REDTONE ASIA, INC

Unit 15A, Plaza Sanhe

No. 121 Yanping Road

JingAn District, 200042 Shanghai,

People Republic of China

(86) 6103 2230

April 24, 2014

United States Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, N.E.

Washington, D.C. 20549

F.A.O.: Mr Larry Spirgel, Assistant Director

Mr Joseph M. Kemp & Mr Dean Suehiro, Senior Staff Accountant

Ms Emily Drazan, Attorney-Advisor

Re: REDtone Asia, Inc.

Form 10-K for the Year Ended May 31, 2013

Filed September 13, 2013

Form 10-Q for the quarterly period ended November 30, 2013

Filed January 15, 2014

File No. 333-129388

Dear. Mr. Larry Spirgel:

We are writing in response to your comment letter dated February 5, 2014, regarding the above referenced filing. Our response to your comments follow each of the comments below.

Form 10-K for the Year Ended May 31, 2013

Business of the Issuer, page 5

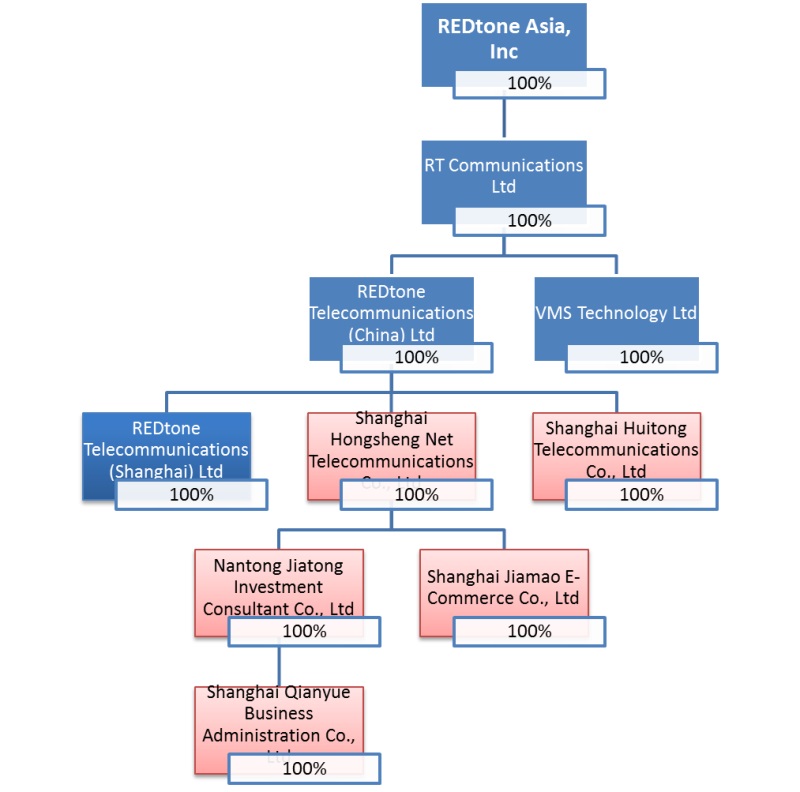

| 1. | Include an organizational chart depicting your corporate structure. Please differentiate share ownership from control due to contractual arrangements in your diagram. If any related party or affiliate owns shares in a variable interest entity, please include that person in the chart and identify the relationship with the Company. |

RESPONSE:

Thank you for your comment. This disclosure has been made in Item 1 of the filing.

Control through equity ownership

Control through equity ownership

Control through contractual binding (“VIE”)

Control through contractual binding (“VIE”)

On November 30, 2006, the Company entered into loan agreements with Huang Bin (“HB”) and Mao Hong (“MH”) for the establishment of Shanghai Hongsheng Net Telecommunications Co., Ltd (“Hongsheng”). On November 30, 2006, the Company entered into an equity pledge agreement which provides that HB and MH will pledge all their equities in Hongsheng to the Company and REDtone Telecommunications (Shanghai) Limited (“REDtone Shanghai”). The agreement also provides that control of Hongsheng by the Company shall take effect from June 1, 2007.

On April 30, 2007, the Company entered into loan agreements with Mao Junbao (“MJ”) and MH for the establishment of Shanghai Huitong Telecommunications Co., Ltd (“Huitong”). On April 30, 2007, the Company entered into an equity pledge agreement, which provides that

MJ and MH would pledge all their equities in Huitong to the Company and REDtone Shanghai.

On May 24, 2011, Hongsheng entered into a nominee agreement between Wang Jianping and Xu Lanying. The nominee agreement provided that Hongsheng would commission Wang Jianping and Xu Lanying to establish Nantong Jiatong Investment Consultant Co., Ltd (“Nantong Jiatong”). The nominee shareholders of Nantong Jiatong are Wang Jianping and Xu Lanying.

On May 24, 2011, the Company entered into a loan Agreement with Nantong Jiatong to extend a loan of RMB22,000,000 (RMB22 million) for the additional capital injection into Hongsheng for the establishment of Shanghai Qianyue Business Administration Co., Ltd (“QBA”). An equity pledge agreement entered into by and amongst the Company, Nantong Jiatong and Hongsheng, provided that Nantong Jiatong would pledge all its equities in Hongsheng to the Company.

Although the Company is not the shareholder of Hongsheng, Huitong, Nantong Jiatong and QBA, the Company has determined that it is the primary beneficiary of these four entities, as the Company has 100% voting powers and is entitled to receive all the benefits from the operations of these four entities. Hence, Hongsheng, Huitong, Nantong Jiatong and QBA are identified as VIEs and are consolidated as if wholly-owned subsidiaries of the Company.

Mr Mao Hong, the newly appointed Chief Operating Officer, is also a shareholder of Hongsheng and HuiTong.

Management’s Discussion and Analysis, page 11

| 2. | We note that you have experienced material declines in revenues on a comparative quarterly basis for the last five consecutive quarters ending November 30, 2013. We also note that you have attributed these declines to various causes such as: lower consumption from the mass market, decreased call traffic in your consumer voice business, “intense price competition in Telecommunication market” and to change of business strategy in QBA (prepaid shopping-card service). Please revise as required by Item 303(a)(3)(ii) of Regulation S-K to include a robust discussion of the known trends and uncertainties in your operating results. Where these changes are attributable to combinations of diverse factors, as they appear to be in your revenues, this discussion should include disclosure of the quantitative contribution of each underlying material factor. See Financial Reporting Codification §501.04 and §501.05. |

RESPONSE:

Thank you for your comment. This disclosure has been made in Item 7 of the filing.

Information of the Company’s segmental revenue as follows:

| | | 2013 | | | 2012 | |

| Revenue from: | | | | | | |

| Telecommunications | | $ | 6,487,707 | | | $ | 8,141,830 | �� |

| Prepaid business solutions | | | 733,133 | | | | 281,219 | |

| | | | 7,220,840 | | | | 8,423,049 | |

The Company generated revenue of $7,220,840 in the fiscal year ended May 31, 2013, representing a 14% decrease as compared with the fiscal year ended May 31, 2012. The decrease in revenues was mainly due to the decrease in call traffics in consumer voice business by $1.65 million, an intense price competition in telecommunication market.

Item 9A. Controls and Procedures

Evaluation of disclosure controls and procedures, page 15

| 3. | We note from the third paragraph of page 16 that you have not completed the review required by Section 404 of Sarbanes-Oxley of your internal control systems. Please revise to clarify that you are delinquent in complying with Item 308 of Regulation S-K. In this regard, tell us how you determined that your disclosure controls and procedures were effective in the absence of your compliance with item 308 of Regulations S-K. |

RESPONSE:

Thank you for your comment. This disclosure has been made in Item 9A of the filing as follows:

Evaluation of Disclosure Controls and Procedures

Our management team, under the supervision and with the participation of our principal executive officer and our principal financial officer, evaluated the effectiveness of the design and operation of our disclosure controls and procedures as such term is defined under Rule 13a-15(e) promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act), as of the last day of the fiscal period covered by this report, May 31, 2013. The term disclosure controls and procedures means our controls and other procedures that are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to management, including our principal executive and principal financial officer, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Based on this evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were effective as of May 31, 2013.

Change in internal controls, page 16

| 4. | Please revise to include the report of management on your internal controls over financial reporting required by item 308 of Regulation S-K |

RESPONSE:

Thank you for your comment. This disclosure has been made in Item 9A of the filing.

Management’s Annual Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and Rule 15d-15(f) under the Exchange Act as a process designed by, or under the supervision of, the issuer’s principal executive and principal financial officers, or persons performing similar functions, and effected by the issuer’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP and includes those policies and procedures that:

| • | pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the issuer; |

| • | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that receipts and expenditures of the issuer are being made only in accordance with authorizations of management and directors of the issuer; and |

| • | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the issuer’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. In accordance with the internal control reporting requirement of the SEC, management completed an assessment of the adequacy of our internal control over financial reporting as of May 31, 2013. In making this assessment, management used the criteria set forth by our Internal Control team.

Based on this assessment and the criteria in our internal control framework, management has concluded that, as of May 31, 2013, our internal control over financial reporting was adequately controlled.

Changes in Internal Control Over Financial Reporting

During the fourth quarter of Fiscal 2013, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Item 13. Certain Relationships and Related Transactions, and Director Independence, Page 19

| 5. | We note your disclosure that “[d] during the fiscal year ended May 31, 2013 and 2012, there were not related transactions between the Company and directors.” Please clarify your disclosure to address transactions with any related parties in addition to the Company’s directors, such as the 2012 $2.1 million payment to a related company disclosed in this Statements of Cash Flow on page F-5. Please review Regulation –K Item 404(d) to ensure appropriate disclosure. |

RESPONSE:

Thank you for your comment. This disclosure has been made in Item 13 of the filing.

During the fiscal year ended May 31, 2013 and 2012, there were no related transactions between the Company and the directors except the followings:

| | | 2013 | | | 2012 | |

| Fellow subsidiary: | | | | | | |

| REDtone Technology Sdn. Bhd. | | | 41,146 | | | | 2,078,955 | |

Financial Statements

Reports of Independent Registered Public Accountants, page F-1

| 6. | Please include reports of independent registered public accountants that clearly identify the financial statements in this Form 10-K upon which the auditors are opining. |

RESPONSE:

Thank you for your comment. This disclosure has already been made in F-1 of the filing.

Note 1 – Organization and Principal Activities, page F-6

| 7. | Please expand the disclosure of your VIEs to provide the information required by SC 810-50-2AA and ASC 810-5-3. |

RESPONSE:

Thanks you for your comment. This disclosure has been made in Note 14 to the financial statements of the filing.

On November 30, 2006, the Company entered into loan agreements with Huang Bin (“HB”) and Mao Hong (“MH”) for the establishment of Hongsheng. On November 30, 2006, the Company entered into an equity pledge agreement, which provides that HB and MH will pledge all their equities in Hongsheng to the Company and REDtone Shanghai. The agreement also provides that the Company’s control of Hongsheng shall take effect from June 1, 2007.

On April 30, 2007, the Company entered into loan agreements with Mao Junbao (“MJ”) and MH for the establishment of Huitong. On April 30, 2007, the Company entered into an equity pledge agreement, which provides that MJ and MH would pledge all their equities in Huitong to the Company and REDtone Shanghai.

On May 24, 2011, Hongsheng entered into a nominee agreement between Wang Jianping and Xu Lanying. The nominee agreement provided that Hongsheng would commission Wang Jianping and Xu Lanying to establish Nantong Jiatong. The nominee shareholders of Nantong Jiatong are Wang Jianping and Xu Lanying.

On May 24, 2011, the Company entered into loan Agreement with Nantong Jiatong to extend a loan of RMB22,000,000 (RMB22 million) for the additional capital injection into Hongsheng for establishment of QBA. An equity pledge agreement entered into by and amongst the Company, Nantong Jiatong and Hongsheng, provided that Nantong Jiatong would pledge all its equities in Hongsheng to the Company

Although the Company is not the shareholder of Hongsheng, Huitong, Nantong Jiatong and QBA, the Company has determined that it is the primary beneficiary of these four entities, as the Company has 100% voting powers and is entitled to receive all the benefits from the operations of these four entities. Hence, Hongsheng, Huitong, Nantong Jiatong and QBA are identified as VIEs and are consolidated as if wholly-owned subsidiaries of the Company.

The status of Hongsheng, Huitong, Nantong Jiatong and QBA as VIEs has not changed since the date of the combination. In addition, the Company did not identify any additional VIEs in which we hold a significant interest

(c) Accounts receivable, page F-7

| 8. | It appears from your financial statements for the year ended May 31, 2013 and for the quarter ended August 31, 2013 that you have made no provision for estimated uncollectible trade receivables in light of the substantial slowdown in the collection of your accounts receivable since May 31, 2012. Please explain. Please also revise your financial statement disclosure to disclose the amounts of your allowance for doubtful accounts at each balance sheet date. Disclose your methodologies for estimating your allowance for doubtful accounts. |

RESPONSE:

Thank you for your comment.

Our trade receivables as of May 31, 2013 are aged less 3 months, which is acceptable in our telecommunication industry. We review the collectability of our receivables on a regular basis. A general provision will usually be provided if the ageing is more than a year whereas specific provision will be provided when the collectability of a specific receivable is too remote. Given the conditions and our policies, we therefore of the view that no allowance for doubtful debts is required as of May 31, 2013, and in fact the balance as of May 31, 2013 was settled during the six months ended November 30, 2013.

Note 16 – Segment Analysis, page F-16

| 9. | We note from the tabular segment disclosure on page F-16 of this Form 10-K and page 14 of your August 31, 2013 Form 10-Q that your prepaid business solutions segment has reported operating losses for the last two years ended May 31, 2013 and 2012 and for the three months ended August 31, 2013. Describe for us the assets included in this segment and describe for us your consideration as to whether or not those assets were impaired. |

RESPONSE:

Thank you for your comment.

Information of the Company’s segmental assets as of May 31, 2013 are as follows:

| | | FY 2013. US$' 000 | |

| Property, plant and equipment | | $ | 191 | |

| Inventory and other receivables | | $ | 13 | |

| Amount due from other segment companies | | $ | 1,329 | |

| Cash & Cash equivalents | | $ | 1,797 | |

| | | $ | 3,330 | |

The assets included in the prepaid business solution were mainly derived from Cash and Cash equivalents and amount due from other segment companies. Therefore, no impairment was required.

| 10. | In this regard please expand Management’s Discussion and Analysis to discuss the impact your operating segments had on your business as a whole. For example: the second paragraph of page 17 attributes an approximate $0.6 million decline in your revenue to lower mass market consumption, a decline that appears to approximate the revenue decline in your prepaid business solutions operating segment. Please also address any material seasonality in your business in accordance with Item 303(a) of Regulation S-K. |

RESPONSE:

Thank you for your comment.

Decline in revenue from prepaid business solution appears immaterial to the Company. A segment revenue analysis is now included in Item 7.

There are no any seasonal aspects to our revenue in prepaid business solutions.

Form 10-Q for the Fiscal Quarter Ended November 30, 2013

Financial Statements

Note 8 – Amount Due From/ (To) related Companies, page 11

| 11. | In your letter to the Staff dated August 19, 2011 and the related amended February 28, 2011 Form 10-Q, filed on August 19, 2011, you represented to us that the approximate $1.2 million then due to you as of May 31, 2010 and August 31, 2011 from Redtone Technologies Sdn Bhd (your former parent and current related company under common control) was “expected to be repaid within three to five years””=. It appears from Note 8 on page 11 of your November 30, 2013 Form 10-Q that your expectations for repayment have receded as much as three and a half years as you now “expected to be repaid within three to five years” from November 30, 2013. Please clarify and tell us your consideration of whether or not such amounts remitted to an affiliate under the common control of your parent company represent a reduction of your equity capital. Tell us also of your consideration of the guidance of Staff Accounting Bulletin Topic 4G given the lack of definitive repayment terms for these receivables and the control inherent in that relationship between the parties and their common parent. We note that the amounts due approximated $3.3 million at November 30, 2013 and May 31, 2013. |

RESPONSE:

Thank you for your comment. This disclosure has been made in Note 8 to the financial statements of the filing.

The amount represents advances to the related company. As of the balance sheet dates, the amount is unsecured, non-interest bearing and is expected to be repaid within Year 2015.

Management’s Discussion and Analysis, page 15

| 12. | We note from the segment disclosure on page 14 of your November 30, 2013 From 10-Q that your prepaid business solutions segment’s interim revenues for the six months ended August 31, 2013 and 2012 were both less than 4% of your total reported revenue for this segment for the year ended May 31, 2013. Tell us and discuss in Management’s Discussion and Analysis any seasonal aspects to your business as required by Instruction 5 to Item 303(b) of Regulation S-K. |

RESPONSE:

Thanks you for your comment. This disclosure has been made in Item 2 of the filing.

Information of the Company’s segmental revenue as follows:

| | | Six Months Ended November 30, 2013 | | | Six Months Ended November 30, 2012 | |

| Revenue from: | | | | | | |

| Telecommunications | | $ | 2,905,070 | | | $ | 3,588,362 | |

| Prepaid business solutions | | | 409 | | | | 24,498 | |

| | | | 2,905,479 | | | | 3,612,860 | |

The Company generated revenue of $2,905,479 in the first 6 months of the fiscal year ending May 31, 2014, representing a 19% decrease as compared with the preceding year’s corresponding quarters. The decrease in revenues was mainly due to the decrease in revenue from telecommunication segment by $0.68 million and the decrease in revenue from prepaid business solution segment by $0.02 million.

The decrease in revenue from telecommunication segment by $0.68 million was mainly due to lower consumption from the competitive market.

There are no any seasonal aspects to our revenue in prepaid business solutions.

Information of the Company’s segmental revenue as follows:

| | | Three Months Ended November 30, 2013 | | | Three Months Ended November 30, 2012 | |

| Revenue from: | | | | | | |

| Telecommunications | | $ | 1,410,803 | | | $ | 1,493,240 | |

| Prepaid business solutions | | | (203 | ) | | | 18,225 | |

| | | | 1,410,600 | | | | 1,511,465 | |

The Company generated revenue of $1,410,600 in the second quarter of the fiscal year ending May 31, 2014, representing a 6.7% marginal decrease as compared with the preceding year’s corresponding quarters. The decrease in revenues was due to the decrease in revenue from telecommunication segment by $0.08 million.

In responding to your comments, the Company hereby acknowledging that:

| · | the Company is responsible for the adequacy and accuracy of the disclosure in the filing: |

| · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking action with respect to the filing; and |

| · | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We trust that the above analysis is satisfactory to you. Please feel free to contact our legal counsel, Brunson Chandler & Jones, PLLC. at (801)303-5721 with any questions or concerns. Thank you for your assistance with this registration.

Sincerely,

_________________

/s/ Chuan Beng Wei

Chuan Beng Wei, CEO

Control through equity ownership

Control through equity ownership Control through contractual binding (“VIE”)

Control through contractual binding (“VIE”)