UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement | o Confidential, For Use of the |

þ Definitive Proxy Statement | Commission Only (as permitted by |

o Definitive Additional Materials | Rule 14a-6(e)(2)) |

o Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | |

BCM ENERGY PARTNERS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee

(Check the appropriate box):

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

BCM ENERGY PARTNERS, INC.

(F/K/A AEON HOLDINGS, INC.)

301 St. Charles, Fl 3

New Orleans, LA 70130

July 22, 2011

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders of BCM Energy Partners, Inc. (f/k/a AEON Holdings, Inc.) that will be held on August 15, 2011, at 2:00 p.m., Central Daylight Time, at 301 St. Charles Avenue, Fl 3, New Orleans, LA 70130

The formal notice of a Special Meeting and the Proxy Statement have been made a part of this invitation.

After reading the Proxy Statement, please mark, date, sign and return, at your earliest convenience, the enclosed proxy in the enclosed prepaid envelope, to ensure that your shares will be represented. You may also vote via the Internet at the following web address: www.proxyvote.com or by telephone by calling 1-800-690-6903.

YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY OR ATTEND A SPECIAL MEETING IN PERSON. Your vote is important, so please return your proxy promptly.

We look forward to seeing you at the meeting.

Sincerely yours,

/s/ Dr. Raymond G. Bailey P.E.

Dr. Raymond G. Bailey P.E.

Chairman and Chief Executive Officer

BCM ENERGY PARTNERS, INC.

(F/K/A AEON HOLDINGS, INC.)

New Orleans, Louisiana

NOTICE OF THE

SPECIAL MEETING OF STOCKHOLDERS

AUGUST 15, 2011

TO THE STOCKHOLDERS OF

BCM ENERGY PARTNERS, INC.:

Notice is hereby given that a Special Meeting of the Stockholders of BCM Energy Partners, Inc., a Delaware corporation formerly known as AEON Holdings, Inc. (the “Corporation”), for 2011, will be held on the 15th day of August, 2011, at 2:00 p.m. Central Daylight Time, at 301 St. Charles Ave., Fl 3, New Orleans, LA 70130. At a Special Meeting, you will be asked to consider and act upon the following matters:

| | 1. | The adoption of our Restated Certificate of Incorporation to effect a fifty to one reverse stock split and the other amendments as set forth on Annex A. |

| | 2. | The transaction of such other business as may properly come before a Special Meeting. |

Only holders of record of the Corporation’s preferred and common stock at the close of business on July 11, 2011 are entitled to notice of and to vote at a Special Meeting or any adjournment thereof. If there are not sufficient votes for a quorum or to approve or ratify resolutions at the time of a Special Meeting, a Special Meeting may be adjourned in order to permit further solicitation of proxies by the Corporation.

Information concerning the matters to be considered and voted upon at a Special Meeting is contained in the attached Proxy Statement. It is important that your shares be represented at a Special Meeting, regardless of the number you hold. To ensure your representation at a Special Meeting, if you are a stockholder of record, you may vote in person at a Special Meeting. We will give you a ballot when you arrive. If you do not wish to vote in person or if you will not be attending a Special Meeting, you may vote by proxy. Whether or not you plan to attend in person, please mark, date and sign the enclosed proxy and mail it promptly. A return envelope is enclosed for your convenience. You may also vote via the Internet at the following web address: www.proxyvote.com or by telephone by calling 1-800-690-6903.

By Order of the Board of Directors

/s/ Dr. Raymond G. Bailey P.E.

Dr. Raymond G. Bailey P.E.

Chairman and Chief Executive Officer

July 22, 2011

BCM ENERGY PARTNERS, INC.

(F/K/A AEON HOLDINGS, INC.)

301 St. Charles, Fl 3

New Orleans, LA 70130

______________________

PROXY STATEMENT

______________________

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of BCM Energy Partners, Inc., a Delaware corporation formerly known as AEON Holdings, Inc. (the “Company”), of proxies in the accompanying form to be used at a Special Meeting of Stockholders of the Company to be held at 301 St. Charles, Fl 3, New Orleans, LA 70130, on August 15, 2011, at 2:00 p.m., Central Daylight Time, and any postponement or adjournment thereof (the “Special Meeting”).

Revocation of Proxies

The shares represented by the proxies received in response to this solicitation and not properly revoked will be voted at a Special Meeting in accordance with the instructions therein. A stockholder who has given a proxy may revoke it at any time before it is exercised by filing with the Secretary of the Company a written revocation, by submitting a duly executed proxy bearing a later date, or by voting in person at a Special Meeting. If your shares are held by a broker, bank or other stockholder of record, in nominee name or otherwise, exercising fiduciary powers (typically referred to as being held in “street name”), and you wish to vote at a Special Meeting, you must obtain and bring to a Special Meeting a proxy card issued in your name from the broker, bank or other nominee. You may also vote via the Internet at the following web address: www.proxyvote.com or by telephone by calling 1-800-690-6903. On the matters coming before a Special Meeting for which a choice has been specified by a stockholder, the shares will be voted accordingly. If no choice is specified, the shares will be voted “FOR” each of the director nominees and the proposal to adopt the Company’s Restated Certificate of Incorporation attached as Annex A.

Who Can Vote

Stockholders of record at the close of business on July 11, 2011 (the “Record Date”) are entitled to vote at a Special Meeting. As of the Record Date, there were 112,965,019 shares of common stock, $0.0001 par value (the “Common Stock”), outstanding. The presence in person or by proxy of the holders of a majority of the outstanding Common Stock constitutes a quorum for the transaction of business at a Special Meeting. Each holder of Common Stock is entitled to one vote for each share held as of the Record Date.

Required Vote

The proposal to adopt the Restated Certificate of Incorporation will be decided by the affirmative vote of the majority of the shares present in person or represented by proxy at a Special Meeting and entitled to vote on such proposal. Abstentions with respect to any proposal are treated as shares present or represented and entitled to vote on that proposal and thus have the same effect as negative votes. If a broker which is the record holder of shares indicates on a proxy that it does not have discretionary authority to vote on a particular proposal as to such shares, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to a particular proposal, these non-voted shares will be counted for quorum purposes, but are not deemed to be present or represented for purposes of determining whether stockholder approval of that proposal has been obtained.

How to Vote

If you are a stockholder with shares registered in your name, you should complete, sign, date and mail the proxy in the envelope provided. You may also vote via the Internet at the following web address: www.proxyvote.com or by telephone by calling 1-800-690-6903. If your shares are held in street name, you may receive a separate voting instruction form with this Proxy Statement, or you may need to contact your broker, bank or other stockholder of record to determine whether you will be able to vote electronically via the Internet or by telephone.

This Proxy Statement and the accompanying form of proxy are being mailed to stockholders on or about July 22, 2011.

IMPORTANT

Please mark, sign and date the enclosed proxy and return it at your earliest convenience in the enclosed postage-prepaid return envelope so that, whether you intend to be present at a Special Meeting or not, your shares can be voted. You may also vote via the Internet at the following web address: www.proxyvote.com or by telephone by calling 1-800-690-6903.

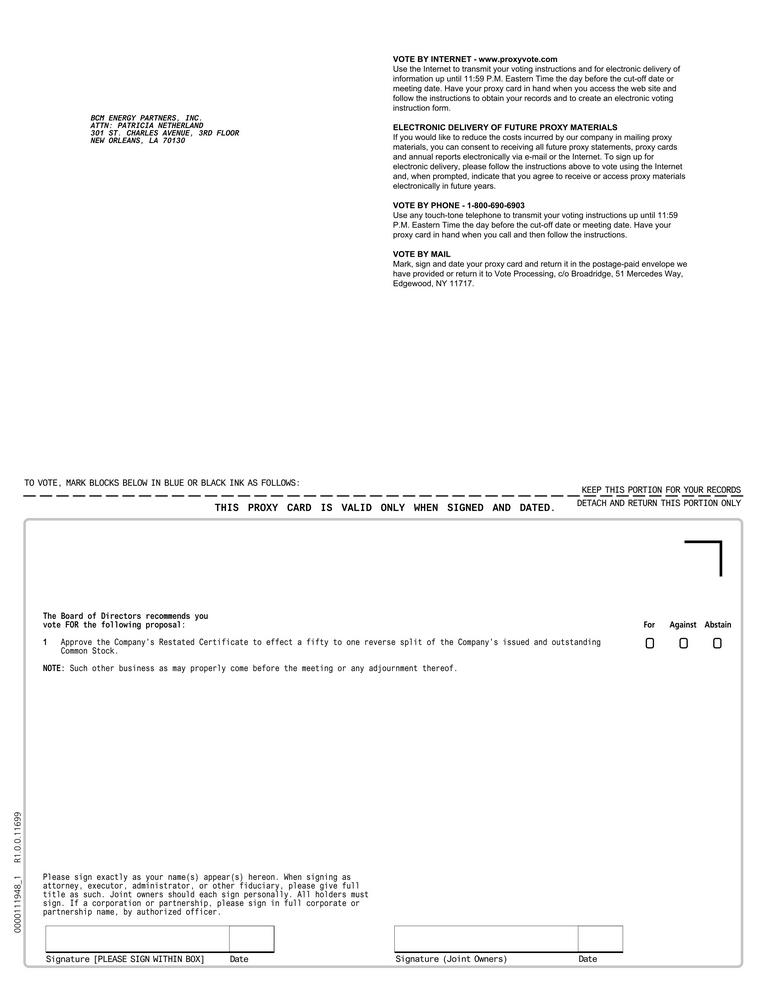

PROPOSAL 1

APPROVAL OF THE COMPANY’S RESTATED CERTIFICATE OF INCORPORATION

General

Our stockholders are being asked to act upon a proposal to approve the Company’s Restated Certificate of Incorporation (the “Restated Certificate”), which is attached as Annex A. The principal effect of the restated certificate is to effect a fifty to one reverse stock split of all of the outstanding shares of Common Stock of the Company, (each, the “Reverse Stock Split”). On June 8, 2011, the Board of Directors approved the Restated Certificate, subject to obtaining stockholder approval, to effect the Reverse Stock Split. The Board of Directors has directed that this proposal to approve the Company’s Restated Certificate be submitted to the stockholders for consideration and action.

Except for adjustments that may result from the treatment of fractional shares as described below, each stockholder will hold the same percentage of Common Stock outstanding immediately following the Reverse Stock Split as such stockholder held immediately prior to the Reverse Stock Split.

The Company’s Restated Certificate that will effect the Reverse Stock Split is set forth as Annex A attached to this Proxy Statement and is incorporated by reference into this Proxy Statement.

If the Restated Certificate is approved by the stockholders, the Board of Directors will implement a Reverse Stock Split. The Company will file the Restated Certificate with the Delaware Secretary of State reflecting the decrease in the issued and outstanding shares of Common Stock. The amendment will become effective on the date the Certificate of Amendment is accepted for filing by the Delaware Secretary of State (the “Effective Date”).

Reasons For Reverse Stock Split

The primary reasons for the Reverse Stock Split is to improve the ability of the Company to raise capital by issuing additional shares of its Common Stock and the marketability of the Company’s Common Stock for its existing investors.

The Board of Directors believes that the current low per share market price of the Common Stock has had a negative effect on the marketability of the Company’s Common Stock and adversely affects the ability of the Company to raise capital by issuing additional shares of its Common Stock. The Board of Directors believes that one of the reasons for these effects is that many institutional investors have internal policies preventing the purchase of low-priced stocks. Moreover, a variety of policies and practices of broker-dealers discourage individual brokers within those firms from dealing in low-priced stocks. Also, because the brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher priced stocks, the current share price of the Common Stock can result in stockholders paying transaction costs (including commissions, markups or markdowns) which are a higher percentage of their total share value than would be the case if the Common Stock share price were higher.

The Board of Directors believes that the decrease in the number of issued and outstanding shares of Common Stock as a consequence of the Reverse Stock Split, and the resulting increase in the price of the Common Stock, could encourage interest in the Common Stock and possibly promote greater liquidity for the Company’s stockholders, although such liquidity could be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split.

In addition, although any increase in the market price of the Common Stock resulting from the Reverse Stock Split may be proportionately less than the decrease in the number of outstanding shares, the Reverse Stock Split could result in a market price for the shares that will be high enough to overcome the reluctance, policies and practices of brokers and investors referred to above and to diminish the adverse impact of trading commissions on the market for the shares.

There can be no assurances, however, that the foregoing events will occur, or that the market price of the Common Stock immediately after the Reverse Stock Split will be maintained for any period of time. Moreover, there can be no assurance that the market price of the Common Stock after the proposed Reverse Stock Split will adjust to reflect the conversion ratio. For example, if the market price is $0.05 before the Reverse Stock Split and the ratio is one new share for every 50 shares outstanding, there can be no assurance that the market price immediately after the Reverse Stock Split will be $2.50 (50 x $0.05)), or that the market price following the Reverse Stock Split will either exceed or remain in excess of the current market price.

No further action on the part of the stockholders will be required to either effect or abandon the Reverse Stock Split.

Effects of Reverse Stock Split on the Common Stock

If the proposed Reverse Stock Split is approved at a Special Meeting, at the Effective Date each outstanding share of Common Stock will immediately and automatically be changed into a fraction of a share of Common Stock. For example, if a stockholder currently owns 100,000 shares of Common Stock, following the Reverse Stock Split, the stockholder will own 2,000 shares of Common Stock – each share of Common Stock will have immediately and automatically have been changed into one-fiftieth of a share of Common Stock.

No fractional shares of the Common Stock will be issued in connection with the proposed Reverse Stock Split. Holders of Common Stock who would otherwise receive a fractional share of Common Stock pursuant to the Reverse Stock Split will receive cash in lieu of the fractional share as explained below.

Because the Reverse Stock Split will apply to all issued and outstanding shares of the Common Stock and outstanding rights to purchase Common Stock, the proposed Reverse Stock Split will not alter the relative rights and preferences of existing stockholders.

The Restated Certificate reduces the number of authorized and available of Common Stock and preferred stock, par value $0.0001 (the “Preferred Stock”), to 15,000,000 and 5,000,000 shares from 150,000,000 and 20,000,00 shares, respectively. Accordingly, the Restated Certificate will increase the available number of shares of the Common Stock and Preferred Stock available for future issuance by the Board of Directors.

The holders of the outstanding shares of Preferred Stock have elected to convert their shares to Common Stock immediately prior to the Record Date. As a result, the Reverse Stock Split will have no positive or negative impact on the percentage ownership of each holder of Common Stock in the Company. However, the Restated Certificate will increase the number of shares of Common Stock and Preferred Stock available by the Company for issuance.

If the Reverse Stock Split is approved at a Special Meeting, some stockholders may consequently own fewer than 100 shares of Common Stock. A purchase or sale of less than 100 shares, known as an “odd lot” transaction, may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own fewer than 100 shares following the Reverse Stock Split may be required to pay higher transaction costs should they then determine to sell their shares of Common Stock.

Stockholders have no right under Delaware law or the Company’s current Certificate of Incorporation or Amended and Restated Bylaws to dissent from the Reverse Stock Split or to dissent from the payment of cash in lieu of issuing fractional shares.

Effect on Reverse Stock Split on Preferred Stock

As of the date hereof, the Company had reduced and cancelled all outstanding shares of Preferred Stock. The Restated Certificate will annul and cancel the existing Certificate of Designation with respect to the Preferred Stock, and the Board of Directors shall again be empowered to determine the rights and designations of the Preferred Stock of the Company.

Effectiveness of the Reverse Stock Split

The Reverse Stock Split, if approved by the Company’s stockholders and implemented by the Board of Directors, will become effective upon the filing of the Restated Certificate with the Delaware Secretary of State. It is expected that this filing will occur shortly after a Special Meeting, assuming that the stockholders approve the Restated Certificate.

Effect on Legal Ability to Pay Dividends

The Board of Directors has not declared, nor does it have any plans to declare in the foreseeable future, any distributions of cash, dividends or other property, and the Company is not in arrears on any dividends and it does not intend to pay any dividends on the common stock in the foreseeable future. In addition, any payment of dividends will be in the discretion of the Board of Directors. Therefore, the Reverse Stock Split will not have any effect on dividends or other future distributions, if any, to the Company’s stockholders.

Payment for Fractional Shares; Exchange of Stock Certificates

The Company will not issue fractional shares in connection with the Reverse Stock Split. Instead the Company will pay each holder of a fractional share an amount in cash equal to the market value of such fractional share as of the Effective Date.

The Company plans to appoint Island Stock Transfer to act as exchange agent for the Common Stock in connection with the Reverse Stock Split (the “Exchange Agent”). The Company will deposit with the Exchange Agent, as soon as practicable after the Effective Date of the Reverse Stock Split, cash in an amount equal to the value of the estimated aggregate number of fractional shares that will result from the Reverse Stock Split. The funds required to purchase the fractional share interests are available and will be paid from the Company’s current cash reserves. The Company’s stockholder list shows that some of the outstanding Common Stock is registered in the names of clearing agencies and broker nominees. Because the Company does not know the numbers of shares held by each beneficial owner for whom the clearing agencies and broker nominees are record holders, the Company cannot predict with certainty the number of fractional shares that will result from the Reverse Stock Split or the total amount it will be required to pay for fractional share interests. However, the Company does not expect that amount will be material. As of the Record Date, the Company had approximately 54 stockholders of record. The Company does not expect the Reverse Stock Split and the payment of cash in lieu of fractional shares to result in a significant reduction in the number of record holders. The Company presently does not intend to seek any change in its status as a reporting company for federal securities law purposes, either before or after the Reverse Stock Split. On or after the Effective Date of the Reverse Stock Split, the exchange agent will mail a letter of transmittal to each stockholder. Each stockholder will be able to obtain a certificate evidencing its post-Reverse Stock Split shares and, if applicable, cash in lieu of a fractional share, only by sending the exchange agent his or her old stock certificate(s), together with the properly executed and completed letter of transmittal and such evidence of ownership of the shares as the Company may require. Stockholders will not receive certificates for post-Reverse Stock Split shares unless and until their old certificates are surrendered. Stockholders should not forward their certificates to the Exchange Agent until they receive the letter of transmittal, and they should send in their certificates only with the letter of transmittal. The Exchange Agent will send each stockholder’s new stock certificate and payment in lieu of any fractional share after receipt of that stockholder’s properly completed letter of transmittal and old stock certificate(s). Stockholders will not have to pay any service charges in connection with the exchange of their certificates or the payment of cash in lieu of fractional shares.

Non-registered stockholders who hold their Common Stock through a bank, broker or other nominee should note that such banks, brokers or other nominees may have different procedures for processing the Reverse Stock Split than those that the Company will put in place for registered stockholders. If you hold your shares with such a bank, broker or other nominee and if you have questions in this regard, you should contact your nominee.

Certain Federal Income Tax Consequences

The following discussion of the material federal income tax consequences of the Reverse Stock Split is based upon the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations promulgated thereunder, judicial decisions, and current administrative rulings and practices, all as in effect on the date hereof, and any or all of which could be repealed, overruled or modified at any time, possibly with retroactive effect. No ruling from the Internal Revenue Service (the “IRS”) with respect to the matters discussed herein has been requested, and there is no assurance that the IRS would agree with the conclusions set forth in this discussion.

This discussion may not address certain federal income tax consequences that may be relevant to particular stockholders in light of their personal circumstances (such as holders who do not hold their shares of Common Stock as capital assets within the meaning of Section 1221 of the Code, who are subject to the alternative minimum tax provisions of the Code, who hold their shares as a hedge or as part of a hedging, straddle, conversion or other risk reduction transaction, who are dealers in securities, banks, insurance companies, foreign individuals and entities, financial institutions or tax-exempt organizations, or who acquired their shares in connection with stock option or stock purchase plans or in other compensatory transactions). This discussion also does not address any tax consequences under state, local or foreign laws.

Stockholders are urged to consult their tax advisors as to the particular federal, state, local, or foreign tax consequences to them of the Reverse Stock Split.

Except as discussed below, a stockholder generally will not recognize a gain or loss by reason of such stockholder’s receipt of new shares of Common Stock pursuant to the Reverse Stock Split solely in exchange for shares of Common Stock held by such stockholder immediately prior to the Reverse Stock Split. A stockholder’s aggregate tax basis in the shares of Common Stock received pursuant to the Reverse Stock Split (including any fractional interest) will equal the stockholder’s aggregate basis in the Common Stock exchanged therefore and will be allocated among the shares of Common Stock received in the Reverse Stock Split on a pro-rata basis. Stockholders who have used the specific identification method to identify their basis in the shares of Common Stock held immediately prior to the Reverse Stock Split should consult their own tax advisers to determine their basis in the shares of Common Stock received in exchange therefore in the Reverse Stock Split. A stockholder’s holding period in the shares of Common Stock received pursuant to the Reverse Stock Split will include the stockholder’s holding period in the shares of Common Stock surrendered in exchange therefore, provided the shares of Common Stock surrendered are held as capital assets at the time of the Reverse Stock Split. A stockholder will recognize a gain or loss on the receipt of cash in lieu of a fractional share of Common Stock issued pursuant to the Reverse Stock Split, measured by the difference between the amount of cash received and such stockholder’s adjusted tax basis in the fractional share interest deemed surrendered in exchange therefore. Any such gain or loss will be a capital gain or loss, provided the shares of Common Stock surrendered are held as capital assets by the stockholder at the time of the Reverse Stock Split, and will be a long-term capital gain or loss if the stockholder’s holding period in the shares of Common Stock surrendered is more than one year.

Provisions with Potential Anti-Takeover Effects

Although the proposed Restated Certificate is not intended for anti-takeover purposes, the rules of the Securities and Exchange Commission require disclosure of the provisions of the Company’s Restated Certificate and Amended and Restated Bylaws, as well as the Company’s stockholder rights plan, that could have an anti-takeover effect. The laws of the State of Delaware contain additional provisions that also may have the effect of delaying, deterring or preventing a change in control of the Company. These provisions are described below.

Provisions in the Company’s Restated Certificate and Amended and Restated Bylaws may have the effect of delaying or preventing a change of control or changes in the Company’s management. These provisions include the right of the Board of Directors to elect a director to fill a vacancy created by the expansion of the Board of Directors; the ability of the Board of Directors to alter the Company’s Amended and Restated Bylaws without obtaining stockholder approval; the establishment of a classified Board of Directors; the ability of the Board of Directors to issue, without stockholder approval, up to 5,000,000

shares of preferred stock with terms set by the Board of Directors, including rights that could be senior to those of Common Stock; and the elimination of the right of stockholders to call an Special Meeting of stockholders and to take action by written consent. Each of these provisions could discourage potential takeover attempts and could lower the market price of the Common Stock.

In addition, because the Company is incorporated in Delaware, it is governed by the provisions of Section 203 of the Delaware General Corporation Law. Section 203 may prohibit large stockholders, in particular those owning 15% or more of the Company’s outstanding voting stock, from merging or combining with the Company.

Required Vote

The affirmative vote of a majority of the Company’s outstanding Common Stock is required to approve the Company’s Restated Certificate to effect a fifty to one reverse split of the Company’s issued and outstanding Common Stock.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSAL TO APPROVE THE RESTATED CERTIFICATE.

PAYMENT OF COSTS

The expense of printing, mailing proxy materials and soliciting of proxies will be borne by the Company. In addition to the solicitation of proxies by mail, solicitation may be made by directors, officers and other employees of the Company by personal interview, telephone or facsimile. No additional compensation will be paid to such persons for such solicitation. The Company will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation materials to beneficial owners of the Common Stock.

STOCKHOLDER PROPOSALS FOR THE 2012 ANNUAL MEETING

Proposals of stockholders of the Company that are intended to be presented at the Company’s 2012 Annual Meeting must be received by the Secretary of the Company no later than October 15, 2011 in order that they may be included in the Company’s proxy statement and form of proxy relating to that meeting.

A stockholder proposal not included in the Company’s proxy statement for the 2012 Annual Meeting will be ineligible for presentation at the meeting unless the stockholder gives timely notice of the proposal in writing to the Secretary of the Company at the principal executive offices of the Company and otherwise complies with the provisions of the Company’s Amended and Restated Bylaws. To be timely, the Amended and Restated Bylaws provide that the Company must have received the stockholder’s notice not less than 60 days nor more than 90 days prior to the scheduled date of the meeting. However, if notice or prior public disclosure of the date of a Annual Meeting is given or made to stockholders less than 75 days prior to the meeting date, the Company must receive the stockholder’s notice by the earlier of (i) the close of business on the 15th day after the earlier of the day the Company mailed notice of a Annual Meeting date or provided public disclosure of the meeting date and (ii) two days prior to the scheduled date of a Annual Meeting.

OTHER MATTERS

The Company knows of no other business that will be presented at a Special Meeting, or any adjournment thereof. If any other business is properly brought before a Special Meeting, it is intended that the proxies will be voted in accordance with the judgment of the persons voting the proxies.

Whether you intend to be present at a Special Meeting or not, we urge you to vote promptly.

By order of the Board of Directors

/s/ Dr. Raymond G. Bailey P.E.

Dr. Raymond G. Bailey P.E.

Chairman and Chief Executive Officer

July 22, 2011

Annex A

RESTATED CERTIFICATE OF INCORPORATION

OF

BCM ENERGY PARTNERS, INC.

Under Section 245

of the

General Corporation Law of Delaware

BCM Energy Partners, Inc. (the “Corporation”), a corporation organized and existing under the laws of the State of Delaware, does hereby certify as follows:

FIRST: The name of the Corporation is BCM Energy Partners, Inc.; the Corporation was originally incorporated as Novori Inc. and was subsequently named AEON Holdings, Inc.

SECOND: The Certificate of Incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on July 26, 2004.

THIRD: This Restated Certificate of Incorporation was duly adopted in accordance with Section 245 of the General Corporation Law of Delaware and only restates and integrates and does not further amend the provisions of the Corporation’s Restated Certificate of Incorporation as heretofore restated, amended and/or supplemented. There is no discrepancy between those provisions and the provisions of this Restated Certificate of Incorporation.

FOURTH: The text of the Restated Certificate of Incorporation of the Corporation, as amended, is hereby restated to read in full, as follows:

RESTATED CERTIFICATE OF INCORPORATION

OF

BCM ENERGY PARTNERS, INC.

ARTICLE I

NAME

The name of the Corporation is BCM Energy Partners, Inc.

ARTICLE II

REGISTERED AGENT

The address of its registered office in the State of Delaware is 2711 Centerville Road, Suite 400, Wilmington, New Castle County, Delaware 19808. The name of its registered agent at such address is The Company Corporation.

ARTICLE III

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of Delaware.

ARTICLE IV

CAPITAL STOCK

Effective as of 12:01 A.M., Eastern Daylight Time, on August 16, 2011, each fifty (50) shares of the Corporation's common stock, par value $0.0001 per share (each, an “Existing Common Share”), then-issued and outstanding shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one (1) share of the Corporation's common stock, par value $0.0001 per share (each, a “Common Share”) and each fifty (50) shares of the Corporation's Series A Convertible Preferred Stock, par value $0.0001 per share, as referenced in that certain Certificate of Designation Preference and Rights of Series A Convertible Preferred Stock of Novori, Inc., filed June 19, 2007 (each, an “Existing Preferred Share”), then-issued and outstanding shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one (1) Common Share. No

fractional shares shall be issued and, in lieu thereof, any holder of less than one share of the Common Share shall be entitled to receive a cash payment representing that holder's proportionate interest in the net proceeds from the sale by the Corporation's transfer agent of the aggregate of fractional Common Shares that would otherwise have been issued, as reasonably determined by the Board of Directors of the Corporation. Whether the stock combination provided above would result in fractional shares for a holder of record shall be determined on the basis of the total number of shares of Existing Common Shares and Existing Preferred Share held by such holder of record at the time the stock split occurs.

The following is a statement of the designations and the powers, privileges and rights, and the qualifications, limitations or restrictions thereof in respect of each class of capital stock of the Corporation.

A. COMMON STOCK.

1. General. 15,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”), are authorized and may be issued from time to time as determined by the Board of Directors. The voting, dividend and liquidation rights of the holders of the Common Stock are subject to and qualified by the rights of the holders of the Preferred Stock of any class or series as may be designated by the Board of Directors upon any issuance of the Preferred Stock of any class or series.

2. Voting. The holders of the Common Stock are entitled to one vote for each share held at all meetings of stockholders (and written actions in lieu of meetings). There shall be no cumulative voting.

3. Dividends. Dividends may be declared and paid on the Common Stock from funds lawfully available therefor as and when determined by the Board of Directors and subject to any preferential dividend rights of any then outstanding Preferred Stock.

4. Liquidation. Subject to any preferential rights of any then-outstanding Preferred Stock, upon the dissolution or liquidation of the Corporation, whether voluntary or involuntary, holders of Common Stock will be entitled to receive all assets of the Corporation available for distribution to its stockholders.

B. PREFERRED STOCK.

1. General. 5,000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”), are authorized and may be issued from time to time as determined by the Board of Directors of the Corporation.

2. Rights and Issuance. The Board of Directors of the Corporation is expressly authorized at any time, and from time to time, to provide for the issuance of shares of Preferred Stock in one or more class or series, with such voting powers, full or limited, or without voting powers, and with such designations, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof, as shall be stated and expressed in the resolution or resolutions providing for the issue thereof adopted by the Board of Directors of the Corporation, and as are not stated and expressed in this Restated Certificate of Incorporation, or any amendment thereto, including (but without limiting the generality of the foregoing) the following:

(a) the designation of such class or series;

(b) the dividend rate of such class or series, the conditions and dates upon which such dividends shall be payable, the preference or relation which such dividends shall bear to the dividends payable on any other class or classes or on any other series of any class or classes of capital stock, and whether such dividends shall be cumulative or non-cumulative;

(c) whether the shares of such class or series shall be subject to redemption by the Corporation, and, if made subject to such redemption, the times, prices and other terms and conditions of such redemption;

(d) the terms and amount of any sinking fund provided for the purchase or redemption of the shares of such class or series;

(e) whether or not the shares of such class or series shall be convertible into or exchangeable for shares of any other class or classes or of any other series of any class or classes of capital stock of the Corporation, and, if provision be made for conversion or exchange, the times, prices, rates, adjustments and other terms and conditions of such conversion or exchange;

(f) the voting rights, if any, of shares of such class or series and whether the shares of any such class or series having voting rights shall have multiple or fractional votes per share;

(g) the extent, if any, to which the holders of the shares of such class or series shall be entitled to vote as a class or otherwise with respect to the election of the directors or otherwise;

(h) the restrictions, if any, on the issue or reissue of any additional Preferred Stock; and

(i) the rights of the holders of the shares of such class or series upon the dissolution of, or upon the distribution of assets of, the Corporation.

Any amendment to this Restated Certificate of Incorporation which shall increase or decrease the authorized capital stock of the Corporation may be adopted by the affirmative vote of the holders of capital stock representing not less than a majority of the voting power represented by the outstanding shares of capital stock of the Corporation entitled to vote.

ARTICLE V

BYLAWS

A. The Corporation’s bylaws may be made, altered, amended or repealed by the Board of Directors of the Corporation or by the affirmative vote of a majority of the voting power of all of the then-outstanding shares of Common and Preferred Stock.

B. Election of directors need not be by ballot unless the bylaws so provide.

ARTICLE VI

DIRECTOR LIABILITY

A. To the fullest extent that the General Corporation Law of Delaware as it exists on the date hereof or as it may hereafter be amended permits the limitation or elimination of the liability of directors, no director of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director. Without limiting the generality of the foregoing, a director of the Corporation shall not be personally liable to the corporation or its stockholders for monetary damages for any breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the General Corporation Law of Delaware, or (iv) for any transaction from which the director derived an improper personal benefit. If the General Corporation Law of Delaware is amended after the approval by the stockholders of the Corporation of this Restated Certificate to authorize corporate action further limiting or eliminating the personal liability of directors, then the liability of a director shall be limited or limited to the fullest extend permitted by the General Corporation Law of Delaware, as so amended.

B. The Corporation shall have the power to indemnify any director, officer, employee or agent of the Corporation or any other person who is serving at the request of the Corporation in any such capacity with another corporation, partnership, joint venture, trust or other enterprise (including, without limitation, any employee benefit plan) to the fullest extent permitted by the General Corporation Law of Delaware as it exists on the date hereof or as it may hereafter be amended, and any such indemnification may continue as to any person who has ceased to be a director, officer, employee or agent and may inure to the benefit of the heirs, executors and administrators of such a person.

C. By action of its Board of Directors of the Corporation, notwithstanding any interest of the directors in the action, the Corporation may purchase and maintain insurance, in such amounts as the Board of Directors of the Corporation deems appropriate, to protect any director, officer, employee or agent of the Corporation or any other person who is serving at the request of the Corporation in any such capacity with another corporation, partnership, joint venture, trust or other enterprise (including, without limitation, any employee benefit plan) against any liability asserted against him or incurred by him in any such capacity or arising out of his status as such (including, without limitation, expenses, judgments, fines and amounts paid in settlement) to the fullest extent permitted by the General Corporation Law of Delaware as it exists on the date hereof or as it may hereafter be amended, and whether or not the Corporation would have the power or would be required to indemnify any such person under the terms of any agreement or by- law or the General Corporation Law of Delaware. For purposes of this paragraph C, “fines” shall include any excise taxes assessed on a person with respect to any employee benefit plan.

D. Any amendment, alteration, change or repeal of this Article VI shall be prospective and shall not affect the rights under this Article VI in effect at the time of any alleged occurrence or any act or omission giving rise to any liability or indemnification.

ARTICLE VII

AMENDMENT

The Corporation reserves the right to amend, alter, change or repeal any provision contained in this Restated Certificate of Incorporation, in the manner now or hereafter prescribed by statute, and all rights conferred upon stockholders herein are granted subject to this reservation.

IN WITNESS WHEREOF, the Corporation has caused this certificate to be signed by its authorized officer and caused the corporate seal of the Corporation to be hereunto affixed this ___ day of August, 2011.

Signed:

By:

Its: Corporate Secretary