UNITED STATES

SECURITIES & EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF CERTAIN REAL ESTATE COMPANIES

SUPREME HOTEL PROPERTIES, INC. |

| (Name of small business issuer in its charter) |

| | | | | |

DELAWARE | | 7011 | | 20-3019239 |

| State or Jurisdiction of incorporation or organization | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

P.O. BOX 690578, Orlando, Florida 32869-0578 (407) 965-0170 |

| (Address and Telephone Number of Principal Executive Offices) |

P.O. BOX 690578, Orlando, Florida 32869-0578 |

| (Address of principal place of business or intended principal place of business) |

Delaware Intercorp, Inc., 113 Barksdale Professional Center, Newark, DE 19711 (888) 324-1817 |

| (Name, Address, and Telephone Number of agent for service) |

Thomas Elliott Chairman & Chief Executive Officer Supreme Hotel Properties, Inc. P.O. Box 690578 Orlando, Florida 32869-0578 (407) 965-0170 | | Copies to: John Swain, Jr, Esq., General Counsel Supreme Hotel Properties, Inc. 203 N. Wabash Ave. - Suite 711 Chicago, IL 60601 (312) 621-8207 |

| Approximate Date of proposed sale to the public: | | As soon as practicable after this Registration Statement becomes effective |

| If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

| If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

| If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o |

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per share (1) | Proposed maximum aggregate offering price | Amount of registration fee |

| |

| |

Common Stock, $.001 par value | 6,925,613 | $0.15 | $1,038,841.95 | $ 122.27 |

TOTALS | 6,925,613 | | $1,038,841.95 | $122.27 |

Notes:

| | 1. | Estimated solely for the purpose of calculating the registration fee in accordance with the provisions of Rule 457(h)(1). There is no trading market for the shares and the aggregate offering price and the fee is computed upon the basis of the book value. Book value is approximately $0.15 per share. |

The information in this information statement/prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This information statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2005

INFORMATION STATEMENT/PROSPECTUS

SHARES OF COMMON STOCK OF

SUPREME HOTEL PROPERTIES, INC. |

This information statement/prospectus relates to the issuance of shares of common stock of Supreme Hotel Properties, Inc. (RealtyCorp) in connection with the spin-off by Supreme Realty Investments, Inc. of its wholly-owned subsidiary, Supreme Hotel Properties, Inc. (HotelCorp) pursuant to a plan adopted by the Board of Directors of Supreme Realty Investments, Inc. on August 22, 2005. As a result of the spin-off, RealtyCorp's stockholders will be entitled to receive 1.37 shares of common stock of HotelCorp for each share of RealtyCorp that they own.

Shares of common stock of Supreme Hotel Properties, Inc. to which this information statement/prospectus relate consist of 6,925,613 shares of common stock of Supreme Hotel Properties, Inc. that the selling stockholders named in this prospectus may offer for resale from time to time. The registration of these shares does not necessarily mean the selling stockholders will offer or sell all or any of these shares of common stock.

We will not receive any of the proceeds from the sale of any shares of common stock by the selling stockholders, but will incur expenses in connection with the offering. We do not expect to pay underwriting discounts or commissions in connection with the issuance or resale of these shares.

The selling stockholders from time to time may offer and resell the shares held by them directly or through agents or broker-dealers on terms to be determined at the time of sale. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any particular offer will be set forth in a prospectus supplement that will accompany this prospectus. A prospectus supplement also may add, update or change information contained in this prospectus.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUESTED TO SEND US A PROXY.

The shares of Supreme Hotel Properties, Inc. are not traded on any national securities market or quotation system. After the spin-off, we will operate as a real estate corporation. We do not intend in the foreseeable future to seek qualification as a REIT or a similar tax-advantaged pass through entity.

You should carefully consider the discussion in the section entitled "Risk Factors" beginning on page 16. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

| | PART I - INFORMATION REQUIRED IN PROSPECTUS | Page |

| | | |

| | | 6 |

| | | 9 |

| | | 9 |

| | | 14 |

| | | 19 |

| | | 20 |

| | | 21 |

| | | 23 |

| | | 24 |

| | | 24 |

| | | 24 |

| | | 25 |

| | | 26 |

| | | 28 |

| | | 28 |

| | | 29 |

| | | 30 |

| | | 31 |

| | | 31 |

| | | 32 |

| | | 33 |

| | | 35 |

| | | 36 |

| | | 40 |

| | | 41 |

| | | 42 |

| | | 43 |

| | | 43 |

| | | 43 |

| | | 45 |

| | | 46 |

| | | 46 |

| | | 47 |

| | | 47 |

| | | 48 |

| | | 50 |

| | | 51 |

| | | 52 |

| | | 53 |

| | | 54 |

| | | 56 |

| | | 56 |

| | | 56 |

| | | 57 |

| | | 85 |

| | | 85 |

| | | |

| | PART II-INFORMATION NOT REQUIRED IN PROSPECTUS | |

| | | |

| | | 85 |

| | | 85 |

| | | 85 |

| | | 86 |

| | | 87 |

| | | 88 |

The Company | |

| | |

Full Name, Address & Phone Number | Supreme Hotel Properties, Inc. P.O. Box 690578 Orlando, FL 32869-0578 (407) 965-0170 |

| | |

Business | Supreme Hotel Properties, Inc. (hereinafter referred to as “HotelCorp”), is a wholly-owned subsidiary of Supreme Realty Investments, Inc.(hereinafter referred to as “RealtyCorp”) that acquires and invests in “upper upscale, “ “upscale,” “lifestyle,”and “midscale” hotel properties located primarily in the United States. To a lesser extent, we may invest, on a selective basis, in premium full service and extended stay hotel properties in urban locations. To further its business purposes, the Board of Directors of RealtyCorp has adopted a plan to spin-off its subsidiary to its shareholders. After the spin-off, HotelCorp plans to continue to operate as a real estate corporation to acquire, develop, own and operate a portfolio of hotel properties. We do not intend in the foreseeable future to seek qualification as a REIT or a similar tax-advantaged pass through entity. |

| | |

Basics About This Spin-off Transaction | On August 22, 2005, the Board of Directors of RealtyCorp adopted a plan to spin off its wholly owned subsidiary, HotelCorp to its shareholders. As a result of the spin-off, RealtyCorp's stockholders will be entitled to receive 1.37 shares of the common stock of HotelCorp for each share of RealtyCorp that they own. The shares of common stock of HotelCorp to which this information statement/prospectus relate consist of 6,925,613 shares of common stock that the selling stockholders named in this prospectus may offer for resale from time to time. The registration of these shares does not necessarily mean the selling stockholders will offer or sell all or any of these shares of common stock. |

Majority Approval Already Obtained for Spin-off | Majority stockholders of RealtyCorp holding over 67% of the issued and outstanding shares of each company have already approved the adoption of the planned spin-off. As a result, no vote by the stockholders of RealtyCorp will be taken because these actions have already been approved by the written consent of the holders of a majority of the outstanding shares as allowed by the Nevada corporate statutes. We have attached the form of stockholders' consent of RealtyCorp as Exhibit 1.0 to this information statement/prospectus. |

| | |

What RealtyCorp Stockholders will receive in the Spin-off | As of September 23, 2005 (Record Date), there were 4,800,000 shares of RealtyCorp outstanding, with no options and no warrants. In addition to the RealtyCorp common shares they already own, as a result of the spin-off, RealtyCorp's stockholders will be entitled to receive 1.37 shares of common stock of HotelCorp for each share of RealtyCorp that they own. HotelCorp will not issue any fractional shares of common stock in connection with the spin-off. Instead, if fractional shares should occur as a result of the exchange rate, such fractional shares will be rounded up to the nearest whole share. |

| | |

Ownership of HotelCorp After the Spin-off | HotelCorp will issue approximately 6,925,613 shares of common stock to RealtyCorp stockholders in connection with the spin-off. RealtyCorp's stockholders will own 100% of the outstanding common stock of HotelCorp after the spin-off. |

| | |

Federal Tax Consequences of the Spin-off | RealtyCorp and HotelCorp intend that the spin-off qualify as a ”reorganization" for federal income tax purposes. If the spin-off qualifies as reorganization, stockholders of HotelCorp's shares will generally not recognize any gain or loss for federal income tax purposes on the exchange of their shares of HotelCorp for the common stock of RealtyCorp in connection with the spin-off. The companies themselves, as well as the current holders of RealtyCorp's common stock, will not recognize gain or loss as a result of the spin-off. We recommend you consult your tax advisor or counsel with respect to certain tax consequences that may be particular to you due to your particular circumstances. |

RealtyCorp Stockholders have no Appraisal or Dissenters Rights | Under the Nevada Revised Statutes, the stockholders of RealtyCorp are not entitled to appraisal or dissenters' rights in connection with the spin-off. |

| | |

Effective Time of Spin-off | The spin-off will become effective at the date and time this registration statement is deemed effective by the Securities and Exchange Commission. |

| | |

No Regulatory Approval Required | No regulatory approval is required in order to consummate the spin-off other than the successful registration of the shares to be issued in connection with the spin-off by the Securities and Exchange Commission and all applicable state securities regulators. |

| | |

No Change of Directors of HotelCorp | The current board of directors of RealtyCorp will be appointed to the board of directors of HotelCorp at the close of the spin-off transaction. |

| | |

Restrictions on the Ability to Sell HotelCorp's Stock | All shares of common stock of HotelCorp received by the stockholders of RealtyCorp in connection with the spin-off will be freely transferable unless the shareholder is considered an affiliate of either RealtyCorp or HotelCorp under the federal securities laws. HotelCorp will place appropriate legends on the certificates of any common stock of to be received by affiliates of HotelCorp which are subject to the resale rules of Rule 144. In addition, affiliates of HotelCorp have also acknowledged the resale restrictions imposed by Rule 145 under the Securities Act of 1933 on shares of common stock of HotelCorp to be received by them in the spin-off. |

| | |

Expenses | HotelCorp has agreed to pay all expenses incurred in connection with the spin-off, including the preparation of the financial statements, SEC filings, exhibits, legal fees, etc. |

| | |

Risks Related to Spin-off Agreement | After the transaction is completed, HotelCorp's success will be totally dependent on the success of the business currently conducted by HotelCorp. There are no assurances that HotelCorp's business operations will be profitable after closing the spin-off agreement. (See "Risk Factors") |

| | |

No Trading Market | The shares of HotelCorp are not quoted for trading on any national market or quotation system. There can be no certainty that the shares of HotelCorp will ever trade in a public market. |

An investment in our common stock involves a number of risks. The risks described below represent the material risks you should carefully consider before making an investment decision. These risks may materially and adversely affect our business, liquidity, financial condition and results of operations, in which case the value of our common stock could decline significantly and you could lose all or a part of your investment. The risk factors described below are not the only risks that may affect us. Some statements in this prospectus, including statements in the following risk factors, constitute forward looking statements. Please refer to the section entitled “Forward Looking Statements.”

We were formed in June, 2005 and have a limited operating history.

We have only recently been organized and have not commenced operations. As a result, we have a limited operating history. We are subject to the risks generally associated with the formation of any new business, including unproven business models, untested plans, uncertain market acceptance and competition with established businesses. Consequently, it may be difficult for you to evaluate our historical performance.

Our management has limited experience operating a public company and therefore may have difficulty in successfully and profitably operating our business.

Prior to joining our company, our management had limited experience operating a public company. As a result, we cannot assure you that we will be able to successfully execute our business strategies as a public company and you should be especially cautious in drawing conclusions about the ability of our management team to execute our business plan.

Because our senior executive officers will have broad discretion to invest the net proceeds of our private placements, they may make investments for which the returns are substantially below expectations or which result in net operating losses.

Because we intend to use a substantial portion of the net proceeds from our private placements to acquire hotel properties, if we are not successful in acquiring these properties, our senior executive officers will have broad discretion, within the investment criteria established by our board of directors, to invest the net proceeds from our private placements and to determine the timing of these investments. This discretion could result in investments that may not yield returns consistent with your expectations or which may result in net operating losses.

Our investment sourcing relationship with Hospitality Real Estate Counselors (HREC) may not result in the acquisition of any hotel properties.

We believe that access to information about hotel property investment opportunities known to Hospitality Real Estate Counselors (HREC) will provide us with a competitive advantage by providing us with knowledge about a potential investment opportunity before it has been widely marketed. Therefore, while we expect that this competitive advantage will lead to favorable investments by us, we cannot assure you that this will result in the acquisition of any hotel properties or provide us with a competitive advantage.

Our results of operations are highly dependent on the management of our hotel properties by third-party hotel management companies.

We do not intend to operate our hotel properties or participate in the decisions that affect the daily operations of our hotel properties. Therefore, we must enter into third-party hotel management agreements with one or more eligible independent contractors. Thus, third-party hotel management companies that enter into management contracts with us will control the daily operations of our hotel properties.

Under the terms of the hotel management agreements that we will enter into in the future with Expotel Hospitality Services, L.L.C. or other third-party hotel management companies, our ability to participate in operating decisions regarding our hotel properties will be limited. We will continue to rely on these hotel management companies to adequately operate our hotel properties under the terms of the hotel management agreements. Even if we believe our hotel properties are being operated inefficiently or in a manner that does not result in satisfactory occupancy rates, ADRs and operating profits, we may not have sufficient rights under our hotel management agreements to enable us to force the hotel management company to change its method of operation. We can only seek redress if a hotel management company violates the terms of the applicable hotel management agreement, and then only to the extent of the remedies provided for under the terms of the hotel management agreement. Our proposed management agreements are generally terminable, subject to certain exceptions for cause or performance (see “Exhibit 6.0 “Hotel Management Agreement”), and in the event that we need to replace any of our hotel management companies pursuant to termination for cause or performance, we may experience significant disruptions at the affected properties, which may adversely affect our ability to make distributions to our stockholders.

Our mortgage agreements and/or ground leases may contain certain provisions that may limit our ability to sell our hotel properties.

In order to assign or transfer our rights and obligations under certain of our mortgage agreements and/or ground leases, we generally must:

| | • | obtain the consent of the lender or lessor; |

| | • | pay a fee equal to a fixed percentage of the outstanding loan balance; and |

| | • | pay any costs incurred by the lender in connection with any such assignment or transfer. |

These provisions of our mortgage agreements and ground leases may limit our ability to sell our hotel properties which, in turn, could adversely impact the price realized from any such sale.

Our current proposed hotel management agreements contain provisions requiring us to pay certain fees to the property manager even if the hotel property is not profitable, which may adversely affect our ability to make distributions to our shareholders.

The hotel management agreements that we expect to enter into in the future contain provisions that require us to pay substantial base management fees to the management company irrespective of whether the hotels are profitable and incentive management fees that represent a substantial portion of the net operating income from the particular hotel property. As a result, these fee payment provisions may adversely affect our ability to make distributions to our shareholders.

Our current hotel management agreements are generally long term, which may adversely affect our ability to sell our hotels.

Our proposed hotel management agreements that we expect to enter into with Expotel Hospitality Services, L.L.C. contain initial terms of five (5) years and have renewal periods, at Expotel’s option, of an additional five (5) years. Because our hotel properties would have to be sold subject to the applicable hotel management agreement, the term length of a hotel management agreement may deter some potential purchasers and could adversely impact the price realized from any such sale.

We are subject to the risk of increased operating expenses.

Our hotel management agreements require us to bear the operating risks of our hotel properties. Our operating risks include not only changes in hotel revenues but also increased operating expenses, including, among other things:

| | • | repair and maintenance expenses; |

| | • | other operating expenses. |

Any decreases in hotel revenues or increases in operating expenses could have a materially adverse effect on our earnings and cash flow.

Our ability to make distributions to our stockholders is subject to fluctuations in our financial performance, operating results and capital improvement requirements.

In the event of downturns in our operating results and financial performance or unanticipated capital improvements to our hotel properties, we may be unable to declare or pay distributions to our stockholders. The timing and amount of distributions are in the sole discretion of our board of directors, which will consider, among other factors, our actual results of operations, debt service requirements, capital expenditure requirements for our properties and our operating expenses. We may not generate sufficient cash in order to fund distributions to our stockholders.

Among the factors which could adversely affect our results of operations and our distributions to stockholders are reduced net operating profits or operating losses, increased debt service requirements and capital expenditures at our hotel properties. Among the factors which could reduce our net operating profits are decreases in hotel property revenues and increases in hotel property operating expenses. Hotel property revenue can decrease for a number of reasons, including increased competition from a new supply of rooms and decreased demand for rooms. These factors can reduce both occupancy and room rates at our hotel properties.

If we were to default on our secured debt in the future, the loss of any property securing the debt would harm our ability to satisfy other obligations.

We expect that a substantial portion of our debt will be secured by first mortgage deeds of trust on our properties. Using our properties as collateral increases our risk of property losses because defaults on indebtedness secured by properties may result in foreclosure actions initiated by lenders and ultimately our loss of the property that secures any loans for which we are in default. For tax purposes, a foreclosure on any of our properties would be treated as a sale of the property for a purchase price equal to the outstanding balance of the debt secured by the mortgage. If the outstanding balance of the debt secured by the mortgage exceeds our tax basis in the property, we would recognize taxable income on foreclosure but would not receive any cash proceeds. As a result, we may be required to identify and utilize other sources of cash for distributions to our stockholders. If this occurs, our financial condition, cash flow and ability to satisfy our other debt obligations or ability to pay dividends may be adversely affected.

Future debt service obligations could adversely affect our operating results, may require us to liquidate our properties and limit our ability to make distributions to our stockholders.

We currently maintain a policy that limits our total debt level to no more than 80% of our aggregate property investment and repositioning costs. Our board of directors, however, may change or eliminate this debt limit, and/or the policy itself, at any time without the approval of our stockholders. In the future, we may be able to incur substantial additional debt, including secured debt. Incurring such debt could subject us to many risks, including the risks that:

| | • | our cash flow from operations will be insufficient to make required payments of principal and interest; |

| | • | we may be more vulnerable to adverse economic and industry conditions; |

| | • | we may be required to dedicate a substantial portion of our cash flow from operations to the repayment of our debt, thereby reducing the cash available for distribution to our stockholders, funds available for operations and capital expenditures, future investment opportunities or other purposes; |

| | • | the terms of any refinancing may not be as favorable as the terms of the debt being refinanced; and |

| | • | the use of leverage could adversely affect our stock price and the ability to make distributions to our stockholders. |

If we violate covenants in our future indebtedness agreements, we could be required to repay all or a portion of our indebtedness before maturity at a time when we might be unable to arrange financing for such repayment on favorable terms, if at all.

If we obtain debt in the future and do not have sufficient funds to repay our debt at maturity, it may be necessary to refinance this debt through additional debt financing, private or public offerings of debt securities, or additional equity financings. If, at the time of any refinancing, prevailing interest rates or other factors result in higher interest rates on refinancings, increases in interest expense could adversely affect our cash flow, and, consequently, our cash available for distribution to our stockholders. If we are unable to refinance our debt on acceptable terms, we may be forced to dispose of our hotel properties on disadvantageous terms, potentially resulting in losses adversely affecting cash flow from operating activities. In addition, we may place mortgages on our hotel properties to secure our line of credit or other debt. To the extent we cannot meet these debt service obligations, we risk losing some or all of those properties to foreclosure. Additionally, our debt covenants could impair our planned strategies and, if violated, result in a default of our debt obligations.

Higher interest rates could increase debt service requirements on our floating rate debt and could reduce the amounts available for distribution to our stockholders, as well as reduce funds available for our operations, future investment opportunities or other purposes.

We may obtain in the future one or more forms of interest rate protection—in the form of swap agreements, interest rate cap contracts or similar agreements—to “hedge” against the possible negative effects of interest rate fluctuations. However, we cannot assure you that any hedging will adequately mitigate the adverse effects of interest rate increases or that counterparties under these agreements will honor their obligations. In addition, we may be subject to risks of default by hedging counterparties. Adverse economic conditions could also cause the terms on which we borrow to be unfavorable.

We currently are negotiating with a number of financial institutions to obtain a secured revolving line of credit that may contain financial covenants that could limit our operations and our ability to make distributions to our stockholders.

Our anticipated secured revolving credit facility may contain financial and operating covenants, including net worth requirements, fixed charge coverage and debt ratios and other limitations on our ability to make distributions or other payments to our stockholders (other than those required by the Code), sell all or substantially all of our assets and engage in mergers, consolidations and certain acquisitions. Failure to meet our financial covenants could result from, among other things, changes in our results of operations, the incurrence of debt or changes in general economic conditions. Advances under our anticipated secured revolving credit facility may be subject to borrowing base requirements based on the hotels securing the facility. These covenants may restrict our ability to engage in transactions that we believe would otherwise be in the best interests of our stockholders. Failure to comply with any of the covenants in our anticipated secured revolving credit facility could result in a default under one or more of our debt instruments. This could cause one or more of our lenders to accelerate the timing of payments and could harm our business, operations, financial condition or liquidity.

If we are unable to complete the proposed acquisitions of the hotel properties we in a timely fashion or at all, we will have no designated use for a majority of the net proceeds of our initial public offering and may experience delays in locating and securing attractive alternative investments.

We intend to use a substantial portion of the net proceeds from our initial public offering to acquire hotel properties that we consider to be “probable” acquisitions. We cannot assure you that we will acquire any of these properties because each proposed acquisition is subject to a variety of factors including: (i) our completion of satisfactory due diligence and (ii) the satisfaction of closing conditions, including the receipt of third-party consents and approvals. If we do not complete these acquisitions within our anticipated time frame or at all, we may experience delays in locating and securing attractive alternative investments. These delays could result in our future operating results not meeting expectations and adversely affect our ability to make distributions to our stockholders. If we are unable to complete the purchase of the hotel properties, we will have no specific designated use for a majority of the net proceeds from our initial public offering and investors will be unable to evaluate in advance the manner in which we invest the net proceeds or the economic merits of the properties we may ultimately acquire with the net proceeds.

Our ownership of properties through ground leases exposes us to the loss of such properties upon breach or termination of the ground leases.

We may acquire interests in hotel properties by acquiring a leasehold interest in the land underlying the property. As lessee under ground leases, we would be exposed to the possibility of losing the hotel property upon termination, or an earlier breach by us, of the ground lease.

Joint venture investments could be adversely affected by our lack of sole decision-making authority, our reliance on co-venturer’s financial condition and disputes between us and our co-venturers.

We may co-invest in the future with third parties through partnerships, joint ventures or other entities, acquiring non-controlling interests in or sharing responsibility for managing the affairs of a property, partnership, joint venture or other entity. In this event, we would not be in a position to exercise sole decision-making authority regarding the property, partnership, joint venture or other entity. Investments in partnerships, joint ventures, or other entities may, under certain circumstances, involve risks not present were a third party not involved, including the possibility that partners or co-venturers might become bankrupt, fail to fund their share of required capital contributions, make dubious business decisions or block or delay necessary decisions. Partners or co-venturers may have economic or other business interests or goals which are inconsistent with our business interests or goals, and may be in a position to take actions contrary to our policies or objectives. Such investments may also have the potential risk of impasses on decisions, such as a sale, because neither we nor the partner or co-venturer would have full control over the partnership or joint venture. Disputes between us and partners or co-venturers may result in litigation or arbitration that would increase our expenses and prevent our officers and/or directors from focusing their time and effort on our business. Consequently, actions by, or disputes with, partners or co-venturers might result in subjecting properties owned by the partnership or joint venture to additional risk. In addition, we may in certain circumstances be liable for the actions of our third-party partners or co-venturers.

Our success depends on key personnel whose continued service is not guaranteed.

We depend on the efforts and expertise of our senior executive officers to manage our day-to-day operations and strategic business direction. The loss of any of their services could have an adverse effect on our operations.

A portion of our revenues may be attributable to operations outside of the United States, which will subject us to different legal, monetary and political risks, as well as currency exchange risks, and may cause unpredictability in a significant source of our cash flows that could adversely affect our ability to make distributions to our stockholders.

We may acquire selective hotel properties outside of the United States. International investments and operations generally are subject to various political and other risks that are different from and in addition to risks in U.S. investments, including:

| | • | the enactment of laws prohibiting or restricting the foreign ownership of property; |

| | • | laws restricting us from removing profits earned from activities within the foreign country to the United States, including the payment of distributions, i.e., nationalization of assets located within a country; |

| | • | variations in the currency exchange rates, mostly arising from revenues made in local currencies; |

| | • | change in the availability, cost and terms of mortgage funds resulting from varying national economic policies; |

| | • | changes in real estate and other tax rates and other operating expenses in particular countries; and |

| | • | more stringent environmental laws or changes in such laws. |

In addition, currency devaluations and unfavorable changes in international monetary and tax policies could have a material adverse effect on our profitability and financing plans, as could other changes in the international regulatory climate and international economic conditions. Liabilities arising from differing legal, monetary and political risks as well as currency fluctuations could adversely affect our financial condition, operating results and our ability to make distributions to our stockholders.

Any properties we invest in outside of the United States may be subject to foreign taxes.

In the future, we may invest in hotel properties in foreign countries. Those foreign countries will impose taxes on our hotel properties and our operations within their jurisdictions. To the extent possible, we will structure our investments and activities to minimize our foreign tax liability, but we will likely incur foreign taxes with respect to non-U.S. properties. As a result, foreign taxes we pay will reduce our income and available cash flow from our foreign hotel properties, which, in turn, could reduce our ability to make distributions to our stockholders.

Failure of the hotel industry to continue to improve may adversely affect our ability to execute our business strategies, which, in turn, would adversely affect our ability to make distributions to our stockholders.

Our business strategy is focused in the hotel industry, and we cannot assure you that hotel industry fundamentals will continue to improve. Economic slowdown and world events outside our control, such as terrorism, have adversely affected the hotel industry in the recent past and if these events reoccur, may adversely affect the industry in the future. In the event conditions in the hotel industry do not continue to improve as we expect, our ability to execute our business strategies will be adversely affected, which, in turn, would adversely affect our ability to make distributions to our stockholders.

Our initial focus is on “upper upscale,” “upscale,” “lifestyle,” and “midscale” hotels; these segments of the hotel market are highly competitive and generally subject to greater volatility than other segments of the market, which could harm our profitability.

The “upper upscale,” “upscale,” “lifestyle,” and “midscale” segments of the hotel business are highly competitive. Our hotels compete on the basis of location, room rates and quality, service levels, reputation and reservation systems, among many other factors. There are many competitors in our hotel chain scale segments, and many of these competitors have substantially greater marketing and financial resources than we have. This competition could reduce occupancy levels and rental revenue at our hotels, which would harm our operations. Also, over-building in the hotel industry may increase the number of rooms available and may decrease the average occupancy and room rates at our hotels. In addition, in periods of weak demand, profitability is negatively affected by the relatively high fixed costs of operating upper upscale and upscale hotels when compared to other classes of hotels.

We expect to experience rapid growth and may not be able to adapt our management and operational systems to integrate the hotel properties we expect to invest in and reposition without unanticipated disruption or expense.

We have developed our business strategies based on the expectation of continued rapid growth. We cannot assure you that we will be able to adapt our management, administrative, accounting, and operational systems, or hire and retain qualified operational staff to integrate and manage our investment in or repositioning of any hotel properties. Our failure to successfully integrate and manage acquisitions could have a material adverse effect on our financial condition and results of operations and our ability to make distributions to our stockholders.

We face competition for the acquisition of hotels and we may not be successful in identifying or completing hotel acquisitions that meet our criteria, which may impede our growth.

One component of our business strategy is expansion through acquisitions, and we may not be successful in identifying or completing acquisitions that are consistent with our strategy. We compete with institutional pension funds, private equity investors, REITs, hotel companies and others who are engaged in the acquisition of hotels. This competition for hotel investments may increase the price we pay for hotels and these competitors may succeed in acquiring those hotels that we seek to acquire. Furthermore, our potential acquisition targets may find our competitors to be more attractive suitors because they may have greater marketing and financial resources, may be willing to pay more or may have a more compatible operating philosophy. In addition, the number of entities competing for suitable hotels may increase in the future, which would increase demand for these hotels and the prices we must pay to acquire them. If we pay higher prices for hotels, our returns on investment and profitability may be reduced. Also, future acquisitions of hotels or hotel companies may not yield the returns we expect and may result in stockholder dilution.

Our ability to make distributions to our stockholders may be affected by factors unique to the hotel industry.

Operating Risks. Our hotel properties are and will continue to be subject to various operating risks common to the hotel industry, many of which are beyond our control, including:

| | • | competition from other hotel properties that may be located in our markets, some of which may have greater marketing and financial resources than us; |

| | • | an over-supply or over-building of hotel properties in our markets, which could adversely affect occupancy rates and revenues at our properties; |

| | • | dependence on business and commercial travelers and tourism; |

| | • | increases in energy costs and other expenses affecting travel, which may affect travel patterns and reduce the number of business and commercial travelers and tourists; |

| | • | increases in operating costs due to inflation and other factors that may not be offset by increased room rates; |

| | • | necessity for periodic capital reinvestment to repair and upgrade our hotel properties; |

| | • | changes in interest rates and in the availability, cost and terms of debt financing; |

| | • | changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance with laws and regulations, fiscal policies and ordinances; |

| | • | adverse effects of a downturn in the hotel industry; and |

| | • | risks generally associated with the ownership of hotel properties and real estate, as we discuss in detail below. |

These factors could reduce the net operating profits, which in turn could adversely affect our ability to make distributions to our stockholders.

Competition for Acquisitions. We compete for hotel investment opportunities with competitors that may have a different tolerance for risk than we do or have substantially greater financial resources than we do. This competition may generally limit the number of suitable investment opportunities offered to us and may also increase the bargaining power of property owners seeking to sell to us, making it more difficult for us to acquire new hotel properties on attractive terms.

Seasonality of Hotel Industry. Some hotel properties that we have acquired or may acquire in the future have business that is seasonal in nature. This seasonality can be expected to cause quarterly fluctuations in our revenues. Our quarterly earnings may be adversely affected by factors outside our control, including weather conditions and poor economic factors. As a result, we may have to enter into short-term borrowings in certain quarters in order to offset these fluctuations in revenues and to make distributions to our stockholders.

Investment Concentration in Single Industry. Our entire business is related to the hotel industry. Therefore, a downturn in the hotel industry, in general, will have a material adverse effect on our hotels’ revenues and the net operating profits and amounts available for distribution to our stockholders.

Capital Expenditures. Our hotel properties have an ongoing need for renovations and other capital improvements, including replacements, from time to time, of furniture, fixtures and equipment. These capital improvements may give rise to the following risks:

| | • | construction cost overruns and delays; |

| | • | a possible shortage of available cash to fund capital improvements and the related possibility that financing for these capital improvements may not be available to us on affordable terms; |

| | • | uncertainties as to market demand or a loss of market demand after capital improvements have begun; and |

| | • | disputes with franchisors/managers regarding compliance with relevant management/franchise agreements. |

The costs of these capital improvements could adversely affect our financial condition and amounts available for distribution to our stockholders.

The development of hotel properties is subject to timing, budgeting and other risks that may adversely affect our operating results and our ability to make distributions to stockholders.

We may selectively engage in new developments of hotel properties as market conditions warrant. Developing hotel properties involves a number of risks, including risks associated with:

| | • | construction delays or cost overruns that may increase project costs; |

| | • | receipt of zoning, occupancy and other required governmental permits and authorizations; |

| | • | development costs incurred for projects that are not pursued to completion; |

| | • | acts of God such as earthquakes, hurricanes, floods or fires that could adversely impact a project; |

| | • | ability to raise capital; and |

| | • | governmental restrictions on the nature or size of a project. |

We cannot assure you that any development project will be completed on time or within budget. Our inability to complete a project on time or within budget may adversely affect our operating results and our ability to make distributions to our stockholders.

The hotel industry is capital intensive and our inability to obtain financing could limit our growth.

Our hotel properties require periodic capital expenditures and renovations to remain competitive and the acquisition of additional hotel properties requires significant capital expenditures. We may not be able to fund capital improvements or acquisitions solely from cash provided from our operating activities. As a result, our ability to fund capital expenditures, or investments through retained earnings, may be limited. Consequently, we will rely upon the availability of debt or equity capital to fund our investments and capital improvements, but these sources of funds may not be available on favorable terms and conditions. Neither our charter nor our bylaws limits the amount of debt that we can incur; however, we may not be able to obtain additional equity or debt financing on favorable terms, if at all.

The events of September 11, 2001, recent economic trends, the military action in Afghanistan and Iraq and the possibility of future terrorist acts and military action have adversely affected the hotel industry generally, and similar future events could adversely affect the industry in the future.

Before September 11, 2001, hotel owners and operators had begun experiencing declining RevPAR, as a result of the slowing U.S. economy. The terrorist attacks of September 11, 2001 and the after-effects (including the possibility of more terror attacks in the United States and abroad), combined with economic trends and the U.S.-led military action in Afghanistan and Iraq, substantially reduced business and leisure travel and hotel industry RevPAR generally. If the economy once again declines or there is a future terrorist attack in the United States, our business may be materially and adversely affected. We cannot predict the extent to which these factors will directly or indirectly impact your investment in our common stock, the hotel industry or our operating results in the future. Declining RevPAR at hotels that we acquire would reduce our net income and restrict our ability to fund capital improvements at our hotels and our ability to make distributions to stockholders. Additional terrorist attacks, acts of war or similar events could have further material adverse effects on the markets on which shares of our common stock will trade, the hotel industry at large and our operations in particular.

Potential future outbreaks of contagious diseases could have a material adverse effect on our revenues and results of operations due to decreased travel, especially in areas significantly affected by the disease.

In 2003, the outbreak of Severe Acute Respiratory Syndrome, (SARS) drastically decreased travel in areas significantly affected by the disease. Potential future outbreaks of SARS, avian flu, or other contagious diseases could adversely impact travel to areas where we have hotel properties, which could have a material adverse effect on our revenues or results of operations.

We place significant reliance on technology.

The hotel industry continues to demand the use of sophisticated technology and systems including technology utilized for property management, procurement, reservation systems, customer loyalty programs, distribution, and guest amenities. These technologies can be expected to require refinements and there is the risk that advanced new technologies will be introduced. If various systems and technologies become outdated or new technology is required, we may not be able to replace outdated technology or introduce or achieve expected benefits from new technology as quickly as our competition, within budgeted costs for such technology, or at all, which in turn may have an adverse effect on our revenues and results of operations.

We may be adversely affected by increased use of business-related technology which may reduce the need for business-related travel.

The increased use of teleconference and video-conference technology by businesses could result in decreased business travel as companies increase the use of technologies that allow multiple parties from different locations to participate at meetings without traveling to a centralized meeting location. To the extent that such technologies play an increased role in day-to-day business and the necessity for business-related travel decreases, demand for hotel properties may decrease and our profitability may be adversely affected.

Uninsured and underinsured losses could adversely affect our operating results and our ability to make distributions to our stockholders.

We intend to acquire and maintain comprehensive insurance on each of our hotel properties, including liability, terrorism, fire and extended coverage, of the type and amount we believe are customarily obtained for or by hotel property owners. We cannot assure you that such coverage will be available at reasonable rates. Various types of catastrophic losses, like earthquakes, hurricanes, floods, losses from foreign terrorist activities such as those on September 11, 2001, or losses from domestic terrorist activities such as the Oklahoma City bombing may not be insurable or may not be insurable on reasonable economic terms. Future lenders may require such insurance and our failure to obtain such insurance could constitute a default under loan agreements. Depending on our access to capital, liquidity and the value of the properties securing the affected loan in relation to the balance of the loan, a default could have a material adverse effect on our results of operations and ability to obtain future financing.

In the event of a substantial loss, our insurance coverage may not be sufficient to cover the full current market value or replacement cost of our lost investment. Should an uninsured loss or a loss in excess of insured limits occur, we could lose all or a portion of the capital we have invested in a hotel property, as well as the anticipated future revenue from that particular hotel. In that event, we might nevertheless remain obligated for any mortgage debt or other financial obligations related to the property. Inflation, changes in building codes and ordinances, environmental considerations and other factors might also keep us from using insurance proceeds to replace or renovate a hotel after it has been damaged or destroyed. Under those circumstances, the insurance proceeds we receive might be inadequate to restore our economic position with regard to the damaged or destroyed property.

Noncompliance with governmental regulations could adversely affect our operating results.

Environmental Matters

Our hotel properties will be subject to various federal, state and local environmental laws. Under these laws, courts and government agencies may have the authority to require us, as owner of a contaminated property, to clean up the property, even if we did not know of or were not responsible for the contamination. These laws also apply to persons who owned a property at the time it became contaminated. In addition to the costs of cleanup, environmental contamination can affect the value of a property and, therefore, an owner’s ability to borrow funds using the property as collateral or to sell the property. Under the environmental laws, courts and government agencies also have the authority to require that a person who sent waste to a waste disposal facility, such as a landfill or an incinerator, pay for the clean-up of that facility if it becomes contaminated and threatens human health or the environment. A person that arranges for the disposal or treatment, or transports for disposal or treatment, a hazardous substance at a property owned by another person may be liable for the costs of removal or remediation of hazardous substances released into the environment at that property.

Furthermore, various court decisions have established that third parties may recover damages for injury caused by property contamination. For instance, a person exposed to asbestos while staying in a hotel may seek to recover damages if he or she suffers injury from the asbestos. Lastly, some of these environmental laws restrict the use of a property or place conditions on various activities. For example, certain laws require a business using chemicals (such as swimming pool chemicals at a hotel property) to manage them carefully and to notify local officials that the chemicals are being used.

We could be responsible for the costs associated with a contaminated property. The costs to clean up a contaminated property, to defend against a claim, or to comply with environmental laws could be material and could adversely affect the funds available for distribution to our stockholders. We cannot assure you that future laws or regulations will not impose material environmental liabilities or that the current environmental condition of our hotel properties will not be affected by the condition of the properties in the vicinity of our hotel properties (such as the presence of leaking underground storage tanks) or by third parties unrelated to us.

We may face liability regardless of:

| | • | our knowledge of the contamination; |

| | • | the timing of the contamination; |

| | • | the cause of the contamination; or |

| | • | the party responsible for the contamination of the property. |

Although we will take commercially reasonable steps to assess the condition of our properties, there may be unknown environmental problems associated with our properties. If environmental contamination exists on our properties, we could become subject to strict, joint and several liability for the contamination by virtue of our ownership interest. In addition, we are obligated to indemnify our lenders for any liability they may incur in connection with a contaminated property.

The presence of hazardous substances on a property may adversely affect our ability to sell the property and could cause us to incur substantial remediation costs. The discovery of environmental liabilities attached to our properties could have a material adverse effect on our results of operations and financial condition and our ability to pay dividends to our stockholders.

Americans with Disabilities Act and Other Changes in Governmental Rules and Regulations

Under the Americans with Disabilities Act of 1990, or the ADA, all public accommodations must meet various federal requirements related to access and use by disabled persons. Compliance with the ADA’s requirements could require removal of access barriers, and non-compliance could result in the U.S. government imposing fines or private litigants winning damages. If we are required to make substantial modifications to our hotel properties, whether to comply with the ADA or other changes in governmental rules and regulations, our financial condition, results of operations and ability to make distributions to our stockholders could be adversely affected.

Illiquidity of real estate investments could significantly impede our ability to respond to adverse changes in the performance of our properties and harm our financial condition.

Because real estate investments are relatively illiquid, our ability to promptly sell one or more hotel properties or investments in our portfolio in response to changing economic, financial and investment conditions may be limited. In addition, because all of our hotel management agreements contain restrictions on our ability to dispose of our hotel properties, are typically long-term and do not terminate in the event of a sale, our ability to sell hotel properties may be further limited. The real estate market is affected by many factors that are beyond our control, including:

| | • | adverse changes in international, national, regional and local economic and market conditions; |

| | • | changes in interest rates and in the availability, cost and terms of debt financing; |

| | • | changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance with laws and regulations, fiscal policies and ordinances; |

| | • | the ongoing need for capital improvements, particularly in older structures; |

| | • | changes in operating expenses; and |

| | • | civil unrest, acts of God, including earthquakes, floods and other natural disasters and acts of war or terrorism, including the consequences of terrorist acts such as those that occurred on September 11, 2001, which may result in uninsured losses. |

We may decide to sell our hotel properties in the future. We cannot predict whether we will be able to sell any hotel property or investment for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a hotel property or loan.

We may be required to expend funds to correct defects or to make improvements before a hotel property can be sold. We cannot assure you that we will have funds available to correct those defects or to make those improvements. In acquiring a hotel property, we may agree to lock-out provisions that materially restrict us from selling that hotel property for a period of time or impose other restrictions, such as a limitation on the amount of debt that can be placed or repaid on that hotel property. These facts and any others that would impede our ability to respond to adverse changes in the performance of our hotel properties could have a material adverse effect on our operating results and financial condition, as well as our ability to make distributions to stockholders.

Increases in our property taxes could adversely affect our ability to make distributions to our stockholders.

Each of our hotel properties is subject to real and personal property taxes. These taxes on our hotel properties may increase as tax rates change and as the properties are assessed or reassessed by taxing authorities. If property taxes increase, our ability to make distributions to our stockholders could be adversely affected.

Our hotel properties may contain or develop harmful mold, which could lead to liability for adverse health effects and costs of remediating the problem.

When excessive moisture accumulates in buildings or on building materials, mold growth may occur, particularly if the moisture problem remains undiscovered or is not addressed over a period of time. Some molds may produce airborne toxins or irritants. Concern about indoor exposure to mold has been increasing, as exposure to mold may cause a variety of adverse health effects and symptoms, including allergic or other reactions. As a result, the presence of mold to which our hotel guests or employees could be exposed at any of our properties could require us to undertake a costly remediation program to contain or remove the mold from the affected property, which would reduce our cash available for distribution. In addition, exposure to mold by our guests or employees, management company employees or others could expose us to liability if property damage or health concerns arise.

Consequences of our operating as a C corporation.

As a C corporation, we generally will be subject to a corporate-level tax on a taxable disposition of any appreciated asset we hold, which tax could reduce the amount that we could otherwise distribute to our stockholders.

Plans should consider ERISA risks of investing in our common stock.

ERISA and Section 4975 of the Code prohibit certain transactions that involve (i) certain pension, profit-sharing, employee benefit, or retirement plans or individual retirement accounts and (ii) any person who is a “party in interest” or “disqualified person” with respect to such plan. Consequently, the fiduciary of a plan contemplating an investment in our common stock should consider whether our company, any other person associated with the issuance of our common stock or any affiliate of the foregoing is or may become a “party in interest” or “disqualified person” with respect to the plan and, if so, whether an exemption from such prohibited transaction rules is applicable. If a fiduciary of a plan engages in certain transactions with a “party in interest” or “disqualified person” for which no prohibited transaction exemption is available, the parties to the transaction could be subject to excise taxes and other penalties. See “ERISA Considerations.”

We may be subject to adverse legislative or regulatory tax changes that could reduce the market price of our common stock.

At any time, the federal income tax laws or regulations, or the administrative interpretations of those laws or regulations, may be amended. Any of those new laws or interpretations may take effect retroactively and could adversely affect us or our stockholders.

We may issue additional shares that may affect a change in control of the company.

Our charter authorizes our board of directors to issue up to 100,000,000 shares of common stock and up to 100,000,000 shares of preferred stock, to classify or reclassify any unissued shares of common stock or preferred stock and to set the preferences, rights and other terms of the classified or reclassified shares. Furthermore, our board of directors may, without any action by the stockholders, amend our charter from time to time to increase or decrease the aggregate number of shares of stock of any class or series that we have authority to issue. Issuances of additional shares of stock may have the effect of delaying, deferring or preventing a transaction or a change in control of our company that might involve a premium to the market price of our common stock or otherwise be in our stockholders’ best interests.

Certain advance notice provisions of our bylaws may limit the ability of a third party to acquire control of our company.

Our bylaws provide that (a) with respect to an annual meeting of stockholders, nominations of persons for election to the board of directors and the proposal of business to be considered by stockholders may be made only (i) pursuant to our notice of the meeting, (ii) by the board of directors or (iii) by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in the bylaws and (b) with respect to special meetings of stockholders, only the business specified in our notice of meeting may be brought before the meeting of stockholders and nominations of persons for election to the board of directors may be made only (i) pursuant to our notice of the meeting, (ii) by the board of directors or (iii) provided that the board of directors has determined that directors shall be elected at such meeting, by a stockholder who is entitled to vote at the meeting and has complied with the advance notice provisions set forth in the bylaws. These advance notice provisions may have the effect of delaying, deferring or preventing a transaction or a change in control of our company that might involve a premium to the market price of our common stock or otherwise be in our stockholders’ best interests.

We cannot assure you that a public market for our common stock will develop.

Prior to our initial public offering, there has not been a public market for our common stock and, even though we intend to apply to list the shares of our common stock on a national exchange or quotation medium in connection with our initial public offering, we cannot assure you that an active trading market for the shares of common stock offered hereby will develop or, if developed, that any such market will be sustained. In the absence of an active public trading market, an investor may be unable to liquidate an investment in our common stock. We cannot assure you that the price at which the shares of common stock will sell in the public market after the closing of our initial public offering will not be lower than the price at which they are sold by the underwriters of our initial public offering.

The market price of our equity securities following our initial public offering may vary substantially.

The trading prices of equity securities issued hotel companies have historically been affected by changes in market interest rates. One of the factors that may influence the price of our common stock in public trading markets is the annual yield from distributions on our common stock as compared to yields on other financial instruments. An increase in market interest rates, or a decrease in our distributions to stockholders, may lead prospective purchasers of our stock to demand a higher annual yield, which could reduce the market price of our equity securities.

Other factors that could affect the market price of our equity securities include the following:

| | • | actual or anticipated variations in our quarterly results of operations; |

| | • | changes in market valuations of companies in the hotel or real estate industries; |

| | • | changes in expectations of future financial performance or changes in estimates of securities analysts; |

| | • | fluctuations in stock market prices and volumes; |

| | • | issuances of common stock or other securities in the future; |

| | • | the addition or departure of key personnel; and |

| | • | announcements by us or our competitors of acquisitions, investments or strategic alliances. |

The number of shares available for future sale could cause our share price to decline.

Upon the completion of our initial public offering, we will have 6,925,613 shares of common stock outstanding. We cannot predict whether future issuances of shares of our common stock or the availability of shares for resale in the open market will decrease the market price of our common stock. Sales of substantial numbers of shares of our common stock in the public market, or the perception that such sales might occur, could adversely affect the market price of our common stock. We may issue from time to time additional common stock or preferred stock in connection with the acquisition of properties and we may grant additional demand or piggyback registration rights in connection with these issuances. Sales of substantial amounts of common stock or the perception that these sales could occur may adversely affect the prevailing market price for our common stock. In addition, the sale of these shares could impair our ability to raise capital through a sale of additional equity securities.

Any future conversion of our preferred stock into common stock, portfolio or business acquisitions and other issuances of our common stock could have an adverse effect on the market price of our common stock. In addition, future issuances of our common stock may be dilutive to existing stockholders.

We cannot assure you that we will be able to make distributions to our stockholders in the future.

Our ability to pay distributions may be adversely affected by the risk factors described in this prospectus. All distributions are made at the discretion of our board of directors and will depend upon our earnings, our financial condition, and such other factors as our board of directors may deem relevant from time to time. We cannot assure you that we will be able to pay distributions in the future. In addition, some of our distributions may include a return of capital.

An increase in market interest rates may have an adverse effect on the market price of our common stock.

One of the factors that investors may consider in deciding whether to buy or sell our common stock is our dividend rate as a percentage of the market price of our common stock, relative to market interest rates. If market interest rates increase, prospective investors may desire a higher dividend or interest rate on our common stock or seek securities paying higher dividends or interest. The market price of our common stock likely will be strongly affected by the earnings and return that we derive from our investments and income with respect to our properties and our related distributions to stockholders, and not from the market value or underlying appraised value of the properties or investments themselves. As a result, interest rate fluctuations and capital market conditions can affect the market price of our common stock. For instance, if interest rates rise without an increase in our dividend rate, the market price of our common stock could decrease because potential investors may require a higher dividend yield on our common stock as market rates on interest-bearing securities, such as bonds, rise. In addition, rising interest rates would result in increased interest expense on our variable rate debt, thereby adversely affecting cash flow and our ability to service our indebtedness and pay dividends.

Future offerings of debt securities or preferred stock, which would be senior to our common stock upon liquidation and for the purposes of distributions, may cause the market price of our common stock to decline.

In the future, we may attempt to increase our capital resources by making additional offerings of debt or equity securities, including commercial paper, medium-term notes, senior or subordinated notes and classes of preferred stock or common stock. We will be able to issue additional shares of common stock or preferred stock without stockholder approval, unless stockholder approval is required by applicable law or the rules of any stock exchange or automated quotation system on which our securities may be listed or traded. Upon liquidation, holders of our debt securities and shares of preferred stock and lenders with respect to other borrowings will receive a distribution of our available assets prior to the holders of our common stock. Additional equity offerings may dilute the holdings of our existing stockholders or reduce the market price of our common stock, or both. Holders of our common stock are not entitled to preemptive rights or other protections against dilution. Preferred stock and debt, if issued, could have a preference on liquidating distributions or a preference on dividend or interest payments that could limit our ability to make a distribution to the holders of our common stock. Because our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, our stockholders bear the risk of our future offerings reducing the market price of our common stock and diluting their interest.

We make statements in this prospectus that are forward-looking statements within the meaning of the federal securities laws. In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, our pro forma financial statements and all of our statements regarding anticipated growth in our funds from operations and anticipated market conditions, demographics and results of operations are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “seek,” “approximately,” “intend,” “plan,” “pro forma,” “estimate” or “anticipate” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans, market statistics, or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

| | • | the factors discussed in this prospectus, including without limitation those set forth under the sections titled “Risk Factors,” “Management’s Plan of Operations,” “Our Business,” “Hotel Industry” and “Proposed Acquisitions”; |

| | • | adverse economic or real estate developments in our markets; |

| | • | general economic conditions; |

| | • | the degree and nature of our competition; |

| | • | increased interest rates and operating costs; |

| | • | our failure to obtain necessary outside financing; |

| | • | difficulties in identifying properties to acquire and completing acquisitions; |

| | • | availability of and our ability to retain qualified personnel; |

| | • | changes in our business or investment strategy; |

| | • | availability, terms and deployment of capital; |

| | • | general volatility of the capital markets and the market price of our common stock; |

| | • | environmental uncertainties and risks related to natural disasters; |

| | • | changes in foreign currency exchange rates; and |

| | • | changes in real estate and zoning laws and increases in real property tax rates. |

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. You should carefully consider this risk when you make an investment decision concerning our common stock. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could impact our future results, performance or transactions, see the section above entitled “Risk Factors.”

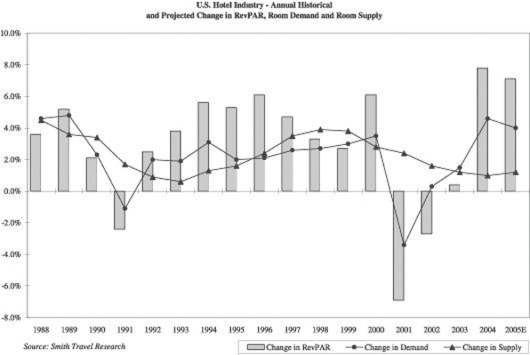

Market data and forecasts used in this prospectus have been obtained from independent industry sources as well as from research reports prepared for other purposes, including market information compiled by Smith Travel Research, Inc. which, among other things, provides research reports and forecasts on the performance of the hotel and travel industry. We have not independently verified the data obtained from these sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this prospectus.

There is no trading market for the shares and the aggregate offering price and the fee is computed upon the basis of the book value. Book value is approximately $0.15 per share.

DILUTION

There is no substantial disparity between the public offering price and the effective cash cost to officers, directors, promoters and affiliated persons of common equity acquired by them in transactions during the past five years. The net tangible book value per share is $0.15 both before and after the offering.

[the rest of this page left blank intentionally]

| LastName | Firstname | # of Shares | % Owned |

| AIWUYO | ESOSA | 137 | 0.00% |

| ALDRICH | TERESA | 5,480 | 0.08% |

| ALLISON, JTWROS | LAVERNE &, CHRI | 3,825 | 0.06% |

| ANDERSON | RUTH DENISE | 4,553 | 0.07% |

| BAKER | CHRIS | 14 | 0.00% |

| BANKS | WILLIE MAE | 14,342 | 0.22% |

| BEASLEY, JR. | EUGENE | 19,123 | 0.29% |

| BOZEMAN | DIANE | 6,850 | 0.10% |

| BROWN | CARLOS | 27,085 | 0.41% |

| BROWN | JEMIL | 3,425 | 0.05% |

| BURT | HORTENSE | 685 | 0.01% |

| CEDE | (FAST) | 52,154 | 0.79% |

| CEDE | (FAST) | 602,247 | 9.16% |

| CEDE | (FAST) | 27,398 | 0.42% |

| CEDE | (FAST) | 27,398 | 0.42% |

| COLE | DARRYL | 205 | 0.00% |

| COLERIDGE | JOHN | 184,939 | 2.81% |

| CORLEY | CARL | 110 | 0.00% |

| EDWARDS | ANGELA | 685 | 0.01% |

| EDWARDS | TONYA | 69 | 0.00% |

| ELLIOTT | JARRED | 9,561 | 0.15% |

| ELLIOTT | PORTIA | 38,246 | 0.58% |

| EQUITIES | TRIANGLE | 252,065 | 3.83% |

| FISERVE | SECURITIES | 6,850 | 0.10% |

| FISERVE | SECURITIES | 6,850 | 0.10% |

| FISERVE | SECURITIES | 13,699 | 0.21% |

| FISERVE | SECURITIES | 4,110 | 0.06% |

| FISERVE | SECURITIES | 3,425 | 0.05% |

| FLETCHER | ANTIOINETTE | 66,931 | 1.02% |

| HALE | LES | 765 | 0.01% |

| HAYWOOD | FREDERIC | 1,912 | 0.03% |

| IBIZUGBE | JANE | 205 | 0.00% |

| IBIZUGBE | IDIA | 82 | 0.00% |

| JONES | JENNIFER | 3,825 | 0.06% |

| JONES | STEVEN | 6,564 | 0.10% |

| KENNER | KEITH | 1,370 | 0.02% |

| LARA | DEBORAH | 342 | 0.01% |

| LLOYD | ANTHONY | 765 | 0.01% |

| MARSHALL | KYLE | 9,561 | 0.15% |

| PALMORE | MARY | 4,781 | 0.07% |

| POWELL, JTWROS | PHYLLIS & LIND. | 685 | 0.01% |

| POWELL, JTWROS | BART ELLIOTT & | 205 | 0.00% |

| REID | JOSHUA | 9,561 | 0.15% |

| REID, III | DAVID PAUL | 9,561 | 0.15% |

| REID, Jr. | DAVID | 66,931 | l.02% |

| ROBERTS | ROBERT | 4,781 | 0.07% |

| ROSE | JAILYN | 9,561 | 0.15% |

| SABREE | NAIM | 19,123 | 0.29% |

| SALES, JTWROS | S.L. & MARLENE | 4,781 | 0.07% |

| SEGOUNIS | NICK | 41,098 | 0.63% |

| SMITH | BRUCE | 9,561 | 0.15% |

| SWAIN, SR. | JOHN | 66,931 | 1.02% |

| THOMAS | RON | 1,530 | 0.02% |

| THOMAS, JTWROS | DONNA GIBSON | 3.060 | 0.05% |

| TILLMAN | JIMMY | 19,123 | 0.29% |

| TILLMAN | JIMMY | 6,850 | 0.10% |

| VEAL | TRIFOROS | 137 | 0.00% |

| WASHINGTON | MANUEL | 4,781 | 0.07% |

| WATERS | ANTHONY | 69 | 0.00% |

| | | 1,701,920 | 26% |

Officers Directors | | |