C A T C H M A R K F I R S T Q U AR T E R 2 0 1 8 1 1

F O R WA R D - L OOK I N G S TAT EM EN T S This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward- looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include we believe that we are well positioned given expected increases in sawtimber pricing, housing starts and lumber consumption and our evolving harvest mix to an increased share of sawtimber; that we will continue to concentrate on disciplined execution of our operating plan while strategically expanding our timberlands holdings and capital relationships; that we believe that we are on target for executing our business plan; that we remain focused on providing a superior and sustainable rate of return to stockholders through disciplined acquisitions, sustainable harvests, increased cash flow and revenue growth, well-timed sales, our joint venture strategy, recurring dividends and opportunistic share repurchases; that we believe that our new growth opportunities, operational execution, and capital allocation strategy are building long-term value, and our guidance and outlook for 2018. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those contemplated by our forward-looking statements including, but not limited to: (i) we may not generate the harvest volumes from our timberlands that we currently anticipate; (ii) the demand for our timber may not increase at the rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our timberlands are located; (iii) the cyclical nature of the real estate market generally, including fluctuations in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties; (iv) timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (v) the supply of timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (vi) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (vii) we may not be able to access external sources of capital at attractive rates or at all; (viii) potential increases in interest rates could have a negative impact on our business; (ix) our share repurchase program may not be successful in improving stockholder value over the long-term; (x) our joint venture strategy may not enable us to access non-dilutive capital and enhance our ability to make acquisitions; and (xi) the factors described in Item 1A. Risk Factors of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and our other filings with Securities and Exchange Commission. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to update our forward-looking statements, except as required by law. 2 COMPANY UPDATE | FIRST QUARTER 2018

TA BLE O F CO NTE NTS SECTION PAGE # CatchMark Overview 4 Timberland Industry Drivers 9 Operating Strategy 16 Portfolio 23 Markets 29 Acquisition and Land Sales Strategy 38 Capital Position 45 Summary and Outlook 49 Appendix 53 3 COMPANY UPDATE | FIRST QUARTER 2018

CatchMark Overview 4 4

CatchMark is a public company that strives to deliver superior and sustainable returns for all stakeholders through disciplined acquisitions, sustainable harvests, and well-timed sales. 5 COMPANY UPDATE | FIRST QUARTER 2018

C ATCHM A RK’ S I NV E S TM E NT DRI V E RS CatchMark drives superior risk-adjusted performance through a focus on higher quality assets in select mill markets and seeks to: • Deliver recurring dividends from sustainable harvests INVESTMENT DRIVERS on prime timberlands and opportunistic land sales, taking advantage of the current housing recovery 1. Prime Timberland Assets • Acquire highly-productive and well-located 2. High Demand Markets timberlands in high demand fiber markets through disciplined capital allocations 3. Active Forest Management 4. Environmental Stewardship • Grow stable and predictable cash flows and enhance NAV through active forest management and concerted environmental stewardship 6 COMPANY UPDATE | FIRST QUARTER 2018

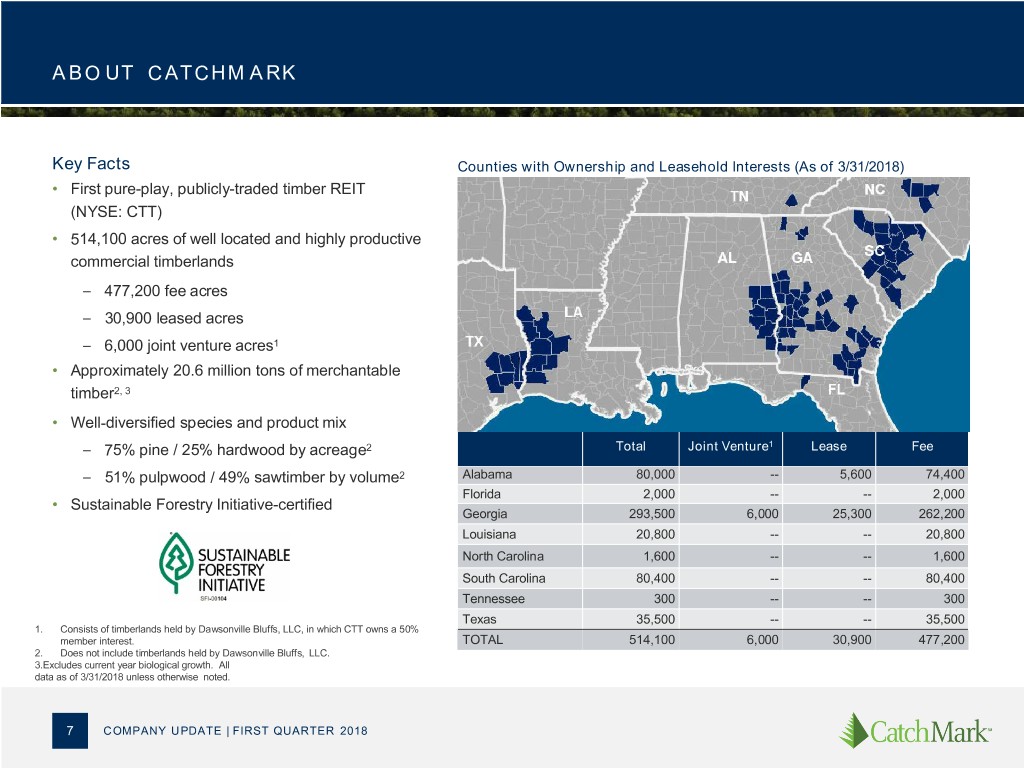

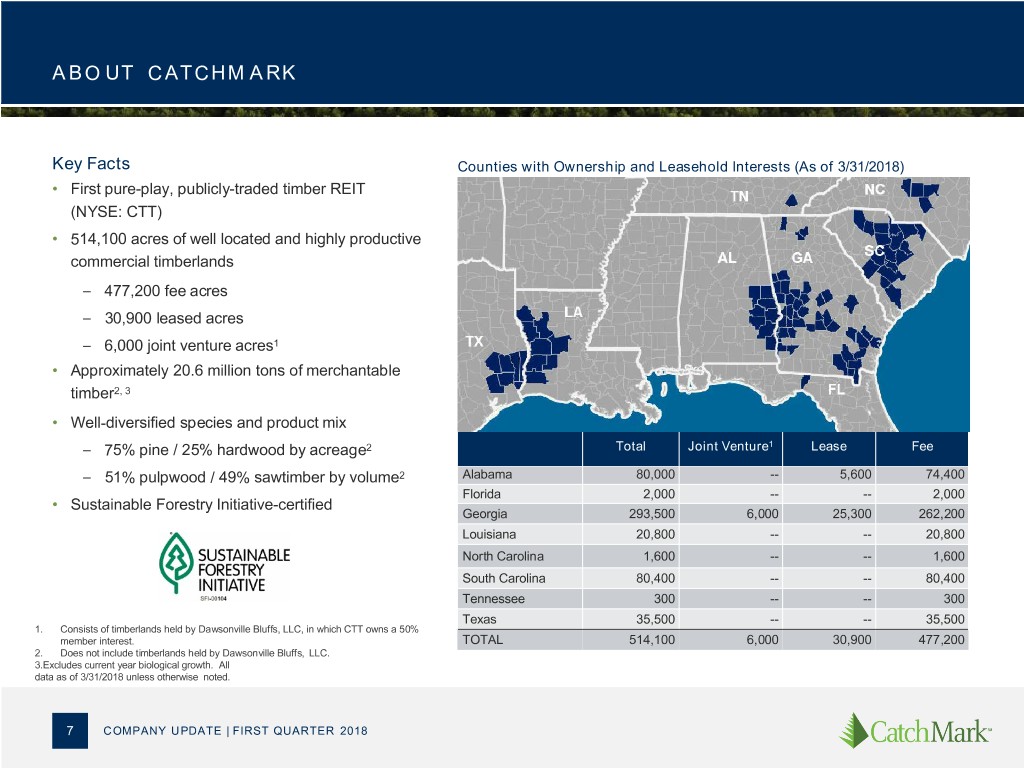

A BO UT C ATCHM A RK Key Facts Counties with Ownership and Leasehold Interests (As of 3/31/2018) • First pure-play, publicly-traded timber REIT (NYSE: CTT) • 514,100 acres of well located and highly productive commercial timberlands – 477,200 fee acres – 30,900 leased acres – 6,000 joint venture acres1 • Approximately 20.6 million tons of merchantable timber2, 3 • Well-diversified species and product mix – 75% pine / 25% hardwood by acreage2 Total Joint Venture1 Lease Fee – 51% pulpwood / 49% sawtimber by volume2 Alabama 80,000 -- 5,600 74,400 Florida 2,000 -- -- 2,000 • Sustainable Forestry Initiative-certified Georgia 293,500 6,000 25,300 262,200 Louisiana 20,800 -- -- 20,800 North Carolina 1,600 -- -- 1,600 South Carolina 80,400 -- -- 80,400 Tennessee 300 -- -- 300 Texas 35,500 -- -- 35,500 1. Consists of timberlands held by Dawsonville Bluffs, LLC, in which CTT owns a 50% member interest. TOTAL 514,100 6,000 30,900 477,200 2. Does not include timberlands held by Dawsonville Bluffs, LLC. 3.Excludes current year biological growth. All data as of 3/31/2018 unless otherwise noted. 7 COMPANY UPDATE | FIRST QUARTER 2018

GR OW T H SI N C E I PO 1 94% Increase in fee timberland ownership 277,000 acres acquired Annual harvest: 156% increase to 2.3 million tons Grew merchantable inventory to 21.2 million tons 104% increase Consistently paid fully-covered quarterly distributions Increased Dividend2 per-share each year Average site index improved from 68 to 72 Timber sales UP 167%, revenues UP 185% and Adjusted EBITDA3 UP 1,110% Compound Annual Growth Rates Timber Sales 28% Revenues 30% Adjusted EBITDA 87% New JV Platform to expand timberland ownership 1. From listed IPO in December 2013 through December 31, 2017. 2. See dividend payout ratio calculation beginning on page 64. 3. See definition of Adjusted EBITDA on page 61, reconciliation of net income (loss) to Adjusted EBITDA on page 62 and Adjusted EBITDA by sources on page 63. 8 COMPANY UPDATE | FIRST QUARTER 2018

Timberland Industry Drivers 9

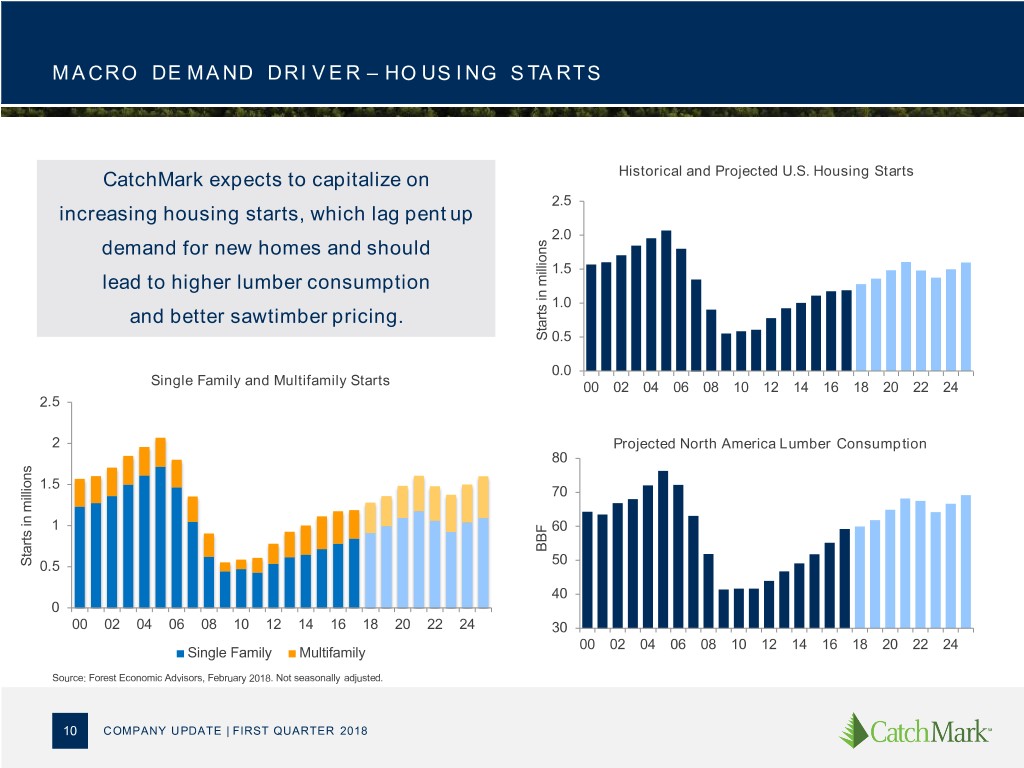

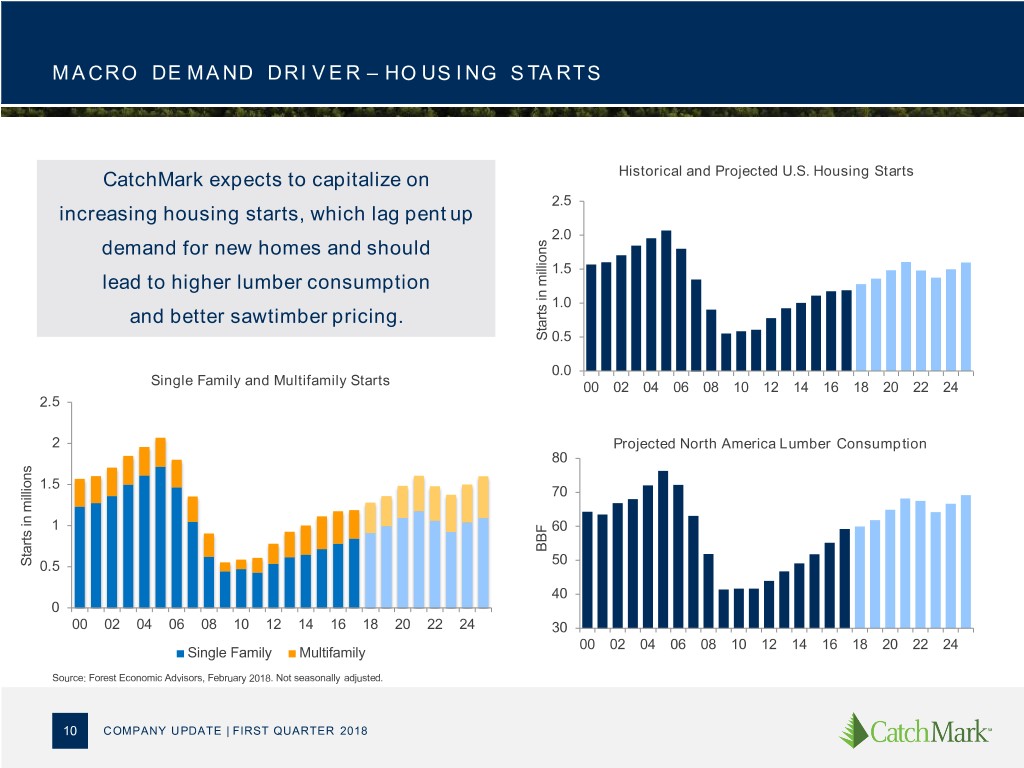

M A CRO DE M A ND DRI V E R – HO US I NG S TA RTS CatchMark expects to capitalize on Historical and Projected U.S. Housing Starts 2.5 increasing housing starts, which lag pent up 2.0 demand for new homes and should 1.5 millions lead to higher lumber consumption in 1.0 and better sawtimber pricing. Starts 0.5 0.0 Single Family and Multifamily Starts 00 02 04 06 08 10 12 14 16 18 20 22 24 2.5 2 Projected North America Lumber Consumption 80 1.5 70 millions in 1 60 BBF Starts 0.5 50 40 0 00 02 04 06 08 10 12 14 16 18 20 22 24 30 00 02 04 06 08 10 12 14 16 18 20 22 24 Single Family Multifamily Source: Forest Economic Advisors, February 2018. Not seasonally adjusted. 10 COMPANY UPDATE | FIRST QUARTER 2018

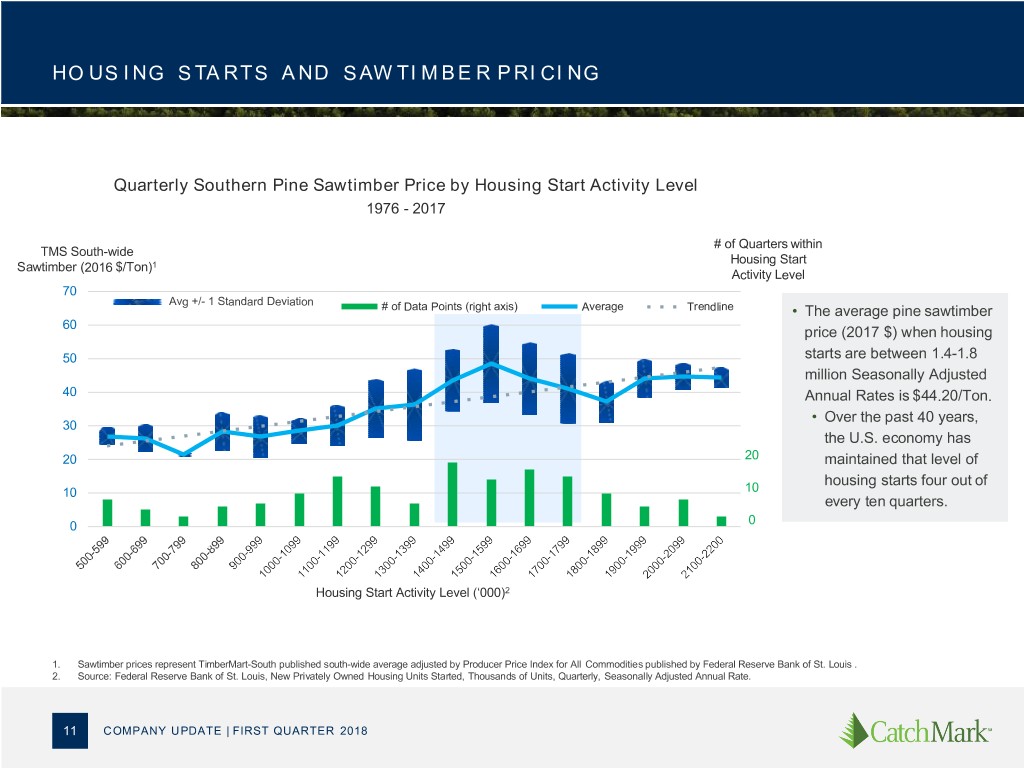

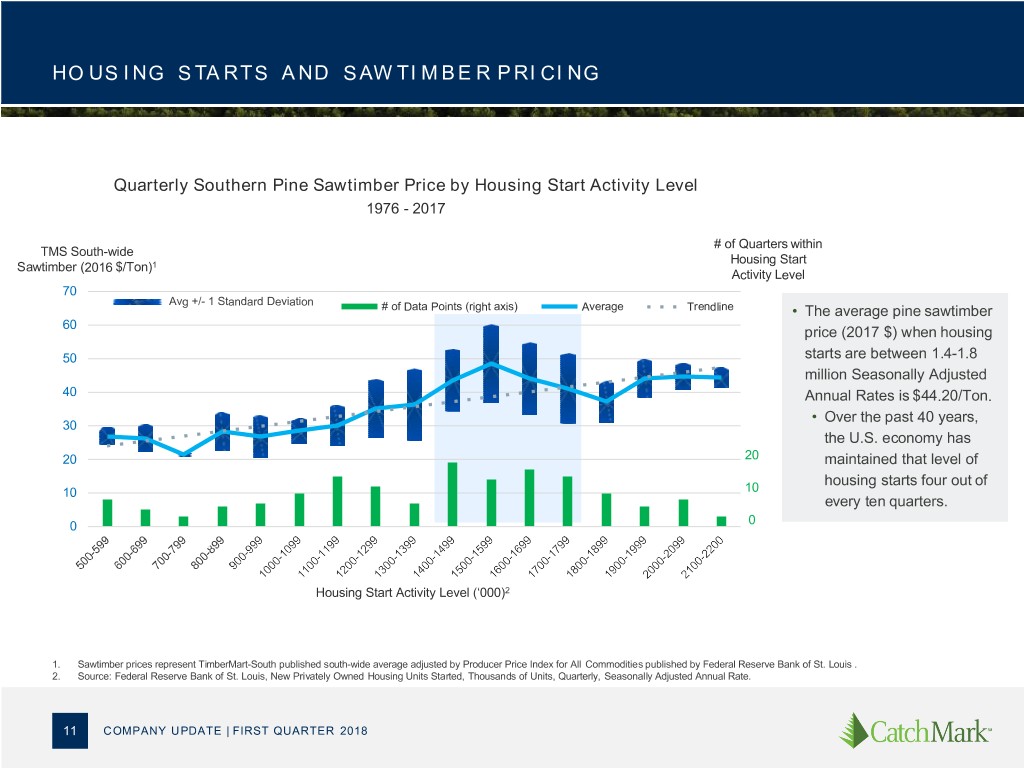

HO US I NG S TA RTS A ND S AW TI M BE R P RI CI NG Quarterly Southern Pine Sawtimber Price by Housing Start Activity Level 1976 - 2017 # of Quarters within TMS South-wide Housing Start Sawtimber (2016 $/Ton)1 Activity Level 70 Avg +/- 1 Standard Deviation # of Data Points (right axis) Average Trendline • The average pine sawtimber 60 price (2017 $) when housing 50 starts are between 1.4-1.8 million Seasonally Adjusted 40 Annual Rates is $44.20/Ton. • Over the past 40 years, 30 the U.S. economy has 20 20 maintained that level of housing starts four out of 10 10 every ten quarters. 0 0 Housing Start Activity Level (‘000)2 1. Sawtimber prices represent TimberMart-South published south-wide average adjusted by Producer Price Index for All Commodities published by Federal Reserve Bank of St. Louis . 2. Source: Federal Reserve Bank of St. Louis, New Privately Owned Housing Units Started, Thousands of Units, Quarterly, Seasonally Adjusted Annual Rate. 11 COMPANY UPDATE | FIRST QUARTER 2018

P E NT UP DE M A ND FO R NE W HO US I NG Construction of new single-family homes is failing to keep up with pent up demand, which is raising prices on existing homes to probably unsustainable levels, and ultimately should lead to increased levels of new home building activity. Homebuilding permits in major metropolitan areas in 2017, • Expected new single-family homes built 2018: 900,000 relative to historic average • Number of new single-family homes needed to meet 1 demand: 1.3 million -25% 0% 25% • Construction costs rising, including labor, with fewer workers available: – 2010: 10.6 million (at housing market bottom)2 – 2017: 10.5 million • Fewer homebuilders, down from 240,000 (2007) to 140,000 (2012-2017)1 • Particularly strong pent up demand in CatchMark markets 1. National Association of Home Builders 2. Build Zoom, U.S. Census Source: The Wall Street Journal, March 18, 2018 12 COMPANY UPDATE | FIRST QUARTER 2018

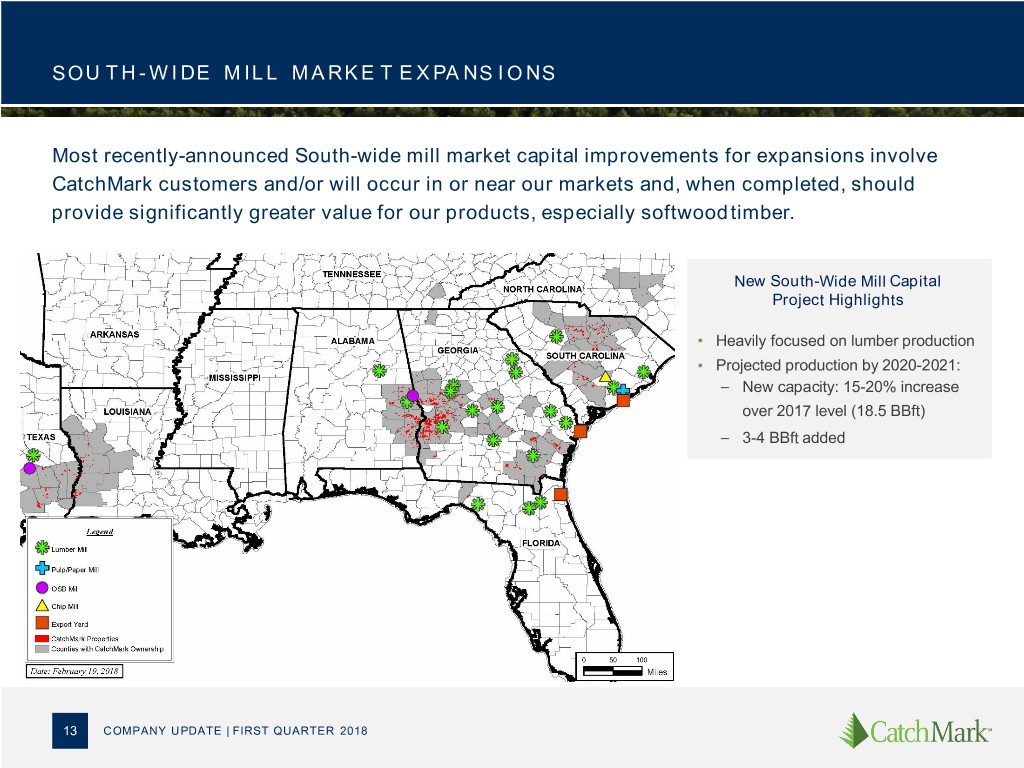

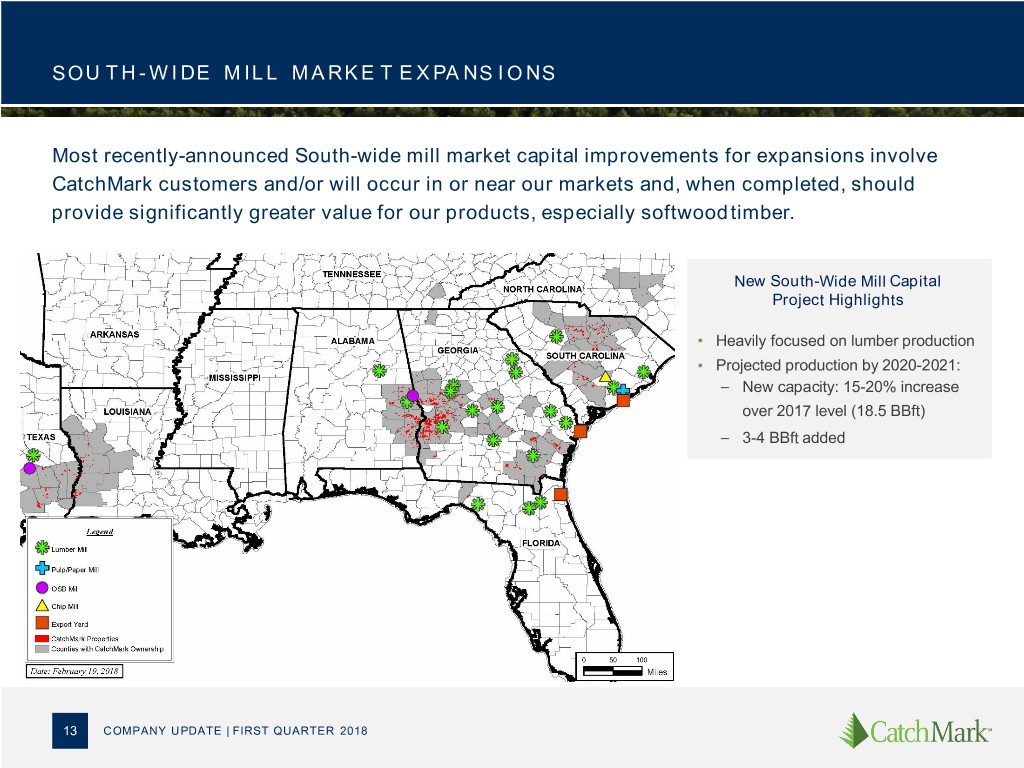

SOU T H - W I DE M ILL M A RKE T E X PA NS I O NS Most recently-announced South-wide mill market capital improvements for expansions involve CatchMark customers and/or will occur in or near our markets and, when completed, should provide significantly greater value for our products, especially softwood timber. New South-Wide Mill Capital Project Highlights • Heavily focused on lumber production • Projected production by 2020-2021: – New capacity: 15-20% increase over 2017 level (18.5 BBft) – 3-4 BBft added 13 COMPANY UPDATE | FIRST QUARTER 2018

M EET I N G GR OW I N G EXPOR T D EM A N D CatchMark’s timberlands, including recent acquisitions, near Charleston, Savannah and Jacksonville ports feed into growing demand from rapidly expanding export markets in China and India. U.S. South Exports to China and India (in green tons) 400 Savannah 350 300 250 200 Charleston 150 100 Jacksonville 50 0 2012 2013 2014 2015 2016 2017E Source: GATS 1. 2017E is based on data from January through August, annualized. U.S. Softwood Exports to China Vol tons (000) Import Year 2015 2016 2017 Total Softwood Import Vol 29,736 33,665 36,500 USA Vol 3,536 4,456 4,990 USA % of Total Imports 12% 13% 14% South % of US Total 6% 10% 17% Source: FEA Wood Markets China Bulletin, January 2018 14 COMPANY UPDATE | FIRST QUARTER 2018

O THE R M A CRO DE M A ND DRI V E RS Timber demand increases in CatchMark regions from commercial construction and bioenergy uses while beetle infestation in British Columbia constrains overall North American supply. Commercial Construction Demand Wood Bioenergy Use Mountain Pine Beetle Scourge • New “Mass Timber” designs significantly • New and expanded wood bioenergy facilities • 55% of British Columbia pine volume expand demand for lumber in in CatchMark operating regions serve may be killed by 20201, increasing timber commercial and multifamily construction. increased wood pellet demand from Europe demand in other regions, particularly the as a result of environmental policies. U.S. South. 1. Ministry of Forests, Lands and Natural Resource Operations, British Columbia – Current projection results, 2016; Bloomberg, “Beetle Bug Spurs Canadians on U.S. Lumber Mill Buying Spree”, June 23, 2015. 15 COMPANY UPDATE | FIRST QUARTER 2018

Operating Strategy 16

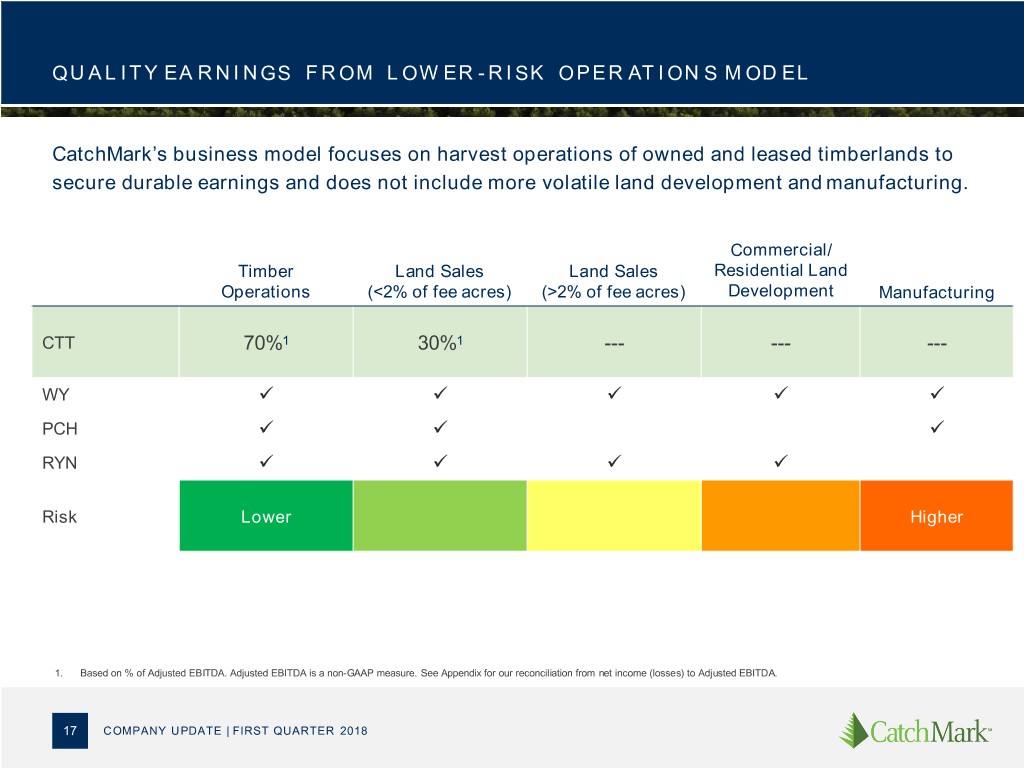

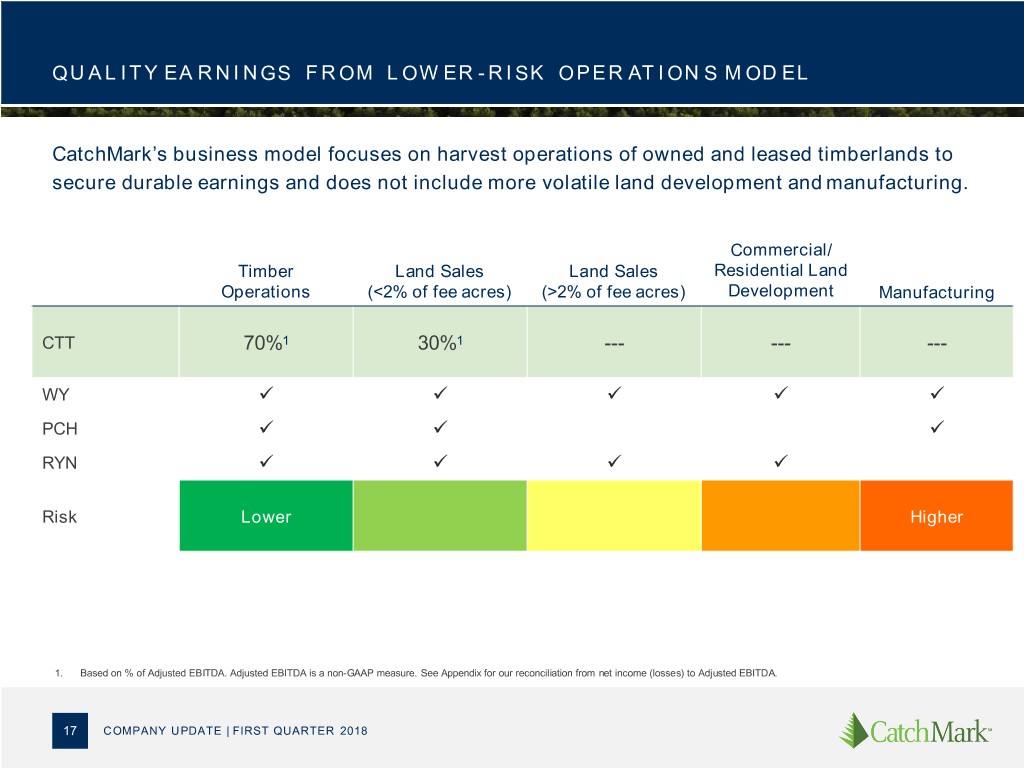

QU A L I T Y EA R N I N GS F R OM L OW ER - R I SK OPER AT I ON S M OD EL CatchMark’s business model focuses on harvest operations of owned and leased timberlands to secure durable earnings and does not include more volatile land development and manufacturing. Commercial/ Timber Land Sales Land Sales Residential Land Operations (<2% of fee acres) (>2% of fee acres) Development Manufacturing CTT 70%1 30%1 --- --- --- WY PCH RYN Risk Lower Higher 1. Based on % of Adjusted EBITDA. Adjusted EBITDA is a non-GAAP measure. See Appendix for our reconciliation from net income (losses) to Adjusted EBITDA. 17 COMPANY UPDATE | FIRST QUARTER 2018

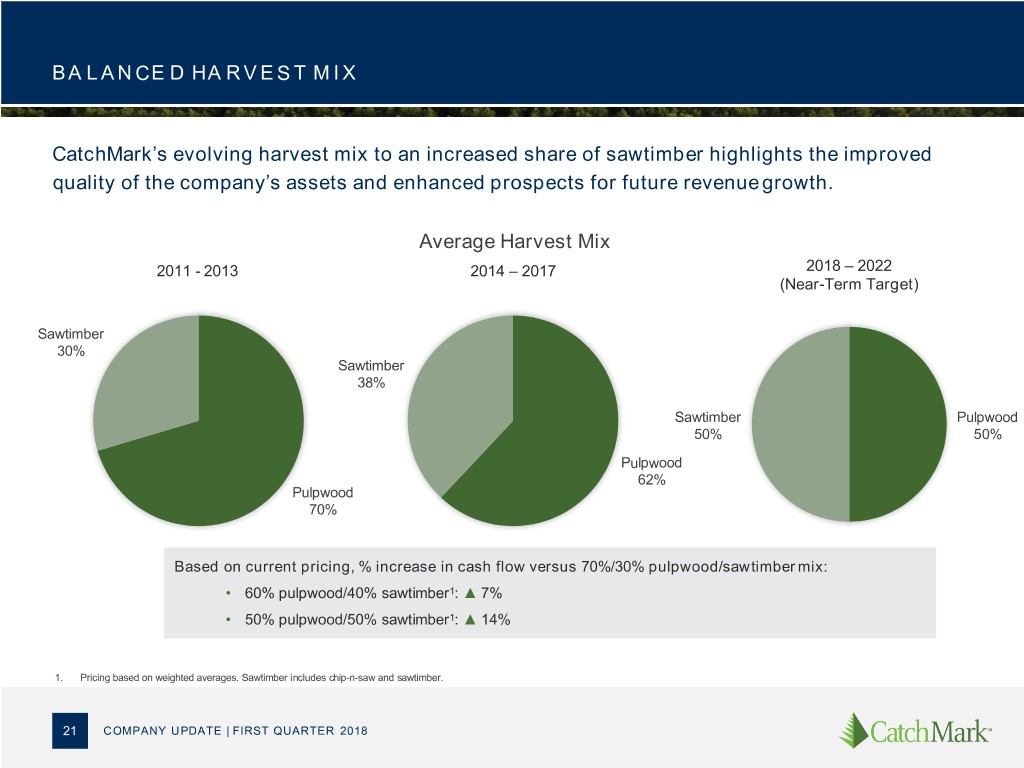

K EY T EN ET S OF OPER AT I ON A L ST R AT EGY CatchMark strategically manages harvest plans, operating in prime mill markets for sawtimber and pulpwood, to serve customers and optimize yields within sustainable parameters. DELIVERED WOOD SALES FIBER SUPPLY AGREEMENTS BALANCED HARVEST MIX Allows greater control of supply chain Provides stable demand with well Improves cash flow per acre. process and deeper relationships with capitalized counter-parties. customer base. 74% of 2017 31% of 2017 50/50 sawlog/pulpwood timber sales volume. timber sales volume. volume mix target1 1. See page 22 for CTT historical and projected harvest mix. 18 COMPANY UPDATE | FIRST QUARTER 2018

D EL I VER ED W OOD SA L ES CatchMark’s focus on delivered wood sales—74% of total timber sales volume1—provides predictability and sustainability in cash flows through greater visibility into its mill markets, reduced friction costs, and steady volume. • Provides predictability and sustainability in Tons Delivered Wood vs. Stumpage in thousands cash flows from timing and targeting logging 700 600 activities through contracts 500 400 300 200 • Creates a win-win situation for both 100 0 CatchMark and its loggers—working together to secure profitable outcomes Delivered Tons Stumpage Tons • Allows shifting wood deliveries 100% opportunistically to mills with greater 80% 60% demand and better pricing 40% 20% 0% 1. For the 12-months ended 12/31/2017. Delivered % of total volume Stumpage % of total volume 19 COMPANY UPDATE | FIRST QUARTER 2018

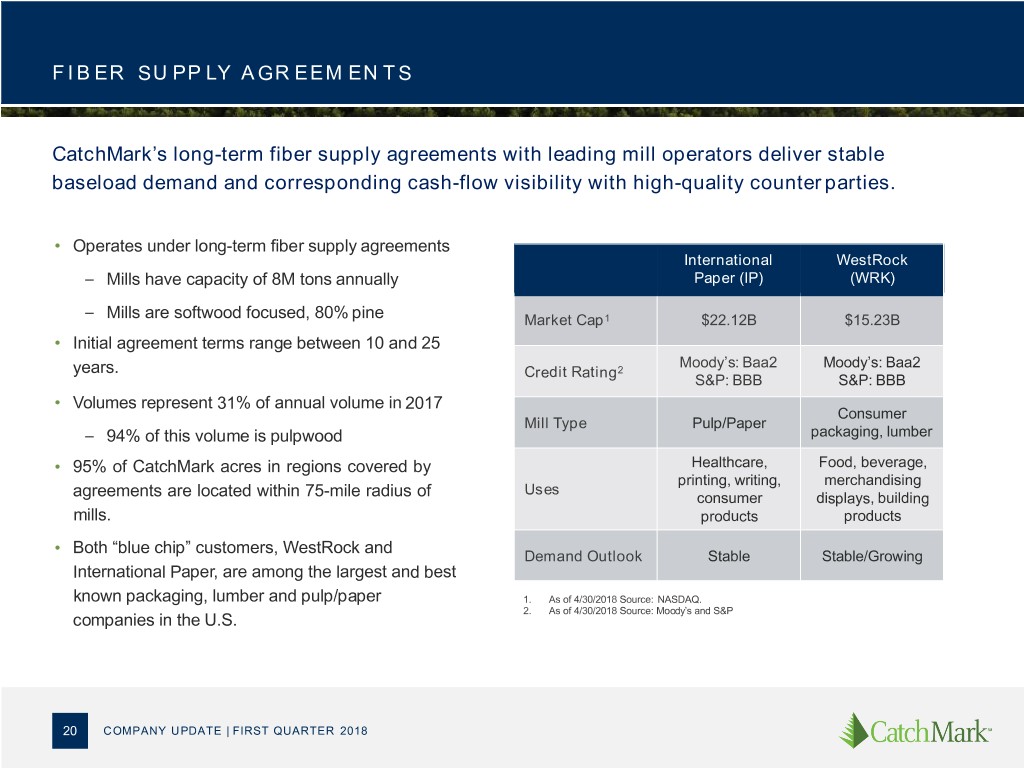

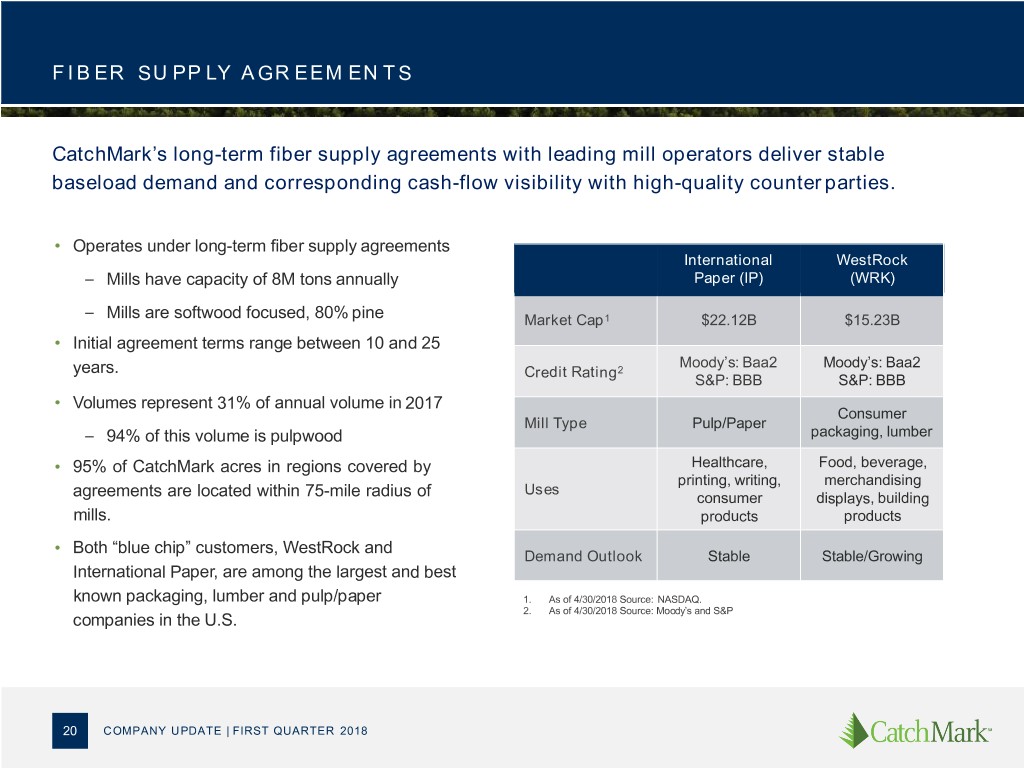

F I B ER SU PP LY A GR EEM EN T S CatchMark’s long-term fiber supply agreements with leading mill operators deliver stable baseload demand and corresponding cash-flow visibility with high-quality counter parties. • Operates under long-term fiber supply agreements International WestRock – Mills have capacity of 8M tons annually Paper (IP) (WRK) – Mills are softwood focused, 80% pine Market Cap1 $22.12B $15.23B • Initial agreement terms range between 10 and 25 Moody’s: Baa2 Moody’s: Baa2 years. Credit Rating2 S&P: BBB S&P: BBB • Volumes represent 31% of annual volume in 2017 Consumer Mill Type Pulp/Paper – 94% of this volume is pulpwood packaging, lumber • 95% of CatchMark acres in regions covered by Healthcare, Food, beverage, printing, writing, merchandising Uses agreements are located within 75-mile radius of consumer displays, building mills. products products • Both “blue chip” customers, WestRock and Demand Outlook Stable Stable/Growing International Paper, are among the largest and best known packaging, lumber and pulp/paper 1. As of 4/30/2018 Source: NASDAQ. 2. As of 4/30/2018 Source: Moody’s and S&P companies in the U.S. 20 COMPANY UPDATE | FIRST QUARTER 2018

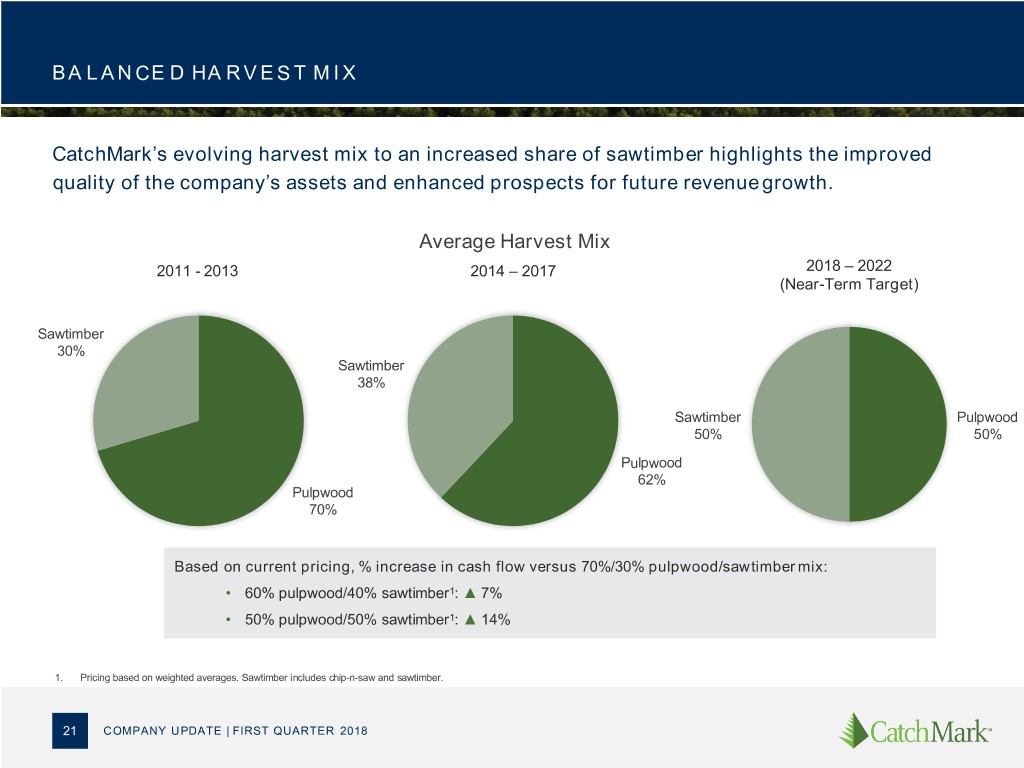

BA L A N CE D HA R V E S T M I X CatchMark’s evolving harvest mix to an increased share of sawtimber highlights the improved quality of the company’s assets and enhanced prospects for future revenue growth. Average Harvest Mix 2011 - 2013 2014 – 2017 2018 – 2022 (Near-Term Target) Sawtimber 30% Sawtimber 38% Sawtimber Pulpwood 50% 50% Pulpwood 62% Pulpwood 70% Based on current pricing, % increase in cash flow versus 70%/30% pulpwood/sawtimber mix: • 60% pulpwood/40% sawtimber1: ▲ 7% • 50% pulpwood/50% sawtimber1: ▲ 14% 1. Pricing based on weighted averages. Sawtimber includes chip-n-saw and sawtimber. 21 COMPANY UPDATE | FIRST QUARTER 2018

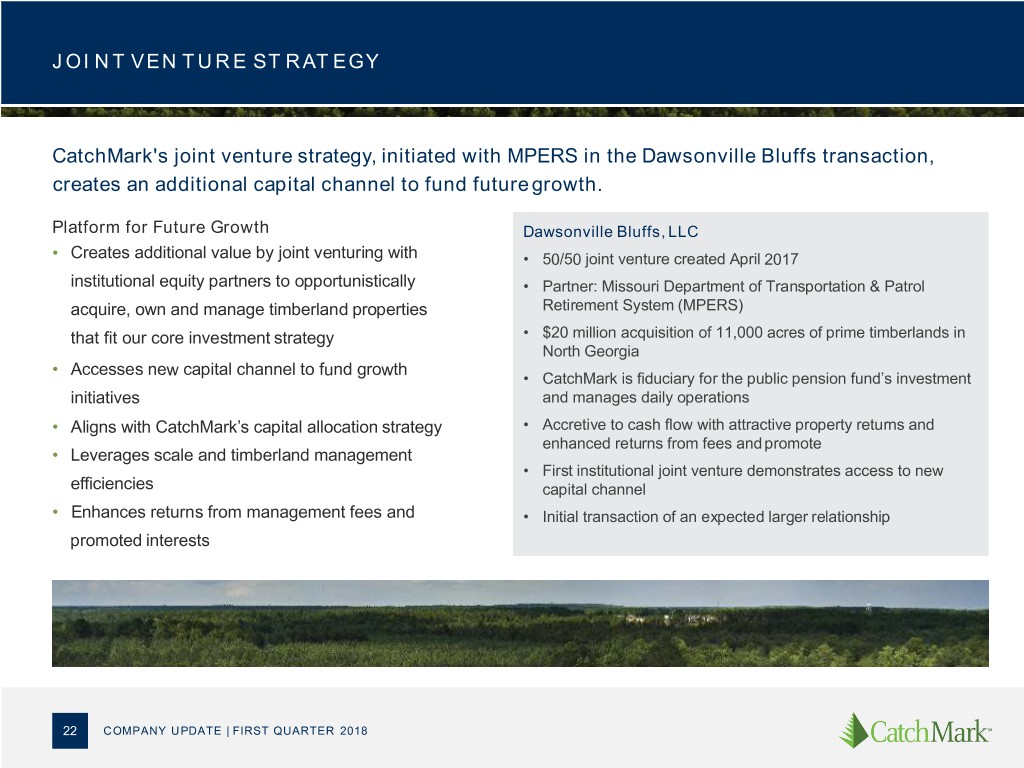

JOI N T VEN T U R E ST R AT EGY CatchMark's joint venture strategy, initiated with MPERS in the Dawsonville Bluffs transaction, creates an additional capital channel to fund future growth. Platform for Future Growth Dawsonville Bluffs, LLC • Creates additional value by joint venturing with • 50/50 joint venture created April 2017 institutional equity partners to opportunistically • Partner: Missouri Department of Transportation & Patrol acquire, own and manage timberland properties Retirement System (MPERS) that fit our core investment strategy • $20 million acquisition of 11,000 acres of prime timberlands in North Georgia • Accesses new capital channel to fund growth • CatchMark is fiduciary for the public pension fund’s investment initiatives and manages daily operations • Aligns with CatchMark’s capital allocation strategy • Accretive to cash flow with attractive property returns and enhanced returns from fees and promote • Leverages scale and timberland management • First institutional joint venture demonstrates access to new efficiencies capital channel • Enhances returns from management fees and • Initial transaction of an expected larger relationship promoted interests 22 COMPANY UPDATE | FIRST QUARTER 2018

Portfolio 23

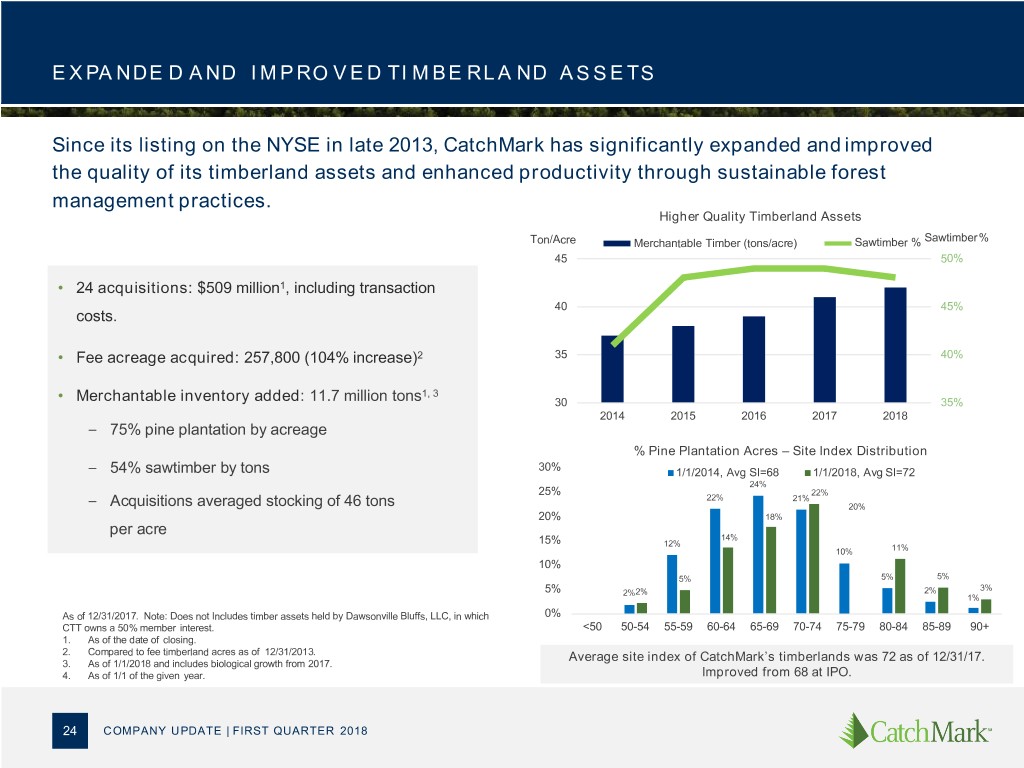

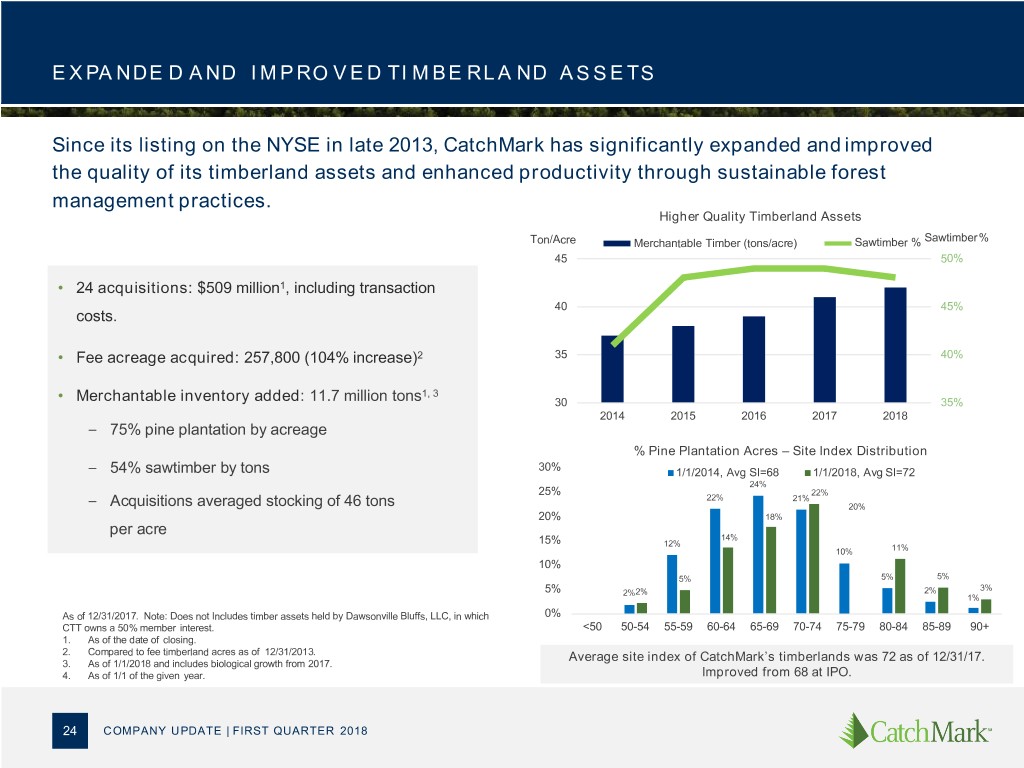

E X PA NDE D A ND I M P RO V E D TI M BE RLA ND A S S E TS Since its listing on the NYSE in late 2013, CatchMark has significantly expanded and improved the quality of its timberland assets and enhanced productivity through sustainable forest management practices. Higher Quality Timberland Assets Ton/Acre Merchantable Timber (tons/acre) Sawtimber % Sawtimber % 45 50% • 24 acquisitions: $509 million1, including transaction 40 45% costs. • Fee acreage acquired: 257,800 (104% increase)2 35 40% 1, 3 • Merchantable inventory added: 11.7 million tons 30 35% 2014 2015 2016 2017 2018 – 75% pine plantation by acreage % Pine Plantation Acres – Site Index Distribution 30% – 54% sawtimber by tons 1/1/2014, Avg SI=68 1/1/2018, Avg SI=72 24% 25% 22% 22% 21% – Acquisitions averaged stocking of 46 tons 20% 20% 18% per acre 14% 15% 12% 10% 11% 10% 5% 5% 5% 3% 5% 2%2% 2% 1% As of 12/31/2017. Note: Does not Includes timber assets held by Dawsonville Bluffs, LLC, in which 0% CTT owns a 50% member interest. <50 50-54 55-59 60-64 65-69 70-74 75-79 80-84 85-89 90+ 1. As of the date of closing. 2. Compared to fee timberland acres as of 12/31/2013. 3. As of 1/1/2018 and includes biological growth from 2017. Average site index of CatchMark’s timberlands was 72 as of 12/31/17. 4. As of 1/1 of the given year. Improved from 68 at IPO. 24 COMPANY UPDATE | FIRST QUARTER 2018

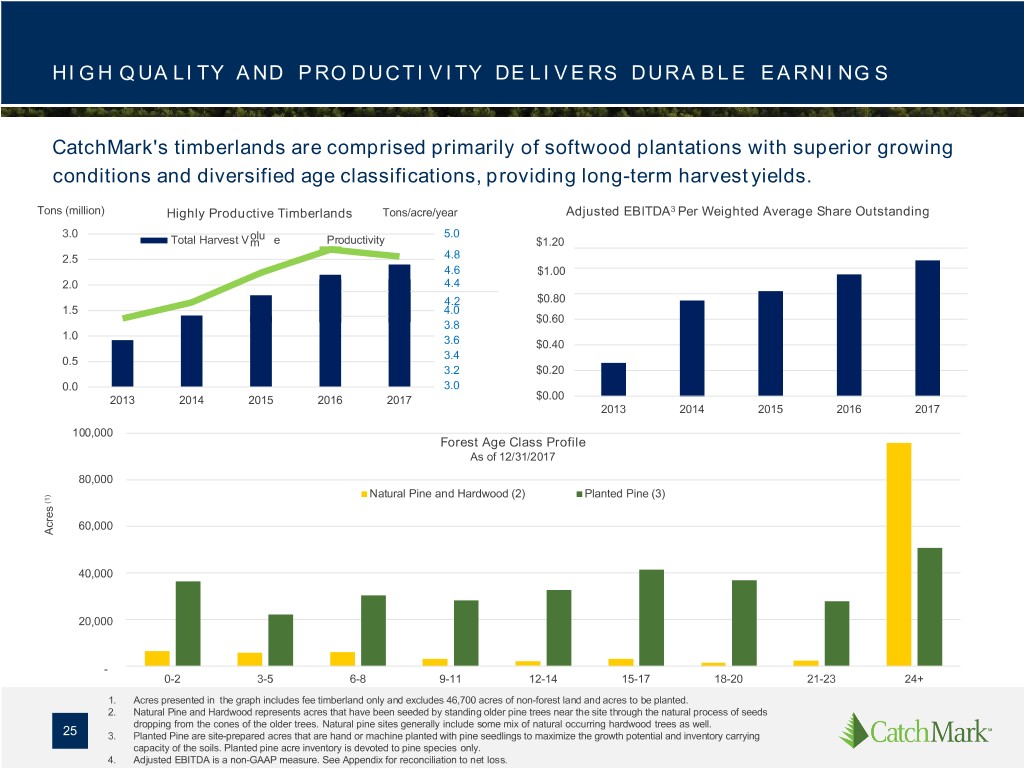

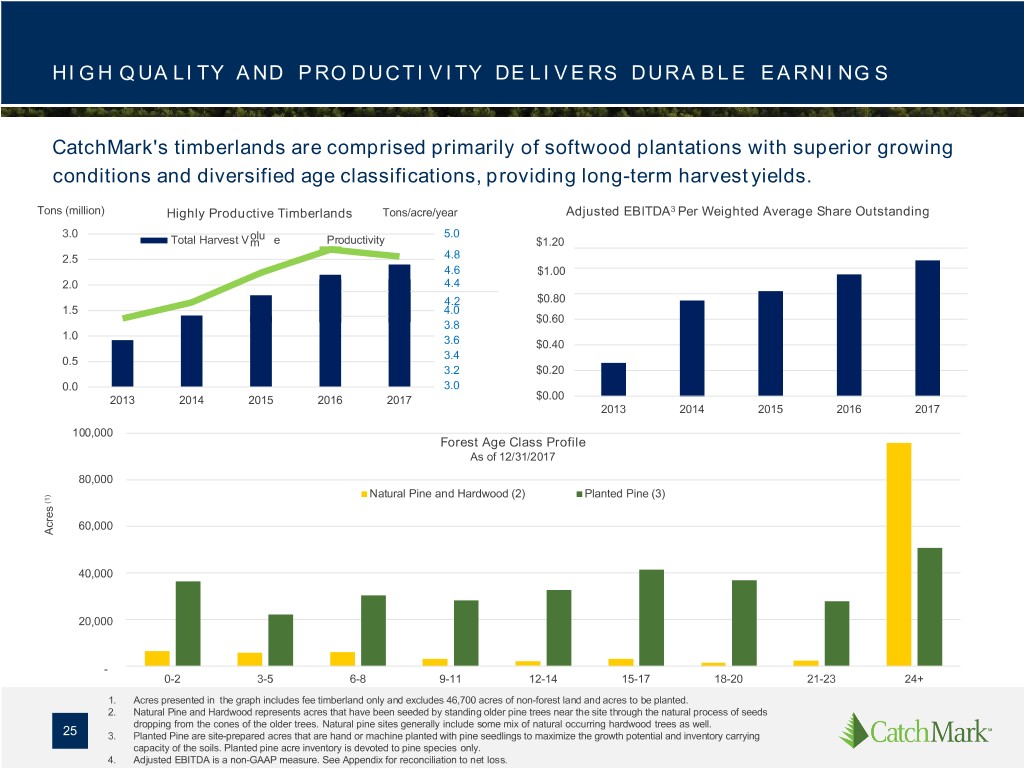

HI G H Q UA LI TY A ND P RO DUCTI V I TY DE LI V E RS DURA BLE E A RNI NG S CatchMark's timberlands are comprised primarily of softwood plantations with superior growing conditions and diversified age classifications, providing long-term harvest yields. Tons (million) Highly Productive Timberlands Tons/acre/year Adjusted EBITDA3 Per Weighted Average Share Outstanding 3.0 olu 5.0 Total Harvest V m e Productivity $1.20 2.5 4.8 4.6 $1.00 2.0 4.4 4.2 $0.80 1.5 4.0 $0.60 3.8 1.0 3.6 $0.40 3.4 0.5 3.2 $0.20 0.0 3.0 2013 2014 2015 2016 2017 $0.00 2013 2014 2015 2016 2017 100,000 Forest Age Class Profile As of 12/31/2017 80,000 Natural Pine and Hardwood (2) Planted Pine (3) (1) 60,000 Acres 40,000 20,000 - 0-2 3-5 6-8 9-11 12-14 15-17 18-20 21-23 24+ 1. Acres presented in the graph includes fee timberland only and excludes 46,700 acres of non-forest land and acres to be planted. 2. Natural Pine and Hardwood represents acres that have been seeded by standing older pine trees near the site through the natural process of seeds dropping from the cones of the older trees. Natural pine sites generally include some mix of natural occurring hardwood trees as well. 25 3. Planted Pine are site-prepared acres that are hand or machine planted with pine seedlings to maximize the growth potential and inventory carrying capacity of the soils. Planted pine acre inventory is devoted to pine species only. 4. Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation to net loss.

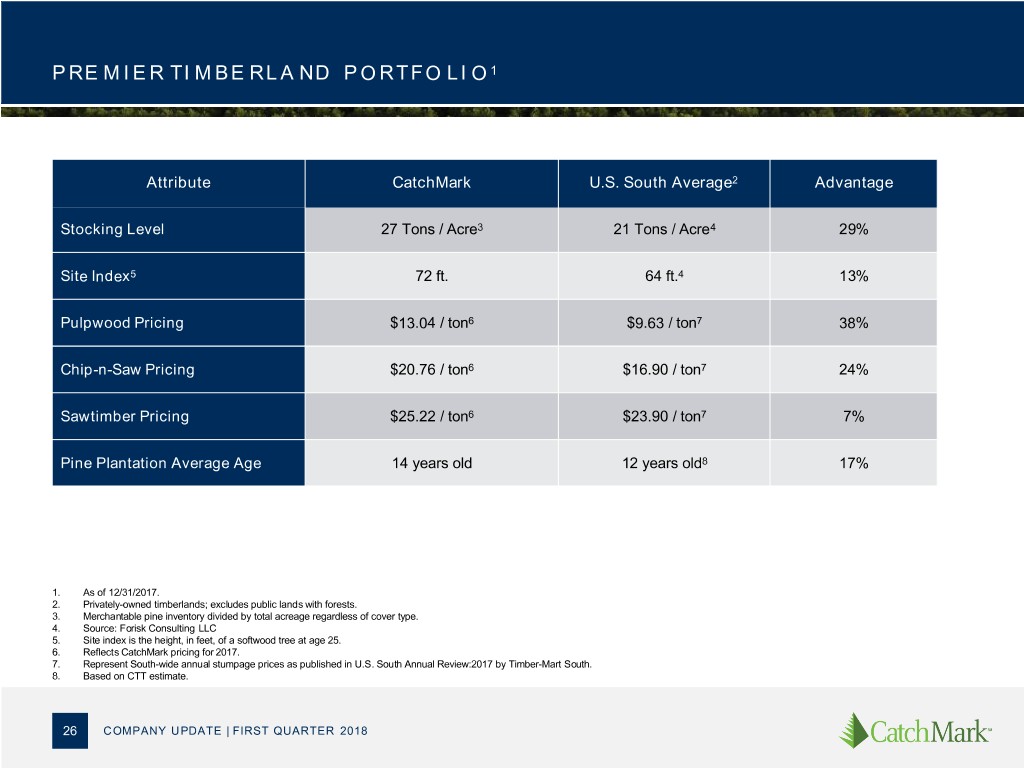

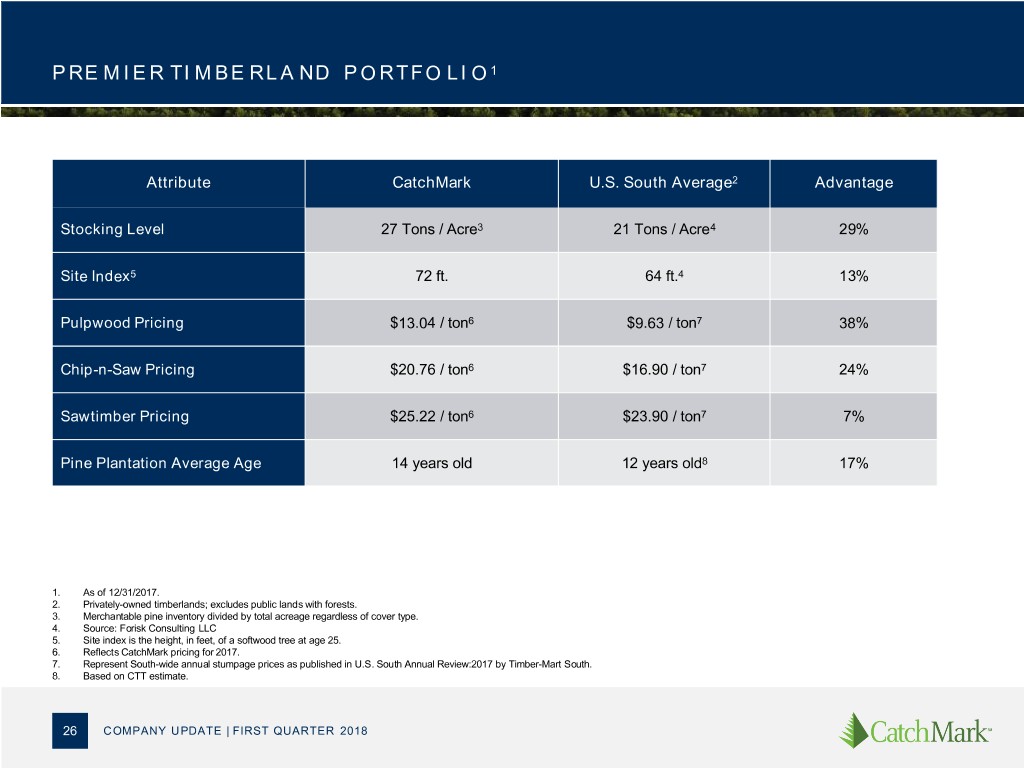

P RE M I E R TI M BE RLA ND P O RTFO LI O 1 Attribute CatchMark U.S. South Average2 Advantage Stocking Level 27 Tons / Acre3 21 Tons / Acre4 29% Site Index5 72 ft. 64 ft.4 13% Pulpwood Pricing $13.04 / ton6 $9.63 / ton7 38% Chip-n-Saw Pricing $20.76 / ton6 $16.90 / ton7 24% Sawtimber Pricing $25.22 / ton6 $23.90 / ton7 7% Pine Plantation Average Age 14 years old 12 years old8 17% 1. As of 12/31/2017. 2. Privately-owned timberlands; excludes public lands with forests. 3. Merchantable pine inventory divided by total acreage regardless of cover type. 4. Source: Forisk Consulting LLC 5. Site index is the height, in feet, of a softwood tree at age 25. 6. Reflects CatchMark pricing for 2017. 7. Represent South-wide annual stumpage prices as published in U.S. South Annual Review:2017 by Timber-Mart South. 8. Based on CTT estimate. 26 COMPANY UPDATE | FIRST QUARTER 2018

A C QU I SI T I ON S I N C R EA SE SU S TA I N A B L E H A R VEST PR OD U C T I ON CatchMark’s acquisitions exhibit strong productivity characteristics, which enhance overall portfolio yields. Drivers of Cash Yield: Harvest Volume per Acre (tons) CTT Acquisitions (10-year Projected Average) —Sustainable harvest: 80% - 90% Comparable Company Data —Recreational leases: 5% - 10% 1 (10-year Historical Average) —Land sales: 5% - 10% 8.0 7.3 - 8.3 7.0 6.0 5.0 - 5.5 4.8 - 5.8 5.0 – 5.4 5.0 2 4.3 - 4.7 4.2 - 4.7 4.2 – 4.4 3.9 3.9 4.0 3.6 3.7 3.1 +40% versus 3.0 Comparable Company 2.0 Historical Average 1.0 0.0 WY RYN PCH Weighted CTT @ Waycross/ Oglethorpe/ Beauregard Carolinas Coastal Weighted CTT Average 12/2013 Panola Satilla Midlands Georgia Average of 5 Pro Forma III Transactions 1. Represents comparable publicly-traded timber company 10-year (2008-2017) historical average. 2. 2018-2022 27 COMPANY UPDATE | FIRST QUARTER 2018

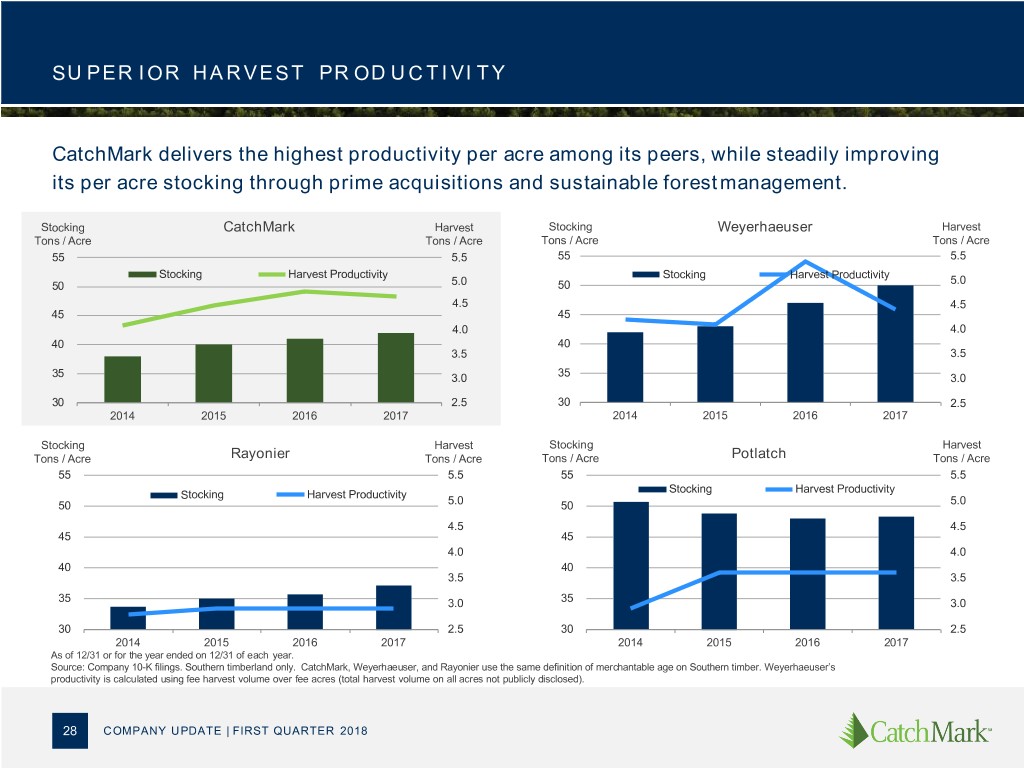

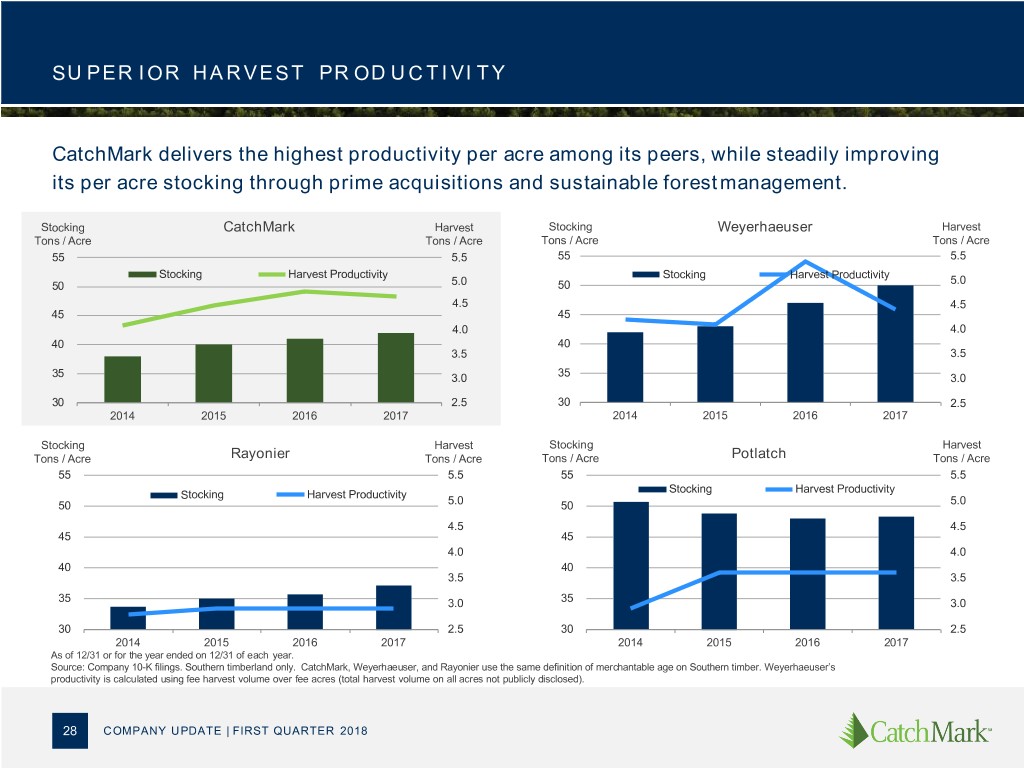

SU PER I OR H A R VEST PR OD U C T I VI T Y CatchMark delivers the highest productivity per acre among its peers, while steadily improving its per acre stocking through prime acquisitions and sustainable forest management. Stocking CatchMark Harvest Stocking Weyerhaeuser Harvest Tons / Acre Tons / Acre Tons / Acre Tons / Acre 55 5.5 55 5.5 Stocking Harvest Productivity Stocking Harvest Productivity 5.0 50 5.0 50 4.5 4.5 45 45 4.0 4.0 40 40 3.5 3.5 35 3.0 35 3.0 30 2.5 30 2.5 2014 2015 2016 2017 2014 2015 2016 2017 Stocking Harvest Stocking Harvest Tons / Acre Rayonier Tons / Acre Tons / Acre Potlatch Tons / Acre 55 5.5 55 5.5 Stocking Harvest Productivity Stocking Harvest Productivity 50 5.0 50 5.0 4.5 4.5 45 45 4.0 4.0 40 40 3.5 3.5 35 3.0 35 3.0 30 2.5 30 2.5 2014 2015 2016 2017 2014 2015 2016 2017 As of 12/31 or for the year ended on 12/31 of each year. Source: Company 10-K filings. Southern timberland only. CatchMark, Weyerhaeuser, and Rayonier use the same definition of merchantable age on Southern timber. Weyerhaeuser’s productivity is calculated using fee harvest volume over fee acres (total harvest volume on all acres not publicly disclosed). 28 COMPANY UPDATE | FIRST QUARTER 2018

Markets 29

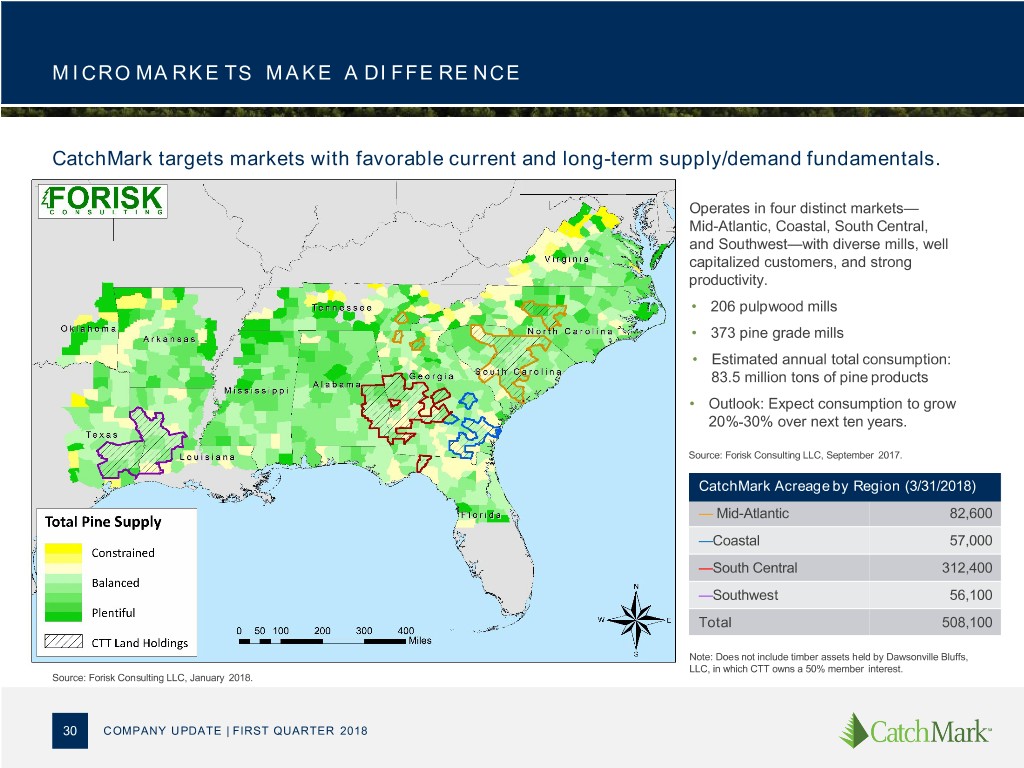

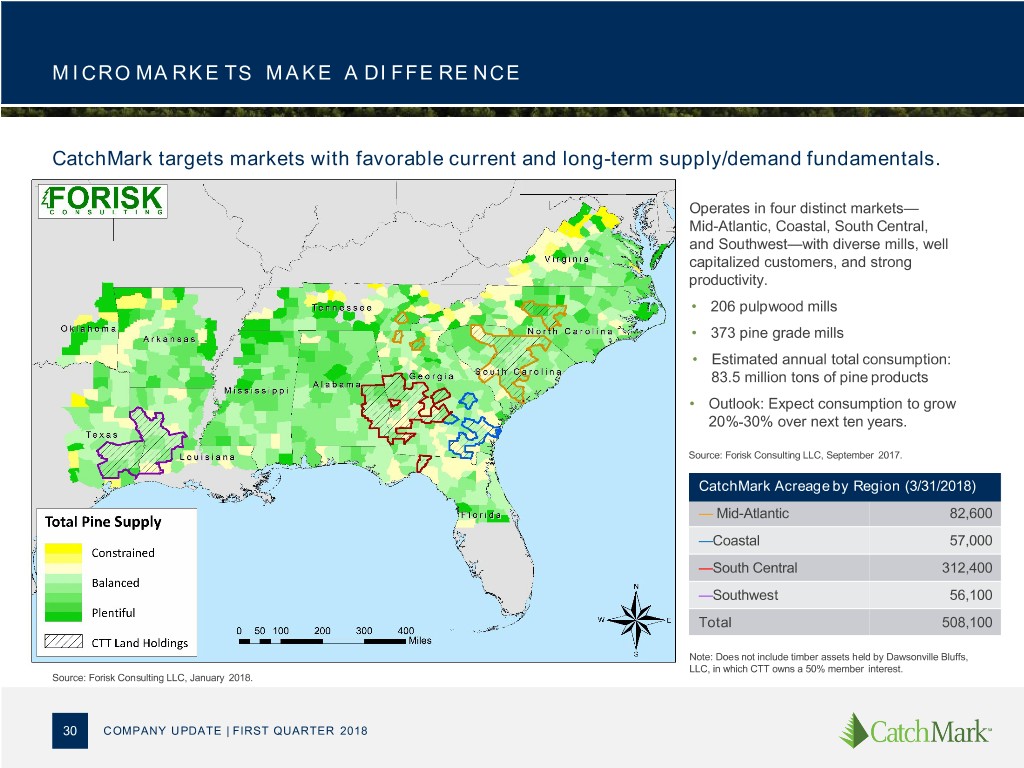

M I CRO MA RKE TS M A KE A DI FFE RE NCE CatchMark targets markets with favorable current and long-term supply/demand fundamentals. Operates in four distinct markets— Mid-Atlantic, Coastal, South Central, and Southwest—with diverse mills, well capitalized customers, and strong productivity. • 206 pulpwood mills • 373 pine grade mills • Estimated annual total consumption: 83.5 million tons of pine products • Outlook: Expect consumption to grow 20%-30% over next ten years. Source: Forisk Consulting LLC, September 2017. CatchMark Acreage by Region (3/31/2018) — Mid-Atlantic 82,600 — Coastal 57,000 — South Central 312,400 — Southwest 56,100 Total 508,100 Note: Does not include timber assets held by Dawsonville Bluffs, LLC, in which CTT owns a 50% member interest. Source: Forisk Consulting LLC, January 2018. 30 COMPANY UPDATE | FIRST QUARTER 2018

O P E R ATI NG I N M A RKE TS W I TH S TRO NG P RO DUCTI V I TY A ND CUS T O M E RS CatchMark markets outperform South-wide Averages1. Pine Chip-n-Saw Prices $28 • Timber prices driven by local supply and $26 $24 demand. $22 $20 • Prices can vary greatly from market to market. $18 $16 $14 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17 1Q18 Pine Pulpwood Prices Pine Sawtimber Prices $24 $35 $22 $33 $20 $18 $31 $16 $29 $14 $27 $12 $10 $25 $8 $23 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17 1Q18 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17 1Q18 1. South-wide Averages published by TimberMart-South. 31 COMPANY UPDATE | FIRST QUARTER 2018

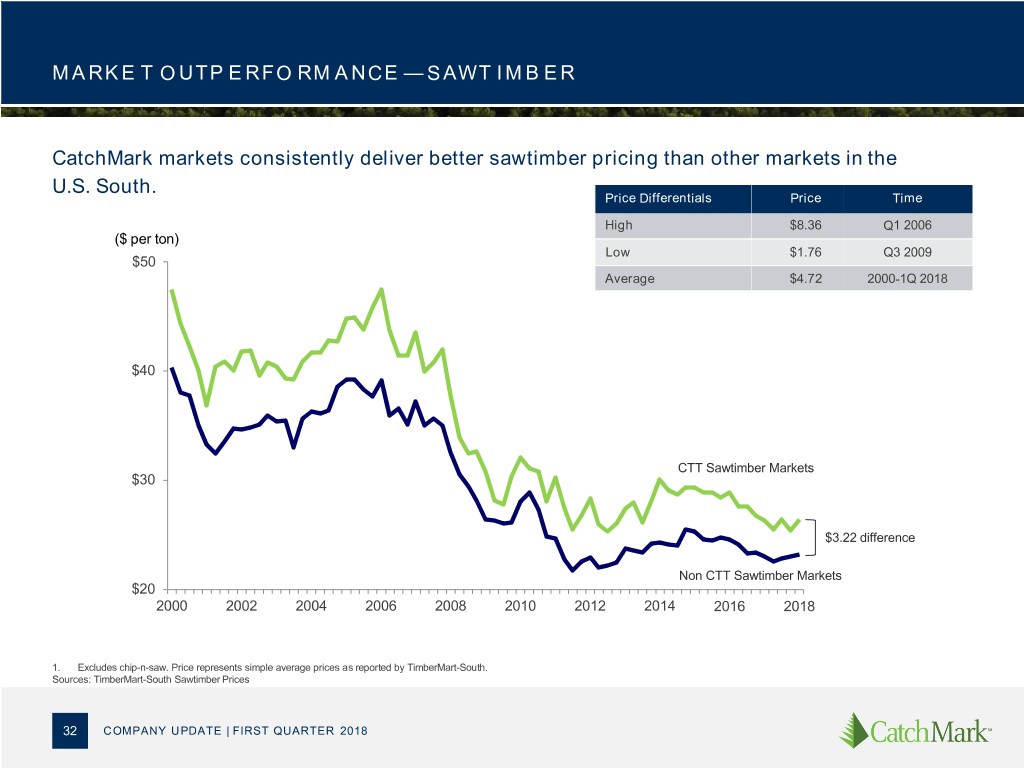

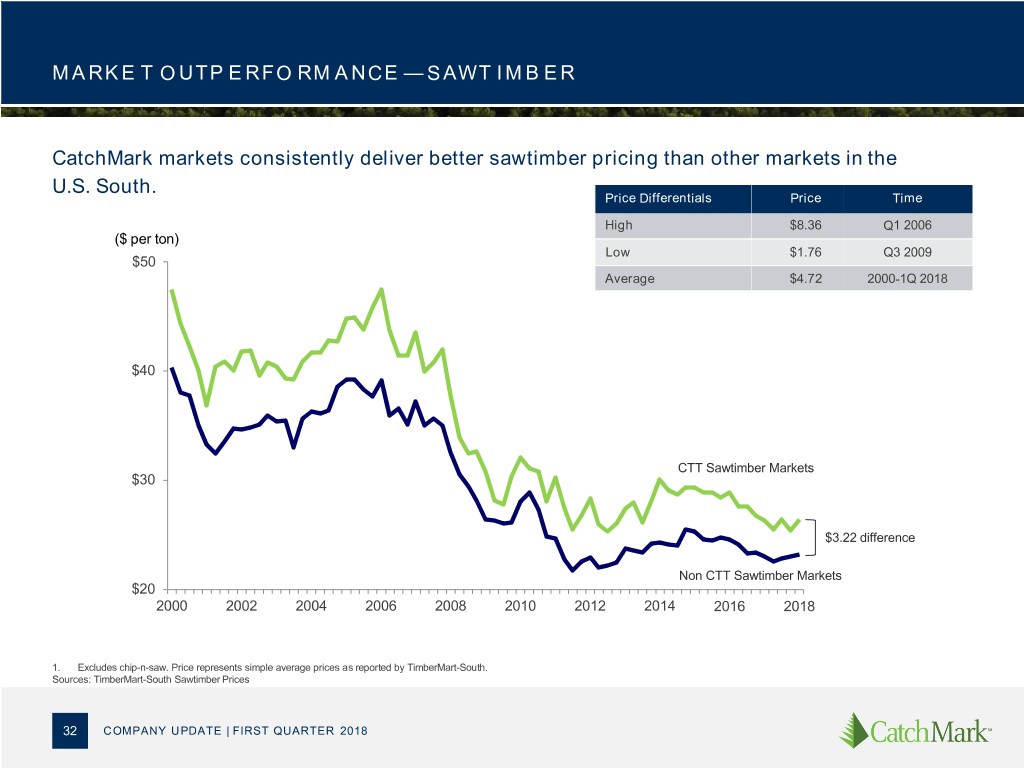

M A RKE T O UTP E RFO RM A NCE — S AWT I M B E R CatchMark markets consistently deliver better sawtimber pricing than other markets in the U.S. South. Price Differentials Price Time High $8.36 Q1 2006 ($ per ton) Low $1.76 Q3 2009 $50 Average $4.72 2000-1Q 2018 $40 CTT Sawtimber Markets $30 $3.22 difference Non CTT Sawtimber Markets $20 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 1. Excludes chip-n-saw. Price represents simple average prices as reported by TimberMart-South. Sources: TimberMart-South Sawtimber Prices 32 COMPANY UPDATE | FIRST QUARTER 2018

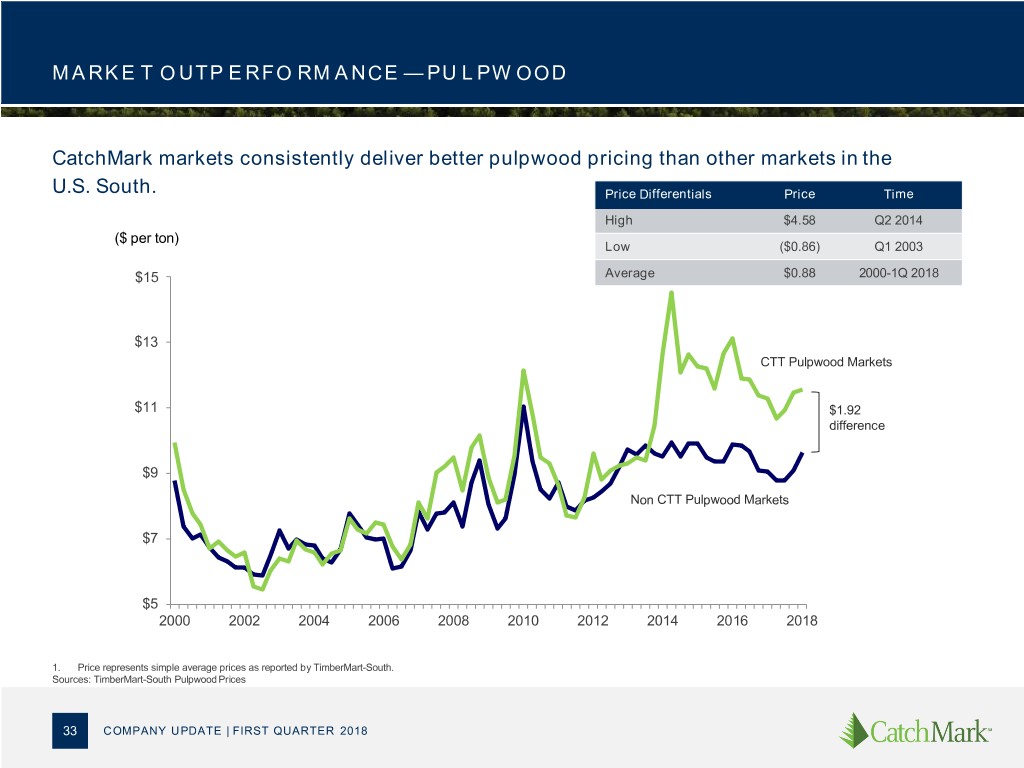

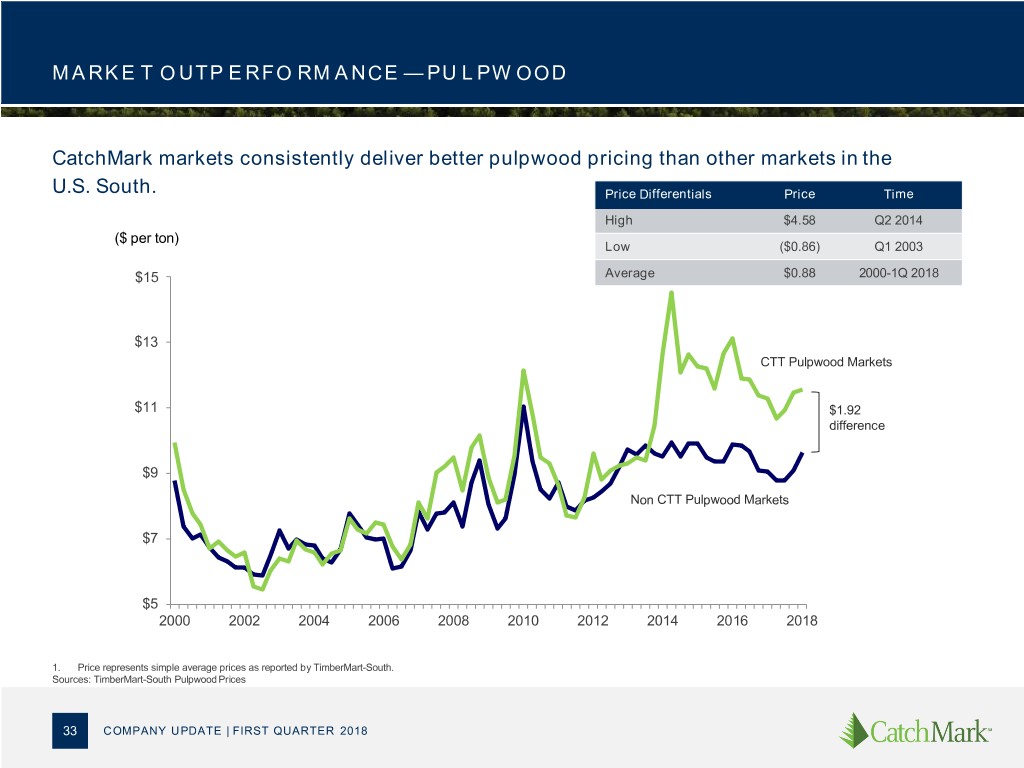

M A RKE T O UTP E RFO RM A NCE — PU L PW OOD CatchMark markets consistently deliver better pulpwood pricing than other markets in the U.S. South. Price Differentials Price Time High $4.58 Q2 2014 ($ per ton) Low ($0.86) Q1 2003 $15 Average $0.88 2000-1Q 2018 $13 CTT Pulpwood Markets $11 $1.92 difference $9 Non CTT Pulpwood Markets $7 $5 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 1. Price represents simple average prices as reported by TimberMart-South. Sources: TimberMart-South Pulpwood Prices 33 COMPANY UPDATE | FIRST QUARTER 2018

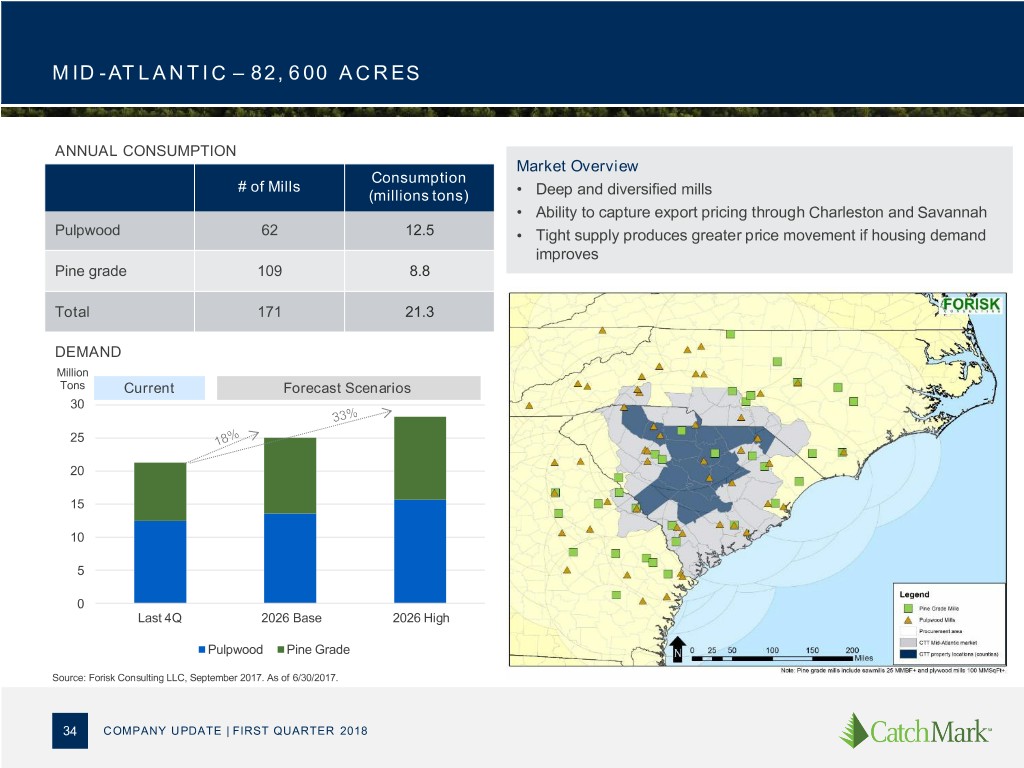

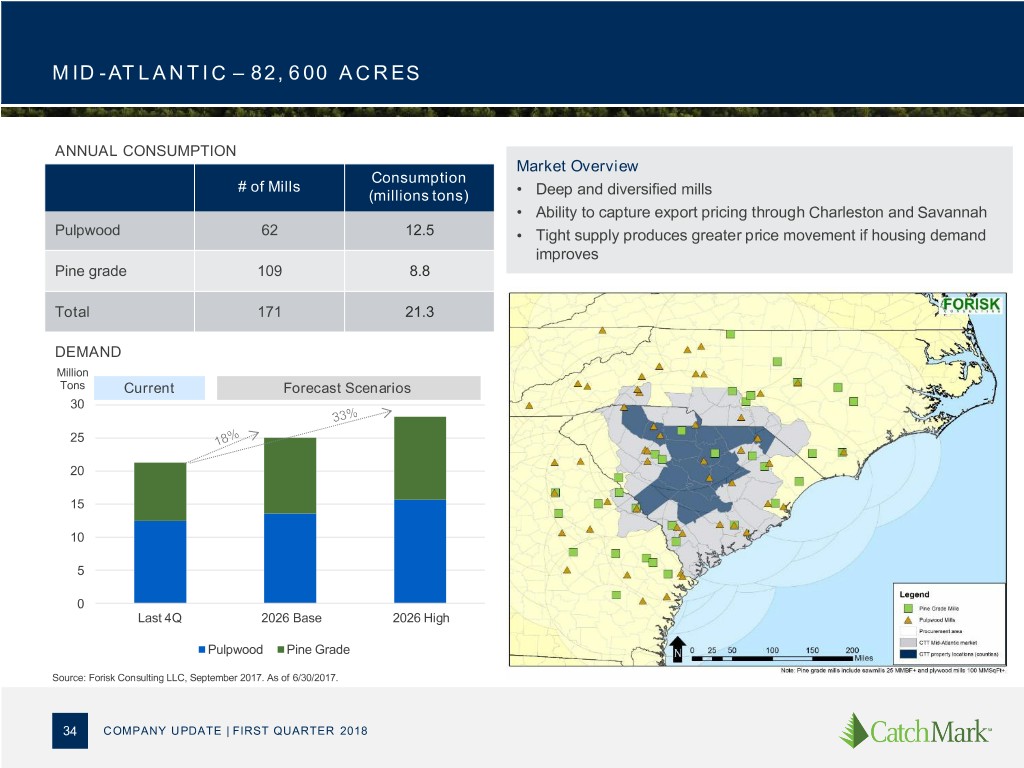

M ID - AT L A N T I C – 82, 6 00 A C R ES ANNUAL CONSUMPTION Market Overview Consumption # of Mills (millions tons) • Deep and diversified mills • Ability to capture export pricing through Charleston and Savannah Pulpwood 62 12.5 • Tight supply produces greater price movement if housing demand improves Pine grade 109 8.8 Total 171 21.3 DEMAND Million Tons Current Forecast Scenarios 30 25 20 15 10 5 0 Last 4Q 2026 Base 2026 High Pulpwood Pine Grade Source: Forisk Consulting LLC, September 2017. As of 6/30/2017. 34 COMPANY UPDATE | FIRST QUARTER 2018

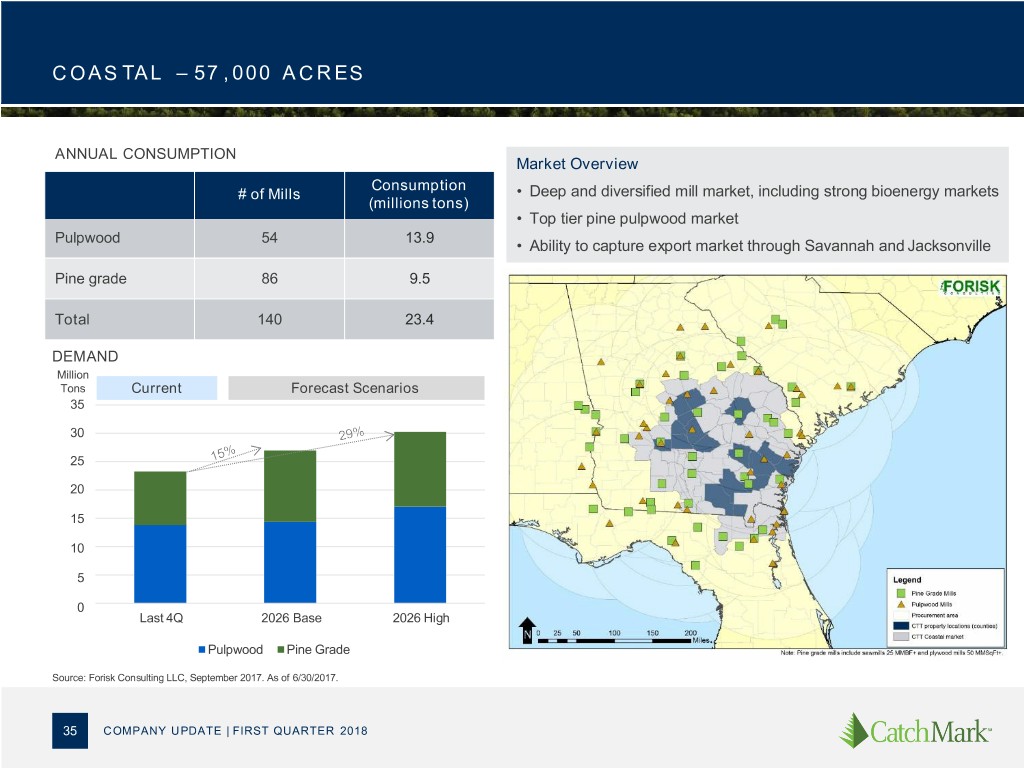

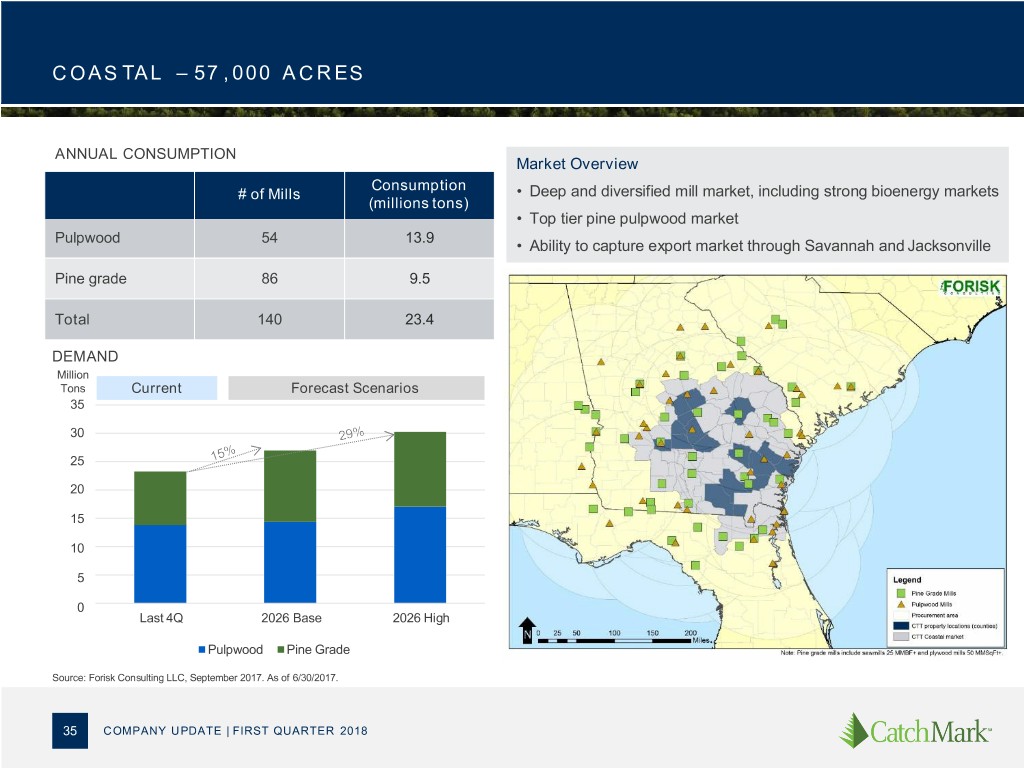

C O AS TAL – 57 , 000 A C R ES ANNUAL CONSUMPTION Market Overview Consumption # of Mills • Deep and diversified mill market, including strong bioenergy markets (millions tons) • Top tier pine pulpwood market Pulpwood 54 13.9 • Ability to capture export market through Savannah and Jacksonville Pine grade 86 9.5 Total 140 23.4 DEMAND Million Tons Current Forecast Scenarios 35 30 25 20 15 10 5 0 Last 4Q 2026 Base 2026 High Pulpwood Pine Grade Source: Forisk Consulting LLC, September 2017. As of 6/30/2017. 35 COMPANY UPDATE | FIRST QUARTER 2018

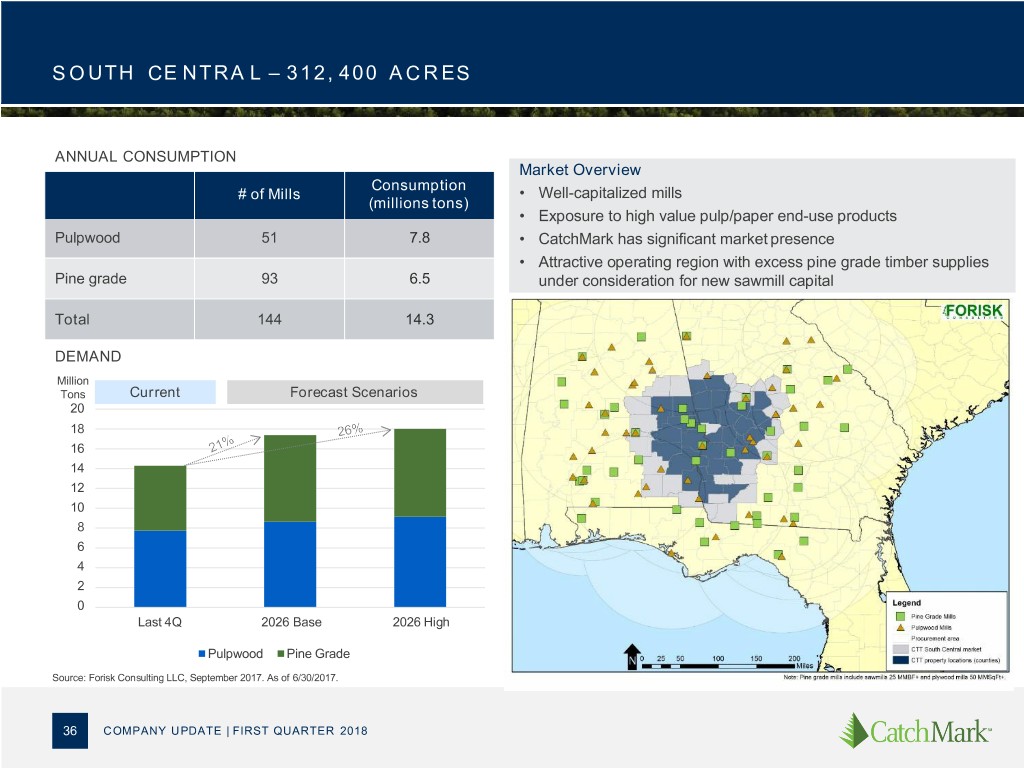

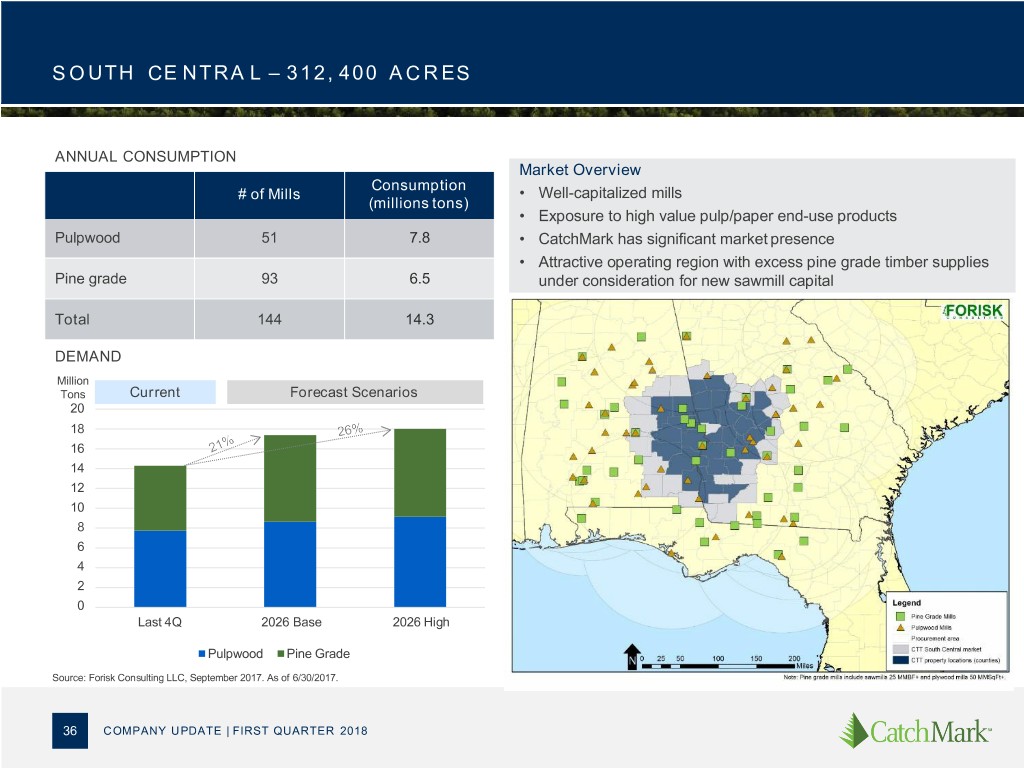

S O UTH CE NTRA L – 312, 400 A C R ES ANNUAL CONSUMPTION Market Overview Consumption # of Mills • Well-capitalized mills (millions tons) • Exposure to high value pulp/paper end-use products Pulpwood 51 7.8 • CatchMark has significant market presence • Attractive operating region with excess pine grade timber supplies Pine grade 93 6.5 under consideration for new sawmill capital Total 144 14.3 DEMAND Million Tons Current Forecast Scenarios 20 18 16 14 12 10 8 6 4 2 0 Last 4Q 2026 Base 2026 High Pulpwood Pine Grade Source: Forisk Consulting LLC, September 2017. As of 6/30/2017. 36 COMPANY UPDATE | FIRST QUARTER 2018

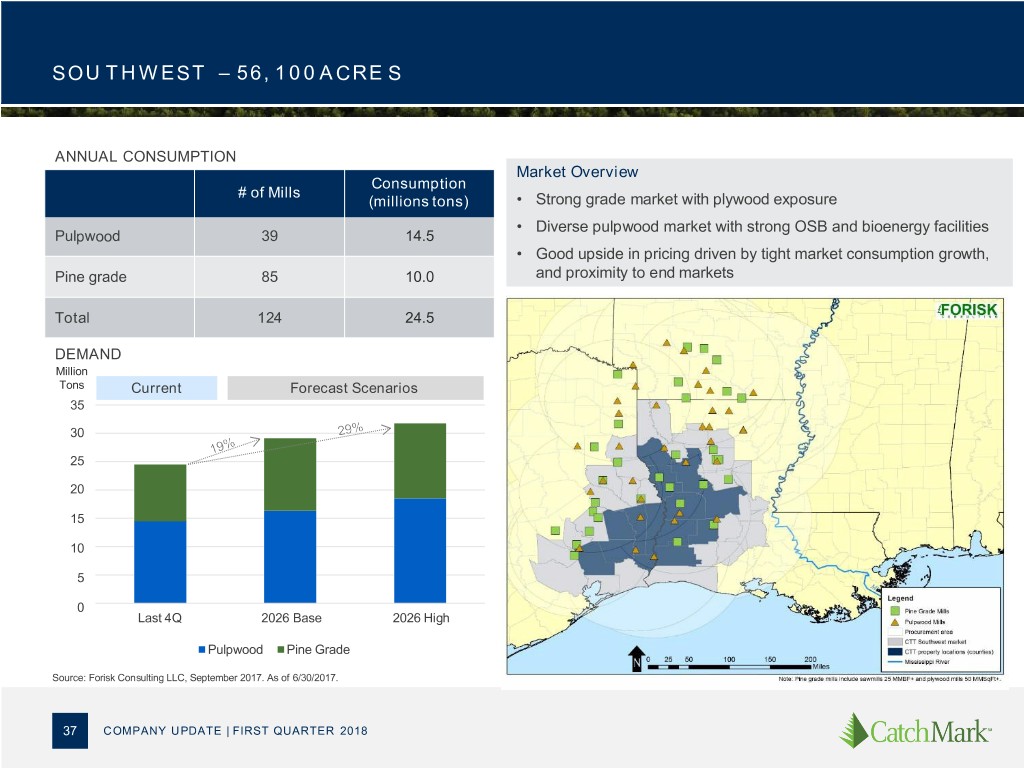

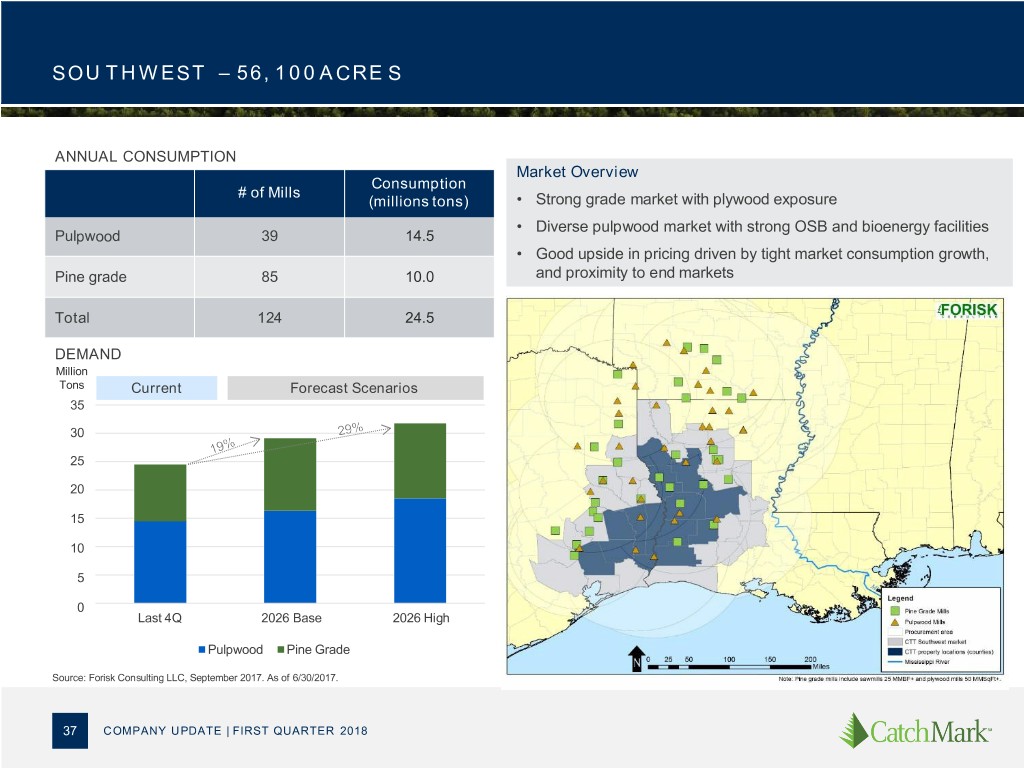

SOU T H W EST – 56, 1 0 0 A CRE S ANNUAL CONSUMPTION Market Overview Consumption # of Mills (millions tons) • Strong grade market with plywood exposure • Diverse pulpwood market with strong OSB and bioenergy facilities Pulpwood 39 14.5 • Good upside in pricing driven by tight market consumption growth, Pine grade 85 10.0 and proximity to end markets Total 124 24.5 DEMAND Million Tons Current Forecast Scenarios 35 30 25 20 15 10 5 0 Last 4Q 2026 Base 2026 High Pulpwood Pine Grade Source: Forisk Consulting LLC, September 2017. As of 6/30/2017. 37 COMPANY UPDATE | FIRST QUARTER 2018

Acquisition and Land Sales Strategy 38

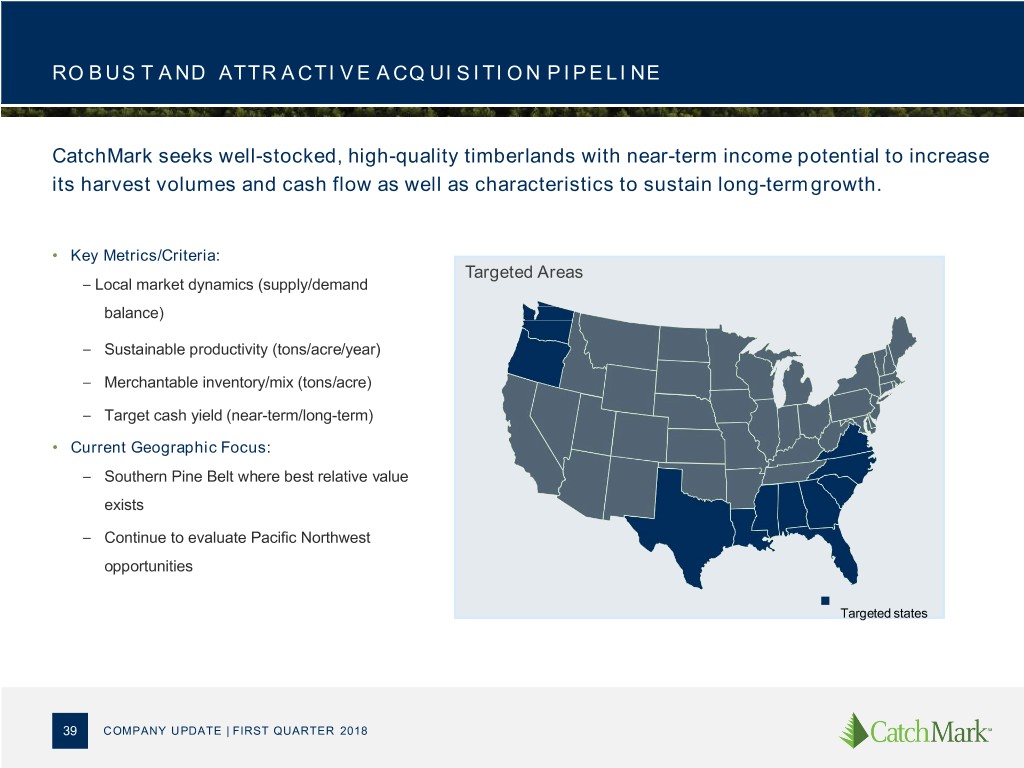

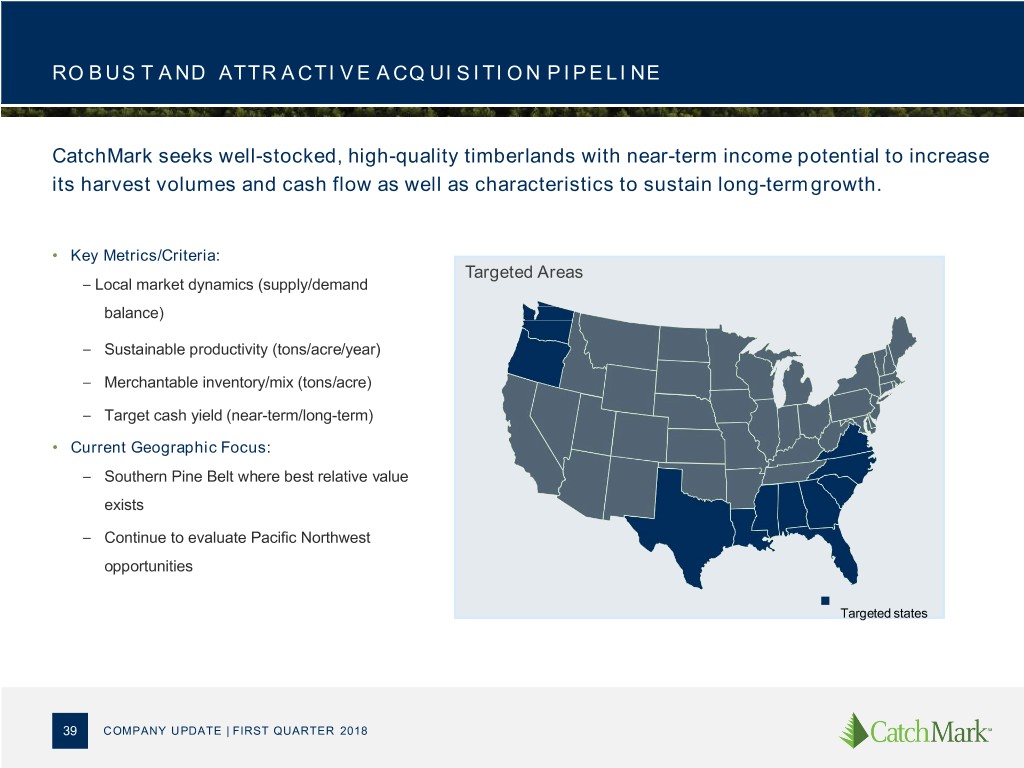

RO BUS T A ND ATTR A CTI V E A CQ UI S I TI O N P I P E LI NE CatchMark seeks well-stocked, high-quality timberlands with near-term income potential to increase its harvest volumes and cash flow as well as characteristics to sustain long-term growth. • Key Metrics/Criteria: Targeted Areas – Local market dynamics (supply/demand balance) – Sustainable productivity (tons/acre/year) – Merchantable inventory/mix (tons/acre) – Target cash yield (near-term/long-term) • Current Geographic Focus: – Southern Pine Belt where best relative value exists – Continue to evaluate Pacific Northwest opportunities Targeted states 39 COMPANY UPDATE | FIRST QUARTER 2018

S TRI NG E NT A CQ UI S I TI O N CRI TE RI A CatchMark undertakes an extremely disciplined approach to evaluating potential acquisitions focusing on durable revenues and enhancing overall timberlands quality. • Key Characteristics/Drivers – Softwood focused – Strong/deep mill markets – Diversified age class with near term harvest yields – High allocation of plantations with superior growing conditions – Good access and harvestability • Key Metrics/Criteria: – Local market dynamics (supply/demand balance) – Sustainable productivity (tons/acre/year) – Merchantable inventory/mix (tons/acre) – Target cash yield (near-term/long-term) 40 COMPANY UPDATE | FIRST QUARTER 2018

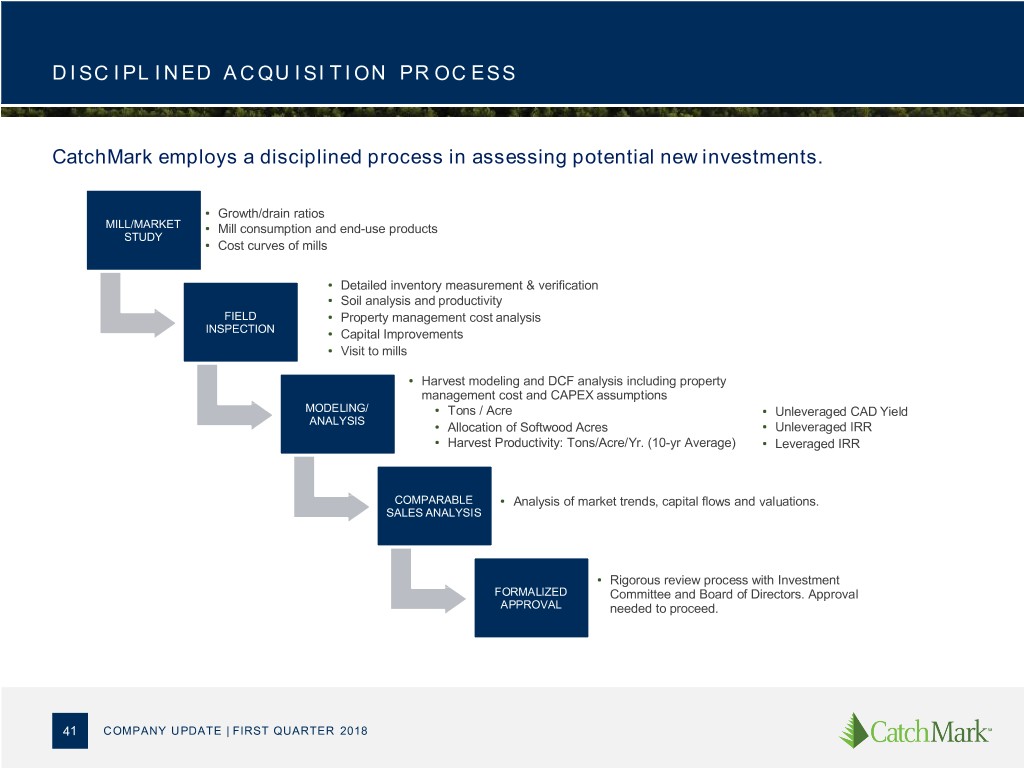

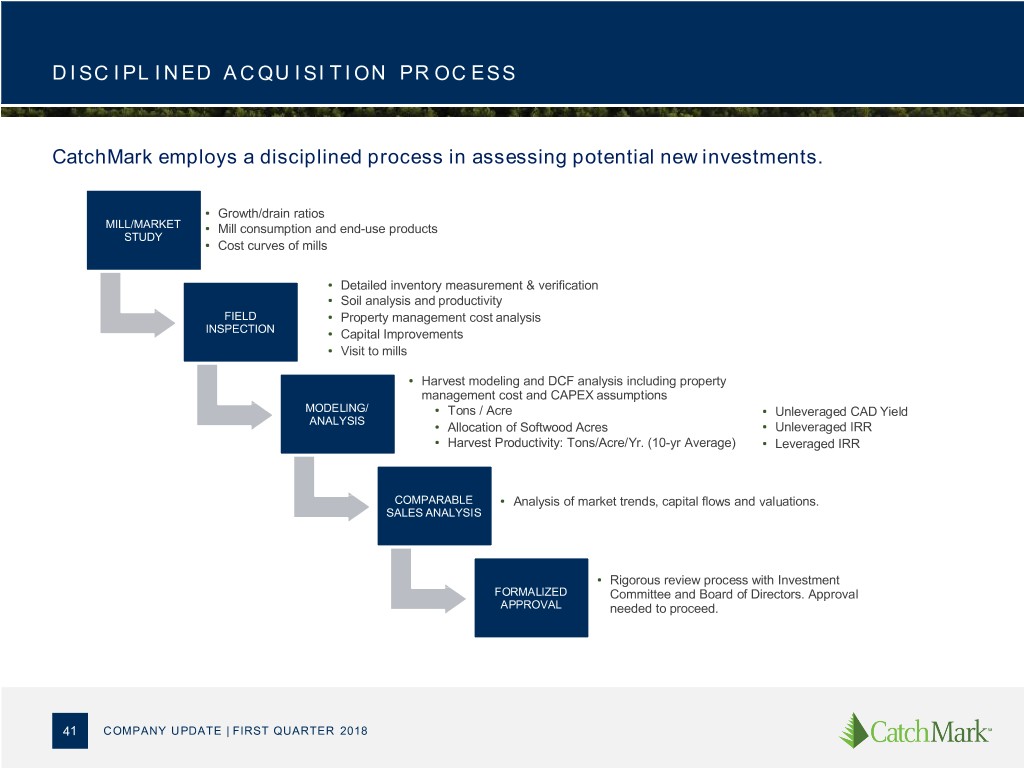

D I SC I PL I N ED A C QU I SI T I ON PR OC ESS CatchMark employs a disciplined process in assessing potential new investments. • Growth/drain ratios MILL/MARKET • Mill consumption and end-use products STUDY • Cost curves of mills • Detailed inventory measurement & verification • Soil analysis and productivity FIELD • Property management cost analysis INSPECTION • Capital Improvements • Visit to mills • Harvest modeling and DCF analysis including property management cost and CAPEX assumptions MODELING/ • Tons / Acre • Unleveraged CAD Yield ANALYSIS • Allocation of Softwood Acres • Unleveraged IRR • Harvest Productivity: Tons/Acre/Yr. (10-yr Average) • Leveraged IRR COMPARABLE • Analysis of market trends, capital flows and valuations. SALES ANALYSIS • Rigorous review process with Investment FORMALIZED Committee and Board of Directors. Approval APPROVAL needed to proceed. 41 COMPANY UPDATE | FIRST QUARTER 2018

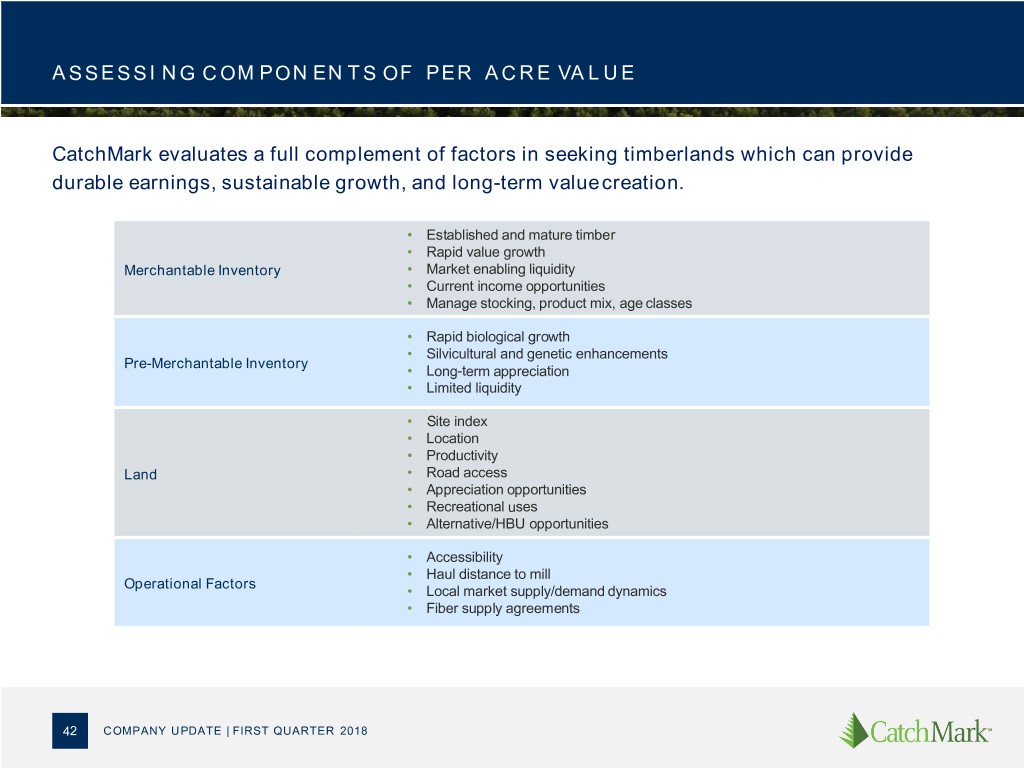

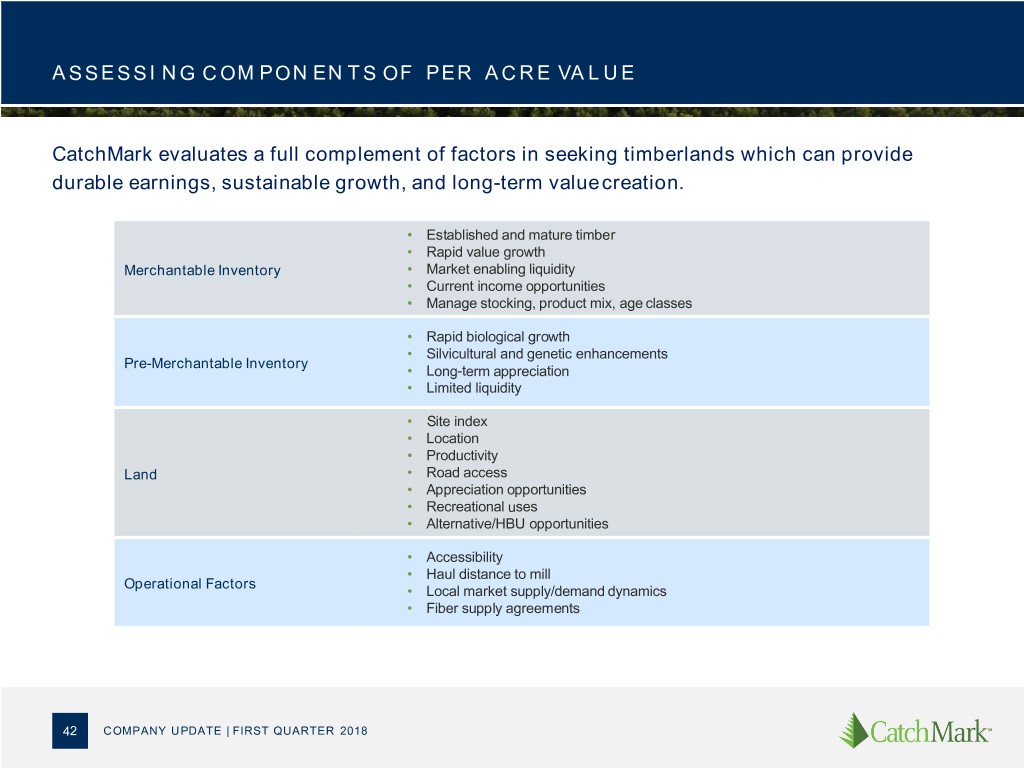

A SSESSI N G C OM PON EN T S OF PER A C R E VA L U E CatchMark evaluates a full complement of factors in seeking timberlands which can provide durable earnings, sustainable growth, and long-term value creation. • Established and mature timber • Rapid value growth Merchantable Inventory • Market enabling liquidity • Current income opportunities • Manage stocking, product mix, age classes • Rapid biological growth • Silvicultural and genetic enhancements Pre-Merchantable Inventory • Long-term appreciation • Limited liquidity • Site index • Location • Productivity Land • Road access • Appreciation opportunities • Recreational uses • Alternative/HBU opportunities • Accessibility • Haul distance to mill Operational Factors • Local market supply/demand dynamics • Fiber supply agreements 42 COMPANY UPDATE | FIRST QUARTER 2018

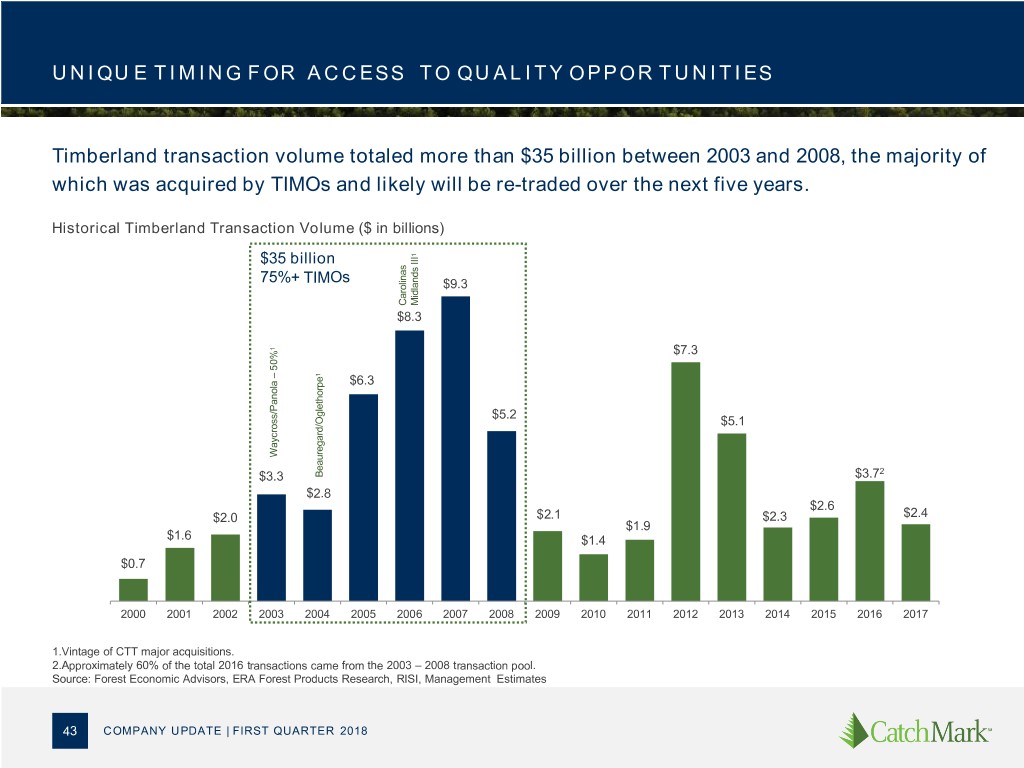

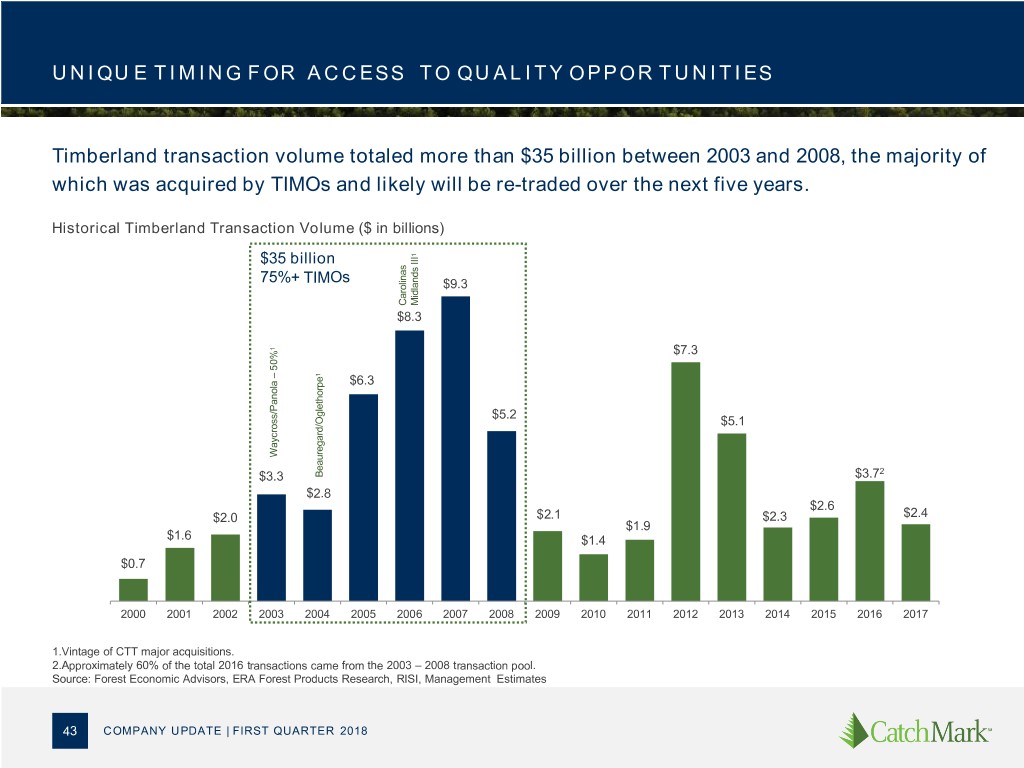

U N I QU E T I M I N G F OR A C C ESS T O QU A L I T Y OPPOR T U N I T I ES Timberland transaction volume totaled more than $35 billion between 2003 and 2008, the majority of which was acquired by TIMOs and likely will be re-traded over the next five years. Historical Timberland Transaction Volume ($ in billions) 1 III $35 billion 75%+ TIMOs $9.3 Carolinas Midlands $8.3 1 $7.3 50% 1 – $6.3 $5.2 $5.1 Waycross/Panola 2 $3.3 Beauregard/Oglethorpe $3.7 $2.8 $2.6 $2.0 $2.1 $2.3 $2.4 $1.9 $1.6 $1.4 $0.7 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1.Vintage of CTT major acquisitions. 2.Approximately 60% of the total 2016 transactions came from the 2003 – 2008 transaction pool. Source: Forest Economic Advisors, ERA Forest Products Research, RISI, Management Estimates 43 COMPANY UPDATE | FIRST QUARTER 2018

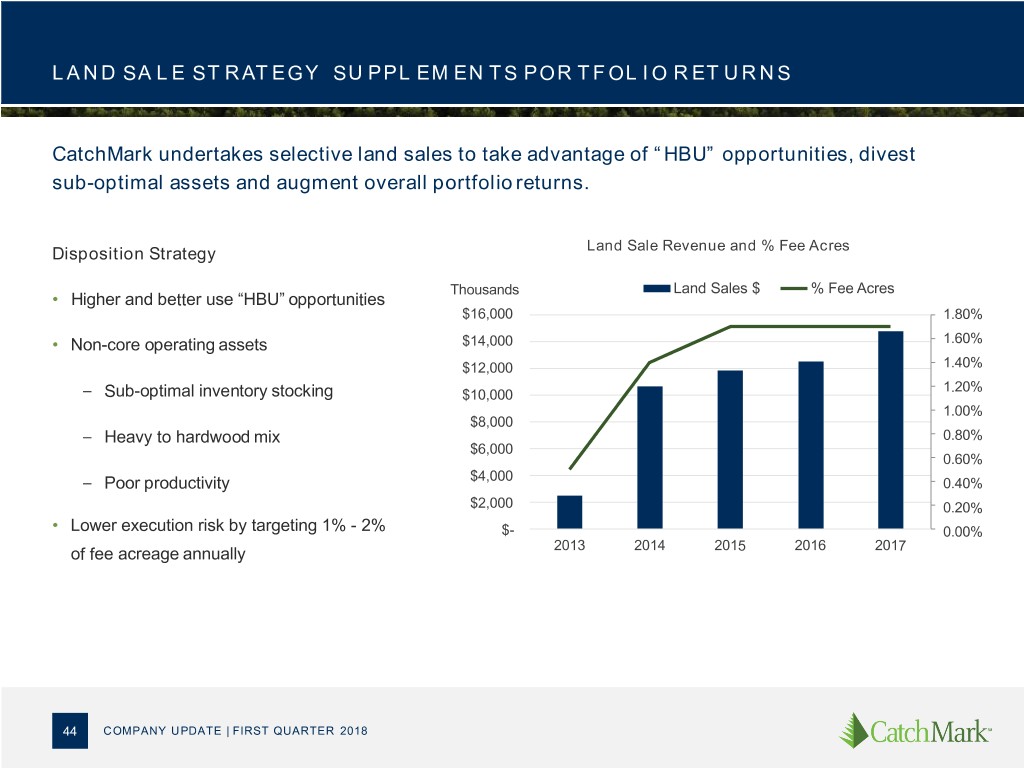

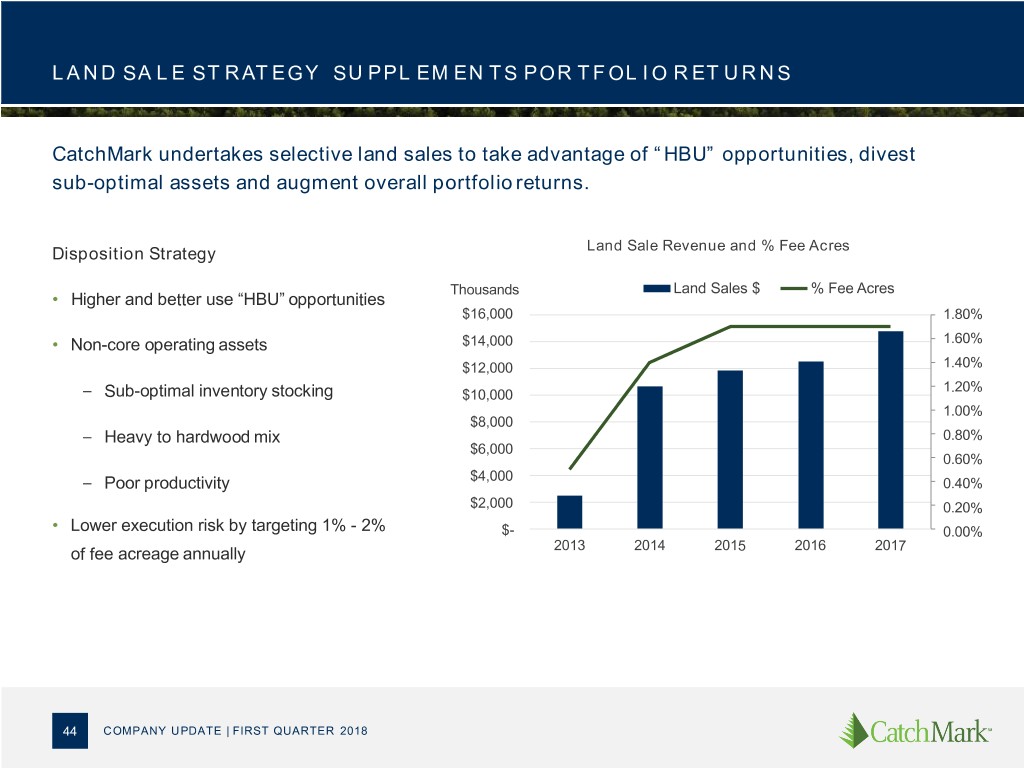

L A N D SA L E ST R AT EGY SU PPL EM EN T S POR T F OL I O R ET U R N S CatchMark undertakes selective land sales to take advantage of “HBU” opportunities, divest sub-optimal assets and augment overall portfolio returns. Land Sale Revenue and % Fee Acres Disposition Strategy Thousands Land Sales $ % Fee Acres • Higher and better use “HBU” opportunities $16,000 1.80% • Non-core operating assets $14,000 1.60% $12,000 1.40% 1.20% – Sub-optimal inventory stocking $10,000 1.00% $8,000 – Heavy to hardwood mix 0.80% $6,000 0.60% $4,000 – Poor productivity 0.40% $2,000 0.20% • Lower execution risk by targeting 1% - 2% $- 0.00% 2013 2014 2015 2016 2017 of fee acreage annually 44 COMPANY UPDATE | FIRST QUARTER 2018

Capital Position 45

DE BT CA P I TA L CA N DRI V E G RO W TH CatchMark’s operating strategy leads to higher supportable debt capacity. ATTRACTIVE COST OF DEBT CAPITAL WITH WELL MANAGED MATURITIES PREDICTABILITY OF CASH FLOW • Delivered wood model • Fiber supply agreements • Strong mill markets • Sustainable harvest history 46 COMPANY UPDATE | FIRST QUARTER 2018

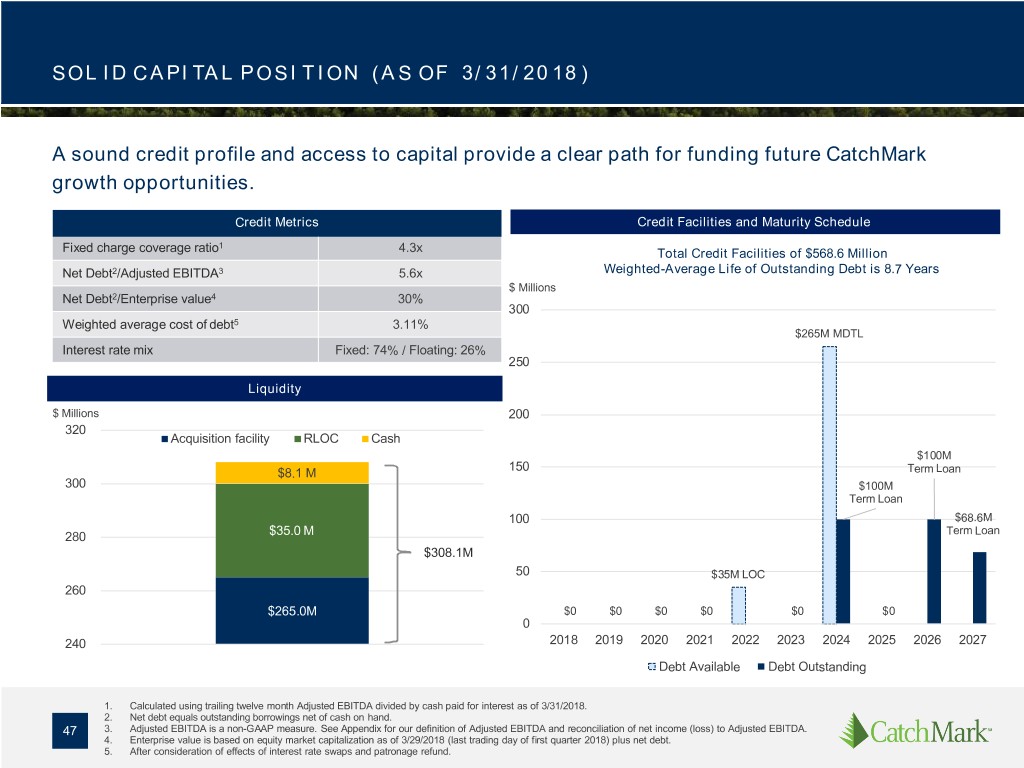

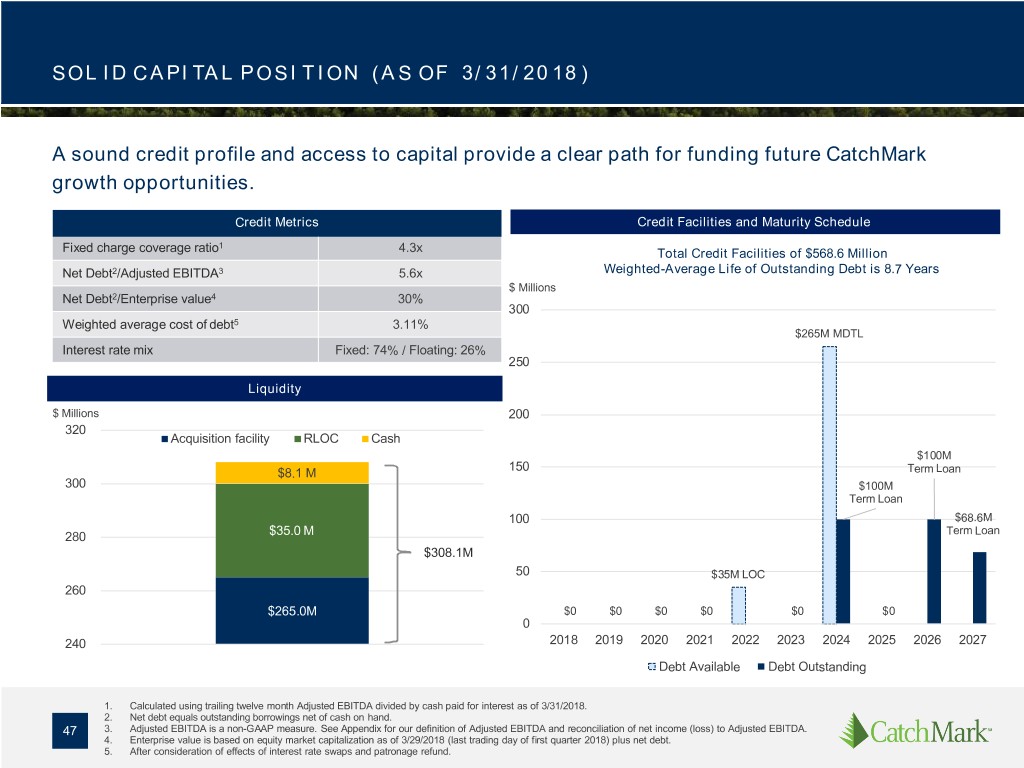

SOL I D C A PI TA L POSI T I ON ( A S OF 3/ 31/ 20 18 ) A sound credit profile and access to capital provide a clear path for funding future CatchMark growth opportunities. Credit Metrics Credit Facilities and Maturity Schedule Fixed charge coverage ratio1 4.3x Total Credit Facilities of $568.6 Million Net Debt2/Adjusted EBITDA3 5.6x Weighted-Average Life of Outstanding Debt is 8.7 Years $ Millions Net Debt2/Enterprise value4 30% 300 Weighted average cost of debt5 3.11% $265M MDTL Interest rate mix Fixed: 74% / Floating: 26% 250 Liquidity $ Millions 200 320 Acquisition facility RLOC Cash $100M 150 $8.1 M Term Loan 300 $100M Term Loan 100 $68.6M Term Loan 280 $35.0 M $308.1M 50 $35M LOC 260 $265.0M $0 $0 $0 $0 $0 $0 0 240 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Debt Available Debt Outstanding 1. Calculated using trailing twelve month Adjusted EBITDA divided by cash paid for interest as of 3/31/2018. 2. Net debt equals outstanding borrowings net of cash on hand. 47 3. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 4. Enterprise value is based on equity market capitalization as of 3/29/2018 (last trading day of first quarter 2018) plus net debt. 5. After consideration of effects of interest rate swaps and patronage refund.

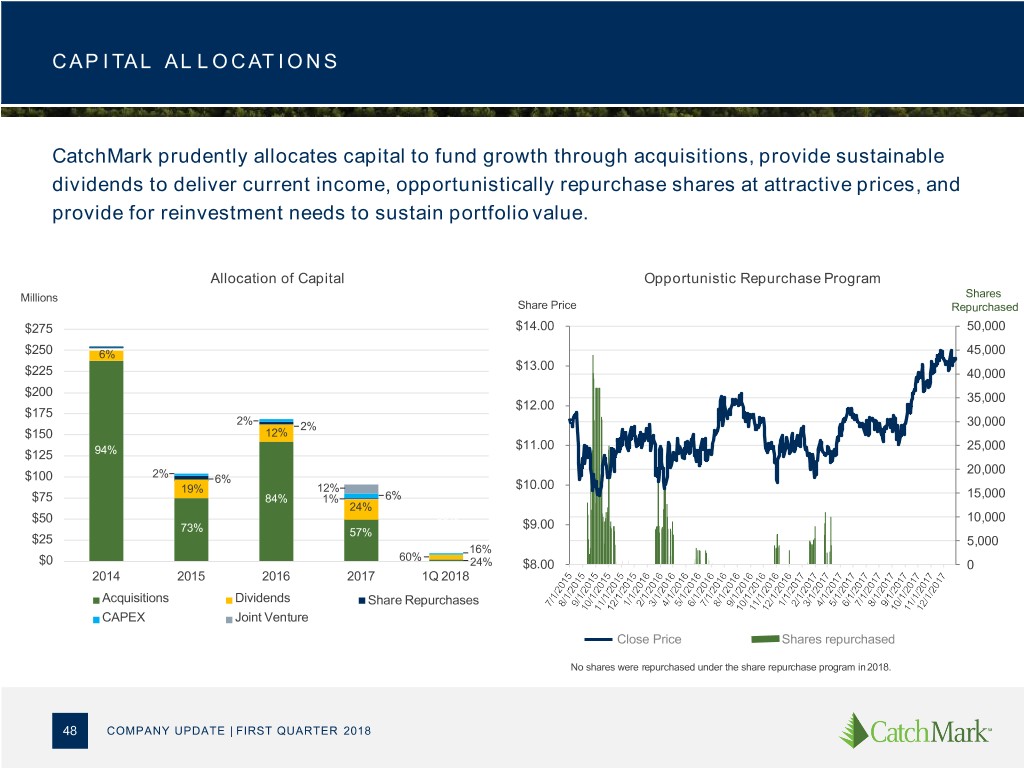

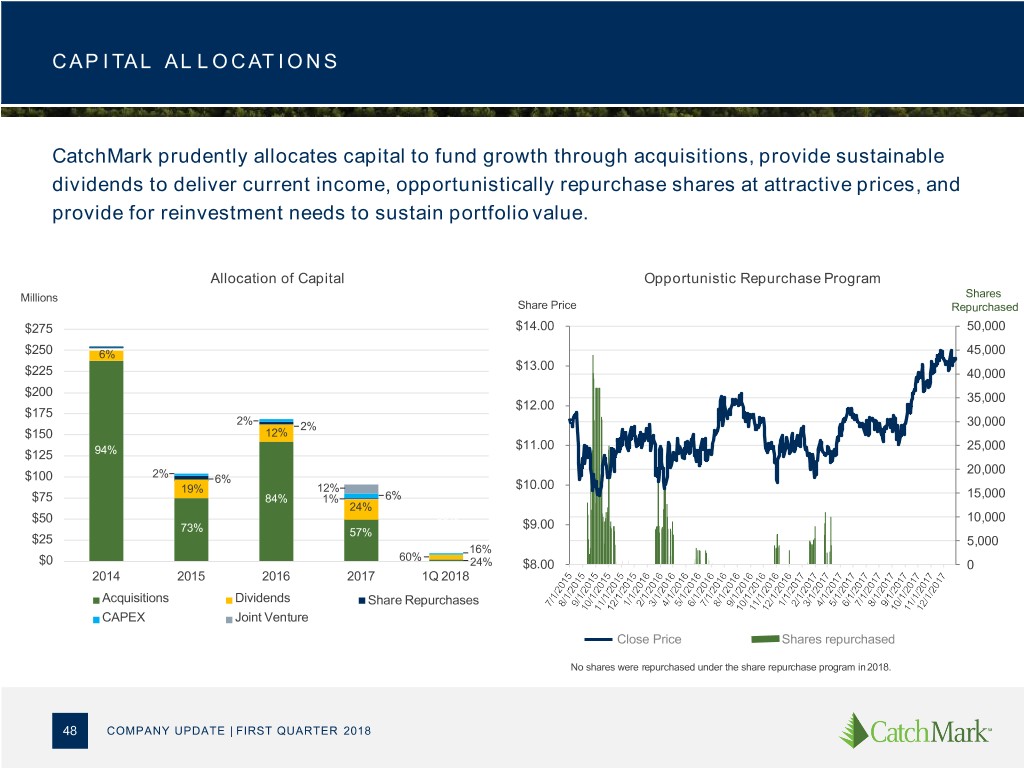

C AP I TAL AL L O C AT I O N S CatchMark prudently allocates capital to fund growth through acquisitions, provide sustainable dividends to deliver current income, opportunistically repurchase shares at attractive prices, and provide for reinvestment needs to sustain portfolio value. Allocation of Capital Opportunistic Repurchase Program Millions Shares Share Price Repurchased $275 $14.00 50,000 $250 6% 45,000 $13.00 $225 40,000 $200 35,000 $12.00 $175 2% 2% 30,000 $150 12% $11.00 25,000 $125 94% 20,000 $100 2% 6% 19% 12% $10.00 $75 84% 1% 6% 15,000 24% 88% 10,000 $50 $9.00 73% 57% $25 5,000 16% 60% $0 24% $8.00 0 2014 2015 2016 2017 1Q 2018 Acquisitions Dividends Share Repurchases CAPEX Joint Venture Close Price Shares repurchased No shares were repurchased under the share repurchase program in 2018. 48 COMPANY UPDATE | FIRST QUARTER 2018

Summary and Outlook 49

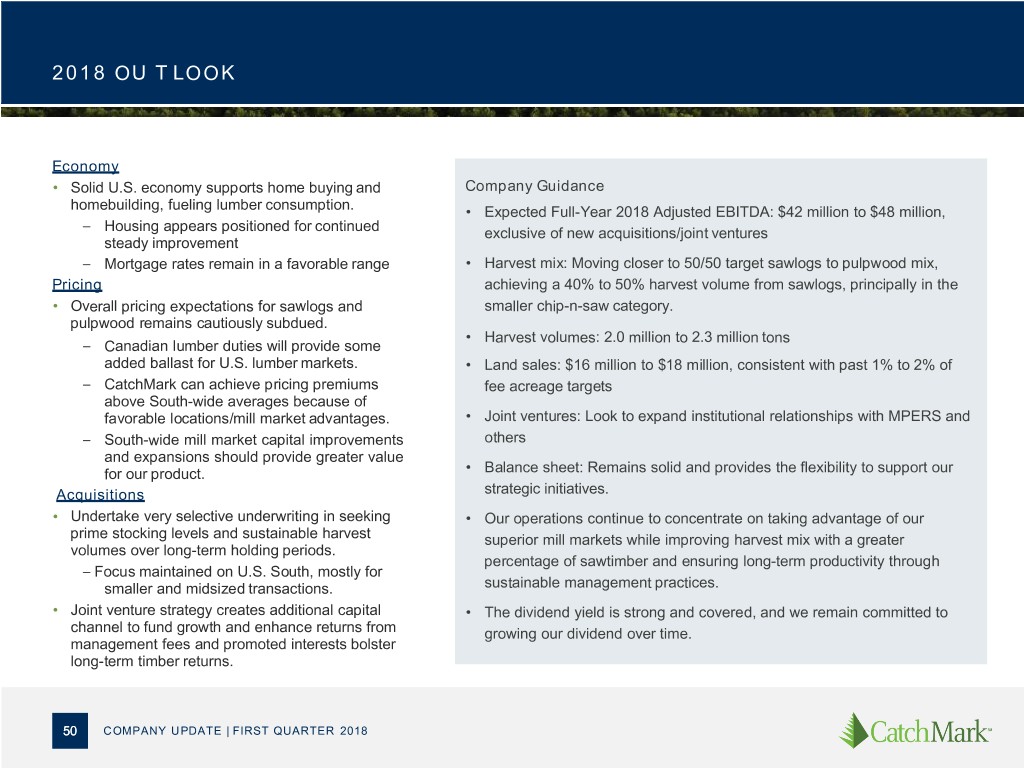

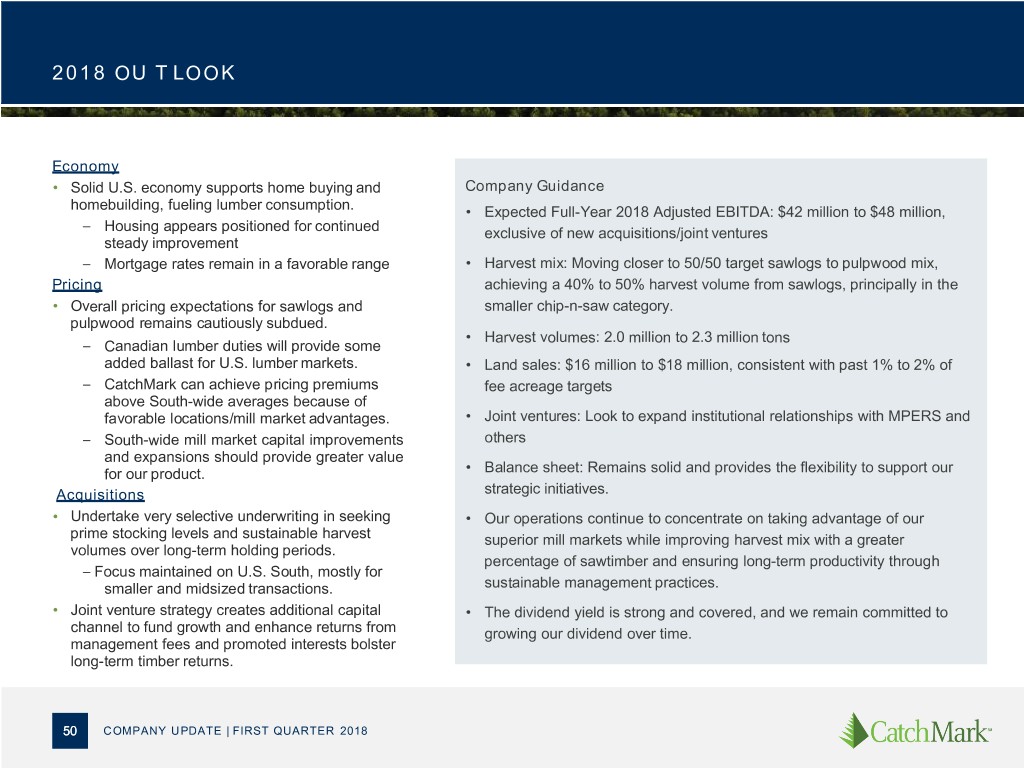

2018 OU T L OOK Economy • Solid U.S. economy supports home buying and Company Guidance homebuilding, fueling lumber consumption. • Expected Full-Year 2018 Adjusted EBITDA: $42 million to $48 million, – Housing appears positioned for continued exclusive of new acquisitions/joint ventures steady improvement – Mortgage rates remain in a favorable range • Harvest mix: Moving closer to 50/50 target sawlogs to pulpwood mix, Pricing achieving a 40% to 50% harvest volume from sawlogs, principally in the • Overall pricing expectations for sawlogs and smaller chip-n-saw category. pulpwood remains cautiously subdued. • Harvest volumes: 2.0 million to 2.3 million tons – Canadian lumber duties will provide some added ballast for U.S. lumber markets. • Land sales: $16 million to $18 million, consistent with past 1% to 2% of – CatchMark can achieve pricing premiums fee acreage targets above South-wide averages because of favorable locations/mill market advantages. • Joint ventures: Look to expand institutional relationships with MPERS and – South-wide mill market capital improvements others and expansions should provide greater value for our product. • Balance sheet: Remains solid and provides the flexibility to support our Acquisitions strategic initiatives. • Undertake very selective underwriting in seeking • Our operations continue to concentrate on taking advantage of our prime stocking levels and sustainable harvest superior mill markets while improving harvest mix with a greater volumes over long-term holding periods. percentage of sawtimber and ensuring long-term productivity through – Focus maintained on U.S. South, mostly for smaller and midsized transactions. sustainable management practices. • Joint venture strategy creates additional capital • The dividend yield is strong and covered, and we remain committed to channel to fund growth and enhance returns from growing our dividend over time. management fees and promoted interests bolster long-term timber returns. 50 COMPANY UPDATE | FIRST QUARTER 2018

2018 OU T L OOK Projected Actual Change Change COMPANY GUIDANCE 2018 2017 $ % Harvest Volume (Tons) 2.0M - 2.3M 2.35M (0.35M) – (0.05M) (15)% - (2)% Mix - Pulpwood 50% - 60% 61% N/A 2% - 18% Mix - Sawtimber 40% - 50% 39% N/A 3% - 28% Land Sales $16M - $18M $14.8M $1.2M - $3.2M 8% - 22% Capital Expenditures $5M - $7M $5.6M $(0.6)M - $1.4M (11)% - 25% Net Loss $12M - $15M $13.5M $(1.5)M - $1.5M (11)% - 11% Adjusted EBITDA (1) $42M - $48M $42.0M $0.0M - $6.0M 0% - 14% All numbers shown in millions except for % change. 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for our reconciliation to Net Loss. 5150 COMPANY UPDATE | FIRST QUARTER 2018

S U M M A RY CatchMark’s focus on quality—timberland assets, operational excellence, and sustainable earnings—helps the company grow cash flow, dividends and shareholder value. S t ra t e g y P e rf o rm a n ce Op p o rt u n i t y • Double–digit timber sales and • Expand holdings of prime, • Invest in a company well- revenue growth year-over-year well-stocked timberlands; positioned to take advantage of since IPO in 2013. manage for durable earnings the improving housing market and increase value through • Increased Adjusted EBITDA by with an experienced and sustainable environmental 14% to $42.0 million, compared proven management team practices; grow cash flow to $36.8 million for full-year implementing a clear strategy, and increase dividends per 2016.1 buoyed by a strong balance share. • Expanded fee ownership by sheet. 94% since IPO. • Increased dividend payout every year since IPO. 1. Net loss for 2017 and 2016 was $13.5 million and $11.1 million. Our net income or losses fluctuate with timber prices, harvest volume and mix, depletion rates, timberland sales, and interest expenses. 5250 COMPANY UPDATE | FIRST QUARTER 2018

Appendix 53

SU S TA I N A B L E F OR EST R Y I N I T I AT I VE C ER T I F I C AT I ON “CatchMark has developed a program that continues to meet the requirements of the SFIS 2015-2019 Forest Management Edition”.* CatchMark SFI Implementation Program • Forest management planning • Forest health and productivity • Protection and maintenance of water resources • Conservation and biological diversity • Management of visual quality and recreational benefits • Protection of special sites • Efficient use of fiber resources • Recognize and respect indigenous people’s rights • Legal and regulatory compliance • Forestry research, science, and technology • Training and education • Community involvement and landowner outreach • Public land management responsibilities • Communications and public reporting • Management review * SFI Re-certification Audit (2017) 54 COMPANY UPDATE | FIRST QUARTER 2018

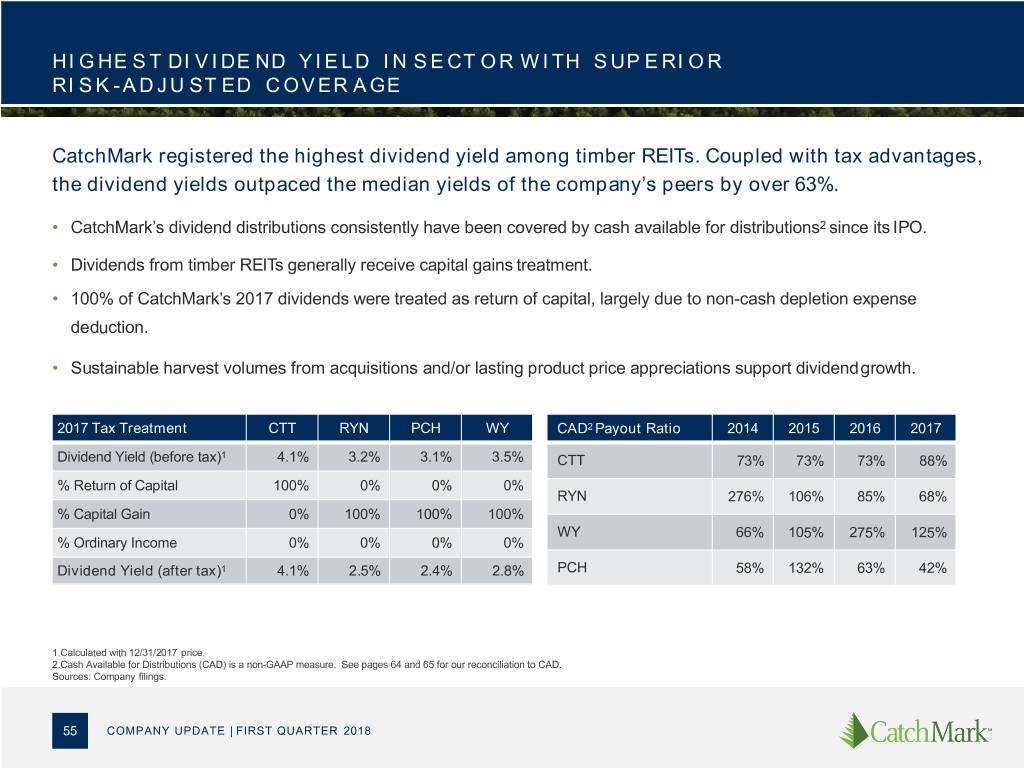

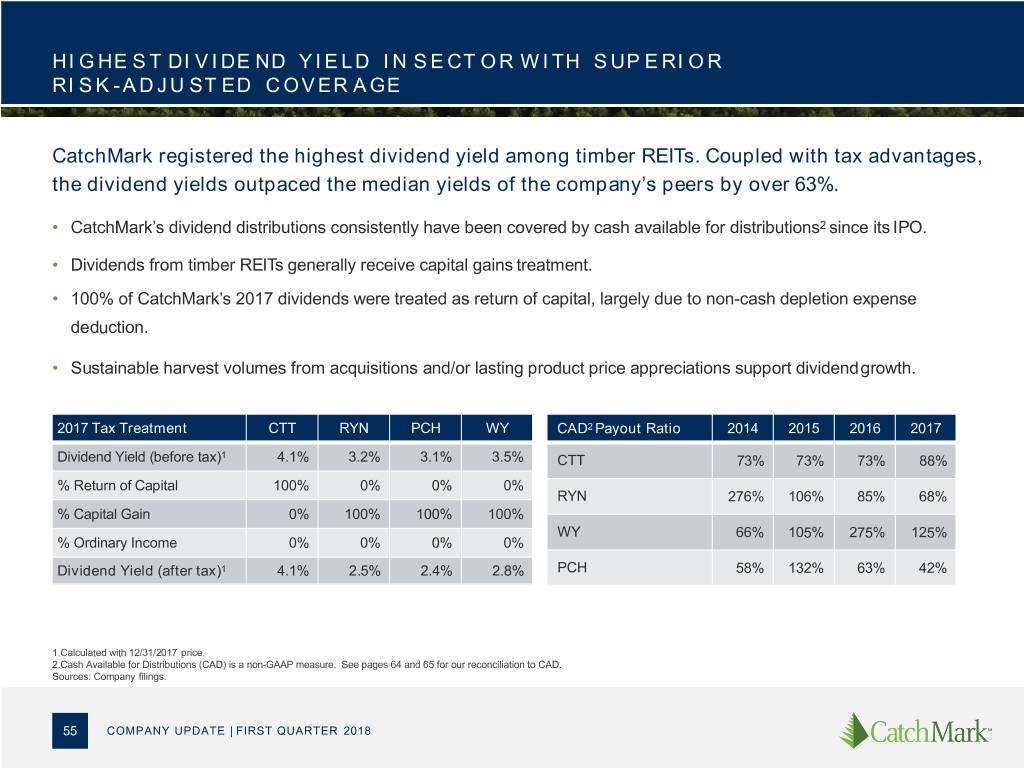

HI G HE S T DI V I DE ND Y I E LD I N S E CT O R W I TH S UP E RI O R RI S K - A D JU ST ED C OVER A GE CatchMark registered the highest dividend yield among timber REITs. Coupled with tax advantages, the dividend yields outpaced the median yields of the company’s peers by over 63%. • CatchMark’s dividend distributions consistently have been covered by cash available for distributions2 since its IPO. • Dividends from timber REITs generally receive capital gains treatment. • 100% of CatchMark’s 2017 dividends were treated as return of capital, largely due to non-cash depletion expense deduction. • Sustainable harvest volumes from acquisitions and/or lasting product price appreciations support dividend growth. 2017 Tax Treatment CTT RYN PCH WY CAD2 Payout Ratio 2014 2015 2016 2017 1 Dividend Yield (before tax) 4.1% 3.2% 3.1% 3.5% CTT 73% 73% 73% 88% % Return of Capital 100% 0% 0% 0% RYN 276% 106% 85% 68% % Capital Gain 0% 100% 100% 100% WY 66% 105% 275% 125% % Ordinary Income 0% 0% 0% 0% Dividend Yield (after tax)1 4.1% 2.5% 2.4% 2.8% PCH 58% 132% 63% 42% 1.Calculated with 12/31/2017 price. 2.Cash Available for Distributions (CAD) is a non-GAAP measure. See pages 64 and 65 for our reconciliation to CAD. Sources: Company filings. 55 COMPANY UPDATE | FIRST QUARTER 2018

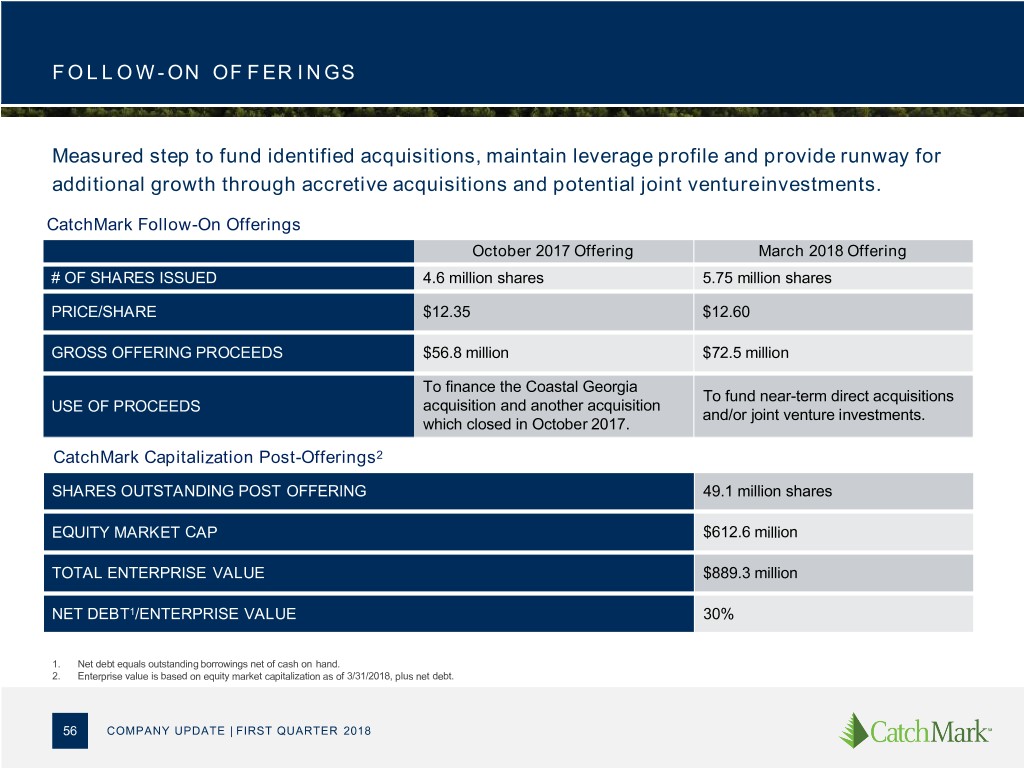

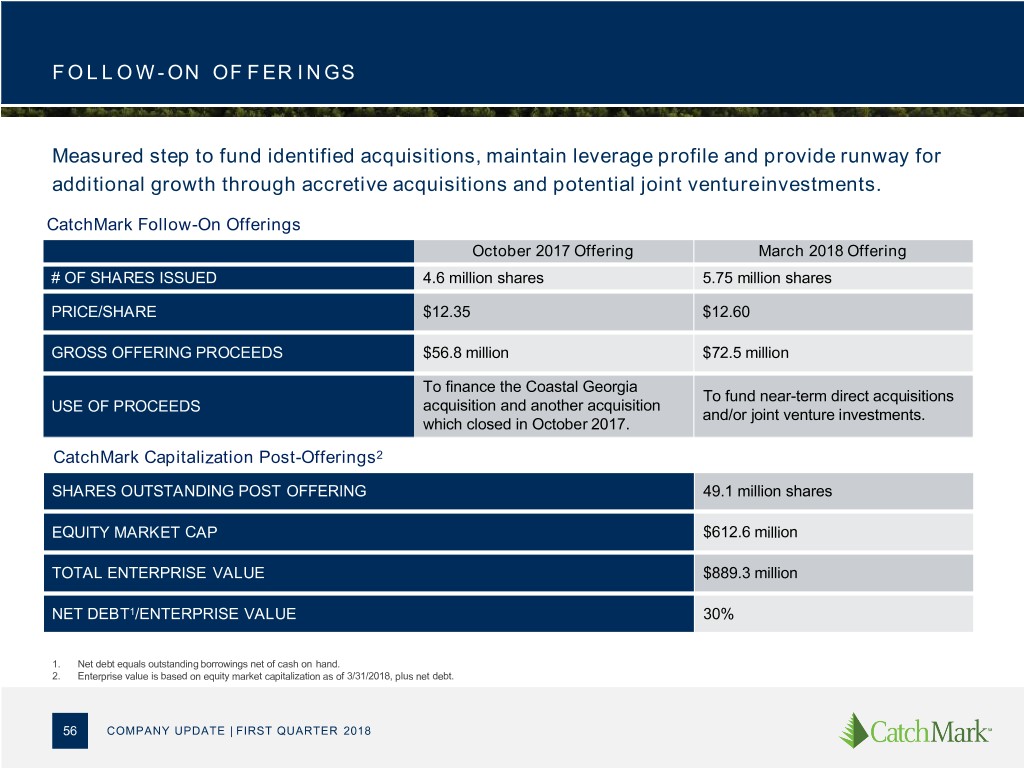

F O L L O W - ON OF F ER I N GS Measured step to fund identified acquisitions, maintain leverage profile and provide runway for additional growth through accretive acquisitions and potential joint venture investments. CatchMark Follow-On Offerings October 2017 Offering March 2018 Offering # OF SHARES ISSUED 4.6 million shares 5.75 million shares PRICE/SHARE $12.35 $12.60 GROSS OFFERING PROCEEDS $56.8 million $72.5 million To finance the Coastal Georgia To fund near-term direct acquisitions acquisition and another acquisition USE OF PROCEEDS and/or joint venture investments. which closed in October 2017. CatchMark Capitalization Post-Offerings2 SHARES OUTSTANDING POST OFFERING 49.1 million shares EQUITY MARKET CAP $612.6 million TOTAL ENTERPRISE VALUE $889.3 million NET DEBT1/ENTERPRISE VALUE 30% 1. Net debt equals outstanding borrowings net of cash on hand. 2. Enterprise value is based on equity market capitalization as of 3/31/2018, plus net debt. 56 COMPANY UPDATE | FIRST QUARTER 2018

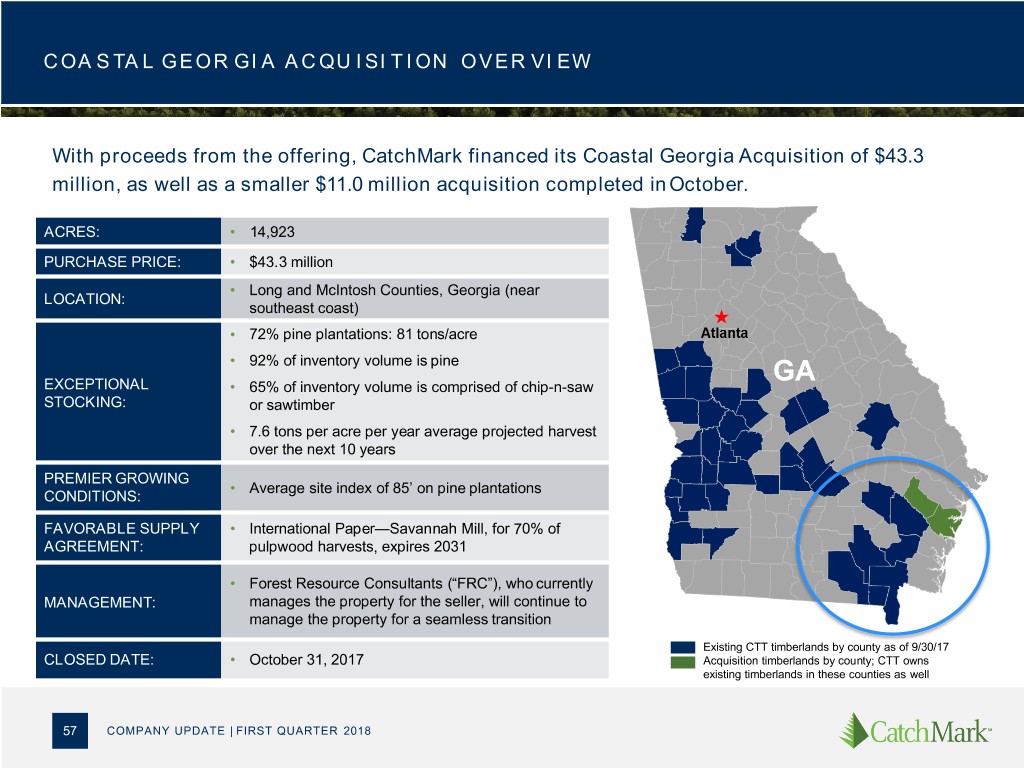

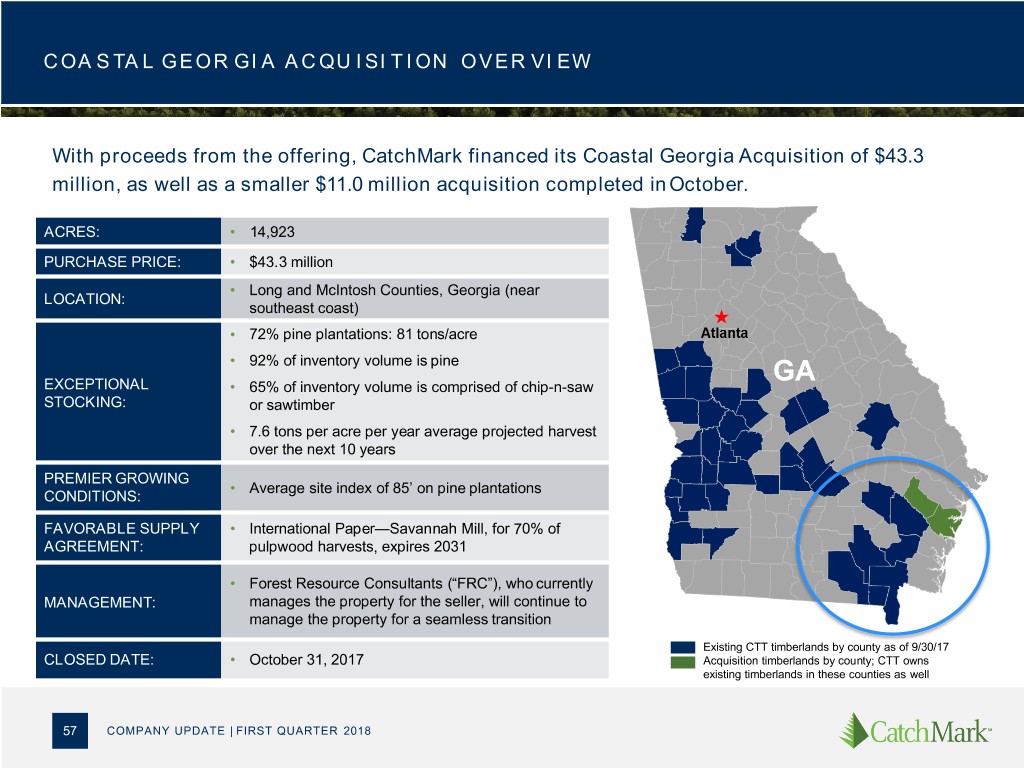

C OA S TA L GEOR GI A A C QU I SI T I ON OVER VI EW With proceeds from the offering, CatchMark financed its Coastal Georgia Acquisition of $43.3 million, as well as a smaller $11.0 million acquisition completed in October. ACRES: • 14,923 PURCHASE PRICE: • $43.3 million • Long and McIntosh Counties, Georgia (near LOCATION: southeast coast) • 72% pine plantations: 81 tons/acre • 92% of inventory volume is pine EXCEPTIONAL • 65% of inventory volume is comprised of chip-n-saw STOCKING: or sawtimber • 7.6 tons per acre per year average projected harvest over the next 10 years PREMIER GROWING • Average site index of 85’ on pine plantations CONDITIONS: FAVORABLE SUPPLY • International Paper—Savannah Mill, for 70% of AGREEMENT: pulpwood harvests, expires 2031 • Forest Resource Consultants (“FRC”), who currently MANAGEMENT: manages the property for the seller, will continue to manage the property for a seamless transition Existing CTT timberlands by county as of 9/30/17 CLOSED DATE: • October 31, 2017 Acquisition timberlands by county; CTT owns existing timberlands in these counties as well 57 COMPANY UPDATE | FIRST QUARTER 2018

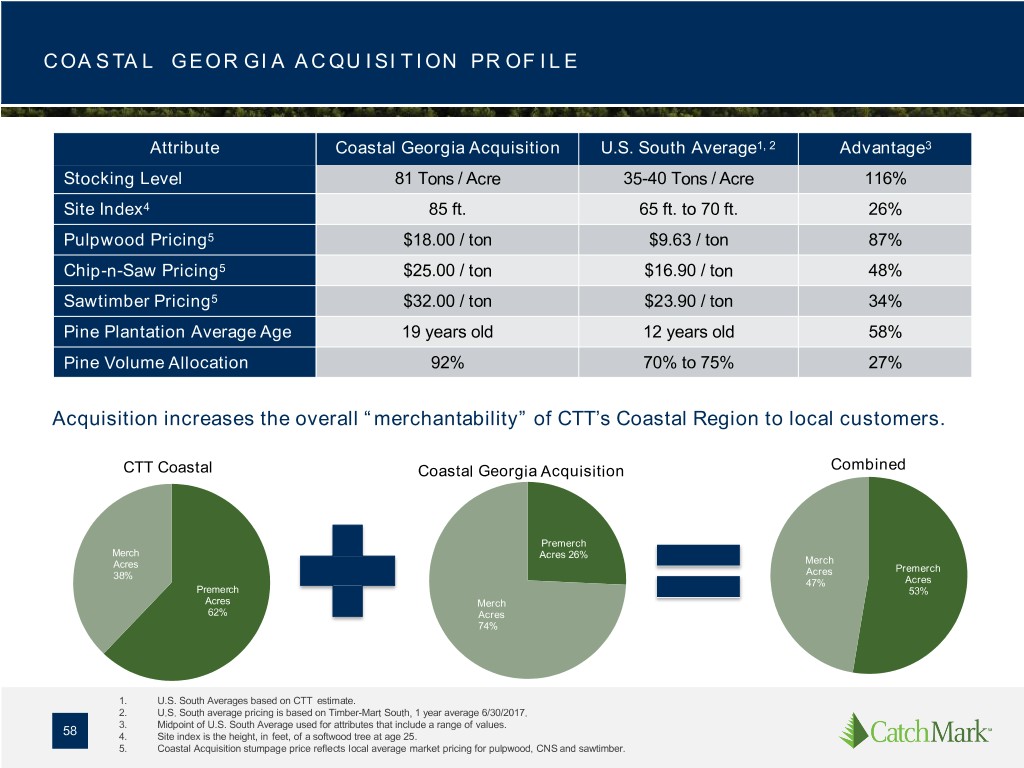

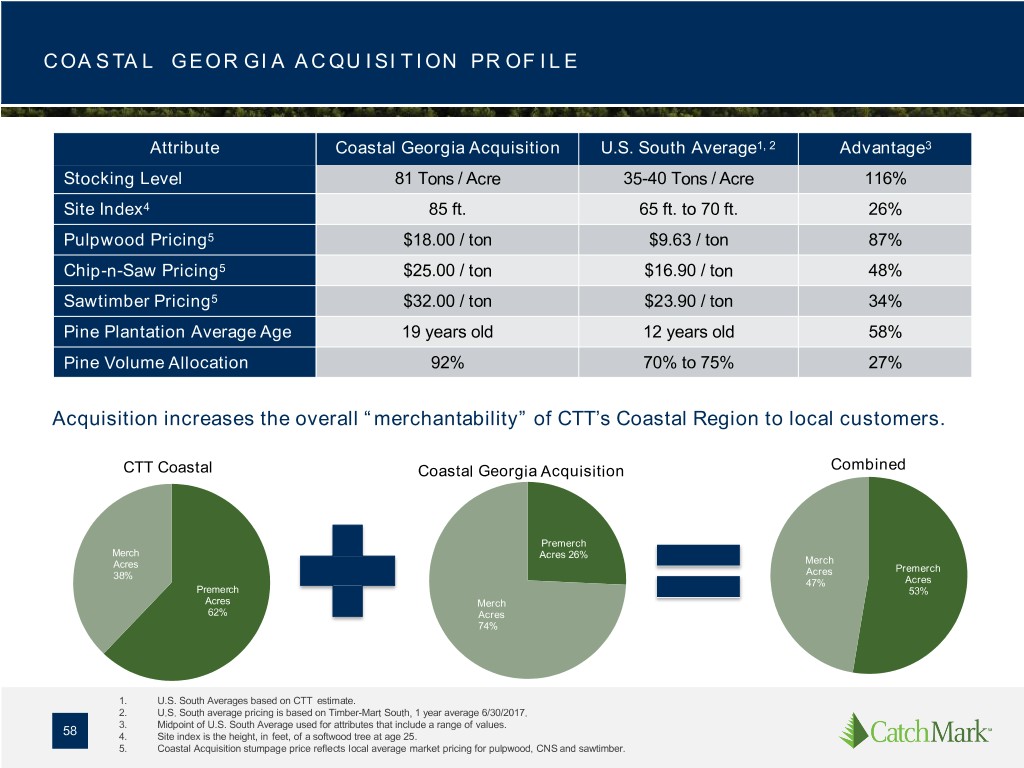

C OA S TA L GEOR GI A A C QU I SI T I ON PR OF I L E Attribute Coastal Georgia Acquisition U.S. South Average1, 2 Advantage3 Stocking Level 81 Tons / Acre 35-40 Tons / Acre 116% Site Index4 85 ft. 65 ft. to 70 ft. 26% Pulpwood Pricing5 $18.00 / ton $9.63 / ton 87% Chip-n-Saw Pricing5 $25.00 / ton $16.90 / ton 48% Sawtimber Pricing5 $32.00 / ton $23.90 / ton 34% Pine Plantation Average Age 19 years old 12 years old 58% Pine Volume Allocation 92% 70% to 75% 27% Acquisition increases the overall “merchantability” of CTT’s Coastal Region to local customers. CTT Coastal Coastal Georgia Acquisition Combined Premerch Merch Acres 26% Merch Acres Premerch 38% Acres 47% Acres Premerch 53% Acres Merch 62% Acres 74% 1. U.S. South Averages based on CTT estimate. 2. U.S. South average pricing is based on Timber-Mart South, 1 year average 6/30/2017. 3. Midpoint of U.S. South Average used for attributes that include a range of values. 58 4. Site index is the height, in feet, of a softwood tree at age 25. 5. Coastal Acquisition stumpage price reflects local average market pricing for pulpwood, CNS and sawtimber.

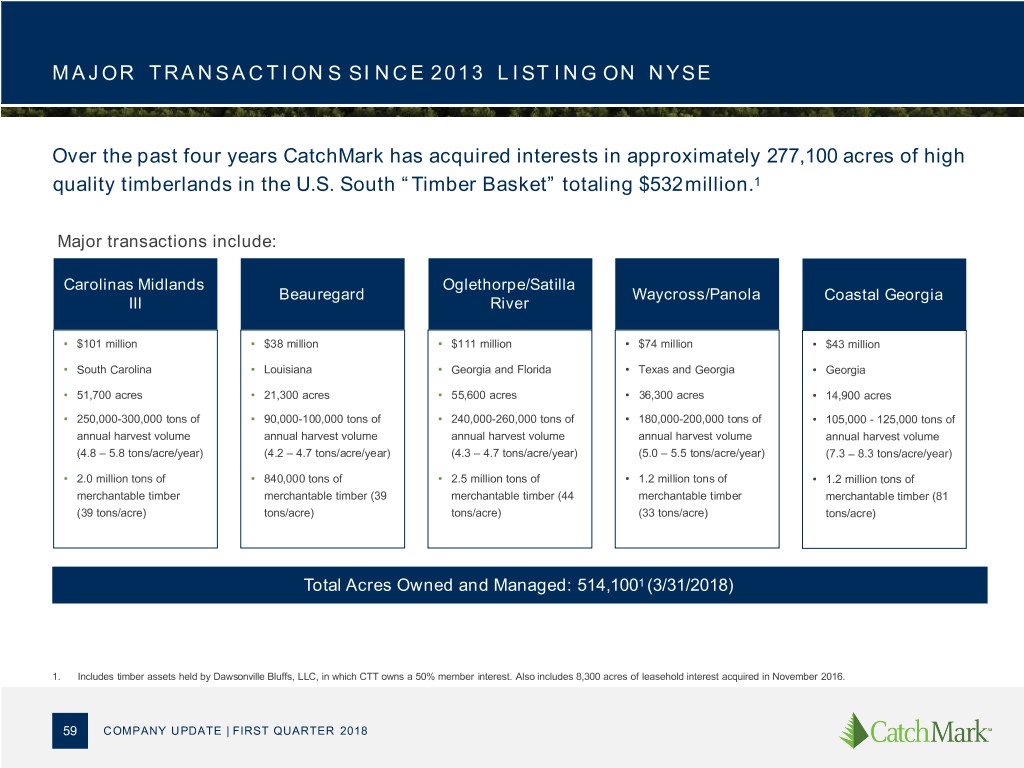

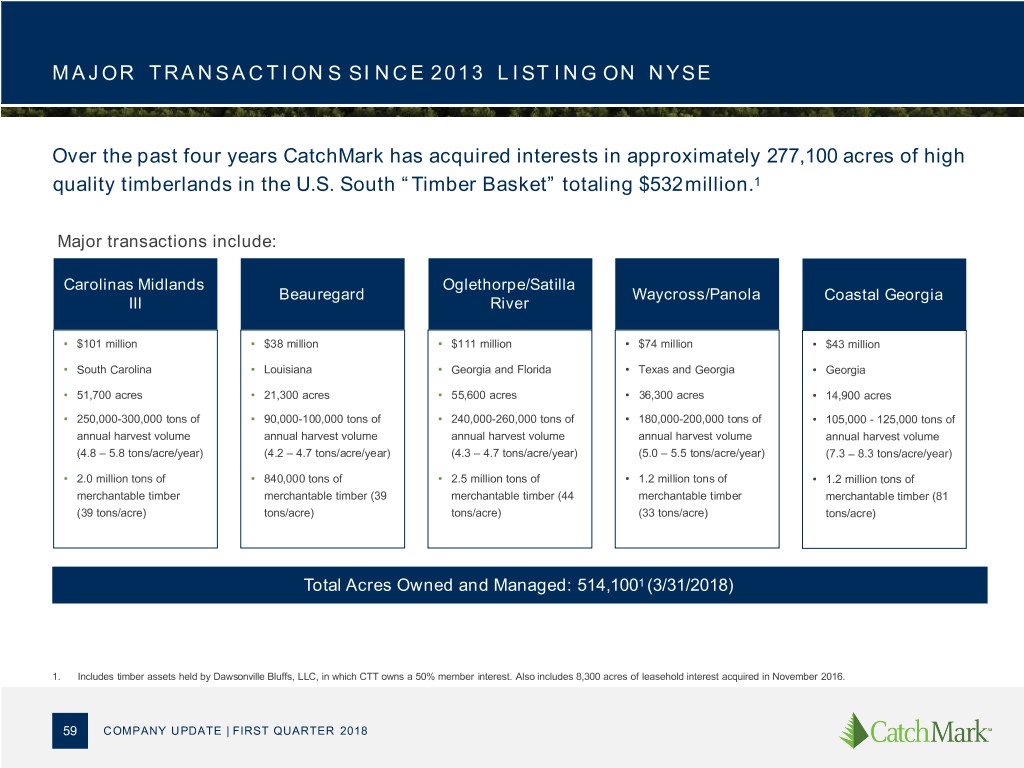

M A JOR T R A N S A C T I ON S SI N C E 2013 L I ST I N G ON N YSE Over the past four years CatchMark has acquired interests in approximately 277,100 acres of high quality timberlands in the U.S. South “Timber Basket” totaling $532 million.1 Major transactions include: Carolinas Midlands Oglethorpe/Satilla Beauregard Waycross/Panola Coastal Georgia III River • $101 million • $38 million • $111 million • $74 million • $43 million • South Carolina • Louisiana • Georgia and Florida • Texas and Georgia • Georgia • 51,700 acres • 21,300 acres • 55,600 acres • 36,300 acres • 14,900 acres • 250,000-300,000 tons of • 90,000-100,000 tons of • 240,000-260,000 tons of • 180,000-200,000 tons of • 105,000 - 125,000 tons of annual harvest volume annual harvest volume annual harvest volume annual harvest volume annual harvest volume (4.8 – 5.8 tons/acre/year) (4.2 – 4.7 tons/acre/year) (4.3 – 4.7 tons/acre/year) (5.0 – 5.5 tons/acre/year) (7.3 – 8.3 tons/acre/year) • 2.0 million tons of • 840,000 tons of • 2.5 million tons of • 1.2 million tons of • 1.2 million tons of merchantable timber merchantable timber (39 merchantable timber (44 merchantable timber merchantable timber (81 (39 tons/acre) tons/acre) tons/acre) (33 tons/acre) tons/acre) Total Acres Owned and Managed: 514,1001 (3/31/2018) 1. Includes timber assets held by Dawsonville Bluffs, LLC, in which CTT owns a 50% member interest. Also includes 8,300 acres of leasehold interest acquired in November 2016. 59 COMPANY UPDATE | FIRST QUARTER 2018

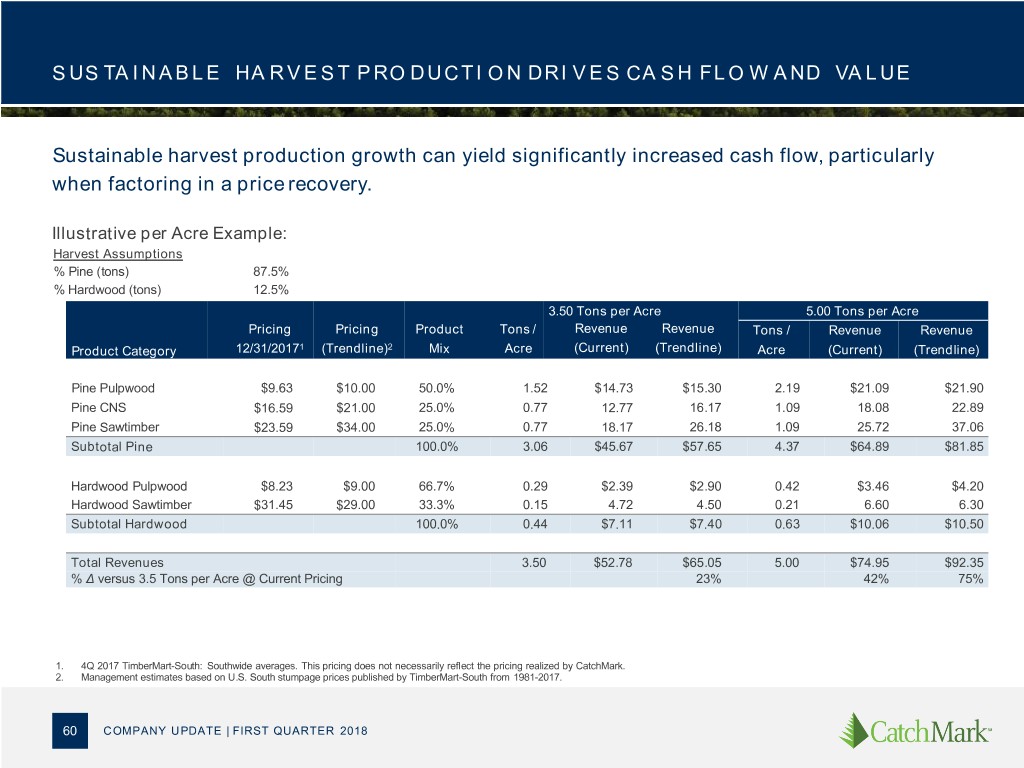

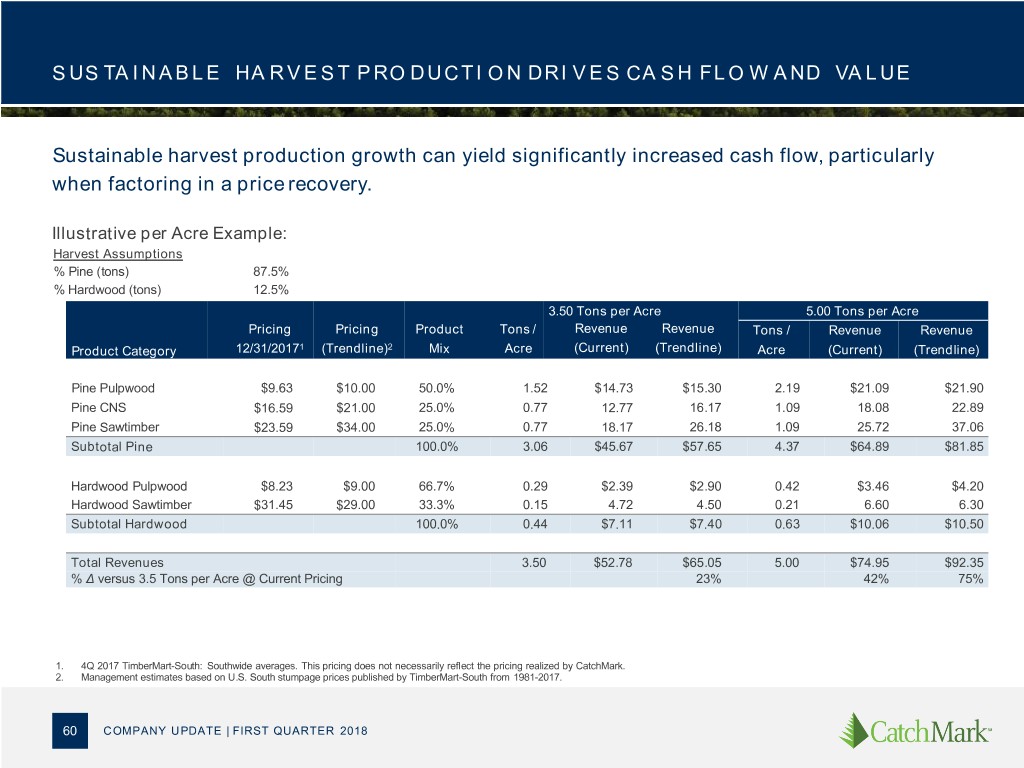

S US TA I N A BLE HA R V E S T P RO DUCTI O N DRI V E S CA S H FLO W A ND VA LUE Sustainable harvest production growth can yield significantly increased cash flow, particularly when factoring in a price recovery. Illustrative per Acre Example: Harvest Assumptions % Pine (tons) 87.5% % Hardwood (tons) 12.5% 3.50 Tons per Acre 5.00 Tons per Acre Pricing Pricing Product Tons / Revenue Revenue Tons / Revenue Revenue Product Category 12/31/20171 (Trendline)2 Mix Acre (Current) (Trendline) Acre (Current) (Trendline) Pine Pulpwood $9.63 $10.00 50.0% 1.52 $14.73 $15.30 2.19 $21.09 $21.90 Pine CNS $16.59 $21.00 25.0% 0.77 12.77 16.17 1.09 18.08 22.89 Pine Sawtimber $23.59 $34.00 25.0% 0.77 18.17 26.18 1.09 25.72 37.06 Subtotal Pine 100.0% 3.06 $45.67 $57.65 4.37 $64.89 $81.85 Hardwood Pulpwood $8.23 $9.00 66.7% 0.29 $2.39 $2.90 0.42 $3.46 $4.20 Hardwood Sawtimber $31.45 $29.00 33.3% 0.15 4.72 4.50 0.21 6.60 6.30 Subtotal Hardwood 100.0% 0.44 $7.11 $7.40 0.63 $10.06 $10.50 Total Revenues 3.50 $52.78 $65.05 5.00 $74.95 $92.35 % Δ versus 3.5 Tons per Acre @ Current Pricing 23% 42% 75% 1. 4Q 2017 TimberMart-South: Southwide averages. This pricing does not necessarily reflect the pricing realized by CatchMark. 2. Management estimates based on U.S. South stumpage prices published by TimberMart-South from 1981-2017. 60 COMPANY UPDATE | FIRST QUARTER 2018

A DJ US TE D E BI TDA Earnings before Interest, Taxes, Depletion, and Amortization (“EBITDA”) is a non-GAAP measure of operating performance. EBITDA is defined by the SEC however, we have excluded certain other expenses which we believe are not indicative of the ongoing operating results of our timberland portfolio, and we refer to this measure as Adjusted EBITDA. As such, our Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies and should not be considered in isolation or as an alternative to, or substitute for net income, cash from operations, or other financial statement data presented in our consolidated financial statements as indicators of our operating performance. Due to the significant amount of timber assets subject to depletion and the significant amount of financing subject to interest and amortization expense, management considers Adjusted EBITDA to be an important measure of our financial performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations are: • Adjusted EBITDA does not reflect our capital expenditures, or our future requirements for capital expenditures; • Adjusted EBITDA does not reflect changes in, or our interest expense or the cash requirements necessary to service interest or principal payments on, our debt; and • Although depletion is a non-cash charge, we will incur expenses to replace the timber being depleted in the future, and Adjusted EBITDA does not reflect all cash requirements for such expenses. Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Our credit agreement contains a minimum debt service coverage ratio based, in part, on Adjusted EBITDA since this measure is representative of adjusted income available for interest payments. 61 COMPANY UPDATE | FIRST QUARTER 2018

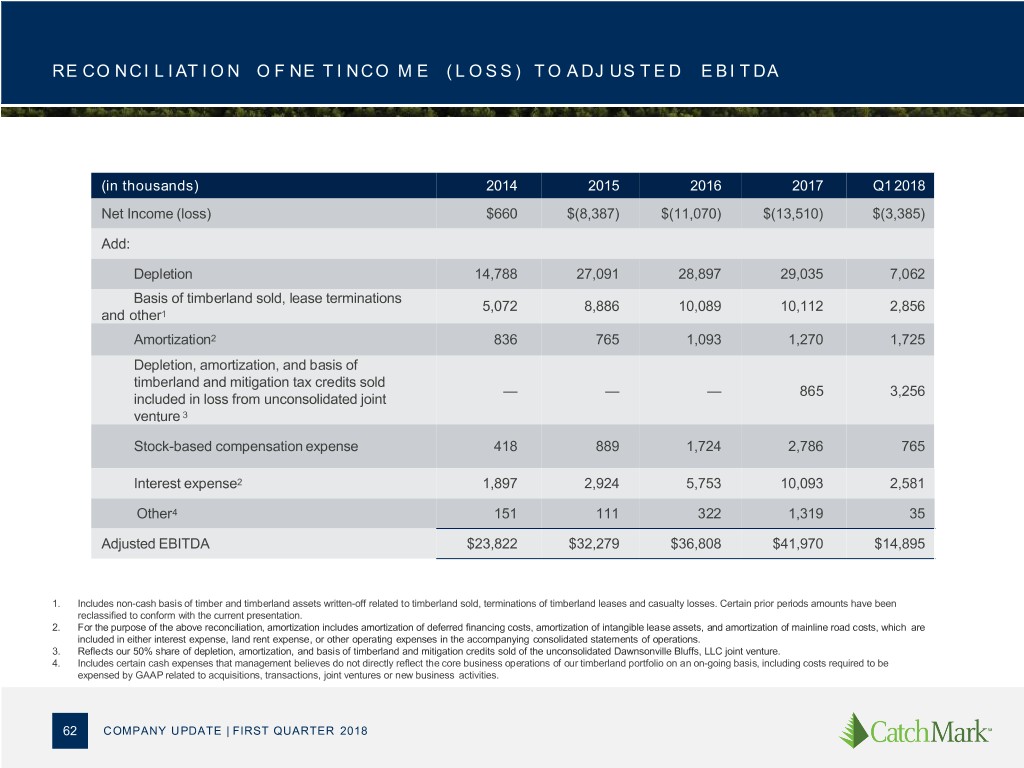

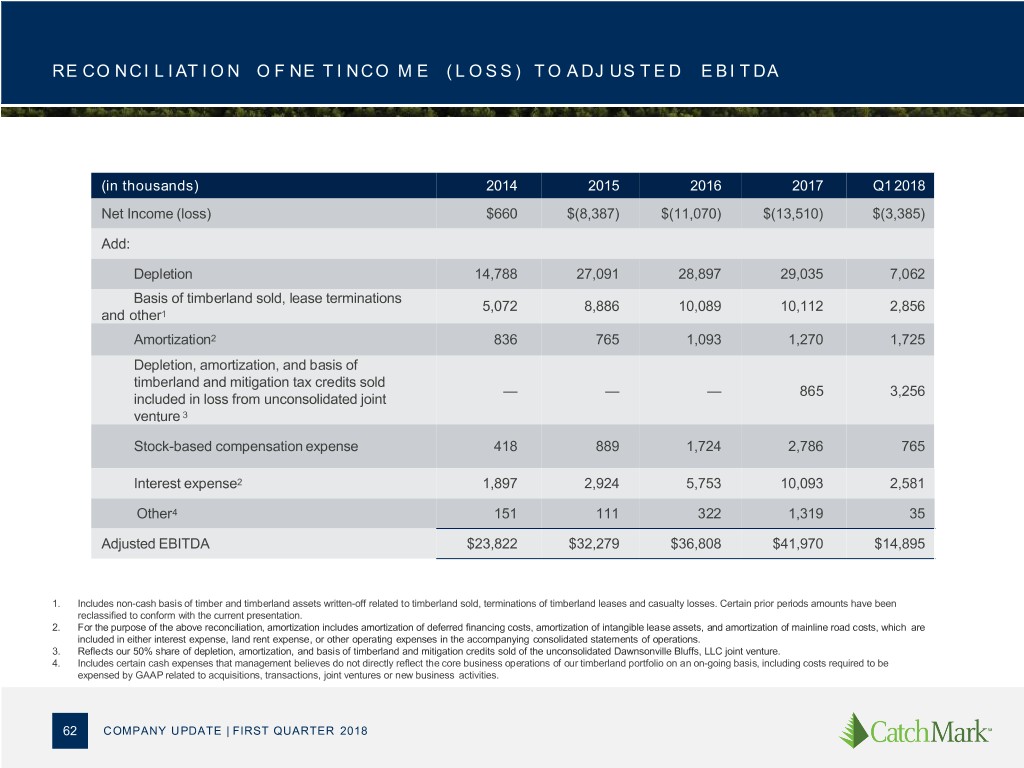

RE CO NCI L I AT I O N O F NE T I NCO M E ( L O S S ) T O A DJ US T E D E BI T DA (in thousands) 2014 2015 2016 2017 Q1 2018 Net Income (loss) $660 $(8,387) $(11,070) $(13,510) $(3,385) Add: Depletion 14,788 27,091 28,897 29,035 7,062 Basis of timberland sold, lease terminations 5,072 8,886 10,089 10,112 2,856 and other1 Amortization2 836 765 1,093 1,270 1,725 Depletion, amortization, and basis of timberland and mitigation tax credits sold — — — 865 3,256 included in loss from unconsolidated joint venture 3 Stock-based compensation expense 418 889 1,724 2,786 765 Interest expense2 1,897 2,924 5,753 10,093 2,581 Other4 151 111 322 1,319 35 Adjusted EBITDA $23,822 $32,279 $36,808 $41,970 $14,895 1. Includes non-cash basis of timber and timberland assets written-off related to timberland sold, terminations of timberland leases and casualty losses. Certain prior periods amounts have been reclassified to conform with the current presentation. 2. For the purpose of the above reconciliation, amortization includes amortization of deferred financing costs, amortization of intangible lease assets, and amortization of mainline road costs, which are included in either interest expense, land rent expense, or other operating expenses in the accompanying consolidated statements of operations. 3. Reflects our 50% share of depletion, amortization, and basis of timberland and mitigation credits sold of the unconsolidated Dawnsonville Bluffs, LLC joint venture. 4. Includes certain cash expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. 62 COMPANY UPDATE | FIRST QUARTER 2018

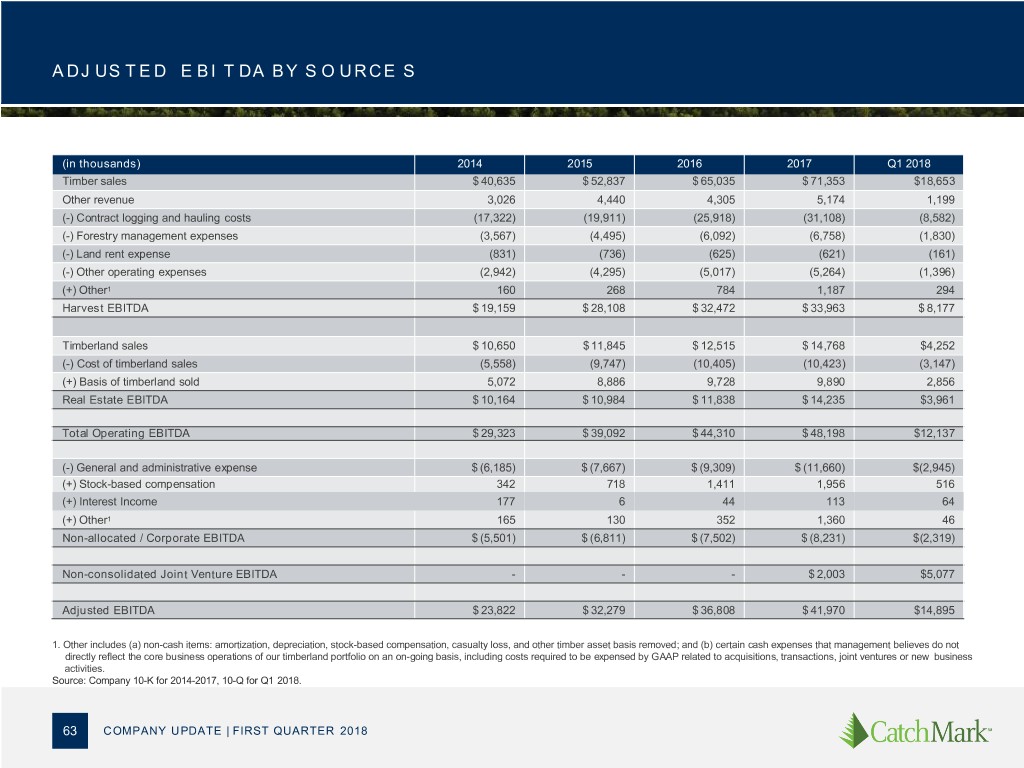

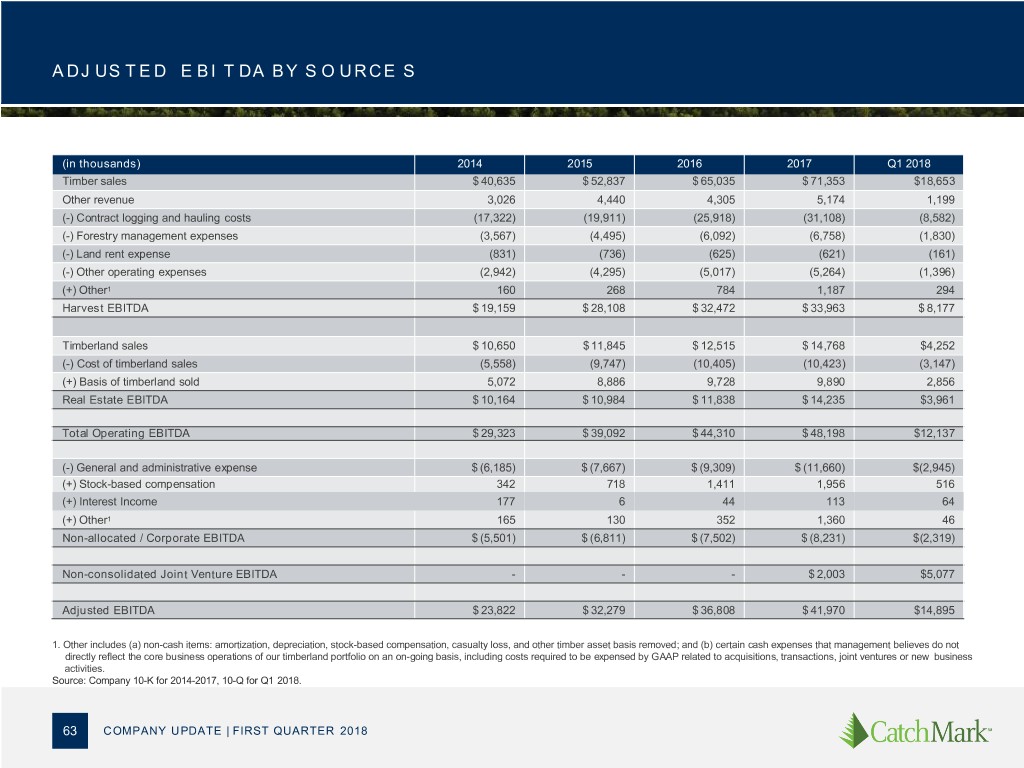

A DJ US T E D E BI T DA BY S O URCE S (in thousands) 2014 2015 2016 2017 Q1 2018 Timber sales $ 40,635 $ 52,837 $ 65,035 $ 71,353 $18,653 Other revenue 3,026 4,440 4,305 5,174 1,199 (-) Contract logging and hauling costs (17,322) (19,911) (25,918) (31,108) (8,582) (-) Forestry management expenses (3,567) (4,495) (6,092) (6,758) (1,830) (-) Land rent expense (831) (736) (625) (621) (161) (-) Other operating expenses (2,942) (4,295) (5,017) (5,264) (1,396) (+) Other1 160 268 784 1,187 294 Harvest EBITDA $ 19,159 $ 28,108 $ 32,472 $ 33,963 $ 8,177 Timberland sales $ 10,650 $ 11,845 $ 12,515 $ 14,768 $4,252 (-) Cost of timberland sales (5,558) (9,747) (10,405) (10,423) (3,147) (+) Basis of timberland sold 5,072 8,886 9,728 9,890 2,856 Real Estate EBITDA $ 10,164 $ 10,984 $ 11,838 $ 14,235 $3,961 Total Operating EBITDA $ 29,323 $ 39,092 $ 44,310 $ 48,198 $12,137 (-) General and administrative expense $ (6,185) $ (7,667) $ (9,309) $ (11,660) $(2,945) (+) Stock-based compensation 342 718 1,411 1,956 516 (+) Interest Income 177 6 44 113 64 (+) Other1 165 130 352 1,360 46 Non-allocated / Corporate EBITDA $ (5,501) $ (6,811) $ (7,502) $ (8,231) $(2,319) Non-consolidated Joint Venture EBITDA - - - $ 2,003 $5,077 Adjusted EBITDA $ 23,822 $ 32,279 $ 36,808 $ 41,970 $14,895 1. Other includes (a) non-cash items: amortization, depreciation, stock-based compensation, casualty loss, and other timber asset basis removed; and (b) certain cash expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. Source: Company 10-K for 2014-2017, 10-Q for Q1 2018. 63 COMPANY UPDATE | FIRST QUARTER 2018

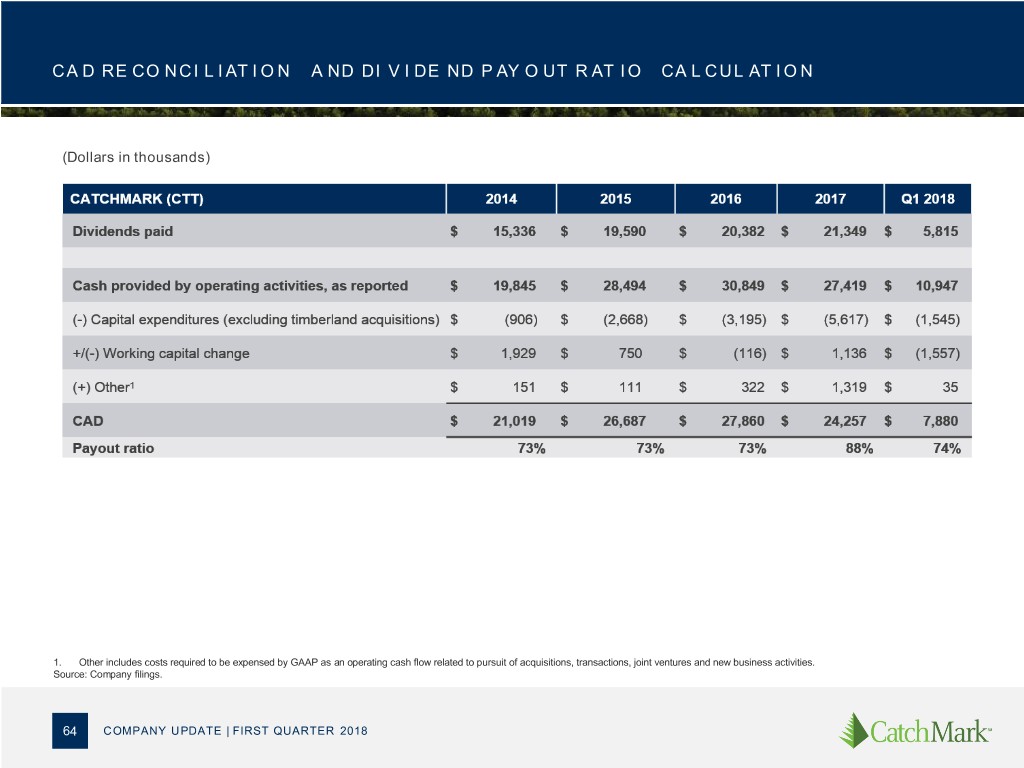

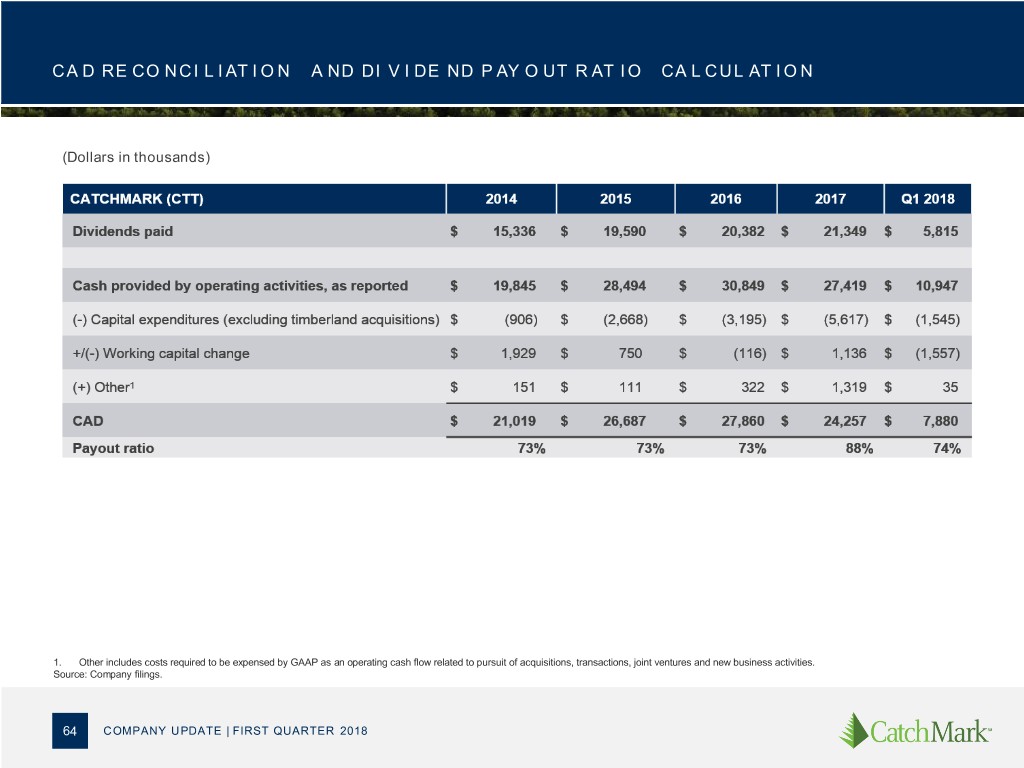

CA D RE CO NCI L I AT I O N A ND DI V I DE ND P AY O UT R AT I O CA L CUL AT I O N (Dollars in thousands) 1. Other includes costs required to be expensed by GAAP as an operating cash flow related to pursuit of acquisitions, transactions, joint ventures and new business activities. Source: Company filings. 64 COMPANY UPDATE | FIRST QUARTER 2018

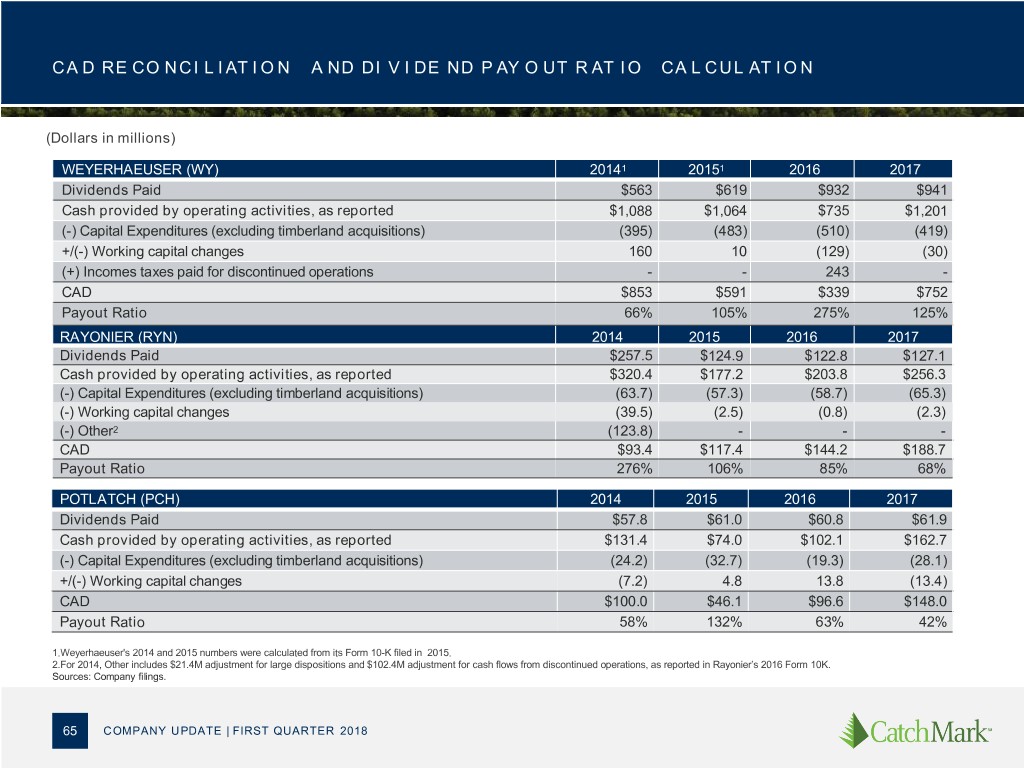

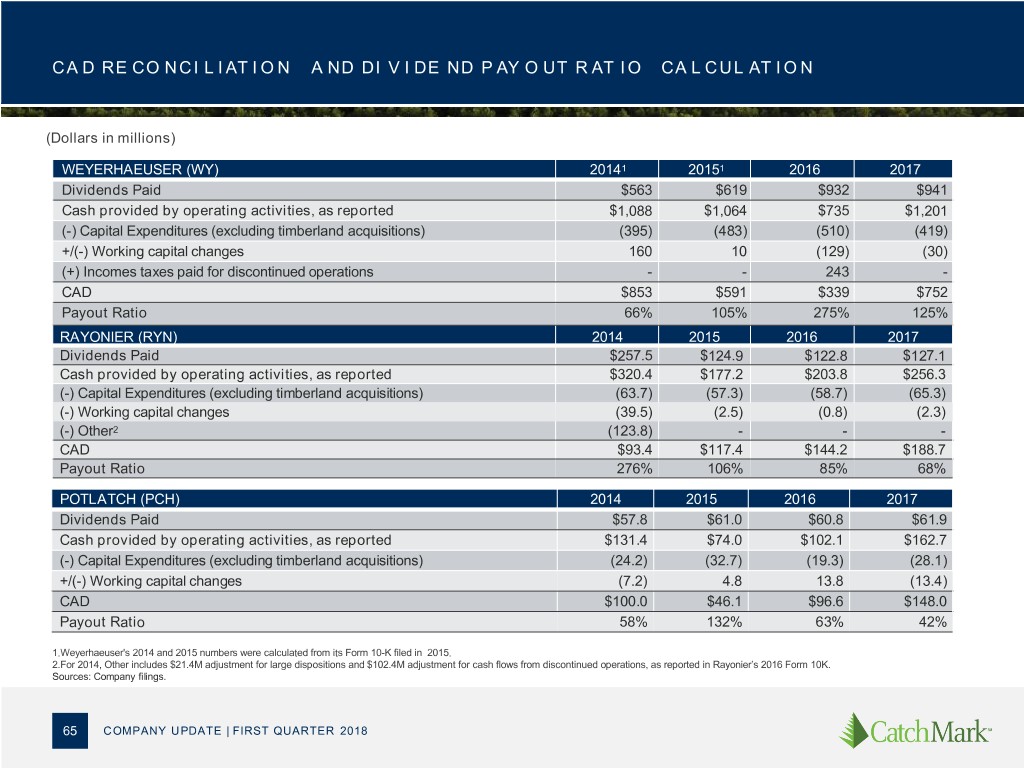

CA D RE CO NCI L I AT I O N A ND DI V I DE ND P AY O UT R AT I O CA L CUL AT I O N (Dollars in millions) WEYERHAEUSER (WY) 20141 20151 2016 2017 Dividends Paid $563 $619 $932 $941 Cash provided by operating activities, as reported $1,088 $1,064 $735 $1,201 (-) Capital Expenditures (excluding timberland acquisitions) (395) (483) (510) (419) +/(-) Working capital changes 160 10 (129) (30) (+) Incomes taxes paid for discontinued operations - - 243 - CAD $853 $591 $339 $752 Payout Ratio 66% 105% 275% 125% RAYONIER (RYN) 2014 2015 2016 2017 Dividends Paid $257.5 $124.9 $122.8 $127.1 Cash provided by operating activities, as reported $320.4 $177.2 $203.8 $256.3 (-) Capital Expenditures (excluding timberland acquisitions) (63.7) (57.3) (58.7) (65.3) (-) Working capital changes (39.5) (2.5) (0.8) (2.3) (-) Other2 (123.8) - - - CAD $93.4 $117.4 $144.2 $188.7 Payout Ratio 276% 106% 85% 68% POTLATCH (PCH) 2014 2015 2016 2017 Dividends Paid $57.8 $61.0 $60.8 $61.9 Cash provided by operating activities, as reported $131.4 $74.0 $102.1 $162.7 (-) Capital Expenditures (excluding timberland acquisitions) (24.2) (32.7) (19.3) (28.1) +/(-) Working capital changes (7.2) 4.8 13.8 (13.4) CAD $100.0 $46.1 $96.6 $148.0 Payout Ratio 58% 132% 63% 42% 1.Weyerhaeuser's 2014 and 2015 numbers were calculated from its Form 10-K filed in 2015. 2.For 2014, Other includes $21.4M adjustment for large dispositions and $102.4M adjustment for cash flows from discontinued operations, as reported in Rayonier’s 2016 Form 10K. Sources: Company filings. 65 COMPANY UPDATE | FIRST QUARTER 2018