| Filed by Informa PLC | |

| Pursuant to Rule 425 under the Securities Act of 1933 | |

| and deemed filed pursuant to Rule 14a-12 under | |

| the Securities Exchange Act of 1934 | |

| Subject Company: TechTarget, Inc. | |

| Commission File No.: 001-33472 |

The following are portions of Informa PLC's Annual Report and Accounts 2023, which was posted on its website on April 26, 2024.

| Chair’s Introduction The last year has been an exciting time to be part of Informa. Informa entered 2023 well placed, thanks to the decisions and actions taken in previous years, and the progressive reopening of the world after the pandemic. Notably, the Board and leadership team had taken the decision to fully focus the business on Academic Markets and B2B Markets, divesting Informa’s Intelligence portfolio to enable the return of capital to shareholders and reinvest in growth initiatives for the benefit of all of Informa’s stakeholders. As a focused business with a clear growth strategy and strong balance sheet, facing into more normalised customer markets, Informa really fired on all cylinders during 2023; fantastic to see after the challenges the company had to manage in prior years. Specialisation and scale The underlying business performed strongly and consistently in all areas in 2023. We expanded further in geographic growth markets, with a particular highlight being our Tahaluf partnership business in Saudi Arabia. This is going from strength to strength as the Kingdom diversifies its industries and invests in bringing new jobs and international connections to the region: all goals that B2B events support well. As many readers will know, adding complementary businesses that operate in attractive specialist markets is an established part of Informa’s approach to growth and building scale, and this was a particular feature of 2023. Thanks to our strong financial position and the proceeds of 2022’s divestments, we took the opportunity to add scale in several specialist markets, welcoming excellent brands and talent in Aviation and Packaging from Tarsus, in Foodservice from Winsight, in Tech Research from Canalys, in Healthcare Tech from HIMSS, in Life Sciences from LSX and in Scientific and Medical Research from Future Science Group over the course of 2023. For several years, Informa has been building its position and capabilities in digital services that serve B2B customers. This accelerated during the pandemic, and when much business activity moved online, the company took the decision to invest in its first -party data platform IIRIS and in the specialist businesses NetLine and Industry Dive. 2024 began with an announcement that signifies the next step in Informa’s progress in B2B Digital Services: a proposed combination of the digital businesses in Informa Tech with US-listed TechTarget. This is subject to satisfying customary approvals and conditions, but is an exciting development that demonstrates Informa’s ambition and capacity for further scale and growth in the years to come. Investment and returns For a business like Informa, ongoing investment in brands, products and platforms is key to delivering a great experience and value for customers. This has been a focus under the 2021-2024 Growth Acceleration Plan – known as GAP 2 – which is the structured, six-part programme through which we are delivering our growth strategy. It will continue to be a focus in 2024 and beyond, including the further deployment of new technology and generative AI-based tools where they can improve customer experience or help the business and our experts be more efficient. We have also invested in accelerating shareholder returns to match the business’s accelerated performance and share a good balance of the benefits of growth with investors. Having restarted ordinary dividends in the middle of 2022, we have confirmed a dividend of 18p for 2023, a year-on-year increase of over 80%. The share buyback programme initiated in early 2022 was further extended in 2023, based on positive feedback from investors on this approach. Change and resilience When I look at the broader world, the landscape that businesses like Informa are operating in is varied and changeable. Sadly, there is conflict in some areas of individual countries, although thankfully this is not directly impacting Informa’s offices or operations. In some markets, inflation and cost of living pressures remain high, but in other markets, we are seeing good levels of growth, investment and innovation. This makes it as important as ever to stay close to what is happening in our markets and with customers, take an agile approach and keep focusing on the areas of greatest opportunity, all of which I know Informa colleagues do well. The company is well diversified by geography, customer market and product, and has a built-in level of resilience that comes from delivering on its purpose: providing must -have knowledge and connections that help specialist markets, and the customers operating in them, succeed. As an international company, we are also mindful of the different circumstances colleagues may face. Over the years Informa has invested in a strong range of support services available to anyone personally affected by developments in the wider world or closer to home. We continued to take a flexible approach to pay reviews during 2023, introducing more frequent reviews for colleagues based in higher-inflation countries to provide confidence and ensure fair financial support. Opportunity and thanks Informa is a very enjoyable company to be a part of and contribute to, and this is one of the most exciting periods in its development. The business is not only in a strong position today, consistently delivering on its commitments to shareholders, customers, partners and colleagues; it is also moving forward with pace, ambition and confidence. Thank you to the shareholders I have met over the last year at Informa’s AGM, the Chair’s annual roadshow or in other forums for the open exchange and the engaged and constructive support shown to the company and its leadership team. And thank you to all of the colleagues at Informa, whose enthusiasm, professionalism, talent and skill make it all possible. John Rishton Chair 7 March 2024 Growth & Opportunity Long-term success and Section 172 Informa’s Board is committed to performing all the duties set out in section 172 of the Companies Act 2006. These include promoting Informa’s success for the benefit of its members as a whole by considering the long -term consequences of decisions, the interests of colleagues, customers and partners and the impact of our operations on the community and environment. Full information on how we performed these duties can be found in the Board’s year (pages 96 to 101) and in our Section 172 Statement on page 102. John Rishton presents to shareholders at the 2023 Informa Annual General Meeting, with Group CEO Stephen A. Carter and Senior Independent Director Mary McDowell alongside him Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 10 11 |

| Group Chief Executive’s Review 2023 was a standout year for Informa by any measure. Our financial performance was strong; we invested in improving our products and serving customers in new ways; we added high-quality brands and businesses that have expanded our positions in the specialist markets we focus on; and our performance on sustainability and environmental, social and governance measures was again well recognised. As a point-in-time snapshot, it is positive and encouraging. For everything that went into creating such a strong and successful year, my deep thanks go to all Informa colleagues. But just as importantly, our 2023 performance reflects the outcomes of decisions and actions taken over the course of the last decade. Informa has progressively become a higher-quality and a higher-growth business, and we are confident that there are further opportunities ahead and more to come for our customers, partners, colleagues and shareholders. We have a clear strategy. Informa is a growth business, and creating accelerated growth through building scale in our chosen specialist markets has long been our focus. The pandemic interrupted and tested the Group, bringing significant disruption to some areas of our business for a prolonged time, as well as challenges to many of our personal and professional lives. But that period also enabled us to look again at the value of our first-party data, expand and invest in our digital services, be creative and flexible in how we serve customers, reassess the markets we were in and double down on the markets where we see the best long-term potential for growth and leadership. Informa also has a clear focus and operating model. After successfully divesting our Intelligence portfolio in 2022, we entered 2023 focused on Academic Markets, where we deliver specialist academic research, advanced learning and open research through Taylor & Francis, and B2B Markets, where we deliver live and on-demand events and digital services through Informa Markets, Informa Connect and Informa Tech. We are a leader in both areas, with the opportunity and the ambition to do more. Early in 2024, we have illustrated this ambition through our agreement to combine the digital businesses of Informa Tech with US-listed TechTarget, to build a leading platform in B2B Digital Services. The proposed combination will create a new TechTarget, listed on Nasdaq, in which Informa will have a 57% ownership position. This is of course subject to customary conditions and approvals, but it represents one of the further growth opportunities we see ahead and reflects the confidence and ambition with which we are entering 2024. Strong and performing businesses Each of our four divisions performed well in 2023 and has clear further growth opportunities ahead. In Academic Markets, Taylor & Francis delivered another year of consistent growth, with total revenues of £619m and underlying revenue growth of 3.0% (2022: 3.0%). Taylor & Francis has transformed since our first Growth Acceleration Plan (GAP 1) in 2014 and is a higher-quality business, a more digital business and, increasingly, a more customer-focused business, centred around researchers and knowledge makers. Over that time, we have consistently invested in platforms and technology that make research more discoverable and easier to apply, maximising its impact and value. We have progressively established a strong position in the growing area of open research too, adding businesses and expanding our capabilities. And in common with all parts of the Group, we have deliberately focused on specialist subject categories where output and demand for expert research are growing, such as in medicine and education. In 2023, pay-to-read subscriptions to research remained resilient, the volume of open research published continued to grow and our advanced learning business performed consistently, with ongoing investment into our digital books platform supporting customers’ continuing shift towards ebooks and other digital formats. We are well placed to step up further in 2024. Taylor & Francis has a clear focus on growth subject categories and offers a choice of publishing models to academic and research institutions, providing a flexible approach that can align to evolving views on funding and research access. These value-added features, combined with the underlying structural growth in higher education and research, mean we are targeting higher underlying revenue growth in 2024 of around 4%. Across our B2B Markets businesses, we delivered an aggregate underlying revenue growth of nearly 40% in 2023. This significant rate of growth reflects strong demand for our major brands as markets progressively reopened after the pandemic, coupled with the long-term decisions we have taken to operate in specialist markets that have good growth characteristics. At the start of the year, it was not clear when, or how quickly, Mainland China and Hong Kong would reopen for travel and live B2B events. That process began in around April and was felt most keenly in Informa Markets, as one of the largest operators of exhibitions in China. The pace at which live events restarted, and the strength of demand from businesses to get back to exhibiting and trading in person, underlines the unique value of what we offer, particularly in a world that is increasingly communicating and interacting online. Our performance prompted us to raise our revenue expectations and market guidance three times during 2023. Elsewhere in Informa Markets and in Informa Connect – our content-led live and on-demand B2B events business – part of our ongoing growth comes from our investment in improving the customer experience and expanding our range of services. This is helping to maintain and increase the benefits and value we deliver to customers, as we will come on to. Specialisation & Scale 30% Group underlying revenue growth in 2023 One of the exhibition halls at LEAP 2023, a global tech event held in Riyadh that brought together over 150,000 local and international tech professionals, start-ups, investors and innovators We are more confident than ever in our brands, businesses and the markets we have chosen to be in. Stephen A. Carter presenting a winner’s trophy on stage at the 2023 colleague Informa Awards Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 12 13 |

| Group Chief Executive’s Review continued As many shareholders will know, in late 2021, we took the decision to divest our Intelligence portfolio, and this too is a significant factor in the opportunities and choices we have today. We invested in our Intelligence businesses significantly during GAP 1, improving products and platforms, refocusing on customer benefits and service and successfully turning around performance from sharp decline to consistent growth. This created a high-performing, high-quality portfolio of businesses, but in 2021, we reached the conclusion that there were limited opportunities here to further scale our positions compared with Academic and B2B Markets. We completed the divestment of our Intelligence businesses during 2022, realising a gross value of almost £2.5bn, and have invested the proceeds in a range of ways that strengthen and expand our business and set us up for future growth. Growth through product and customer investment In the markets in which Informa operates, to stand still is to move backwards. Investing in our brands, products and platforms has been a consistent feature of the company over the last decade, to keep pace with market and technology developments and continue delivering benefits and value to our customers. These investments are also part of driving future growth. In Academic Markets, one of the areas we have focused on is making our production processes more efficient and effective through technology, particularly for open research. This helps us to better serve researchers by getting their work published more quickly and means we can accept higher volumes of submissions, expanding our specialist content and titles. As recent examples, in 2023 Taylor & Francis piloted technology that screens and identifies duplicate submissions more efficiently and accurately, helping maintain the integrity of the publishing process as we expand. We also introduced an article transfer service across a network of over 50 journals, helping researchers find the right journal for their work and maximising the original, peer-reviewed content we publish. In B2B Markets and since the return of live events after the pandemic, we have prioritised investments that enhance customers’ experience and maximise their return on investment. Technology, including existing and newer forms of AI, is creating new ways to extend the value customers get from the connections they make and knowledge they gain at and around live events. In Informa Tech too, we saw strong growth from our portfolio of technology-focused live and on-demand events and a good performance from our specialist research brand Omdia. The broader tech market was somewhat volatile in 2023. While we experienced some knock-on effects to budgets for the specialist B2B digital services Informa Tech delivers, we see significant long-term growth potential for data-driven products that enable tech vendors to identify and access active buyers. Our confidence, combined with supportive market conditions, opened up the opportunity to expand by joining forces with a US leader, TechTarget, which we look forward to progressing over the course of 2024. In this market and through this proposed combination, our goal is to serve B2B customers at scale digitally, as we already do in live and on-demand events. Read more in the conversation opposite. Across our B2B Markets businesses, we are also seeing – and starting to capture – additional growth opportunities through geographic expansion. Scale B2B live events can create considerable value for the countries and communities they are held in, by bringing business and trade to the area and supporting employment and economic activity in and around the event. We have a diversified international portfolio and see the potential to expand further in markets such as India, Thailand and the Middle East. Our Tahaluf partnership in Saudi Arabia is one such example. From a near standing start, Tahaluf now operates some of the region’s, and the world’s, largest events, including tech event LEAP, and we will be launching a number of other Informa brands in the Kingdom in 2024. Growth through business strength and performance In our B2B Markets businesses, we see a path to high-single-digit underlying revenue growth in 2024, outside of any effects from the proposed combination with TechTarget. This is real growth, and the strength and momentum of our underlying business put us in a great place for 2024, giving us both confidence and an increased ability to invest for further growth and opportunity. This is supported by a strong balance sheet, which is the result of consistent discipline in allocating capital and relentlessly prioritising cash conversion and cash generation. The dynamics of our business model – and, in particular, the forward commitments that companies make to exhibit at live events and pay for annual and multi-year research subscriptions – give us good visibility on revenue streams, which in turn helps us plan ahead and invest with confidence. 57% Shareholding in new TechTarget, subject to completion in 2024 AAA Informa’s ESG rating from MSCI Omdia’s VP of Sales Rikki Schmidle and Media & Entertainment Practice Lead Rob Gallagher sat down with Stephen A. Carter to talk about the proposed combination of Informa Tech’s digital businesses with TechTarget. Q. Stephen, what was the journey to this proposed combination? So why did we create Informa Tech in the first place? We did it because we believed there was a market, which today we’re calling the Digital Services market, providing a range of services to enterprise technology customers that you both know well: thought pieces, research, analytics, audience discovery, lead generation, buyer intent... Now back in the day, really, we were way bigger in the B2B events market than we were in anything else. But a few years on, we’ve added some other services, some other businesses, some other capabilities. And today, we combine those with TechTarget with an intention of creating a market-leading platform in that B2B Digital Services market. It’s taken us five or six years to get to this point, and it will create a leading business with a full suite of capabilities and a real potential to be the leading player. Q. You’ve mentioned our businesses have many complementary features. Can you say more about that? If you take the end-to-end process… you want to scope the market, we can do that. You want to research the market, you can do that. You’ve identified your product and you want to bring that product to life either through an analytical thought piece or a piece of custom content. This new company can do that. You want to reach your customers through direct marketing either webinars or video material. We can do that. They own BrightTALK. You need a digital media real estate which is focused on your end audience. This company will have probably a unique set of digital media real estate. You want to identify your buyers, you want to determine what the buyer intent is, how close they are to the decision making. From the beginning of the discovery point to the point of buyer contact, new TechTarget will have a full suite of products and services. Q. Can you say more about how we’ll be organised? We’re going to take the world-class enterprise technology event franchises back and stand them up alongside our other world-class content-led event franchises in Informa Connect. Everything else will be combined with the existing TechTarget business to create new TechTarget. I think for Omdia it will possibly be the biggest change, and I think the best change, because rather than being organised in a distributed way around end markets with multi functions, Omdia will be stood up as a standalone business. This conversation has been lightly condensed; watch it in full on our website. In conversation with Omdia Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 14 15 |

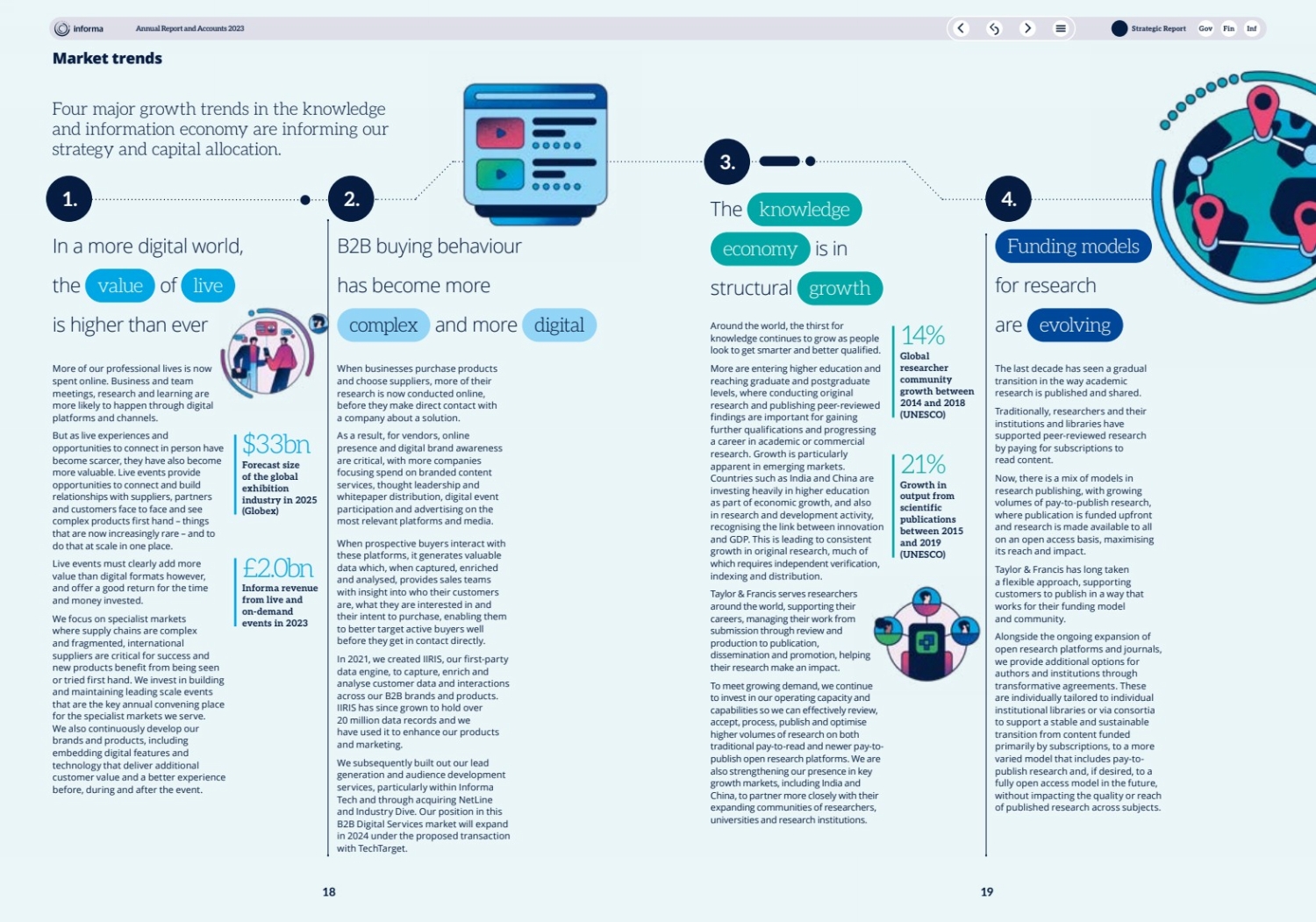

| The knowledge economy is in structural growth Funding models for research are evolving When businesses purchase products and choose suppliers, more of their research is now conducted online, before they make direct contact with a company about a solution. As a result, for vendors, online presence and digital brand awareness are critical, with more companies focusing spend on branded content services, thought leadership and whitepaper distribution, digital event participation and advertising on the most relevant platforms and media. When prospective buyers interact with these platforms, it generates valuable data which, when captured, enriched and analysed, provides sales teams with insight into who their customers are, what they are interested in and their intent to purchase, enabling them to better target active buyers well before they get in contact directly. In 2021, we created IIRIS, our first-party data engine, to capture, enrich and analyse customer data and interactions across our B2B brands and products. IIRIS has since grown to hold over 20 million data records and we have used it to enhance our products and marketing. We subsequently built out our lead generation and audience development services, particularly within Informa Tech and through acquiring NetLine and Industry Dive. Our position in this B2B Digital Services market will expand in 2024 under the proposed transaction with TechTarget. B2B buying behaviour has become more complex and more digital Four major growth trends in the knowledge and information economy are informing our strategy and capital allocation. Market trends $33bn Forecast size of the global exhibition industry in 2025 (Globex) £2.0bn Informa revenue from live and on-demand events in 2023 21% Growth in output from scientific publications between 2015 and 2019 (UNESCO) 14% Global researcher community growth between 2014 and 2018 (UNESCO) More of our professional lives is now spent online. Business and team meetings, research and learning are more likely to happen through digital platforms and channels. But as live experiences and opportunities to connect in person have become scarcer, they have also become more valuable. Live events provide opportunities to connect and build relationships with suppliers, partners and customers face to face and see complex products first hand – things that are now increasingly rare – and to do that at scale in one place. Live events must clearly add more value than digital formats however, and offer a good return for the time and money invested. We focus on specialist markets where supply chains are complex and fragmented, international suppliers are critical for success and new products benefit from being seen or tried first hand. We invest in building and maintaining leading scale events that are the key annual convening place for the specialist markets we serve. We also continuously develop our brands and products, including embedding digital features and technology that deliver additional customer value and a better experience before, during and after the event. Around the world, the thirst for knowledge continues to grow as people look to get smarter and better qualified. More are entering higher education and reaching graduate and postgraduate levels, where conducting original research and publishing peer-reviewed findings are important for gaining further qualifications and progressing a career in academic or commercial research. Growth is particularly apparent in emerging markets. Countries such as India and China are investing heavily in higher education as part of economic growth, and also in research and development activity, recognising the link between innovation and GDP. This is leading to consistent growth in original research, much of which requires independent verification, indexing and distribution. Taylor & Francis serves researchers around the world, supporting their careers, managing their work from submission through review and production to publication, dissemination and promotion, helping their research make an impact. To meet growing demand, we continue to invest in our operating capacity and capabilities so we can effectively review, accept, process, publish and optimise higher volumes of research on both traditional pay-to-read and newer pay-to-publish open research platforms. We are also strengthening our presence in key growth markets, including India and China, to partner more closely with their expanding communities of researchers, universities and research institutions. The last decade has seen a gradual transition in the way academic research is published and shared. Traditionally, researchers and their institutions and libraries have supported peer-reviewed research by paying for subscriptions to read content. Now, there is a mix of models in research publishing, with growing volumes of pay-to-publish research, where publication is funded upfront and research is made available to all on an open access basis, maximising its reach and impact. Taylor & Francis has long taken a flexible approach, supporting customers to publish in a way that works for their funding model and community. Alongside the ongoing expansion of open research platforms and journals, we provide additional options for authors and institutions through transformative agreements. These are individually tailored to individual institutional libraries or via consortia to support a stable and sustainable transition from content funded primarily by subscriptions, to a more varied model that includes pay-to-publish research and, if desired, to a fully open access model in the future, without impacting the quality or reach of published research across subjects. 1. 2. 3. 4. In a more digital world, the value of live is higher than ever Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 18 19 |

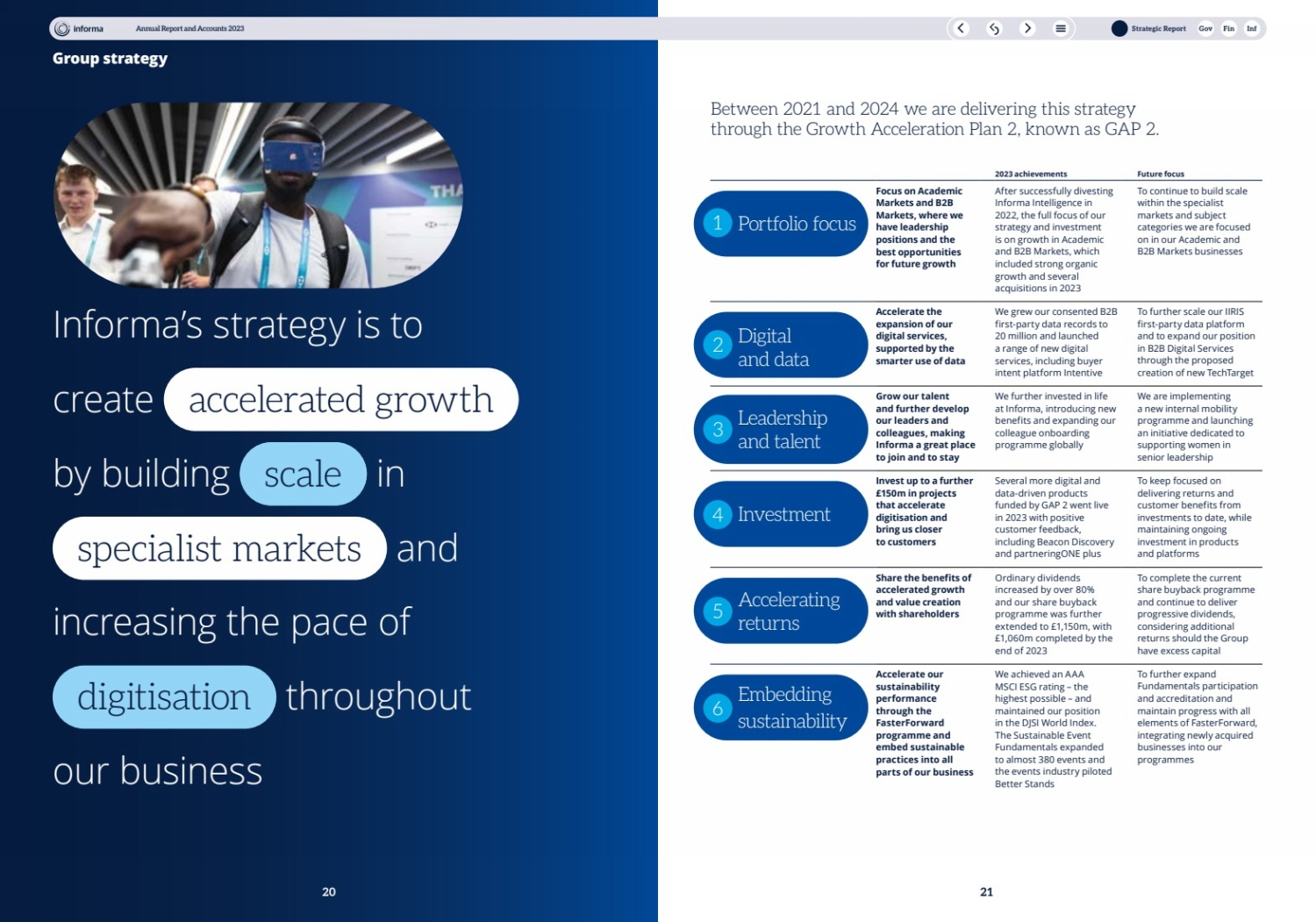

| 2023 achievements Future focus Focus on Academic Markets and B2B Markets, where we have leadership positions and the best opportunities for future growth After successfully divesting Informa Intelligence in 2022, the full focus of our strategy and investment is on growth in Academic and B2B Markets, which included strong organic growth and several acquisitions in 2023 To continue to build scale within the specialist markets and subject categories we are focused on in our Academic and B2B Markets businesses Accelerate the expansion of our digital services, supported by the smarter use of data We grew our consented B2B first-party data records to 20 million and launched a range of new digital services, including buyer intent platform Intentive To further scale our IIRIS first-party data platform and to expand our position in B2B Digital Services through the proposed creation of new TechTarget Grow our talent and further develop our leaders and colleagues, making Informa a great place to join and to stay We further invested in life at Informa, introducing new benefits and expanding our colleague onboarding programme globally We are implementing a new internal mobility programme and launching an initiative dedicated to supporting women in senior leadership Invest up to a further £150m in projects that accelerate digitisation and bring us closer to customers Several more digital and data-driven products funded by GAP 2 went live in 2023 with positive customer feedback, including Beacon Discovery and partneringONE plus To keep focused on delivering returns and customer benefits from investments to date, while maintaining ongoing investment in products and platforms Share the benefits of accelerated growth and value creation with shareholders Ordinary dividends increased by over 80% and our share buyback programme was further extended to £1,150m, with £1,060m completed by the end of 2023 To complete the current share buyback programme and continue to deliver progressive dividends, considering additional returns should the Group have excess capital Accelerate our sustainability performance through the FasterForward programme and embed sustainable practices into all parts of our business We achieved an AAA MSCI ESG rating – the highest possible – and maintained our position in the DJSI World Index. The Sustainable Event Fundamentals expanded to almost 380 events and the events industry piloted Better Stands To further expand Fundamentals participation and accreditation and maintain progress with all elements of FasterForward, integrating newly acquired businesses into our programmes 1 Portfolio focus Digital and data 2 Leadership and talent 3 4 Investment Accelerating returns 5 Embedding sustainability 6 Group strategy Informa’s strategy is to create accelerated growth by building scale in specialist markets and increasing the pace of digitisation throughout our business Between 2021 and 2024 we are delivering this strategy through the Growth Acceleration Plan 2, known as GAP 2. Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 20 21 |

| 70% 15% North America Continental Europe UK 6% China 1% Middle East 5% Rest of the world 3% Business Review continued Informa Connect will operate in six growth markets: Biotech & Life Sciences, Finance, Foodservice, Anti-Ageing & Aesthetics, Lifestyle and Technology, following the proposed combination of Informa Tech’s digital businesses with TechTarget. Within these markets, we own and operate long-established, marquee brands such as BIO-Europe, SuperReturn, the National Restaurant Association Show and AMWC. These brands deliver highly respected, must-attend live events and experiences. These are the places where people can meet key industry players, learn about the latest developments, build on existing relationships, and establish new connections with customers, suppliers and peers. Over recent years we have developed Streamly an on-demand, digital library of high-quality business video content, delivered by experts speaking at our events and elsewhere. This allows event attendees to access content they may have missed, while also reaching new customers who are interested in the content but did not attend the live event. Audience data from Streamly is collected, collated and managed through our centralised customer data platform, IIRIS. This provides audience insights, enabling us to develop the product to meet customer needs, enhance the value to attendees and market our brands in a more targeted way. It also allows us to provide our events partners and sponsors with rich data and knowledge of the audience through Lead Insights reports. These reports provide a summary of who engaged with brands through speaker sessions, individual conversations and online interactions. The 2023 edition saw record attendance, over 75% higher than the 2019 event, underlining the strength of the brand and the significant role it plays for its community. The addition of Winsight, a US-focused B2B business, brought a portfolio of B2B events, data and media for the Foodservice market. This significantly expands our position in this attractive growth market, where we already own brands such as Catersource. Winsight’s flagship event, the National Restaurant Association Show, is a Top 20 TSNN event, attracting more than 50,000 participants each year. Similarly, the addition of Tarsus added further scale to our Anti-Ageing & Aesthetics portfolio that complements our position in this market through brands like AMWC. In 2023, around 30% of Tarsus’ revenue was added to Informa Connect, with the remainder added to Informa Markets. Across our portfolio of brands, we are increasingly embedding technology to improve the customer experience and deliver more value both within the live experience and pre/post event, as shown on pages 46 and 47. Our events use the ConnectMe app that incorporates a range of tools to help deepen engagement and enhance our data collection capability. Data collected at events fuels the Lead Insights reports which have become very popular with sponsors as we have deepened the insights they provide, creating an end-to-end platform for scoring, qualifying and activating leads. Within our portfolio we also have a range of subscription-based, specialist data and intelligence businesses, including Curinos, IGM and Zephyr. These deliver predictable and growing revenue by helping customers to better understand their markets, assess the competition and price their products optimally to deliver growth. These brands also provide cross-marketing opportunities with events in our portfolio. 2023 performance review Informa Connect continued to expand in 2023 through strong underlying growth, the additions of Tarsus and Winsight and the internal transfer of the content-led Anti-Ageing & Aesthetics portfolio from Informa Markets. The transformation of the business over the last decade has seen it diversify its revenues away from small conferences to large-scale branded events and subscription-based content and data products. This shift in portfolio focus and quality delivered strong underlying revenue growth of 14% in 2023 (2022: 45%), with events revenue growing 27% year-on-year and subscriptions growing around 7% on an underlying basis, reflecting strong performances across all its markets. Finance remains our largest portfolio and SuperReturn International its largest individual brand. It serves the private equity community, bringing together over 5,000 decision makers from over 70 countries annually. Informa Connect delivers content-led live and on-demand events and experiences and specialist digital content that connect audiences and help professionals to know more, do more and be more. Revenue £581m 2022: £415m Outlook and opportunities 2023 was a standout year for Informa Connect, delivering strong underlying growth and further expansion. With the pandemic firmly in the past, and with an expanded portfolio of high-value events and digital services, Informa Connect is well placed to continue to grow strongly in 2024. We are targeting annualised revenues in excess of $1bn. We welcomed more than 450 colleagues from Tarsus, Winsight and LSX into Informa Connect last year. A key task in 2024 will be to make sure these brands and colleagues are fully embedded into the business and reaping the benefits of being part of a scale international group. This will include the adoption of IIRIS by these events, which will provide additional insights into our customers that can be used to further improve the event experience and value to customers. As we look beyond 2024, we are excited at the opportunities for Informa Connect in live and on-demand events and connected digital and data products. The power of AI should also provide real benefits to such a content-led business, whether by improving events delivery through optimised layouts and traffic flow, creating personalised experiences for participants or enabling automated content generation. There is lots of exciting potential. Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 44 45 |

| North 69% America Continental Europe 4% UK 7% China 3% Middle East 7% Rest of the world 10% Business Review continued Informa Tech is our B2B business exclusively focused on the Technology market, helping businesses and professionals connect, learn, make better decisions and drive revenue. The business is international in scope and reach but with its heart in the vibrant US market, home to many of our customers and much of the business activity. We have depth in a range of Technology segments, with particular strength in cyber security, gaming and enterprise IT. We own and operate major event brands, such as Black Hat, LEAP, AfricaCom and Game Developer Conference, which act as convening destinations for their industries, bringing together respected voices that guide and support future growth and innovation. Our events are where specialists in their market come together, exchange knowledge, discover trends, forge partnerships, finalise sales, gain accreditation and hear the latest thought leadership perspectives. Firms often use an event as a pivotal moment in their own calendars to make major announcements and promote new product launches. Through our research brands Omdia and, more recently, Canalys we bring together deep industry knowledge and experience. Our expert analysts and editors provide customers with actionable insights and intelligence that help companies quantify risks, identify opportunities and plan. Our research brands are complemented by a range of specialist digital content and media brands, including Light Reading, Information Week, AI Business and Industry Dive, which provide a range of high-quality targeted news, product features, reviews and insights. Our flagship cyber security event, Black Hat, which runs in August in Las Vegas each year, also saw strong growth. Exhibitor numbers were over 30% higher than in 2019, underlining the enduring strength of the brand. The growth potential and strategic importance of the cyber market led to the launch of Black Hat Middle East in Riyadh later in the year, another key launch brand for our Tahaluf partnership in the region. Omdia, our specialist technology research business, delivered steady growth through the year, with some impact of the slowdown in technology investment evident in custom research commitments. In September we expanded our research reach into the Channel and Mobility sectors through the addition of Canalys. Our specialist media and demand generation businesses felt the greatest impact of the broader Technology market slowdown, as marketing campaigns were paused and commitments reduced, although the strength of our brands meant we outperformed wider trends. We used the subdued market conditions to invest further in our brands and expand our reach. Industry Dive launched eight new Dives during the year, ranging from Hotel Dive to Fashion Dive and Packaging Dive, leveraging IIRIS first-party data to accelerate the pace and effectiveness of the rollout. At NetLine, we launched Intentive, a new buyer intent platform, which uses data from IIRIS to provide real-time B2B insights to marketers. The content we produce attracts specialist audiences, who register their details to gain access and simultaneously provide permission for us to track their activity online. These generate valuable first-party data and insights that help us understand which customers are interested in certain product categories at any moment in time. These buyer intent signals provide technology vendors with valuable intelligence on where to focus their sales outreach and marketing activity, identifying a set of highly qualified sales leads. 2023 performance review In 2023, live and on-demand events represented just under half of Informa Tech’s business. As we saw elsewhere in our portfolio, this area performed strongly as markets reopened post pandemic. This provided a good counterbalance to volatility in the broader Technology market, where higher interest rates saw technology investment slow. This impacted the growth in our research business, Omdia, and more significantly in our media and demand generation businesses. Overall, Informa Tech produced a good outcome in the year, with underlying revenue growth of 5.6% (2022: 43%). In live events, a major highlight was LEAP in Riyadh. In only its second year, it attracted almost 900 exhibitors and around 100,000 attendees, making it one of the leading events in the Technology calendar globally. Focused on the tech industry, we provide B2B data and market access to customers through live and on- demand events, specialist research, specialist media brands, digital demand generation and buyer intent. Revenue £397m 2022: £321m Outlook and opportunities Early in 2024 we made a significant announcement in relation to Informa Tech, confirming an agreement to combine Informa Tech’s digital businesses with US-listed TechTarget, creating a new TechTarget. This is subject to satisfying customary approvals and conditions, but is an exciting development that will create a leading platform for B2B data and market access and will enable B2B buyers and sellers to meet digitally at scale, in the same way they do in person at our live events. TechTarget’s and Informa Tech’s products are highly complementary. The expanded research teams and portfolio of more than 220 specialist media brands will become a go-to source for data, insights, features and reviews. This will generate valuable first-party data at scale, expanding the growth opportunity in demand generation and buyer intent. New TechTarget will be listed in the US, where the majority of the market, the customers and the value are located. The combined business will be led by the current Informa Tech CEO, Gary Nugent. Informa Tech’s content-led event brands will continue to deliver world-class experiences to business tech communities through their new home within Informa Connect. Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 48 49 |

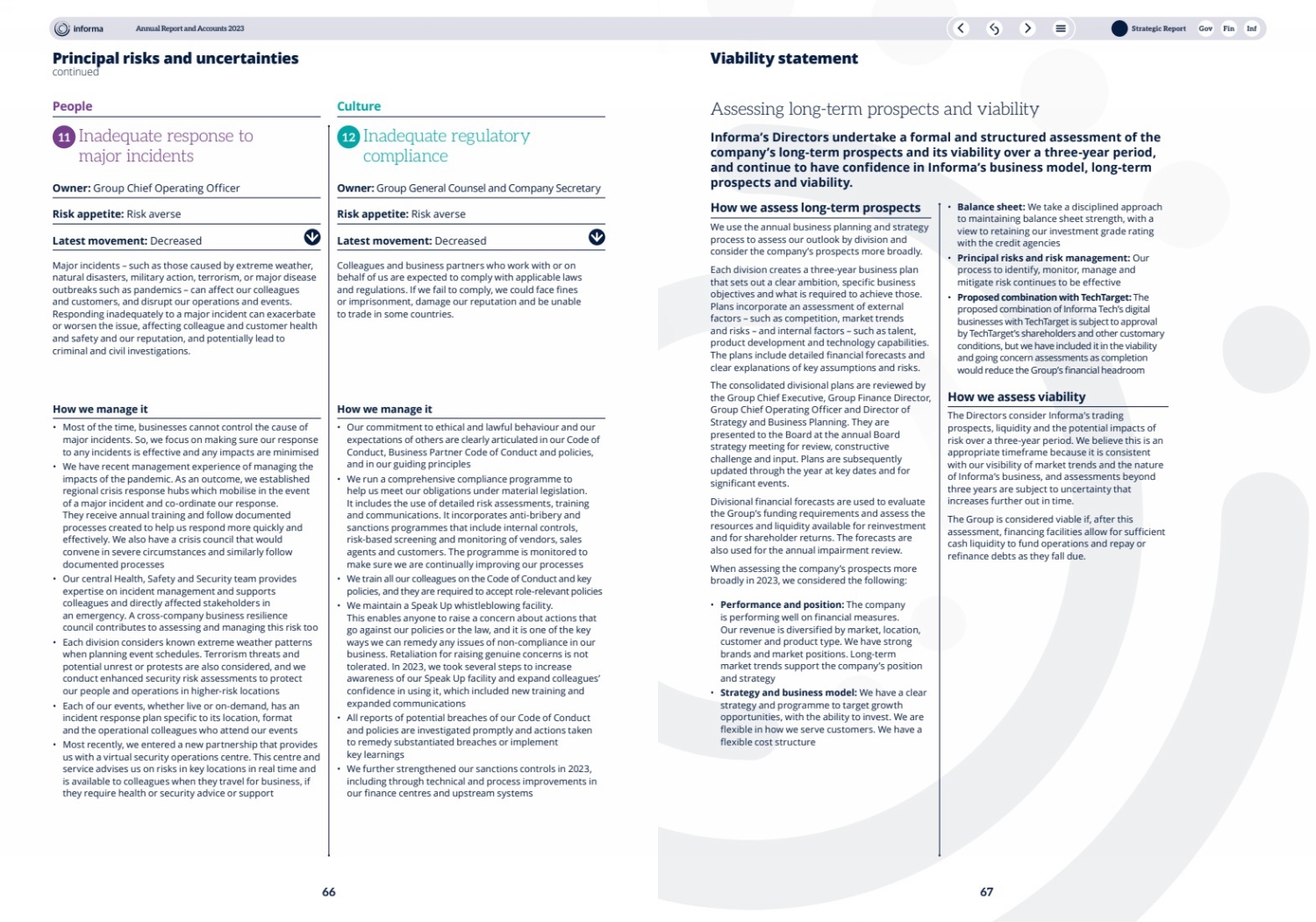

| Principal risks and uncertainties continued People Owner: Group Chief Operating Officer Risk appetite: Risk averse Latest movement: Decreased Major incidents – such as those caused by extreme weather, natural disasters, military action, terrorism, or major disease outbreaks such as pandemics – can affect our colleagues and customers, and disrupt our operations and events. Responding inadequately to a major incident can exacerbate or worsen the issue, affecting colleague and customer health and safety and our reputation, and potentially lead to criminal and civil investigations. 11 Inadequate response to major incidents Culture Owner: Group General Counsel and Company Secretary Risk appetite: Risk averse Latest movement: Decreased Colleagues and business partners who work with or on behalf of us are expected to comply with applicable laws and regulations. If we fail to comply, we could face fines or imprisonment, damage our reputation and be unable to trade in some countries. 12 Inadequate regulatory compliance Viability statement • Balance sheet: We take a disciplined approach to maintaining balance sheet strength, with a view to retaining our investment grade rating with the credit agencies • Principal risks and risk management: Our process to identify, monitor, manage and mitigate risk continues to be effective • Proposed combination with TechTarget: The proposed combination of Informa Tech’s digital businesses with TechTarget is subject to approval by TechTarget’s shareholders and other customary conditions, but we have included it in the viability and going concern assessments as completion would reduce the Group’s financial headroom How we assess viability The Directors consider Informa’s trading prospects, liquidity and the potential impacts of risk over a three-year period. We believe this is an appropriate timeframe because it is consistent with our visibility of market trends and the nature of Informa’s business, and assessments beyond three years are subject to uncertainty that increases further out in time. The Group is considered viable if, after this assessment, financing facilities allow for sufficient cash liquidity to fund operations and repay or refinance debts as they fall due. How we assess long-term prospects We use the annual business planning and strategy process to assess our outlook by division and consider the company’s prospects more broadly. Each division creates a three-year business plan that sets out a clear ambition, specific business objectives and what is required to achieve those. Plans incorporate an assessment of external factors – such as competition, market trends and risks – and internal factors – such as talent, product development and technology capabilities. The plans include detailed financial forecasts and clear explanations of key assumptions and risks. The consolidated divisional plans are reviewed by the Group Chief Executive, Group Finance Director, Group Chief Operating Officer and Director of Strategy and Business Planning. They are presented to the Board at the annual Board strategy meeting for review, constructive challenge and input. Plans are subsequently updated through the year at key dates and for significant events. Divisional financial forecasts are used to evaluate the Group’s funding requirements and assess the resources and liquidity available for reinvestment and for shareholder returns. The forecasts are also used for the annual impairment review. When assessing the company’s prospects more broadly in 2023, we considered the following: • Performance and position: The company is performing well on financial measures. Our revenue is diversified by market, location, customer and product type. We have strong brands and market positions. Long-term market trends support the company’s position and strategy • Strategy and business model: We have a clear strategy and programme to target growth opportunities, with the ability to invest. We are flexible in how we serve customers. We have a flexible cost structure Assessing long-term prospects and viability Informa’s Directors undertake a formal and structured assessment of the company’s long-term prospects and its viability over a three-year period, and continue to have confidence in Informa’s business model, long-term prospects and viability. How we manage it • Most of the time, businesses cannot control the cause of major incidents. So, we focus on making sure our response to any incidents is effective and any impacts are minimised • We have recent management experience of managing the impacts of the pandemic. As an outcome, we established regional crisis response hubs which mobilise in the event of a major incident and co-ordinate our response. They receive annual training and follow documented processes created to help us respond more quickly and effectively. We also have a crisis council that would convene in severe circumstances and similarly follow documented processes • Our central Health, Safety and Security team provides expertise on incident management and supports colleagues and directly affected stakeholders in an emergency. A cross-company business resilience council contributes to assessing and managing this risk too • Each division considers known extreme weather patterns when planning event schedules. Terrorism threats and potential unrest or protests are also considered, and we conduct enhanced security risk assessments to protect our people and operations in higher-risk locations • Each of our events, whether live or on-demand, has an incident response plan specific to its location, format and the operational colleagues who attend our events • Most recently, we entered a new partnership that provides us with a virtual security operations centre. This centre and service advises us on risks in key locations in real time and is available to colleagues when they travel for business, if they require health or security advice or support How we manage it • Our commitment to ethical and lawful behaviour and our expectations of others are clearly articulated in our Code of Conduct, Business Partner Code of Conduct and policies, and in our guiding principles • We run a comprehensive compliance programme to help us meet our obligations under material legislation. It includes the use of detailed risk assessments, training and communications. It incorporates anti-bribery and sanctions programmes that include internal controls, risk-based screening and monitoring of vendors, sales agents and customers. The programme is monitored to make sure we are continually improving our processes • We train all our colleagues on the Code of Conduct and key policies, and they are required to accept role-relevant policies • We maintain a Speak Up whistleblowing facility. This enables anyone to raise a concern about actions that go against our policies or the law, and it is one of the key ways we can remedy any issues of non-compliance in our business. Retaliation for raising genuine concerns is not tolerated. In 2023, we took several steps to increase awareness of our Speak Up facility and expand colleagues’ confidence in using it, which included new training and expanded communications • All reports of potential breaches of our Code of Conduct and policies are investigated promptly and actions taken to remedy substantiated breaches or implement key learnings • We further strengthened our sanctions controls in 2023, including through technical and process improvements in our finance centres and upstream systems Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 66 67 |

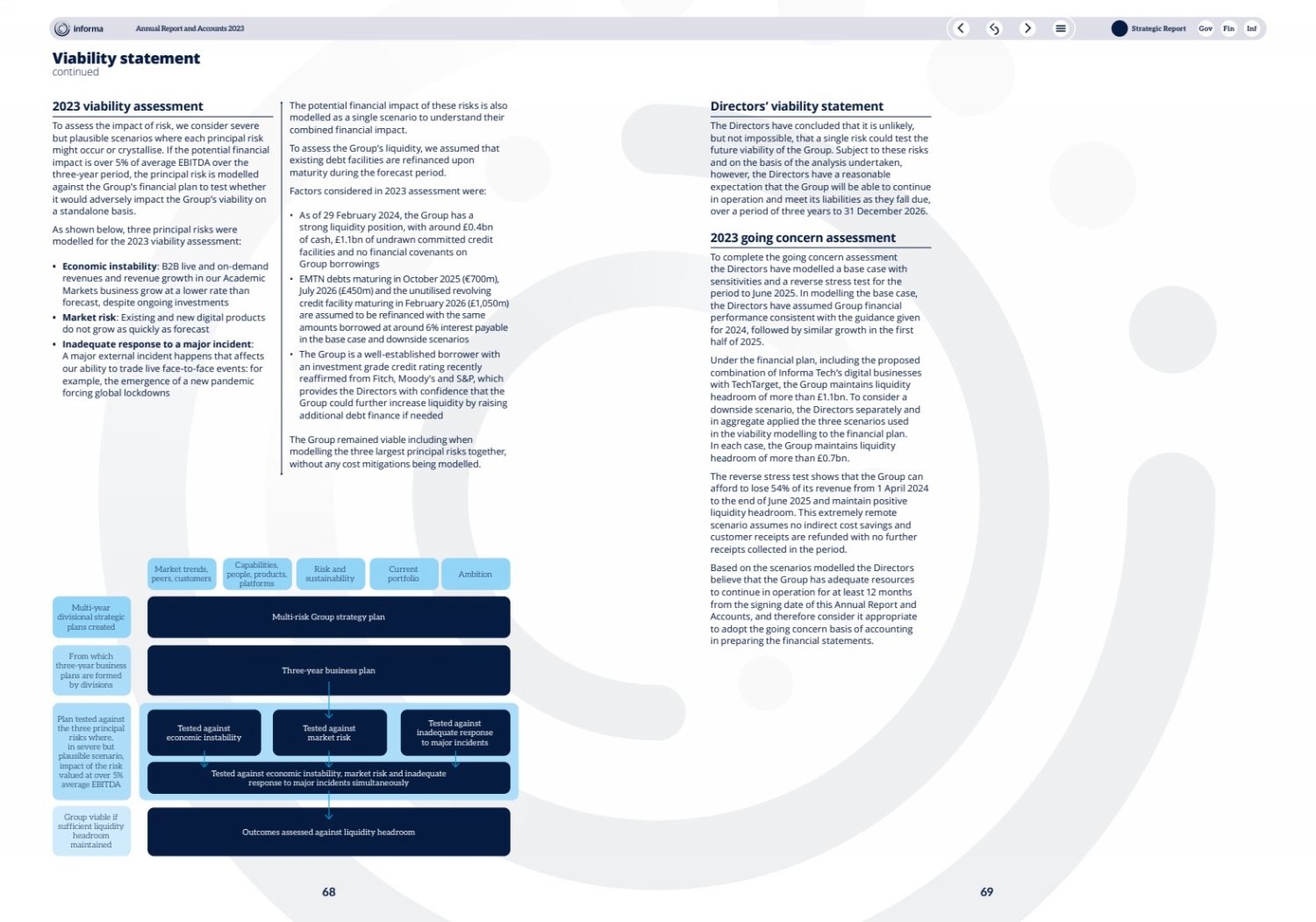

| The potential financial impact of these risks is also modelled as a single scenario to understand their combined financial impact. To assess the Group’s liquidity, we assumed that existing debt facilities are refinanced upon maturity during the forecast period. Factors considered in 2023 assessment were: • As of 29 February 2024, the Group has a strong liquidity position, with around £0.4bn of cash, £1.1bn of undrawn committed credit facilities and no financial covenants on Group borrowings • EMTN debts maturing in October 2025 (€700m), July 2026 (£450m) and the unutilised revolving credit facility maturing in February 2026 (£1,050m) are assumed to be refinanced with the same amounts borrowed at around 6% interest payable in the base case and downside scenarios • The Group is a well-established borrower with an investment grade credit rating recently reaffirmed from Fitch, Moody’s and S&P, which provides the Directors with confidence that the Group could further increase liquidity by raising additional debt finance if needed The Group remained viable including when modelling the three largest principal risks together, without any cost mitigations being modelled. 2023 viability assessment To assess the impact of risk, we consider severe but plausible scenarios where each principal risk might occur or crystallise. If the potential financial impact is over 5% of average EBITDA over the three-year period, the principal risk is modelled against the Group’s financial plan to test whether it would adversely impact the Group’s viability on a standalone basis. As shown below, three principal risks were modelled for the 2023 viability assessment: • Economic instability: B2B live and on-demand revenues and revenue growth in our Academic Markets business grow at a lower rate than forecast, despite ongoing investments • Market risk: Existing and new digital products do not grow as quickly as forecast • Inadequate response to a major incident: A major external incident happens that affects our ability to trade live face-to-face events: for example, the emergence of a new pandemic forcing global lockdowns Market trends, peers, customers Multi-year divisional strategic plans created Multi-risk Group strategy plan Three-year business plan From which three-year business plans are formed by divisions Group viable if sufficient liquidity headroom maintained Plan tested against the three principal risks where, in severe but plausible scenario, impact of the risk valued at over 5% average EBITDA Capabilities, people, products, platforms Risk and sustainability Current portfolio Ambition Tested against economic instability Tested against economic instability, market risk and inadequate response to major incidents simultaneously Outcomes assessed against liquidity headroom Tested against market risk Tested against inadequate response to major incidents Viability statement continued Directors’ viability statement The Directors have concluded that it is unlikely, but not impossible, that a single risk could test the future viability of the Group. Subject to these risks and on the basis of the analysis undertaken, however, the Directors have a reasonable expectation that the Group will be able to continue in operation and meet its liabilities as they fall due, over a period of three years to 31 December 2026. 2023 going concern assessment To complete the going concern assessment the Directors have modelled a base case with sensitivities and a reverse stress test for the period to June 2025. In modelling the base case, the Directors have assumed Group financial performance consistent with the guidance given for 2024, followed by similar growth in the first half of 2025. Under the financial plan, including the proposed combination of Informa Tech’s digital businesses with TechTarget, the Group maintains liquidity headroom of more than £1.1bn. To consider a downside scenario, the Directors separately and in aggregate applied the three scenarios used in the viability modelling to the financial plan. In each case, the Group maintains liquidity headroom of more than £0.7bn. The reverse stress test shows that the Group can afford to lose 54% of its revenue from 1 April 2024 to the end of June 2025 and maintain positive liquidity headroom. This extremely remote scenario assumes no indirect cost savings and customer receipts are refunded with no further receipts collected in the period. Based on the scenarios modelled the Directors believe that the Group has adequate resources to continue in operation for at least 12 months from the signing date of this Annual Report and Accounts, and therefore consider it appropriate to adopt the going concern basis of accounting in preparing the financial statements. Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 68 69 |

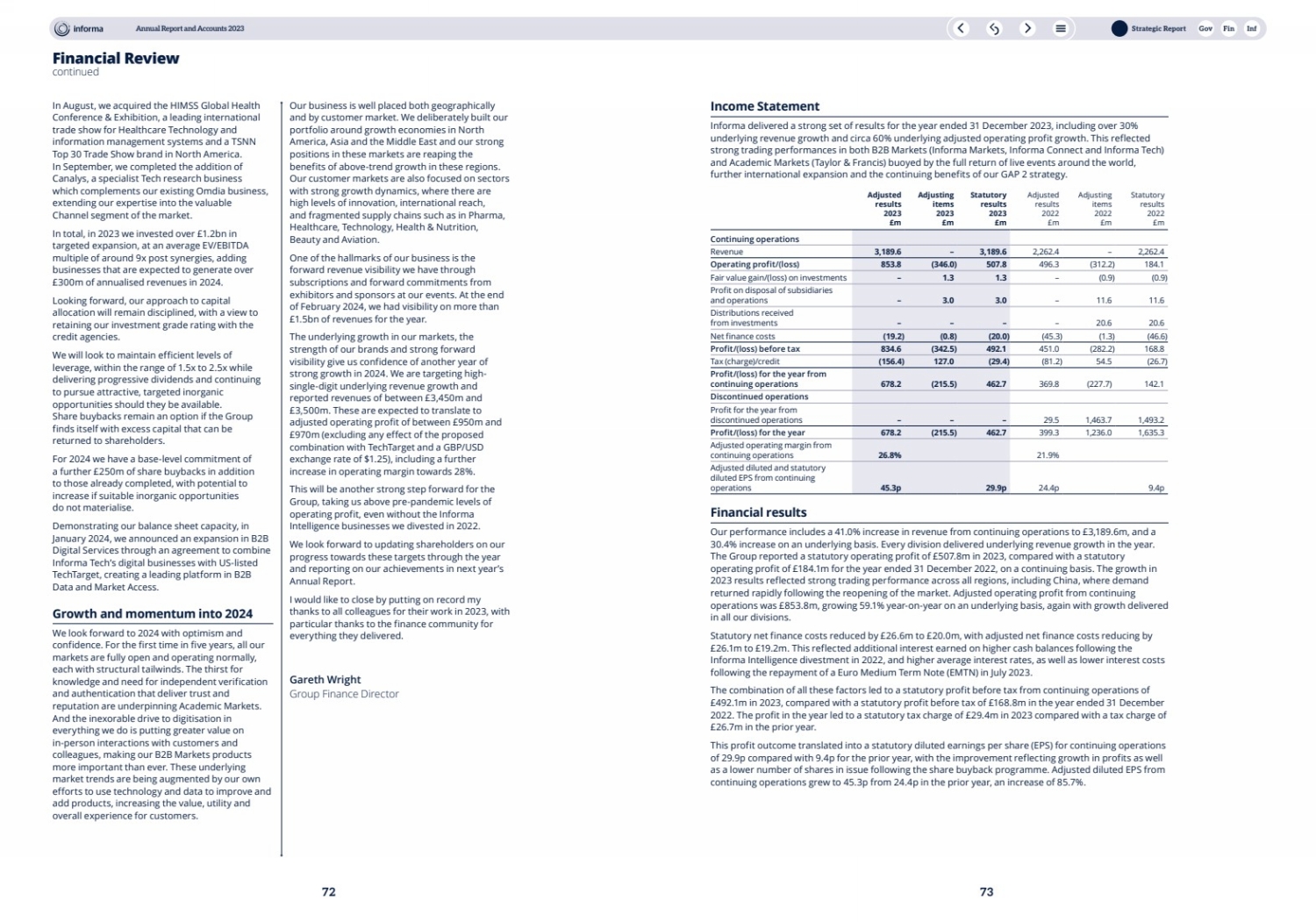

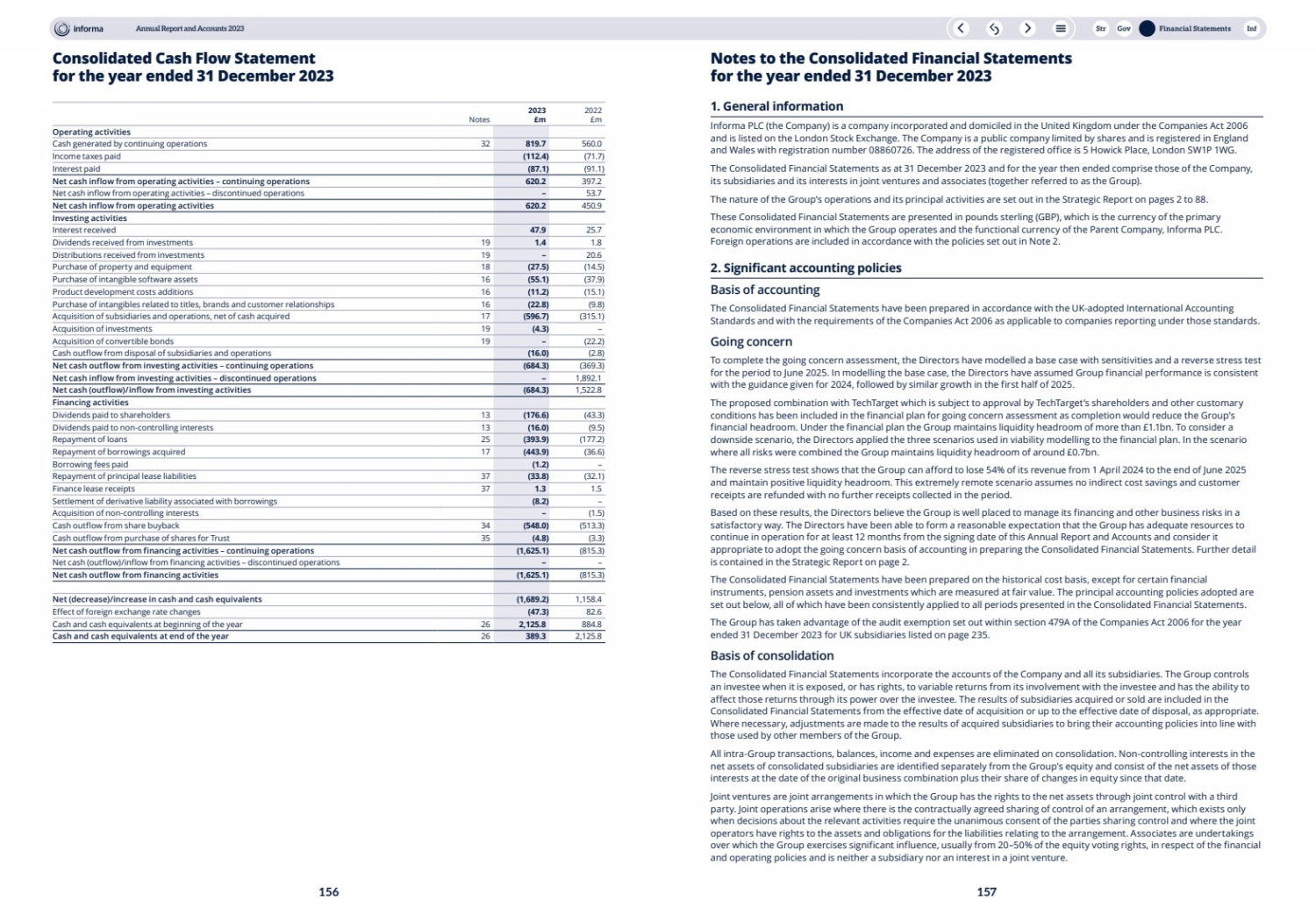

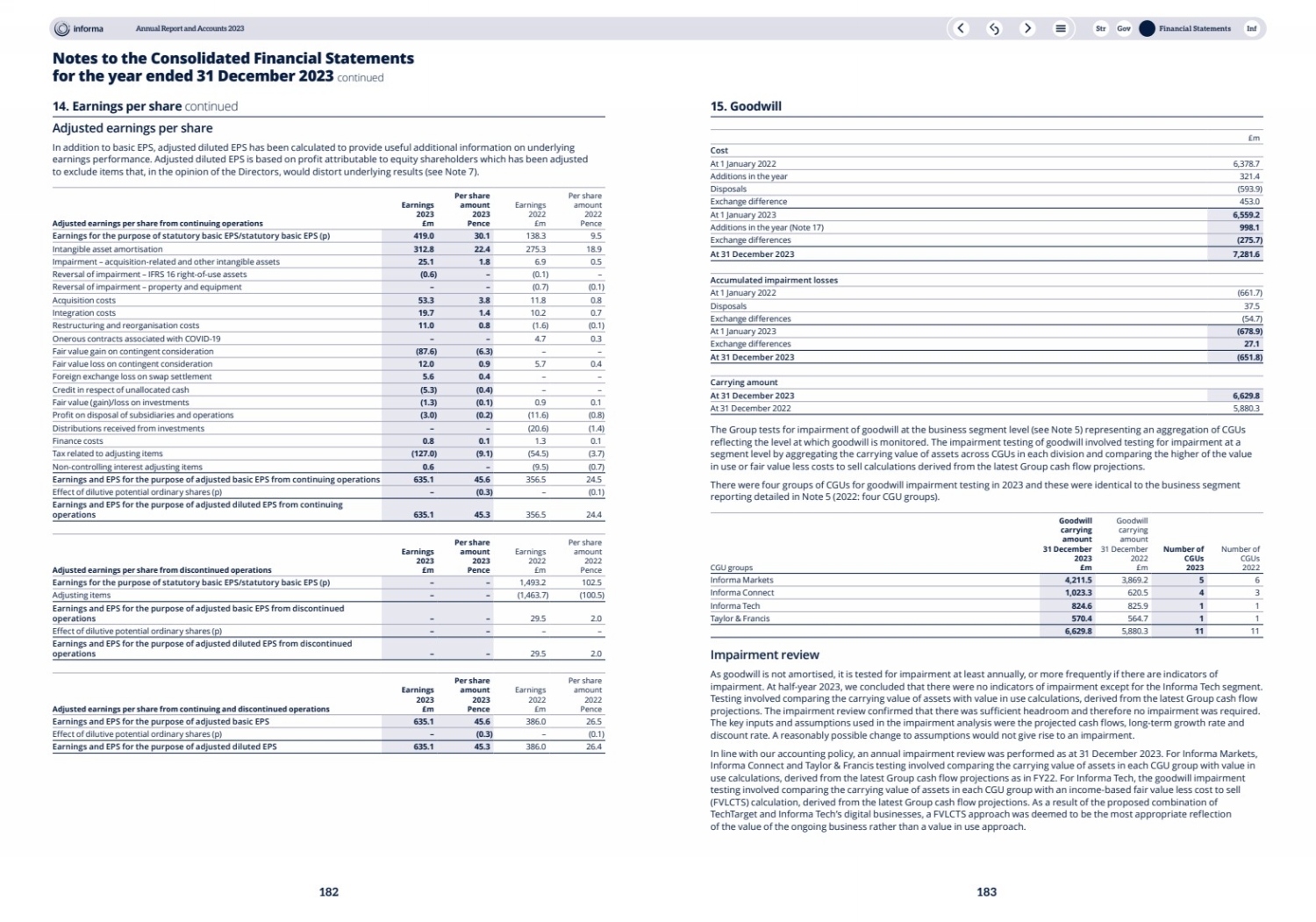

| Financial Review continued Our business is well placed both geographically and by customer market. We deliberately built our portfolio around growth economies in North America, Asia and the Middle East and our strong positions in these markets are reaping the benefits of above-trend growth in these regions. Our customer markets are also focused on sectors with strong growth dynamics, where there are high levels of innovation, international reach, and fragmented supply chains such as in Pharma, Healthcare, Technology, Health & Nutrition, Beauty and Aviation. One of the hallmarks of our business is the forward revenue visibility we have through subscriptions and forward commitments from exhibitors and sponsors at our events. At the end of February 2024, we had visibility on more than £1.5bn of revenues for the year. The underlying growth in our markets, the strength of our brands and strong forward visibility give us confidence of another year of strong growth in 2024. We are targeting high-single-digit underlying revenue growth and reported revenues of between £3,450m and £3,500m. These are expected to translate to adjusted operating profit of between £950m and £970m (excluding any effect of the proposed combination with TechTarget and a GBP/USD exchange rate of $1.25), including a further increase in operating margin towards 28%. This will be another strong step forward for the Group, taking us above pre-pandemic levels of operating profit, even without the Informa Intelligence businesses we divested in 2022. We look forward to updating shareholders on our progress towards these targets through the year and reporting on our achievements in next year’s Annual Report. I would like to close by putting on record my thanks to all colleagues for their work in 2023, with particular thanks to the finance community for everything they delivered. Gareth Wright Group Finance Director In August, we acquired the HIMSS Global Health Conference & Exhibition, a leading international trade show for Healthcare Technology and information management systems and a TSNN Top 30 Trade Show brand in North America. In September, we completed the addition of Canalys, a specialist Tech research business which complements our existing Omdia business, extending our expertise into the valuable Channel segment of the market. In total, in 2023 we invested over £1.2bn in targeted expansion, at an average EV/EBITDA multiple of around 9x post synergies, adding businesses that are expected to generate over £300m of annualised revenues in 2024. Looking forward, our approach to capital allocation will remain disciplined, with a view to retaining our investment grade rating with the credit agencies. We will look to maintain efficient levels of leverage, within the range of 1.5x to 2.5x while delivering progressive dividends and continuing to pursue attractive, targeted inorganic opportunities should they be available. Share buybacks remain an option if the Group finds itself with excess capital that can be returned to shareholders. For 2024 we have a base-level commitment of a further £250m of share buybacks in addition to those already completed, with potential to increase if suitable inorganic opportunities do not materialise. Demonstrating our balance sheet capacity, in January 2024, we announced an expansion in B2B Digital Services through an agreement to combine Informa Tech’s digital businesses with US-listed TechTarget, creating a leading platform in B2B Data and Market Access. Growth and momentum into 2024 We look forward to 2024 with optimism and confidence. For the first time in five years, all our markets are fully open and operating normally, each with structural tailwinds. The thirst for knowledge and need for independent verification and authentication that deliver trust and reputation are underpinning Academic Markets. And the inexorable drive to digitisation in everything we do is putting greater value on in-person interactions with customers and colleagues, making our B2B Markets products more important than ever. These underlying market trends are being augmented by our own efforts to use technology and data to improve and add products, increasing the value, utility and overall experience for customers. Income Statement Informa delivered a strong set of results for the year ended 31 December 2023, including over 30% underlying revenue growth and circa 60% underlying adjusted operating profit growth. This reflected strong trading performances in both B2B Markets (Informa Markets, Informa Connect and Informa Tech) and Academic Markets (Taylor & Francis) buoyed by the full return of live events around the world, further international expansion and the continuing benefits of our GAP 2 strategy. Adjusted results 2023 £m Adjusting items 2023 £m Statutory results 2023 £m Adjusted results 2022 £m Adjusting items 2022 £m Statutory results 2022 £m Continuing operations Revenue 3,189.6 – 3,189.6 2,262.4 – 2,262.4 Operating profit/(loss) 853.8 (346.0) 507.8 496.3 (312.2) 184.1 Fair value gain/(loss) on investments – 1.3 1.3 – (0.9) (0.9) Profit on disposal of subsidiaries and operations – 3.0 3.0 – 11.6 11.6 Distributions received from investments – – – – 20.6 20.6 Net finance costs (19.2) (0.8) (20.0) (45.3) (1.3) (46.6) Profit/(loss) before tax 834.6 (342.5) 492.1 451.0 (282.2) 168.8 Tax (charge)/credit (156.4) 127.0 (29.4) (81.2) 54.5 (26.7) Profit/(loss) for the year from continuing operations 678.2 (215.5) 462.7 369.8 (227.7) 142.1 Discontinued operations Profit for the year from discontinued operations – – – 29.5 1,463.7 1,493.2 Profit/(loss) for the year 678.2 (215.5) 462.7 399.3 1,236.0 1,635.3 Adjusted operating margin from continuing operations 26.8% 21.9% Adjusted diluted and statutory diluted EPS from continuing operations 45.3p 29.9p 24.4p 9.4p Financial results Our performance includes a 41.0% increase in revenue from continuing operations to £3,189.6m, and a 30.4% increase on an underlying basis. Every division delivered underlying revenue growth in the year. The Group reported a statutory operating profit of £507.8m in 2023, compared with a statutory operating profit of £184.1m for the year ended 31 December 2022, on a continuing basis. The growth in 2023 results reflected strong trading performance across all regions, including China, where demand returned rapidly following the reopening of the market. Adjusted operating profit from continuing operations was £853.8m, growing 59.1% year-on-year on an underlying basis, again with growth delivered in all our divisions. Statutory net finance costs reduced by £26.6m to £20.0m, with adjusted net finance costs reducing by £26.1m to £19.2m. This reflected additional interest earned on higher cash balances following the Informa Intelligence divestment in 2022, and higher average interest rates, as well as lower interest costs following the repayment of a Euro Medium Term Note (EMTN) in July 2023. The combination of all these factors led to a statutory profit before tax from continuing operations of £492.1m in 2023, compared with a statutory profit before tax of £168.8m in the year ended 31 December 2022. The profit in the year led to a statutory tax charge of £29.4m in 2023 compared with a tax charge of £26.7m in the prior year. This profit outcome translated into a statutory diluted earnings per share (EPS) for continuing operations of 29.9p compared with 9.4p for the prior year, with the improvement reflecting growth in profits as well as a lower number of shares in issue following the share buyback programme. Adjusted diluted EPS from continuing operations grew to 45.3p from 24.4p in the prior year, an increase of 85.7%. Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 72 73 |

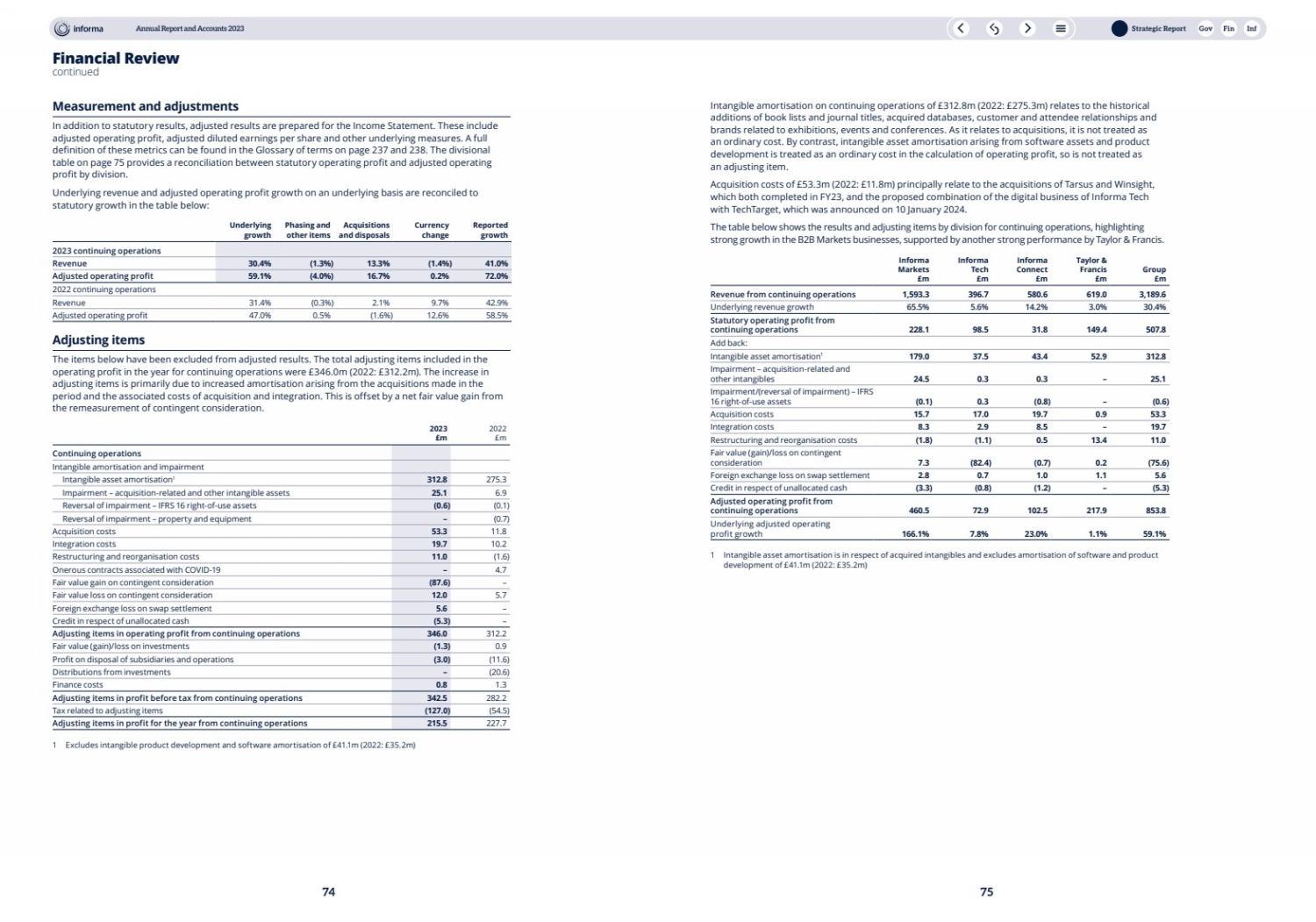

| Financial Review continued Measurement and adjustments In addition to statutory results, adjusted results are prepared for the Income Statement. These include adjusted operating profit, adjusted diluted earnings per share and other underlying measures. A full definition of these metrics can be found in the Glossary of terms on page 237 and 238. The divisional table on page 75 provides a reconciliation between statutory operating profit and adjusted operating profit by division. Underlying revenue and adjusted operating profit growth on an underlying basis are reconciled to statutory growth in the table below: Underlying growth Phasing and other items Acquisitions and disposals Currency change Reported growth 2023 continuing operations Revenue 30.4% (1.3%) 13.3% (1.4%) 41.0% Adjusted operating profit 59.1% (4.0%) 16.7% 0.2% 72.0% 2022 continuing operations Revenue 31.4% (0.3%) 2.1% 9.7% 42.9% Adjusted operating profit 47.0% 0.5% (1.6%) 12.6% 58.5% Adjusting items The items below have been excluded from adjusted results. The total adjusting items included in the operating profit in the year for continuing operations were £346.0m (2022: £312.2m). The increase in adjusting items is primarily due to increased amortisation arising from the acquisitions made in the period and the associated costs of acquisition and integration. This is offset by a net fair value gain from the remeasurement of contingent consideration. 2023 £m 2022 £m Continuing operations Intangible amortisation and impairment Intangible asset amortisation1 312.8 275.3 Impairment – acquisition-related and other intangible assets 25.1 6.9 Reversal of impairment – IFRS 16 right-of-use assets (0.6) (0.1) Reversal of impairment – property and equipment – (0.7) Acquisition costs 53.3 11.8 Integration costs 19.7 10.2 Restructuring and reorganisation costs 11.0 (1.6) Onerous contracts associated with COVID-19 – 4.7 Fair value gain on contingent consideration (87.6) – Fair value loss on contingent consideration 12.0 5.7 Foreign exchange loss on swap settlement 5.6 – Credit in respect of unallocated cash (5.3) – Adjusting items in operating profit from continuing operations 346.0 312.2 Fair value (gain)/loss on investments (1.3) 0.9 Profit on disposal of subsidiaries and operations (3.0) (11.6) Distributions from investments – (20.6) Finance costs 0.8 1.3 Adjusting items in profit before tax from continuing operations 342.5 282.2 Tax related to adjusting items (127.0) (54.5) Adjusting items in profit for the year from continuing operations 215.5 227.7 1 Excludes intangible product development and software amortisation of £41.1m (2022: £35.2m) Intangible amortisation on continuing operations of £312.8m (2022: £275.3m) relates to the historical additions of book lists and journal titles, acquired databases, customer and attendee relationships and brands related to exhibitions, events and conferences. As it relates to acquisitions, it is not treated as an ordinary cost. By contrast, intangible asset amortisation arising from software assets and product development is treated as an ordinary cost in the calculation of operating profit, so is not treated as an adjusting item. Acquisition costs of £53.3m (2022: £11.8m) principally relate to the acquisitions of Tarsus and Winsight, which both completed in FY23, and the proposed combination of the digital business of Informa Tech with TechTarget, which was announced on 10 January 2024. The table below shows the results and adjusting items by division for continuing operations, highlighting strong growth in the B2B Markets businesses, supported by another strong performance by Taylor & Francis. Informa Markets £m Informa Tech £m Informa Connect £m Taylor & Francis £m Group £m Revenue from continuing operations 1,593.3 396.7 580.6 619.0 3,189.6 Underlying revenue growth 65.5% 5.6% 14.2% 3.0% 30.4% Statutory operating profit from continuing operations 228.1 98.5 31.8 149.4 507.8 Add back: Intangible asset amortisation1 179.0 37.5 43.4 52.9 312.8 Impairment – acquisition-related and other intangibles 24.5 0.3 0.3 – 25.1 Impairment/(reversal of impairment) – IFRS 16 right-of-use assets (0.1) 0.3 (0.8) – (0.6) Acquisition costs 15.7 17.0 19.7 0.9 53.3 Integration costs 8.3 2.9 8.5 – 19.7 Restructuring and reorganisation costs (1.8) (1.1) 0.5 13.4 11.0 Fair value (gain)/loss on contingent consideration 7.3 (82.4) (0.7) 0.2 (75.6) Foreign exchange loss on swap settlement 2.8 0.7 1.0 1.1 5.6 Credit in respect of unallocated cash (3.3) (0.8) (1.2) – (5.3) Adjusted operating profit from continuing operations 460.5 72.9 102.5 217.9 853.8 Underlying adjusted operating profit growth 166.1% 7.8% 23.0% 1.1% 59.1% 1 Intangible asset amortisation is in respect of acquired intangibles and excludes amortisation of software and product development of £41.1m (2022: £35.2m) Annual Report and Accounts 2023 Strategic Report Gov Fin Inf 74 75 |

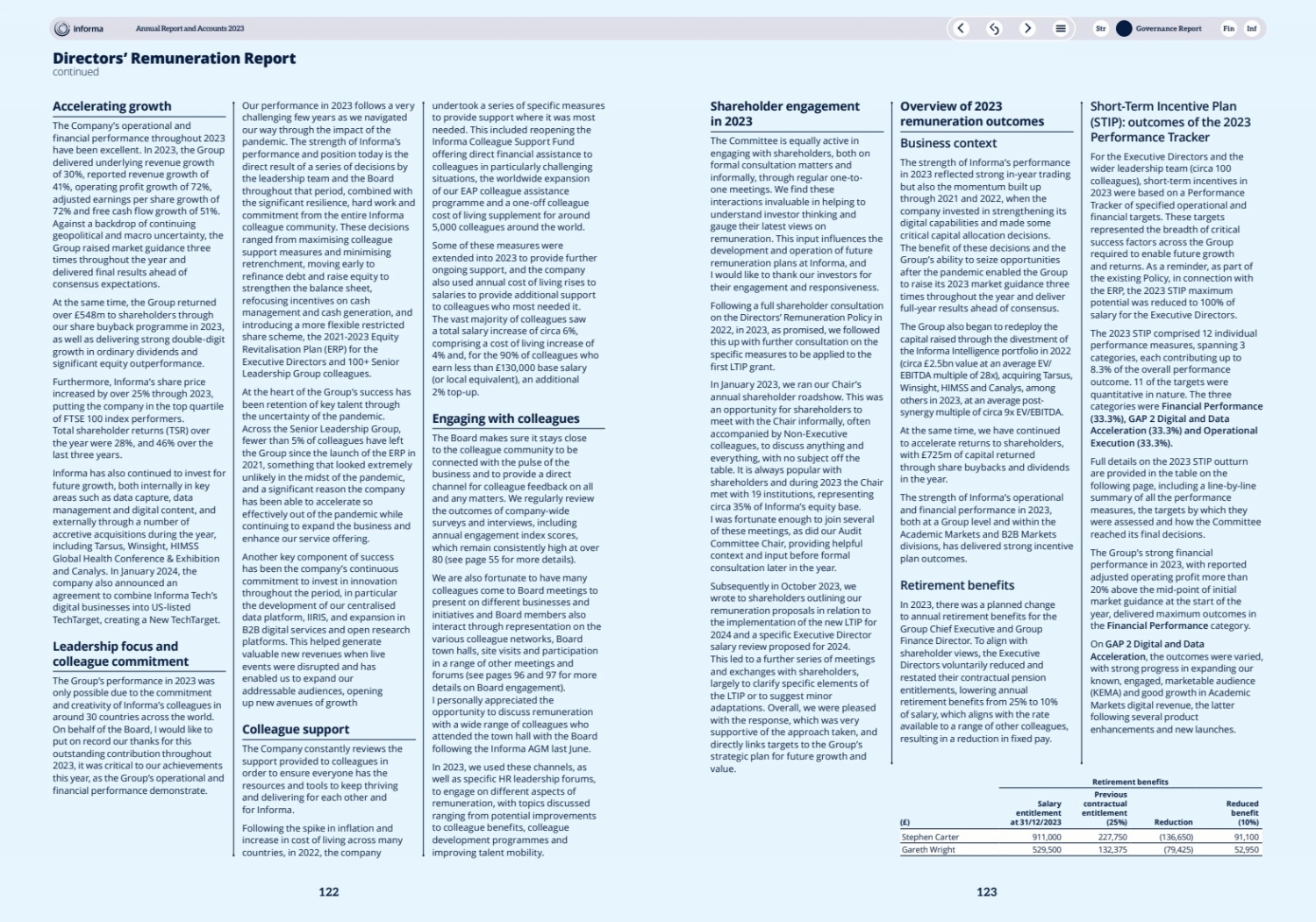

| Chair’s introduction to governance Another significant factor in our future growth is investing in digital technologies, including AI, to enhance our customers’ experience and make the business as efficient and productive as possible. Equally important are resilient systems that let us deliver products and services reliably and seamlessly. This year, the Board has again overseen the business in making investments and managing risks in these areas. A wide range of skills to steer the business To be able to support the business effectively on this and other matters, the Board needs a broad range of expertise and outlooks. Our Directors’ backgrounds include finance, digital, HR and marketing, while the international perspective that our Board colleagues from the US and China bring to world events and economic developments is also refreshing. Overall, I believe the Board has the diversity of thought and approach that is integral to making sound decisions and providing good counsel and positive challenge to the leadership. In 2023, we said farewell to Helen Owers after nine years on the Board, and on behalf of us all I thank her for her service. We also welcomed Andy Ransom, whose experience as CEO of Rentokil Initial, and expertise in areas including financial markets, adds another dimension to our discussions as we help Informa navigate a period of great possibility. Making the most of our strengths As with all businesses, our company faces risks as well as opportunities, and we mitigate them through a focused strategy, good growth prospects and strong balance sheet, as discussed in the Risk Management section (pages 56 to 59). Perhaps most important in mitigating risk, however – and seizing opportunities – is the quality and commitment of our colleagues. As a Board, we are also mindful that a business is only as strong as its culture, and we monitor it carefully. The company’s engagement survey data shows we are in a good place, with a completion rate of 85% and an overall engagement score of 80. Amid higher levels of inflation, we were pleased to be able to help colleagues living in particularly high cost of living countries with supplementary pay increases (for more details, see page 34). The Board oversaw significant strategic activity, driven by our growth plan, and we ended the year in an excellent position as a stronger, more focused Informa. As Chair of the Group, my excitement about Informa’s prospects has, if anything, increased. Now emphatically post-COVID, the company has delivered exceptional growth through 2023, with revenues comfortably surpassing pre-pandemic levels. This has put us in a good position to forge further ahead with our growth strategy, with the support of our shareholders and contribution of our colleagues. It has been a joy to see colleagues and everything they bring to the business first hand. I was privileged to be able to travel widely again, including visiting colleagues at Taylor & Francis in Oxford and meeting teams onsite at some of our larger events in Egypt and the US. Seeing colleagues at work, I have been humbled and inspired by their professionalism, and struck by their enthusiasm for Informa and our future – something it was great to see rewarded at our annual Informa Awards ceremony. I am pleased that this support for our business is also borne out by our investors. Their confidence stems from our growth prospects and strong balance sheet, but also from our leadership team and their consistent delivery of good financial results. I would like to thank Stephen and his team for the diligence, energy and expertise they have once again brought to decision making and leadership this year. Overseeing growth The main focus of the Board’s work this year has been to support and advise the leadership team in delivering GAP 2, which is now in its final year. A key part of GAP 2, and vital to our future growth, is to further scale and strengthen our position in Academic and B2B Markets. With the proceeds generated by divesting our Intelligence business in 2022, in 2023 we took the opportunity to acquire a number of excellent businesses. These included events group Tarsus, food services specialist Winsight and medical publisher Future Science Group. In January 2024, we also announced our agreement to combine Informa Tech’s digital businesses with US-based TechTarget to strengthen our position in B2B Digital Services. For Informa, acquisition does not simply mean adding assets but rather bringing complementary businesses and portfolios into the Group whose brands, talent and customer relationships will find a natural home with us and be able to further develop as part of Informa. Successful additions are therefore not just about commercial or market fit, but about cultural fit too. In practice, this means making sure new colleagues feel welcomed and supported, with minimal disruption for both them and their customers, so that they quickly start to feel the benefits of being part of a larger company. I am pleased to say that the integration of these new businesses has started well, and the sense of purpose behind them gives a lift to everyone, existing and new colleagues alike. As the impact of climate change intensifies, it is also clear that a business’s long-term prospects are linked to its sustainability. This is why the Board takes a close interest in Informa’s FasterForward sustainability programme, another facet of GAP 2. As the business has returned to full intensity after the pandemic, so the pace of activity has quickened on FasterForward. This is especially important in events and exhibitions, where being a leader makes our work to manage our environmental impact and share knowledge with peers particularly influential. We are also conscious that good governance is another part of what keeps a business strong and on a positive trajectory, driving conformance as well as performance. Even though the UK Government’s audit and governance reforms will not now be going ahead at this time, for example, the work the business has done to prepare for them will stand us in good stead, including for the changes to the UK Corporate Governance Code announced by the Financial Reporting Council in January 2024. Looking ahead Going into 2024, I am upbeat about the company’s prospects. This is arguably the most exciting period in Informa’s development, and Informa colleagues have done a lot of hard work to put us in this position. We have great growth opportunities, and great people with the capabilities to make the most of them. I look forward to continuing to offer my support and guidance alongside the rest of the Board. John Rishton Chair 7 March 2024 With the pandemic firmly behind us, Informa has gone from strength to strength this year. As a Board, we have supported and constructively challenged our leadership team to help them deliver the opportunities the company’s growth strategy presents. Annual Report and Accounts 2023 Str Governance Report Fin Inf 94 95 |