Nasdaq: CELH Celsius Holdings Announces Second Quarter 2023 Financial Results Record second quarter revenue of $326 million in Q2 2023, up 112% from $154 million in Q2 2022 North American revenue increased 114% to $311 million in Q2 2023, up from $145 million in Q2 2022 *The Company reports financial results in accordance with generally accepted accounting principles in the United States (“GAAP”), but management believes that disclosure of adjusted EBITDA , a non-GAAP financial measure, may provide users investors with additional insights into operating performance. Reconciliations of this non-GAAP meas- ure to the most directly comparable GAAP measure can be found in the financial table at the end of this presentation. Celsius achieved record second quarter revenue of $326 million, up 112% from $154 million in the prior year second quarter. North American revenue grew 114% to $311 million from $145 million in the prior year second quarter driven by continued gains in distribution points, increase in average SKUs per location, accelerated Club Channel growth, and increased sales and marketing investments. International revenue increased 76% to $15.1 million, up from $8.6 million in the prior year second quarter driven by new flavor innovation and brand awareness. Gross profit for the second quarter of 2023 was $159 million, an increase of 168% from $59 million in the prior year second quarter. Gross profit as a percentage of revenue was 48.8% for the three months ending June 30, 2023, up from 38.5% in the prior year second quarter. Gross profit margin improvements are attributed to lower package and raw material unit cost, reduced product waste/scrap, and improved inbound and outbound freight efficiency. Net income attributable to common stockholders totaled $40.9 million, or $0.52 per diluted share for the second quarter of 2023, compared to a net income of $9.2 million, or $0.12 per diluted share in the prior year second quarter. Non-GAAP Adjusted EBITDA* increased 357% to approximately $78 million for the second quarter of 2023, compared to $17 million in the prior year second quarter benefiting from substantial revenue growth and significantly improved gross margins as well as continued leverage across SG&A. As of June 30, 2023, Celsius had $681 million in cash and cash equivalents compared to $60 million on June 30, 2022. “During the second quarter of 2023, Celsius delivered an all-time quarterly record revenue of $326 million in sales and $41 million in net income, driven by expanded availability and increased consumer awareness. In addition, we continue to further leverage PepsiCo’s best in class distribution system”, commented John Fieldly, President and Chief Executive Officer. Flash Financials $(000)’s 2Q 2023 2Q 2022 % Change Revenue $325.9 $154.0 112% N. America $310.8 $145.4 114% International $15.1 $8.6 76% Gross Margin % 48.8% 38.5% +1,030 BPS Net Income att. to Common Shareholders $40.9 $9.2 345% Diluted Earnings per Share $0.52 $0.12 333% Adjusted EBITDA* $78.1 $17.1 357% 1H 2023 $585.8 $559.4 $26.5 46.6% $72.4 $0.92 $126.9 1H 2022 $287.4 $268.9 $18.5 39.4% $15.8 $0.20 $31.9 % Change 104% 108% 43% +720 BPS 358% 360% 298%

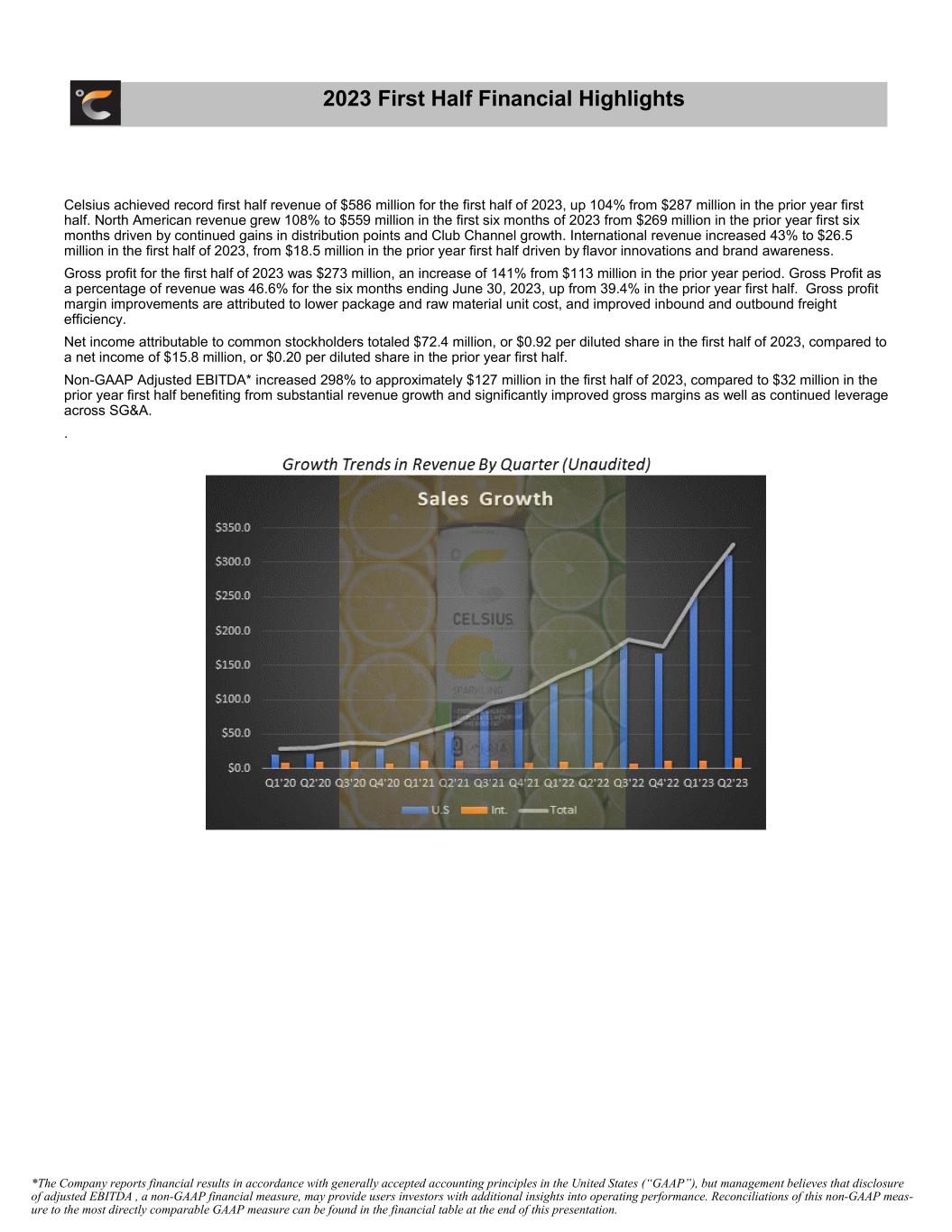

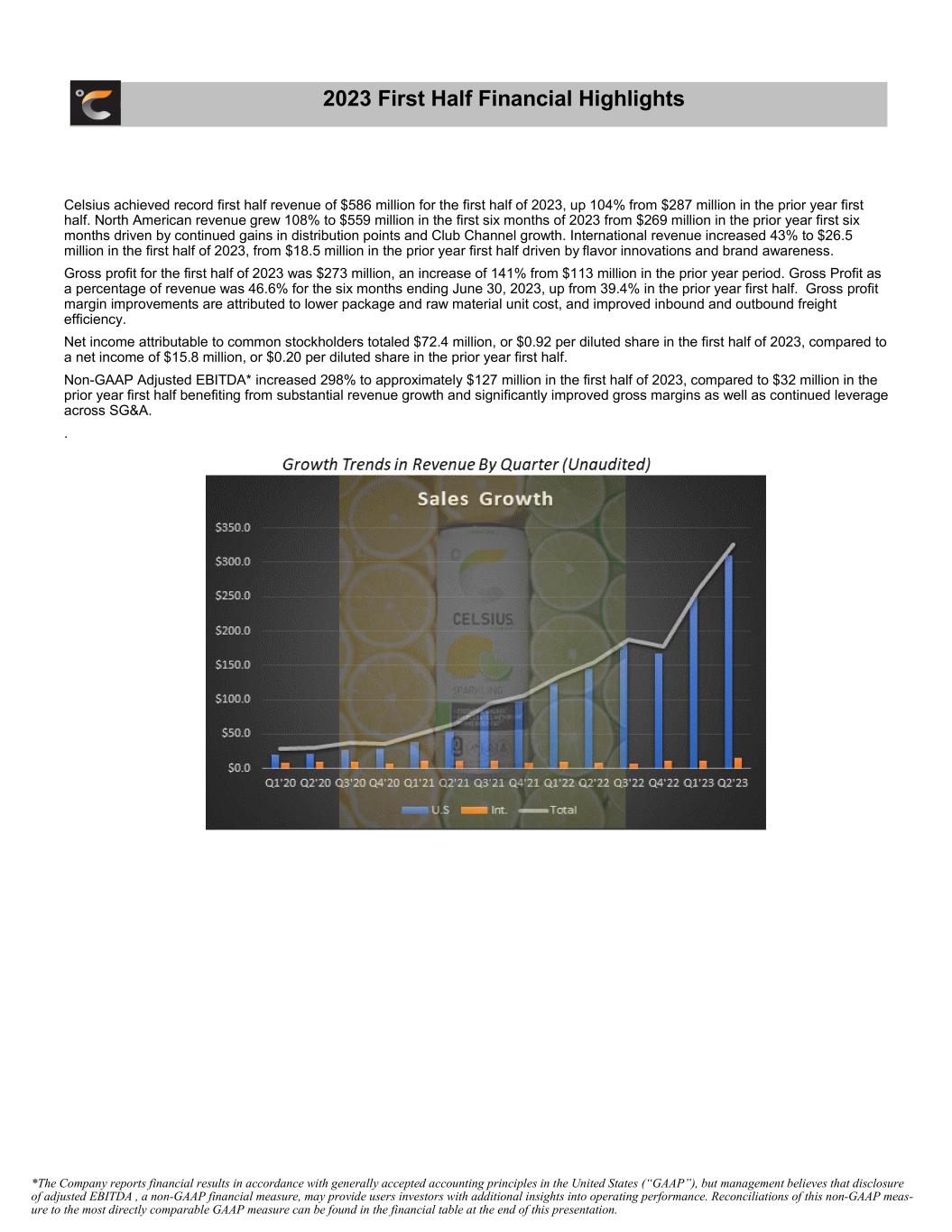

*The Company reports financial results in accordance with generally accepted accounting principles in the United States (“GAAP”), but management believes that disclosure of adjusted EBITDA , a non-GAAP financial measure, may provide users investors with additional insights into operating performance. Reconciliations of this non-GAAP meas- ure to the most directly comparable GAAP measure can be found in the financial table at the end of this presentation. Celsius achieved record first half revenue of $586 million for the first half of 2023, up 104% from $287 million in the prior year first half. North American revenue grew 108% to $559 million in the first six months of 2023 from $269 million in the prior year first six months driven by continued gains in distribution points and Club Channel growth. International revenue increased 43% to $26.5 million in the first half of 2023, from $18.5 million in the prior year first half driven by flavor innovations and brand awareness. Gross profit for the first half of 2023 was $273 million, an increase of 141% from $113 million in the prior year period. Gross Profit as a percentage of revenue was 46.6% for the six months ending June 30, 2023, up from 39.4% in the prior year first half. Gross profit margin improvements are attributed to lower package and raw material unit cost, and improved inbound and outbound freight efficiency. Net income attributable to common stockholders totaled $72.4 million, or $0.92 per diluted share in the first half of 2023, compared to a net income of $15.8 million, or $0.20 per diluted share in the prior year first half. Non-GAAP Adjusted EBITDA* increased 298% to approximately $127 million in the first half of 2023, compared to $32 million in the prior year first half benefiting from substantial revenue growth and significantly improved gross margins as well as continued leverage across SG&A. . 2023 First Half Financial Highlights

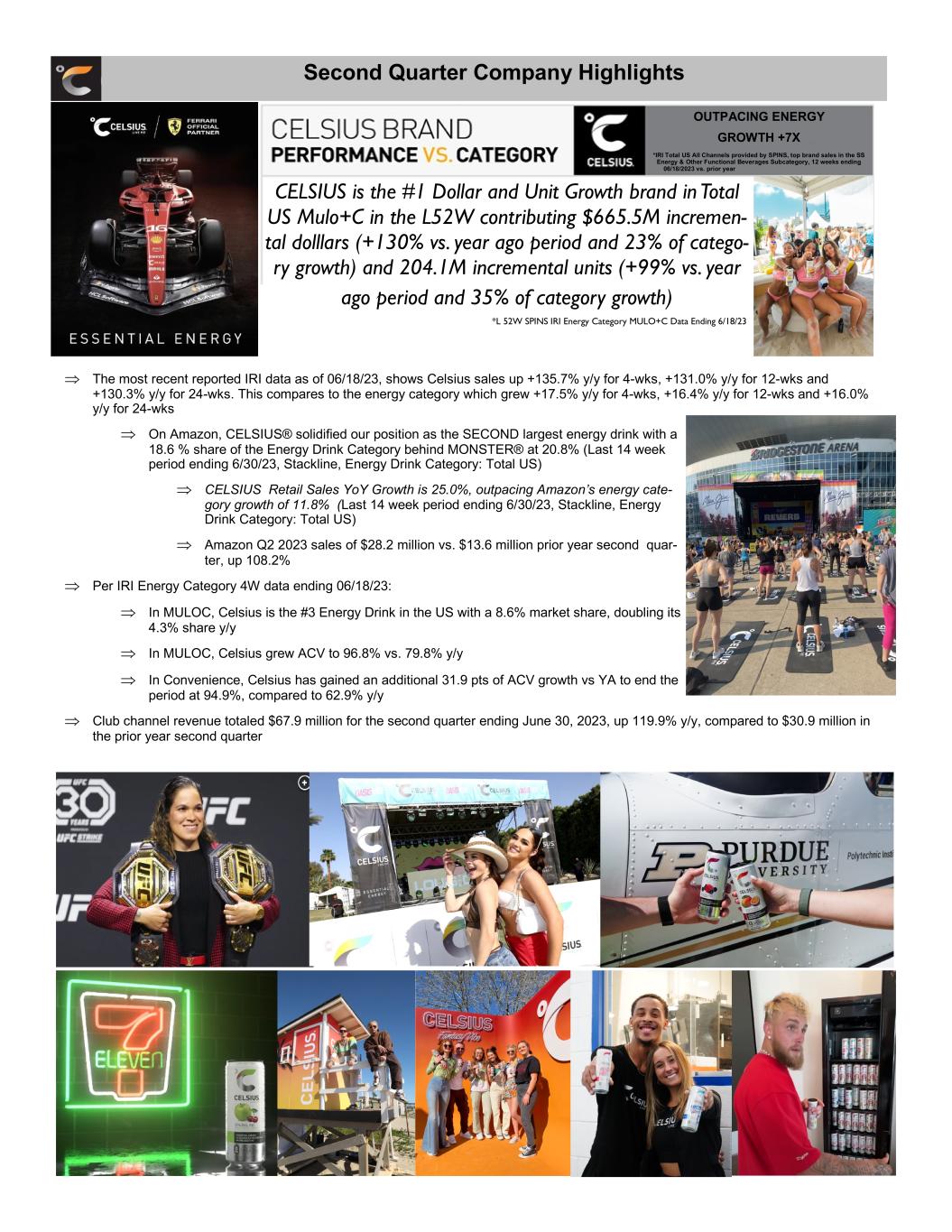

Second Quarter Company Highlights OUTPACING ENERGY GROWTH +7X *IRI Total US All Channels provided by SPINS, top brand sales in the SS Energy & Other Functional Beverages Subcategory, 12 weeks ending 06/18/2023 vs. prior year Þ The most recent reported IRI data as of 06/18/23, shows Celsius sales up +135.7% y/y for 4-wks, +131.0% y/y for 12-wks and +130.3% y/y for 24-wks. This compares to the energy category which grew +17.5% y/y for 4-wks, +16.4% y/y for 12-wks and +16.0% y/y for 24-wks Þ On Amazon, CELSIUS® solidified our position as the SECOND largest energy drink with a 18.6 % share of the Energy Drink Category behind MONSTER® at 20.8% (Last 14 week period ending 6/30/23, Stackline, Energy Drink Category: Total US) Þ CELSIUS Retail Sales YoY Growth is 25.0%, outpacing Amazon’s energy cate- gory growth of 11.8% (Last 14 week period ending 6/30/23, Stackline, Energy Drink Category: Total US) Þ Amazon Q2 2023 sales of $28.2 million vs. $13.6 million prior year second quar- ter, up 108.2% Þ Per IRI Energy Category 4W data ending 06/18/23: Þ In MULOC, Celsius is the #3 Energy Drink in the US with a 8.6% market share, doubling its 4.3% share y/y Þ In MULOC, Celsius grew ACV to 96.8% vs. 79.8% y/y Þ In Convenience, Celsius has gained an additional 31.9 pts of ACV growth vs YA to end the period at 94.9%, compared to 62.9% y/y Þ Club channel revenue totaled $67.9 million for the second quarter ending June 30, 2023, up 119.9% y/y, compared to $30.9 million in the prior year second quarter CELSIUS is the #1 Dollar and Unit Growth brand in Total US Mulo+C in the L52W contributing $665.5M incremen- tal dolllars (+130% vs. year ago period and 23% of catego- ry growth) and 204.1M incremental units (+99% vs. year ago period and 35% of category growth) *L 52W SPINS IRI Energy Category MULO+C Data Ending 6/18/23

Q2 2023 Sales Activations Conference Call Management will host a conference call today, Tuesday August 8, 2023 at 4:30 p.m. ET to discuss the results with the investment community. To participate in the conference call, please call one of the following telephone numbers at least 10 minutes before the start of the call: Toll Free: (888) 645-4404 International: (862) 298-0702 Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=iNIK9byK A replay of the call will be available through the webcast link above, after the conclusion of the event. Disclosures can be found on the Company's online disclosure portal at: https://www.celsiusholdingsinc.com/sec-filings/ Investor Contact: investorrelations@celsius.com About Celsius Holdings, Inc. Celsius Holdings, Inc. (Nasdaq: CELH), is a global consumer packaged goods company with a proprietary, clinically proven formula for its master brand CELSIUS®. A lifestyle energy drink born in fitness and a pioneer in the rapidly growing energy category. CELSIUS® offers pro- prietary, functional, essential energy formulas clinically-proven to offer significant health benefits to its users. CELSIUS® is backed by six uni- versity studies that were published in peer-reviewed journals validating the unique benefits CELSIUS® provides. For more information, please visit: http://www.celsiusholdingsinc.com Forward-Looking Statements This press release may contain statements that are not historical facts and are considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements contain projections of Celsius Holdings’ future results of opera- tions and/or financial position, or state other forward-looking information. In some cases, you can identify these statements by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” or similar words. You should not rely on forward-looking statements since Celsius Holdings’ actual results may differ materially from those indicated by forward-looking state- ments as a result of a number of important factors. These factors include but are not limited to: general economic and business conditions; our business strategy for expanding our presence in our industry; our expectations of revenue; operating costs and profitability; our expecta- tions regarding our strategy and investments; our expectations regarding our business, including market opportunity, consumer demand and our competitive advantage; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; the Company’s ability to satisfy in a timely manner, all Securities and Ex- change Commission (the “SEC”) required filings and the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations adopted under that Section; and other risks and uncertainties discussed in the reports Celsius Holdings has filed previously with the SEC. Celsius Holdings does not intend to and undertakes no duty to update the information contained in this press release.

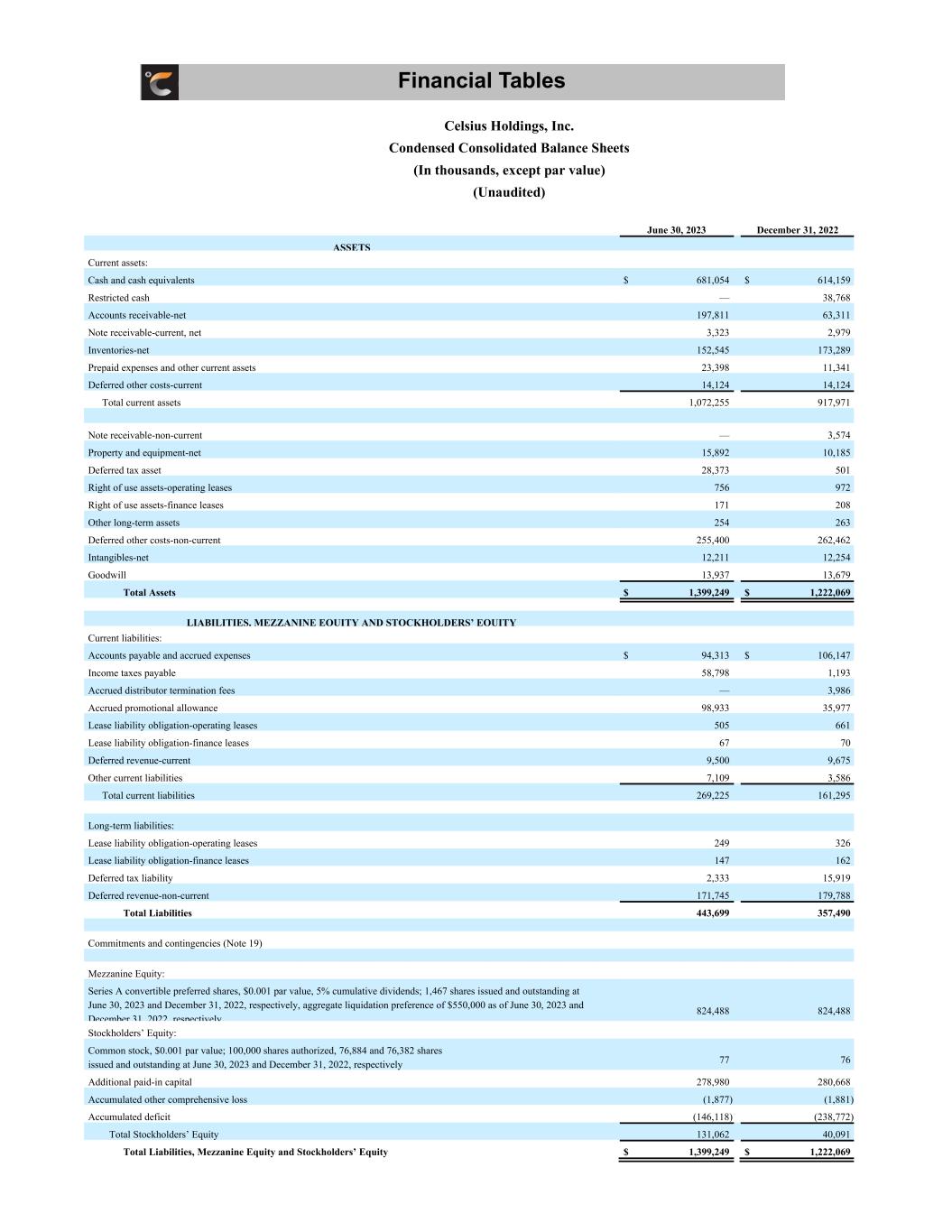

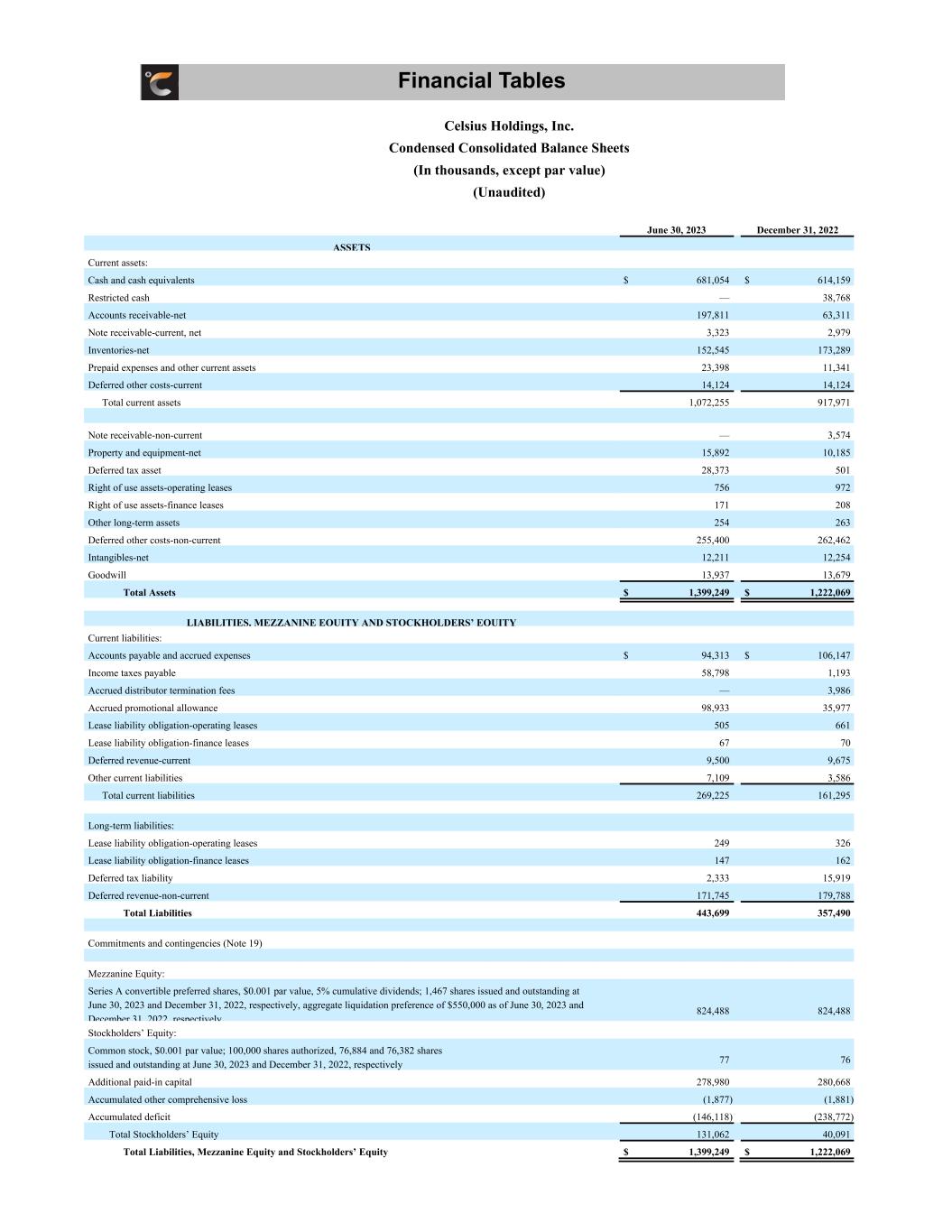

Financial Tables Celsius Holdings, Inc. Condensed Consolidated Balance Sheets (In thousands, except par value) (Unaudited) June 30, 2023 December 31, 2022 ASSETS Current assets: Cash and cash equivalents $ 681,054 $ 614,159 Restricted cash — 38,768 Accounts receivable-net 197,811 63,311 Note receivable-current, net 3,323 2,979 Inventories-net 152,545 173,289 Prepaid expenses and other current assets 23,398 11,341 Deferred other costs-current 14,124 14,124 Total current assets 1,072,255 917,971 Note receivable-non-current — 3,574 Property and equipment-net 15,892 10,185 Deferred tax asset 28,373 501 Right of use assets-operating leases 756 972 Right of use assets-finance leases 171 208 Other long-term assets 254 263 Deferred other costs-non-current 255,400 262,462 Intangibles-net 12,211 12,254 Goodwill 13,937 13,679 Total Assets $ 1,399,249 $ 1,222,069 LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable and accrued expenses $ 94,313 $ 106,147 Income taxes payable 58,798 1,193 Accrued distributor termination fees — 3,986 Accrued promotional allowance 98,933 35,977 Lease liability obligation-operating leases 505 661 Lease liability obligation-finance leases 67 70 Deferred revenue-current 9,500 9,675 Other current liabilities 7,109 3,586 Total current liabilities 269,225 161,295 Long-term liabilities: Lease liability obligation-operating leases 249 326 Lease liability obligation-finance leases 147 162 Deferred tax liability 2,333 15,919 Deferred revenue-non-current 171,745 179,788 Total Liabilities 443,699 357,490 Commitments and contingencies (Note 19) Mezzanine Equity: Series A convertible preferred shares, $0.001 par value, 5% cumulative dividends; 1,467 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively, aggregate liquidation preference of $550,000 as of June 30, 2023 and December 31, 2022, respectively 824,488 824,488 Stockholders’ Equity: Common stock, $0.001 par value; 100,000 shares authorized, 76,884 and 76,382 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively 77 76 Additional paid-in capital 278,980 280,668 Accumulated other comprehensive loss (1,877) (1,881) Accumulated deficit (146,118) (238,772) Total Stockholders’ Equity 131,062 40,091 Total Liabilities, Mezzanine Equity and Stockholders’ Equity $ 1,399,249 $ 1,222,069

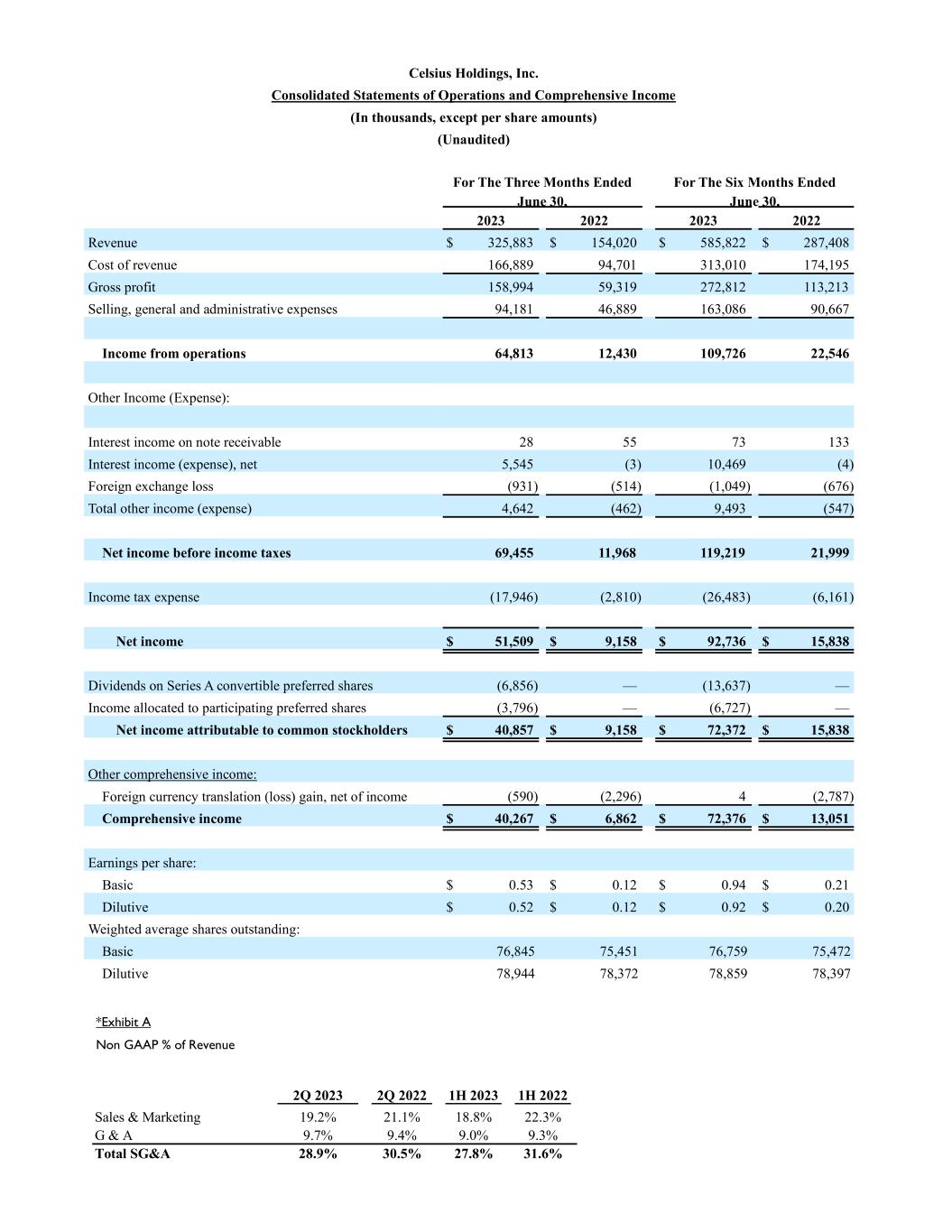

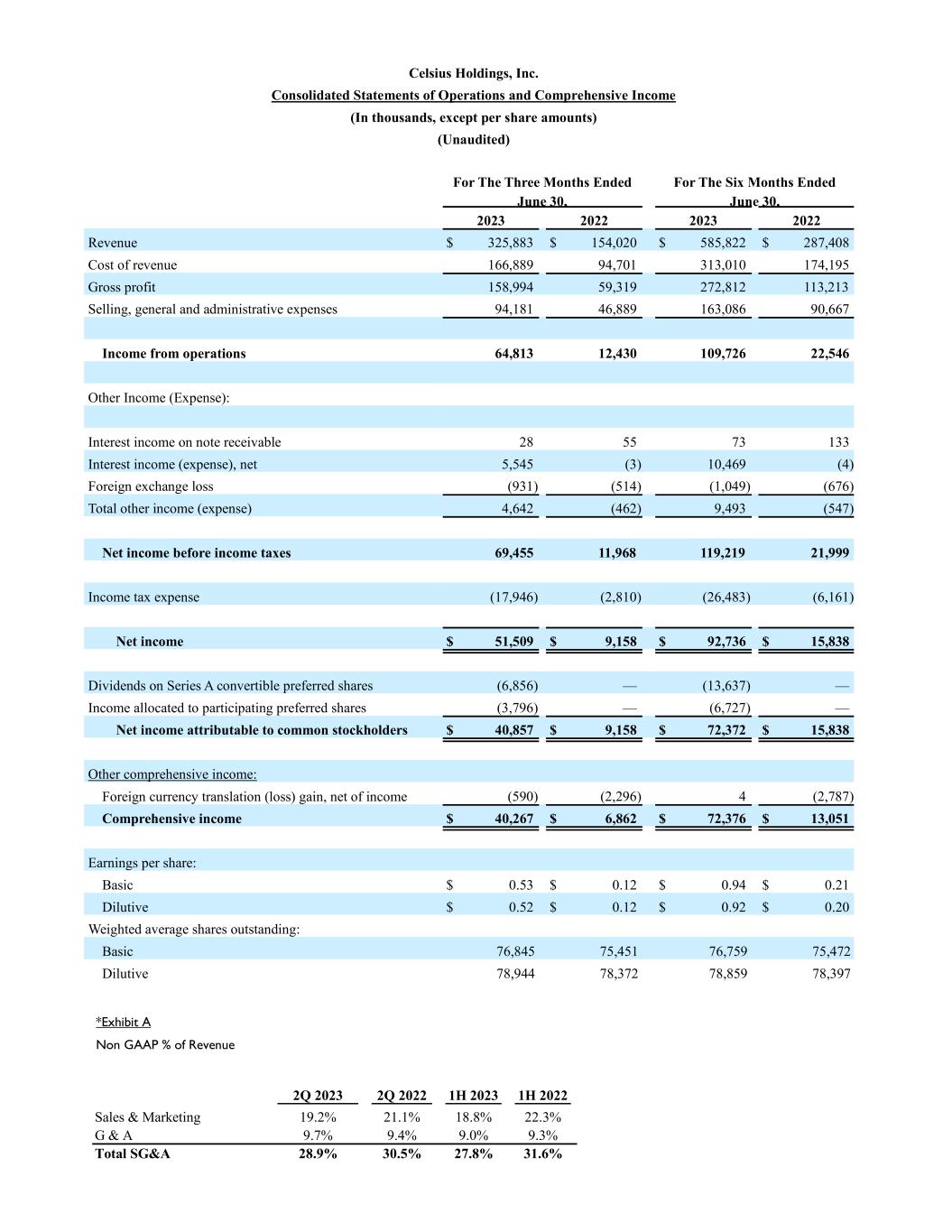

Celsius Holdings, Inc. Consolidated Statements of Operations and Comprehensive Income (In thousands, except per share amounts) (Unaudited) *Exhibit A Non GAAP % of Revenue 2Q 2023 2Q 2022 1H 2023 1H 2022 Sales & Marketing 19.2% 21.1% 18.8% 22.3% G & A 9.7% 9.4% 9.0% 9.3% Total SG&A 28.9% 30.5% 27.8% 31.6% For The Three Months Ended June 30, For The Six Months Ended June 30, 2023 2022 2023 2022 Revenue $ 325,883 $ 154,020 $ 585,822 $ 287,408 Cost of revenue 166,889 94,701 313,010 174,195 Gross profit 158,994 59,319 272,812 113,213 Selling, general and administrative expenses 94,181 46,889 163,086 90,667 Income from operations 64,813 12,430 109,726 22,546 Other Income (Expense): Interest income on note receivable 28 55 73 133 Interest income (expense), net 5,545 (3) 10,469 (4) Foreign exchange loss (931) (514) (1,049) (676) Total other income (expense) 4,642 (462) 9,493 (547) Net income before income taxes 69,455 11,968 119,219 21,999 Income tax expense (17,946) (2,810) (26,483) (6,161) Net income $ 51,509 $ 9,158 $ 92,736 $ 15,838 Dividends on Series A convertible preferred shares (6,856) — (13,637) — Income allocated to participating preferred shares (3,796) — (6,727) — Net income attributable to common stockholders $ 40,857 $ 9,158 $ 72,372 $ 15,838 Other comprehensive income: Foreign currency translation (loss) gain, net of income taxes (590) (2,296) 4 (2,787) Comprehensive income $ 40,267 $ 6,862 $ 72,376 $ 13,051 Earnings per share: Basic $ 0.53 $ 0.12 $ 0.94 $ 0.21 Dilutive $ 0.52 $ 0.12 $ 0.92 $ 0.20 Weighted average shares outstanding: Basic 76,845 75,451 76,759 75,472 Dilutive 78,944 78,372 78,859 78,397

*The Company reports financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), but management believes that disclosure of adjusted EBITDA, a non-GAAP financial measure, may provide users with additional insights into operating performance. Celsius Holdings, Inc. Reconciliation of Non-GAAP Financial Measure* (Unaudited) Six months ended June 30, 2023 2022 Net income (GAAP measure) $ 92,736 $ 15,83 8 Add back/(Deduct): Net interest (10,542) (129 ) Income tax expense 26,483 6,161 Depreciation and amortization expense 1,246 831 Non-GAAP EBITDA 109,923 22,701 Stock-based compensation1 11,242 8,517 Foreign exchange 1,049 676 Distributor Termination2 (3,241) - Legal settlement costs3 7,900 - Non-GAAP Adjusted EBITDA $ 126,873 $ 31,894 1 Selling, general and administrative expenses related to employer stock-based compensation. Stock based compensation expense consists of non-cash charges for the estimated fair value of unvested restricted share unit and stock option awards granted to employees and directors. The Company believes that the exclusion provides a more accurate comparison of operating results and is useful to investors to understand the stock-based compensation expense has on its operating results. 2 Distributor termination represents reversals of accrued termination payments. The unused funds designated for termination expense payment to legacy distributors, were reimbursed to Pepsi for the quarter ended June 30th, 2023. 3 Legal class action settlement accrual for the quarter ended June 30th, 2023, pertaining to the McCallion vs Celsius Holdings, class action lawsuit. The Company accrued for legal settlement losses that were considered probable and estimable. These costs are excluded by the Company’s management in assessing current operating performance and forecasting future earnings, and are therefore added back in the non-GAAP Adjusted EBITDA measures.