UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | |

(MARK ONE) |

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the fiscal year ended May 31, 2009 |

| |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the transition period from ______ to______ |

| |

| Commission file number 0-52396 |

| |

HOTGATE TECHNOLOGY, INC. |

(Exact Name of registrant as specified in its charter) |

| | |

Nevada | | 71-098116 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| | |

Room 1602, Aitken Vanson, 61, Hoi Yuen Road, Kwun Tong, Hong Kong | | |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code (852) 2270-0688

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act. Yes o Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (of for such shorter period that the registrant was required to submit and post such files). Yes o No £

1

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| |

| |

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The issuer’s revenues for its most recent fiscal year were $710,758.

The aggregate market value of voting and non-voting stock held by non-affiliates of the registrant as of May 31, 2009 was $-0-. Although listed on the OTCBB under the symbol HTGT, there is currently no active trading for the registrant’s common stock. Therefore, the aggregate market value of the stock is deemed to be $-0-.

At July 31, 2009, there were 186,684,199 outstanding shares of Hotgate Technology, Inc. Common Stock, $0.0001 par value.

Documents Incorporated by Reference: None

Transitional Small Business Disclosure Format (check one) Yes o No x

2

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

4

ITEM 1A. RISK FACTORS

8

ITEM 1B. UNRESOLVED STAFF COMMENTS

12

ITEM 2. PROPERTIES

12

ITEM 3. LEGAL PROCEEDINGS

13

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

13

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES 13

ITEM 6. SELECTED FINANCIAL DATA

14

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 14

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

17

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

17

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. 18

ITEM 9A. CONTROLS AND PROCEDURES

18

ITEM 9B. OTHER INFORMATION

19

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORP ORATE GOVERNANCE

19

ITEM 11. EXECUTIVE COMPENSATION.

21

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS 22

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

23

ITEM 14. PRINCIPAL ACCO UNTANT FEES AND SERVICES

23

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SC HEDULES

24

SIGNATURES

42

3

Note About Forward-Looking Statements

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” “possible,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” (refer to Part I, Item 1A). We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

Historical Overview

Hotgate Technology, Inc. (the “Company” or “HTGT”) (formerly RNS Software, Inc.) was incorporated on January 6, 2005 in Nevada as File4ward Software, Inc.

On May 16, 2008, the Company entered into an Agreement for Share Exchange (the “Agreement”) with Hotgate Holding Limited, a British Virgin Island company (“HHL”) and the shareholders of HHL, namely Redtone Telecommunications Sdn Bhd, a Malaysia company, Pang Wee Tak, Alvin James and Michael Yang, individually. Such shareholders collectively own 100% of the shares of HHL and are sometimes referred to herein collectively as the “Shareholders”. Pursuant to the terms of the Agreement, HTGT shall acquire 100% ownership of HHL. Consideration to be paid by HTGT shall be a total of 121,108,929 shares (post 1:2.5 forward split) of its common stock (the “Exchange Shares”) in exchange for 100% ownership of HHL. According to the terms of the Agreement, Redtone Telecommunications Sdn Bhd shall receive 36,332,678 shares of common stock of the Company, Pang Wee Tak shall receive 35,969,351 sha res of common stock of the Company, Alvin James shall receive 363,327 shares of common stock of the Company and Michael Yang shall receive 48,443,573 shares of common stock of the Company. Immediately following completion of the share exchange transaction through issuance of the Exchange Shares, HTGT shall have a total of approximately 186,321,429 shares of its common stock issued and outstanding. In connection with these changes, the Company received a new trading symbol of HTGT on June 9, 2008. The closing of the Agreement shall subject to the fulfillment of the following up to the satisfaction of the Shareholders:

1. Complete a due diligence review to the Shareholders reasonable satisfaction;

2. Increase the Company’s authorized capital stock to 300,000,000 shares of Common Stock;

3. Complete a 1:2.5 forward split of the Company’s common stock; and

4. The Company changes its name to Hotgate Technology Inc.,

(herein referred to as the “Conditions”).

On July 3, 2008 (herein referred to as the “Closing”), the Company closed the Agreement for Share Exchange (the “Agreement”) with HHL and the shareholders of HHL, namely Redtone Telecommunications Sdn Bhd, a Malaysia company, Pang Wee Tak, Alvin James and Michael Yang, individually. All the Conditions of the Agreement were met prior to Closing. Pursuant to the transactions completed by the Agreement described above, there has been a change in control of the Company.

According to the Share Exchange Agreement entered that closed on July 3, 2008 and was previously reported on Form 8-K filed July 10, 2008, the Company has adopted the fiscal year of Hotgate Technology, Inc. Accordingly, the Company’s new fiscal year-end is May 31. The Company’s first filing under the new fiscal year was for the period ended August 31, 2008.

4

During the 4 th quarter of the fiscal year ended May 31, 2009, the management has implemented a drastic downsizing arrangement for the Group as a measure to braise through the current severe economic crisis and the spread of Influenza A virus (H1N1), which would reduce headcounts and overheads significantly. In line with the change of the economic condition, there will be a change in the business strategies to direct sales of the internet billing solutions with the focus on internet media business remains. In view of the severe economic crisis and the spread of Influenza A Virus (H1N1), it is foresee that revenue will be minimal for the coming quarters. Therefore, the expenses and resources has been kept down in line with the forth coming level of business.

On April 13, 2009, Mr. Michael Yang submitted his resignation as the President of the Company and Mr. Wee Tak Pang submitted his resignation as the CEO of the Company. On that same day, Mr. Chuan Beng Wei was appointed to serve as Chief Executive Officer and Mr. Wee Tak Pang was appointed to serve as Chief Technology Officer.

On May 1, 2009, Mr. Wee Tak Pang submitted his resignation as the CFO of the company. On the same day, Ms. Li Li Wong was appointed to serve as CFO. On August 27, 2009, the Board of Directors of the Company accepted the resignation of Mr. Wee Tak Pang as the CTO and Director of the Company. Mr. Pang has not had any disagreements with the Company and has no claims against the Company.

Business of the Issuer

Business Overview

We are an information and communication technology (ICT) application provider in China and Asia specializing in internet connectivity, internet value-added services, wireless solutions and voice services for the hospitality industry. We provide consulting, implementation, operating and support services for ICT systems such as telephone systems, internet systems, wireless solutions, and online concierge systems to hotels. We have provided telephony systems to more than 300 hotels throughout China, Hong Kong, Macau, Singapore, Taiwan, Malaysia, Indonesia and the United States. We have also provided our internet connectivity and internet billing solutions to some hotels in Malaysia and Hong Kong. Currently, we have offices located in Hong Kong, and Puchong, Malaysia.

Products and Services

We offer two major kinds of services to our customers: a Hotgate Hospitality Solution and a Wi-Fi Hotspot Solution.

Hotgate Hospitality Solution

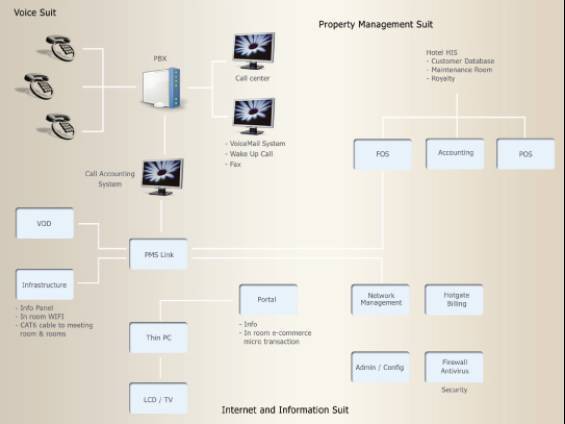

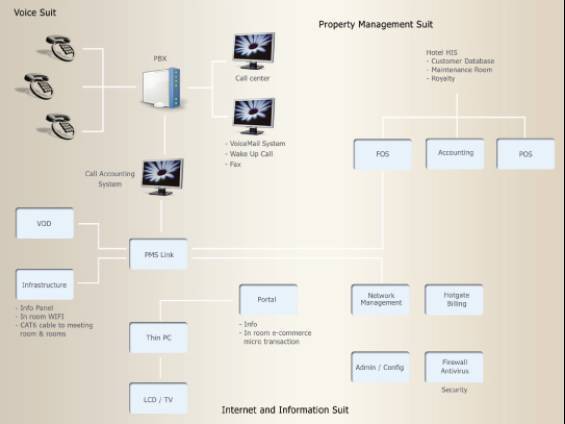

The Hospitality Hotgate Solution is a tailor-made solution for hotels that offer traditional voice services and internet services to the guests. The solution has three levels of services that each fulfill different requirements for hotels in a variety of ICT setups and offerings. The levels of services are referred to as “suites” and classified as the infrastructure suite, the data suite and the voice suite.

The infrastructure suite offers technical services to hotels for ICT infrastructure building and maintenance. At this service level, we provide consulting services related to infrastructure building such as planning the network, selecting and procuring equipment, designing the infrastructure and selecting vendors. We also provide project management services for the deployment of the infrastructure, vendor management, and testing and trial runs of the services. We provide daily monitoring and support services to ensure quality ICT services for the hotel guests. We also provide our proprietary software and equipment of hospitality ICT infrastructure to our customers.

The data suite covers data and internet applications provided by the hotel for the guests. In additional to providing internet access in guests rooms, conferences rooms and public areas such as lounges and lobbies, we provide online concierge systems that allow the hotel guests to access typical hotel services as well as other travel, entertainment, business and e-commerce services offered by local and professional service providers. The operation and billing of the services provided by the online concierge systems are fully integrated into the management information system of the hotels. The online concierge system provides a variety of price models and payment methods for the hotels and their guests to fulfill different payment requirements and consumption behaviors.

5

The voice suite provides traditional telecommunication applications including phone systems, voice mail, fax and other phone-based services. Like data suites, all the operation and billing of the services provided by voice suites are fully integrated into the management information system of the hotels.

A typical infrastructure of Hotgate Hospitality Solution is shown below:

Wi-Fi Hotspot Solution

The Wi-Fi Hotspot Solution is a specialized solution for wireless internet access in public area. Using the solution, our customers can provide customized Wi-Fi internet access to their clients and guests using their own computers, mobile devices and provided computers. Features of our solution include user management, access controls, payment systems, customized login procedures, advertisement insertion, navigation portals, virus protection, content filters and system availability monitoring. Our customers and partners can present online promotion material and advertising to their clients using the Wi-Fi Hotspot Solution. We also provide a full range of technical services to our customers for infrastructure building and maintenance.

By leveraging our technical and managerial expertise, we also provide technical consulting and implementation services to other industries.

Sales and Marketing

We market our products through three channels: strategic partners, direct sales and resellers.

Our senior management team is responsible for all strategic partnerships. We form partnerships with telecom companies, internet service providers and international information technology companies to market our products and services through joint sales programs, partnership programs and referral programs.

6

Our regional offices take care of direct sales and reseller channels according to geographical location. Currently we have two regional offices. Our Hong Kong office is responsible for the Southern China, Taiwan, Macao and Hong Kong markets; and our Malaysia office is responsible for the South East Asia region. Each regional office is also responsible for marketing activities within its territory. Direct sales activities include cross-selling products and services to existing customers, managing customer relationships and satisfaction, and conducting demonstrations to prospective customers. Each region also manages resellers by providing product training and support, developing system integrators and trading companies and controlling the performance and quality of resellers.

Competition

The market of ICT solutions for the hospitality industry throughout Asia is highly competitive. We compete with various companies in respect to specific elements of our business. Many of our competitors are large companies with substantially greater resources. Our competitors also include small firms offering network services, divisions of large entities and other large independent firms. Our major competitors included InterTouch owned by NTT DoCoMo, Inc., iBAHN owned by STSN Inc., Juru Data Sdn Bhd and FCS Computer Systems. The principal competitive factors in our markets include:

·

service functionality, quality, reliability and performance;

·

customer service and support;

·

pricing;

·

flexibility in integrating the solutions into the operation of the customers; and

·

ability to introduce new products and services to the market in a timely manner

Regulatory Matters

We do not anticipate having to expend significant resources to comply with any governmental regulations applicable to our operations. We are subject to the laws and regulations which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes.

Costs of Compliance with Environmental Laws

We are not presently affected by and do not have any costs associated with compliance with environmental laws.

Customers and Suppliers

Our major customers are hotels located in Asia. We serve a wide range of hotels from domestic motels to international brands. We provide our customers with ICT services through any or our entire product offering suites and hospitality solutions. We also provide hotels with our Wi-Fi Hotspot Solutions.

Intellectual Property and Research and Development

The Company has no registered patents, trademarks or copyrights and no applications for patents, trademarks or copyrights are pending.

The Company utilized intellectual property pursuant to an agreement signed between its wholly owned subsidiary, Hotgate Technology (M) Sdn Bhd and Synchroweb Technology Sdn Bhd on December 18, 2006 in respect of the HOTGATE patent and solutions for internet billing gateway and customer list, and another agreement between its wholly owned subsidiary, Hotgate VMS Technology Limited (“VMS”) and Redtone Technology Sdn Bhd on 28 February 2008 which grants VMS a non-transferable and non-exclusive perpetual license to use the licensed Telecare Voice Mail System source code.

The Company has insignificant research and development expenses in the fiscal year ended May 31, 2009.

Number of Employees

Subsequent to the downsizing plan, 4 persons on a full-time basis have remained with the Company, including our Chief Executive Officer. Continued implementation of the Company’s business plan will result in the need to hire additional employees. We believe that we will have to increase the number of our personnel over the next approximately 6-12 months as our business expands. Our personnel are not subject to any collective bargaining agreements and management believes that its relationship with the Company’s personnel is good.

7

ITEM 1A. RISK FACTORS

Risks Related to Our Business

Our customers are concentrated in a limited number of industries.

Our customers are concentrated primarily in the hospitality industry, where the current trend is to improve their ICT offerings to cope with the demand of their customers in efficient and convenient communication services. Our ability to generate revenue depends on the demand for our services in these industries. An economic downturn, or a slowdown or reversal of the tendency in any of these industries in investment of ICT solutions could have a material adverse effect on our business, results of operations or financial condition.

The markets in which we operate are highly competitive and fragmented and we may not be able to maintain market share.

We operate in highly competitive markets and expect competition to persist and intensify in the future. Our major competitors include InterTouch owned by NTT DoCoMo Inc., iBAHN Corporation, Juru Data Sdn Bhd and FCS Computer Systems. Our competitors also include small firms offering network services, divisions of large entities and other large independent firms. We face the risk that new competitors with greater resources than us will enter our markets.

Competition among hotel companies in greater China can lead to a reduction in services fees that can be charged by such companies. If a reduction in services fees negatively impacts revenue generated by our customers, they may require us to reduce the price of our services, or seek competitors that charge less, which could reduce our market share. If we must significantly reduce the price of our services, the decrease in revenue could adversely affect our profitability.

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business .

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Chuan Beng Wei, our Chief Executive Officer and director, Michael Yang, our director. They also depend on our ability to attract and retain additional qualified management, technical, marketing and sales and support personnel for our operations and growth. If we lose a key employee or if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete our institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the technical, marketing and sales aspects of our business, any part of which could be harmed by further turnover.

Although individual members of our management team have experience as officers of publicly-traded companies, much of that experience came prior to the adoption of the Sarbanes-Oxley Act.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent auditor certifications that Sarbanes-Oxley Act requires publicly-traded companies to obtain.

8

International operations require significant management attention.

Our operations in China and in other Asian countries are subject to risks, including the following, which, if not planned and managed properly, could materially adversely affect our business, financial condition and operating results:

·

legal uncertainties or unanticipated changes regarding regulatory requirements, political instability, liability, export and import restrictions, tariffs and other trade barriers;

·

longer customer payment cycles and greater difficulties in collecting accounts receivable

·

historically volatile markets with relatively recent recessions and economic difficulties;

·

changes in monetary policy or fluctuations in the local currencies;

·

uncertainties of laws and enforcement relating to the protection of intellectual property; and

·

potentially uncertain or adverse tax consequences

If we need additional financing, the funding may not be available on satisfactory terms or at all.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we would incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to your interest in bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

We must respond quickly and effectively to new technological developments.

Our business is highly dependent on our computer and telecommunications equipment and software systems. Our failure to maintain our technological capabilities or to respond effectively to technological changes could adversely affect our business, results of operations or financial condition. Our future success also depends on our ability to enhance existing software and systems and to respond to changing technological developments. If we are unable to successfully develop and bring to market new software and systems in a timely manner, our competitors’ technologies or services may render our products or services noncompetitive or obsolete.

If the market does not accept our other new products or upgrades to existing products that we launch from time to time, our operating results and financial condition would be materially adversely affected.

From time to time, we plan on launching new products and upgrades to existing products. Our future success with our next generation product offerings will depend on our ability to accurately determine the functionality and features required by our customers, as well as the ability to enhance our products and deliver them in a timely manner. We cannot predict the present and future size of the potential market for our next generation of products, and we may incur substantial costs to enhance and modify our products and services in order to meet the demands of this potential market.

If we experience delays in product development or the introduction of new products or new versions of existing products, our business and sales will be negatively affected.

There can be no assurance that we will not experience delays in connection with our current product development or future development activities. If we are unable to develop and introduce new products, or enhancements to existing products in a timely manner in response to changing market conditions or customer requirements, it may materially and adversely affect our operating results and financial condition. Because we have limited resources, we must effectively manage and properly allocate and prioritize our product development efforts. There can be no assurance that these efforts will be successful or, even if successful, that any resulting products will achieve customer acceptance.

9

Lower than expected demand for our products and services will impair our business and could materially adversely affect our results of operations and financial condition.

If we meet a lower demand for our products and services than we are expecting, our business, results of operations and financial condition are likely to be materially adversely affected. Moreover, overall demand for ICT products and services in general may grow slowly or decrease in upcoming quarters and years because of unfavorable general economic conditions, decreased spending by hospitality industry, food and drinks and media industries in need of ICT solutions or otherwise. This may reflect a saturation of the market for ICT solutions. To the extent that there is a slowdown in the overall market for ICT solutions, our business, results of operations and financial condition are likely to be materially adversely affected.

We have only limited protection of our proprietary rights and technology.

Our success is heavily dependent upon our proprietary technology. We rely on a combination of the protections provided under applicable copyright, trademark and trade secret laws, confidentiality procedures and licensing arrangements, to establish and protect our proprietary rights. As part of our confidentiality procedures, we generally enter into non-disclosure agreements with our developers, distributors and marketers. Despite these precautions, it may be possible for unauthorized third parties to copy certain portions of our products or to reverse engineer or obtain and use information that we regard as proprietary, to use our products or technology without authorization, or to develop similar technology independently. Moreover, the laws of some other countries do not protect our proprietary rights to the same extent as do the laws of the United States. Furthermore, we have no patents and existing copyright laws afford onl y limited protection. There can be no assurance that we will be able to protect our proprietary software against unauthorized third party copying or use, which could adversely affect our competitive position.

Customer claims, whether successful or not, could be expensive and could harm our business.

The sale and support of our products may entail the risk of product liability claims. Our agreements typically contain provisions designed to limit exposure to potential product liability claims. It is possible, however, that the limitation of liability provisions contained in such agreements may not be effective as a result of federal, state or local laws or ordinances or unfavorable judicial decisions. A successful product liability claim brought against us relating to our product or third party software embedded in our products could have a material adverse effect upon our business, operating results and financial condition.

If we infringe the rights of third parties, we could be prevented from selling products, forced to pay damages and compelled to defend against litigation.

If our products, methods, processes and other technologies infringe proprietary rights of other parties, we could incur substantial costs, and may have to obtain licenses (which may not be available on commercially reasonable terms, if at all), redesign our products or processes, stop using the subject matter claimed in the asserted patents, pay damages, or defend litigation or administrative proceedings, which may be costly whether it wins or loses. All these could result in a substantial diversion of valuable management resources.

We believe we have taken reasonable steps, including comprehensive internal and external prior patent searches, to ensure we have freedom to operate and that our development and commercialization efforts can be carried out as planned without infringing others’ proprietary rights. However, we cannot guarantee that no third party patent has been filed or will be filed that may contain subject matter of relevance to our development, causing a third party patent holder to claim infringement. Resolving such issues has traditionally resulted, and could in our case result, in lengthy and costly legal proceedings, the outcome of which cannot be predicted accurately.

We have never paid cash dividends and are not likely to do so in the foreseeable future.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

10

Risks Associated With Doing Business In China and Asia

There are substantial risks associated with doing business in China and Asia, as set forth in the following risk factors.

Our operations and assets in China are subject to significant political and economic uncertainties .

Changes in PRC laws and regulations, their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results from operations and financial condition. Under current leadership of the PRC, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

Our business is largely subject to the uncertain legal environment in China and your legal protection could be limited .

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, the Chinese legal system is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign invested enterprises in China. However, these laws, regulations and legal requirements are relatively recent and evolving rapidly, and their interpretation and enforcement involve various uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold business licenses and permits. In addition, all of our executive officers and directors are not residents of the U.S., and most of the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to serve proces s on these individuals in the U.S., or to enforce a judgment obtained in the U.S. against the Company or any of these persons.

The Chinese and Malaysian governments exert substantial influence over the manner in which we must conduct our business activities which could have an adverse effect on our ability to operate in China and Malaysia .

China has only recently permitted provincial and local economic autonomy and private economic activities. The Chinese and Malaysian governments continue to exercise substantial control over virtually every sector of the economy through regulation and state ownership. Our ability to operate may be harmed by changes in laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe our operations in China and Malaysia are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy could have a significant effect on economic conditions in China and Malaysia. Additionally, regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in particular regions of China and Malaysia, and could require us to divest ourselves of any interest we then hold in Chinese or Malaysian properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China .

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

11

Any recurrence of severe acute respiratory syndrome, or SARS, or another widespread public health problem, could harm our operations.

A renewed outbreak of SARS or another widespread public health problem in China or other countries where our operations are conducted could have a negative effect on our operations.

Our operations may be impacted by a number of health-related factors, including the following:

·

quarantines or closures of some of our offices which would severely disrupt our operations,

·

a negative economic impact upon our target industries including hospitality and food and beverage,

·

the sickness or death of our key officers and employees, and

·

a general slowdown in the Asian economy.

Any of the foregoing events or other unforeseen consequences of public health problems could damage our operations.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively .

The substantial portion of our revenues will be settled in RMB, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to pay dividends or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents at banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We canno t be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and RMB and other local currencies .

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and RMB, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into RMB for our operational needs and should the RMB appreciate against the U.S. dollar at that time, our financial position, the business of the company, and the price of our common stock may be harmed. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the RMB, then the U.S. dollar equivalent of our earnings from our subsidiaries in China would be reduced.

I TEM 1B. UNRESOLVED STAFF COMMENTS

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

I TEM 2. PROPERTIES

The Company’s principal executive offices are located at Suites 22-28, 5 th Floor, IOI Business Park, 47100 Puchong, Selangor, Malaysia, which is the main office of an affiliate, Redtone Telecommunications Sdn Bhd. Additional office space will be needed as additional employees are hired and are expected to be available at the Company’s present location. The Company’s management believes that all facilities occupied by the Company are adequate for present requirements, and that the Company’s current equipment is in good condition and is suitable for the operations involved.

12

ITEM 3. LEGAL PROCEEDINGS

We are not a party to and none of our property is subject to any material pending or threatened legal, governmental, administrative or judicial proceedings.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted to a vote of the Company’s security holders during the fourth quarter of the fiscal year covered by this Annual Report.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s Articles of Incorporation provide that the Company has the authority to issue 300,000,000 shares of common stock at par value of $0.0001 per share. As of July 31, 2009, we had 186,684,199 outstanding shares of Common Stock.

On June 9, 2008, our common stock began being quoted on the OTCBB under the symbol “HTGT”. We have not had any active trading in our stock as at the date of this report

The Company has never paid any cash dividends on its stock and does not plan to pay any cash dividends in the foreseeable future.

As of May 31, 2009, we had approximately 49 shareholders of record.

Equity Compensation Plans

The Company does not have any equity compensation plans in place as of the date of this report, and had no options, warrants or other convertible securities outstanding as of that date.

Sales of Unregistered Securities

During the fiscal year ended May 31, 2009, the Company has sold unregistered securities to close friends of a director of the Company as listed in a schedule contained herein. These shares were sold to stockholders who acknowledges and understands that the certificates representing the shares has not been registered under the Securities Act 1933, as amended (“The Act”) and are restricted securities as that term is defined in Rule 144 under the Act, and requires written release from either the issuing Company or their attorney prior to legend removal.

| | | | | | |

Summary of sale of unregistered securities : | | | |

No. | Date of Share certificate | Share Certificate Number | Name of Shareholder | No. of Shares | Subscription Price (per share) | Total Subscription Price (US$) |

| | | | | | |

1 | Aug 18, 2008 | 1127 | Michael Ting Sii Ching | 70,000 | US$ 1.00 | 70,000.00 |

2 | Aug 18, 2008 | 1128 | Tan Suat Eam | 4,000 | US$ 1.50 | 6,000.00 |

3 | Aug 18, 2008 | 1129 | Soon Yeow | 10,000 | US$ 1.50 | 15,000.00 |

4 | Aug 18, 2008 | 1130 | Yap Jek Nam | 10,000 | US$ 2.00 | 20,000.00 |

5 | Aug 18, 2008 | 1131 | Poh Chee Seng | 20,000 | US$ 2.00 | 40,000.00 |

6 | Aug 28, 2008 | 1133 | Shaifubahrim Bin Mohd Saleh | 20,000 | US$ 1.00 | 20,000.00 |

7 | Oct 2, 2008 | 1137 | Alburn Selvam William | 105,000 | US$ 1.00 | 105,000.00 |

8 | Nov 6, 2008 | 1139 | Poh Chee Seng | 30,000 | US$ 2.00 | 60,000.00 |

9 | Dec 8, 2008 | 1140 | Soon Yeow | 58,770 | US$ 1.50 | 88,155.00 |

10 | Mar 12, 2009 | 1147 | Suhaimi Bin Badrul Jamil | 5,000 | US$ 0.50 | 2,500.00 |

11 | Mar 12, 2009 | 1148 | Vieven Goon | 30,000 | US$ 0.50 | 15,000.00 |

13

ITEM 6. SELECTED FINANCIAL DATA

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

I TEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are an information and communication technology (ICT) application provider in China and Asia specializing in internet connectivity, internet value-added services, wireless solutions and voice services for the hospitality industry. We provide consulting, implementation, operating and support services for ICT systems such as telephone systems, internet systems, wireless solutions, and online concierge systems to hotels. We have provided telephony systems to more than 300 hotels throughout China, Hong Kong, Macau, Singapore, Taiwan, Malaysia, Indonesia and the United States. We have also provided our internet connectivity and internet billing solutions to some hotels in Malaysia and Hong Kong. Currently, we have offices located in Hong Kong, China and Puchong, Malaysia.

We intend to establish new core business that is aligned to the core experience and competency of the management and previous business along with the scope of business in internet based solutions especially to ride on the growth of mobile internet and telecommunication value added services, leveraging of business partners in market such as China. We may consider merger and acquisition in this new direction and shall pursue such opportunity. We believe this may deliver new value to our business. To the extent that we may raise additional capital by issuing equity securities in such exercise, our stockholders may experience dilution.

However, there can be no assurance that we will be successful in executing our business plan.

We have a working capital shortage, and must continue to seek and secure significant capital from outside funding sources as our cash flow from operations is insufficient to sustain operations. No assurances can be given that we will be successful in obtaining such needed capital. Our inability to promptly secure needed capital will materially adversely affect the Company and its operations, as we believe our current cash position and anticipated receipt of revenues will enable us to sustain current operations for up to approximately six months from the date of this filing.

We have no financing sources in place and no assurances are given as to the availability of any financing, or if available, the terms thereof. We will require additional capital within the next six months to continue our operations, the failure of which to obtain could materially adversely affect the Company and its business.

We anticipate that even in the event we are able to raise sufficient capital to continue our operations, such capital will not necessarily assure our success or profitability in view of, among other factors, our limited operating history in this business, the uncertainties associated with marketing emerging technologies, and the capital intensive nature of the data suite industry. We are subject to all the substantial risks inherent in the development of a business enterprise within a sector of hospitality solutions that has itself generated only limited revenues to date. Accordingly, no assurances can be given that our business will ever be successful or that we will ever be or remain profitable.

We believe that we will have to increase the number of our personnel over the next approximately 6-12 months in line with our business plan due to the need to increase our networking and marketing efforts.

14

Results of Operations

Financial Presentation

The following sets forth a discussion and analysis of the Company’s financial condition and results of operations for the two years ended May 31, 2009 and 2008. This discussion and analysis should be read in conjunction with our consolidated financial statements appearing elsewhere in this Annual Report on Form 10-K. The following discussion contains forward-looking statements. Our actual results may differ significantly from the results discussed in such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in “Item 1A — Risk Factors” of this Annual Report on Form 10-K.

| | | | | | | |

| | Fiscal year ended May 31, | | Increase /(Decrease) |

| | 2009 | | 2008 | | from previous year |

| | | | | | | % |

Revenue | $ | 716,531 | $ | 562,763 | $ | 153,768 | 27% |

Cost of goods sold | | 155,507 | | 198,718 | | (43,211) | -22% |

Gross profit | | 561,024 | | 364,045 | | 196,979 | 54% |

General and administrative expenses | | 1,151,174 | | 771,609 | | 379,565 | 49% |

Net (loss) profit from operations | | (590,150) | | (407,564) | | (182,586) | 45% |

Income on long distance calling services | | - | | 1,821 | | (1,821) | -100% |

Other income | | - | | 1,025 | | (1,025) | -100% |

Impairment loss on investment in a subsidiary | | (307,123) | | - | | (307,123) | - |

Interest received | | 687 | | 7,754 | | (7,067) | -91% |

Total Other Income (Expense) | | (306,436) | | 10,600 | | (317,036) | -2991% |

Net (loss) profits before provision for income taxes | | (896,586) | | (396,964) | | (499,622) | 126% |

Provision for income taxes | | - | | - | | - | - |

Net (loss) profits | | (896,586) | | (396,964) | | (499,622) | 126% |

Year ended May 31, 2009 compared to year ended May 31, 2008

Revenues. Revenues from operations for the year ended May 31, 2009 of $710,758 reflected an increase of $147,995 over the fiscal year ended May 31, 2008. This is due to the increase of overall sales of Hotgate VMS Technology Limited (“VMS”) by 27% over the fiscal year 2008. The increase in sales was mainly due to the granting of the 20 years license for the use of voice mail system software to Mr. Sim Hock Ming, a former director of VMS.

Cost of Sales. Costs of sales has registered a reduction of 22% over the fiscal year ended May 31, 2008.

General and administrative expenses. The high increase in the general and administrative expenses for the fiscal year ended May 31, 2009 over the fiscal year ended May 31, 2008 was primarily due to the expansion of operation in China and Malaysia which led to the increase in staff salaries and headcount related costs, such as, pension fund, travelling and entertainment, and due to the listing obligation which has incurred more legal, advisory and consultancy related professional costs. Apart from that, the increase in the allowance for doubtful debts of $78,333 for the fiscal year under review has also contributed to the increase in the general and administrative expenses.

Impairment loss on investment in a subsidiary. During the fiscal year ended May 31, 2009, the Company formed a subsidiary, namely Beijing Hotgate Technology Limited (“Beijing Hotgate”), in Beijing, China. Due to continued losses and projected negative cash flow, the Company closed down the business operation of Beijing Hotgate. During the year under review, the Company has recorded a total impairment loss of $307,123, being the investment cost and advances to Beijing Hotgate, considered not recoverable.

Other expenses. There Company has not incurred any other expenses for the fiscal year.

15

Net Loss before income tax. For the fiscal year under review, the expansion of operation in China and Malaysia has led to the increase in staff cost and headcount related costs, such as, pension fund, travelling and entertainment, and due to the listing obligation, the Company has incurred more legal and professional cost. The increase in the allowance for doubtful debt of $78,333 during the year under review has also contributed to the increase in the net loss for the fiscal year under review. As a result, the net loss before income tax has reflected a high increase in the fiscal year ended May 31, 2009 over the fiscal year 2008.

Liquidity and Capital Resources.

Cash

Our cash balance at May 31, 2009, was $10,911, representing a decrease of $265,112, from our cash balance of $276,023 at May 31, 2008.

Cash Flow (before effect of exchange rate changes).

| | | | | |

| | Fiscal year ended May 31, | |

| | 2009 | | 2008 | Percentage change (%) |

Net cash used from operating activities | $ | (265,356) | $ | (318,078) | -17% |

Net cash used in investing activities | | (435,856) | | (63,691) | 584% |

Net cash provided by financing activities | | 441,655 | | 6,069 | 7177% |

Net decrease in cash | | (259,557) | | (375,700) | -31% |

Net cash used from operations during the fiscal year ended May 31, 2009 amounted to $265,356 as compared to net cash used from operations of $318,078 in the same period of 2008.

Our net cash used in investing activities during the fiscal year ended May 31, 2009 amounted to $435,856 as compared to $63,691 in the same period of 2008. The increase in the investment activities is primarily due to the investment and advances made in Beijing, China for $307,123. The increase in the investing activities is also due to the expansion in the hotel ICT business where office renovation for new offices in China and Malaysia was incurred, purchased of furniture and fittings, new notebooks and computers for new staff in the new offices of China and Malaysia during the early quarters of the fiscal year ended May 31, 2009, and increase in the purchased of hotel ICT equipments of $120,950.

Our net cash provided by financing activities amounted to $ 441,655 for the fiscal year ended May 31, 2009 as compared to $6,069 in the same period last year. During the fiscal year ended May 31, 2009, the Company has further issued 362,770 shares of common stock at a total consideration of $441,655.

Working Capital

Our working capital was a deficit of $1,210,256 at May 31, 2009. From time to time, we may identify new expansion opportunities for which there will be a need for the use of cash.

Our financial statements appearing elsewhere in this report have been prepared on a going concern basis that contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. Management realizes that we must generate capital and revenue resources to enable us to achieve profitable operations. To the extent that we are unable to obtain additional working capital from operations and/or other sources as required or otherwise desired, our financial statements will be materially affected.

We were in a working capital shortage at the fiscal year end of May 31, 2009 and cash flow from operations is insufficient to sustain our operations as of the date of this filing. As of the date of this filing, the Company still requires additional financing to sustain operations until additional subscribers can be obtained. No assurances are given that we will be successful in obtaining additional needed capital. Our inability to secure such additional capital will materially adversely affect the Company and its operations. We believe our current cash position after funding and anticipated receipt of revenues will enable us to sustain current operations for up to approximately six month.

16

At May 31, 2009, we had stockholders’ deficit of $1,067,666, total assets of $246,436 and total current liabilities of $1,314,102. For the year ended May 31, 2009, we have incurred losses of $896,586 and for the year ended May 31, 2009, we used cash in operations of $265,356. Our operations and acquisitions have been funded by the sale of equity in private equity financing from private investors. These funds have been used for working capital, general corporate purposes, investment in subsidiary, purchase of plant and equipments, and customer lists and voice mail software costs in furtherance of our business plan.

We do not currently anticipate any material capital expenditures for our existing operations. We do not currently anticipate purchasing or leasing any plant and equipment during approximately the next twelve (12) months.

We do not believe that inflation has had a material effect on our results of operations. However, there can be no assurances that our business will not be affected by inflation in the future.

We have no off balance sheet arrangements.

Critical Accounting Policies and Estimates

Revenue Recognition.

Revenue represents the invoiced value of services rendered and receivable during the year. Revenue is recognized when all of the following criteria are met:

a)

Persuasive evidence of an arrangement exists,

b)

Delivery has occurred or services have been rendered,

c)

The seller’s price to the buyer is fixed or determinable, and

d)

Collectability is reasonably assured

e)

The Company recognizes revenues from the sale of its voice mail systems once the system has been sold and installed at the customer’s location. Revenues from maintenance services are recognized when the service has been delivered and completed.

Recent Accounting Pronouncements.

The Company does not expect the adoption of any recent accounting pronouncements will have any material impact on its financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a smaller reporting company, the Company is not required to provide disclosure required by this item.

I TEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company’s audited financial statements and the notes thereto appear in Part IV, Item 15, of this report.

17

I TEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

As approved by the Registrant’s Board of Directors on September 8, 2008, the accounting firm of Madsen and Associates CPA’s, Inc., (“Madsen”) was engaged to take over the audit responsibilities from Dale Matheson Carr Hilton LaBonte LLP (“DMCHL”) and DMCHL was dismissed on that same date.

DMCHL had served as the Registrant’s independent auditor since the Company’s inception.

Since the engagement of DMCHL, the Registrant (or someone on its behalf) has not consulted with Madsen, or any other auditor, regarding any accounting or audit concerns, to include, but not by way of limitation, those stated in Item 304(a)(2) of Regulation S-B.

During the period that DMCHL served as the Registrant’s independent auditor and through the date of dismissal, the Registrant has not had any disagreements with DMCHL, whether resolved or not resolved, on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to said accountants' satisfaction, would have caused it to make reference to the subject matter of the disagreements(s) in connection with its report.

Registrant has provided the information required to comply with Item 304(a)(3) of Regulation S-B to DMCHL and requested that DMCHL furnish it with a letter addressed to the Securities and Exchange Commission stating whether it agrees with the above statements. A copy of DMCHL’s letter dated September 8, 2008 is filed as Exhibit 16 to the Current Report on Form 8-K filed on September 9, 2008.

I TEM 9A. CONTROLS AND PROCEDURES

Evaluation of disclosure controls and procedures

As of May 31, 2009, the end of the fiscal year covered by this Form 10-K, our management performed, under the supervision and with the participation of our principal executive officer and principal financial officer, an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended). Based on this evaluation, our principal executive officer and principal financial officer have concluded that, as of May 31, 2009, our disclosure controls and procedures were not effective, because they did not have proper application of accounting principles to ensure a material transaction was accounted for in accordance to the United States generally accepted accounting principles. The remedial action plan is for the management to provide further technical review over the accounting policies used in ensuring that the financial reports comply with the United States generally a ccepted accounting principles. Otherwise, information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding disclosure.

The management believes that a control system, no matter how well designed and operated, cannot provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote. However, management believes that our system of disclosure controls and procedure is designed to provide a reasonable level of assurance that the objectives of the system will be met.

Management is aware that there is a lack of segregation of duties due to the small number of employees dealing with general administrative and financial matters. However, management has concluded that considering the employees involved and the control procedures in place, the risks associated with such lack of segregation are insignificant and the potential benefits of adding employees to clearly segregate duties do not justify the expenses associated with such increases.

18

Changes in internal controls

There were no material changes in the Company’s internal controls or in other factors that could materially affect these controls subsequent to the date of their evaluation. Disclosure controls and procedures are the Company’s controls and other procedures that are designed to ensure that information required to be disclosed in the reports that the Company files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. There were no changes in the Company’s internal control over financial reporting that occurred during the last quarter that has materially affected, or is reasonable likely to materially affect, the Company’s internal control over financial reporting.

Sarbanes - Oxley Act 404 compliance

The Company anticipates that it will be fully compliant with section 404 of the Sarbanes-Oxley Act of 2002 by the required date for non-accelerated filers and it is in the process of reviewing its internal control systems in order to be compliant with Section 404 of the Sarbanes Oxley Act. However, at this time the Company makes no representation that its systems of internal control comply with Section 404 of the Sarbanes-Oxley Act.

ITEM 9B. OTHER INFORMATION

There were no items required to be disclosed in a report on Form 8-K during the fourth quarter of the fiscal year ended May 31, 2009 that have not been already disclosed on a Form 8-K filed with the SEC.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

The following table sets forth as of the date hereof, except as otherwise noted, the names, ages and positions held with respect to each director, executive officer, and significant employee expected to make a significant contribution to the Company:

| | | | | | |

Name | | Age | | Position | | Period |

| | | | | | |

Chuan Beng Wei | | 44 | | CEO Director | | April 2009 – Present July 2008 - Present |

| | | | | | |

Michael Yang Chee Hoong | | 61 | | Director Former President | | July 2008 – Present July 2008 – April 2009 |

| | | | | | |

Li Li Wong | | 43 | | CFO | | May 2009 - Present |

Mr. Chuan Beng Wei took office as CEO and Director with HTGT on April 13, 2009. Chuan Beng Wei, age 42, is now the CEO and a director of the Company. In 1996, he founded Redtone Telecommunications Sdn Bhd which later became a subsidiary of Redtone International Bhd (“Redtone”), a company specializing in value-added telecommunications services. Redtone is listed on the Mesdaq market of Bursa Malaysia. He served as the Managing Director of Redtone and was in charge of business development and strategic management. Mr. Wei began his career with Agilent Technologies (M) Sdn Bhd in 1989 and performed duties as a System Engineer and Major Account Manager. In 1995, he founded TQC Consultants (IT Division) Sdn Bhd, a software development and system integration company. Mr. Wei is also a Council Member and the chairperson for Communication Special Interest Gro up for Persatuan Industri Komputer dan Multimedia Malaysia (“The Association of Computer and Multimedia Malaysia”) and the Vice President for the Kuala Lumpur/Selangor Darul Ehsan Telecommunication Association. He holds a Bachelor’s Degree in Electrical Engineering from the University of Technology in Malaysia and a Diploma in Management from the Malaysia Institute of Management.

19

Michael Yang, age 61, is a director of the Company. Since 1994, Mr. Yang has been the managing director of Zephyr Capital, an investment and management consulting company with clients in Australia, Malaysia, Hong Kong, China and other Asia countries. He is also a director of a number of companies including PHI Bhd., Cash Bhd. and EB Capital Bhd., a company listed on the Mesdaq Stock Exchange in Malaysia. Mr. Yang started his career in 1975 with Amanah-Chase Merchant Bank Bhd, the Malaysian merchant banking arm of Chase Manhattan Bank (now known as JP Morgan Chase) where he served as a General Manager and head of corporate banking. Mr. Yang holds a Master’s Degree in Business Administration from Cranfield University in the United Kingdom, a Bachelor of Economics degree (with honors) from the University of Malaya, Malaysia and a Diploma in Marketing from the Institute of Marketing in the United Kingdom.

Ms. Lili Wong, age 43, is appointed as Chief Financial Officer of the Company on May 1, 2009. Ms Wong has worked in the account and financial field since 1993 and has extensive knowledge and experience in accounting operation, financial analysis, internal control and financial reporting. Ms. Wong joined the Company in July 2008 and has served as the financial manager of the company. She is in charge of the overall accounting and financial operations, reporting and financial analysis of the company by leading the account team. Before joining the Company, Ms Wong was the senior accountant of Pilecon Engineering Bhd, a building and construction company in Malaysia, from January 2003 to June 2008. Her main duties included analytic review of the financial reports, financial statement consolidation, tax planning and submission and financial forecasts. Ms. Wong holds a professional certificate in Accountancy and Finance from Kolej Damansara Utama, Regen t School of Economics, ATC School of Business, Malaysia. She is a member of Association of Chartered Certified Accountants.

Number and Terms of Office of Directors

A Board of Directors, consisting of at least one (1) person shall be chosen annually by the Stockholders at their meeting to manage the affairs of the company. The Directors' term of office shall be one year, and Directors may be re-elected for successive annual terms. There is no family relationship between any of our executive officers and directors.

Code of Ethics

The Company has not yet adopted a Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, comprising written standards that are reasonably designed to deter wrongdoing and to promote the behavior described in Item 406 of Regulation S-K promulgated by the Securities and Exchange Commission. Due to the small size of the Company, management does not believe such a code is needed at this time.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who own more than 10% of the Company’s stock (collectively, “Reporting Persons”) to file with the SEC initial reports of ownership and changes in ownership of the Company’s Common Stock. Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file. To the Company’s knowledge, based solely on its review of the copies of such reports received or written representations from certain Reporting Persons that no other reports were required, the Company believes that during its fiscal year ended May 31, 2009, all Reporting Persons complied with all applicable filing requirements.

20

ITEM 11. EXECUTIVE COMPENSATION.

The following table sets forth, for the fiscal years ended May 31, 2009 and 2008, certain information regarding the compensation earned by the Company’s named executive officers. Where columns have been omitted from the Summary Compensation Table below, it is because no such compensation was paid to the named executive officer during the 2009 or 2008 fiscal years.

| | | | | |

SUMMARY COMPENSATION TABLE |

| | | | | |

| | Annual Compensation | |

| | | | Other | All Other |

Name and | Year | | | Annual | Compen- |

Principal | Ended | Salary | Bonus | Compen- | sation |

Position | May 31 | ($) | ($) | sation ($) | ($) |

Chuan Beng Wei, | 2009 | -0- | -0- | -0- | -0- |

CEO, Director | 2008 | -0- | -0- | -0- | -0- |

| | | | | |

Michael Yang Chee Hoong, | 2009 | -0- | -0- | 18,058(1) | |

Director, Former President | 2008 | -0- | -0- | -0- | -0- |

| | | | | |

Li Li Wong, CFO | 2009 | -0- | -0- | 2,675 (2) | -0- |

| 2008 | -0- | -0- | -0- | -0- |

| | | | | |

| | | | | |

(1) The Company paid Mr Yang $18,058 in advisory fee pursuant to a service agreement for the fiscal year ended May 31, 2009 . |

(2) The Company paid salary for the fiscal year ended May 31, 2009 from the date of appointment as a certifying officer. |

Director Compensation

Members of the Board of Directors did not receive any cash or non-cash compensation for their service as Directors during our 2009 and 2008 fiscal years.

Compensation Committee Interlocks and Insider Participation

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

Compensation Committee Report

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

21

I TEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth beneficial ownership information as of July 31, 2009: (i) each of the Company’s officers and directors, (ii) each person who is known by the Company to own beneficially more than 5% of the outstanding shares of common stock, and (iii) all of the Company’s officers and directors as a group. As of July 31, 2009, the Company had 186,684,199 shares of common stock outstanding.

(i)

Security Ownership of directors and executive officers:

| | | | | | |

| | | | | | |

Title of Class | | Name and Address | | Amount & Nature of Beneficial Ownership | | Percentage of Class |

| | | | | | |

Common shares

|

| Michael Yang Chee Hoong, 154-2- 10, Villa Flora, Jalan Burhanuddin Helmi, Taman Tun Dr. Ismail, 60000 Kuala Lumpur, Malaysia. | | 48,443,573 | | 26% |

(ii)

Security ownership of certain beneficial owners:

| | | |

| | | |

Title of Class | Name and Address | Amount & Nature of Beneficial Ownership | Percentage of Class |

| | | |

Common shares | Redtone Telecommunications Sdn Bhd, Suites 22-28, 5 th Floor, IOI Business Park, 47100 Puchong, Malaysia. | 36,332,678 | 19.5% |

| | |

| | |

| | |

Common Shares | Pang Wee Tak | 35,969,351 | 19.3% |

| | | |

(iii)

Secuityy ownership of officers and directors as a group: None.

22

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

In the year 2008, a wholly owned subsidiary of the Company has entered into a Service Agreement with Michael Yang Chee Hoong, a director of the Company as described in Item 11.

During the fiscal years ended May 31, 2008 , a minority stockholder, REDtone Telecommunications Sdn. Bhd., paid for the listing and other expenses on behalf of the Company amounting to $786,134. The loan does not bear interest and is repayable on demand.

I TEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Madsen and Associates CPA’s Inc, served as the Company’s principal accountant from September 8, 2008. Their fees billed to the Company for the past two fiscal years are set forth below:

| | | | |

| | Fiscal Year ended May 31, |

| | 2009 | | 2008 |

Audit Fees | $ | 0 | $ | 0 |

| | | | |

Audit Related Fees | | 0 | | 0 |

| | | | |

Tax Fees | | 0 | | 0 |

| | | | |

All Other Fees | | 0 | | 0 |

| | | | |

Total Fees | | 0 | | 0 |

| |

• | Audit Fees. |

| -Including fees for professional services for the audit of our annual financial statements and for the reviews of the financial statements included in each of our quarterly reports on Form 10-QSB and 10-Q. |

| |

• | Audit Related Fees |

| -Consists of assurance related services by the independent auditors that are reasonably related to the performance of the audit and review of our financial statements and are not included under audit fees. |

| |

• | Tax Fees |

| - These services included assistance regarding federal, state and local tax compliance and return preparation. |

| |

• | All Other Fees |

| -Includes time and procedures related to change in independent accountants and research and assistance provided to the Company. |

During its fiscal year ended May 31, 2009, the Company did not have an Audit Committee and the Company’s sole director pre-approved all fees of the principal accountant.

23

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a) The following documents are filed as a part of this Report:

FINANCIAL STATEMENTS - beginning on page F-1 of this Report:

-

| |

Independent Auditors’ Report – Madsen and Associates CPA’s Inc. | F-1 |

Consolidated Balance Sheets at May 31, 2009 and 2008 | F-2 |

Consolidated Statements of Operations and Comprehensive Loss for the Years Ended May 31, 2009 and 2008 | F-3 |

Consolidated Statements of Changes in Stockholders’ Deficit for the Years Ended May 31, 2009 and 2008 | F-4 |

Consolidated Statements of Cash Flows for the Years Ended May 31, 2009 and 2008 | F-5 |

Notes to Consolidated Financial Statements | F-6 -17 |

(b) EXHIBITS –the following exhibits are filed as part of this report

| |

| |

Exhibit # | Description |

| |

31.1 | Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 - Chief Executive Officer, filed herewith. |

| |

31.2 | Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 - Chief Financial Officer, filed herewith. |

| |

32.1 | Certifications Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, Chief Executive Officer filed herewith. |

| |

32.1 | Certifications Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, Chief Financial Officer filed herewith. |

24

Board of Directors

Hotgate Technology, Inc. and Subsidiaries

Hong Kong

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have audited the accompanying consolidated balance sheets of Hotgate Technology, Inc. and subsidiaries (the Company) as of May 31, 2009 and 2008 and the consolidated statements of operations, stockholders’ deficit and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (“PCAOB”). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accou nting principles used, significant estimates made by management and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these consolidated financial statements referred to above present fairly, in all material aspects, the consolidated financial position of the Company as of May 31, 2009 and 2008, and the consolidated results of its operations and cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company does not have the necessary working capital to service its debt and for its planned activity, which raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are described in Note 16 to the financial statements. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Madsen & Associates CPA’s Inc.

Madsen & Associates CPA’s, Inc.

September 14, 2009

Salt Lake City, Utah

F-1

HOTGATE TECHNOLOGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

As of May 31, 2009 and 2008

| | | | | |

| | 2009 | | 2008 |

ASSETS | | | | |

CURRENT ASSETS | | | | |

Cash and cash equivalents | $ | 10,911 | $ | 276,023 |

Accounts receivable, net of allowance | | 79,370 | | 267,450 |

Inventories | | 6,048 | | 50,792 |

Deposits, prepayments and other receivables | | 7,517 | | 71,592 |

Total current assets | | 103,846 | | 665,857 |

| | | | |

PLANT & EQUIPMENT | | | | |

At cost: | | | | |

Computer hardware and software | | 27,325 | | 23,002 |

IT equipment | | 78,038 | | - |