Exhibit 99.2

May 8, 2023

Fellow Shareholders:

On behalf of the Board of Directors and management of Fortuna Silver Mines Inc., I write in connection with the 2023 annual general meeting of shareholders. The meeting will be held in the Cheakamus Room, Fairmont Waterfront Hotel, 900 Canada Place, Vancouver, BC on Thursday, June 22, 2023 at 10:00 a.m. (Vancouver time).

The accompanying Management Information Circular contains important information regarding recording your votes, the directors nominated for election, our corporate governance practices, and how we compensate our executives and directors.

We encourage you to exercise your vote, either in person at the meeting, or by providing your proxy vote, either in paper form, by telephone or online.

We look forward to seeing you at the meeting.

Sincerely,

Jorge Ganoza Durant

President and Chief Executive Officer

| Management Information Circular | |

NOTIFICATION OF NOTICE AND ACCESS TO SHAREHOLDERS

AND

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the “Meeting”) of the shareholders of Fortuna Silver Mines Inc. (the “Company”) will be held in the Cheakamus Room, Fairmont Waterfront Hotel, 900 Canada Place, Vancouver, British Columbia on Thursday, June 22, 2023 at the hour of 10:00 a.m. (local time), where shareholders will be asked:

| (a) | To receive the financial statements of the Company for the fiscal year ended December 31, 2022, together with the report of the auditors thereon; |

| (b) | To appoint auditors and to authorize the directors of the Company (the “Directors”) to fix their remuneration (for further information, please see the section entitled “Particulars of Matters to be Acted Upon – Appointment and Remuneration of Auditors” in the Circular, as defined below); |

| (c) | To determine the number of Directors at eight (for further information, please see the section entitled “Particulars of Matters to be Acted Upon – Election of Directors” in the Circular); |

| (d) | To elect Directors (for further information, please see the section entitled “Particulars of Matters to be Acted Upon – Election of Directors” in the Circular); and |

| (e) | To consider, and if thought fit, pass an ordinary resolution to approve the renewal of the Company’s share unit plan (the “Share Unit Plan”) and to approve the unallocated entitlements under the Share Unit Plan (for further information, please see the section entitled “Particulars of Other Matters to be Acted Upon – Approval of the Company’s Share Unit Plan” in the Circular). |

Shareholders are also hereby notified that the Company is using the notice-and-access provisions (“Notice-and-Access”) contained in National Instrument 54-101 for the delivery to its shareholders of the proxy materials for the Meeting (the “Meeting Materials”), which include the Management Information Circular for the Meeting (the “Circular”). Under Notice- and-Access, instead of receiving paper copies of the Meeting Materials, shareholders receive this notice to advise them how to either obtain the Meeting Materials electronically or request a paper copy of the Meeting Materials.

Those shareholders with existing instructions on their account to receive paper materials will receive paper copies of the Meeting Materials with this Notice.

Accessing Meeting Materials Online

The Meeting Materials are available on the Company’s SEDAR profile located at www.sedar.com and are also available on the Company’s website at: https://fortunasilver.com/investors/shareholder-meeting-materials/. The Meeting Materials will remain on the Company’s website for one year following the date of this notice. Shareholders are reminded to access and review all of the information contained in the Circular and other Meeting Materials before voting.

Requesting Printed Meeting Materials

Registered shareholders may request a paper copy of the Meeting Materials by telephone at any time prior to the Meeting by calling toll-free at 1-866-962-0498 (or, for holders outside of North America, 1-514-982-8716) and entering the control number located on the proxy and following the instructions provided. A paper copy will be sent to you within three business days of receiving your request. To receive the Meeting Materials prior to the proxy cut-off for the Meeting, you should make your request by Thursday, June 8, 2023.

| Management Information Circular | Page | i |

Beneficial shareholders may request a paper copy by going on-line at www.proxyvote.com or by calling toll-free at 1-877- 907-7643 and entering the control number located on the voting instruction form and following the instructions provided. If you do not have a control number, please call toll-free at 1-855-887-2243. A paper copy will be sent to you within three business days of receiving your request. To receive the Meeting Materials prior to the proxy cut-off for the Meeting, you should make your request by Thursday, June 8, 2023.

For paper copy requests made on or after the date of the Meeting, all shareholders may call toll-free at 1-877-907-7643 (if you have a control number) or 1-855-887-2243 (if you do not have a control number) and a paper copy will be sent to you within 10 calendar days of receiving your request.

Shareholders may obtain a printed copy of the Meeting Materials at no cost until the date that is one year following the date of this notice by calling Broadridge toll free at 1-877-907-7643.

Voting of Proxies

Registered Shareholders

Registered shareholders will still receive a proxy form enabling them to vote at the Meeting. Such proxy will not be valid unless a completed, dated and signed form of proxy is received by Computershare Trust Company, 100 University Avenue, 8th Floor, Toronto, ON M5J 2Y1, no less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof, or, at the discretion of the Chairman, is delivered to the Chairman of the Meeting prior to commencement of the Meeting or any adjournment thereof.

Non-Registered Shareholders

Shareholders who hold common shares of the Company beneficially (“Non-Registered Holders”), but registered in the name of intermediaries, such as brokers, investment firms, clearing houses and similar entities (“Intermediaries”) may receive certain other materials from their Intermediary, such as a voting instruction form to vote their shares. If you are a Non- Registered Holder of the Company and receive these materials through your broker or through another Intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or by the other Intermediary.

| Voting Methods |  |  |  |

| Internet | Telephone or Fax | Mail |

Registered Shareholders

Shares are held in own name and represented by a physical certificate or DRS Advice | Vote online at

www.investorvote.com | Telephone: 1-866-732-8683

Fax: 1-866-249-7775 | Return the form of proxy in the enclosed envelope. |

Beneficial Shareholders

Shares held with a broker, bank or other Intermediary. | Vote online at

www.proxyvote.com | Call or fax to the number(s) listed on your voting instruction form. | Return the voting instruction form in the enclosed envelope. |

Questions

If you have any questions about Notice-and-Access and the information contained in this notice, you may obtain further information by calling Broadridge toll free at 1-855-887-2244.

| DATED the 8th day of May, 2023. | BY ORDER OF THE BOARD |

| | |

| | Jorge Ganoza Durant, |

| | President and Chief Executive Officer |

| Management Information Circular | Page | ii |

MANAGEMENT INFORMATION CIRCULAR

TABLE OF CONTENTS

| PROXIES | 1 |

| Notice-and-Access Process | 1 |

| Solicitation and Deposit of Proxies | 1 |

| Non-Registered Holders | 2 |

| Voting of Proxies | 2 |

| Revocation of Proxies | 3 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF | 3 |

| PARTICULARS OF MATTERS TO BE ACTED UPON | 3 |

| Appointment and Remuneration of Auditors | 3 |

| Election of Directors | 4 |

| Renewal of the Company’s Share Unit Plan | 9 |

| OTHER INFORMATION | 10 |

| Audit Committee Disclosure | 10 |

| Renewal of Normal Course Issuer Bid | 10 |

| Summary of Incentive Plans | 11 |

| Interest of Certain Persons in Matters To Be Acted Upon | 11 |

| Interest of Informed Persons in Material Transactions | 11 |

| Additional Information | 12 |

| Schedule “A” | Share Unit Plan |

| Schedule “B” | Statement of Executive Compensation |

| Schedule “C” | Corporate Governance |

| Management Information Circular | |

MANAGEMENT INFORMATION CIRCULAR

As at May 8, 2023

(Monetary amounts expressed in US dollars, unless otherwise indicated)

This Management Information Circular (“Circular”) is furnished in connection with the solicitation of proxies by and on behalf of the management of Fortuna Silver Mines Inc. (the “Company” or “Fortuna”) for use at the Annual General Meeting of the holders of common shares (“Common Shares”) of the Company to be held on Thursday, June 22, 2023 (the “Meeting”) and any adjournment thereof, at the time and place and for the purposes set forth in the notice of the Meeting (the “Notice of the Meeting”).

In this Circular, references to “Non-Registered Holders” means shareholders who do not hold Common Shares in their own name and “Intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Non-Registered Holders.

PROXIES

Notice-and-Access Process

The Company has elected to use the notice-and-access provisions (“Notice-and-Access”) of National Instrument 54-101 for distribution of this Circular, form of proxy (“Proxy”) and other meeting materials (the “Meeting Materials”) to registered shareholders and Non-Registered Holders of the Company.

Under Notice-and-Access, rather than the Company mailing paper copies of the Meeting Materials to shareholders, the Meeting Materials can be accessed online on the Company’s SEDAR profile at www.sedar.com or on the Company’s website at: https://fortunasilver.com/investors/shareholder-meeting-materials/. The Company has adopted this alternative means of delivery for the Meeting Materials in order to reduce paper use and the printing and mailing costs.

Shareholders will receive a “notice package” (the “Notice-and-Access Notification”) by prepaid mail, with details regarding the Meeting date, location and purpose, and information on how to access the Meeting Materials online or request a paper copy.

Shareholders will not receive a paper copy of the Meeting Materials unless they contact Broadridge at the applicable toll free number as set out in the Notice of the Meeting. Provided the request is made prior to the Meeting, Broadridge will mail the requested materials within three business days. Requests for paper copies of the Meeting Materials should be made by June 8, 2023 in order to receive the Meeting Materials in time to vote before the Meeting.

Shareholders with questions about Notice-and-Access may contact Broadridge toll-free at 1-855-887-2244.

Solicitation and Deposit of Proxies

While it is expected that the solicitation will be primarily by Notice-and-Access and mail, Proxies may be solicited personally or by telephone by the directors and regular employees of the Company. All costs of solicitation will be borne by the Company. We have arranged for Intermediaries to forward the Notice-and-Access Notification to Non-Registered Holders of Common Shares held as of record by those Intermediaries and we may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

The individuals named in the Proxy are directors of the Company, senior management and the Corporate Secretary of the Company. A shareholder wishing to appoint some other person (who need not be a shareholder) to represent him or her at the Meeting has the right to do so, either by inserting such person’s name in the blank space provided in the Proxy and striking out the two printed names or by completing another form of proxy. The Proxy will not be valid unless the completed, dated and signed form of proxy is received by Computershare Trust Company, 100 University Avenue, 8th Floor, Ontario M5J 2Y1, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof, or, at the discretion of the Chairman, is delivered to the Chairman of the Meeting prior to commencement of the Meeting or any adjournment thereof.

| Management Information Circular | Page | 1 |

Non-Registered Holders

Only registered holders of Common Shares or the persons they appoint as their proxyholders are permitted to vote at the Meeting. In many cases, however, Common Shares beneficially owned by a Non-Registered Holder are registered either:

| (a) | in the name of an Intermediary that the Non-Registered Holder deals with in respect of the shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans, or |

| (b) | in the name of a clearing agency, such as The Canadian Depository for Securities Limited (CDS), of which the Intermediary is a participant. |

There are two kinds of Non-Registered Holders – those who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company, referred to as “Non-Objecting Beneficial Owners”, and those who have objected to their Intermediary disclosing ownership information about themselves to the Company, referred to as “Objecting Beneficial Owners” (“OBOs”).

In accordance with the requirements of NI 54-101, the Company will distribute the Notice-and-Access Notification to Intermediaries and clearing agencies for onward distribution to all Non-Registered Holders. Intermediaries are required to forward the Notice-and-Access Notification to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive Meeting Materials. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Holders. The Company intends to pay for the delivery to OBOs, by Intermediaries, of any proxy-related materials and Form 54-101F7 – Request for Voting Instructions made by Intermediary for the Meeting.

Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will be sent a voting instruction form which must be completed, signed and returned by the Non-Registered Holder in accordance with the Intermediary’s directions on the voting instruction form. In some cases, such Non-Registered Holders will instead be given a Proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. This form of proxy does not need to be signed by the Non-Registered Holder, but, to be used at the Meeting, needs to be properly completed and deposited with Computershare Trust Company as described under “Solicitation and Deposit of Proxies” above.

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares that they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the Proxy and insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form.

Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies, including instructions regarding when and where the voting instruction form or Proxy form is to be delivered.

Voting of Proxies

Common Shares represented by any properly executed Proxy will be voted or withheld from voting on any ballot that may be called for in accordance with the instructions given by the shareholder. In the absence of such direction, such Common Shares will be voted in favour of the matters set forth herein.

The Proxy, when properly completed and delivered and not revoked, confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of the Meeting, and with respect to other matters which may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of the Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the Proxy to vote in accordance with their best judgment on such matters or business. As at the date hereof, the management of the Company knows of no such amendment, variation or other matter that may come before the Meeting.

| Management Information Circular | Page | 2 |

Revocation of Proxies

A shareholder who has given a Proxy may revoke it by an instrument in writing executed by the shareholder or by his or her attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered either to the registered office of the Company, 200 Burrard Street, Suite 650, Vancouver, British Columbia, V6C 3L6, at any time up to and including the last business day preceding the day of the Meeting, or if adjourned, any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or, if adjourned, any reconvening thereof or in any other manner provided by law. A revocation of a Proxy does not affect any matter on which a vote has been taken prior to the revocation.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As at the record date of May 8, 2023 (the “Record Date”), the Company had issued and outstanding 290,882,649 fully paid and non-assessable Common Shares, each share carrying the right to one vote. The Company has no other classes of voting securities.

Holders of Common Shares as at the Record Date who either personally attend the Meeting or who have completed and delivered a Proxy or VIF in the manner and subject to the provisions described above shall be entitled to vote or to have their Common Shares voted at the Meeting.

To the knowledge of the directors and officers of the Company, as at the Record Date, no person or company directly or indirectly beneficially owns or exercises control or direction over Common Shares carrying more than 10% of the voting rights attached to all outstanding Common Shares of the Company, other than:

| Name | | No. of Common Shares | | | % of Outstanding Common Shares |

| Van Eck Associates Corporation | | | 30,690,608 | | | | 10.55% |

PARTICULARS OF MATTERS TO BE ACTED UPON

To the knowledge of the Board of directors of the Company (the “Board”), the only matters to be brought before the Meeting are those matters set forth in the Notice of the Meeting, as more particularly described as follows:

Appointment and Remuneration of Auditors

Effective July 13, 2017, KPMG LLP, Chartered Professional Accountants, were appointed as auditors of the Company. The management of the Company will recommend to the Meeting to appoint KPMG LLP as auditors of the Company for the ensuing year, and to authorize the directors to fix their remuneration.

Recommendation: Management of the Company recommends that Shareholders VOTE FOR the appointment of KPMG LLP as Fortuna's auditors and authorizing the directors to fix their remuneration.

Proxies: Unless otherwise instructed, Proxies in favour of the management designees will VOTE FOR the appointment of KPMG LLP as Fortuna's auditors and authorizing the directors to fix their remuneration.

| Management Information Circular | Page | 3 |

Election of Directors

The Board presently consists of eight directors. Shareholders will be asked at the Meeting to determine the number of directors at eight, and to elect eight directors. The term of office for all the current directors will expire on the date of the Meeting. The persons named below (the “Director Nominees”) will be presented for election at the Meeting as management’s nominees and the persons named in the Proxy intend to vote for the election of these nominees. Management does not contemplate that any of these nominees will be unable to serve as a director. Each director elected will hold office until the next annual general meeting of the Company or until his or her successor is elected or appointed, unless his or her office is earlier vacated in accordance with the Articles of the Company, or with the provisions of the British Columbia Business Corporations Act.

| Recommendation: Management of the Company recommends that Shareholders VOTE FOR the election of each of the Director Nominees. |

| Proxies: Unless otherwise instructed, Proxies in favour of the management designees will VOTE FOR the ordinary resolution for the election of the eight Director Nominees |

Information regarding the Director Nominees is set out below:

JORGE GANOZA DURANT - Director, President and Chief Executive Officer Jorge Ganoza Durant is a geological engineer with over 25 years of experience in mineral exploration, mining and business development throughout Latin America. He is a graduate from the New Mexico Institute of Mining and Technology. He is a fourth generation miner from a Peruvian family that has owned and operated underground gold, silver and polymetallic mines in Peru and Panama. Before co- founding Fortuna in 2004, Jorge was involved in business development at senior levels for several private and public Canadian junior mining companies working in Central and South America. |  |

Residence: Age: | Lima, Peru 53 | Principal Occupation: President and CEO of the Company | | Areas of Expertise: Strategy and Leadership Operations and Exploration Risk Management Corporate Governance Metals and Mining Safety, Sustainability and ESG Finance Human Capital Management Financial Literacy International Business |

| | | | | |

| Independent: | No | Equity Ownership: | | |

| Director since: | December 2, 2004 | | Number | Value * |

| 2022 vote results: | 99.26% in favour | Common Shares | 2,377,418 | $9,248,156 |

| | | RSUs (cash-settled) | 494,359 | $1,923,057 |

| | | PSUs (share-settled) | 694,365 | $2,701,080 |

| | | | 3,566,142 | $13,872,292 |

| 2022 Meeting Attendance: | Mr. Ganoza meets the Company’s minimum equity ownership requirements. |

| Board: | 7 of 7 |

| Overall: | 100% | | Spanish Language |

Other Public Boards: Nil | | * Based on $3.89 per share, being the closing price of the Common Shares on the NYSE as at May 8, 2023 | | Diverse Perspectives |

| | | | | | |

| | | | | | | |

| Management Information Circular | Page | 4 |

DAVID LAING - Director; Chair of the Board; Chair of Sustainability Committee; Member of Compensation Committee. David Laing is a mining engineer with over 35 years of experience in the industry. He was the COO of Equinox Gold Corp. and predecessors from August 2016 to November 2018, and was the COO of Luna Gold from August 2016 to March 2017 when it merged with JDL Gold i to form Trek Mining. Before joining Luna Gold, David was the COO of True Gold, which developed the Karma gold mine in Burkina Faso and was acquired by Endeavour Mining in April 2016. Prior to joining True Gold, David was COO and EVP of Quintana Resources Capital, a base metals streaming company. David was also one of the original executives of Endeavour Mining, a gold producer in West Africa. Prior to these roles, David held senior positions in mining investment banking at Standard Bank in New York, technical consulting at MRDI in California, the Refugio project at Bema Gold Corp., and various roles at Billiton with operations in Peru, South Africa, and northern Chile. |  |

Residence: Age: | BC, Canada 67 | Principal Occupation: Mining Engineer; Independent Mining Consultant | | Areas of Expertise: Strategy and Leadership Operations and Exploration Risk Management Corporate Governance Metals and Mining Safety, Sustainability and ESG Finance Human Capital Management Financial Literacy |

| | | | | |

| Independent: | Yes | Equity Ownership: | | |

| Director since: | September 26, 2016 | | Number | Value * |

| 2022 vote results: | 76.42% in favour | Common Shares | 74,150 | $288,444 |

| | | DSUs (cash-settled) | 145,801 | $567,166 |

| | | | 219,951 | $855,609 |

| 2022 Meeting Attendance: | Mr. Laing meets the Company’s minimum equity ownership requirements. * Based on $3.89 per share, being the closing price of the Common Shares on the NYSE as at May 8, 2023 |

| Board: | 7 of 7 |

| Committees: | 8 of 8 | | International Business |

| Independent Directors: | 7 of 7 | | Spanish Language |

| Overall: | 100% | | Diverse Perspectives |

| | | | | | |

Other Public Boards: Arizona Sonoran Copper Company Inc. (TSX); Blackrock Silver Corp. (TSX Venture Exchange; FSE; OTC); Northern Dynasty Minerals Ltd. (TSX; NYSE American) |

| | | | | | | |

MARIO SZOTLENDER - Director and Member of Sustainability Committee Mario Szotlender is a co-founder of Fortuna Silver Mines Inc. He holds a degree in international relations and is fluent in several languages. He has successfully directed Latin American affairs for numerous private and public companies over the past 20 years, specializing in developing new business opportunities and establishing relations within the investment community. He has been involved in various mineral exploration and development joint ventures (precious metals and diamonds) in Central and South America, including heading several mineral operations in Venezuela, such as Las Cristinas in the 1980s. He was President of Mena Resources Inc. until it was purchased by Rusoro Mining Ltd., of which he was also President. |  |

Residence: Age: | Caracas, Venezuela

61 | Principal Occupation: Independent Consultant and Director of public resource companies | | Areas of Expertise: Strategy and Leadership Operations and Exploration Risk Management Corporate Governance Metals and Mining Safety, Sustainability and ESG Finance Human Capital Management Financial Literacy |

| | | | | |

| Independent: | No | Equity Ownership: | | |

| Director since: | June 16, 2008 | | Number | Value * |

| 2022 vote results: | 98.97% in favour | Common Shares | 171,700 | $667,913 |

| | | DSUs (cash-settled) | 306,105 | $1,190,748 |

| | | | 477,805 | $1,858,661 |

| 2022 Meeting Attendance: | Mr. Szotlender meets the Company’s minimum equity ownership requirements. * Based on $3.89 per share, being the closing price of the Common Shares on the NYSE as at May 8, 2023 |

| Board: | 7 of 7 |

| Committees: | 5 of 5 | | International Business |

| Overall: | 100% | | Spanish Language |

| | | | Diverse Perspectives |

Other Public Boards: Atico Mining Corp. (TSX Venture Exchange); Endeavour Silver Corp. (TSX and NYSE); Radius Gold Inc. (TSX Venture Exchange) |

| | | | | | | |

| Management Information Circular | Page | 5 |

DAVID FARRELL - Director; Chair of CG&N and Compensation Committees; Member of Audit Committee David Farrell is a Corporate Director, with over 25 years of corporate and mining experience, and has negotiated, structured and closed more than $25 billion worth of M&A and structured financing transactions for natural resource companies. Previously, he was President of Davisa Consulting, a private consulting firm working with global mining companies. Prior to founding Davisa, he was Managing Director of Mergers & Acquisitions at Endeavour Financial, working in Vancouver and London. Prior to Endeavour Financial, David was a lawyer at Stikeman Elliott, working in Vancouver, Budapest and London. Mr. Farrell graduated from the University of British Columbia with a B.Comm. (Honours, Finance) and an LL.B. and has earned his ICD.D designation from the UofT Rotman School of Management and the Institute of Corporate Directors. |  |

Residence: Age: | BC, Canada 54 | Principal Occupation: Corporate Director; President of Davisa Consulting (private consulting) | | Areas of Expertise: Strategy and Leadership Risk Management Corporate Governance Metals and Mining Finance Human Capital Management Financial Literacy International Business |

| | | | | |

| Independent: | Yes | Equity Ownership: | |

| Director since: | July 15, 2013 | | Number | Value * |

| 2022 vote results: | 82.87% in favour | Common Shares | 15,000 | $58,350 |

| | | DSUs (cash-settled): | 289,514 | $1,126,209 |

| | | | | |

| | | | 304,514 | $1,184,559 |

| 2022 Meeting Attendance: | Mr. Farrell meets the Company’s minimum equity ownership requirements. * Based on $3.89 per share, being the closing price of the Common Shares on the NYSE as at May 8, 2023 |

Board: Committees: | 7 of 7 11 of 11 |

| Independent Directors: Overall: | 7 of 7 100% | | |

Other Public Boards: Hillcrest Energy Technologies Ltd. (CSE); Luminex Resources Corp. (TSX Venture Exchange) |

| | | | | | |

| | | | | | | |

ALFREDO SILLAU - Director; Member of Audit, Compensation and CG&N Committees Alfredo Sillau is a graduate of Harvard Business School and is Managing Partner and Director of Faro Capital, an investment management firm that manages private equity and real estate funds. Previously, Alfredo headed the business development in Peru for Compass Group, a regional investment management firm, until late 2011. As CEO of Compass, Alfredo actively took part in the structuring, promoting and management of investment funds with approximately $500 million in assets under management. |  |

Residence: Age: | Lima, Peru 56 | Principal Occupation: Managing Partner and Director of Faro Capital (investment management) | | Areas of Expertise: Strategy and Leadership Risk Management Corporate Governance Metals and Mining Finance Human Capital Management Financial Literacy International Business Spanish Language Diverse Perspectives |

| | | | | |

| Independent: | Yes | Equity Ownership: | |

| Director since: | November 29, 2016 | | Number | Value * |

| 2022 vote results: | 85.32% in favour | Common Shares | 36,502 | $141,993 |

| | | DSUs (cash-settled): | 114,750 | $446,378 |

| | | | | |

| | | | 151,252 | $588,370 |

| 2021 Meeting Attendance: | Mr. Sillau meets the Company’s minimum equity ownership requirements. * Based on $3.89 per share, being the closing price of the Common Shares on the NYSE as at May 8, 2023 |

Board: Committees: | 7 of 7 11 of 11 |

Independent Directors: Overall: | 7 of 7 100% | | |

| Other Public Boards: Nil |

| | | | | | |

| | | | | | | |

| Management Information Circular | Page | 6 |

KYLIE DICKSON - Director; Chair of Audit Committee; Member of CG&N Committee Kylie Dickson is a Canadian CPA, CA with more than 14 years’ experience working with publicly traded resource companies. She received her Bachelor of Business Administration degree in Accounting from Simon Fraser University. Until March 2020, she was Vice-President, Business Development of Equinox Gold Corp. and previously held the position of Chief Financial Officer of several mineral exploration and mining companies. Prior to her work with public companies, Ms. Dickson was an audit manager in the mining group of a major audit firm. |  |

Residence: Age: | BC, Canada 43 | Principal Occupation: Corporate Director of public resource companies | | Areas of Expertise: Strategy and Leadership Operations and Exploration Risk Management Corporate Governance Metals and Mining Finance Human Capital Management Financial Literacy International Business Diverse Perspectives |

| | | | | |

| Independent: | Yes | Equity Ownership: | |

| Director since: | August 16, 2017 | | Number | Value * |

| 2022 vote results: | 97.62% in favour | Common Shares | 3,500 | $13,615 |

| | | DSUs (cash-settled): | 116,206 | $452,041 |

| | | | | |

| | | | 119,706 | $465,656 |

| 2022 Meeting Attendance: | Ms. Dickson meets the Company’s minimum equity ownership requirements. * Based on $3.89 per share, being the closing price of the Common Shares on the NYSE as at May 8, 2023 |

Board: Committees: | 7 of 7 8 of 8 |

Independent Directors: Overall: | 7 of 7 100% | | |

| Other Public Boards: Hillcrest Energy Technologies Ltd. (CSE); Star Royalties Inc. (TSX Venture Exchange) |

| | | | | | |

| | | | | | | |

KATE HARCOURT - Director; Member of Sustainability Committee Kate Harcourt is a sustainability professional with over 30 years of experience, principally in the mining industry. She has worked with a number of mining companies and as a consultant for International Finance Corp. She received a BSc Hons, Environmental Science, from Sheffield University and a MSc Environmental Technology, from Imperial College, London, and is a Chartered Environmentalist (CEnv) and a Member of the Institution of Environmental Scientists. |

|

Residence: Age: | Wales, UK 59 | Principal Occupation: Independent Environmental and Social Advisor | | Areas of Expertise: Strategy and Leadership Risk Management Corporate Governance Metals and Mining Safety, Sustainability and ESG Finance Human Capital Management Financial Literacy International Business Diverse Perspectives |

| | | | | |

| Independent: | Yes | Equity Ownership: | |

| Director since: | July 2, 2021 | | Number | Value * |

| 2022 vote results: | 99.06% | Common Shares | Nil | $Nil |

| | | DSUs (cash-settled): | 44,998 | $175,042 |

| | | | | |

| | | | 44,998 | $175,042 |

| 2021 Meeting Attendance: | * The deadline for Ms. Harcourt to meet the Company’s minimum equity ownership requirements is July 2, 2026. |

Board: Committees: | 7 of 7 5 of 5 |

Independent Directors: Overall: | 7 of 7 100% | | |

| Other Public Boards: Condor Gold plc (TSX; AIM-LSE); Orezone Gold Corporation (TSX); Atalaya Mining plc (AIM-LSE) |

| | | | | | |

| | | | | | | |

| Management Information Circular | Page | 7 |

SALMA SEETAROO - Director Salma Seetaroo is the co-founder and chief executive officer of Cashew Coast, an integrated cashew business located in Côte d’Ivoire, with two processing factories employing over 1,000 people, primarily women, and supporting 5,000 farmers. Salma has spent over 16 years working in debt, equity and special situations investments in Africa as an investment banker. She is a member of the Global Advisory Board of the Bayes Business School, City University London, UK where she earned an Executive MBA. Salma started her career as a City solicitor with a global law firm, Norton Rose Fulbright in London. |  |

Residence: Age: | Abidjan, Côte d’Ivoire 45 | Principal Occupation: Chief Executive Officer, Cashew Coast | | Areas of Expertise: Strategy and Leadership Risk Management Corporate Governance Metals and Mining Safety, Sustainability and ESG Finance Human Capital Management Financial Literacy International Business French Language Diverse Perspectives |

| | | | | |

| Independent: | Yes | Equity Ownership: | | |

| Director since: | June 27,2022 | | Number | Value * |

| 2022 vote results: | N/A | Common Shares: | Nil | $Nil |

| | | DSUs (cash-settled): | 31,126 | $121,080 |

| | | | 31,126 | $121,080 |

| | | | | |

| 2022 Meeting Attendance: | * The deadline for Ms. Seetaroo to meet the Company’s minimum equity ownership requirements is June 27, 2027. |

Board: Independent Directors: | 4 of 4 4 of 4 |

| Overall: | 100% | | |

| Other Public Boards: | GoviEx Uranum Inc. (TSX Venture Exchange) | | | | |

| | | | | | | |

Due to a review by the United States Securities and Exchange Commission (the “SEC”) of the Company’s use of inferred resources for the calculation of depletion expense in its audited financial statements contained in the Annual Report on Form 40-F for the year ended December 31, 2015, the Company was delayed in filing its annual audited financial statements and related MD&A for the years ended December 31, 2016 and 2015, and its annual information form for the year ended December 31, 2016 (collectively, the “Annual Financial Documents”). In connection with the delayed filing of the Annual Financial Documents, the Company applied for and received on April 3, 2017 a management cease trade order (“MCTO”) from the British Columbia Securities Commission and other Canadian provincial securities regulatory authorities. The MCTO prohibited certain executive officers of the Company from trading in securities of the Company until the Company completed the required filing of the Annual Financial Documents and is current on all filing obligations.

On May 1, 2017, the Company reported that the SEC had verbally communicated it will accept the Company’s use of inferred resources for the calculation of depletion expense, provided that the Company includes additional disclosure regarding these calculations. Accordingly, the Company proceeded to finalize the Annual Financial Documents and filed them on May 15, 2017. The SEC formally concluded its review on May 17, 2017.

Due to the delay in finalizing the Annual Financial Documents, the Company was delayed in filing its interim financial statements and related MD&A for the three months ended March 31, 2017 and 2016 (together, the “Interim Financial Documents”). The Company filed the Interim Financial Documents on May 24, 2017, and the MCTO was revoked by the British Columbia Securities Commission on May 25, 2017.

On June 22, 2020, the Autorité des marches financiers and the Ontario Securities Commission each issued a cease-trade order against Algold Resources Inc. (“Algold”) for having failed to file its annual statements for the fiscal year ended December 31, 2019. The cease trade order came into effect automatically in every jurisdiction in Canada that the company was reporting pursuant to automatic reciprocity legislation. In addition, Algold filed under the Bankruptcy and Insolvency Act in February 2021. A proposal made in the context of a notice of intention was approved by the creditors and homologated by the court on March 26, 2021. Under such proposal, Algold became a wholly-owned subsidiary of Aya Gold & Silver Inc. and ceased to be a reporting issuer, effective as of June 11, 2021. Ms. Seetaroo was a director of Algold at the time the cease trade order was issued, and at the time of the bankruptcy filing.

| Management Information Circular | Page | 8 |

Advance Notice Policy

Pursuant to the Advance Notice Policy of the Company which was ratified by the shareholders in 2018, any additional director nominations by a shareholder of the Company must be received by the Company by May 23, 2023 and must be in compliance with the Advance Notice Policy. The Company will provide details of any such additional director nominations through a public announcement.

A copy of the Advance Notice Policy is available for viewing on the Company’s website and on SEDAR at www.sedar.com.

Majority Voting Policy

The Board has adopted a Majority Voting Policy for the election of directors in uncontested elections. Under this policy, if a nominee receives a greater number of votes withheld from his or her election than votes for such election, the director shall immediately tender his or her resignation to the Chairman of the Board. The Corporate Governance and Nominating Committee will consider the resignation and recommend to the Board whether or not to accept it. Any director who tenders his or her resignation may not participate in the deliberations of either the Committee or the Board. In its deliberations, the Committee will consider the following: the effect such resignation may have on the Company’s ability to comply with any applicable corporate or securities laws or any applicable governance rules and policies; whether such resignation would result in a violation of a contractual provision by the Company; the stated reasons, if any, why certain shareholders cast “withheld” votes for the director, the qualifications of the director, whether the director’s resignation from the Board would be in the best interests of the Company; whether the director is a key member of an established, active special committee which has a defined term or mandate (such as a strategic review) and accepting the resignation of such director would jeopardize the achievement of the special committee’s mandate; and any other exceptional factors that the Committee considers relevant.

The Board will review the recommendation of the Corporate Governance and Nominating Committee and determine whether to accept or reject the resignation. Within 90 days after the applicable shareholder meeting, the Company will file its decision with the Toronto Stock Exchange (“TSX”) and issue a news release disclosing the Board’s decision (and, if applicable, the reasons for rejecting the resignation). If the Board accepts any tendered resignation in accordance with the Majority Voting Policy, then the Board may proceed to either fill the vacancy through the appointment of a new director, or not to fill the vacancy and instead decrease the size of the Board.

A copy of the Majority Voting Policy is available for viewing on the Company’s website.

Renewal of the Company’s Share Unit Plan

At the Meeting, Shareholders will be asked to vote on an ordinary resolution to approve the renewal of the Company’s amended and restated share unit plan dated April 20, 2020 (the “Share Unit Plan”), pursuant to which the maximum number of shares that may be reserved under the plan is 2.25% of the issued Common Shares from time to time, and to approve the unallocated awards under the Share Unit Plan.

The purposes of the Share Unit Plan are to promote a greater alignment of interests between officers and employees of the Company and the shareholders of the Company, to associate a portion of officer and employee compensation with the returns achieved by shareholders of the Company over the medium term, and to attract and retain officers and employees with the knowledge, experience and expertise required by the Company. The Board may award such number of RSUs or PSUs to an eligible officer or employee to provide appropriate equity-based compensation for the services that he or she renders to the Company.

The Share Unit Plan provides for awards of PSUs and RSUs. Please see Schedule “B” Statement of Executive Compensation pages B-18 to B-21 which set out the history and a summary (the “Summary”) of the Share Unit Plan. All defined terms not otherwise defined in this section shall have the meanings ascribed to them in the Summary. The Summary is qualified in its entirety by reference to the full text of the Share Unit Plan which is appended as Schedule “A” to this Circular.

| Management Information Circular | Page | 9 |

Unallocated Entitlements

Pursuant to the rules and policies of the TSX, unallocated options, rights or other entitlements under an issuer’s security- based compensation arrangement that does not have a fixed maximum number of securities issuable (such as the Share Unit Plan) must be approved by a majority of the issuer’s directors and by the issuer’s shareholders every three years.

Pursuant to the Share Unit Plan, the aggregate number of Common Shares reserved for issuance upon the pay out of all Share Units granted thereunder may not exceed 2.25% of the issued and outstanding Common Shares from time to time. The maximum number of common shares issuable pursuant to the Share Units granted under the Share Unit Plan, together with all of the Company’s other share compensation arrangements, in aggregate shall not exceed 10% of the Common Shares issued and outstanding at the time of the grant. The number of unallocated entitlements is calculated by subtracting (i) the number of Common Shares issuable pursuant to outstanding share units under the Share Unit Plan from (ii) the number calculated as 2.25% of the issued and outstanding Common Shares at the time.

As at the date of this Circular, the Company had 290,882,649 Common Shares issued and outstanding and 1,896,991 Common Shares issuable under existing share unit grants representing 0.652% of the issued and outstanding Common Shares. If the Share Unit Plan is adopted, ratified and confirmed by the Shareholders and approved by the TSX, there is the potential for unallocated entitlements to a maximum of 4,647,869 Common Shares under the Share Unit Plan. The TSX has conditionally accepted the renewal of the Share Unit Plan and unallocated share unit entitlements thereunder.

If the shareholders approve the unallocated entitlements at the Meeting, the Company will next be required to seek similar approval from the shareholders no later than June 22, 2026. If the Share Unit Plan is not approved by the shareholders at the Meeting, or by the TSX, then after June 18, 2023, being the three-year expiry of the previous shareholder approval of the Company’s share unit plan, the Company may not grant share-settled Share Units under the Share Unit Plan, but will be permitted to issue Common Shares in satisfaction of the vesting of the outstanding Share Units for which Common Shares have been allocated and reserved prior to June 18, 2023. Further, if the Share Unit Plan is not approved by the shareholders at the Meeting, then after June 18, 2023 the Company will still be permitted to grant cash-settled Share Units and settle such Share Units in cash.

Unless otherwise directed, the management proxy nominees named in the accompanying form of proxy intend to vote the Common Shares represented thereby in respect of the Meeting “for” the approval of the Share Unit Plan and the approval of the unallocated entitlements.

To be effective, the following resolution to approve the Share Unit Plan and the approval of the unallocated entitlements (the “Share Unit Plan Resolution”) must be authorized and approved by a simple majority of the votes cast by holders of Common Shares present in person or represented by proxy and entitled to vote at the Meeting:

“Resolved that:

| i. | the Company’s share unit plan as amended and restated as of April 20, 2020 (the “Share Unit Plan”), as more particularly described in the Management Information Circular dated May 8, 2023, be and is hereby ratified and confirmed as the share unit plan of the Company; |

| ii. | the unallocated restricted share units and performance share units under the Share Unit Plan, as amended from time to time, be and are hereby approved and authorized, and the Company will have the ability to continue granting restricted share units and performance share units thereunder until June 22, 2026; and |

| iii. | any director or officer of the Company be and is hereby authorized and directed to execute and deliver for and in the name of and on behalf of the Company whether under its corporate seal or not, all such certificates, instruments, agreements, documents and notices and to do all such other acts and things as in such person’s opinion may be necessary or desirable for the purpose of giving effect to this ordinary resolution.” |

| Management Information Circular | Page | 10 |

Recommendation: The Board has determined that the Share Unit Plan is in the best interests of the Shareholders and unanimously recommends that Shareholders VOTE FOR the Share Unit Plan Resolution.

Proxies: Unless otherwise instructed, Proxies in favour of the management designees will VOTE FOR the Share Unit Plan Resolution.

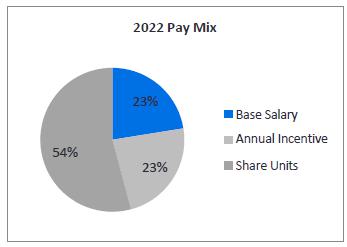

Executive Compensation & Corporate Governance

See Schedule “B” to this Circular for information regarding the Company's compensation strategy, its executive compensation philosophy and the objectives of the Company’s compensation structures. For additional information on the Director Nominees and the Company’s corporate governance practices, see Schedule “C” to this Circular.

OTHER INFORMATION

Audit Committee Disclosure

Pursuant to the provisions of National Instrument 52-110 – Audit Committees, the Company’s Annual Information Form dated March 28, 2023 (the “AIF”) includes under the heading “Audit Committee” a description of the Company’s Audit Committee and related matters. A copy of the Audit Committee charter setting out the Committee’s mandate and responsibilities is attached as a schedule to the AIF. The AIF is available for viewing at www.sedar.com.

Renewal of Normal Course Issuer Bid

In April 2023, the Board approved the renewal of a share repurchase program pursuant to a normal course issuer bid (the “NCIB”). On April 28, 2023, the Company announced the acceptance by the TSX of the Company’s NCIB to purchase up to five percent of its outstanding Common Shares. Under the NCIB, purchases of Common Shares may be made through the facilities of the TSX, the NYSE and/or alternative Canadian trading systems, commencing on May 2, 2023 and expiring on the earlier of May 1, 2024 and the date on which the Company has acquired the maximum number of Common Shares allowable under the NCIB or the date on which the Company otherwise decides not to make any further repurchases under the NCIB. The Company’s securityholders may obtain a copy of the notice of the normal course issuer bid, without charge, by contacting the Corporate Secretary of the Company by email at: info@fortunasilver.com.

| Management Information Circular | Page | 11 |

Summary of Incentive Plans

The following table sets out information regarding compensation plans under which equity securities of the Company are authorized for issuance, as at December 31, 2022:

EQUITY COMPENSATION PLAN

| |

| Plan Category | | | (a) No. of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights | | | | (b) Weighted Average Exercise

Price of Outstanding

Options, Warrants and

Rights (CAD$) | | | | (c) No. of Securities Remaining

Available for Future

Issuance under

Equity Compensation Plans

(excluding Securities

Reflected in

column (a)) | |

| Equity Compensation Plans Approved by Shareholders1: | | | | | | | | | | | | |

| Options | | | 509,468 | | | $ | 6.21 | | | | 2,441,061 | |

| Share Units | | | 1,798,588 | | | $ | 5.89 | | | | 5,341,839 | |

| Equity Compensation Plans Not Approved by Shareholders: | | | | | | | | | | | | |

| | | | N/A | | | | N/A | | | | N/A | |

| Total: | | | 2,308,056 | | | | N/A | | | | 7,782,900 | |

Notes:

| 1. | In connection with Fortuna’s acquisition of Roxgold Inc. (“Roxgold”) on July 2, 2021 by way of a court-approved plan of arrangement, Fortuna issued certain replacement options (“Legacy Options”) and assumed certain share units (“Legacy Share Units”) which continue to be governed by the terms of the stock option plan of Roxgold dated March 5, 2020 (as amended) and the restricted share unit plan of Roxgold dated December 18, 2012 (as amended). The Company does not intend to make any subsequent grants of securities under the foregoing plans. |

As at December 31, 2022, an aggregate of 127,350 Legacy Options (which entitle the holder to purchase up to 127,350 common shares of Fortuna) and 746,723 Legacy Share Units (which entitle the holder on settlement to an aggregate of up to 746,723 common shares of Fortuna or their cash equivalent, at the election of Fortuna) were outstanding. The Legacy Options and Legacy Share Units are not included in the total securities referred to in the Equity Compensation table above.

Interest of Certain Persons in Matters To Be Acted Upon

Other than as disclosed elsewhere in this Circular, none of the directors or executive officers of the Company, no proposed nominee for election as a director of the Company, none of the persons who have been directors or executive officers of the Company since the commencement of the Company’s last completed financial year and no associate or affiliate of any of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting.

Interest of Informed Persons in Material Transactions

Other than as disclosed in this Circular, no insider, proposed nominee for election as a director, or any associate or affiliate of the foregoing, had any material interest, direct or indirect, in any transaction or proposed transaction since the commencement of the Company’s last completed financial year which has materially affected or would materially affect the Company or its subsidiaries.

| Management Information Circular | Page | 12 |

Additional Information

Additional information relating to the Company is available for viewing at www.sedar.com. Financial information is provided in the Company’s financial statements and accompanying management’s discussion and analysis for the fiscal year ended December 31, 2022, and its annual information form dated March 28, 2023. Copies of these documents may be obtained by contacting the Company, attention Corporate Secretary, at 200 Burrard Street, Suite 650, Vancouver, BC V6C 3L6 (Tel: 604-484-4085; Fax: 604-484-4029).

| | BY ORDER OF THE BOARD |

| | |

| | Jorge Ganoza Durant, |

| | President and Chief Executive Officer |

| Management Information Circular | Page | 13 |

Schedule "A"

Share Unit Plan

FORTUNA SILVER MINES INC.

AMENDED AND RESTATED SHARE UNIT PLAN

April 20, 2020

| Management Information Circular | Share Unit Plan Page | A-1 |

ARTICLE 1

INTERPRETATION

The purposes of the Plan are:

| (a) | to promote a further alignment of interests between officers and employees and the shareholders of the Corporation; |

| (b) | to associate a portion of officers’ and employees’ compensation with the returns achieved for shareholders of the Corporation over the medium term; and |

| (c) | to attract and retain officers and employees with the knowledge, experience and expertise required by the Corporation. |

Whenever used in this Plan, the following words and terms have the respective meanings set out below unless the context otherwise requires:

| (a) | “Account” has the meaning ascribed thereto in Section 4.3; |

| (b) | “Affiliate” has the meaning ascribed to that term in the Securities Act (British Columbia); |

| (c) | “Applicable Law” means any applicable provision of law, domestic or foreign, including, without limitation, applicable securities legislation, together with all regulations, rules, policy statements, rulings, notices, orders or other instruments promulgated thereunder, and the rules of any stock exchange upon which the Shares are listed; |

| (d) | “Applicable Withholding Taxes” has the meaning ascribed thereto in Section 2.2(b); |

| (e) | “Beneficiary” means, subject to Applicable Law, an individual who has been designated by an Eligible Participant, in such form and manner as the Board may determine, to receive benefits payable under the Plan upon the death of the Eligible Participant, or, where no such designation is validly in effect at the time of death, or where the designated individual does not survive the Eligible Participant, the Eligible Participant’s legal representative; |

| (f) | “Board” means the board of directors of the Corporation or, if established and duly authorized to act with respect to this Plan, any committee of the board of directors of the Corporation; |

| (g) | “Cause” in respect of an Eligible Participant means: |

| (i) | the Eligible Participant committing theft, embezzlement, fraud, obtaining funds or property under false pretences or similar acts of gross misconduct with respect to the property of the Corporation or its employees or the Corporation’s customers or suppliers; |

| (ii) | the Eligible Participant entering into a guilty plea or being convicted of any crime involving fraud, misrepresentation, breach of trust or indictable offence or |

| (iii) | any other act that would constitute just cause according to Applicable Law; |

except that if, at the time of such Eligible Participant’s Termination Date, the Eligible Participant is party to an employment, severance, retention or similar contract or agreement with the Corporation or an Affiliate of the Corporation that contains a definition of the term “cause” or a similar term, the term “cause” shall have the meaning, if any, assigned thereto (or to such similar term) in such contract or agreement;

| Management Information Circular | Share Unit Plan Page | A-2 |

| (h) | “Cease Trade Date” has the meaning ascribed thereto in Section 6.9(e); |

| (i) | “Change of Control” will mean the occurrence of any of the following events: |

| (i) | the direct or indirect acquisition or conversion of more than 50% of the issued and outstanding shares of the Corporation by a person or group of persons acting in concert, other than through an employee share purchase plan or employee share ownership plan and other than by persons who are or who are controlled by, the existing shareholders of the Corporation; |

| (ii) | a change in the composition of the Board which results in the majority of the directors of the Corporation not being individuals nominated by the Corporation’s then incumbent directors, or |

| (iii) | a merger or amalgamation of the voting shares of the Corporation where the voting shares of the resulting merged or amalgamated company are owned or controlled by shareholders of whom more than 50% are not the same as the shareholders of the Corporation immediately prior to the merger. |

Notwithstanding the foregoing, if, at the time of a Change of Control, the Eligible Participant is party to an employment, severance, retention or similar contract or agreement with the Corporation or an Affiliate of the Corporation that contains a definition of the term “Change of Control” or a similar term, the term “Change of Control” shall have the meaning, if any, assigned thereto (or to such similar term) in such contract or agreement;

| (j) | “Code” means the United States Internal Revenue Code, as amended from time to time; |

| (k) | “Corporation” means Fortuna Silver Mines Inc. and includes any successor corporation thereof, and any reference in the Plan to action by the Corporation means action by or under the authority of the Board; |

| (l) | “Disability” means the Eligible Participant’s physical or mental incapacity that prevents such Eligible Participant from substantially fulfilling his or her duties and responsibilities on behalf of the Corporation or, if applicable, an Affiliate of the Corporation, and in respect of which the Eligible Participant commences receiving, or is eligible to receive, disability benefits under the Corporation’s or an Affiliate’s short-term or long-term disability plan; except that if, at any relevant time, the Eligible Participant is party to an employment, severance, retention or similar contract or agreement with the Corporation or an Affiliate of the Corporation that contains a definition of the term “disability” or a similar term, the term “disability” shall have the meaning, if any, assigned thereto (or to such similar term) in such contract or agreement; |

| (m) | “Effective Date” has the meaning ascribed thereto in Section 1.4; |

| (n) | “Eligible Participant” has the meaning ascribed thereto in Section 3.1(a); |

| (o) | “Expiry Date” means, with respect to a Grant of Share Units, the date specified in a Grant Agreement, if any, as the date on which the Share Unit will be terminated and cancelled or, if later or no such date is specified in the Grant Agreement, December 31 of the third (3rd) calendar year following the end of the year in which the services to which the grant of such Share Unit relates (or where such services straddle two (2) calendar years, the first (1st) calendar year in which the services to which the grant of such Share Units relates) were rendered; |

| Management Information Circular | Share Unit Plan Page | A-3 |

| (p) | “Fair Market Value” means, with respect to any particular date, the average closing price for a Share on the Stock Exchange on the five (5) Trading Days immediately prior to that date or, in the event of a Cease Trade Date, such other value as may be determined pursuant to Section 6.9; |

| (q) | “Good Reason” means one or more of the following changes in the circumstances of the Eligible Participant’s employment without the Eligible Participant’s express written consent: |

| (i) | a reduction or diminution in the level of authority, responsibility, title or reporting relationship of the Executive; |

| (ii) | a reduction in the Eligible Participant’s base salary or percentage of target annual bonus; or |

| (iii) | a requirement by the Board that the Eligible Participant’s position and office be based and located in another geographic location. |

| (r) | “Grant” means a grant of Share Units made pursuant to Section 4.1; |

| (s) | “Grant Agreement” means an agreement between the Corporation and an Eligible Participant under which a Share Unit is granted, as contemplated by Section 4.2, together with such schedules, amendments, deletions or changes thereto as are permitted under the Plan; |

| (t) | “Grant Date” means the effective date of a Grant; |

| (u) | “Insider” has the meaning provided for purposes of the Stock Exchange relating to Security Based Compensation Arrangements; |

| (v) | “Payment Date” means, in respect of a Grant of Share Units, the Vesting Date or such other date as may be specified in the applicable Grant Agreement pursuant to Section 4.1(c); |

| (w) | “Payout” means a payout of Vested Share Units in cash, Shares or a combination of cash and Shares, as determined by the Board, in an amount equal to the Fair Market Value of the Vested Share Unit on the Payment Date; |

| (x) | “Performance Period” means, with respect to PSUs, the period specified by the Board for achievement of any applicable Performance Conditions as a condition to Vesting; |

| (y) | “Performance Conditions” means such financial, personal, operational or transaction-based performance criteria as may be determined by the Board in respect of a Grant to any Eligible Participant and set out in a Grant Agreement. Performance Conditions may apply to the Corporation, or a subsidiary or Affiliate of the Corporation, either individually, or in any combination, and may be measured either in total, incrementally or cumulatively over a specified performance period, on an absolute basis or relative to a pre-established target or milestone, to previous years' results or to a designated comparator group, or otherwise; |

| (z) | “Person” means any individual, sole proprietorship, partnership, firm, entity, unincorporated association, unincorporated syndicate, unincorporated organization, trust, body corporate, fund, organization or other group of organized persons, government, governmental regulatory authority, governmental department, agency, commission, board, tribunal, dispute settlement panel or body, bureau, court, and where the context requires any of the foregoing when they are acting as trustee, executor, administrator or other legal representative; |

| Management Information Circular | Share Unit Plan Page | A-4 |

| (aa) | “Plan” means this Fortuna Silver Mines Inc. Amended and Restated Share Unit Plan including any Grant Agreement and all Schedules hereto, as amended from time to time in accordance with the terms; |

| (bb) | “PSU” means a right, granted to an Eligible Participant in accordance with Section 4.1, to receive a Payout, that generally becomes Vested, if at all, subject to the attainment of certain Performance Conditions and satisfaction of such other conditions to Vesting, if any, as may be determined by the Board; |

| (cc) | “RSU” means a right granted to an Eligible Participant in accordance with Section 4.1, to receive a Payout, that generally becomes Vested, if at all, following a period of continuous employment of the Eligible Participant with the Corporation or an Affiliate of the Corporation; |

| (dd) | “Retirement” means the Eligible Participant’s retirement from the Corporation or an Affiliate, as applicable, following a period of service of at least two years, provided that such retirement is accepted by the Corporation or Affiliate pursuant to a letter from the Corporation or Affiliate granting the Eligible Participant retirement status and confirming the Eligible Participant’s date of retirement; |

| (ee) | “Security Based Compensation Arrangement” has the meaning defined in the provisions of the TSX Company Manual relating to security based compensation arrangements; |

| (ff) | “Share” means a common share of the Corporation and such other share as may be substituted for it as a result of amendments to the articles of the Corporation, arrangement, reorganization or otherwise, including any rights that form a part of the common share or substituted share; |

| (gg) | “Share Unit” means either an RSU or a PSU, as the context requires; |

| (hh) | “Stock Exchange” means The Toronto Stock Exchange, or if the Shares are not listed on The Toronto Stock Exchange, such other stock exchange on which the Shares are listed, or if the Shares are not listed on any stock exchange, then on the over-the-counter market; |

| (ii) | “Termination Date” means, in respect of an Eligible Participant, the date that the Eligible Participant ceases to be actively employed by the Corporation or an Affiliate of the Corporation for any reason which, for purposes of the Plan, specifically does not mean the date on which any statutory or common law severance period or any period of reasonable notice that the Corporation or an Affiliate may be required at Applicable Law to provide to the Eligible Participant, would expire. The Board will have sole discretion to determine whether an Eligible Participant has ceased active employment and the effective date on which the Eligible Participant ceased active employment. An Eligible Participant will not be deemed to have ceased to be an employee of the Corporation or an Affiliate in the case of: |

| (i) | a transfer of his or her employment between the Corporation and an Affiliate of the Corporation or a transfer of employment between Affiliates, as applicable; |

| (iii) | any other leave of absence approved by the Corporation or an Affiliate of the Corporation, as applicable, in respect of which the Eligible Participant is guaranteed reemployment by contract or statute upon expiration of such leave, except that in the event active employment is not renewed at the end of the leave of absence, the employment relationship shall be deemed to have ceased at the beginning of the leave of absence. |

| Management Information Circular | Share Unit Plan Page | A-5 |

| (jj) | “Time Vesting Criteria” shall mean such time-based criteria as may be determined by the Board in respect of any Eligible Participant or Eligible Participants as may be specified by the Board in its sole discretion; |

| (kk) | “Trading Day” means any date on which the Stock Exchange is open for the trading of Shares and on which Shares are actually traded; |

| (ll) | “U.S. Taxpayer” means an Eligible Participant for whom the Share Units or amounts payable or provided under this Plan are subject to United States federal income taxation under the Code. Special rules applicable to U.S. Taxpayers are contained in Schedule “C”, which is attached hereto and incorporated by reference; |

| (mm) | “Vested Share Units” means Share Units that have Vested in accordance with the terms of this Plan and/or the terms of any applicable Grant Agreement; |

| (nn) | “Vested” means the applicable Time Vesting Criteria, Performance Conditions and/or any other conditions for settlement (subject to any conditions on such settlement imposed in respect of US Taxpayers under Schedule “C” hereto) in relation to a whole number, or a percentage of the number, of PSUs or RSUs determined by the Board in connection with a Grant of PSUs or Grant of RSUs, as the case may be, (i) have been met; or (ii) have been waived or deemed to be met pursuant to Section 2.1 or 4.1(c), and “Vesting” and “Vest” shall be construed accordingly; |

| (oo) | “Vesting Date” means the date on which the applicable Time Vesting Criteria, Performance Conditions and/or any other conditions for a Share Unit becoming Vested are met, deemed to have been met, or waived, as contemplated in the definition of “Vested”; and |

| (pp) | “Vesting Period” means, with respect to a Grant, the period specified by the Board, commencing on the Grant Date and ending on the last Vesting Date for Share Units subject to such Grant which, unless otherwise determined by the Board, shall not be later than December 15 of the third year following the year in which the Eligible Participant performed the services to which the Grant relates. |

| 1.3 | Construction and Interpretation |

| (a) | In this Plan, all references to the masculine include the feminine; references to the singular shall include the plural and vice versa, as the context shall require. |

| (b) | The headings of all articles, sections and paragraphs in the Plan are inserted for convenience of reference only and shall not affect the construction or interpretation of the Plan. References to “Article”, “Section” or “Paragraph” mean an article, section or paragraph contained in the Plan unless expressly stated otherwise. |

| (c) | In this Plan, “including” and “includes” mean including or includes, as the case may be, without limitation. The words “hereto”, “herein”, “hereby”, “hereunder”, “hereof” and similar expressions mean or refer to the Plan as a whole and not to any particular article, section, paragraph or other part hereof. |

| (d) | Whenever the Board is to exercise discretion in the administration of the terms and conditions of this Plan, the term “discretion” means the sole and absolute discretion of the Board. |

The Plan shall be effective as of April 20, 2020, (the “Effective Date”). All Share Units granted by the Corporation after the date of this Amended and Restated Share Unit Plan shall be granted upon and subject to the terms and conditions set forth in this Amended and Restated Share Unit Plan. All Share Units granted by the Corporation prior to the date of this Amended and Restated Share Unit Plan shall continue to be governed by the terms and conditions set forth in the version of the Corporation’s share unit plan in effect at the time of the grant of such Share Units. The Board shall review and confirm the terms of the Plan from time to time.

| Management Information Circular | Share Unit Plan Page | A-6 |

ARTICLE 2

ADMINISTRATION OF THE PLAN

| 2.1 | Administration of the Plan |

| (a) | This Plan will be administered by the Board and the Board has the sole and complete authority, in its discretion, to: |

| (i) | interpret the Plan and prescribe, modify and rescind rules and regulations relating to the Plan; |

| (ii) | correct any defect or supply any omission or reconcile any inconsistency in the Plan in the manner and to the extent it considers necessary or advisable for the implementation and administration of the Plan; |

| (iii) | exercise rights reserved to the Corporation under the Plan; |

| (iv) | determine the terms and conditions of Grants granted to any Eligible Participant, including, without limitation, (A) the type of Share Unit, (B) the number of RSUs or PSUs subject to a Grant, (C) the Vesting Period(s) applicable to a Grant, (D) the conditions to the Vesting of any Share Units granted hereunder, including terms relating to Performance Conditions, Time Vesting Criteria and/or other Vesting conditions, the Performance Period for PSUs and the conditions, if any, upon which Vesting of any Share Unit will be waived or accelerated without any further action by the Board (including, without limitation, the effect of a Change of Control and an Eligible Participant's termination in connection therewith), (E) the circumstances upon which a Share Unit shall be forfeited, cancelled or expire, (F) the consequences of a termination with respect to a Share Unit, and (G) the manner and time of exercise or settlement of Vested Share Units; |

| (v) | determine whether and the extent to which any Performance Conditions or other criteria applicable to the Vesting of a Share Unit have been satisfied or shall be waived or modified; |

| (vi) | determine the form of Payout of the Vested Share Units; |

| (vii) | prescribe forms for notices to be prescribed by the Corporation under the Plan; and |

| (viii) | make all other determinations and take all other actions as it considers necessary or advisable for the implementation and administration of the Plan. |

The Board’s determinations and actions under this Plan are final, conclusive and binding on the Corporation, the Eligible Participants and all other Persons.

| 2.2 | Taxes and Other Source Deductions |

| (a) | Except as provided in this Section 2.2, the Corporation and its Affiliates shall not be liable for any tax imposed on any Eligible Participant as a result of amounts paid or credited to such Eligible Participant under the Plan. Eligible Participants are advised to consult with their own tax adviser(s). |

| Management Information Circular | Share Unit Plan Page | A-7 |

| (b) | The Payout of a Share Unit granted under the Plan is subject to the condition that if at any time the Corporation determines, in its discretion, that the satisfaction of withholding tax or other source deductions is necessary or desirable in respect of such Payout, such Payout will not occur unless such withholding has been, or will be, effected to the satisfaction of the Corporation. |

If the Corporation is required under the Income Tax Act (Canada) or any other Applicable Law to remit to any governmental authority an amount on account of tax or other amounts it may be required by law to withhold (the “Applicable Withholding Taxes”) in connection with any amount paid or credited hereunder to an Eligible Participant, then the Eligible Participant shall:

| (i) | authorize the Corporation and any of its Affiliates, as applicable, to deduct from any amount paid or credited hereunder the Applicable Withholding Taxes, in such manner as it determines in its sole discretion; |

| (ii) | pay to the Corporation and any of its Affiliates, as applicable, sufficient cash as is determined by the Corporation or its Affiliate, as the case may be, to be the amount necessary to fund the Applicable Withholding Taxes; or |

| (iii) | make other arrangements acceptable to the Corporation and any of its Affiliates, as applicable, to fund the Applicable Withholding Taxes. |

The Corporation shall not be required to issue any Shares under the Plan unless the Eligible Participant has made suitable arrangements with the Corporation and any of its Affiliates, as applicable, to fund any withholding obligation.

Without limiting the generality of the foregoing, the Corporation and any of its Affiliates, as applicable, will have the right to deduct from payments of any kind otherwise due to the Eligible Participant any taxes of any kind required to be withheld by the Corporation or its Affiliate, as the case may be, as a result of the Eligible Participant’s participation under hereunder.

All expenses of administration of the Plan shall be borne by the Corporation as determined by the Board.

| 2.3 | Eligible Participant Information |

| (a) | Each Eligible Participant shall provide the Corporation with all information (including personal information) the Board requires in order to administer the Plan (the “Eligible Participant Information”). |

| (b) | The Corporation may from time to time transfer or provide access to Eligible Participant Information to a third party service provider for purposes of the administration of the Plan provided that such service providers will be provided with such information for the sole purpose of providing services to the Corporation in connection with the operation and administration of the Plan. The Corporation may also transfer and provide access to Eligible Participant Information to its Affiliates for purposes of preparing financial statements or other necessary reports and facilitating payment or reimbursement of Plan expenses. By participating in the Plan, each Eligible Participant acknowledges that Eligible Participant Information may be so provided and agrees and consents to its provision on the terms set forth herein. |

| (c) | The Corporation shall not disclose Eligible Participant Information except (i) as contemplated in Section 2.3(b) above, (ii) in response to regulatory filings or other requirements for the information by a governmental authority or regulatory body, or (iii) for the purpose of complying with a subpoena, warrant or other order by a court, Person or body having jurisdiction over the Corporation to compel production of the information. |

| Management Information Circular | Share Unit Plan Page | A-8 |

ARTICLE 3

PLAN PARTICIPATION

| (a) | Each employee or officer of the Corporation or an Affiliate of the Corporation who is designated by the Board, in its sole discretion, as eligible for participation in the Plan or whose contract of employment or service with the Corporation or an Affiliate specifies that he or she shall participate in the Plan and who is subsequently designated by the Board, in its sole discretion, as being eligible for participation in the Plan (an “Eligible Participant”) shall commence participation in the Plan upon such designation. |