Exhibit 10.4

Execution Version

OPTION AGREEMENT

THIS OPTION AGREEMENT (this “Agreement”), made as of the Effective Date (as defined in paragraph 26 below), by and among FIA TIMBER PARTNERS II, L.P., a Delaware limited partnership (hereinafter referred to as “Seller”), CATCHMARK TIMBER TRUST, INC., a Maryland corporation (hereinafter referred to as “Purchaser”).

W I T N E S S E T H:

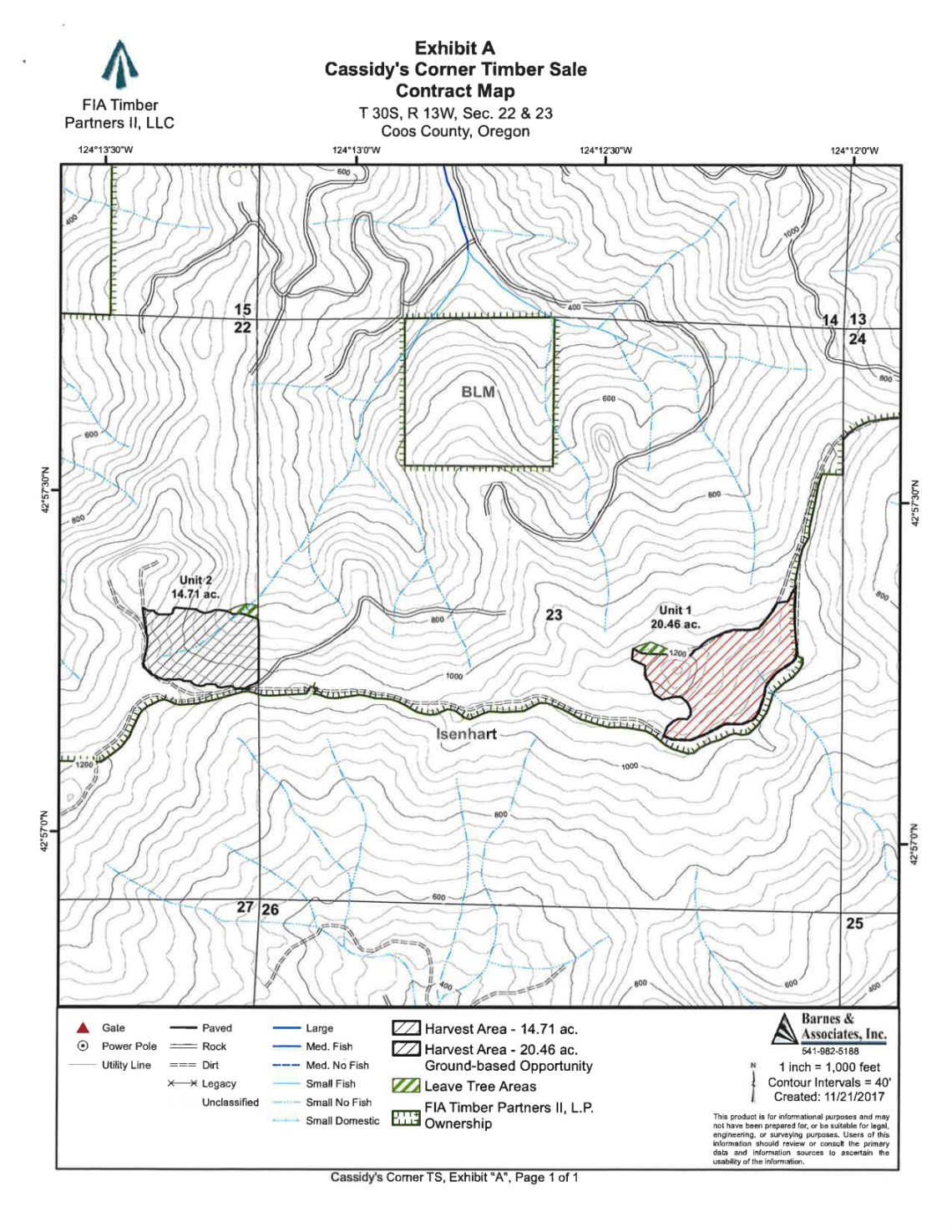

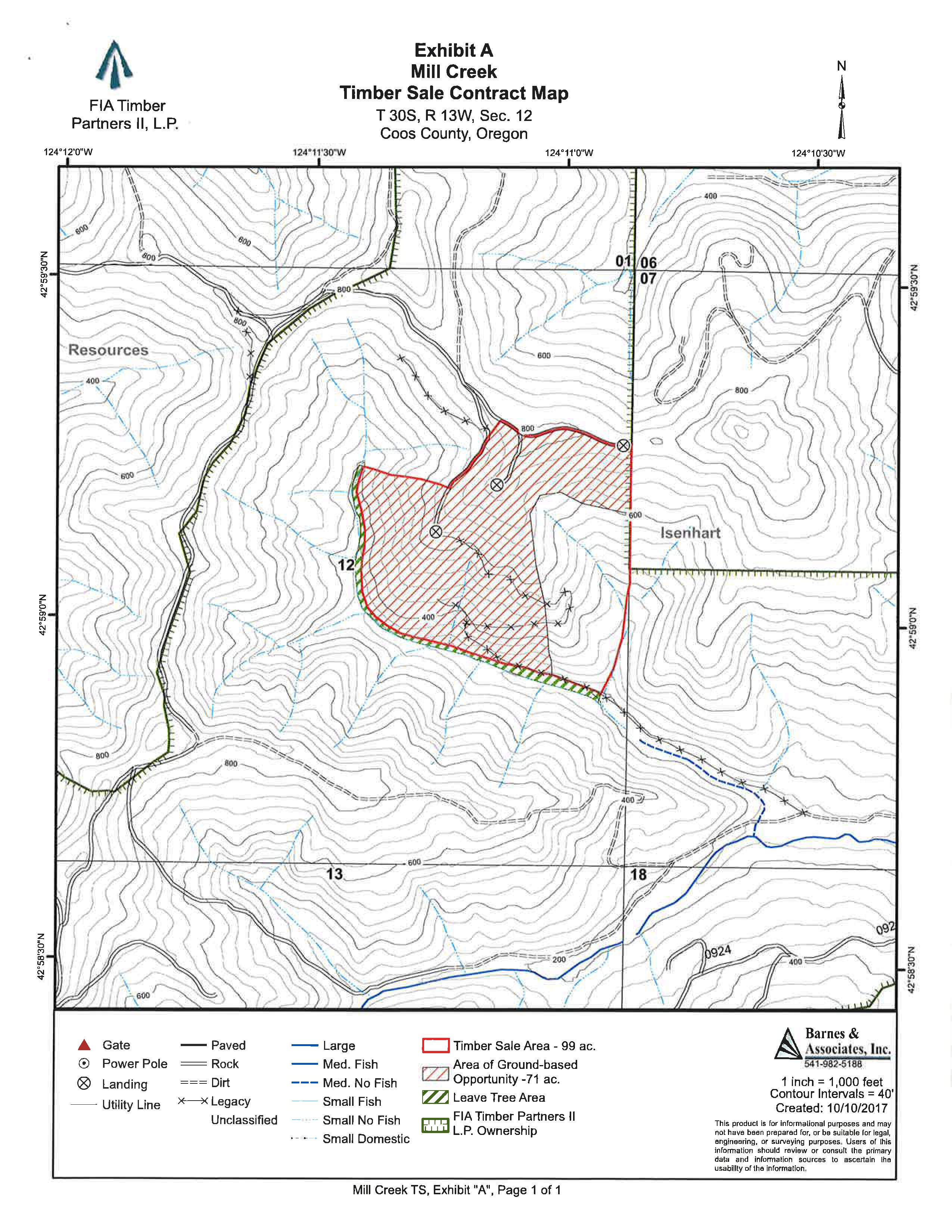

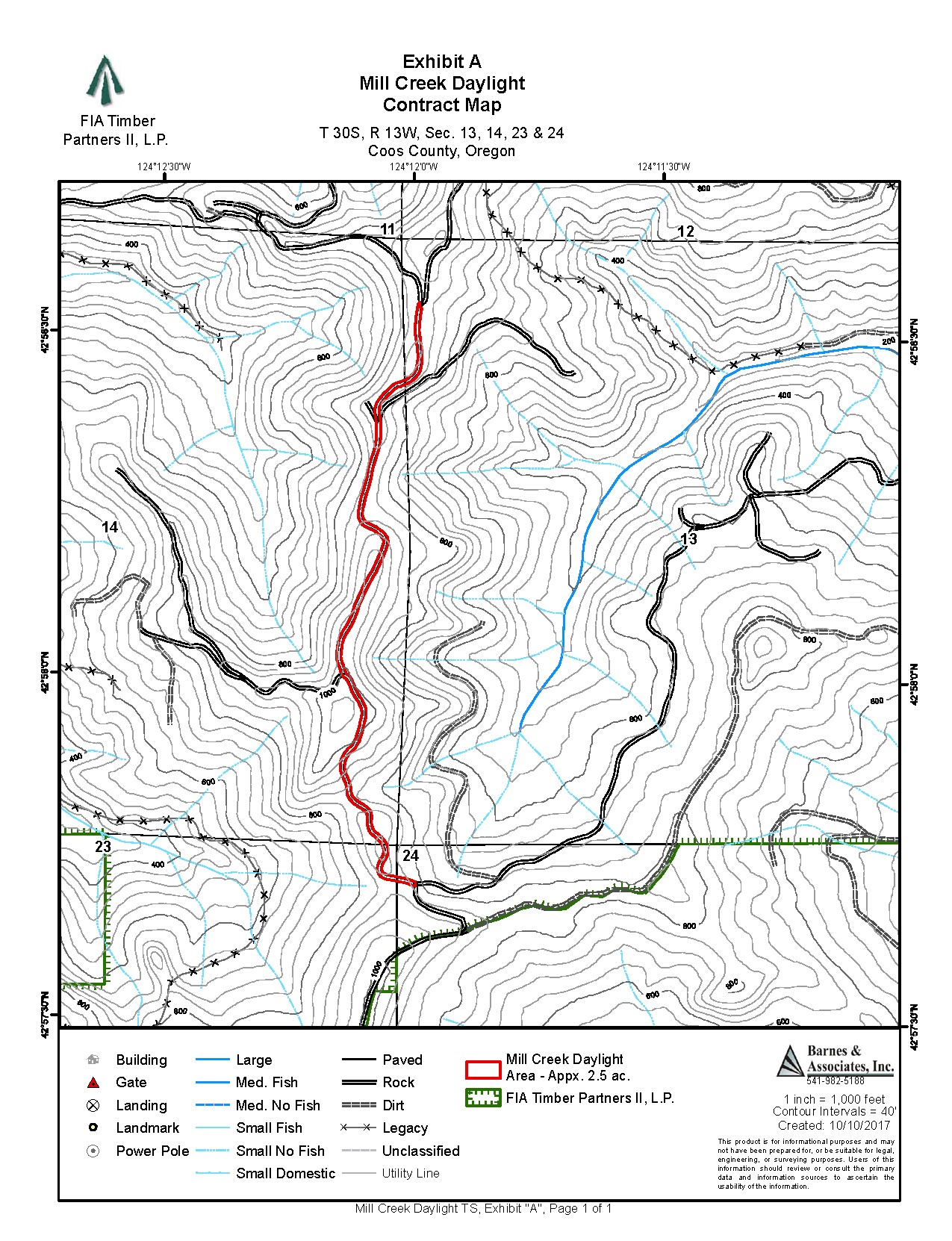

WHEREAS, Seller is the owner of those certain tracts or parcels of land in Coos and Curry Counties, Oregon, containing approximately ± 5,239 acres, which tracts or parcels are more fully described in Exhibit A-1 and which are identified as being owned by Seller as approximately depicted on the maps in Exhibit A-2, each attached hereto and hereby made a part hereof (the “Real Property”), together with Seller’s right, title and interest in the following: all buildings, structures, and other improvements located thereon, all tenements, hereditaments, easements, appurtenances and privileges thereto belonging, all trees, timber, sand, gravel, rock and crops now located thereon or thereunder, and all oil, gas and mineral rights and interests in the Real Property not reserved or conveyed by Seller or Seller’s predecessors in title prior to the Effective Date, and, to the extent assignable, Seller’s interests under the Unrecorded Encumbrances set forth on attached Exhibit D, less any of the Unrecorded Encumbrances that expire prior to Closing (the foregoing hereinafter referred to collectively with the Real Property and the Personal Property as defined in Section 4(b)(vi) below as the “Property”); and

WHEREAS, Purchaser desires to acquire an option to purchase the Property, and Seller is willing to grant to Purchaser an option sell the Property on the terms and subject to the conditions set forth in this Agreement;

NOW, THEREFORE, the parties have agreed and do hereby agree as follows:

1.Grant and Terms of Option. Subject to the provisions of this Agreement, and for the consideration herein stated, Seller hereby grants to Purchaser an exclusive and irrevocable option to purchase the Property (the “Option”). The Option shall be effective as of the Effective Date and shall continue in effect until 5:00 pm Eastern Time on June 29, 2018 (such date and time the “Option Expiration Time” and the period running between the Effective Date and the Option Expiration Time, the “Option Period”). Purchaser shall exercise the Option, if at all, by giving written notice to Seller within the Option Term stating that the Option is exercised (the “Exercise Notice”). Purchaser may exercise the Option only as to all of the Property and no partial exercise of the Option shall be permitted. Upon timely exercise of the Option, Seller shall be obligated to sell, and Purchaser shall be obligated to purchase, the Property for the price and on the terms and conditions set forth in this Agreement. If Purchaser fails to exercise the Option within the Option

Term, this Agreement will automatically terminate, Seller will retain the Option Consideration and Purchaser will have no further right to acquire the Property.

2. Purchase Price; Assumed Liabilities. If Purchaser timely exercises the Option, the purchase price (subject to adjustment as provided herein, hereinafter referred to as the “Purchase Price”) to be paid by Purchaser for the Property shall be TWENTY-FIVE MILLION THREE HUNDRED NINETY-EIGHT THOUSAND FOUR HUNDRED SEVENTY-FOUR AND 45/100 DOLLARS ($25,398,474.45), and shall be payable to Seller by wire transfer of immediately available funds at the date of Closing to an account designated by Seller. The purchase and sale pursuant to this Agreement is not based on a per-acre price and the Purchase Price shall not be subject to adjustment if the acres within the Property are more or less than the above-stated numbers of acres. The Purchase Price shall be allocated between the Personal Property and the Real Property as set forth on attached Exhibit K. Any subsequent adjustment to the Purchase Price under this Agreement shall be deemed an adjustment to the amount allocated to the Real Property. The portion of the Purchase Price which is allocated to the Real Property pursuant to Exhibit K (as such allocation may be subsequently adjusted pursuant to this Agreement) shall be used as the consideration required to be stated on the face of the Deed. As additional consideration for the purchase and sale transaction contemplated by this Agreement, Purchaser shall assume from Seller at Closing: (a) all liabilities and obligations of Seller arising on or after the Closing Date (as defined herein) under easements and other matters of record affecting the Real Property which impose obligations on the owner thereof and under the Unrecorded Encumbrances (as defined herein) other than the Timber Cutting Agreements set forth on Exhibit D (the “Timber Cutting Agreements”, which Timber Cutting Agreements are being retained by Seller); and (b) all Continuing Obligations as defined in Section 36 below (collectively, the “Assumed Liabilities”).

3. Option Consideration. Contemporaneously with Purchaser’s execution of this Agreement, Purchaser has delivered to Seller by wire transfer of immediately available funds the sum of $1,015,938,98 as non-refundable option consideration (said amount is hereinafter referred to as the “Option Consideration”). The Option Consideration is non-refundable except as otherwise provided in this Agreement and shall be considered earned by Seller on receipt, but shall be credited against the Purchase Price at Closing (if Closing occurs).

4. Closing.

(a) If the Option is exercised, the delivery of the funds, documents and instruments for the consummation of the purchase and sale pursuant hereto (herein referred to as the “Closing”) shall take place on July 13, 2018 at 10:00 a.m. Pacific Time through the escrow services of First American Title Insurance Company, Six Concourse Parkway, Suite 2000, Atlanta, Georgia 30328 (hereinafter referred to as “Title Company” and "Escrow Agent"), or on such earlier date and time, and/or such other location, as may be mutually agreeable to Seller and Purchaser (the “Closing Date”).

2

97087663.1 0067129-00001

(b) At the Closing, Seller shall deliver the following:

(i) one or more (at Purchaser’s election) Statutory Special Warranty Deeds (warranting only against the claims of persons claiming by, through or under Seller) for each county in which the Real Property is located, in the form of Exhibit B attached hereto, and subject only to the Unrecorded Encumbrances and the Permitted Encumbrances (both as hereinafter defined) and further excepting from Seller’s warranties contained in such deed(s) those certain matters affecting Seller’s title set forth on attached Exhibit C (collectively, the “Deed”); and, to the extent the Seller or its timber buyers under the Timber Cutting Agreements have not, by Closing, completed harvesting and removal of the timber from the Harvest Parcels identified on Exhibit E (the “Unharvested Timber”), the Deed shall contain a reservation of the Unharvested Timber in favor of Seller. The legal description of the Real Property to be contained in the Deed shall be the legal description of the Real Property as set forth on Exhibit A attached hereto and hereby made a part hereof (as the same description may have been modified in connection with the Title Commitment or any Update thereto);

(ii) an affidavit as to the non-foreign status of Seller in form satisfactory to Seller;

(iii) a certificate or other documentary evidence complying with ORS 314.258 that is reasonably acceptable to the Title Company and sufficient to assure the Title Company that no withholding is required under ORS 314.258;

(iv) an assignment and assumption agreement with respect to Purchaser’s assumption of the Assumed Liabilities from Seller, in form attached as Exhibit F (the “Assignment and Assumption Agreement”);

(v) if Purchaser elects to purchase loan policy coverage or extended coverage or endorsements to the Basic Title Policy (as defined herein), an owner’s affidavit in the form attached hereto as Exhibit I (the “Owner’s Affidavit”);

(vi) a bill of sale, substantially in the form of attached Exhibit J, with respect to the crushed rock culvert stock listed on Schedule 4(b)(vi) (the “Personal Property”);

3

97087663.1 0067129-00001

(vii) a Closing statement; and

(viii) Seller hereby agrees to execute such other certificates, and do such other acts as may be reasonably necessary to consummate the purchase and sale contemplated hereby and to enable Purchaser to obtain the Basic Title Policy in accordance with this Agreement. The Owner’s Affidavit contemplated by Section 4(b)(v) above and any other affidavits or certificates executed by or on behalf of Seller at the Closing shall be given to the actual knowledge of the person or entity executing the same, without independent investigation or inquiry.

(c) At the Closing, Purchaser shall deliver the following:

(i) the Assignment and Assumption Agreement;

(ii) a Closing statement; and

(iii) Purchaser hereby agrees to deliver the Purchase Price (as it may be adjusted for the prorations and other adjustments required by this Agreement) less the credit for the Option Consideration and to execute such other certificates and affidavits, and do such other acts as may be reasonably necessary to consummate the purchase and sale contemplated hereby and to obtain the Basic Title Policy in accordance with this Agreement.

5. Title.

(a) If the Option is timely exercised, Seller agrees to convey to Purchaser at Closing fee simple title to the Real Property by the Deed, free and clear of all liens, encumbrances, mortgages, deeds of trust, deeds to secure debt, assessments, agreements, options and covenants created or suffered by, through or under Seller, except for and subject to the Permitted Encumbrances, as hereinafter defined, and the matters set forth on attached Exhibit C.

4

97087663.1 0067129-00001

(b) To the extent not previously provided, contemporaneously with Seller’s execution of this Agreement, Seller will, at Seller’s cost, cause to be delivered to Purchaser a title insurance commitment, or similar title report sufficient to allow the Title Company to issue the Basic Title Policy, together with complete and legible copies of all documentary title exceptions listed or referred to therein, (the “Title Commitment”) issued by the Title Company. During the Option Period, Purchaser shall have the right to review Seller’s title to the Real Property and provide Seller with written notice (the “Title Objection Notice”) of Purchaser’s objections, if any, to Seller’s title. Purchaser shall have the right to object to any title matter affecting Seller’s title to the Real Property; provided, however, that Purchaser shall not object to (i) the lien of real property taxes not yet due and payable and additional taxes which may be assessed if the Real Property is disqualified for assessment as forest or farm land; and (ii) any title matter which does not adversely affect the use or value of the Property as commercial timberlands or for resale as timberlands. Failure of Purchaser to provide the Title Objection Notice to Seller within the Option Period will be deemed an election by Purchaser to waive any objection to the matters disclosed in such Title Commitment (in which case all liens, encumbrances, or other defects or special exceptions to coverage in such Title Commitment will thereafter be Permitted Encumbrances) and to accept such title as Seller is able to convey without any reduction in the Purchase Price.

(c) If Purchaser delivers the Title Objection Notice to Seller within the Option Period, Seller shall give written notice to Purchaser of its response to such objections indicating whether or not Seller will cure the matters objected to by Purchaser (the “Title Objection Response”); provided, however, that Seller shall at its sole cost secure the release of any monetary liens or encumbrances created by Seller and of a definite or ascertainable amount by Seller’s payment or bonding against the same at or prior to Closing other than the lien of real property taxes not yet due and payable and additional taxes which may be assessed if the Real Property is disqualified for assessment as forest or farm land (“Required Cure Matters”). Any failure of Seller to deliver a Title Objection Response within the Option Period shall be deemed an election by Seller not to cure any title objections raised in Purchaser’s Title Objection Notice. Other than with respect to Required Cure Matters, if Seller fails to, or elects not to, cure or satisfy any objections contained in the Title Objection Notice (a “Title Defect”) then Purchaser’s exercise of the Option shall be deemed Purchaser’s waiver of such Title Defect(s) and Purchaser will be required to close the sale without regard to said Title Defect(s) and without an adjustment to the Purchase Price (in which event such Title Defect(s) shall become Permitted Encumbrances for all purposes).

In the event that Seller delivers the Title Objection Response indicating that Seller will cure some or all of the Title Defects, Seller shall cure such Title Defects prior to Closing and, Seller, in its sole discretion, may extend the Closing Date for so many days as Seller may elect in order to cure such Title Defects, but in no event shall the aggregate number of days of extension exceed thirty (30) calendar days.

5

97087663.1 0067129-00001

(d) If Purchaser timely exercises the Option, within three (3) days following Purchaser’s receipt of any update to the Title Commitment disclosing any title matter which first appears in said updated Title Commitment or Purchaser’s receipt of notice of any unrecorded encumbrance affecting Seller’s title to the Real Property which comes into existence after Purchaser’s exercise of the Option (as applicable, an “Update”), in each case other than (i) any Pre-Closing Easements permitted under Section 5(e) below, (ii) any matter which has become a Permitted Encumbrance pursuant to Section 5(b) or 5(c) above, (iii) any title matter which does not adversely affect the use or value of the Property as commercial timberlands or for resale as timberlands, and (iv) the lien of real property taxes not yet due and payable and additional taxes which may be assessed if the Real Property is disqualified for assessment as forest or farm land, Purchaser shall have the right to notify Seller in writing of Purchaser’s objection to such new matter (a “Supplemental Title Objection Notice”). Failure of Purchaser to provide Seller with a Supplemental Title Objection Notice within such 3-day period will be deemed an election by Purchaser to waive any objection to the additional matters disclosed in such Update (in which case all liens, encumbrances, or other defects or special exceptions to coverage in such Update will thereafter be Permitted Encumbrances) and to accept such title as Seller is able to convey without any reduction in the Purchase Price. If Purchaser delivers a Supplemental Title Objection Notice to Seller within such 3-day period, Seller shall give written notice to Purchaser of its response to such objections within three (3) days after Seller’s receipt of Purchaser’s notice indicating whether Seller will cure the matters objected to by Purchaser (a “Supplemental Title Objection Response”); provided, however, that Seller shall at its sole cost secure the release of any Required Cure Matters appearing in the Update. Any failure of Seller to deliver a Supplemental Title Objection Response within the foregoing 3-day period shall be deemed an election by Seller not to cure any title objections raised in Purchaser’s Supplemental Title Objection Notice. Other than with respect to Required Cure Matters, if Seller fails to, or elects not to, cure or satisfy any objections contained in the Supplemental Title Objection Notice then Purchaser shall, as its sole and exclusive remedy, elect either to: (i) waive such objection and close the sale without an adjustment to the Purchase Price (in which event the matters set forth in the Supplemental Title Objection Notice shall become Permitted Encumbrances for all purposes); or (ii) terminate this Agreement and receive a refund of the Option Consideration.

In the event that Seller delivers the Supplemental Title Objection Response indicating that Seller will cure some or all of the matters set forth in the Supplemental Title Objection Notice, Seller shall cure such matters prior to Closing and, Seller, in its sole discretion, may extend the Closing Date for so many days as Seller may elect in order to cure such matters, but in no event shall the aggregate number of days of extension exceed thirty (30) calendar days.

6

97087663.1 0067129-00001

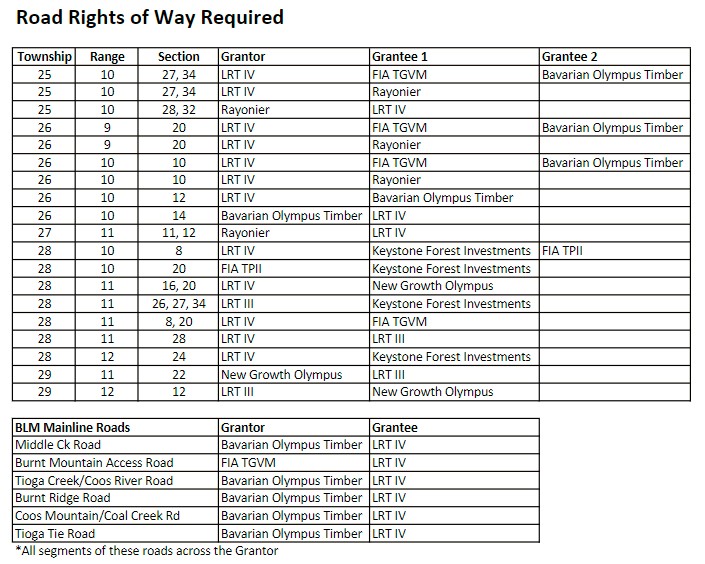

(e) For so long as this Agreement remains in force, Seller shall not lease, encumber or convey all or part of the Property or any interest therein, or enter into any agreement granting to any person any right with respect to the Property or any portion thereof, without the prior written consent of Purchaser; provided, however, that prior to Closing Seller shall be entitled to enter into (i) renewals or replacements of the Unrecorded Encumbrances listed on attached Exhibit D on substantially the same terms as existing on the Effective Date (except that Seller shall not, without the prior consent of Purchaser, enter into any renewals, extensions or replacements of any Timber Cutting Agreement that are not already permitted by the terms of such Timber Cutting Agreement, as amended through the Effective Date), and (ii) reciprocal or unilateral road easement agreements as more particularly outlined for Seller on attached Schedule 5(e), pursuant to which Seller, as applicable, may (a) as a grantor, grant to third parties access rights over existing roads located on the Real Property for purposes of transporting forest products and rock, timber management (including fire protection and suppression), and access to identified lands of such third parties; (b) as a grantee, be granted access over and across certain lands of third parties for purposes of transporting forest products and rock to and from, timber management (including fire protection and suppression) on, and access to and from portions of the Real Property (the foregoing collectively, the “Pre-Closing Easements”).

(f) For purposes of this Agreement, “Permitted Encumbrances” shall mean, collectively, (i) the Unrecorded Encumbrances; and (ii) and any other title matter to which Purchaser does not object, or for which Purchaser waives its objection or is deemed to have accepted pursuant to this Section 5.

(g) Purchaser acknowledges and agrees that Seller may continue to conduct ongoing timber harvesting operations until Closing on those harvest planning units identified in Exhibit E (the “Harvest Parcels”). If Seller is unable to complete such harvesting operations by Closing, Seller shall reserve in the Deed all right and title to the Unharvested Timber on such Harvest Parcels together with the right to complete such harvesting operations on such Harvest Parcels for one (1) year after the Closing (as such time for removal may be further extended under the terms of the Post Closing Harvest Agreement defined below). In such event, Purchaser and Seller shall enter into an access and harvest agreement at Closing in the form attached hereto as Exhibit H (the “Post Closing Harvest Agreement”). Seller shall retain all rights to such timber and all proceeds therefrom until Closing, and through the term of the Post Closing Harvest Agreement, if applicable.

6. Inspection.

(a) Purchaser and its agents, representatives, employees, engineers and contractors (“Purchaser Representatives”) shall have the right at any time during the term of this Agreement to enter upon the Real Property at their own risk to inspect, examine, survey and make

7

97087663.1 0067129-00001

timber cruises and other engineering tests or surveys, including a Phase I environmental site assessment (collectively, the “Tests”) which it may deem necessary or advisable, all at Purchaser’s sole cost and expense. Purchaser and the Purchaser Representatives will comply with such reasonable restrictions and requirements as Seller may impose in connection with their activities on the Real Property and, if so required by Seller, Purchaser will, prior to Purchaser or the Purchaser Representatives entering the Real Property, provide Seller with evidence of liability insurance in an amount and issued by an insurer reasonably satisfactory to Seller, covering the activities of Purchaser and the Purchaser Representatives on the Real Property and naming Seller as an additional insured. Upon completion of the Tests, Purchaser shall repair, at its sole cost and expense, any physical damage caused to the Real Property by Purchaser’s (or any Purchaser Representative’s) inspection of the Real Property and the Tests, and shall remove all debris and materials placed on the Real Property in connection with Purchaser’s inspection of the Real Property and the Tests. Purchaser shall keep the Real Property free of any liens resulting from Purchaser’s inspection of the Real Property and the Tests.

(b) Purchaser hereby agrees to indemnify, defend and hold Seller harmless from and against, and will compensate and reimburse Seller for, any and all causes, claims, demands, losses, liabilities, costs, damages, expenses and fees (including, but not limited to, reasonable attorney’s fees incurred at any level of proceedings including appeal) incurred or suffered by or asserted against Seller caused by or related to Purchaser’s or the Purchaser Representatives inspection of the Real Property or the Tests, with the exception of any causes, claims, demands, losses, liabilities, costs, damages, expenses and fees caused by the gross negligence of Seller. The foregoing indemnification shall survive any termination, cancellation or expiration of this Agreement or the Closing of the purchase and sale contemplated hereby.

7. [Intentionally Deleted]

8. Condition of Property; Damage; Condemnation.

(a) Seller agrees that at the Closing the Property shall be in the same condition as exists on the date hereof, subject to natural wear and tear, trespass, condemnation, removal of timber from the Harvest Parcels or pursuant to rights granted to third parties under the Unrecorded Encumbrances or under recorded instruments disclosed in the Title Commitment and any Updates thereto, Casualty (as defined herein), and the Permitted Encumbrances. During the term of this Agreement, Seller shall neither cut or remove nor permit the cutting or removal of any timber or trees which are included as part of the Property subject to and excepting from the foregoing prohibition any removal of timber from the Harvest Parcels or other Real Property pursuant to rights granted to third parties under the Unrecorded Encumbrances or under recorded instruments disclosed in the Title Commitment and any Updates thereto.

8

97087663.1 0067129-00001

(b) If at any time prior to the Closing, the Property or any part thereof (including, but not limited to, any timber or trees which are included as part of the Property) is destroyed or damaged by fire or other Casualty (as hereinafter defined), Seller shall deliver to Purchaser prompt written notice of such destruction or damage along with Seller’s good faith calculation of the amount of such damage resulting from the Casualty (calculated as the fair market value of the destroyed or damaged Property less the salvage value of such destroyed or damaged Property), and the transactions contemplated by this Agreement shall be subject to the provisions of this Section 8(b). The Closing Date shall be extended to the extent necessary to permit the compliance with all procedures set forth in this Section 8(b).

(i) If the amount of such damage (as finally determined pursuant to this Section 8) does not exceed $50,000 (the “Threshold Amount”), and Purchaser exercises the Option, or has previously exercised the Option, then Purchaser shall be required to purchase the Property in accordance with this Agreement without a reduction of the Purchase Price.

(ii) If the amount of such damage (as finally determined pursuant to this Section 8) exceeds the Threshold Amount but does not exceed $3,000,000, then, if Purchaser exercises the Option, or has previously exercised the Option, Purchaser shall be required to purchase the Property in accordance with this Agreement, provided that the Purchase Price shall be reduced by an amount equal to the amount of such damage (as finally determined pursuant to this Section 8).

(iii) If the amount of such damage (as finally determined pursuant to this Section 8) exceeds $3,000,000, then either party may, at its sole option, elect to cancel this Agreement by delivering written notice to the other party, whereupon Seller shall promptly return the Option Consideration to Purchaser and no party hereto shall have any further rights or obligations hereunder (except as may otherwise be expressly provided herein). If neither party elects to cancel this Agreement in accordance with the foregoing sentence, and Purchaser exercises the Option, or has previously exercised the Option, then the parties will proceed to Closing (subject to the other terms and conditions set forth in this Agreement) and the Purchase Price shall be reduced at Closing by an amount equal to the amount of such damage (as finally determined pursuant to this Section 8).

(iv) If Purchaser, by delivering written notice to Seller within fifteen (15) days following Seller’s delivery of written notice of any Casualty, disputes the amount of damage reported by Seller, Purchaser and Seller shall attempt in good faith to resolve such dispute and agree upon the amount of the damage. If Purchaser and Seller agree upon the amount of the damage resulting from the Casualty, such agreed amount shall be final and binding on the parties for purposes of this Section 8. However, if Purchaser and

9

97087663.1 0067129-00001

Seller are unable to agree as to the amount of damage from fire or other Casualty on or before ten (10) days after Purchaser delivers to Seller written notice of its dispute, then the amount of damage will be determined in accordance with Section 23 of this Agreement.

(c) If at any time prior to the Closing, any action or proceeding is filed or threatened under which any portion of the Property may be taken pursuant to any law, ordinance or regulation by condemnation or the right of eminent domain, Seller shall deliver to Purchaser prompt notice thereof. To the extent such action or proceeding would result in the taking of one thousand (1,000) acres or more, then Purchaser at its sole option shall elect, by delivering written notice to Seller within fifteen (15) days following Seller’s delivery of notice to Purchaser, either (i) to cancel this Agreement, whereupon Seller shall promptly return the Option Consideration to Purchaser and no party hereto shall have any further rights or obligations hereunder (except as may otherwise be expressly provided herein), or (ii) to purchase the Property pursuant to this Agreement, notwithstanding such action or proceeding. Failure by Purchaser to deliver written notice to Seller of its election within such fifteen (15) day period shall be deemed an election of clause (ii). If the action or proceeding would result in the taking of less than one thousand (1,000) acres, or if Purchaser elects or is deemed to elect clause (ii) above, then Purchaser shall receive a credit against the Purchase Price at Closing in the amount of all proceeds of any awards actually paid to Seller prior to Closing with respect to the Property so taken (less the costs of Seller incurred in procuring such proceeds or awards), or, if such amount is not known or received at the time of the Closing, the Purchase Price shall not be reduced and Seller shall instead assign to Purchaser at the Closing all of Seller’s right to such proceeds from such action or proceeding to the extent not yet received by Seller. To the extent such action or proceeding would result in the taking of one thousand (1,000) acres or more, the Closing Date shall be extended to the extent necessary to permit the exercise of such election by Purchaser.

9. Warranties and Representations; Indemnification.

(a) Seller hereby warrants and represents to Purchaser that as of the Effective Date and as of the date of Closing:

(i) Seller is a limited partnership duly registered and validly existing under the laws of the State of Delaware.

(ii) Seller has the full right, power, and authority to enter into and perform its obligations under this Agreement; and no consent, approval, order or authorization of any court or other governmental entity is required to be obtained by Seller in connection with the execution and delivery of this Agreement or the performance hereof by Seller.

10

97087663.1 0067129-00001

(iii) Attached hereto as Exhibit D is a true and accurate summary of all unrecorded agreements, Timber Cutting Agreements and other unrecorded licenses created by Seller that currently affect the Real Property that will remain in effect as of the Closing Date (the “Unrecorded Encumbrances”). The Unrecorded Encumbrances remain in full force and effect and have not been modified or amended, except as indicated on said Exhibit D. To Seller’s knowledge, no event or condition exists or has occurred which with notice, the passage of time or otherwise would constitute a material default or event of default under any of the Unrecorded Encumbrances.

(iv) There is no pending or, to Seller’s knowledge, threatened litigation, action or proceeding (including, but not limited to, any condemnation or eminent domain action or proceeding or any litigation regarding the location of lines and corners of the Property or any action or proceeding regarding adverse possession by third parties of any Real Property) before any court, governmental agency or arbitrator which may adversely affect Seller’s ability to perform this Agreement or which may affect the Property.

(v) To Seller’s knowledge, (i) Seller’s use of the Real Property is in material compliance with all statutes, ordinances, rules, regulations, orders and requirements of all federal, state and local authorities and any other governmental entity having jurisdiction over the Property (“Laws”), and (ii) no condition exists on the Property which violates any Laws in any material respect. Seller has not received any notice from any such governmental entity of any violation of any Laws.

(vi) Seller has received no written notice of any pending or threatened actions against Seller or the Real Property based upon the presence on the Real Property of any species listed as threatened or endangered under the Endangered Species Act of the United States or any law of the State of Oregon protecting endangered or threatened animal or plant species, and Seller has no knowledge of the current or past presence on the Real Property of any such threatened or endangered species that would adversely affect the Purchaser’s ability to conduct commercial timber operations on the Real Property.

(vii) Seller (which for this purpose includes Seller’s partners, members, principal stockholders and managers) (x) has not been designated as a “specifically designated national and blocked person” on the most current list published by the U.S. Treasury Department Office of Foreign Assets Control at its official website, <http://www.treas.gov/ofac/t11sdn.pdf> or at any replacement website or other replacement official publication of such list and (y) is currently in compliance with and will at all times during the term of this Agreement remain in compliance with the regulations of the Office of Foreign Asset Control of the Department of the Treasury and any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action relating thereto.

11

97087663.1 0067129-00001

(viii) Except as disclosed in the Phase I, Neither Seller nor, to Seller’s knowledge, any other person has used any portion of the Real Property as a land fill or as a dump to receive garbage, refuse, or waste, whether or not hazardous (other than unauthorized household refuse dump sites typical of rural timberlands not more than 1/4 acre in size), and, except as disclosed in the Phase I, neither Seller nor, to Seller’s knowledge, any other person has stored, handled, installed or disposed in, on or about the Real Property any Hazardous Substance, except for, in accordance with applicable Law, (A) the use of motor vehicle lubricants and fuels, and (B) the application of silvicultural and agricultural chemicals. For purposes of this warranty, the term “Hazardous Substance” means any chemical, compound, constituent, material, waste, contaminant (including petroleum, crude oil or any fraction thereof) or other substance, defined as hazardous or toxic, or otherwise regulated by any of the following laws and regulations promulgated thereunder as amended from time to time prior to the Effective Date: (1) the Comprehensive Environmental Response, Compensation and Liability Act (as amended by the Superfund Amendments and Reauthorization Act), 42 U.S.C. § 9601 et seq.; (2) the Resource Conservation and Recovery Act of 1976, 42 U.S.C. § 6901 et seq.; (3) the Hazardous Materials Transportation Act, 49 U.S.C. § 1801 et seq.; (4) the Toxic Substances Control Act, 15 U.S.C. § 2601 et seq.; (5) the Clean Water Act, 33 U.S.C. § 1251 et seq.; (6) the Clean Air Act, 42 U.S.C. § 1857 et seq.; and (7) all laws of the State of Oregon that are based on, or substantially similar to, the federal statutes listed in clauses (1) through (6) of this sentence.

(ix) Except as provided under the Unrecorded Encumbrances (including the Timber Cutting Agreements) and under recorded instruments disclosed in the Title Commitment and any Updates thereto: (A) to Seller’s knowledge, no third party has any rights to enter upon the Real Property to harvest and remove any timber therefrom; and (B) no timber or trees have been removed or harvested from the Real Property or affected by any Casualty causing damage in excess of the Threshold Amount since February 2, 2018 (the “Inventory Date”). For purposes of this Agreement, “Casualty” shall mean any physical damage to or loss of the timber on any portion of the Property by fire, earthquake, flood, insects, disease or other calamity, or as a result of timber trespass or unauthorized harvest.

(x) except for the Unrecorded Encumbrances, to Seller’s knowledge, there are no unrecorded contracts, leases, or other agreements that affect the ownership, use or operation of the Real Property and that would be binding on Purchaser after the Closing date.

(xi) to Seller’s knowledge, except as disclosed in the Title Commitment and any Updates thereto, (A) no taxes or assessments relating to the Property are delinquent, and (B) there are no special taxes, assessments or charges proposed, pending or threatened against the Property. During the period of Seller’s ownership of the Real

12

97087663.1 0067129-00001

Property, neither Seller nor, to the best of Seller’s knowledge, any other person or entity has caused any portion of the Real Property to violate the terms and conditions of any program in which such portion is enrolled that allows reduced ad valorem real property tax assessments for agricultural or silvicultural use.

(xii) to Seller’s knowledge, there have been no active mining operations conducted on the Real Property during the period in which Seller has owned the Real Property, and Seller has no knowledge of any proposed mineral activity on the Real Property.

(xiii) Subject to the limitations set forth in Section 9(d) and 9(e) below, if Purchaser exercises the Option, Seller will hold harmless, indemnify and defend Purchaser from and against any and all obligations, liabilities, claims, liens or damages suffered or incurred by Purchaser or imposed against the Property on account of any breach of any representation or warranty of Seller set forth in this Section 9(a).

(b) For purposes of this Agreement, “Seller’s knowledge” and similar phrases with respect to matters known by Seller shall be defined as the present, actual knowledge possessed by Sarah Hall and Jack Stover, without any duty of inquiry.

(c) Purchaser hereby warrants and represents to Seller, as of the Effective Date and as of Closing, that:

(i) Purchaser is a corporation duly organized and validly existing under the laws of the State of Maryland.

(ii) Purchaser has the full right, power and authority to enter into and perform its obligations under this Agreement; and no consent, approval, order or authorization of any court or other governmental entity is required to be obtained by Purchaser in connection with the execution and delivery of this Agreement or the performance hereof by Purchaser.

13

97087663.1 0067129-00001

(d) Notwithstanding anything herein to the contrary, all representations and warranties contained in this Section 9 shall survive the Closing and the delivery of the conveyance instruments to Purchaser for a period of one (1) year after the Closing Date (the “Survival Period”). No claim for a breach of any Seller representation or warranty, or the failure or default of a covenant or agreement of Seller that survives Closing, shall be actionable or payable unless written notice containing a description of the specific nature of such breach shall have been delivered by Purchaser to Seller prior to the expiration of the Survival Period. The maximum amount that Purchaser shall be entitled to collect from Seller in connection with all suits, litigation or administrative proceedings resulting from all breaches by Seller of any Seller representations or any covenants of Seller shall in no event exceed ten percent (10%) of the Purchase Price in the aggregate.

(e) The indemnification provisions set forth in this Section 9 shall provide the parties’ exclusive post-Closing remedy for breach of any representation or warranty set forth in this Agreement. Notwithstanding anything in this Agreement to the contrary, the limitations on remedies set forth in this Section and elsewhere in this Agreement shall not apply to or limit in any way any post-Closing rights or remedies (i) contained in or derived from the Deed or the other conveyance documents delivered at Closing, (ii) arising out of any fraud or intentional misconduct on the part of either party hereto, or (iii) any right of contribution or indemnification existing under any statute or law resulting from the existence on the Closing date of any “Recognized Environmental Condition” (as such term is defined in ASTM Practice E 2247-16 Standard Practice for Environmental Site Assessments: Phase I Environmental Site Assessment Process for Forestland or Rural Property) affecting the Property.

10. Brokerage Commission. Seller shall indemnify and hold Purchaser harmless from all claims, losses, liabilities and expenses (including but not limited to reasonable attorneys’ fees and court costs actually incurred) which Purchaser may incur on account of any claim which may be asserted against Purchaser, whether or not meritorious, by any broker or other person on the basis of any agreements made or alleged to have been made by or on behalf of Seller for commissions or other compensation for bringing about the transaction contemplated by this Agreement. Purchaser shall indemnify and hold Seller harmless from all claims, losses, liabilities and expenses (including but not limited to reasonable attorneys’ fees and court costs actually incurred) which Seller may incur on account of any claim which may be asserted against Seller, whether or not meritorious, by any broker or other person on the basis of any agreements made or alleged to have been made by or on behalf of Purchaser for commissions or other compensation for bringing about the transaction contemplated by this Agreement. This Section 10 shall survive the Closing or any termination, cancellation or expiration of this Agreement.

11. Prorations of Income; Taxes; Expenses.

14

97087663.1 0067129-00001

(a) All rent and other income and all expenses relating to the Property (other than any deficit or surplus balances under BLM road use agreements) shall be prorated as of the date of Closing. If the actual rent and other income and all expenses relating to the Property are not known as of the date of Closing, then within thirty (30) days after Closing or the date such amounts became known (whichever is later), Seller and Purchaser shall reconcile such actual rent and other income and all expenses with the prorations done at Closing, and an adjusting payment shall be made between the parties to effectuate the final prorated amounts. This obligation shall survive the Closing.

(b) Ad valorem real property taxes on the Property and special assessments (including, without limitation, fire protection district assessments) shall be prorated as of the Closing Date. If actual tax bills for the calendar year of Closing are not available, said taxes shall be prorated based on tax bills for the previous calendar year and the parties hereto agree to cause a reproration of said taxes upon the receipt of tax bills for the calendar year of Closing and an adjusting payment shall be made between the parties to effectuate the final prorated amounts. This obligation to reprorate shall survive the closing of the purchase and sale contemplated hereby. If the Real Property is not designated a separate tax parcel from any real property which is not being purchased by Purchaser under this Agreement, the taxes for such tax parcel shall be adjusted to an amount bearing the same relationship to the total tax bill which the acreage contained within the Real Property bears to the acreage contained within the total real property included within said tax bill.

(c) Purchaser and Seller shall each pay one-half of the Escrow Agent’s standard closing fees for the transaction. Purchaser shall pay the costs of recordation of the Deed.

15

97087663.1 0067129-00001

(d) Seller shall pay any and all fees, costs and expenses for title searches and examinations and other title-related charges in connection with obtaining the initial Title Commitment (if any charged separately from the Basic Title Policy premium), and the premium for the issuance of a single standard coverage owner’s policy of title policy in the amount of the Purchase Price and without endorsements or extended coverage insuring Purchaser of good and marketable title to the Real Property, subject only to the Permitted Encumbrances and the standard printed exceptions appearing in such policy form (the “Basic Title Policy”). Purchaser shall pay any and all fees, costs and expenses for any additional title searches and examinations and other title-related charges (if any charged separately from the Basic Title Policy premium) in connection with the issuance of any Updates or any title search and examination which is required in connection with any Title Objection Notice or Supplemental Title Objection Notice delivered by Purchaser. Purchaser shall also pay the premium and title related charges for any loan policies and extended coverage form policies of title insurance and any endorsements thereto or to the Basic Title Policy, if requested by Purchaser, and for any loan title policy required by Purchaser’s lender; provided, however, that a commitment to issue any such loan policies and extended coverage or endorsements shall not be a condition precedent to Purchaser’s obligations to close the transactions contemplated by this Agreement and Seller shall not be obligated in any event to indemnify the Title Company to induce it to issue the Basic Title Policy or any extended coverage or endorsements requested by Purchaser (other than a standard “gap” indemnity, if required by the Title Company, and delivery of the Owner’s Affidavit contemplated by Section 4(b)(v) above).

(e) Each party shall pay its respective costs and expenses of legal representation.

(f) Purchaser shall be solely responsible and liable for any deferred, rollback, recapture or other tax or assessment (“Rollback Taxes”) imposed or charged with respect to the Property or any part thereof for or relating to any periods prior to or subsequent to the Closing based on any change of use of the Property by Purchaser. Seller shall be responsible for any Rollback Taxes based upon the actions of Seller, including but not limited to the sale of the Property to Purchaser. The provisions of this subparagraph (f) shall survive the Closing.

12. Default; Remedies.

(a) If Purchaser timely exercises the Option, and the purchase and sale of the Property contemplated hereby is not thereafter consummated on or prior to the Closing Date (as it may be extended under this Agreement) because of a default by Purchaser under this Agreement, then, in addition to Seller retaining the Option Consideration, Purchaser shall reimburse Seller on demand for Seller’s reasonable and documented third party cost and expenses incurred in connection with this Agreement, provided said reimbursement obligation under this Agreement

16

97087663.1 0067129-00001

shall not exceed $100,000.00 in the aggregate. Purchaser’s payment of Seller’s expenses as provided above shall be Seller’s sole remedy.

(b) If Purchaser timely exercises the Option, and the purchase and sale of the Property contemplated hereby is not thereafter consummated on or prior to the Closing Date (as it may be extended under this Agreement) because of a default by Seller under this Agreement, then Purchaser shall have the right, as its sole and exclusive remedy, either (i) to terminate this Agreement, whereupon Seller will return the Option Consideration to Purchaser, and the parties hereto will have no further rights or obligations hereunder (except as otherwise expressly provided herein), (ii) to waive any such default and proceed to Closing, (iii) to seek specific performance of this Agreement, or (iv) if specific performance is not available to Purchaser, Seller shall reimburse Purchaser on demand for Purchaser’s reasonable and documented third party cost and expenses incurred in connection with this Agreement, provided said reimbursement obligation under this Agreement shall not exceed $100,000.00 in the aggregate.

13. Assignment. Except as otherwise expressly permitted in this Agreement, neither party hereto shall assign its rights or obligations hereunder, in whole or in part, without the prior written consent of the other party, which written consent will not be unreasonably withheld of delayed. Notwithstanding the foregoing, (a) Purchaser shall have the right, upon written notice given to Seller not less than five (5) days prior to the Closing Date, to assign its rights and obligations under this Agreement in whole or in part to any affiliate or affiliates of Purchaser, provided that Purchaser shall remain liable for all obligations under this Agreement to the extent arising out of or relating to performance, acts or omissions occurring prior to Closing; and (b) Purchaser may assign this Agreement at the Closing, but not earlier, to any institutional lender or lenders as security for obligations to such lender or lenders in respect of financing arrangements of Purchaser or any affiliates thereof with such lender or lenders. Without limiting the generality of the foregoing, Purchaser may elect to have some or all of the Property, and/or the timber located thereon, conveyed directly at Closing to one or more of Purchaser’s affiliates and in such event the Deed shall be delivered to, and the applicable instruments of conveyance and assumption delivered at Closing shall be executed by, such affiliate or affiliates, as applicable.

14. No Waiver. No action or failure to act by any party hereto shall constitute a waiver of any right or duty afforded to such party under this Agreement, nor shall any such action or failure to act constitute an approval of or acquiescence in any breach of this Agreement except as may be specifically agreed in writing.

15. Governing Law. This Agreement shall be governed by the laws of the State of Oregon.

17

97087663.1 0067129-00001

16. Notice. Any and all notices, elections and communications required or permitted by this Agreement shall be made or given in writing and shall be delivered in person or sent by postage, pre-paid, United States Mail, certified or registered, return receipt requested, or by a recognized overnight courier such as FedEx or UPS, or by facsimile or e-mail, to the other parties at the addresses set forth below, or such other address as may be furnished by notice in accordance with this paragraph. The date of notice given by personal delivery shall be the date of such delivery. The effective date of notice by mail, facsimile, email or overnight courier shall be the date such notice is mailed, faxed, emailed or deposited with such overnight courier. In the event that the last day for giving notice hereunder or for the performance of any obligation hereunder, including Closing, falls upon a Saturday, Sunday or a legal holiday, the last day for said notice or performance shall be deemed to be the next day which is neither a Saturday, Sunday nor a legal holiday.

Seller: FIA Timber Partners II, L.P.

c/o Forest Investment Associates L.P.

15 Piedmont Center

Suite 1250

Atlanta, Georgia 30305

Attention: Sarah Hall

Email: shall@forestinvest.com

with a copy to: Stoel Rives LLP

760 SW Ninth Ave., Suite 3000

Portland, OR 97205

Attention: Adam H. Dittman

Attention: Mark A. Norby

Facsimile: (503) 220-2480

Email: adam.dittman@stoel.com

Email: mark.norby@stoel.com

Purchaser: c/o CatchMark Timber Trust

Five Concourse Parkway

Suite 2325

Atlanta, Georgia 30328

Attention: John D. Capriotti

Facsimile No.: (770) 243-8172

Email: john.capriotti@catchmark.com

with a copy to: Smith, Gambrell & Russell, LLP

Suite 3100, Promenade II

1230 Peachtree Street, N.E.

Atlanta, Georgia 30309-3592

Attention: Mark G. Pottorff

Facsimile: (404) 685-6897

Email: mpottorff@sgrlaw.com

18

97087663.1 0067129-00001

17. Entire Agreement. This Agreement and the Confidentiality Agreement contain the entire agreement among the parties hereto with respect to the subject matter hereof and cannot be amended or supplemented except by a written agreement signed by Seller and Purchaser.

18. Captions. The captions of paragraphs in this Agreement are for convenience and reference only and are not part of the substance hereof.

19. Severability. In the event that any one or more of the provisions, paragraphs, words, clauses, phrases or sentences contained in this Agreement, or the application thereof in any circumstance is held invalid, illegal or unenforceable in any respect for any reason, the validity, legality and enforceability of any such provision, paragraph, word, clause, phrase or sentence in every other respect and of the remaining provisions, paragraphs, words, clauses, phrases or sentences of this Agreement, shall not be in any way impaired, it being the intention of the parties that this Agreement shall be enforceable to the fullest extent permitted by laws.

20. Counterparts. This Agreement may be executed in multiple counterparts which shall be construed together as one instrument. This Agreement, including any amendments thereto, may be executed and delivered by facsimile transmission, with the intention that such facsimile signature and delivery shall have the same effect as an original signature and actual delivery.

21. Binding Effect. This Agreement shall bind the parties hereto and their respective heirs, legal representatives, successors and assigns.

22. Time; Business Day.

(a) Time is of the essence of this Agreement; provided that in the event that the last day for performance of any obligation hereunder falls upon a day that is not a business day (as defined below), the last day for said performance shall be deemed to be the next business day.

(b) As used in this Agreement, the term “business day” shall mean any day that is not a Saturday, a Sunday, a legal holiday in the United States of America, or a legal holiday in the State of Oregon.

19

97087663.1 0067129-00001

23. Resolution of Disputes. In the event that any provision of this Agreement refers to this Section 23 for a determination of the amount of any change in the value of the Property or the fair market value of any portion(s) of the Property or the timber on the Property or to resolve a disagreement between the parties with respect to the allocation of the Purchase Price, Seller and Purchaser will promptly make a good faith attempt to mutually agree upon such fair market value or allocation. In the event Seller and Purchaser are unable to so agree within the time period specified in this Agreement after notice of the event or circumstance necessitating the need for such determination from either party to the other party, Seller and Purchaser will each promptly appoint an independent forestry consultant, each of which may be a consultant previously engaged by the appointing party with respect to the Property, and such two consultants will in turn promptly select a third independent forestry consultant (which third consultant may not be a consultant previously engaged by either party) to act with them in a panel to determine the appropriate fair market valuation or allocation. The panel of consultants will reach a binding decision within thirty (30) days of the selection of the third consultant, and the decision of the panel of consultants as to the fair market valuation or the amount of the Purchase Price to be allocated to Real Property or Personal Property that is in dispute will be final. Each party will submit its determination of value or, in the case of a dispute regarding the allocation of the Purchase Price, its position regarding the amount to be allocated to the item(s) in dispute to the panel of consultants within three (3) days of selection of the third consultant. When making is determination of value or of the proper allocation to attribute to a disputed allocation to Real Property or Personal Property, as applicable, the panel of consultants shall select the submission of the party that the panel determines most closely represents the fair market valuation of the Real Property or Personal Property for which the allocation of value is disputed taking into account any guidelines set forth in the applicable section of this Agreement, but the panel shall not be authorized to select a different amount. Seller shall pay the cost of its appointed consultant; Purchaser shall pay the cost of its appointed consultant; and Seller and Purchaser shall each pay one-half (1/2) of the cost of the third consultant. The Closing Date shall be extended to the extent necessary for such consultants to reach such decision but not by more than forty-five (45) days.

24. Public Announcements. Seller and Purchaser hereby agree that prior to the Closing, except as required by applicable laws or any applicable stock exchange rules, all press releases and other public announcements with respect to the transactions contemplated by this Agreement, including the time, form and content of such release or announcement, shall be made only with the prior mutual written agreement of Purchaser and Seller; provided, however, that any disclosure required to be made under applicable law may be made only if a party required to make such disclosure has determined in good faith and upon advice of legal counsel that it is necessary to do so and such party has used reasonable efforts, prior to the issuance of the disclosure, to provide the other party with a copy of the proposed disclosure and to discuss the proposed disclosure with the other party.

25. Patriot Act Compliance. Purchaser represents that neither Purchaser nor any of Purchaser’s affiliates, nor any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors, representatives or agents is, nor

20

97087663.1 0067129-00001

will they become, a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of the Treasury (including those named on OFAC’s Specially Designated and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action and is not and will not attempt to assign this contract to, contract with or otherwise engage in any dealings or transactions or be otherwise associated with such persons or entities. Any assignee of this contract is deemed to make this representation upon acceptance of an assignment of this contract. Purchaser’s primary address is as set forth in the notice section of this Agreement. Purchaser hereby covenants and agrees that if Purchaser obtains knowledge that Purchaser or any owner of any controlling interest in Purchaser becomes listed on the foregoing or is indicted, arraigned, or custodially detained on charges involving money laundering or predicate crimes to money laundering, Purchaser will immediately notify Seller in writing, and in such event, Seller will have the right to terminate this Agreement without penalty or liability to Seller immediately upon delivery of written notice thereof to Purchaser, in which event the Earnest Money will be returned to Purchaser and neither party will have any further rights or obligations under this Agreement, except for such as specifically survive termination.

26. Effective Date. The “Effective Date” of this Agreement will be the date the later of Seller and Purchaser has executed this Agreement, as indicated on the signature page(s) below.

27. Incorporation of Exhibits. All exhibits referred to herein are hereby incorporated in this Agreement by this reference.

28. AS IS. PURCHASER ACKNOWLEDGES THAT, EXCEPT FOR SELLER’S REPRESENTATIONS AND WARRANTIES SET FORTH IN SELLER’S SPECIAL WARRANTY OF TITLE IN THE DEED AND EXCEPT FOR SELLER’S REPRESENTATIONS AND WARRANTIES CONTAINED IN SECTION 9 OF THIS AGREEMENT: (I) NO REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, HAVE BEEN OR ARE BEING MADE BY OR ON BEHALF OF SELLER OR ANY OTHER PERSON, INCLUDING WITH RESPECT TO THE CONDITION OR VALUE OF THE PROPERTY OR THE TIMBER THEREON, AND SELLER HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES, EITHER EXPRESS OR IMPLIED, INCLUDING MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND SUITABILITY FOR ITS INTENDED USE, (II) IN ENTERING INTO THIS AGREEMENT, PURCHASER HAS NOT RELIED ON AND DOES NOT RELY ON ANY SUCH REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, BY OR ON BEHALF OF SELLER OR ANY OTHER PERSON, AND (III) PURCHASER SHALL ACQUIRE THE PROPERTY IN “AS IS, WHERE IS, AND WITH ALL FAULTS” CONDITION ON THE CLOSING DATE.

21

97087663.1 0067129-00001

29. Property Data and Materials; Confidentiality Agreement. Purchaser acknowledges that, except as may otherwise be provided in Section 9, any information or materials provided or made available to Purchaser or its representatives in hard copy, by facsimile or electronic transmission or via the online data room managed by Forest Investment Associates L.P., including, without limitation, any cost or other estimates, projections, acreage, and timber information, the Title Commitment, other title commitments, and other title policies, are not and shall not be deemed representations or warranties by or on behalf of Seller. Purchaser acknowledges and agrees that Purchaser is and will remain, until the Closing, subject to and bound by all of the prohibitions, requirements, restrictions and other provisions of that certain Confidentiality Agreement, dated as of February 16, 2018, between Forest Investment Associates L.P., in its capacity as investment manager, on behalf of Seller and Purchaser (the “Confidentiality Agreement”), and Purchaser reaffirms all of its obligations and liabilities thereunder.

30. No Survival. Except as otherwise provided herein, the provisions of this Agreement shall not survive the Closing of the purchase and sale contemplated hereby and shall be merged into the delivery of the Deed and other documents and the payment of all monies pursuant hereto.

31. No Solicitation. Seller agrees that it shall not after the Effective Date and until this Agreement is terminated, directly or indirectly, through any officer, director, employee, agent or otherwise, (a) solicit, initiate or encourage submission of proposals, offers or expressions of interest from any person or entity other than Purchaser relating to any acquisition or purchase of all or a portion of the Property (any of the foregoing proposals, offers or expressions of interest being referred to herein as an “Acquisition Proposal”), or (b) participate in any negotiations or discussions with any person other than Purchaser regarding, or furnish to such person any nonpublic information with respect to, or otherwise cooperate in any way with, or assist or participate in, facilitate or encourage, any Acquisition Proposal.

32. [Intentionally Deleted]

33. Property Information. To the extent not already delivered to Purchaser, and to the extent transferrable, Seller shall make available to Purchaser within ten (10) days of the date hereof copies of all title information owned by Seller and within Seller’s possession relating the Real Property, inventory information, GIS information, current third party contracts for silvicultural activities with respect to the Property, and plot data from Seller’s latest cruise of the Property (the “Property Information”). At Closing, Seller shall deliver both hard copies and electronic versions (to the extent in existence and to the extent transferrable) of the Property Information as Purchaser may reasonably request; provided, however, that Seller shall have no obligation to provide or make available to Purchaser at any time, and the term “Property Information” shall not include: (a) any information that is subject to the attorney-client, attorney work product doctrine or other privilege (as reasonably and in good faith determined by Seller), (b) any information regarding the pricing

22

97087663.1 0067129-00001

of timber, internal or external appraisals of the Real Property, other valuations or similar pricing or financial records, or any other information that is confidential and proprietary to Seller, (c) all communications by Seller personnel prior to the Closing Date regarding the transactions contemplated by this Agreement and any other documentation relating to the negotiation, documentation, and consummation of the transactions contemplated by this Agreement, (d) Seller’s investor and manager communications and (e) any document or item which Seller is contractually bound to keep confidential.

34. Statutory Notice. THE PROPERTY DESCRIBED IN THIS INSTRUMENT MAY NOT BE WITHIN A FIRE PROTECTION DISTRICT PROTECTING STRUCTURES. THE PROPERTY IS SUBJECT TO LAND USE LAWS AND REGULATIONS THAT, IN FARM OR FOREST ZONES, MAY NOT AUTHORIZE CONSTRUCTION OR SITING OF A RESIDENCE AND THAT LIMIT LAWSUITS AGAINST FARMING OR FOREST PRACTICES, AS DEFINED IN ORS 30.930, IN ALL ZONES. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON TRANSFERRING FEE TITLE SHOULD INQUIRE ABOUT THE PERSON’S RIGHTS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON ACQUIRING FEE TITLE TO THE PROPERTY SHOULD CHECK WITH THE APPROPRIATE CITY OR COUNTY PLANNING DEPARTMENT TO VERIFY THAT THE UNIT OF LAND BEING TRANSFERRED IS A LAWFULLY ESTABLISHED LOT OR PARCEL, AS DEFINED IN ORS 92.010 OR 215.010, TO VERIFY THE APPROVED USES OF THE LOT OR PARCEL, TO VERIFY THE EXISTENCE OF FIRE PROTECTION FOR STRUCTURES AND TO INQUIRE ABOUT THE RIGHTS OF NEIGHBORING PROPERTY OWNERS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009, AND SECTIONS 2 TO 7, CHAPTER 8, OREGON LAWS 2010.

35. Post-Closing Permit Transfer. Upon Seller’s completion, after Closing, of the harvest of Unharvested Timber, if any, from the Harvest Parcels listed on Exhibit E, or, if earlier, the date that Seller’s reservation of the Unharvested Timber expires (such date, as to each permit, the “Post-Closing Permit Transfer Date”), Seller shall assign the notifications of operations/permits for such harvest unit to Purchaser and Purchaser shall be deemed to have assumed the obligations arising under such permits, and such permits shall thereafter be Assumed Liabilities, except that Purchaser is not assuming, and shall not be liable for, any liabilities or obligations of Seller under such permits arising prior to the Post-Closing Permit Transfer Date other than unperformed reforestation obligations under such permits.

36. Continuing Obligations. Purchaser acknowledges that the Real Property is subject to certain reforestation and/or slash removal obligations imposed by applicable law or governmental regulations, including, without limitation, the Oregon Forest Practices Act,

23

97087663.1 0067129-00001

concerning the Real Property, including but not limited to the continuing obligations under the notifications listed on attached Exhibit G (collectively, the “Continuing Obligations”). The parties acknowledge that the disclosures set forth in Exhibit G satisfy the statutory requirements of ORS 527.665. As of the Closing, Purchaser assumes and agrees to perform the Continuing Obligations at Purchaser’s sole cost and expense in a timely fashion, and to indemnify, defend and hold Seller harmless from and against the Continuing Obligations and any claim, loss, damage, cost or expense arising from Purchaser’s failure to perform the same. The obligations under this Section shall survive Closing.

37. Fees and Expenses; Attorney’s Fees. Except as expressly provided in this Agreement to the contrary, whether or not the transactions contemplated by this Agreement are consummated, all legal and other costs and expenses incurred in connection the due diligence, preparation, negotiation and execution of this Agreement and in connection with the transactions contemplated hereby shall be paid by the party incurring such costs and expenses. Should any legal action or proceeding be commenced by either party in order to enforce this Agreement or any provision hereof or any agreement or instrument executed and delivered in connection with this Agreement, or in connection with any alleged dispute, breach, default, or misrepresentation in connection with any provision herein or therein contained, the prevailing party shall be entitled to recover reasonable attorneys’ fees and costs incurred in connection with such action or proceeding, including reasonable title insurance company charges or fees and reasonable and necessary expert witness fee and costs of pursuing or defending any legal action, including, without limitation, any on appeal, discovery or negotiation and preparation of settlement arrangements, in addition to such other relief as may be granted.

38. Conditions.

(a) Unless waived by Purchaser, if the Option is exercised, the obligations of Purchaser to purchase the Property under this Agreement are expressly made subject to the fulfillment in all respects of the following conditions precedent:

(i) the truth and accuracy as of the date of Closing of each and every warranty and representation herein made by Seller; and

(ii) Seller’s timely performance of and compliance with each and every term, condition, agreement, restriction and obligation to be performed and complied with by Seller prior to Closing under this Agreement; and

(iii) Purchaser shall have received, in the form of a “marked binder” delivered at Closing, an irrevocable commitment by the Title Company to issue to Purchaser the Basic Title Policy subject only to the payment of the premiums therefor

24

97087663.1 0067129-00001

at Closing (but, for the avoidance of doubt, the Title Company’s commitment to issue any extended coverage or endorsements to the Basic Title Policy or to issue loan policies to Purchaser’s lenders shall not be a condition to Closing).

In the event that Purchaser has exercised the Option, if any of the above conditions is not satisfied on or before the Closing, Purchaser will have the right, exercisable at Purchaser’s sole election, to exercise the remedies described in Section 12(b), provided however, that Purchaser shall not be entitled to exercise the remedies described in Section 12(b) if the failure of any such condition to be satisfied is on account of any fault of Purchaser or breach of this Agreement by Purchaser.

(b) Unless waived by Seller, upon exercise of the Option, the obligations of Seller to sell the Property under this Agreement are expressly made subject to the fulfillment in all respects of the following conditions precedent:

(i) the truth and accuracy as of the date of Closing of each and every warranty and representation herein made by Purchaser; and

(ii) Purchaser’s timely performance of and compliance with each and every term, condition, agreement, restriction and obligation to be performed and complied with by Purchaser prior to Closing under this Agreement.

In the event that Purchaser has exercised the Option, if any of the above conditions is not satisfied on or before the Closing, Seller will have the right, exercisable at Seller’s sole election, to exercise the remedies described in Section 12(a) provided however, that Seller shall not be entitled to exercise the remedies described in Section 12(a) if the failure of any such condition to be satisfied is on account of any fault of Seller or breach of this Agreement by Seller.

39. [signatures commence on following page]

25

97087663.1 0067129-00001

IN WITNESS WHEREOF, this Agreement has been duly executed, sealed and delivered by the parties hereto the day and year first above written.

Date of Seller’s Execution: ________________________ | SELLER: FIA TIMBER PARTNERS II, L.P., a Delaware limited partnership By: FIA Timber Management II, LLC, its General Partner By: Name: Charles L. VanOver Title: Vice President | |

[signatures continue on following page]

Date of Purchaser’s Execution: ________________________ | PURCHASER: CATCHMARK TIMBER TRUST, INC., a Maryland corporation By: _________________________ (SEAL) Name: _______________________ Title: _________________________ | |

[end of signatures]

Schedule of Exhibits

Exhibit A-1 - Real Property Descriptions

Exhibit A-2 - Maps Depicting Real Property

Exhibit B - Form of Deed

Exhibit C - Certain Title Matters

Exhibit D - Schedule of Unrecorded Encumbrances

Exhibit E - Harvest Parcels

Exhibit F - Form of Assignment and Assumption Agreement

Exhibit G - Continuing Obligations

Exhibit H - Form of Post-Closing Harvest Agreement

Exhibit I - Form of Owner’s Affidavit

Exhibit J - Form of Bill of Sale

Exhibit K - Allocation

97087663.1 0067129-00001

EXHIBIT A-1

Real Property Descriptions

Real property in the County of Coos, State of Oregon, described as follows:

TOWNSHIP 30 SOUTH, RANGE 12 WEST and

TOWNSHIP 30 SOUTH, RANGE 12 WEST andTOWNSHIP 30 SOUTH, RANGE 13 WEST

Parcel 54

97087663.1 0067129-00001

Secitons 13 and 18: All thoase portion of the NE 1/4, the NW 1/4, the SW 1/4 of Section 18, Township 30 South, Range 12 West of the Willamette Meridian, Coos County, Oregon and the SE 1/4, the SE 1/4 of the SW 1/4 of Section 13, Township 30 South, Range 13 West of the Willamette Meridian, Coos County, Oregon, lying Northwesterly of a line beginning at an iron pipe on the Section line between Sections 13 and 24, Townsip 30 South, Range 13 West of the Willamette Meridian, Coos County, Oregon 451.7 feet West from the South quarter corner of said Section 13; thence North 17° 13’ East 188.8 feet; thence North 23° 13’ East 351.7 feet to a iron pipe; thence North 35° 06’ East 1171.2 feet to an iron pipe on the West edge of a road; thence along the Northwesterly edge of said road North 17° 50’ East 142.8 feet; North 05° 32’ West 191.6 feet; North 30° 21’ East 133.2 feet North 54° 52’ East 263.6 feet; South 72° 07’ East 124.7 feet; South 51° 36’ East 160.2 feet; South 77° 22’ East 150.8 feet; South 87° 38’ East 281.2 feet; South 60° 45’ East 128.3 feet; North 63° 22’ East 310.8 feet; South 57° 47’ East 131.7 feet to an iron pipe on the Westelry edge of said road; thence South 80° 05’ East 324.3 feet to an iron pipe; thence North 44° 48’ East 210.5 feet to an iron pipe; thence North 42° 17’ East 404.0 feet to an iron pipe; thence North 40° 22’ East 546.2 feet to an iron pipe; thence North 71° 36’ East 205.3 feet to an iron pipe; thence North 44° 04’ East 411.8 feet to an iron pipe; thence North 33° 17’ East 129.6 feet to an iron pipe; thence North 42° 31’ East 218.5 feet to an iron pipe; thence North 36° 44’ East 196.8 feet to an iron pipe; thence North 29° 09’ East 240.6 feet to an iron pipe; thence North 51° 40’ East 150.8 feet to an iron pipe; thence North 63° 08’ East 313.1 feet to an iron pipe; thence North 65° 23’ East 135.7 feet to an iron pipe; thence North 76° 46’ East 160.8 feet to an iron pipe; thence North 77° 14’ East 245.4 feet to an iron pipe; thence North 39° 42’ East 199.7 feet to an iron pipe; thence North 67° 15’ East 306.2 feet to an iron pipe; thence North 39° 35’ East 247.7 feet to an iron pipe; thence South 85° 03’ East 185.7 feet to an iron pipe; thence South 40° 23’ East 148.3 feet to an iron pipe; thence South 39° 29’ East 124.1 feet to an iron pipe; thence South 86° 09’ East 154.1 feet to an iron pipe; thence North 64° 39’ East 187.9 feet to an iron pipe; thence North 41° 49’ East 291.6 feet to an iron pipe; thence North 28° 49’ East 87.2 feet to an iron pipe; thence North 47° 28’ East 149.8 feet to an iron pipe; thence North 38° 17’ East 93.8 feet to an iron pipe; thence North 21° 58’ East 115.7 feet to an iron pipe; thence North 03° 48 East 328.6 feet to an iron pipe on the Section line between Sections 7 and 18, Townsip 30 South, Range 12 West of the Willamette Meridian, Coos County, Oregon, 60.0 feet West from the East 1/16th corner between said Sections 7 and 18.

TOGETHER WITH access easement rights reserved in instrument recorded as Document No. 75-2-110740, Coos County, Oregon records.

97087663.1 0067129-00001

South 47° 06’ 19” West 63.10 feet; thence North 72° 20’ 22” West 76.24 feet; thence

South 82° 28’ 19” West 88.27 feet; thence South 04° 30’ 41” West 125.94 feet; thence

South 29° 31’ 31” East 56.95 feet; thence South 12° 05’ 18” West 70.96 feet; thence

South 73° 53’ 11” West 244.04 feet; thence North 77° 53’ 55” West 70.92 feet; thence

South 55° 39’ 18” West 81.99 feet; thence South 02° 44’ 10” West 86.74 feet; thence

South 32° 46’ 09” East 158.73 feet; thence South 00° 44’ 37” East 174.20 feet; thence

South 41° 17’ 32” West 99.36 feet; thence South 88° 05’ 23” West 67.86 feet; thence

North 32° 43’ 13” West 75.29 feet; thence North 10° 32’ 00” East 197.42 feet; thence

North 62° 38’ 12” West 74.21 feet; thence South 56° 02’ 53” West 291.64 feet; thence

South 27° 48’ 38” West 92.07 feet; thence South 09° 39’ 16” East 107.85 feet; thence

South 87° 30’ 32” West 52.05 feet; thence South 27° 44’ 42” West 48.57 feet; thence

97087663.1 0067129-00001

Parcel 60

Section 11: The S 1/2 of the NE 1/4; the NW 1/4 of the NE 1/4; the N 1/2 of the SE 1/4; the SE 1/4 of the SE 1/4; the NE 1/4 of the SW 1/4; the SE 1/4 of the NW 1/4.

PARCEL 61

Section 13: The N 1/2; the N 1/2 of the SW 1/4; the SW 1/4 of the SW 1/4.

Parcel 62

Section 14: The E 1/2; the SW 1/4 and that portion of the NW 1/4 lying South of that boundary line described in Property Line Adjustment Deed recorded in Coos County Microfilm Reel No. 94-05-0751.

Parcel 63

Section 15: The SE 1/4 of the SE 1/4; the S 1/2 of the SW 1/4.

thence South 34° 16’ 46” West 55.32 feet; thence South 48° 38’ 28” West 52.52 feet;

thence South 89° 06’ 09” West 55.56 feet; thence North 77° 59’ 44” West 135.45 feet;

97087663.1 0067129-00001

thence South 74° 35’ 54” West 67.00 feet; thence South 72° 46’ 04” West 64.23 feet;

thence South 56° 28’ 57” West 73.26 feet; thence South 63° 05’ 11” West 65.70 feet;

thence South 78° 44’ 49” West 69.13 feet; thence South 88° 46’ 33” West 76.31 feet;

thence South 78° 19’ 46” West 69.20 feet; thence South 79° 16’ 54” West 71.32 feet;

thence South 81° 04’ 10” West 72.26 feet; thence South 62° 11’ 57” West 67.86 feet;

thence South 60° 44’ 45” West 73.19 feet; thence South 53° 41’ 22” West 49.85 feet;

thence South 46° 20’ 51” West 5.53 feet; thence South 46° 20’ 51” West 58.84 feet;

thence South 45° 37’ 10” West 67.32 feet; thence South 45° 42’ 31” West 58.71 feet;

thence South 26° 27’ 40” West 62.97 feet; thence South 13° 46’ 17” West 68.24 feet;

thence South 25° 14’ 45” West 133.33 feet; thence South 17° 47’ 43” West 1.17 feet;

thence South 67° 57’ 47” West 53.17 feet; thence South 54° 10’ 19” West 52.03 feet;

thence South 59° 44’ 53” West 54.94 feet; thence South 85° 51’ 50” West 64.71 feet;

thence South 89° 51’ 10” West 67.65 feet; thence South 80° 17’ 10” West 66.53 feet;

97087663.1 0067129-00001

thence North 83° 12’ 14” West 55.96 feet; thence North 87° 57’ 55” West 54.79 feet;

thence South 67° 22’ 29” West 56.80 feet; thence South 56° 58’ 00” West 59.43 feet;

thence South 66° 45’ 36” West 56.38 feet; thence North 74° 47’ 28” West 49.20 feet;

thence North 47° 14’ 06” West 31.87 feet; thence North 50° 23’ 12” West 51.32 feet;

thence North 75° 23’ 23” West 47.13 feet; thence North 88° 09’ 18” West 48.96 feet;

thence South 63° 13’ 58” West 50.80 feet; thence South 60° 22’ 23” West 51.83 feet;