Investor Presentation July 2018 Exhibit 99.1

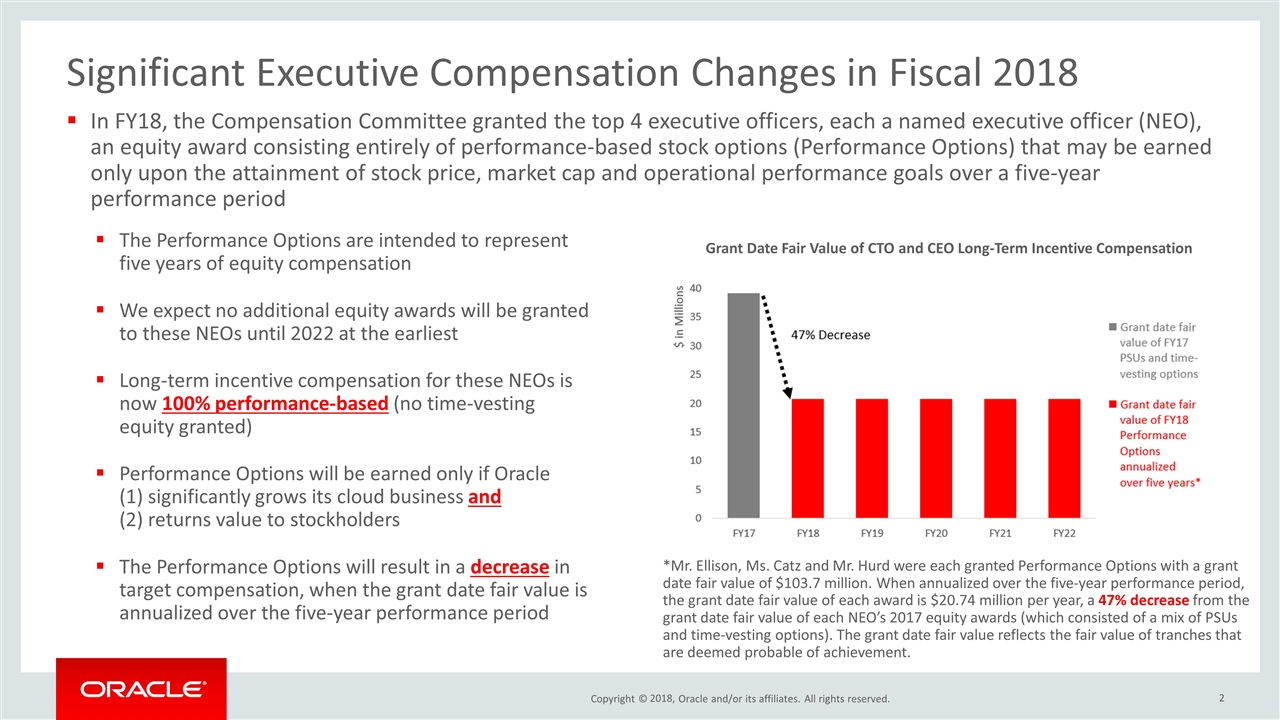

Significant Executive Compensation Changes in Fiscal 2018 In FY18, the Compensation Committee granted the top 4 executive officers, each a named executive officer (NEO), an equity award consisting entirely of performance-based stock options (Performance Options) that may be earned only upon the attainment of stock price, market cap and operational performance goals over a five-year performance period 2018, The Performance Options are intended to represent five years of equity compensation We expect no additional equity awards will be granted to these NEOs until 2022 at the earliest Long-term incentive compensation for these NEOs is now 100% performance-based (no time-vesting equity granted) Performance Options will be earned only if Oracle (1) significantly grows its cloud business and (2) returns value to stockholders The Performance Options will result in a decrease in target compensation, when the grant date fair value is annualized over the five-year performance period *Mr. Ellison, Ms. Catz and Mr. Hurd were each granted Performance Options with a grant date fair value of $103.7 million. When annualized over the five-year performance period, the grant date fair value of each award is $20.74 million per year, a 47% decrease from the grant date fair value of each NEO’s 2017 equity awards (which consisted of a mix of PSUs and time-vesting options). The grant date fair value reflects the fair value of tranches that are deemed probable of achievement. Grant Date Fair Value of CTO and CEO Long-Term Incentive Compensation

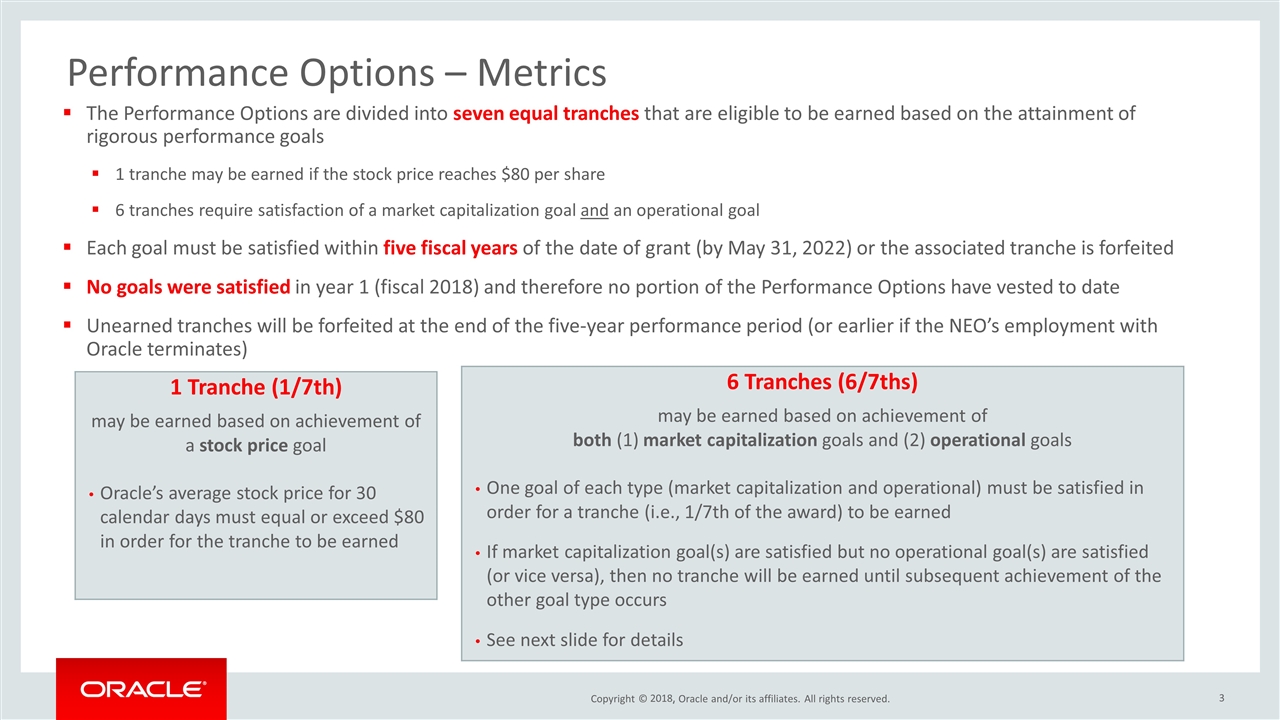

Performance Options – Metrics The Performance Options are divided into seven equal tranches that are eligible to be earned based on the attainment of rigorous performance goals 1 tranche may be earned if the stock price reaches $80 per share 6 tranches require satisfaction of a market capitalization goal and an operational goal Each goal must be satisfied within five fiscal years of the date of grant (by May 31, 2022) or the associated tranche is forfeited No goals were satisfied in year 1 (fiscal 2018) and therefore no portion of the Performance Options have vested to date Unearned tranches will be forfeited at the end of the five-year performance period (or earlier if the NEO’s employment with Oracle terminates) 2018, 1 Tranche (1/7th) may be earned based on achievement of a stock price goal Oracle’s average stock price for 30 calendar days must equal or exceed $80 in order for the tranche to be earned 6 Tranches (6/7ths) may be earned based on achievement of both (1) market capitalization goals and (2) operational goals One goal of each type (market capitalization and operational) must be satisfied in order for a tranche (i.e., 1/7th of the award) to be earned If market capitalization goal(s) are satisfied but no operational goal(s) are satisfied (or vice versa), then no tranche will be earned until subsequent achievement of the other goal type occurs See next slide for details

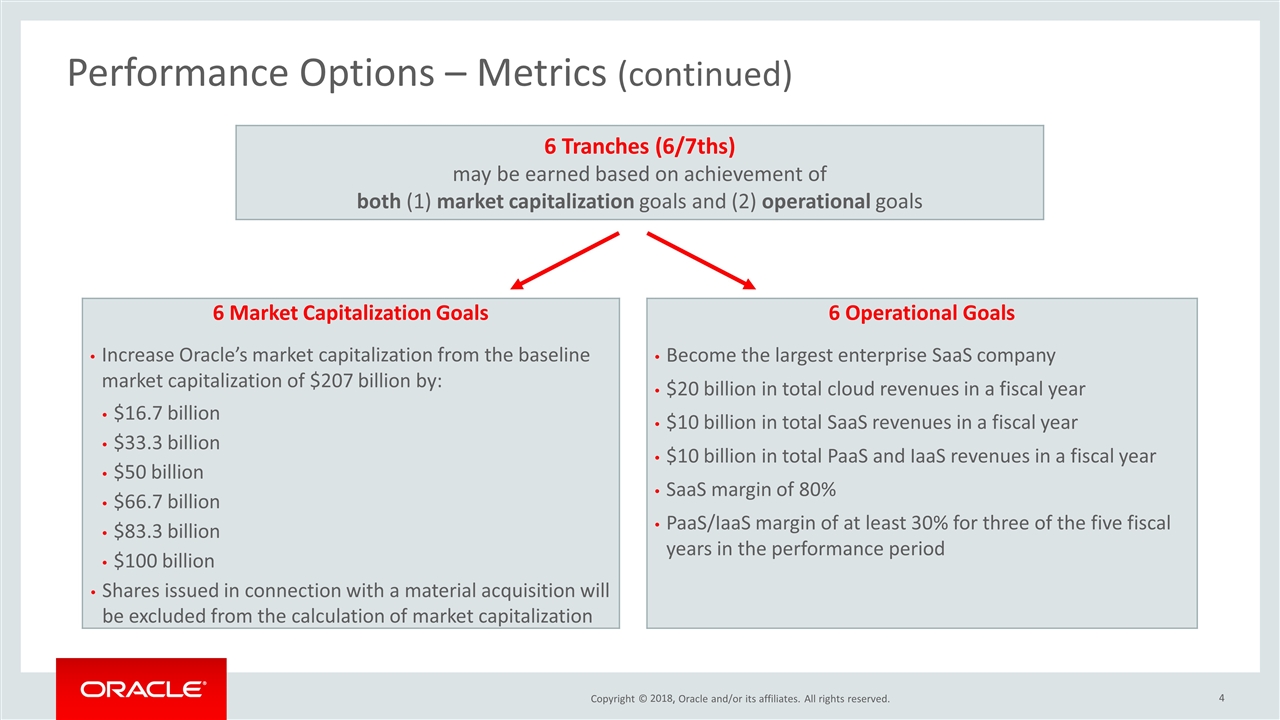

Performance Options – Metrics (continued) 2018, 6 Tranches (6/7ths) may be earned based on achievement of both (1) market capitalization goals and (2) operational goals 6 Market Capitalization Goals Increase Oracle’s market capitalization from the baseline market capitalization of $207 billion by: $16.7 billion $33.3 billion $50 billion $66.7 billion $83.3 billion $100 billion Shares issued in connection with a material acquisition will be excluded from the calculation of market capitalization 6 Operational Goals Become the largest enterprise SaaS company $20 billion in total cloud revenues in a fiscal year $10 billion in total SaaS revenues in a fiscal year $10 billion in total PaaS and IaaS revenues in a fiscal year SaaS margin of 80% PaaS/IaaS margin of at least 30% for three of the five fiscal years in the performance period

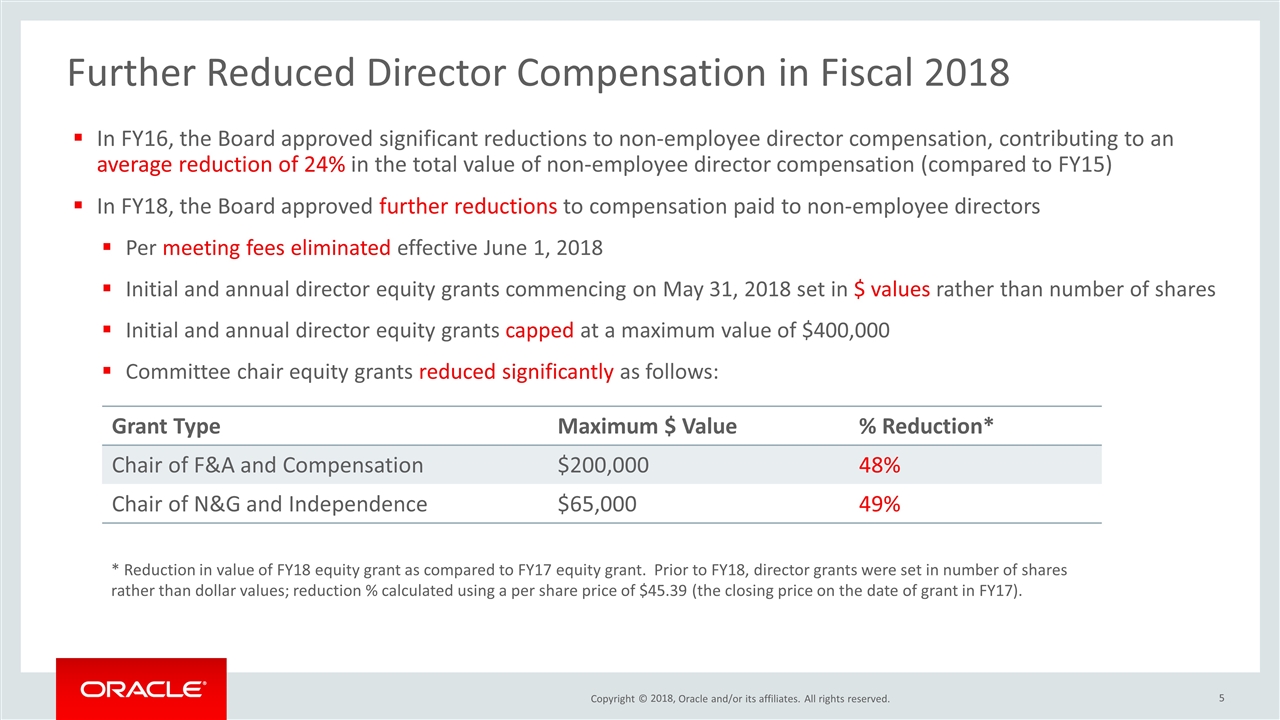

Further Reduced Director Compensation in Fiscal 2018 In FY16, the Board approved significant reductions to non-employee director compensation, contributing to an average reduction of 24% in the total value of non-employee director compensation (compared to FY15) In FY18, the Board approved further reductions to compensation paid to non-employee directors Per meeting fees eliminated effective June 1, 2018 Initial and annual director equity grants commencing on May 31, 2018 set in $ values rather than number of shares Initial and annual director equity grants capped at a maximum value of $400,000 Committee chair equity grants reduced significantly as follows: 2018, Grant Type Maximum $ Value % Reduction* Chair of F&A and Compensation $200,000 48% Chair of N&G and Independence $65,000 49% * Reduction in value of FY18 equity grant as compared to FY17 equity grant. Prior to FY18, director grants were set in number of shares rather than dollar values; reduction % calculated using a per share price of $45.39 (the closing price on the date of grant in FY17).

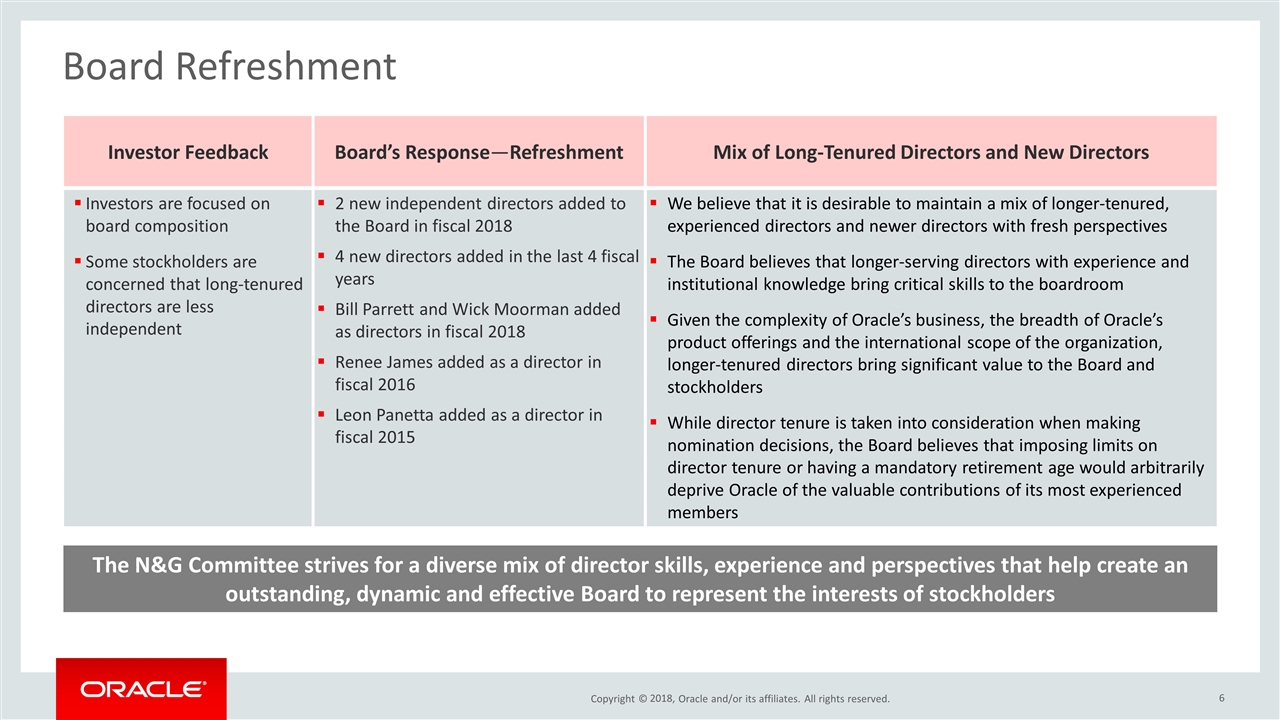

Board Refreshment The N&G Committee strives for a diverse mix of director skills, experience and perspectives that help create an outstanding, dynamic and effective Board to represent the interests of stockholders Investor Feedback Board’s Response—Refreshment Mix of Long-Tenured Directors and New Directors Investors are focused on board composition Some stockholders are concerned that long-tenured directors are less independent 2 new independent directors added to the Board in fiscal 2018 4 new directors added in the last 4 fiscal years Bill Parrett and Wick Moorman added as directors in fiscal 2018 Renee James added as a director in fiscal 2016 Leon Panetta added as a director in fiscal 2015 We believe that it is desirable to maintain a mix of longer-tenured, experienced directors and newer directors with fresh perspectives The Board believes that longer-serving directors with experience and institutional knowledge bring critical skills to the boardroom Given the complexity of Oracle’s business, the breadth of Oracle’s product offerings and the international scope of the organization, longer-tenured directors bring significant value to the Board and stockholders While director tenure is taken into consideration when making nomination decisions, the Board believes that imposing limits on director tenure or having a mandatory retirement age would arbitrarily deprive Oracle of the valuable contributions of its most experienced members 6 2018,

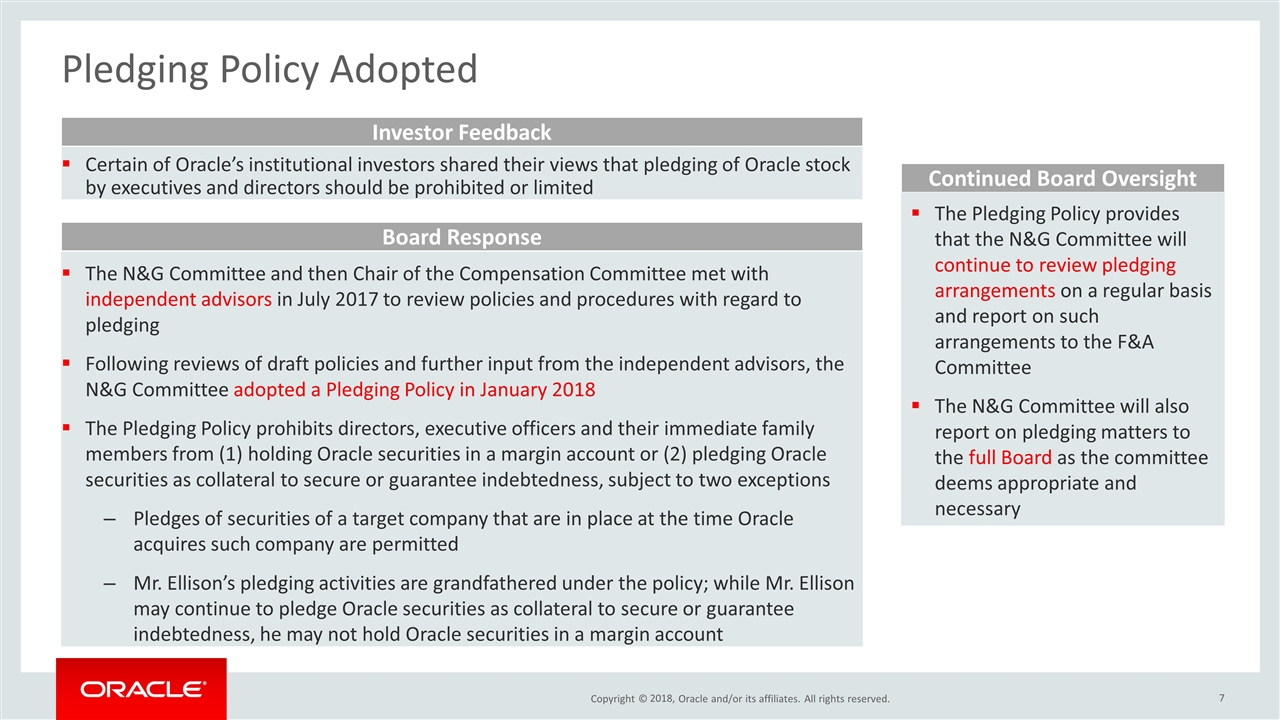

Pledging Policy Adopted Certain of Oracle’s institutional investors shared their views that pledging of Oracle stock by executives and directors should be prohibited or limited The N&G Committee and then Chair of the Compensation Committee met with independent advisors in July 2017 to review policies and procedures with regard to pledging Following reviews of draft policies and further input from the independent advisors, the N&G Committee adopted a Pledging Policy in January 2018 The Pledging Policy prohibits directors, executive officers and their immediate family members from (1) holding Oracle securities in a margin account or (2) pledging Oracle securities as collateral to secure or guarantee indebtedness, subject to two exceptions Pledges of securities of a target company that are in place at the time Oracle acquires such company are permitted Mr. Ellison’s pledging activities are grandfathered under the policy; while Mr. Ellison may continue to pledge Oracle securities as collateral to secure or guarantee indebtedness, he may not hold Oracle securities in a margin account Investor Feedback Continued Board Oversight 7 2018, Board Response The Pledging Policy provides that the N&G Committee will continue to review pledging arrangements on a regular basis and report on such arrangements to the F&A Committee The N&G Committee will also report on pledging matters to the full Board as the committee deems appropriate and necessary

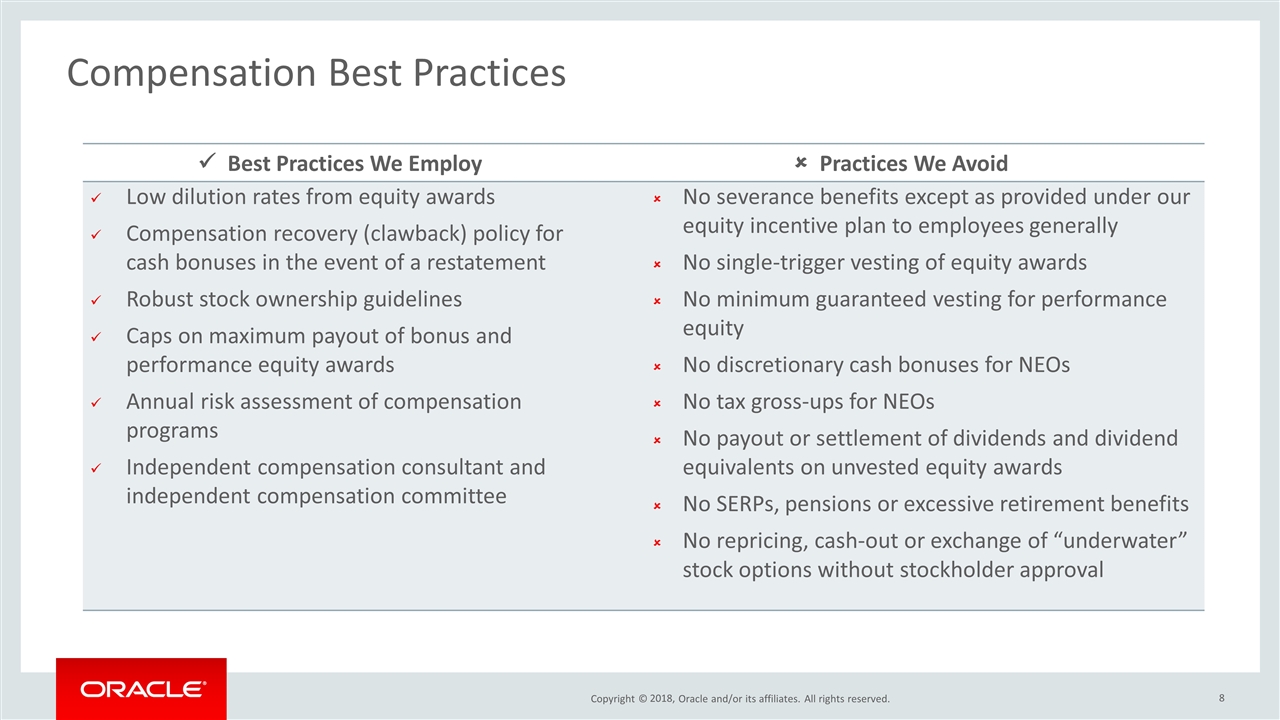

Compensation Best Practices 2018, ü Best Practices We Employ û Practices We Avoid Low dilution rates from equity awards Compensation recovery (clawback) policy for cash bonuses in the event of a restatement Robust stock ownership guidelines Caps on maximum payout of bonus and performance equity awards Annual risk assessment of compensation programs Independent compensation consultant and independent compensation committee No severance benefits except as provided under our equity incentive plan to employees generally No single-trigger vesting of equity awards No minimum guaranteed vesting for performance equity No discretionary cash bonuses for NEOs No tax gross-ups for NEOs No payout or settlement of dividends and dividend equivalents on unvested equity awards No SERPs, pensions or excessive retirement benefits No repricing, cash-out or exchange of “underwater” stock options without stockholder approval

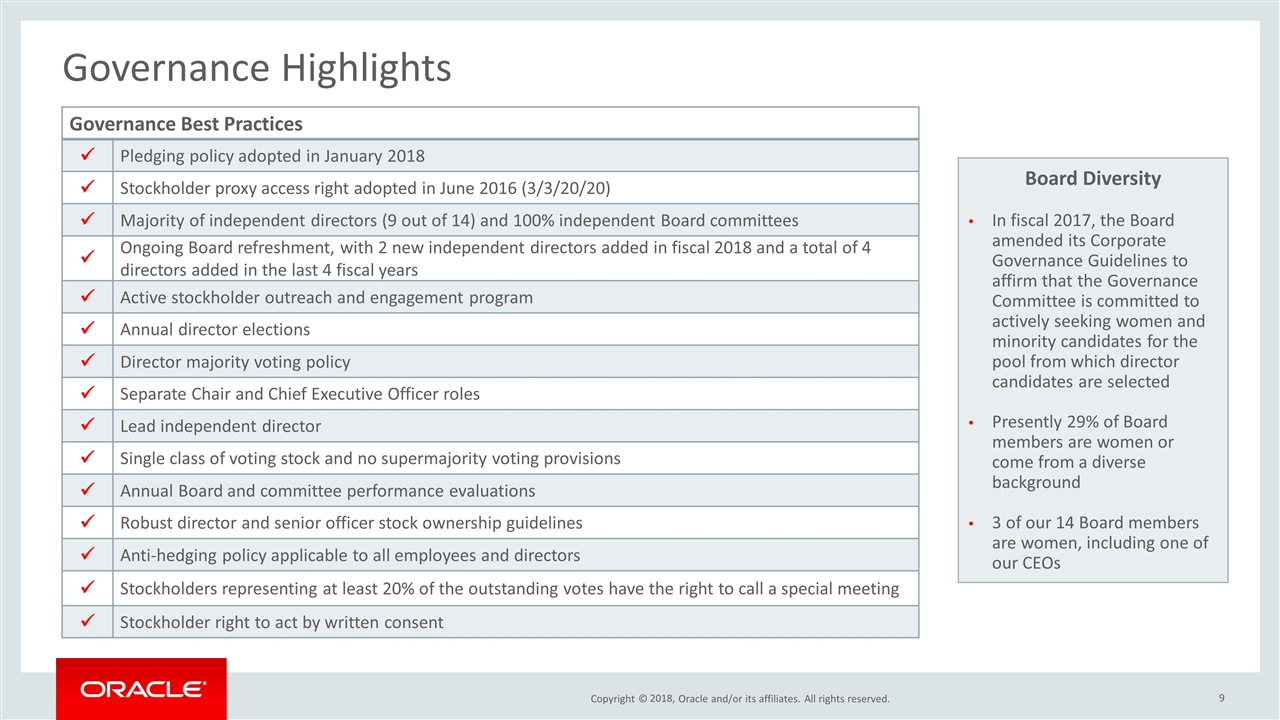

Governance Highlights 2018, Governance Best Practices ü Pledging policy adopted in January 2018 ü Stockholder proxy access right adopted in June 2016 (3/3/20/20) ü Majority of independent directors (9 out of 14) and 100% independent Board committees ü Ongoing Board refreshment, with 2 new independent directors added in fiscal 2018 and a total of 4 directors added in the last 4 fiscal years ü Active stockholder outreach and engagement program ü Annual director elections ü Director majority voting policy ü Separate Chair and Chief Executive Officer roles ü Lead independent director ü Single class of voting stock and no supermajority voting provisions ü Annual Board and committee performance evaluations ü Robust director and senior officer stock ownership guidelines ü Anti-hedging policy applicable to all employees and directors ü Stockholders representing at least 20% of the outstanding votes have the right to call a special meeting ü Stockholder right to act by written consent Board Diversity In fiscal 2017, the Board amended its Corporate Governance Guidelines to affirm that the Governance Committee is committed to actively seeking women and minority candidates for the pool from which director candidates are selected Presently 29% of Board members are women or come from a diverse background 3 of our 14 Board members are women, including one of our CEOs

Safe Harbor Statement: Statements in this presentation relating to Oracle’s future plans, expectations, beliefs, intentions and prospects are “forward-looking statements” and are subject to material risks and uncertainties. A detailed discussion of these factors and other risks that affect our business is contained in our SEC filings, including our most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.” Copies of these filings are available online from the SEC or by contacting Oracle Corporation’s Investor Relations Department at (650) 506-4073 or by clicking on SEC Filings on Oracle’s Investor Relations website at http://www.oracle.com/investor. All information set forth in this presentation is current as of July 30, 2018. Oracle undertakes no duty to update any statement in light of new information or future events. Safe Harbor Statement 2018,