| As filed with the Securities and Exchange Commission on January 24, 2014 | File No. 333-192759 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AMERICAN MINING CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

1000

(Primary Standard Industrial Classification Code Number)

20-3373669

(I.R.S. Employer Identification No.)

970 Caughlin Crossing, Suite 100

Reno, Nevada 89519

(702) 465-5213

(Address and telephone number of principal executive offices)

Laughlin International

2533 Carson Street

Carson City, Nevada 89706

775.883.8484

(Name, address and telephone number of agent for service)

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box:x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filero | Accelerated filero | Non-accelerated filero | Smaller reporting companyx |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Number of Shares to be Registered (4) | Proposed Offering Price per Share | Proposed Maximum Aggregate Offering Price (3) | Amount of Registration Fee | |||

Common Stock (1)

Common Stock (2)

Total: |

20,000,000

500,000

20,500,000 |

$

$

$ |

0.005

0.005

0.005 |

$

$

$ |

100,000

2,500

102,500 |

$

$

$ |

12.88

0.32

13.20 |

(1) Shares offered by the Registrant

(2) Shares offered by the Selling Stockholder.

(3) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. (the “Securities Act”).

(4) Pursuant to Rule 416 of the Securities Act, the securities registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

(5) Fee already paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Information contained herein is subject to completion or amendment. A registration statement concerning the offered shares has been filed with the Securities and Exchange Commission. The offered shares may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of any offer to buy nor shall there be any sale of the offered shares in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Subject to Completion

Preliminary Prospectus dated January ____, 2014

AMERICAN MINING CORPORATION

20,500,000 SHARES OF COMMON STOCK

$0.005 PER SHARE

This is a public offering of shares of common stock of American Mining Corporation.

We are offering a total of 20,000,000 shares of the common stock of American Mining Corporation, Inc., a Nevada corporation, par value $0.0001 per share, in a direct public offering, without any involvement of underwriters or broker-dealers at a fixed price of $0.005 per share for the duration of the offering. The shares being offered by us are being offered through our sole officer and director, Andrew Grundman, on a best efforts basis pursuant to an exemption as a broker-dealer under Rule 3a 4-1 of the Securities Exchange Act of 1934. There is no minimum number of shares that must be sold by us in this offering and any funds received will be immediately available to us. There is no guarantee that this offering will successfully raise enough funds to institute our business plan. We are offering the shares from time to time on a continuous basis at a fixed price of $0.005 per share, for up to 270 days from the date that this Registration Statement becomes effective, unless our board of directors extends the offering for a further period of 90 days. We may terminate the offering at any time.

This prospectus also relates to the resale of up to 500,000 shares of common stock of American Mining Corporation by the selling stockholder identified in this prospectus. These shares have already been acquired by the selling stockholder through private transactions that were exempt from the registration and prospectus delivery requirements of the Securities Act of 1933, as amended. We will not receive any of the proceeds from the sale of shares by the selling stockholder. The selling stockholder will sell shares from time to time at prevailing market prices or at privately negotiated prices. The offering by the Selling Stockholder will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement, or (ii) 360 days from the effective date of this prospectus.

The resale of the shares is not being underwritten. The selling stockholder may sell or distribute the shares, from time to time, depending on market conditions and other factors, through underwriters, dealers, brokers or other agents, or directly to one or more purchasers. We are paying substantially all expenses incidental to registration of the shares.

We have earned no meaningful revenue since inception. We have also incurred significant operating losses since inception and we expect to continue to incur losses to implement our business plan. Our auditors have expressed substantial doubt about our ability to continue as a going concern. If we cannot continue as a going concern, then our stockholders may lose all of their investment.

Our common stock is quoted on the OTCQB Marketplace, operated by the OTC Markets Group, Inc. (“OTCQB”) under the symbol “AMCM”. Trading of our stock is sporadic and does not constitute an established public trading market for our shares. The most recent sale price of our common stock on the OTCQB was $0.07 on January 3, 2014 .

Prospective investors should rely only on the information contained in this prospectus or any prospectus supplement or amendment thereto. We have not authorized anyone to provide investors with different information. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus is only accurate on the date of this prospectus, regardless of the time of any sale of securities.

An investment in our stock is extremely speculative and involves several significant risks. Prospective investors are cautioned not to invest unless they can afford to lose their entire investment. We urge all prospective investors to read the “Risk Factors” section of this prospectus beginning on page 5 and the rest of this prospectus before making an investment decision.

Neither the Securities and Exchange Commission nor any state regulatory agency has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Table of Contents

| Page | |

| Prospectus Summary | 1 |

| Our Business | 3 |

| The Offering | 4 |

| Risk Factors | 5 |

| Cautionary Note Regarding Forward-Looking Statements | 9 |

| Use of Proceeds | 10 |

| Determination of Offering Price | 10 |

| Dilution | 11 |

| Selling Stockholder | 12 |

| Market for Common Equity and Related Stockholder Matters | 13 |

| No Established Public Market for Common Stock | 13 |

| Shareholders | 13 |

| Dividend Policy | 13 |

| Registration Rights | 13 |

| Options, Warrants and Convertible Securities | 13 |

| Description of Business | 14 |

| History | 14 |

| Mineral Exploration | 14 |

| Eagle River Property | 15 |

| Mineral Claims | 15 |

| History of the Claims | 16 |

| Location and Access | 16 |

| Technical Report | 16 |

| Management Experience | 17 |

| Geological and Technical Consultants | 17 |

| Competitive Factors | 18 |

| Location Challenges | 18 |

| Regulations | 18 |

| Employees | 19 |

| Description of Property | 19 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Results of Operations | 20 |

| Three Months Ended November 30, 2013 Compared to the Three Months Ended November 30, 2012 | 21 |

| Year Ended August 31, 2013 Compared to the Year Ended August 31, 2012 | 21 |

| Liquidity and Capital Resources | 21 |

| Legal Proceedings | 21 |

| Directors, Executive Officers, Promoters and Control Persons | 21 |

| Involvement in Certain Legal Proceedings | 22 |

| Committees of the Board | 22 |

| Audit Committee Financial Expert | 23 |

| Indemnification | 23 |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 23 |

| Executive Compensation | 23 |

| Security Ownership of Certain Beneficial Owners and Management | 24 |

| Transactions With Related Persons, Promoters and Certain Control Persons | 24 |

| Plan of Distribution | 25 |

| Shares Offered by the Company | 25 |

| Shares Offered by the Selling Stockholder | 25 |

| Terms of the Offering | 27 |

| Offering Proceeds | 27 |

| Procedures and Requirements for Subscription | 27 |

| Right to Reject Subscriptions | 27 |

| Description of Capital Stock | 28 |

| Common Stock | 28 |

| Preferred Stock | 28 |

| Anti-takeover Effects of Our Articles of Incorporation and Bylaws | 28 |

| Nevada Anti-Takeover laws | 29 |

| Business Combinations | 29 |

| Control Share Acquisitions | 30 |

| Transfer Agent | 30 |

| Legal Matters | 30 |

| Experts | 30 |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 30 |

| Available Information | 30 |

| Index to Financial Statements | F-1 |

Prospectus Summary

The following summary is not complete and does not contain all of the information that may be important to prospective investors. Each prospective investor is urged to read this prospectus in its entirety, including the section entitled “Risk Factors,” before making an investment decision to purchase our common stock.

As used in this prospectus, unless the context otherwise requires, “the Company”, “we”, “us”, or “our” refers to American Mining Corporation, “SEC” refers to the Securities and Exchange Commission, “Securities Act” refers to the Securities Act of 1933, as amended, “Exchange Act” refers to the Securities Exchange Act of 1934, as amended, and “NRS” refer to the Nevada Revised Statutes, as amended.

Our Business

American Mining Corporation (formerly Thrust Energy Corp.) was incorporated in the State of Nevada on September 15, 2004. Our office is located at 970 Caughlin Crossing, Suite 100, Reno, Nevada 89519. Our telephone number is (702) 465-5213. Our facsimile number is (775) 201-0127.

We are an exploration stage company, which means that we do not have an established commercially mineable deposit for extraction. We are engaged in the business of acquiring mineral exploration rights throughout North America, exploring for commercially producible quantities of minerals, and exploiting any mineral deposits we discover that demonstrate economic feasibility.

Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on any mineral property may not result in the discovery of commercially exploitable reserves of valuable minerals. The probability of a mineral claim ever having commercially exploitable reserves is extremely remote, and in all probability our mineral claims do not contain any reserves. Any funds spent on the acquisition and exploration of these claims will probably be lost. If we are unable to find reserves of valuable minerals or we cannot remove the minerals because we either do not have the capital to do so, or because it is not economically feasible to do so, then we may cease operations and our investors will lose their investment.

We intend to seek out prospective mineral exploration properties by retaining the services of professional mining geologists. As of the date of this prospectus, we have not selected a geologist. We are initially focusing our exploration efforts in the Province of Newfoundland and Labrador, but we will also consider exploration opportunities elsewhere in North America.

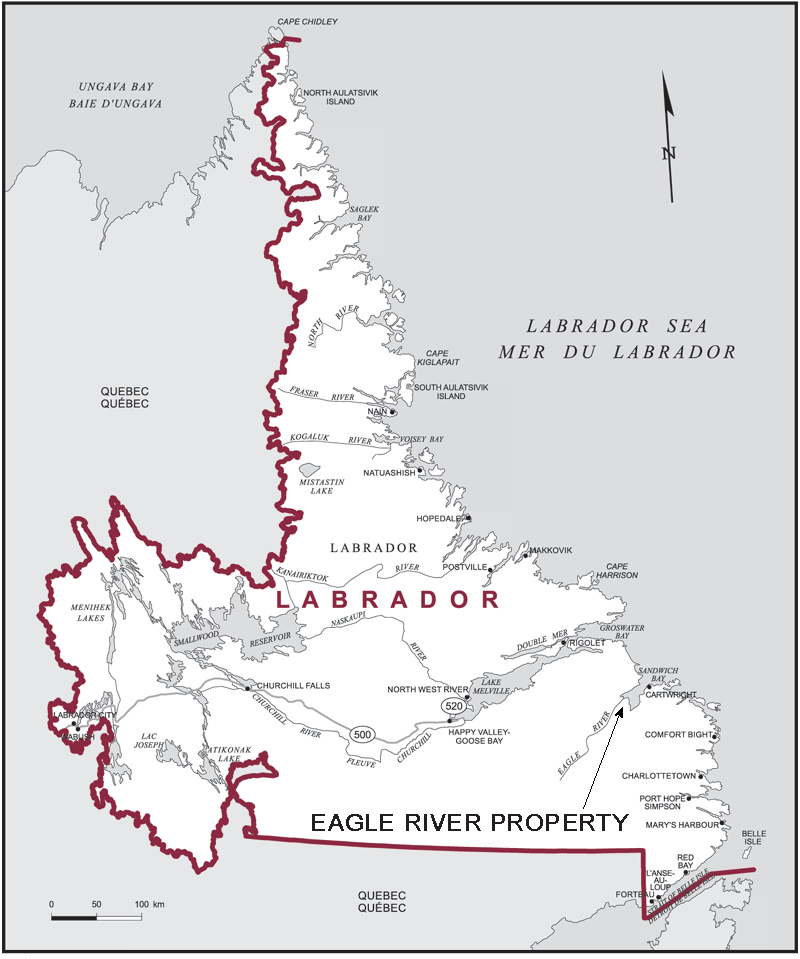

We own a 100% undivided mineral interest in 16 non-contiguous mineral claims covering 400 hectares located within the southeastern part of Labrador, in the province of Newfoundland and Labrador, Canada (the “Eagle River Property”). A mineral claim is a mining right that grants the holder the exclusive right to search for and develop any mineral substance within a given area. Our claims give us the exclusive right to all of the mineral deposits situated on the Eagle River Property.

Under Newfoundland law, our mineral claims may be held for one year after the date of issuance, and thereafter from year to year if, on or before the anniversary date, we perform assessment work on the underlying claims having a minimum value of not less than C$200 per claim in the first year, C$250 per claim in the second year, and C$300 per claim in the third year. If we are unable to complete the assessment work required to be done in any twelve month period, we can maintain our claims in good standing by posting a cash security deposit for the amount of the deficiency. When the deficient work is completed and accepted the security deposit will be refunded. Otherwise, the security deposit will be forfeited. If we do not comply with these maintenance requirements, then we will forfeit our claims at the end of the anniversary date for each respective claim. All of our claims are presently in good standing, which means that they are free and clear of all work and/or monetary holding requirements.

We intend to obtain a Technical Report on the Eagle River Property prepared by a professional engineer before contemplating any exploration activity. The report will include property description and location, history, geological setting, deposit types, mineralization, exploration, drilling, sampling method and approach, sample preparation, analyses and security, data verification, mineral resource and mineral reserve estimates, as well as other relevant data and information. We do not have any plans, arrangements or understandings with any professional engineer or anyone else for the preparation of a Technical Report on the Eagle River Property, and we do not intend to do so until we have completed this offering.

| 1 |

If the Technical Report identifies claim positions for which there is sufficient indication of economic geological value to support further exploration, we plan to seek additional financing to complete any exploration program concerning the Eagle River Property that may be recommended in the Technical Report. We do not know how much it will cost to implement any such exploration program and there is no way for us to reasonably predict the cost.

We are an exploration stage company and have not generated any revenue from operations. We cannot guarantee that our business will be successful. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of properties we may secure, and possible cost overruns due to price and cost increases in services.

We have not generated revenue since the date of inception, but have suffered recurring losses and net cash outflows from operations. We expect to continue to incur substantial losses to implement our business plan until we obtain an interest in a property, find mineralized material, identify an ore body, and begin profitably removing and selling minerals. We have no proven or probable mineral reserves, and there is no assurance that any mineral claims that we now have or may acquire in the future will contain commercially exploitable reserves of valuable minerals.

To date, our activities have been financed from the proceeds of share subscriptions and loans from management and non-affiliated third parties. We have not established any other source of equity or debt financing and there can be no assurance that we will be able to obtain sufficient funds to implement our business plan. As a result of the foregoing, our auditors have expressed substantial doubt about our ability to continue as a going concern. If we cannot continue as a going concern, then our investors may lose all of their investment.

Our sole officer and director does not have any professional training or technical credentials in the exploration, development, or operation of mines. We therefore intend to retain qualified persons on a contract basis to perform the surveying, exploration, and excavating of the property as needed. We do not have any verbal or written agreement regarding the retention of any qualified engineer or geologist for our exploration program.

We currently have no employees other than our sole officer and director, who devotes 10 hours per week to our operations. We are presently seeking to employ a President and Chief Executive Officer with experience in mineral exploration. We do not intend to hire any other employees for the next 12 months or until we have proven mineral reserves.

Please carefully read both this prospectus and any prospectus supplement together with the additional information described below under the section entitled “Available Information”.

[THE REST OF THIS PAGE IS BLANK]

| 2 |

The Offering

Securities Offered:

| 20,500,000 shares of common stock, of which 20,000,000 shares are offered by the Company and 500,000 shares are offered by the Selling Stockholder. |

| Common stock outstanding before this offering: | 20,680,203 shares |

| Common stock outstanding after this offering: | 40,680,203 shares, assuming the sale of all shares offered by the Company |

| Offering Period: | The offering by the Company will terminate on the earlier of the sale of all of the shares offered by the Company or 270 days after the date of the prospectus, unless extended by our Board of Directors for an additional 90 days.

The offering by the Selling Stockholder will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement, or (ii) 360 days from the effective date of this prospectus. |

| Offering price: | All of the shares being registered for sale by the Company will be sold at a fixed price per share of $0.005 for the duration of the offering.

The Selling Stockholder will sell his shares at prevailing market prices or in privately negotiated transactions. |

| Net proceeds to us: | $84,000 assuming 100% of the shares offered by the Company are sold. If the Company is only able to sell 75%, 50% or 25% of its offered shares, the proceeds will be $75,000, $50,000 or $25,000 respectively.

We will not receive any of the proceeds from the sale or other disposition of shares of our common stock by the Selling Stockholder. |

| Use of proceeds: | We intend to use the net proceeds of the shares offered by the Company in the manner described in this prospectus. See “Use of Proceeds” for additional information. |

| 3 |

Risk Factors

We are in the business of mineral exploration and mine development, which is a highly speculative activity. An investment in our securities involves a high degree of risk. No one should invest in our securities if they cannot afford to lose their entire investment. In deciding whether to invest in our securities, a prospective investor should carefully consider the following information together with all of the other information contained in this prospectus. Any of the following risk factors could cause our business, prospects, financial condition or results of operations to suffer and our investors to lose all or part of their investment. Prospective investors should read the section entitled “Cautionary Note Regarding Forward-Looking Statements” on page 9 of this prospectus for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

| (1) | Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing. |

In their audit report with regard to our financial statements for each of our last two fiscal years, our independent registered public accountants have expressed an opinion that substantial doubt exists as to whether we can continue as a going concern. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations and working capital deficiency. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such funding methods will prove successful.

| (2) | It is impossible to evaluate the investment merits of our Company because we have no operating history. |

We are an exploration stage company with no operating history upon which an evaluation of our future success or failure can be made. As a start-up enterprise, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a new business. There can be no assurance that our business will be successful or that we will be able to attain profitability. We have experienced losses from operations since our inception in 2004, and we expect to continue to incur losses unless and until we generate sufficient revenue from production to fund continuing operations including exploration and development costs. There is no assurance we will ever be profitable for any quarterly or annual period. Our failure to report profits may adversely affect the price of our common stock and you may lose all or part of your investment.

| (3) | Since mineral exploration is a highly speculative venture, anyone purchasing our stock will likely lose their entire investment. |

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. Exploration for minerals is a highly speculative venture necessarily involving substantial risk. The expenditures to be made by us on any mineral property may not result in the discovery of commercially exploitable reserves of valuable minerals. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. The probability of a mineral claim ever having commercially exploitable reserves is extremely remote, and in all probability our mineral claims do not contain any reserves. Any funds spent on the exploration of these claims will probably be lost. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. We may also become subject to significant liability for pollution, cave-ins or hazards, which we cannot insure or which we may elect not to insure. In such a case, we would be unable to complete our business plan and our stockholders may lose their entire investment. Each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor before determining if the offered shares are a suitable investment.

| 4 |

| (4) | Since our mineral property has not been physically examined by a professional geologist or mining engineer, we face a significant risk that the property will not contain commercially viable deposits of minerals. |

We have not had a professional geologist or mining engineer physically examine the Eagle River Property in the field. Furthermore, no officer or director of the Company has visited the Eagle River Property. As a result, we face an enhanced risk that, upon physical examination of the mineral property, no commercially viable deposits of minerals will be located. If we are unable to find reserves of valuable minerals or if we cannot remove the minerals because we do not have the capital to do so or because it is not economically feasible to do so, we may abandon the Eagle River Property and our investors may lose all of their investment.

| (5) | We have no proven or probable reserves, and any funds spent by us on exploration or development could be lost. |

We have not established the presence of any proven or probable mineral reserves, as defined by the SEC, at any of our properties. In what is known as Industry Guide 7, the SEC has defined a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Any mineralized material discovered or produced by us should not be considered proven or probable reserves.

In order to demonstrate the existence of proven or probable reserves, it would be necessary for us to perform additional exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and then obtain a positive feasibility study. Exploration is inherently risky, with few properties ultimately proving economically successful. Establishing reserves also requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically and legally extracted and produced. We have not completed a feasibility study with regard to all or a portion of any of our properties to date. The absence of proven or probable reserves makes it more likely that our properties may never be profitable and that the money we have spent on exploration and development may never be recovered.

| (6) | If we do not obtain additional financing, our business may fail. |

Our business plan calls for significant expenses in connection with the exploration of our mineral property. We do not presently have sufficient information about our claims to estimate the amount required to determine if they contain commercially producible quantities of minerals, or to place the mineral claims into commercial production if they do. There is a risk that we may not be able to obtain whatever financing is required on a timely basis, or at all. Obtaining additional financing will depend on a number of factors, including market prices for minerals, investor acceptance of our properties, and investor sentiment. These factors may make the timing, amount, terms or conditions of additional financing impracticable. If we are unsuccessful in obtaining additional financing when we need it, our business may fail before we ever become profitable and our stockholders may lose their entire investment.

| (7) | Since market factors in the mining business are out of our control, we may not be able to profitably sell any minerals that we find. |

If we are successful in locating a commercially exploitable reserve of minerals, we can provide no assurance that we will be able to exploit it. Numerous factors beyond our control may affect the marketability of any minerals discovered. These factors include fluctuations in the market price of such minerals due to changes in supply or demand, the proximity and capacity of processing facilities for the discovered minerals, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The precise effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital so that our investors may lose their entire investment.

| 5 |

| (8) | Competition in the mining industry is intense, and we have limited financial and personnel resources with which to compete. |

Competition in the mining industry for desirable properties, investment capital and personnel is intense. Numerous companies headquartered in the United States, Canada and elsewhere throughout the world compete for properties on a global basis. We are an insignificant participant in the mining industry due to our limited financial and personnel resources. We presently operate with a limited number of personnel and we anticipate that we will compete with other companies in our industry to hire additional qualified personnel which will be required to successfully operate our milling and exploration activities. We may be unable to attract the necessary investment capital or personnel to fully explore and if warranted, develop our properties and be unable to acquire other desirable properties.

| (9) | Compliance with government regulations in the course of exploring our mineral property may increase the anticipated time and cost of our exploration program so that we are unable to complete the program or achieve profitability. |

Exploration and exploitation activities are subject to federal, provincial and local laws, regulations and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Exploration and exploitation activities are also subject to federal, provincial, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment.

We will be subject to the Mining Act of Newfoundland with respect to our current mineral claims. We may be required to obtain work permits, post bonds, and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While we plan to comply with all applicable regulations, there is a risk that new regulations could increase our time and cost of doing business and prevent us from carrying out exploration and development, or achieve profitability.

| (10) | A controlling percentage of our voting stock is held by one stockholder, which will allow it to make key decisions and effect transactions without further stockholder approval. |

As of the date of this prospectus, the stockholder offering his shares under this prospectus owns 99.1% of our outstanding voting stock. Even if all the shares offered under this prospectus are sold, the same stockholder will beneficially own 49.2% of our outstanding voting stock. Accordingly, he may be able to control the outcome of stockholder votes, including votes concerning the election of directors, the adoption or amendment of provisions in our Articles of Incorporation and our Bylaws, and the approval of mergers and other significant corporate transactions. These factors may also have the effect of delaying or preventing a change in our management or our voting control. Our Articles of Incorporation do not provide for cumulative voting.

| (11) | Since our business involves numerous operating hazards, we may be subject to claims of a significant size which would cost a significant amount of funds and resources to rectify, which could force us to cease our operations and will result in the loss of your investment. |

Our operations are subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure and cratering. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs and force us to cease our operations, which will cause our investors to lose their investment.

Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. Even though we are at liberty to obtain insurance against certain risks in such amounts we deem adequate, the nature of those risks is such that liabilities could over exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and we may not obtain such insurance in the future. There are also risks against which we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, thereby hurting our financial position, future earnings, and/or competitive positions. We may not have enough capital to continue operations and our investors will lose their investment.

| 6 |

| (12) | Since our sole officer has other business interests, he will only be devoting ten hours per week to our operations, which may result in periodic interruptions or suspensions of exploration. |

Our sole officer has other outside business activities and will only be devoting 10 hours per week, to our operations. As a result, our operations may be sporadic and occur at times that are convenient to him. Consequently, our business activities may be periodically interrupted or suspended.

| (13) | Since our sole officer and director has no experience in mineral exploration and does not have formal training specific to mineral exploration, there is a higher risk that our business will fail. |

Our sole officer has no experience in mineral exploration and does not have formal training in geology or in the technical aspects of management of a mineral exploration company. This inexperience presents a higher risk that we will be unable to complete our business plan for the exploration of our mineral claims. In addition, we must rely on the technical services of others with expertise in geological exploration in order for us to carry out our planned exploration program. If we are unable to contract for the services of such individuals, it will make it difficult and may be impossible to pursue our business plan. There is thus a higher risk that our operations, earnings and ultimate financial success could suffer irreparable harm and that our investors will lose all of their investment.

| (14) | If we are unable to hire and retain key personnel, we may not be able to implement our business plan and our business may fail. |

Our future success depends, to a significant extent, on our ability to attract, train and retain capable technical, sales and managerial personnel. Recruiting and retaining capable personnel, particularly those with expertise with mineral exploration, is vital to our success. There is substantial competition for qualified technical and managerial personnel, and there can be no assurance that we will be able to attract or retain the necessary persons. If we are unable to attract and retain qualified employees, our business may fail and our investors could lose their investment.

| (15) | Certain provisions of our Articles of Incorporation and Bylaws may discourage mergers and other transactions. |

Certain provisions of our Articles of Incorporation and By-laws could make it more difficult for someone to acquire control of our Company and limit the price that certain investors might be willing to pay for shares of our common stock. These provisions may make it more difficult for stockholders to take certain corporate actions and could delay or prevent someone from acquiring our business. The provisions could be beneficial to our management and the board of directors in a hostile tender offer, and could have an adverse impact on stockholders who might want to participate in such tender offer, or who might want to replace some or all of the members of the board of directors.

| (16) | We may issue shares of preferred stock with greater rights than our common stock, which may entrench management and result in dilution of our stockholders' investment. |

Our Articles of Incorporation authorize the issuance of up to 100 million shares of preferred stock, par value $0.0001 per share. The authorized but unissued preferred stock may be issued by our board of directors from time to time on any number of occasions, without stockholder approval, as one or more separate series of shares comprised of any number of the authorized but unissued shares of preferred stock, designated by resolution of our board of directors stating the name and number of shares of each series and setting forth separately for such series the relative rights, privileges and preferences thereof, including, if any, the: (i) rate of dividends payable thereon; (ii) price, terms and conditions of redemption; (iii) voluntary and involuntary liquidation preferences; (iv) provisions of a sinking fund for redemption or repurchase; (v) terms of conversion to common stock, including conversion price, and (vi) voting rights. Such preferred stock may enable our board of directors to hinder or discourage any attempt to gain control of us by a merger, tender offer at a control premium price, proxy contest or otherwise. Consequently, the preferred stock could entrench our management. The market price of our common stock could be depressed by the existence of the preferred stock. As of the date of this prospectus, no shares of preferred stock have been issued.

| 7 |

| (17) | We may issue additional common shares, which would reduce the proportion of ownership of our stockholders and may dilute our share value. |

Our Articles of Incorporation authorize the issuance of 900 million shares of common stock, par value $0.0001. The future issuance of common stock may result in substantial dilution in the proportion of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

| (18) | Since our board of directors does not intend to pay dividends on our common stock in the foreseeable future, it is likely that investors will only be able to realize a return on their investment by reselling shares purchased through this offering. |

We have not paid any cash dividends on our common stock since our inception and we do not anticipate paying cash dividends in the foreseeable future. We intend to retain our earnings, if any, to provide funds for reinvestment in our acquisition and exploration activities. The payment of dividends, if any, in the future is within the discretion of the board of directors and will depend on our earnings, if any, our capital requirements, financial condition and other relevant factors.

| (19) | Investors may not be able to resell any shares they purchase through this offering because we do not intend to register our shares for sale in any State and there is no established public trading market for our common stock. |

It may be difficult or impossible for investors to sell our common stock or for them to sell our common stock for more than the offering price even if our operating results are positive. We do not intend to register our common stock with any state. Therefore, investors will not be able to resell their shares in any state unless the resale is exempt under the Blue Sky laws of the state in which the shares are to be sold. While our common stock is presently quoted on the OTCQB, there is no established trading market for it. Most of our common stock will be held by a small number of investors that will further reduce the liquidity of our common stock. Furthermore, the offering price of our common stock was arbitrarily determined by us, without considering assets, earnings, book value, net worth or other economic or recognized criteria or future value of our common stock. Market fluctuations and volatility, as well as general economic, market and political conditions, could reduce our market price.

| (20) | The level of trading activity in our stock may be reduced because we are subject to the “Penny Stock” rules. |

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on NASDAQ). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

| 8 |

Cautionary Note Regarding Forward-Looking Statements

This prospectus contains certain forward-looking statements that involve risks, uncertainties and assumptions that are difficult to predict. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as “believes,” “hopes,” “intends,” “estimates,” “expects,” “projects,” “plans,” “anticipates” and variations thereof, or the use of future tense, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Our forward-looking statements are not guarantees of performance and actual results could differ materially from those contained in or expressed by such statements. In evaluating all such statements we urge you to specifically consider various risk factors identified in this prospectus, including the matters set forth under the heading “Risk Factors,” any of which could cause actual results to differ materially from those indicated by our forward-looking statements.

Our forward-looking statements reflect our current views with respect to future events and are based on currently available financial, economic, scientific, and competitive data and information on current business plans. You should not place undue reliance on our forward-looking statements, which are subject to risks and uncertainties relating to, among other things: (i) the highly speculative nature of mineral exploration; (ii) the likelihood that our mineral claims do not contain commercially viable mineral deposits; (iii) our lack of experience in mineral exploration, (iv) general economic and business conditions; (v) changes in foreign, political, and social conditions; (vi) regulatory initiatives, compliance with governmental regulations and the regulatory approval process, (vii) the specific risk factors discussed under the heading “Risk Factors” below, and (viii) various other matters, many of which are beyond our control. Should one or more of these risks or uncertainties develop, or should underlying assumptions prove to be incorrect, actual results may vary materially and adversely from those anticipated, believed, estimated, or otherwise indicated by our forward–looking statements.

We intend that all forward-looking statements made in this prospectus will be subject to safe harbor protection of the federal securities laws pursuant to Section 27A of the Securities Act of 1933, as amended. Except as required by law, we do not undertake any responsibility to update these forward-looking statements to take into account events or circumstances that occur after the date of this prospectus. Additionally, we do not undertake any responsibility to update you on the occurrence of any unanticipated events which may cause actual results to differ from those expressed or implied by these forward-looking statements.

| 9 |

Use of Proceeds

We will not receive any proceeds from the resale of the common stock by the Selling Stockholder.

The offering by the Company is being made on a best-efforts, self-underwritten basis. There is no minimum amount the Company is required to raise in its offering, and any funds received from the sale of stock by the Company will be immediately available to it.

The following table sets forth the uses of proceeds from the sale of the shares by the Company, assuming the sale of 25%, 50%, 75% and 100% respectively.

| 25% | 50% | 75% | 100% | ||||||||

| Gross Proceeds | $ | 25,000 | $ | 50,000 | $ | 75,000 | $ | 100,000 | |||

| Offering Expenses (1) | 16,000 | 16,000 | 16,000 | 16,000 | |||||||

| Net Proceeds | $ | 9,000 | $ | 34,000 | $ | 59,000 | $ | 84,000 | |||

| Professional Fees (2) | 9,000 | 10,000 | 10,000 | 10,000 | |||||||

| Mineral Properties (3) | - | 15,000 | 25,000 | 30,000 | |||||||

| Consulting Fees (4) | - | 6,000 | 6,000 | 22,000 | |||||||

| Debt Repayment (5) | - | - | 10,000 | 10,000 | |||||||

| Working Capital (6) | - | 3,000 | 8,000 | 12,000 | |||||||

| Total Use of Proceeds | $ | 25,000 | $ | 50,000 | $ | 75,000 | $ | 100,000 |

(1) “Offering Expenses” are estimates only. Actual costs may exceed estimates. To the extent that offering expenses differ from estimates, the amount of proceeds to be used for mineral property acquisition and consulting fees will be adjusted accordingly.

(2) “Professional Fees” refers to accounting fees and legal expenses that will be incurred by the Company.

(3) “Mineral Properties” refers to the costs associated with the acquisition of mineral exploration rights, including options and leases in respect of same.

(4) “Consulting Fees” refers to the costs associated with engaging qualified persons to assist the Company in locating and acquiring mineral exploration properties and in the preparation of a technical report.

(5) “Debt Repayment” refers to the repayment of disbursements incurred on our behalf by our controlling stockholder.

(6) “Working Capital” includes office expenses and contingencies, such as unanticipated exploration costs and professional fees.

The Company reserves the right to change the use of proceeds from this offering under the following circumstances:

1. If the Company’s working capital requirements significantly exceed expectations due to unforeseen contingencies, such as unanticipated regulatory matters or greater than expected professional fees, the Company may apply such proceeds from this offering that would otherwise have been used for consulting fees, mineral properties and debt repayment towards paying such expenses.

2. If the Company is presented with an opportunity to acquire one or more mineral properties (including options and leases) that have an aggregate acquisition cost in excess of the allocation of proceeds set forth above, the Company may apply towards such expenditures the proceeds from this offering that would otherwise have been used for any other purpose. To the extent necessary to complete such acquisitions, the Company may seek additional sources of funding, such as debt or equity financings and joint ventures.

No proceeds from the offering by the Company will be paid to our officers or directors.

Determination of Offering Price

While shares of our common stock are quoted on the OTCQB, there is no established public market for the shares being registered.

| 10 |

The offering price and other terms and conditions relative to the shares of common stock offered by the Company in this offering have been arbitrarily determined by us in order to raise up to $100,000 in this offering. The offering price bears no relationship whatsoever to our assets, earnings, book value or other criteria of value. In addition, no investment banker, appraiser or other independent, third party has been consulted concerning the offering price for the shares or the fairness of the price used for the shares. Among the factors considered in setting the offering price were our lack of operating history in the field of mineral exploration, the amount of proceeds to be raised by this offering, the lack of an established market for the offered shares, the bid price for our shares on the OTCQB, the amount of capital to be contributed by purchasers in this offering in proportion to the amount of stock to be retained by our existing stockholders, and our cash requirements.

The Selling Stockholder may sell all or a portion of his shares in the OTCQB at prices prevailing at the time of sale, or related to the market price at the time or sale, or at other negotiated prices.

Dilution

The shares to be sold by the Selling Stockholder are common stock that is currently issued and outstanding and such sales will not result in any dilution to our existing stockholders.

The investment by any purchaser in the shares of common stock offered by the Company will be diluted immediately to the extent of the difference between the public offering price per share and the net tangible book value per share of common stock immediately after this offering. The net tangible book value as of November 30, 2013, was $(18,734) or approximately $(0.001) per common share. Net tangible book value per share is determined by dividing tangible stockholders’ equity, which is total tangible assets less total liabilities, by the aggregate number of shares of common stock outstanding. Tangible assets represent total assets excluding goodwill and other intangible assets. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the net tangible book value per share of our common stock immediately after the closing of this offering.

The following table illustrates the increase to existing stockholders and the dilution to purchasers of the offered shares in their net tangible book value per share, before deducting estimated offering expenses:

| Percentage of Offered Shares Sold | |||||||||

| 100% | 75% | 50% | 25% | ||||||

| Number of Shares Sold | 20,000,000 | 15,000,000 | 10,000,000 | 5,000,000 | |||||

| Gross Proceeds | 100,000 | 75,000 | 50,000 | 25,000 | |||||

| Offering price per share | $ | 0.005 | $ | 0.005 | $ | 0.005 | $ | 0.005 | |

| Net tangible book value per common share before offering | $ | (0.001) | $ | (0.001) | $ | (0.001) | $ | (0.001) | |

| Increase per common share attributable to investors | $ | 0.003 | $ | 0.003 | $ | 0.002 | $ | 0.001 | |

| Pro forma net tangible book value per common share after offering | $ | 0.002 | $ | 0.002 | $ | 0.001 | $ | 0 | |

| Dilution to investors | $ | 0.003 | $ | 0.003 | $ | 0.004 | $ | 0.005 | |

| Dilution as a percentage of offering price | 60% | 60% | 80% | 100% | |||||

The table is based on 20,680,203 common shares outstanding and total stockholders’ equity of $(18,734) as of November 30, 2013.

During the past five years, the officers, directors, promoters and affiliated persons have paid an aggregate average price of $0.005 per common share in comparison to the offering price of $0.005 per common share.

We may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

| 11 |

Selling Stockholder

Thomas Mills is the sole shareholder offering shares of Company’s common stock through this prospectus (the “Selling Stockholder”). The term “Selling Stockholder” also includes any transferees, pledges, donees, or other successors in interest to the Selling Stockholder. We will file a supplement to this prospectus (or a post-effective amendment hereto, if necessary) to name successors to the Selling Stockholder who are able to use this prospectus to resell the securities registered hereby.

During the last three years, the Selling Stockholder has been the controlling shareholder of the Company, and has held the offices of President, CEO and Chief Financial Officer, as well as being a member of the Company’s board of directors. Except as noted herein, the Selling Stockholder does not have any family relationships with our officers or directors. The Selling Stockholder is not a broker-dealer.

The Selling Stockholder is offering 500,000 shares of the Issuer’s common stock offered through this prospectus. The shares being offered by the Selling Stockholder are composed of:

| (1) | 400,000 shares of the Company’s common stock issued to the Selling Stockholder on June 5, 2005, through a private placement that was exempt from registration in reliance upon Rule 903(b)(3) of Regulation S promulgated under the Securities Act; and |

| (2) | 100,000 shares of the Company’s common stock acquired by the Selling Stockholder on September 24, 2007, through a private transaction that was exempt from registration under section 4(1) of the Securities Act. |

To the best of our knowledge, the Selling Stockholder is the beneficial owner and has the sole voting and investment power over all shares or rights to the shares he is offering under this prospectus. All of the shares offered by the Selling Stockholder under this prospectus are being offered by the Selling Stockholder for his own account. All information with respect to share ownership has been furnished by the Selling Stockholder.

The shares being offered by the Selling Stockholder under this prospectus are being registered to permit public secondary trading and the Selling Stockholder may offer all or part of the shares for resale from time to time. However, the Selling Stockholder is under no obligation to sell all or any portion of such shares nor is the Selling Stockholder obligated to sell any shares immediately upon effectiveness of this prospectus.

The following table sets forth certain information regarding the Selling Stockholder and the shares he is offering through this prospectus. Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by the Selling Stockholder and his percentage of ownership, shares of common stock underlying shares of convertible preferred stock, options or warrants held by the Selling Stockholder that are convertible or exercisable, as the case may be, within 60 days are included.

| Beneficial | Shares of | Beneficial | Percentage | |

| Ownership | Common Stock | Ownership | of Common | |

| Before the | Included in | After the | Stock Owned | |

| Name | Offering | Prospectus | Offering(1) | After Offering (2) |

| Thomas Mills | 20,500,003 | 500,000 | 20,000,003 | 49.2% |

| (1) | It is assumed for the purposes of this table that the Selling Stockholder will sell all of the shares included in this prospectus, that the Selling Stockholder will only sell shares of common stock that are included in this prospectus, and that the Selling Stockholder will not purchase additional shares of common stock. |

| (2) | Based on 20,680,203 shares outstanding as of November 30, 2013. |

We may require the Selling Stockholder to suspend the sale of the shares he is offering under this prospectus upon the occurrence of any event that makes any statement in this prospectus or the related registration statement untrue in any material respect or that requires the changing of statements in these documents in order to make statements in those documents not misleading.

| 12 |

Market for Common Equity and Related Stockholder Matters

No Established Public Market for Common Stock

Our common stock is quoted on the OTCQB under the symbol "AMCM". Trading of our stock is sporadic and does not constitute an established public trading market for our shares. The most recent sale price of our common stock on the OTCQB was $0.07 on January 3, 2014.

There is no assurance that a public trading market for our common stock will ever be established. Furthermore, since the shares purchased in this offering will be immediately resalable, such resale could have a depressive effect on the market price of our common stock.

Very limited trading of our common stock has occurred during the past two years. Therefore, only limited historical price information is available. The following table sets forth the high and low closing bid prices of our common stock (USD) for the last two fiscal years, as reported by OTC Markets Group Inc. and represents inter dealer quotations, without retail mark-up, mark-down or commission and may not be reflective of actual transactions:

| QUARTER ENDED | HIGH | LOW | ||||||||

| November 30, 2013 | $ | 0.20 | $ | 0.15 | ||||||

| August 31, 2013 | $ | 0.15 | $ | 0.15 | ||||||

| May 31, 2013 | $ | 0.17 | $ | 0.15 | ||||||

| February 28, 2013 | $ | 0.20 | $ | 0.17 | ||||||

| November 30, 2012 | $ | 0.20 | $ | 0.15 | ||||||

| August 31, 2012 | $ | 0.20 | $ | 0.20 | ||||||

| May 31, 2012 | $ | 0.20 | $ | 0.14 | ||||||

| February 28, 2012 | $ | 0.15 | $ | 0.13 | ||||||

| November 30, 2011 | $ | 0.33 | $ | 0.13 |

Shareholders

On November 28, 2013, the shareholders' list of our shares of common stock showed 26 registered holders of our shares of common stock and 20,680,203 shares of common stock outstanding. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of shares of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

Dividend Policy

We have not declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Registration Rights

As of the date of this prospectus, we have no outstanding shares of common stock or any other securities to which we have granted registration rights.

Options, Warrants and Convertible Securities

As of the date of this prospectus, there are no outstanding options or warrants to purchase, or securities convertible into shares of our common stock.

| 13 |

Description of Business

We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on any property we acquire. Exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Our principal offices are located at 970 Caughlin Crossing, Suite 100, Reno, Nevada 89519. Our telephone number is (702) 465-5213. Our facsimile number is (775) 201-0127.

History

American Mining Corporation was incorporated on September 15, 2004, under the laws of the State of Nevada, as Thrust Energy Corp., for the purpose of acquiring undivided working interests in small oil and gas exploration properties and non-operating interests in both producing and exploration projects throughout the United States and Canada.

On September 30, 2010, we increased our authorized capital to 900 million shares of common stock (par value $0.0001) and 100 million shares of preferred stock (par value $0.0001), and effected a 20-for-1 reverse split of our issued and outstanding common stock. As a result of the reverse split, our issued and outstanding common stock was reduced from 13,604,000 shares to 680,202 shares.

Due to our inability to earn any meaningful revenue from oil and gas exploration, our management determined in April 2011 that we should change our business plan to include mineral exploration and development.

On May 5, 2011, we effected a change of name to American Mining Corporation by completing a short form merger with a wholly-owned subsidiary.

Mineral Exploration

We are an exploration stage company engaged in the business of acquiring mineral exploration rights throughout North America, exploring for commercially producible quantities of minerals, and exploiting any mineral deposits we discover that demonstrate economic feasibility. Since we are an exploration stage company, there is no assurance that commercially exploitable reserves of valuable minerals exist on any property that we now own or may own in the future. We will need to do further exploration before a final evaluation of the economic and legal feasibility of our future exploration is determined.

Our success will depend upon finding commercially producible quantities of minerals, which are mineral deposits that have been identified through appropriate spaced drilling or underground sampling as having sufficient tonnage and average grade of metals to profitably remove them. If we are unable to find reserves of valuable minerals or if we cannot remove the minerals because we either do not have the capital to do so, or because it is not economically feasible to do so, then we may cease operations and our stockholders may lose their investment. There can be no assurance that we will be able to acquire any mineral property that has commercially producible quantities of any mineral, or that we will discover them if they exist.

We intend to seek out prospective mineral exploration properties by retaining the services of professional mining geologists to be selected. As of the date of this prospectus, we have not selected a geologist. We are initially focusing our exploration efforts in the Province of Newfoundland and Labrador, but we will also consider exploration opportunities elsewhere in North America.

Any mineral property to be considered for acquisition will require due diligence by our management. Due diligence would likely include purchase investigation costs such as professional fees charged by consulting geologists, preparation of geological reports on properties, title searches and travel costs associated with on-site inspections. During this period, we will also need to maintain our periodic filings with the appropriate regulatory authorities and will incur legal and accounting costs in that regard. In the event that our available capital is insufficient to acquire an additional mineral property and sustain minimum operations, we will need to secure additional funding.

| 14 |

If we are successful in selling all the offered shares, we intend to pay up to $30,000 for the acquisition of additional mineral exploration rights. Such rights will likely be in the form of an option on patented or unpatented mineral claims prospective for precious metals or ore minerals in North America. We intend to acquire the mineral rights within six months of the completion of this offering. We do not have any specific plan, proposal or arrangement to acquire additional mineral exploration rights.

Upon acquiring the additional mineral exploration rights, we will require further funding to explore the underlying claims to determine if they contain commercially producible quantities of precious metals or ore minerals. We will be unable to estimate the cost of such exploration until we know the size and location of the property underlying our mineral rights. We expect that such exploration costs will typically consist of fees to be paid for consulting services connected with exploration, the cost of rock sampling (the collection of a series of small chips over a measured distance, which is then submitted for a chemical analysis, usually to determine the metallic content over the sampled interval, a pre-determined location(s) on the property), and the cost of analyzing these samples.

If we discover significant quantities of precious metals or mineral ores on the property underlying our mineral rights, we will begin technical and economic feasibility studies to determine if we have reserves. We will not be able to estimate the cost of such feasibility studies until we know the size and location of the property. We will only consider developing the property if we have proved reserves of precious metals or mineral ores that can be profitably extracted.

Any work that would be conducted on a property will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The professional engineers and geologists we engage will evaluate the information derived from the exploration and excavation, and will advise us on the economic feasibility of removing the mineralized material.

We presently have no known reserves of any type of mineral.

Eagle River Property

On December 2, 2013, we acquired a 100% interest in two non-contiguous mineral exploration licenses made up of 16 claims located along southeastern Labrador (the “Eagle Ridge Property”). Our claims are located approximately 49 kilometers southwest of the community of Cartwright in Labrador, Canada and have a total area of 400 hectares (988 acres). The mineral licenses underlying the Eagle River Property are registered with the Government of Newfoundland and Labrador and are presently in good standing. The claims were staked on our behalf by our controlling shareholder and then transferred to us. The cost of staking the claims was $960 CAD.

There can be no assurance that commercially producible reserves of valuable minerals exist on the Eagle River Property, or that we will discover them, if they exist. If we are unable to find reserves of valuable minerals or if we cannot remove the minerals because we either do not have the capital to do so, or because it is not economically feasible to do so, then we will abandon our interest in the Eagle River Property.

Mineral Claims

The Eagle River Property consists of two non-contiguous mineral exploration licenses comprising a total of 16 claims having a total area of 400 hectares (mineral rights license numbers 021755M and 021756M). We hold all of our mineral titles free and clear of any encumbrances or liens.

Our mineral exploration licenses entitle us to explore the claims composing the Eagle River Property subject to the laws and regulations of the Province of Newfoundland and Labrador. Title to mineral claims are issued and administered by the Mineral Lands Division of the Ministry of Natural Resources, and title must comply with all provisions under the Mineral Act of Newfoundland and Labrador.

Under Newfoundland law, our mineral licenses may be held for one year after the date of issuance, and thereafter from year to year if, on or before the anniversary date, we perform assessment work on the underlying claims having a minimum value of not less than C$200 per claim in the first year, C$250 per claim in the second year, and C$300 per claim in the third year. If we are unable to complete the assessment work required to be done in any twelve month period, we can maintain our claims in good standing by posting a cash security deposit for the amount of the deficiency. When the deficient work is completed and accepted the security deposit will be refunded. Otherwise, the security deposit will be forfeited. If we do not comply with these maintenance requirements, then we will forfeit our claims at the end of the anniversary date for each respective claim. All of our claims are presently in good standing, which means that they are free and clear of all work and/or monetary holding requirements.

| 15 |

History of the Claims

Early knowledge of the area is based mainly on descriptions of coastal localities and 1:500000 scale reconnaissance mapping and mineral exploration of the interior. More recently, complete aeromagnetic coverage and lake-sediment geochemical data have become available for the region.

Geological mapping at 1:100,000 scale, as a 5-year Canada-Newfoundland joint project aimed at mapping an 80 km coastal fringe of the Grenville Province in southern Labrador, was carried out from 1984 to 1987 by the Newfoundland and Labrador Geological Survey. Further studies conducted between 1986 and 1994 used U-Pb geochronology to directly determine the age of deformation within the zones developed throughout the region.

The earliest reported exploration activity in the area includes intermittent work carried out by the British Newfoundland Exploration Company (BRINEX). Initial geological mapping and mineral potential evaluation was carried out in 1954, which resulted in a favorable recommendation of the area for titanium, copper, nickel and gold mineralization. In 1959, airborne magnetic and electromagnetic surveys were flown, and a combined geological, lake sediment geochemical, ground electromagnetic and prospecting program was undertaken in 1965. Active interest by BR1NEX ceased after further reconnaissance geological mapping in 1966.

Spurred on by the mineral exploration staking rush following the Voisey’s Bay discovery, the area has seen mineral exploration during the late 1990s. Consolidated Viscount Resources Ltd and Consolidated Magna Ventures Limited completed some detailed exploration work in the area. Detailed work was completed during 1995 and 1996 over this area, and included prospecting, geological mapping, geochemical sampling, grid establishment and geophysics.

Location and Access

The Eagle River Property is located approximately 49 km southwest of the community of Cartwright, in Labrador, Canada, which is located 225 km east of the town of Happy Valley. Happy Valley has a gravel air strip for scheduled air traffic, and is serviced by chartered float plane and scheduled coastal boat traffic during ice free months (June to October).

Our claims are located approximately 17 km from tidewater and 11.5 km from the Trans-Labrador Highway. They are accessible by helicopter for the purpose of an initial property assessment.

Technical Report

We intend to commission a technical report on the Eagle River Property before contemplating any exploration activities. The technical report will be prepared by a qualified professional engineer and will comply with the provisions of National Instrument 43-101, Standards of Disclosure for Mineral Projects, published by the Canadian Securities Administrators (the “Technical Report”). We do not have any plans, arrangements or understandings with any professional engineer or anyone else for the preparation of the Technical Report, and we do not intend to do so until we have completed this offering.

The Technical Report will follow the guidelines specified by the Canadian Council of Professional Geoscientists ("CCPG") and will include property description and location, history, geological setting, deposit types, mineralization, exploration, drilling, sampling method and approach, sample preparation, analyses and security, data verification, mineral resource and mineral reserve estimates, as well as other relevant data and information. General tasks to be completed include: (i) a geologic examination of the mineral property; (ii) a compilation and review of all existing documents and data; (iii) preparation of a summary of the documents and data in accordance with NI 43-101 requirements; and (iv) preparation of the Technical Report.

| 16 |

The Company is unable to disclose any scientific or technical information about the Eagle River Property without a technical report.

U.S. reporting requirements for disclosure of mineral properties are governed by the SEC Guide 7. The standards of disclosure of mineral properties under NI 43-101 and SEC Guide 7 are substantially different. All mineral resources disclosed in our Technical Report will be estimated in accordance with the definition standards on mineral resources and mineral reserves of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in NI 43-101. Accordingly, when the Technical Report is produced, the Company will disclose it on Form 8-K in order to satisfy our "public disclosure" obligations under SEC Regulation FD, but the Technical Report will not be filed with the SEC.

If the Technical Report identifies claim positions for which there is sufficient indication of economic geological value to support further exploration (“high priority targets”), we plan to seek additional financing to complete any exploration program concerning the Eagle River Property that may be recommended in the Technical Report. We do not know how much it will cost to implement any such exploration program and there is no way for us to reasonably predict the cost.

Our management estimates that the Technical Report will take 30-60 days to produce, and subject to financing and weather conditions, will be completed by August 2014, at a cost of $20,000. We do not currently have sufficient capital to commission the preparation of the Technical Report. If the Company is successful in selling all of the shares it is offering through this prospectus, we intend to commission the preparation of the Technical Report from the proceeds of the offering. If, however, our operating costs are greater than expected or opportunities to acquire mineral properties arise, we may use the proceeds earmarked for the Technical Report to instead pay for such costs or acquisitions (See “Use of Proceeds).

Management Experience

Our management has no professional training or technical credentials in the exploration, development, or operation of mines. Consequently, we may not be able to recognize or take advantage of potential acquisition and exploration opportunities in the sector without the aid of qualified geological consultants. Moreover, with no direct training or experience, our management may not be fully aware of the specific requirements related to working in this industry. Our management may make mistakes in decisions and choices that could cause our operations and ultimate financial success to suffer irreparable harm.

Our sole executive officer will only be devoting approximately 10 hours per week of his time to our business. We do not foresee this limited involvement as negatively impacting the Company over the next 12 months because all exploratory work will be performed by an outside consultant. If, however, the demands of our business require more time of our executive officer, such as raising additional capital or addressing unforeseen issues with regard to our exploration efforts, he is prepared to adjust his timetable to devote more time to our business. He may not, however, be able to devote sufficient time to the management of our business, as and when needed.

Geological and Technical Consultants

Since our management is inexperienced with exploration, we intend to retain qualified persons on a contract basis as needed to assist us with our exploration activities, including the survey, exploration, and excavation of the Eagle River Property. We do not presently have any verbal or written agreement regarding the retention of any such persons, and we do not intend to retain anyone until we have completed this offering.

We do not have any verbal or written agreement regarding the retention of any qualified engineer for the preparation of the Technical Report.

| 17 |

Competitive Factors