- CELH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Celsius (CELH) DEF 14ADefinitive proxy

Filed: 1 May 23, 4:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | ☒ | |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule Sec.240.14a-12 |

Celsius Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CELSIUS HOLDINGS, INC.

2424 N. Federal Highway, Suite 208

Boca Raton, Florida 33431

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held June 1, 2023

To our Stockholders:

On behalf of the Board of Directors it is my pleasure to invite you to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Celsius Holdings, Inc., a Nevada corporation (the “Company”), which will be held at 2:00 pm, Eastern Time on June 1, 2023, or such later date or dates as such Annual Meeting date may be adjourned. The meeting will be transmitted via a virtual platform.

You may attend the Annual Meeting virtually via the internet at https://agm.issuerdirect.com/celh where you will be able to vote electronically. Please be sure to follow the instructions contained in these proxy materials.

The Annual Meeting will be held for the following purposes, as more fully described in the accompanying proxy statement:

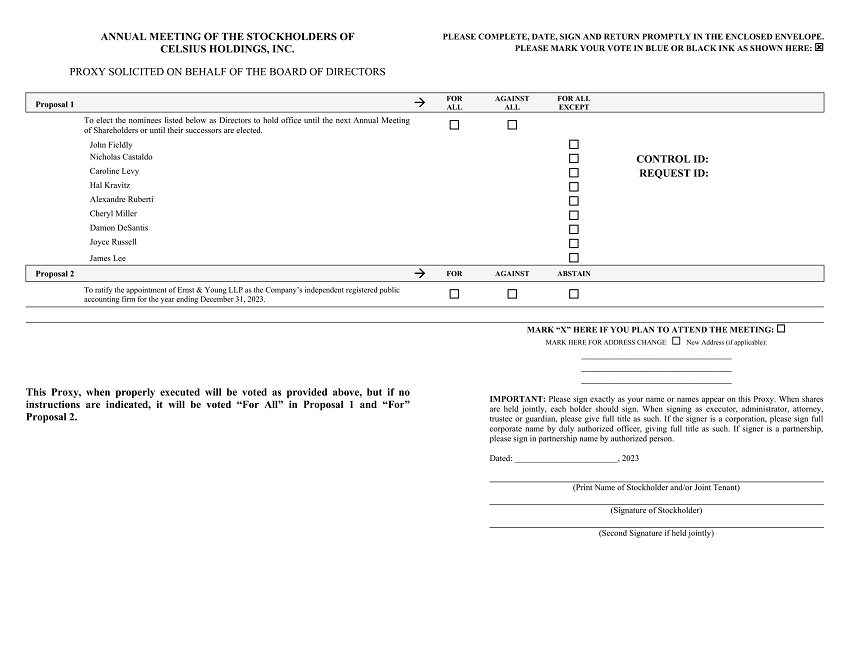

| 1. | To elect as directors the nominees named in the proxy statement; | |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent public accountant for the fiscal year ending December 31, 2023; and | |

| 3. | To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

The foregoing business items are more fully described in the following pages, which are made part of this notice.

The Board of Directors of the Company has fixed the close of business on April 3, 2023 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments thereof. Accordingly, you may vote if you were a record owner of the Company’s common stock at the close of business on April 3, 2023.

As of the Record Date there were 76,752,970 shares of common stock outstanding and entitled to vote at the Annual Meeting. For instructions on voting, please refer to the enclosed proxy card or voting information form. A list of stockholders of record will be available at the Annual Meeting and, during the ten (10) days prior to the Annual Meeting, at the office of the Secretary of the Company at 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431.

Pursuant to the rules promulgated by the Securities and Exchange Commission (the “SEC”), the Company is providing access to its proxy materials both by sending you a full set of proxy materials and making copies of these materials available on the internet at https://www.iproxydirect.com/celh.

It is important that you cast your vote either by remote communication at the meeting or by proxy. You may vote over the internet, telephone or by mail. You are urged to vote in accordance with the instructions set forth in this proxy statement.

Thank you for your continued support of Celsius Holdings, Inc. We look forward to your participation in the Annual Meeting.

| Dated: May 1, 2023 | By Order of the Board of Directors of Celsius Holdings, Inc. |

| Sincerely, | |

| /s/ John Fieldly | |

| John Fieldly | |

| Chairman of the Board and Chief Executive Officer |

YOUR VOTE AT THE ANNUAL MEETING IS IMPORTANT

Your vote is important. Please vote as promptly as possible even if you plan to attend the Annual Meeting virtually.

For information on how to vote your shares, please see the instruction from your broker or other fiduciary, as applicable, as well as the “General Information About the Annual Meeting” in the proxy statement accompanying this notice.

If you have questions about voting your shares, please contact our Corporate Secretary at Celsius Holdings, Inc., at 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431, telephone number (561) 276-2239.

If you decide to change your vote, you may revoke your proxy in the manner described in the attached proxy statement at any time before it is voted.

We urge you to review the accompanying materials carefully and to vote as promptly as possible.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 1, 2023 AT 2:00 PM EASTERN TIME.

The Notice of Annual Meeting of Stockholders, our Proxy Statement and 2022 Annual Report are available at:

https://www.iproxydirect.com/celh

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement incorporates important business and financial information about Celsius Holdings, Inc. that is not included in or delivered with this document. You may obtain this information without charge through the Securities and Exchange Commission website (www.sec.gov) or upon your written or oral request by contacting the Chief Financial Officer of Celsius Holdings, Inc., at 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431, telephone number (561) 276-2239.

Table of Contents

i

CELSIUS HOLDINGS, INC.

2424 N. Federal Highway, Suite 208

Boca Raton, Florida 33431

(561) 276-2239

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 1, 2023

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement, along with the accompanying Notice of the Annual Meeting of Stockholders, contains information about the Annual Meeting of Stockholders of Celsius Holdings, Inc., including any adjournments or postponements thereof (referred to herein as the “Annual Meeting”). The Annual Meeting will be held at 2:00 pm Eastern Time on June 1, 2023, or such later date or dates as such Annual Meeting date may be adjourned. We have adopted a virtual format for our Annual Meeting that includes a virtual meeting to provide a consistent and convenient experience to all stockholders regardless of location.

This proxy statement and our 2022 Annual Report is first being mailed on or about May 1, 2023 to all stockholders entitled to vote at the Annual Meeting. This proxy statement has been prepared by the management of Celsius Holdings, Inc.

These proxy materials also are available via the internet at https://www.iproxydirect.com/celh. You are encouraged to read the proxy materials carefully and, in their entirety, and submit your proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. Even if you plan to attend the Annual Meeting virtually, you are encouraged to submit your vote promptly. You have a choice of submitting your proxy by internet, by telephone or by mail, and the proxy materials provide instructions for each option.

When used in this proxy statement, unless otherwise indicated, the terms “the Company,” “Celsius,” “we,” “us” and “our” refers to Celsius Holdings, Inc. and its subsidiaries.

The Board of Directors of the Company (referred to herein as the “Board of Directors” or the “Board”) is soliciting proxies, in the accompanying form, to be used at the Annual Meeting and any adjournments thereof. This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on June 1, 2023: The Notice of Annual Meeting of Stockholders, our Proxy Statement and 2022 Annual Report are available at https://www.iproxydirect.com/celh

Why is this year’s Annual Meeting being held in a virtual format?

In an effort to ensure that all stockholders have an opportunity to attend our Annual Meeting and minimize potential travel burdens, our Board of Directors has determined to hold our Annual Meeting by remote communication via webcast. Stockholders may attend the meeting via webcast, regardless of location. Our decision to hold the Annual Meeting in a virtual format relates only to the 2023 Annual Meeting at this time, however the Board of Directors may decide to continue this format or introduce it as an option for subsequent annual meetings.

How can I participate in the Annual Meeting?

You can attend the Annual Meeting by accessing the meeting URL at https://agm.issuerdirect.com/celh and entering in your stockholder information provided on your ballot or proxy information in the Notice previously mailed to you.

Online access will be available prior to the meeting for you to obtain your information and to vote your shares should you not have done so previously. We encourage you to access the meeting webcast prior to the start time.

Rules for the virtual meeting will be no different than if it was solely an in-person meeting. Professional conduct is appreciated and all Q&A sessions will be conducted at the appropriate time during the meeting.

1

How can I ask questions during the Annual Meeting?

You can submit questions via the meeting planner; telephone, chat feature on the virtual meeting website, email or pass a note to the virtual meeting attendant during the Annual Meeting in the Q&A tab on the virtual platform. You must first join the meeting as described above in “How can I participate in the Annual Meeting?”

Who Can Vote?

Stockholders who owned common stock of the Company at the close of business on April 3, 2023 (the “Record Date”), are entitled to vote at the Annual Meeting. On the Record Date, there were 76,752,970 shares of common stock outstanding and entitled to vote.

You do not need to attend the Annual Meeting virtually to vote your shares. Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. A stockholder may revoke a proxy before the proxy is voted by delivering to our Secretary a signed statement of revocation or a duly executed proxy card bearing a later date. Any stockholder who has executed a proxy card but attends the Annual Meeting may revoke the proxy and vote at the Annual Meeting.

How Many Votes Do I Have?

Each share of common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the Annual Meeting virtually or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via internet or telephone. You may specify whether your shares should be voted for or withheld for each nominee for director, and how your shares should be voted with respect to each of the other proposals. Except as set forth below, if you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Direct Transfer LLC, or you have stock certificates, you may vote:

| ● | By mail. You may complete and mail the proxy card in the postage prepaid envelope we will provide. Your proxy will be voted in accordance with your instructions. If you sign the proxy card, but do not specify how you want your shares voted, they will be voted as recommended by the Board. | |

| ● | By internet. At https://www.iproxydirect.com/celh | |

| ● | By remote communication at the Annual Meeting. You may vote at the Annual Meeting virtually after you have joined the Annual Meeting by accessing the meeting URL at https://agm.issuerdirect.com/celh and following the instructions provided therein. |

If your shares are held in “street name” (held in the name of a bank, broker or other nominee), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

| ● | By internet or by telephone. Follow the instructions you receive from your broker to vote by internet or telephone. | |

| ● | By mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. | |

| ● | By remote communication at the Annual Meeting. Contact the broker or other nominee who holds your shares to obtain a broker’s proxy card and present it to the inspector of election with your ballot when you vote at the Annual Meeting virtually. You will not be able to attend the Annual Meeting virtually unless you have a proxy card from your broker. |

2

How Does the Board Recommend That I Vote on the Proposals?

The Board recommends that you vote as follows:

| ● | “FOR” for the election of the Board nominees as directors; and | |

| ● | “FOR” ratification of the selection of Ernst & Young LLP as our independent public accountant for the fiscal year ending December 31, 2023. |

If any other matter is presented, the proxy card provides that your shares will be voted by the proxy holder listed on the proxy card in accordance with his or her best judgment. As of the date of this proxy statement, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| ● | signing a new proxy card and submitting it as instructed above; | |

| ● | if your shares are held in street name, re-voting by internet or by telephone as instructed above – only your latest internet or telephone vote will be counted; | |

| ● | if your shares are registered in your name, notifying the Company’s Secretary in writing before the Annual Meeting that you have revoked your proxy; or | |

| ● | voting virtually at the Annual Meeting. |

What If I Receive More Than One Proxy Card?

You may receive more than one proxy card or voting instruction form if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above or under “Voting Instructions” on the proxy card for each account to ensure that all of your shares are voted.

Will My Shares Be Voted If I Do Not Return My Proxy Card?

If your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy card by mail or vote at the Annual Meeting as described above under “How Do I Vote?” If your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter, or because your broker chooses not to vote on a matter for which it does have discretionary voting authority, this is referred to as a “broker non-vote.” The New York Stock Exchange (“NYSE”) has rules that govern brokers who have record ownership of listed company stock (including stock such as ours that is listed on The Nasdaq Capital Market) held in brokerage accounts for their clients who beneficially own the shares. Under these rules, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“routine matters”), but do not have the discretion to vote uninstructed shares as to certain other matters (“non-routine matters”). Under NYSE interpretations, Proposal 1 (election of directors), is considered a non-routine matters. Proposal 2 (the ratification of our independent public accountant) is considered a routine matter. If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above under “How Do I Vote?,” the bank, broker or other nominee has the authority, even if it does not receive instructions from you, to vote your unvoted shares for Proposal 2 (the ratification of our independent public accountant), but does not have authority to vote your unvoted shares for Proposal 1 (election of directors). We encourage you to provide voting instructions. This ensures your shares will be voted at the Annual Meeting in the manner you desire.

3

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Proposal 1: Election of Directors

Under our Amended and Restated Bylaws (“Bylaws”), in an uncontested election, the affirmative vote of a majority of the votes cast for this proposal is required to elect directors. In a contested elected, directors shall be elected by a plurality of the votes cast. Our Bylaws also provide that any director that does not receive an affirmative vote of the majority of the votes cast shall submit such person’s resignation to the Board of Directors. The Board of Directors is not legally obligated to accept such resignation and can take any factors and other information into consideration that it deems appropriate or relevant. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

Proposal 2: Ratification of the Appointment of Ernst & Young LLP as our Independent Public Accountant for the Fiscal Year Ending December 31, 2023

The affirmative vote of a majority of the votes cast for this proposal is required to ratify the appointment of the Company’s independent public accountant. Abstentions will be counted towards the tabulation of votes cast on this proposal and will have the same effect as a negative vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to appoint the Company’s independent accountant. However, if our stockholders do not ratify the appointment of Ernst &Young LLP as the Company’s independent public accountant for the fiscal year ending December 31, 2023, the Audit and Enterprise Risk Committee of the Board may reconsider its appointment.

What Constitutes a Quorum for the Annual Meeting?

The presence, virtually or by proxy, of the holders of a majority of the shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting virtually or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Householding of Annual Disclosure Documents

The Securities and Exchange Commission (the “SEC”) previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding our shares on your behalf to send a single set of our annual report and proxy statement to any household at which two or more of our stockholders reside, if either we or the brokers believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both stockholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once stockholders receive notice from their brokers or from us that communications to their addresses will be “householded,” the practice will continue until stockholders are otherwise notified or until they revoke their consent to the practice. Each stockholder will continue to receive a separate proxy card or voting instruction card.

Those stockholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years or (ii) who share an address with another one of our stockholders and who would like to receive only a single set of our annual disclosure documents should follow the instructions described below:

| ● | Stockholders whose shares are registered in their own name should contact our transfer agent, Direct Transfer LLC, 1 Glenwood Avenue STE 1001 Raleigh, NC 27603. Telephone: (919) 481-4000. E-mail: Proxy@issuerdirect.com. |

| ● | Stockholders whose shares are held by a broker or other nominee should contact such broker or other nominee directly and inform them of their request, stockholders should be sure to include their name, the name of their brokerage firm and their account number. |

Upon written or oral request of a stockholder at a shared address to which a single copy of the proxy statement and annual report was delivered, we will deliver promptly separate copies of these documents.

4

Who is paying for this proxy solicitation?

Celsius pays the cost of soliciting your proxy. In addition to mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers and employees any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our Company or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to this Current Report on Form 8-K as soon as they become available.

When are stockholder proposals due for next year’s annual meeting?

At our annual meeting each year, our Board of Directors submits to stockholders its nominees for election as directors. In addition, the Board of Directors may submit other matters to the stockholders for action at the annual meeting.

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), stockholders may present proper proposals for inclusion in the Company’s proxy statement for consideration at the following annual meeting of stockholders (after the one referenced herein) by submitting their proposals to the Company in a timely manner. These proposals must meet the stockholders eligibility and other requirements of the SEC. To be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing by January 2, 2024 to our Corporate Secretary, 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431.

The Company’s Bylaws set forth specific procedures and requirements in order to nominate a director or submit a proposal to be considered at the 2024 Annual Meeting of Stockholders. These procedures require that any nominations or proposals must be received by the Company no earlier than the close of business on February 2, 2024, and no later than the close of business on March 4, 2024, in order to be considered.

If, however, the date of the 2024 Annual Meeting is more than 30 days before or more than 70 days after June 1, 2024, stockholders must submit such nominations or proposals not later than the earlier of: (A) the close of business of the 10th day following the day the public announcement of the date of the annual meeting is first made by the Company and (B) the close of business on the date which is 90 days prior to the date of the annual meeting. In addition, with respect to nominations for directors, if the number of directors to be elected at the 2024 Annual Meeting is increased and there is no public announcement by us naming all of the nominees for director or specifying the size of the increased Board of Directors at least 10 days before the last day a stockholder may deliver a notice of nominations, notice will also be considered timely, but only with respect to nominees for any new positions created by such increase, if it is delivered to the Secretary at our principal executive offices not later than the close of business on the 10th day following the day on which such public announcement is first made by us.

In addition to satisfying the foregoing advance notice requirements under our Bylaws, to comply with the universal proxy rules under the Exchange Act, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 2, 2024.

Pursuant to Rule 14a-4(c)(1) promulgated under the Exchange Act, the proxies designated by us for the Annual Meeting will have discretionary authority to vote with respect to any proposal received after March 17, 2023, which is 45 days before the date on which the Company first sent the proxy materials for the Annual Meeting. In addition, our Bylaws provide that any matter to be presented at the Annual Meeting must be proper business to be transacted at the Annual Meeting or a proper nomination to be decided on at the Annual Meeting and must have been properly brought before such meeting pursuant to our Bylaws.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the Record Date, the beneficial ownership of our common stock, or an earlier date for information based on filings with the SEC, by each executive officer, each current director and nominee for director, each person known by us to beneficially own 5% or more of our common stock and by executive officers and directors as a group. The address of the each of the executive officers and directors set forth in the table is c/o the Company, 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431.

Beneficial ownership is determined in accordance with the rules of the SEC. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons listed in the table have sole investment and voting power with respect to all Company securities owned by them.

Under the rules of the SEC, a person (or group of persons) is deemed to be a “beneficial owner” of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security including securities that he or she has the right to acquire within 60 days. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. The following information is based upon information provided to us or filed with the SEC by the stockholders. Percentage ownership calculations are based on 76,752,970 shares of common stock outstanding as of the Record Date.

| Names and addresses of beneficial owners | Number of Shares of common stock | Percentage of class (%) | |||||||||

| John Fieldly | 1,279,472 | (1) | 1.7 | % | |||||||

| Jarrod Langhans | 9,930 | (2) | * | ||||||||

| Nicholas Castaldo | 246,491 | (3) | * | ||||||||

| Caroline Levy | 49,867 | (4) | * | ||||||||

| Cheryl S. Miller | 4,950 | (5) | * | ||||||||

| Joyce Russell | 4,950 | (6) | * | ||||||||

| Damon DeSantis | 237,944 | (7) | * | ||||||||

| Hal Kravitz | 126,297 | (8) | * | ||||||||

| Alexandre Ruberti | 13,200 | (9) | * | ||||||||

| James Lee | - | * | |||||||||

| Edwin Negron | 100,677 | (10) | * | ||||||||

| Tony Guilfoyle | - | * | |||||||||

| Toby David | 18,224 | (11) | * | ||||||||

| Paul Storey | - | * | |||||||||

| All officers and directors as a group (ten (10) persons) | 2,092,002 | 2.7 | % | ||||||||

| Other 5% or greater stockholders: | |||||||||||

| Carl DeSantis | 17,961,960 | (12) | 23.4 | % | |||||||

| 3161 Jasmine Drive Delray Beach, Florida 33483 | |||||||||||

| William H. Milmoe | 9,813,462 | (13) | 12.8 | % | |||||||

| 3299 NW 2nd Avenue Boca Raton, FL 33431 | |||||||||||

| BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 5,201,341 | (14) | 6.8 | % | |||||||

| FMR LLC 245 Summer Street Boston, MA 02210 | 7,917,950 | (15) | 10.3 | % | |||||||

| Chau Hoi Shuen Solina Holly Suites PT. 2909 & 2910, Harbour Centre 25 Harbour Road Wanchai, Hong Kong 999077 | 8,846,232 | (16) | 11.5 | % | |||||||

| The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 4,236,566 | (17) | 5.5 | % | |||||||

| * | Less than 1% |

6

| (1) | Represents (a) 966,075 shares of our common stock that are issuable upon exercise of stock options and (b) 313,397 shares of common stock held of record by Mr. Fieldly which include vested RSUs. |

| (2) | Represents (a) 3,719 shares of common stock subject to RSUs that will vest within 60 days of the Record Date, (b) 6,211 shares of common stock held of record by Mr. Langhans which include vested RSUs and (c) 50 shares of common stock held jointly with his spouse. |

| (3) | Represents (a) 110,000 shares of common stock issuable upon the exercise of stock options and (b) 136,491 shares of common stock held of record by N.A. Castaldo Separate Property Trust, controlled by Mr. Castaldo which include vested RSUs. |

| (4) | Represents (a) 36,667 shares of common stock issuable upon the exercise of stock options and (b) 13,200 shares of common stock held of record by Ms. Levy which include vested RSUs. |

| (5) | Represents 4,950 shares of common stock held of record by Ms. Miller which include vested RSUs. |

| (6) | Represents 4,950 shares of common stock held of record by Ms. Russell which include vested RSUs. |

| (7) | Represents 237,944 shares of common stock held of record by Mr. DeSantis which include vested RSUs. |

| (8) | Represents (a) 110,000 shares of common stock issuable upon the exercise of stock options and (b) 16,297 shares of common stock held of record by Mr. Kravitz which include vested RSUs. |

| (9) | Represents 13,200 shares of common stock held of record by Mr. Ruberti which include vested RSUs. |

| (10) | Represents 100,677 shares of common stock held of record by Mr. Negron which include vested RSUs. |

| (11) | Represents 18,224 shares of common stock held of record by Mr. David which include vested RSUs. |

| (12) | Represents (a) 2,550,311 shares of common stock held of record by CDS Ventures, LLC (“CDS Ventures”), (b) 7,213,236 shares of common stock held of record by CD Financial LLC (“CD Financial”), (c) 3,600,000 shares of common stock held of records by GRAT 1, LLC, (d) 3,888,413 shares of common stock held by Carl DeSantis Retained Annuity Trust 2, and (e) 710,000 shares of common stock held of record by Carl Angus DeSantis Foundation. Voting power of shares of common stock beneficially owned by CDS Ventures and CD Financial is shared by Mr. Damon DeSantis and Mr. William Milmoe. Mr. DeSantis has sole dispositive power with respect to such shares. |

| (13) | Represents (a) 49,915 shares of common stock held of record by Mr. Milmoe, (b) 2,550,311 shares of common stock held of record by CDS Ventures, and (c) 7,213,236 shares of common stock held of record by CD Financial. Mr. Milmoe and Carl DeSantis share voting power with respect to shares of common stock beneficially owned by CDS Ventures and CD Financial. Mr. Milmoe does not have dispositive power with respect to such shares of common stock. |

| (14) | The information as to beneficial ownership is based on a Schedule 13G/A filed on February 1, 2023 with the SEC on behalf of BlackRock, Inc. The Schedule 13G/A states that BlackRock, Inc. has sole voting power over 5,141,693 shares of common stock and sole dispositive power over 5,201,341 shares of common stock. |

| (15) | The information as to beneficial ownership is based on a Schedule 13G/A filed on March 10, 2023 with the SEC on behalf of FMR LLC. The Schedule 13G/A states that FMR LLC has sole voting power over 7,249,994 shares of common stock and sole dispositive power over 7,917,950 shares of common stock. |

| (16) | The information as to beneficial ownership is based on a Schedule 13G/A filed on November 30, 2022 with the SEC on behalf of Chau Hoi Shuen Solina Holly, Grieg International Limited and Oscar Time Limited and a Form 4 filed by Chau Hoi Shuen Solina Holly on March 8, 2023. The Schedule 13G/A states that Chau Hoi Shuen Solina Holly has sole voting and dispositive power over the 9,164,294 shares of common stock held of record by Grieg International Limited and the 235,955 shares of common stock held of record by Oscar Time Limited. The Form 4 states that Chau Hoi Shuen Solina Holly sold 554,017 shares of common stock. |

| (17) | The information as to beneficial ownership is based on a Schedule 13G/A filed on February 9, 2023 with the SEC on behalf of The Vanguard Group - 23-1945930 (the “Vanguard Reporting Person”). The Schedule 13G/A states that Vanguard Reporting Person has shared voting power over 92,395 shares of common stock, shared dispositive power over 134,606 shares of common stock and sole dispositive power over 4,101,960 shares of common stock. |

7

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers, directors and persons owning more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership of all equity and derivative securities of the Company with the SEC and Nasdaq. Based solely on a review of such forms and related amendments filed with the SEC, and, where applicable, written representations from the Company’s officers and directors that no Form 5s were required to be filed, the Company believes that during the year ended December 31, 2022, all of the Company’s executive officers, directors and beneficial owners of more than ten percent of the Company’s equity securities timely complied with all applicable filing requirement under Section 16(a) of the Exchange Act, except that (i) one report, covering one transaction, was filed late by Mr. Langhans, (ii) four reports, covering a total of five transactions, were filed late by Ms. Levy, (iii) two reports, covering a total of two transactions, were filed late by Ms. Miller, (iv) two reports, covering a total of two transactions, were filed late by Ms. Russell, (v) one report, covering a total of two transactions, was filed late by Mr. Kravitz, (vi) two reports, covering a total of three transactions, were filed late by Mr. Ruberti, and (vii) one report, covering one transaction, was filed late by Mr. Carl Desantis.

8

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Governance and Nominating Committee of the Board of Directors and the Board of Directors as a whole have unanimously approved the recommended slate of nine directors.

The following table shows the Company’s nominees for election to the Board of Directors. Each nominee, if elected, will serve until the next annual meeting of stockholders and until a successor is named and qualified, or until his or her earlier resignation or removal. All of the nominees are members of the present Board of Directors. We have no reason to believe that any of the nominees is unable or will decline to serve as a director if elected. Unless otherwise indicated by the stockholder, the accompanying proxy will be voted for the election of the nine persons named under the heading “Nominees for Directors.” Although the Company knows of no reason why any nominee could not serve as a director, if any nominee shall be unable to serve, the accompanying proxy will be voted for a substitute nominee.

Nominees for Director

| Name | Age | Position with the Company | ||

| John Fieldly | 43 | Chairman of the Board and Chief Executive Officer and Director | ||

| Nicholas Castaldo | 71 | Director | ||

| Caroline Levy | 60 | Director | ||

| Hal Kravitz | 65 | Lead Independent Director | ||

| Alexandre Ruberti | 47 | Director | ||

| . | ||||

| Cheryl Miller | 50 | Director | ||

| Damon DeSantis | 59 | Director | ||

| Joyce Russell | 62 | Director | ||

| James Lee | 48 | Director |

The Governance and Nominating Committee and the Board seek, and the Board is comprised of, individuals whose characteristics, skills, expertise, and experience complement those of other Board members. We have set out below biographical and professional information about each of the nominees, along with a brief discussion of the experience, qualifications, and skills that the Board considered important in concluding that the individual should serve as a current director and as a nominee for re-election or election as a member of our Board.

Nominee Biographies

John Fieldly has served as Chairman of the Board since August 2020, as Chief Executive Officer since April 2018 and a member of the Company’s Board of Directors since March 2017. Mr. Fieldly originally joined Celsius in January 2012 as its Chief Financial Officer and from March 2017 to March 2018 served as Interim Chief Executive Officer and Chief Financial Officer. Prior to joining Celsius Holdings, Inc. he held leadership roles at Lebhar-Friedman, Oragenics, Inc. and Eckerd Drugs, Inc. Mr. Fieldly is a Certified Public Accountant in Florida. Mr. Fieldly brings to our Board his impressive experience in accounting, finance and executive leadership. In addition, Mr. Fieldly’s long tenure with the Company and knowledge of our operations and financial history make him a valuable member of our Board o in addition to his position as Chief Executive Officer.

9

Nicholas Castaldo Mr. Castaldo joined the Board in March 2013. His career spans over 30 years in consumer businesses in the food and beverage industry with executive positions in public and private companies, multi-nationals and start-ups. He is a member of the Advisory Board of Frank Pepe Pizzeria, a regional casual dining restaurant concept. He is an Equity Partner of Lime Fresh Mexican Grill, a fast-casual Mexican restaurant chain and served as the company’s CMO for 2 years. Mr. Castaldo was an Equity Partner and member of the founding management team of Anthony’s Coal Fired Pizza, a casual dining restaurant chain, and served as President, Senior Vice-President/Chief Marketing Officer, and Board Member for 12 years. He served for 8 years as President of Pollo Tropical, a Miami-based fast casual restaurant chain. He has held senior Marketing positions at Denny’s, CitiCorp Savings and Burger King. He is a member of the Marketing Advisory Board and an Adjunct Professor at the H. Wayne Huizenga College of Business and Entrepreneurship at Nova Southeastern University teaching courses in Marketing and Entrepreneurship. He earned his MBA from the Harvard Business School at Harvard University. His significant experience in the food and beverage industry, as well as his executive leadership and management experience, qualifies him as a valuable member of our Board.

Caroline Levy has served as a director of Celsius since July 2020. Ms. Levy most recently served as Senior Equity Research Analyst at Macquarie covering both large and small cap beverage companies. Prior to this, Ms. Levy spent eight years as a managing director and senior analyst at CLSA. This followed a decade at UBS, where Ms. Levy headed the US consumer research team, while also holding the position of COO for all research and Chair of the Investment Review Committee. Caroline has made numerous media appearances including CNBC’s “Mad Money with Jim Cramer” and Bloomberg. Additionally, she has been recognized multiple times including, “The Institutional Investor All Star survey” and “The Wall Street Journal analyst rankings”, for stock picking and earnings accuracy. Ms. Levy’s equity analysis and capital markets experience, with a focus on beverage companies, brings a unique perspective to her position on our Board.

Hal Kravitz became a director of Celsius in April 2016 and the Lead Independent Director effective July 2021. From November 2018 through November 2021, Mr. Kravitz served as President, Certified Management Group, a division of Advantage Solutions. From 2014 to 2018, Mr. Kravitz served as Chief Executive Officer of AQUAhydrate, Inc., a company engaged in the manufacture, distribution, and marketing of premium bottled water. In 2013, Mr. Kravitz as a founding member, helped form InterContinental Beverage Capital, a New York-based merchant bank focused on investments in the beverage and other CPG industries. For over thirty (30) years prior thereto, Mr. Kravitz served as an executive officer and in other management positions in various units of the Coca-Cola system including President of its acquired Glaceau Company, makers of Vitaminwater® and Smartwater®. We believe that Mr. Kravitz’s extensive experience in the beverage industry makes him a valuable member of Board.

Alexandre Ruberti joined the Board of Directors in February 2021. Mr. Ruberti brings a wealth of experience to Celsius having spent the past 25 years in the beverage industry across the Americas. Currently, Mr. Ruberti serves as CEO and Board Member of Future Farm USA, a plant-based meat company with a presence in 28 countries. Previously, Mr. Ruberti served in various positions at Red Bull as the President of Red Bull Distribution Company USA, Executive Vice President of Sales for Red Bull North America, and as Head of National Sales and Distribution of Brazil. Prior to Red Bull, he spent nine years at Coca-Cola Bottlers in Brazil. Ruberti obtained his MBA from Fundação Getulio Vargas in Brazil. He also serves as a Member of the Young Presidents’ Organization – YPO - Santa Monica Bay chapter and is an active angel investor. Given Mr. Ruberti’s extensive experience in the beverage industry, we believe that he will provide valuable perspectives to executing our strategy, driving profitability and enhancing value for our stockholders.

Cheryl S. Miller joined the Board of Directors in August 2021. Ms. Miller most recently served as chief financial officer of West Marine, the nation’s leading omni-channel provider of products, services and expertise for the marine aftermarket. Cheryl previously served as an executive strategic advisor for, and executive vice president and chief financial officer of, JM Family Enterprises, a diversified automotive company ranked No. 20 on Forbes’ lists of Americas Largest Private Companies. Cheryl has also previously served as President and Chief Executive Officer and held positions of Ex VP and Chief Financial Officer, Treasurer and VP of Investor Relations between 2010 and April 2021 with AutoNation Inc., a publicly traded Fortune 150 automotive retailer while also serving on their board from July 2019 to July 2020. In addition, since 2016, Cheryl has been serving as a director of Tyson Foods, Inc., one of the world’s largest public food companies where she is a member of Tyson’s Audit committee and chairs the Compensation & Leadership Development committee. Ms. Miller holds a bachelor’s degree in finance and business administration from James Madison University and brings over 20 years of corporate finance experience in consumer-focused industries specializing in M&A, cybersecurity, e-commence and public company stockholder relations. We believe that Ms. Miller’s experience as a corporate chief financial officer makes her a valuable addition to our Board.

10

Damon DeSantis joined the Board of Directors in August 2021. Mr. DeSantis currently serves as a board member of MacPherson’s, the largest employee-owned distributor of creative materials and art supplies in North America. His corporate business interests continue with ownership, direct investment, and board membership in a variety of private businesses in the hospitality, financial services, automotive, spirits and cannabis industries. Previously, Damon served as Chief Executive Officer of Rexall Sundown Nutritional Company, a former Nasdaq 100 company until 2001 as well as a board member of the company. Rexall Sundown was in the business of developing, manufacturing, packaging, marketing, and distributing nutritional products of over 2800 SKUs to wholesalers, distributors, retailers in the US and worldwide. Damon is the son of Carl DeSantis, one of the principal stockholders of Celsius. We believe that Mr. DeSantis’ wide array of business experience brings a valuable viewpoint to our Board.

Joyce Russell joined the Board of Directors in August 2021. Ms. Russell currently serves as President of the Adecco Group U.S. Foundation, which is focused on up/re-skilling American workers and helping to ensure work equality for all. The Foundation was formed in 2019 and Ms. Russell was appointed its first President. She previously served as President of Adecco Staffing US from 2004 to 2018, an affiliate of the Swiss public company Adecco Group AG, a Fortune Global 500 company, and she brings over 34 years of experience specializing in human resources. Ms. Russell is a panelist and participates at the World Economic Forum in Davos and Fortune’s Most Powerful Women Summits and serves on the Board of Directors of the American Staffing Association. Ms. Russell holds a Bachelor of Arts degree in business and communications from Baylor University. We believe that Ms. Russell’s experience in human resources makes her a valuable member of our Board.

James Lee joined the Board of Directors in August 2022. Mr. Lee is currently Senior Vice President, Corporate Finance for PepsiCo, leading the company’s tax and treasury functions as well as the global SAP transformation program. He was previously Senior Vice President, Chief Strategy and Transformation Officer for PepsiCo Beverages North America (“PBNA”) where he was responsible for leading the PBNA’s long-term strategy, business development, digital and value chain transformation, and sustainability. Mr. Lee joined PepsiCo in 1998 and has held several finance leadership roles since that time, including Senior Vice President for PBNA, Senior Vice President and CFO of the Russia and CIS Region, Vice President and CFO of Southeast Europe, Senior Director and CFO of PepsiCo Australia and New Zealand, and Senior Director, Strategy and Planning of China Beverages. Prior to joining PepsiCo, Mr. Lee worked for the management consultancy, Marakon Associates. Mr. Lee holds a BSE in Operations Research from Princeton University and an MBA from Columbia University. We believe that Mr. Lee’s experience in the beverage industry makes him a valuable member of our Board.

Mr. Lee was elected to serve on the Board pursuant to that certain arrangement between the Company and PepsiCo, Inc. (“Pepsi”) whereby the Company agreed to permit Pepsi to designate one nominee to the Board for so long as Pepsi beneficially owns at least 3,666,665 shares of the Company’s outstanding common stock on an as-converted basis. See “Certain Relationships and Related Transactions and Director Independence” for additional information regarding such arrangement. Other than the arrangement with Pepsi described above, there are not any arrangements or understandings between any of our director nominees or executive officers or any other person pursuant to which any executive officer or director was or is to be selected as an executive officer or director.

Other than the arrangement with Pepsi described above, there are not any arrangements or understandings between any of our director nominees or executive officers or any other person pursuant to which any executive officer or director was or is to be selected as an executive officer or director.

Family Relationships

There are no family relationships among our executive officers and director nominees.

Involvement in Certain Legal Proceedings

During the past ten years, none of our directors, executive officers, promoters, control persons, or nominees has been involved in any legal proceedings requiring disclosure under Item 401(f) of Regulation S-K promulgated under the Securities Act of 1933, as amended.

11

Vote Required

Under our Bylaws, in an uncontested election, the affirmative vote of a majority of the votes cast for this proposal is required to elect directors. In a contested elected, directors shall be elected by a plurality of the votes cast. Our Bylaws also provide that any director that does not receive an affirmative vote of the majority of the votes cast shall submit such person’s resignation to the Board of Directors. The Board of Directors is not legally obligated to accept such resignation and can take any factors and other information into consideration that it deems appropriate or relevant. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE AS DIRECTORS, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

12

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND

CORPORATE GOVERNANCE

Director Attendance at Board, Committee, and Other Meetings

During the year ended December 31, 2022, the Board of Directors held nine (9) meetings, the Audit and Enterprise Risk Committee met eight (8) times, and the Human Resource and Compensation Committee met twelve (12) times. The Governance and Nominating Committee met two (2) times. No director attended fewer than 75% of the total number of meetings of the Board or of any committee such director served on (in each case, during the periods that such director served). We do not have a formal policy in place with respect to director attendance at the Company’s annual meeting of stockholders. All of our directors attended the 2022 annual meeting of stockholders

Board Committees and Independence

Our Board of Directors has established three standing committees: the Audit and Enterprise Risk Committee; Human Resource and Compensation Committee; and the Governance and Nominating Committee. The table below sets forth the members of each of the aforementioned committees:

| Audit and Enterprise Risk Committee | Human Resource and Compensation Committee | Governance and Nominating Committee |

Cheryl S. Miller (Chairperson) Joyce Russell Caroline Levy James Lee | Joyce Russell (Chairperson) Nicholas Castaldo Hal Kravitz Alexandre Ruberti | Damon DeSantis (Chairperson) Nicholas Castaldo Cheryl S. Miller Caroline Levy James Lee |

The principal responsibilities of each of these committees are described generally below and in detail in their respective committee charters which are available on the Company’s website at www.celsiusholdingsinc.com. The information on our website is not incorporated by reference into, or a part of, this proxy statement.

Our Board of Directors has determined that each of our current directors, except John Fieldly, and each of our director nominees is “independent” within the meaning of the applicable rules and regulations of the SEC and the listing standards of the Nasdaq Stock Market. See “Certain Relationships and Related Transactions and Director Independence” for additional information regarding the Board’s determination of director independence.

In addition, we believe Ms. Levy, Mr. Lee and Ms. Miller qualify as an “audit committee financial expert” as the term is defined by the applicable rules and regulations of the SEC and the Nasdaq Stock Market listing standards, based on their respective business professional experience in the financial and accounting fields.

Audit and Enterprise Risk Committee

The Audit and Enterprise Risk Committee assists our Board of Directors in its oversight of the company’s accounting and financial reporting processes and the audits of the company’s financial statements, including (i) the quality and integrity of the company’s financial statements, (ii) the company’s compliance with legal and regulatory requirements, (iii) the independent auditors’ qualifications and independence and (iv) the performance of our company’s internal audit functions and independent auditors, as well as other matters which may come before it as directed by the Board of Directors. Further, the Audit and Enterprise Risk Committee, to the extent it deems necessary or appropriate, among its several other responsibilities, shall:

| ● | have sole responsibility for the appointment, compensation, retention, evaluation, termination and oversight of the work of any independent auditor engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for our Company (subject, if appropriate to ratification by a vote of the stockholders of the Company); |

13

| ● | review and pre-approve all the audit services to be performed and the proposed fees in connection with such audit services; |

| ● | review with management, the independent auditors and the internal auditors the quality and adequacy of internal controls that could significantly affect the Company’s financial statements and the disclosure controls and procedures designed to ensure compliance with applicable laws and regulations; | |

| ● | review with the independent auditors the Company’s relationships and transactions with related parties that are significant to the Company; | |

| ● | discuss with management and the independent auditors the quality and adequacy of the Company’s internal controls and disclosure controls and procedures, and review disclosures made by the Company’s principal executive officer and principal financial officer in the Company’s periodic reports filed with the SEC regarding compliance with their certification obligations; | |

| ● | discuss the annual audited financial statements and the quarterly unaudited financial statements with management and the independent auditor prior to their filing with the SEC in our annual report on Form 10-K and quarterly reports on Form 10-Q; | |

| ● | review and discuss with management and the independent auditors the Company’s quarterly earnings press releases, as well as financial information and earnings guidance to be provided to investors, analysts or rating agencies; | |

| ● | review with the Company’s financial management the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, that may have a material impact on the Company’s financial statements; | |

| ● | discuss with management and the independent auditors matters related to (a) the Company’s major financial risk exposures, including financial, operational, compliance, strategic, privacy, cybersecurity, business continuity, third party risks, legal and regulatory risks, any emerging risks, (b) the Company’s policies with respect to risk assessment and risk management, and (c) the steps management has taken to monitor and control these exposures; | |

| ● | review with the Company’s General Counsel legal and regulatory matters that may have a material impact on the financial statements, including legal cases against or regulatory investigations of the Company, and any material reports or inquiries received from regulators or government agencies; | |

| ● | periodically review the Company’s material policies and procedures regarding ethics and compliance, including the Company’s Code of Ethical Conduct and the Company’s Code of Ethics for Senior Financial Officers; | |

| ● | maintain open, continuing and direct communication between the Board of Directors, the Audit and Enterprise Risk Committee and our independent auditors; and | |

| ● | annually review and reassess the adequacy of, and compliance with, the Committee’s charter, and recommend any proposed changes to the Board for approval. |

Ms. Miller is the current chairperson of our Audit and Enterprise Risk Committee and will stand for re-election as a director at the Annual Meeting.

14

Human Resource and Compensation Committee

The Human Resource and Compensation Committee aids our Board of Directors (which is sometimes referred to in this proxy statement as the “Compensation Committee”) (i) in meeting its responsibilities relating to the compensation of our Company’s executive officers, (ii) to administer all incentive compensation plans and equity-based plans of the Company, including the plans under which Company securities may be acquired by directors, executive officers, employees and consultants, and (iii) reviewing and making recommendations to the Board regarding compensation of non-employee directors, among other duties. Further, the Human Resource and Compensation Committee, among its several other responsibilities, shall:

| ● | annually review and approve the goals, objectives and philosophies with respect to the compensation of the Company’s Chief Executive Officer and other executive officers, and oversee their implementation, consistent with approved compensation plans, to ensure that compensation decisions regarding executive officers are aligned with such goals, objectives and philosophies; | |

| ● | annually review and approve the compensation of our executive officers, including annual base salary, short-term incentive awards, long-term incentive awards, severance benefits, perquisites and any other special or supplemental benefits; | |

| ● | review and approve compensation plans and retirement plans with respect to our executive officers and, to the extent it deems necessary or appropriate, make recommendations regarding the establishment, amendment or modification of any such plans; | |

| ● | administer and interpret the Company’s incentive and equity compensation plans, to the extent required by the terms of such plans, or applicable law, rules or regulations; | |

| ● | review and approve employment, severance, change in control, termination and retirement arrangements for our executive officers; | |

| ● | at least annually, review non-employee director compensation and benefits for service on the Board and Board committees in relation to other comparable companies and in light of such factors as the Committee may deem appropriate, and make recommendations to the Board regarding compensation for non-employee directors; | |

| ● | review and approve all of the Company’s material compensation-related policies (including policies on claw backs, hedging and pledging); | |

| ● | review periodically reports from management regarding funding the Company’s pension, retirement, long-term disability and other management welfare and benefit plans; | |

| ● | oversee and at least annually review the assessment and mitigation of risks associated with the Company’s compensation policies and practices; | |

| ● | review and discuss with management the Company’s Compensation Discussion and Analysis (“CD&A”) and, based on such review and discussion, recommend to the Board that the CD&A should be included in the Company’s annual report on Form 10-K or proxy statement on Schedule 14A; | |

| ● | prepare an annual “Compensation Committee Report” for inclusion in the Company’s annual report on Form 10-K or proxy statement on Schedule 14A; and | |

| ● | annually review and reassess the adequacy of the Committee’s charter, structure, processes and membership requirements, and submit any recommended changes to the Board. |

Ms. Russell is the current chairperson of our Human Resource and Compensation Committee and will stand for re-election as a director at the Annual Meeting.

15

Governance and Nominating Committee

The Governance and Nominating Committee considers and makes recommendations to the Board regarding matters relating to: (i) the identification and qualification of Board members and potential Board members; (ii) advising the Board with respect to the Board composition, procedures and committees; (iii) corporate governance principles applicable to the Company and other corporate governance matters, including any related corporate governance matters required by the federal securities laws; and (iv) the evaluation of the Board and the Company’s management, among other duties.

Further, the Governance and Nominating Committee, among its several other responsibilities shall:

| ● | identify, screen and recommend candidates for membership on the Board to fill vacancies and newly created directorships, consistent with the criteria recommended by the Governance and Nominating Committee and approved by the Board, both in connection with the annual meeting of stockholders and at other times when a vacancy or newly created directorship may exist, as well as consider director nominees proposed by stockholders; | |

| ● | make recommendations to the Board regarding the selection and approval of the nominees for director to be submitted to a stockholder vote at the annual meeting of stockholders or for appointment by the Board; and in connection with the foregoing, ensure that the Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity required for the Board as a whole and contains at least the minimum number of independent directors required by Nasdaq listing standards; | |

| ● | review the suitability for continued service as a director of each member of the Board of Directors when his or her term expires or when he or she has a significant change in status; | |

| ● | periodically review and make recommendations to the Board concerning the size, structure, composition, and procedures of the Board and Board committees; | |

| ● | at least annually review and assess the independence of each director in accordance with the guidelines established by the Board, applicable Nasdaq listing standards and federal rules and regulations, and make recommendations to the Board regarding the independence of each director; | |

| ● | consider matters of corporate governance and periodically review the Company’s corporate governance policies and recommend to the Board modifications to the policies as appropriate; | |

| ● | review, approve and oversee any transaction between the Company and any related person (as defined in Item 404 of Regulation S-K) on an ongoing basis, and to develop and review policies and procedures for the Committee’s approval of related party transactions; | |

| ● | provide oversight of and make recommendations to the Board regarding the Company’s response to stockholder proposals submitted to the Company for consideration at the Company’s annual meeting of stockholders; and | |

| ● | annually review and reassess the adequacy of the Committee’s charter, structure, processes and membership requirements, and submit any recommended changes to the Board. |

Mr. DeSantis is the current chairperson of our Governance and Nominating committee and will stand for re-election as a director at the Annual Meeting.

Non-Employee Director Stock Ownership Policy

The Board has adopted stock ownership requirements for non-employee directors. These requirements provide that each non-employee director is required to own shares of common stock with an aggregate value of $300,000. Non-employee directors of the Company must satisfy the ownership requirement within five years of the later of November 1, 2022, or the date of their appointment to the applicable position. If the executive or director fails to meet the stock ownership requirement, he or she is required to retain all shares held by the executive or director, including all shares received upon the vesting of equity awards (net of the exercise price of options and tax withholding).

16

Director Rotation Policy

The Board has adopted a director rotation policy. This policy provides that director who have served for fifteen (15) years or who have served for ten (10) years and have reached the age of 72, will rotate off the Board of Directors by not standing for reelection at the next Annual Meeting of Stockholders.

Board Leadership Structure

The Board of Directors does not have a policy on whether or not the roles of Chief Executive Officer and Chairman of the Board should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee. The Board of Directors believes that whether to have the same individual serve as Chairman of the Board and Chief Executive Officer should be decided by the Board, from time to time, in accordance with its business judgment after considering relevant factors, including the specific needs of the business and what is in the best interest of the Company’s stockholders. The Board believes that John Fieldly, the Company’s current Chief Executive Officer is best suited to serve as Chairman of the Board. The Board believes that its current leadership structure is appropriate and effective at this time, given the Company’s stage of development.

Lead Independent Director

In July 2021, the independent directors of the Board approved the creation of the position of Lead Independent Director. If the offices of Chairman of the Board and Chief Executive Officer are held by the same person, the independent members of the Board of Directors will annually elect, with a majority vote, an independent director to serve in a lead capacity. Although elected annually, the Lead Independent Director is generally expected to serve for more than one year. The Lead Independent Director may be removed or replaced at any time with or without cause by a majority vote of the independent members of the Board. Hal Kravitz is currently the Lead Independent Director. As an experience career professional in the food and beverage industry, he brings to the Board a wealth of knowledge regarding the Company’s performance and its growth and development.

Code of Ethics

We have adopted a Code of Ethics Conduct (“Code of Ethics”) that applies to all of our executive officers, directors and employees and which codifies the business and ethical principles that govern all aspects of our business. The Board also adopted a Code of Ethics for Senior Financial Officers (the “Senior Financial Officer Code of Ethics”, and collectively with the Code of Ethics, the “Codes”), which is applicable to all senior executive officers (including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions). A copy of each of the Codes is available on the Company’s website at https://www.celsiusholdingsinc.com/code-of-ethics/. If we make any substantive amendments to the Codes or grant any waiver from a provision of the Codes to any executive officer or director, we intend to promptly disclose the nature of the amendment or waiver on our website, to the extent required by the applicable rules and exchange requirements. The information on the Company’s website does not constitute part of this Proxy Statement and is not incorporated by reference herein. T

Board of Directors’ Role in Risk Oversight

Members of the Board of Directors have periodic meetings with management and the Company’s independent auditors to perform risk oversight with respect to the Company’s internal control processes. The Company believes that the Board’s role in risk oversight does not materially affect the leadership structure of the Company.

Anti-Hedging and Pledging Policy

We have adopted a policy prohibiting the hedging and pledging of our securities, which applies to all officers, directors, employees and independent contractors or advisors of the Company and provides that such individuals are prohibited from (i) engaging in any hedging transactions (including forward sale or purchase contracts, equity swaps, collars or exchange funds) with respect to securities of the Company, and (ii) holding the Company’s securities in a margin account or pledging Company securities as collateral for a loan. As of the date of this proxy statement, all of our directors and executive officers are in compliance with this policy.

17

Consideration of Director Nominees

We seek directors with the highest standards of ethics and integrity, sound business judgment, and the willingness to make a strong commitment to the Company and its success. The Governance and Nominating Committee works with the Board on an annual basis to determine the appropriate and desirable mix of characteristics, skills, expertise, and experience for the full Board and each committee, taking into account both existing directors and all nominees for election as directors, as well as any diversity considerations and the membership criteria applied by the Governance and Nominating Committee. The Governance and Nominating Committee and the Board, which do not have a formal diversity policy, consider diversity in a broad sense when evaluating Board composition and nominations; and they seek to include directors with a diversity of experience, professions, viewpoints, skills, and backgrounds that will enable them to make significant contributions to the Board and the Company, both as individuals and as part of a group of directors. The Board evaluates each individual in the context of the full Board, with the objective of recommending a group that can best contribute to the success of the business and represents stockholder interests through the exercise of sound judgment. In determining whether to recommend a director for re-election, the Governance and Nominating Committee also considers the director’s attendance at meetings and participation in and contributions to the activities of the Board and its committees.

The Governance and Nominating Committee will consider director candidates recommended by stockholders, and its process for considering such recommendations is no different than its process for screening and evaluating candidates suggested by directors, management of the Company, or third parties. See “General Information About the Annual Meeting - When are stockholder proposals due for next year’s annual meeting?” for the procedures to be followed by stockholders to submit recommendations for director candidates.

Board Diversity

We are committed to diversity and inclusion, and the highly diverse nature of the Board reflects that commitment. The below Board Diversity Matrix reports self-identified diversity statistics for the Board in the format required by Nasdaq’s rules.

| Board Diversity Matrix (As of April 15, 2023) | ||||

| Board Size: | ||||

| Total Number of Directors | 9 | |||

| Female | Male | Non- Binary | Did not Disclose Gender | |

| Gender: | ||||

| Directors | 3 | 6 | 0 | 0 |

| Number of Directors who identify in Any of the Categories Below: | ||||

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian (other than South Asian) | 0 | 1 | 0 | 0 |

| South Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 1 | 1 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 4 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 | |||

| Persons with Disabilities | 0 | |||

18

Communications with the Board of Directors

Stockholders and other parties may communicate directly with the Board of Directors or the relevant Board member by addressing communications to:

Celsius Holdings, Inc.

c/o Corporate Secretary

2424 N. Federal Highway, Suite 208

Boca Raton, Florida 33134

All stockholder correspondence will be compiled by our corporate secretary. Communications will be distributed to the Board of Directors, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Items that are unrelated to the duties and responsibilities of the Board of Directors may be excluded, such as:

| ● | junk mail and mass mailings; | |

| ● | resumes and other forms of job inquiries; | |

| ● | surveys; and | |

| ● | solicitations and advertisements. |

In addition, any material that is unduly hostile, threatening, or illegal in nature may be excluded, provided that any communication that is filtered out will be made available to any independent director upon request.

19

EXECUTIVE OFFICERS

The following persons are our executive officers and hold the offices set forth opposite their names.

| Name | Age | Principal Occupation | Officer Since | |||

| John Fieldly | 43 | Chairman of the Board, and Chief Executive Officer | 2016 | |||

| Jarrod Langhans | 42 | Chief Financial Officer | 2022 |

John Fieldly, Chairman of the Board and Chief Executive Officer

The biography for John Fieldly is contained in the information disclosures relating to the Company’s nominees for director.

Jarrod Langhans, Chief Financial Officer

Mr. Langhans became our Chief Financial Officer effective April 18, 2022. From June 2020 until joining Celsius, Mr. Langhans served as Chief Financial Officer of the European and Israel operating segments of Primo Water Corporation. From July 2012 through May 2020, has held various executive positions within Primo Water Corporation across the accounting, finance and investor relations areas. Mr. Langhans’ prior experience also includes working for major accounting firms such as CBIZ Mayer Hoffman McCann (MHM) and Cherry Bekaert. He is a Certified Public Accountant in Florida and has an extensive and diversified financial and leadership background across areas such as financial reporting including SEC, GAAP and IFRS, financial planning and analysis (FPA), mergers and acquisitions (M&A), investor relations (IR), debt and equity issuances, as well as strategic and business analysis and transformation. Mr. Langhans has a Master’s Degree in Accounting from the University of Florida.

Edwin Negron-Carballo, who had served as Celsius’ Chief Financial Officer since July 2018, decided to retire and stepped down from the Chief Financial Officer position effective April 18, 2022. Mr. Negron-Carballo remained with the Company in an executive advisory capacity through January 31, 2023.

20

COMPENSATION DISCUSSION AND ANALYSIS

The following CD&A describes our 2022 executive compensation program as it applied to our CEO, our CFO and our former CFO, and our three most highly paid other executive officers (collectively, our “NEOs”). For 2022, our NEOs were:

The following Compensation Discussion and Analysis (“CD&A”) describes our 2022 executive compensation program as it applied to our CEO, our CFO and our former CFO, and our three most highly paid other executive officers (collectively, our “NEOs”). For 2022, our NEOs were:

| ● | John Fieldly - our Chief Executive Officer |

| ● | Jarrod Langhans - our Chief Financial Officer |

| ● | Edwin Negron-Carballo - our Chief Financial Officer until April 18, 2022 |

| ● | Tony Guilfoyle - Executive Vice President, Domestic Sales |

| ● | Toby David - Executive Vice President |

| ● | Paul Storey - Senior Vice President, Operations |

As used in this section, all references to the “Committee” or the “Compensation Committee” mean the Human Resources and Compensation Committee of the Board of Directors, which oversees the design and operation of our executive compensation program. For more information about the Committee and its role and responsibilities, please see the discussion under the heading “Human Resources and Compensation Committee” above.

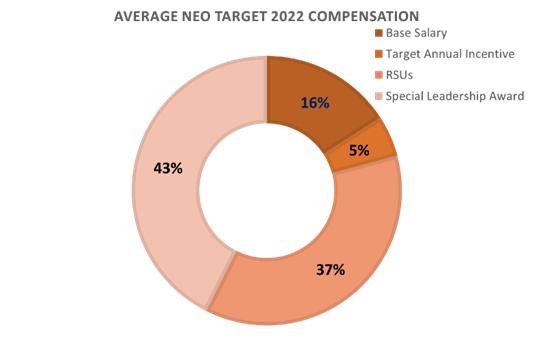

CD&A Executive Summary

2022 was an important year for the company and resulted in significant growth and strong financial results. Our financial results in 2022 enabled us to continue to fulfill our commitment to deliver attractive total stockholder returns of 40% during 2022 and a three-year total stockholder return of approximately 178%. A summary of our financial successes is outlined below.

21