UNITED STATES SECURITIES AND EXCHANGE COMMISSION

| (MARK ONE) |

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended May 31, 2015 |

| |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from ______ to______ |

| |

| Commission file number 333-129388 |

| |

| REDTONE ASIA, INC |

| (Exact Name of registrant as specified in its charter) |

| | | |

| Nevada | | 71-098116 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| | | |

| Unit 15A, Plaza Sanhe, No. 121,Yanping Road, JingAn District, 200042 Shanghai, PRC | | |

| (Address of principal executive offices) | | (Zip Code) |

| | | |

Registrant’s telephone number, including area code (86) 6103 2230

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act. Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (of for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of voting and non-voting stock held by non-affiliates of the registrant as of May 31, 2015 was $16,938,921. Although listed on the OTCBB under the symbol RTAS, there is currently no active trading for the registrant’s common stock. Therefore, the aggregate market value of the stock is deemed to be $16,938,921.

At the date of this report, there were 282,315,356 outstanding shares of REDtone Asia, Inc. Common Stock, $0.0001 par value.

Documents Incorporated by Reference: None

Note About Forward-Looking Statements

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe”, “project”, “expect”, “anticipate”, “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” “possible,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” (refer to Part I, Item 1A). We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

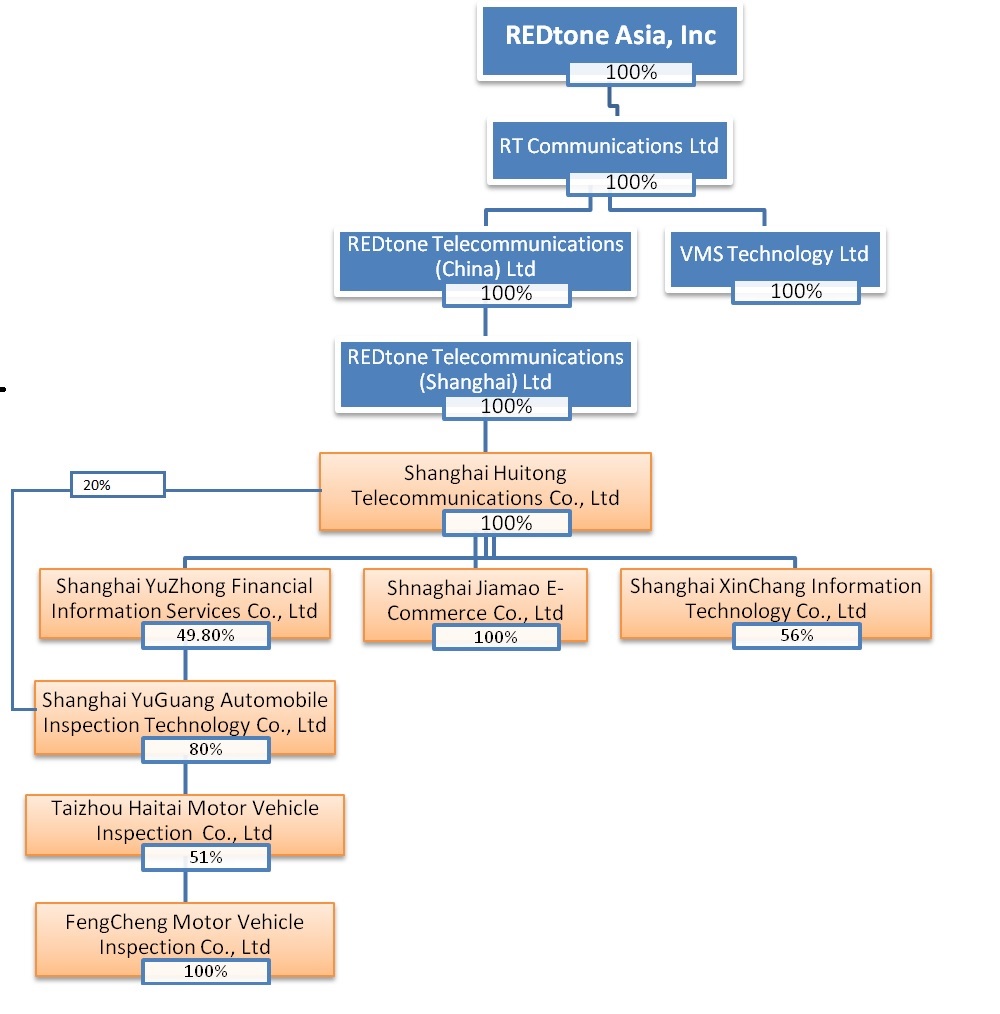

The Company’s major subsidiaries during the years are illustrated as follows:

| Name | | Domicile and date of incorporation | | Effective ownership | | Principal activities |

| Redtone Telecommunication (China) Limited (“Redtone China”) | | Hong Kong May 26, 2005 | | 100% | | Investment holding |

| | | | | | | |

| Redtone Telecommunications (Shanghai) Limited (“Redtone Shanghai”) | | The PRC July, 26, 2005 | | 100% | | Provides technical support services to group companies |

| | | | | | | |

Shanghai Hongsheng Net Telecommunication Company Limited (“Hongsheng”) 1, 2 | | The PRC November 29, 2006 | | 100% | | Marketing and distribution of discounted call services to PRC consumer market |

| | | | | | | |

Shanghai Huitong Telecommunication Company Limited (“Huitong”) 2 | | The PRC March, 26, 2007 | | 100% | | Marketing and distribution of IP call and discounted call services in the PRC |

| | | | | | | |

Shanghai Jiamao E-Commerce Company Limited (“Jiamao”) 2 | | The PRC March 21, 2008 | | 100% | | Marketing and distribution of products on the internet |

| | | | | | | |

Nantong Jiatong Investment Consultant Co., Ltd (“Nantong Jiatong”) 2, 3 | | The PRC May 17, 2011 | | 100% | | Investment holding |

| | | | | | | |

Shanghai QianYue Business Administration Co., Ltd. ("QBA") 1, 2 | | The PRC December 12, 2008 | | 100% | | Provision of prepaid shopping-card services in the PRC |

| | | | | | | |

Shanghai Xin Chang Information Technology Company Limited (“Xin Chang”) 2 | | The PRC January 13, 2006 | | 56% | | Marketing and distribution of IP call and discounted call services in the PRC |

| | | | | | | |

| VMS Technology Limited | | Hong Kong September 14, 1998 | | 100% | | Trading of discounted call related equipment and provision of related services |

| | | | | | | |

| RT Communications Ltd | | BVI February 24, 2010 | | 100% | | Investment holding |

| | | | | | | |

Shanghai YuZhong Financial Information Service Co., Ltd (“YuZhong”) 2, 4 | | The PRC July 16, 2014 | | 49.8% | | Investment holding |

| | | | | | | |

| | | | | | | |

Shanghai YuGuang Automobile Inspection Technology Co., Ltd (“YuGuang”) 2, 4 | | The PRC July 17, 2014 | | 59.8% | | Investment holding |

| | | | | | | |

Taizhou Haitai Motor Vehicle Inspection Co, Ltd. (“Haitai”) 2, 4 | | The PRC October 31, 2013 | | 30.5% | | Investment holding |

| | | | | | | |

Feng Cheng Motor Vehicle Inspection Co., Ltd. (“FengCheng”) 2, 4 | | The PRC November 30, 2012 | | 30.5% | | Provision of services for motor vehicle technical and emission inspection |

| | | | | | | |

1 - Disposed of during the year

2 - Variable interest entities

3 - Deregistered during the year

4 - Acquired/incorporated during the year

Corporate Structure

| Control through equity ownership |

| Control through contractual binding (“VIE”) |

On November 30, 2006, the Company entered into loan agreements with Huang Bin (“HB”) and Mao Hong (“MH”) for the establishment of Shanghai Hongsheng Net Telecommunications Co., Ltd (“Hongsheng”). On November 30, 2006, the Company entered into an equity pledge agreement which provides that HB and MH will pledge all their equities in Hongsheng to the Company and REDtone Telecommunications (Shanghai) Limited (“REDtone Shanghai”). The agreement also provides that control of Hongsheng by the Company shall take effect from June 1, 2007.

On April 30, 2007, the Company entered into loan agreements with Mao Junbao (“MJ”) and MH for the establishment of Shanghai Huitong Telecommunications Co., Ltd (“Huitong”). On April 30, 2007, the Company entered into an equity pledge agreement, which provides that MJ and MH would pledge all their equities in Huitong to the Company and REDtone Shanghai.

On May 24, 2011, Hongsheng entered into a nominee agreement between Wang Jianping and Xu Lanying. The nominee agreement provided that Hongsheng would commission Wang Jianping and Xu Lanying to establish Nantong Jiatong

Investment Consultant Co., Ltd (“Nantong Jiatong”). The nominee shareholders of Nantong Jiatong are Wang Jianping and Xu Lanying.

On May 24, 2011, the Company entered into a loan Agreement with Nantong Jiatong to extend a loan of RMB22,000,000 (RMB22 million) for the additional capital injection into Hongsheng for the establishment of Shanghai Qianyue Business Administration Co., Ltd (“QBA”). An equity pledge agreement entered into by and amongst the Company, Nantong Jiatong and Hongsheng, provided that Nantong Jiatong would pledge all its equities in Hongsheng to the Company

On January 22, 2014, Hongsheng completed the acquisition of a 56% equity interest in Xin Chang from Diao Xi Rui (“DXR”), a non-affiliated person. The consideration of $245,655 was paid upon signing of the Acquisition Agreement; while another $489,900 to be paid to Xin Chang as an operating fund in batches based on Xin Chang’s financial needs as determined by the Company. Pursuant to the agreement, the assets and liabilities of Xin Chang immediate before the acquisition was transferred to DXR. Therefore, the acquisition is in fact the purchase of operating concession.

On July 25, 2014, the Company entered into an agreement to dispose of its entire equity interest in Hongsheng, a VIE subsidiary, to Guotai Investment Holdings Limited at a total cash consideration of approximately $4.54 million.

Pursuant to the agreement, Hongsheng is transferred all its operations, assets and liabilities other than investment in QBA prior to the completion of the above transaction. Therefore, the entire arrangement is to dispose of the shell of Hongsheng together with the entire interest in QBA.

The disposal and transfer of the aforementioned operations, assets and liabilities, and also statutory approval by PRC local government is completed in September 2014.

Prior to disposal of Hongsheng, the Company transferred its equity interest in Jiamao and Xin Chang to Huitong.

On July 16, 2014, Huitong, Mao Hong, a director and nominee shareholder of certain VIEs, and Wei Gang, an independent third party jointly incorporated Shanghai YuZhong Financial Information Service Co., Ltd (“YuZhong”) and the founders owned 49.8%, 25.1% and 25.1% of equity interests in YuZhong, respectively.

On July 17, 2014, Huitong and YuZhong jointly incorporated Shanghai YuGuang Automobile Inspection Technology Co., Ltd (“YuGuang”). Huitong and YuZhong owns 20% and 80% of equity interests in YuGuang, respectively.

On September 11, 2014, YuGuang entered into an agreement with Zhou Jin Shan and Chen Xiu Lan to acquire 51% equity interest in Taizhou Haitai Motor Vehicle Inspection Co, Ltd. (“Haitai”) from Zhou Jin Shan at a consideration of RMB652,800. Haitai is principally engaged in the provision of motor vehicle inspection service in the PRC. The acquisition was completed in January 2015.

As of the date of acquisition, Haitai has 51% equity interest in Feng Cheng Motor Vehicle Inspection Co., Ltd. (“FengCheng”). FengCheng is principally engaged in the provision of services for motor vehicle technical and emission inspection. Haitai and FengCheng was collectively known as “Haitai Group”.

Although the Company is not the shareholder of Huitong, Jiamao, Xin Chang, YuZhong, YuGuang, Haitai, and FengCheng, the Company has determined that it is the primary beneficiary of these seven (7) entities, as the Company has their respective voting powers and is entitled to receive all the benefits from the operations of these seven (7) entities. Hence, Huitong, Jiamao, Xin Chang, YuZhong, YuGuang, Haitai, and FengCheng, are identified as VIEs and are consolidated as subsidiaries of the Company.

Mr Mao Hong, the appointed Chief Operating Officer, is also a shareholder of and Huitong and YuZhong.

Business Overview

We are principally involved in the business of offering discounted call services for end users and corporate segment and paperless reload services for prepaid mobile air-time reload for end users in Shanghai covering all three major telecommunication operators namely China Mobile, China Unicom and China Telecom.

On July 25, 2015, REDtone China entered into a Share Sale Agreement (“SSA”) with Guotai Investment Holdings Limited (“Guotai”) for the divestment of Hongsheng for a total cash consideration of RMB28,000,000 for the purpose of Guotai acquiring the third party payment license, held by its wholly owned subsidiary, QBA.

Hongsheng is conducting telco related services in Shanghai. These telco related businesses is transferred to Huitong, a subsidiary of REDtone China from the Completion date. Therefore, all existing telco businesses of Hongsheng is still remain within the REDtone Group.

Products and Services

During the year ended May 31, 2015, REDtone China offers the following services to customers:

1. Discounted call services for consumers (“EMS”)

2. Discounted call services for corporate customers

3. Reload services for prepaid mobile

4. Discontinued prepaid shopping-card services – revenue recognized is the commission earned.

We plan to venture into the car inspection business with a “One-Stop Center” located in Taizhou City of the PRC.

We have yet to commence operations and the One-Stop Center is currently under construction. The One-Stop Center has a gross area of 26,015sqm and comprises of:

(1) 2 buildings for safety inspection &emissions check;

(2) parking area for vehicles to be inspected; and

(3) a building for repair & other related services.

We estimate the total investment costs of the One-Stop Center will be approximately $5.3 million. As of May 31, 2015, the total capital commitment related to the One-Stop Center is approximately $2.8 million.

With the modern and efficient car inspection facilities and equipment, we expect the One-Stop Center would reduce the existing waiting time of the car owners significantly. We anticipate construction will be completed and operations will commence in calendar year 2016.

The telecommunications industry in China is dominated by three state-run corporations: China Telecom Corporation Limited, China Mobile Communications Corporation and China United Network Communications Group Co., Ltd, all of whom have 3G licenses and engaged fixed-line and mobile business in China.

(i) Direct Telecommunication Operators namely China Telecom Corporation Limited, China Mobile Communications Corporation and China United Network Communications Group Co., Ltd. These companies may adopt a more aggressive pricing on their local and international calls and have direct impact on our discounted call services for corporate segment. Likewise, if these operators offer very competitive rates for domestic, long distance and international calls, it could pose a substitution threat to our EMS services.

(ii) Other Discounted Service Providers

The discounted service providers such as Super E-Secretary operate domestic calls and the tool to compete is to provide discount on long distance calls. This company, despite being a small player (less than 15% market share) in the Shanghai discounted consumer call market, may cause the price disruption when they compete on price aggressively.

(iii) Other Mobile air-time reload service providers

Other competitors like Smartpay, Defeng and YiQiao offers similar mobile air-time reload services in Shanghai. They entered into this reload services earlier than us but we command slightly better price advantage and better system support for paperless mobile reload in comparison with conventional paper-based reload model.

We believe our competitive advantage is derived from the following strengths:

We, being one of the leading alternative voice service providers in Shanghai in terms of market share, could command the economies of scale to achieve lower minutes cost and lower operating cost per minute. Additional cost advantage is the low capital investment with self-developed technology.

By having advantage of longer market presence, credibility and dominant market share, we can afford to price its products and services competitively while maintaining healthy gross margins.

Innovation embodied in all the products and services is the key to the competitive advantage of our operations. In addition, innovation also helps us to truly serve the needs of the customers and to provide value-added services and products to the customers.

Close communication with our front line resellers will enable us to gather market intelligence and assist us in strategy formulation that is relevant to market needs.

For the telecommunications services we provide, customers would also benefit from value added services in our convenient reload, customer care services and support, and e-billings.

REDtone China does not provide direct telecommunication services in PRC. REDtone China acts as a distributor for CTT. REDtone China has a business licence issued by PRC’s State Administration for Industry and Commerce to carry out the distribution services. REDtone China does not require a telecommunication licence to carry out its distribution activities.

We do not anticipate having to expend significant resources to comply with any governmental regulations applicable to our operations. We are subject to the laws and regulations which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes.

However, the telecommunications industry is highly regulated in China. PRC laws and regulations will be modified and updated from time to time by the China government. In addition, many PRC laws and regulations are subject to extensive interpretive power of governmental agencies and commissions, and there is substantial uncertainty regarding the future interpretation and application of these laws or regulations.

Costs of Compliance with Environmental Laws

We are not presently affected by and do not have any costs associated with compliance with environmental laws.

Customers and Suppliers

Our major customers are end users and corporate clients in Shanghai. Our suppliers are mainly termination partners and telecommunication players such as China TieTong Telecommunications (“CTT”), China Mobile and China Unicom and China Telecom.

Intellectual Property and Research and Development

The Company has no registered patents, trademarks or copyrights and no applications for patents, trademarks or copyrights are pending.

The Company utilized intellectual property pursuant to an agreement signed between REDtone Technology Sdn. Bhd, and REDtone Telecommunications (China) Ltd on 11 August 2005 in respect of the acquisition of the software with regards to the Customer billing, commission management, top-up management, traffic management, cardless system and gateway interface system suite.

The “REDtone” logo in Chinese is registered trademarks in China valid until October 13, 2020.

The Company did not incur any research and development expenses in the fiscal year ended May 31, 2015.

Number of Employees

Currently, our Chief Executive Officer manages the Company. We had fifty two (52) employees including fourteen (14) in the Management team, twenty two (22) in Research & Development, Customer Care, Sales and Marketing as well as Finance and Administrative, and balance of sixteen (16) in Technical supports. None of our employees are represented by labor unions or subject to collective bargaining agreements. We believe our employee relations are good and have no employee related dispute recorded over the years.

As a smaller reporting company, the Company is not required to provide the information required by this item.

The Company’s principal executive offices are located at Suites 15A, E,F, Plaza Sanhe, No. 121 Yanping Road, Jing An District, Shanghai, PRC. The Company’s management believes that all facilities occupied by the Company are adequate for present requirements, and that the Company’s current equipment is in good condition and is suitable for the operations involved.

The car inspection center is located at Haining Industrial Park, Taizhou City

We are not a party to and none of our property is subject to any material pending or threatened legal, governmental, administrative or judicial proceedings.

The Company’s Articles of Incorporation provide that the Company has the authority to issue 300,000,000 shares of common stock at par value of $0.0001 per share. As of May 31, 2015, we had 282,315,356outstanding shares of Common Stock.

On March 25, 2011, our common stock began being quoted on the OTCBB under the symbol “RTAS”. We have not had any active trading in our stock as of the date of this report.

The Company has never paid any cash dividends on its stock and does not plan to pay any cash dividends in the foreseeable future.

As of May 31, 2015, we had approximately 49 shareholders of record.

Equity Compensation Plans

The Company does not have any equity compensation plans in place as of the date of this report, and had no options, warrants or other convertible securities outstanding as of that date.

Sales of Unregistered Securities

For the period from June 1, 2014 to the date of this report, there is no sale of unregistered securities.

As a smaller reporting company, the Company is not required to provide the information required by this item.

Overview

We are principally involved in the business of offering discounted call services for end users and corporate segment and paperless reload services for prepaid mobile air-time reload for end user in Shanghai covering all three major telecommunication operators namely China Mobile, China Unicom and China Telecom.

We are also venturing into car inspection business in PRC since January 2015 but the said business yet to commence as of the date of this report.

Results of Operations

Financial Presentation

The following sets forth a discussion and analysis of the Company’s financial condition and results of operations for the two years ended May 31, 2015 and 2014. This discussion and analysis should be read in conjunction with our consolidated financial statements appearing elsewhere in this Annual Report on Form 10-K. The following discussion contains forward-looking statements. Our actual results may differ significantly from the results discussed in such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in “Item 1A — Risk Factors” of this Annual Report on Form 10-K.

Continuing operations

Results of continuing operations for year ended May 31, 2015 compared to year ended May 31, 2014

| | | Year ended | | | | |

| | | May 31, 2015 | | | May 31, 2014 | | | Increase/(Decrease) from previous year | |

| Revenue | | | 8,423,788 | | | | 6,176,820 | | | | 2,246,968 | | | | 36 | % |

| Other income and gains | | | 117,179 | | | | 149,588 | | | | (32,409 | ) | | | -22 | % |

| Service costs | | | (6,908,020 | ) | | | (2,955,367 | ) | | | 3,952,653 | | | | 134 | % |

| Personnel cost | | | (827,606 | ) | | | (752,868 | ) | | | 74,738 | | | | 10 | % |

| Depreciation expense | | | (541,142 | ) | | | (484,432 | ) | | | 56,710 | | | | 12 | % |

| Amortization expense | | | (321,033 | ) | | | (137,452 | ) | | | 183,581 | | | | 134 | % |

| Administrative and other expenses | | | (1,165,708 | ) | | | (806,221 | ) | | | 359,487 | | | | 45 | % |

| | | | | | | | | | | | | | | | | |

| (Loss)/Income before provision for income taxes | | | (1,222,542 | ) | | | 1,190,068 | | | | (2,412,610 | ) | | | N/A | |

| Provision for income taxes | | | (68,002 | ) | | | 104,362 | | | | (172,364 | ) | | | N/A | |

| | | | | | | | | | | | | | | | | |

| Net (loss)/income before non-controlling interest | | | (1,290,544 | ) | | | 1,294,430 | | | | (2,584,974 | ) | | | N/A | |

| | | | | | | | | | | | | | | | | |

Revenues. The Company generated revenue of $8,423,788 in the fiscal year ended May 31, 2015, representing a 36% increase as compared with the fiscal year ended May 31, 2014. The increase was mainly due to a full year’s operation of Xin Chang in fiscal year 2015 as compared to a 5 months post acquisition results in fiscal year 2014 that contributed an increase revenue from by $1.26 million in current year.

Other income and gains. During the fiscal year ended May 31, 2015, the Company recorded other income and gains of $117,179, a decrease of $32,409 or 22% compared with last year. The decrease was due to decrease in interest income from time deposits.

Service cost. Service costs from operations for the year ended May 31, 2015 of $6,908,020 reflected an increase of $3,952,653 over the fiscal year ended May 31, 2014. The increase was mainly due to increase in traffic costs charged by the main operators of approximately $2.8 million and an increase in Xin Chang’s service cost by $1,063,828 due to a full year’s inclusion of operations in fiscal year 2015.

Personnel expenses. The personnel expenses have increased 10% or $74,738 to $827,606 for the year ended May 31, 2015. This is mainly due to a full year’s operation of Xin Chang in fiscal year 2015 as compared to a 5 months post acquisition results in fiscal year 2014. Xin Chang’s payroll was increased by $108,554 as compared to last year.

Depreciation and amortization expenses. The depreciation is increased by 12% or $56,710 compared to last year. The increase is mainly contributed by the increase in Xin Chang’s depreciation expenses of $43,128 as compared to last year.

Amortization expense has increased by $183,581 or 134% compared to last year. The increase in amortization expense was mainly attributable to the amortization of a newly acquired customer base of $161,400 during the year.

Administrative and other operating expenses. The general and administrative expenses have increased $359,487 or 45% to $1,165,708. This is mainly due to the inclusion of the full year’s Xin Chang operation in fiscal year 2015 and contributed an increase of $127,468 during the year and also the professional expenses incurred during the year in related to the disposal of QBA of $90,388.

(Loss)/Income before provision for income taxes. For the financial year under review, the dramatically increased in service costs has caused the loss before provision for income taxes stood at $1,222,542 as compared to an income before provision for income taxes of $1,190,068 over fiscal year 2014.

Provision for income taxes. For the financial year under review, there is an income tax provision of $68,002 compared to income tax income of $104,362 over the financial year 2014.

Net (loss)/income before non-controlling interest. For the fiscal year under review, the increased in service costs has caused the net loss before non-controlling interest stood at $1,290,544 as compared to a net income of $1,294,430 over fiscal year 2014.

Discontinued Operations

Results of discontinued operations for year ended May 31, 2015 compared to year ended May 31, 2014

| | | Year ended | | | | |

| | | May 31, 2015 | | | May 31, 2014 | | | Increase/(Decrease) from previous year | |

| Revenue | | | 3 | | | | 63,849 | | | | (63,846 | ) | | | -100 | % |

| Other income and gains | | | 164 | | | | 97,390 | | | | (97,226 | ) | | | -100 | % |

| Service costs | | | - | | | | (14,354 | ) | | | (14,354 | ) | | | -100 | % |

| Personnel cost | | | (93,580 | ) | | | (157,777 | ) | | | (64,197 | ) | | | -41 | % |

| Depreciation expense | | | (3,689 | ) | | | (182,797 | ) | | | (179,108 | ) | | | -98 | % |

| Administrative and other expenses | | | (6,916 | ) | | | (50,548 | ) | | | (43,632 | ) | | | -86 | % |

| | | | | | | | | | | | | | | | | |

| Loss before provision for income taxes | | | (104,018 | ) | | | (244,237 | ) | | | (140,219 | ) | | | -57 | % |

| Provision for income taxes | | | - | | | | - | | | | - | | | | N/A | |

| | | | | | | | | | | | | | | | | |

| Net loss before non-controlling interest | | | (104,018 | ) | | | (244,237 | ) | | | (140,219 | ) | | | -57 | % |

| | | | | | | | | | | | | | | | | |

Revenues. The Company generated revenue of $3 in the fiscal year ended May 31, 2015, representing a 100% decrease as compared with the fiscal year ended May 31, 2014. The decrease was mainly due to the Company was ceased operation in July 2014.

Other income and gains. During the fiscal year ended May 31, 2015, the Company recorded other income and gains of $164, a decrease of $97,226 or 100% compared with last year. The decrease was due to the Company was ceased operation in July 2014.

Service cost. Service costs from operations for the year ended May 31, 2015 was nil due to creased operation during the year under review.

Personnel expenses. The personnel expenses have decreased by 41% or $64,197 to $93,580 for the year ended May 31, 2015. This is mainly due to the Company was ceased operation in July 2014.

Loss before provision for income taxes. The net loss before provision for income taxes stood at $104,018 as compared to $244,237 over fiscal year 2014 mainly due to the Company was ceased operation in July 2014.

Liquidity and Capital Resources.

Cash

Our cash balance at May 31, 2015, was $5,062,576, representing anincrease of $2,071,300, from previous cash balance of $2,991,276 as of May 31, 2014.

Cash Flow from Continuing Operations (before effect of exchange rate changes).

| | | May 31,2015 | | | May 31, 2014 | | | | +/- | |

| Net cash provided by/ (used in) operating activities | | $ | 704,909 | | | $ | (196,758 | ) | | | 901,667 | |

| Net cash provided by/(used in) investing activities | | $ | 2,591,274 | | | $ | (518,807 | ) | | | 3,110,081 | |

| Net cash provided by/ (used in) financing activities | | $ | (1,161,676 | ) | | $ | 32,473 | | | | (1,194,149 | ) |

| Net (decrease)/increase in cash and cash equivalents | | | 2,134,507 | | | | (683,092 | ) | | | 2,817,599 | |

Net cash provided by operations during the fiscal year ended May 31, 2015 amounted to $704,909 as compared to net cash used in operations of $196,758 in the same period of FY2014, the change was mainly due to higher revenue generated during the year.

Net cash flow provided by investing activities for the fiscal year ended May 31, 2015 amounted to $2,591,274 mainly represents consideration received for the disposal of QBA during the year of approximately $4.6 million, net off with cash paid in purchase of property, plant and equipment of approximately $1.7 million.

There was net cash used in financing activities for the year ended May 31, 2015 total $1,161,676 mainly represents settlement of amount due to discontinued activities.

Our working capital was a positive of $1,104,747 at May 31, 2015, a decrease of 70% year on year. The decreased in working capital is mainly due to the disposal of asset less liabilities held for sale (i.e. QBA) of approximately $1.7 million during the year.

At May 31, 2015, we had stockholders’ equity of $7,443,389; total assets of $12,211,843 and total current liabilities of $5,149,350.

We currently anticipate capital expenditures amounted $2,785,647 for our existing operations the next twelve (12) months.

We do not believe that inflation has had a material effect on our results of operations. However, there can be no assurances that our business will not be affected by inflation in the future.

We have no off balance sheet arrangements.

Critical Accounting Policies and Estimates

The Company assesses appropriate revenue recognition policy for each type of operation according to ASC 605-45

Revenue represents the invoiced value of services rendered and receivable during the year. Revenue is recognized when all of the following criteria are met:

| | ● | Persuasive evidence of an arrangement exists, |

| | ● | Delivery has occurred or services have been rendered, |

| | ● | The seller’s price to the buyer is fixed or determinable, and |

| | ● | Collectability is reasonably assured |

Revenue Recognition policy for each of the major products and services:

| 1. | Discounted call services for consumer (EMS) as follow: ● Collaboration with CTT – REDtone China is appointed as the sole distributor for EMS and we will recognize the revenue when airtime is utilize by the consumer and it is on net basis which is computed based on a fixed sharing ratio of the total airtime utilize by consumers after netting of direct traffic termination cost and incidental expenses as per the collaboration agreement with CTT. REDtone China’s role for Business Collaboration with CTT would be as “Agent” as REDtone China is the sole distributor for EMS brand owned and controlled by CTT; and ● Collaboration with other telecommunication providers – REDtone China will act as discounted consumer call Reseller whereby REDtone China will decide on service and package specification, pricing policy while China Unicom merely acts as passive termination partner for call traffic. REDtone China will pay China United Network Communications Company Ltd (“China Unicom”) solely based on call traffic termination by China Unicom at prescribed rate (defined as traffic termination cost in the book of REDtone China). In this regard, REDtone China will recognize the revenue when airtime is utilized by the consumer and the value recognize is the call charges gross value. REDtone China role for Business Collaboration with China Unicom would be as “Principal” as China Unicom is playing passive role as traffic termination partner while REDtone China is fully responsible for the entire management of discounted call services. As this is a prepaid product, there is an expiry date for the product sold. If the airtime is not utilize by the expiry date, which is currently one year from the activation date, it will be deemed expired and recognize as revenue based on the remaining gross value of the expired prepaid product |

| 2. | Discounted call services for corporate as follow: ● Collaboration with CTT – the revenue recognize is the commission earn from distributing the discounted call services to corporate customer; and ● Collaboration with other telecommunication providers –the revenue recognize is the commission earn from distributing the discounted call services to corporate customer. |

| 3. | Reload services for prepaid mobile – revenue recognize is the commission earn. |

| 4. | Discontinued prepaid shopping-card services – revenue recognized is the commission earned. |

Recent Accounting Pronouncements.

The Company does not expect the adoption of any recent accounting pronouncements which are further elaborated in Note 3 (o) of Notes to Consolidated Financial Statements will have any material impact on its financial statements.

As a smaller reporting company, the Company is not required to provide information required by this item.

The Company’s audited financial statements and the notes thereto appear in Part IV, Item 15, of this report.

(a) Evaluation of Disclosure Controls and Procedures. Under the supervision and with the participation of our management, including our chief executive officer and chief financial officer, we evaluated the effectiveness of our disclosure controls and procedures, as such term is defined under Rule 13a-15(e) promulgated under the Securities Exchange Act of 1934, as amended. Based upon that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls were effective as of the end of the period covered by this annual report.

(b) Changes in Internal Controls. There have been no changes in our internal controls over financial reporting during the fiscal year ended May 31, 2015 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

(c) Management’s Report on Internal Control over Financial Reporting. Management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Exchange Act, as amended. The Company’s internal control over financial reporting is designed to provide reasonable assurance as to the reliability of the Company’s financial reporting and the preparation of financial statements in accordance with GAAP. Our internal control over financial reporting includes those policies and procedures that:

| | · | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| | · | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and |

| | · | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the Company’s consolidated financial statements. |

Internal control over financial reporting, no matter how well designed, has inherent limitations. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, internal control over financial reporting determined to be effective can provide only reasonable assurance with respect to financial statement preparation and may not prevent or detect all misstatements. Moreover, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management has assessed the effectiveness of the Company’s internal control over financial reporting as of May 31, 2015. In making this assessment, management used the criteria established by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control — Integrated Framework (1992).

Based on the Company’s processes and assessment, as described above, management has concluded that, as of May 31, 2015, the Company’s internal control over financial reporting was effective.

This Annual Report on Form 10-K does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation requirements by the Company’s registered public accounting firm pursuant to rules of the SEC that permit the Company to provide only management’s report in this Annual Report on Form 10-K for the year ended May 31, 2015.

There were no items required to be disclosed in a report on Form 8-K during the fourth quarter of the fiscal year ended May 31, 2015 that have not been already disclosed on a Form 8-K filed with the SEC.

The following table sets forth as of the date hereof, except as otherwise noted, the names, ages and positions held with respect to each director, executive officer, and significant employee expected to make a significant contribution to the Company:

| | | | |

| Name | Age | Position | Period |

| | | | |

| Chuan Beng Wei | 50 | Director CEO | July 2008 - Present October 2010- Present |

| Lau Bik Soon | 45 | Director | October 2010-Present |

| Ng Hui Nooi | 42 | CFO | March 2012-Present |

Mr Chuan Beng Wei, age 50, is now the Chief Executive Officer of the Company. Mr Wei has been and will continue serving on the Board of Directors of the Company. He obtained his Bachelor’s Degree in Electrical Engineering from University of Technology Malaysia in 1989 and Diploma in Management (Gold Medalist Award Winner) from the Malaysian Institute of Management, Kuala Lumpur in 1995. He also completed an Entrepreneur Development Program from the renowned MIT Sloan School of Management in USA in January 2006.

He began his career with Hewlett Packard Sales Malaysia Sdn Bhd in 1989 as a Systems Engineer responsible for information technology (“IT”) technical and customer relations, and was subsequently promoted to Major Account Manager. Having gained wide exposure in IT, electronics and the telecommunications industry, he began his entrepreneur pursuit. He started REDtone Telecommunications Sdn Bhd in 1996 with two other partners. As one of the founding members of the REDtone Group, he is instrumental in shaping the Group’s business relations and policies. His main responsibilities include management of the Group’s overall business, expanding its overseas markets and financial-related matters. Mr Wei also serves as the Managing Director of the REDtone Group, which was listed in January 2004 in the ACE Market of Bursa Malaysia. In addition, in 2007, Mr Wei started REDtone China where he played a significant role in developing business strategy in China. He was the past Chairman for The Association of Computer and Multimedia Malaysia and the past Deputy Chapter Chairperson for the exclusive Young Presidents’ Organization (YPO).

Mr. Bik Soon Lau, age 45, obtained his first-class honors degree in electrical engineering from the University of Technology in Malaysia. He joined REDtone in 2008, as an executive director responsible for expanding the Group’s Malaysia business which includes data, broadband, Wifi and discounted call services. Prior to joining REDtone, he was the Country Manager for Hitachi Data Systems Malaysia from year 2005 to 2008. Under his leadership in Hitachi, he strengthened the organisation and company’s channel partner, and helped the company grow its business in Malaysia.

Mr. Lau’s 16 years of experience as Sales Director in the ICT and telecommunications industry provides expertise in corporate leadership and strategic marketing planning. In his career, he has held numerous other positions, including sales director, partner sales manager, enterprise division account manager, business development manager, systems engineer, and research and design engineer. He has held these positions with organizations such as Cisco Systems, Sun Microsystems, Compaq Computer, TQC Consultant (IT Division) Sdn Bhd, and Motorola Penang. During his tenure with these organizations, he received various Partner Management Excellence awards as well as many accolades as a high achiever in sales.

Ms. Hui Nooi Ng, age 42, a Malaysian Chartered Accountant, obtained her Professional Degree from The Association of Chartered Certified Accountants in 2004. Ms. Ng has more than eighteen years of working experience in accountancy and has held various positions from accountant to finance manager with companies in Malaysia and Vietnam. In 1999, she joined ChemQuest Sdn Bhd, as an accountant, fully responsible for the finance and accounting operations for the company. In 2010, she joined Poh Huat Furniture Ind. Vietnam Joint Stock Co, a Malaysian manufacturing company based in Vietnam as the Finance Manager. In this position, her main responsibilities included financial review and reporting, budgeting, business planning and risk management and treasury functions.

Number and Terms of Office of Directors

A Board of Directors, consisting of at least one (1) person shall be chosen annually by the Stockholders at their meeting to manage the affairs of the company. The Directors' term of office shall be one year, and Directors may be re-elected for successive annual terms. There is no family relationship between any of our executive officers and directors.

Code of Ethics

The Company has not yet adopted a Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, comprising written standards that are reasonably designed to deter wrongdoing and to promote the behavior described in Item 406 of Regulation S-K promulgated by the Securities and Exchange Commission. Due to the small size of the Company, management does not believe such a code is needed at this time.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who own more than 10% of the Company’s stock (collectively, “Reporting Persons”) to file with the SEC initial reports of ownership and changes in ownership of the Company’s Common Stock. Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file. To the Company’s knowledge, based solely on its review of the copies of such reports received or written representations from certain Reporting Persons that no other reports were required, the Company believes that during its fiscal year ended May 31, 2015, all Reporting Persons complied with all applicable filing requirements.

The following table sets forth, for the fiscal years ended May 31, 2015 and 2014, certain information regarding the compensation earned by the Company’s named executive officers. Where columns have been omitted from the Summary Compensation Table below, it is because no such compensation was paid to the named executive officer during the 2015 or 2014 fiscal years.

| SUMMARY COMPENSATION TABLE | |

| | | | | | | | | | | | | | |

| | | | Annual Compensation | | | | |

| | | | | | | | | | Other | | | All Other | |

| Name and | Year | | | | | | | | Annual | | | Compen- | |

| Principal | Ended | | Salary | | | Bonus | | | Compen- | | | Sation | |

| Position | May 31 | | ($) | | | ($) | | | sation ($) | | | ($) | |

| Chuan Beng Wei, | 2015 | | -0- | | | -0- | | | -0- | | | -0- | |

| Director, CEO | 2014 | | -0- | | | -0- | | | -0- | | | -0- | |

| | | | | | | | | | | | | | |

| Bik Soon, Lau | 2015 | | -0- | | | -0- | | | -0- | | | -0- | |

| Director | 2014 | | -0- | | | -0- | | | -0- | | | -0- | |

| | | | | | | | | | | | | | |

| Hui Nooi, Ng | 2015 | | 15,495 | | | -0- | | | -0- | | | -0- | |

| CFO | 2014 | | 15,638 | | | -0- | | | -0- | | | -0- | |

| | |

Director Compensation

Members of the Board of Directors did not receive any cash or non-cash compensation for their service as Directors during our 2015 and 2014 fiscal years.

Compensation Committee Interlocks and Insider Participation

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

Compensation Committee Report

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

The following table sets forth beneficial ownership information as of May 31, 2015: (i) each of the Company’s officers and directors, (ii) each person who is known by the Company to own beneficially more than 5% of the outstanding shares of common stock, and (iii) all of the Company’s officers and directors as a group. As of the date of this report, the Company had 282,315,356 shares of common stock outstanding.

(i) Security Ownership of directors and executive officers: None |

(ii) Security ownership of certain beneficial owners:

| | | | | | | | |

| Title of Class | Name and Address | | Amount & Nature of Beneficial Ownership | | | Percentage of Class | |

| | | | | | | | |

Common shares | REDtone International Bhd, Suites 22-28, 5th Floor, IOI Business Park, 47100 Puchong, Malaysia. | | | 260,619,365 | | | | 92.31 | % |

| | (iii) | Security ownership of officers and directors as a group: None. |

During the fiscal year ended May 31, 2015 and 2014, there were no related transactions between the Company and the directors except the followings:

Amount due from a related company

| | | 2015 | | | 2014 | |

| Fellow subsidiary: | | | | | | |

| REDtone Technology Sdn. Bhd. | | $ | 3,289,447 | | | $ | 3,272,950 | |

Amount due to related parties

| | | 2015 | | | 2014 | |

| Fellow subsidiary: | | | | | | |

| REDtone Telecommunications Sdn Bhd | | $ | 160,420 | | | $ | 148,791 | |

| Non-controlling interests | | | 1,873,432 | | | | - | |

| | | | | | | | | |

| | | | 2,033,852 | | | | 148,791 | |

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for our audit of annual financial statements and review of financial statements included in our Form 10-K or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were:

| Fiscal year ended May31, 2015 | AWC (CPA) Limited | | $ | 52,500 | |

| | | | | | |

| Fiscal year ended May31, 2014 | Albert Wong & Co | | $ | 48,000 | |

| • | Audit Fees. |

| | |

| | -Including fees for professional services for the audit of our annual financial statements and for the reviews of the financial statements included in each of our quarterly reports on Form 10-Q. |

| | |

| • | Audit Related Fees |

| | |

| | -Consists of assurance related services by the independent auditors that are reasonably related to the performance of the audit and review of our financial statements and are not included under audit fees. |

| | |

| • | Tax Fees |

| | |

| | - These services included assistance regarding federal, state and local tax compliance and return preparation. |

| | |

| • | All Other Fees |

| | |

| | -Includes time and procedures related to change in independent accountants and research and assistance provided to the Company. |

During its fiscal year ended May 31, 2015, the Company did not have an Audit Committee and the Company’s director pre-approved all fees of the principal accountant.

(a) The following documents are filed as a part of this Report:

| 1. FINANCIAL STATEMENTS - beginning on page F-1 of this Report: | |

| - Independent Auditors’ Report | F1 |

| - Consolidated Balance Sheet at May 31, 2015 and 2014 | F2 |

| - Consolidated Statements of Incomeand Comprehensive Income for the Years Ended May 31, 2015 and 2014 | F3 |

| - Consolidated Statements of Changes in Equity for the Years Ended May 31, 2015 and 2014 | F4 |

| - Consolidated Statements of Cash Flows for the Year Ended May 31, 2015 and 2014 | F5 |

| - Notes to Consolidated Financial Statements | F6 |

To the board of directors and stockholders of REDtone Asia, Inc.

Report of Independent Registered Public Accounting Firm

We have audited the accompanying consolidated balance sheets of REDtone Asia, Inc. and its subsidiaries (“the Company”) as of May 31, 2015 and 2014 and the related consolidated statements of income and comprehensive income, stockholders' equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

We were not engaged to examine management’s assertion about the effectiveness of the Company’s internal control over financial reporting as of May 31, 2015 included in the Company’s Item 9A “Controls and Procedures” in the Annual Report on Form 10-K and, accordingly, we do not express an opinion thereon.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of REDtone Asia, Inc. and its subsidiaries as of May 31, 2015 and 2014 and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ AWC (CPA) Limited

AWC (CPA) Limited

Hong Kong, China

September 11, 2015

REDTONE ASIA, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

At May 31, 2015 and 2014

| | | 2015 | | | 2014 | |

| Assets | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 5,062,576 | | | $ | 2,991,276 | |

| Inventories | | | 3,951 | | | | 3,974 | |

| Accounts receivable | | | 825,790 | | | | 2,898,976 | |

| Tax recoverable | | | - | | | | 23,372 | |

| Other receivables and deposits | | | 361,780 | | | | 1,083,269 | |

| Assets held for sale | | | - | | | | 1,713,011 | |

| Total current assets | | | 6,254,097 | | | | 8,713,878 | |

| | | | | | | | | |

| Property, plant and equipment, net | | | 3,803,404 | | | | 1,451,894 | |

| Intangible assets, net | | | 1,777,171 | | | | 1,939,613 | |

| Goodwill | | | 377,171 | | | | 610,386 | |

| | | | | | | | | |

| Total assets | | | 12,211,843 | | | | 12,715,771 | |

| | | | | | | | | |

| Liabilities and stockholders’ equity | | | | | | | | |

| Liabilities | | | | | | | | |

| Current liabilities | | | | | | | | |

| Deferred income | | | 794,435 | | | | 743,793 | |

| Accounts payable | | | 781,362 | | | | 2,798,373 | |

| Accrued expenses and other payables | | | 883,459 | | | | 582,240 | |

| Amount due to related parties | | | 2,033,852 | | | | 148,791 | |

| Taxes payable | | | 656,242 | | | | 671,125 | |

| Liabilities related to assets held for sale | | | - | | | | 56,861 | |

| Total current liabilities | | | 5,149,350 | | | | 5,001,183 | |

| | | | | | | | | |

| Deferred tax liabilities | | | - | | | | 4,780 | |

| | | | | | | | | |

| Total liabilities | | | 5,149,350 | | | | 5,005,963 | |

| | | | | | | | | |

| Equity | | | | | | | | |

| Common stock, US$0.0001 par value , 300,000,000 shares authorized; 282,315,356 shares issued and outstanding, respectively | | | 28,232 | | | | 28,232 | |

| Additional paid in capital | | | 7,726,893 | | | | 7,726,893 | |

| Less: Amount due from a related company | | | (3,289,447 | ) | | | (3,272,950 | ) |

| Retained earnings | | | 2,141,129 | | | | 2,172,842 | |

| Accumulated other comprehensive income | | | 836,582 | | | | 891,021 | |

| Total stockholders’ equity | | | 7,443,389 | | | | 7,546,038 | |

| Non-controlling interests | | | (380,896 | ) | | | 163,770 | |

| Total equity | | | 7,062,493 | | | | 7,709,808 | |

| | | | | | | | | |

| Total liabilities and stockholders’ equity | | | 12,211,843 | | | | 12,715,771 | |

| | | | | | | | | |

See accompanying notes to the consolidated financial statements.

REDTONE ASIA, INC. AND SUBSIDIARIESs

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

Years ended May 31, 2015 and 201

| | | 2015 | | | 2014 | |

| Continuing operations | | | | | | |

| Revenue | | | 8,423,788 | | | | 6,176,820 | |

| Other income and gains | | | 117,179 | | | | 149,588 | |

| Service costs | | | (6,908,020 | ) | | | (2,955,367 | ) |

| Personnel cost | | | (827,606 | ) | | | (752,868 | ) |

| Depreciation expense | | | (541,142 | ) | | | (484,432 | ) |

| Amortization expense | | | (321,033 | ) | | | (137,452 | ) |

| Administrative and other expenses | | | (1,165,708 | ) | | | (806,221 | ) |

| | | | | | | | | |

| (Loss)/income before provision for income taxes | | | (1,222,542 | ) | | | 1,190,068 | |

| (Provision for income taxes)/income tax income | | | (68,002 | ) | | | 104,362 | |

| | | | | | | | | |

| Net (loss)/income before non-controlling interest | | | (1,290,544 | ) | | | 1,294,430 | |

| Share of loss by non-controlling interest | | | 351,862 | | | | 27,435 | |

| | | | | | | | | |

| Net (loss)/income | | | (938,682 | ) | | | 1,321,865 | |

| | | | | | | | | |

| Discontinued operations | | | | | | | | |

| Net loss | | | (104,018 | ) | | | (244,237 | ) |

| Gain on disposal of discontinued operations | | | 1,010,987 | | | | - | |

| | | | | | | | | |

| Net income/(loss) for the year | | | 906,969 | | | | (244,237 | ) |

| Net (loss)/income for the year | | | | | | | | |

| Net (loss)/income before non-controlling interest | | | (383,575 | ) | | | 1,050,193 | |

| Non-controlling interest | | | 351,862 | | | | 27,435 | |

| Net (loss)/income for the year | | | (31,713 | ) | | | 1,077,628 | |

| | | | | | | | | |

| Other comprehensive (loss)/income | | | | | | | | |

| Loss on foreign currency translation of continuing operations | | | (71,601 | ) | | | (4,876 | ) |

| Share of other comprehensive income by non-controlling interest | | | 4,089 | | | | (1,810 | ) |

| Other comprehensive loss attributable to shareholders of the Company | | | (67,512 | ) | | | (6,686 | ) |

| Gain on foreign currency translation of discontinued operations | | | 17,162 | | | | 7,962 | |

| Total other comprehensive (loss)/income | | | (50,350 | ) | | | 1,276 | |

| | | | | | | | | |

| Total comprehensive (loss)/income | | | | | | | | |

| - Attributable to continuing operations | | | (1,006,194 | ) | | | 1,315,179 | |

| - Attributable to discontinued operations | | | 924,131 | | | | (236,275 | ) |

| | | | | | | | | |

| Total comprehensive (loss)/income | | | (82,063 | ) | | | 1,078,904 | |

| | | | | | | | | |

| Earnings per share, basic and diluted | | | | | | | | |

| – continuing operations | | | (0.00 | ) | | | 0.00 | |

| – discontinued operations | | | 0.00 | | | | (0.00 | ) |

| Weighted average number of shares | | | 282,315,325 | | | | 282,315,325 | |

| | | | | | | | | |

See accompanying notes to the consolidated financial statements.

REDTONE ASIA, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Years ended May 31, 2015 and 2014

| | | Issued common shares | | | Common stock | | | Additional paid in capital | | | Amount due from a related company | | | Retained earnings | | | Other comprehensive income | | | Total stock- holders’ equity | | | Non- controlling interests | | | Total equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 1, 2013 | | | 282,315,356 | | | $ | 28,232 | | | $ | 7,726,893 | | | $ | - | | | $ | 1,095,214 | | | $ | 887,935 | | | $ | 9,738,274 | | | $ | - | | | $ | 9,738,274 | |

| Non-controlling interest arising from acquisition of subsidiary | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 193,015 | | | | 193,015 | |

| Amount due from a related party recognized as an offset against equity | | | | | | | | | | | | | | | (3,272,950 | ) | | | - | | | | - | | | | (3,272,950 | ) | | | | | | | (3,272,950 | ) |

| Net income for the year | | | - | | | | - | | | | - | | | | - | | | | 1,077,628 | | | | - | | | | 1,077,628 | | | | (27,435 | ) | | | 1,050,193 | |

| Foreign currency translation adjustments | | | - | | | | - | | | | - | | | | - | | | | - | | | | 3,086 | | | | 3,086 | | | | (1,810 | ) | | | 1,276 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at May 31, 2014 | | | 282,315,356 | | | $ | 28,232 | | | $ | 7,726,893 | | | $ | (3,272,950 | ) | | $ | 2,172,842 | | | $ | 891,021 | | | $ | 7,546,038 | | | $ | 163,770 | | | $ | 7,709,808 | |

| Non-controlling interest arising from acquisition of subsidiary | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (196,893 | ) | | | (196,893 | ) |

| Increase in amount due from a related company | | | - | | | | - | | | | - | | | | (16,497 | ) | | | - | | | | - | | | | (16,497 | ) | | | - | | | | (16,497 | ) |

| Net income for the year | | | - | | | | - | | | | - | | | | - | | | | (31,713 | ) | | | - | | | | (31,713 | ) | | | (351,862 | ) | | | (383,575 | ) |

| Foreign currency translation adjustments | | | - | | | | - | | | | - | | | | - | | | | - | | | | (54,439 | ) | | | (54,439 | ) | | | 4,089 | | | | (50,350 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at May 31, 2015 | | | 282,315,356 | | | $ | 28,232 | | | $ | 7,726,893 | | | $ | (3,289,447 | ) | | $ | 2,141,129 | | | $ | 836,582 | | | $ | 7,443,389 | | | $ | (380,896 | ) | | $ | 7,062,493 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to the consolidated financial statements.

REDTONE ASIA, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended May 31, 2015 and 2014

| | | 2015 | | | 2014 | |

| Cash flows from operating activities | | | | | | |

| Cash flows from continuing operating activities | | | | | | |

| Net (loss)/income before non-controlling interest | | | (1,290,544 | ) | | | 1,294,430 | |

| Adjustments to reconcile net income to net cash (used in)/provided by operating activities: | | | | | | | | |

| Amortization expense | | | 321,033 | | | | 137,452 | |

| Depreciation expense | | | 541,142 | | | | 484,432 | |

| Deferred tax | | | (4,759 | ) | | | (15,071 | ) |

| Provision for doubtful accounts | | | - | | | | 141,289 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Decrease/(increase) in accounts receivable | | | 2,073,186 | | | | (501,009 | ) |

| Decrease/(increase)in inventories | | | 23 | | | | (9 | ) |

| Decrease/(increase) in other receivables and deposits | | | 721,489 | | | | (795,539 | ) |

| Decrease/(increase) in tax recoverable | | | 23,372 | | | | (49 | ) |

| Decrease in deferred income | | | 50,642 | | | | (96,947 | ) |

| (Decrease) in accounts payable | | | (2,017,011 | ) | | | (887,585 | ) |

| (Decrease) in tax payables | | | (14,883 | ) | | | (46,959 | ) |

| Increase in accrued liabilities and other payables | | | 301,219 | | | | 88,807 | |

| | | | | | | | | |

| Net cash provided by/(used in) continuing operating activities | | | 704,909 | | | | (196,758 | ) |

| Net cash (used in) discontinued operating activities | | | (113,811 | ) | | | (114,149 | ) |

| | | | 591,098 | | | | (310,907 | ) |

| | | | | | | | | |

| Cash flows from investing activities | | | | | | | | |

| Cash flows from investing activities – continuing operations | | | | | | | | |

| Purchase of property, plant and equipment | | | (1,692,890 | ) | | | (221,053 | ) |

| Purchases of intangible assets | | | (161,400 | ) | | | (81,450 | ) |

| (Increase)/decrease in amount due from a related company | | | (16,497 | ) | | | 29,351 | |

| Net cash (used in) acquisition of interest in subsidiaries | | | (103,874 | ) | | | (245,655 | ) |

| Proceeds from disposal of subsidiaries | | | 4,565,935 | | | | - | |

| | | | | | | | | |

| Net cash provided by/(used in) continuing investing activities | | | 2,591,274 | | | | (518,807 | ) |

| Net cash flows (used in) discontinued investing activities | | | (1,590,743 | ) | | | - | |

| | | | 1,000,531 | | | | (518,807 | ) |

| | | | | | | | | |

| Cash flows from financing activities | | | | | | | | |

| Cash flows from continuing financing activities | | | | | | | | |

| Decrease in amount due to discontinued operations | | | (1,375,268 | ) | | | - | |

| Capital contributed by non-controlling interests | | | 64,599 | | | | - | |

| Increase in amount due to related parties | | | 148,993 | | | | 32,473 | |

| | | | | | | | | |

| Net cash (used in)/provided by continuing financing activities | | | (1,161,676 | ) | | | 32,473 | |

| Net cash flows from discontinued financing activities | | | - | | | | - | |

| | | | (1,161,676 | ) | | | 32,473 | |

| | | | | | | | | |

| Net increase/(decrease) in cash and cash equivalents | | | | | | | | |

| Continuing operations | | | 2,134,507 | | | | (683,092 | ) |

| Discontinued operations | | | (1,704,554 | ) | | | (114,149 | ) |

| | | | 429,953 | | | | (797,241 | ) |

| | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | | | | | | | |

| Continuing operations | | | (63,207 | ) | | | (7,483 | ) |

| Discontinued operations | | | 17,162 | | | | 4,301 | |

| | | | (46,045 | ) | | | (3,182 | ) |

| | | | | | | | | |

| Cash and cash equivalents at beginning of year | | | | | | | | |

| Continuing operations | | | 2,991,276 | | | | 3,681,851 | |

| Discontinued operations | | | 1,687,392 | | | | 1,797,240 | |

| Combined Cash and cash equivalent at beginning of year | | | 4,678,668 | | | | 5,479,091 | |

| Less: cash and cash equivalents included in beginning assets held for sale | | | (1,687,392 | ) | | | - | |

| Cash and cash equivalent at beginning of year | | | 2,991,276 | | | | 5,479,091 | |

| Cash and cash equivalents at end of year | | | | | | | | |

| Continuing operations | | | 5,062,576 | | | | 2,991,276 | |

| Discontinued operations (included in assets held for sale) | | | - | | | | 1,687,392 | |

| | | | 5,062,576 | | | | 4,678,668 | |

| | | | | | | | | |

| Supplementary information – continuing operations | | | | | | | | |

| Cash paid for income taxes | | | 42,639 | | | | - | |

| Cash paid for interest | | | - | | | | - | |

| | | | | | | | | |

See accompanying notes to the consolidated financial statements.

REDTONE ASIA, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

May 31, 2015

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES

REDtone Asia, Inc. and subsidiaries (the “Company”) are a group of companies in The People’s Republic of China (“PRC”). The principal activities of the Company are that of a Telecommunications provider for mobile, fixed and international gateway services. REDtone provides a wide range of telecommunication services, including prepaid and postpaid discounted call services to corporate customers and consumers as well as prepaid mobile air-time top-up. The Company also offers prepaid shopping card services.

The Company’s major subsidiaries during the years are illustrated as follows:

| Name | | Domicile and date of incorporation | | Effective ownership | | Principal activities |

| Redtone Telecommunication (China) Limited (“Redtone China”) | | Hong Kong May 26, 2005 | | 100% | | Investment holding |

| | | | | | | |

| Redtone Telecommunications (Shanghai) Limited (“Redtone Shanghai”) | | The PRC July, 26, 2005 | | 100% | | Provides technical support services to group companies |

| | | | | | | |

Shanghai Hongsheng Net Telecommunication Company Limited (“Hongsheng”) 1, 2 | | The PRC November 29, 2006 | | 100% | | Marketing and distribution of discounted call services to PRC consumer market |

| | | | | | | |

Shanghai Huitong Telecommunication Company Limited (“Huitong”) 2 | | The PRC March, 26, 2007 | | 100% | | Marketing and distribution of IP call and discounted call services in the PRC |

| | | | | | | |

Shanghai Jiamao E-Commerce Company Limited (“Jiamao”) 2 | | The PRC March 21, 2008 | | 100% | | Marketing and distribution of products on the internet |

| | | | | | | |

Nantong Jiatong Investment Consultant Co., Ltd (“Nantong Jiatong”) 2, 3 | | The PRC May 17, 2011 | | 100% | | Investment holding |

| | | | | | | |

Shanghai QianYue Business Administration Co., Ltd. ("QBA") 1, 2 | | The PRC December 12, 2008 | | 100% | | Provision of prepaid shopping-card services in the PRC |

| | | | | | | |

Shanghai Xin Chang Information Technology Company Limited (“Xin Chang”) 2 | | The PRC January 13, 2006 | | 56% | | Marketing and distribution of IP call and discounted call services in the PRC |

| | | | | | | |

| VMS Technology Limited | | Hong Kong September 14, 1998 | | 100% | | Trading of discounted call related equipment and provision of related services |

| | | | | | | |

| RT Communications Ltd | | BVI February 24, 2010 | | 100% | | Investment holding |

| | | | | | | |

Shanghai YuZhong Financial Information Service Co., Ltd (“YuZhong”) 2, 4 | | The PRC July 16, 2014 | | 49.8% | | Investment holding |

| | | | | | | |

Shanghai YuGuang Automobile Inspection Technology Co., Ltd (“YuGuang”) 2, 4 | | The PRC July 17, 2014 | | 59.8% | | Investment holding |

| | | | | | | |

Taizhou Haitai Motor Vehicle Inspection Co, Ltd. (“Haitai”) 2, 4 | | The PRC October 31, 2013 | | 30.5% | | Investment holding |

| | | | | | | |

Feng Cheng Motor Vehicle Inspection Co., Ltd. (“FengCheng”) 2, 4 | | The PRC November 30, 2012 | | 30.5% | | Provision of services for motor vehicle technical and emission inspection |

| | | | | | | |

1 - Disposed of during the year

2 - Variable interest entities

3 - Deregistered during the year

4 - Acquired/incorporated during the year

Nantong Jiatong, Hongsheng and QBA were disposed of July 25, 2014. The related assets held for sale and liabilities as of May 31, 2014 are reclassified in the consolidated balance sheet, while the corresponding results for years ended May 31, 2015 (up to disposal date) and 2014, respectively, are reported as discontinued operations. See also Footnote 4.

Prior to disposal of Hongsheng, the Company transferred its equity interest in Xin Chang to Huitong. The statutory registration was completed in September 2014.

YuZhong, YuGuang, Haitai and FengCheng are new subsidiaries during the year. See also Footnote 5.

NOTE 2 – PRINCIPLES OF CONSOLIDATION

The accompanying consolidated financial statements for the years ended May 31, 2015 and 2014 include the accounts of the Company, the Company’s subsidiaries and VIEs (see Note 1). The consolidated financial statements are prepared in accordance with generally accepted accounting principles used in the United States of America, and all significant intercompany balances and transactions have been eliminated. The functional currency for the majority of the Company’s operations is the Renminbi (“RMB”), while the reporting currency is the US Dollar.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Economic and political risk

The Company’s major operations are conducted in the PRC. Accordingly, the political, economic, and legal environments in PRC may influence the Company’s business, financial condition, and results of operations.

The Company’s major operations in the PRC are subject to considerations and significant risks typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic, and legal environment. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

(b) Cash and cash equivalents

The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents.

(c) Accounts receivable and other receivables

Trade receivables are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An estimate for doubtful accounts is made when collection of the full amount is no longer probable.

Provision for doubtful accounts for the years ended May 31, 2015 and 2014 amounted to $nil and $141,289, respectively.

(d) Property, plant and equipment

Property, plant and equipment are carried at cost less accumulated depreciation. The cost of maintenance and repairs is charged to the statement of operations as incurred, whereas significant renewals and improvements are capitalized. The cost and the related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of operations.

The Company provides for depreciation of property, plant and equipment principally by use of the straight-line method for financial reporting purposes. Plant and equipment are depreciated over the following estimated useful lives:

| Computer and software | 5 years |

| Furniture, fixtures and equipment | 5 years |

| Motor vehicles | 5 years |

| Leasehold improvements | 5 years |

| Telecommunication equipment | 10 years |

Depreciation expense attributable to continuing operations for the years ended May 31, 2015 and 2014 amounted to $541,142 and $484,432, respectively. Depreciation expense attributable to discontinued operations for the years ended May 31, 2015 and 2014 amounted to $3,689 and $182,797, respectively.

(e) Intangible assets

IT license and software and operating license and are generally amortized on a straight-line basis over the expected periods of benefit, in 20 years. Customer base are amortized on a straight-line basis over 3 years.

The Company performs regular review of identified intangible assets to determine if facts and circumstances indicate that the useful life is shorter than the original Company policies. If such facts and circumstances exist, the Company regularly assesses the recoverability of identified intangible assets by comparing the projected undiscounted net cash flows associated with the related asset or group of assets over their remaining lives against their respective carrying amounts. Impairments, if any, are based on the excess of the carrying amount over the fair value of those assets. If the useful life is shorter than originally estimated, we accelerate the rate of amortization and amortize the remaining carrying value over the new shorter useful life.

Amortization expense attributable to continuing operations for the years ended May 31, 2015 and 2014 amounted to $321,033 and $137,452, respectively. Amortization expense attributable to discontinued operations for the years ended May 31, 2014 and 2013 amounted to $nil and $nil, respectively.

(f) Available-for-sale investments

Investments in equity securities that do not have a quoted market price in an active market and whose fair value cannot be reliably measured are recognized in the balance sheet at cost less impairment losses.

(g) Accounting for the impairment of long-lived assets

The long-lived assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. It is reasonably possible that these assets could become impaired as a result of technology or other industry changes. Determination of recoverability of assets to be held and used is by comparing the carrying amount of an asset to future net undiscounted cash flows to be generated by the assets. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

There is no impairment loss recognized during the years ended May 31, 2015 and 2014.

(h) Income tax

Income taxes are based on pre-tax financial accounting income. Deferred tax assets and liabilities are recognized for the expected tax consequences of temporary differences between the tax bases of assets and liabilities and their reported amounts. The Company periodically assesses the need to establish valuation allowances against its deferred tax assets to the extent the Company no longer believes it is more likely than not that the tax assets will be fully utilized.

The Company evaluates a tax position to determine whether it is more likely than not that the tax position will be sustained upon examination, based upon the technical merits of the position. A tax position that meets the more-likely-than-not recognition threshold is subject to a measurement assessment to determine the amount of benefit to recognize and the appropriate reserve to establish, if any. If a tax position does not meet the more-likely-than-not recognition threshold, no benefit is recognized.

(i) Fair value of financial instruments

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. To increase the comparability of fair value measures, the following hierarchy prioritizes the inputs to valuation methodologies used to measure fair value:

| | Level 1—Valuations based on quoted prices for identical assets and liabilities in active markets. |