UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington , DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

CIK #1342645

As at January 21, 2008

FARALLON RESOURCES LTD.

800 West Pender Street, Suite 1020

Vancouver, British Columbia

V6C 2V6

(address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F...X.... Form 40-F.........

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ..... No .....

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

By: /s/ Dick Whittington

President and CEO

Date: January 21, 2008

Print the name and title of the signing officer under his signature.

Ste. 1020, 800 West Pender Street

Vancouver, BC V6C 2V6 -684-8092

www.farallonresources.com

Tel: 604-684-6365

Fax: 604

FARALLON RESUMES DRILLING AT G-9 DEPOSIT:

INFILL DRILLING OF NORTH ZONE TO CONTINUE

10 METRES OF 11% ZINC & 8 G/T GOLD IN HOLE 7699

January 21, 2008, Vancouver, BC - Dick Whittington, President and CEO of Farallon Resources Ltd. (TSX:FAN; OTCBB: FRLLF) ("Farallon" or the "Company"), is pleased to provide an update on the ongoing core drilling program on the G-9 deposit at the Campo Morado polymetallic (zinc, copper, silver, gold, lead) project in Guerrero State, Mexico. Infill drilling in the North zone has recommenced and is expected to continue until March. A third drill will be added in early March at which time, exploration drilling will restart. Several new assay results are also available from drilling carried out late last year.

Two drills are currently on site, focused on infill drilling of the North zone at G-9. This drilling is being carried out to further delineate the North zone and to improve the level of confidence and upgrade the category of the mineral resource in this zone. This objective is in line with the Company's plans to develop a sufficient base of Measured and/or Indicated resources in the G-9 deposit to enable more detailed mine planning to be carried out.

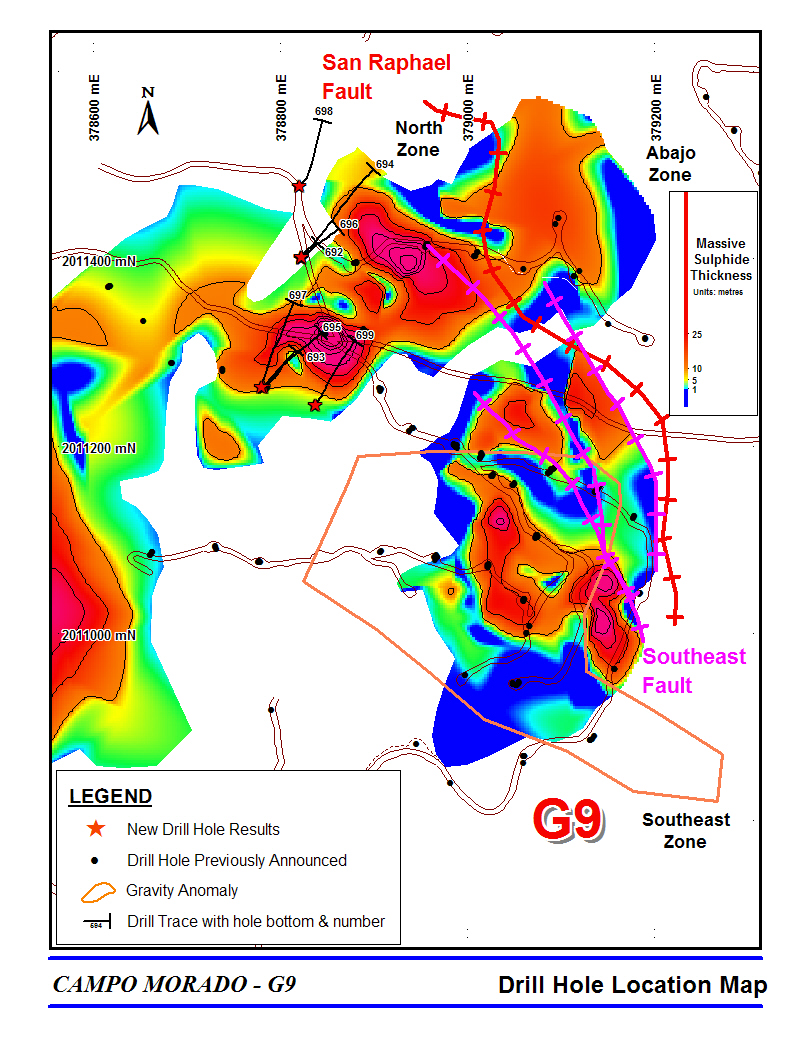

A third drill will be added in early March and will be fully dedicated to exploration drilling north of the San Raphael fault. In 2007, a significant number of massive sulphide intersections were made in the "Abajo" zone. This zone is stratigraphically approximately 200 metres below the horizon that hosts the Reforma, El Rey, Naranjo and El Largo deposits. The Company will be testing for further extensions or zones of G-9 type mineralization in this deeper stratigraphic horizon. The Abajo discovery has re-opened the entire area north of the San Raphael fault to further exploration drilling and will be a key focus for the Company in 2008.

The new results are from 7 holes in the North zone. Results are included in the Table of Assay Results - G-9 Deposit and hole locations are shown on the G-9 Drill Hole Location Map, both of which are attached. Highlights are tabulated below.

Drill Hole

Number |

From (metres) |

To (metres) |

Interval (metres) |

Estimated True Width (metres) |

Au

g/t |

Ag

g/t |

Cu

% |

Pb

% |

Zn

% |

7695 |

| 514 | 548 | 34 | 32 | 3.3 | 171 | 1.55 | 1.09 | 8.5 |

|

Incl. | 543 | 548 | 4.8 | 4.6 | 2.7 | 209 | 2.45 | 1.03 | 13.5 |

7699 | |

509 |

563 | 54 | 51 | 4.7 | 181 | 0.53 | 1.95 | 5.74 |

| Incl. | 515 | 526 | 11 | 10 | 8.1 | 312 | 0.50 | 3.93 | 11.31 |

These results now complete the 2007 infill drilling program for the North zone. This program was conducted to enable a new resource estimate for this zone to be prepared. The Company has retained resource estimation experts from the consulting company Behre Dolbear to provide an opinion on the categories of the mineral resources at G-9. An updated estimate for the North zone, based on the tighter drill spacing used in the 2007 drill program, is expected by the end of January 2008.

President and CEO Dick Whittington said: "These results reaffirm the grade and tonnage potential of the North zone. Although, the grades are, in general, not as high in the North zone as those for the Southeast zone, there are significant intersections such as 29% zinc in hole 7691 announced in December 2007. This is the highest grade zinc intersection in the G-9 deposit to date. Our objective is to outline 300 - 500,000 tonnes of measured and indicated resources in this zone to give us added flexibility in any mine plans developed prior to a final production decision.

We are looking forward to adding the third drill in early March. We have significantly enhanced the exploration potential by the discovery of the "Abajo" deposit in 2007. We will continue to explore the area north of the San Raphael fault with the goal of advancing our second key exploration objective: finding another G-9-type deposit."

The in-house qualified person for the drilling program and selection of samples for metallurgical testwork at Campo Morado is Daniel Kilby, P.Eng., who has reviewed the contents of this release. ALS Chemex is the analytical laboratory for the project; sample preparation is done in Guadalajara, Mexico and analysis is done in Vancouver, BC. All samples are assayed for gold by fire assay fusion with a gravimetric or Atomic Absorption (AA) finish. Silver, copper, lead, zinc and 27 to 30 additional elements are determined for all samples by acid digestion, followed by an AA or ICP finish. Duplicates are analyzed by Acme Analytical Laboratories in Vancouver.

Farallon is advancing the G-9 deposit through a parallel track program. Exploration drilling is expanding and confirming the high-grade mineralization within the G-9 deposit, and mine planning and design, equipment acquisition and site preparation activities are also taking place with the goal of beginning production in July 2008. The Company has a strong cash position of US$38 million, held in interest earning current accounts with Scotiabank, to support its ongoing programs.

For further details on Farallon Resources Ltd. and its Campo Morado property, please visit the Company's website at www.farallonresources.com or contact Investor Services at (604) 684-6365 or within North America at 1-800-667-2114.

ON BEHALF OF THE BOARD OF DIRECTORS

/s/ J.R.H. Whittington

J.R.H. (Dick) Whittington

President & CEO

No regulatory authority has approved or disapproved the information contained in this news release.

Forward Looking Information

This release includes certain statements that may be deemed "forward-looking statements." All statements in this release, other than statements of historical facts, that address future production, reserve potential, continuity of mineralization, exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. Although the Company believes that the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward looking statements. The likelihood of future mining at Campo Morado is subject to a large number of risks and may require achievement of a number of technical, economic and legal objectives, including obtaining lower than expected grades and quantities of mineralization and resources, recovery rates and mining rates, changes in and the effect of government policies with respect to mineral exploration and exploitation, the possibility of adverse developments in the financial markets generally, delays in exploration, development and construction projects, fluctuations in the prices of zinc, gold, silver, copper, lead and other commodities, obtaining additional mining and construction permits, completion of pre-feasibility and final feasibility studies, preparation of all necessary engineering for underground and processing facilities as well as receipt of additional financing to fund mine construction. Such funding may not be available to the Company on acceptable terms or on any terms at all. There is no known ore at Campo Morado and there is no assurance that the mineralization at Campo Morado will ever be classified as ore. For more information on the Company and the risk factors inherent in its business, investors should review the Company's Annual Information Form at www.sedar.com and the Company's annual report on Form 20-F at www.sec.gov.

TABLE OF G-9 ASSAY RESULTS - JANUARY 21 2008

Drill Hole Number |

From (metres) |

To (metres) |

Interval (metres) |

Estimated True Width (metres) |

Au g/t |

Ag g/t |

Cu % |

Pb % |

Zn

% |

| 7693 |

|

538.50 |

540.50 |

2.00 |

1.99 |

1.07 |

111 |

1.02 |

0.35 |

4.90 |

7693 |

|

552.25 |

554.70 |

2.45 |

2.43 |

2.93 |

156 |

1.10 |

0.83 |

7.67 |

7695 |

|

496.00 |

500.70 |

4.70 |

4.52 |

0.75 |

32 |

1.11 |

0.27 |

4.95 |

7695 |

|

507.70 |

509.25 |

1.55 |

1.49 |

1.33 |

156 |

1.81 |

1.70 |

15.18 |

7695 |

|

514.60 |

548.35 |

33.75 |

32.44 |

3.32 |

171 |

1.55 |

1.09 |

8.50 |

7695 |

Incl. |

514.60 |

524.60 |

10.00 |

9.61 |

3.35 |

153 |

1.49 |

1.26 |

11.41 |

7695 |

Incl. |

524.60 |

532.60 |

8.00 |

7.69 |

3.29 |

179 |

1.14 |

1.14 |

8.48 |

7695 |

Incl. |

532.60 |

543.60 |

11.00 |

10.57 |

3.62 |

167 |

1.51 |

0.91 |

3.74 |

7695 |

Incl. |

543.60 |

548.35 |

4.75 |

4.57 |

2.66 |

209 |

2.45 |

1.03 |

13.45 |

7696 |

|

588.00 |

589.00 |

1.00 |

0.98 |

2.41 |

95 |

0.44 |

1.04 |

4.10 |

7699 |

|

509.00 |

563.36 |

54.36 |

51.08 |

4.70 |

181 |

0.53 |

1.95 |

5.74 |

7699 |

Incl. |

509.00 |

535.00 |

26.00 |

24.43 |

5.92 |

258 |

0.71 |

2.94 |

9.25 |

7699 |

and |

509.00 |

526.00 |

17.00 |

15.97 |

5.78 |

243 |

0.68 |

3.38 |

10.19 |

7699 |

and |

515.00 |

526.00 |

11.00 |

10.34 |

8.11 |

312 |

0.52 |

3.93 |

11.31 |

7699 |

and |

530.00 |

535.00 |

5.00 |

4.70 |

8.26 |

390 |

0.95 |

2.06 |

7.04 |