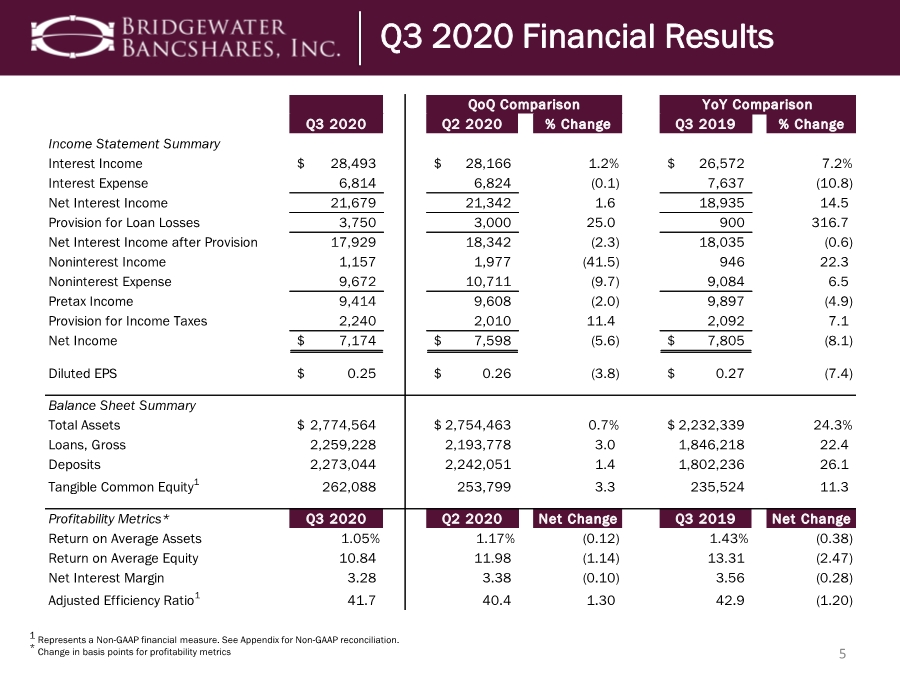

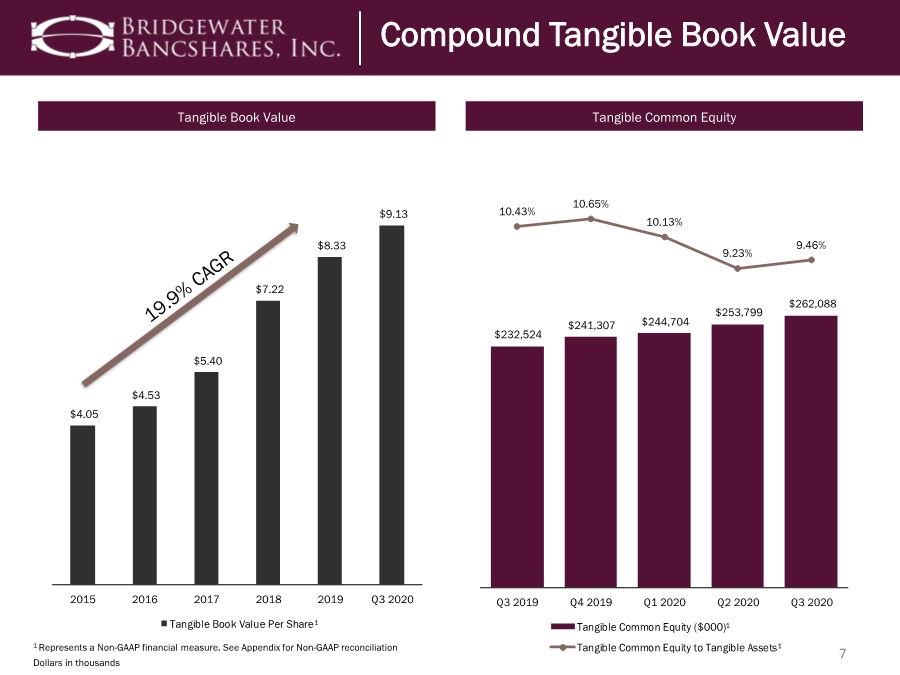

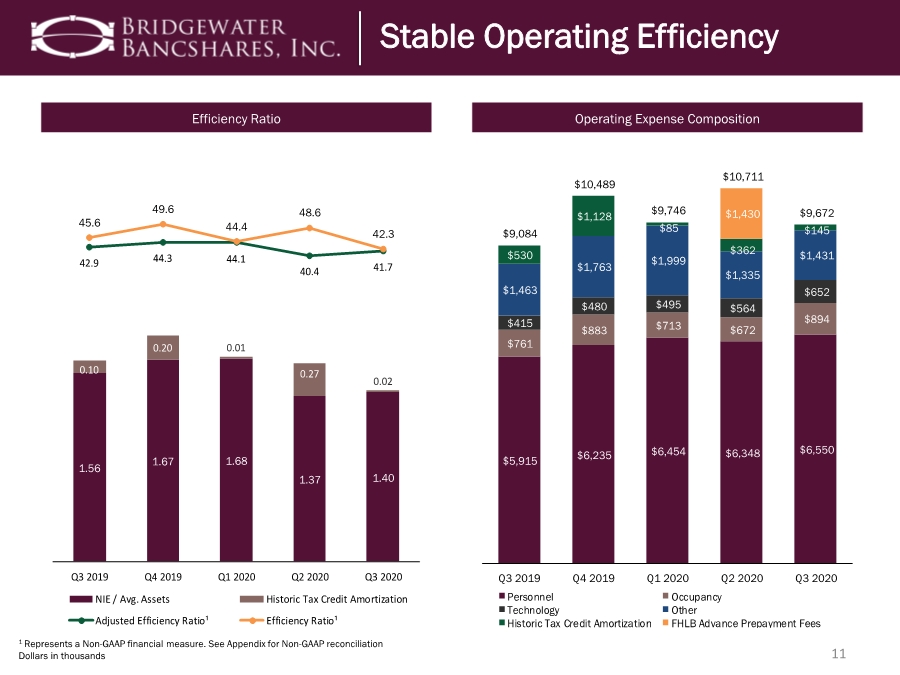

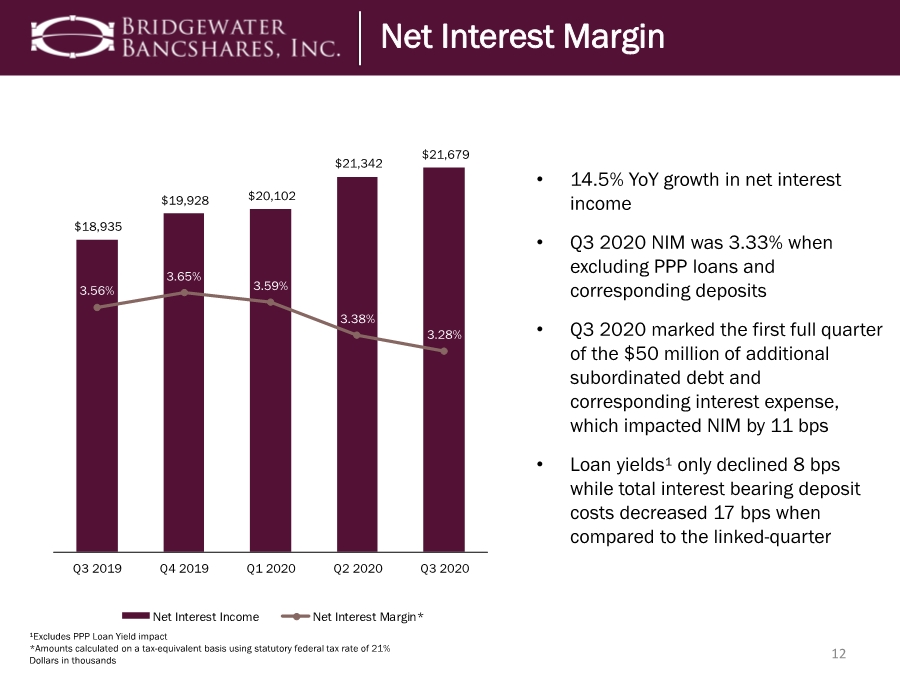

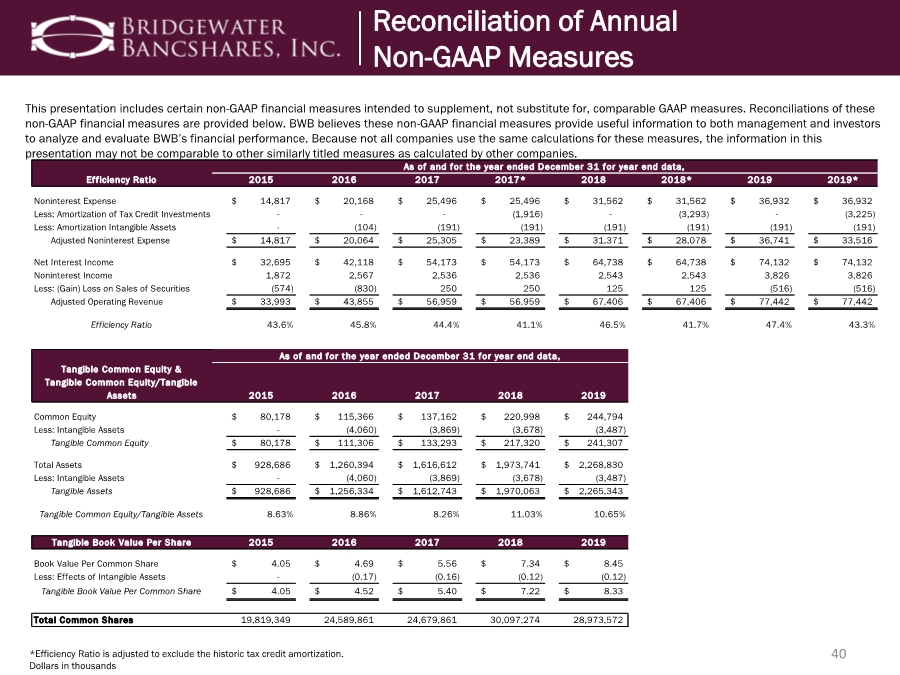

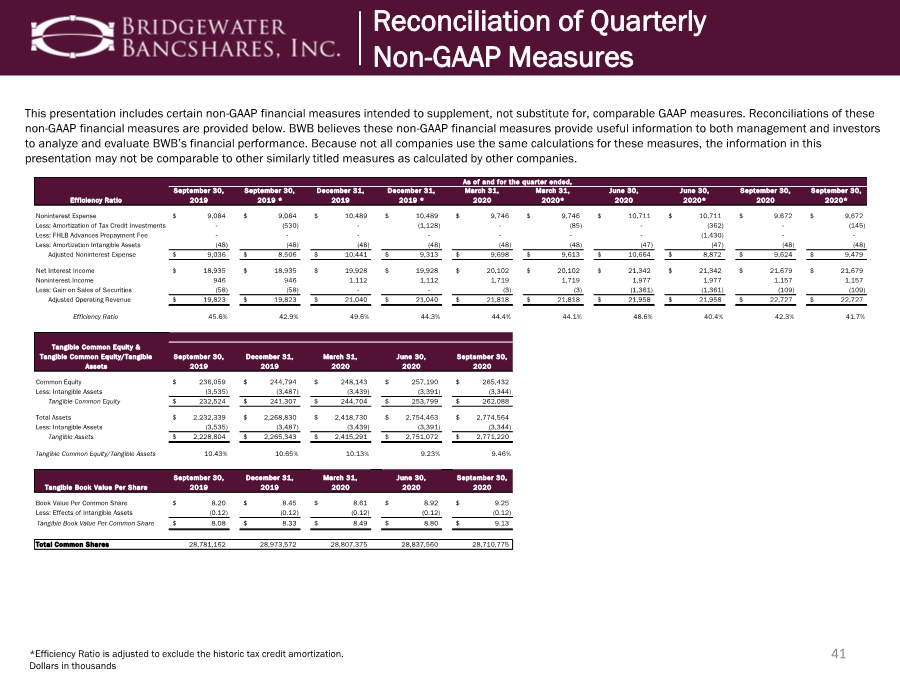

| 41 This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of these non-GAAP financial measures are provided below. BWB believes these non-GAAP financial measures provide useful information to both management and investors to analyze and evaluate BWB’s financial performance. Because not all companies use the same calculations for these measures, the information in this presentation may not be comparable to other similarly titled measures as calculated by other companies. *Efficiency Ratio is adjusted to exclude the historic tax credit amortization. Dollars in thousands Reconciliation of Quarterly Non-GAAP Measures Efficiency Ratio September 30, 2019 September 30, 2019 * December 31, 2019 December 31, 2019 * March 31, 2020 March 31, 2020* June 30, 2020 June 30, 2020* September 30, 2020 September 30, 2020* Noninterest Expense 9,084 $ 9,084 $ 10,489 $ 10,489 $ 9,746 $ 9,746 $ 10,711 $ 10,711 $ 9,672 $ 9,672 $ Less: Amortization of Tax Credit Investments - (530) - (1,128) - (85) - (362) - (145) Less: FHLB Advances Prepayment Fee - - - - - - - (1,430) - - Less: Amortization Intangible Assets (48) (48) (48) (48) (48) (48) (47) (47) (48) (48) Adjusted Noninterest Expense 9,036 $ 8,506 $ 10,441 $ 9,313 $ 9,698 $ 9,613 $ 10,664 $ 8,872 $ 9,624 $ 9,479 $ Net Interest Income 18,935 $ 18,935 $ 19,928 $ 19,928 $ 20,102 $ 20,102 $ 21,342 $ 21,342 $ 21,679 $ 21,679 $ Noninterest Income 946 946 1,112 1,112 1,719 1,719 1,977 1,977 1,157 1,157 Less: Gain on Sales of Securities (58) (58) - - (3) (3) (1,361) (1,361) (109) (109) Adjusted Operating Revenue 19,823 $ 19,823 $ 21,040 $ 21,040 $ 21,818 $ 21,818 $ 21,958 $ 21,958 $ 22,727 $ 22,727 $ Efficiency Ratio 45.6% 42.9% 49.6% 44.3% 44.4% 44.1% 48.6% 40.4% 42.3% 41.7% Tangible Common Equity & Tangible Common Equity/Tangible Assets September 30, 2019 December 31, 2019 March 31, 2020 June 30, 2020 September 30, 2020 Common Equity 236,059 $ 244,794 $ 248,143 $ 257,190 $ 265,432 $ Less: Intangible Assets (3,535) (3,487) (3,439) (3,391) (3,344) Tangible Common Equity 232,524 $ 241,307 $ 244,704 $ 253,799 $ 262,088 $ Total Assets 2,232,339 $ 2,268,830 $ 2,418,730 $ 2,754,463 $ 2,774,564 $ Less: Intangible Assets (3,535) (3,487) (3,439) (3,391) (3,344) Tangible Assets 2,228,804 $ 2,265,343 $ 2,415,291 $ 2,751,072 $ 2,771,220 $ Tangible Common Equity/Tangible Assets 10.43% 10.65% 10.13% 9.23% 9.46% Tangible Book Value Per Share September 30, 2019 December 31, 2019 March 31, 2020 June 30, 2020 September 30, 2020 Book Value Per Common Share 8.20 $ 8.45 $ 8.61 $ 8.92 $ 9.25 $ Less: Effects of Intangible Assets (0.12) (0.12) (0.12) (0.12) (0.12) Tangible Book Value Per Common Share 8.08 $ 8.33 $ 8.49 $ 8.80 $ 9.13 $ Total Common Shares 28,781,162 28,973,572 28,807,375 28,837,560 28,710,775 As of and for the quarter ended, |