Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-190842;

333-190842-01; 333-190842-02;

333-190842-03; 333-190842-04;

and 333-190842-05

PROSPECTUS

Quiksilver, Inc.

QS Wholesale, Inc.

Offer to Exchange

$225,000,000 aggregate principal amount of 10.000% Senior Notes due 2020

(CUSIPs 74840D AC4 and U7487D AB1)

for

$225,000,000 aggregate principal amount of 10.000% Senior Notes due 2020

(CUSIP 74840D AB6)

that have been registered under the Securities Act of 1933, as amended

The exchange offer will expire at 5:00 p.m., New York City time, on November 7, 2013, unless we extend or earlier terminate the exchange offer.

Quiksilver, Inc. and QS Wholesale, Inc. (together, the “Issuers”) hereby offer, on the terms and subject to the conditions set forth in this prospectus and in the accompanying letter of transmittal (which together constitute the “exchange offer”), to exchange up to $225,000,000 aggregate outstanding principal amount of their 10.000% Senior Notes due 2020 that have been registered under the Securities Act of 1933, as amended (the “Securities Act”), which we refer to as the “new notes,” for a like aggregate principal amount of their outstanding 10.000% Senior Notes due 2020, which we refer to as the “old notes.”

Terms of the exchange offer:

| | • | | On the terms and subject to the conditions of the exchange offer, we will exchange new notes for all outstanding old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. |

| | • | | You may withdraw tenders of old notes at any time prior to the expiration of the exchange offer. |

| | • | | The terms of the new notes are substantially identical to those of the old notes, except that the transfer restrictions, registration rights and special interest provisions relating to the old notes will not apply to the new notes. |

| | • | | The exchange of old notes for new notes will not be a taxable transaction for United States federal income tax purposes, but you should see the discussion under the heading “Material United States Federal Income Tax Considerations” for more information. |

| | • | | We will not receive any proceeds from the exchange offer. |

| | • | | The Issuers issued the old notes in a transaction not requiring registration under the Securities Act, and as a result, the transfer of the old notes is restricted under the securities laws. We are making the exchange offer to satisfy your registration rights as a holder of old notes. |

There is no established trading market for the new notes or the old notes.

Each broker-dealer that receives new notes in exchange for old notes that were acquired for its own account as a result of market-making activities or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities (other than old notes acquired directly from the Issuers). Under the registration rights agreement the Issuers have agreed that, for a period up to the earlier of (i) 180 days after the date on which the registration statement of which this prospectus forms a part is declared effective and (ii) the date on which a broker-dealer is no longer required to deliver this prospectus in connection with market-making or other trading activities, the Issuers will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

See “Risk Factors” beginning on page 23 for a discussion of risks you should consider prior to tendering your outstanding old notes for exchange.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 9, 2013

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any person to give any information to you or to make any representation other than those contained in this prospectus in connection with the exchange offer and, if given or made, such information or representation must not be relied upon as having been authorized by us. We are not making an offer to exchange the new notes in any state or jurisdiction where the offer is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus is accurate as of any date other than the date on the cover of this prospectus or the date of any document incorporated by reference, as applicable.

TABLE OF CONTENTS

This prospectus contains summaries believed to be accurate with respect to certain documents, but reference is made to the actual documents for complete information. All such summaries are qualified in their entirety by this reference. This prospectus also incorporates business and financial information about the Company that is not included in or delivered with this prospectus. Copies of documents referred to in this prospectus and such business and financial information, except for certain exhibits and schedules, will be made available to you without charge upon written or oral request to us. Requests for documents or other additional information should be directed to Quiksilver, Inc., 15202 Graham Street, Huntington Beach, California 92649, Attention: General Counsel, Telephone: (714) 889-2200.To obtain timely delivery of documents or information, we must receive your request no later than five (5) business days before the expiration date of the exchange offer.

The terms “Quiksilver,” the “Company,” “we,” “our” and “us” refer to Quiksilver, Inc. and all of its consolidated subsidiaries collectively, including QS Wholesale, Inc., in each case, except as otherwise specified or the context otherwise requires and the terms “Issuers” and “Issuer” refer to Quiksilver, Inc. and QS Wholesale, Inc. collectively and individually, as applicable, and not to any of their subsidiaries. The 10.000% Senior Notes due 2020 are sometimes referred to herein as the “notes,” which term, except with respect to discussion of income tax consequences and unless the context otherwise requires, includes the new notes and the old notes.

i

“Fiscal 2008,” “fiscal 2009,” “fiscal 2010,” “fiscal 2011,” “fiscal 2012” and “fiscal 2013” mean the12-month periods ended October 31, 2008, 2009, 2010, 2011, 2012 and 2013, respectively.

References to “euros,” “Euros” or “€” are to the lawful currency of the European Economic and Monetary Union and references to “U.S. dollars,” “dollars” or “$” are to the lawful currency of the United States.

This prospectus contains some of our trademarks and trade names. See “Business—Trademarks, Licensing Agreements and Patents.” All other trademarks or trade names of any other company appearing in this prospectus belong to their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

ii

MARKET AND INDUSTRY DATA

Certain market and industry data contained or incorporated by reference in this prospectus have been obtained from third party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications and third party forecasts in conjunction with our assumptions about our markets. We have not independently verified such third party information and cannot assure you of its accuracy or completeness. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This prospectus, including the documents incorporated by reference herein, contains “forward-looking” statements within the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are often, but not always, identified by words such as: “anticipate,” “intend,” “plan,” “potential,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “outlook,” “strategy,” “future,” “likely,” “may,” “should,” “could,” “will” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements we make regarding:

| | • | | current or future volatility in certain economies, credit markets and future market conditions; |

| | • | | our belief that we have sufficient liquidity to fund our business operations during the next twelve months; and |

| | • | | our expectations regarding the implementation of our recently announced multi-year Profit Improvement Plan. |

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

| | • | | our ability to execute our mission and strategies; |

| | • | | our ability to achieve the financial results that we anticipate; |

| | • | | our ability to successfully implement our multi-year Profit Improvement Plan; |

| | • | | our ability to effectively transition our supply chain and certain other business processes to a global scope; |

| | • | | future expenditures for capital projects, including the ongoing implementation of our global enterprise-wide reporting system; |

| | • | | increases in production costs and raw materials and disruptions in the supply chains for these materials; |

| | • | | deterioration of global economic conditions and credit and capital markets; |

| | • | | potential non-cash asset impairment charges for goodwill or other assets; |

| | • | | our ability to continue to maintain our brand image and reputation; |

iii

| | • | | foreign currency exchange rate fluctuations; |

| | • | | our ability to remain compliant with our debt covenants; |

| | • | | payments due on contractual commitments and other debt obligations; |

| | • | | changes in political, social and economic conditions and local regulations, particularly in Europe and Asia; |

| | • | | the occurrence of hostilities or catastrophic events; |

| | • | | changes in customer demand; and |

| | • | | disruptions to our computer systems and software, as well as natural events such as severe weather, fires, floods and earthquakes or man-made or other disruptions of our operating systems, structures or equipment. |

Any or all forward-looking statements in this prospectus, the documents incorporated by reference herein and in any other public filings or statements we make (including statements about future financial performance) are necessarily dependent on assumptions, data and methods that may be incorrect or imprecise, and there can be no assurance that such statements will be realized. In that regard, certain important factors, among others and in addition to the matters discussed in this prospectus and in reports and documents filed by us with the SEC, could cause actual results and other matters to differ materially from those discussed in such forward-looking statements. A detailed description of certain of these factors is included under the heading “Risk Factors” in this prospectus, as well as in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. These risk factors should be considered in conjunction with any discussion of operations or results by us or our representatives, including any forward-looking discussion, as well as any comments contained in press releases, presentations to securities analysts or investors or other communications by us.

Any forward-looking statement made by us in this prospectus, the documents incorporated by reference herein and in any other public filings or statements we make (including statements about future financial performance) is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

iv

SUMMARY

This summary contains basic information about the Issuers and the exchange offer and highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that is important to you and that you should consider. For a more complete understanding of the Issuers and this exchange offer, you should read this prospectus, including any information incorporated by reference into this prospectus, in its entirety. Investing in the notes involves risks, including without limitation the risks that are described in this prospectus under the heading “Risk Factors.”

The Company

We are one of the world’s leading outdoor sports lifestyle companies. We design, develop and distribute branded apparel, footwear, accessories and related products. Our three core brands, Quiksilver, Roxy and DC, are synonymous with the heritage and culture of surfing, snowboarding and skateboarding. Our brands, inspired by the passion for outdoor action sports, represent an action sports lifestyle for young-minded people who connect with our boardriding culture and heritage. Our products combine decades of brand heritage, authenticity and design experience with the latest technical performance innovations available in the marketplace. Our mission is to build authentic, active brands into significant sustainable successes. In May 2013, we announced the framework for our multi-year Profit Improvement Plan, which over the next three years we believe will meaningfully improve the competitive position of our core brands, grow sales and significantly improve our operating efficiency and profitability.

TheQuiksilver brand was founded in 1969 in Torquay, Australia. We began operations in 1976 making boardshorts for surfers in California for distribution in the United States under a license agreement with theQuiksilver brand founders. Our product offering expanded in the 1980s as we expanded our distribution channels. After going public in 1986 and purchasing the rights to theQuiksilver brand in the United States, we further expanded our product offerings and began to diversify. In 1991, we acquired the European licensee ofQuiksilver and introducedRoxy, our surf brand for women. We also expanded demographically in the 1990s by adding products for boys and girls, and we introduced our proprietary Boardriders retail store concept that displays the heritage and products ofQuiksilver andRoxy. In 2000, we acquired the internationalQuiksilver andRoxy trademarks, and in 2002, we acquired our licensees in Australia and Japan in order to control our core brands on a global basis. In 2004, we acquiredDC to expand our presence in skateboarding.

Today, our business is highly diversified by brand, product, geography and distribution channel. The three core brands in our product portfolio are:

A leading men’s global action sports brand with over a 40-year heritage rooted in surfing, technical innovation and authenticity.Quiksilver is the largest global brand inspired by the boardriding lifestyle which offers performance and technically superior apparel and accessories for young-minded people who aspire to our boardriding culture and heritage. We have grown ourQuiksilver brand from its origins as a boardshort line for young men to include a wide range of athletic apparel and accessories, including boardshorts, walk shorts, tops, bottoms, sandals, technical outerwear and accessories.

A leading men’s global action sports brand with over a 40-year heritage rooted in surfing, technical innovation and authenticity.Quiksilver is the largest global brand inspired by the boardriding lifestyle which offers performance and technically superior apparel and accessories for young-minded people who aspire to our boardriding culture and heritage. We have grown ourQuiksilver brand from its origins as a boardshort line for young men to include a wide range of athletic apparel and accessories, including boardshorts, walk shorts, tops, bottoms, sandals, technical outerwear and accessories.

A leading women’s global action sports brand founded in the surfing and snowboarding lifestyle.Roxy offers a wide range of surf- and snowboarding- inspired collections, including sportswear, swimwear, sandals, technical outerwear and other action sports apparel and accessories.Roxy is inspired by the beach, mountain, fitness and training lifestyle and is one of the few global action sports brands exclusively focused on active females.

A leading women’s global action sports brand founded in the surfing and snowboarding lifestyle.Roxy offers a wide range of surf- and snowboarding- inspired collections, including sportswear, swimwear, sandals, technical outerwear and other action sports apparel and accessories.Roxy is inspired by the beach, mountain, fitness and training lifestyle and is one of the few global action sports brands exclusively focused on active females.

1

A leading global skateboarding and motocross inspired action sports brand specializing in performance skateboard shoes, sandals and apparel for young men.DC targets the alternative action sports lifestyle and its product line includes footwear, T-shirts, walk shorts, winterwear, caps and accessories.

A leading global skateboarding and motocross inspired action sports brand specializing in performance skateboard shoes, sandals and apparel for young men.DC targets the alternative action sports lifestyle and its product line includes footwear, T-shirts, walk shorts, winterwear, caps and accessories.

For the twelve months ended July 31, 2013, we generated net revenues of $1.9 billion, net loss from continuing operations attributable to Quiksilver, Inc. of $57.1 million and Adjusted EBITDA of $102.8 million. For a definition of Adjusted EBITDA, which is a non-GAAP financial measure, and a reconciliation of net loss from continuing operations attributable to Quiksilver, Inc. to Adjusted EBITDA, see footnote (3) to the table under “—Summary Historical Consolidated Financial and Other Data.” Our global headquarters is in Huntington Beach, California. Our common stock is listed on the New York Stock Exchange under the symbol “ZQK” and as of September 24, 2013 we had an equity market value of approximately $1.2 billion.

Multi-Year Profit Improvement Plan

In January 2013, we hired Andy Mooney as President and Chief Executive Officer. Mr. Mooney brought with him over 30 years of experience in building consumer brands, developing worldwide marketing strategies and driving global growth. Prior to joining Quiksilver, Mr. Mooney spent 11 years as Chairman of the Consumer Products division at Disney and 20 years at Nike, most recently serving as Chief Marketing Officer, responsible for worldwide marketing strategies for the Nike and Jordan brands. While at Disney’s Consumer Products division, Mr. Mooney guided a significant turnaround in profitability for its business.

On May 16, 2013, we announced a multi-year Profit Improvement Plan designed to accelerate the Company’s three fundamental strategies of strengthening our brands, growing sales and improving operational efficiencies. Our new strategy is designed to focus the Company on its three core brands, globalize key functions and reduce our cost structure. Our previous organizational structure, which was decentralized with each of our Americas segment, Europe, Middle East and Africa (“EMEA”) segment and Asia/Pacific (“APAC”) segment operating primarily independently, created a fragmented enterprise with regional brand inconsistencies, suboptimal coordination and limited our ability to take advantage of our global scale. In response to these challenges, our senior management team, with the assistance from outside consultants, completed a thorough review of our global operations to determine the best path for sustainable cost savings and profitable growth. The resulting Profit Improvement Plan is already being implemented, with focus on:

Brand Strength

| | • | | Clarifying the positioning of our three flagship brands (Quiksilver,Roxy andDC); |

| | • | | Divesting certain non-core brands; |

| | • | | Globalizing product design and merchandising; and |

| | • | | Licensing of secondary or peripheral product categories. |

Sales Growth

| | • | | Reprioritizing our marketing investments to emphasize in-store and print marketing along with digital and social media; |

| | • | | Continued investment in emerging markets and e-commerce; and |

| | • | | Improving sales execution. |

2

Operational Efficiencies

| | • | | Optimizing our supply chain; |

| | • | | Reducing our product styles by over 30%; |

| | • | | Improving selling, general and administrative expense (“SG&A”) by at least 300 basis points; |

| | • | | Centralizing global responsibility for key functions, including product design, supply chain, marketing, retail stores, licensing and administrative functions; and |

| | • | | Closing underperforming retail stores. |

We expect that the plan, when fully implemented by the end of our fiscal year 2016, will increase our Adjusted EBITDA by approximately $150 million over our fiscal year 2012 Adjusted EBITDA. Of this increase, approximately 50% is expected to come from supply chain optimization and the rest is expected to be primarily comprised of corporate overhead reductions, licensing opportunities, improved pricing management, along with modest net revenue growth. The key factors we expect to drive this improvement are:

New Management Team and Centralized Organizational Structure. In addition to Mr. Mooney, we have added several key executives, as well as expanded the roles of existing executives to newly created global positions, designed to centralize our core global business processes under the leadership of experienced, world-class executives each with functional expertise in their area of responsibility. The following table highlights the key members of our newly-expanded management team:

| | | | | | |

Name | | Title | | Joined | | Previous Experience |

Andy Mooney | | President and Chief Executive Officer | | 2013 | | Nike (20 years); Disney (10 years) |

| | | |

Pierre Agnes | | Global Head of Apparel | | 1988 | | Quiksilver (25 years) |

| | | |

Nicholas Drake | | Chief Marketing Officer | | 2013 | | TBWIA\Chiat\Day Los Angeles (4 years); Adidas (6 years) |

| | | |

Charlie Exon | | General Counsel and Chief Administrative Officer | | 2000 | | Quiksilver (13 years) |

| | | |

Steve Finney | | Head of Retail / e-Commerce North America | | 2013 | | Disney (21 years) |

| | | |

Tom Hartge | | Global Head of Footwear | | 2013 | | Nike (24 years); Patagonia (2 years) |

| | | |

Pam Lifford | | Global Licensing | | 2013 | | Disney (11 years) |

| | | |

Kasey Mazzone | | Global Head of Supply Chain | | 2013 | | Gap (2 years); Levi’s (13 years); American Eagle (3 years); Lands End (3 years) |

| | | |

Carol Scherman | | Global EVP Human Resources | | 2006 | | Quiksilver (7 years) |

| | | |

Richard Shields | | Chief Financial Officer | | 2012 | | Oakley (7 years); AST (9 years) |

These changes represent an ongoing evolution away from our historical organizational structure where design, development, marketing, supply chain, e-commerce and retail operations were each regionally-based towards a new centralized structure in which core functions with global scope will have central leadership, resulting in greater efficiency, reduced headcount and fewer redundant processes. We plan to maintain regional responsibility for local execution of wholesale sales and customer support.

3

Focus on Three Core Brands.We intend to increase our focus and resources deployed to our three flagship brands,Quiksilver, Roxy andDC. We have already taken steps to reduce our brand portfolio from 11 brands to our three core brands, with the closure of theVSTR brand and exit of theSummer Teeth brand. We will consider strategic alternatives for our other peripheral brands. Additionally, we have recently clarified the brand positioning and gender focus of our core brands, withQuiksilver now focusing exclusively on men’s surf and snow,Roxy, our flagship brand for women, focusing on surf and snow, andDC refocused on its core heritage in skateboarding. This refinement will allow us to further drive sales and consumer awareness for each of the brands while reducing overlap across our brands. As part of this strategy, we have exited theQuiksilver women’s business and discontinued skateboarding lines atQuiksilverandRoxy. Within each of these brands, we will further focus on brand defining product categories (e.g. boardshorts atQuiksilver, swimsuits atRoxy and skate footwear atDC), while evaluating licensing opportunities for select peripheral product categories.

Operational Efficiencies. We intend to improve our operational efficiencies across four areas of focus:

Supply Chain Optimization

We have detailed plans to undertake specific initiatives designed to optimize our supply chain, contributing approximately $75 million of potential cost of goods savings and reduced general and administrative costs. These initiatives include:

| | • | | Demand Aggregation: Moving away from regional design/sourcing in local markets towards global product design and purchase orders, providing benefits of global scale |

| | • | | Style Rationalization: Reducing annual style counts currently being designed by at least 30% |

| | • | | Vendor Consolidation: Reducing vendor count from over 620 to less than 230, increasing average order size and utilizing more vendors across multiple brands |

| | • | | Strategic Sourcing: Shifting sourcing towards higher value countries, right-sizing our Asia sourcing operations and reducing our dependence on China, which currently accounts for approximately 55% of purchases |

Product Design

We plan to rationalize our global design team and transition from 21 local design centers to two global design Centers of Excellence, one in California and one in France. In order to allow for global idea sharing, these global design Centers of Excellence will coordinate amongst our employees and drive more efficient operations. In addition, we plan to reduce our design calendar from 66 weeks to 52 weeks and remove approximately 60% of the steps involved in our product design process that we no longer feel are necessary. We will also increase design focus on brand-defining “must-win” categories for each brand, improve alignment of our design teams with our supply chain and increase our percentage of global styles.

Sales Efficiency

We believe there is a significant opportunity to improve our sales efficiency across each of our channels. In our wholesale segment, we plan to use a single sales team to support all brands, redeploy marketing funds to point of sale support, accelerate investment in fast growing emerging markets, and improve governance over product pricing. In our retail operations, we will focus on closing underperforming locations, improving store labor scheduling, improving buying and merchandising processes and utilizing in-store technology to support e-commerce orders. In addition, we plan to leverage our e-commerce platform to grow sales by implementing a new backend fulfillment system, improving linkage to social media and mobile technology, and aligning global marketing messages on our websites to present consistent brand messaging.

4

Licensing

We believe that a significant licensing opportunity exists for our peripheral categories, which are not typically sold through our core wholesale channels. These categories are time and cost intensive to design, source, market and distribute in-house and currently account for an immaterial portion of our net revenues. We believe licensees would be able to operate these categories more efficiently, generating greater sales and strengthening our brands globally. We therefore plan to partner with third-party providers to offer these products, with Quiksilver to maintain approval over quality, design and distribution. Targeted license categories could include kids, eyewear, watches, gloves, bags and small accessories.

Reinvest in Demand Creation. As part of our multi-year Profit Improvement Plan, we plan to shift a majority of our marketing spend away from athletes and events, and towards traditional demand creation (in-store and print marketing along with digital and social media). In fiscal 2012, approximately 15% of our marketing budget was spent on traditional demand creation, while approximately 85% was spent on athletes, events, and the marketing team supporting these activities. We plan to deemphasize athletes and events, where we believe the return on marketing investment has been relatively low, and instead reprioritize traditional demand creation, shifting the proportion of our marketing budget spend on demand creation to approximately 70%, while reducing the investment in athletes and events. Additionally, we plan to reallocate a meaningful portion of our SG&A savings resulting from our multi-year Profit Improvement Plan to increase marketing spending. We believe a more targeted marketing approach will enable us to drive sales growth more efficiently.

Competitive Strengths

We believe the following competitive strengths position us to execute our strategic transformation and will drive our future growth:

Three Iconic, Global Action Sports Brands. Our three core brands represent an authentic lifestyle connection for young-minded people who aspire to our boardriding culture and heritage.Quiksilver is a leading men’s global action sports brand with over a 40-year heritage rooted in surfing, technical innovation and authenticity. Founded in 1969 in Australia as a boardshort brand for surfers,Quiksilver currently develops a broad range of innovative and technically superior apparel and accessories inspired by the boardriding lifestyle. Similarly,Roxy is a leading women’s global action sports brand founded in the surfing and snowboarding lifestyles and offers surf- and snowboarding- inspired collections including sportswear, swimwear, sandals, technical outerwear and other action sports apparel and accessories.DC is a leading global skateboarding and motocross inspired action sports brand specializing in performance skateboard shoes, sandals and apparel for young men. DC targets the alternative action sports lifestyle and we believe its brand image is well-positioned within the global outdoor youth market, with consumer appeal beyond its skateboarding base. Each of our core brands has demonstrated leadership within its target segment and extendibility across apparel, footwear and accessories on a global basis.

5

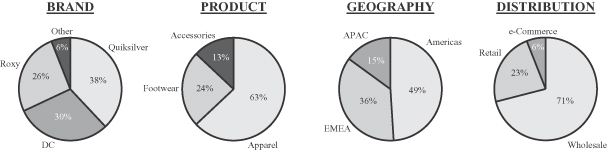

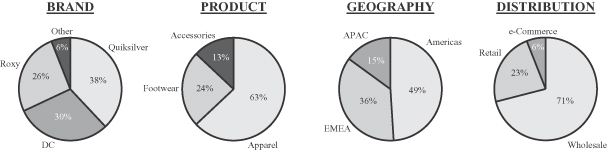

Globally Diversified Business Model. The following charts depict our diversified business model based on net revenues for the twelve months ended July 31, 2013 by brand, geography and distribution channel. The product chart is based on fiscal 2012 net revenues.

| | • | | By brand: Our three core brands,Quiksilver,Roxy andDC, offer authentic and technical products with significant scale and are targeted at separate customers. |

| | • | | By product: We offer a broad product range. Within apparel, we offer a range of products from boardshorts and technical outerwear to full lines of tops and bottoms. Within footwear, we offer performance skateboard shoes, sandals and casual shoes. We vary our products somewhat by region while maintaining global brand integrity and design consistency, making them globally recognizable and locally relevant. |

| | • | | By geography: Our products are sold in over 90 countries worldwide, with a majority of our revenue and earnings generated outside of the United States. Our businesses in emerging markets, such as Brazil, China and Russia, also contribute to growth and profitability and represent key growth opportunities for us. |

| | • | | By channel: We are primarily a wholesale portfolio of brands with approximately 70% of our products sold through our wholesale channels and approximately 30% through our own retail stores and via e-commerce. We distribute our products through approximately 48,000 doors worldwide. Our largest wholesale customer represented approximately 3% of our net revenues during fiscal 2012 and the majority of our customers are small independent surf, skate and snow shops. As of July 31, 2013, we operated 632 Company-owned retail stores, as well as dedicated e-commerce sites for each of our core brands. |

Recent Refinancing Enhances Liquidity Profile and Extends Maturities. We recently amended and restated our existing asset-based revolving credit facility for our Americas operations with a new five-year, $230 million asset-based revolving credit facility, which provides us with an improved liquidity profile and extends the maturity of the credit facility to 2018. By strengthening our balance sheet and extending our debt maturities, including as a result of the Recent Notes Offering described below and the use of proceeds therefrom, we believe we will have the financial flexibility to focus on executing our multi-year Profit Improvement Plan.

Experienced Management Team with Deep Industry Experience. Under our new organizational structure, our business is run by global heads of functional areas including, product design, marketing, supply chain, sales execution and administration. Our management team is led by Andy Mooney, who has over 30 years of experience in building consumer brands, developing worldwide marketing strategies and driving global growth. Prior to joining Quiksilver, Mr. Mooney spent 11 years at Disney Consumer Products and 20 years at Nike. The remainder of our senior executive team has substantial expertise and experience in managing successful global apparel and footwear companies.

6

Business Strategy

We believe we have significant opportunities to grow our net revenues and improve our profitability as we implement our strategic transformation. Our long-term business strategies include:

Strengthening Brands. We believe we can further strengthen our brand portfolio by increasing focus and resources on our core brands,Quiksilver,Roxy andDC.By narrowing our brand portfolio from 11 brands to our three core brands, reducing style counts and focusing each of our brands in the marketplace, we believe we have the opportunity to produce fewer, but better products that have a clear and consistent brand message.

Growing Sales. Under our multi-year Profit Improvement Plan, we expect to grow net revenues from fiscal 2012 to 2016 by a compounded annual growth rate of approximately 2.5%. We have several initiatives that we believe will drive revenue growth:

| | • | | Invest in demand creation: We plan to reallocate a meaningful portion of our current marketing spending to demand creation. In addition, we plan to redeploy a portion of the SG&A savings expected from our multi-year Profit Improvement Plan to increase our marketing spend by an extra 2.5% of net sales. |

| | • | | Improve sales efficiency: We believe that we have an opportunity to improve sales efficiency across each of our channels. In our wholesale segment, we plan to use a single sales team to support all brands, become more disciplined in our use and approval of discounts and redeploy marketing funds to point of sale support. In our retail operations, we will focus on continuing to close underperforming locations, improving store labor scheduling, improving buying and merchandising processes and utilizing in-store technology to support e-commerce orders. In addition, we plan to implement several e-commerce initiatives, including better aligning each of our websites with our global marketing messages in order to present our brands consistently. |

| | • | | Expansion in Brazil, China and Russia: We plan to accelerate investments in those regions where we believe we have a significant opportunity to rapidly grow and gain market share, including Brazil, China and Russia. |

Driving Operational Efficiencies. We believe that our multi-year Profit Improvement Plan provides us with a meaningful opportunity to improve our profitability and increase our operating margins. As we centralize our organization, we expect meaningful savings from reducing redundancies across geographies, including, but not limited to, headcount reductions, reducing overall style count and transforming from a brand-oriented to a customer account-oriented wholesale model. Once completed in fiscal 2016, we believe our multi-year Profit Improvement Plan will drive our operating margins to approximately 13% of net revenues which is more in line with our peer group. We believe our plan has the opportunity to increase our Adjusted EBITDA by approximately $150 million by the end of fiscal 2016.

| | • | | Through supply chain optimization, we expect to achieve approximately $75 million of potential cost of goods sold savings and reduced general and administrative costs. |

| | • | | Through centralizing global product design, sales efficiencies, licensing opportunities, improved pricing management, headcount, corporate overhead and other selling, general and administrative cost reductions, we plan to realize approximately $75 million in additional Adjusted EBITDA, net of the reinvestments we plan to make in demand creation, compared with our fiscal 2012 results. |

Improve Operating Cash Flow Generation. We believe our multi-year Profit Improvement Plan provides a significant opportunity to improve operating cash flow generation. We have moderate maintenance capital expenditure requirements, which we believe will result in strong cash conversion as our profitability improves over time. Additionally, we are focused on improving our operating cash flow generation through divesting peripheral brands, licensing peripheral product categories, improving inventory turnover, and centralizing treasury operations.

7

New Asset-Based Credit Facility

On May 24, 2013, we amended and restated our existing asset-based revolving credit facility for our Americas operations (the “Americas Credit Facility”). The new asset-based revolving credit facility (the “ABL Credit Facility”) increased the maximum borrowing capacity to $230 million, expanded the perimeter to include our operations in the United States, Canada, Japan and Australia, and extended the maturity of the credit facility to 2018. We used a portion of the initial borrowings under the ABL Credit Facility to repay all amounts outstanding under our then existing asset-based revolving credit facility for our Americas operations and our then existing credit facility for our APAC operations ($78.8 million and $14.0 million, respectively).

For more information regarding the ABL Credit Facility, see “Description of Certain Other Indebtedness.”

Recent Notes Offering

On July 16, 2013, the Issuers issued (i) $280,000,000 aggregate principal amount of their 7.875% Senior Secured Notes due 2018 (the “Existing Senior Secured Notes”) pursuant to the indenture, dated as of July 16, 2013, by and among the Issuers, the subsidiary guarantors party thereto and Wells Fargo Bank, National Association, as trustee and as collateral agent, and (ii) $225,000,000 aggregate principal amount of the old notes pursuant to the indenture, dated as of July 16, 2013, by and among the Issuers, the guarantors party thereto and Wells Fargo Bank, National Association, as trustee (the “Recent Notes Offering”). The following table summarizes the sources and uses of funds in connection with Recent Notes Offering and the ABL Credit Facility described above under “—New Asset-Based Credit Facility.” You should read the following together with the information above under “—New Asset-Based Credit Facility” and in “Description of Certain Other Indebtedness.”

| | | | | | | | | | |

Sources | | Amount | | | Uses | | Amount | |

| (Dollars in millions) | |

ABL Credit Facility(1) | | $ | 24.8 | | | Repay Americas Credit Facility(1) | | $ | 78.8 | |

Existing Senior Secured Notes(2) | | | 278.6 | | | Repay APAC Credit Facility(1) | | | 14.0 | |

Old Notes(3) | | | 222.2 | | | Repay Americas Term Loan(4) | | | 14.0 | |

| | | | | | Redeem Redeemed Notes(4) | | | 409.2 | |

| | | | | | Estimated fees and expenses(5) | | | 9.6 | |

| | | | | | | | | | |

Total Sources | | $ | 525.6 | | | Total Uses | | $ | 525.6 | |

| | | | | | | | | | |

| (1) | We entered into the ABL Credit Facility on May 24, 2013 and borrowed an aggregate principal amount of $93 million thereunder, which replaced all borrowings then outstanding under the Americas Credit Facility and our credit facility for our APAC operations (the “APAC Credit Facility”). We used a portion of the proceeds from the Recent Notes Offering to reduce the amount of borrowings under the ABL Credit Facility outstanding at the time of the closing of the Recent Notes Offering. The actual amount outstanding under the ABL Credit Facility after the closing of the Recent Notes Offering may differ from the amount reflected in the table above due to our normal working capital fluctuations. The ABL Credit Facility has a five-year maturity and provides for aggregate revolving borrowings in multiple jurisdictions up to $230 million, subject to sub-limits for borrowers in each jurisdiction and customary borrowing base limitations, and includes an option to expand the aggregate commitments by up to an additional $125 million on certain conditions. For a more detailed description of the ABL Credit Facility, see “Description of Certain Other Indebtedness.” |

8

| (2) | Reflects the gross proceeds from the sale of the Existing Senior Secured Notes, issued at a price of 99.483%. |

| (3) | Reflects the gross proceeds from the sale of the old notes, issued at a price of 98.757%. |

| (4) | We used approximately $14.0 million of the net proceeds from the Recent Notes Offering to repay in full and terminate our term loan for our Americas’ operations (the “Americas Term Loan”) as of July 16, 2013 and approximately $409.2 million of the net proceeds from the Recent Notes Offering to redeem all of Quiksilver, Inc.’s outstanding 6.875% Senior Notes due 2015 (the “Redeemed Notes”) as of August 15, 2013. |

| (5) | Reflects the fees and expenses paid by us in connection with the Recent Notes Offering and the use of the proceeds therefrom, including placement and underwriting discounts, professional fees and other transaction costs and expenses. Does not include fees and expenses incurred in connection with our entry into the ABL Credit Facility on May 24, 2013. |

Issuer Information

Quiksilver, Inc., incorporated under the laws of the State of Delaware, is a publicly traded company with common stock listed on the New York Stock Exchange under the symbol “ZQK.” QS Wholesale, Inc., incorporated under the laws of the State of California, is a wholly-owned subsidiary of Quiksilver, Inc. Our executive offices are located at 15202 Graham Street, Huntington Beach, California 92649, and our telephone number is (714) 889-2200. Our website iswww.quiksilverinc.com. However, the information on our website is not part of this prospectus.

9

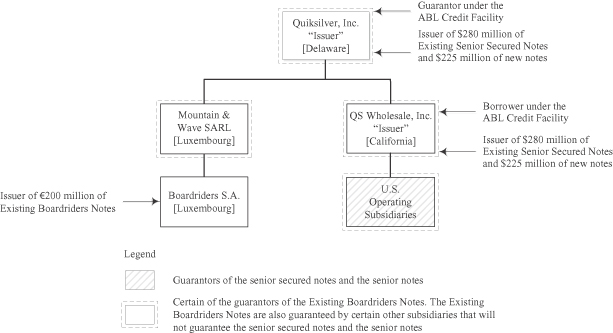

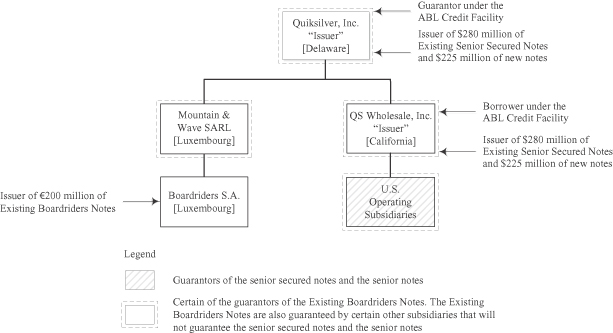

Organizational Structure

The following chart illustrates our simplified organizational structure as of the date of this prospectus, after giving effect to this exchange offer:

Not all of the subsidiaries of Quiksilver, Inc. will guarantee the new notes. In the event of a bankruptcy, liquidation or reorganization of any of these non-guarantor subsidiaries, such non-guarantor subsidiaries will pay the holders of their debt (including their guarantees of other debt) and their trade creditors before they will be able to distribute any of their assets to the Issuers or the guarantors of the new notes. For the twelve months ended July 31, 2013, our non-guarantor subsidiaries had net revenues of approximately $1,182.4 million, which represented approximately 61% of our consolidated net revenues, and net income from continuing operations of approximately $24.3 million, compared to our $57.1 million consolidated net loss from continuing operations attributable to Quiksilver, Inc., and Adjusted EBITDA of approximately $80.7 million, which represented approximately 78% of our Adjusted EBITDA, and, as of July 31, 2013, our non-guarantor subsidiaries had total assets of approximately $1,241.6 million, which represented approximately 57% of our consolidated total assets. The foregoing consolidated amounts are inclusive of the results of operations and financial position of Quiksilver, Inc., the entity at which we incur all of our corporate level expenses. If such consolidated amounts excluded Quiksilver, Inc., the non-guarantor subsidiaries would have represented approximately 61% of both the net income from continuing operations attributable to all of Quiksilver, Inc.’s subsidiaries as a group and the Adjusted EBITDA of such group for the twelve months ended July 31, 2013.

10

Summary Description of the Exchange Offer

We are offering to exchange up to $225,000,000 aggregate outstanding principal amount of the new notes for a like aggregate principal amount of the old notes, as described below. The “The Exchange Offer; Registration Rights Agreement,” section in this prospectus contains a more complete description of the terms and conditions of the exchange offer.

Old Notes | 10.000% Senior Notes due 2020, which the Issuers issued on July 16, 2013. The old notes were issued under the indenture, dated as of July 16, 2013, by and among the Issuers, the guarantors party thereto and Wells Fargo Bank, National Association, as trustee. |

New Notes | 10.000% Senior Notes due 2020, the issuance of which has been registered under the Securities Act. The form and the terms of the new notes are substantially identical to those of the old notes, except that the transfer restrictions, registration rights and special interest provisions relating to the old notes do not apply to the new notes. |

Exchange Offer for Notes | The Issuers are offering to issue up to $225,000,000 aggregate principal amount of new notes in exchange for a like principal amount of old notes to satisfy our obligations under the registration rights agreement that the Issuers entered into when the old notes were issued in a transaction consummated in reliance upon the exemptions from registration provided by Rule 144A and Regulation S under the Securities Act. |

Expiration Date; Tenders | The exchange offer will expire at 5:00 p.m., New York City time, on November 7, 2013, unless we extend or earlier terminate the exchange offer. By tendering your old notes, you represent to us that: |

| | • | | any new notes you receive in the exchange offer are being acquired by you in the ordinary course of your business; |

| | • | | at the time of the commencement of the exchange offer, neither you nor, to your knowledge, anyone receiving new notes from you, has any arrangement or understanding with any person to participate in the distribution, as defined in the Securities Act, of the new notes in violation of the Securities Act; |

| | • | | you are neither our “affiliate,” as defined in Rule 405 under the Securities Act, nor a broker-dealer tendering old notes acquired directly from the Issuers for your own account; |

| | • | | if you are a broker-dealer that will receive the new notes in exchange for old notes that were acquired for your own account as a result of market-making or other trading activities, you will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the new notes you receive; for further information regarding resales of the new notes by participating broker-dealers, see the discussion under the caption “Plan of Distribution”; and |

11

| | • | | if you are not a broker-dealer, you are not engaged in, and do not intend to engage in, the distribution, as defined in the Securities Act, of the new notes. |

Withdrawal; Non-Acceptance | You may withdraw any old notes tendered in the exchange offer at any time prior to 5:00 p.m., New York City time, on November 7, 2013, unless we extend or earlier terminate the exchange offer. If we decide for any reason not to accept any old notes tendered for exchange, the old notes will be returned to the registered holder at our expense promptly after the expiration or termination of the exchange offer. In the case of old notes tendered by book-entry transfer into the exchange agent’s account at The Depository Trust Company (“DTC”), any withdrawn or unaccepted old notes will be credited to the tendering holder’s account at DTC. For further information regarding the withdrawal of tendered old notes, see “The Exchange Offer; Registration Rights Agreement—Terms of the Exchange Offer; Period for Tendering Old Notes” and “The Exchange Offer; Registration Rights Agreement—Withdrawal Rights.” |

Conditions to the Exchange Offer | We are not required to accept for exchange or to issue new notes in exchange for any old notes, and we may terminate or amend the exchange offer, if any of the following events occur prior to the expiration of the exchange offer: |

| | • | | the exchange offer violates any applicable law or applicable interpretation of the staff of the SEC; |

| | • | | an action or proceeding shall have been instituted or threatened in any court or by any governmental agency that might materially impair our or the guarantors’ ability to proceed with the exchange offer; |

| | • | | we do not receive all the governmental approvals that we believe are necessary to consummate the exchange offer; or |

| | • | | there has been proposed, adopted, or enacted any law, statute, rule or regulation that, in our reasonable judgment, would materially impair our ability to consummate the exchange offer. |

| | We may waive any of the above conditions in our reasonable discretion. See the discussion below under the caption ���The Exchange Offer; Registration Rights Agreement—Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer. |

Procedures for Tendering Old Notes | Unless you comply with the procedure described below under the caption “The Exchange Offer; Registration Rights Agreement—Guaranteed Delivery Procedures,” you must do one of the following on or prior to the expiration or termination of the exchange offer to participate in the exchange offer: |

| | • | | tender your old notes by sending (i) the certificates for your old notes (in proper form for transfer), (ii) a properly completed and |

12

| | duly executed letter of transmittal and (iii) all other documents required by the letter of transmittal to Wells Fargo Bank, National Association, as exchange agent, at one of the addresses listed below under the caption “The Exchange Offer; Registration Rights Agreement—Exchange Agent”; or |

| | • | | tender your old notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly executed letter of transmittal, or an agent’s message instead of the letter of transmittal, to the exchange agent. For a book-entry transfer to constitute a valid tender of your old notes in the exchange offer, Wells Fargo Bank, National Association, as exchange agent, must receive a confirmation of book-entry transfer of your old notes into the exchange agent’s account at DTC prior to the expiration or termination of the exchange offer. For more information regarding the use of book-entry transfer procedures, including a description of the required agent’s message, see the discussion below under the caption “Book Entry, Delivery and Form.” As used in this prospectus, the term “agent’s message” means a message, transmitted by DTC to and received by the exchange agent and forming a part of a book-entry confirmation, which states that DTC has received an express acknowledgment from the tendering participant stating that such participant has received and agrees to be bound by the letter of transmittal and that we may enforce such letter of transmittal against such participant. |

Guaranteed Delivery Procedures | If you are a registered holder of old notes and wish to tender your old notes in the exchange offer, but: |

| | • | | the old notes are not immediately available; |

| | • | | time will not permit your old notes or other required documents to reach the exchange agent before the expiration or termination of the exchange offer; or |

| | • | | the procedure for book-entry transfer cannot be completed prior to the expiration or termination of the exchange offer; |

| | then you may tender old notes by following the procedures described below under the caption “The Exchange Offer; Registration Rights Agreement—Guaranteed Delivery Procedures. |

Special Procedures for Beneficial Owners | If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the exchange offer, you should promptly contact the person in whose name the old notes are registered and instruct that person to tender them on your behalf. If you wish to tender in the exchange offer on your own behalf, prior to completing and executing the letter of transmittal and delivering your old notes, you must either make appropriate arrangements to |

13

| | register ownership of the old notes in your name, or obtain a properly completed bond power from the person in whose name the old notes are registered. |

Material United States Federal Income Tax Considerations | The exchange of old notes for new notes in the exchange offer will not be a taxable transaction for United States federal income tax purposes. See the discussion below under the caption “Material United States Federal Income Tax Considerations” for more information regarding the United States federal income tax consequences to you of the exchange offer. |

Use of Proceeds | We will not receive any proceeds from the exchange offer. |

Exchange Agent | Wells Fargo Bank, National Association is the exchange agent for the exchange offer. You can find the address and telephone number of the exchange agent below under the caption, “The Exchange Offer; Registration Rights Agreement—Exchange Agent.” |

Resales | Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties, we believe that the new notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: |

| | • | | you are acquiring the new notes in the ordinary course of your business; |

| | • | | you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in a distribution of the new notes; and |

| | • | | you are neither an affiliate of ours nor a broker-dealer tendering old notes acquired directly from the Issuers for your own account. |

| | If you are an affiliate of ours, are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in, the distribution of new notes: |

| | • | | you cannot rely on the applicable interpretations of the staff of the SEC; |

| | • | | you will not be entitled to tender your old notes in the exchange offer; and |

| | • | | you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. |

| | Each broker or dealer that receives new notes for its own account in exchange for old notes that were acquired as a result of market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of |

14

| | the Securities Act in connection with any offer, resale or other transfer of the new notes issued in the exchange offer, including information with respect to any selling holder required by the Securities Act in connection with any resale of the new notes. Furthermore, any broker-dealer that acquired any of its old notes directly from the Issuers: |

| | • | | may not rely on the applicable interpretation of the staff of the SEC’s position contained in Morgan Stanley & Co. Incorporated, SEC no-action letter (publicly available June 5, 1991) and Exxon Capital Holdings Corp., SEC no-action letter (publicly available May 13, 1988), as interpreted in Shearman & Sterling, SEC no-action letter (publicly available July 2, 1993) and similar no-action letters; and |

| | • | | must also be named as a selling noteholder in connection with the registration and prospectus delivery requirements of the Securities Act relating to any resale transaction. |

Broker-Dealers | Each broker-dealer that receives new notes in exchange for old notes that were acquired for its own account as a result of market-making activities or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities (other than old notes acquired directly from the Issuers). Under the registration rights agreement, the Issuers have agreed that for a period of up to the earlier of (i) 180 days after the date on which the registration statement of which this prospectus forms a part is declared effective and (ii) the date on which a broker-dealer is no longer required to deliver this prospectus in connection with market-making or other trading activities, the Issuers will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution” beginning on page 153 for more information. |

Registration Rights Agreement for the Old Notes | When the Issuers issued the old notes on July 16, 2013, the Issuers entered into a registration rights agreement with the guarantors and the initial purchasers of the old notes party thereto. Under the terms of the registration rights agreement, the Issuers and the guarantors agreed to: |

| | • | | file the exchange offer registration statement with the SEC on or prior to February 11, 2014; |

15

| | • | | use commercially reasonable efforts to cause the exchange offer registration statement to be declared effective no later than May 12, 2014; |

| | • | | use commercially reasonable efforts to cause the exchange offer to be consummated on the earliest practicable date after the exchange offer registration statement is declared effective, but in no event later than 30 business days after the effective date of the exchange offer registration statement; |

| | • | | use commercially reasonable efforts to file a shelf registration statement for the resale of the old notes if we cannot effect an exchange offer within the time periods listed above and in certain other circumstances; and |

| | • | | if we fail to meet our registration obligations under the registration rights agreement, we will pay special interest at a rate of 0.25% per annum for the first 90-day period immediately following the occurrence of such default, to be increased by an additional 0.25% per annum with respect to each subsequent 90-day period until all such defaults have been cured, up to a maximum special interest rate of 1.0% per annum. |

Consequences of Not Exchanging Old Notes

If you do not exchange your old notes in the exchange offer, you will continue to be subject to the restrictions on transfer described in the legend on the certificate for your old notes. In general, you may offer or sell your old notes only:

| | • | | if they are registered under the Securities Act and applicable state securities laws; |

| | • | | if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

| | • | | if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

We do not intend to register the old notes under the Securities Act, and holders of old notes that do not exchange old notes for new notes in the exchange offer will no longer have registration rights with respect to the old notes except in the limited circumstances provided in the registration rights agreement. Under some circumstances, as described in the registration rights agreement, holders of the old notes, including holders who are not permitted to participate in the exchange offer or who may not freely sell new notes received in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of the old notes by such holders. For more information regarding the consequences of not tendering your old notes and our obligations to file a shelf registration statement, see “The Exchange Offer; Registration Rights Agreement—Consequences of Exchanging or Failing to Exchange Old Notes” and “The Exchange Offer; Registration Rights Agreement—Registration Rights Agreement.”

16

Summary Description of the New Notes

The summary below describes the principal terms of the new notes. The terms of the new notes and those of the old notes are substantially identical, except that the transfer restrictions, registration rights and special interest provisions relating to the old notes do not apply to the new notes. Certain of the terms and conditions described below are subject to important limitation and exceptions. The “Description of the New Notes” section of this prospectus contains a more detailed description of the terms and conditions of the new notes. For purposes of this section, references to the “Company” refer only to Quiksilver, Inc. and not to any of its subsidiaries; references to the “Issuers” refer only to Quiksilver, Inc. and QS Wholesale, Inc. collectively and individually, as applicable, and not to any of their subsidiaries; and references to “we,” “us,” and “our” refer to Quiksilver, Inc. and all of its consolidated subsidiaries collectively, including QS Wholesale, Inc.

Issuers | Quiksilver, Inc. and QS Wholesale, Inc. |

Notes Offered | $225,000,000 aggregate principal amount of 10.000% Senior Notes due 2020. The Issuers may issue additional notes in the future, subject to compliance with the covenants in the indenture governing the notes. |

Maturity | August 1, 2020, unless earlier redeemed or repurchased. |

Interest Rate | 10.000% per year on the principal amount. |

Interest Payment Dates | Interest will be payable semi-annually in arrears on February 1 and August 1 of each year, beginning on February 1, 2014. The new notes will bear interest from the most recent date to which interest has been paid on the old notes. If no interest has been paid on the old notes, holders of new notes will receive interest accruing from July 16, 2013. If your old notes are tendered and accepted for exchange, you will receive interest on the new notes and not on the old notes. Any old notes not tendered or not accepted for exchange will remain outstanding and will continue to accrue interest according to their terms. |

Denominations | Each new note will have a minimum denomination of $2,000 or integral multiples of $1,000 in excess thereof. |

Form and Terms | The form and terms of the new notes will be the same as the form and terms of the old notes except that: |

| | • | | the new notes will bear a different CUSIP number from the old notes; |

| | • | | the new notes have been registered under the Securities Act and, therefore, will not bear legends restricting their transfer; and |

| | • | | you will not be entitled to any exchange or registration rights with respect to the new notes, and the new notes will not provide for special interest in connection with registration defaults. |

| | The new notes will evidence the same debt as the old notes. They will be entitled to the benefits of the indenture governing the notes and will be treated under the indenture as a single class with the old notes. |

17

Guarantees | The new notes will be unconditionally guaranteed, jointly and severally, on a senior unsecured basis by each of the Company’s existing and future domestic restricted subsidiaries (other than QS Wholesale, Inc.) that guarantees any indebtedness of the Issuers or any of the Company’s restricted subsidiaries, or is an obligor under the ABL Credit Facility. |

Ranking | The new notes and the related guarantees will be unsecured senior obligations. Accordingly, they will: |

| | • | | rank equally in right of payment to all of the Issuers’ and the guarantors’ existing and future senior unsecured debt; |

| | • | | rank senior in right of payment to the Issuers’ and the guarantors’ future debt, if any, that is expressly subordinated in right of payment to the new notes and the related guarantees; |

| | • | | be effectively subordinated to the Issuers’ and the guarantors’ secured indebtedness, including indebtedness under the ABL Credit Facility and the Existing Senior Secured Notes, to the extent of the value of the collateral securing such indebtedness; and |

| | • | | be structurally subordinated to all of the existing and future liabilities, including trade payables, of any of the Company’s subsidiaries (other than QS Wholesale, Inc.) that do not guarantee the new notes. |

| | • | | the Issuers and the guarantors had approximately $287.6 million of secured indebtedness (including $278.6 million of the Existing Senior Secured Notes) and would have been able to borrow at least $99.4 million of additional secured indebtedness under the ABL Credit Facility, all of which secured indebtedness would be effectively senior to the new notes to the extent of the value of the collateral securing such indebtedness; |

| | • | | the non-guarantor subsidiaries had approximately $574.2 million of total indebtedness and other liabilities (excluding intercompany liabilities), including the Existing Boardriders Notes and trade payables; and |

| | • | | the Issuers and the guarantors had guarantees outstanding in respect of $265.3 million of Existing Boardriders Notes, which guarantees would rank equal in right of payment with the new notes and related guarantees (except that the Existing Boardriders Notes were issued by Boardriders S.A., a subsidiary that will not guarantee the new notes, and are guaranteed by other European and Asian subsidiaries that will not guarantee the new notes). |

| | Not all of the subsidiaries of Quiksilver, Inc. will guarantee the new notes. For the twelve months ended July 31, 2013, our non-guarantor subsidiaries had net revenues of approximately $1,182.4 million, which represented approximately 61% of our consolidated net |

18

| | revenues, net income from continuing operations of approximately $24.3 million, compared to our $57.1 million consolidated net loss from continuing operations attributable to Quiksilver, Inc., and Adjusted EBITDA of approximately $80.7 million, which represented approximately 78% of our Adjusted EBITDA, and, as of July 31, 2013, our non-guarantor subsidiaries had total assets of approximately $1,241.6 million, which represented approximately 57% of our consolidated total assets. The foregoing consolidated amounts are inclusive of the results of operations and financial position of Quiksilver, Inc., the entity at which we incur all of our corporate level expenses. If such consolidated amounts excluded Quiksilver, Inc., the non-guarantor subsidiaries would have represented approximately 61% of both the net income from continuing operations attributable to all of Quiksilver, Inc.’s subsidiaries as a group and the Adjusted EBITDA of such group for the twelve months ended July 31, 2013. |

Repurchase Upon Change of Control | If either of the Issuers undergoes a “change of control” (as defined in this prospectus under “Description of the New Notes—Change of Control”), subject to certain conditions, you will have the option to require the Issuers to purchase all or any portion of your new notes for cash. The change of control purchase price will be 101% of the principal amount of the new notes to be purchased plus accrued and unpaid interest to, but excluding, the change of control purchase date. |

Optional Redemption | On or after August 1, 2016 and prior to the maturity date, the Issuers may redeem some or all of the new notes at any time at the redemption prices described in “Description of the New Notes—Optional Redemption,” plus accrued and unpaid interest, if any, to, but excluding, the redemption date. |

| | Before August 1, 2016, the Issuers may redeem some or all of the new notes at any time at a redemption price of 100% of the principal amount of the new notes redeemed, plus a “make-whole” premium as described under “Description of the New Notes—Optional Redemption” and accrued and unpaid interest, if any, to, but excluding, the redemption date. |

| | Before August 1, 2016, the Issuers may redeem up to 35% of the aggregate principal amount of the new notes with the proceeds from certain equity offerings at the redemption price described in “Description of the New Notes—Optional Redemption,” plus accrued and unpaid interest, if any, to, but excluding, the redemption date. |

Asset Sale Proceeds | If we sell assets under certain circumstances, we may be required to offer to purchase the new notes from holders at a purchase price equal to 100% of the principal amount plus accrued and unpaid interest thereon. See “Description of the New Notes—Certain Covenants—Limitation on Asset Sales.” |

19

Certain Covenants | The Issuers will issue the new notes under the indenture, dated as of July 16, 2013, by and among the Issuers, the guarantors party thereto and Wells Fargo Bank, National Association, as trustee. The indenture, among other things, restricts the ability of the Issuers and the Company’s restricted subsidiaries to: |

| | • | | incur additional debt and guarantees; |

| | • | | pay distributions or dividends and repurchase stock; |

| | • | | make other restricted payments, including without limitation, certain restricted investments; |

| | • | | transfer or sell assets; |

| | • | | enter into agreements that restrict dividends from subsidiaries; |

| | • | | engage in transactions with affiliates; and |

| | • | | enter into mergers, consolidations or sales of all or substantially all of the assets of the Issuers. |

| | These covenants are subject to a number of important exceptions, limitations and qualifications that are described under “Description of the New Notes—Certain Covenants.” Many of these covenants will be suspended before the notes mature if the specified rating agencies both assign the notes investment grade ratings in the future and no default exists under the indenture. |

No Prior Market; No Listing | The new notes will be a new issue of securities for which there is currently no market. The new notes will not be listed on any national securities exchange or included on any automated dealer quotation system. Accordingly, we cannot assure you that a liquid market for the new notes will develop or be maintained. |

Trustee | Wells Fargo Bank, National Association. |

Risk Factors | You should refer to the section entitled “Risk Factors,” beginning on page 23, as well as the other information included in or incorporated by reference into this prospectus for a discussion of certain risks involved in investing in the notes and tendering your old notes in the exchange offer. |

20

Summary Historical Consolidated Financial and Other Data

The following table presents our summary historical consolidated financial and other data as of July 31, 2013, for the nine months ended July 31, 2013 and 2012, as of and for the years ended October 31, 2012, 2011 and 2010, and for the twelve months ended July 31, 2013. The summary historical consolidated financial and other data as of October 31, 2012 and 2011 and for the years ended October 31, 2012, 2011 and 2010 have been derived from our audited historical consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial and other data as of October 31, 2010 has been derived from our audited historical financial statements not included in this prospectus. The summary historical consolidated financial and other data as of July 31, 2013, and for the nine months ended July 31, 2013 and 2012, have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited historical financial data for the twelve months ended July 31, 2013 has been derived by adding our historical financial data for the year ended October 31, 2012 to our historical financial data for the nine months ended July 31, 2013 and subtracting our historical financial data for the nine months ended July 31, 2012. Results for the nine months ended July 31, 2013 are not necessarily indicative of the results to be expected for the full year or for any other period. The unaudited interim summary historical consolidated financial data reflect all adjustments, consisting only of normal and recurring adjustments, which are, in the opinion of management, necessary to present fairly the financial data for the interim periods.

The summary historical consolidated financial and other data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements and related notes included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Twelve

Months Ended

July 31, | | | For the Nine Months

Ended July 31, | | | For the Year Ended October 31, | |

| | | 2013(1) | | | 2013(1) | | | 2012(1) | | | 2012(1) | | | 2011(1) | | | 2010(1)(2) | |

| | | (Dollars in thousands) | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues, net | | $ | 1,944,496 | | | $ | 1,385,530 | | | $ | 1,454,273 | | | $ | 2,013,239 | | | $ | 1,953,061 | | | $ | 1,837,620 | |

Cost of goods sold | | | 1,012,119 | | | | 709,912 | | | | 730,686 | | | | 1,032,893 | | | | 929,227 | | | | 870,372 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 932,377 | | | | 675,618 | | | | 723,587 | | | | 980,346 | | | | 1,023,834 | | | | 967,248 | |

Selling, general and administrative expense | | | 895,973 | | | | 660,042 | | | | 680,213 | | | | 916,144 | | | | 895,949 | | | | 832,066 | |

Asset impairments | | | 17,330 | | | | 10,652 | | | | 556 | | | | 7,234 | | | | 86,373 | | | | 11,657 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income/(loss) | | | 19,074 | | | | 4,924 | | | | 42,818 | | | | 56,968 | | | | 41,512 | | | | 123,525 | |

Interest expense, net | | | 66,350 | | | | 50,991 | | | | 45,464 | | | | 60,823 | | | | 73,808 | | | | 114,109 | |

Foreign currency loss/(gain) | | | 7,661 | | | | 4,629 | | | | (4,701 | ) | | | (1,669 | ) | | | (111 | ) | | | (5,917 | ) |

Provision/(benefit) for income taxes | | | 2,966 | | | | 10,322 | | | | 14,913 | | | | 7,557 | | | | (14,315 | ) | | | 23,433 | |

Less: net loss/(income) attributable to non-controlling interest | | | 809 | | | | (435 | ) | | | (2,257 | ) | | | (1,013 | ) | | | (3,388 | ) | | | (3,414 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net loss from continuing operations attributable to Quiksilver, Inc. | | | (57,094 | ) | | | (61,453 | ) | | | (15,115 | ) | | | (10,756 | ) | | | (21,258 | ) | | | (11,514 | ) |

Income from discontinued operations attributable to Quiksilver, Inc., net of tax | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,830 | |

| | | | | | | | | | | | | | | | | | | | | | | | |