Exhibit 99.1

(“Fortuna” or the “Company”)

FORM 51-102F6

STATEMENT OF EXECUTIVE COMPENSATION

for the fiscal year ended December 31, 2020

Letter from the Compensation Committee Chair

My fellow shareholders,

2020 created challenges beyond anyone’s expectations. Thank you for your support as we worked with our host communities and our thousands of workers, contractors, suppliers and service providers to mitigate the impact of COVID-19. As requested by many in the investment and governance communities, we are enhancing our disclosure this year to explain how we dealt with the implications of COVID-19 as it impacted our compensation structure. Here are some highlights of what happened and how we responded, and I invite you to read the detail in the body of this Statement of Executive Compensation:

| · | Operations at San Jose in Mexico were suspended for 54 days. |

| · | Operations at Caylloma in Peru were suspended for 21 days. |

| · | Construction activities at Lindero in Argentina were suspended for 60 days. |

| · | We operated with a reduced workforce and a reliance on temporary workers at all of our operations. |

| · | We implemented comprehensive testing and health protocols at all of our work sites. |

| · | We supported our host communities with testing, supplies, respirators and food. |

| · | We protected our most vulnerable people. |

| · | We withdrew our production and cost guidance in April 2020. |

| · | We froze executive salaries, which had remained unchanged from 2019. |

| · | We suspended and subsequently adjusted our executives’ short-term performance scorecards so that, even though our production and cost guidance had been suspended, we could ultimately base executive compensation on KPI’s that had been originally set out before COVID-19 set in, thereby minimizing the amount of discretion used to determine compensation. |

| · | We maintained key employee retention incentives by granting back-end loaded, 3-year vesting RSUs when PSUs became unworkable this year due to the suspension of our production and cost guidance. |

| · | We reduced the number of shares that can be issued upon the vesting of Share Units down from 5% to 2.25%, to avoid the risk of excessive dilution. |

| · | For 2021, we increased ESG performance indicators to have a 35% weighting in our corporate short-term incentive indicators. Our CEO’s and CFO’s short-term incentives are based 100% and 75% on our corporate indicators, respectively. |

I would like to thank all of our team members for their dedication and ingenuity in navigating 2020.

Respectfully submitted,

David Farrell

Chair, Compensation Committee

Table of Contents

| Introduction | 1 |

| Overview | 1 |

| Response to COVID-19 and Effect on our Operations | 1 |

| 2020 Business Performance | 2 |

| Pay for Performance Alignment | 3 |

| Executive Compensation Philosophy | 3 |

| Non-IFRS Financial Measures | 3 |

| Compensation Governance | 4 |

| Objectives of Compensation | 4 |

| Share Ownership Policy | 4 |

| Role of the Compensation Committee | 4 |

| Role of the Chief Executive Officer | 6 |

| Role of Independent Third Party Compensation Advisors | 6 |

| Elements of Executive Compensation | 6 |

| Peer Comparator Companies - Benchmarking | 7 |

| Risk Assessment | 8 |

| Vesting Philosophy | 9 |

| Incentive Compensation Clawback Policy | 9 |

| Anti-Hedging Policy | 9 |

| NEO Compensation | 9 |

| Base Salary | 10 |

| Annual Performance-Based Cash Incentives | 10 |

| Medium- and Long-Term Incentives | 15 |

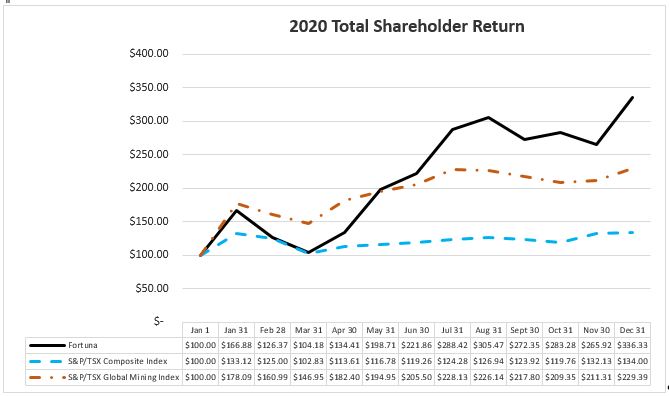

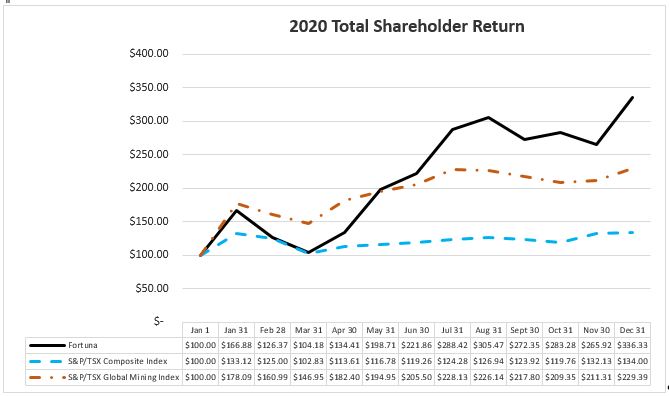

| Performance Graphs | 24 |

| NEO Profiles | 26 |

| Summary Compensation Table | 28 |

| Incentive Plan Awards to NEOs | 30 |

| Management Contracts / Termination and Change of Control Benefits | 30 |

| Director Compensation | 32 |

| Deferred Share Unit Plan | 32 |

| Retainer Fees | 33 |

| Director Compensation Table | 34 |

| Option-Based and Share-Based Awards to the Directors | 35 |

Introduction

At Fortuna, we believe executive compensation is key to helping us achieve our strategic goals and retain our success-proven team, and we design and oversee our compensation strategy with these goals in mind. Our compensation structures are built on three pillars:

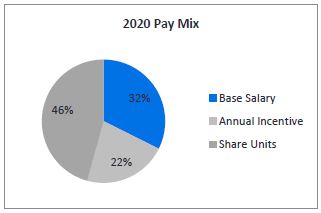

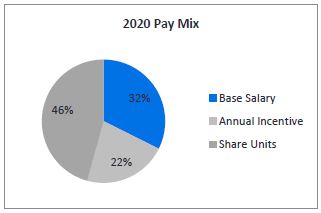

| 1. | Pay for Performance. Our executives’ pay is highly geared to their achievement of pre-defined performance metrics, using individual short-term performance scorecards and long-term performance share units. In 2020, 75% of our CEO’s compensation was performance-based or at-risk pay. |

| 2. | Attraction and Retention of Quality People. Our strength is our people. We operate in a highly competitive global environment and structure our compensation to balance prudent fiscal management and attractive, long-term incentives to bring the best people to work for you, our shareholders. |

| 3. | Shareholder Alignment. A fundamental tenet of our executive compensation is to establish the right mix of fixed short-term, and at-risk long-term compensation in order to encourage management to focus on long-term shareholder value. We structure our compensation to promote and provide the incentive for growth and long-term management of our business through all aspects of the cyclical commodity price cycle. |

What We Do

| ü | We pay for performance | ü | We have an anti-hedging policy |

| ü | We report details of our Pay for Performance metrics (see pages 10 to 15) | ü | We have a trading blackout and insider-trading policy |

| ü | We require minimum share ownership levels for executives and directors | ü | We promote retention with equity awards that vest over three years |

| ü | We have a double trigger for cash severance upon a change of control | ü | We engage independent compensation consultants |

| ü | Our compensation plans mitigate undue risk taking | ü | We promote retention and performance with equity awards that are based on performance |

| ü | We have an incentive compensation clawback policy | ü | We work to provide comprehensive compensation disclosure to strengthen shareholder communication and engagement |

| | |

| What We Don’t Do |

| |

| x | We do not reprice underwater stock options | x | We do not guarantee incentive compensation |

| x | We do not grant stock options to non-executive directors | x | We do not provide tax gross-ups for perquisites |

Overview

Set out below is a brief summary of our Company’s performance in 2020, our alignment when it comes to pay for performance, and our executive compensation philosophy. All values in this Statement of Executive Compensation are in US$ unless otherwise noted.

Response to COVID-19 and Effect on our Operations

The outbreak of COVID-19, which was declared a global pandemic by the World Health Organization in March 2020 has resulted in a widespread global health crisis and has negatively affected economies and financial markets. Like most companies, our operations were affected by the impact of the pandemic. During 2020, in response to the pandemic, the Governments of Mexico, Peru and Argentina implemented measures to curb the spread of COVID-19, which included among others, the closure of international borders, temporary suspension of non-essential activities and the declaration of mandatory quarantine periods. Certain of these measures were subsequently eliminated or relaxed during the year. The Company’s operations were negatively impacted by the spread of the COVID-19 pandemic. Operations at the San Jose Mine were suspended for 54 days in the second quarter as a result of a government mandated national quarantine in Mexico, and construction activities were suspended at the Lindero Mine, Argentina for 60 days during the first and second quarter due to a government mandated period of national social isolation in Argentina. In response to a period of social isolation mandated by the Peruvian government in the first and second quarter of 2020, operations were able to continue at the Caylloma Mine, initially by drawing ore from the coarse ore stockpile during the first quarter, and as the stockpile decreased the mine was subsequently re-started in the second quarter using a reduced taskforce in compliance with applicable Peruvian Government requirements. However, operations were voluntarily suspended for 21 days at the Caylloma Mine in the third quarter to, among other things sanitize and disinfect the mine and make infrastructure improvements to accommodate social distancing guidelines.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 1 |

As the situation with respect to the COVID-19 pandemic was extremely uncertain and involved government mandated restrictions on operations, the Company was unable to determine the impact of COVID-19 on its production and cost guidance for 2020, and on April 2, 2020, it withdrew its production and cost guidance for the remainder of 2020. The Company also implemented measures to reduce spending and capital expenses consistent with the uncertain business environment. Such measures included a freeze on salary increases for all senior officers in 2020, and the suspension of annual bonuses for all senior officers for 2020.

Although our mines are currently operating at full capacity, COVID-19 cases and deaths are either on the rise or at elevated levels in the countries that host our mining operations. The Company has also experienced an increase in COVID-19 cases in Peru which has affected operations at the Caylloma Mine and has resulted in a reduced workforce and quarantine periods for those affected. Each of the Company’s mine sites is, at the date of this Statement of Executive Compensation, operating with a reduced workforce. Worker availability continues to be a challenge but is currently being mitigated by increasing the use of temporary workers and contractors. Health protocols are in place at each mine site for control, isolation and quarantine, as necessary, and these continue to be reviewed and adjusted accordingly based on the circumstances at each location. The Company’s focus is the health and safety of its workforce and on measures to prevent and manage the transmission of COVID-19 amongst the workforce and the communities in which the Company operates.

2020 Business Performance

The COVID-19 pandemic had a significant impact on the Company’s business particularly in the first half of 2020, which included the suspension of operations at our mine sites, restrictions on travel and delays to construction and commissioning activities at the Lindero Mine as referred to in “Response to COVID-19 and Effect on our Operations” above.

The main focus for 2020 was the continued construction at the Lindero Mine. However, construction activities were temporarily halted on March 19, 2020 in response to the Government of Argentina’s mandated period of isolation following the outbreak of COVID-19 in the country. On April 28, 2020, the Company submitted and received approval to resume operations at the Lindero property under a Minimum Emergency Operations Program. Mobilization of a reduced workforce and recommencement of construction activities began in mid-May 2020.

In July 2020, the Company announced the successful completion of commissioning of the primary and secondary crushing circuits and the start of stacking of ore on the heap leach pad. Irrigation and leaching of ore placed on the heap leach pad commenced in early September, and first gold was poured on October 20. Doré production for the year was 13,435 ounces of gold, which was in line with the revised production forecast for the year. Commissioning of the HPGR, agglomeration plant, and stacking system was completed in mid-December with all systems in the ramp up phase. Commissioning activities at the Lindero Mine suffered some delays during the year as some equipment had to be commissioned with remote assistance due to in country travel restrictions which limited vendor technical support at site.

As at the end of 2020, construction at the Lindero Mine was substantially complete, with construction capital expenditures projected to be within the Company’s previously issued $320 million guidance (refer to Fortuna news release dated May 8, 2020), including remaining capital expenditures of $2.0 million to be allocated to finalize construction of ancillary facilities and to commissioning activities.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 2 |

During fiscal 2020, the San Jose mine produced 6,165,606 ounces of silver and 37,805 ounces of gold in 2020, a decrease of 22% and 23% over 2019, as production was impacted by the COVID-19 related restrictions. However, annual production of silver, lead and zinc at the Caylloma mine totalled 968,111 ounces of silver, 29.6 million pounds of lead and 45.5 million pounds of zinc which represent a 3% increase in silver and lead while zinc production was flat year-over year. Gold dore from commissioning at the Lindero Mine in the fourth quarter of fiscal 2020 was 13,435 ounces, and was in line with revised production guidance for the mine (refer to Fortuna news release dated November 12, 2020).

Despite the challenges encountered during fiscal 2020, consolidated sales for fiscal 2020 increased 8% to $279 million compared to $257.2 million reported for the same period in 2019. The increase was driven by a 31% and 30% increase in the prices of silver and gold, respectively, and receipt of $20.3 million from the sale of 10,935 ounces of gold from the Lindero Mine.

Pay for Performance Alignment

A significant portion of executive pay is provided in the form of equity compensation. We made this pay-for-performance alignment with shareholder interests even stronger by introducing a performance share unit plan (the “Share Unit Plan”) in 2017. The Compensation Committee notes that total compensation for the NEOs (as defined below), as disclosed in the Summary Compensation Table on page 28, includes the grant date value of option and share based compensation. As such, the total compensation disclosure does not reflect the fluctuations in value realizable by executives, which ultimately aligns our executive compensation with shareholder experience. For example, the grant date value of RSUs awarded to the CEO, Jorge Ganoza Durant, in 2020 was $1,421,600; however, due to the vesting restrictions imposed, the value of these awards at December 31, 2020 was $Nil as no portion of the awards had vested by that date. The Compensation Committee believes that deferment of some components of compensation through the application of time-vesting and performance vesting schedules supports retention of executives and long-term alignment with shareholder value.

Executive Compensation Philosophy

Fortuna’s success is built on our people. In addition to investing in high quality tangible assets, Fortuna also invests in market leading human and intellectual capital. Our compensation philosophy is designed to attract and retain highly qualified and motivated executives who are dedicated to the long-term success of the Company and to the creation and protection of shareholder value. Our goal is to focus and motivate employees to achieve higher levels of performance and to appropriately reward those employees for their results. We believe that shareholders should also be rewarded by the efforts of our team, as evidenced by Fortuna’s strong balance sheet and growth in silver and gold production – with low costs - over the past five years.

We believe our pay-for-performance compensation structure aligns our executives with the long-term interests of shareholders. Based on results achieved by both the individual and the Company, our executive compensation structure is strongly performance-based. Our program with a significant proportion of executive compensation at risk, in the form of performance-based short-term cash incentives, as well as long-term share price contingent stock options, RSUs and PSUs, illustrates our strong focus on pay-for-performance.

Fortuna’s executive compensation program and practices are described in detail below. The Compensation Committee believes that Fortuna’s compensation governance provides transparent and effective support for the attainment of Fortuna’s key business objectives, alignment with its shareholders’ interests and the creation of long-term value for all stakeholders.

Non-IFRS Financial Measures

This Statement of Executive Compensation refers to certain non-International Reporting Financial Standards (“IFRS”) measures that are used by Fortuna to analyze and evaluate the performance of Fortuna's business and are widely reported in the mining industry as benchmarks for performance. These measures include “cash cost”, “free cash flow" (“FCF”), "all-in sustaining cash cost" (“AISC”) and "return on assets" (“ROA”). The Company believes that certain investors use these non-IFRS financial measures to evaluate the Company’s performance. However, the measures do not have a standardized meaning and may differ from measures used by other companies with similar descriptions. Accordingly, they should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 3 |

For additional information regarding these non-IFRS measures, including reconciliations to the closest comparable IFRS measures, see "Non-GAAP Financial Measures" in the Company's management's discussion and analysis for the year ended December 31, 2020, which is available under the Company's SEDAR profile at www.sedar.com and is incorporated by reference in this Statement of Executive Compensation.

Compensation Governance

Objectives of Compensation

Fortuna operates a complex business in a highly competitive market for experienced executives. We compete with both public and private, and often larger, mining companies across the Americas and the world for experienced management capable of delivering superior value. Fortuna’s people make the difference in distinguishing its performance relative to its peers. The Company’s compensation program is therefore designed to be competitive with its peers to ensure that they can attract, motivate and retain the highly-qualified individuals with the skills and experience necessary to execute the Company’s growth-oriented strategic plan and create sustainable value for Fortuna’s shareholders.

The primary objectives of Fortuna’s executive compensation program are to attract, motivate and retain top-quality, experienced executives who will deliver long-term superior value. Noting that ours is a commodity-based business, Fortuna’s share price is heavily influenced by the price of silver and gold. Fortuna therefore balances its compensation program with rewards for the attainment of operational measures and risk management that are within executives’ ability to influence. Essential to our core business objectives are the following elements:

| · | To recruit and retain high calibre, appropriately qualified executive officers by offering overall base salary compensation competitive with that offered for comparable positions among a peer group of similarly situated mineral resource companies, while strongly aligning total compensation with performance. For example, executive compensation is structured so that the “at risk” component represents a significant portion of each executive’s total compensation. Our goal is to offer superior opportunities to achieve personal and career goals in a growth-focused team with corresponding pay for performance. |

| · | To motivate executives to achieve important corporate and individual performance objectives that may be influenced by the executive and reward them when such objectives are met or exceeded. |

| · | To align the interests of executive officers with shareholders’ interests by providing incentives that balance short- and long-term business goals, reflect value created for shareholders, and support the retention of key executives. This element is delivered primarily through a cash-based short-term incentive plan and a long-term incentive plan consisting of share units granted to vest with performance and over time. While the bonus plan rewards executives on attainment of annual objectives/milestones, typically, our executives see the majority of their compensation in the form of long-term equity tied to long-term value creation. Previous equity grants are taken into account when the granting of new share units or other equity awards is contemplated. |

| · | To ensure that total compensation paid takes into account the Company’s overall financial position. |

Share Ownership Policy

The Company’s executives and directors are required to achieve and maintain minimum shareholding thresholds. As at the date hereof, all executive officers and directors have met their minimum shareholding targets.

Role of the Compensation Committee

The Compensation Committee is responsible for reviewing matters pertaining to the Company’s compensation philosophy, programs and policies, including director and executive compensation and grants, and making recommendations to the Company’s Board of Directors (“Board”) for approval. In particular, the Compensation Committee’s duties include making recommendations to the Board regarding: the goals and objectives of the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), and evaluating the CEO’s and CFO’s performance in light thereof; CEO, CFO and director compensation; bonus plans for executives; equity-based plans; and approving the Company’s annual Statement of Executive Compensation.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 4 |

The Compensation Committee meets at least twice annually and is comprised of three directors, all of whom (including the chair) are independent within the meaning of section 1.4 of National Instrument 52-110 – Audit Committees. David Farrell is independent, was appointed chair on March 12, 2015 and has served on the Compensation Committee since May 9, 2014. David Laing is independent and has served on the Compensation Committee since December 21, 2016, and Alfredo Sillau is also independent and has served on the Committee since May 1, 2018. In March 2021, the provisions of the Charter of the Compensation Committee relating to composition were strengthened to provide that no member of the Committee may shall have served as the CEO of the Company or of an affiliate, within the past five years, or as the CFO of the Company or of an affiliate, within the past three years.

The Compensation Committee members have the necessary experience to enable them to make decisions on the suitability of the Company’s compensation policies or practices. Messrs. Farrell and Laing have in the past served, or currently serve, on compensation committees of other public resource or mining companies. The Board is satisfied that the composition of the Compensation Committee ensures an objective process for determining compensation.

In support of the fulfilment of their role, the Compensation Committee may, from time to time, engage and receive input from external independent advisors skilled in executive compensation matters, with knowledge of the mining industry. In 2019 and 2020, the Committee engaged Global Governance Advisors (“GGA”), an independent executive compensation and governance advisory firm with significant experience advising mining company boards. For certain compensation matters pertaining to executive officers other than the CEO and CFO, the Compensation Committee fulfils its responsibility in consultation with the CEO. The Compensation Committee reviews recommendations made by the CEO and has discretion to modify any of the recommendations before making its independent recommendations to the Board.

When considering the appropriate compensation to be paid to executive officers, the Compensation Committee considers a number of factors including:

| · | Recruiting and retaining executives critical to the success of Fortuna and the enhancement of shareholder value; |

| · | Providing fair and competitive compensation that provides pay for performance; |

| · | Aligning the interests of management and shareholders by including measures of shareholder value among key performance metrics for executive compensation awards and compensation elements that emphasize contingent at-risk and equity-linked compensation; |

| · | Rewarding performance that supports long-term sustainable value, both on an individual basis and at an overall company level; and |

| · | Available financial resources and the economic outlook affecting Fortuna’s business. |

In 2019, the Compensation Committee obtained updated reports from GGA and based on these reports approved an increase of 3% in the base salaries of the NEOs, no change to the short term incentive program targets, and a shift in the weighting of long term incentive program components with more emphasis being placed on performance contingent awards.

No changes were made to compensation levels for fiscal 2020 as the Company implemented measures to reduce spending and capital expenses consistent with the uncertain business environment related to the impact and duration of the COVID-19 pandemic on the Company’s business and operations.

The complete terms of the Compensation Committee Charter are available on Fortuna’s website on the “Our Governance” page.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 5 |

Role of the Chief Executive Officer

The CEO plays a role in executive compensation decisions by making recommendations to:

| · | the Board regarding the Company’s annual objectives that provide the structure for the assessment of compensable corporate performance and alignment of individual annual objectives of other executive officers and employees; and |

| · | the Compensation Committee regarding CEO and CFO base salary adjustments, target annual performance-based cash incentives awards and actual payouts, and long-term incentive awards in the form of stock options and grants under the Share Unit Plan. |

Role of Independent Third Party Compensation Advisors

In early 2019, the Compensation Committee engaged GGA to provide reports (the “2019 GGA Reports”) regarding a review of the compensation programs for the NEOs in relation to peer group compensation and supplemental benchmarks from GGAs custom survey databases. In early 2020, a report (the “2020 GGA Report” and together with the 2019 GGA Reports, the “GGA Reports”) was received from GGA regarding the Company’s Share Unit Plan design and cost, and non-executive director equity award trends.

The Committee and the Board considered the advice contained in the GGA Reports when determining the Company’s executive compensation program for 2019 and 2020.

For the financial years ended December 31, 2019 and 2020, the Company paid independent compensation advisors the following amounts:

| | | | 2019 | | | | 2020 | |

| Executive Compensation-Related Fees - GGA | | | CAD$ | 37,832 | | | | CAD$ | 15,736 | |

| All Other Fees | | | Nil | | | | Nil | |

| Total | | | CAD$ | 37,832 | | | | CAD$ | 15,736 | |

Elements of Executive Compensation

As discussed above, Fortuna’s compensation program has been comprised of three main elements: base salary, an annual performance-based cash incentive award, and grants of equity-based long-term incentive compensation in the form of performance share units (“PSUs”), restricted share units (“RSUs”) and stock options.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 6 |

Due to the COVID-19 pandemic and the government mandated restrictions on the business of the Company and the resulting withdrawal of the Company’s 2020 operating guidance in April 2020, the base salaries of the Company’s executives for 2020 remained unchanged from 2019, and no PSUs were granted to executives. RSUs were granted in 2020, one-half of which were cash settled and the balance were share-settled in order to align executive compensation with shareholder interests. The specific design, rationale, determination of amounts, and related information regarding each of these components are outlined below.

Element of

Compensation | | Description | | Relationship to Corporate Objectives | | Element “At-

Risk” or “Fixed” |

| Base Salary | | Base salaries are the only fixed pay element and are set based on the position and the individual executive’s growth-to-competence in the role. They are also used as the base to determine the value of other elements of compensation (i.e. multiple of base salary). | | Competitive base salaries enable the Company to attract and retain highly qualified executives and provide essential stability in times of market volatility. | | Fixed |

| | | | | | | |

| Annual Performance-Based Cash Incentives | | Annual performance-based cash incentives are a variable element of compensation designed to reward executive officers for achievement of annual milestones consistent with the long term strategic plan and split between corporate and individual performance metrics. Target percentages are fixed each year by the Board. | | Short-term milestone goals typically represent a balanced portfolio of metrics with a one-year horizon. They are structured to balance elements that are within the control of management (for example: production, safety and development milestones) with external factors (financial metrics which fluctuate with metal prices, and TSR which is influenced by short-term market sentiment). | | At-Risk |

| | | | | | | |

| Long-Term Equity Incentives | | RSUs, PSUs and stock options are a variable element of compensation intended to reward executives for success in achieving sustained shareholder value reflected in stock price. As these grants vest over time, they are also important for executive retention. | | Long-term incentives encourage executives to focus on consistent value creation over the longer term (3 years in the case of RSUs and PSUs and up to 5 years for stock options). Equity grants strongly align the interests of executives with long-term interests of shareholders since the received value is dependent on absolute future share performance. | | At-Risk |

Peer Comparator Companies - Benchmarking

Fundamental to Fortuna’s compensation philosophy is to provide competitive compensation in support of the attraction and retention of high calibre executives. Accordingly, the Compensation Committee relies on input from independent compensation advisors from time to time and other outside information, including the insight of Board members.

Our goal is to design and implement compensation packages that are fair and reasonable, based in large part on benchmarking against similar companies, but offering significant incentive for above-average performance. The ultimate test of this process is our ability to attract and retain high-performance executives over the long term.

In determining an appropriate group of comparator mining companies for consideration in determining the Company’s compensation levels, the Compensation Committee reviewed its comparator mining companies in light of the growth of the Company (principally through the construction of the Lindero Mine) and receipt of the GGA Reports. GGA recommended the following criteria in creating our peer group:

| · | companies of similar scope to Fortuna’s metrics including Lindero, primarily from a market capitalization perspective, but also considering other factors such as revenue, production levels, and total assets; |

| · | companies primarily mining for silver or other precious metals; |

| · | companies who are operational and produce revenue; |

| · | companies with a similar business strategy and scope of operations to Fortuna; and |

| · | publicly traded companies on major Canadian and U.S. exchanges. |

Based on these factors and in discussion with GGA, it was determined that the following companies were suitable peer comparators for consideration in determining senior executive compensation for 2020:

| Alacer Gold Inc. | Eldorado Gold Corporaton. | New Gold Inc. |

| Alamos Gold Inc. | Endeavour Silver Corp. | Pan American Silver Corp. |

| Argonaut Gold Corp. | First Majestic Silver Corp. | Sierra Metals Inc. |

| Coeur Mining Inc. | Hecla Mining Company | SSR Mining Inc. |

| Dundee Precious Metals Inc. | MAG Silver Corp. | Torex Gold Resources Inc. |

For 2021, our peer group has been updated and expanded by GGA and we have replaced Alacer Gold Inc., Endeavour Silver Corp., MAG Silver Corp. and Sierra Metals Inc with Centerra Gold Inc, Equinox Gold Corp., Lundin Gold Inc., OceanaGold Corp., Pretium Resources Inc., and Wesdome Gold Mines Inc.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 7 |

Our compensation decisions are guided by experience and professional judgment, with due consideration of our benchmark data, but including assessment of a complex range of factors including the experience, tenure, and unique leadership characteristics of our executives. Our benchmarking process is a guideline to making the right decision in specific cases, not a pre-determination of compensation decisions.

Risk Assessment

The Compensation Committee considers the risk implications associated with Fortuna’s compensation policies and practices on an on-going basis and as part of its annual compensation review. There are no identified risks arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company. The executive compensation program seeks to encourage actions and behaviours directed towards increasing long-term value while modifying and limiting incentives that promote inappropriate risk-taking.

The Compensation Committee’s risk assessment and management is based on the underlying philosophy that guides the Committee in the design of the key elements of compensation as follows:

| · | provide total compensation that is competitive to attract, retain and motivate high calibre executives in a mining employment marketplace with a shortage of world-class executive talent; |

| · | balance the mix or relative value of the key elements of compensation (salary, annual performance-based cash incentives, long-term incentives), providing sufficient stable income at a competitive level so as to discourage inappropriate risk taking while also providing an important portion of total compensation that is variable and “at-risk” for executives; |

| · | strengthen and maintain the link between pay and performance, both Company and individual performance, and ensure the objectives against which performance is measured can be fairly assessed and do not encourage inappropriate risk taking; and |

| · | defer a significant portion of “at-risk” compensation to keep executives focused on continuous long-term, sustainable performance. |

Some specific controls that are in place to mitigate certain risks are as follows:

| · | Business Continuity and Executive Retention Risk. Total compensation is reviewed annually to ensure it remains competitive year over year, and that we have sufficient ‘holds’ on our key talent through potential forfeiture of unvested incentives, for example. |

| · | Environmental and Safety Risk. Environmental and safety are important factors used to assess the on-going performance of the Company and have an important (and direct) impact on executive pay, in that improvements in safety and environmental metrics are rewarded and negative environmental and safety events will negatively affect contingent compensation. |

| · | Cash Flow Risk. Salary levels are fixed in advance, while annual performance-based cash incentive awards are limited, in that they are linked to performance and are a percentage of salary. |

| · | Stock Dilution Risk (from issuances of long-term incentives in the form of stock options and certain RSUs and PSUs which will be share-settled). Fortuna’s stock option plan (“Stock Option Plan”) has been limited to 12,200,000 Common Shares under option for many years. In addition, deferred share units (“DSUs”) are paid in cash based on the Common Share price at the time of payout, rather than by issuing stock. Further, certain RSUs have been paid in cash based on the Common Share price at the time of payout, rather than by issuing stock, noting that one-half of RSUs granted in 2020 are to be paid out in stock, which is consistent with 2019 and 2018. In 2020, we also reduced the maximum share reservation limit from 5% to 2.25% under our Share Unit Plan. See “Share Unit Plan” on page 17. |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 8 |

| · | Inappropriate Risk Taking. Align executive interests with interests of shareholders by encouraging equity exposure through long-term incentives such as RSUs, PSUs and stock options, and mitigating incentives to undermine value through an anti-hedging policy. |

Vesting Philosophy

The Compensation Committee believes that deferment of some components of compensation through the application of vesting schedules and performance goals supports retention of executives and long-term alignment with shareholder value. Accordingly, equity awards have the following vesting schedules:

| Stock Options: | 50% vest after one year; 50% vest after two years |

| RSUs: | 20% vest after one year; 30% vest after two years; 50% vest after three years |

| PSUs: | 20% vest after one year; 30% vest after two years; 50% vest after three years – each vesting subject to fulfillment of performance goals by each vesting date. |

Incentive Compensation Clawback Policy

On the recommendation of the Compensation Committee, in 2016 the Board adopted an Incentive Compensation Clawback Policy in order to provide a measure of accountability and to ensure that incentive compensation paid by the Company to its officers, directors and employees is based on accurate financial and operational data. Up to the entire amount of annual incentives, performance based compensation and short- and long-term incentives awarded, paid or payable to officers, directors and employees of the Company may be forfeit or subject to repayment if: (a) the payment, grant or vesting of such compensation was based on the achievement of financial or operational results that were subsequently the subject of a restatement of financial statements issued in a prior fiscal year; (b) the Board determines that the applicable personnel member engaged in fraud, gross misconduct or gross negligence that caused, or meaningfully and directly contributed to, the restatement; (c) the amount of incentive compensation that would have been received by such personnel member would have been lower than the amount actually received had the financial results been properly reported; and (d) the Board determines that the forfeiture or repayment is in the best interest of the Company and its shareholders.

Anti-Hedging Policy

Pursuant to the Company’s Anti-Hedging Policy adopted in early 2015, no director or officer of Fortuna is permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of any Company securities granted as compensation or held, directly or indirectly, by such director or officer.

NEO Compensation

During the fiscal year ended December 31, 2020, the Company’s most recent fiscal year end, five individuals were “named executive officers” of the Company within the meaning of the definition set out in National Instrument Form 51-102F6, “Statement of Executive Compensation”. The following information provides disclosure of the compensation paid or payable by the Company to its CEO, CFO and three most highly compensated executive officers (other than the CEO and CFO):

| · | Jorge Ganoza Durant, the President (since January 23, 2006) and CEO (since August 13, 2008), |

| · | Luis Ganoza Durant, the CFO (since June 5, 2006), |

| · | Manuel Ruiz-Conejo, the Vice-President, Operations (since August 1, 2011), |

| · | Jose Pacora, the Vice-President, Project Development (since November 10, 2014), and |

| · | David Volkert, the Vice-President, Exploration (since August 8, 2016). |

(herein together referred to as “NEOs”).

STATEMENT OF EXECUTIVE COMPENSATION | Page | 9 |

Base Salary

In establishing levels of cash and equity-based compensation, the Company considers the executive’s performance, level of expertise, responsibilities, and comparable levels of remuneration paid to executives of other companies of similar size, development and complexity within the mining industry. Fortuna believes that it is not always appropriate, however, to place full reliance on external salary surveys because of the years of service and experience of the Company’s executive team and the specific circumstances of the Company. The base salaries for the CEO and the CFO are reviewed by the Compensation Committee and any increase is recommended to the Board at the beginning of a fiscal year. Base salaries for the other NEOs are assessed and set by the CEO.

The Compensation Committee continues to monitor competitive conditions including executive retention risks, and reviewed the GGA Reports in respect of executive officers base salaries for 2020. Base salaries for 2020 were not increased from the 2019 levels in recognition of the uncertainties caused by the COVID-19 pandemic.

Annual Performance-Based Cash Incentives

Based on the recommendations of the Compensation Committee, the Board will approve the bonus target and form of scorecard for each of the CEO and CFO. The CEO will approve the bonus target and form of scorecard for each Vice President and will evaluate the performance of those individuals. Notwithstanding the foregoing, the Board has the discretion to adjust the amounts of annual performance-based cash incentives based on a recommendation by the Compensation Committee.

In early 2020, the Company suspended the approval of an annual cash bonus plan for its executive officers due to the uncertainties caused by the COVID-19 pandemic, and the individual annual performance scorecards for NEOs which include personal and corporate performance metrics for 2020 were also suspended.

In early 2021, taking into account the response of the executive officers to the challenges presented by the impact of the pandemic on the Company’s business, annual cash bonuses were paid to the executive officers for fiscal 2020 based on each executive’s personal performance and the Company’s corporate performance during 2020.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 10 |

2020 Bonuses - Achievement Factors and Results

The cash incentive bonuses paid for fiscal 2020 were based on the personal performance of each NEO (as determined by the Board for the CEO and the CFO and by the CEO for each Vice President) and the Company’s corporate performance during 2020. The corporate performance indicators established and their results are set out below:

| Category | Weight | Sub Category | | Subweight | Original KPI (Target-

100%) 1 | COVID-19 Target Adjustment1 | 2020 Results | Incentive

score |

| 1 | Financial | 30% | Financial | | 30% | FCF: $63.9M - $91.4M(5) | None | FCF: $78.3M | 100% |

| 2 | Operational | 45% | Production | | 8% | San Jose (Ag): 6.6M - 7.3M oz

San Jose (Au): 41k - 45k oz | San Jose (Ag): 5.7M-6.3M oz San Jose (Au) 35k-38k oz | San Jose (Ag): 6.2M oz

San Jose (Au): 37.8k oz | 100% |

| | 8% | Caylloma (Ag): 0.9M - 1.0M oz | None | Caylloma (Ag): 0.9M | 100% |

| | 8% | Lindero (Au): 60k - 80k oz | 24k ozs | Lindero (Au): 13.4k oz | 50% |

| Costs | | 7% | AISC San Jose: $9.6 - $11.7/oz Ag Eq. | Costs impacted by COVID-19 shut-down | AISC: 12.3/oz Ag Eq. (5) | 75% |

| | 7% | AISC Caylloma: $14.8 - $18.1/oz Ag Eq. | Costs impacted by COVID-19 shut-down | AISC: 17.9/oz Ag Eq. | 100% |

| | 7% | AISC Mansfield: $520 - $620/oz Au | Costs impacted by COVID-19 shut-down | AISC: 1,079/oz Au | 50% |

| 3 | ESG | 25% | Safety 2 | | 5% | 1.22 ≤LTIFR≤ 1.5 | None | LTIFR = 3.11 | 30% |

| | 5% | 109 ≤SR≤ 133 | None | SR = 174 | 69% |

| | 5% | 3.52 ≤TRIFR≤ 4.3 | None | TRIFR = 5.90 | 64% |

| Environment | | 5% | 0 major environmental incidents 3 | None | 0 major environmental incidents | 100% |

| Social | | 5% | days of blockages ≤ 7 per operation4 | None | days of blockages < 7 per operation | 100% |

| | | 100% | | | 100% | | | | 84.0% |

| | COVID-19 | Execution of COVID-19

Response & Mitigation Plan | | Unique 2020 Factor | | 5% |

| | | | | | | | | CPI RESULT: | 89.0% |

Notes:

CALCULATION FORMULA: Values outside 100% range calculated pro-rata based on limits corresponding to each range:

| 1. | KPI targets as approved in March 2020 (before the COVID-19 outbreak). Operational goals as per 2020 Guidance, withdrawn on April 2, 2020. COVID-19 Target Adjustment reviewed and approved by the Compensation Committee to apply known COVID-19 implications from Government mandated shut-downs and COVID-19 response. |

| 2. | If Fatality Rate (FR) > 0, Safety incentive (LTIFR, SR, TRIFR) will be 0. |

| 3. | As per GRI definition, a significant incident (spill) is included in the organization´s financial statements, for example due to resulting liabilities, or is recorded as an incident by the organization |

| 4. | Days of blockages to the operation: blockages which prevent personnel from entering the main site. |

| 5. | FCF and AISC are non-IFRS financial measures. See the "Non-IFRS Financial Measures" section of this Statement of Executive Compensation. |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 11 |

The personal performance results for each of the NEOs for 2020 are as follows:

| NEO | Category | Weighting | 2020 Achievement | 2020

Rating |

| CEO | Corporate Performance | 100% | 89% | 89% |

| | | | | |

| | OVERALL CORPORATE AND PERSONAL ACHIEVEMENT RATING: 89% | |

| | | | | |

| CFO | Personal Performance | 25% | Devised and lead the development of the comprehensive KPIs project across the organization, allowing for an efficient and scalable cost management system aligned with best practices and bringing a competitive edge to Fortuna against its peers; integral part of the negotiations and completion of a bought-deal financing for US$69 million, which closed successfully in May and secured the funding for the completion of Lindero considering the uncertainties brought by the COVID-19 pandemic; contributed to the decision-making process of the COVID-19 crisis committee and provided valuable advice to other senior management team members through the COVID-19 crisis. - 120% Achievement | 30% |

| | | | | |

| | Corporate Performance | 75% | 89% | 66.75% |

| | | | | |

| | OVERALL CORPORATE AND PERSONAL ACHIEVEMENT RATING: 96.8% |

| | | | | |

| VP Operations | Personal Performance | 25% | Contributed to strengthening the corporate structure through participation in the KPIs program and management in the ESG area. Safety performance not fully achieved. - 75% Achievement | 18.75% |

| | | | | |

| | Corporate Performance | 75% | 89% | 66.75% |

| | | | | |

| | OVERALL CORPORATE AND PERSONAL ACHIEVEMENT RATING: 85.5% |

| | |

| VP Project Development | Personal Performance | 75% | Overcame tremendous challenges caused by COVID-19 pandemic restrictions. Lindero Mine commissioning, start-up and production goals originally planned for 2020 could not be fully achieved. - 75% Achievement | 56.25% |

| | | | | |

| | Corporate Performance | 25% | 89% | 22.25% |

| | | | | |

| | OVERALL CORPORATE AND PERSONAL ACHIEVEMENT RATING: 78.5% |

| | |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 12 |

| VP Exploration | Personal Performance | 40% | Lead inititiates which resulted in the acquisition of various new exploration opportunities, and the development of new exploration plans at the San Jose property. - 100% Achievement | 40% |

| | | | | |

| | Corporate Performance | 60% | 89% | 53.4% |

| | | | | |

| | OVERALL CORPORATE AND PERSONAL ACHIEVEMENT RATING: 93.4% |

| | |

Forward-Looking 2021 Achievement Targets

In response to requests from the investment and governance communities, the following are the forward-looking short-term incentive Corporate Performance Indicators for NEOs for 2021 (which encompass more environmental and social governance targets than in previous years):

2021 Corporate Performance Objectives:

Category &

Weight | Sub

Category | | Sub

Weight | KPI

(Target - 100%) | Minimum (Incentive at 50%) | Target

(Incentive at 100%) | Maximum (Incentive at 150%) | Note |

| Financial 25% | Financial | | 25.0% | Free Cash Flow (FCF)1 6: 138M - 183M | 87M | 138M - 183M | ≥227M | Target range based on guidance range. Minimum and Maximum consistent with cumulative effect of minimum and maximum production and cash cost6 ranges. |

| Operational 40% | Production | | 6.0% | Ag: 6.8M - 7.6M oz | 6.1M oz | Ag: 6.8M - 7.6M oz | ≥8.4M oz | Target range based on guidance range. Minimum and Maximum calculated +-10% deviation from high/low end of guidance range |

| | 14.0% | Au: 178k - 202k oz | 160k oz | Au: 178k - 202k oz | ≥222k oz | Target range based on guidance range. Minimum and Maximum calculated +-10% deviation from high/low end of guidance range |

| Costs2 | | 7.0% | AISC6 San Jose: $12.4 - $14.7/oz Ag Eq. | 17.3/oz Ag Eq. | $12.4 - $14.7/oz Ag Eq. | ≤10.6/oz Ag Eq. | Target range based on guidance range. Minimum and Maximum calculated +-10% deviation from high/low end of guidance range for production and unit cash cost6 |

| | 3.0% | AISC6 Caylloma: $19.4 - $23.0/oz Ag Eq. | 24.8/oz Ag Eq. | $19.4 - $23/oz Ag Eq. | ≤17.6/oz Ag Eq. | Target range based on guidance range. Minimum and Maximum calculated +-10% deviation from high/low end of guidance range for production and unit cash cost6 |

| | 10.0% | AISC6 Mansfield: $730 - $860/oz Au | 925/oz Au | $730 - $860/oz Au | ≤665/oz Au | Target range based on guidance range. Minimum and Maximum calculated +-10% deviation from high/low end of guidance range for production and unit cash cost6 |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 13 |

| ESG 35% | Safety 3 | | 7.5% | LTIFR: 1.50 | 2.48 | 1.35 ≤LTIFR≤ 1.65 | <0.68 | Range constructed as follows: Target 100%:+-10%. Threshold and Maximum is around 50% of target cap and floor, respectively |

| | 7.5% | TRIFR: 4.80 | 7.92 | 4.32 ≤TRIFR≤ 5.28 | <2.16 | Range constructed as follows: Target 100%:+-10%. Threshold and Maximum is around 50% of target cap and floor, respectively |

| Environment | | 5.0% | # of significant spills4 = 0 | | 0 significant spills | | |

| Social | | 5.0% | # of significant disputes with local communities related to land and the use of other resources5 = 0 | # of significant disputes ≤ 3 per operation | # of significant disputes = 0 per operation | | |

| ESG Framework | | 10.0% | Implementation of ESG Framework | Below

expectations | Meets

expectations | Above

expectations | Board of Directors discretion |

| 100% | | | 100.0% | | | | | |

CALCULATION FORMULA: Values outside 100% range calculated pro-rata based on limits corresponding to each range. Incentive for results below Minimum equals Nil, unless extenuating circumstances related to COVID-19 or other major events.

NOTES:

| 1 | FCF: Metal prices on actual results will be normalized if lower than budget and left unadjusted if higher, as long as both production and opex targets are met. |

| 2 | Cost: Ag Eq ratios fixed as follows: Au:Ag = 81.8, Pb:Ag = 86.4, Zn:Ag = 104.5. |

| 3 | If fatality occurs at any company location, entire Safety metric default to 0. |

| 4 | If a significant spill occurs at any company location, Environment metric default to 0. |

| | Significant spills: Any type of spill that meets one or more of the following parameters: |

| | Permanent impact on multiple people: injury, damage, disability, or irreversible effect on health. |

| | Limited reversible impact on ecosystems, restoration is possible and takes more than 3 months. |

| | Loss of trust and breakdown of communication with the community that generates actions against the company or generalized closure of 3 days or more. |

| | Negative media coverage at the local level resulting in a partial loss of confidence. |

| 5 | Significant disputes with local communities: Loss of trust and communication breakdown with communities that generates actions against the company and generalized closure of a minimum of 3 days. |

| 6. | FCF, cash cost, and AISC are non-IFRS financial measures. See the "Non-IFRS Financial Measures" section of this Statement of Executive Compensation. |

2021 NEO Performance Objectives:

The following table ses out the weighting of each NEO’s short-term incentive as set out in the 2021 Corporate Performance Objectives above:

| NEO | | Weighting of 2021 Corporate

Performance Objectives | |

| Jorge Ganoza Durant, President & CEO | | | 100 | % |

| Luis Ganoza Durant, CFO | | | 75 | % |

| Manuel Ruiz-Conejo, VP Operations | | | 75 | % |

| Jose Pacora, VP Project Development | | | 60 | % |

| David Volkert, VP Exploration | | | 60 | % |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 14 |

Annual Performance-Based Cash Incentives Awarded

As set forth above, the Company’s operational objectives for 2020 were negatively impacted by the impact of the COVID-19 pandemic on operations, which also delayed the construction and commissioning at the Lindero Mine. In addition, one of the Company’s sustainability objectives related to health and safety performance was not met in the past year. In 2020, our consolidated lost time injury frequency rate, total recordable injury frequency rate and severity rate were all above their key performance indicator targets, which is attributable to a higher than normal turnover of personnel as a result the COVID-19 pandemic. In addition, at the Lindero Mine, the LTIR and LTISR increased in 2020 compared to 2019, due mainly to hiring and training plans not being executed as planned due to border closures and sanitary restrictions as a result of the COVID-19 pandemic. The Company has taken steps to improve its health and safety performance in 2021. As a result, and in line with our pay-for-performance philosophy, the performance-based cash incentives for all NEOs were reduced. Certain aspects of the commissioning and start-up activities and production goals at the Lindero Mine were not achieved in 2020 and as a result the performance-based cash incentive for the VP Project Development was reduced. Based on the foregoing factors, and on the personal performance of our NEOs for 2020, annual performance-based cash incentives for the financial year ended December 31, 2020 were determined in March 2021 and paid to NEOs as follows:

NEO | | Annual Performance-Based Cash Incentive Amount | | | Achievement Level Percentage | |

| Jorge Ganoza Durant, President & CEO | | $ | 440,016 | | | | 89.0 | % |

| Luis Ganoza Durant, CFO | | $ | 272,051 | | | | 96.8 | % |

| Manuel Ruiz-Conejo, VP Operations | | $ | 184,937 | | | | 85.5 | % |

| Jose Pacora, VP Project Development | | $ | 511,408 | | | | 78.5 | % |

| David Volkert, VP Exploration | | $ | 180,496 | | | | 93.4 | % |

Medium- and Long-Term Incentives

Stock Option Plan

The Stock Option Plan is designed to be competitive within the natural resource industry, and its objective is to align the interests of the Company’s personnel with shareholders by linking compensation to the longer term performance of Common Shares, and to provide our personnel with a significant incentive to continue and increase their efforts in advancing the Company’s operations. Incentive stock options have been a significant component of executive compensation as it allows the Company to reward each individual’s efforts to increase shareholder value without requiring the use of the Company’s cash reserves.

Incentive options have been granted annually since the establishment of the Stock Option Plan in 2011 through 2015, and in 2017 and 2018. However, during the years ended December 31, 2019 and 2020, no stock options were granted. When stock options are granted they generally have a term of five years and have a vesting restriction of 50% exercisable after one year and 100% exercisable after two years from the date of grant. Upon vesting, the holder of an option is free to exercise and sell the underlying Common Shares subject to applicable securities laws. It is the Company’s policy to not re-price outstanding stock options.

The Company does not have a policy in respect of holding or retention periods for exercised stock options.

Since 2013, non-executive directors are no longer granted incentive stock options, rather they receive equity-based compensation through DSUs.

The Stock Option Plan was approved by the shareholders on May 26, 2011, as subsequently amended and restated effective March 1, 2015. The material terms of the Stock Option Plan are summarized as follows:

| 1. | options may be granted under the Stock Option Plan to such directors, officers, employees and service providers of Fortuna or its subsidiaries as the Board may from time to time designate; |

| 2. | the Stock Option Plan reserves a maximum of 12,200,000 Common Shares for issuance on exercise of options (representing 6.62% of the issued and outstanding Common Shares as at December 31, 2020); |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 15 |

| 3. | Fortuna currently has options outstanding to purchase 1,013,943 Common Shares (0.55% of Fortuna’s current issued share capital) and as a result of option exercises and cancellations since the Stock Option Plan was established, the total number of Common Shares underlying options that are currently available for future grants is 2,092,236 (1.13% of Fortuna’s current issued share capital); |

| 4. | the number of options granted to independent directors in any 12 month period cannot exceed 1% of Fortuna’s total issued and outstanding securities (the Company has not issued stock options to independent directors since 2013); |

| 5. | the number of Common Shares reserved for issuance to any one individual in any 12 month period may not exceed 5% of the issued capital, unless Fortuna has obtained disinterested shareholder approval; |

| 6. | the number of Common Shares underlying options: (i) issued to insiders of the Company, within any one year period, and (ii) issuable to insiders of Fortuna, at any time, under the Stock Option Plan, or when combined with all of Fortuna’s other security-based compensation arrangements, cannot exceed 10% of Fortuna’s total issued and outstanding securities, respectively; |

| 7. | the minimum exercise price of an option shall not be less than the closing price of the Common Shares as traded on the TSX on the last trading day immediately preceding the date of the grant of the option, provided that in the event that the Common Shares are not listed on the TSX at the time of the grant, the option exercise price shall not be less than: (i) the price allowed by any other stock exchange or regulatory authority having jurisdiction, or (ii) if the Common Shares are not listed for trading on any other stock exchange, the fair market value of the Fortuna Shares as determined by the Board; |

| 8. | the exercise price of an option may not subsequently be reduced; |

| 9. | options will be granted for a period of up to 10 years, subject to extension in the event of a self-imposed “black out” or similar period imposed under any insider trading policy or similar policy of the Company (in such case the end of the term of the options will be the tenth business day after the end of such black out period), and may have vesting restrictions if and as determined by the Board at the time of grant; |

| 10. | options are non-assignable and non-transferable; |

| 11. | unless otherwise determined by the Board, a vested option is exercisable for up to 90 days from the date the optionee ceases to be a director, officer, employee or service provider of Fortuna or of its subsidiaries, unless: (i) such optionee was terminated for cause, in which case the option shall be cancelled, or (ii) if an optionee dies, the legal representative of the optionee may exercise the option for up to one year from the date of death; |

| 12. | unless otherwise determined by the Board, if an optionee’s employment or service with Fortuna is terminated by Fortuna without cause, by the optionee for “Good Reason” (as defined in the Stock Option Plan) or due to disability or death, a portion of the unvested options held by such optionee shall immediately vest according to a set formula; |

| 13. | unless otherwise determined by the Board, where an optionee’s employment is terminated by Fortuna within 12 months after a change of control of Fortuna, the optionee resigns for Good Reason within 12 months after a change of control, or if the optionee dies while performing his or her regular duties as a director, officer and/or employee of Fortuna of its subsidiaries, then all of his or her outstanding options shall immediately vest; |

| 14. | the Stock Option Plan contains a provision that allows the Board to amend the Stock Option Plan, without shareholder approval, in such manner as the Board, in its sole discretion, determine appropriate. The Board may make amendments: for the purposes of making formal minor or technical modifications to any of the provisions of the Stock Option Plan; to correct any ambiguity, defective provisions, error or omission in the provisions of the Stock Option Plan; to change any vesting provisions of options; to change the termination provisions of the options or the Stock Option Plan; to change the persons who qualify as eligible directors, officers, employees and service providers under the Stock Option Plan; to add a cashless exercise feature to the Stock Option Plan; and to extend the term of any option previously granted under the Stock Option Plan. However, shareholder approval shall be obtained to any amendment to the Stock Option Plan that results in an increase in the number of Common Shares issuable pursuant to the Stock Option Plan, an extension of the term of an option, any amendment to remove or exceed the insider participation limit discussed in paragraph 6 above, or amendments to the amending provision in the Stock Option Plan; |

| 15. | there are provisions for adjustment in the number of Common Shares issuable on exercise of options in the event of a share consolidation, split, reclassification or other relevant change in Fortuna’s corporate structure or capitalization; and |

| 16. | Fortuna may withhold from any amount payable to an optionee such amount as may be necessary so as to ensure that Fortuna will be able to comply with the applicable provisions of any federal, provincial, state or local law relating to the withholding of tax or other required deductions. |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 16 |

Share Unit Plan

Overview

In November 2010, the Board, on the recommendation of the Compensation Committee, established the Share Unit Plan which initially provided for the granting of RSUs only, but was amended in March 2015 to include PSUs. The purposes of the Share Unit Plan are to promote a greater alignment of interests between officers and employees of the Company and the shareholders of the Company, to associate a portion of officer and employee compensation with the returns achieved by shareholders of the Company over the medium term, and to attract and retain officers and employees with the knowledge, experience and expertise required by the Company. The Board may award such number of RSUs or PSUs (“Share Units”) to an eligible officer or employee (a “Grantee”) to provide appropriate equity-based compensation for the services that he or she renders to the Company.

In 2017, the Board approved, on the recommendation of the Compensation Committee, and the shareholders subsequently ratified, amendments to the Share Unit Plan which permit the Board to grant RSUs and PSUs that will be settled in Common Shares, or a mix of Common Shares and cash, rather than purely in cash. The purpose of these amendments was to better align executive compensation with the interests of the Company’s shareholders, to reduce the mark-to-market effect of cash-settled Share Units on the Company’s financial results, and to bring the terms of the Company’s Share Units in line with those granted by its peers.

On April 20, 2020, the Board approved, on the recommendation of the Compensation Committee, and the shareholders subsequently ratified, an amendment to the Share Unit Plan which reduced the number of shares that can be issued upon vesting of Share Units at the time of grant from 5% to 2.25%. This amendment was made to better align the Share Unit Plan with governance best practices.

The number of Common Shares issuable under the Share Unit Plan is limited to a fixed maximum percentage of 2.25% of the issued and outstanding Common Shares from time to time, provided that, in combination with all other security-based compensation arrangements of the Company, the aggregate number of Common Shares issuable thereunder will not exceed 10% of the issued and outstanding Common Shares from time to time. The maximum number of Common Shares issuable under the Share Unit Plan to insiders of the Company, in combination with all other security-based compensation arrangements of the Company, at any time will not exceed 10% of the issued and outstanding Common Shares, and the number of securities to be issued to insiders of the Company pursuant to such arrangements within any one-year period will not exceed 10% of the issued and outstanding Common Shares. The maximum number of Common Shares issuable under the Share Unit Plan to any one individual, together with any Common Shares issuable pursuant to any other security-based compensation arrangement of the Company, will not exceed 2% of the total number of issued and outstanding Common Shares from time to time which equaled 3,683,915 Common Shares as at December 31, 2020. The Share Unit Plan also requires that shareholder approval be obtained for certain amendments in accordance with the requirements of the TSX, including in the event of an increase in the maximum number of Common Shares issuable under the Share Unit Plan or an extension of the expiry date for the Share Units granted under the Share Unit Plan (see “Amendments” below for further details).

There were currently 2,044,653 Common Shares issuable pursuant to share-settled Share Units granted under the Share Unit Plan (1.10% of the Company’s current issued share capital) and as a result of the settlement of share units and cancellations since the Share Unit Plan was established, the total number of Common Shares underlying Share Units that are currently available for future grants is 2,124,978 (1.15% of the Company’s current issued share capital).

We grant a balanced number of time-vested RSUs and PSUs to our executives through annual grants. The PSUs have performance targets which are related solely to three-year Total Shareholder Return (50% of PSUs) and Return on Assets (50% of PSUs) which is intended to further align management of our business with long-term shareholder interest. Due to the uncertainties around the impact and the duration of the COVID-19 pandemic on the Company’s business and operations, when the production guidance for 2020 was withdrawn the individual annual performance scorecards for NEOs which include corporate performance metrics for 2020 were suspended. As a result, it was not deemed appropriate in the circumstances to grant PSUs for 2020.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 17 |

On the recommendation of the Compensation Committee, the Board approved the granting of an aggregate of 1,871,427 RSUs during the 2020 financial year to the officers and key employees of the Company which had a vesting restriction of 20% one year after granting, 30% two years after granting, and the remaining 50% three years after granting.

Eligible Participants

Participation in the Share Unit Plan is restricted to employees and officers of the Company or an affiliate of the Company (each, an “Eligible Participant”).

Transferability

The rights or interests, including Share Units, of a Grantee under the Share Unit Plan may not be assigned, transferred or alienated in any way (other than to the beneficiary or estate of a Grantee, as the case may be, upon the death of the Grantee).

Administration of the Plan

The Share Unit Plan permits the Board to grant awards of Share Units to an Eligible Participant. Upon vesting, the Share Units give the Grantee a right to payment in cash in an amount equal to the fair market value of the vested Share Unit on the date of payment, less any withholding taxes. Share Units granted after the adoption of the amendments to the Share Unit Plan approved in 2017, which have vested, may be paid out in Common Shares, cash or a combination of Common Shares and cash equal to the fair market value of the vested Share Unit on the date of payment. “Fair market value” means, with respect to any particular date, the average closing price for a Common Share on the TSX on the five trading days immediately prior to that date.

Share Units shall expire if they have not vested prior to the expiry date of the Share Unit as established by the Board, which shall be no later than December 31 of the third calendar year following the end of the year in which the services to which the grant of such Share Unit relates (or where such services straddle two calendar years, the first calendar year in which the services to which the grant of such Share Units relates) were rendered. In addition, PSUs will be terminated to the extent that the performance objectives or other vesting criteria have not been met.

If a Grantee’s employment or service with the Company is terminated due to the voluntary resignation of the Grantee, then all Share Units granted to such person which have not vested prior to their resignation shall be forfeited and cancelled, and any vested Share Units credited to the Grantee’s account shall be paid out to such person as soon as practicable.

If a Grantee’s employment or service with the Company is terminated by the Company without cause, by such person for “good reason” (such as a demotion, a reduction in pay or a required relocation) or due to a disability or such person’s retirement, then: 1) such person shall be entitled to a pay out of that portion of PSUs that have vested as of the termination date, and all unvested PSUs shall be forfeited and cancelled; and 2) a fraction of such person’s unvested RSUs shall immediately vest in proportion to the number of days that such person was actively employed between the grant date and the termination date, with the remainder of the unvested RSUs held by such person being forfeited and cancelled. Any vested Share Units credited to the Grantee’s account as of the termination date shall be paid out to such person as soon as practicable.

If a Grantee is terminated for cause, such person’s Share Units, whether vested or unvested, shall be forfeited and cancelled as of the termination date. If a Grantee’s employment or service with the Company is terminated by the Company within 12 months of the occurrence of a change of control, or such person terminates his or her employment for “good reason” within 12 months after a change of control occurs, then all outstanding Share Units which have not vested shall immediately vest and be paid out.

If a Grantee’s employment or service with the Company is terminated due to the death of such person, then: 1) such person’s beneficiaries shall be entitled to be paid out that portion of the PSUs that have vested, and all unvested PSUs shall be forfeited and cancelled; and 2) a fraction of such person’s unvested RSUs shall immediately vest in proportion to the number of days that such person was actively employed between the grant date and his or her date of death, with the remainder of the unvested RSUs held by such person being forfeited and cancelled. Any vested Share Units credited to the Grantee’s account as of the date of his or her death shall be paid out to such person’s beneficiaries as soon as practicable. Notwithstanding the foregoing, if a Grantee’s employment or service with the Company is terminated due to his or her death while performing his or her regular duties as an officer or employee of the Company, then all outstanding Share Units which have not vested shall immediately vest and be paid out to such person’s beneficiaries.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 18 |

Payment of Share Units

Share Units granted after the adoption of the 2017 amendments to the Share Unit Plan which have vested, may be paid out in Common Shares, cash or a combination of Common Shares and cash equal to the fair market value of the vested Share Unit on the date of payment. Share Units are paid upon each vesting date in Common Shares, cash or a mix of Common Shares and cash, at the Board’s discretion, in an amount equal to the fair market value of the Share Units; however, the payout of PSUs is also subject to satisfaction of performance criteria.

Dividends

Share Units are not considered to be Common Shares of the Company under the Share Unit Plan, and do not entitle a Grantee to dividends.

Fractional Entitlements

No fractional Common Shares may be issued under the Share Unit Plan, before or after the amendments described hereunder.

Amendments

The Share Unit Plan may be amended, suspended or terminated by the Board, in whole or in part, at any time; provided, however, that no such amendment shall, without the consent of the Eligible Participants affected by the amendment, adversely affect the rights accrued to such Eligible Participants with respect to Share Units granted prior to the date of the amendment.

Notwithstanding the foregoing, shareholder approval shall be obtained in accordance with the requirements of the TSX for any amendment that results in:

| (a) | an increase in the maximum number of Common Shares issuable under the Share Unit Plan; |

| (b) | an amendment to the individuals designated as Eligible Participants under the Share Unit Plan; |

| (c) | an extension of the expiry date for Share Units granted under the Share Unit Plan; |

| (d) | an amendment that would permit a Share Unit to be transferable or assignable, other than by will or the laws of descent and distribution; or |

| (e) | an amendment to the amendment provisions contained in the Share Unit Plan. |

STATEMENT OF EXECUTIVE COMPENSATION | Page | 19 |

Annual Burn Rate

The table below sets out the number of Options and Share Units granted during the past three fiscal years, expressed as a percentage of the weighted average number of Fortuna Shares outstanding for the respective fiscal year:

| Type of Security | | 2020 | | | 2019 | | | 2018 | |

| Stock Options | | | Nil | | | | Nil | | | | 0.41 | % |

| Share-settled Share Units | | | 0.47 | % | | | 0.66 | % | | | 0.89 | % |

PSUs Granted in 2019

In 2019, the Board approved the following grants of PSUs (the “2019 PSUs”) to the following NEOs, which are subject solely to performance targets related 50% to three-year Total Shareholder Return and 50% to Return on Assets, which is intended to further align management of our business with long-term shareholder interest:

| NEO | | No. of 2019 PSUs | |

| Jorge Ganoza Durant, President & CEO | | | 156,900 | |

| Luis Ganoza Durant, CFO | | | 62,591 | |

| Manuel Ruiz-Conejo, VP Operations | | | 46,929 | |

| Jose Pacora, VP Project Development | | | 46,890 | |

| David Volkert, VP Exploration | | | 43,135 | |

The 2019 PSUs are subject to the corporate performance and time-vesting metrics set out below:

| Vesting/Payout Date | | Amount Vested | | | Performance Targets |

| 12 months from grant | | | 20 | % | | See the 2019 Corporate Performance Targets table below |

| 24 months from grant | | | 30 | % | | See the 2019 Corporate Performance Targets table below |

| 36 months from grant | | | 50 | % | | See the 2019 Corporate Performance Targets table below |

The 2019 PSUs are subject to a multiplier ranging from 50% to 200% depending on the achievement level of certain performance targets. See the table below.

STATEMENT OF EXECUTIVE COMPENSATION | Page | 20 |

2019 PSUs - Corporate Performance Targets The corporate performance targets set for the 2019 PSUs are as follows: |

| Category | Weight | Threshold | 50% range | 100% range | 200% range | Note |

| TSR | 50% | NA | -750 bps | 0 bps | +750 bps | Rolling 3-year TSR against GGA Primary Peer

Group |

| ROA12 | 50% | 6% | 6%<=ROA<8% | 8%<=ROA<=12% | 12%<ROA<=14% | ROA is calculated by dividing the Net Operating Profit After Taxes by the Adjusted Opening Balance of Assets for the period. Net Operating Profit After Taxes is net income adjusted for write-downs and certain non-cash, non-recurring items plus the after-tax interest expense. The Adjusted Opening Balance of Assets is based on balances as at the end of the prior fiscal period and consists of non-current assets and net working capital. Non-current assets include add-backs for any prior year impairments and other write-downs and exclude any large construction projects not contributing to net income in the fiscal year. Net working capital is current assets less cash and short term investments minus non-interest-bearing current liabilities. | Values outside 100% range calculated pro-rata based on limits corresponding to each range |

| | 100% | | | | | | | |

Notes:

1 ROA 200% range payable only if TSR>=100%