UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2007

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to ______

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

COMMISSION FILE NUMBER: 000-51641

FARALLON RESOURCES LTD.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 1020, 800 West Pender Street

Vancouver, British Columbia

Canada

(Address of principal executive offices)

Securities registered or to be registered pursuant to section 12(b) of the Act:

| Title of each Class | Name of each exchange on which registered |

| None | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Common Shares: 284,723,668 as of June 30, 2007

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark if the Registrant is a well known seasoned issuer as defined in Rule 405 of theSecurities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of theSecurities Exchange Act of 1934

Yes [ ] No [X]

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of theSecurities Exchange Act of 1934during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer or non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b 2 of the Exchange Act.

[ ] Large Accelerated Filer [ ] Accelerated Filer [X] Non Accelerated Filer

Indicate by check mark which financial statement item Registrant has elected to follow:

Item 17 [X] Item 18 [ ]

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act):

Yes [ ] No [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of theSecurities Exchange Act of 1934subsequent to the distribution of securities under a plan confirmed by a court.

NOT APPLICABLE

page 3

T A B L E O F C O N T E N T S

page 4

page 5

GENERAL

In this Annual Report on Form 20-F, all references to “Farallon” and the “Company” refer to Farallon Resources Ltd. and its consolidated subsidiaries.

The Company uses the United States dollar as its reporting currency. All references in this document to “dollars” or “$” are expressed in United States dollars, unless otherwise indicated. References to "Cdn$" refer to Canadian dollars.

Except as noted, the information set forth in this Annual Report is as of January 10, 2008 and all information included in this document should only be considered correct as of such date.

References to this “Annual Report” are references to this Annual Report on Form 20-F for the fiscal period ended June 30, 2007.

NOTE REGARDING FORWARD LOOKING STATEMENTS

Except for statements of historical fact, certain information contained herein constitutes “forward-looking statements” including, without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects” and words of similar import, as well as all projections of future results. Such forward-looking statements involved known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Farallon to be materially different from any future results, performance or achievements of Farallon expressed or implied by such forward-looking statements. Such risks are discussed in Item 3D “Risk Factors.” The statements contained in Item 4B “Business Overview”, Item 5 “Operating and Financial Review and Prospects” and Item 11 “Quantitative and Qualitative Disclosures About Market Risk” are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly.

GLOSSARY OF TERMS USED IN THIS FORM 20-F

Certain terms used herein are defined as follows:

| Assay | Quantitative test of minerals and ore by chemical and/or fire techniques. |

| | |

| Autoclave | See Pressure Oxidation below. |

| | |

| Cyanidation | A dilute solution of sodium (or potassium) cyanide in the presence of atmospheric oxygen causes the dissolution of gold and silver, which are subsequently removed and purified to final commercial metal products. |

| | |

| Common Shares | Farallon’s common shares without par value being the only class or kind of Farallon’s authorized capital. |

| | |

| Concession | Mining rights granted by the Mexican government through the Consejo. As of changes to the mining law in 2005, there is only one kind of concession. These are subject to certain requirements and conditions during the exploration and exploitation stages. |

page 6

| Consejo | The Consejo de Recursos Minerales is a decentralized entity with independent legal capacity under the Mexican Federal Ministry of Energy, Mines and Governmental Industry. The Consejo is obligated, under the “Mining Law of Mexico”, made effective September 25, 1992, to identify and record the potential mineral resources of Mexico, to assist the government with the promotion and development of such resources and to determine which resources should be made available as Concessions. |

| | |

| Consejo Agreement | An agreed program of exploration to be conducted on an exploration concession in order to fulfill the terms of the open bid proposal pursuant to which such concession was awarded by the Consejo. Farallon has exercised an option to acquire its Concessions forming the principal part of its Concessions from the original owner who originally acquired it subject to the underlying Consejo Agreement. |

| | |

| Flotation | A process of mineral separation, in which after the mined rock is crushed and finely ground, and subjected to chemicals that cause the metal-bearing minerals to be separated from the rest of the rock to produce a concentrate. |

| | |

| Hydrometallurgy | Processing of economic minerals into their commercial metal elements and economic/waste by-products by chemical means. |

| | |

| Massive Sulfide | Mineralized rock rich in sulfide minerals (greater than 50%). |

| | |

| Minas | The Direccion General de Minas - the Mexican Director of Mines, who is the public official responsible for the admittance and analysis of Concession applications and the reports and filings required by the federal laws of Mexico. |

| | |

| Mineral Deposit | A deposit of mineralization, which may or may not be ore, the determination of which requires a comprehensive feasibility study. |

| | |

| Mineral Reserve | Securities and Exchange Commission Industry Guide 7, “Description ofProperty by Issuers Engaged or to be Engaged in Significant MiningOperations”of the Securities and Exchange Commission defines a ‘reserve’ as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

| | |

| (1)Proven (Measured) Reserves.Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| | |

| (2)Probable (Indicated) Reserves.Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

page 7

| Mineral Resource | National Instrument 43-101, “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators defines a “Mineral Resource” as a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | |

| Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource. |

| | |

| (1)Inferred Mineral Resource.An ‘Inferred Mineral Resource’ is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

| | |

| (2)Indicated Mineral Resource.An ‘Indicated Mineral Resource’ is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| | |

| (3)Measured Mineral Resource.A ‘Measured Mineral Resource’ is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| | |

| Industry Guide 7, “Description of Property by Issuers Engaged or to beEngaged in Significant Mining Operations”of the Securities and Exchange Commission does not define or recognize resources. As used in this Annual Report, “resources” are as defined in National Instrument 43-101. |

page 8

| Mineral Symbols | Ag – silver; Au – gold; Ba – barium; Ca – calcium; Cu – copper; Fe – iron; K– potassium; Pb – lead; Na – sodium; Zn – Zinc. |

| | |

| OTCBB | Over-the-Counter Bulletin Board |

| | |

| Pressure Oxidation | Controlled oxidation of sulfide minerals in a pressure vessel, called an autoclave, in the presence of heat and pure oxygen. The sulfide minerals are changed from sulfide compounds to soluble oxide compounds while the released sulfur is converted to sulfuric acid and elemental sulfur. |

| | |

| Pesos | The legal currency of Mexico. |

| | |

| Solvent Extraction/Electrowinning(SX/EW) | Solvent Extraction is the technique of transferring a solute from one solution to another, for example when copper oxide is dissolved into solution, copper becomes the solute. Electrowinning is the process in which an electric current flows between a pair of electrodes (anode & cathode) in a solution containing metal ions (electrolyte). Metal is deposited on the cathode in accordance with the metal’s ability to gain or lose electrons. Since ion deposition is selective, the cathode product is generally high grade and requires little further refining. |

| | |

| Sulfide | Group of minerals consisting of metals combined with sulfur; common metallic ores. |

| | |

| TSX | The Toronto Stock Exchange (formerly the TSE), Toronto, Ontario, Canada. |

| | |

| Vein | A tabular or sheet like mineral deposit with identifiable walls, often filling a fracture or fissure. |

page 9

PART I

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

page 10

| A. | Selected Financial Data |

The following table presents selected consolidated financial data derived from the audited consolidated financial statements of Farallon for the last five fiscal years ended June 30, 2007, 2006, 2005, 2004, and 2003. This information should be read in conjunction with the consolidated financial statements for the three years ended June 30, 2007 included elsewhere in this Annual Report.

Farallon’s 2007 annual financial statements have been audited by its current independent auditor, KPMG LLP, Chartered Accountants. The financial statements have been prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Note 13 to the annual financial statements provides descriptions of material measurement differences between Canadian GAAP and accounting principles generally accepted in the United States of America (“US GAAP”) as they relate to Farallon and a reconciliation of Farallon’s financial statements to US GAAP.

All information provided in the Summary of Financial Information below and in this Annual Report is presented in US dollars ("$" or “US$”), unless indicated otherwise, and is in accordance with Canadian GAAP (except as set out in the two tables below).

SUMMARY OF FINANCIAL INFORMATION

IN FARALLON’S FINANCIAL STATEMENTS

Consolidated Statementsof

Operations Data | Years ended June 30

|

| | 2007 | 2006 | 2005 | 2004 | 2003 |

Interest income

Canadian GAAP

US GAAP |

1,533,056

1,533,056 |

313,389

313,389 |

268,513

268,513 |

76,110

76,110 |

16,697

16,697 |

Foreign exchange gain

(loss)

Canadian GAAP

US GAAP |

3,669,903

3,669,903 |

812,696

812,696 |

19,266

19,266 |

(273,484)

(273,484) |

(52,041)

(52,041) |

Recovery of accounts

receivable previously

written off

Canadian GAAP

US GAAP |

–

– |

–

– |

–

– |

152,065

152,065 |

–

– |

Gain on sale of buildings

and equipment

Canadian GAAP

US GAAP |

–

– |

–

– |

3,141

3,141 |

–

– |

–

– |

Recovery of value-added

taxes paid

Canadian GAAP

US GAAP |

–

– |

–

– |

–

– |

273,646

273,646 |

211,717

211,717 |

Stock-based compensation

(expense)

Canadian GAAP

US GAAP |

(2,502,199)

(2,502,199) |

(1,033,268)

(1,033,268) |

(771,951)

(771,951) |

(831,337)

(831,337) |

(1,733)

(1,733) |

Net loss from operations

and continuing operations

Canadian GAAP

US GAAP |

(16,860,860)

(16,860,860) |

(12,457,013)

(12,457,013) |

(12,431,831)

(12,431,831) |

(2,408,885)

(2,408,885) |

(943,394)

(943,394) |

page 11

Consolidated Statementsof

Operations Data | Years ended June 30

|

| | 2007 | 2006 | 2005 | 2004 | 2003 |

Basic and diluted earnings

(loss) per common share

Canadian GAAP

US GAAP |

(0.10)

(0.10) |

(0.12)

(0.12) |

(0.15)

(0.15) |

(0.05)

(0.05) |

(0.03)

(0.03) |

BALANCE SHEETS

| As at June 30

|

| | 2007 | 2006 | 2005 | 2004 | 2003 |

Working capital (deficiency)

Canadian GAAP

US GAAP |

57,788,826

57,788,826 |

5,566,615

5,566,615 |

13,926,287

13,926,287 |

5,691,935

5,691,935 |

(677,325)

(677,325) |

Total assets

Canadian GAAP

US GAAP |

75,873,177

75,873,177 |

15,516,495

15,516,495 |

23,996,334

23,996,334 |

14,889,452

14,889,452 |

9,308,746

9,308,746 |

Buildings and equipment

Canadian GAAP

US GAAP |

3,733,142

3,733,142 |

302,281

302,281 |

384,324

384,324 |

88,987

88,987 |

129,019

129,019 |

Mineral property interests

Canadian GAAP

US GAAP |

8,963,127

8,963,127 |

8,963,127

8,963,127 |

8,963,127

8,963,127 |

8,963,127

8,963,127 |

8,963,127

8,963,127 |

Total liabilities

Canadian GAAP

US GAAP |

4,539,082

4,539,082 |

684,472

684,472 |

722,596

722,596 |

145,403

145,403 |

893,925

893,925 |

Share capital

Canadian GAAP

US GAAP |

147,970,632

147,970,632 |

77,082,934

77,082,934 |

73,800,541

73,800,541 |

52,851,474

52,851,474 |

44,944,698

44,944,698 |

Contributed surplus

Canadian GAAP

US GAAP |

4,053,662

4,073,183 |

1,578,428

1,597,949 |

845,523

865,044 |

833,070

852,591 |

1,733

21,254 |

Deficit

Canadian GAAP

US GAAP |

(80,690,199)

(80,709,720) |

(63,829,339)

(63,848,860) |

(51,372,326)

(51,391,847) |

(38,940,495)

(38,960,016) |

(36,531,610)

(36,551,131) |

Shareholders equity

Canadian GAAP

US GAAP |

71,334,095

71,334,095 |

14,832,023

14,832,023 |

23,273,738

23,273,738 |

14,744,049

14,744,049 |

8,414,821

8,414,821 |

Number of outstanding

common shares at end of

period

Number |

284,723,668 |

105,822,331 |

99,244,985 |

59,636,536 |

32,638,134 |

No cash or other dividends have ever been declared by Farallon.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

page 12

The securities of Farallon are highly speculative and subject to a number of risks. A prospective investor or other person reviewing Farallon for a prospective investor should not consider an investment in Farallon unless the investor is capable of sustaining an economic loss of the entire investment.

The risks associated with Farallon’s business include:

Farallon’s Mineral Resources are estimates only and may not reflect the actual deposits or the economic viability of extraction.

The figures presented for Mineral Resources herein and in the documents incorporated herein by reference are estimates only. The estimating of Mineral Resources is a subjective process and the accuracy of reserve and resource estimates is a function of the quantity and quality of available data and the assumptions used and judgments made in interpreting engineering and geological information. There is significant uncertainty in any resource estimate, and the actual deposits encountered and the economic viability of mining a deposit may differ materially from our estimates.

Estimated Mineral Resources may have to be recalculated based on changes in metals prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence resource estimates.

Farallon’s exploration and project advancement activities on the Campo Morado Property may not be commercially successful, which could lead Farallon to abandon its plans to develop the property and its investments in exploration.

Farallon’s long-term success depends on its ability to establish commercially recoverable quantities of mineralization on the Campo Morado Property that can then be developed into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of gold, silver, copper, zinc and lead exploration is determined in part by the following factors:

- the identification of potential gold, silver, copper, zinc and lead mineralization based on superficial analysis;

- availability of government-granted exploration permits;

- the quality of management and geological and technical expertise; and

- the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. Farallon may invest significant capital and resources in exploration activities and abandon such investments if it is unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of Farallon’s common shares and impair Farallon’s ability to raise future financing. Farallon cannot provide any assurance to investors that it will discover or acquire any mineralized material in sufficient quantities on any of its properties to justify commercial

page 13

operations. Further, Farallon will not be able to recover the funds that it spends on exploration if it is not able to establish commercially recoverable quantities of ore on the Campo Morado Project.

No feasibility studies have been completed.

The known mineralization at the Campo Morado Project has not yet been determined to be economic ore, and may never be determined to be economic. Although the Company believes that exploration data available is encouraging in respect of these properties, there can be no assurance that a commercially mineable ore body exists on the Company’s properties. The engineering studies that are underway have not yet been completed. There is no assurance that any feasibility level studies carried out by the Company will result in a positive determination that the Campo Morado Project can be commercially developed.

If a mine is developed, operating results projected may not be achieved.

Feasibility studies are typically used to determine the economic viability of a deposit. Many factors are involved in the determination of the economic viability of a deposit, including the achievement of satisfactory mineral reserve estimates, the level of estimated metallurgical recoveries, capital and operating cost estimates and the estimate of future metals prices. Capital and operating cost estimates are based upon many factors, including anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, ground and mining conditions, expected recovery rates of the metals from the ore and anticipated environmental and regulatory compliance costs. Each of these factors involves uncertainties and as a result, Farallon cannot give any assurance that its exploration projects will become operating mines. If a mine is developed, actual operating results may differ from those anticipated.

The known mineralization at the Campo Morado Project has not yet been determined to be ore.

The Campo Morado Project has no known body of economic mineralization. The known mineralization has not yet been determined to be economic, and may never be determined to be economic. Although the Company believes that exploration data available is encouraging in respect of these properties, there can be no assurance that a commercially mineable ore body exists on the Company’s property. There is no certainty that any expenditure made in the exploration of the Company’s mineral property will result in discoveries of commercially recoverable quantities of ore. Such assurance will require completion of final comprehensive feasibility studies and, possibly, further associated exploration and other work that concludes a potential mine at each of these projects is likely to be economic. There is no assurance that any feasibility level studies carried out by the Company will result in a positive determination that the Campo Morado Project can be commercially developed. In order to carry out exploration and project advancement programs of any economic ore body and place it into commercial production, the Company must raise substantial additional funding. Farallon’s properties do not contain reserves, and there is no assurance that any feasibility studies carried out by Farallon will establish reserves.

Project advancement of the G-9 deposit may encounter delays in completion or higher than anticipated costs.

Project advancement of the G-9 deposit may require significant capital expenditures during the advancement phase. Further project advancement of G-9 is subject to the completion of the construction of the underground decline, advancement of detailed project and mine planning, procurement and purchase of equipment and receipt of adequate financing. All of these factors are subject to potential delays in completion and rising costs, which could alter the economic return of the project.

page 14

Government regulations significantly affect operations and changes in the regulations could have a significant adverse impact on current and planned operations.

Farallon’s exploration and project advancement activities are subject to extensive laws and regulations governing health and worker safety, employment standards, waste disposal, protection of the environment, protection of historic and archaeological sites, project advancement and protection of endangered and protected species and other matters. Farallon generally requires permits from government authorities to authorize operations. These permits relate to virtually every aspect of Farallon’s exploration and project advancement activities. It is possible that future changes in applicable laws, regulations or changes in their enforcement or regulatory interpretation could result in changes in legal requirements or in the terms of existing permits which could have a significant adverse impact on Farallon’s current operations or planned projects.

Farallon has obtained its major permits for mining at Campo Morado. However, obtaining permits can be a complex, time consuming process and we cannot predict whether final permits will be obtainable on acceptable terms, in a timely manner or at all. In addition, the costs and delays associated with complying with these permits and applicable laws and regulations could stop or materially delay or restrict us from proceeding with the advancement of a project. Any failure to comply with applicable laws and regulations or permits, even if inadvertent, could result in interruption or closure of exploration operations or material fines, penalties or other liabilities.

Political instability and uncertainty in Mexico could increase the cost to Farallon of carrying out its plan of operations, delay its exploration and, if warranted, project advancement activities and make it more difficult for Farallon to obtain additional financing.

The majority of Farallon’s operations and its only mineral property is located in Mexico. Operating in a foreign country, particularly Mexico, usually involves great uncertainties relating to political and economic matters. Any change of government may result in changes to government legislation and policy. These changes in legislation and policy may include changes that impact on Farallon’s ownership of the Campo Morado Property and its ability to continue exploration and, if warranted, advancement of the Campo Morado Project. Further, changes in the government in Mexico may result in political and economic uncertainty which may cause Farallon to delay its plan of operations or which may decrease the willingness of investors to provide financing to Farallon. Accordingly, changes in legislation and policy could result in the increase of the costs to explore and, if warranted, develop the Campo Morado Project and could delay these activities.

Changes in government legislation in Mexico could affect Farallon’s exploration of the Campo Morado Project and could preclude Farallon from continuing to explore and, if warranted, to develop the Campo Morado Project.

Farallon is required to carry out its exploration and project advancement activities in accordance with Mexican federal and state legislation and regulations. Farallon is conducting its activities on the Campo Morado Project in compliance with its current applicable mining permit and exploration requirements. Changes in government legislation, including changes in environmental regulations or land claims, or the adoption of new legislation governing mining operations, failure to comply with current or future legislation, ownership of mineral properties or environmental protection could increase the cost to Farallon of conducting its exploration activities and, if warranted, advancement of the Campo Morado Project or could preclude Farallon from proceeding with its exploration and project activities.

page 15

Farallon must continue to maintain the concessions that comprise the Campo Morado Property in good standing in order to maintain its rights to continue exploration and, if warranted, the advancement of the Campo Morado Project.

The Campo Morado Property is comprised of concessions that have been granted under Mexican mining law. Farallon must pay an annual surface tax and complete an investment or achieve production for each concession in accordance with a sliding scale based upon the area and age of the claim. Farallon’s failure to maintain the concessions that comprise the Campo Morado Property in good standing could cause it to lose its interest in these mineral properties, with the result that Farallon would lose its rights to continue exploration and, if warranted, the advancement of the Campo Morado Project.

Farallon may lose the ability to continue exploration and, if warranted, advancement of the Campo Morado Property in the event that it does not own valid title to its mining claims and leases.

Farallon is the owner of concessions to the mineral properties that comprise the Campo Morado Project, but its ownership has been contested for a number of years. Farallon’s ownership of these concessions should not be construed as a guarantee that title to such interests will not be challenged or impugned. The concessions may be subject to prior unregistered agreements or transfers or claims on title. The concessions may also be affected by undetected defects. If Farallon does not have valid title to its concessions, then it may lose the rights to continue exploration and, if warranted, the advancement of the Campo Morado Project.

The presence of unknown environmental hazards on Farallon’s mineral properties may result in significant unanticipated compliance and reclamation costs that may increase the costs to Farallon of exploring and, if warranted, developing the Campo Morado Project.

Environmental hazards may exist on the properties in which Farallon holds interests which are unknown to Farallon at present and which have been caused by previous or existing owners or operators of the properties. The presence of such environmental hazards may result in Farallon being required to comply with environmental reclamation, closure and other requirements that may involve significant costs and other liabilities. In particular, Farallon’s operations and exploration activities are subject to Mexican laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive.

The adoption of stricter environmental legislation governing the Campo Morado Project could increase the costs to Farallon of exploring and, if warranted, developing the Campo Morado Project and could delay these activities.

Farallon must comply with applicable environmental legislation in carrying out its exploration and, if warranted, advancement of the Campo Morado Project. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Changes in environmental legislation could increase the cost to Farallon of carrying out its exploration and advancement of the Campo Morado Project. Further, compliance with stricter environmental legislation may result in delays to Farallon’s exploration and project activities.

As Farallon conducts its Mexican mineral exploration activities through foreign subsidiaries, any limitation imposed by any government or legislation on the transfer of assets and cash between Farallon and its subsidiaries could restrict Farallon’s ability to funds its operations efficiently or at all.

page 16

Farallon conducts its operations through foreign subsidiaries and substantially all of its assets, other than cash, are held in such entities. Accordingly any limitation on the transfer of cash or other assets between the parent company and such entities, or among such entities, could restrict Farallon’s ability to fund its operations efficiently or at all. Any such limitations, or the perception that such limitations may exist in the future, could have an adverse impact upon Farallon’s valuation and stock price.

As the Campo Morado Property is Farallon’s only material mineral property, Farallon is economically dependent on the Campo Morado Property in achieving its business objectives. The failure of Farallon to establish that the Campo Morado Property possesses commercially viable deposits of mineralization or the loss of the Campo Morado property due to Farallon’s outstanding litigation may force Farallon to abandon the Campo Morado Property which could result in a significant decline in the trading price of Farallon’s common shares.

The Campo Morado Property is Farallon’s only material mineral property and as a result, Farallon is economically dependent on the Campo Morado Property for the achievement of its business objectives. Farallon’s principal business objective is to establish whether the Campo Morado Property possess commercially viable deposits of ore and then to extract the ore. If Farallon is not successful with its exploration activities to determine commercially viable deposits, or if Farallon loses its interest in the Campo Morado Property due to its outstanding litigation, Farallon would not be able to continue its operations on the Campo Morado Property and would be forced to seek a new mineral property to explore or acquire an interest in a new mineral property or project. Farallon anticipates that such an outcome would result in a significant decline in the trading price of Farallon’s common shares.

Farallon has no history of earnings and no foreseeable earning.

Farallon has a long history of losses and there can be no assurance that Farallon will ever be profitable. Farallon has paid no dividends on its shares since incorporation. Farallon anticipates that it will retain future earnings and other cash resources for the future operation and development of its business. Farallon does not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends is solely at the discretion of Farallon’s Board of Directors, which will take into account many factors including Farallon’s operating results, financial conditions and anticipated cash needs. Investors cannot expect to see net income or to receive a dividend on their investment in the foreseeable future, it at all. Accordingly, it is likely investors will not receive any return on their investment in Farallon’s securities other than possible capital gains for the foreseeable future.

Farallon will require financings to achieve its business objectives.

Farallon may need to raise additional capital to complete the exploration and/or project advancement at its G-9 deposit. Although the Company has appointed a financial institution as the lead arranger for the debt financing package for the project advancement at G-9, the financing has yet to be completed and there can be no assurance that Farallon or its appointee will be successful in its efforts to complete the debt financing or on terms satisfactory to Farallon.

Farallon may also need to raise capital to complete any feasibility studies for the Campo Morado Property. Furthermore, if the costs of Farallon’s planned exploration and/or project advancement programs are greater than anticipated, the Company may have to seek additional funds through public and private share offerings, arrangements with corporate partners, or debt financing. There can be no assurance that Farallon will be successful in its efforts to raise funds at all, or on terms satisfactory to it. The continued development of Farallon’s business will depend upon Farallon’s ability to develop its cash flow from operations and reach profitable operations. Farallon currently has no revenue from operations and is experiencing significant negative cash flow. Accordingly, the only other sources of

page 17

funds presently available to Farallon are through the sale of equity and debt capital. Alternatively, Farallon may finance its business by offering an interest in its mineral properties to be earned by another party or parties carrying out further exploration and development thereof or to obtain project or operating financing from financial institutions, neither of which is presently intended.

If Farallon cannot obtain sufficient capital to fund planned expenditures, its planned operations and exploration programs may be significantly delayed or abandoned. This would have a material adverse effect on Farallon, its business and results of operations, which might result in Farallon not meeting its business objectives.

Farallon’s operations are subject to economic risks.

The future profitability of Farallon’s operations will be significantly affected by changes in the market price of the metals it mines or explores for. The prices of gold, silver, zinc, copper and lead are volatile, and are affected by numerous factors beyond Farallon’s control. The level of interest rates, the rate of inflation, the world supply of gold, silver, zinc, copper and lead and the stability of exchange rates can all cause fluctuations in these prices. Such external economic factors are influenced by changes in international investment patterns and monetary systems and political developments. The prices of gold, silver, zinc, copper and lead have fluctuated in recent years, and future significant price declines could cause commercial production to be uneconomic and may have a material adverse effect on Farallon’s business, results of operations and financial condition.

Farallon depends on key personnel.

Farallon’s success is dependent upon the performance of key personnel working in management, supervisory and administrative capacities, or as consultants. These personnel include Dick Whittington, who is the President and Chief Executive Officer, and Larry Yau, Chief Financial Officer of the Company. Farallon does not maintain life insurance or key-man insurance. The loss of the services of senior management or key personnel could have a material and adverse effect on Farallon, its business and results of operations.

If Farallon was to lose the services of Dick Whittington or other members of its management team, then it may be delayed in its plan of operations for the Campo Morado Project and its operating expenses may be increased.

Farallon relies on the services of Dick Whittington, who is president and Chief Executive Officer, Larry Yau, Chief Financial Officer of the Company and other members of its management team to carry out its plan of operations. Mr. Whittington and Mr. Yau are the only members of the Company’s management team that provide services on a full time basis. Farallon does not maintain life insurance or key man insurance for such personnel. Farallon’s success is dependent on the performance of key personnel working in management, supervisory and administrative capacities, or as consultants in advancing its corporate objectives. The loss of the services of senior management or key personnel who are capable of managing Farallon’s business activities will result in Farallon being required to identify and engage qualified management to replace members of the management team. The time and expense involved in this process could result in a delay in Farallon completing its planned exploration programs. The loss of the management team could result in the most extensive delay as Farallon would be required to locate, engage and orient a new chief executive officer. The services of Farallon’s management team are provided pursuant to a contract with Hunter Dickinson Inc, a related party by virtue of common directors, and do not have a direct employment contract with Farallon. If Farallon was to lose the services of members of its management team, Farallon’s plan of operations for the Campo Morado Property may be affected and its operating expenses may be increased.

page 18

If Farallon loses the services of the independent contractors that it engages to undertake its exploration, then Farallon’s plan of operations may be delayed or be more expensive to undertake than anticipated.

Farallon’s success depends to a significant extent on the performance and continued service of certain independent contractors, including Hunter Dickinson Inc. Farallon has contracted the services of professional drillers and other contractors for exploration, environmental and engineering services. Poor performance by such contractors or the loss of such services could result in the exploration activities planned to be undertaken by Farallon being delayed or being more expensive to undertake than anticipated.

The unsuccessful resolution of litigation relating to the Campo Morado Property may result in Farallon losing its interest in the Campo Morado Property.

The Campo Morado Project has been the subject of litigation for over eight years in lawsuits in Canada, the United States and Mexico. Farallon won unappealable decisions in the Canadian and U.S. lawsuits while its successes in the Mexican courts have continued to be challenged with appeals and new suits. While Farallon believes in the merits of its position and case, there can be no certainty of the ultimate outcome. See “Legal Proceedings” in Item 8A below.

If Farallon is not successful in defending this litigation, Farallon will lose its interest in the Campo Morado Property with the result that it would be forced to abandon its efforts to continue exploration and, if warranted, development of the Campo Morado Property. In this event, Farallon anticipates that the trading price of its common shares will decrease significantly and Farallon may not be able to raise the additional financing that will be required to finance Farallon to sustain its business operations. Further, the continued presence of this litigation may impair the ability of Farallon to obtain additional financing for the further exploration and, if warranted, development of the Campo Morado Property. The inability to obtain financing would result in Farallon’s inability to complete its exploration activities and, if warranted, development of the Campo Morado Property.

Farallon competes with larger, better capitalized competitors in the mining industry.

The mining industry is competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Because of the high costs associated with exploration, the expertise required to analyze a project’s potential and the capital required to develop a mine, larger companies with significant resources may have a competitive advantage over the Company. Farallon faces strong competition from other mining companies, many with greater financial resources, operational experience and technical capabilities than Farallon. As a result of this competition, Farallon may be unable to maintain or acquire financing, personnel, technical resources or attractive mining properties on terms Farallon considers acceptable or at all.

Farallon is subject to many risks that are not insurable and, as a result, Farallon will not be able to recover losses through insurance should such risks occur.

Hazards such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and development. Farallon may become subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it may elect not to insure. The payment of such liabilities would result in increase in Farallon’s operating expenses which would, in turn, have a material adverse effect on Farallon’s financial position and its results of operations. Although Farallon maintains liability insurance in an amount which it considers adequate, the nature of these risks is such that the liabilities might exceed policy limits, the liabilities and hazards might not be insurable against,

page 19

or Farallon might not elect to insure itself against such liabilities due to high premium costs or other reasons, in which event Farallon could incur significant liabilities and costs that could materially increase Farallon’s operating expenses.

Farallon does not have a history of paying dividends and does not have any intention of paying dividends in the foreseeable future.

Investors cannot expect to receive a dividend on their investment in the foreseeable future, if at all. Accordingly, it is likely investors will not receive any return on their investment in Farallon’s securities other than possible capital gains.

Farallon’s consolidated financial statements have been prepared assuming Farallon will continue on a going concern basis, but there can be no assurance that the Company will continue as a going concern.

Farallon’s consolidated financial statements have been prepared on the basis that Farallon will continue as a going concern. At June 30, 2007, Farallon had working capital of approximately $57.8 million. These funds may not be sufficient to meet its planned business objectives and project advancement of the G9 deposit on its Campo Morado Property. Management recognizes that Farallon may need to generate additional financial resources in order to meet its planned business objectives. There can be no assurances that Farallon will continue to obtain additional financial resources and/or achieve profitability or positive cash flows. If Farallon is unable to obtain adequate additional financing, Farallon will be required to curtail operations and/or its exploration and development activities. Furthermore, failure to continue as a going concern would require that Farallon's assets and liabilities be restated on a liquidation basis which would differ significantly from the going concern basis.

As there is no established market for Farallon’s securities in the United States, U.S. investors may not be able to sell their common share of Farallon within the United States.

There is no established market in the United States of America for Farallon’s securities. Accordingly, investors must rely on Canadian equity markets to trade in Farallon’s securities. Such markets might not have the liquidity found in markets in the United States, resulting in investors being unable to dispose of Farallon’s securities.

U.S. investors who obtain judgments against Farallon or its officers or directors for breaches of U.S. securities laws may have difficulty in enforcing such judgments against Farallon and its officers and directors.

Farallon is incorporated under the laws of a province of Canada and a majority of Farallon’s directors and officers are residents of Canada. Consequently, it may be difficult for United States investors to effect service of process within the United States upon Farallon or upon those directors or officers who are not residents of the United States, or to enforce, inside or outside of the United States, any judgments of United States courts predicated upon civil liabilities under the United StatesSecurities Exchange Act of 1934, as amended. A judgment of a U.S. court predicated solely upon such civil liabilities may not be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained is determined by the Canadian court not to have had jurisdiction in the matter. Furthermore, an original action might not be able to be brought successfully in Canada against any of such persons or Farallon predicated solely upon such civil liabilities.

page 20

Fluctuations in foreign currency exchange rates may increase Farallon’s operating expenditures.

Farallon raises its equity in Canadian dollars, conducts certain operating expenditures in Mexican pesos and maintains its financial reporting in U.S. dollars. The Company does hold, from time to time, significant funds on deposit denominated in Canadian dollars and in Mexican pesos. Farallon’s exploration expenditures are generally denominated in United States dollars or Mexican pesos. As a result, Farallon’s expenditures are subject to foreign currency fluctuations. Foreign currency fluctuations may materially and adversely increase Farallon’s operating expenditures and reduce the amount exploration activities that Farallon is able to complete with its current capital. Farallon does not engage in any hedging or other transactions to protect itself against such currency fluctuations.

If Farallon’s directors cause it to enter into transactions in which its officers and/or directors have an interest, Farallon may enter into transactions that are on less favorable terms than would be negotiated with an arms length party.

Directors of Farallon also serve as directors of other similar companies involved in natural resource development. Accordingly, it may occur that properties will be offered to both Farallon and such other companies. Furthermore, those other companies may participate in the same properties as those in which Farallon has an interest. As a result there may be situations which involve a conflict of interest. In that event, the directors would not be entitled to vote at meetings of directors which evoke any such conflict. The directors will attempt to avoid dealing with such other companies in situations where conflicts might arise and will at all times use their best efforts to act in the best interests of Farallon. If Farallon’s directors cause it to enter into transactions in which its officers and/or directors have an interest, Farallon may enter into transactions that are on less favorable terms than would be negotiated with an arms length party.

The failure of Farallon to maintain effective internal controls could result in Farallon not being able to produce reliable financial statements.

Farallon is in the process of documenting and testing our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires annual management assessments of the effectiveness of the Company’s internal controls over financial reporting and a report by the Company’s Independent Auditors addressing these assessments. During the course of this testing, Farallon may identify deficiencies which the Company may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. In addition, if Farallon fails to achieve and maintain the adequacy of the Company’s internal controls, as such standards are modified, supplemented or amended from time to time, Farallon may not be able to ensure that it can conclude on an ongoing basis that the Company has effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls are necessary for the Company to produce reliable financial reports and are important to helping prevent financial fraud. If Farallon cannot provide reliable financial reports or prevent fraud, Farallon’s business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of Farallon’s stock could drop significantly.

As Farallon is likely a passive foreign investment company under U.S. tax laws, U.S. investors in Farallon may be required to include as ordinary income each year the excess of the fair market value of the common shares over the investor’s tax basis in such shares.

Potential investors who are U.S. taxpayers should be aware that Farallon expects to be a passive foreign investment company ("PFIC") for the current fiscal year, and may also have been a PFIC in prior years and may also be a PFIC in subsequent years. If Farallon is a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayer generally will be required to treat any so-called "excess

page 21

distribution" received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund ("QEF") election or a mark-to-market election with respect to the shares of Farallon. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis his or her share of Farallon’s net capital gain and ordinary earnings for any year in which Farallon is a PFIC, whether or not Farallon distributes any amounts to its shareholders. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s tax basis therein.U.S. taxpayers are advised to seek the counsel of their professional tax advisors.

The exercise of outstanding options and share purchase warrants issued by Farallon will result in the issuance by Farallon of additional common shares and the unrestricted resale of these additional common shares may have a depressing effect on the current or future trading price of Farallon’s common shares.

At January 10, 2008 there were approximately 11.8 million options and 105.5 million warrants of Farallon outstanding. As a consequence of the passage of time since the date of their original sale and issuance, no options of Farallon remain subject to any hold period restrictions in Canada as of January 10, 2008. Dilutive securities represent approximately 40% of Farallon’s issued shares as at January 10, 2008. The exercise of these outstanding options and warrants will result in the issue by Farallon of additional common shares and the resale of these additional common shares may have a depressing effect on the current or future trading price of Farallon's common shares.

Broker-dealers may be discouraged from effecting transactions in Farallon’s common shares because they are considered a penny stock and are subject to the SEC’s penny stock rules.

The SEC has adopted rules (the “Penny Stock Rules”) that regulate broker-dealer practices in connection with transactions in ‘penny’ stocks. Penny stocks are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current prices and volume information with respect to transactions in such securities is provided by the exchange or system).

The Penny Stock Rules require a broker-dealer, prior to effecting a transaction in a penny stock not otherwise exempt from such rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. In particular the statement must contain:

| (a) | a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | |

| (b) | a description of the broker-dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| | |

| (c) | a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| | |

| (d) | a toll-free telephone number for inquiries on disciplinary actions; |

page 22

| (e) | the definitions of significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| | |

| (f) | such other information and be in such form, including language, type, size and format, as the Commission shall require by rule or regulation. |

The broker-dealer must obtain from the customer a written acknowledgement of receipt of the standardized disclosure document.

The broker-dealer also must provide the customer with:

| (a) | the inside bid and offer quotations for the penny stock, or other bid and offer price information for the penny stock if inside bid and offer quotations are not available; |

| | |

| (b) | the compensation of the broker-dealer and its salespersons in the transaction; |

| | |

| (c) | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| | |

| (d) | a monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the Penny Stock Rules require that prior to a transaction in a penny stock not otherwise exempt from such rules the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. At the present market prices Farallon’s common shares will (and in the foreseeable future are expected to continue to) fall within the definition of a penny stock. Accordingly, United States broker-dealers trading in Farallon’s shares will be subject to the Penny Stock Rules. Rather than complying with those rules, some broker-dealers may refuse to attempt to sell penny stock. As a result, shareholders and their broker-dealers in the United States may find it more difficult to sell their shares of Farallon, if a market for the shares should develop in the United States.

page 23

| ITEM 4 | INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

Name, Incorporation and Offices

Farallon is a mineral exploration company incorporated on July 4, 1991, pursuant to theCompany Act of the Province of British Columbia, Canada under the name “Farallon Resources Ltd.” by registration of its memorandum and articles of association. On December 5, 1991, Farallon’s common shares were listed for trading on the TSX Venture Exchange (formerly the Vancouver Stock Exchange). Effective October 30, 1997, Farallon’s common shares began trading on the TSX. On August 1, 2007, Farallon’s shares were cleared for quotation and have also been trading in the United States on the Over the Counter Bulletin Board (“OTCBB” – symbol FRLLF).

Farallon Minera Mexicana SA de CV (“Farallon Minera Mexicana”), Farallon’s only operating subsidiary, was incorporated in Mexico on November 10, 1994, and holds title to the Mexican mineral interests.

Farallon has incorporated wholly owned holding companies under the laws of the United States and the British Virgin Islands, as described under Item 4.C below.

Farallon’s head office is located at Suite 1020, 800 West Pender Street, Vancouver, British Columbia, Canada V6C 2V6, telephone (604) 684-6365, facsimile (604) 684-8092. Farallon’s legal registered office is located at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, Canada V6E 4N7.

History

The Campo Morado Project

Farallon is engaged in the exploration of the Campo Morado Project, located in Guerrero State, Mexico. The Campo Morado Project is the Company’s only material mineral property.

The Campo Morado Project covers an area of approximately 11,814 hectares and is comprised of the six concessions granted by the Mexican government through the Consejo (see Table 1 under Plant Property and Equipment below).

The Campo Morado Project contains former mines that produced (from the early 1900s) limited amounts of gold, silver and lead from oxidized massive sulfide deposits.

page 24

Acquisition of the Campo Morado and La Alina Concessions

The Company acquired the Campo Morado and La Alina Concessions pursuant to an option agreement (the “Option Agreement”) finalized in January 1996 among Messrs. Alvaro J. Villagrán Garcia, J. Pedro Villagrán Garcia and J. Pedro Villagrán Ochoa (collectively the “Villagráns”) and their company Minera Summit de Mexico SA de CV (“Minera Summit”), as optionor, and its subsidiary Farallon Minera Mexicana, as optionee. Under the terms of the Option Agreement, Farallon Minera Mexicana SA de CV was granted the exclusive option (the “Option”) to acquire from Minera Summit a 100% interest (subject to what is effectively a sliding scale 3% net profits royalty to a government entity) in the Campo Morado Property. The Campo Morado and La Alina Concessions were exploration concessions at the time the parties entered into the Option Agreement. The Option Agreement was negotiated at arm’s length due to the fact that the Villagráns were not directors, officers or significant shareholders at the time of the negotiation of the Option Agreement. Subsequent to the signing of the Option Agreement the Villagráns were appointed to Farallon’s board of directors in 1998 and remained on Farallon’s board until March 2002.

Minera Summit won the Campo Morado and La Alina Concessions on October 31, 1994 in an open bid process whereby interested parties were invited to propose an exploration program for the Campo Morado and La Alina Concessions for consideration by the Dirección General de Minas (“Minas”), which considered the bids with a view to, among other things, the best interests of furthering the mineral wealth of Mexico. The proposal of Minera Summit was chosen and the Campo Morado and La Alina Concessions were conditionally granted to it. Minera Summit’s agreement with the Consejo (the “Consejo Agreement”) respecting the Campo Morado and La Alina Concessions required a minimum expenditure of 14.7 million pesos on staged exploration over a three-year period ending September 14, 1997. This expenditure requirement had been met and exceeded by January 1997.

Under the Option Agreement, Farallon was required to pay to Minera Summit the aggregate sum of $1,235,388 over the staged programs under the bid (which has been paid) and issue 750,000 shares of Farallon (which have been issued) to earn the 100% interest in the Campo Morado and La Alina Concessions. A potential further issuance of 750,000 shares is issuable dependent on the amount of recoverable gold equivalent (gold and silver only) if, as and when determined by a feasibility study.

Farallon Minera Mexicana completed the three stage exploration program which the Consejo required to be completed in order to satisfy the minimum expenditure requirements under Minera Summit’s agreement with the Consejo and the Option Agreement. Stage One was primarily comprised of a review of the previous work done on the Campo Morado and La Alina Concessions, including examination of the 33 mineral occurrences known at that time as well as reviewing mine and surface topography and mine geology, and examining drainage conditions and previous sampling information. The cost of work required in Stage One was 48,760 pesos ($3,650). Stage Two was comprised of road construction, more detailed geological mapping, underground rehabilitation, assessment of the topography of old mine workings, airborne geophysical surveys, metallurgical research and test work, construction of new topographic and other maps, and drill mobilization. The cost of work required in Stage Two was 4,037,150 pesos ($538,000). Stage Three was comprised of the reconditioning of existing mine workings, detailed geological mapping, further rock sampling and diamond drilling as well as additional sampling, analysis, interpretation, and metallurgy. The expenditure required for Stage Three was 4,933,000 pesos ($658,000). Other general investment in the Campo Morado and La Alina Concessions, comprising the establishment of camp facilities, transportation, professional services, labour, payroll taxes and contingencies, was to total 5,681,090 pesos ($758,000). The total costs of Farallon’s programs were well in excess of the required expenditures, and the Consejo accepted the transfer of title of the concessions from Minera Summit to Farallon Minera Mexicana on January 10, 1997.

page 25

Under the terms of the Option Agreement, if and when Farallon completes a feasibility study (the “Feasibility Study”) with respect to the Campo Morado and La Alina Concessions, Farallon will be obligated to issue to Minera Summit up to 750,000 additional common shares of Farallon. The number of shares issuable will be based on the value of the Campo Morado and La Alina Concessions as assessed in an independent calculation of the property’s “Recoverable Gold Equivalent Ounces” from the Feasibility Study. For these purposes, “Recoverable Gold Equivalent Ounces” means economically recoverable, net payable, gold ounces after smelting deductions for gold and silver ounces (with silver ounces converted to gold equivalent at the then-prevailing prices for gold and silver) from any mineable reserves on the property and any other property of Farallon within a defined Area of Influence (as defined in the Option Agreement and which includes all Concessions comprising the Campo Morado Project). The Option Agreement also acknowledges that the Campo Morado and La Alina Concessions could be subject to moral claims of some previous investors, who had invested money in certain private companies that had sought an interest in Campo Morado prior to Farallon’s involvement in the Campo Morado and La Alina Concessions. In 1996, Farallon purchased 97% of the shares of the private companies from those investors, for an amount of approximately $578,000. Farallon also agreed to waive Minera Summit’s obligation to contribute one-half of the private company share purchase amount, as consideration for the continuing and future assistance being provided to Farallon by the Villagráns in Mexico, and for Minera Summit consenting to Farallon acquiring all the private company’s shares. All of the investors in the defunct private companies were at all times at arm’slength to Farallon.

Acquisition of the La Trinidad Concession

Farallon Minera Mexicana won the La Trinidad Concession on November 16, 1999 in an open bid process. Interested parties were invited to propose a purchase price for consideration by the Direccion General de Minas, which would be reviewed with a view to, among other things, determine the maximum bid and ensure that it exceeded a minimum bid set by Minas. The bid of Farallon Minera Mexicana was chosen and the La Trinidad Concession was granted to Farallon Minera Mexicana. The purchase price of the Concession was $150,000 of which 60%, or $90,000, was paid on November 16, 1999. The remainder of the purchase price (40% or $60,000) was paid prior to November 16, 2000. The Minas retains a sliding scale 3% net profits royalty on the Concession.

Exploration Programs

During the period of 1995-2000, Farallon conducted exploration, including geological, geophysical and geochemical surveys as well as diamond drilling in 320 holes totaling 64,211 meters. In 2004, Farallon completed a resource estimate based on the drilling that had been completed to 2000, and then carried out a 15,000 meter core drilling program that included holes for exploration, resource definition and metallurgical sampling. In 2005, a three phase “proof of principle” metallurgical program and 50,128 meters of drilling was completed. In fiscal 2006, work was re-focused on G-9. Metallurgical testwork and 48,461 meters of drilling were done, as well as preliminary engineering and socioeconomic studies. In fiscal 2007, 32,820 meters were drilled from surface, and a fourth phase of metallurgical testwork was done on G-9. Development of an underground exploration access decline began in August 2006, and mine planning, acquisition of equipment and site preparation work also took place.

Capital Expenditures

Farallon has not made any material capital expenditures or divestures in any of the last three financial years and no material capital expenditures or divestitures are currently in progress. However, the Company is proceeding with its exploration and project advancement program.

page 26

Takeover Offers

Farallon is not aware of any indication of any public takeover offers by third parties in respect of Farallon’s common shares, which have occurred during the last or current financial years.

Farallon’s Business Strategy and Principal Activities

Farallon is an exploration stage company focused on exploring the Campo Morado Project. Farallon has undertaken the following activities in connection with the implementation of its business plan.

During the period from 1995 to 2000, Farallon conducted exploration, including diamond drilling and geological, geophysical and geochemical surveying, at the Campo Morado Project. This exploration included diamond drilling of 320 drill holes, totalling 64,200 meters.

During the period from 2001 to 2003, Farallon placed the Campo Morado Project in care and maintenance status due to low metal prices at the time and pending resolution of litigation regarding Farallon’s ownership of the Campo Morado Project. This litigation related to the ownership of the Campo Morado Property. During this period, only routine exploration activities of a minor nature were undertaken with all site buildings and assets being kept in a secure and ready state in anticipation of resolution of the litigation. Decisions on legal actions in British Columbia and Nevada were in Farallon’s favor, and proceedings in Mexico were dismissed. A new legal proceeding was commenced in Mexico in January 2004 which remains unresolved. The original legal proceedings and the new legal proceeding are discussed in detail in Item 8A of this Annual Report on Form 20-F under the heading "Legal Proceedings”.

Farallon re-initiated comprehensive programs for Campo Morado in 2004. In July 2004, Farallon completed an estimate of the Mineral Resources at Campo Morado as outlined by the 1995-2000 programs and re-initiated metallurgical studies. The first phase of drilling, totalling approximately 15,000 meters of core holes, took place from August 2004 to December 2004. Most of the exploration drilling tested the El Largo deposit and most of the drilling to obtain metallurgical samples took place at the Reforma and Naranjo deposits. The 2004 program cost $3 million.

Farallon began another phase of exploration and engineering studies early in calendar 2005. Over the year, approximately 50,000 meters of drilling was completed, designed to expand and upgrade the Mineral Resources, and once Measured or Indicated Resources were established, to provide necessary data for the completion of a preliminary feasibility study. Pilot plant testing of the flow sheet for a hydrometallurgical process for the Reforma, Naranjo, El Rey and El Largo deposits was successfully completed as well as some mine planning. Completion of an options analysis and selection of the most optimal mine development alternative was expected to be completed by the end of November 2005. However, as a result of the discovery of the G-9 deposit completion of the options analysis was deferred until drilling and testing of G-9 could be completed. Costs for programs from January to June 2005 were $8.5 million and from July to December 2005 were $4.2 million.

From January to June 30, 2006 a program mainly focusing on the G-9 deposit and comprising approximately 25,000 meters of drilling and two phases of preliminary metallurgical testing were completed at a cost of $4.8 million. Preliminary metallurgical test work indicated that the mineralization in the G-9 deposit could be treated by conventional flotation to extract metals. These positive results, and those from ongoing drilling at G-9, resulted in the decision to defer further work on El Largo, Reforma, El Rey and Naranjo, as efforts have been redirected toward G-9.

page 27

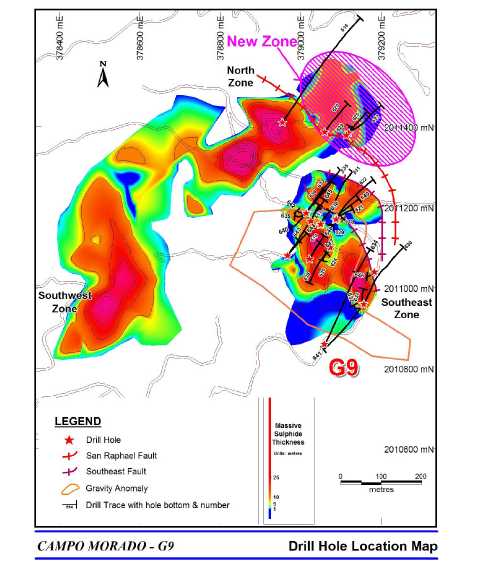

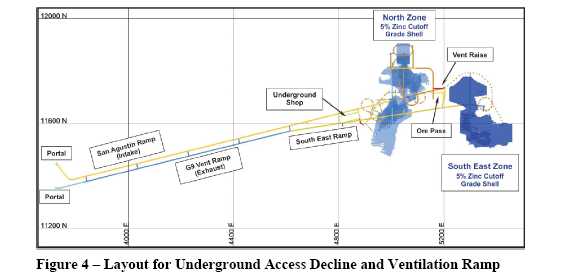

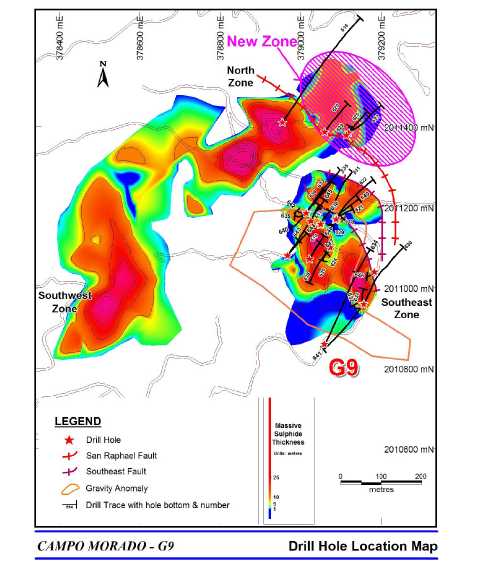

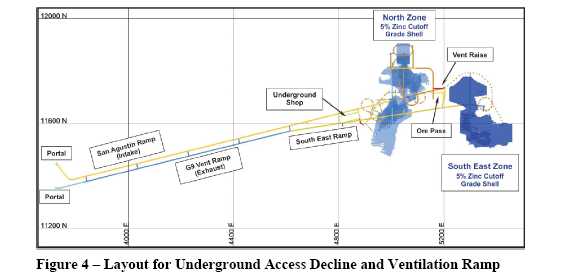

In fiscal 2007, the Company was focused on two objectives – exploration drilling to expand the G-9 deposit and find other G-9 style deposits and activities directed toward advancing the G-9 deposit toward production. During the year, a number of activities were completed to advance resource development objectives, including approximately 32,820 meters of surface drilling in 75 holes; a new resource estimate for G-9 deposit in November 2006; and additional surface drilling since the estimate indicates expansion of the G-9 deposit, in particular, the high grade Southeast zone, and discovery of a new zone. To advance the G-9 deposit, development of an underground access decline was initiated in August 2006. Project planning was advanced in all key areas, including metallurgical testing and detailed mill design; initiation of education enhancement and planning and implementation of training programs for employees, and members of local communities for direct and indirect employment associated with the project; completion of two financings; and ongoing office, general management and community engagement activities.

In a December 2006 technical report, a work plan with a budget of Cdn$55 million (US$51.6 million at June 30, 2007 exchange rate of 1.0654) was recommended; the program was designed to advance exploration and engineering studies of the G-9 Deposit. The report recommended a surface and underground drilling program to define, reclassify and expand the Mineral Resources of the G-9 Deposit to enable mine planning and design work for the deposit to be undertaken. The report also recommended test mining and bulk sampling, as well as a comprehensive metallurgical test program to enable the development of a process plant flow sheet, layout and detailed design. Additional engineering, socio-economic and environmental studies to provide support for design engineering were also recommended. The information was to be used in the assessment of whether to develop a mine at G-9.