UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

CHINA PHARMACEUTICALS, INC.

(Name of small business issuer in its charter)

| Nevada | 2834 | 20-2638087 |

(State or other jurisdiction of incorporation or organization) | (primary standard industrial classification code number) | (I.R.S. Employer Identification No.) |

24th Floor, Building A, Zhengxin Mansion

No. 5 of 1st Gaoxin Rd, Hi-Tech Development Zone

Xi’an City, People’s Republic of China

86-29-8406-7215

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

c/o Incorp Services, Inc.

375 North Stephanie Street, Suite 1411

Henderson, NV 89014-8909

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

William L. MacDonald

Macdonald Tuskey Corporate & Securities Lawyers

Suite #1210, 777 Hornby Street, Vancouver, B.C., V6Z 1S4, Canada

Telephone: (604) 648-1670, Facsimile: (604) 681-4760

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ¨ | | Accelerated Filer | ¨ |

| Non-Accelerated Filer | ¨ | | Smaller Reporting Company | þ |

Title Of Each Class of Securities To be Registered | | Amount To Be Registered | | | Proposed Maximum Offering Price Per Share(1) | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee(3) | |

| Common stock, par value $0.001 per share (2)(3) | | | 4,300,000 | | | $ | 1.42 | | | $ | 8,084,000 | | | $ | | |

| Warrants (2)(3) | | | 3,500,000 | | | $ | 1.42 | | | $ | 6,580,000 | | | $ | | |

| Total | | | 7,800,000 | | | | 1.42 | | | $ | 11,076,000 | | | $ | 789.72 | |

———————

(1) Estimated solely for purposes of calculating the registration fee. The registration fee is calculated pursuant to Rule 457(c).

(2) We are registering 7,800,000 shares of our common stock including 4,300,000 issued shares and 3,500,000 unissued shares underlying warrants.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

PROSPECTUS

CHINA PHARMACEUTICALS, INC.

4,300,000 Shares of Issued Common Stock

3,500,000 Shares of Common Stock Underlying Warrants

This prospectus relates to the resale by the selling stockholders of up to 7,800,000 shares of our common stock, par value $0.001 per share, including 4,300,000 issued shares and 3,500,000 unissued shares issuable upon the exercise of purchase warrants.

The selling stockholders may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions. The selling stockholders may be deemed underwriters of the shares of common stock, which they are offering. We will pay the expenses of registering these shares.

We are not selling any shares of common stock in this offering and therefore will not receive any proceeds from the sale of common stock hereunder. We would receive proceeds from the exercise of any of the 3,500,000 outstanding warrants to purchase common shares that are being registered in this prospectus. Our common stock is quoted on the OTC Bulletin Board under the symbol "CFMI". The last sale price of our common stock was $1.63 per share on July 9, 2010.

Investing in these securities involves significant risks. See “Risk Factors” beginning on page 5.

No other underwriter or person has been engaged to facilitate the sale of shares of common stock in this offering. None of the proceeds from the sale of stock by the selling stockholders will be placed in escrow, trust or any similar account.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 20, 2010

You should rely only on the information contained in the prospectus. We have not authorized anyone to provide you with information or to make any representations about us, the selling stockholders, the securities or any matter discussed in this prospectus, other than that contained in the prospectus. If any other information or representation is given or made, such information or representations may not be relied upon as having been authorized by us or any selling stockholder. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful. The information contained in this prospe ctus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

When used in this prospectus, the following terms shall have the meanings stated below:

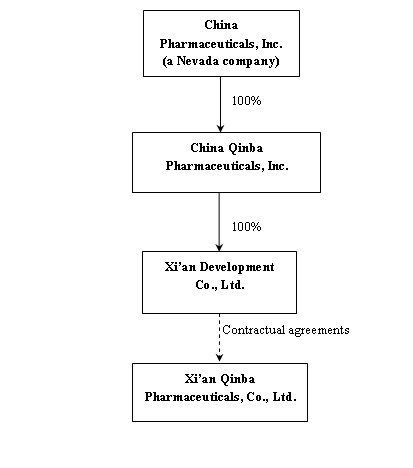

| ● | “China Pharmaceuticals”, the “Company”, “we”, “our”, “us” or similar terms, refers to China Pharmaceuticals, Inc., a Delaware corporation, and, where appropriate, to our subsidiaries. |

| ● | China Qinba,” refers to our wholly owned subsidiary China QinBa Pharmaceuticals, Inc., a Delaware corporation. |

| ● | “Xi’an Development” refers to our wholly owned subsidiary Xi’an Pharmaceuticals Development Co., Ltd., a limited liability company organized under the laws of the Peoples Republic of China. |

| ● | “Xi’an Pharmaceuticals” refers to our variable interest entity (“VIE”), Xi’an Qinba Pharmaceuticals Co., Ltd., a company organized under the laws of the Peoples Republic of China that has entered into a series of agreements with Xi’an Development that (i) give Xi’an Development control over the board of directors, officers, operations and finances of Xi’an Pharmaceuticals; (ii) permit Xi’an Pharmaceuticals to be treated as a subsidiary of Xi’an Development under the laws of the People’s Republic of China; and (iii) allow us to consolidate its financial statements under GAAP. |

| ● | “WOFE” refers to Xi’an Development which is a “wholly owned foreign enterprise” under the laws of the People’s Republic of China. |

| ● | “Xi’an Shareholders” refers to the shareholders of Xi’an Pharmaceuticals who are also the shareholders of China QinBa. |

| ● | “Yuan” or “RMB” refer to the Chinese Yuan (also known as the Renminbi). According to the currency website xe.com, as of December 31, 2009 (the close of our last completed fiscal year), USD$1 = Yuan 6.82. As of March 31, 2009, (the close of our last completed fiscal quarter) and as of December 31, 2009, (the close of our last completed fiscal year) USD$1=Yuan 6.82. |

| ● | “PRC” or “China” refers to the People’s Republic of China. |

| ● | “SFDA” refers to the PRC State Food and Drug Administration. |

| ● | “OTC Bulletin Board” or the “OTCBB” refers to the Over-the-Counter Bulletin Board, an electronic quotation system for equity securities overseen by the Financial Industry Regulatory Authority (formerly the National Association of Securities Dealers), which is accessible through its website at WWW.OTCBB.COM. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION CONTAINED IN THIS PROSPECTUS

This prospectus contains some forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements include statements regarding, among other things, (a) projected sales, profitability, and cash flows, (b) growth strategies, (c) anticipated trends, (d) future financing plans and (e) anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipates,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,̶ 1; “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. These statements may be found

under “Management’s Discussion and Analysis of Financial Condition and Plan of Operation” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of the forward-looking statements in this prospectus may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in the prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

This summary highlights selected information contained elsewhere in this prospectus. The summary is intended for quick reference only and does not contain all of the information that you should consider before investing in our common stock. To understand this offering fully, you should read the entire prospectus and all exhibits to this prospectus carefully, including but not limited to the section entitled “Risk Factors”, and the Consolidated Financial Statements and the Related Notes.

Business Overview

China Pharmaceuticals, Inc. (formerly Allstar Restaurants) was incorporated in the State of Nevada on December 22, 2004. On February 12, 2010, pursuant to the closing of a merger agreement with China Qinba Pharmaceuticals, Inc., an interest holder of Xi’an Qinba Pharmaceuticals, Co., Ltd.’s (“Xi’an Pharmaceuticals”), Xi’an Pharmaceuticals became our variable interest entity, making us the primary beneficiary of its business, and permitting us to consolidate its financial statements with our own. Xi’an Pharmaceuticals was formed in October 15, 1969 under the laws of the Peoples Republic of China (“PRC”) and is engaged in the research, development, manufacture, packaging, marketing, and distribution of pharmaceutical and medical products in China for human u se for the treatment of a variety of diseases and conditions. Our business is conducted primarily through Xi’an Pharmaceuticals in Xixiang County, Hanzhong, PRC, and the Xi’an Jinghe Industrial Zone, PRC, where our two manufacturing facilities are located. Through Zi’an Pharmaceuticals, we manufacture pharmaceutical products in the form of capsules, oral solutions, tablets, granules, syrups, medicinal teas, tinctures and freeze dried powders for the preparation of small and large volume solutions for injection (parenteral solutions). Applications for the pharmaceutical products that we manufacture include the treatment of viral pneumonia, hypotonicity dehydration, viral influenza and many other diseases and indications.

We currently manufacture 85 pharmaceutical products which are sold to numerous distributors who distribute our products pursuant to distribution agreements to licensed healthcare providers such as hospitals, clinics and pharmacies. We currently have 35 active distribution agreements. The raw materials used to manufacture our products include various medicinal herbs such as tumeric and zedoary, which we obtain from specified and PRC qualified suppliers.Other raw materials include sulfamethoxazole, an antibiotic, which is primarily used in the manufacture of our product “Fufang Qiguanyan Pian, a medication for the treatment of chronic cough and bronchitis. We also enter into trading agreements for the supply of many of the materials used to manufacture and package our products including aluminum foil, which we use as the inner packing materials for products in tablet form. Xi’an Pharmaceuticals has entered into written agreements with substantially all of its suppliers. The agreements with three of Xi’an Pharmaceuticals’ largest suppliers each commenced January 1, 2008 and expire December 31, 2010. These agreements typically provide that the suppliers are to supply product to Xi’an Pharmaceuticals within a specified period of time following the placement of an order by Xi’an Pharmaceuticals’. Typically, Xi’an Pharmaceuticals is required to pay for the products within 60 days of their receipt. The price paid for the products is the market price published at the time of purchase.

Our focus has been on the development and sale of pharmaceutical products based on traditional Chinese medicines designed to address numerous diseases and indications, with an emphasis on sales to community hospitals and rural medical institutions.

For more information about our business you should read the section entitled “OUR BUSINESS” on page 32 of this prospectus.

Our Corporate Information

We maintain our corporate headquarters at 24th Floor, Building A, Zhengxin Mansion, No. 5 of 1st Gaoxin Rd, Hi-Tech Development Zone, Xi’an City, People’s Republic of China. Our telephone number is 86-29-8406-7215 and our facsimile number is 86-29-8781-5521.

Background

On December 17, 2009, our subsidiary, China Qinba Pharmaceuticals, Inc. entered into an agreement with Dragon Link Investments, Inc. to obtain certain consulting services. As consideration for the services provided by Dragon Link Investments, Inc., (and in accordance with a warrant placement agreement dated February 12, 2010 between us and Dragon Link) China Qinba Pharmaceuticals agreed to issue to Dragon Link Investments, Inc., warrants to acquire 1,200,000 shares of our common stock, subject to adjustment for any forward or reverse splits (and subsequently reduced to 1,000,000 shares post reverse split), with registration rights, and exercisable at a price of $1.00 per post-split share within three years after the control acquisition or merger by China Qinba with a public company identified by Dragon Link . ;The warrants will expire on February 11, 2013.

On January 5, 2010, our subsidiary, China Qinba Pharmaceuticals, Inc., entered into an agreement with IFG Investments Services, Inc. to obtain certain consulting services including advising on a merger/acquisition transaction and regulatory filings, and other services and support as requested. In consideration for the consulting services to be performed by IFG Investments (and in accordance with a warrant placement agreement dated February 12, 2010 between us and IFG Investments), China Qinba Pharmaceuticals agreed to issue to IFG Investments warrants to acquire 1,800,000 shares of our common stock, subject to adjustment for any forward or reverse splits (and subsequently reduced to 1,500,000 shares post reverse split), with registration rights, exercisable at $1.00 per post-split share within three years after the closing of the control acquisition or merger by China Qinba with public company. The warrants will expire on February 11, 2013.

On January 27, 2010, our subsidiary, China Qinba Pharmaceuticals, Inc., entered into an investor relations agreement with HACG Investor Relations Services, Inc., to obtain certain public company sector services, including advising on and with respect to investor relations. The term of the contract expires January 31, 2011. As consideration for the services to be performed by HACG (and in accordance with a warrant placement agreement dated February 12, 2010 between us us and HACG), China Qinba Pharmaceuticals agreed to issue to HACG warrants to acquire 1,200,000 common shares of the Company’s stock, subject to adjustment for any forward or reverse splits (and subsequently reduced to 1,000,000 shares post reverse split), with registration rights, exercisable at $1.00 per post-split share until January 31, 2013.

The above noted securities issued to our consultants, Dragon Link Investments, Inc., IFG Investments Services, Inc., and HACG Investor Relations Services, Inc. were not registered under the Securities Act of 1933. The issuance of these securities was exempt from registration under Section 4(2) of the Securities Act. We made this determination based on the representations of the consultants, which included, in pertinent part, that such consultants were "accredited investors" within the meaning of Rule 501 of Regulation D promulgated under the Securities Act and that the consultants were acquiring our securities for investment purposes for their own respective accounts and not as nominees or agents, and not with a view to the resale or distribution thereof, and that the consultants understood that the shares of our common stock may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

On February 12, 2010, pursuant to a merger agreement with China Qinba Pharmaceuticals, Inc., dated of the same date (the “Merger Agreement”), we issued 33,600,000 shares of our Common Stock to the shareholders China Qinba Pharmaceuticals in exchange for 100% of the outstanding shares of China Qinba Pharmaceuticals. The 33,600,000 shares (which were subsequently reduced to 28,000,000 shares post reverse split) were not registered under the Securities Act of 1933. The issuance of these shares was exempt from registration, in part pursuant to Regulation S and Regulation D under the Securities Act of 1933 and in part pursuant to Section 4(2) of the Securities Act of 1933. We made this determination based on the representations of China Qinba Pharmaceuticals, which included, in pertinent part, that suc h shareholders were either (a) "accredited investors" within the meaning of Rule 501 of Regulation D promulgated under the Securities Act, or (b) not a "U.S. person" as that term is defined in Rule 902(k) of Regulation S under the Act, and that such shareholders were acquiring our common stock, for investment purposes for their own respective accounts and not as nominees or agents, and not with a view to the resale or distribution thereof, and that China Qinba Pharmaceuticals’ shareholders understood that the shares of our common stock may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

Pursuant to a share exchange agreement between us and Terry G. Bowering dated February 12, 2010, Mr. Bowering transferred 5,100,000 shares of our common stock for cancellation in exchange for 100% of the issued and outstanding of our former subsidiary, China Doll Foods Ltd. The 5,100,000 shares were cancelled on February 12, 2010.

On June 8, 2010, we effected a five-for six reverse split of our common stock reducing our number of outstanding common shares from 38,450,000 to 32,041,667 shares.

| Common stock outstanding prior to this offering (on July 14, 2010) | | | 32,041,667 | |

| | | | | | |

| Common stock being offered for resale to the public | | | 7,800,000 | (1) |

| | | | | | |

| Common stock outstanding after this offering | | | 35,541,667 | (2) |

| | | | | | |

| Percentage of common stock outstanding before this offering that shares being registered for resale represent | | | 21.94.0 | %(2) |

| | | | | | |

| (1) | Includes 4,300,000 issued shares of common stock and 3,500,000 shares of unissued common stock underlying warrants. | |

| (2) | Assumes the issuance of 3,500,000 shares of common stock underlying warrants being registered in this prospectus. | |

Total proceeds raised in the offering: We will not receive any proceeds from the resale of the 4,300,000 shares of issued common stock being registered in this prospectus. We will receive proceeds in the event that the selling shareholders purchase any of the 3,500,000 unissued common shares underlying warrants being registered in this prospectus.

Warrants

The consultants who have been issued warrants are granted the right to purchase in the aggregate 3,500,000 shares of our common stock. We have agreed to register 100% of the shares underlying these warrants, or 3,500,000 common shares, pursuant to the consulting agreements we have entered into with each of the warrant holders. The warrant entitles its holder to one share of our common stock upon exercise. The warrants may be exercised at any time on or after the initial exercise eligibility date of February 12, 2010 through January 31, 2010 (with respect to 1,000,000 shares/warrants) or February 11, 2013 (with respect to 2,500,000 shares/ warrants), at an exercise price of $1.00 per share. The exercise price was negotiated based on the price of our common stock as quoted on the OTC Bulletin Board at the time the wa rrants were issued.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Some of the statements contained in this Form S-1 that are not historical facts are “forward-looking statements” which can be identified by the use of terminology such as “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,” “intends,” or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. We urge you to be cautious of the forward-looking statements, that such statements, which are contained in this Form S-1, reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties and other factors affecting our operations, market growth, services, products and licenses. No assurances can be given regarding the achievement of fut ure results, as actual results may differ materially as a result of the risks we face, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include without limitation:

| | ● | Our ability to attract and retain management, and to integrate and maintain technical information and management information systems; |

| | ● | Our ability to raise capital when needed and on acceptable terms and conditions; |

| | ● | The intensity of competition; and |

| | ● | General economic conditions. |

All written and oral forward-looking statements made in connection with this Form S-1 that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

This offering is not being underwritten. The selling stockholders directly, through agents designated by them from time to time or through brokers or dealers also to be designated, may sell their shares from time to time, in or through privately negotiated transactions, or in one or more transactions, including block transactions, on the OTC Bulletin Board or on any stock exchange on which the shares may be listed in the future pursuant to and in accordance with the applicable rules of such exchange or otherwise. The selling price of the shares may be at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices after the shares are quoted on the OTC Bulletin Board. To the extent required, the specific shares to be sold, the names of the selling stockholders, the respec tive purchase prices and public offering prices, the names of any such agent, broker or dealer and any applicable commission or discounts with respect to a particular offer will be described in an accompanying prospectus. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus. We will keep this prospectus current until the expiration dates of the convertible securities, even if the convertible securities which underlie certain shares of our common stock subject to this prospectus are out of the money.

The selling security holders and any other persons participating in the sale or distribution of the shares offered under this prospectus will be subject to applicable provisions of the Exchange Act, and the rules and regulations under that act, including Regulation M. These provisions may restrict activities of, and limit the timing of purchases and sales of any of the shares by, the selling security holders or any other person. Furthermore, under Regulation M, persons engaged in a distribution of securities are prohibited from simultaneously engaging in market making and other activities with respect to those securities for a specified period of time prior to the commencement of such distributions, subject to specified exceptions or exemptions. All of these limitations may affect the marketability of the shares.

We will not receive any proceeds from sales of shares by the selling stockholders. However, if any of the selling stockholders decide to exercise their Warrants, we will receive the net proceeds of the exercise of such security held by the selling stockholders. We intend to use any proceeds we receive from the exercise of the Warrants for working capital and other general corporate purposes. We cannot assure you that any of the Warrants will ever be exercised.

We will pay all expenses of registration incurred in connection with this offering (estimated to be $37,000), but the selling stockholders will pay all of the selling commissions, brokerage fees and related expenses.

The selling stockholders and any broker-dealers or agents that participate with the selling stockholders in the distribution of any of the shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We conduct substantially all of our business through our variable interest entity (“VIR”), Xi’an Pharmaceuticals, a company organized under the laws of the Peoples Republic of China which we manage and control by contractual arrangement through our subsidiaries, and whose financial statement are consolidated with our own. Xi’an Pharmaceuticals commenced its current line of business operations in October 15, 1969 and received its Good

Manufacturing Practices (“GMP”) certifications in March 2006 and January 2007. These certifications must be renewed every five years for Xi’an Pharmaceuticals to stay in business. Xi’an Pharmaceuticals’ operating history may not provide a meaningful basis on which to evaluate its business. We cannot assure you that Xi’an Pharmaceuticals will maintain its profitability or that we will not incur net losses in the future. We expect that Xi’an Pharmaceuticals’ operating expenses will increase as it expands. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| | ● | raise adequate capital for expansion and operations; |

| | ● | implement our business model and strategy and adapt and modify them as needed; |

| | ● | increase awareness of our brand name, protect our reputation and develop customer loyalty; |

| | ● | manage our expanding operations and service offerings, including the integration of any future acquisitions; |

| | ● | maintain adequate control of our expenses; |

| | ● | anticipate and adapt to changing conditions in the medical over the counter, pharmaceutical and nutritional supplement markets in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

The loss of Xi’an Pharmaceuticals as our operating business would have a material adverse effect on our business and the price of our common stock.

We have no equity ownership interest in Xi’an Pharmaceuticals. Our ability to control Xi’an Pharmaceuticals and consolidate its financial results is through a series of contractual agreements between Xi’an Pharmaceuticals and our wholly-owned subsidiary Xi’an Development. The management of Xi’an Pharmaceuticals is an affiliate of us and of Xi’an Development and the stockholders of Xi’an Pharmaceuticals are also our shareholders. Thus the Management Entrustment Agreement was not entered into as a result of arms’ length negotiations because the parties to the agreement are under common control. Mr. Wang, our CEO and Chairman, and Mr. Guiping Zhang, our President, hold in the aggregate approximately 34.25% of the shares of Xi’an Pharmaceuticals and approximately 29% of o ur common stock. The Management Entrustment Agreement may be terminated upon the termination of the business of Xi’an Pharmaceuticals or upon the date upon which Xi’an Development completes the acquisition of Xi’an Pharmaceuticals. Any other termination would be a breach of the agreement. While the Company has been advised by its PRC counsel that the Management Entrustment Agreement is legal and enforceable under PRC law, these affiliates control the parties to the Management Entrustment Agreement and it could be possible for them to cause Xi’an Pharmaceuticals to breach the Management Entrustment Agreement and our unaffiliated investors would have little or no recourse because of the inherent difficulties in enforcing their rights since all our assets are located in the PRC. (See, Risk Factor “The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any ch anges in such PRC laws and regulations may harm our business.”) In the event that management of Xi’an Pharmaceuticals decides to breach the Management Entrustment Agreement, the risk of loss of the affiliated shareholders of Xi’an Pharmaceuticals could be lower than unaffiliated investors and the interests of the management and shareholders of Xi’an Pharmaceuticals would be in conflict with the interest of our other stockholders.

Xi’an Pharmaceuticals’ failure to compete effectively may adversely affect our ability to generate revenue.

Xi’an Pharmaceuticals competes with other companies, many of whom are developing or can be expected to develop products similar to Xi’an Pharmaceuticals. Xi’an Pharmaceuticals’ market is a large market with many competitors. Many of its competitors are more established than Xi’an Pharmaceuticals is, and have significantly greater financial, technical, marketing and other resources than it presently possess. Some of Xi’an Pharmaceuticals’ competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot a ssure you that Xi’an Pharmaceuticals will be able to compete effectively with current or future competitors or that the competitive pressures it faces will not harm it business.

We may not be able to effectively control and manage the growth of Xi’an Pharmaceuticals.

If Xi’an Pharmaceuticals’ business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. An expansion would increase demands on existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect its operations and cause delay in production and delivery of its pharmaceutical prescription, over the counter and medical nutrient products as well as administrative inefficiencies.

We may require additional financing in the future and a failure to obtain such required financing will inhibit Xi’an Pharmaceuticals’ ability to grow.

The continued growth of Xi’an Pharmaceuticals’ business may require additional funding from time to time, which we expect to raise in private placements of our equity or debt securities with accredited investors or by offering our securities for sale pursuant to an effective registration statement on a market where our common stock is traded. The proceeds of these funding will be forwarded to Xi’an Pharmaceuticals and accounted for as a loan to Xi’an Pharmaceuticals and eliminated during consolidation. The proceeds would be used for general corporate purposes of Xi’an Pharmaceuticals, which could include acquisitions, investments, repayment of debt and capital expenditures among other things. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt. Obtaining additional funding would be subject to a number of factors including market conditions, operating performance and investor sentiment, many of which are outside of our control. These factors could make the timing, amount, terms and conditions of additional funding unattractive or unavailable to us. Our management believes that we currently have sufficient funds from working capital to meet our current operating costs over the next 12 months.

The terms of any future financing may adversely affect your interest as stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of Xi’an Pharmaceuticals’ business more difficult because the lender's consent could be required before we take certain actions. Similarly the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

We, through our subsidiary and affiliated companies, China Qinba, Xi’an Development, or Xi’an Pharmaceuticals, may engage in future acquisitions that could dilute the ownership interests of our stockholders, cause us to incur debt and assume contingent liabilities.

We, through our subsidiary and affiliated companies, China Qinba, Xi’an Development or Xi’an Pharmaceuticals, may review acquisition and strategic investment prospects that we believe would complement the current product offerings of Xi’an Pharmaceuticals, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time Xi’an Pharmaceuticals reviews investments in new businesses and we, through our subsidiaries/affiliated companies China Qinba, Xi’an Development or Xi’an Pharmaceuticals, expect to make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor while the proceeds will be forwarded to Xi’an Pharmaceuticals and accounted for as a loan to Xi’an Pharmaceuticals and eliminated during consolidation. In the event of any future acquisitions, we could:

| | ● | issue equity securities which would dilute current stockholders’ percentage ownership; |

| | ● | incur substantial debt; |

| | ● | assume contingent liabilities; or |

| | ● | expend significant cash. |

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if through our subsidiary, Xi’an Development or Xi’an Pharmaceuticals, we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

| | ● | difficulties in the assimilation of acquired operations, technologies and/or products; |

| | ● | unanticipated costs associated with the acquisition or investment transaction; |

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal accounting controls. We expect to continue to improve our internal accounting control for budgeting, forecasting, managing and allocating our funds and to better account for them as we grow. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting, and attestation of this assessment by our company's independent registered public accountants. The SEC extended the compliance dates for "non-accelerated filers," as defined by the SEC. Accordingly, we believe that the annual assessment of our internal controls requirement first applied to our annual report for the 2007 fiscal year and the attestation requirement of management's assessment by our independent registered public accountants will first apply to our annual report for the 2010 fiscal year. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, te sting and possible remediation to meet the detailed standards. We have not yet evaluated our internal controls over financial reporting in order to allow management to report on, and our independent auditors to attest to, our internal controls over financial reporting, as will be required by Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations of the SEC. We have never performed the system and process evaluation and testing required in an effort to comply with the management assessment and auditor certification requirements of Section 404, which will initially apply to us as of December 31, 2007 and December 31, 2010 respectively. Our lack of familiarity with Section 404 may unduly divert management's time and resources in executing the business plan. If, in the future, management identifies one or more material weaknesses, or our external auditors are unable to attest that our management's report is fairly stated or to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price and/or subject us to sanctions or investigation by regulatory authorities. So far, our external auditors have not reported to our board of directors any significant weakness on our internal control and provided recommendations accordingly.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and pharmaceutical factory operational expertise of key personnel. Guozhu Wang, our Chief Executive Officer and Chairman of the Board, Guiping Zhang, our President, and Tao Lei, our Chief Financial Officer, perform key functions in the operation of our and Xi’an Pharmaceuticals’ business. There can be no assurance that Xi’an Pharmaceuticals will be able to retain these officers after the term of their employment contracts expire. The loss of these officers could have a material adverse effect upon our business, financial condition, and results of operations. Xi’an Pharmaceuticals must attract, recruit and retain a sizeable workforce of technically competent employees. We do not carry key man l ife insurance for any of our key personnel or personnel nor do we foresee purchasing such insurance to protect against a loss of key personnel and the key personnel.

We are dependent upon the services of Mr. Wang and Mr. Zhang, for the continued growth and operation of our company because of their experience in the industry and his personal and business contacts in the PRC. Although we have entered into two-year employment agreements with Mr. Wang and Mr. Zhang and we have no reason to believe that they will discontinue their services with the Company or Xi’an Pharmaceuticals, the interruption or loss of his services would adversely affect our ability to effectively run our business and pursue our business strategy as well as our results of operations.

We may not be able to hire and retain qualified personnel to support its growth and if it is unable to retain or hire these personnel in the future, its ability to improve its products and implement its business objectives could be adversely affected.

Competition for senior management and senior personnel in the PRC is intense, the pool of qualified candidates in the PRC is very limited, and we may not be able to retain the services of our senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. This failure could materially and adversely affect our future growth and financial condition. We expect to hire additional sales and plant personnel throughout fiscal year 2010 in order to accommodate its growth.

If we fail to increase our brand recognition, we may face difficulty in obtaining new customers and business partners.

We believe that establishing, maintaining and enhancing our brand in a cost-effective manner is critical to achieving widespread acceptance of our current and future products and services and is an important element in our effort to increase our customer base and obtain new business partners. We believe that the importance of brand recognition will increase as competition in our market develops. Some of our potential competitors already have well-established brands in the pharmaceutical promotion and distribution industry. Successful promotion of our brand will depend largely on our ability to maintain a sizeable and active customer base, our marketing efforts and ability to provide reliable and useful products and services at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses we will incur in building our brand. If we fail to successfully promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to promote and maintain our brand, we may fail to attract enough new customers or retain our existing customers to the extent necessary to realize a sufficient return on our brand-building efforts, in which case our business, operating results and financial condition, would be materially adversely affected.

Our operating results may fluctuate as a result of factors beyond our control.

Our operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are beyond our control. These factors include:

| | ● | the costs of pharmaceutical products and development; |

| | ● | the relative speed and success with which we can obtain and maintain customers, merchants and vendors for our products; |

| | ● | capital expenditure for equipment; |

| | ● | marketing and promotional activities and other costs; |

| | ● | changes in our pricing policies, suppliers and competitors; |

| | ● | the ability of our suppliers to provide products in a timely manner to their customers; |

| | ● | changes in operating expenses; |

| | ● | increased competition in the pharmaceutical markets; and |

| | ● | other general economic and seasonal factors. |

We face risks related to product liability claims.

We presently do not maintain product liability insurance. We face the risk of loss because of adverse publicity associated with product liability lawsuits, whether or not such claims are valid. We may not be able to avoid such claims. Although product liability lawsuits in the PRC are rare, and we have not, to date, experienced significant failure of our products, there is no guarantee that we will not face such liability in the future. This liability could be substantial and the occurrence of such loss or liability may have a material adverse effect on our business, financial condition and prospects.

We face marketing risks.

Newly developed drugs and technology may not be compatible with market needs. Because markets for drugs differentiate geographically inside the PRC, we must develop and manufacture our products to accurately target specific markets to ensure product sales. If we fail to invest in extensive market research to understand the health needs of consumers in different geographic areas, we may face limited market acceptance of our products, which could have material adverse effect on our sales and earnings.

We face risks relating to difficulty in defending intellectual property rights from infringement.

Our success depends on protection of our current and future technology and products and our ability to defend our intellectual property rights. Xi’an Pharmaceuticals has filed for trademark protection for the various names and brands of its products sold in the PRC. However, it is possible for its competitors to develop similar competitive products even thought it has taken steps to protect its intellectual property. If we fail to protect Xi’an Pharmaceuticals’ intellectual property adequately, competitors may manufacture and market products similar to Xi’an Pharmaceuticals. We expect to file patent applications seeking to protect newly developed technology and products in various countries, including the PRC. Some patent applications in the PRC are maintained in secrecy until the patent is issued . Because the publication of discoveries tends to follow their actual discovery by many months, we may not be the first to invent, or file patent applications on any of our discoveries. Patents may not be issued with respect to any of our patent applications and existing or future patents issued to or licensed by us may not provide competitive advantages for our products. Patents that are issued may be challenged, invalidated or circumvented by our competitors. Furthermore, our patent rights may not prevent our competitors from developing, using or commercializing products that are similar or functionally equivalent to our products.

We also rely on trade secrets, non-patented proprietary expertise and continuing technological innovation that we shall seek to protect, in part, by entering into confidentiality agreements with licensees, suppliers, employees and consultants. These agreements may be breached and there may not be adequate remedies in the event of a breach. Disputes may arise concerning the ownership of intellectual property or the applicability of confidentiality agreements. Moreover, our trade secrets and proprietary technology may otherwise become known or be independently developed by our competitors. If patents are not issued with respect to products arising from research, we may not be able to maintain the confidentiality of information relating to these products.

We face risks relating to third parties that may claim that we infringe on their proprietary rights and may prevent us from manufacturing and selling certain of our products.

There has been substantial litigation in the pharmaceutical industry with respect to the manufacturing, use and sale of new products. These lawsuits relate to the validity and infringement of patents or proprietary rights of third parties. We may be required to commence or defend against charges relating to the infringement of patents or proprietary rights. Any such litigation could:

| | ● | require us to incur substantial expense, even if covered by insurance or are successful in the litigation; |

| | ● | require us to divert significant time and effort of our technical and management personnel; |

| | ● | result in the loss of our rights to develop or make certain products; and |

| | ● | require us to pay substantial monetary damages or royalties in order to license proprietary rights from third parties. |

Although intellectual property disputes within the pharmaceutical industry have often been settled through licensing or similar arrangements, costs associated with these arrangements may be substantial and could include the long-term payment of royalties. These arrangements may be investigated by regulatory agencies and, if improper, may be invalidated. Furthermore, the required licenses may not be made available to us on acceptable terms. Accordingly, an adverse determination in a judicial or administrative proceeding or a failure to obtain necessary licenses could prevent us from manufacturing and selling some of our products or increase our costs to market these products.

In addition, when seeking regulatory approval for some of our products, we may be required to certify to regulatory authorities, including the SFDA, that such products do not infringe upon third party patent rights. Filing a certification against a patent gives the patent holder the right to bring a patent infringement lawsuit against us. Any lawsuit would delay the receipt of regulatory approvals. A claim of infringement and the resulting delay could result in substantial expenses and even prevent us from manufacturing and selling certain of our products.

Our launch of a product prior to a final court decision or the expiration of a patent held by a third party may result in substantial damages to us. If we are found to infringe a patent held by a third party and become subject to such damages, these damages could have a material adverse effect on the results of our operations and financial condition.

We face risks related to research and the ability to develop new drugs.

Our growth and survival depends on our ability to consistently discover, develop and commercialize new products and find new and improve on existing technology and platforms. As such, if we fail to make sufficient investments in research, be attentive to consumer needs or does not focus on the most advanced technology, our current and future products could be surpassed by more effective or advanced products of other companies.

Risk Related To the Pharmaceutical Industry

Our certificates, permits, and licenses related to our pharmaceutical operations are subject to governmental control and renewal and failure to obtain renewal will cause all or part of our operations to be terminated.

Xi’an Pharmaceuticals is subject to various PRC laws and regulations pertaining to the pharmaceutical industry. Xi’an Pharmaceuticals has obtained certificates, permits, and licenses required for the operation of a pharmaceutical enterprise and the manufacturing of pharmaceutical products in the PRC.

In 1998, the SFDA introduced the Good Manufacturing Practice (GMP) Certificate in order to promote quality and safety of pharmaceutical production. The Good Manufacturing Practices were revised in July and October, 2004. We and our competitors are required to meet GMP standards in order to continue manufacturing pharmaceutical products and health foods. For each new product, Xi’an Pharmaceuticals prepares documentation of pharmacological, toxicity, pharmacokinetics and drug metabolism studies in addition to providing samples of the drug. The documentation and samples are then submitted to provincial food and drug administration. This process typically takes approximately three months. After the documentation and samples have been approved by the provincial food and drug administration, the provincial administration submits the approved doc umentation and samples to the SFDA. The SFDA examines the documentation and tests the samples and presents the findings to the New Drug Examination Committee for approval. If the application is approved by the SFDA, the SFDA will issue a clinical trial license to the applicant for clinical trials. This clinical trial license approval typically takes one year, followed by approximately two years of trials, depending on the category and class of the new drug. The SFDA then examines the documentation from the trial and, if approved, issues the new drug license to the applicant. This process usually takes eight months. The entire process takes anywhere from three to four years.

Xi’an Pharmaceuticals initially obtained pharmaceutical products and health food production permits by submitting its manufacturing processes and product tests to the SFDA who verified that its production processes and products met the standards by onsite inspections, review of test results and a determination that the market was not saturated by its products. The production permits are permanent once issued as long as they are renewed by the expiration date.

The GMP certificate is valid for a term of five years, the pharmaceutical products production permits are subject to renewal every five years, and each must be renewed before its expiration, if applicable. We manufacture and package our products at two factories, one located in Xixiang County in Hanzhong and one in Xi’an Jinghe Industrial Zone, China. Both facilities are in compliance with Good Manufacturing Practice (GMP) standards and have three GMP certificates for its 85 products, dated March 9, 2006 (Certificate No. H0192 for Xi’an Production Base), January 8, 2007 (Certificate No. H4109 for Xi’an Production Base) and January 8, 2007 (Certificate No. H4119 for Hanzong Production Base), respectively. The certificates remain valid until March 8, 2011, January 7, 2012 and January 7, 2012, respectively. All of the complete production lines at each facility meet international food and drug safety guidelines. If the GMP certificates expire without renewal, Xi’an Pharmaceuticals will not be able to continue medicine production, which will cause its operations to be terminated. Xi’an Pharmaceuticals intends to apply for renewed GMP certificates for its two production facilities before its current certificates expire.

According to Drug Administration Law of the PRC and its implementing rules, the SFDA approvals, including Pharmaceutical Manufacturing Permit and Drug Approval Numbers, may be suspended or revoked prior to the expiration date under circumstances that include:

| | ● | producing counterfeit medicine; |

| | ● | producing inferior quality products; |

| | ● | failing to meet the drug GMP standards; |

| | ● | purchasing medical ingredients used in the production of products sources that do not have Pharmaceutical Manufacturing Permit or Pharmaceutical Trade Permit; |

| | ● | fraudulent reporting of results or product samples in application process; |

| | ● | failing to meet drug labeling and direction standards; |

| | ● | bribing doctors or hospital personnel to entice them to use products, |

| | ● | producing pharmaceuticals for use or resale by companies that are not approved by the SFDA, or |

| | ● | the approved drug has a serious side effect. |

If our pharmaceutical products fail to receive regulatory approval or are severely limited in these products' scope of use, we may be unable to recoup considerable research and development expenditures.

Our research and development of pharmaceutical products is subject to the regulatory approval of the SFDA in the PRC. The regulatory approval procedure for pharmaceuticals can be quite lengthy, costly, and uncertain. Depending upon the discretion of the SFDA, the approval process may be significantly delayed by additional clinical testing and require the expenditure of resources not currently available; in such an event, it may be necessary for us to abandon our application. Even where approval of the product is granted, it may contain significant limitations in the form of narrow indications, warnings, precautions, or contra-indications with respect to conditions of use. If approval of our product is denied, abandoned, or severely limited in terms of the scope of products use, it may result in the inability to recoup considerable research and development expenditures. During the fiscal year ended December 31, 2008, we obtained certificates and approvals of drug production for thirteen new drug batches, ten of which we have begun to sell. During the year ended December 31, 2009, we obtained certificates and approvals for two new drug batches, and we began production of these two new drug batches in October 2009. If we do not receive timely approval for any of our drugs, then production will be delayed and sales of the products cannot be planned for.

Price control regulations may decrease our profitability.

The laws of the PRC provide for the government to fix and adjust prices. The prices of certain medicines we distribute, including those listed in the Chinese government's catalogue of medications that are reimbursable under the PRC’s social insurance program, or the Insurance Catalogue, are subject to control by the relevant state or provincial price administration authorities. The PRC establishes price levels for products based on market conditions, average industry cost, supply and demand and social responsibility. In practice, price control with respect to these medicines sets a ceiling on their retail price. The actual price of such medicines set by manufacturers, wholesalers and retailers cannot historically exceed the price ceiling imposed by applicable government price control regulations. Although, as a general matte r, government price control regulations have resulted in drug prices tending to decline over time, there has been no predictable pattern for such decreases.

For the year ended December 31, 2009 and December 31, 2008, we have not had any products subject to specific pricing control and production and trading of none of our pharmaceutical products constitutes a monopoly. However, it is possible that our products may be subject to price control in the future. To the extent that our products are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our sales will be limited and we may face no limitation on our costs. Further, if price controls affect both our revenue and costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable regulatory authorities in the PRC.

If the medicines we produce are replaced by other medicines or are removed from the PRC's insurance catalogue in the future, our revenue may suffer.

Under PRC regulations, patients purchasing medicine listed by the PRC's state and/or provincial governments in the Insurance Catalogue may be reimbursed, in part or in whole, by a social medicine fund. Accordingly, pharmaceutical distributors prefer to engage in the distribution of medicine listed in the Insurance Catalogue. Currently, our main prescription products are listed in the Insurance Catalogue. The content of the Insurance Catalogue is subject to change by the PRC Ministry of Labor and Social Security, and new medicine may be added to the Insurance Catalogue by provincial level authorities as part of their limited ability to change certain medicines listed in the Insurance Catalogue. If the medicine we produce are replaced by other medicines or removed from the Insurance Catalogue in the future, our revenue may suffer.

Adverse publicity associated with our products, ingredients or network marketing program, or those of similar companies, could harm our financial condition and operating results.

The results of our operations may be significantly affected by the public's perception of our product and similar companies. This perception is dependent upon opinions concerning:

| | ● | the safety and quality of our products and ingredients; |

| | ● | the safety and quality of similar products and ingredients distributed by other companies; and |

| | ● | our sales force. |

Adverse publicity concerning any actual or purported failure to comply with applicable laws and regulations regarding product claims and advertising, good manufacturing practices, or other aspects of our business, whether or not resulting in enforcement actions or the imposition of penalties, could have an adverse affect on our goodwill and could negatively affect our sales and ability to generate revenue.

In addition, our consumers' perception of the safety and quality of products and ingredients as well as similar products and ingredients distributed by other companies can be significantly influenced by media attention, publicized scientific research or findings, widespread product liability claims and other publicity concerning our products or ingredients or similar products and ingredients distributed by other companies. Adverse publicity, whether or not accurate or resulting from consumers' use or misuse of our products, that associates consumption of our products or ingredients or any similar products or ingredients with illness or other adverse effects, questions the benefits of our or similar products or claims that any such products are ineffective, inappropriately labeled or have inaccurate instructions as t o their use, could negatively impact our reputation or the market demand for our products.

If we fail to develop new products with high profit margins, and our high profit margin products are substituted by competitor's products, our gross and net profit margins will be adversely affected.

There is no assurance that we will be able to sustain our profit margins in the future. The pharmaceutical industry is very competitive, and there may be pressure to reduce sale prices of products without a corresponding decrease in the price of raw materials. In addition, the medical industry in the PRC is highly competitive and new products are constantly being introduced to the market. In order to increase our sales and expand our market share, we may be forced to reduce prices in the future, leading to a decrease in gross profit margin. The research and development of new products and technology is costly and time consuming, and there are no assurances that our research and development of new products will either be successful or completed within the anticipated timeframe, if ever at all. There is no assurance that&# 160;our competitors' new products, technology, and processes will not render our existing products obsolete or non-competitive. To the extent that we fail to develop new products with high profit margins and our high profit margin products are substituted by competitors' products, our gross profit margins will be adversely affected.

The commercial success of our products depends upon the degree of market acceptance among the medical community and failure to attain market acceptance among the medical community may have an adverse impact on our operations and profitability.

The commercial success of our products depends upon the degree of market acceptance among the medical community, such as hospitals and physicians. Even if our products are approved by the SFDA, there is no assurance that physicians will prescribe or recommend our products to patients. Furthermore, a product's prevalence and use at hospitals may be contingent upon its relationship with the medical community, particularly products that are only available by medical prescription. The acceptance of our products among the medical community may depend upon several factors, including but not limited to, the product's acceptance by physicians and patients as a safe and effective treatment, cost effectiveness, potential advantages over alternative treatments, and the prevalence and severity of side effects. Failure to attain market accepta nce among the medical community may have an adverse impact on our operations and profitability.

We enjoy certain preferential tax concessions and loss of these preferential tax concessions will cause its tax liabilities to increase and its profitability to decline.

Xi’an Pharmaceuticals enjoys preferential tax concessions in the PRC as a high-tech enterprise because of the research and development methodologies it employs to develop new products. Pursuant to the State Council's Regulations on Encouraging Investment in and Development, Xi’an Pharmaceuticals was granted a reduction in its income tax rate under which it paid no income taxes from January 1, 2005 to December 31, 2006 and had had an income tax rate of 16.5% since January 1, 2007 which is a 50% reduction on the current effective income tax rate. This favorable 50% tax exemption treatment expired on December 31, 2009. There is no assurance that the preferential tax treatment in the PRC will remain unchanged and effective. Its tax liabilities will increase and its profits may accordingly decline if its reduced income tax rate is no longer applicable and/or the tax relief on investment in PRC is no longer available.

Additionally, as a company organized in the PRC, Xi’an Pharmaceuticals is subject to the PRC Enterprise Income Tax Law (the "EIT Law"), which was enacted on March 16, 2007. Under the EIT Law, effective January 1, 2008, the PRC adopted a uniform tax rate of 25.0% for all enterprises (including foreign-invested enterprises) and cancelled several tax incentives enjoyed by foreign-invested enterprises. However, for foreign-invested enterprises established

before the promulgation of the EIT Law, a five-year transition period is provided during which reduced rates will apply but gradually be phased out. As a high-tech enterprise and under the EIT Law, Xi’an Pharmaceuticals enjoyed a two-year tax exemption for 2006 through 2007, and since 2008, it has received the statutory rate of 15%. Since the PRC government has not announced implementation measures for the transitional policy with regards to such preferential tax rates, we cannot reasonably estimate the financial impact of the new tax law to Xi’an Pharmaceuticals at this time. Further, any future increase in the enterprise income tax rate applicable to it or other adverse tax treatments, such as the discontinuation of preferential tax treatments for high and new technology enterprises, would have a material a dverse effect on its results of operations and financial condition.

Risks Related to Doing Business in the PRC

Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

Our business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the PRC’s Communist Party. The Chinese government exerts substantial influence and control over the manner in which we and it must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1988. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy, particularly the pharmaceutical industry, through regulation and state ownership. Our ability to operate in the PRC may be adversely affected by changes in Chinese laws and regulations, including those relating to taxatio n, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The PRC's economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case.

A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social life.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm its business.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. The PRC’s legal system is a civil law system based on written statutes, in which system decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations deal ing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We are considered a foreign persons or foreign funded enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on its businesses. If the relevant authorities find that we are in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

| | ● | levying fines; |

| | ● | revoking Xi’an Pharmaceuticals’ business and other licenses; |

| | ● | requiring that we restructure our ownership or operations; and |

| | ● | requiring that we discontinue any portion or all of our business. |

Among the material laws that we are subject to are the Medicine Management Law, governing the management of pharmaceutical companies, medicine production procedure, packaging, prices, Advertisement Law of the People’s Republic of China and Rules of Medicine Advertisements Management from State Admission for Industry and Commerce, Regulations on Control of Advertisements from State Council, governing rules on advertising, Standardization of the Management on the Quality of Medicine Production issued by SFDA, providing standards for staff, plants, equipment, materials, environment, production management, products laws, and the Price Law of The People’s Republic of China, Measurement Law of The People’s Republic of China, Tax Law, Environmental Protection Law, Contract Law, Patent Law, Accounting Laws and Labor Law.

A slowdown, inflation or other adverse developments in the PRC economy may harm our customers and the demand for our services and products.

All of our operations are conducted in the PRC and all of our revenue is generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that this growth will continue. A slowdown in overall economic growth, an economic downturn, a recession or other adverse economic developments in the PRC could significantly reduce the demand for our products and harm our business.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth could lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may harm our profitability. In order to control inflation in the past, the PRC government has imposed controls on bank credit, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth. In October 2004, the People's Bank of China, the PRC's central bank, raised interest rates for the first time in nearly a decade and indicated in a statement that the measure was prompted by inflationary concerns in the Chinese economy. Repeated rises in interest rates by the central bank would likely slow economic activity in the PRC which could, in turn, materially increase its costs and also reduce demand for its products.

Governmental control of currency conversion may affect the value of your investment.