EXHIBIT 10.2

PURCHASE AND SALE AGREEMENT

DATED AS OF MARCH 13, 2014

BETWEEN

FORESTREE VI LP and FORESTREE VI TEXAS LP,

AS SELLER

AND

CATCHMARK TIMBER TRUST, INC.,

AS BUYER

PURCHASE AND SALE AGREEMENT

WAYCROSS - PANOLA

THIS PURCHASE AND SALE AGREEMENT (“Agreement”) is made and entered into as of the 13th day of March, 2014 (the “Effective Date”), by and among FORESTREE VI LP, a Delaware limited partnership (“ForesTree”), and FORESTREE VI TEXAS LP, a Delaware limited partnership (“ForesTree Texas”) (ForesTree and ForesTree Texas each may be referred to herein independently as a "Seller”, and collectively, as the “Sellers”) and CATCHMARK TIMBER TRUST, INC., a Maryland corporation (“Buyer”) (Buyer and Seller may each be referred to herein as a “Party” or collectively, as the “Parties”).

RECITALS

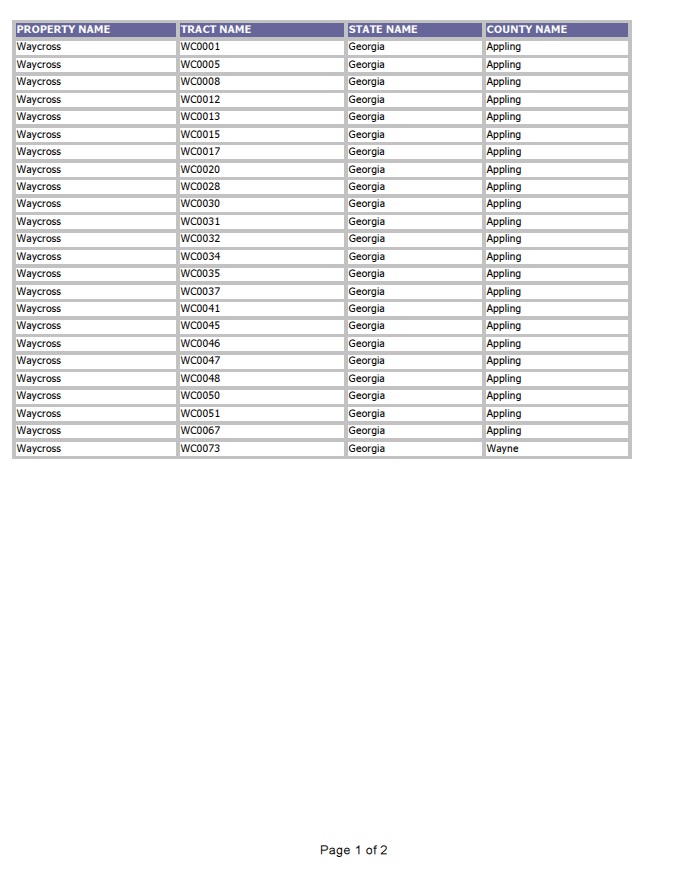

| A. | ForesTree is the owner of approximately 17,863 acres of timberlands and timber rights located in Appling and Wayne Counties, Georgia, that it wishes to sell, assign, transfer or convey together with certain other assets, rights under certain continuing leases, licenses, contracts and other agreements, to Buyer in accordance with the terms and subject to the conditions set forth in this Agreement. |

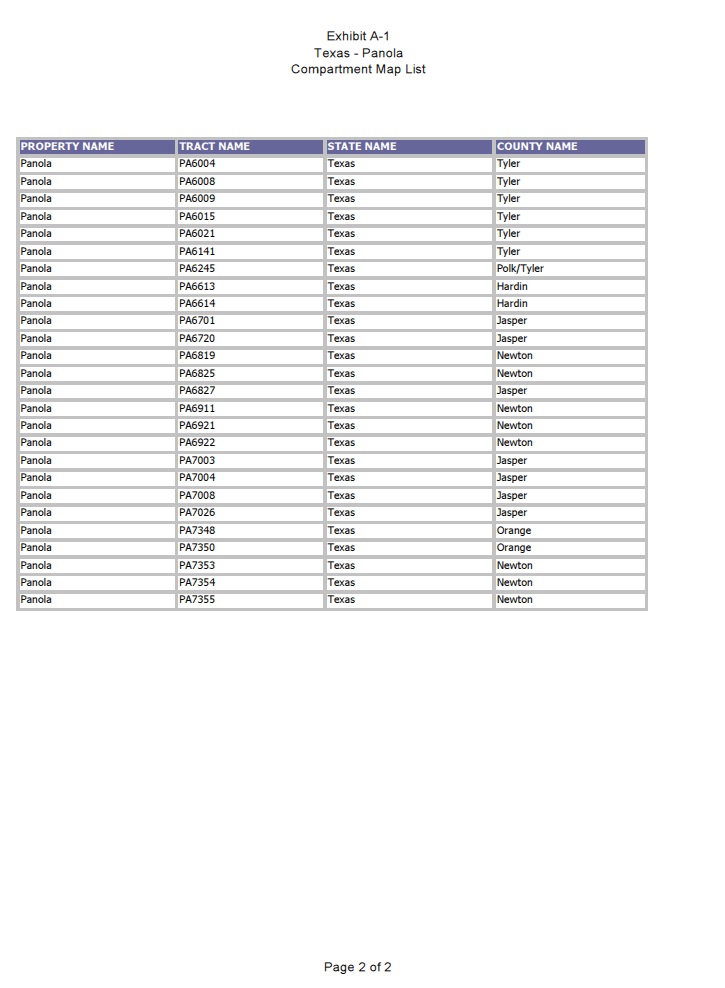

| B. | ForesTree Texas is the owner of approximately 18,477 acres of timberlands and timber rights located in Hardin, Jasper, Newton, Orange, Polk and Tyler Counties, Texas, that it wishes to sell, assign, transfer or convey together with certain other assets, rights under certain continuing leases, licenses, contracts and other agreements, to Buyer in accordance with the terms and subject to the conditions set forth in this Agreement. |

| C. | Buyer wishes to acquire and accept such timberlands and other assets, rights under certain continuing leases, licenses, contracts and other agreements, being transferred to it in accordance with the terms and subject to the conditions set forth in this Agreement. |

NOW, THEREFORE, in consideration of the foregoing, their respective representations, warranties, covenants and agreements set forth in this Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

ARTICLE I

PROPERTY AND PURCHASE PRICE

Section 1.1 Agreement to Purchase and Sell. Subject to and in accordance with the terms and provisions of this Agreement, for the consideration stated herein, and upon satisfaction of the conditions set forth in Article X, Seller shall at the Closing sell, assign, transfer and convey to Buyer, and Buyer shall acquire, assume and accept from Seller, all right, title and interest to the following assets (collectively, the “Property”), subject to the Permitted Exceptions, as defined below, but free and clear of all Liens, as defined below:

| (a) | Timberlands. The real property held by Sellers in fee simple identified in Exhibit A, together with (i) all down and standing trees or timber located thereon, excluding the timber which may be harvested and removed in Georgia in accordance with the supply agreement as described in Schedule 1.1(a)(A) (the “Georgia Supply Agreement”) (ii) all buildings thereon, (iii) all roads, bridges and other improvements and fixtures thereon, (iv) without warranty, all right, title and interest in and to all gas, |

oil, minerals, coal, sand, gravel and all other substances or minerals of any kind or character underlying or relating to such land to the extent not retained or conveyed out by Seller’s predecessors in title, (v) all other privileges, appurtenances, easements (including the Buyer Easements in respect thereof) and other rights appertaining thereto ( the “Timberlands”), subject to the Permitted Exceptions. The Georgia Supply Agreement affects only those portions of the Timberlands located in Georgia. Additional terms related to the Georgia Supply Agreement and Seller’s obligation to cause certain amounts of timber to be cut and delivered to the purchaser under the Georgia Supply Agreement are set forth in Section 5.6, Section 6.7, Section 12.1 and Schedule 1.1(a)(A).

| (b) | Assumed Contracts. The rights of Seller under the contracts in effect at the Effective Time that (i) exclusively relate to all or any portion of the Timberlands, including, but not limited to, the Georgia Supply Agreement, or are necessary to the forest operations conducted on the Timberlands and (ii) are described in Exhibit B, but excluding the rights of Seller under any Real Property Lease (collectively, the “Assumed Contracts”). |

| (c) | Real Property Leases. The rights of Seller with respect to the leases in effect at the Effective Time (i) that relate to all or any portion of the Timberlands to which Seller is a lessor and are described in Exhibit C, including any lease under which Seller has granted to a third party hunting or other recreational rights with respect to the Timberlands (or, with respect to any hunting lease in respect of the Timberlands listed on Exhibit C that expires prior to the Closing Date, any new hunting lease entered into with the same person or entity prior to the Closing Date on terms no less favorable to Seller as the applicable prior lease) or (ii) under which a Seller is a lessee of facilities related to the forest operations on the Timberlands and are described on Exhibit C (collectively, the “Real Property Leases”). |

Unless expressly identified or described in this Section 1.1, no other assets of Seller are included in the Property.

Section 1.2 Assumed Liabilities. Subject to the terms and provisions of this Agreement and upon satisfaction of the conditions set forth in Article X, each Seller shall at the Closing assign to Buyer, and Buyer shall assume from each Seller, the liabilities and obligations of Sellers under the Assumed Contracts and the Real Property Leases, to the extent such liabilities and obligations accrue or arise, or are related to periods commencing, on or after the Effective Time (collectively, the “Assumed Liabilities”).

Section 1.3 Purchase Price. The purchase price for the Property is SEVENTY-FOUR MILLION AND NO/100 DOLLARS ($74,000,000.00), subject to adjustment as provided herein (the “Purchase Price”). At Closing (defined below), Buyer shall pay Sellers by wire transfer or otherwise immediately available federal funds (US Dollars) the entire Purchase Price, of which the Earnest Money (defined below) is a part.

ARTICLE II

EARNEST MONEY; ESCROW

Section 2.1 Earnest Money; Escrow. Within three (3) business days after all parties have executed and delivered this Agreement, Buyer will deposit with the First American Title Insurance Company based in Atlanta, Georgia (Attn: Mr. Kevin Wood) (the “Escrow Agent”), the amount of THREE MILLION SEVEN HUNDRED THOUSAND AND NO/100 DOLLARS ($3,700,000.00), in immediately available federal funds (US Dollars), paid or delivered as earnest money (said amount, together with all interest earned thereon, the "Earnest Money"). The Earnest Money shall either (i) be applied to the Purchase Price at Closing (defined below) or returned to Buyer at Closing provided that Buyer delivers the entire Purchase Price to Escrow Agent, or (ii) be disbursed in accordance with the terms of this Agreement if the Closing does not occur. Upon mutual execution of this Agreement, the parties shall execute and deliver the escrow agreement in the form of Exhibit D.

ARTICLE III

CLOSING

Section 3.1 Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place, subject to the satisfaction, or waiver by the Party entitled to the benefit thereof, of the conditions set forth in Article X, at the office of Buyer’s counsel, Smith, Gambrell & Russell, LLP, 1230 Peachtree Street, N.E., Suite 3100, Atlanta, Georgia 30309-3592, or another place mutually agreed upon by Buyer and Sellers (or through escrow established with the Title Company), at 9:00 a.m., on or before April 11, 2014, in accordance with this Agreement or at such other time and date as the Parties shall agree in writing (the date on which the Closing occurs, the “Closing Date”). Upon completion of the Closing, the transactions contemplated by this Agreement shall be deemed effective as of 12:01 a.m. Eastern Time on the Closing Date (the “Effective Time”). Closing shall mean the point at which all documentation and monies required to close the transaction pursuant to the terms of this Agreement have been delivered in escrow to Escrow Agent (with necessary authorizations to release and disburse same), including signed closing statements and escrow instructions. Buyer shall have the right to a one-time extension of the Closing Date for up to fourteen (14) days, which right shall be exercised by notice to Seller delivered on or before April 7, 2014, and if Buyer timely exercises its right to extend the Closing Date as provided in this Section 3.1, (i) Buyer shall be required to deposit with Escrow Agent on or before April 7, 2014, as an additional deposit the amount of One Million and No/100 Dollars ($1,000,000.00), which amount shall be considered upon delivery, a part of the Earnest Money, and (ii) and all references to $250,000.00 in Section 9.1 and Section 9.2 shall be increased to $1,000,000.00. THE PARTIES AGREE THAT TIME IS OF THE ESSENCE WITH RESPECT TO CLOSING AND THIS AGREEMENT.

ARTICLE IV

TITLE

Section 4.1 Condition of Title and Title Insurance.

(a) As of the Closing Date, title to the Timberlands is to be free of all encumbrances or defects except the “Permitted Exceptions” described on Exhibit X.

(b) Sellers have provided or made available current title commitments prepared by the Title Company (such commitments together with legible copies of all documentary exceptions referred to in such commitments are hereinafter, collectively referred to as the “Title Commitment”), to Buyer at Sellers' expense. Sellers shall pay the search and exam fees and other costs of preparing and delivering to Buyer the Title Commitment. Buyer shall pay for any title insurance premiums and any premiums, costs and expenses associated with expanded title insurance coverage or title endorsements.

(c) Buyer shall have until seven (7) days prior to the Closing Date (the “Due Diligence Period”) to deliver to Sellers written notice of any objection to any matters reflected in any Title Commitment, which, in Buyer’s reasonable judgment, would materially adversely affect the use or enjoyment by Buyer of any parcel or portion of the Timberlands for growing, managing, and commercially harvesting timber (each, a “Title Objection” and collectively, the “Title Objections”); provided, however, that Buyer shall be permitted to object to all Title Failures affecting the Timberlands. For the purposes of this Agreement, the term “Title Failure” shall mean any portion of the Timberlands that is not, or immediately prior to the Closing will not be, (i) owned by Seller or (ii) insurable by the Title Company without exception (other than the Permitted Exceptions). Notwithstanding anything to the contrary set forth herein, Buyer shall have no right to object to any Permitted Exceptions and, for the purposes of this Agreement, such items will not be considered Title Objections. Upon receipt of the Title Objections, Seller may elect (but shall not be obligated) to cure or cause to be cured any such Title Objection, and Seller shall notify Buyer in writing within ten (10) days after receipt of the Title Objections whether Seller elects to cure the same. Failure of Seller to respond in writing within such time period shall be deemed an election by Seller not to cure such Title Objections. Any Title Objection shall be deemed to be cured if Seller causes the Title Company, at no additional cost to Buyer, to issue an owner’s title policy for the affected Timberlands affirmatively insuring over such Title Objection

in the owner’s title policy. Notwithstanding the foregoing, Seller shall be obligated to cure, on or before the Closing Date, all Liens against the Timberlands evidencing a debt (other than Liens for non-delinquent real estate Taxes or assessments) (“Monetary Liens”) created as a result of the acts or omissions of Seller or its affiliates. For the purposes of this Agreement, the term “Lien” means any mortgage, lien, charge, pledge, hypothecation, assignment, deposit, arrangement, encumbrance, security interest, assessment, adverse claim, levy, preference or priority or other security agreement of any kind or nature whatsoever (whether voluntary or involuntary, affirmative or negative (but excluding all negative pledges), and whether imposed or created by operation of law or otherwise) in, on or with respect to, or pledge of, any Property, or any other interest in the Property, designed to secure the repayment of debt or any other obligation, whether arising by contract, operation of law or otherwise. If Seller does not receive written notice of the Title Objections for any objection to matters reflected in the Title Commitment on or before the expiration of the Due Diligence Period, Buyer shall be deemed to have waived its right to object to any and all matters reflected in the Title Commitment and Buyer shall be deemed to accept title to the Timberlands encompassed within such Title Commitment subject to such matters; provided, however, that Buyer shall have the right to object to any matters affecting title not appearing in any Title Commitment as of the end of the Due Diligence Period and/or first appearing of record between the effective date of the Title Commitment and the Closing Date, which right may be exercised by delivering to Seller a subsequent notice of Title Objections on or before the Closing Date, and such subsequent Title Objections shall be resolved in the same manner as set forth above for Title Objections raised within the Due Diligence Period. Any Title Objection waived (or deemed waived) by Buyer shall be deemed to constitute a Permitted Exception, and the Closing shall occur as herein provided without any reduction of the Purchase Price therefor.

With regard to Title Objections or Title Failures timely raised by Buyer per the terms of this Section, Seller shall have the right, but not the obligation, to cure and remove such items within thirty (30) days after Seller’s receipt of Buyer’s written notice of Title Objections or Title Failures. For purposes of this Agreement, curing a Title Objection or Title Failure may include obtaining affirmative title coverage insuring against loss or damage arising from such Title Objection or Title Failure. In the event Seller elects not to cure a Title Objection or Title Failure timely made by Buyer, Buyer shall have the right, at its option, to accept the Timberlands subject to the uncured Title Objection or Title Failure or to reduce the Purchase Price by the fair market value of the affected parcel and require Seller to proceed to the Closing with those portions of the Timberlands that are subject to the Title Failure or Title Objection excluded from the Property to be conveyed to Buyer at Closing (a “Title Carveout”). Said fair market value shall be determined by Buyer and Seller by reference to the agreed upon land and timber values for the Timberlands, which values are set forth on Schedule 4.1 attached hereto and hereby made a part hereof (the “Value Table”). If the Parties are unable to agree upon the fair market value of any Title Carveout, said fair market value shall be determined as provided in Section 9.3 below. Notwithstanding the foregoing, if any portion or parcel of the Timberlands is to be excluded from the transaction pursuant to this Section 4.1 or as otherwise provided in this Agreement and such parcel comprises less than all of a discrete parcel of land with an adequate, insurable legal description, Seller shall determine (subject to Buyer’s right of reasonable approval as to shape or configuration and provided that the Title Carveout is a Marketable Parcel) the exact boundaries and dimensions of the portion of the Timberlands to be retained by Seller, and Seller shall make arrangements to have said portion of the Timberlands surveyed by a surveyor licensed to practice in the applicable State in order to produce an insurable legal description for said retained parcel. Seller shall pay all costs of any surveys so obtained. Seller shall also obtain any and all subdivision approvals required for Seller’s retention of the Title Carveouts. Buyer agrees to grant without cost to Seller access easements over and across any portion of the Timberlands acquired by Buyer upon reasonable terms and over reasonable routes as may be necessary for Seller’s access to any Title Carveouts, and Seller agrees to grant to Buyer without cost access easements over and across the Title Carveouts (and any other portion of the Timberlands retained by Seller) upon reasonable terms and over reasonable routes as may be necessary for Buyer’s access to the Timberlands. For purposes of this Agreement, “Marketable Parcel” means a parcel or tract of land containing at least forty (40) acres. The Closing Date shall be extended for any applicable cure periods under this Section.

ARTICLE V

INSPECTION; CONDITION OF PROPERTY

Section 5.1 Inspection. Buyer acknowledges that Buyer has been given the opportunity to inspect the Property and that neither Sellers nor their agents, officers, employees or assigns shall be held to any covenant respecting the condition of the Property or any improvements thereof nor shall Buyer or Sellers or the assigns of either be held to any covenant or agreement for alterations, improvements or repairs unless the covenant or agreement relied on is contained herein or is in writing and attached to and made a part of this Agreement or is contained in the Deeds. Buyer acknowledges and agrees that any documents, cruises, compilations, timber inventories, surveys, plans, specifications, reports and studies (the "Information") made available to Buyer by Seller are or have been provided as information only, and Seller makes no warranty with respect to the accuracy or completeness of the Information except as otherwise expressly provided herein or in the Deeds.

Upon reasonable prior written notice to Seller (which notice can be by email to Sellers’ designated representative), and receipt of authorization from Seller (which shall not be unreasonably withheld), prior to the Closing Date or termination of this Agreement in accordance with the terms of this Agreement, Buyer, through its authorized agents or representatives, may enter upon the Timberlands at all reasonable times for the purposes of making inspections and other studies; provided, however, that neither Buyer nor its agents or representatives shall (i) enter upon the Timberlands, for the purpose of preparing Phase II Environmental Reports or making any soil borings or other invasive or other subsurface environmental investigations relating to all or any portion of the Timberlands, (ii) prepare or instruct its agents or representatives to prepare Phase II Environmental Reports or make any soil borings or other invasive or other subsurface environmental investigations relating to all or any portion of the Timberlands, or (iii) except as may be required by applicable law and except pursuant to the ordinary course of Buyer’s due diligence investigations, contact any official or representative of any governmental authority regarding hazardous substances on or the environmental condition of the Timberlands without Seller’s prior written consent thereto. Upon the completion of such inspections and studies, Buyer, at its expense, shall repair any damage caused to the Timberlands and remove all debris and all other material placed on the Timberlands in connection with Buyer’s inspections and studies. Buyer hereby agrees to assume all liability for and shall indemnify, defend and hold harmless Seller, Hancock Natural Resource Group, Inc., Hancock Forest Management, Inc., John Hancock Timber Resource Corporation and their respective officers, employees, and agents (“HNRG Parties”) against any and all damages, claims, fines, penalties, demands, costs (including, without limitation, reasonable attorneys’ fees and court costs), or causes of action, of every kind, nature and description, arising out of or in any way connected with Buyer’s due diligence process or Buyer’s inspection of the Timberlands, except to the extent the same arise out of the intentional misconduct or negligence of any of the HNRG Parties. Notwithstanding anything to the contrary set forth in this Agreement, the foregoing indemnification shall survive any termination, cancellation or expiration of the Agreement or the Closing. Buyer agrees that from and after the date of this Agreement until Closing, Buyer, and the contractors, representatives and agents of Buyer who enter upon the Timberlands, shall maintain commercial general liability insurance with a reputable insurer naming Seller, Hancock Natural Resource Group, Inc., Hancock Forest Management, Inc., and John Hancock Timber Resource Corporation, as additional insureds in an amount not less than $2,000,000. Upon written request of Seller, Buyer shall provide evidence of such insurance (in form reasonably acceptable to Seller) to Seller.

Section 5.2 Condition of Property. Buyer specifically acknowledges and agrees that except as set forth in Sellers’ limited warranty of title in the Deeds and as set forth in Section 6 below and as set forth in any other instrument delivered by Sellers in connection with the Closing, (1) Sellers do not make any representations or warranties of any kind whatsoever, either express or implied, with respect to and shall have no liability for the Property (or any related matters), and (2) the Property is sold to Buyer in an “AS IS” and “WITH ALL FAULTS” condition as of the Closing, including, without limitation, (i) the existence or non-existence of legal access to or from the Timberlands or any portion thereof; (ii) the number of acres comprising the Timberlands; (iii) the volume, condition or quality of timber on the Timberlands; (iv) logging conditions or feasibility; (v) the stability of soils; (vi) suitability, habitability, merchantability or fitness of the Timberlands

for any construction or development, or for the Buyer’s intended use; (vii) the condition of any other structure or improvements on the Timberlands; (viii) encroachment or boundary questions; (ix) compliance with any laws; (x) drainage, availability or adequacy of water, sewer or other utilities, zoning, access and similar matters; and (xi) any other matters related to the Property.

Section 5.3 Continued Operation. Between the Effective Date and the Closing Date, Sellers shall (i) maintain and keep the Timberlands in substantially the same condition as existed on the Effective Date, (ii) not remove or permit the removal of any timber, harvestable crop, improvements, or other items from the Timberlands, except as may be permitted under the Georgia Supply Agreement, (iii) not encumber or enter into any contract, lease or other agreement (including any amendment to any of the Assumed Contracts, the Real Property Leases or the Georgia Supply Agreement) (other than the proposed amendment to the Georgia Supply Agreement previously provided to Buyer) the Timberlands without the prior written consent of Buyer, which consent may be withheld in Buyer’s sole discretion.

Section 5.4 No Reliance. Buyer acknowledges that any materials provided to it, including any cost or other estimates, projections, acreage, and timber information, the Confidential Information Memorandum for “Project Waycross - Panola” any management presentations and any materials and information provided on data disks or in any on-line data rooms, are not and shall not be deemed representations or warranties by or on behalf of Seller or any other person and are not to be relied upon by Buyer, except as otherwise provided herein.

Section 5.5 Environmental Report. Buyer acknowledges receipt of (i) that certain Phase I environmental site assessment for the Timberlands located in Georgia conducted by SLR, Inc. (the “Environmental Consultant”), dated January, 2014, and (ii) that certain Phase I environmental site assessment for the Timberlands located in Texas conducted by the Environmental Consultant dated December, 2013 (collectively, the “Phase I Assessments”). Buyer has no objections to the matters set forth in the Phase I Assessments. On or before Closing, Sellers shall cause the Environmental Consultant to either issue in favor of Buyer and Buyer’s lender, CoBank, ACB, as Administrative Agent (“CoBank”) a reliance letter for the Phase I Assessments in form reasonably acceptable to Buyer (the “Reliance Letter”) or to revise and amend the Phase I Assessments to name Buyer and CoBank as an additional intended users of the Phase I Assessments. Sellers and Buyer shall share equally the cost of the Phase I Assessments. Seller has advised Buyer that said total cost will not exceed $13,000.00.

Section 5.6 Georgia Supply Agreement. The Timberlands located in Georgia are subject to the Georgia Supply Agreement. FORESTREE VI LP and Georgia Biomass, LLC, purchaser under the Georgia Supply Agreement (“Georgia Biomass”), have agreed upon the Annual Purchase Amount, as defined in the Georgia Supply Agreement, and the stands of Timber, as defined in the Georgia Supply Agreement, to be thinned during the 2014 Harvesting Year, as defined in the Georgia Supply Agreement, to satisfy the Annual Purchase Amount (the “2014 Stands”). The 2014 Stands are also set forth in Schedule 1.1(a)(A). Seller may cause the harvesting and removal of Timber under the Georgia Supply Agreement to resume on March 4, 2014 (the “Adjustment Date”).

ARTICLE VI

REPRESENTATIONS AND WARRANTIES OF SELLER

Representations and Warranties of Seller. Sellers represent and warrant to Buyer as of this date and as of the date of the Closing:

Section 6.1 Organization and Good Standing. Each Seller is a limited partnership which is duly organized and validly existing under the laws of the State of Delaware. Each Seller is qualified to conduct business in the State of Georgia and the State of Texas.

Section 6.2 Power and Authority for Transaction. Except as expressly provided in Section 16.21 below, each Seller has the power and authority to execute, deliver and perform this Agreement and the transactions contemplated herein in accordance with the terms hereof.

Section 6.3 Authorization; No Violation or Conflicts. The execution and delivery by each Seller of this Agreement and the due consummation of the transactions contemplated herein have been duly and validly authorized by all necessary corporate actions on the part of each Seller and this Agreement constitutes a valid and legally binding agreement of each Seller. Neither the execution and delivery of this Agreement by each Seller nor the consummation by each Seller of the transactions contemplated herein constitute a violation of applicable law or of each Seller's partnership agreement or other organizational documentation or agreements or result in the breach of, or the imposition of any lien on any assets of each Seller pursuant to, or constitute a default under, any indenture or bank loan or credit agreement, or other agreement or instrument to which each Seller is a party or by which it or any of its properties may be bound or affected. Except for consents, approvals, or authorizations which will have been obtained or actions which will have been taken on or prior to the Closing Date, no consent, approval, authorization or action by any governmental authority or any person or entity having legal rights against or jurisdiction over each Seller is required in connection with the execution and delivery by each Seller of this Agreement or for consummation by each Seller of the transactions contemplated herein.

Section 6.4 Litigation and Condemnation. There is no pending or, to each Seller’s knowledge, threatened action or proceeding (including, but not limited to, any condemnation or eminent domain action or proceeding) before any court, governmental agency or arbitrator which may adversely affect each Seller’s ability to perform this Agreement or which may affect the Property.

Section 6.5 Compliance with Laws. To Sellers’ knowledge, (i) Sellers’ use of the Timberlands is in material compliance with all statutes, ordinances, rules, regulations, orders and requirements of all federal, state and local authorities and any other governmental entity having jurisdiction over the Timberlands (“Laws”), and (ii) Sellers have not received any notice from any such governmental entity of any violation of any Laws.

Section 6.6 Environmental Matters. To Sellers’ knowledge, except as may be otherwise specifically identified in the Phase I Assessments, (x) the Timberlands has not at any time been used for the generation, transportation, management, handling, treatment, storage, manufacture, emission disposal, release or deposit of any hazardous substances or fill or other material containing hazardous substances in material violation of levels permitted under applicable laws; provided, however, the Timberlands may contain small, unauthorized household dump sites typical of rural timberlands; (y) there are no underground storage tanks on the Timberlands, and (z) Sellers have received no written notice from any federal, state or local governmental authority, to the effect that any portion of the Timberlands is not in compliance with applicable federal, state or local environmental laws, including, without limitation and as the same may be amended from time to time: (i) the Resource Conservation and Recovery Act of 1976, 42 USC §6901 et. seq. (RCLA); (ii) the Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 USC §9601 et. seq. (CERCLA); (iii) the Hazardous Materials Transportation Act, 49 USC §1801, et. seq.; (iv) applicable laws of the States of Georgia and Texas, and (v) any federal, state or local regulations, rules or orders issued or promulgated under or pursuant to any of the foregoing or otherwise by any department, agency or other administrative, regulatory or judicial body.

Section 6.7 Harvest Rights. Except for any timber harvest operations conducted under the Georgia Supply Agreement, there are no outstanding contracts or agreements entered into by Sellers pursuant to which any party has the contractual right to cut or remove timber from the Timberlands. To Sellers’ knowledge: (i) there has been no timber harvested or removed from the Timberlands located in Georgia since January 11, 2014 (the “Georgia Inventory Date”); (ii) there has been no timber harvested or removed from the Timberlands located in Texas since January 8, 2014 (the “Texas Inventory Date”); and (iii) Sellers shall not permit any harvesting or removal of timber from the Timberlands under the Georgia Supply Agreement until the Adjustment Date. From and after the Adjustment Date, Timber may be harvested

and removed from the Timberlands located in Georgia pursuant to the terms of the Georgia Supply Agreement.

Section 6.8 ERISA. For purposes of Section 3(14) of the Employee Retirement and Income Security Act of 1974, as amended (hereinafter referred to as “ERISA”), Sellers are not a party in interest with Buyer. The Property does not constitute an asset of an employee benefit plan affiliated with Sellers, as defined in Section 3(3) of ERISA.

Section 6.9 OFAC. Sellers are not, and will not become, a person or entity with whom U.S. persons are restricted from doing business with under the regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of Treasury (including those named on OFAC’s Specially Designed and Blocked Persons list) or under any statute, executive order (including the September 24, 2001 Executive Order Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism), the US Patriot Act, or other governmental action.

Section 6.10 Assumed Contracts and Real Property Leases. With respect to each Assumed Contract and Real Property Lease: (i) such Assumed Contract and Real Property Lease is legal, valid, binding, enforceable and in full force and effect and has not been modified or amended except as indicated on Exhibit B or Exhibit C attached hereto; (ii) the transactions contemplated by this Agreement will not result in a breach or default under any such Assumed Contract or Real Property Lease, or otherwise cause such Assumed Contract or Real Property Lease to cease to be legal, valid, binding, enforceable and in full force and effect on identical terms following the Closing; (iii) neither Sellers, nor to Sellers’ knowledge, any other party to any such Assumed Contract or Real Property Lease is in breach or default under such Assumed Contract or Real Property Lease; and (iv) to Sellers’ knowledge, no event has occurred or failed to occur or circumstances exist which, with the delivery of notice, the passage of time or both, would constitute a breach or default under any such Assumed Contract or Real Property Lease or permit the termination, modification or acceleration of rent under such Assumed Contract or Real Property Lease.

Section 6.11 Endangered, Threatened or Listed Species. To Sellers’ knowledge, there are no activity centers for species listed as endangered or threatened under the Federal Endangered Species Act located on the Timberlands. Seller has not received any written notice of any threatened or contemplated actions against Seller or the Timberlands based upon the presence of any species listed as endangered or threatened under the Federal Endangered Species Act on the Timberlands.

Section 6.12 No Casualty. To Sellers’ knowledge, no trees or timber having an aggregate value in excess of $100,000.00 have been lost or damaged by fire or other Casualty since the applicable Inventory Date. For purposes of this Agreement, Casualty shall mean any physical damage to or loss of the timber on any portion of the Timberlands by fire, earthquake, flood, insects, disease or other casualty, or as a result of timber trespass or unauthorized harvest.

Section 6.13 Unrecorded Documents. To Sellers’ knowledge, Sellers have not entered into any unrecorded agreements, easements, permits or contracts that will affect the Timberlands after Closing, except for the Georgia Supply Agreement, the Assumed Contracts and the Real Property Leases.

Section 6.14 Title. To Sellers’ knowledge, (i) FORESTREE VI LP owns fee-simple title to the Timberlands, as described in the Title Commitments, located in Georgia, and (ii) FORESTREE VI TEXAS LP owns fee-simple title to the Timberlands, as described in the Title Commitments, located in Texas, free and clear of all monetary liens, but expressly subject to all Permitted Exceptions, the Georgia Supply Agreement, the Real Property Leases and the Assumed Contracts.

Section 6.15 Boundary Disputes. Except as described in Schedule 6.15, to Sellers’ knowledge, there are no boundary disputes and no encroachments affecting the Timberlands or any portion thereof, nor is any person or entity adversely possessing or using any of the Timberlands or any portion thereof.

Section 6.16 Georgia Supply Agreement. No consent is required for the assignment by FORESTREE VI LP of the Georgia Supply Agreement, and all of the property subject to the Georgia Supply Agreement is included in the Georgia Timberlands.

Section 6.17 Mining. Except as described in Schedule 6.17, to Sellers’ knowledge, there have been no active mining operations conducted on the Timberlands during the past five (5) years, and Seller has no knowledge of any proposed mineral activity on the Timberlands.

Section 6.18 Property Taxes. To Sellers’ knowledge, (i) no taxes or assessments relating to the Timberlands are delinquent, and (ii) there are no special taxes, assessments or charges proposed, pending or threatened against the Timberlands. Neither Sellers nor, to Sellers’ knowledge, any other person or entity has applied the Timberlands or any portion thereof to a use other than agricultural or silvicultural.

For the purpose of this Agreement, the phrase “to Sellers’ knowledge” or “to Seller’s knowledge” shall be defined as the present, actual knowledge only, and not any implied, imputed or constructive knowledge, without any independent investigation having been made or any implied duty to investigate, of the following listed officers and employees of Sellers and Hancock Natural Resource Group, Inc.: (a) for the portion of the Timberlands located in Georgia: David Kimbrough, Manager, Dispositions - North America, Tim Jarrell, Area Forester, and Benjamin Addison, Area Manager; and (b) for the portion of the Timberlands located in Texas: David Kimbrough, Lee Wise, Area Forester, and Christy Nichol, Area Manager.

The truth of the representations and warranties set forth above is a condition to Buyer's obligation to purchase, and if any of the representations and warranties are not true at the date of Closing, then Buyer may rescind this Agreement and receive a return of the Earnest Money, and in the event any such false representation or warranty constitutes a default by Sellers hereunder, Buyer may also exercise any available remedy permitted under this Agreement. The representations and warranties set forth above shall survive Closing for a period of twelve (12) months after Closing, however, unless Buyer notifies Sellers in writing of an apparent or claimed breach of representation or warranty within twelve (12) months of Closing, then Sellers shall have no further liability resulting from the breach of said representations or warranties. Buyer shall have no right to bring any action against Sellers as a result of any breach, untruth or inaccuracy of the representations and warranties contained herein unless and until the aggregate amount of all liability and losses, claims, causes of action, damages, costs and expenses, including reasonable attorneys’ fees and expenses (collectively, “Loss”) arising out of any such untruth or inaccuracy or breach, together with the Loss resulting from any other such untruth, inaccuracy or breach exceeds or is reasonably likely to exceed $200,000.00. The maximum amount of Sellers’ aggregate liability resulting from any such untruth, inaccuracy or breach of a representation and warranty hereunder shall in no event exceed an aggregate amount in excess of $14,800,000.00. Sellers shall have no liability with respect to any breach of Seller’s representations and warranties herein if, prior to the Closing, Buyer obtains actual knowledge of any such breach or contradiction of a representation or warranty of Sellers herein, including, without limitation, as a result of Buyer’s due diligence or the inclusion of information in a written disclosure by Sellers to Buyer, and Buyer nevertheless consummates the transaction contemplated by this Agreement. In addition, Sellers shall be liable for actual damages only and shall have no liability hereunder for indirect, special, consequential or punitive damages. For purposes of this paragraph, Buyer’s actual knowledge shall mean the actual knowledge of Jerry Barag, Buyer’s President and Chief Executive Officer, and John D. Capriotti, Buyer’s Director of Acquisitions.

ARTICLE VII

REPRESENTATIONS AND WARRANTIES OF BUYER

Representations and Warranties of Buyer. Buyer represents and warrants to Sellers that as of this date and as of the date of the Closing:

Section 7.1 Organization. Buyer is a corporation duly organized and validly existing under the laws of the State of Maryland.

Section 7.2 Power and Authority for Transaction. Buyer has the power and authority to execute, deliver and perform this Agreement and the transactions contemplated herein in accordance with the terms hereof.

Section 7.3 Authorization; No Violation or Conflicts. The execution and delivery of this Agreement by Buyer and the due consummation of the transactions contemplated herein have been duly and validly authorized by all necessary [partnership or corporate] action on the part of Buyer, and this Agreement constitutes a valid and legally binding agreement of Buyer. Neither the execution and delivery of this Agreement by Buyer nor the consummation by Buyer of the transactions contemplated herein constitute a violation of applicable law or of Buyer’s partnership agreement, charter or bylaws or other organizational documentation or agreements or result in the breach of, or the imposition of any lien on any assets of Buyer pursuant to, or constitute a default under, any indenture or bank loan or credit agreement, or other agreement or instrument to which Buyer is a party or by which it or any of its properties may be bound or affected. Except for consents, approvals, or authorizations which will have been obtained or actions which will have been taken on or prior to the Closing Date, no consent, approval, authorization or action by any governmental authority or any person or entity having legal rights against or jurisdiction over Buyer is required in connection with the execution and delivery by Buyer of this Agreement or for consummation by Buyer of the transactions contemplated herein.

Section 7.4 Funding. Buyer has available or has binding subscriptions for, and will at the Closing have available, sufficient funds to pay the Purchase Price and to pay all other amounts due and payable by Buyer pursuant to the terms of this Agreement.

Section 7.5 OFAC. Buyer is not, and will not become, a person or entity with whom U.S. persons are restricted from doing business with under the regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of Treasury (including those named on OFAC’s Specially Designed and Blocked Persons list) or under any statute, executive order (including the September 24, 2001 Executive Order Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism), the US Patriot Act, or other governmental action.

The representations and warranties set forth above shall survive Closing for a period of twelve (12) months after Closing, however, unless Seller notifies Buyer in writing of an apparent or claimed breach of warranty within twelve (12) months of Closing, then Buyer shall have no further liability to Seller with respect to the representations or warranties. Buyer shall have no liability with respect to a breach of a representation or warranty herein if, prior to the Closing, Seller obtains knowledge of such breach or contradiction of a representation or warranty of Buyer herein, including, without limitation, as a result the inclusion of information in a written disclosure by Buyer to Seller, and Seller nevertheless consummates the transaction contemplated by this Agreement. In addition, Buyer shall be liable for actual damages only and shall have no liability hereunder to Seller or Seller’s successors and assigns for indirect, special, consequential or punitive damages in favor of Seller.

ARTICLE VIII

ENVIRONMENTAL RELEASE

Section 8.1 Environmental Release. From and after the date which is twelve (12) months after the Closing Date (the “Release Date”), Buyer hereby releases Sellers from all costs, losses, liabilities, obligations and claims, of any nature whatsoever, known and unknown, that Buyer may have against Sellers based in whole or in part upon the presence, release or disposal of any hazardous substance, solid waste, or any other environmental contamination on, within, or from the Timberlands before or as of the Closing Date. Anything to the contrary notwithstanding, Buyer’s waiver and release of Sellers as described above shall not eliminate Sellers’ liability for the warranty and representation set forth in Section 6.6 hereof, or for any claim made by Buyer prior to the Release Date. Buyer or its successors and assigns shall have no obligation at any time or as a result of this release to indemnify, defend or save harmless Sellers from claims

by third parties for any conditions, actions or omissions which occurred prior to the Closing Date regardless of whether claims are brought before or after Closing. As used in this Section, the term “applicable environmental laws” shall mean all state, federal, or local laws, statutes, ordinances, rules, regulations or orders pertaining to health or the environment, including, without limitation, the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (“CERCLA”) and the Resource Conservation and Recovery Act of 1976 (“RCRA”), as each may be amended from time to time. As used herein, the terms “hazardous substance” and “release” have the meanings specified in CERCLA, and the terms “solid waste” and “disposal” (or “disposed”) have the meanings specified in RCRA. If either CERCLA or RCRA is amended to broaden the meaning of any term defined thereby, the broader meaning shall apply to this Section after the effective date of the amendment. Moreover, to the extent that Georgia or Texas law establishes a meaning for “hazardous substance,” “release,” “solid waste,” or “disposal” that is broader than that specified in either CERCLA or RCRA, the broader meaning shall apply. In addition, this Section shall survive the date of closing for all purposes and shall not be deemed to have merged into any of the documents executed or delivered at Closing.

ARTICLE IX

CONDEMNATION; CASUALTY

Section 9.1 Buyer’s Risk. Buyer shall bear the risk of loss or damage to the Timberlands from Casualty loss or any other cause whatsoever, or condemnation of any portion of the Timberlands, prior to Closing, if, but only if, such loss, damage or condemnation does not cause a reduction in the value of the Property greater than $250,000.00, it being assumed for purposes of this computation that the value of the land and timber comprising the Timberlands is the value shown on the Value Table. Notwithstanding the occurrence of any such loss, damage or condemnation which is $250,000.00 or less, Buyer and Sellers shall complete the Closing without adjustment of the Purchase Price.

Section 9.2 Sellers’ Risk. Sellers shall bear the risk of loss or damage to the Timberlands and improvements thereon from Casualty loss or any other cause whatsoever, or condemnation of any portion of the Timberlands, prior to Closing if, but only if, such loss, damage or condemnation causes a reduction in the value of the Property greater than $250,000.00. In the event of such loss, damage, or condemnation prior to Closing which causes a reduction in value of the Property greater than $250,000.00 but less than ten percent (10%) of the Purchase Price, Buyer shall proceed with Closing provided that (i) in the case of damage, Buyer shall receive a reduction in the Purchase Price equal to the amount of such damage as determined in accordance with Section 9.3 below, or (ii) in the case of a condemnation, Sellers shall assign all of Sellers’ rights to such condemnation award or proceeds for the Property to Buyer. In the event that such loss, damage or condemnation occurs prior to Closing and causes a reduction in the value of the Property in excess of ten percent (10%), Buyer, at its election, may terminate this Agreement without any further liability of either party to the other, except that Sellers shall direct the Escrow Agent to refund the Earnest Money to Buyer or if Buyer fails to terminate this Agreement as provided herein within five (5) business days after the determination of the reduction in value of the Property, then Buyer shall be deemed to have waived such termination right and Buyer and Sellers shall complete the Closing provided that (i) in the case of damage, Buyer shall receive a reduction in the Purchase Price equal to the amount of such damage as determined in accordance with Section 9.3 below, or (ii) in the case of a condemnation, Sellers shall assign all of Sellers’ rights to such condemnation award or proceeds for the Property to Buyer.

Section 9.3 Adjustment. In the event it shall become necessary, pursuant to Sections 9.1 or 9.2, to determine the amount of any change in the value of the Property, and Sellers and Buyer are unable to agree on the amount of such change within ten (10) days after the occurrence of such loss, damage or condemnation, then such determination shall be made by a majority of a panel of three (3) independent professional forestry consultants each of whom has no less than ten (10) years’ experience in the practice of forestry in the general area of the Timberlands. One such consultant shall be appointed by Sellers, one such consultant shall be appointed by the Buyer, and the third consultant shall be chosen by the first two consultants. The decision of such consultants shall be final and binding on both parties, and the costs of such determination shall be divided equally between Buyer and Sellers. Said consultants shall use the land

and timber values set forth in the Value Table in making their determination. The date of Closing shall be extended to the extent reasonably necessary to permit the determination of the amount of any change in the value of the Property and/or to permit any election made pursuant to the provisions of this Section 9.3.

ARTICLE X

CONDITIONS PRECEDENT

Section 10.1 Conditions to Obligations of Each Party to Close. The obligations of the Parties to consummate the transactions contemplated by this Agreement shall be subject to the satisfaction or waiver, on or before the Closing Date, of the following conditions:

| (a) | No Injunction. There shall be no injunction, restraining order or decree of any nature of any court or Governmental Authority that is in effect, that does not result from the default of any party to this Agreement and that restrains or prohibits the consummation of the transactions contemplated by this Agreement or imposes conditions on such consummation not otherwise provided for herein. |

| (b) | No Investigation. No Party shall have been advised by any United States federal government agency (which advisory has not been officially withdrawn on or prior to the Closing Date) that such government agency is investigating the transactions contemplated by this Agreement to determine whether to file or commence any litigation that seeks or would seek to enjoin, restrain or prohibit the consummation of the transactions contemplated by this Agreement. |

| (c) | Purchase Price Reduction Limit. In the event the aggregate fair market value of (i) Title Carveouts, and (ii) the fair market value of the lost and damaged timber from all losses arising from Casualty or condemnation exceeds an amount equal to twenty percent (20%) of the Purchase Price, prior to any adjustment as contemplated by Section 12.1, either Party may terminate this Agreement by delivering written notice of the same to the other Party, in which event this Agreement shall terminate, the Earnest Money shall be returned immediately to Buyer, and neither Party shall have any further liability hereunder (except for such liabilities as expressly survive termination of this Agreement). |

Section 10.2 Conditions to Obligations of Buyer to Close. The obligation of Buyer to consummate the transactions contemplated by this Agreement shall be subject to the satisfaction or waiver, on or before the Closing Date, of the following conditions:

| (a) | Representations and Warranties. Each of the representations and warranties of Sellers contained in this Agreement shall be true and correct, in each case as of the date of this Agreement and as of the Closing with the same effect as though made as of the Closing (except to the extent expressly made as of an earlier date, in which case as of such date). |

| (b) | Agreements and Covenants. Sellers shall have performed or complied with, in all material respects, all agreements and covenants required by this Agreement to be performed or complied with by Seller on or prior to the Closing. |

| (c) | Seller Deliveries. Sellers shall have tendered for delivery or caused to be tendered for delivery to Buyer the items set forth in Section 12.3 (a). |

| (d) | Title Policies. Buyer shall have received, in the form of a “marked binder” delivered at Closing, one or more owners policies of title insurance issued by First American Title Insurance Company (or, another national title insurance company acceptable to Buyer) in the amount of the Purchase Price (as adjusted) insuring title to the Timberlands as of the date of Closing subject only to the Permitted Exceptions, and otherwise in form and content (with endorsements reasonably acceptable to Buyer) satisfactory to Buyer. |

Section 10.3 Conditions to Obligations of Sellers. The obligation of Sellers to consummate the transactions contemplated by this Agreement shall be subject to the satisfaction or waiver, on or before the Closing Date, of the following conditions:

| (a) | Representations and Warranties. Each of the representations and warranties of Buyer contained in this Agreement shall be true and correct in each case as of the date of this Agreement and as of the Closing with the same effect as though made as of the Closing (except to the extent expressly made as of an earlier date, in which case as of such date). |

| (b) | Agreements and Covenants. Buyer shall have performed or complied with, in all material respects, with all agreements and covenants required by this Agreement to be performed or complied with by it on or prior to the Closing. |

| (c) | Deliveries. Buyer shall have tendered for delivery or caused to be tendered for delivery to Sellers the items set forth in Section 12.3(b). |

ARTICLE XI

ASSIGNMENT

Section 11.1 Assignment. Except as expressly set forth below, this Agreement shall not be assigned or encumbered, or otherwise transferred in any way, by Buyer without the prior written consent of Sellers, and shall not be recorded in any County records or other office where public records are maintained. Buyer may assign this Agreement to any institutional lender or lenders as security for obligations to such lender or lenders in respect of financing arrangements of Buyer or any Affiliates thereof with such lender or lenders. Buyer may assign its rights and obligations under this Agreement to effectuate a like-kind exchange of real property pursuant to Section 1031(a) of the Internal Revenue Code 1986 as amended and the parties agree to cooperate with each other in effecting such an exchange and will execute the necessary documentation for an exchange. Following any such assignment Buyer shall remain liable for the performance of Buyer’s obligations hereunder and any such assignment and activities relating thereto cannot extend Closing. Any expenses incurred by Sellers in connection with such assignment activity will be paid to Sellers by Buyer. In addition, Sellers agree that Buyer may assign its rights and obligations under the Agreement in its sole discretion to one or more entities directly or indirectly controlled by, controlling or under common control with, or whose timber investments are managed by, Buyer (each an “Affiliate”) and cause Sellers to deed such Timberlands directly to such Affiliates as long as Buyer remains obligated for the performance of this Agreement. Sellers shall not incur any additional cost or liability by reason of the this Section 11, and Buyer shall give Sellers at least ten (10) days prior written notice before Closing of the identity of the grantee of the Deed, if other than Buyer.

ARTICLE XII

APPORTIONMENTS; CLOSING COSTS; CLOSING DELIVERIES

Section 12.1 Apportionments. Except as provided in Section 12.2, the following shall be apportioned between Buyer and Sellers as of the Effective Time (on a per diem basis): (i) property and other non-income taxes and assessments in respect of the Property with respect to the tax period in which the Effective Time occurs; (ii) revenue from the Real Property Leases, including hunting and other recreational lease revenue; (iii) revenues or expenses and payments received or made by Sellers in respect of any Assumed Contract ((i) - (iii) collectively, “Apportionments”); provided, however, all revenue received by Seller under the Georgia Supply Agreement for all Timber cut from and after the Adjustment Date shall be credited (dollar for dollar) against the Purchase Price. At Closing, and again thirty (30) days after Closing to the extent such revenues are received by Seller after Closing, Seller shall provide Buyer with an accounting of (1) the volume of Timber harvested, and (2) all revenue received by Seller, from and after the Adjustment Date under the Georgia Supply Agreement. Not later than sixty (60) days after the later of the Closing Date or the date that all the applicable tax rates have been fixed or the value assessments have been made and finally determined with respect to all of the Timberlands for the applicable tax periods in which the Effective

Time occurs, Sellers and Buyer shall determine the Apportionments, and the Purchase Price shall be increased or decreased, as applicable, by the aggregate amount of such Apportionments; provided if the net aggregate amount of such apportionments relating to property Taxes is $1,000.00 or less, no adjustment shall be made. Any adjustment to be made pursuant to this Section 12.1 shall be made no later than five (5) Business Days following the determination of the aggregate amount of the Apportionments. Sellers and Buyer agree to furnish each other with such documents and other records as may be reasonably requested in order to confirm all Apportionment calculations made pursuant to this Section 12.1. Except for the adjustment set forth above, there shall not be any proration of property taxes or other non-income taxes and assessments and, as between Buyer and Sellers, Buyer agrees that Buyer shall be solely responsible for all such property taxes and other non-income taxes and assessments due and payable in respect of the Property after the Closing. In addition, Sellers shall be responsible for payment of any rollback, recapture, or other taxes related to or caused by a change of use of the Timberlands due to actions of Sellers (other than merely the sale of the Timberlands to Buyer). Sellers’ responsibility for such taxes shall survive the Closing.

Section 12.2 Closing Costs. Each Party shall be responsible for its own attorneys’ fees and expenses. Sellers shall be responsible for the preparation of the Deeds at Sellers’ expense. Sellers shall pay the following costs and expenses in connection with the transactions contemplated by this Agreement: (i) search and exam fees to prepare the Title Commitment; (ii) one-half of any escrow fees, if any, charged by the Escrow Agent; (iii) one-half of the costs to prepare and issue the Phase I Assessment; and (iv) one-half of all sales, use, excise, documentary, stamp duty, registration, transfer, conveyance, economic interest transfer and other similar taxes related to the conveyance of the Timberlands from Sellers to Buyer arising in connection with the transactions contemplated by this Agreement (collectively, “Transfer Taxes”). Buyer shall pay the following costs and expenses in connection with the transactions contemplated by this Agreement: (i) one-half of all Transfer Taxes; (ii) one-half of any escrow fees, if any, charged by the Escrow Agent; (iii) one-half of the costs to prepare and issue the Phase I Assessment and all costs incurred for the Reliance Letter; (iv) all recording and filing fees associated with recording or filing any documents, including the Deeds; (v) all title insurance premiums, premiums for expanded title coverage and endorsement fees and premiums; and (vi) any recapture, reassessment, roll-back taxes or changes in tax assessments in respect of the Timberlands that may become due and payable after the Effective Time caused by any action or inaction of Buyer with respect to the continuation or removal of the Timberlands after the Effective Time from the present classification, or changes in use after the Effective Time, except to the extent the same are caused by actions of the Sellers (other than the mere transfer of the Timberlands to Buyer). The Party having primary responsibility under applicable law shall timely prepare and file tax returns in respect of such Transfer Taxes with the applicable taxing authority. All other costs shall be paid by the Party incurring such costs.

Section 12.3. Closing Deliveries.

| (a) | Closing Deliveries by Sellers. Sellers shall deliver the following items to Buyer at the Closing: |

| (i) | duly executed special or limited warranty deeds (one or more for each county, at Buyer’s election pursuant to Section 11.1 above) warranting only against persons claiming by, though or under each Seller and subject only to the Permitted Exceptions, in each case substantially in the form of Exhibit E (Georgia) and Exhibit E-1 (Texas) attached hereto (collectively, the “Deeds”); |

| (ii) | duly executed counterparts of assignment and assumption agreements under which each Seller assigns to Buyer all of each Seller’s right, title and interest in and to the Real Property Leases and Buyer assumes all of each Seller’s obligations, covenants and responsibilities under the Real Property Leases in each case substantially in the form of Exhibit F (each, an “Assignment and Assumption of Real Property Leases”); |

| (iii) | duly executed counterparts of assignment and assumption agreements under which each Seller assigns to Buyer all of each Seller’s right, title and interest in and to the Assumed |

Contracts, and Buyer assumes all of each Seller’s obligations, covenants and responsibilities under the Assumed Contracts in each case substantially in the form of Exhibit G -1 (each, an “Assignment and Assumption of Assumed Contracts”);

| (iv) | duly executed counterparts of assignment and assumption agreements under which FORESTREE VI LP assigns to Buyer all of FORESTREE VI LP’s right, title and interest in and to the Georgia Supply Agreement, and Buyer assumes all of FORESTREE VI LP’s obligations, covenants and responsibilities under the Georgia Supply Agreement substantially in the form of Exhibit G-2 (the “Assignment and Assumption of Georgia Supply Agreement”); |

| (v) | duly executed certificate of each Seller certifying that each Seller’s respective representations and warranties set forth in Article VI of this Agreement are true, correct and complete as of the Closing Date; |

| (vi) | an affidavit stating the taxpayer identification number of each Seller and that each Seller is not a “foreign person” for purposes of Section 1445 of the Code and the Treasury Regulations thereunder; |

| (vii) | an Owner’s Title Affidavit reasonably requested by the Title Company, substantially in the form of Exhibit H; |

| (viii) | an Affidavit of Seller’s Residence, substantially in the form of Exhibit I; |

| (ix) | such assignments, affidavits, certificates of title and other instruments of assignment and conveyance, all in form reasonably satisfactory to Buyer, as are necessary to convey fully and effectively to Buyer Sellers’ interest in the Property in accordance with the terms hereof and in order to permit Buyer to obtain title insurance on the Timberlands, as contemplated herein; |

| (x) | an executed closing statement with respect to the transactions contemplated hereby; and |

| (xi) | an estoppel letter in a form provided in the Georgia Supply Agreement from Georgia Biomass under the Georgia Supply Agreement, to the extent requested by Buyer. |

| (b) | Closing Deliveries by Buyer. At the Closing, Buyer shall deliver the following items to Seller: |

| (i) | the balance of the Purchase Price, subject to Apportionments and adjustments as set forth herein; |

| (ii) | duly executed counterparts of the Assignment and Assumption of Assumed Contracts; |

| (iii) | duly executed counterparts of the Assignment and Assumption of Georgia Supply Agreement; |

| (iv) | duly executed counterparts of the Assignment and Assumption of Real Property Leases; |

| (v) | duly executed certificate of Buyer certifying that Buyer’s representations and warranties set forth in Article VII of this Agreement are true, correct and complete as of the Closing Date; |

| (vi) | intentionally deleted; |

| (vii) | such assignments, certificates of title and other instruments of assignment and conveyance, all in form reasonably satisfactory to Seller, as are necessary to consummate the transactions contemplated by this Agreement; and |

| (viii) | an executed closing statement with respect to the transactions contemplated hereby. |

| (c) | Other Closing Deliveries. The Parties shall each execute and deliver such other and further certificates, assurances and documents as may reasonably be required by the other Parties in connection with the consummation of the transactions contemplated by this Agreement. Seller |

acknowledges that Buyer and CoBank may request that Georgia Biomass execute a consent to Buyer’s collateral assignment of the Georgia Supply Agreement, and Sellers covenant and agree to (i) deliver such consent documentation to Georgia Biomass within seven (7) days after receipt of same from Buyer, and (ii) use good faith efforts, at no cost or expense to Sellers, to obtain the execution and delivery of such consent documentation by Georgia Biomass; provided, however, Sellers and Buyer acknowledge and agree that the execution and delivery of such consent documentation by Georgia Biomass is not a condition to closing.

ARTICLE XIII

BROKER’S COMMISSION

Section 13.1 Commission. Buyer and Sellers each represent and warrant to the other that, no broker, agent or finder, licensed or otherwise has been engaged by it, respectively, in connection with the transaction contemplated by this Agreement. In the event of any such claim for broker’s, agent’s or finder’s fee or commission in connection with the negotiation, execution or consummation of this transaction, the party upon whose alleged statement, representation or agreement such claim or liability arises shall indemnify, hold harmless and defend the other party from and against such claim and liability, including without limitation, reasonable attorney’s fees and court costs. Buyer and Sellers acknowledge that the representations and warranties contained in this Section shall survive the Closing.

ARTICLE XIV

CONFIDENTIALITY AND PUBLIC ANNOUNCEMENTS

Section 14.1 Confidentiality. Each Party will hold, and will cause its officers, employees, accountants, counsel, financial advisors and other representatives and affiliates to hold, any nonpublic information confidential in accordance with the terms of that certain Confidentiality Agreement dated January 8, 2014, entered into by and between the parties (the “Confidentiality Agreement”).

Section 14.2 Public Announcements. This Agreement (or a memorandum thereof) shall not be recorded by Buyer in any real property records. If this Agreement (or a memorandum thereof) is so recorded by Buyer, each Seller may, at its option, terminate this Agreement. Notwithstanding anything to the contrary set forth in Section 14.1 or the Confidentiality Agreement, except as required by applicable Law (including rules and regulations promulgated by the SEC) or stock exchange rules, (i) any press release or public announcement by Buyer regarding the transactions contemplated by this Agreement shall only be made simultaneously with or after a press release or public announcement by Sellers on or after the Effective Date regarding the transactions contemplated by this Agreement, and (ii) Sellers and Buyer shall consult with each other before issuing, and will provide each other the opportunity to review, comment upon and concur with, and use commercially reasonable efforts to agree on, any press release and other public announcement with respect to the transactions contemplated by this Agreement, including the time, form and content of such press release or public announcement, and shall not issue any such press release or make any such public announcement prior to such consultation; provided, however, that any disclosure required to be made under applicable Law, stock exchange rules or rules and regulations promulgated by the SEC may be made without such mutual agreement if a Party required to make such disclosure has determined in good faith that it is necessary to do so and has used commercially reasonable efforts, prior to the issuance of the disclosure, to provide the other Party with a copy of the proposed disclosure and to discuss the proposed disclosure with the other Party. For the purposes of this Agreement, the term “Law” shall mean any rule, regulation, statute, order, ordinance, guideline, code or other legally enforceable requirement, including common law, state and federal laws and laws of foreign jurisdictions.

ARTICLE XV

DEFAULT

Section 15.1 Buyer Default. If the purchase and sale contemplated hereby is not consummated because of a default by Buyer under this Agreement, then Escrow Agent will deliver the Earnest Money to

Seller as full liquidated damages (the parties hereto acknowledging that Seller’s damages as a result of such default are not capable of exact ascertainment and that said liquidated damages are fair and reasonable), said payment being Sellers’ sole and exclusive remedy hereunder on account of any default by Buyer, whereupon this Agreement will terminate and neither party hereto will have any further rights or obligations hereunder.

Section 15.2 Seller Default If the purchase and sale contemplated hereby is not consummated because of a default by Seller under this Agreement, Buyer may elect, in its sole discretion either (i) to terminate this Agreement whereupon the Escrow Agent will return the Earnest Money to Buyer and to obtain a reimbursement from Seller for Buyer’s actual third party expenses incurred in connection with this Agreement, not to exceed $250,000.00, or (ii) to seek specific performance of this Agreement, in which event Escrow Agent shall continue to hold the Earnest Money until the final disposition of the action for specific performance, whereupon the Earnest Money shall be applied to the Purchase Price, or, if specific performance is not final, after disposition of all appeals which may have been taken, decreed to Buyer, then Escrow Agent shall pay the Earnest Money to Buyer.

ARTICLE XVI

GENERAL PROVISIONS

Section 16.1 Attorneys’ Fees. In the event any legal proceeding should be brought to enforce the terms of this Agreement or for breach of any provision of this Agreement, the non-prevailing Party shall reimburse the prevailing Party for all reasonable costs and expenses of the prevailing Party (including its attorneys’ fees and disbursements). For purposes of the foregoing, (i) “prevailing Party” means (A) in the case of the Party initiating the enforcement of rights or remedies, that it recovered substantially all of its claims, and (B) in the case of the Party defending against such enforcement, that it successfully defended substantially all of the claims made against it, and (ii) if no Party is a “prevailing Party” within the meaning of the foregoing, then no Party will be entitled to recover its costs and expenses (including attorney’s fees and disbursements) from any other Party.

Section 16.2. Governing Law. This Agreement shall be interpreted, construed and enforced according to the laws of the State of Georgia. Each party irrevocably submits to the jurisdiction of the Courts of the State of Georgia and the Federal Courts of the United States of America in and for the City of Atlanta, Georgia for the purpose of any action or proceeding arising out of this Agreement.

Section 16.3 Notices. All notices, requests, demands, and other communications hereunder shall be in writing, and shall be deemed to have been duly given if delivered in person, sent by facsimile or electronic mail transmission or sent by overnight courier service (with all fees prepaid) as follows:

If to Sellers, to:

ForesTree VI LP and ForesTree VI Texas LP

c/o Hancock Natural Resource Group, Inc.

13950 Ballantyne Corporate Place, Suite 150

Charlotte, NC 28277

Attention: David Kimbrough, Manager, Dispositions - North America

Email: dkimbrough@hnrg.com; Facsimile: 617.210.8672

with a copy to:

ForesTree VI LP and ForesTree VI Texas LP

c/o John Hancock Timber Resource Corporation

99 High Street, 26th Floor

Boston, MA 02110

Attention: Donna Frankel, General Counsel

Email: dfrankel@hnrg.com; Facsimile: 617.747.1536

and

Womble Carlyle Sandridge & Rice, LLP

One West Fourth Street

Winston-Salem, NC 27101

Attention: Trent E. Jernigan

Email: tjernigan@wcsr.com; Facsimile: 336.726.8082

If to Buyer:

CatchMark Timber Trust, Inc.

6200 The Corners Parkway

Norcross, Georgia 30092-3365

Attention: John D. Capriotti

Email: john.capriotti@catchmark.com; Facsimile: 770.243.8172

With a copy to:

Smith, Gambrell & Russell, LLP

Promenade, Suite 3100

1230 Peachtree Street, N.E.

Atlanta, Georgia 30309-3592

Attention: Mark G. Pottorff

Email: mpottorff@sgrlaw.com; Facsimile: 404.685.6897

Any such notice, request, demand or other communication shall be deemed to be given and effective if delivered in person, on the date delivered, if sent by overnight courier service, on the date sent as evidenced by the date of the bill of lading, or if sent by facsimile or email transmission, on the date transmitted; and shall be deemed received if delivered in person, on the date of personal delivery, if sent by overnight courier service, on the first business day after the date sent, or if by facsimile or email transmission, on the date sent (provided that such delivery by facsimile or email transmission is followed by delivery on the next business day in person or by overnight courier service). Any notice, request, demand or other communication shall be given to such other representative or at such other address as a Party may furnish to the other Parties in writing pursuant to this Section.

Section 16.4 Time of Performance. Time is of the essence of this Agreement and of all acts required to be done and performed by the parties hereto, including, but not limited to, the proper tender of each of the sums required by the terms hereof to be paid.

Section 16.5 Section Headings. The word or words appearing at the commencement of Sections and sub-Sections of this Agreement are included only as a guide to the contents thereof and are not to be considered as controlling, enlarging or restricting the language or meaning of those Sections or sub-Sections.

Section 16.6 Severability of Provisions. If any provision of this Agreement (including any phrase, sentence, clause, Section or subsection) is inoperative, invalid, illegal or unenforceable for any reason, all other provisions of this Agreement shall remain in full force and effect so long as the economic or legal

substance of the transactions contemplated hereby is not affected in any manner materially adverse to any Party. Upon any such determination, the Parties shall negotiate in good faith to modify this Agreement so as to give effect to the original intent of the Parties as closely as possible in an acceptable manner to the end that transactions contemplated hereby are fulfilled to the extent possible.

Section 16.7 Legal Relationships. The Parties to this Agreement execute the same solely as a seller and a buyer. No partnership, joint venture or joint undertaking shall be construed from these presents, and except as herein specifically provided, neither party shall have the right to make any representation for, act on behalf of, or be liable for the debts of the other. All terms, covenants and conditions to be observed and performed by either of the parties hereto shall be joint and several if entered into by more than one person on behalf of such party, and a default by any one or more of such persons shall be deemed a default on the part of the party with whom said person or persons are identified. No third party is intended to be benefited by this Agreement.

Section 16.8 Possession. Unless a different date is provided for herein, Buyer shall be entitled to possession of the Timberlands on the Closing Date, subject to the Permitted Exceptions.

Section 16.9 Entire Agreement; Waiver. All understandings and agreements previously existing between the parties, if any, are merged into this Agreement, which alone fully and completely expresses their agreement, and the same is entered into after full investigation, neither party relying upon any statement or representation made by the other not embodied herein. This Agreement may not be amended or modified in any manner other than by an agreement in writing signed by all of the Parties or their respective successors or permitted assigns. No waiver under this Agreement shall be valid or binding unless set forth in a writing duly executed and delivered by each Party against whom enforcement of such waiver is sought. Neither the waiver by any of the Parties of a breach of or a default under any provision of this Agreement, nor the failure by any of the Parties, on one or more occasions, to enforce any provision of this Agreement or to exercise any right or privilege hereunder, shall be construed as a waiver of any other breach or default of a similar nature, or as a waiver of any of such provisions, rights or privileges hereunder.

Section 16.10 Interpretation. This Agreement has been reviewed by both Parties and each Party has had the opportunity to consult with independent counsel with respect to the terms hereof and has done so to the extent that such party desired. No stricter construction or interpretation of the terms hereof shall be applied against either Party as the drafter hereof.

Section 16.11 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed to be an original instrument. All such counterparts together shall constitute a fully executed Agreement. Electronic signatures shall constitute originals.