Fourth Quarter 2018 Investor Presentation 1 1

DISCLOSURES In this presentation (1) “CatchMark” refers to CatchMark Timber Trust, Inc., a Maryland corporation that has elected to be taxed as a real estate investment trust (NYSE: CTT), (2) “Triple T” refers to TexMark Timber Treasury, L.P., a Delaware limited partnership that is a joint venture managed by CatchMark and in which CatchMark holds a common limited partnership interest, (3) “Dawsonville Bluffs” refers to Dawsonville Bluffs, LLC, a Delaware limited liability company that is a joint venture managed by CatchMark and in which CatchMark holds a 50% limited liability company interest, and (4) “IPO” refers to CatchMark’s initial listed offering in December 2013. 2

FORWARD- LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward- looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Forward-looking statements in this presentation include, but are not limited to, that we will grow our cash flows through actively managing our timberlands located in high demand mill markets, that the strong productivity characteristics of our timberlands will enhance overall portfolio yields, that our evolving harvest mix will enhance our prospects for revenue growth, and that we will unlock future value in the Triple T joint venture by optimizing the inventory and delivery on existing supply agreements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations, including, but not limited to: (i) we may not generate the harvest volumes from our timberlands that we currently anticipate may not be able to deliver cash flow growth; (ii) the demand for our timber may not increase at the rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our timberlands are located; (iii) the cyclical nature of the real estate market generally, including fluctuations in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties or to recycle capital into better performing properties; (iv) timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (v) the supply of timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (vi) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (vii) we may not be able to access external sources of capital at attractive rates or at all; (viii) potential increases in interest rates could have a negative impact on our business; (ix) our share repurchase program may not be successful in improving stockholder value over the long- term; (x) our joint venture strategy may not enable us to access non-dilutive capital and enhance our ability to make acquisitions; (xi) we may not be successful in operating the Triple T joint venture in a manner that unlocks additional value or enable us to earn the asset management fee or an incentive-based promote; and (xii) the factors described in Item 1A Risk Factors of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and our other filings with Securities and Exchange Commission. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to update our forward-looking statements, except as required by law. 3

TABLE OF CONTENTS SECTION PAGE # CatchMark Overview 5 Disciplined Acquisitions 10 Superior Operations 22 Capital Strategy 28 Investment Opportunity 34 Summary 37 Appendix 39 4

CatchMark Overview 5 5

CatchMark (NYSE: CTT) seeks to deliver consistent and growing per share cash flow from the disciplined acquisition and superior operation of prime timberlands. 6

ABOUT CATCHMARK Significant Growth: IPO - 20182 Acres Owned Total1 Compound Annual Growth Rates U.S. South Alabama 78,200 ‒ Revenues 25% Florida 2,000 ‒ Adjusted EBITDA 70% Georgia 291,200 Consistently paid fully-covered quarterly distributions North Carolina 600 South Carolina 77,700 Expanded investment management platform—recognized $5.6 million in new Tennessee 300 asset management fee revenues in 2018 Texas 1,099,800 75% Increase in fee timberland ownership, 295,100 acres acquired 1,549,800 Pacific Northwest Diversified into the Pacific Northwest—acquired 18,100 acres, primarily Oregon 18,100 sawtimber, and integrated into operations Total 1,567,900 Annual harvest: 136% increase to 2.2 million tons Increased acreage under control and management by 5x IMPROVED EARNINGS DIVERSITY – Adjusted EBITDA by Source3 27% 35% 52% 65% 21% 2014 2018 1. Includes timberlands held by Dawsonville Bluffs and Triple T, in which CTT owns interests. 2. From IPO in December 2013 through December 31, 2018. 7 3. See definition of Adjusted EBITDA, a non-GAAP measure, reconciliation of net income (loss) to Adjusted EBITDA and Adjusted EBITDA by source in Appendix. All data as of 12/31/2018.

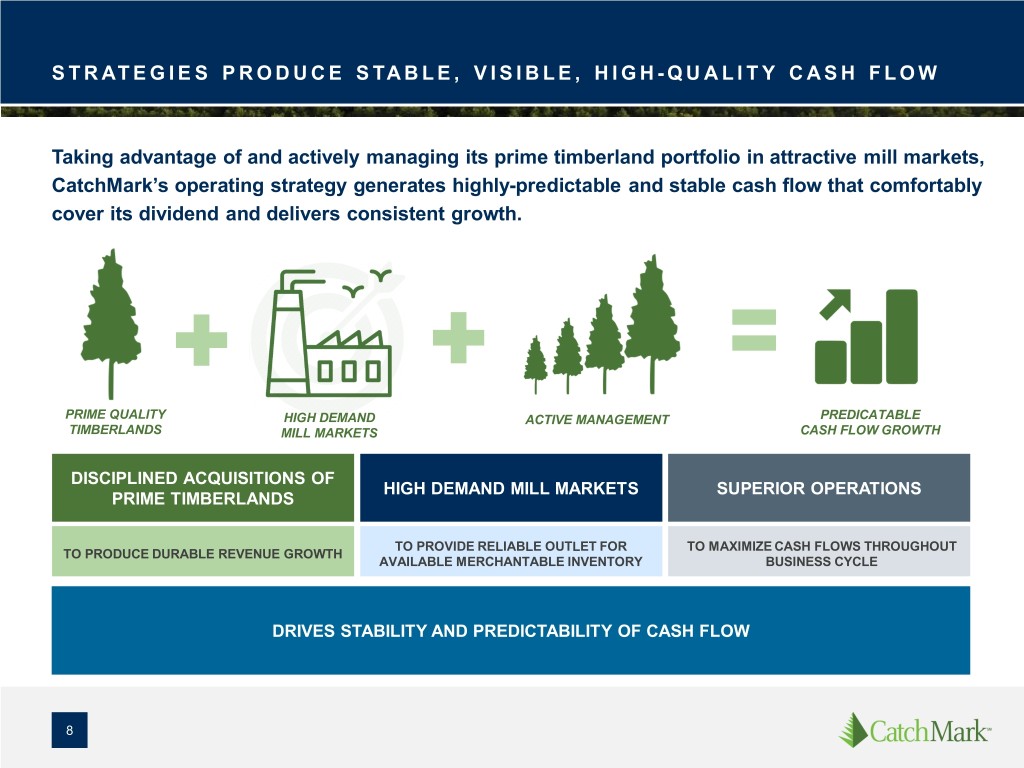

STRATEGIES PRODUCE STABLE, VISIBLE, HIGH- QUALITY CASH FLOW Taking advantage of and actively managing its prime timberland portfolio in attractive mill markets, CatchMark’s operating strategy generates highly-predictable and stable cash flow that comfortably cover its dividend and delivers consistent growth. PRIME QUALITY HIGH DEMAND ACTIVE MANAGEMENT PREDICATABLE TIMBERLANDS MILL MARKETS CASH FLOW GROWTH DISCIPLINED ACQUISITIONS OF HIGH DEMAND MILL MARKETS SUPERIOR OPERATIONS PRIME TIMBERLANDS TO PROVIDE RELIABLE OUTLET FOR TO MAXIMIZE CASH FLOWS THROUGHOUT TO PRODUCE DURABLE REVENUE GROWTH AVAILABLE MERCHANTABLE INVENTORY BUSINESS CYCLE DRIVES STABILITY AND PREDICTABILITY OF CASH FLOW 8

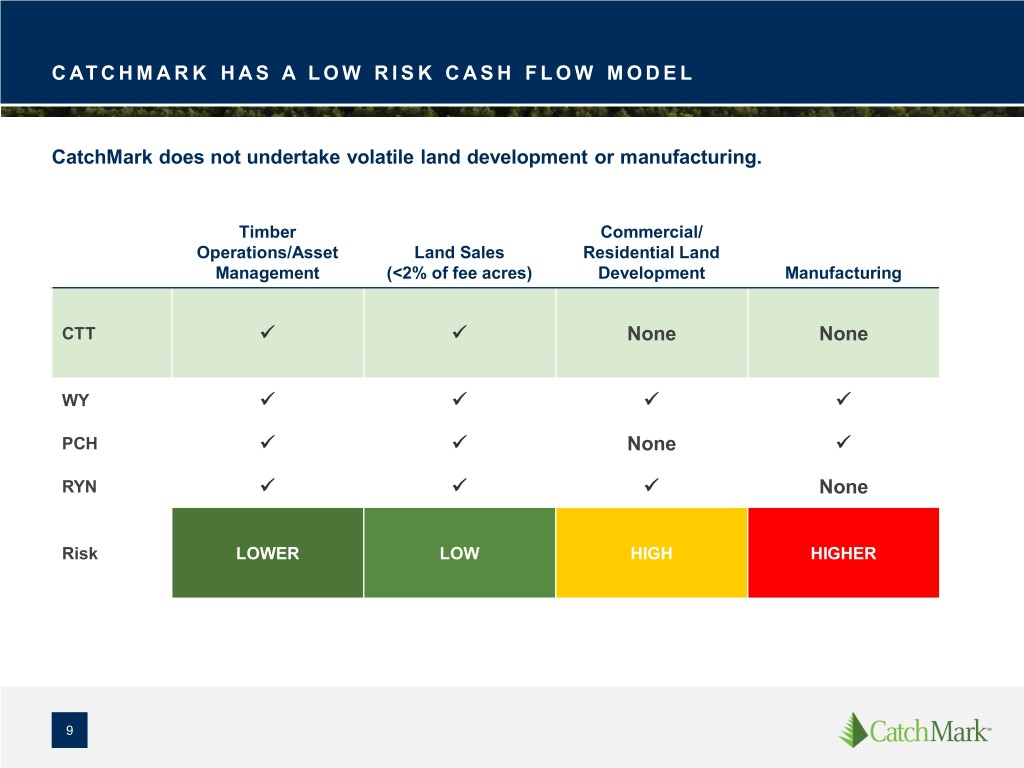

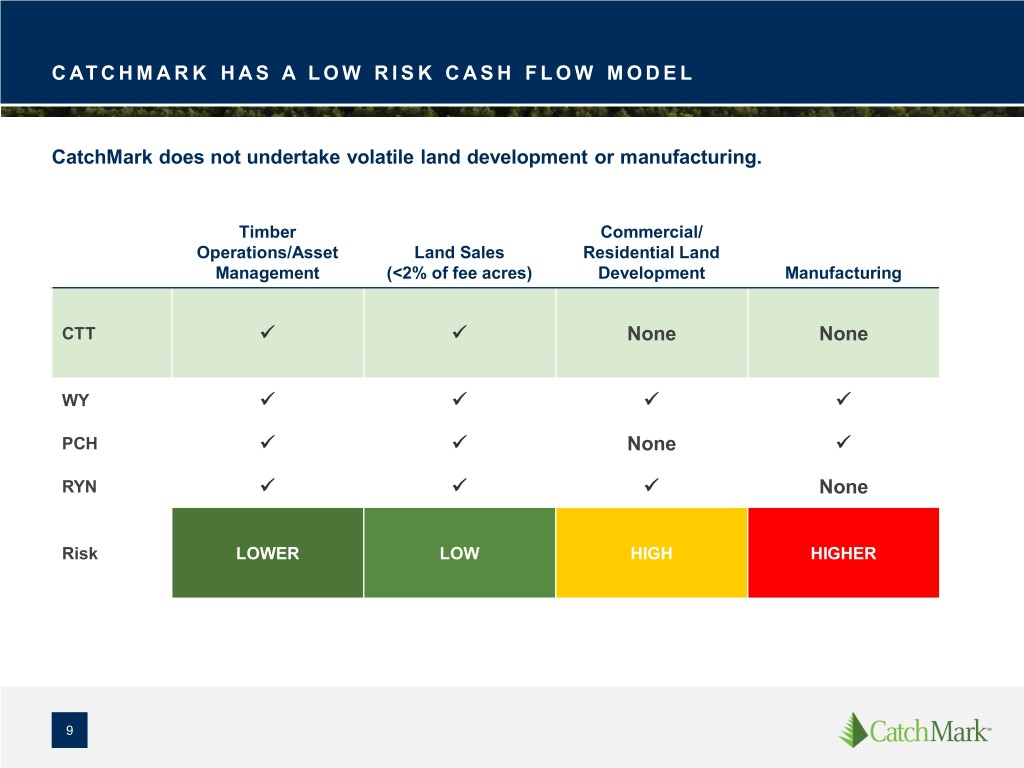

CATCHMARK HAS A LOW RISK CASH FLOW MODEL CatchMark does not undertake volatile land development or manufacturing. Timber Commercial/ Operations/Asset Land Sales Residential Land Management (<2% of fee acres) Development Manufacturing CTT None None WY PCH None RYN None Risk LOWER LOW HIGH HIGHER 9

Disciplined Acquisitions 10

ONLY PRIME TIMBERLANDS CatchMark pursues investments in prime timberlands located in leading mill markets, which can produce durable cash flows. • Pursue assets with superior stocking characteristics that Targeted Areas complement and smooth our annual achievable harvest volume. • Diversify overall holdings by reducing individual market volatility and customer concentration. • Enhance returns through synergies with existing holdings, including the ability to deliver increased volume to our best customers, spread our fixed operating costs over larger tracts, and fully exploit our in-place forestry operations and foresters. • Focus on only highly-desirable wood basket and mill markets with tight supply-demand dynamics and both domestic and international exposure. • Seek superior timber and organic growth potential due to better soil and a consistent and favorable growing environment. • Target visible and steady opportunities for profitable HBU sales. 11

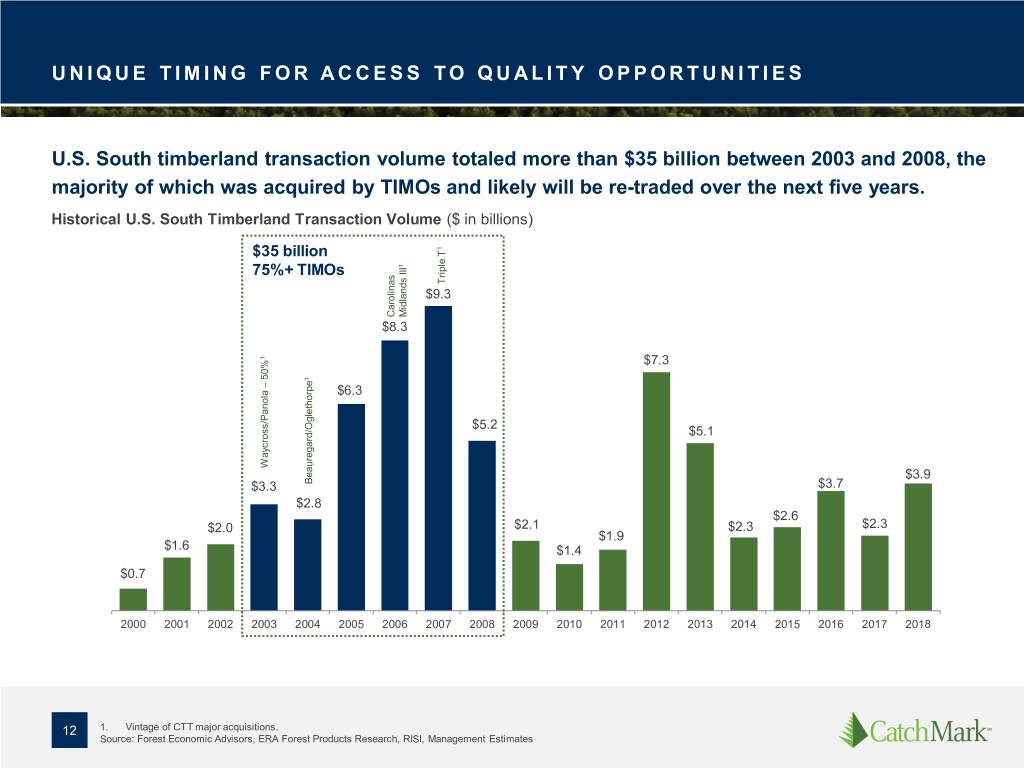

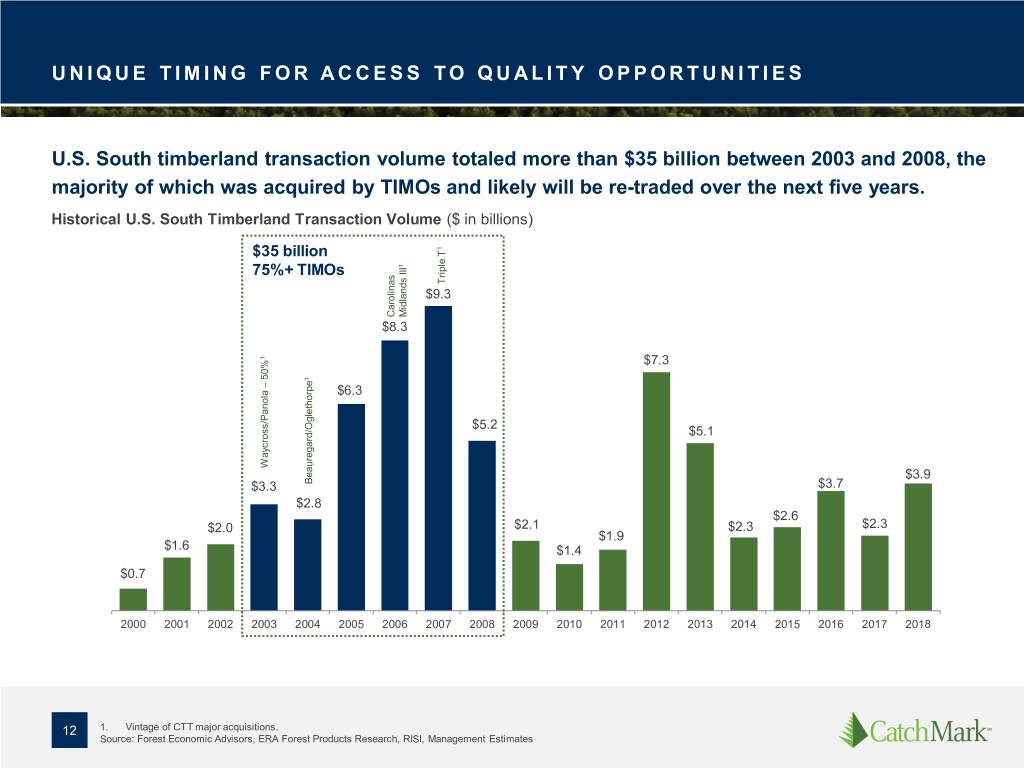

UNIQUE TIMING FOR ACCESS TO QUALITY OPPORTUNITIES U.S. South timberland transaction volume totaled more than $35 billion between 2003 and 2008, the majority of which was acquired by TIMOs and likely will be re-traded over the next five years. Historical U.S. South Timberland Transaction Volume ($ in billions) $35 billion 1 75%+ TIMOs 1 Triple T $9.3 Carolinas Midlands III $8.3 1 $7.3 50% 1 – $6.3 $5.2 $5.1 Waycross/Panola $3.9 $3.3 Beauregard/Oglethorpe $3.7 $2.8 $2.6 $2.0 $2.1 $2.3 $2.3 $1.9 $1.6 $1.4 $0.7 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 12 1. Vintage of CTT major acquisitions. Source: Forest Economic Advisors, ERA Forest Products Research, RISI, Management Estimates

ACQUISITION PROCESS CatchMark employs a disciplined process in assessing potential new investments. • Growth/drain ratios MILL/MARKET STUDY • Mill consumption and end-use products • Cost curves of mills • Detailed inventory measurement & verification • Soil analysis and productivity FIELD • Property management cost analysis INSPECTION • Capital Improvements • Visit to mills • Harvest modeling and DCF analysis including property management cost and CAPEX assumptions MODELING/ • Tons / Acre • Unleveraged CAD Yield ANALYSIS • Allocation of Softwood Acres • Unleveraged IRR • Harvest Productivity: Tons/Acre/Yr. (10-yr Average) • Leveraged IRR COMPARABLE • Analysis of market trends, capital flows and valuations. SALES ANALYSIS • Rigorous review process with Investment FORMALIZED Committee and Board of Directors. Approval APPROVAL needed to proceed. 13

EXPANDED AND IMPROVED U.S. SOUTH TIMBERLAND ASSETS Since its IPO in late 2013, CatchMark has significantly expanded and improved the quality of its timberland assets and enhanced productivity through sustainable forest management practices. Higher Quality Timberland Assets3 Ton/Acre3 Sawtimber % Merchantable Timber (tons/acre) Sawtimber % 45 50% • 24 acquisitions: $509 million, including transaction 40 45% costs. 1 • Fee acreage acquired: 257,800 (104% increase) 35 40% • Merchantable inventory added: 11.7 million tons 2 30 35% 2014 2015 2016 2017 2018 2019 – 75% pine plantation by acreage % Pine Plantation Acres – Site Index Distribution – 49% sawtimber by tons 30% 1/1/2014, Avg SI=68 1/1/2019, Avg SI=73 24% 25% – Acquisitions averaged stocking of 46 tons 22% 21% 22% 20% 18% per acre 17% 14% 15% 12% 12% 10% 10% 5% 6% 5% 4% 5% 2% 2% 2% 1% 0% <50 50-54 55-59 60-64 65-69 70-74 75-79 80-84 85-89 90+ Average site index of U.S. South timberlands was 73 as of 1/1/19. Improved from 68 at IPO. As of 12/31/2018. Note: Does not include timberlands held by Dawsonville Bluffs and Triple T, in which CTT owns interests. 14 1. Compared to fee timberland acres as of 12/31/2013. 2. As of the respective acquisition date. 3. As of 1/1 of each year and includes biological growth.

ACQUISITIONS ENHANCE OVERALL PORTFOLIO YIELD CatchMark’s acquisitions exhibit strong productivity characteristics, which enhance overall portfolio yields. Drivers of Cash Yield: Harvest Volume per Acre (tons) ─ Sustainable harvest: 80% - 90% ─ Recreational leases: 5% - 10% CTT U.S. South Acquisitions ─ Land sales: 5% - 10% (10-year Projected Average2) Comparable Company Data (U.S. South) 1 6.0 (10-year Historical Average) 5.0 - 5.5 5.0 4.3 - 4.7 3.9 3.9 4.0 3.7 3.5 3.0 +29% versus 3.0 Comparable Company 2.0 Historical Average 1.0 0.0 WY RYN PCH Average CTT @ Weighted CTT 12/2013 Average of Top 5 Pro Forma Transactions3 1. Represents comparable publicly-traded timber company 10-year (2009-2018) historical average in the U.S. South. 15 2. 2019-2023 3. Does not include timberlands held by Dawsonville Bluffs and Triple T, in which CTT owns interests

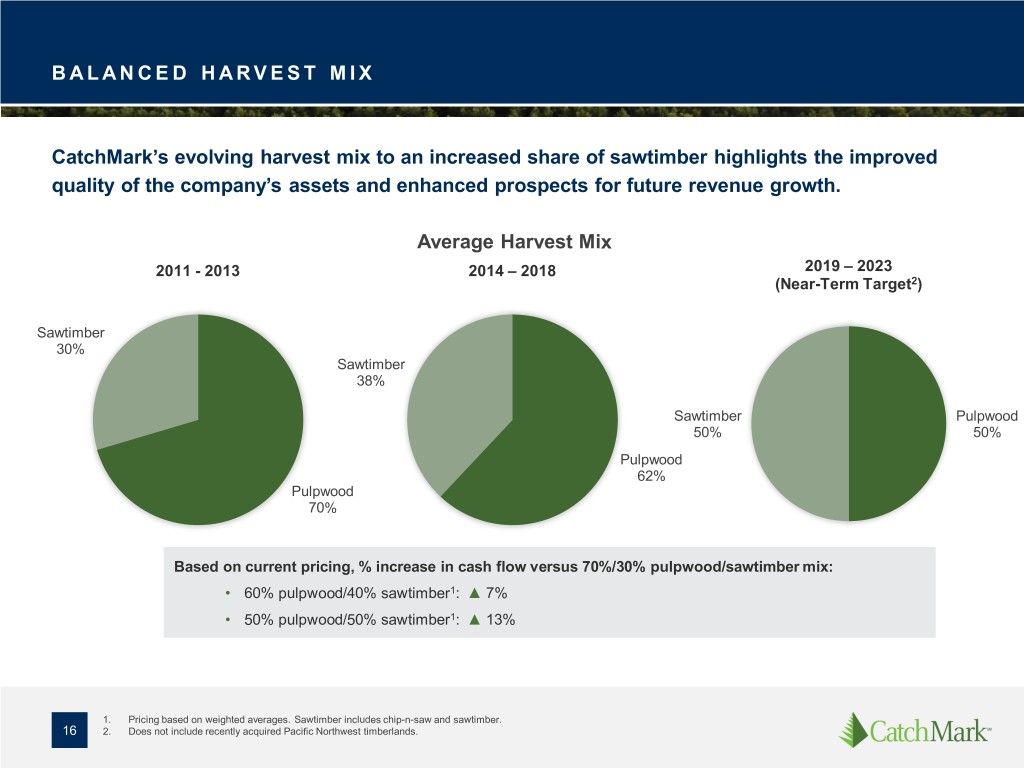

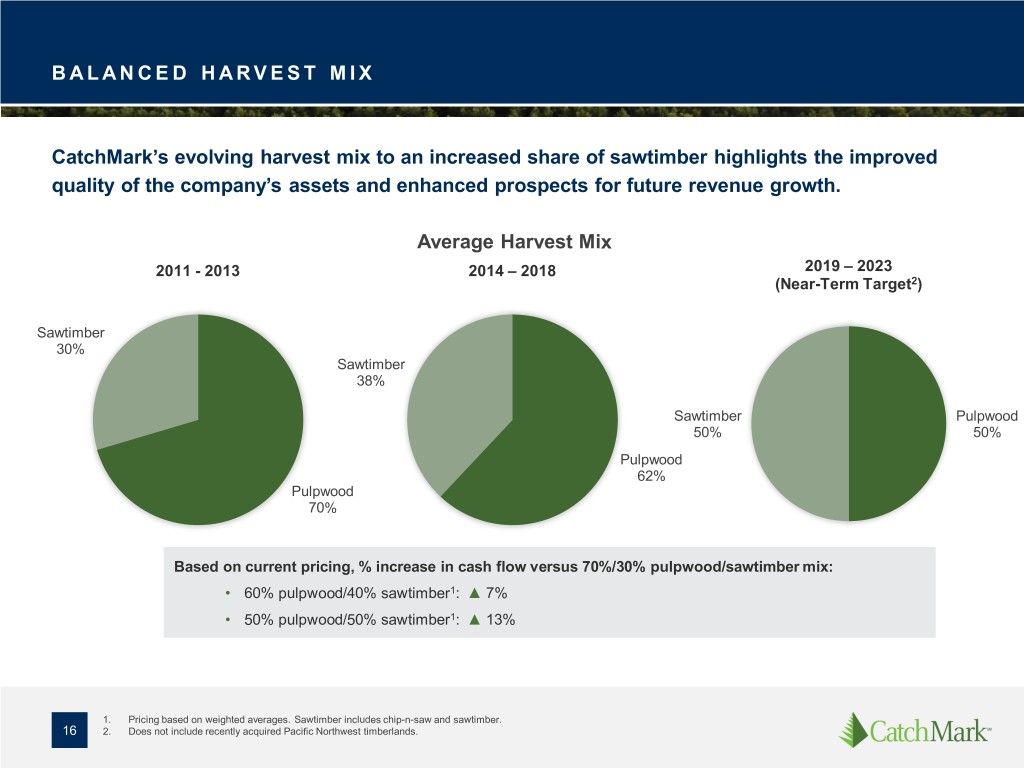

BALANCED HARVEST MIX CatchMark’s evolving harvest mix to an increased share of sawtimber highlights the improved quality of the company’s assets and enhanced prospects for future revenue growth. Average Harvest Mix 2011 - 2013 2014 – 2018 2019 – 2023 (Near-Term Target2) Sawtimber 30% Sawtimber 38% Sawtimber Pulpwood 50% 50% Pulpwood 62% Pulpwood 70% Based on current pricing, % increase in cash flow versus 70%/30% pulpwood/sawtimber mix: • 60% pulpwood/40% sawtimber1: ▲ 7% • 50% pulpwood/50% sawtimber1: ▲ 13% 1. Pricing based on weighted averages. Sawtimber includes chip-n-saw and sawtimber. 16 2. Does not include recently acquired Pacific Northwest timberlands.

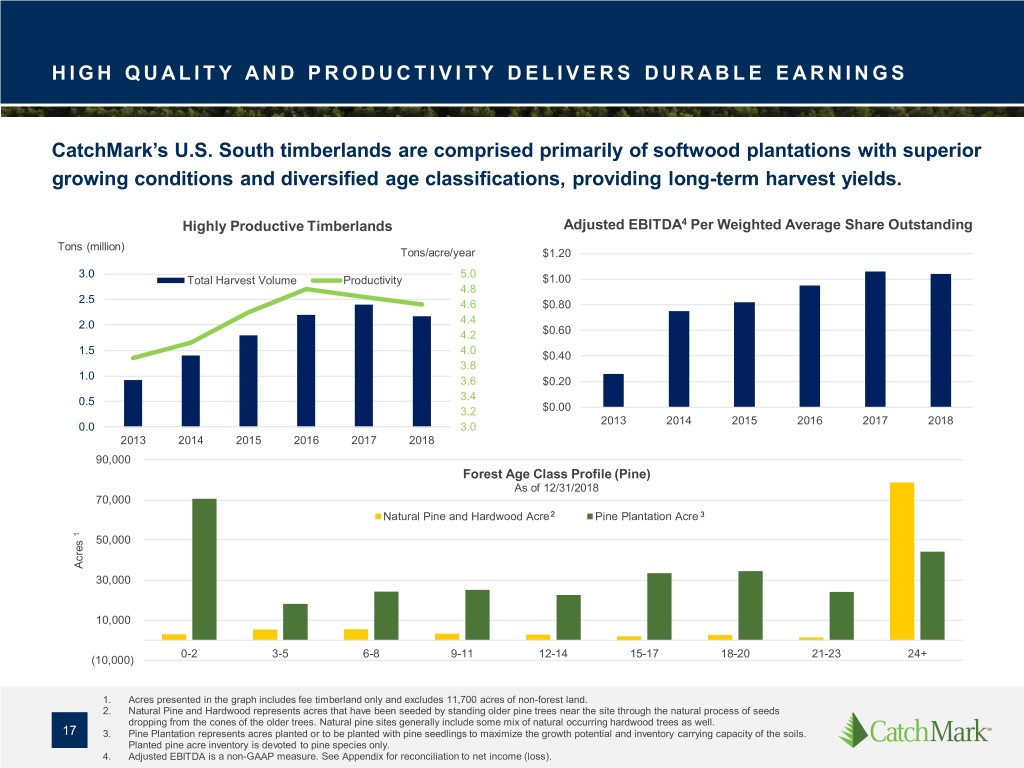

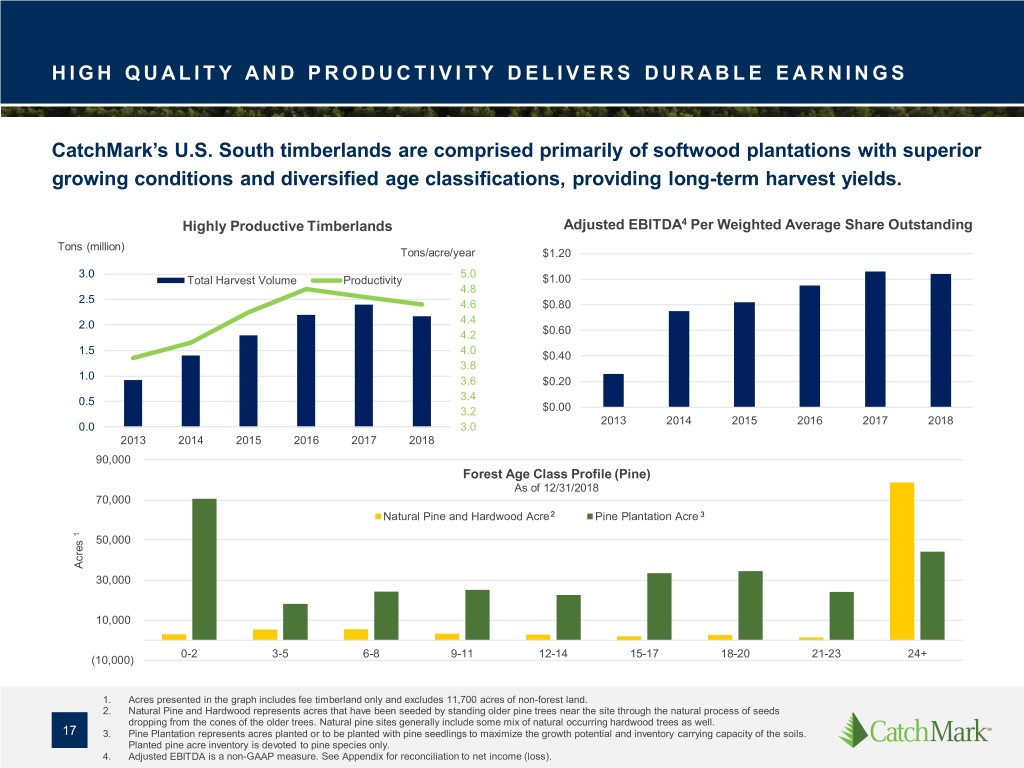

HIGH QUALITY AND PRODUCTIVITY DELIVERS DURABLE EARNINGS CatchMark’s U.S. South timberlands are comprised primarily of softwood plantations with superior growing conditions and diversified age classifications, providing long-term harvest yields. Highly Productive Timberlands Adjusted EBITDA4 Per Weighted Average Share Outstanding Tons (million) Tons/acre/year $1.20 3.0 5.0 Total Harvest Volume Productivity $1.00 4.8 2.5 4.6 $0.80 2.0 4.4 4.2 $0.60 1.5 4.0 $0.40 3.8 1.0 3.6 $0.20 0.5 3.4 3.2 $0.00 2013 2014 2015 2016 2017 2018 0.0 3.0 2013 2014 2015 2016 2017 2018 90,000 Forest Age Class Profile (Pine) As of 12/31/2018 70,000 Natural Pine and Hardwood Acre 2 Pine Plantation Acre 3 1 50,000 Acres Acres 30,000 10,000 0-2 3-5 6-8 9-11 12-14 15-17 18-20 21-23 24+ (10,000) 1. Acres presented in the graph includes fee timberland only and excludes 11,700 acres of non-forest land. 2. Natural Pine and Hardwood represents acres that have been seeded by standing older pine trees near the site through the natural process of seeds dropping from the cones of the older trees. Natural pine sites generally include some mix of natural occurring hardwood trees as well. 17 3. Pine Plantation represents acres planted or to be planted with pine seedlings to maximize the growth potential and inventory carrying capacity of the soils. Planted pine acre inventory is devoted to pine species only. 4. Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation to net income (loss).

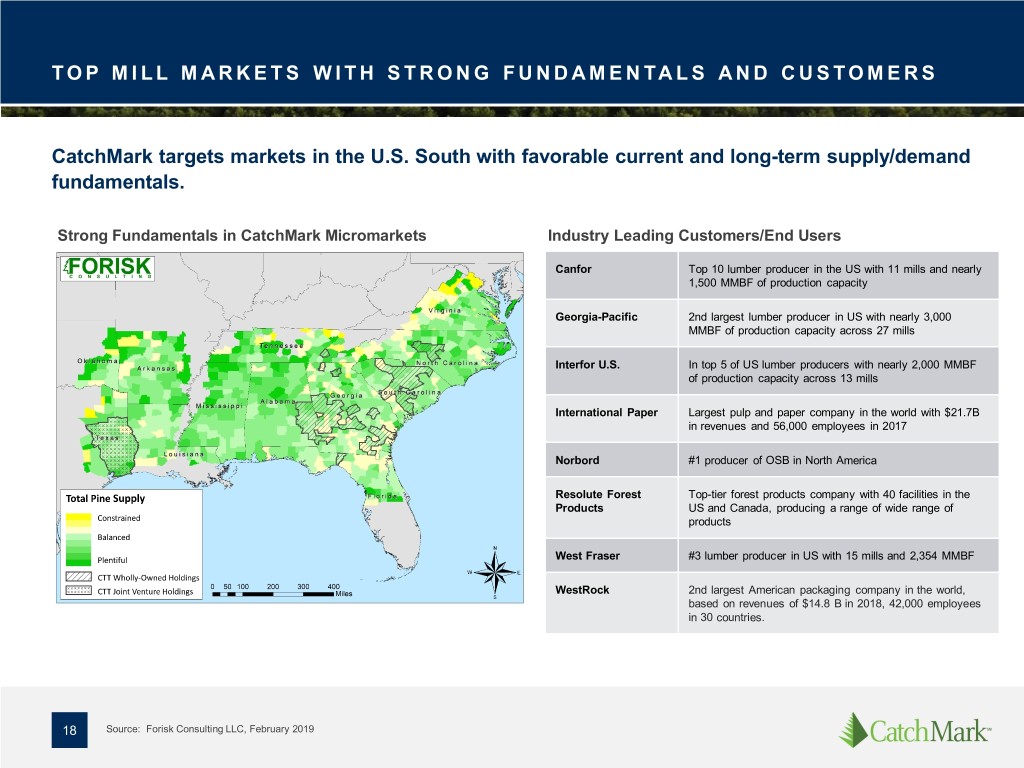

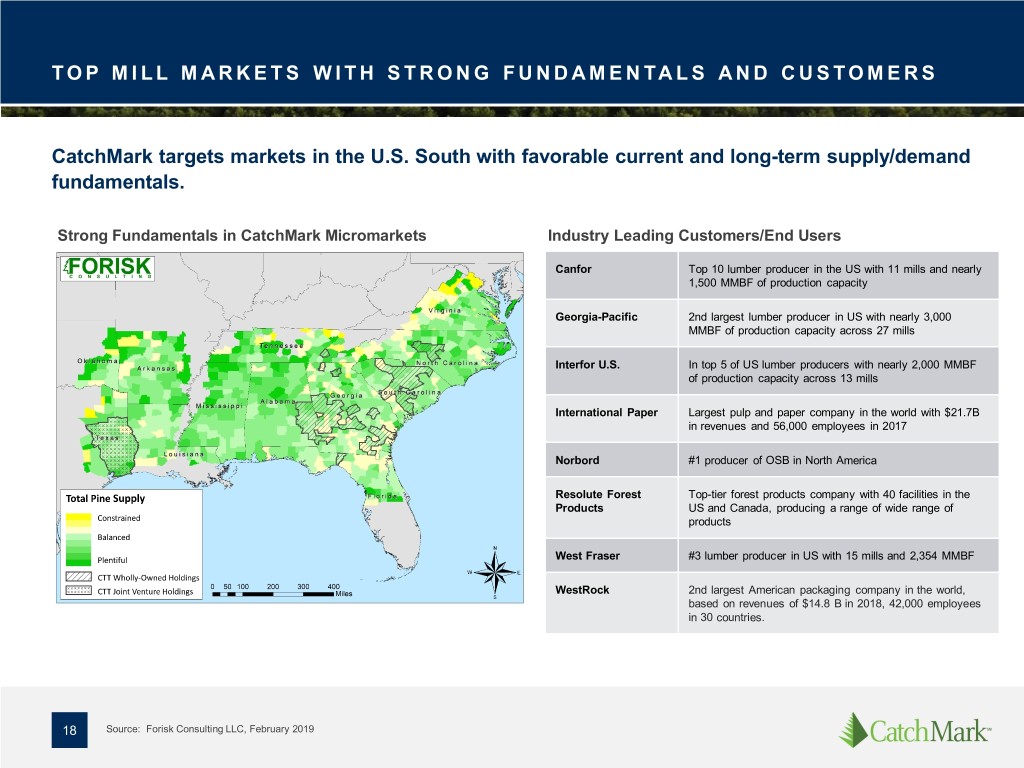

TOP MILL MARKETS WITH STRONG FUNDAMENTALS AND CUSTOMERS CatchMark targets markets in the U.S. South with favorable current and long-term supply/demand fundamentals. Strong Fundamentals in CatchMark Micromarkets Industry Leading Customers/End Users Canfor Top 10 lumber producer in the US with 11 mills and nearly 1,500 MMBF of production capacity Georgia-Pacific 2nd largest lumber producer in US with nearly 3,000 MMBF of production capacity across 27 mills Interfor U.S. In top 5 of US lumber producers with nearly 2,000 MMBF of production capacity across 13 mills International Paper Largest pulp and paper company in the world with $21.7B in revenues and 56,000 employees in 2017 Norbord #1 producer of OSB in North America Resolute Forest Top-tier forest products company with 40 facilities in the Products US and Canada, producing a range of wide range of products West Fraser #3 lumber producer in US with 15 mills and 2,354 MMBF WestRock 2nd largest American packaging company in the world, based on revenues of $14.8 B in 2018, 42,000 employees in 30 countries. 18 Source: Forisk Consulting LLC, February 2019

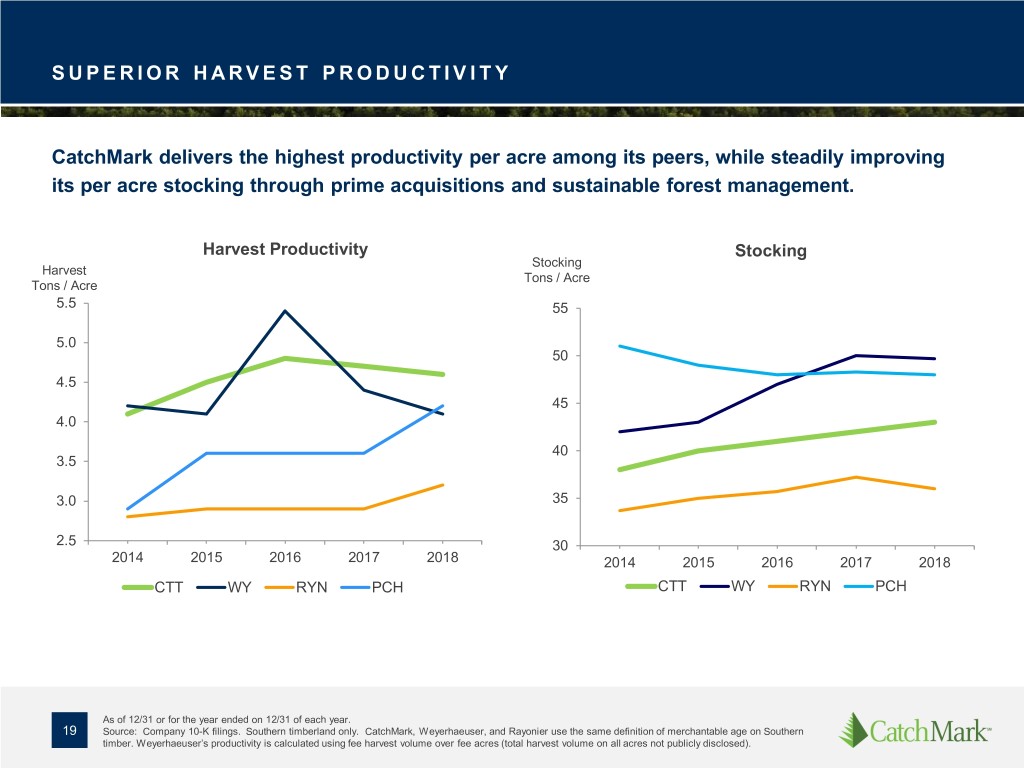

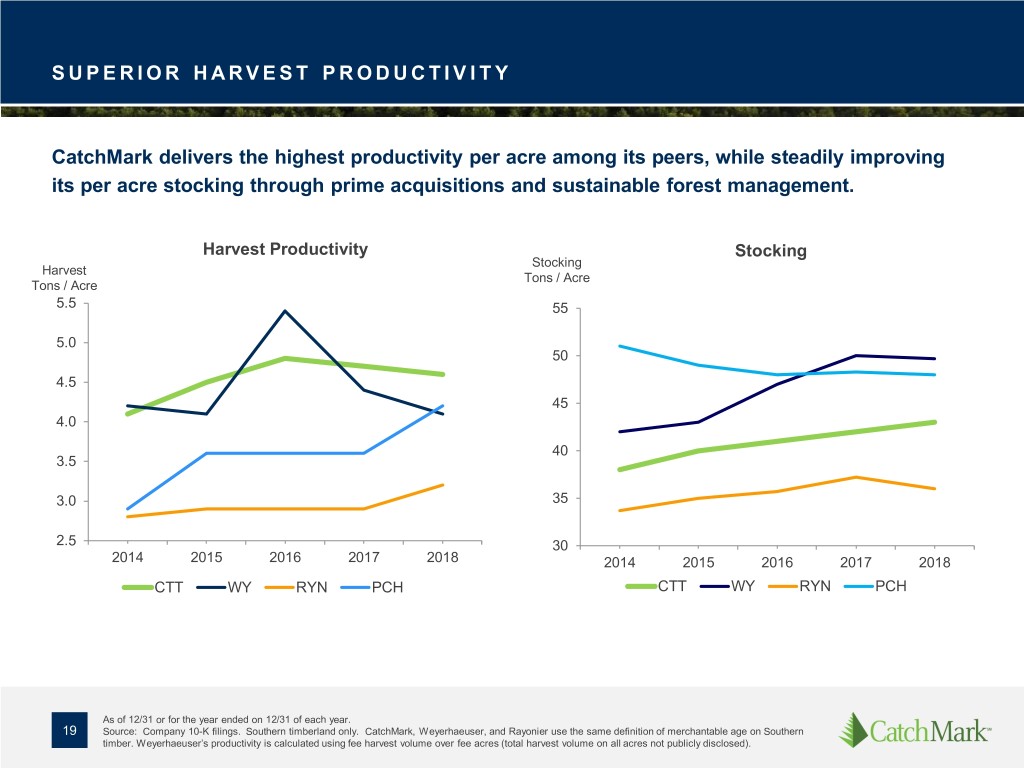

SUPERIOR HARVEST PRODUCTIVITY CatchMark delivers the highest productivity per acre among its peers, while steadily improving its per acre stocking through prime acquisitions and sustainable forest management. Harvest Productivity Stocking Stocking Harvest Tons / Acre Tons / Acre 5.5 55 5.0 50 4.5 45 4.0 40 3.5 3.0 35 2.5 30 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 CTT WY RYN PCH CTT WY RYN PCH As of 12/31 or for the year ended on 12/31 of each year. 19 Source: Company 10-K filings. Southern timberland only. CatchMark, Weyerhaeuser, and Rayonier use the same definition of merchantable age on Southern timber. Weyerhaeuser’s productivity is calculated using fee harvest volume over fee acres (total harvest volume on all acres not publicly disclosed).

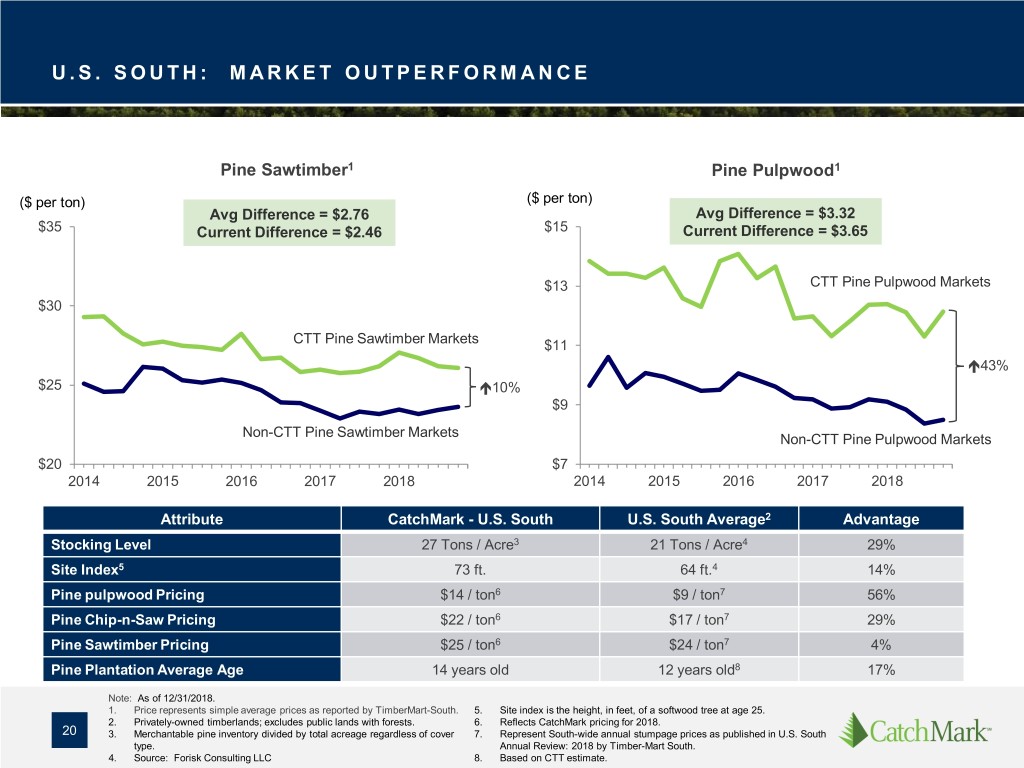

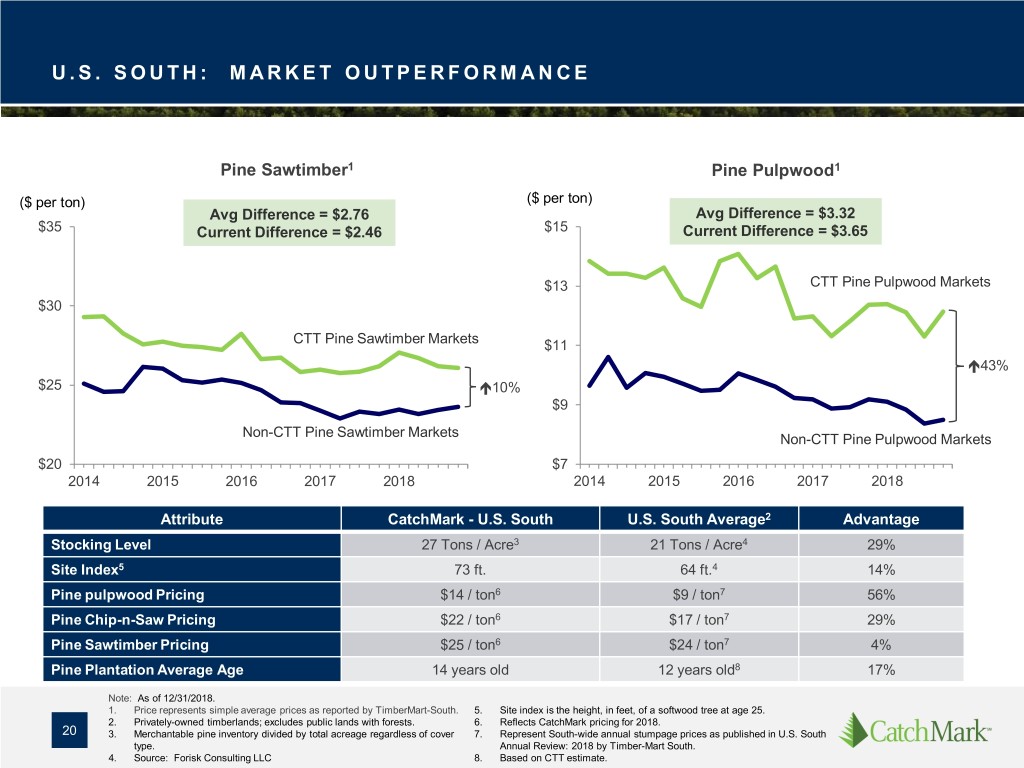

U.S. SOUTH: MARKET OUTPERFORMANCE Pine Sawtimber1 Pine Pulpwood1 ($ per ton) ($ per ton) Avg Difference = $2.76 Avg Difference = $3.32 $35 Current Difference = $2.46 $15 Current Difference = $3.65 $13 CTT Pine Pulpwood Markets $30 CTT Pine Sawtimber Markets $11 43% $25 10% $9 Non-CTT Pine Sawtimber Markets Non-CTT Pine Pulpwood Markets $20 $7 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Attribute CatchMark - U.S. South U.S. South Average2 Advantage Stocking Level 27 Tons / Acre3 21 Tons / Acre4 29% Site Index5 73 ft. 64 ft.4 14% Pine pulpwood Pricing $14 / ton6 $9 / ton7 56% Pine Chip-n-Saw Pricing $22 / ton6 $17 / ton7 29% Pine Sawtimber Pricing $25 / ton6 $24 / ton7 4% Pine Plantation Average Age 14 years old 12 years old8 17% Note: As of 12/31/2018. 1. Price represents simple average prices as reported by TimberMart-South. 5. Site index is the height, in feet, of a softwood tree at age 25. 2. Privately-owned timberlands; excludes public lands with forests. 6. Reflects CatchMark pricing for 2018. 20 3. Merchantable pine inventory divided by total acreage regardless of cover 7. Represent South-wide annual stumpage prices as published in U.S. South type. Annual Review: 2018 by Timber-Mart South. 4. Source: Forisk Consulting LLC 8. Based on CTT estimate.

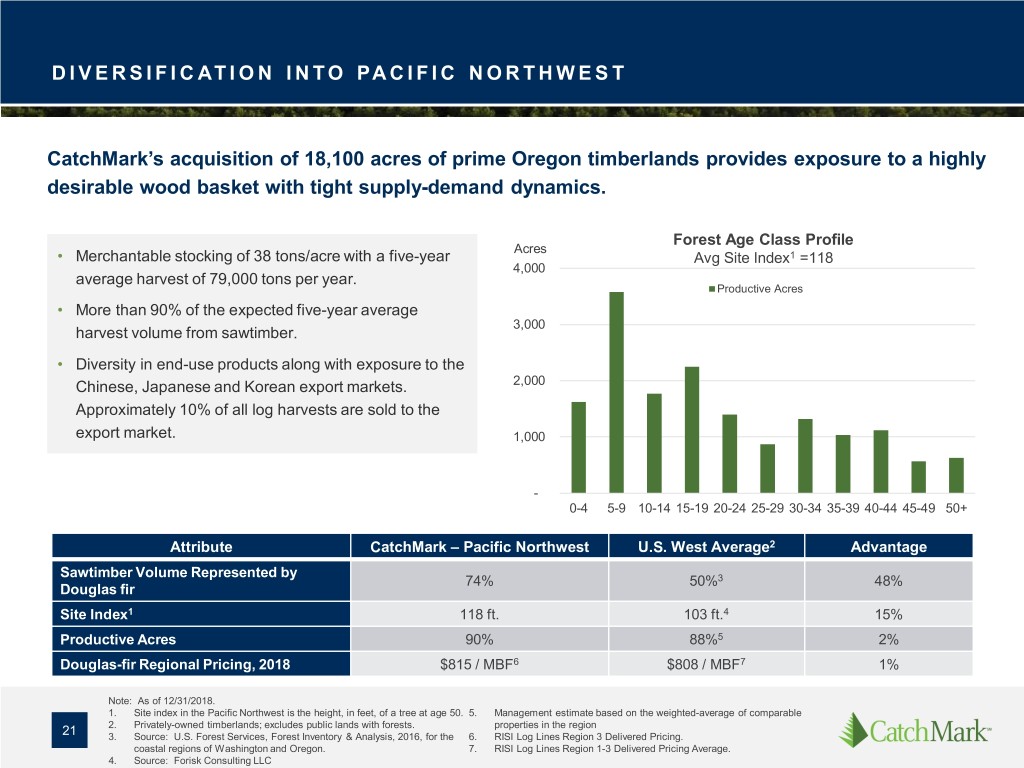

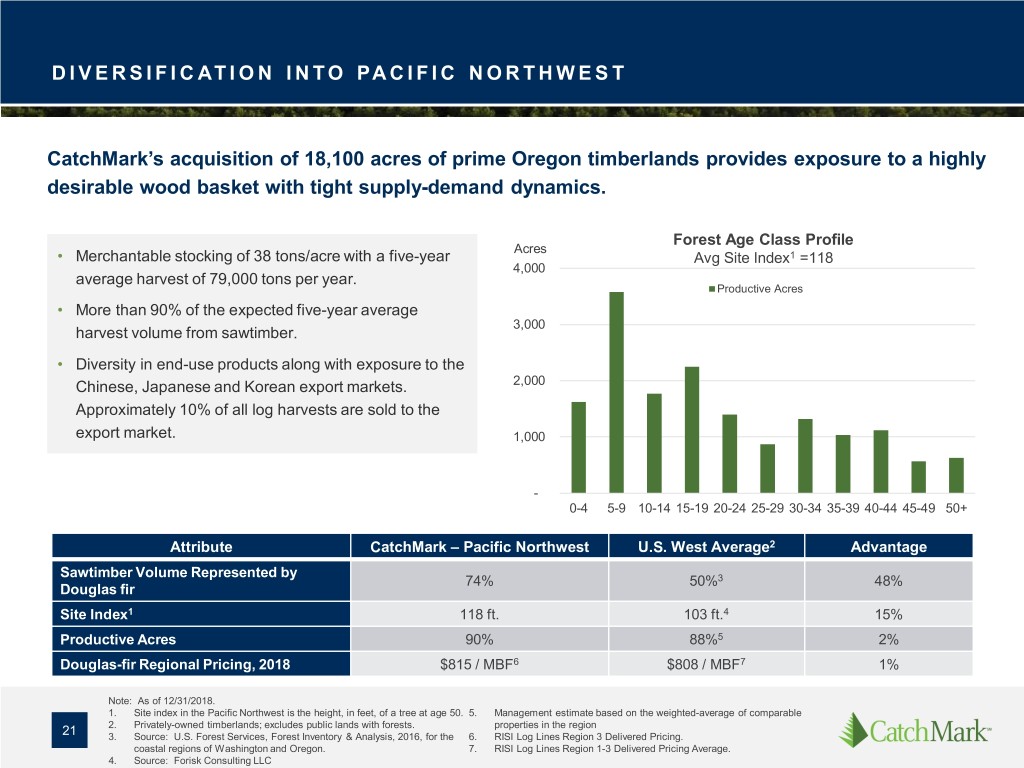

DIVERSIFICATION INTO PACIFIC NORTHWEST CatchMark’s acquisition of 18,100 acres of prime Oregon timberlands provides exposure to a highly desirable wood basket with tight supply-demand dynamics. Forest Age Class Profile Acres • Merchantable stocking of 38 tons/acre with a five-year Avg Site Index1 =118 4,000 average harvest of 79,000 tons per year. Productive Acres • More than 90% of the expected five-year average 3,000 harvest volume from sawtimber. • Diversity in end-use products along with exposure to the Chinese, Japanese and Korean export markets. 2,000 Approximately 10% of all log harvests are sold to the export market. 1,000 - 0-4 5-9 10-14 15-19 20-24 25-29 30-34 35-39 40-44 45-49 50+ Attribute CatchMark – Pacific Northwest U.S. West Average2 Advantage Sawtimber Volume Represented by 74% 50%3 48% Douglas fir Site Index1 118 ft. 103 ft.4 15% Productive Acres 90% 88%5 2% Douglas-fir Regional Pricing, 2018 $815 / MBF6 $808 / MBF7 1% Note: As of 12/31/2018. 1. Site index in the Pacific Northwest is the height, in feet, of a tree at age 50. 5. Management estimate based on the weighted-average of comparable 2. Privately-owned timberlands; excludes public lands with forests. properties in the region 21 3. Source: U.S. Forest Services, Forest Inventory & Analysis, 2016, for the 6. RISI Log Lines Region 3 Delivered Pricing. coastal regions of Washington and Oregon. 7. RISI Log Lines Region 1-3 Delivered Pricing Average. 4. Source: Forisk Consulting LLC

Superior Operations 22

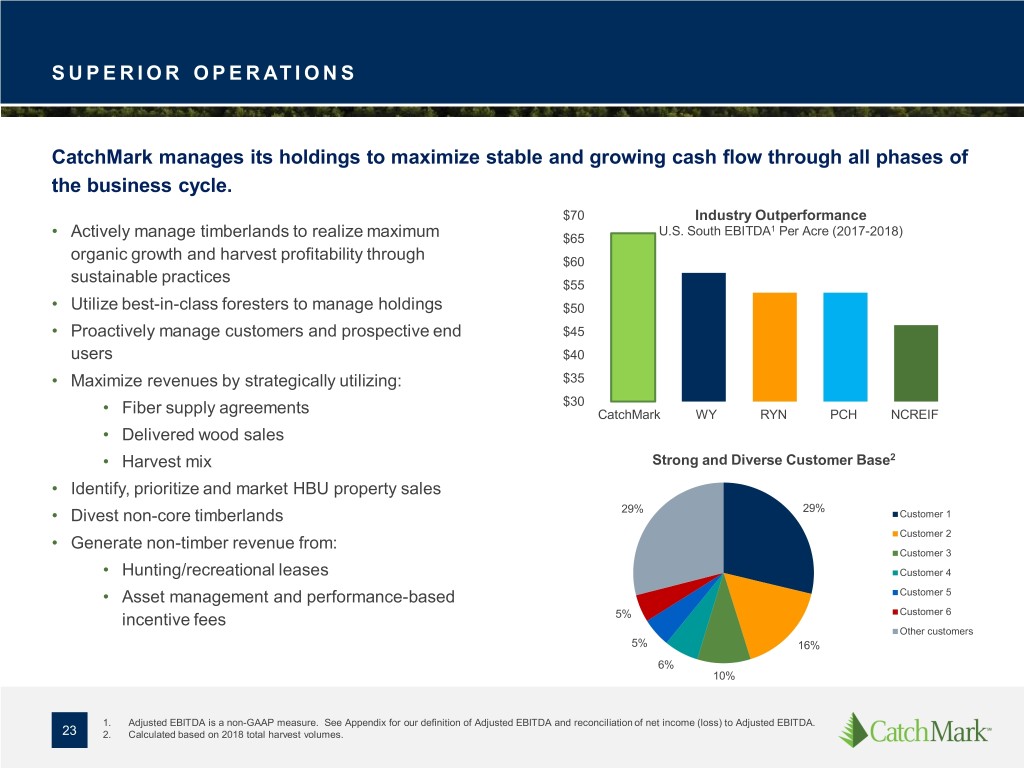

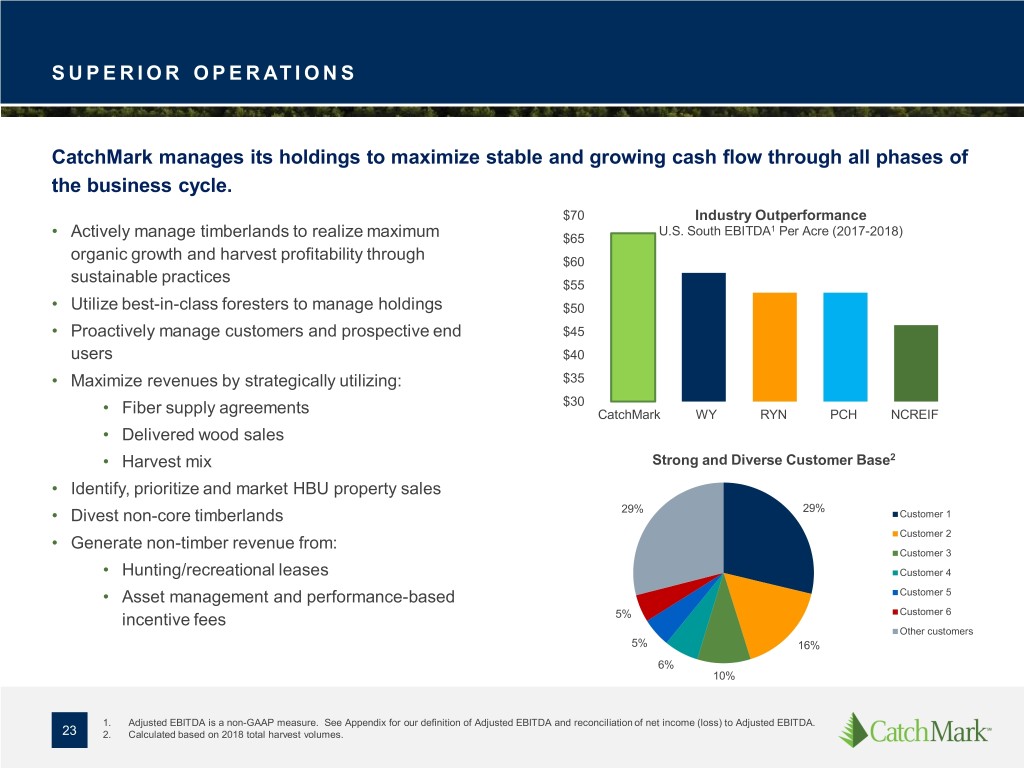

SUPERIOR OPERATIONS CatchMark manages its holdings to maximize stable and growing cash flow through all phases of the business cycle. $70 Industry Outperformance U.S. South EBITDA1 Per Acre (2017-2018) • Actively manage timberlands to realize maximum $65 organic growth and harvest profitability through $60 sustainable practices $55 • Utilize best-in-class foresters to manage holdings $50 • Proactively manage customers and prospective end $45 users $40 • Maximize revenues by strategically utilizing: $35 $30 • Fiber supply agreements CatchMark WY RYN PCH NCREIF • Delivered wood sales • Harvest mix Strong and Diverse Customer Base2 • Identify, prioritize and market HBU property sales 29% • Divest non-core timberlands 29% Customer 1 Customer 2 • Generate non-timber revenue from: Customer 3 • Hunting/recreational leases Customer 4 • Asset management and performance-based Customer 5 Customer 6 incentive fees 5% Other customers 5% 16% 6% 10% 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 23 2. Calculated based on 2018 total harvest volumes.

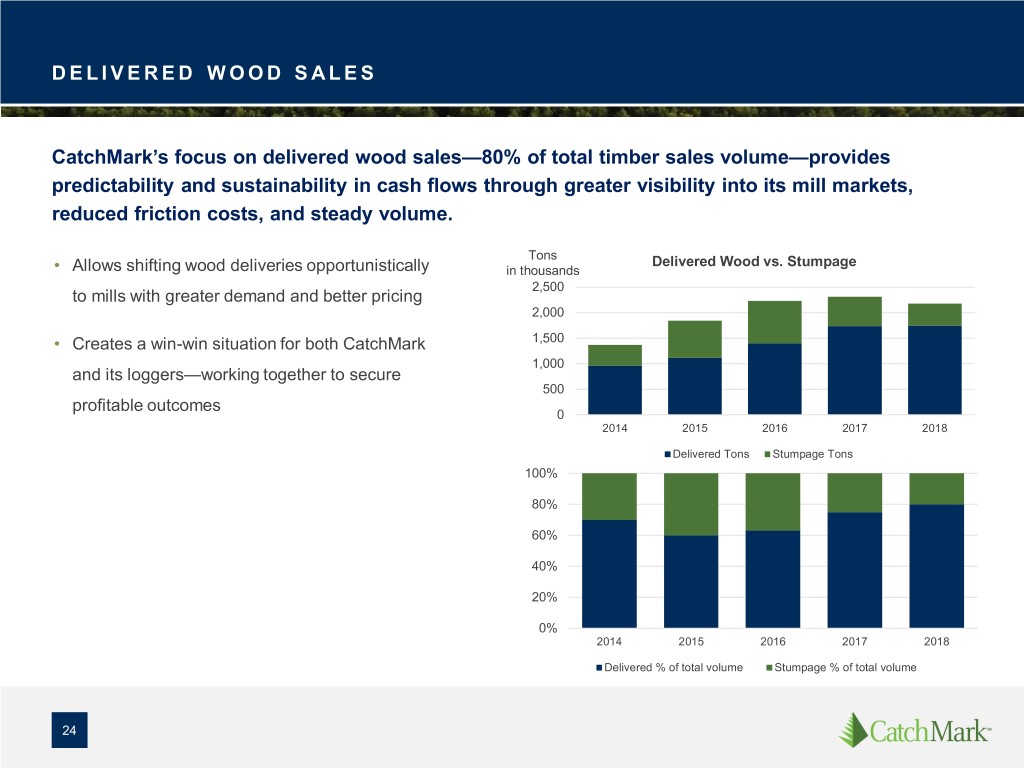

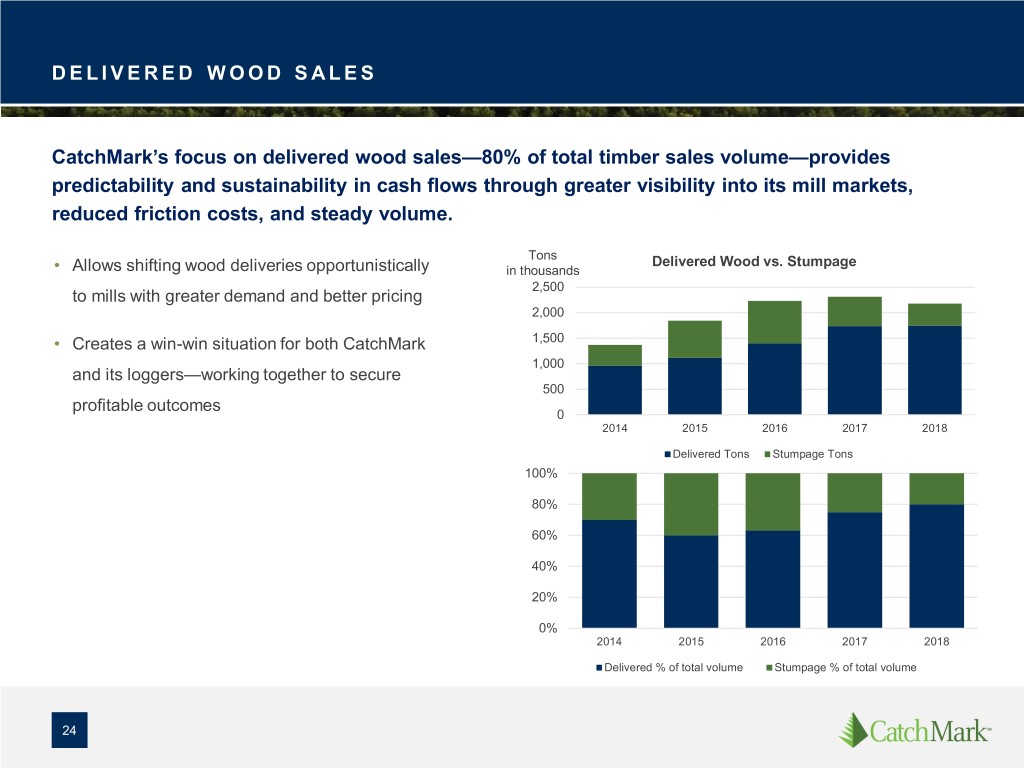

DELIVERED WOOD SALES CatchMark’s focus on delivered wood sales—80% of total timber sales volume—provides predictability and sustainability in cash flows through greater visibility into its mill markets, reduced friction costs, and steady volume. Tons Delivered Wood vs. Stumpage • Allows shifting wood deliveries opportunistically in thousands 2,500 to mills with greater demand and better pricing 2,000 • Creates a win-win situation for both CatchMark 1,500 1,000 and its loggers—working together to secure 500 profitable outcomes 0 2014 2015 2016 2017 2018 Delivered Tons Stumpage Tons 100% 80% 60% 40% 20% 0% 2014 2015 2016 2017 2018 Delivered % of total volume Stumpage % of total volume 24

LONG- TERM FIBER SUPPLY AGREEMENTS CatchMark’s long-term fiber supply agreements with leading mill operators deliver stable baseload demand and corresponding cash-flow visibility with high-quality counterparties. • Mills have capacity of 8M tons annually; softwood Key Counterparties focused, 80% pine International WestRock • Initial agreement terms range between 10 and 25 Paper (IP) (WRK) years. 1 • Harvest volumes under FSAs represent 33% of total Market Cap $18.9B $10.2B volume in 2018 Moody’s: Baa2 Moody’s: Baa2 Credit Rating2 – 93% of this volume is pulpwood S&P: BBB S&P: BBB Consumer • 95% of CatchMark acres in regions covered by Mill Type Pulp/Paper packaging, lumber agreements are located within 75-mile radius of mills. Healthcare, Food, beverage, printing, writing, merchandising Uses consumer displays, building products products Demand Outlook Stable Stable/Growing 1. As of 02/21/2019 Source: NASDAQ. 2. As of 02/21/2019 Source: Moody’s and S&P 25

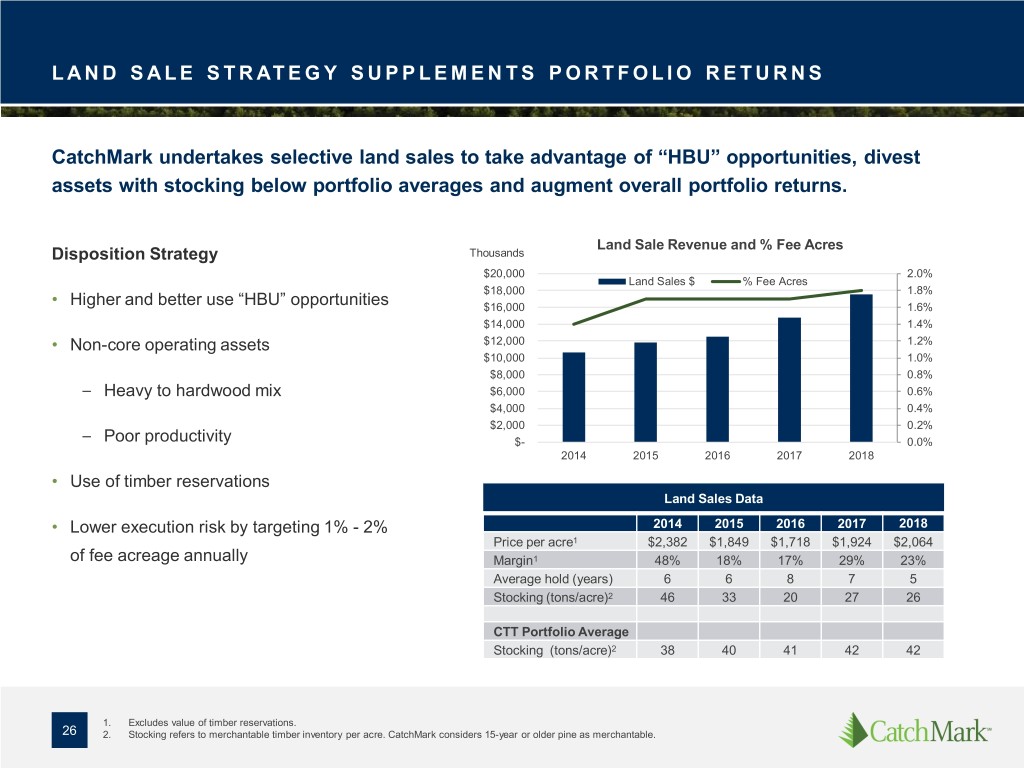

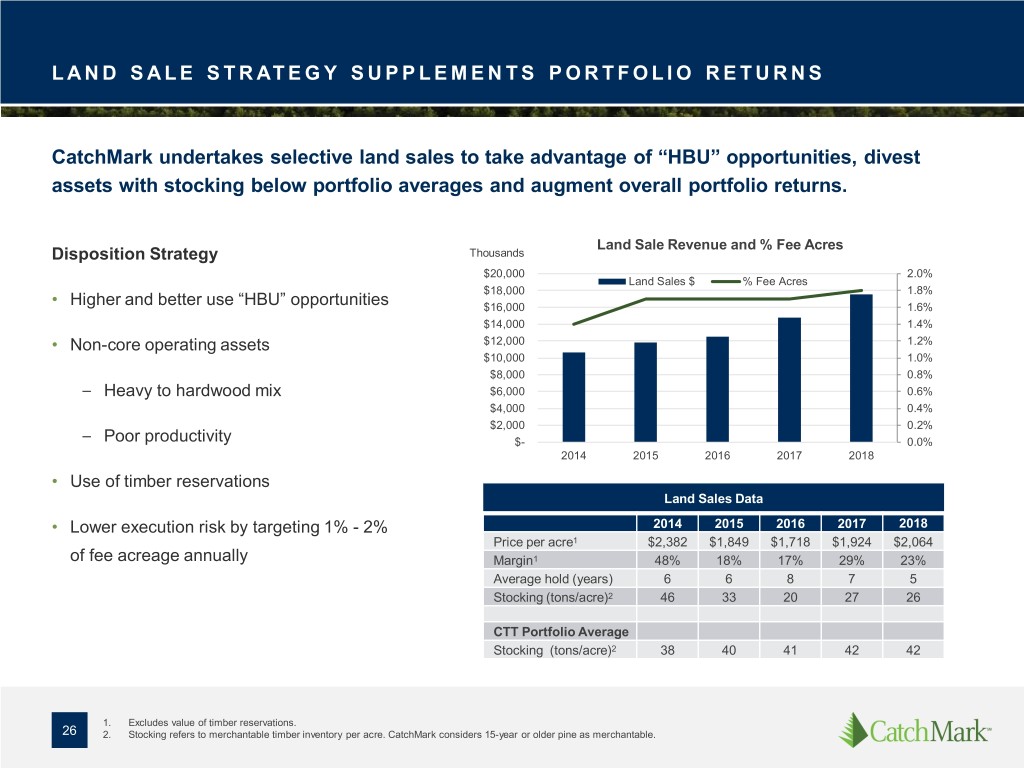

LAND SALE STRATEGY SUPPLEMENTS PORTFOLIO RETURNS CatchMark undertakes selective land sales to take advantage of “HBU” opportunities, divest assets with stocking below portfolio averages and augment overall portfolio returns. Land Sale Revenue and % Fee Acres Disposition Strategy Thousands $20,000 2.0% Land Sales $ % Fee Acres $18,000 1.8% • Higher and better use “HBU” opportunities $16,000 1.6% $14,000 1.4% • Non-core operating assets $12,000 1.2% $10,000 1.0% $8,000 0.8% – Heavy to hardwood mix $6,000 0.6% $4,000 0.4% $2,000 0.2% – Poor productivity $- 0.0% 2014 2015 2016 2017 2018 • Use of timber reservations Land Sales Data • Lower execution risk by targeting 1% - 2% 2014 2015 2016 2017 2018 Price per acre1 $2,382 $1,849 $1,718 $1,924 $2,064 of fee acreage annually Margin1 48% 18% 17% 29% 23% Average hold (years) 6 6 8 7 5 Stocking (tons/acre)2 46 33 20 27 26 CTT Portfolio Average Stocking (tons/acre)2 38 40 41 42 42 1. Excludes value of timber reservations. 26 2. Stocking refers to merchantable timber inventory per acre. CatchMark considers 15-year or older pine as merchantable.

SUSTAINABLE FORESTRY INITIATIVE CERTIFICATION “CatchMark has developed a program that continues to meet the requirements of the SFIS 2015-2019 Forest Management Edition”.* CatchMark SFI Implementation Program • Forest management planning • Forest health and productivity • Protection and maintenance of water resources • Conservation and biological diversity • Management of visual quality and recreational benefits • Protection of special sites • Efficient use of fiber resources • Recognize and respect indigenous people’s rights • Legal and regulatory compliance • Forestry research, science, and technology • Training and education • Community involvement and landowner outreach • Public land management responsibilities • Communications and public reporting • Management review 27 * SFI Re-certification Audit (2018)

Capital Strategy 28

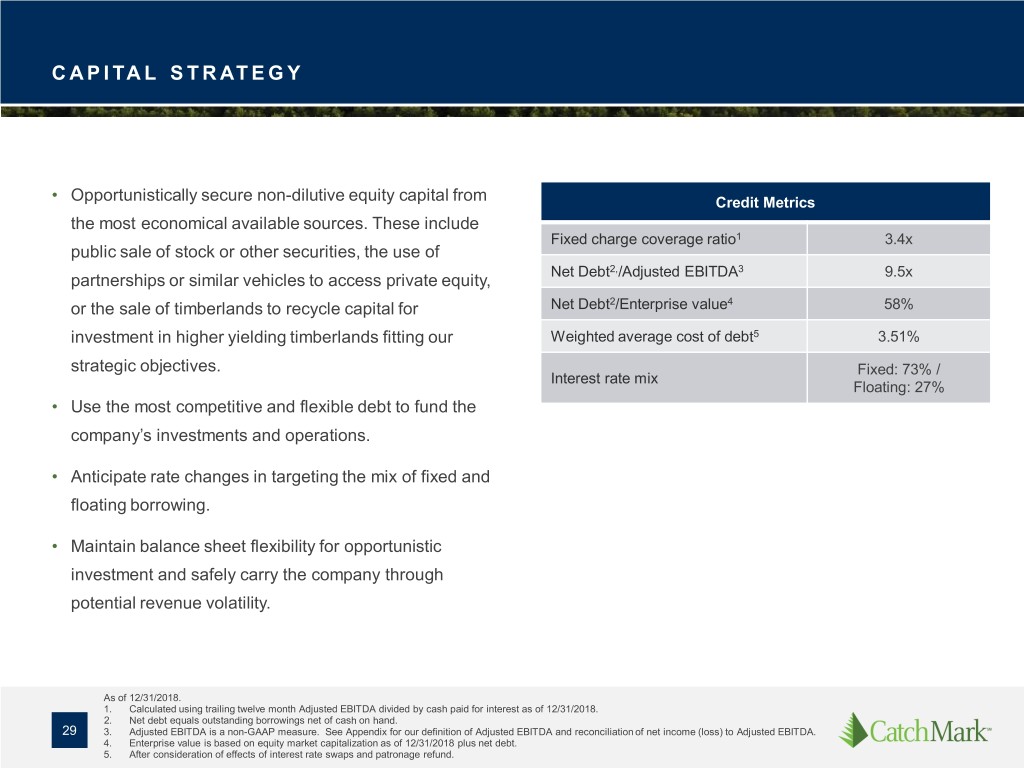

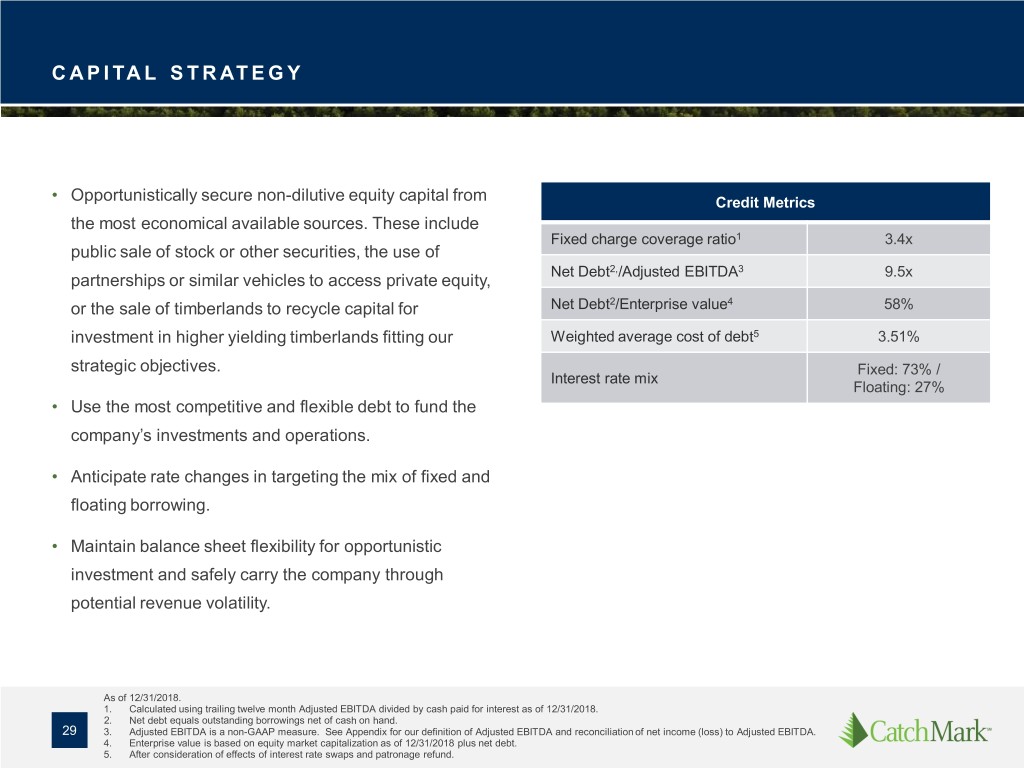

CAPITAL STRATEGY • Opportunistically secure non-dilutive equity capital from Credit Metrics the most economical available sources. These include Fixed charge coverage ratio1 3.4x public sale of stock or other securities, the use of Net Debt2,/Adjusted EBITDA3 9.5x partnerships or similar vehicles to access private equity, or the sale of timberlands to recycle capital for Net Debt2/Enterprise value4 58% investment in higher yielding timberlands fitting our Weighted average cost of debt5 3.51% strategic objectives. Fixed: 73% / Interest rate mix Floating: 27% • Use the most competitive and flexible debt to fund the company’s investments and operations. • Anticipate rate changes in targeting the mix of fixed and floating borrowing. • Maintain balance sheet flexibility for opportunistic investment and safely carry the company through potential revenue volatility. As of 12/31/2018. 1. Calculated using trailing twelve month Adjusted EBITDA divided by cash paid for interest as of 12/31/2018. 2. Net debt equals outstanding borrowings net of cash on hand. 29 3. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 4. Enterprise value is based on equity market capitalization as of 12/31/2018 plus net debt. 5. After consideration of effects of interest rate swaps and patronage refund.

ACCESS TO PRIVATE CAPITAL CatchMark gains scale and diversification by partnering with major institutions aligned with company investment objectives. Triple T Dawsonville Bluffs • $1.39 billion acquisition of 1.1 million acres of high- • $20 million acquisition of 11,000 acres of prime quality industrial East Texas timberlands in July 2018 timberlands in North Georgia • CatchMark tripled its acreage under management by • 50/50 joint venture fund, formed April 2017 investing $200 million in this transaction. • Partner: Missouri Department of Transportation & • Partners: Consortium of institutional investors Patrol Retirement System (MPERS) 30

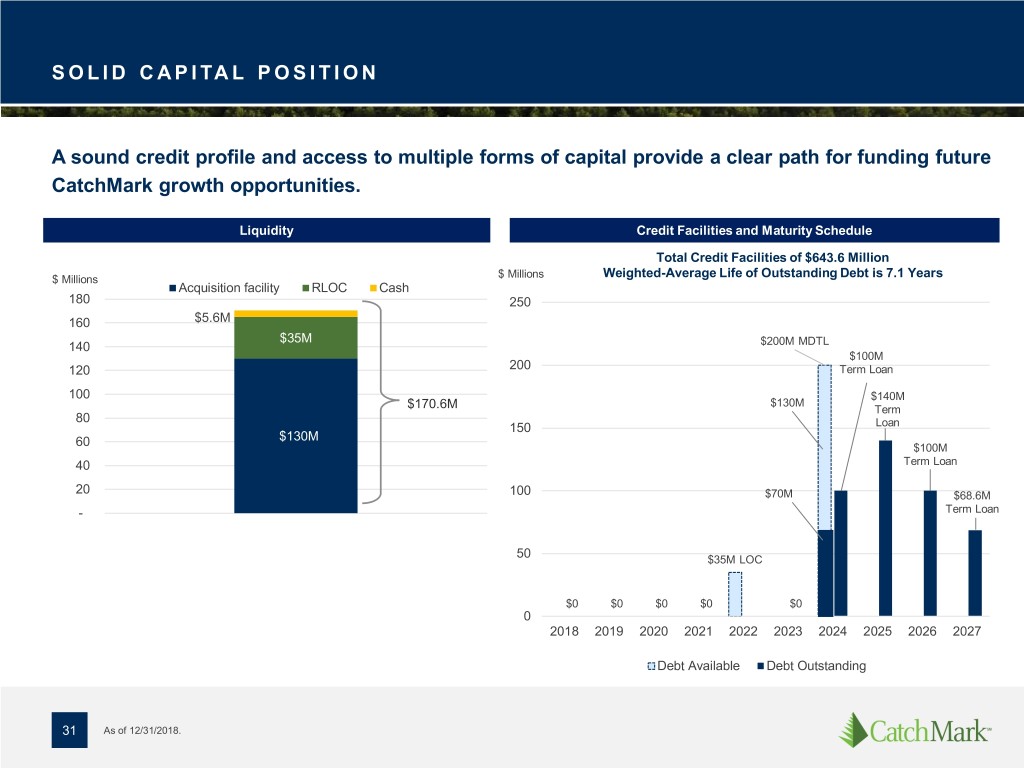

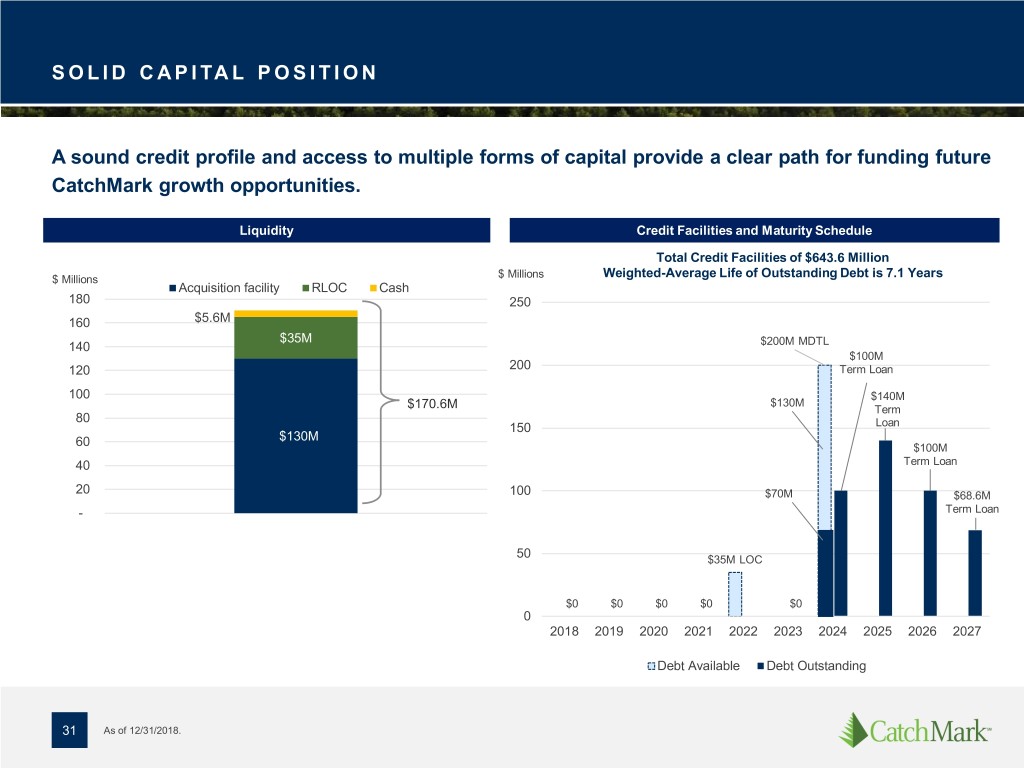

SOLID CAPITAL POSITION A sound credit profile and access to multiple forms of capital provide a clear path for funding future CatchMark growth opportunities. Liquidity Credit Facilities and Maturity Schedule Total Credit Facilities of $643.6 Million $ Millions $ Millions Weighted-Average Life of Outstanding Debt is 7.1 Years Acquisition facility RLOC Cash 180 250 160 $5.6M $35M 140 $200M MDTL $100M 120 200 Term Loan 100 $140M $130M $170.6M Term 80 150 Loan $130M 60 $100M 40 Term Loan 20 100 $70M $68.6M - Term Loan 50 $35M LOC $0 $0 $0 $0 $0 0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Debt Available Debt Outstanding 31 As of 12/31/2018.

CAPITAL ALLOCATIONS CatchMark prudently allocates capital to fund growth through acquisitions, make sustainable distributions to deliver current income to its investors, opportunistically repurchase shares at attractive prices, and provide for reinvestment needs to sustain portfolio value. Allocation of Capital Opportunistic Repurchase Program Millions Shares Share Price Repurchased $350 $14.00 50,000 $325 45,000 $300 $13.00 $275 40,000 $12.00 $250 6% 35,000 $225 $11.00 62% 30,000 $200 $175 $10.00 25,000 2% 2% $150 12% 20,000 $125 94% $9.00 84% 1% $100 2% 6% 8% 15,000 19% 12% $8.00 $75 73% 84% 1% 6% 24% 10,000 $50 73% 29% $7.00 $25 57% 5,000 xx% $0 $6.00 0 2014 2015 2016 2017 2018 Acquisitions Dividends Share Repurchases CAPEX Joint Venture Close Price Shares repurchased 32

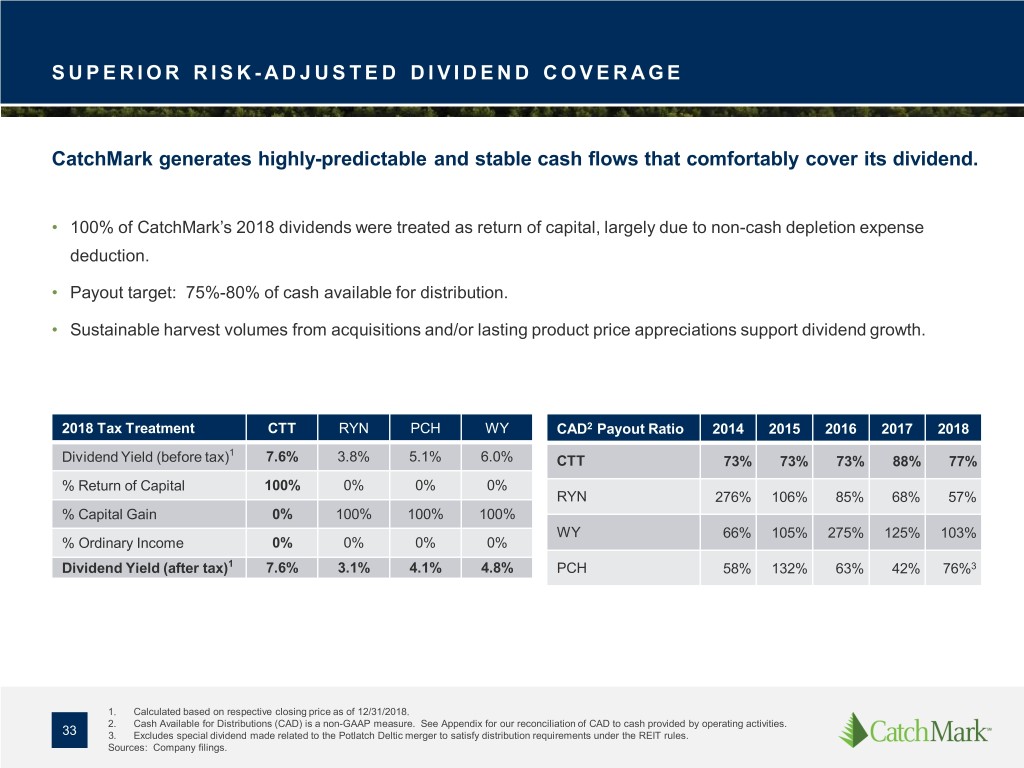

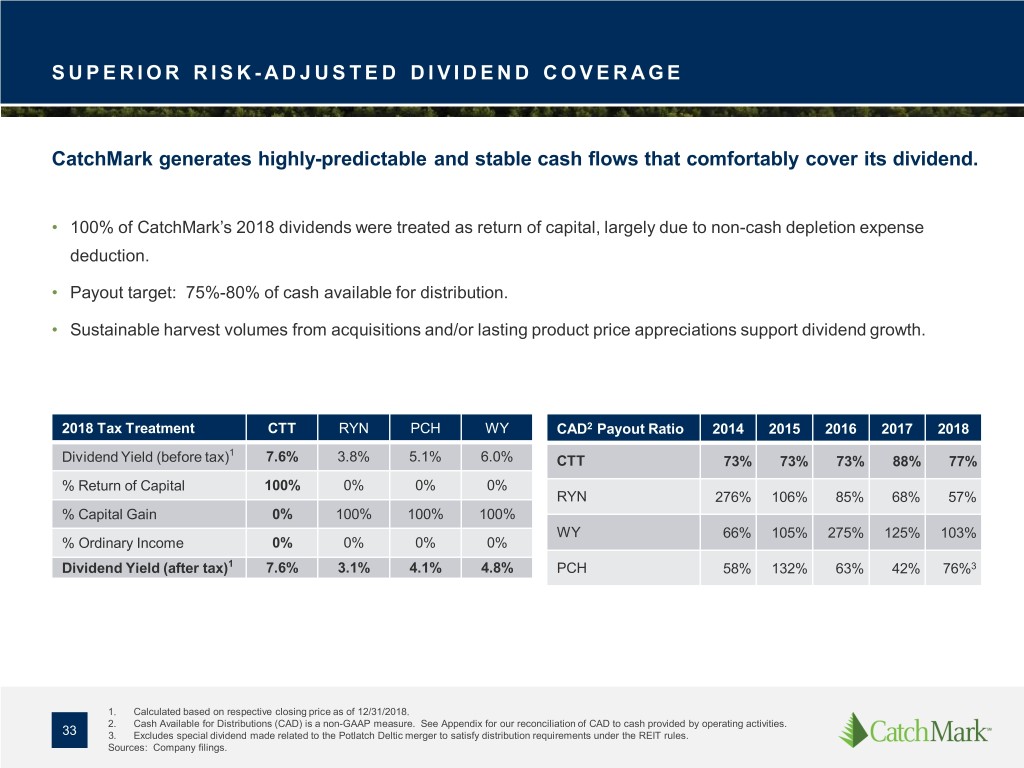

SUPERIOR RISK- ADJUSTED DIVIDEND COVERAGE CatchMark generates highly-predictable and stable cash flows that comfortably cover its dividend. • 100% of CatchMark’s 2018 dividends were treated as return of capital, largely due to non-cash depletion expense deduction. • Payout target: 75%-80% of cash available for distribution. • Sustainable harvest volumes from acquisitions and/or lasting product price appreciations support dividend growth. 2018 Tax Treatment CTT RYN PCH WY CAD2 Payout Ratio 2014 2015 2016 2017 2018 1 Dividend Yield (before tax) 7.6% 3.8% 5.1% 6.0% CTT 73% 73% 73% 88% 77% % Return of Capital 100% 0% 0% 0% RYN 276% 106% 85% 68% 57% % Capital Gain 0% 100% 100% 100% WY 66% 105% 275% 125% 103% % Ordinary Income 0% 0% 0% 0% Dividend Yield (after tax)1 7.6% 3.1% 4.1% 4.8% PCH 58% 132% 63% 42% 76%3 1. Calculated based on respective closing price as of 12/31/2018. 2. Cash Available for Distributions (CAD) is a non-GAAP measure. See Appendix for our reconciliation of CAD to cash provided by operating activities. 33 3. Excludes special dividend made related to the Potlatch Deltic merger to satisfy distribution requirements under the REIT rules. Sources: Company filings.

Investment Opportunity 34

INVESTMENT OPPORTUNITY CatchMark offers sustainable cash flows to its investors through an attractive, covered dividend; capital appreciation potential from its prime timberland portfolio; and upside from its investment in the Triple T joint venture. PRIME QUALITY HIGH DEMAND ACTIVE MANAGEMENT PREDICATABLE TIMBERLANDS MILL MARKETS CASH FLOW GROWTH TRIPLE T • Improving harvest inventory, long-term stocking profile provide durable cash flows DIVIDEND • Value-add returns possible from • Superior risk-adjusted dividend coverage. significant appreciation potential • Ongoing asset management fees and incentive-based promotes offer additional revenues and upside opportunity 35

UPSIDE PARTICIPATION – TRIPLE T CatchMark’s $200 million investment in the $1.39 billion Triple T joint venture provides significant upside potential from an improving inventory profile, opportunities to unlock future value through sophisticated harvest management, and significant asset management fee income as well as incentive-based promotes. • Immediately CAD Accretive: The JV secures ongoing asset management fee income and potential for attractive promotes. • Rapidly Improving Inventory Profile: Results in enhanced future harvests and provides the opportunity to restructure operations to optimize cash flow and value. • Ability to Recapitalize: CatchMark can recapitalize the asset in the future, retaining long-term ownership control. • High-Quality Portfolio: Triple T fits CatchMark’s profile for high quality timberland assets with excellent stocking that can provide durable growth for shareholders. • Unlocking Future Value: CatchMark has identified opportunities to unlock future value, including optimizing inventory and delivery on existing long-term supply agreements. • Expanded Investment Management Business: CatchMark has expanded its investment management business, supplementing harvest revenues with additional fee income to support its dividend and growth strategy. 36

Summary 37

SUMMARY Taking advantage of and actively managing its prime timberland portfolio in attractive mill markets, CatchMark’s operating strategy generates highly-predictable and stable cash flow that comfortably cover its dividend and delivers consistent growth. PRIME QUALITY HIGH DEMAND ACTIVE MANAGEMENT PREDICATABLE TIMBERLANDS MILL MARKETS CASH FLOW GROWTH DISCIPLINED ACQUISITIONS OF HIGH DEMAND MILL MARKETS SUPERIOR OPERATIONS PRIME TIMBERLANDS TO PROVIDE RELIABLE OUTLET FOR TO MAXIMIZE CASH FLOWS THROUGHOUT TO PRODUCE DURABLE REVENUE GROWTH AVAILABLE MERCHANTABLE INVENTORY BUSINESS CYCLE DRIVES STABILITY AND PREDICTABILITY OF CASH FLOW 38

Appendix 39

ADJUSTED EBITDA Earnings before Interest, Taxes, Depletion, and Amortization (“EBITDA”) is a non-GAAP measure of operating performance. EBITDA is defined by the SEC however, we have excluded certain other expenses which we believe are not indicative of the ongoing operating results of our timberland portfolio, and we refer to this measure as Adjusted EBITDA. As such, our Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies and should not be considered in isolation or as an alternative to, or substitute for net income, cash from operations, or other financial statement data presented in our consolidated financial statements as indicators of our operating performance. Due to the significant amount of timber assets subject to depletion, significant income (losses) from unconsolidated joint ventures based on HLBV, and the significant amount of financing subject to interest and amortization expense, management considers Adjusted EBITDA to be an important measure of our financial performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations are: • Adjusted EBITDA does not reflect our capital expenditures, or our future requirements for capital expenditures; • Adjusted EBITDA does not reflect changes in, or our interest expense or the cash requirements necessary to service interest or principal payments on, our debt; and • Although depletion is a non-cash charge, we will incur expenses to replace the timber being depleted in the future, and Adjusted EBITDA does not reflect all cash requirements for such expenses. • Although HLBV income and losses are primarily hypothetical and non-cash in nature, Adjusted EBITDA does not reflect cash income or losses from unconsolidated joint ventures for which we use the HLBV method of accounting to determine our equity in earnings. Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Our credit agreement contains a minimum debt service coverage ratio based, in part, on Adjusted EBITDA since this measure is representative of adjusted income available for interest payments. 40

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA (in thousands unless otherwise noted) 2014 2015 2016 2017 2018 Net Income (loss) $660 $(8,387) $(11,070) $(13,510) $(122,007) Add: Depletion 14,788 27,091 28,897 29,035 25,912 Basis of timberland sold, lease terminations and other1 5,072 8,886 10,089 10,112 13,053 Amortization2 836 765 1,093 1,270 2,821 Depletion, amortization, and basis of timberland and mitigation tax credits sold included in loss from unconsolidated — — — 865 4,195 Dawsonville Bluffs Joint Venture 3 HLBV (income) loss from unconsolidated joint venture4 — — — — 109,550 Stock-based compensation expense 418 889 1,724 2,786 2,689 Interest expense2 1,897 2,924 5,753 10,093 13,643 (Gain) loss from large dispositions5 — — — — 390 Other6 151 111 322 1,319 (460) Adjusted EBITDA $23,822 $32,279 $36,808 $41,970 $49,786 1. Includes non-cash basis of timber and timberland assets written-off related to timberland sold, terminations of timberland leases and casualty losses. Certain prior periods amounts have been reclassified to conform with the current presentation. 2. For the purpose of the above reconciliation, amortization includes amortization of deferred financing costs, amortization of intangible lease assets, and amortization of mainline road costs, which are included in either interest expense, land rent expense, or other operating expenses in the accompanying consolidated statements of operations. 3. Reflects our 50% share of depletion, amortization, and basis of timberland and mitigation credits sold of the unconsolidated Dawnsonville Bluffs, LLC joint venture. 4. Reflects HLBV (income) losses from the Triple T Joint Venture, which is determined based on a hypothetical liquidation of the underlying joint venture at book value as of the reporting date rather than a liquidation at fair value as of a date that is more in-line with the joint venture’s expected timing for a liquidity event. 5. Large dispositions are defined as larger transactions in acreage and gross sales price than recurring HBU sales. Large dispositions are not part of core operations, are infrequent in nature and would cause material variances in comparative results if not reported separately. Large dispositions may or may not have a higher or better use than timber production or result in a price premium above the land’s timber production value. 6. Includes certain gains, reimbursements, losses and/or expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. 41

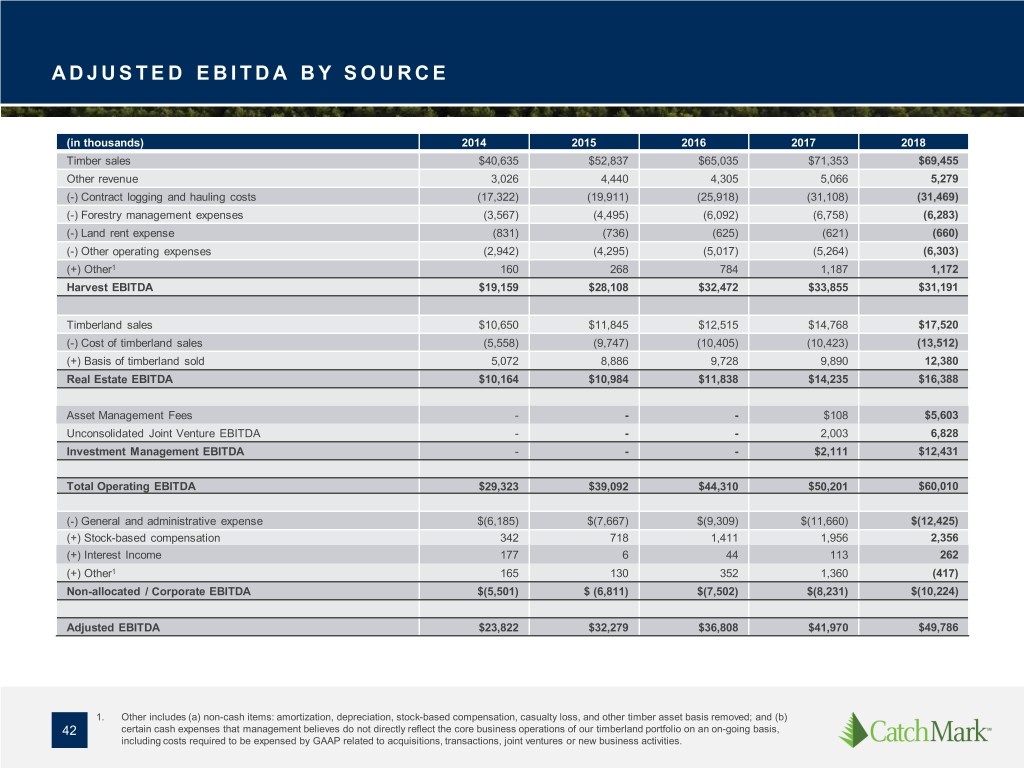

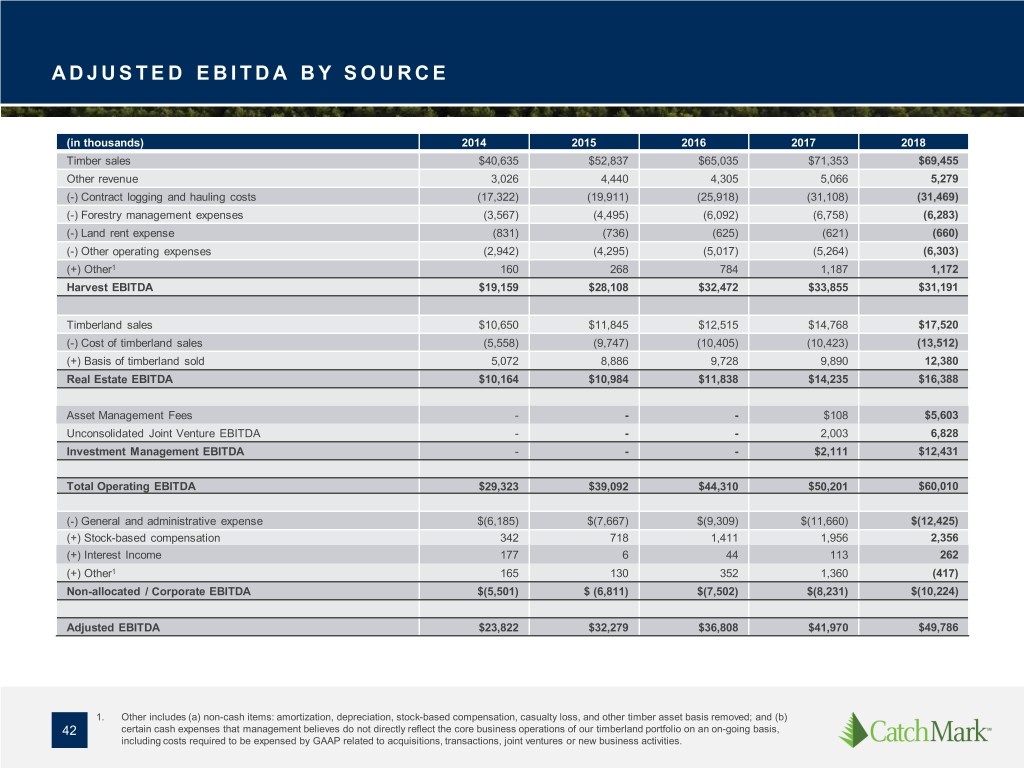

ADJUSTED EBITDA BY SOURCE (in thousands) 2014 2015 2016 2017 2018 Timber sales $40,635 $52,837 $65,035 $71,353 $69,455 Other revenue 3,026 4,440 4,305 5,066 5,279 (-) Contract logging and hauling costs (17,322) (19,911) (25,918) (31,108) (31,469) (-) Forestry management expenses (3,567) (4,495) (6,092) (6,758) (6,283) (-) Land rent expense (831) (736) (625) (621) (660) (-) Other operating expenses (2,942) (4,295) (5,017) (5,264) (6,303) (+) Other1 160 268 784 1,187 1,172 Harvest EBITDA $19,159 $28,108 $32,472 $33,855 $31,191 Timberland sales $10,650 $11,845 $12,515 $14,768 $17,520 (-) Cost of timberland sales (5,558) (9,747) (10,405) (10,423) (13,512) (+) Basis of timberland sold 5,072 8,886 9,728 9,890 12,380 Real Estate EBITDA $10,164 $10,984 $11,838 $14,235 $16,388 Asset Management Fees - - - $108 $5,603 Unconsolidated Joint Venture EBITDA - - - 2,003 6,828 Investment Management EBITDA - - - $2,111 $12,431 Total Operating EBITDA $29,323 $39,092 $44,310 $50,201 $60,010 (-) General and administrative expense $(6,185) $(7,667) $(9,309) $(11,660) $(12,425) (+) Stock-based compensation 342 718 1,411 1,956 2,356 (+) Interest Income 177 6 44 113 262 (+) Other1 165 130 352 1,360 (417) Non-allocated / Corporate EBITDA $(5,501) $ (6,811) $(7,502) $(8,231) $(10,224) Adjusted EBITDA $23,822 $32,279 $36,808 $41,970 $49,786 1. Other includes (a) non-cash items: amortization, depreciation, stock-based compensation, casualty loss, and other timber asset basis removed; and (b) 42 certain cash expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities.

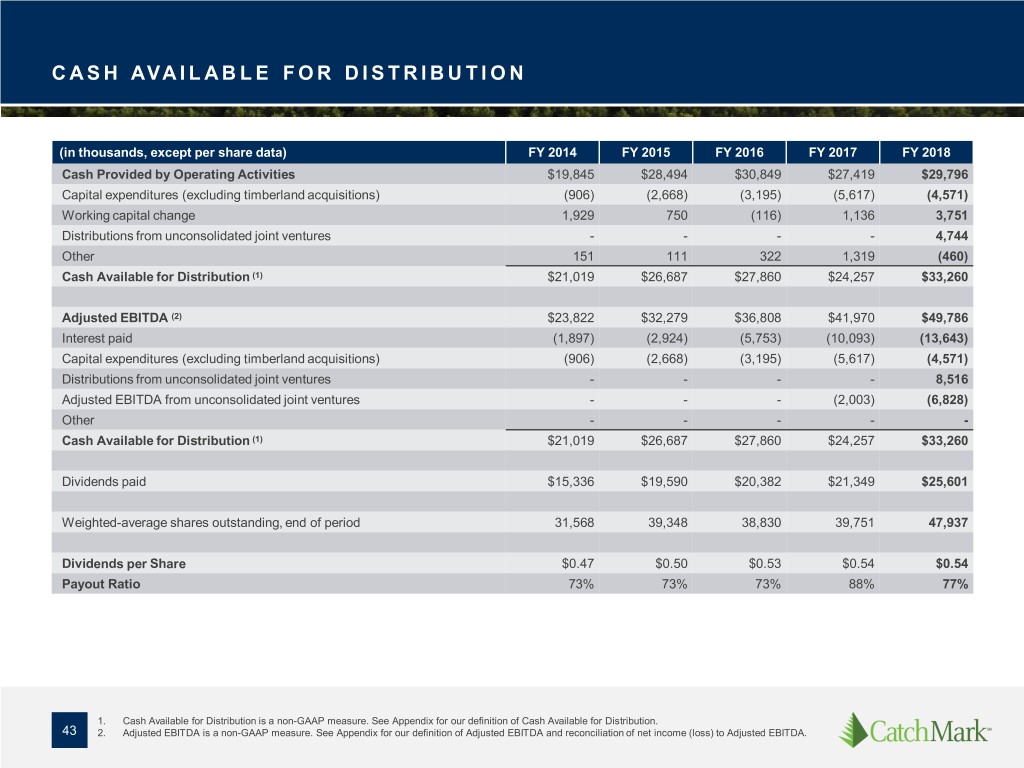

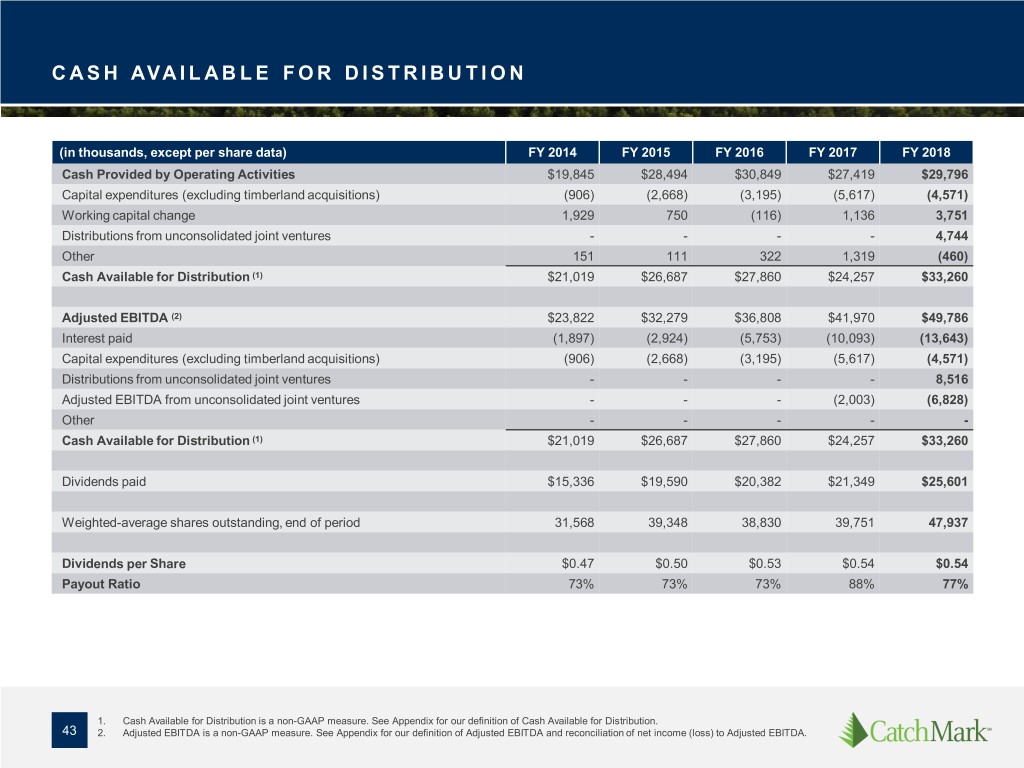

CASH AVAILABLE FOR DISTRIBUTION (in thousands, except per share data) FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 Cash Provided by Operating Activities $19,845 $28,494 $30,849 $27,419 $29,796 Capital expenditures (excluding timberland acquisitions) (906) (2,668) (3,195) (5,617) (4,571) Working capital change 1,929 750 (116) 1,136 3,751 Distributions from unconsolidated joint ventures - - - - 4,744 Other 151 111 322 1,319 (460) Cash Available for Distribution (1) $21,019 $26,687 $27,860 $24,257 $33,260 Adjusted EBITDA (2) $23,822 $32,279 $36,808 $41,970 $49,786 Interest paid (1,897) (2,924) (5,753) (10,093) (13,643) Capital expenditures (excluding timberland acquisitions) (906) (2,668) (3,195) (5,617) (4,571) Distributions from unconsolidated joint ventures - - - - 8,516 Adjusted EBITDA from unconsolidated joint ventures - - - (2,003) (6,828) Other - - - - - Cash Available for Distribution (1) $21,019 $26,687 $27,860 $24,257 $33,260 Dividends paid $15,336 $19,590 $20,382 $21,349 $25,601 Weighted-average shares outstanding, end of period 31,568 39,348 38,830 39,751 47,937 Dividends per Share $0.47 $0.50 $0.53 $0.54 $0.54 Payout Ratio 73% 73% 73% 88% 77% 1. Cash Available for Distribution is a non-GAAP measure. See Appendix for our definition of Cash Available for Distribution. 43 2. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA.

CAD RECONCILIATION AND DIVIDEND PAYOUT RATIO CALCULATION (Dollars in millions) RAYONIER (RYN) 2014 2015 2016 2017 2018 Dividends Paid $257.5 $124.9 $122.8 $127.1 $136.8 Cash provided by operating activities, as reported $320.4 $177.2 $203.8 $256.3 $310.1 (-) Capital Expenditures (excluding timberland acquisitions) (63.7) (57.3) (58.7) (65.3) (62.3) (-) Working capital changes (39.5) (2.5) (0.8) (2.3) (7.7) (-) Other2 (123.8) - - - - CAD $93.4 $117.4 $144.3 $188.7 $240.1 Payout Ratio 276% 106% 85% 68% 57% WEYERHAEUSER (WY) 20141 20151 2016 2017 2018 Dividends Paid $563 $619 $932 $941 $136.8 Cash provided by operating activities, as reported $1,088 $1,064 $735 $1,201 $1,112.0 (-) Capital Expenditures (excluding timberland acquisitions) (395) (483) (510) (419) (370) +/(-) Working capital changes 160 10 (129) (30) 227 (+) Incomes taxes paid for discontinued operations - - 243 - - CAD $853 $591 $339 $752 $969 Payout Ratio 66% 105% 275% 125% 103% POTLATCHDELTIC (PCH) 2014 2015 2016 2017 20183 Dividends Paid $57.8 $61.0 $60.8 $61.9 $102.3 Cash provided by operating activities, as reported $131.4 $74.0 $102.1 $162.7 $178.9 (-) Capital Expenditures (excluding timberland acquisitions) (24.2) (32.7) (19.3) (28.1) (52.1) +/(-) Working capital changes (7.2) 4.8 13.8 13.4 - CAD $100.0 $46.1 $96.6 $148.0 $126.8 Payout Ratio 58% 132% 63% 42% 76% 1. Weyerhaeuser's 2014 and 2015 numbers were calculated from its Form 10-K filed in 2015. 2. For 2014, Other includes $21.4M adjustment for large dispositions and $102.4M adjustment for cash flows from discontinued operations, as reported in 44 Rayonier’s 2016 Form 10K. 3. Excludes special dividend made related to the Potlatch Deltic merger to satisfy distribution requirements under the REIT rules. Sources: Company filings.