If you purchase shares of common stock in this offering, you will experience immediate and substantial dilution.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Based on shares of our common stock being sold at the public offering price of $ per share, for aggregate gross proceeds of approximately $ million, and after deducting underwriting discounts and commissions and estimated aggregate offering expenses payable by us, you will experience immediate dilution of $ per share, representing the difference between our as adjusted net tangible book value per share as of June 30, 2018 after giving effect to this offering and the public offering price. In addition, we are not restricted from issuing additional securities in the future, including shares of common stock, securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or substantially similar securities. The issuance of these securities may cause further dilution to our stockholders. The exercise of outstanding stock options and the vesting of outstanding restricted stock units may also result in further dilution of your investment. See the section entitled “Dilution” on pageS-13 below for a more detailed illustration of the dilution you may incur if you participate in this offering.

We may allocate our cash resources, including the proceeds from this offering, in ways that you and other stockholders may not approve.

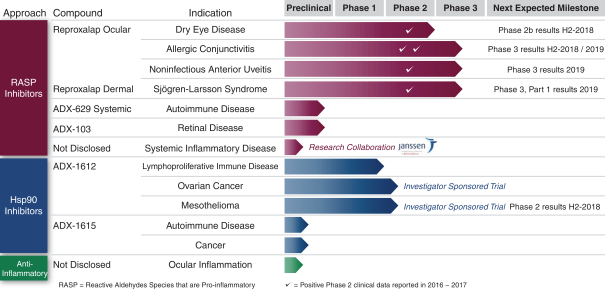

Our management has broad discretion in the application of our cash, cash equivalents and marketable securities, including the proceeds from this offering. Because of the number and variability of factors that will determine our use of our cash resources, their ultimate use may vary substantially from their currently intended use. Our management might not apply our cash resources in ways that ultimately increase the value of your investment. We intend to use the net proceeds from this offering, together with our existing cash resources, for the continued development of reproxalap and our other product candidates, including a planned Phase 3 clinical program in dry eye disease, our Phase 3 clinical trial programs in noninfectious anterior uveitis, allergic conjunctivitis, and SLS, one or more planned Phase 1 clinical trials of systemically or intravitreally administered reproxalap or another product candidate, one or more planned Phase 2a clinical trials of reproxalap or another product candidate in SLS, or systemic inflammation, a planned Phase 2 clinical trial ofADX-1612 in patients with pleural malignant mesothelioma, and a planned Phase 2 clinical trial in post-transplant lymphoproliferative disorder, debt maintenance, working capital and other general corporate purposes. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest our cash resources in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders. If we do not invest or apply our cash resources, including the proceeds from this offering, in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

Because a small number of our existing stockholders own a majority of our voting stock, your ability to influence corporate matters will be limited.

As of June 30, 2018, our executive officers, directors and greater than 5% stockholders, in the aggregate, owned approximately 42.0% of our outstanding common stock. As a result, such persons, acting together, will have the ability to control our management and business affairs and substantially all matters submitted to our stockholders for approval, including the election and removal of directors and approval of any significant transaction. This concentration of ownership may have the effect of delaying, deferring or preventing a change in control, impeding a merger, consolidation, takeover or other business combination involving us, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our business, even if such a transaction would benefit other stockholders.

We do not intend to pay dividends on our common stock and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividend on our common stock and do not currently intend to do so for the foreseeable future. We currently anticipate that we will retain future earnings for the development,

S-8