PRIME TIMBERLANDS HIGH-DEMAND MILL MARKETS SUPERIOR MANAGEMENT THIRD QUARTER 2021 Financial Supplement

DISCLOSURES In this presentation (1) “CatchMark” refers to CatchMark Timber Trust, Inc., a Maryland corporation that has elected to be taxed as a real estate investment trust (NYSE: CTT), (2) “Triple T” refers to TexMark Timber Treasury, L.P., a Delaware limited partnership that is a joint venture that was managed by CatchMark and in which CatchMark held a common limited partnership interest as of September 30, 2021, and (3) “Dawsonville Bluffs” refers to Dawsonville Bluffs, LLC, a Delaware limited liability company that is a joint venture managed by CatchMark and in which CatchMark holds a 50% limited liability company interest. Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Forward-looking statements in this presentation include, but are not limited to, that we will manage our operations to generate highly predictable and stable cash flow that covers our dividend and is designed to deliver consistent growth throughout the business cycle, and our guidance with respect to our anticipated 2021 results. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations, including, but not limited to: (i) the supply of timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (ii) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (iii) we may not be able to access external sources of capital at attractive rates or at all; (iv) potential increases in interest rates could have a negative impact on our business; (v) timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (vi) we may not generate the harvest volumes from our timberlands that we currently anticipate; (vii) the demand for our timber may not increase at the rate we currently anticipate or could decline due to changes in general economic and business conditions in the geographic regions where our timberlands are located, including as a result of the COVID-19 pandemic and the measures taken as a response thereto; (viii) a downturn in the real estate market, including decreases in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties; (ix) we may not be able to make large dispositions of timberland in capital recycling transactions at prices that are attractive to us or at all; (x) our dividends are not guaranteed and are subject to change; (xi) the markets for carbon sequestration credits, wetlands mitigation banking and solar projects are still developing and we maybe unsuccessful in generating the revenues from environmental initiatives that we currently expect or in the timeframe anticipated; (xii) our share repurchase program may not be successful in improving stockholder value over the long-term; (xiii) our joint venture strategy may not enable us to access non-dilutive capital and enhance our ability to make acquisitions; and (xiv) the factors described in Part I, Item 1A Risk Factors of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and our other filings with Securities and Exchange Commission. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to update our forward-looking statements, except as required by law. 2

THREE PILLAR BUSINESS MODEL 3 PRIME QUALITY TIMBERLANDS HIGH-DEMAND MILL MARKETS SUPERIOR MANAGEMENT Acquiring and owning prime timberlands through prudent and disciplined allocation of capital Expanding acquisition activity and harvest operations in leading mill markets in the U.S. South, the nation’s premier timber basket Optimizing results through superior management, which historically has produced industry leading productivity on a per-acre basis, and the value realization of environmental initiatives STRATEGIC FOCUS DRIVES STABLE AND PREDICTABLE CASH FLOW CatchMark acquires prime timberlands in high-demand mill markets and optimizes operations to generate highly-predictable and stable cash flow that covers its dividend and is designed to deliver consistent growth throughout the business cycle.

4 F I N A N C I A L A N D O P E R A T I N G I N F O R M A T I O N

FINANCIAL HIGHLIGHTS 5 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 2. Debt is gross of deferred financing costs. 3. Enterprise value is based on equity market capitalization as of the last trading day of the respective period plus net debt. 4. Cash Available for Distribution is a non-GAAP measure. See Appendix for our definition of Cash Available for Distribution and slide 7 for a reconciliation of Cash Provided by Operating Activities to Cash Available for Distribution. Results of Operations Q3 2021 Q2 2021 Q3 2020 2021 YTD 2020 YTD Revenues $22,073 $31,940 $24,613 $81,699 $73,342 Income (loss) before unconsolidated joint ventures and income taxes $23,351 $1,704 $(1,855) $23,890 $(9,854) Net income (loss) $23,308 $1,753 $(4,149) $24,510 $(14,581) Net income (loss) attributable to common stockholders $23,252 $1,749 $(4,149) $24,451 $(14,581) Net income (loss) per common share – basic $0.48 $0.04 $(0.09) $0.51 $(0.30) Adjusted EBITDA1 $9,864 $17,577 $12,399 $40,378 $34,723 Weighted-average common shares outstanding - basic 48,441 48,421 48,766 48,412 48,833 (in thousands, except per-share data) Capital Resources and Liquidity Q3 2021 Q2 2021 Q3 2020 2021 YTD 2020 YTD Cash provided by operating activities $6,830 $18,460 $7,617 $36,882 $27,647 Cash provided by (used in) investing activities $99,357 $6,603 $(839) $103,643 $11,658 Cash used in financing activities $(103,912) $(15,428) $(8,094) $(127,883) $(42,758) Cash Available for Distribution (CAD)4 $7,152 $14,024 $8,433 $28,752 $21,257 9/30/2021 12/31/2020 Debt2 $340,000 $442,705 (-) Cash (24,566) (11,924) Net Debt $315,434 $430,781 Net Debt/Adjusted EBITDA1 5.5x 8.3x Net Debt/Enterprise Value3 35% 49% Cash $24,566 $11,924 Credit Facilities Capacity Revolving line of credit $35,000 $35,000 Acquisition facilities 218,619 115,914 $253,619 $150,914

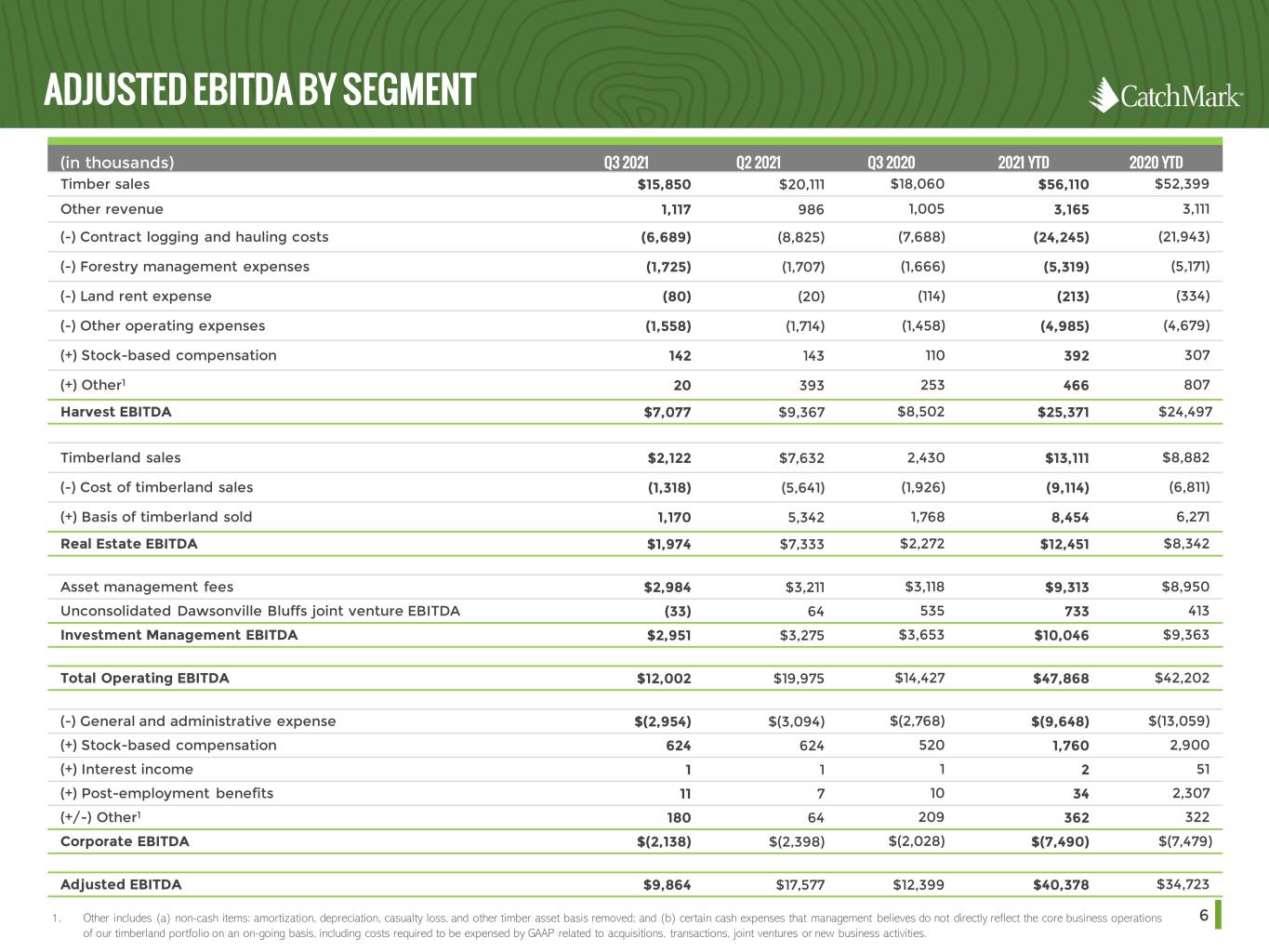

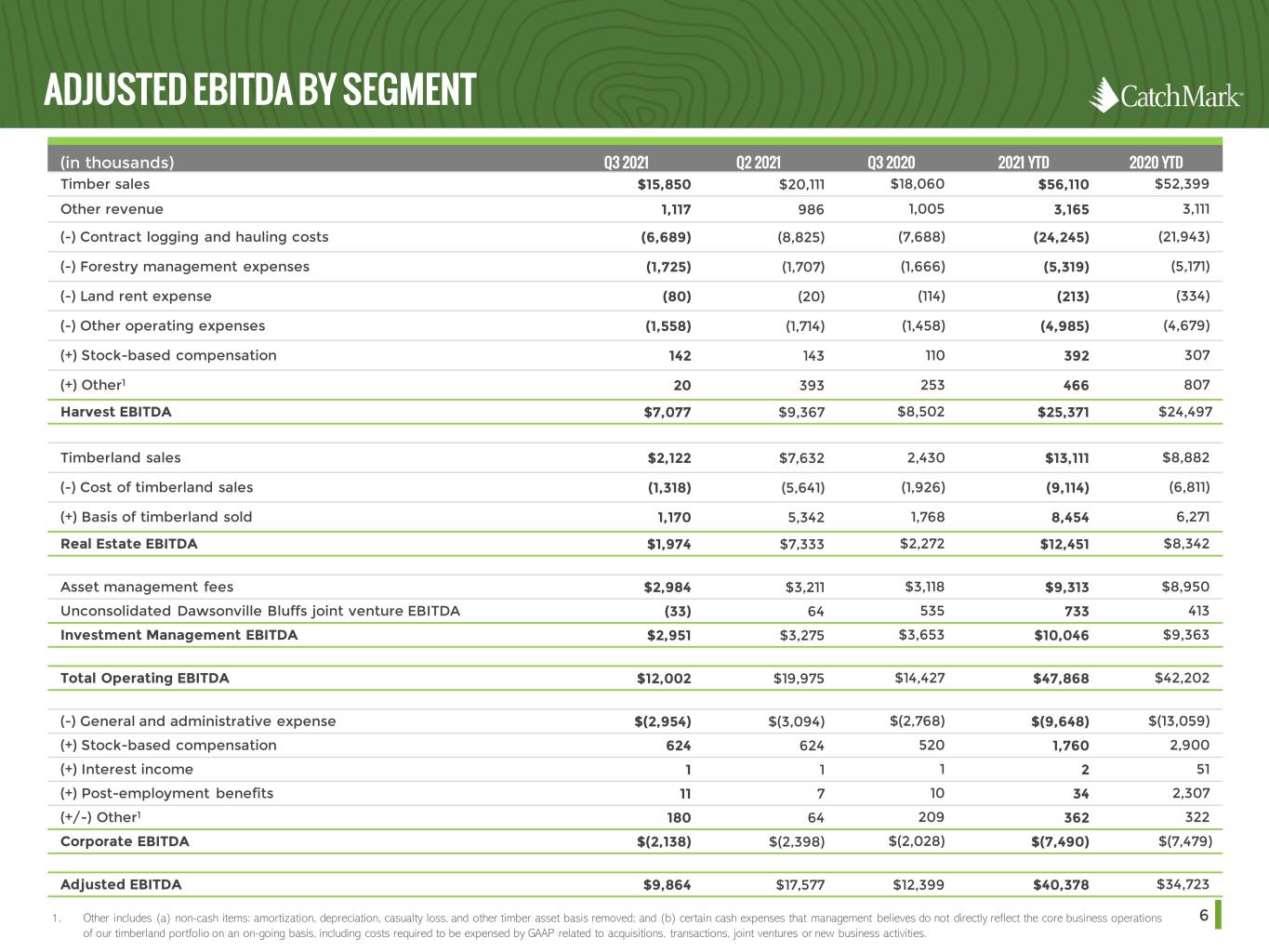

ADJUSTED EBITDA BY SEGMENT 61. Other includes (a) non-cash items: amortization, depreciation, casualty loss, and other timber asset basis removed; and (b) certain cash expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. (in thousands) Q3 2021 Q2 2021 Q3 2020 2021 YTD 2020 YTD Timber sales $15,850 $20,111 $18,060 $56,110 $52,399 Other revenue 1,117 986 1,005 3,165 3,111 (-) Contract logging and hauling costs (6,689) (8,825) (7,688) (24,245) (21,943) (-) Forestry management expenses (1,725) (1,707) (1,666) (5,319) (5,171) (-) Land rent expense (80) (20) (114) (213) (334) (-) Other operating expenses (1,558) (1,714) (1,458) (4,985) (4,679) (+) Stock-based compensation 142 143 110 392 307 (+) Other1 20 393 253 466 807 Harvest EBITDA $7,077 $9,367 $8,502 $25,371 $24,497 Timberland sales $2,122 $7,632 2,430 $13,111 $8,882 (-) Cost of timberland sales (1,318) (5,641) (1,926) (9,114) (6,811) (+) Basis of timberland sold 1,170 5,342 1,768 8,454 6,271 Real Estate EBITDA $1,974 $7,333 $2,272 $12,451 $8,342 Asset management fees $2,984 $3,211 $3,118 $9,313 $8,950 Unconsolidated Dawsonville Bluffs joint venture EBITDA (33) 64 535 733 413 Investment Management EBITDA $2,951 $3,275 $3,653 $10,046 $9,363 Total Operating EBITDA $12,002 $19,975 $14,427 $47,868 $42,202 (-) General and administrative expense $(2,954) $(3,094) $(2,768) $(9,648) $(13,059) (+) Stock-based compensation 624 624 520 1,760 2,900 (+) Interest income 1 1 1 2 51 (+) Post-employment benefits 11 7 10 34 2,307 (+/-) Other1 180 64 209 362 322 Corporate EBITDA $(2,138) $(2,398) $(2,028) $(7,490) $(7,479) Adjusted EBITDA $9,864 $17,577 $12,399 $40,378 $34,723

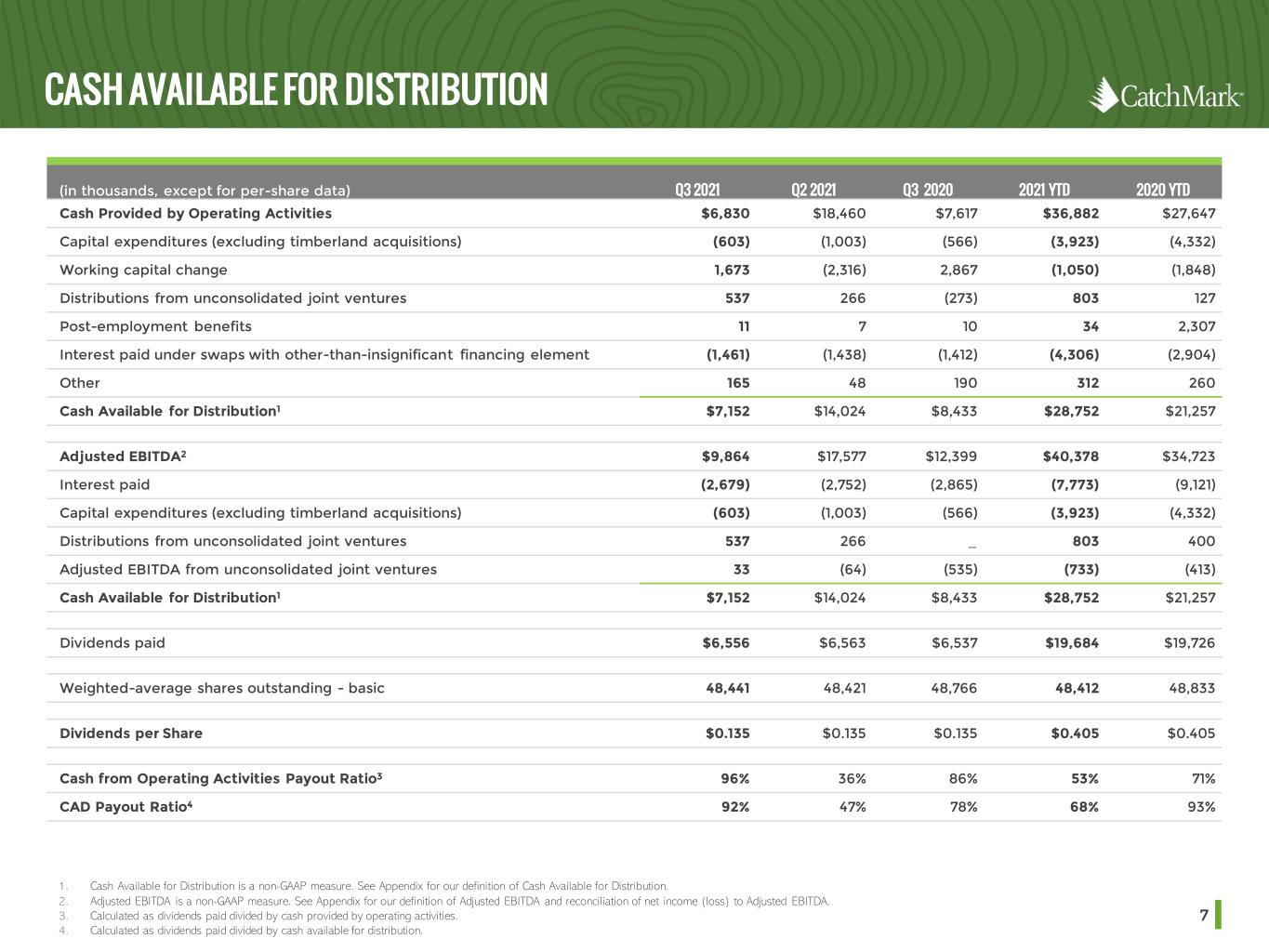

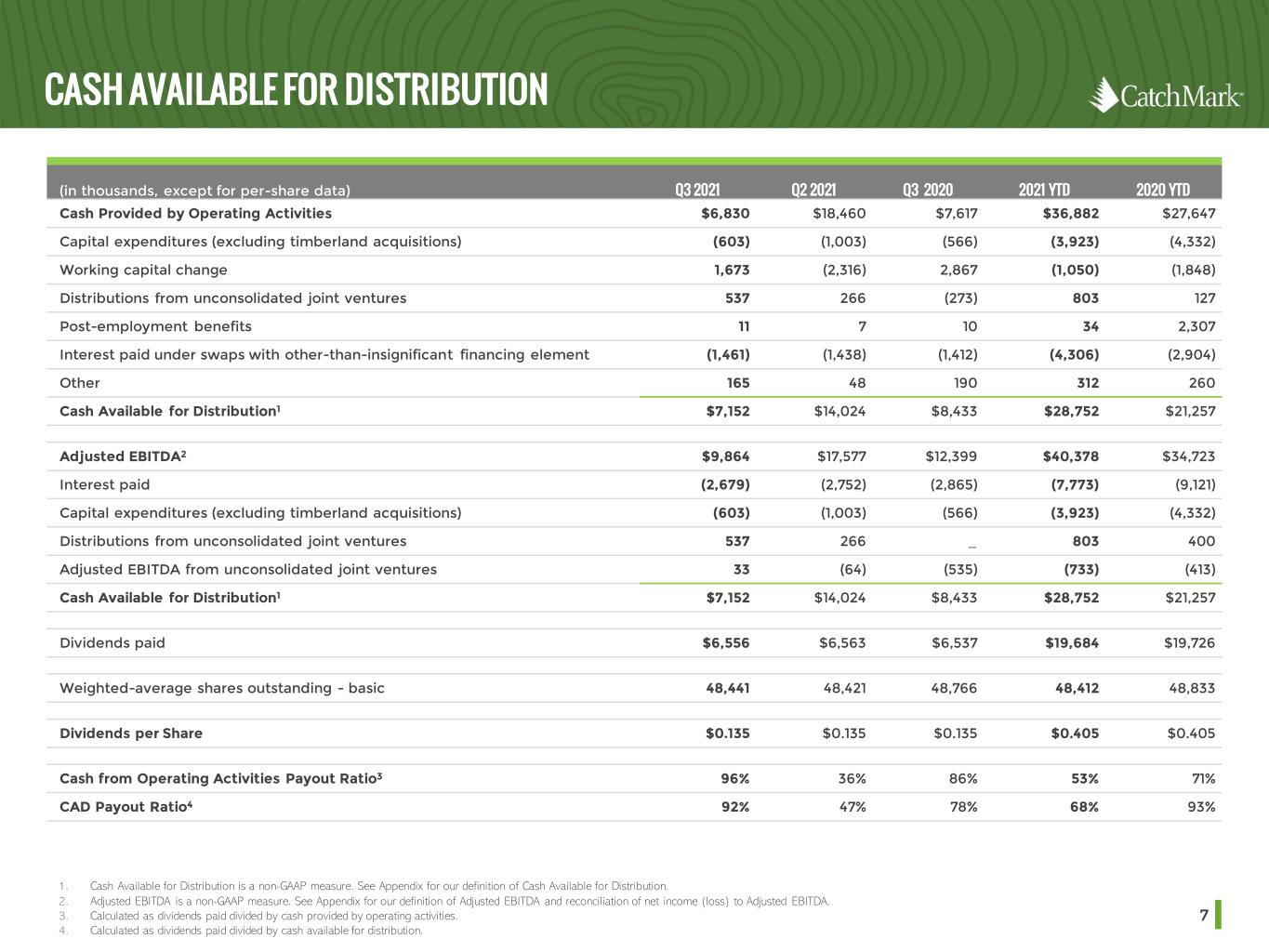

CASH AVAILABLE FOR DISTRIBUTION 7 1. Cash Available for Distribution is a non-GAAP measure. See Appendix for our definition of Cash Available for Distribution. 2. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 3. Calculated as dividends paid divided by cash provided by operating activities. 4. Calculated as dividends paid divided by cash available for distribution. (in thousands, except for per-share data) Q3 2021 Q2 2021 Q3 2020 2021 YTD 2020 YTD Cash Provided by Operating Activities $6,830 $18,460 $7,617 $36,882 $27,647 Capital expenditures (excluding timberland acquisitions) (603) (1,003) (566) (3,923) (4,332) Working capital change 1,673 (2,316) 2,867 (1,050) (1,848) Distributions from unconsolidated joint ventures 537 266 (273) 803 127 Post-employment benefits 11 7 10 34 2,307 Interest paid under swaps with other-than-insignificant financing element (1,461) (1,438) (1,412) (4,306) (2,904) Other 165 48 190 312 260 Cash Available for Distribution1 $7,152 $14,024 $8,433 $28,752 $21,257 Adjusted EBITDA2 $9,864 $17,577 $12,399 $40,378 $34,723 Interest paid (2,679) (2,752) (2,865) (7,773) (9,121) Capital expenditures (excluding timberland acquisitions) (603) (1,003) (566) (3,923) (4,332) Distributions from unconsolidated joint ventures 537 266 _ 803 400 Adjusted EBITDA from unconsolidated joint ventures 33 (64) (535) (733) (413) Cash Available for Distribution1 $7,152 $14,024 $8,433 $28,752 $21,257 Dividends paid $6,556 $6,563 $6,537 $19,684 $19,726 Weighted-average shares outstanding - basic 48,441 48,421 48,766 48,412 48,833 Dividends per Share $0.135 $0.135 $0.135 $0.405 $0.405 Cash from Operating Activities Payout Ratio3 96% 36% 86% 53% 71% CAD Payout Ratio4 92% 47% 78% 68% 93%

U.S. SOUTH TIMBER OVERVIEW 8 2020 2021 1Q 2Q 3Q 4Q FY 1Q 2Q 3Q YTD Timber Sales Volume ('000 tons) Pulpwood 320 352 346 303 1,321 271 297 286 854 Sawtimber 250 195 206 226 877 205 194 204 603 Total 570 547 552 529 2,198 476 491 490 1,457 Delivered vs. Stumpage Delivered % as of total volume 63% 61% 63% 59% 62% 74% 77% 70% 74% Stumpage % as of total volume 37% 39% 37% 41% 38% 26% 23% 30% 26% Net Timber Sales Price ($ per ton) Pulpwood $13 $12 $13 $12 $13 $14 $15 $14 $14 Sawtimber $23 $23 $22 $23 $23 $25 $26 $25 $25 Sold Under Timber Supply Agreements Volume 103 120 182 125 530 109 133 144 386 % of total volume 18% 22% 31% 24% 24% 23% 27% 29% 27% Summary Financial Data ($ in '000s) Timber sales $16,272 $14,565 $15,385 $14,576 $60,798 $15,207 $16,400 $15,478 $47,085 (-) Contract logging and hauling costs (6,309) (5,967) (6,307) (5,721) (24,304) (6,206) (7,025) (6,491) (19,722) Net timber sales 9,963 8,598 9,078 8,855 36,494 9,001 9,375 8,987 27,363 Other revenues 1,052 1,051 1,001 1,009 4,113 1,061 984 1,117 3,162 Total net timber sales and other revenues $11,015 $9,649 $10,079 $9,864 $40,607 $10,062 $10,359 $10,104 $30,525 Period-end Acres Fee 375 374 372 368 368 367 375 356 356 Lease 22 22 22 22 22 15 15 14 14 Wholly-owned total 397 396 394 390 390 382 390 370 370 Joint venture interest 1,092 1,092 1,085 1,083 1,083 1,081 1,080 774 774 Total 1,489 1,488 1,479 1,473 1,473 1,463 1,470 1,144 1,144

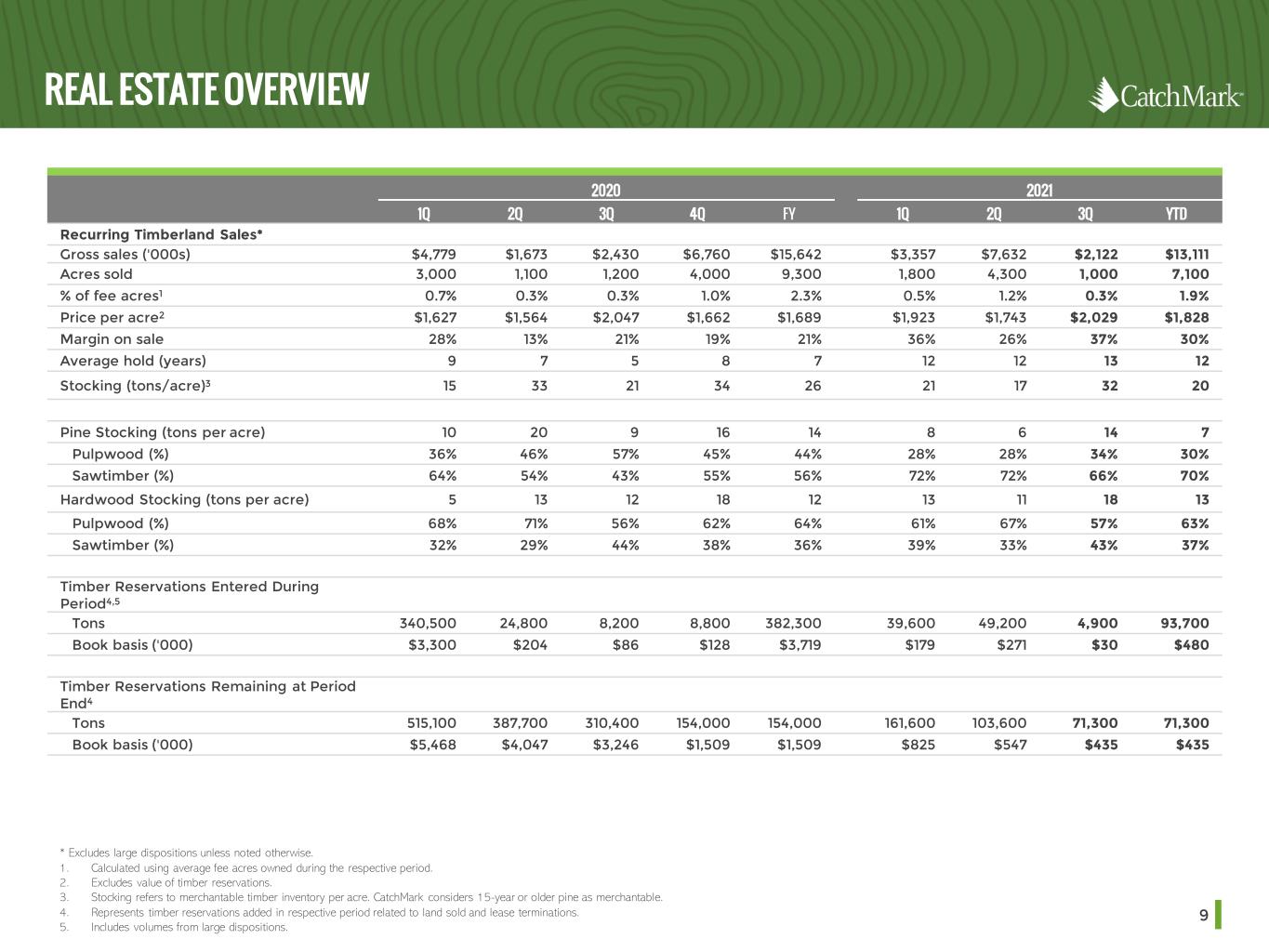

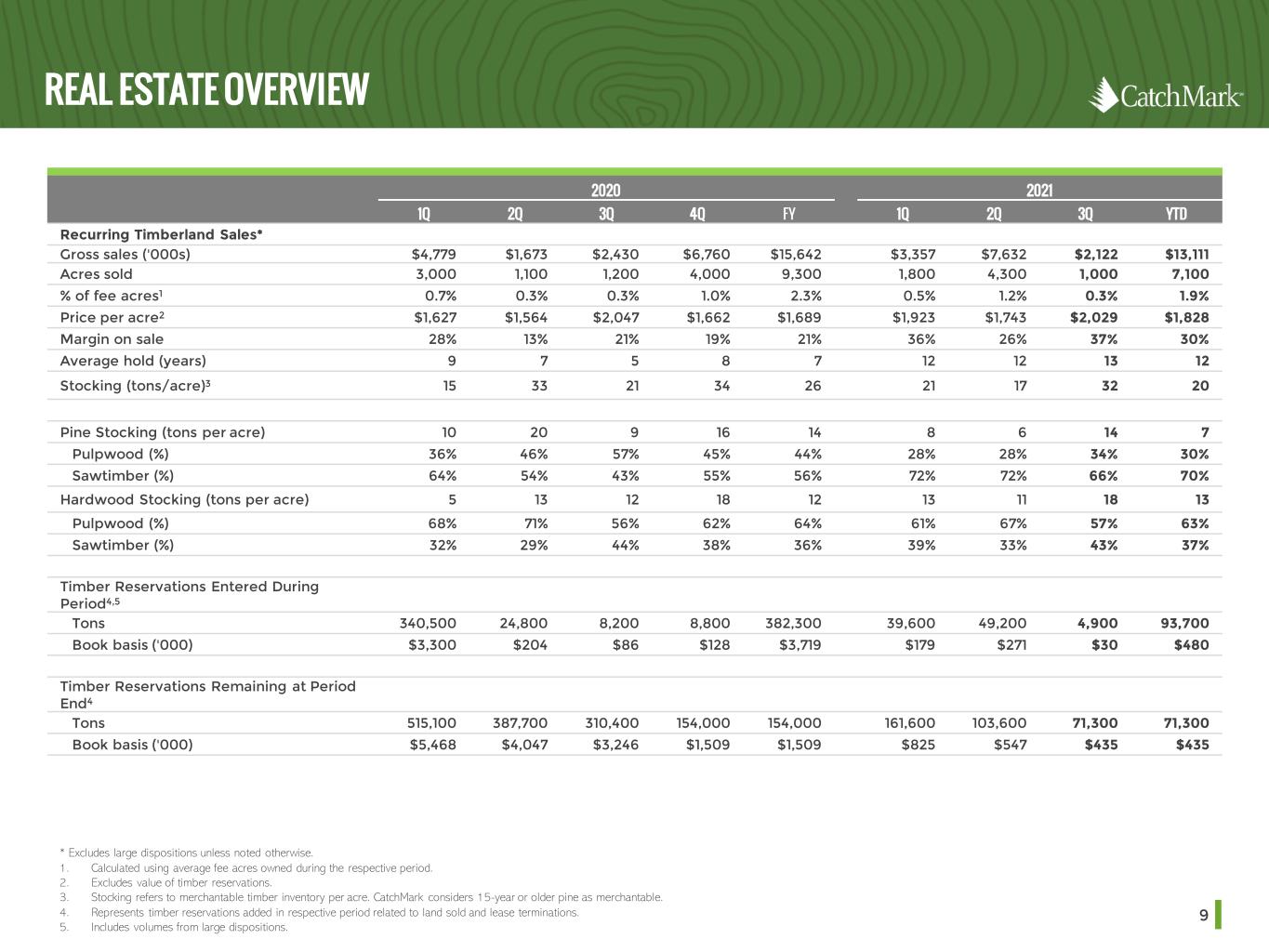

REAL ESTATE OVERVIEW 9 * Excludes large dispositions unless noted otherwise. 1. Calculated using average fee acres owned during the respective period. 2. Excludes value of timber reservations. 3. Stocking refers to merchantable timber inventory per acre. CatchMark considers 15-year or older pine as merchantable. 4. Represents timber reservations added in respective period related to land sold and lease terminations. 5. Includes volumes from large dispositions. 2020 2021 1Q 2Q 3Q 4Q FY 1Q 2Q 3Q YTD Recurring Timberland Sales* Gross sales ('000s) $4,779 $1,673 $2,430 $6,760 $15,642 $3,357 $7,632 $2,122 $13,111 Acres sold 3,000 1,100 1,200 4,000 9,300 1,800 4,300 1,000 7,100 % of fee acres1 0.7% 0.3% 0.3% 1.0% 2.3% 0.5% 1.2% 0.3% 1.9% Price per acre2 $1,627 $1,564 $2,047 $1,662 $1,689 $1,923 $1,743 $2,029 $1,828 Margin on sale 28% 13% 21% 19% 21% 36% 26% 37% 30% Average hold (years) 9 7 5 8 7 12 12 13 12 Stocking (tons/acre)3 15 33 21 34 26 21 17 32 20 Pine Stocking (tons per acre) 10 20 9 16 14 8 6 14 7 Pulpwood (%) 36% 46% 57% 45% 44% 28% 28% 34% 30% Sawtimber (%) 64% 54% 43% 55% 56% 72% 72% 66% 70% Hardwood Stocking (tons per acre) 5 13 12 18 12 13 11 18 13 Pulpwood (%) 68% 71% 56% 62% 64% 61% 67% 57% 63% Sawtimber (%) 32% 29% 44% 38% 36% 39% 33% 43% 37% Timber Reservations Entered During Period4,5 Tons 340,500 24,800 8,200 8,800 382,300 39,600 49,200 4,900 93,700 Book basis ('000) $3,300 $204 $86 $128 $3,719 $179 $271 $30 $480 Timber Reservations Remaining at Period End4 Tons 515,100 387,700 310,400 154,000 154,000 161,600 103,600 71,300 71,300 Book basis ('000) $5,468 $4,047 $3,246 $1,509 $1,509 $825 $547 $435 $435

SOLID CAPITAL POSITION 10 $0 $50 $100 $150 $200 $250 $300 Acquisition facilities LOC Cash $278.2M Millions Liquidity $218.6M $35M $24.6M Credit Facilities and Maturity Schedule7 Total Credit Facilities of $553.6 Million Weighted-Average Life of Outstanding Debt is 4.1 YearsMillions $150M Acquisition Facility $35M LOC $68.6M Term Loan $84.7M Term Loan $125.6M Term Loan $89.7M Term Loan $0 $50 $100 $150 $200 2021 2022 2023 2024 2025 2026 2027 Debt Available Outstanding No debt maturities until late 2024. Well-laddered maturity schedule. 1. Calculated using trailing twelve-month Adjusted EBITDA divided by trailing twelve-month cash paid for interest as of 9/30/2021. This calculation differs from the calculation of the fixed charge ratio covenant under our credit facilities and should not be viewed as an indication of compliance with such covenant. 2. Net debt equals outstanding borrowings as of 10/15/2021 net of cash on hand as of 9/30/2021. 3. Trailing twelve-month Adjusted EBITDA as of 9/30/2021. 4. Adjusted EBITDA is a non-GAAP measure. See page 9 for the reconciliation of net income (loss) to Adjusted EBITDA. 5. Enterprise value is based on equity market capitalization as of 10/15/2021 plus net debt. 6. After consideration of effects of interest rate swaps and patronage refund as of 10/15/2021. 7. As of 10/15/2021. Credit Metrics Fixed charge coverage ratio1 5.0x Net Debt2/Adjusted EBITDA3,4 4.8x Net Debt2/Enterprise value5 37% Weighted average cost of debt6 2.92% Interest rate mix7 Fixed: 92% / Floating: 8% $0 $100 $200 $300 $400 $500 $600 9/30/18 12/31/2018 12/31/2019 12/31/2020 10/15/2021 Millions Southwest capital recycling disposition GA/AL capital recycling disposition GA capital recycling disposition Bandon and Oglethorpe capital recycling dispositions and TTT exit Significant Reduction in Leverage Reduced leverage by $260M or 45% since TTT and Bandon initial investments Post-TTT/ Bandon Investments

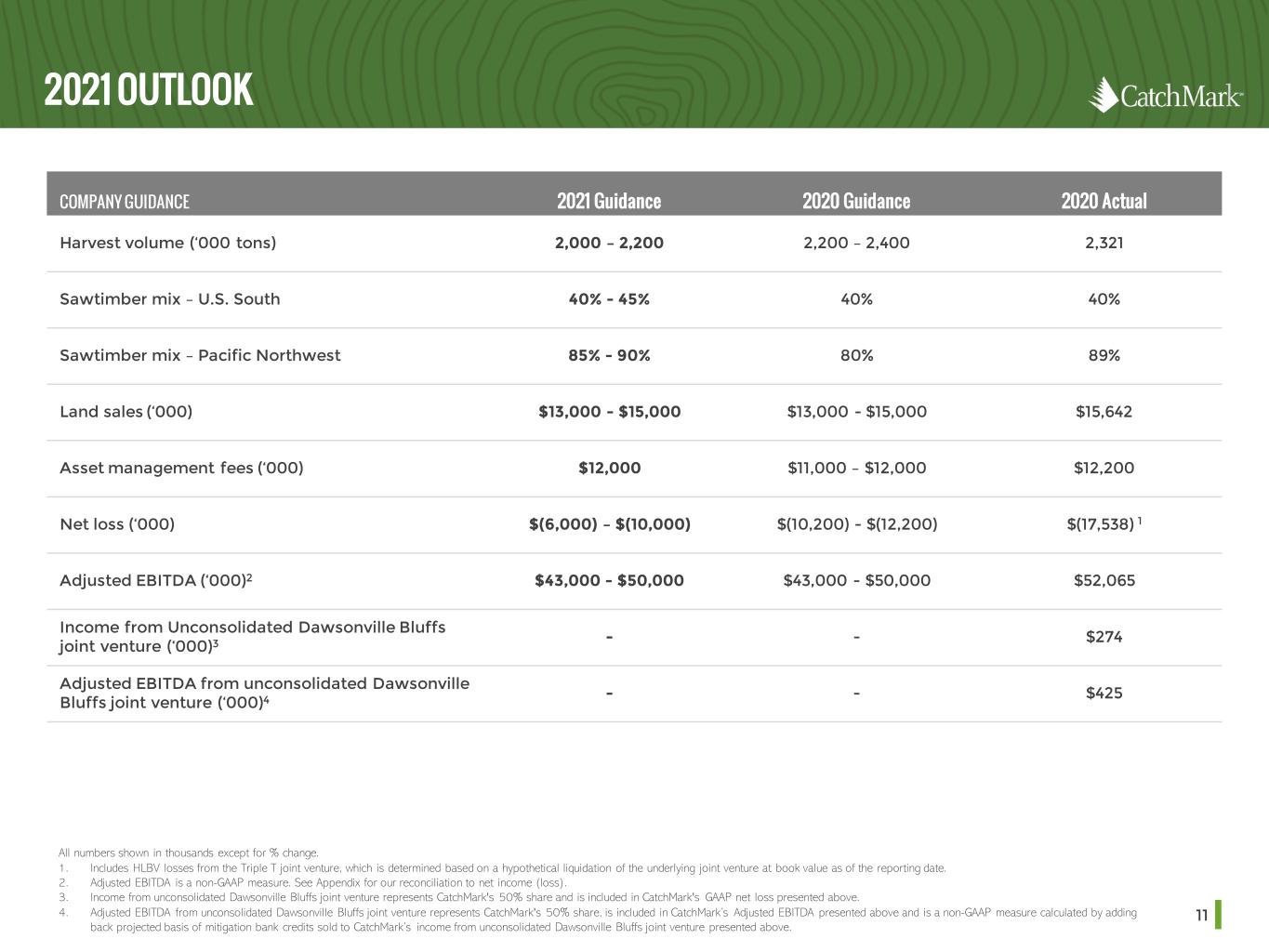

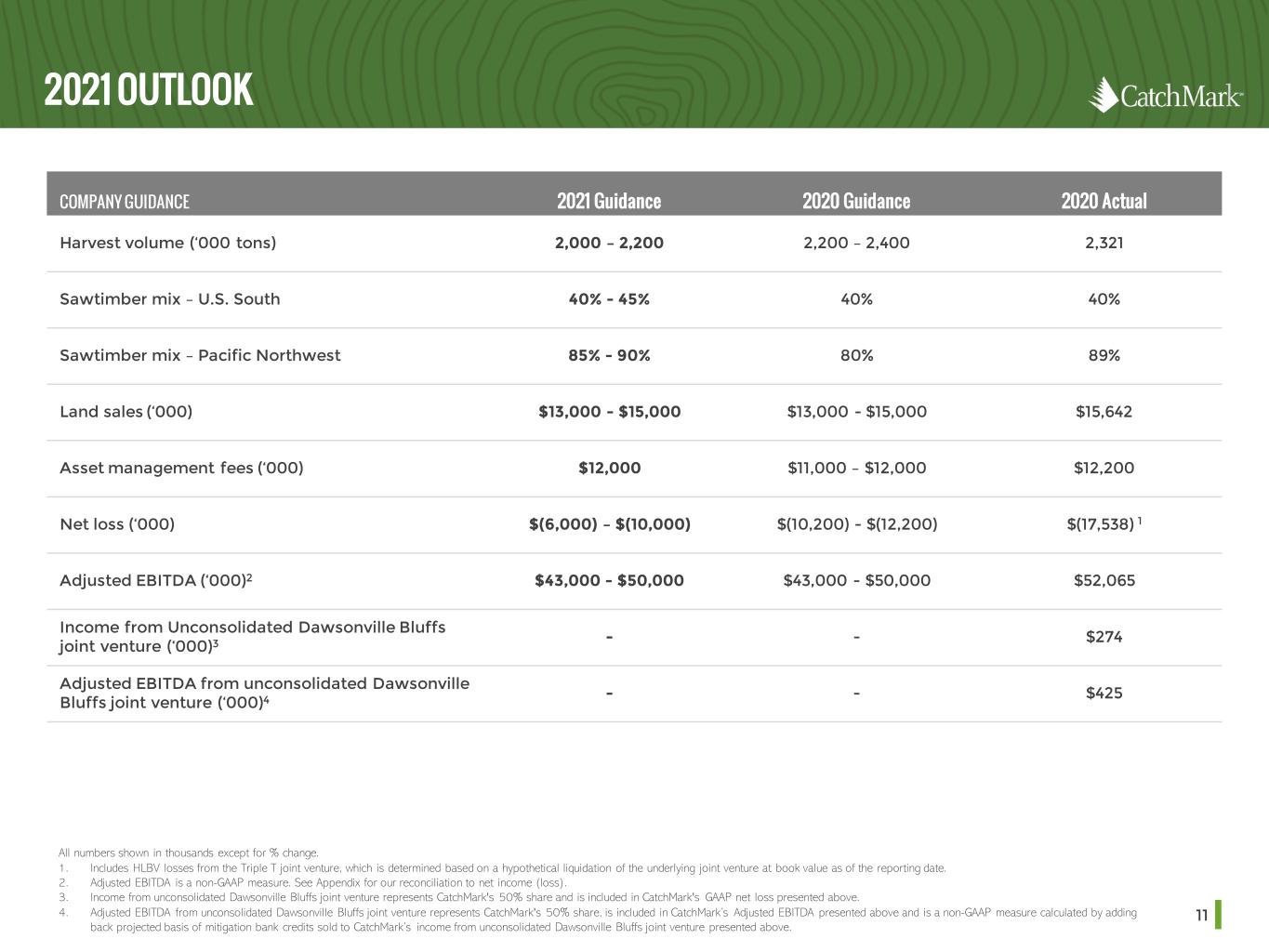

2021 OUTLOOK 11 All numbers shown in thousands except for % change. 1. Includes HLBV losses from the Triple T joint venture, which is determined based on a hypothetical liquidation of the underlying joint venture at book value as of the reporting date. 2. Adjusted EBITDA is a non-GAAP measure. See Appendix for our reconciliation to net income (loss). 3. Income from unconsolidated Dawsonville Bluffs joint venture represents CatchMark's 50% share and is included in CatchMark's GAAP net loss presented above. 4. Adjusted EBITDA from unconsolidated Dawsonville Bluffs joint venture represents CatchMark's 50% share, is included in CatchMark’s Adjusted EBITDA presented above and is a non-GAAP measure calculated by adding back projected basis of mitigation bank credits sold to CatchMark’s income from unconsolidated Dawsonville Bluffs joint venture presented above. COMPANY GUIDANCE 2021 Guidance 2020 Guidance 2020 Actual Harvest volume (‘000 tons) 2,000 – 2,200 2,200 – 2,400 2,321 Sawtimber mix – U.S. South 40% - 45% 40% 40% Sawtimber mix – Pacific Northwest 85% - 90% 80% 89% Land sales (‘000) $13,000 - $15,000 $13,000 - $15,000 $15,642 Asset management fees (‘000) $12,000 $11,000 – $12,000 $12,200 Net loss (‘000) $(6,000) – $(10,000) $(10,200) - $(12,200) $(17,538) 1 Adjusted EBITDA (‘000)2 $43,000 - $50,000 $43,000 - $50,000 $52,065 Income from Unconsolidated Dawsonville Bluffs joint venture (‘000)3 - - $274 Adjusted EBITDA from unconsolidated Dawsonville Bluffs joint venture (‘000)4 - - $425

12 A P P E N D I X

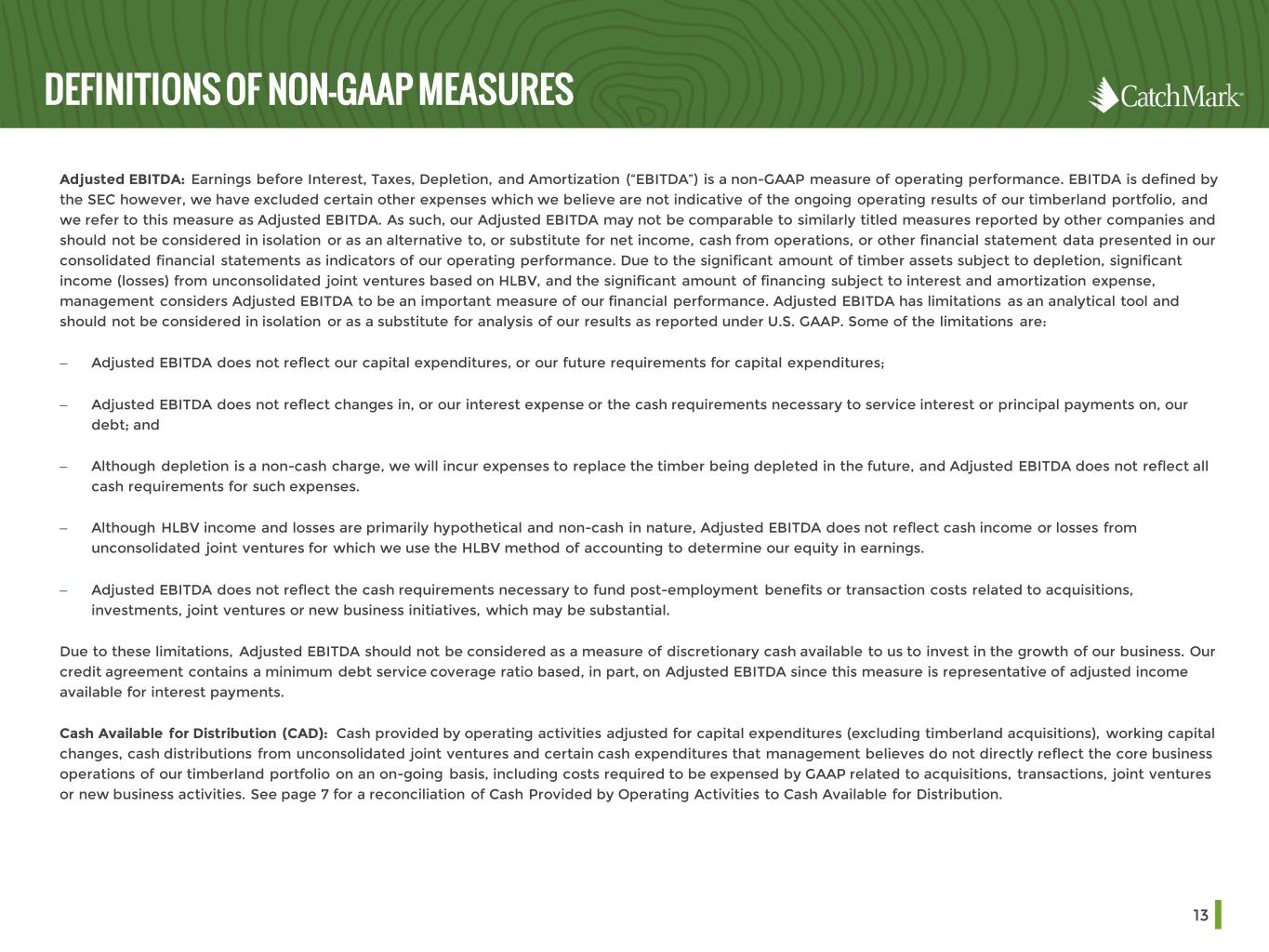

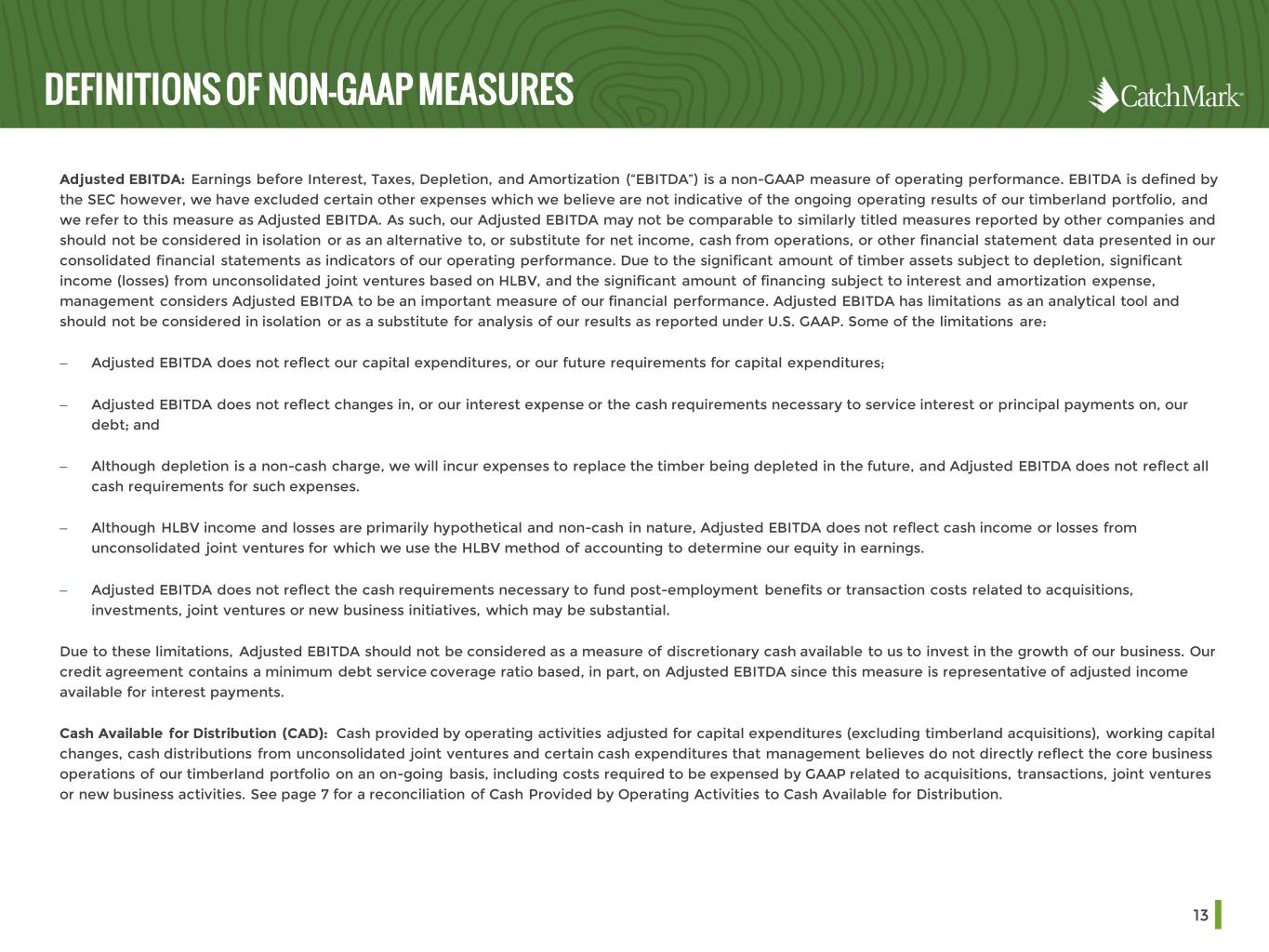

DEFINITIONS OF NON-GAAP MEASURES Adjusted EBITDA: Earnings before Interest, Taxes, Depletion, and Amortization (“EBITDA”) is a non-GAAP measure of operating performance. EBITDA is defined by the SEC however, we have excluded certain other expenses which we believe are not indicative of the ongoing operating results of our timberland portfolio, and we refer to this measure as Adjusted EBITDA. As such, our Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies and should not be considered in isolation or as an alternative to, or substitute for net income, cash from operations, or other financial statement data presented in our consolidated financial statements as indicators of our operating performance. Due to the significant amount of timber assets subject to depletion, significant income (losses) from unconsolidated joint ventures based on HLBV, and the significant amount of financing subject to interest and amortization expense, management considers Adjusted EBITDA to be an important measure of our financial performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations are: ‒ Adjusted EBITDA does not reflect our capital expenditures, or our future requirements for capital expenditures; ‒ Adjusted EBITDA does not reflect changes in, or our interest expense or the cash requirements necessary to service interest or principal payments on, our debt; and ‒ Although depletion is a non-cash charge, we will incur expenses to replace the timber being depleted in the future, and Adjusted EBITDA does not reflect all cash requirements for such expenses. ‒ Although HLBV income and losses are primarily hypothetical and non-cash in nature, Adjusted EBITDA does not reflect cash income or losses from unconsolidated joint ventures for which we use the HLBV method of accounting to determine our equity in earnings. ‒ Adjusted EBITDA does not reflect the cash requirements necessary to fund post-employment benefits or transaction costs related to acquisitions, investments, joint ventures or new business initiatives, which may be substantial. Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Our credit agreement contains a minimum debt service coverage ratio based, in part, on Adjusted EBITDA since this measure is representative of adjusted income available for interest payments. Cash Available for Distribution (CAD): Cash provided by operating activities adjusted for capital expenditures (excluding timberland acquisitions), working capital changes, cash distributions from unconsolidated joint ventures and certain cash expenditures that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. See page 7 for a reconciliation of Cash Provided by Operating Activities to Cash Available for Distribution. 13

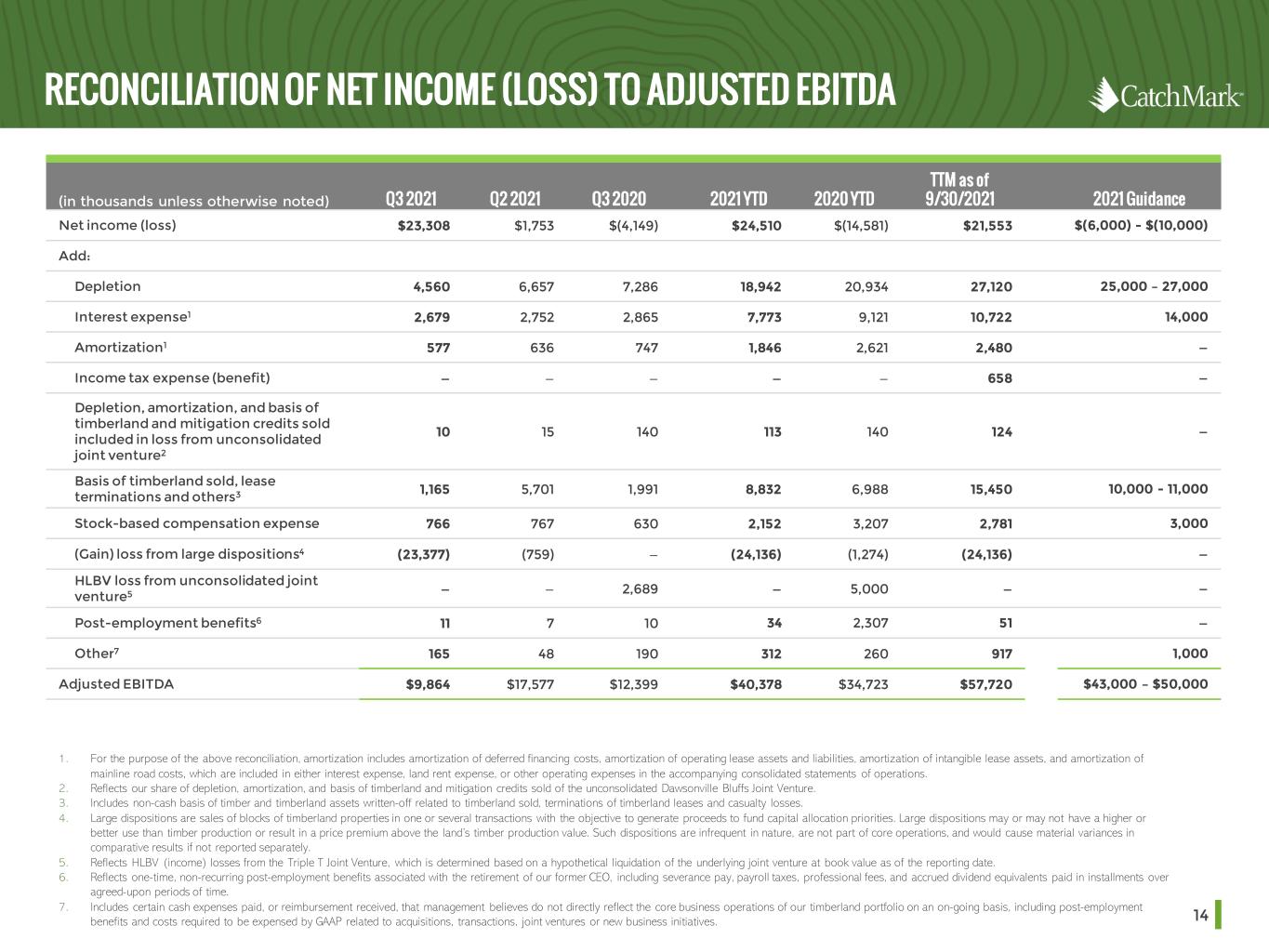

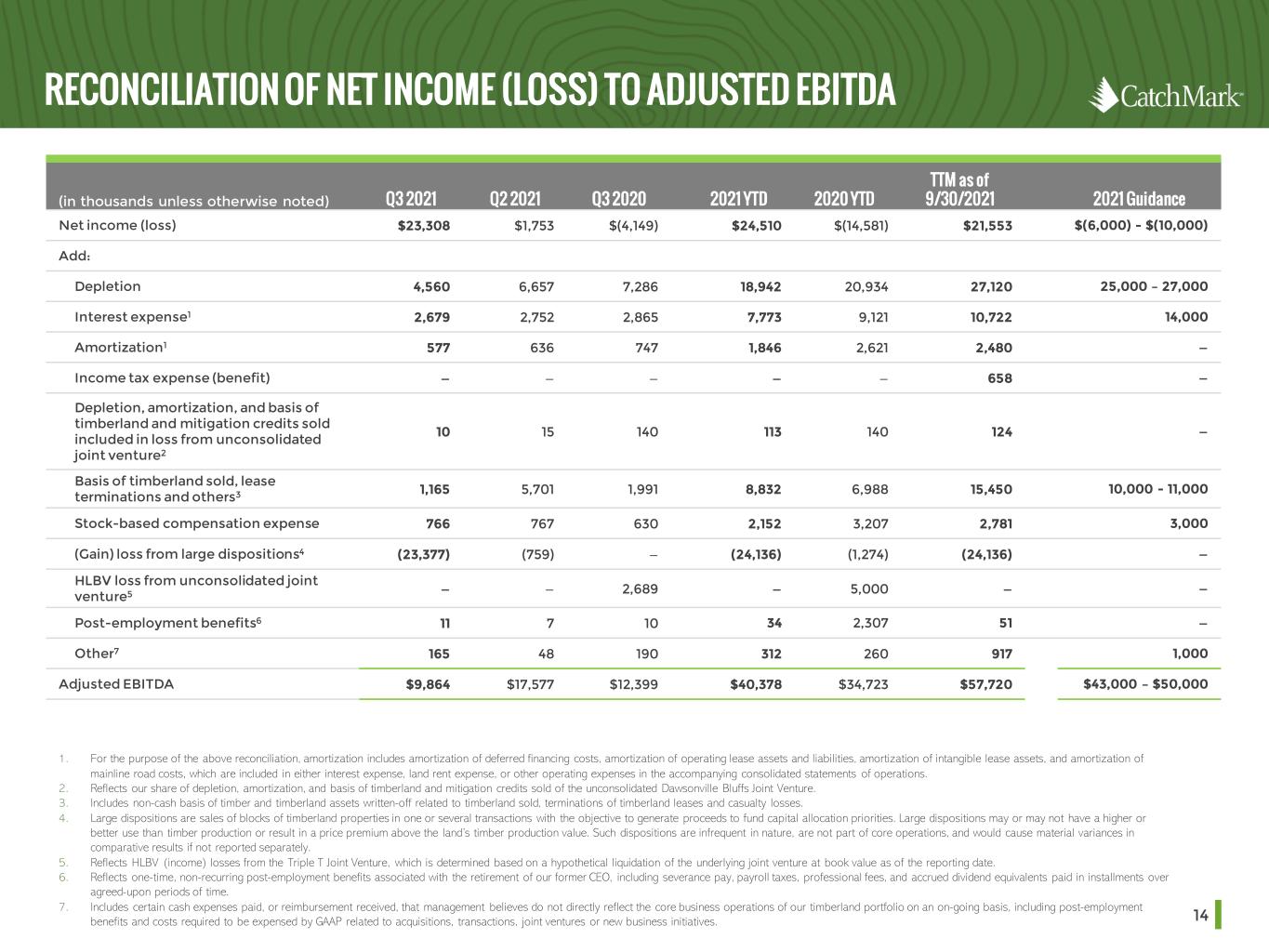

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA 14 1. For the purpose of the above reconciliation, amortization includes amortization of deferred financing costs, amortization of operating lease assets and liabilities, amortization of intangible lease assets, and amortization of mainline road costs, which are included in either interest expense, land rent expense, or other operating expenses in the accompanying consolidated statements of operations. 2. Reflects our share of depletion, amortization, and basis of timberland and mitigation credits sold of the unconsolidated Dawsonville Bluffs Joint Venture. 3. Includes non-cash basis of timber and timberland assets written-off related to timberland sold, terminations of timberland leases and casualty losses. 4. Large dispositions are sales of blocks of timberland properties in one or several transactions with the objective to generate proceeds to fund capital allocation priorities. Large dispositions may or may not have a higher or better use than timber production or result in a price premium above the land’s timber production value. Such dispositions are infrequent in nature, are not part of core operations, and would cause material variances in comparative results if not reported separately. 5. Reflects HLBV (income) losses from the Triple T Joint Venture, which is determined based on a hypothetical liquidation of the underlying joint venture at book value as of the reporting date. 6. Reflects one-time, non-recurring post-employment benefits associated with the retirement of our former CEO, including severance pay, payroll taxes, professional fees, and accrued dividend equivalents paid in installments over agreed-upon periods of time. 7. Includes certain cash expenses paid, or reimbursement received, that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including post-employment benefits and costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business initiatives. (in thousands unless otherwise noted) Q3 2021 Q2 2021 Q3 2020 2021 YTD 2020 YTD TTM as of 9/30/2021 2021 Guidance Net income (loss) $23,308 $1,753 $(4,149) $24,510 $(14,581) $21,553 $(6,000) - $(10,000) Add: Depletion 4,560 6,657 7,286 18,942 20,934 27,120 25,000 – 27,000 Interest expense1 2,679 2,752 2,865 7,773 9,121 10,722 14,000 Amortization1 577 636 747 1,846 2,621 2,480 — Income tax expense (benefit) — — — — — 658 — Depletion, amortization, and basis of timberland and mitigation credits sold included in loss from unconsolidated joint venture2 10 15 140 113 140 124 — Basis of timberland sold, lease terminations and others3 1,165 5,701 1,991 8,832 6,988 15,450 10,000 - 11,000 Stock-based compensation expense 766 767 630 2,152 3,207 2,781 3,000 (Gain) loss from large dispositions4 (23,377) (759) — (24,136) (1,274) (24,136) — HLBV loss from unconsolidated joint venture5 — — 2,689 — 5,000 — — Post-employment benefits6 11 7 10 34 2,307 51 — Other7 165 48 190 312 260 917 1,000 Adjusted EBITDA $9,864 $17,577 $12,399 $40,378 $34,723 $57,720 $43,000 – $50,000

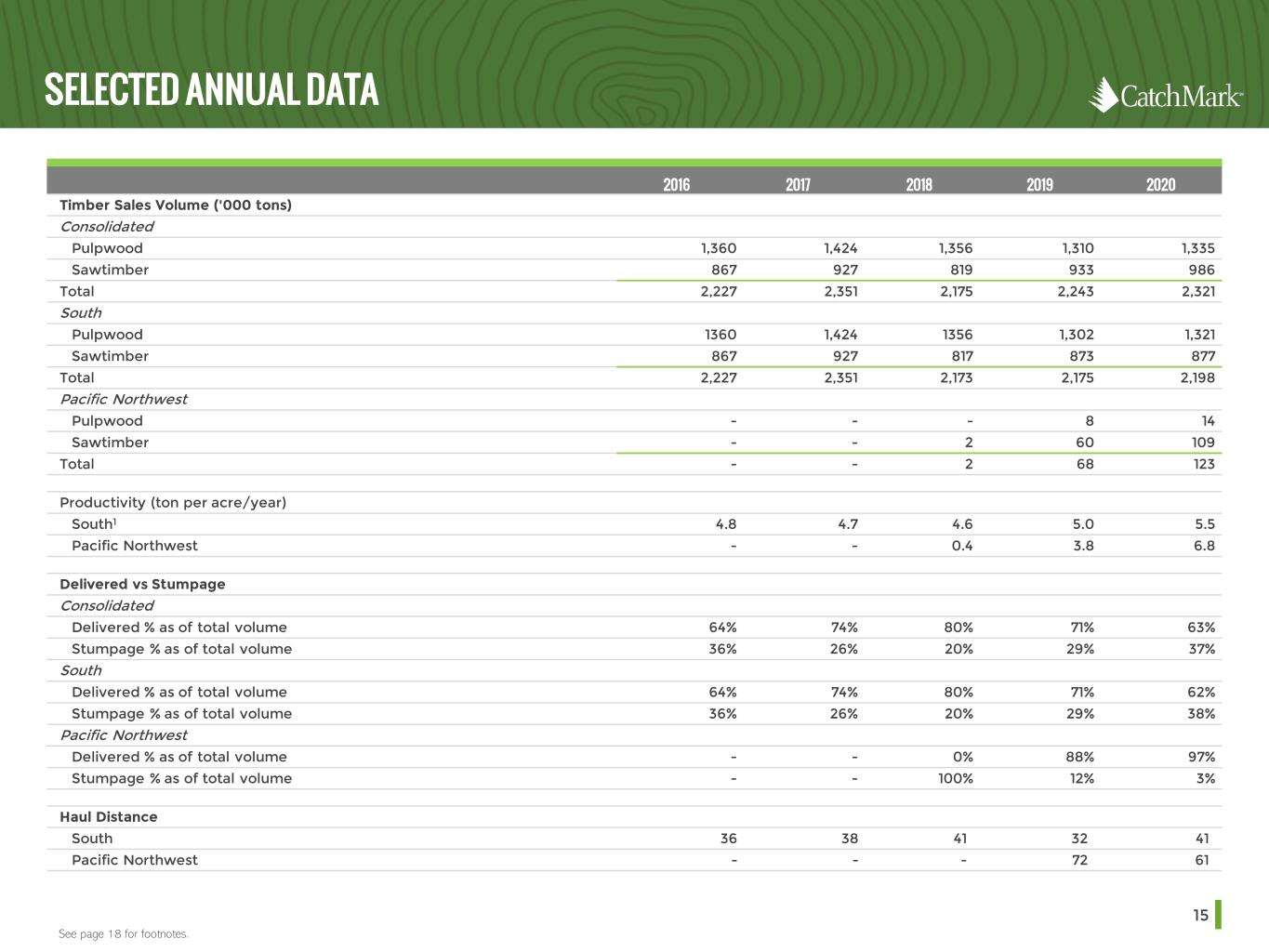

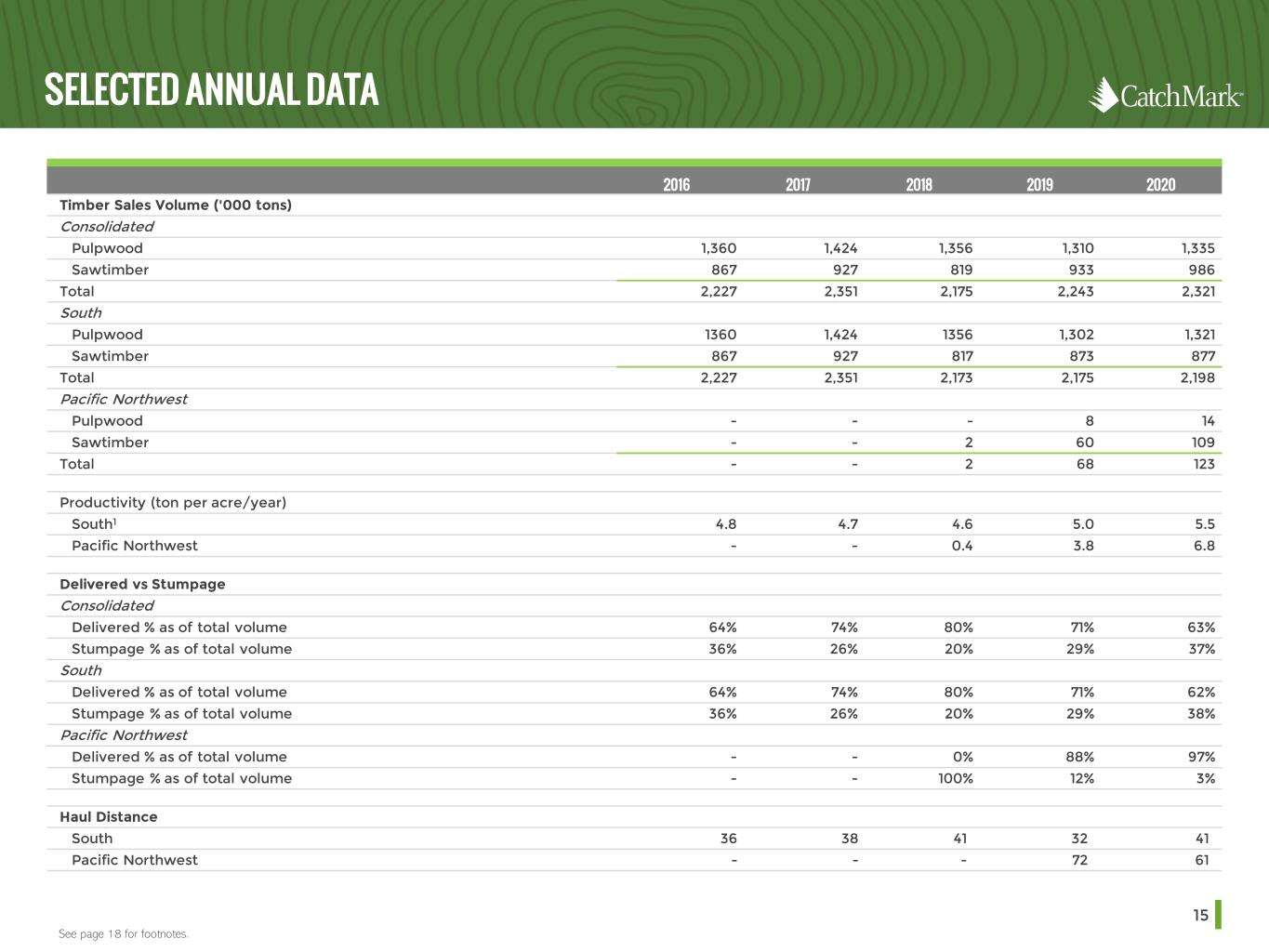

SELECTED ANNUAL DATA 15 2016 2017 2018 2019 2020 Timber Sales Volume ('000 tons) Consolidated Pulpwood 1,360 1,424 1,356 1,310 1,335 Sawtimber 867 927 819 933 986 Total 2,227 2,351 2,175 2,243 2,321 South Pulpwood 1360 1,424 1356 1,302 1,321 Sawtimber 867 927 817 873 877 Total 2,227 2,351 2,173 2,175 2,198 Pacific Northwest Pulpwood - - - 8 14 Sawtimber - - 2 60 109 Total - - 2 68 123 Productivity (ton per acre/year) South1 4.8 4.7 4.6 5.0 5.5 Pacific Northwest - - 0.4 3.8 6.8 Delivered vs Stumpage Consolidated Delivered % as of total volume 64% 74% 80% 71% 63% Stumpage % as of total volume 36% 26% 20% 29% 37% South Delivered % as of total volume 64% 74% 80% 71% 62% Stumpage % as of total volume 36% 26% 20% 29% 38% Pacific Northwest Delivered % as of total volume - - 0% 88% 97% Stumpage % as of total volume - - 100% 12% 3% Haul Distance South 36 38 41 32 41 Pacific Northwest - - - 72 61 See page 18 for footnotes.

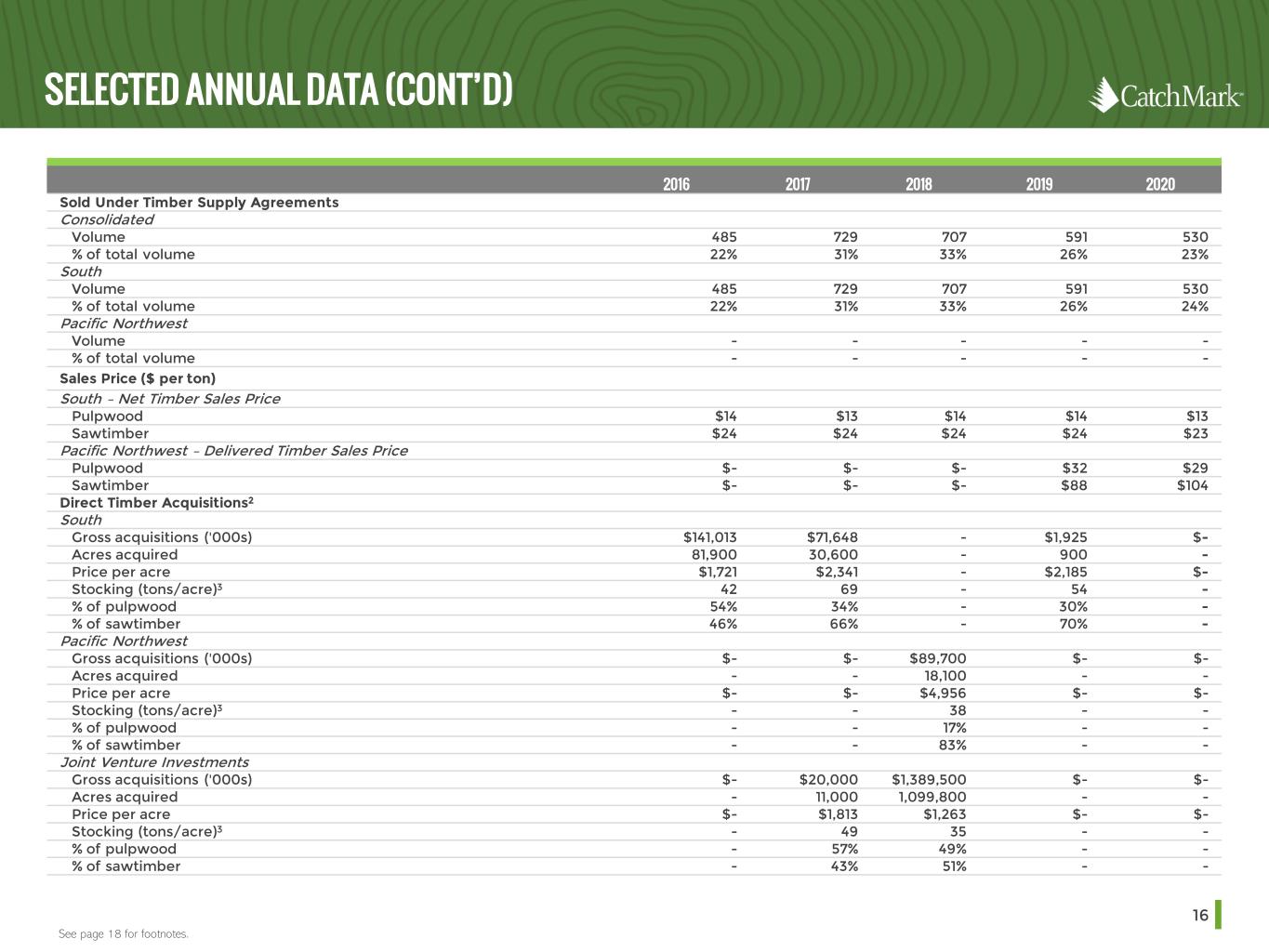

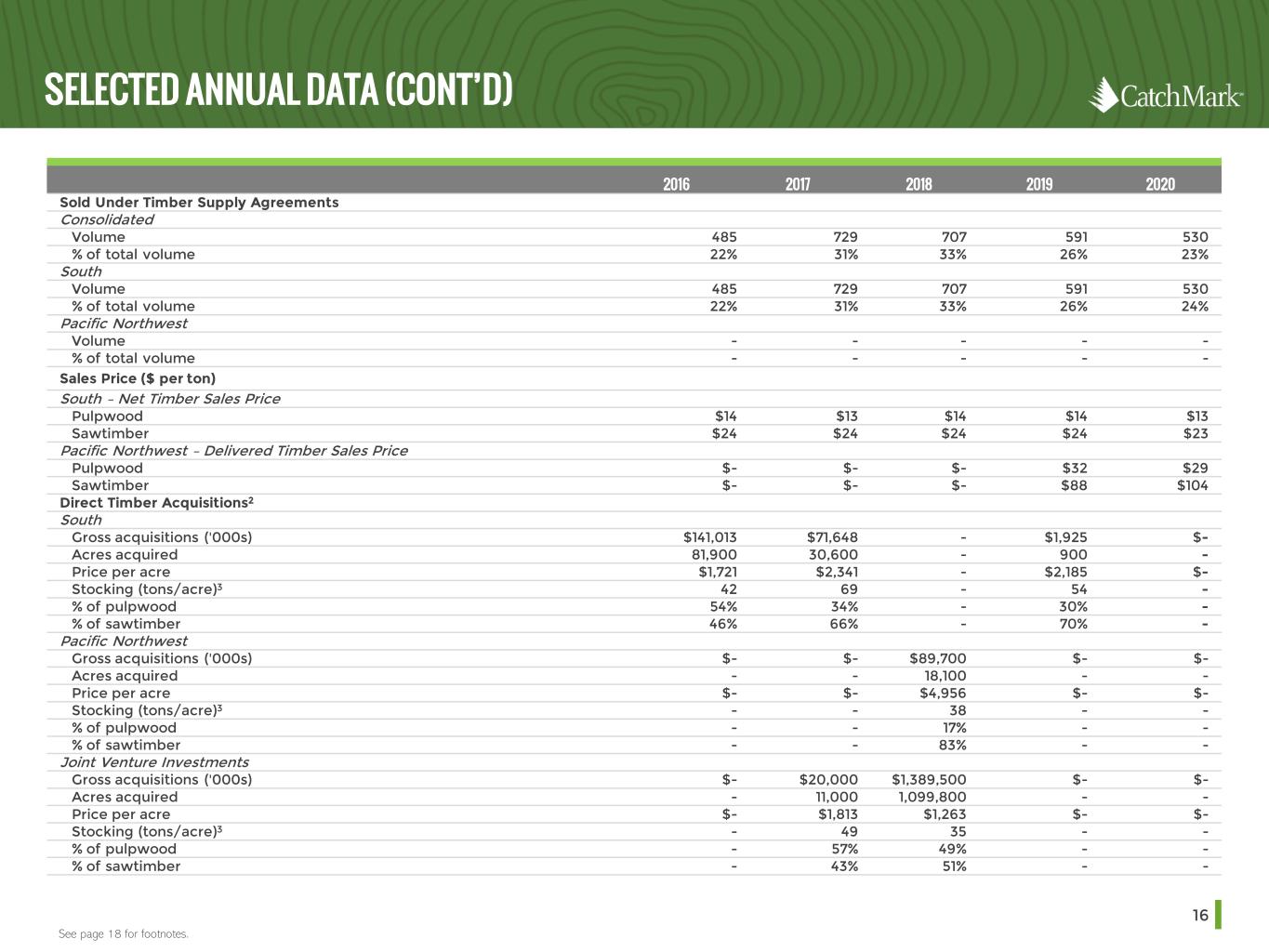

SELECTED ANNUAL DATA (CONT’D) 16 See page 18 for footnotes. 2016 2017 2018 2019 2020 Sold Under Timber Supply Agreements Consolidated Volume 485 729 707 591 530 % of total volume 22% 31% 33% 26% 23% South Volume 485 729 707 591 530 % of total volume 22% 31% 33% 26% 24% Pacific Northwest Volume - - - - - % of total volume - - - - - Sales Price ($ per ton) South – Net Timber Sales Price Pulpwood $14 $13 $14 $14 $13 Sawtimber $24 $24 $24 $24 $23 Pacific Northwest – Delivered Timber Sales Price Pulpwood $- $- $- $32 $29 Sawtimber $- $- $- $88 $104 Direct Timber Acquisitions2 South Gross acquisitions ('000s) $141,013 $71,648 - $1,925 $- Acres acquired 81,900 30,600 - 900 - Price per acre $1,721 $2,341 - $2,185 $- Stocking (tons/acre)3 42 69 - 54 - % of pulpwood 54% 34% - 30% - % of sawtimber 46% 66% - 70% - Pacific Northwest Gross acquisitions ('000s) $- $- $89,700 $- $- Acres acquired - - 18,100 - - Price per acre $- $- $4,956 $- $- Stocking (tons/acre)3 - - 38 - - % of pulpwood - - 17% - - % of sawtimber - - 83% - - Joint Venture Investments Gross acquisitions ('000s) $- $20,000 $1,389,500 $- $- Acres acquired - 11,000 1,099,800 - - Price per acre $- $1,813 $1,263 $- $- Stocking (tons/acre)3 - 49 35 - - % of pulpwood - 57% 49% - - % of sawtimber - 43% 51% - -

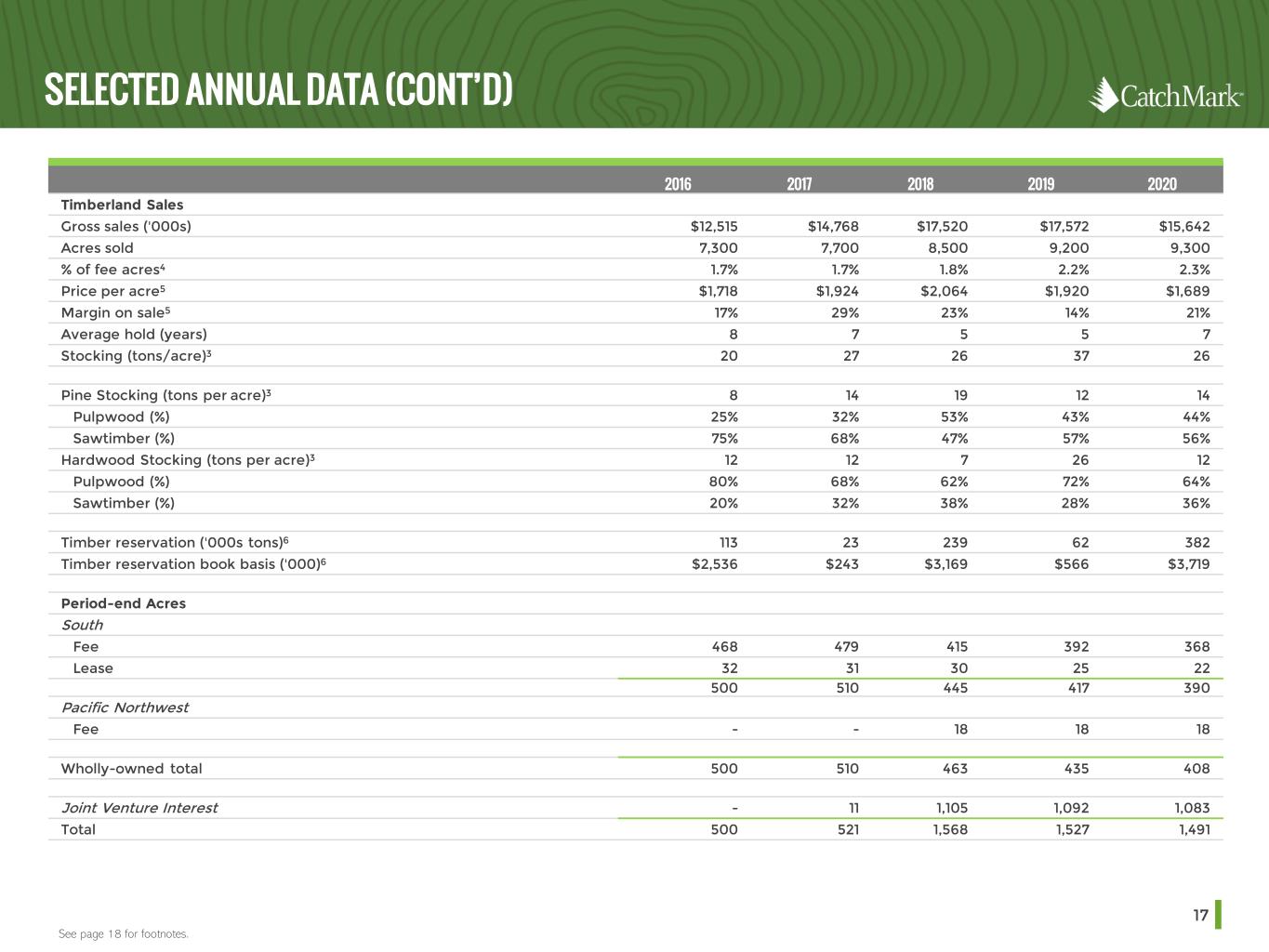

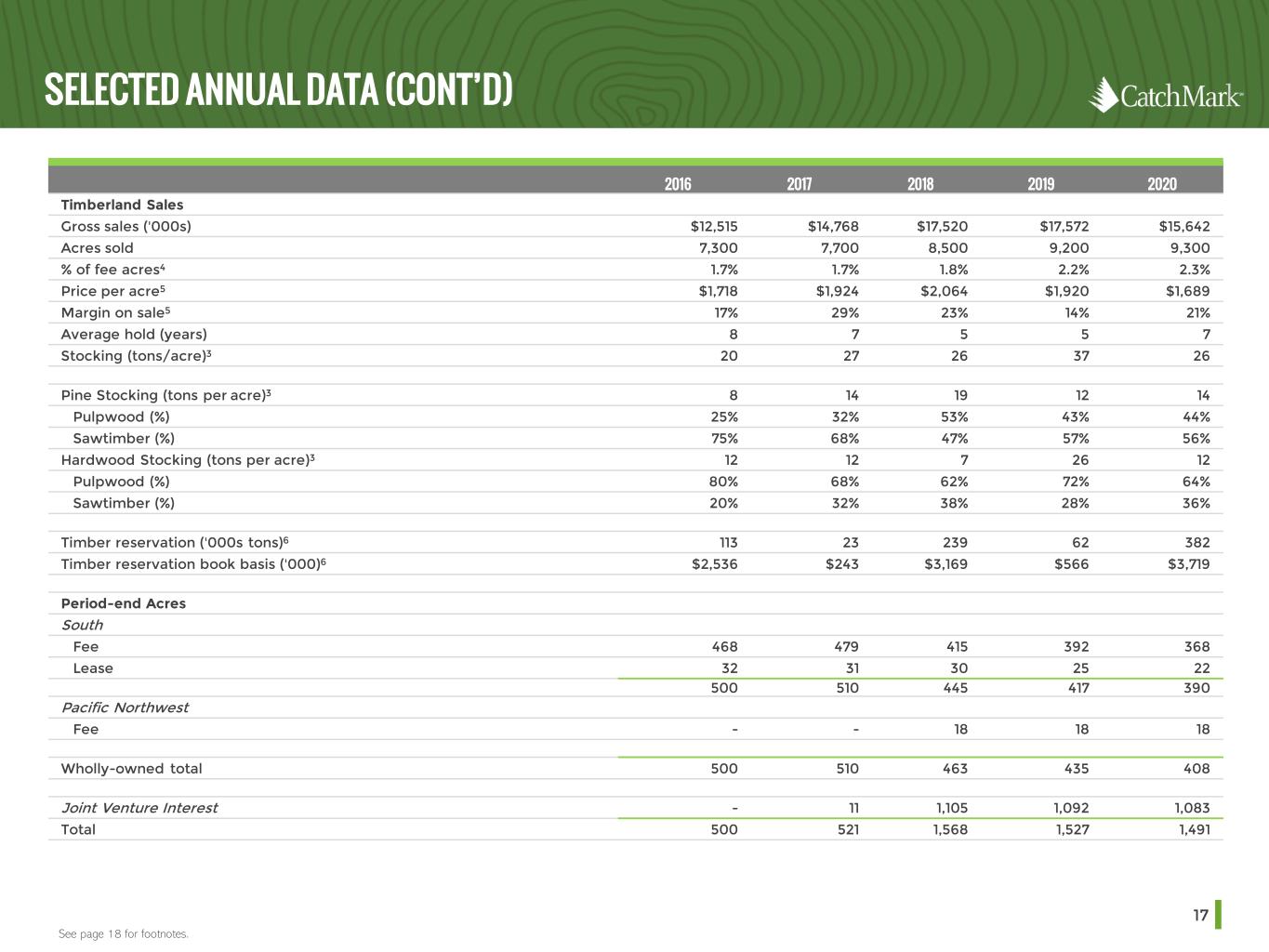

SELECTED ANNUAL DATA (CONT’D) 17 2016 2017 2018 2019 2020 Timberland Sales Gross sales ('000s) $12,515 $14,768 $17,520 $17,572 $15,642 Acres sold 7,300 7,700 8,500 9,200 9,300 % of fee acres4 1.7% 1.7% 1.8% 2.2% 2.3% Price per acre5 $1,718 $1,924 $2,064 $1,920 $1,689 Margin on sale5 17% 29% 23% 14% 21% Average hold (years) 8 7 5 5 7 Stocking (tons/acre)3 20 27 26 37 26 Pine Stocking (tons per acre)3 8 14 19 12 14 Pulpwood (%) 25% 32% 53% 43% 44% Sawtimber (%) 75% 68% 47% 57% 56% Hardwood Stocking (tons per acre)3 12 12 7 26 12 Pulpwood (%) 80% 68% 62% 72% 64% Sawtimber (%) 20% 32% 38% 28% 36% Timber reservation ('000s tons)6 113 23 239 62 382 Timber reservation book basis ('000)6 $2,536 $243 $3,169 $566 $3,719 Period-end Acres South Fee 468 479 415 392 368 Lease 32 31 30 25 22 500 510 445 417 390 Pacific Northwest Fee - - 18 18 18 Wholly-owned total 500 510 463 435 408 Joint Venture Interest - 11 1,105 1,092 1,083 Total 500 521 1,568 1,527 1,491 See page 18 for footnotes.

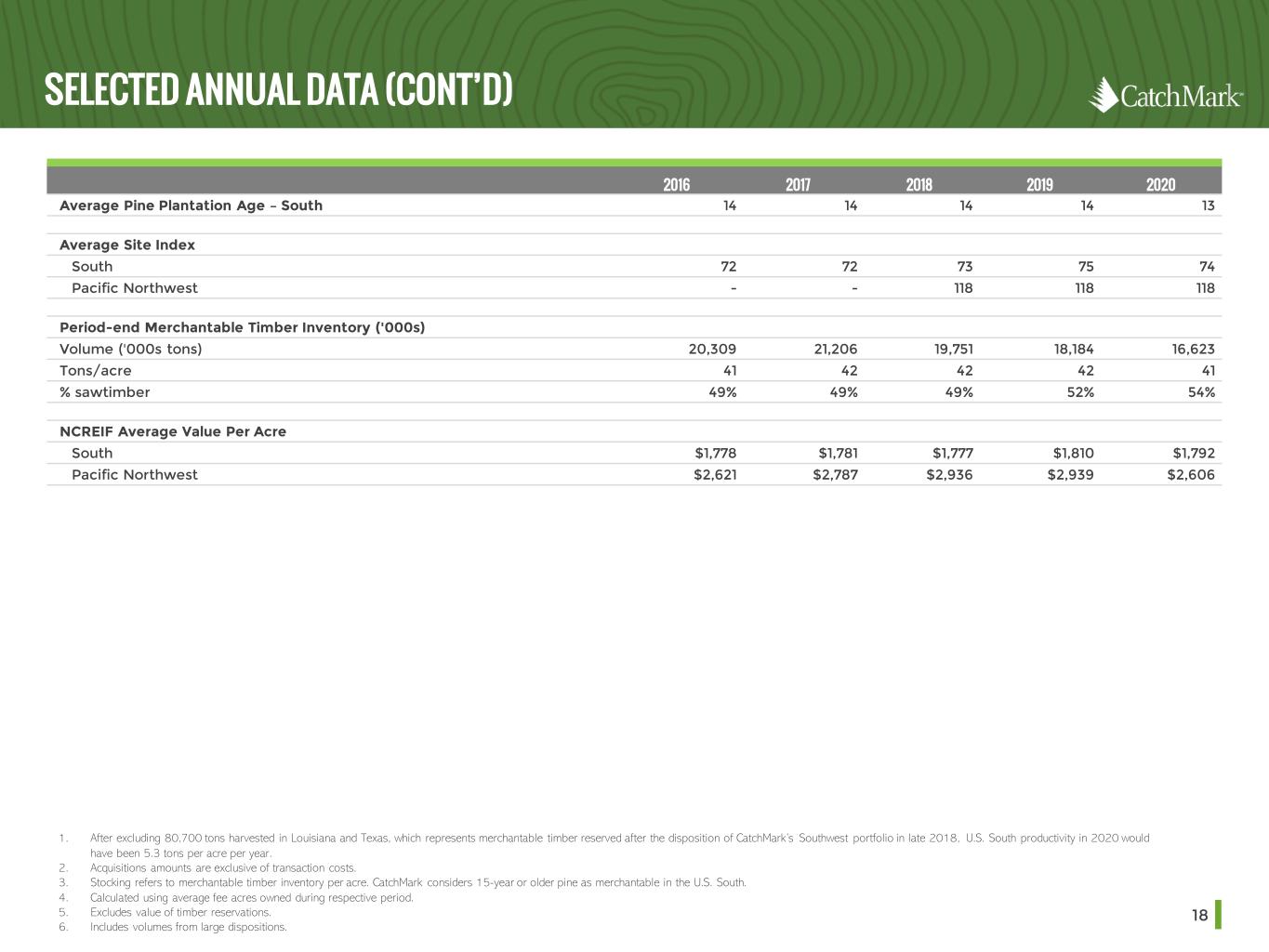

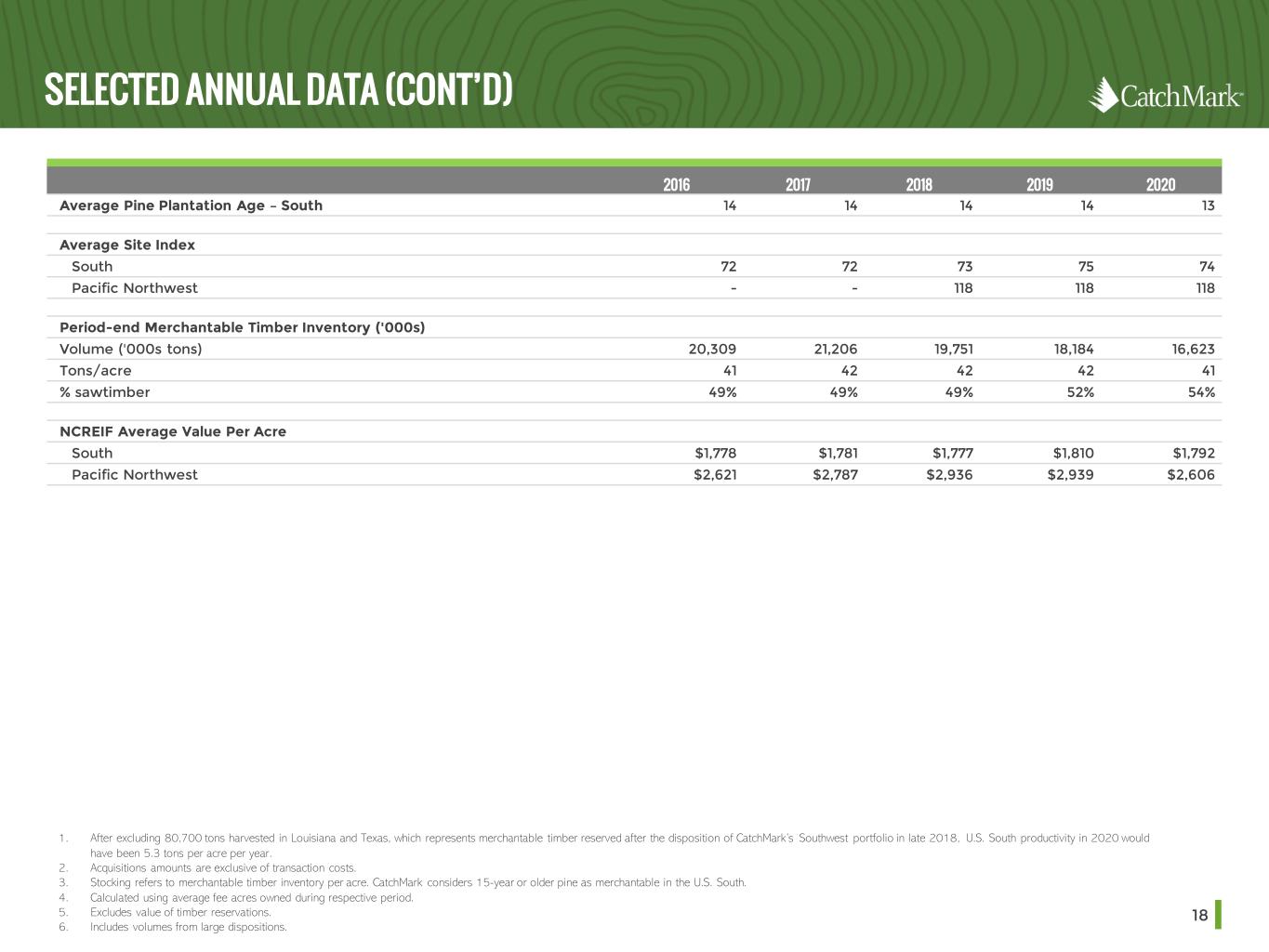

SELECTED ANNUAL DATA (CONT’D) 18 2016 2017 2018 2019 2020 Average Pine Plantation Age – South 14 14 14 14 13 Average Site Index South 72 72 73 75 74 Pacific Northwest - - 118 118 118 Period-end Merchantable Timber Inventory ('000s) Volume ('000s tons) 20,309 21,206 19,751 18,184 16,623 Tons/acre 41 42 42 42 41 % sawtimber 49% 49% 49% 52% 54% NCREIF Average Value Per Acre South $1,778 $1,781 $1,777 $1,810 $1,792 Pacific Northwest $2,621 $2,787 $2,936 $2,939 $2,606 1. After excluding 80,700 tons harvested in Louisiana and Texas, which represents merchantable timber reserved after the disposition of CatchMark’s Southwest portfolio in late 2018, U.S. South productivity in 2020 would have been 5.3 tons per acre per year. 2. Acquisitions amounts are exclusive of transaction costs. 3. Stocking refers to merchantable timber inventory per acre. CatchMark considers 15-year or older pine as merchantable in the U.S. South. 4. Calculated using average fee acres owned during respective period. 5. Excludes value of timber reservations. 6. Includes volumes from large dispositions.

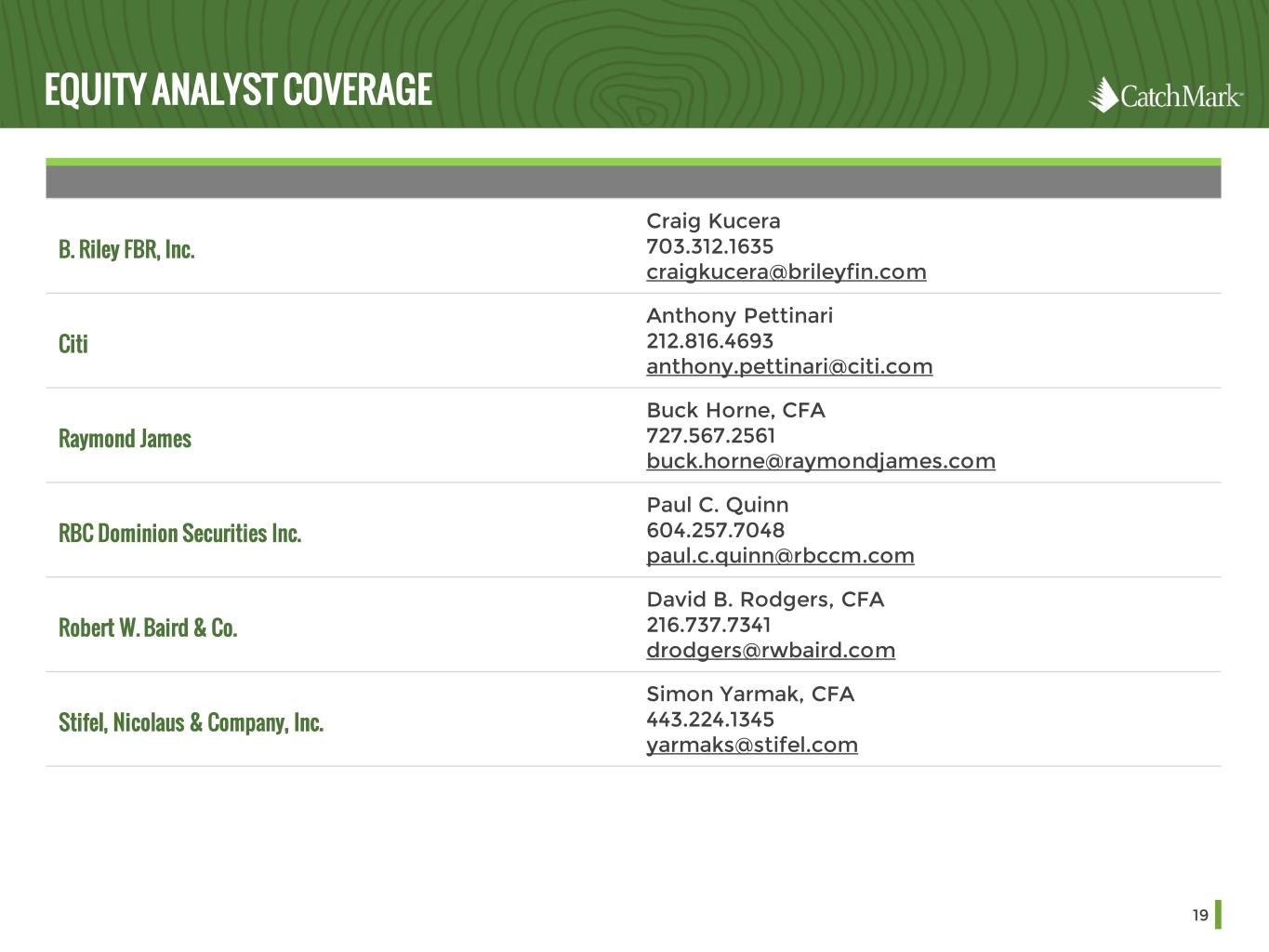

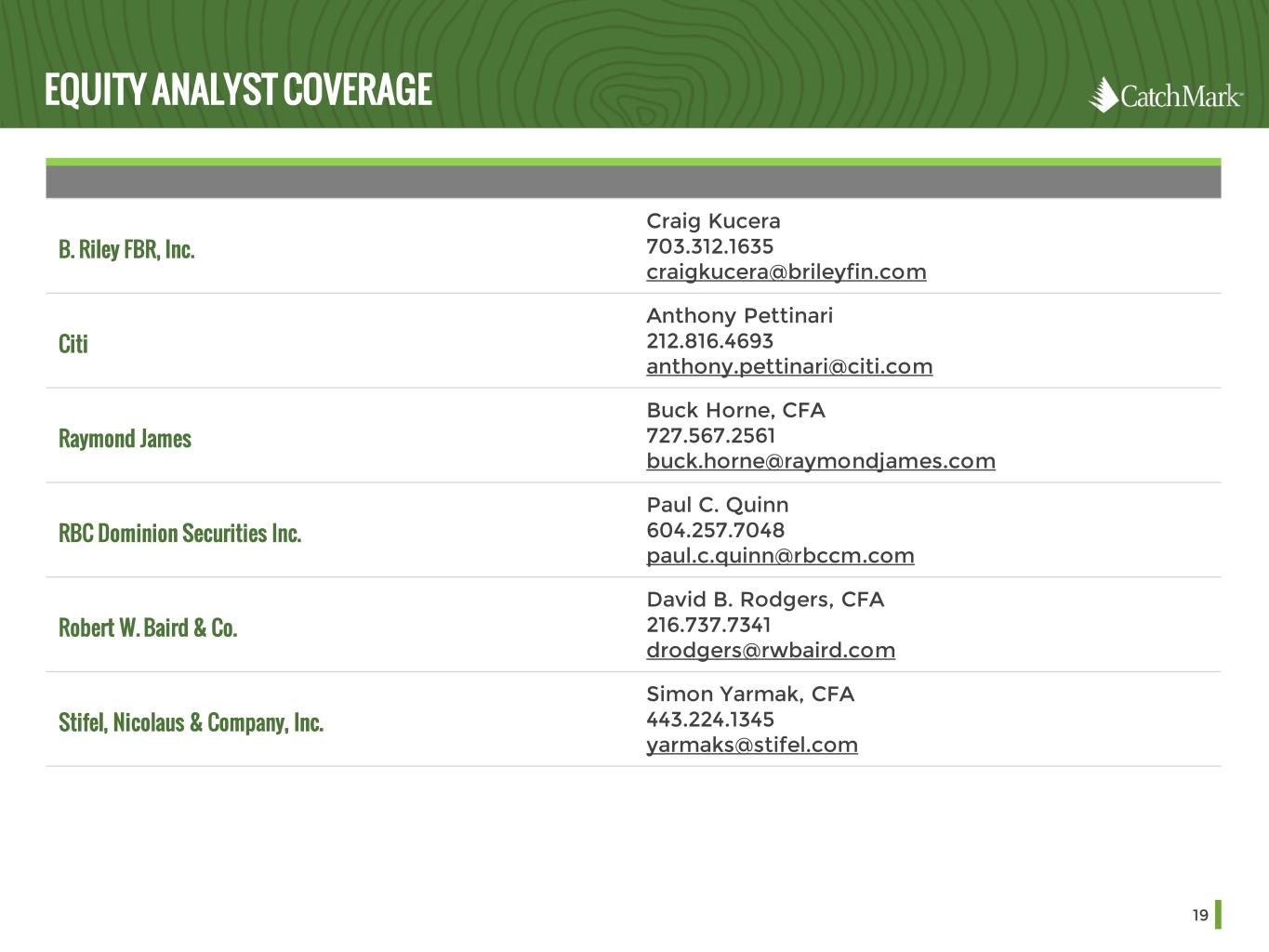

EQUITY ANALYST COVERAGE 19 B. Riley FBR, Inc. Craig Kucera 703.312.1635 craigkucera@brileyfin.com Citi Anthony Pettinari 212.816.4693 anthony.pettinari@citi.com Raymond James Buck Horne, CFA 727.567.2561 buck.horne@raymondjames.com RBC Dominion Securities Inc. Paul C. Quinn 604.257.7048 paul.c.quinn@rbccm.com Robert W. Baird & Co. David B. Rodgers, CFA 216.737.7341 drodgers@rwbaird.com Stifel, Nicolaus & Company, Inc. Simon Yarmak, CFA 443.224.1345 yarmaks@stifel.com

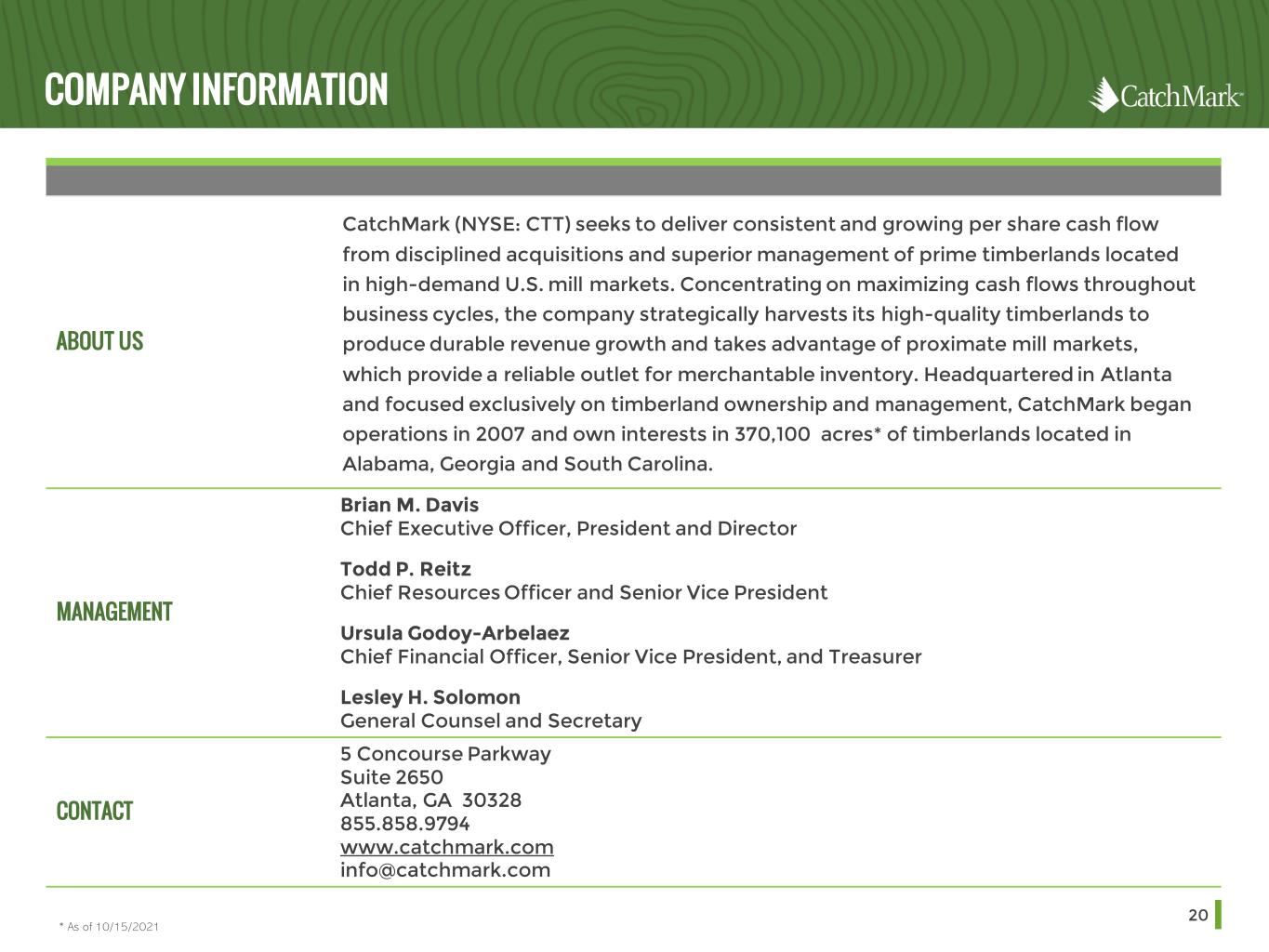

COMPANY INFORMATION 20 * As of 10/15/2021 ABOUT US CatchMark (NYSE: CTT) seeks to deliver consistent and growing per share cash flow from disciplined acquisitions and superior management of prime timberlands located in high-demand U.S. mill markets. Concentrating on maximizing cash flows throughout business cycles, the company strategically harvests its high-quality timberlands to produce durable revenue growth and takes advantage of proximate mill markets, which provide a reliable outlet for merchantable inventory. Headquartered in Atlanta and focused exclusively on timberland ownership and management, CatchMark began operations in 2007 and own interests in 370,100 acres* of timberlands located in Alabama, Georgia and South Carolina. MANAGEMENT Brian M. Davis Chief Executive Officer, President and Director Todd P. Reitz Chief Resources Officer and Senior Vice President Ursula Godoy-Arbelaez Chief Financial Officer, Senior Vice President, and Treasurer Lesley H. Solomon General Counsel and Secretary CONTACT 5 Concourse Parkway Suite 2650 Atlanta, GA 30328 855.858.9794 www.catchmark.com info@catchmark.com