Exhibit 99.1

Confidential Celsius & PepsiCo Announce Long - Term Distribution Agreement and Investment August 1, 2022

Notice and Disclaimer This presentation has been prepared by us (the "Company“ or “Celsius Holdings”) and is made for informational purposes only. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither the delivery of this presentation at any time, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third - party sources and the Company's own internal estimates and research. While the Company believes these third - party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its own internal research is reliable, such research has not been verified by any independent source. This presentation may contain statements that are not historical facts and are considered forward - looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward - looking statements contain projections of Celsius Holdings’ future results of operations and/or financial position, or state other forward - looking information. In some cases, you can identify these statements by forward looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” or similar words, including all statements regarding the distribution rights agreement with PepsiCo, such as our expectations of a long - term strategic distribution partnership with PepsiCo and plans for global distribution expansion, statements regarding PepsiCo’s equity investment in Celsius Holdings, such as becoming a core player in PepsiCo’s global energy portfolio and expected use of proceeds from such investment, plans to establish Celsius as the leading lifestyl e energy drink nationwide, all statements regarding the impact of the transactions with PepsiCo on Celsius Holdings’ business, financial condition, and operating results such as the pro forma impact of such transactions and all statements on the “Use of Proceeds from Equity Investment” section of this presentation. You should not rely on forward - looking statements since Celsius Holdings’ actual results may differ materially from those indicated by forward - looking statements as a result of a number of important factors. These factors include, but are not limited to: the impact of and the ability to complete and integrate str ategic partnerships, including the distribution partnership with PepsiCo; general economic and business conditions; our business strategy for expanding our presence in our industry; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; and other risks and uncertainties discussed in the reports Celsius Holdings has filed previously with the Securities and Exchange Commission. Cel sius Holdings does not intend to and undertakes no duty to update the information contained in this presentation. This presentation is made pursuant to Rule 163B of the Securities Act of 1933, as amended, and is intended solely for investo rs that are qualified institutional buyers or certain institutional accredited investors solely for the purposes of familiarizing such investors with the Company and determining whether such investors might have an interest in a securities offering contemplated by the Company. Any such offering of securities will only be made by means of a registration statement (including a prospectus) filed with the U.S. Securities and Exchange Commission, after such registration statement becomes effective. No such registration statement has been filed, or become effective, as of the date of this communication. This communication shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the sec urities laws of any such state or jurisdiction. 1

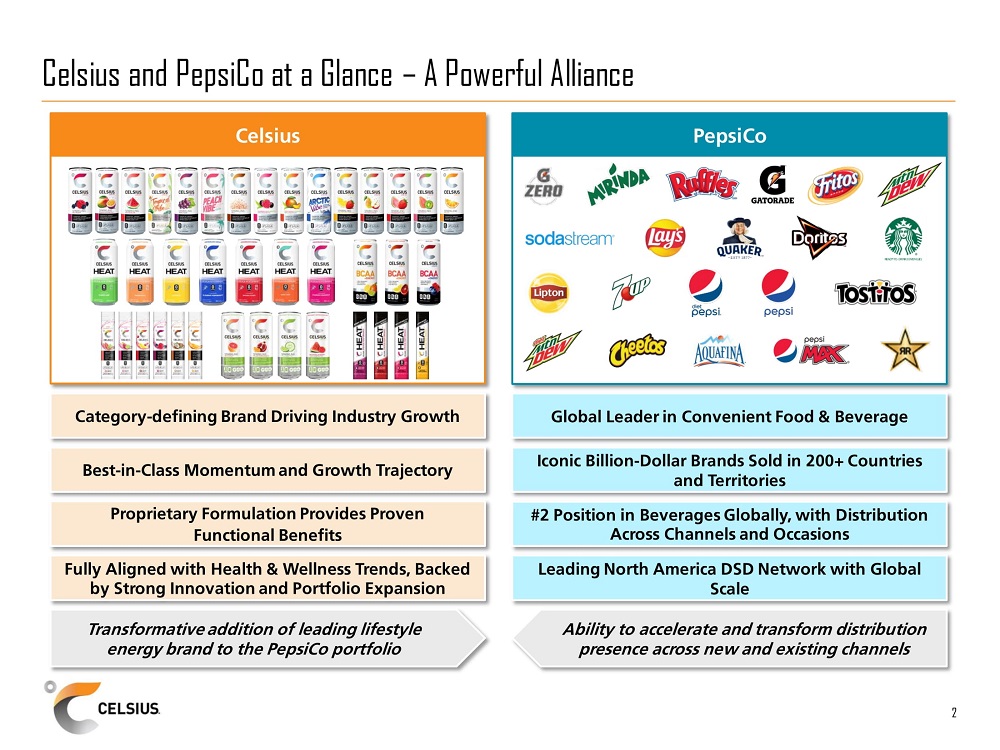

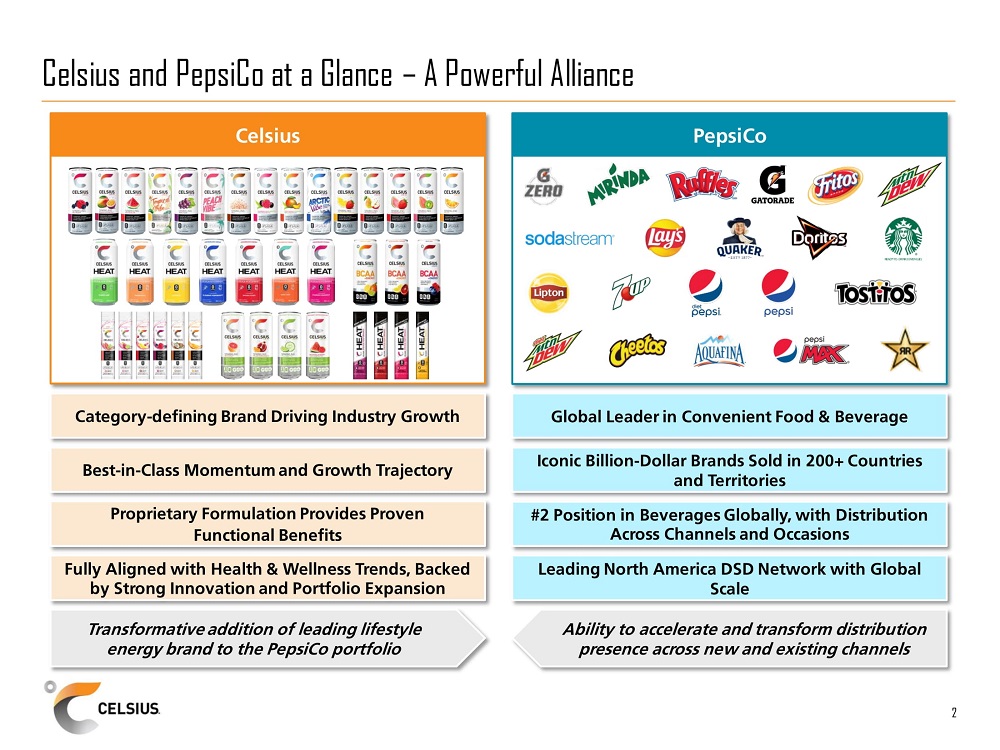

Celsius and PepsiCo at a Glance – A Powerful Alliance Transformative addition of leading lifestyle energy brand to the PepsiCo portfolio Celsius Category - defining Brand Driving Industry Growth Best - in - Class Momentum and Growth Trajectory Proprietary Formulation Provides Proven Functional Benefits Fully Aligned with Health & Wellness Trends, Backed by Strong Innovation and Portfolio Expansion PepsiCo Global Leader in Convenient Food & Beverage Iconic Billion - Dollar Brands Sold in 200+ Countries and Territories #2 Position in Beverages Globally, with Distribution Across Channels and Occasions Leading North America DSD Network with Global Scale Ability to accelerate and transform distribution presence across new and existing channels 2

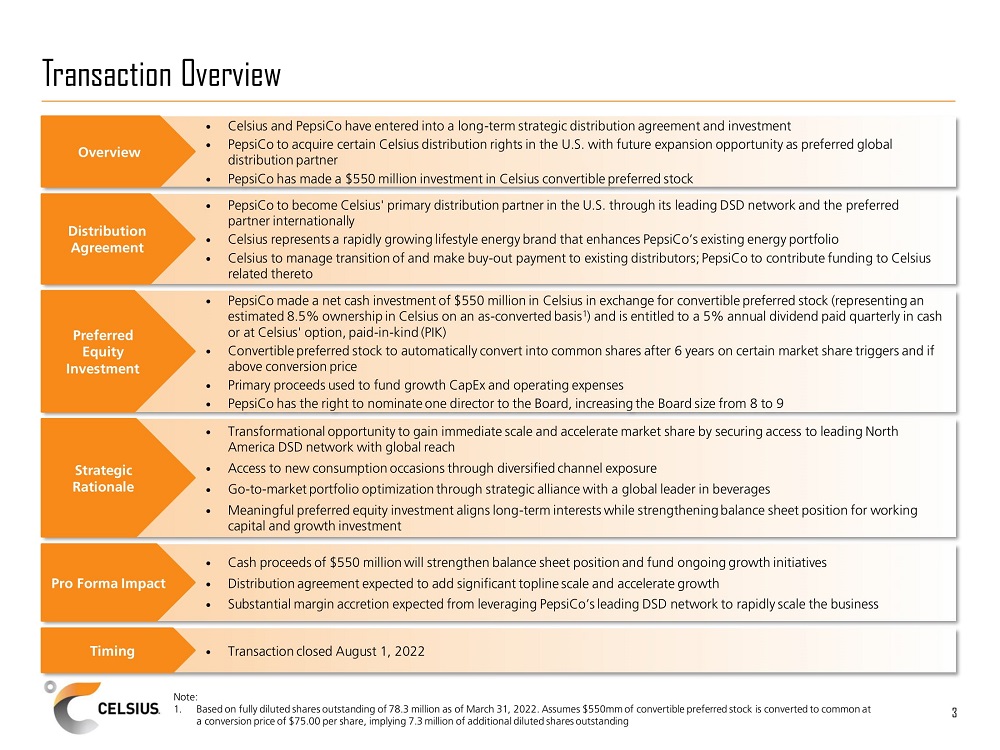

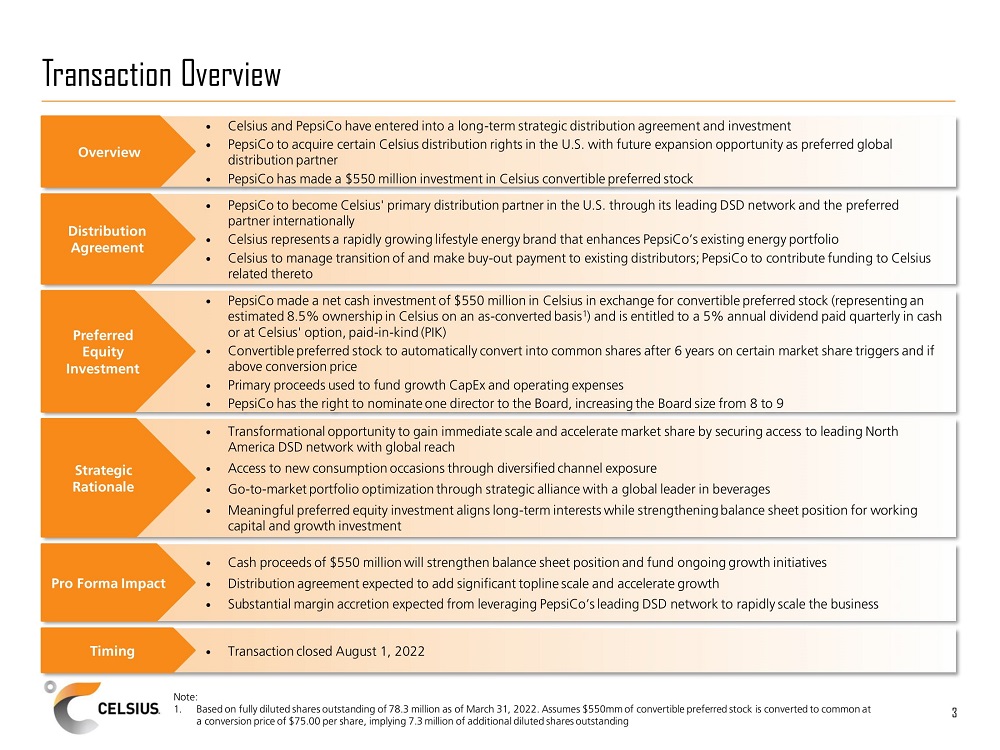

3 Celsius and PepsiCo have entered into a long - term strategic distribution agreement and investment Overview PepsiCo to acquire certain Celsius distribution rights in the U.S. with future expansion opportunity as preferred global distribution partner PepsiCo has made a $550 million investment in Celsius convertible preferred stock PepsiCo to become Celsius' primary distribution partner in the U.S. through its leading DSD network and the preferred Distribution partner internationally Agreement Celsius represents a rapidly growing lifestyle energy brand that enhances PepsiCo’s existing energy portfolio Celsius to manage transition of and make buy - out payment to existing distributors; PepsiCo to contribute funding to Celsius related thereto PepsiCo made a net cash investment of $550 million in Celsius in exchange for convertible preferred stock (representing an estimated 8.5% ownership in Celsius on an as - converted basis 1 ) and is entitled to a 5% annual dividend paid quarterly in cash Preferred or at Celsius' option, paid - in - kind (PIK) Equity Convertible preferred stock to automatically convert into common shares after 6 years on certain market share triggers and if Investment above conversion price Primary proceeds used to fund growth CapEx and operating expenses PepsiCo has the right to nominate one director to the Board, increasing the Board size from 8 to 9 Transformational opportunity to gain immediate scale and accelerate market share by securing access to leading North America DSD network with global reach Strategic Access to new consumption occasions through diversified channel exposure Rationale Go - to - market portfolio optimization through strategic alliance with a global leader in beverages Meaningful preferred equity investment aligns long - term interests while strengthening balance sheet position for working capital and growth investment Cash proceeds of $550 million will strengthen balance sheet position and fund ongoing growth initiatives Pro Forma Impact Distribution agreement expected to add significant topline scale and accelerate growth Substantial margin accretion expected from leveraging PepsiCo’s leading DSD network to rapidly scale the business Timing Transaction closed August 1, 2022 Transaction Overview Note: 1. Based on fully diluted shares outstanding of 78.3 million as of March 31, 2022. Assumes $550mm of convertible preferred stock is converted to common at a conversion price of $75.00 per share, implying 7.3 million of additional diluted shares outstanding

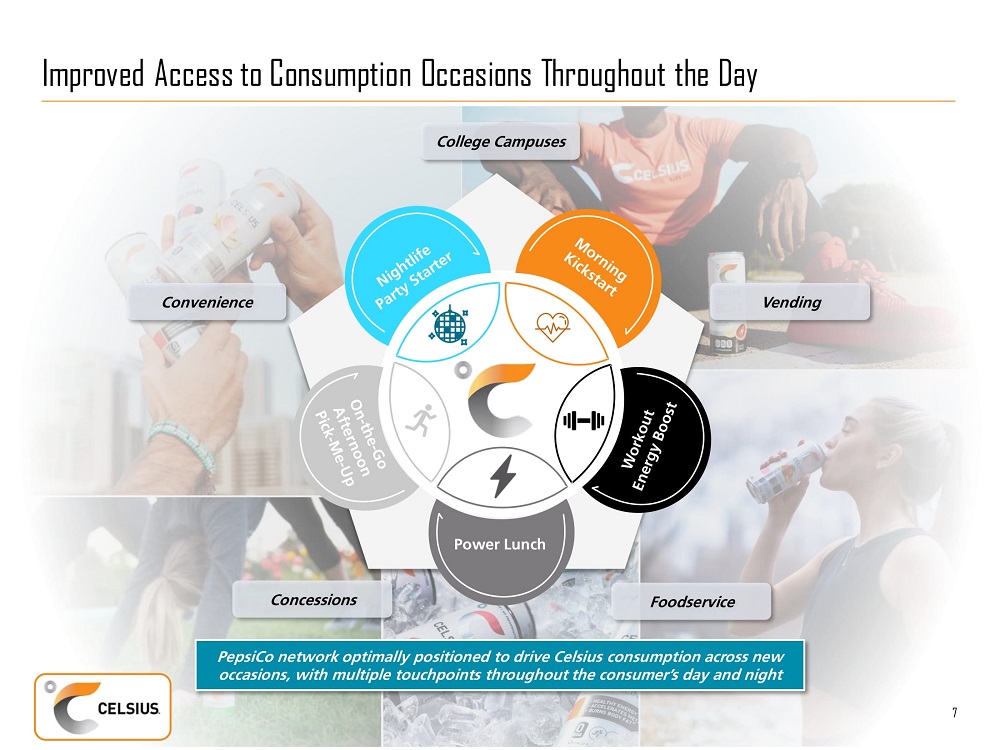

Highly Compelling Strategic Rationale Go - to - market portfolio optimization through strategic alliance with a global leader in beverages – Adds a rapidly growing lifestyle energy brand to PepsiCo’s existing energy portfolio – Benefit from PepsiCo’s vast experience and resources as a global beverage leader while retaining entrepreneurial identity and agility 3 Transformational opportunity to gain immediate scale and accelerate market share by securing access to leading North America DSD network with global reach – Expanded access across new and existing channels with addition of significant incremental doors, coolers and ACV upside – Streamlined supply chain with aligned incentives and added focus – Substantial international whitespace for global expansion 1 Access to new consumption occasions through diversified channel exposure – Meaningful penetration gains across channels including foodservice, independent convenience (through PepsiCo’s Medals program), vending, college campuses, concessions and the military – Reach new customers and occasions by leveraging unique product versatility that caters to all times of the day and night 2 Meaningful preferred equity investment aligns long - term interests while strengthening balance sheet position for working capital and growth investment – Development of joint distribution business plan with clear goals to ensure alignment – Deploy capital to support growth plan including cooler / vending rollout, sales & marketing, and salesforce fleet, as well as international expansion 4 4

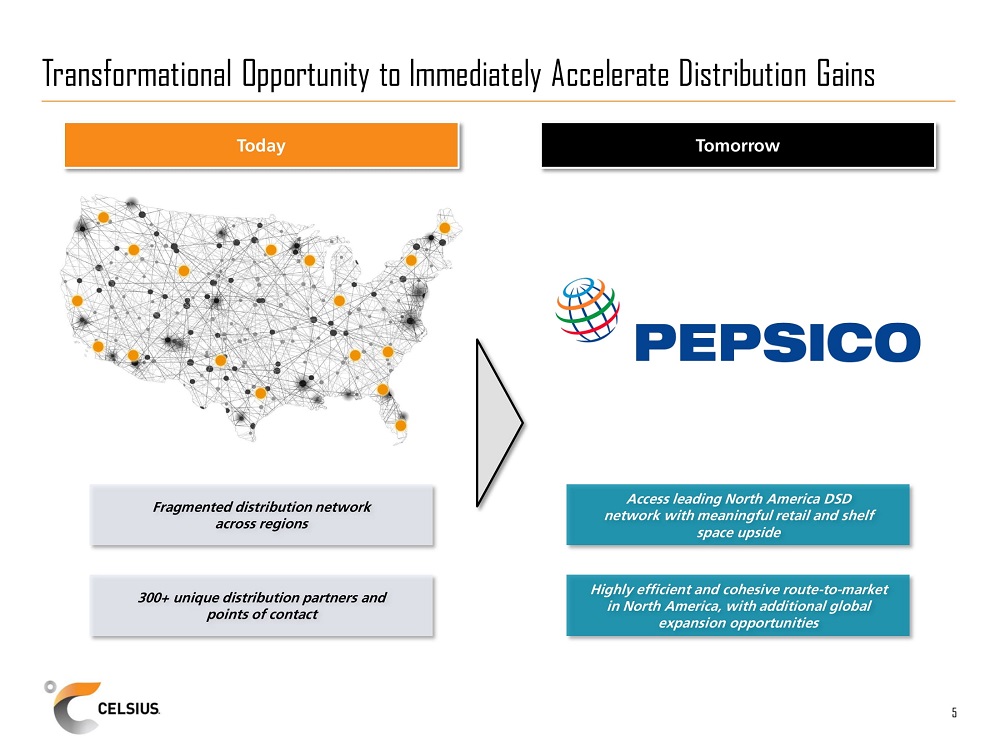

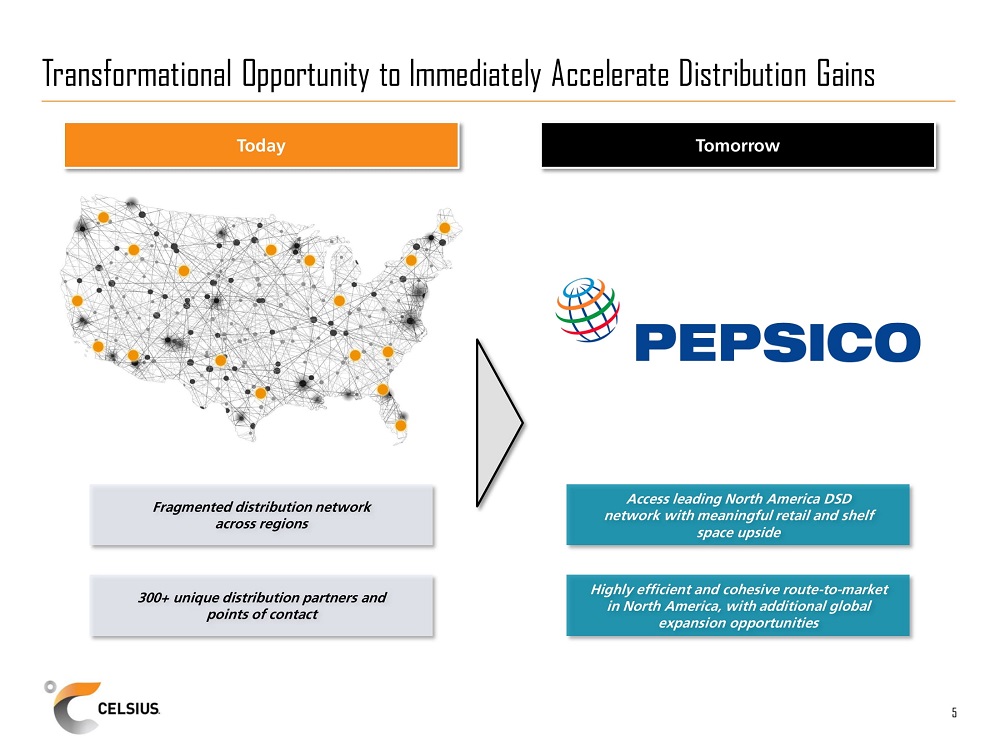

Transformational Opportunity to Immediately Accelerate Distribution Gains Today Tomorrow Fragmented distribution network across regions Access leading North America DSD network with meaningful retail and shelf space upside 300+ unique distribution partners and points of contact Highly efficient and cohesive route - to - market in North America, with additional global expansion opportunities 5

Convenience (Incl. Independents) Conventional Grocery Strengthen Penetration with New and Existing Customers / Channels Mass Market Natural Vending Military Vitamin, Specialty & Drug Lifestyle / Fitness College Campuses Foodservice Transform Channel Presence Within PepsiCo Network Accelerate Distribution in Existing Channels 6

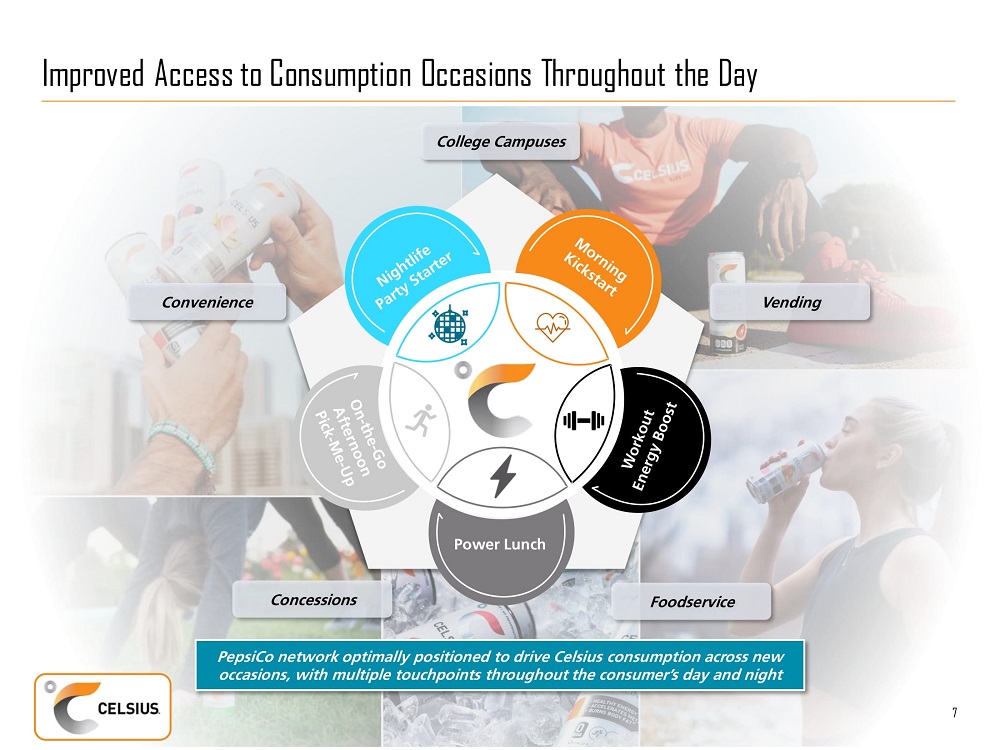

7 Improved Access to Consumption Occasions Throughout the Day Power Lunch PepsiCo network optimally positioned to drive Celsius consumption across new occasions, with multiple touchpoints throughout the consumer’s day and night Vending Foodservice Concessions College Campuses Convenience 7

Use of Proceeds from Equity Investment Proceeds will accelerate numerous growth initiatives and significantly enhance balance sheet optionality Roll - out of additional coolers Investment in sales / marketing and R&D Fleet investment to support salesforce Facilitate entry into new channels and geographies Growth Investment Strengthen balance sheet position Fund working capital for next phase of growth, including international expansion Balance Sheet and Working Capital Provides opportunity to pursue highly strategic M&A opportunities on a selective basis M&A 8

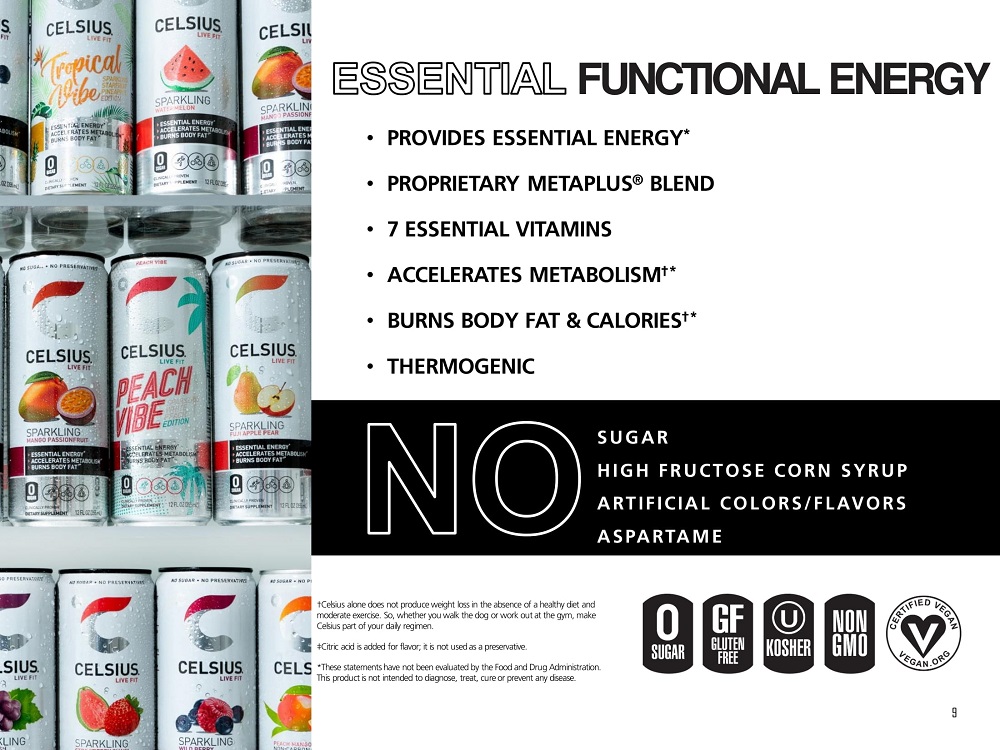

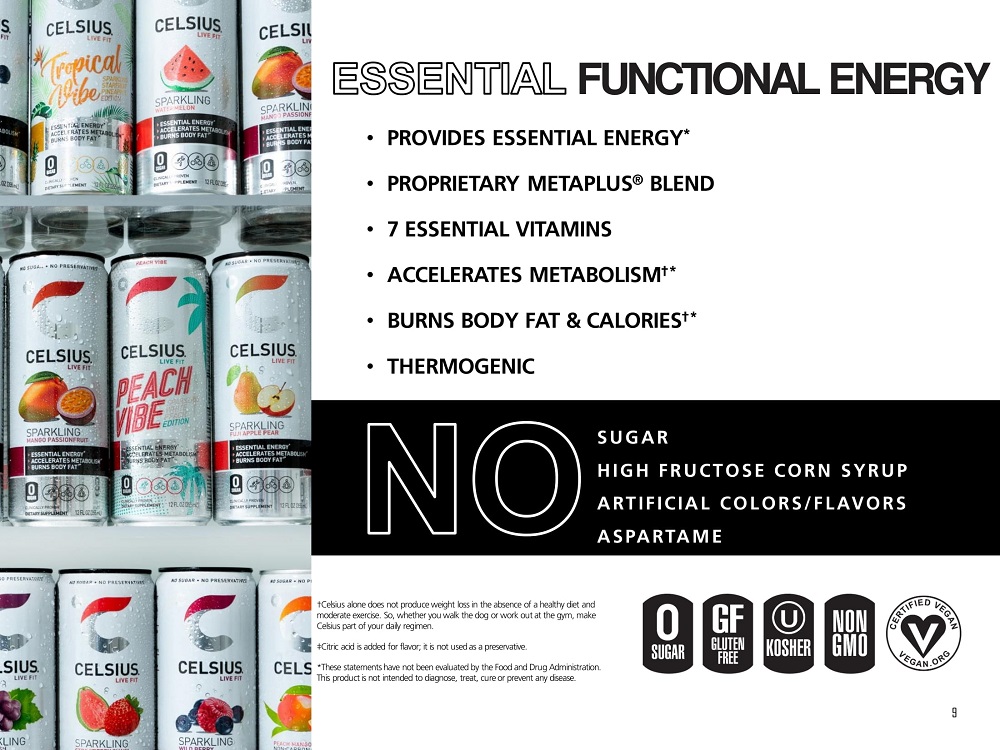

• PROVIDES ESSENTIAL ENERGY * • PROPRIETARY METAPLUS ® BLEND • 7 ESSENTIAL VITAMINS • ACCELERATES METABOLISM †* • BURNS BODY FAT & CALORIES †* • THERMOGENIC FUNCTIONAL ENERGY SUGAR H IGH F RUCT OSE CORN SYRUP ART IF ICIAL COL ORS/ F L AVORS ASPARTAME †Celsius alone does not produce weight loss in the absence of a healthy diet and moderate exercise . So, whether you walk the dog or work out at the gym, make Celsius part of your daily regimen . ‡Citric acid is added for flavor; it is not used as a preservative. *These statements have not been evaluated by the Food and Drug Administration. This product is not intended to diagnose, treat, cure or prevent any disease. 9

IT WORK? WE’ RE NOT LIKE OTHE R ENERGY DRINK S 10 10 CELSIUS® proprietary MetaPlus ® formula, including green tea with ECGC, ginger and guarana seed, turns on thermogenisis, a process that boosts your body’s metabolic rate.†* Drinking CELSIUS® prior to lifestyle / fitness activities is proven to energize, accelerate metabolism, burn body fat and calories.†* †*CELSIUS alone does not produce weight loss in the abscense of a health diet and moderate exercise. In a 10 - week clinical study published in the Journal of International Society of Sports Nutrition, with sedentary men and woman, the group who drank one CELSIUS per day experienced significantly better results.

Question & Answer 11