regulatory and clinical activities for the following two (2) six (6)-month periods ending December 31 and June 30; and |

| | 4.2.3 | Thereafter, no later than sixty (60) days after the end of each calendar year, BIOMEDICA shall provide written reports to MIP containing the information specified in clause (i) above for each calendar year preceding such report and a summary of material planned regulatory and clinical activities for the following calendar year (each report referred to in clauses (i), (ii) and (iii), a “Development Report”). MIP shall be permitted to disclose summaries of Development Reports provided by BIOMEDICA to MIP. |

| 4.3 | Development Efforts. BIOMEDICA shall use Commercially Reasonable Efforts to develop and register the Product and shall be solely responsible for compiling the NDA for each Product in the BIOMEDICA Field at its own expense. BIOMEDICA may request MIP’s involvement with any NDA, and BIOMEDICA shall pay all charges associated with MIP’s assistance on a time and materials basis for any requested involvement by MIP’s personnel. |

| | 4.3.1 | Medical Symposia, Advisory Boards or other Meetings with Key Opinion Leaders. BIOMEDICA agrees that, if it is planning to hold such a meeting, at least one member of MIP’s management shall have the right to attend (at MIP’s sole expense) |

13

| 4.4 | Development Committee. The parties shall establish a development committee to review and discuss current material clinical development activities and safety information relating to the Compound and the Product, and review and discuss as appropriate future material clinical development, medical symposia, publications in top peer reviewed journals and regulatory plans for the Compound and the Product. BIOMEDICA and MIP may each appoint up to four (4) members to the development committee. |

| | 4.4.1 | Development Committee Meetings. Beginning no later than ninety (90) days after the Effective Date, the Development Committee shall meet quarterly through the Initial Period. After the Initial Period the Development Committee will meet semi-annually during the Interim Period. Thereafter, the Development Committee shall meet annually. All meetings of the Development Committee will be timed to follow the receipt of the Reports (as defined in Section 4.2 above) and will be held in person at a mutually agreeable time and location. |

| 4.5 | Clinical Trials. BIOMEDICA shall be solely responsible for and shall bear all the costs related to the conduct of clinical trials required to file NDAs in the Territory. BIOMEDICA undertakes to run the clinical trial program in accordance with GCP. MIP retains the right to read and access data from BIOMEDICA’s clinical trial including supporting data for MIP’s NDAs in regions outside the territories. |

| 4.6 | Marketing Efforts - Market Launch. BIOMEDICA shall use Commercially Reasonable Efforts to launch and sell the Product in the Territory for as long as this Agreement is in effect. The parties agree to meet and discuss marketing and market launch activities with a post development committee as set forth below in section 4.7. |

| 4.7 | Post-Development Committee: Within six (6) months of the Effective Date, the parties shall establish a “Post-Development Committee” to provide information sharing and be a forum for creative discussion and problem solving relating to (i) BIOMEDICA’s pre-launch activities, timelines and pre-commercialization plan ii) sales force development plans and marketing plans (iii) an overview of the market penetration rates by territory and any other relevant issues. Each party shall appoint no more than three (3) members to the Post-Development Committee. |

| | 4.7.1 | Post-Development Committee Meetings: The first meeting of the Post-Development Committee shall occur within one (1) year of the Effective Date at which meeting time the committee meeting schedule will be determined. |

14

| | 4.7.2 | Post-Development Committee Meeting Expenses. Each party shall bear all expenses of their respective members relating to their participation on the Post-Development Committee. |

| 4.8 | Booking Sales. BIOMEDICA shall, at its own expense, book sales of the Compound and the Product as distributed by or on behalf of BIOMEDICA. |

| 4.9 | Pricing. BIOMEDICA shall be free to set prices of the Compound and the Product. |

| 4.10 | Product Name. Product sold or distributed pursuant to this Agreement shall be sold or distributed under the ONALTA Trademark and all such use shall be governed by the terms provided herein. |

| 4.11 | Compound Name. Compound sold or distributed pursuant to this Agreement shall be sold or distributed under the name edotreotide radiolabeling kit for intravenous use and all such use shall be governed by the terms provided herein. |

5. CONSIDERATION

| 5.1 | License Fee. Upon execution of this Agreement, in consideration of the exclusivity in negotiations enjoyed by BIOMEDICA prior to execution of this Agreement for the rights granted to BIOMEDICA hereunder, BIOMEDICA shall pay and shall cause to be released to MIP the sum of ****** that the Parties have previously escrowed. In addition, in further consideration of the rights granted herein, BIOMEDICA shall pay to MIP, the additional sum of ****** such payment due upon execution of this Agreement. These initial license payments shall not be credited against any royalty or other payments to be made pursuant to this Agreement, and shall not be refundable. |

| 5.2 | Milestone Payments. In consideration of the rights granted to BIOMEDICA by MIP hereunder, BIOMEDICA shall make the following milestone payments to MIP. These milestone payments shall not be credited against any royalty or other payments to be made pursuant to this Agreement, and shall not be refundable unless otherwise indicated. BIOMEDICA shall spontaneously notify MIP of such events upon occurrence thereof, whereupon MIP shall submit an invoice to BIOMEDICA requesting such milestone payment. The payment shall be received by MIP 60 days after the occurrence of such milestone. |

| | 5.2.1 | ****** shall be due three (3) months after a first sale of the Compound following EMEA approval for or consent to compassionate use of the Compound |

15

*Confidential Treatment Requested*

| | 5.2.2 | ****** shall be due upon submission of the first NDA by BIOMEDICA in the Territory. |

| | 5.2.3 | ****** shall be due upon NDA Acceptance in the Territory. |

| | 5.2.4 | In addition to the amount provided in article 5.2.3, ****** shall be due and payable upon the granting of Marketing Authorization by the EMEA. |

| | 5.2.5 | The payments under article 5.2.2 and 5.2.3 shall be reduced ****** going forward, or will be retroactively refunded in the amount of ****** of the stated sum if the milestone has already be achieved, upon MIP submitting an NDA or obtaining NDA Acceptance outside of the Territory. |

| | 5.2.6 | If subsequent to the Effective Date, pursuant to article 2.4 the Parties expand the Territory to include additional countries not specified as part of the Territory as of the Effective Date, and the additional countries generate an incremental increase in Net Sales greater than ****** over the original countries in the Territory,then BIOMEDICA shall not be entitled to the reduction or refund specified in article 5.2.5. In addition, to the extent any refund has been paid by MIP, then BIOMEDICA shall repay the corresponding refunded portion to MIP. |

| 5.3 | Additional Milestone Payments. The following milestone payments shall be in addition to those specified in Section 5.2, and shall be payable to MIP in the Calendar Quarter following that in which the milestone is achieved pursuant to article 5.10. The following additional milestones under this article 5.3 shall be cumulative. These additional milestone payments shall not be credited against any royalty or other payments to be made pursuant to this Agreement, and shall not be refundable. The payment shall be received by MIP 60 days after the occurrence of such milestone. |

| | 5.3.1 | ****** shall be due upon achieving cumulative Net Sales of the Compound and/or the Product in excess of ******; |

| | 5.3.2 | An additional ****** shall be due and payable upon achieving cumulative Net Sales of the Compound and/or the Product in excess of ******; |

16

*Confidential Treatment Requested*

| | 5.3.3 | An additional ****** shall be due and payable upon achieving cumulative Net Sales of the Compound and/or the Product in excess of ******; and |

| | 5.3.4 | An additional ****** shall be due and payable upon achieving cumulative Net Sales of the Compound and/or the Product in excess of ******. |

| 5.4 | Contingent Milestone Payments. MIP’s rights under the Novartis Patents, and by extension BIOMEDICA’s license rights thereto, are subject to a one-time Call-Back Option as defined by the Novartis and MIP License Agreement and as essentially set forth below in article 6 herein. The Call Back Option is triggered when aggregate worldwide Net Sales of Product in a Calendar Year first reach ******. |

| | 5.4.1 | BIOMEDICA shall provide MIP with reasonable advance notice if its sales forecasts project potential Net Sales of the Compound and/or the Product could reach ****** in a Calendar Year. |

| | 5.4.2 | If worldwide Net Sales of the Compound or the Product reach ****** in a Calendar Year, then BIOMEDICA agrees to fully cooperate with MIP as part of any Novartis due diligence inquiry. BIOMEDICA shall assume all costs associated with its involvement in such due diligence. |

| | 5.4.3 | Should Novartis decide not to exercise its Call Back Option, then BIOMEDICA shall pay the following contingent milestone payments to MIP on a pro-rata basis as determined by BIOMEDICA Net Sales as a proportion of worldwide Net Sales. Where a previously-triggered contingent milestone payment is triggered in a future year, then ****** shall govern an equitable contribution and credit back to any sublicensee having earlier contributed to such previously triggered contingent milestone payment. |

| | 5.4.3.1 | ****** once an annual worldwide Net Sales amount of ****** is achieved, payable in two equal installments, the first payment due by January 31st of the Calendar Year following the year in which the milestone is achieved and the second payment 12 months later. |

| | 5.4.3.2 | An additional ****** once an annual worldwide Net Sales of ****** is achieved, payable in two equal installments, the first payment due by January 31st of the Calendar Year following the year in which the milestone is achieved and the second payment 12 months later. |

| | 5.4.3.3 | An additional ****** once an annual worldwide Net Sales amount to ****** is achieved, payable in two equal installments, the first payment by January 31st of the Calendar Year following the year in which the milestone is achieved and the second payment 12 months later. |

17

*Confidential Treatment Requested*

| 5.5 | Royalties. In addition to the license fees set forth in article 5.1 and the milestone payments set forth in articles 5.2, 5.3 and 5.4, and as further consideration for the license rights granted to BIOMEDICA hereunder, BIOMEDICA further agrees to pay to MIP royalties on BIOMEDICA’s and/or its Sub-licensee’s aggregate Net Sales for both the Compound and/or the Product in the Territory, during the Royalty Term at a rate calculated according to the following: |

| | 5.5.1 | ****** of the annual Net Sales of the Compound and/or the Product for Net Sales amounting to less than ****** annually. |

| | 5.5.2 | ****** of the Net Sales of the Compound and/or the Product on the incremental sales between ****** and ****** annually. |

| | 5.5.3 | ****** of the Net sales of the Compound and/or the Product on the incremental sales over ******. |

| 5.6 | Royalty Term: Royalties shall be payable quarterly on a country-by-country basis from the First Commercial Sale of the Product until the occurrence of the later of: (i) the expiration of the latest to expire Novartis Patent including any extensions in each such country or (ii) 10 years from First Commercial Sale. Royalty payments shall be received by MIP no later than 30 days from the close of the quarter. |

| 5.7 | The Combination Royalty: In the event that the Peptide, Compound and / or Product (“MIP Component”) is formulated with a different or other active ingredient or a second product to comprise a fixed Combination Product, the “net sales” of the MIP Component, for purposes of determining royalty payments to Novartis and MIP, shall be determined by multiplying the Net Sales of the Combination Product by the fraction, A/(A+B), whereas A is the weighted average sales price of the Product (by sales volume) when sold independently and B is the weighted average sales price (by sales volume) of the other product-component when sold independently. In the event the weighted average sales price cannot be determined for either “A” or “B”, the Parties hereto shall agree on an alternative method for calculating “net sales” of the MIP Component of the Combination Product for purposes of calculating royalties to Novartis and MIP. In such event, the Parties shall agree on the methodology prior to submitting the registration dossier for the Combination Product, taking into account relevant factors such as, but not limited to, the relative cost and value contributed by each component weighted proportionally. |

18

*Confidential Treatment Requested*

| 5.8 | Equity/Option Rights. In addition to the license fees set forth in article 5.1, the milestone payments set forth in articles 5.2, 5.3 and 5.4, and the royalty payments in article 5.5, and as further consideration for the license rights granted to BIOMEDICA hereunder, MIP is entitled to the following stock option grant and conditions: |

| | 5.8.1 | BIOMEDICA grants MIP an option to have BIOMEDICA assign, transfer and convey a minority shareholder interest in BIOMEDICA to MIP upon conclusion of and execution of the Comprehensive Agreement: |

| | 5.8.2 | BIOMEDICA grants MIP an option to have BIOMEDICA assign, transfer and convey a minority shareholder interest in BIOMEDICA to MIP upon EMEA approval. |

| | 5.8.3 | The amount in equivalent shares which MIP shall have the right to exercise under the option grant in (i) and (ii) above, is exactly ****** of the total, non-diluted interest, in all classes of any issued and authorized shares outstanding in BIOMEDICA at the time of each exercise, assuming a fair market valuation of BIOMEDICA at ****** on the Effective Date of this Agreement; |

| | 5.8.4 | To the extent B BIOMEDICA’s grant of the option grant in (i) and (ii) above is subject to Board or shareholder approval, BIOMEDICA agrees to, in good faith, seek to secure all necessary approvals, or alternatively, to secure a commitment by a major shareholder for the transfer of its shares to MIP. |

| | 5.8.5. | BIOMEDICA represents that it believes that it has the legal right to make the above commitments. In the event that such commitments violate applicable Greek or E.U. securities laws or rules, then the above grants may, to the extent possible, be rewritten or amended, consistent with the intent of the parties, to cure any deficiencies therein, and if this is not possible, the commitments are automatically null and void. |

| | 5.8.6 | In the event of a change of control, bankruptcy or dissolution by MIP, or in the event that MIP desires to transfer or assign any equity interest that it may hold in BIOMEDICA, BIOMEDICA shall have a right of first refusal to buy back all or a portion of MIP’s interest in BIOMEDICA’s equity. |

| 5.9 | Sales Reports. After the First Commercial Sale of the Compound or the Product and during the Term of this Agreement, BIOMEDICA shall furnish or cause to be furnished to MIP on a quarterly basis a written report showing the Net Sales of Product in each country in the Territory. |

| | 5.9.1 | Timing. Each quarterly report shall be due within thirty (30) days following the close of each quarter. |

| | 5.9.2 | Records. BIOMEDICA shall keep accurate records in sufficient detail to enable the amounts due hereunder to be determined and to be verified by an independent certified public accountant mutually agreed upon by the Parties. |

19

*Confidential Treatment Requested*

| 5.10 | Currency Exchange. All royalty payments shall be made in United States Dollars (“USD”). With respect to sales or other dispositions of the Compound or the Product invoiced in a currency other than USD, the Net Sales and amounts due to MIP hereunder will be expressed in USD equivalent calculated on a monthly basis in the currency of the country of sale and converted to their dollar equivalent using the Daily Spot Rate on the last day of the period, published in the Reuters System - Reuters Daily Rates between 09:00 a.m. and 10 a.m. CET. |

| 5.11 | Payment Due Date; Accrual.Payments shall be made by wire transfer as directed by the receiving Party or to the address designated herein. Milestones and Royalties which have accrued during any Calendar Year and are required to be shown on a sales report provided under this Article 5 of the Agreement shall be due and payable as set forth in the relevant sections in this Article 5 pertaining to such Milestones and Royalties. |

| | 5.11.1 | BIOMEDICA and Sub-licensees shall keep for three (3) years from the date of each payment of milestones and royalties, complete and accurate records of sales by BIOMEDICA and Sub-licensees of the Compound and the Product in sufficient detail to allow the accruing payments to be determined accurately. |

| | 5.11.2 | MIP shall have the right for a period of three (3) years after receiving any report or statement with respect to royalties or milestones due and payable to appoint an independent certified public accountant reasonably acceptable to BIOMEDICA to inspect the relevant records of BIOMEDICA and its Affiliates and Sub-licensees to verify such report or statement. MIP may exercise this right once with respect to each year’s Net Sales. If the right is not exercised during the three (3) year period described, the report shall be deemed accepted. MIP may exercise this right only once in any year. |

| | 5.11.3 | BIOMEDICA and Sub-licensees shall each make its records available for inspection by such independent certified public accountant during regular business hours at such place or places where such records are customarily kept, upon reasonable notice from MIP, solely to verify the accuracy of the reports and payments. Such inspection right shall not be exercised more than once in any Calendar Year. |

| | 5.11.4 | MIP agrees to hold in strict confidence and use only for the purpose described in this Article 5 all information concerning payments and reports, and all information learned in the course of any audit or inspection (and not to make copies of such reports and information), except to the extent necessary for MIP to reveal such information in order to enforce its rights under this Agreement or if disclosure is required by law, regulation or judicial order. The results of each inspection, if any, shall be binding on both Parties. |

| | 5.11.5 | MIP shall pay for such inspections, except that in the event there is any upward adjustment in aggregate royalties payable for any year shown by such inspection of more than ****** of the amount paid, BIOMEDICA shall pay for such inspection. Any overpayments shall be fully creditable against amounts payable in subsequent payment periods. |

20

*Confidential Treatment Requested*

| | 5.11.6 | Any upward adjustment in aggregate royalties payable for any year shown by such inspection of not more than ****** of the amount paid shall not be deemed a Material Breach according to article 11.4, but shall be repayable by BIOMEDICA in full with interest as set forth in article 5.12 and promptly be paid upon MIP’s request. |

| | 5.11.7 | BIOMEDICA shall include in each sub-license or commercialization agreement entered into by it pursuant to this Agreement a provision requiring the Sub-licensee or commercialization partner to keep and maintain adequate records of sales made pursuant to such sub-license or commercialization agreement and to grant access to such records by the aforementioned independent public accountant for the reasons specified in this article. |

| 5.12 | Tax Withholding. All payments pursuant to this Agreement are exclusive of any applicable Value Added Tax. Withholding tax applied by a government of any country of the Territory on payments made by BIOMEDICA to MIP hereunder shall be borne by MIP. BIOMEDICA, its Affiliates and Sub-licensees, shall cooperate with MIP to enable MIP to claim exemption therefore under any double taxation or similar agreement in force and shall provide to MIP proper evidence of payments of withholding tax and assist MIP by obtaining or providing in as far as reasonably possible the required documentation for the purpose of MIP’s returns. BIOMEDICA undertakes to make all payments due under this Agreement that are subject to a withholding tax treatment, including double taxation or similar agreement, from the USA. |

| 5.13 | Interest Due. In case of any delay in payment (including underpayment) by BIOMEDICA to MIP not occasioned by Force Majeure, interest on the overdue payment shall accrue at an annual interest rate, compounded monthly, equal to the ******, as determined for each month on the last day of that month, assessed from the day payment was initially due. The foregoing interest shall be due from BIOMEDICA without any special notice. |

6. CALL BACK OPTION AND

RIGHT OF FIRST DISCUSSIONS.

| 6.1 | Call Back Option. Subject to the provisions of this article 6, Novartis shall have a one time call back option to re-acquire the rights to the Compound and Product in the event that worldwide Net Sales of the Product first reaches ****** in a calendar year (“Call Back Option”). |

| 6.2 | Information. In order to enable Novartis to determine whether it wishes to exercise the Call Back Option, MIP and/or Novartis shall be entitled to perform a full due diligence of all the information reasonably available to BIOMEDICA, at MIP’s and/or |

21

*Confidential Treatment Requested*

| | Novartis’ expense, such information shall include, but not be limited to all relevant clinical data, manufacturing data, marketing data, and other data reasonably needed by MIP for reviewing its interest in exercising the Call Back Option. BIOMEDICA shall give access to MIP or Novartis to all information necessary to complete the due diligence. |

| 6.3 | Exercise of Call-Back Option. If Novartis exercises the Call-Back Option (“Call Back Exercise”), the following rights and obligations shall apply as between the Parties: |

| | 6.3.1 | MIP shall immediately notify BIOMEDICA in writing that Novartis has initiated the Call-Back Exercise. |

| | 6.3.2 | This Agreement, including the licenses and rights granted by MIP to BIOMEDICA shall terminate and BIOMEDICA shall grant to MIP an exclusive, worldwide license in the BIOMEDICA Field under all BIOMEDICA Know-How and BIOMEDICA’s interest in any Third Party intellectual property if such interest may be conveyed, as necessary for MIP or Novartis to develop, make, use, sell, offer for sale and import the Compound and/or Products, and MIP or Novartis shall conduct (or have conducted) under its control the Commercialization of the Product. BIOMEDICA undertakes to use Commercially Reasonable Efforts to secure sub-license rights under any Third Party intellectual property. |

| | 6.3.3 | In return for the termination of this Agreement and for the grant of the license in article 6.3.2, following MIP’s receipt of payment by Novartis, MIP shall pay to BIOMEDICA a portion of such Novartis payment in an amount equal to BIOMEDICA’s percent of worldwide Net Sales contribution generated, such payment to BIOMEDICA not to exceed a maximum amount of ****** of the total Novartis payment to MIP. MIP acknowledges and agrees that should a portion of the Novartis payment is due to an additional sublicense of MIP such payment will be owed and paid by MIP. |

| | 6.3.4 | In the event that Novartis at its sole discretion, decides to involve BIOMEDICA in the further Development of the Compound after Novartis has exercised the Call Back Option, BIOMEDICA and Novartis may discuss the nature and scope of such BIOMEDICA involvement and agree in writing the nature of any further BIOMEDICA involvement, but there shall be no obligation on MIP to do so. |

| | 6.3.5 | All obligations on BIOMEDICA to pay Milestones as set forth in article 5 which at the time of the Call Back Exercise, are not already due and payable pursuant to article 5, shall lapse. |

22

*Confidential Treatment Requested*

| | 6.3.6 | For the sake of clarity MIP will not pay BIOMEDICA any other payments or royalties. |

| | 6.3.7 | Any Third Party sub-licenses granted by BIOMEDICA will be transferred to Novartis. |

| 6.4 | Non-Exercise of Call Back Option. If Novartis does not exercise the Call Back Option, this Agreement shall continue but the Contingent Milestones shall be thereafter be due as set forth in article 5.4. |

7. INTELLECTUAL PROPERTY

| 7.1 | Inventions and Know-How. |

| | 7.1.1 | MIP Patent Prosecution. MIP agrees it will not abandon, to the extent under MIP control, any Novartis Patent in any country or region of the Territory. |

| 7.2 | Infringement Claims by Third Parties |

| | 7.2.1 | Notice. If the manufacture, use or sale of Product results in a claim or a threatened claim by a Third Party against a Party hereto for patent infringement or for inducing or contributing to patent infringement (“Infringement Claim”), the Party first having notice of an Infringement Claim shall promptly notify the other in writing. The notice shall set forth the facts of the Infringement Claim in reasonable detail. |

| | 7.2.2 | Third Party Licenses. In the event the Parties agree that practicing under the Novartis Patents in connection with manufacture, use or sale of the Compound or the Product in a country would infringe a Third Party Patent and a license to such Third Party Patent is available and BIOMEDICA in its sole discretion determines that it requires such a license, the Parties agree that: |

| | 7.2.2.1 | BIOMEDICA will use commercially reasonable efforts to obtain any such required licenses under the Third Party’s Patents; and |

| | 7.2.2.2 | In the event that BIOMEDICA obtain any such required licenses from Third Party under which BIOMEDICA shall pay the Third Party certain royalties, BIOMEDICA may deduct such Third Party payment from its royalty payments to MIP under article 5 but in no event will such deductions reduce the Royalty payments in any quarter to MIP by greater than ******. |

23

*Confidential Treatment Requested*

| | 7.2.3 | Litigation. If a Third Party asserts that a patent, trademark or other intellectual properties owned by it is infringed by the importation, manufacture, offer for sale, use or sale of Compound or Product, or if either Party learns of a claim or assertion that the manufacture, use, marketing, promotion, importation, offer for sale, distribution or sale of Compound or Product infringes or otherwise violates the intellectual property rights of any Third Party, then such Party will promptly notify the other Party in writing. MIP and/or Novartis will have the first right, but not the obligation, to control such defense at their own expense. If MIP/Novartis does not assume control of such defense within 120 days of the notice described above, then BIOMEDICA shall have the right to control such defense at its own expense. In any event, the Party not controlling such defense will have the right to be represented in any such action by counsel of its choosing at its own expense; this includes Novartis. The Party controlling such defense shall keep the other Party advised of the status of such action and shall consider recommendations made by the other Party in respect thereto. The Party not controlling such defense will assist and cooperate in any such infringement litigation at the defending Party’s reasonable request and expense. The costs and expenses (including attorneys’ fees) of any suit brought in accordance with this Article shall be borne by the Party controlling the prosecution of such suit. Any costs borne by BIOMEDICA in accordance with this article shall however be entirely off-set against any payments due to MIP under Article 5. |

| 7.3 | Infringement Claims Against Third Parties |

| | 7.3.1 | Notice. If any Novartis Patents are infringed by a Third Party, the Party to this Agreement first having knowledge of such infringement, or knowledge of a reasonable probability of such infringement, shall promptly notify the other in writing. The notice shall set forth the facts of such infringement in reasonable detail. |

| | 7.3.2 | Institution of Proceedings. MIP and/or Novartis shall have the primary right, but not the obligation, to institute, prosecute, and control with its own counsel at its own expense any action or proceeding with respect to infringement of the claims of such Novartis Patents. In the event MIP/Novartis does not take any action with respect to any such infringement within 120 days after receiving notice of such infringement thereof, BIOMEDICA may request in writing permission to undertake such defense thereof, at its own expense. The Party undertaking the defense shall have the sole charge and direction of the defense of any such suit or action and the other Party including Novartis shall have the right, |

24

| | but not the obligation and at its own expense, to be represented in such action by its own counsel action. Each Party agrees to cooperate fully in the prosecution of any such suit or action undertaken hereunder by the other Party and to provide all evidence in its reasonable control. |

| | 7.3.3 | Division of Damages Award. Each Party shall recover their respective actual out-of-pocket expenses, or equitable proportions thereof, associated with any litigation or settlement thereof from any recovery made by any Party. Any excess amount allocated as a damage award shall be shared between the Parties as follows: MIP shall be allocated an amount equal to its royalty loss and BIOMEDICA shall be allocated the remainder of damages; any amount allocated as a penalty shall be shared equally between the Parties. |

| | 7.3.4 | Settlement. The Parties shall keep each other informed of the status of and of their respective activities regarding any litigation or settlement thereof concerning Product; provided, however, that no settlement or consent judgment or other voluntary final disposition of a suit under this article 7 may be undertaken without the consent of the other Party if such settlement would require the other Party to be subject to an injunction or to make a monetary payment or would otherwise adversely affect the other Party’s rights under this Agreement. |

| 7.4 | Notice of Certification. MIP and BIOMEDICA each shall immediately give notice to the other of any certification filed under the “U.S. Drug Price Competition and Patent Term Restoration Act of 1984” (or its foreign equivalent) claiming that a Novartis Patent is invalid or that infringement will not arise from the manufacture, use or sale of any Product by a Third Party. |

| | 7.4.1 | If MIP decides not to bring infringement proceedings against the entity making such a certification, MIP shall give notice to BIOMEDICA of its decision not to bring suit within twenty-one (21) days after receipt of notice of such certification. |

| | 7.4.2 | BIOMEDICA may then, but is not required to, bring suit against the Party that filed the certification at its own expense. |

| | 7.4.3 | Any suit by BIOMEDICA or MIP shall either be in the name of BIOMEDICA or in the name of MIP, or jointly in the name of BIOMEDICA and MIP, and further including Novartis as may be required by law. |

25

| | 7.4.4 | For this purpose, the Party not bringing suit shall execute such legal papers necessary for the prosecution of such suit as may be reasonably requested by the Party bringing suit. |

| 7.5 | Patent Term Extensions. The Parties shall cooperate in good faith with each other in gaining patent term extension wherever applicable to the Compound or Product. All filings for such extension shall be made by MIP, provided, however, that in the event that if MIP elects not to file for an extension, it shall (i) inform BIOMEDICA of its intention not to file and (ii) BIOMEDICA shall have the right to file for such extension. |

| 7.6 | BIOMEDICA New Intellectual Property. |

| | 7.6.1 | Ownership of BIOMEDICA New Intellectual Property. During the Term of the Agreement, New Intellectual Property shall be owned by BIOMEDICA. BIOMEDICA shall inform MIP of new patent applications and action on them in the report provided by BIOMEDICA to MIP pursuant to section 4.2. |

| | 7.6.2 | BIOMEDICA shall have the sole right to file, prosecute, and maintain all of the patents within the BIOMEDICA New Intellectual Property included herein, and shall have the right to determine whether or not, and where, to file a patent application, to abandon the prosecution of any patent or patent application, or to discontinue the maintenance of any patent application. |

| | 7.6.3 | Should MIP terminate this Agreement due to a breach by BIOMEDICA of its obligation hereunder, BIOMEDICA shall grant to MIP a perpetual, world-wide, royalty-bearing, exclusive license to such BIOMEDICA New Intellectual Property, with the right to grant sublicenses, to use any BIOMEDICA New Intellectual Property invented or generated by persons obliged to assign their rights to BIOMEDICA in the BIOMEDICA Field. The royalty rate on the MIPs’ Net Sales of the product shall be determined by the Parties upon termination of the Agreement, shall be based on reasonable commercial terms and in no event shall exceed ****** of the royalty rates payable by BIOMEDICA under section 5.5 of this Agreement. |

| | 7.6.4 | BIOMEDICA New Intellectual Product that relates to the Product or the Compound may be subject to rights by Novartis, during the Term of this Agreement. |

| | 7.7.1 | Generalities. MIP is the owner of all right and title in and to the ONALTA Trademark throughout the Territory including but not limited to all applications therefore and registrations thereof and all goodwill associated therewith. |

26

*Confidential Treatment Requested*

| | 7.7.2 | Use of the Trademarks. BIOMEDICA and/or its Sub-licensee shall promote, market, sell and distribute the Product in the Territory under the Trademark during the Term. |

| | 7.7.3 | Quality Control Standards; Compliance with Laws: Upon MIP prior written request, BIOMEDICA shall furnish to MIP a sample of products and materials bearing the TRADEMARK. If MIP reasonably and in good faith believes the samples bearing the TRADEMARK do not meet a Minimum Quality Threshold (as defined below), MIP shall notify BIOMEDICA in writing, and MIP shall have a reasonable period of time (but in no event more than 30 days from the date of receipt of notice) to make the changes and/or corrections that the parties mutually agree are necessary to protect the TRADEMARK. For purposes of this Agreement, “Minimum Quality Threshold” shall mean, with respect to each product or advertising material bearing the TRADEMARK, the level of quality necessary to comply: (a) in all material respects, with the respective specifications and technical requirements of MIP’s customers applicable to such product; and (b) in all respects, with all statutory and regulatory standards applicable to such product or product advertising. |

| | 7.7.4 | BIOMEDICA agrees to cooperate with MIP in facilitating MIP’s control of such nature and quality, to permit reasonable inspection of BIOMEDICA operations, and to supply MIP with specimens of all uses of the ONALTA mark upon request. BIOMEDICA shall comply with all applicable laws and regulations and obtain all appropriate government approvals pertaining to the sale, distribution and advertising of goods and services covered by this license. |

| | 7.7.5 | BIOMEDICA agrees to use the ONALTA mark only in the form and manner and with appropriate legends as prescribed from time to time by MIP, and not to use any other trademark or service mark in combination with the ONALTA mark without prior written approval of MIP. |

| | 7.7.6 | Domain Name and Website Agreement provision. The Parties shall enter into a separate Domain name and website agreement within 120 days of the Effective Date I connection with the Onalta domain name. |

| | 7.7.7 | BIOMEDICA agrees to notify MIP of any unauthorized use of the ONALTA mark by others promptly as it comes to BIOMEDICA’s attention. MIP shall have the sole right and discretion to bring infringement or other proceedings involving the ONALTA mark. BIOMEDICA agrees to cooperate in any investigation or suit in the Territory relating to the ONALTA mark at the expense of MIP. |

27

8. REPRESENTATIONS AND WARRANTIES

| 8.1 | MIP Representations and Warranties |

| | 8.1.1 | This Agreement has been duly executed and delivered by MIP and constitutes the valid and binding obligation of MIP, enforceable against MIP in accordance with its terms except as enforceability may be limited by bankruptcy, fraudulent conveyance, insolvency, reorganization, moratorium and other laws relating to or affecting creditors’ rights generally and by general equitable principles. The execution, delivery and performance of this Agreement have been duly authorized by all necessary action on the part of MIP, its officers and directors. |

| | 8.1.2 | As of the Effective Date MIP owns or Controls or otherwise possesses adequate licenses or other rights necessary to make, use and sell the Compound and the Product covered by the Novartis Patents and to grant the sublicenses provided herein; and the granting of the license to BIOMEDICA hereunder does not violate any right known to MIP of a Third Party. |

| | 8.1.3 | The execution, delivery and performance of this Agreement by MIP does not conflict with any agreement, instrument or understanding, oral or written, to which it is a party or by which it may be bound, and to the best of its knowledge, does not violate any material law or regulation of any court, governmental body or administrative or other agency having authority over it. |

| | 8.1.4 | MIP has disclosed to BIOMEDICA any and all material information in its Control pertaining to the suitability of Compound as a pharmaceutical candidate. |

| | 8.1.5 | MIP is not currently a Party to, and during the term of this Agreement will not enter into, any agreements, oral or written, that are inconsistent with its obligations under this Agreement. MIP has disclosed to BIOMEDICA that ****** is currently unavailable. Should ****** become available, BIOMEDICA shall have the right, at its option, to expand its Territory to include ******. No upfront payments will be required for BIOMEDICA to exercise this option. |

28

*Confidential Treatment Requested*

| | 8.1.6 | MIP is duly organized and validly existing under the laws of the country of the United States and has full legal power and authority to enter into this Agreement. |

| | 8.1.7 | MIP is not subject to any order, decree or injunction by a court of competent jurisdiction which prevents or materially delays the consummation of the transactions contemplated by this Agreement. |

| 8.2 | BIOMEDICA Representations and Warranties |

| | 8.2.1 | This Agreement has been duly executed and delivered by BIOMEDICA and constitutes the valid and binding obligation of BIOMEDICA, enforceable against BIOMEDICA in accordance with its terms except as enforceability may be limited by bankruptcy, fraudulent conveyance, insolvency, reorganization, moratorium and other laws relating to or affecting creditors’ rights generally and by general equitable principles. The execution, delivery and performance of this Agreement have been duly authorized by all necessary action on the part of BIOMEDICA, its officers and directors; |

| | 8.2.2 | BIOMEDICA is not currently a Party to, and during the term of this Agreement will not enter into, any agreements, oral or written, that are inconsistent with its obligations under this Agreement; |

| | 8.2.3 | BIOMEDICA is duly organized and validly existing under the laws of Greece and has full legal power and authority to enter into this Agreement; and |

| | 8.2.4 | BIOMEDICA is not subject to any order, decree or injunction by a court of competent jurisdiction which prevents or materially delays the consummation of the transactions contemplated by this Agreement. |

| | 8.2.5 | BIOMEDICA has sufficient credit commitments and/or capital commitments, such that it will be able to develop and commercialize Products within all countries in the Territory, consistent with the scope of and pursuant to the license granted herein. |

| | 8.2.6 | BIOMEDICA has obtained any approval or consent needed from BIOMEDICA’s shareholders or its Board of Directors, to execute this Agreement and perform the activities specified herein. |

| | 8.2.7 | BIOMEDICA acknowledges and agrees that MIP is the owner of the ONALTA mark and further agrees that it will do nothing inconsistent with such ownership and that all use of the ONALTA mark by BIOMEDICA shall inure to the benefit of and be on behalf of MIP. BIOMEDICA will not apply to register the ONALTA mark in its own name but shall assist MIP in filing any applications to register the ONALTA mark in the name of MIP or its designated agents, to |

29

| | the extent the same have not already been filed, and in recording this Agreement with appropriate government authorities. BIOMEDICA agrees that nothing in this Trademark License or any related document shall give BIOMEDICA any right, title or interest in the ONALTA mark other than the right to use the ONALTA mark in the Territory and consistent with this Trademark License and BIOMEDICA agrees that it will not attack the title of MIP in the ONALTA mark or the validity of this Trademark License. |

| 8.3 | THE LIMITED WARRANTIES CONTAINED IN THIS ARTICLE ARE THE SOLE WARRANTIES GIVEN BY THE PARTIES AND ARE MADE EXPRESSLY IN LIEU OF AND EXCLUDE ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, TITLE, INFRINGEMENT OR OTHERWISE, AND ALL OTHER EXPRESS OR IMPLIED REPRESENTATIONS AND WARRANTIES PROVIDED BY COMMON LAW, STATUTE OR OTHERWISE ARE HEREBY DISCLAIMED BY BOTH PARTIES. |

9. CONFIDENTIALITY

| 9.1 | Confidentiality. Subject to the exercise of the licenses granted in Article 2, during the Term of this Agreement, and for a period of five (5) years thereafter, each Party hereto will maintain in confidence all information generated under this Agreement as well as any information disclosed by the other Party hereto (“Confidential Information”). Neither Party shall use, disclose or grant use of such Confidential Information except as required under this Agreement. Each Party shall use the same standard of care as it uses to protect its own Confidential Information to ensure that its and its Affiliates’ employees, agents, consultants, Sub-licensee(s) and clinical investigators only make use of Confidential Information for the purpose of this Agreement and do not disclose or make any unauthorized use of such Confidential Information. Each Party shall promptly notify the other upon discovery of any unauthorized use or disclosure of Confidential Information. |

| | 9.1.1 | Confidential Information shall not include any information which and to the extent: was already known to the receiving Party, other than under an obligation of confidentiality, at the time of disclosure by the other Party; was generally available to the public or otherwise part of the public domain at the time of its disclosure to the other Party; becomes generally available to the public or otherwise part of the public domain after its disclosure and other than through any act or omission of the receiving Party in breach of this Agreement; was disclosed to the receiving Party, by a Third Party who had no obligation to the other Party not to disclose such information; or was independently developed by the receiving Party without reference to the disclosure by the other Party. |

30

| 9.2 | The Parties agree that the material financial terms of the Agreement and the reports described in article 4.2 shall be considered the Confidential Information of both Parties. |

| 9.3 | Each Party may disclose the Confidential Information to the extent such disclosure is reasonably necessary in filing or prosecuting patent applications, prosecuting or defending litigation, or complying with any applicable statute or governmental regulation provided such Party has given the disclosing Party prompt written notice allowing it to limit such disclosure. In addition, either Party may disclose Confidential Information to its Affiliates and to its Sub-licensees; provided, however, in connection with any such disclosure the disclosing Party shall secure confidential treatment of such Confidential Information. |

| 9.4 | The Parties shall undertake to ensure that all their employees who have access to Confidential Information of the other Party are under obligations of confidentiality fully consistent with those provided in this article. |

| 9.5 | BIOMEDICA agrees that the Confidential Information it receives, including but not limited to the financial information, may be disclosed by MIP to Novartis without further notice, provided that Novartis shall be subject to the same confidential obligations as MIP, as set forth herein. |

10. ANNOUNCEMENT, PUBLICITY AND PUBLICATIONS

| 10.1 | Except with the prior written consent of the other Party not to be unreasonably withheld, neither Party hereto shall make any disclosure to any third Party except Affiliates concerning the terms of this Agreement. Each Party will inform the other prior to the disclosure of this Agreement or any of its terms to any government authorities or agencies and will observe all reasonable requirements of the other in regard to any such disclosure. In addition, MIP may make a public statement, including in analyst meetings, concerning this Agreement or the progress of the Product, at MIP’s discretion including but not limited to the events described in Exhibit D. The restrictions on disclosure specified herein shall not apply to announcements required by law or regulations or stock exchange rules, including announcements required by law, regulations or stock exchange rules to be made by either Party to their respective shareholders. It is, however, the Parties’ intent that they will co-ordinate to such extent as may be reasonably possible with respect to the wording of any such announcements and that the financial terms of this Agreement shall not be made public. |

| 10.2 | BIOMEDICA will, and will cause its Sub-licensees to obtain MIP’s prior written permission to use MIP’s name, symbols and any other marks in any form of publicity. |

31

| 10.3 | None of BIOMEDICA, its Affiliates, or any of its or its Affiliates’ or present any information, including, without limitation, the results of any work performed under the Agreement, or preclinical or clinical studies with respect to the Compound or Product, without MIP’s prior written consent. Neither party shall have the right to publish or present Confidential Information of the other party. |

11. TERM AND TERMINATION

| 11.1 | Term. Unless earlier terminated as provided under article 6, 11.2 or 11.3 the term of this Agreement shall commence as of the Effective Date and shall remain in full force and effect on a country-by-country basis until the end of the last to expire payment obligations of BIOMEDICA under article 5.6 (“Term”). |