This preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these notes has been filed with the Securities and Exchange Commission and is effective. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these notes and are not soliciting an offer to buy these notes in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-277990

SUBJECT TO COMPLETION, DATED JANUARY 30, 2025

Preliminary Prospectus Supplement

(To Prospectus dated March 15, 2024)

$ Floating Rate Notes due 2028

$ % Notes due 2028

$ % Notes due 2032

$ % Notes due 2035

$ % Notes due 2055

$ % Notes due 2065

Oracle Corporation is offering $ aggregate principal amount of floating rate notes due 2028 (the “Floating Rate Notes”), $ aggregate principal amount of % notes due 2028 (the “2028 Fixed Rate Notes”), $ aggregate principal amount of % notes due 2032 (the “2032 Fixed Rate Notes”), $ aggregate principal amount of % notes due 2035 (the “2035 Fixed Rate Notes”), $ aggregate principal amount of % notes due 2055 (the “2055 Fixed Rate Notes”) and $ aggregate principal amount of % notes due 2065 (the “2065 Fixed Rate Notes” and, together with the 2028 Fixed Rate Notes, the 2032 Fixed Rate Notes, the 2035 Fixed Rate Notes and the 2055 Fixed Rate Notes, the “Fixed Rate Notes”). We refer to the Floating Rate Notes and the Fixed Rate Notes collectively as the “Notes.”

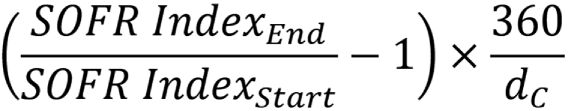

The Floating Rate Notes will bear interest at a floating rate equal to Compounded SOFR (as defined herein), plus % per year. Interest on the Floating Rate Notes will be payable quarterly on , , and , commencing , .

The 2028 Fixed Rate Notes will bear interest at the rate of % per year, the 2032 Fixed Rate Notes will bear interest at the rate of % per year, the 2035 Fixed Rate Notes will bear interest at the rate of % per year, the 2055 Fixed Rate Notes will bear interest at the rate of % per year and the 2065 Fixed Rate Notes will bear interest at the rate of % per year. Interest on the Fixed Rate Notes will be payable semi-annually on and , commencing , .

The Floating Rate Notes will mature on , 2028, the 2028 Fixed Rate Notes will mature on , 2028, the 2032 Fixed Rate Notes will mature on , 2032, the 2035 Fixed Rate Notes will mature on , 2035, the 2055 Fixed Rate Notes will mature on , 2055 and the 2065 Fixed Rate Notes will mature on , 2065.

We may not redeem the Floating Rate Notes prior to maturity. We may redeem the Fixed Rate Notes of any series, in whole or in part, at any time, each at the applicable redemption prices indicated under the heading “Description of the Notes—Optional Redemption” beginning on page S-20 of this prospectus supplement. The Notes will rank equally with all of our other existing and future unsecured and unsubordinated indebtedness from time to time outstanding.

Investing in the Notes involves risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement and see Part I, Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended May 31, 2024, which is incorporated by reference herein, for a discussion of certain risks that should be considered in connection with an investment in the Notes.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Notes or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | |

| | | Public offer

price(1) | | | Underwriting

discount | | | Proceeds before

expenses, to us | |

Floating Rate Notes | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

2028 Fixed Rate Notes | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

2032 Fixed Rate Notes | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

2035 Fixed Rate Notes | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

2055 Fixed Rate Notes | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

2065 Fixed Rate Notes | | | % | | | | % | | | | % | |

Total | | $ | | | | $ | | | | $ | | |

| | | | | | | | | | | | |

Total | | $ | | | | $ | | | | $ | | |

| | | | | | | | | | | | |

| (1) | Plus accrued interest, if any, from , 2025, if settlement occurs after that date. |

The Notes will be issued in book-entry form only, in denominations of $2,000 and multiples of $1,000 thereafter. The Notes are new issues of securities with no established trading markets. We do not intend to apply for listing of the Notes on any securities exchange.

The underwriters expect to deliver the Notes to purchasers through the book-entry delivery system of The Depository Trust Company and its participants, including Euroclear Bank S.A./N.V. and Clearstream Banking, S.A., on or about , 2025, which is the second business day following the date of this prospectus supplement. See “Underwriting” in this prospectus supplement.

Joint Book-Running Managers

| | | | | | | | |

| BofA Securities | | Citigroup | | Goldman Sachs & Co. LLC | | HSBC | | J.P. Morgan |

, 2025