UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

ýANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2007

or

¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: _____________ to _____________

———————

BAXL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

———————

| | |

Nevada | 333-130492 | 352255990 |

(State or Other Jurisdiction | (Commission | (I.R.S. Employer |

of Incorporation or Organization) | File Number) | Identification No.) |

6 Berkshire Boulevard, Bethel, CT 06801

(Address of Principal Executive Office) (Zip Code)

(203) 730-1791

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

———————

Securities registered under Section 12(b) of the Exchange Act: NONE

Securities registered under Section 12(g) of the Exchange Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting companyý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference The issuer's revenues for its most recent year were $1,450,466.

The aggregate market value of the issuer's voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as reported on the Over-The-Counter Bulletin Board on June 29, 2007, the last business day of the registrant’s most recently completed second fiscal quarter was approximately $1,251,250.

At March 14, 2008 there were 14,721,150 shares of the Issuer's common stock outstanding.

TABLE OF CONTENTS

PART I

PART II

| | |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 20 |

ITEM 6. | SELECTED FINANCIAL DATA | 21 |

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 21 |

ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 25 |

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 25 |

| | |

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 25 |

ITEM 9A(T). | CONTROLS AND PROCEDURES | 25 |

ITEM 9B. | OTHER INFORMATION | 27 |

PART III

| | |

ITEM 10. | ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 28 |

ITEM 11. | ITEM 11. EXECUTIVE COMPENSATION | 30 |

ITEM 12. | ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 31 |

ITEM 13. | ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 32 |

ITEM 14. | ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 33 |

| | |

PART IV

i

FORWARD-LOOKING STATEMENTS

ALL STATEMENTS IN THIS DISCUSSION THAT ARE NOT HISTORICAL ARE FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED. STATEMENTS PRECEDED BY, FOLLOWED BY OR THAT OTHERWISE INCLUDE THE WORDS "BELIEVES", "EXPECTS", "ANTICIPATES", "INTENDS", "PROJECTS", "ESTIMATES", "PLANS", "MAY INCREASE", "MAY FLUCTUATE" AND SIMILAR EXPRESSIONS OR FUTURE OR CONDITIONAL VERBS SUCH AS "SHOULD", "WOULD", "MAY" AND "COULD" ARE GENERALLY FORWARD-LOOKING IN NATURE AND NOT HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS WERE BASED ON VARIOUS FACTORS AND WERE DERIVED UTILIZING NUMEROUS IMPORTANT ASSUMPTIONS AND OTHER IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN THE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE THE INFORMATION CONCERNING OUR FUTURE FINANCIAL PERFORMANCE, BUSINESS STRATEGY, PROJECTED PLANS AND OBJECTIVES. THESE FACTORS INCLUDE, AMONG OTHERS, THE FACTORS SET FORTH BELOW UNDER THE HEADING "RISK FACTORS." ALTHOUGH WE BELIEVE THAT THE EXPECTATIONS REFLECTED IN THE FORWARD-LOOKING STATEMENTS ARE REASONABLE, WE CANNOT GUARANTEE FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS. MOST OF THESE FACTORS ARE DIFFICULT TO PREDICT ACCURATELY AND ARE GENERALLY BEYOND OUR CONTROL. WE ARE UNDER NO OBLIGATION TO PUBLICLY UPDATE ANY OF THE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER THE DATE HEREOF OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS. READERS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS. REFERENCES IN THIS FORM 10-K, UNLESS ANOTHER DATE IS STATED, ARE TO DECEMBER 31, 2007. AS USED HEREIN, THE "COMPANY," "WE," "US," "OUR" AND WORDS OF SIMILAR MEANING REFER TO BAXL HOLDINGS, INC.

ii

PART I

ITEM 1.

BUSINESS

History

We are a Nevada corporation formerly known as Allmarine Consultants Corporation. On August 29, 2007, we acquired in a reverse merger transaction (the “Merger”) all of the outstanding securities of BAXL Technologies, Inc. and shortly thereafter changed our name to BAXL Holdings, Inc. See “Description of the Reverse Merger” below. In connection with our acquisition of BAXL Technologies, Inc., in August 2007 we sold in a private offering to accredited investors 5,649,669 shares of our common stock for gross proceeds of approximately $8.5 million (the “August Private Offering”).

Upon completion of the acquisition of BAXL Technologies, Inc., we ceased our prior business and going forward our sole business consisted of the business of BAXL Technologies, Inc. Accordingly, since our sole business is conducted solely through our wholly owned subsidiary, the following discussion of our business shall reference BAXL Technologies, Inc., which we refer to as “BAXL” or “BAXL Technologies.”

Overview

BAXL Technologies, formerly known as Merlot Communications, Inc., was founded in 1997 and manufactures and markets products incorporating proprietary and, what BAXL believes to be, innovative technology that enables the delivery of wired and wireless broadband applications including Internet access, Video on Demand, VoIP and Video Surveillance over existing telephone wiring. BAXL believes that the following characteristics of its technologies and products provide it with a competitive advantage in the market and distinguish them from its competitors:

·

BAXL’s technology is designed to work over most types of in-building wiring, with continuous fixed bandwidth and remote power and it is not aware of any other products currently on the market which provide the same capabilities. BAXL believes its solution is elegant and aesthetically pleasing, easy to install and use and yet powerful enough to fully utilize all the benefits of present day and future broadband applications;

·

BAXL’s Solution enables carriers and application service providers an alternate option to offer broadband services such as High Speed Internet Access (10Mbps), Video on Demand, Voice over IP and Video Surveillance creating opportunities in new markets. BAXL believes it has the only solution that supports all applications concurrently; and

·

BAXL’s reliable and cost effective solution offers property owners the ability to deliver a wide range of broadband services to their clients and guests with minimal disruption.

BAXL believes its technology is unique in the industry which allows it to differentiate itself from its competitors by providing customers with a ‘one stop shop’ for broadband state-of-the-art products and services.

BAXL has formed, and is actively involved in, several alliances to implement its expansion plans, broaden its operations and maximize its sales. BAXL distributes products through carriers and partners like British Telecom to service Multiple Tenant Units (MTUs) and Multiple Dwelling Units (MDUs), healthcare, education and government markets. BAXL believes these types of properties tend to recognize the benefits of this solution, as many customers can be reached with a relatively smaller infrastructure investment.

Technology

BAXL’s Merlot Solution™ includes a transceiver that is specifically designed for in-building wiring, where there are no set standards for wire topologies and cable bundling.

BAXL uses:

·

Simple digital transmission techniques that deliver continuous fixed bandwidth.

·

A low-level signal driver that greatly reduces cross talk problems with non-Telco-standard wiring.

·

A simple digital receiver that makes it relatively immune to adjacent noise.

1

As compared to Digital Subscriber Line (DSL) Technology

DSL transceivers are designed for the local loop between the central office and the customer premises where there are set standards for wire topologies and cable bundling.

DSL uses:

·

Complex modulation techniques with little control on fixed bandwidth.

·

High level signal drivers that create cross talk on non-standard topologies or bundles found in building environments.

·

Complex and sensitive analog receivers that are susceptible to the noise commonly found in building environments.

Products

BAXL products and technologies enable the delivery of broadband applications including voice, video and data, over existing telephone wiring. BAXL's products are based upon proprietary technology, called the “Merlot Solution™.” The Merlot Solution enables customers to deliver High Speed Internet Access, Video on Demand, Voice over IP and Video Surveillance over conventional telephone lines without the use of modems or power outlets. BAXL believes that the Merlot Solution is even effective under the worst wiring conditions.

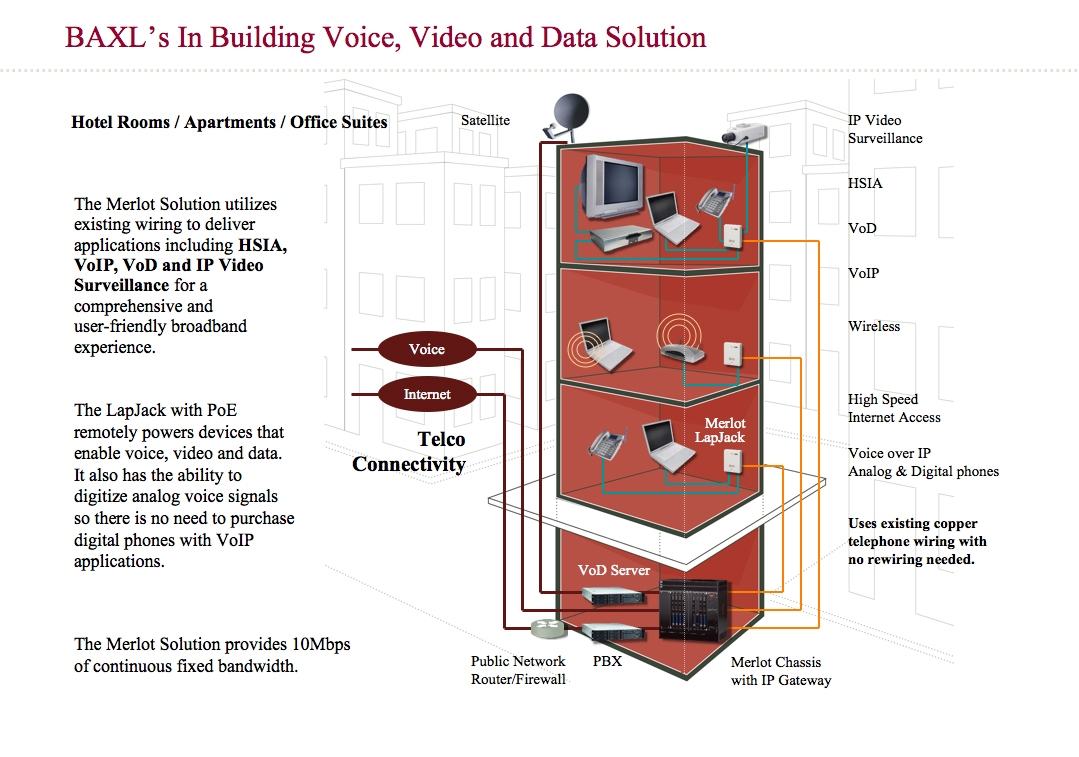

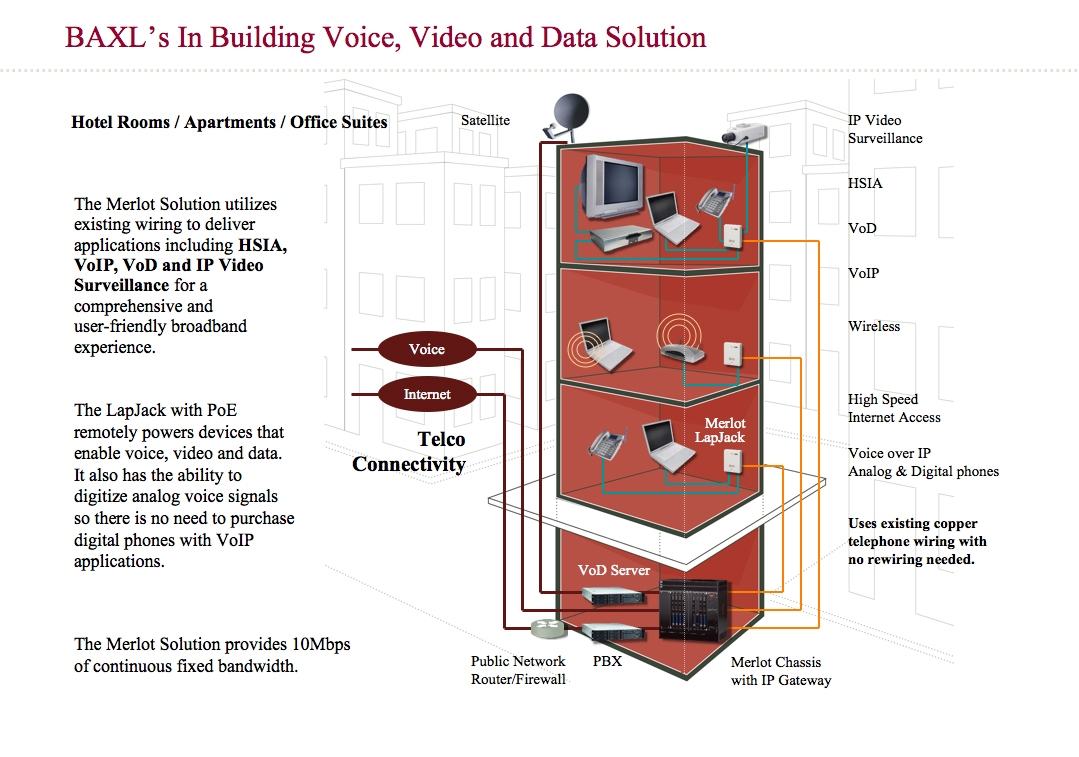

BAXL believes its customers like the ease of use of BAXL products. All that is required to install and use BAXL products in a building are; the building’s existing telephone wiring, a few BAXL components in the building’s communications room and a telephone jack. The existing telephone jack is removed, BAXL’s LapJack is installed in its place and users can just plug in to the jack and be instantly connected to the Internet, as well as use the product for other broadband applications. The illustration below shows how each room or apartment can use BAXL products:

2

The Merlot Solution products include:

Merlot Solution - Chassis

The Chassis has a 96-192 unit capacity and combined with the LapJack in-room device, and Universal Services Gateway, forms a complete broadband solution with applications including High Speed Internet Access, VoIP, Video on Demand, IP Video Security & Surveillance.

Merlot Solution - Mini Chassis

The Mini Chassis has a 24-36 unit capacity and is best suited for small or partial installations or distributed areas such as resorts and campus type environments, while still keeping the cost of ownership similar to larger deployments.

Merlot Solution – Multi-Media LapJack

BAXL believes the LapJack is the only device on the market today that combines continuous fixed speed (10Mbps), remote power and digitizes analog voice signals over existing single pair telephone wiring.

LapJack Key Features include:

·

Standard Ethernet connections

·

Runs over single pair voice grade wiring up to 1,000 feet

·

Continuous fixed speed of 10Mbps

·

Remotely powered

·

Wall or surface mount

·

Two isolated, auto-sensing Ethernet ports

·

Internet port for HSIA

·

Aux/Data port for Video

·

Cable crossover detection and correction

·

Two phone ports

·

Multi-Media LapJack 1 - voice coder-decoder for single pair applications

·

Multi-Media LapJack 2 - voice pass through for multi pair applications

Merlot Wireless Solution

BAXL and Colubris Networks have co-developed an integrated wired and wireless broadband solution. This solution delivers a rich set of network services to 802.11a/b/g devices, providing what BAXL believes is a convenient method for offering users the highest degree of flexibility and configurability while also offering unprecedented ease of deployment and management.

The Wireless Solution combines the simplicity of a plug and play unit, the security of 128-bit encryption and the ease of a software-free installation to quickly connect users to a network. BAXL believes the Wireless Solution delivers seamless mobility, strong security, minimal operating costs, and offers users the convenience of an unwired connection experience and the peace of mind that their data is safe over the airwaves.

The Wireless Solution supports up to 16 individual independent Virtual Service Communities (VSCs). It also has comprehensive support for Voice over Wireless Local Area Network (VoWLAN), roaming and configurable access points or Dynamic Wireless Distributing Systems (WDS) operating modes.

Merlot Solution - Video on Demand

BAXL believes that its technology integrated with a 3rd party Video on Demand Solution offers a mutually beneficial relationship between a property and its users or residents. Users can perform e-commerce transactions, receive TV-based messages regarding calls or visitors, send and receive e-mail and attachments, as well as print documents to a common business center. All of the transactions occur through a graphical user interface (GUI) on their TV.

The GUI allows users to be up-to-date on all of the current events at the property. As an example for hospitality applications, users can charge Internet services, order food, and movies right from the TV achieving a leap forward form a passive TV entertainment system.

3

The Video on Demand solution’s GUI allows the property to add its branding and photos to the on-screen information so that the look and information become an integral part of the property services. The scalability of this solution allows the property to add and remove features as the need arises, giving the property, BAXL believes, the flexibility to minimize the total cost of ownership for now and the future.

Merlot Solution - Category 5 (CAT5)

BAXL believes its CAT5 solution utilizing 3rd party switches is powerful and cost effective. It leverages highly reliable hardware with extensive feature sets to support a full suite of broadband data applications. The Category 5 solution supports all IEEE 802.3-compliant devices such as personal computers, routers, and wireless access points, typically deployed in apartments, meeting rooms, conference areas, guest rooms, etc.

The CAT5 Solution provides port-to-port isolation using Virtual Local Area Networks (VLANS) to create a secure environment from all other users. Data Packets receive from any non-trusted source are dropped, creating a secure environment and eliminating extraneous traffic on the system. This solution consists of 3rd party switches, which support 24/48 port IEEE 802.3-compliant Ethernet devices up to 100 meters (328 feet) over CAT5 cabling. Power over Ethernet (PoE) 802.3af compliant models are also available for wireless distribution, Voice over IP (VoIP) and Video on Demand (VoD) applications.

WI-FI Embedded Lapjack

BAXL has developed and is producing what it believes will be an innovative approach to offering wired and wireless broadband delivery by integrating its wired LapJack with a 3rd party wireless access point. BAXL believes that this integration could improve reliability, security and product aesthetics while reducing the overall cost of deploying a wired solution with a separate wireless overlay. BAXL contemplates that this potential new member of the Merlot Solution family of LapJacks would support both wired and wireless services, while maintaining support for HSIA, VOIP and VOD applications.

Application/Opportunity:

·

Creates a cost-effective, single-vendor, combined wired and wireless solution for properties requiring both access types.

·

Opportunity to “own the customer”, simplify installations, undercut pricing of stand-alone WiFi competitors, expand addressable market, and organically enhance margins.

Research and Development

During the 2 year period before the Merger, due to lack of capital, BAXL was not able to sufficiently fund research and development. BAXL intends to use a portion of the net proceeds of the August Private Offering (assuming sufficient funds remain available for such purpose) to engage in research and development to advance its products to achieve multiple broadband applications.

Potential Future Products/Features

Below is a description of the some of the new products that BAXL will be attempting to develop. No assurance can be given as to when, if ever, such products will be developed or, if developed, whether such products will be available to the market. In addition, no assurances can be given that if such products are developed and introduced to the market, that such products will generate future revenues.

1. Power Over Ethernet (PoE) LapJack

BAXL intends to develop a process of combining its LapJack solution with industry standard Power over Ethernet (PoE). PoE technology allows any system to transmit electrical power, along with data, to remote devices over standard twisted-pair cable in an Ethernet network. PoE technology is useful for powering digital telephones, wireless access points, video surveillance, etc., where it would be inconvenient or infeasible to supply power separately. BAXL’s PoE LapJack’s anticipated wattage and distance is 7 – 9 watts at 1000 feet and 15.4 watts at 750 feet.

4

Application/Opportunity:

·

Creates a cost-effective solution for properties seeking to deploy PoE-driven peripherals.

·

Opportunity to enhance BAXL’s differentiation with DSL, WiFi and WiMax, undercut potential competitive advantage of Broadband-over-Power Line (“BPL”), and maintain advantage over CAT 5E retrofit in PoE-required installations.

2. High Speed LapJack Solution

In an effort to create a cost-effective solution for advanced IP-based peripherals and applications. BAXL is developing a LapJack with speeds in excess of 50 Megabits per second that also maintains remote power capabilities, as well as its fixed bandwidth configurations.

BAXL may continue to use its technology to increase the bandwidth speed, as well as review new and future DSL technology. BAXL currently intends to have this solution available in all LapJack versions.

Application/Opportunity

·

Creates a cost-effective solution for advanced IP-based peripherals and applications

·

Opportunity to further establish bandwidth as a positive differentiator to DSL and 802.11b WiFi

3. Ethernet Switch (ES-24) Card Upgrade

BAXL believes that one of the benefits of using its technology is the ability to provide broadband application over any type of older sub-Category 5 wiring. However, in many properties there are multiple types of wiring. This may occur if a new building or wing is added to an older property. BAXL is working on developing an Ethernet switch card that will allow for broadband applications over newer Category 5 or 6e wiring environments as well as older sub-Category 5 wiring in order to provide properties with both types of wiring with a single vendor solution.

Application/Opportunity

·

Creates a cost-effective, single vendor solution for both in-building distribution infrastructure and Internet access router/switch platform.

·

Reduces price points and costs (versus 3rd party switch), and increases revenue opportunities and improves margins.

Sales, Marketing, Distribution

BAXL markets and distributes its products directly through its own in house sales force (which currently consists of 8 full time persons) and through resellers and distributors. Since its inception, BAXL has directly sold and serviced its proprietary solution to properties worldwide. Through such direct selling and servicing, BAXL has realized the benefit of receiving primary feedback and first hand knowledge of end user acceptance for feature functionality and price performance. BAXL has attempted to use this knowledge to provide the basis for its various reseller and distributor arrangements.

During approximately the past 4 years, BAXL has installed its products in over 180 properties and 30,000 rooms in the hospitality marketplace. BAXL believes that direct and consistent client feedback from customers operating hotels, including customers operating hotels in such chains as Marriott, Hilton and Radisson, has helped, BAXL to hone both its product development efforts and marketing message.

BAXL has used its experience in the hospitality sector to attempt to position itself within the broader marketplace of supplying technical solutions for global service providers, OEMs, system integrators and carriers. In 2006, BAXL worked to develop relationships with the following:

5

1. British Telecom (BT)

BT is presently marketing and selling BAXL technology into their hospitality, local business enterprise and convergent technology divisions.

2. Nortel Networks

Nortel Networks’ hospitality division has added BAXL Technologies to their Open Developer Program as a means to offer BAXL products as an upgrade path to their legacy PBX customers. By virtue of the added flexibility of the Merlot Solution, BAXL believes that Nortel can also sell secondary and tertiary applications across BAXL’s broadband backbone.

3. RCI Resorts

BAXLhas beenselected to supply High Speed Internet Access across1,100 RCI resorts in Europe. RCI has further requested that BAXL supply Wireless overlays and at certain properties Video on Demand in concert with its high speed solution.

In addition to supporting the above global strategicinitiatives, BAXL’s business strategy is to engage local resellers and system integrators in Mexico, as well as Central and Eastern Europe where the age of the inside wiring and building architecture best meets BAXL’s building profile.

Competition

The market for products such those developed by BAXL is highly competitive and we face competition from a number of companies, most of which have substantially greater brand name recognition and financial, research and development, production and other resources than we do. BAXL believes its competition falls into two categories:

·

Low-Tech competition such as rewiring an entire building with an alternative medium of Category 5, Category 6E or coaxial cable.

·

High-Tech competition such as various flavors of Digital Subscriber Lines (DSL); including Asymmetric Digital Subscriber Line (ADSL); Symmetric Digital Subscriber Line (SDSL); High-data-rate DSL (HDSL) and Very high DSL (VDSL), as well as cable modems and wireless.

Based upon BAXL’s past experience marketing its products, BAXL believes that customers view the low-tech option as highly unappealing. The potential costs, inconvenience and disruption resulting from having to re-wire a property create a competitive disadvantage for BAXL’s low-tech competition.

BAXL’s primary high-tech competition is DSL. Given that the telecommunications industry has standardized on this technology, it is typically viewed as the option of first choice to resolve broadband challenges.

BAXL believes that its products offer the following advantages to DSL:

·

Product development specifically focused on inside wiring;

·

High tolerance to wiring noise;

·

Power over Ethernet, providing electrical power for peripheral devices such as wireless access points, set top boxes, etc.;

·

The ability to digitize analog voice signals at the jack level; and

·

Continuous fixed bandwidth speeds of 10Mbps

Customers

Historically, BAXL has marketed and distributed its Merlot Solution ™ into the hospitality marketplace. Through a combination of both direct sales as well as through strategic partnerships, BAXL presently has successfully installed and serviced in excess of 180 customers with over 30,000 rooms globally. BAXL markets its products to hotel owners and operators. Some of BAXL’s customers own hotels within some of the more notable hotel chains including:

6

| | |

● Marriott | ● Ritz Carlton | ● Best Western |

● Marriott Vacation Clubs | ● Ramada | ● Westin |

● Hilton | ��� Radisson | ● Sheraton |

Historically, BAXL has focused its marketing efforts on the hospitality sector, and has found that the hospitality marketplace has been very receptive to Merlot Solution ™. However, BAXL believes the potential market for its products and technology are not limited to the hospitality market. BAXL believes the key elements to properties benefiting from using BAXL technology isn’t a specific market but the actual building profile, wiring type and broadband application requirements. More specifically, BAXL believes the profile for using BAXL’s Merlot Solution includes properties or buildings with any or all of the following criteria:

·

A need to offer multiple broadband applications such as High Speed Internet Access, Voice over IP, Video on Demand, Video Surveillance, SmartRoom solutions, to business clients, guests, or tenants

·

Buildings that are 8+ years old

·

Multiple units/apartments/rooms (24+ units)

·

Any condition of existing wiring

·

No budget for rewiring with Category 5 cable

·

No desire for defacing the building

·

Requirement for minimal disruption to clients, guests or tenants

·

No ready access to coaxial cable

·

Requirement for a combination of wired and wireless broadband service with a preference to work with one vendor

·

Lack of existing broadband solution

·

Requirement for a reliable, easy to install, and user friendly broadband solution

As BAXL attempts to expand its marketing presence, one of its goals will be to establish and fortify a position with global service providers, system integrators and carriers as the technology of choice for all backbone and broadband application solutions to all markets. Whether the building in question is part of the healthcare, government, education, housing or multi-tenant industries, BAXL’s technology will prove effective in supporting the end user’s broadband needs.

Manufacturing

BAXL is an Original Equipment Manufacturer (“OEM”) and its manufacturing is based on a production schedule that is driven by both sales orders and sales forecasts. Production is done through contract manufacturers utilizing existing software to generate an MRP (Material Requirement Plan) for all components. BAXL monitors and adjusts the production plan weekly to meet the changing demand. This controls the amount of inventory on hand over a 3 month rolling forecast.

BAXL has entered into agreements with its primary suppliers in order to attempt to ensure that components are available when needed. The suppliers maintain a predetermined quantity at their location based the ability to replenish the stock levels within lead time.

All other material, sub assemblies, etc., are ordered as required based on various parameters. All aspects of procurement are conducted on a purchase order basis. Finished goods are shipped from BAXL’s main headquarters located in Bethel, Connecticut.

At present, most stages of manufacturing are done in a sub-contractor’s production facility located in Connecticut. BAXL believes that the current manufacturing facilities are sufficient for their needs for the foreseeable future. If sales volume requirements increase, BAXL will attempt to identify other contract manufacturers to either replace or supplement the existing ones.

Employees

As of March 14, 2008, we had a total of 31 full time employees. None of our employees are represented by a trade union.

7

Intellectual Property

BAXL is currently contemplating potential patent applications and intends to attempt to pursue obtaining patents on new products. BAXL protects its intellectual property and proprietary technology by entering into confidentiality or license agreements with 3rd parties as needed, and by generally limiting access to and distribution of their trade secret technology and proprietary information. BAXL products utilize technology patented by a third party. BAXL has entered into a non-exclusive license agreement with such third party pursuant to which BAXL licenses certain technology used in its products in exchange for a lump sum payment of $200,000 payable in eight quarterly installments from October 2006 through July 2008 and a 3% royalty on products sold. Such royalty payments are capped at a maximum of $1.8 million.

Insurance Matters

BAXL maintains a general business liability policy and other coverage specific to their industry and operations. It also maintains general product liability coverage, and directors and officers liability coverage. BAXL believes that its insurance programs provide adequate coverage for all reasonable risks associated with operating its business.

Government Regulation

BAXL products are subject to the following government regulations.

In North America, BAXL must be in compliance with the Federal Communications Commissions (FCC) Part 15 of Title 47 of the code of Federal Regulations. This code regulates low power, unlicensed devices that could cause interference to the amateur radio service and vice versa.

In the European Union (EU) BAXL’s products are subject to the ElectroMagnetic Compatibility (EMC) directive which governs the electromagnetic emissions of electronic equipment in order to ensure that, in its intended use, such equipment does not disturb radio and telecommunication, as well as seeks to ensure that this equipment is not disturbed by radio emissions normally present used as intended.

Worldwide, Underwriters Laboratories Inc. (UL) is an independent, not-for-profit product safety testing and certification organization. BAXL’s products are in compliance with UL IEC 7609-1 which is the International Standard for Safety of Information Technology Equipment. It encompasses information technology equipment, communication equipment, office appliances, and multi-media equipment for use in the home, office, business, school, computer room and similar ordinary locations.

BAXL’s specific US and foreign regulations include the following:

1) US and Canada Regulations:

·

FCC Part 15 for Emissions

·

UL, CSA 60950-1 with a cTUVus certificate for Product Safety

2) International Regulations:

·

European EMC directive (EN55022, EN55024. EN61000–3-2 & 3-3) for Emissions/Susceptibility, CE Mark

·

IEC 60950-1, full CB report for safety

3) BAXL’s products are also RoHS compliant, per Directive 2002/95/EC of the European Union.

Description of the Reverse Merger

Effective August 29, 2007, pursuant to the terms of an Agreement and Plan of Merger (the “Merger Agreement”) dated as of May 25, 2007 between us, our wholly owned subsidiary Allmarine Acquisition Corporation (“AAC”) and BAXL Technologies, Inc., AAC merged with and into BAXL Technologies, with BAXL Technologies as the surviving corporation (the “Merger”).

8

Pursuant to the terms of the Merger Agreement, we issued an aggregate of 7,581,481shares of our restricted common stock to the holders of BAXL securities as follows:

·

2,274,444 shares of our common stock issued in exchange for all issued and outstanding shares of BAXL Technologies, Inc. Series A-1 Preferred Stock, Series B-1 Preferred Stock and common stock.

·

5,307,037 shares of our common stock and warrants to purchase 796,055 shares of our common stock issued upon conversion of BAXL Technologies, Inc. 12% Convertible Notes.

·

Warrants to purchase 320,500 shares of our common stock issued to holders of BAXL Technologies non-convertible subordinated notes.

The shares of common stock issued in connection with the Merger were issued in reliance on the exemption from registration afforded by Section 4(2) and Regulation D (Rule 506) under the Securities Act of 1933, as amended and corresponding provisions of state securities laws, which exempts transactions by an issuer not involving any public offering.

BAXL Warrants and Options Conversion

Pursuant to the terms of the Merger Agreement, all outstanding warrants to purchase BAXL Technologies common stock converted into warrants to purchase up to approximately 450,000 shares of our common stock and all outstanding options to acquire BAXL Technologies common stock were cancelled.

SUBSEQUENT EVENTS

Subsequent to the period covered by this report, on March 5, 2008, BAXL entered into a Securities Purchase Agreement with Edward H. Arnold, who is one of our directors and a director of BAXL, pursuant to which the BAXL may issue 9% Senior Secured Convertible Notes (the “New Notes”) in an aggregate principal amount of up to $4,000,000 to Mr. Arnold or other investors. On March 5, 2008, BAXL issued a New Note to Mr. Arnold in the principal amount of $200,000. Each New Note issued under the Securities Purchase Agreement will mature in August 2008, provided, however, that all amounts outstanding may become immediately due and payable prior thereto upon the occurrence of an event of default (as defined in the New Notes). Upon maturity, the principal amount of each New Note will either, at the election of the holder, be repaid or convert into shares of the our common stock, at a conversion price that is equal to the lesser of (a) $1.50 and (b) 75% of the price of t he shares of our common stock that we issue in private offerings after March 5, 2008. The New Notes constitute senior indebtedness of BAXL and provide that BAXL cannot incur any additional indebtedness (subject to customary exceptions) without the consent of the New Note holders. Each New Note bears interest at a per annum rate of 9%, except if the principal amount of any New Note is not repaid or converted on the maturity date, in which case interest shall accrue at a per annum rate of 12%. In addition to receiving New Notes, each investor will receive a warrant to purchase a number of shares of our common stock that is equal to 15% of the principal amount of the New Note purchased by such investor divided by $1.50 (the “Warrants”). The Warrants are exercisable until February 2013 at an exercise price of $1.88 per share. Accordingly, we issued to Mr. Arnold in connection with his New Note, a Warrant to purchase up to 20,000 shares of our common stock at an exercise price of $1.88 .

Pursuant to the terms of the Securities Purchase Agreement, the Subsidiary and each New Note holder will sign a Security Agreement dated March 5, 2008 pursuant to which the Company’s obligations under the New Notes are secured by all of the Subsidiary’s assets. In addition, the Subsidiary will pay certain commission fees to the placement agent and the Registrant will issue to the placement agent a warrant to purchase a number of shares of Registrant’s Common Stock that is equal to 15% of the maximum number of shares of Registrant’s Common Stock that may be issued upon conversion of the New Notes divided by $1.50 at an exercise price of $1.88 per share.

ITEM 1A.

RISK FACTORS

You should carefully consider the following risk factors and the other information included herein before investing in our common stock. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline, and you could lose all of your investment.

9

Risks related to our business

We have a history of significant losses, and may never achieve profitability.

We have incurred substantial net losses and experienced negative cash flow for each quarter since our inception. As of December 31, 2007 and 2006, we had an accumulated deficit of approximately $57.0 million and $51.4 million, respectively. We expect to incur losses in the near future. Moreover, we may never achieve profitability and, even if we do, we may not be able to maintain profitability. We may not be able to generate a sufficient level of revenue to offset our current level of expenses. Moreover, because our expenditures for sales and marketing, research and development, and general and administrative functions are relatively fixed in the short-term, we may be unable to adjust spending in a timely manner to respond to any unanticipated decline in revenue. We expect to incur substantial operating expenses in order to fund the expansion of our business and intend to use a portion of the net proceeds from our August Private Offering for sales and marketing, resear ch and development, and operating expenses. As a result, we expect to continue to experience substantial negative cash flow for at least the foreseeable future and cannot predict when, or even if, we might become profitable. If we are unable to attain profitable operations, we may be forced to curtail and/or abandon our business operations, which would have a material adverse effect on our, business, financial condition and results of operations.

Going concern opinions

Our independent auditors have included a paragraph in their reports for the fiscal years ended December 31, 2007 and 2006 indicating that such financial statements were prepared assuming that we would continue as a going concern. However, they have indicated that they have substantial doubt about our ability to continue as a going concern.

BAXL Technologies was subject to a third party claim alleging infringement of intellectual property rights.

BAXL Technologies was subject to a claim alleging that certain of its products infringed upon patents held by a third party. In settlement of the claim, BAXL Technologies entered into a settlement and patent license agreement pursuant to which BAXL Technologies was granted a non-exclusive license to such patented technology in exchange for a lump sum payment of $200,000, payable in eight installments, and royalty payments equal to 3% of the net sales of BAXL Technologies’ products sold. Such royalty payments are capped at a maximum of $1.8 million. BAXL Technologies’ license to the technology is non-exclusive, and therefore no assurance can be given that other persons or competitors will not also enter into license agreements to use such technology to manufacture products similar to BAXL Technologies’ products. In addition, there can be no assurance given that we will not be subject to similar claims in the future and, if so, that we will be able t o enter into license agreements to license such technology on terms and conditions acceptable to us.

Potential claims alleging infringement of third party’s intellectual property by us could harm our ability to compete and result in significant expense to us and loss of significant rights.

From time to time, third parties may assert patent, copyright, trademark and other intellectual property rights to technologies that are important to our business. Any claims, with or without merit, could be time-consuming, result in costly litigation, divert the efforts of our technical and management personnel, cause product shipment delays, disrupt our relationships with its customers or require us to enter into royalty or licensing agreements, any of which could have a material adverse effect upon our operating results. Royalty or licensing agreements, if required, may not be available on terms acceptable to us. If an infringement claim against us is successful and we cannot obtain a license to the relevant technology on acceptable terms, license a substitute technology or redesign our products to avoid infringement, our business, financial condition and results of operations would be materially adversely affected.

Commercial acceptance of any technological solution that competes with technology based on communication over copper telephone wire could materially and adversely impact demand for our products, revenue and growth strategy.

The markets for video content processing, transmission and high-speed data access systems and services are characterized by several competing communication technologies, including fiber optic cables, coaxial cables, satellites and other wireless facilities. Many of our products are based on communication over copper telephone

10

wire. Because there are physical limits to the speed and distance over which data can be transmitted over copper wire, our products may not be a viable solution for customers requiring service at performance levels beyond the current limits of copper telephone wire. A portion of our customer base is dependent upon telephone service providers that have a large investment in copper wire technology. If these customers lose market share to their competitors who use competing technologies that are not as constrained by physical limitations as copper telephone wire, and that are able to provide faster access, greater reliability, increased cost-effectiveness or other advantages, demand for our products will decrease. Moreover, to the extent that our customers choose to install fiber optic cable or other transmission media as part of their infrastructure, or to the extent that home owners and businesses install other transmission media within their homes and bui ldings, respectively, demand for our products may decline. The occurrence of any one or more of these events would harm demand for our products, which would thereby adversely affect our business, operating results, revenue, financial condition and growth strategy and could cause us to curtail or abandon our current business plan.

If the projected growth in demand for broadband applications such as video on demand services from telephone service providers does not materialize or if our customers find alternative methods of delivering video services, future sales for our video solution will suffer.

Through our wholly owned subsidiary, BAXL Technologies, we manufacture products that enable the delivery of broadband applications including voice, video and data over existing telephone wiring. One segment of our customer base, telephone service providers, may face competition from cable companies, satellite service providers and wireless companies. For some users, these competing solutions provide fast access, high reliability and cost-effective solutions for delivering data, including video services. We believe that telephone service providers hoping to maintain their market share in their core business of voice telephony as well as increase their revenue per customer, may attempt to do so by offering their customers more services, including video services and high-speed data services. However, if telephone service providers find alternative ways of maintaining and growing their market share in their core business in ways that do not include offering video services, deman d for our line of video products will decrease substantially. Moreover, if technological advancements are developed that allow telephone service providers to deliver video services without upgrading their current system infrastructure, or to deliver video services on a more cost effective basis than our video services, sales of our video solution will suffer. Alternatively, even if telephone service providers choose our video solution, they may not be successful in marketing video services to their customers, in which case our sales would decrease which would have an adverse affect on our business, revenue, operating results, and financial condition.

We face competition from a number of large and small companies having greater financial, research and development, production and other resources than we do.

We face competition from large and small competitors with longer operating histories, greater name recognition, larger customer bases and significantly greater financial, technical, sales, marketing and other resources than we have. In addition, to the extent that our current competitors, or new entrants into the markets that we serve, offer better or comparable broadband products at lower prices than we do, our business and results of operations could be adversely affected. Our competitors can be expected to continue to improve the design and performance of their products and to introduce new products with competitive performance characteristics. If any of our competitors were to successfully commit greater technical, sales, marketing and other resources to the markets we serve, or if they were to reduce prices for their products over a sustained period of time, our ability to successfully sell our products could be adversely affected decrease which would have an adve rse affect on our business, revenue, operating results, and financial condition.

See “Business – Competition.”

A significant amount of the net proceeds of the August Private Offering were used to repay outstanding debt of BAXL Technologies, to repurchase shares of our common stock, and to pay costs related to the Merger and the August Private Offering and we may require significant additional capital to support the growth of our business and this capital might not be available.

Out of the proceeds of our August Private Offering, we used $2,283,091 to repay outstanding interest and principal on certain outstanding BAXL Technologies notes; $665,550 was used to redeem shares of our common stock held by MV Equity Partners, Inc.; and $2,391,329 (including $950,000 of M&A fees) was used to pay the expenses and other costs related to the Merger and the August Private Offering. As a result, we had remaining $3,134,534 of net

11

proceeds from the August Private Offering. As of December 31, 2007 our available cash balances were $855,934. However, if, among other reasons, our revenue and/or expense estimates prove inaccurate, we will be required to raise substantial additional capital. Such capital might be raised through public or private financings, as well as borrowings and other sources. There can be no assurance that additional or sufficient financing will be available, or, if available, that it will be available on acceptable terms. If we fail to obtain required financing when needed it could result in our having to substantially scale back our operations which would have an adverse effect on our business, revenue, operating results, and financial condition.

If we fail to accurately forecast demand for our products, our revenue, profitability and reputation could be harmed.

In addition to performing assembly, test and system integration in house, we also rely on third-party original equipment manufacturers (OEMs) to assemble, test and package our products. We also depend on third-party suppliers for the materials and parts that constitute our products. Our reliance on OEMs and third-party suppliers requires us to accurately forecast the demand for our products and to coordinate our efforts with those of our contract manufacturers, OEMs and suppliers. We often make significant up-front financial commitments to our OEMs and suppliers in order to procure raw materials and begin assembly of our products. If we fail to accurately forecast demand or coordinate our efforts with our suppliers, OEMs and contract manufacturers, we may face supply, manufacturing or testing capacity constraints. These constraints could result in delays in the delivery of our products, which could lead to the loss of existing or potential customers and could the reby result in lost sales and damage to our reputation, which would adversely affect our revenue and profitability. Further, we manufacture products based on forecasts of sales. If orders for products exceed forecasts, we may have difficulty meeting customers’ orders in a timely manner, which could damage our reputation or result in lost sales. Conversely, if forecasts exceed the orders actually received and we are unable to cancel future purchase and manufacturing commitments in a timely manner, our inventory levels would increase. This could expose us to losses related to slow moving and obsolete inventory, which would have a material adverse effect on our business, revenue, operating results, and financial condition.

If we fail to develop and introduce new products in response to technological changes in the markets in which we compete, we will not remain competitive.

The markets for broadband transmission and high-speed data access systems are characterized by rapid technological developments, frequent enhancements to existing products and new product introductions, changes in end-user requirements and evolving industry standards. To remain competitive, we must continually improve the performance, features and reliability of our products. We cannot assure you that we will be able to respond quickly and effectively to technological change. We may have only limited time to enter certain markets, and cannot assure you that we will be successful in achieving widespread acceptance of our products before competitors can offer products and services similar or superior to our products. If we fail to introduce new products that address technological changes or if we experiences delays in product introductions, our ability to compete would be materially adversely affected, thereby harming our business, revenue, operating results, financial c ondition and growth strategy.

If our third-party OEMs and third-party suppliers fail to produce quality products or parts or deliver raw materials in a timely manner, we may not be able to meet our customers’ demands.

We rely upon third party OEM’s, contract manufactures and suppliers to provide us with the components necessary to manufacture our products. We do not have, and we don’t believe that our contract manufacturers or OEMs have, any guaranteed supply arrangements with suppliers. If our suppliers fail to provide a sufficient supply of key components, we could experience difficulties in obtaining alternative sources at reasonable prices, if at all, or in altering our product designs so that we may use alternative components. Moreover, if our contract manufacturers or OEMs fail to deliver quality products in a timely manner, such failure would harm our ability to meet our scheduled product deliveries to customers. Delays and reductions in product shipments could increase our production costs, damage customer relationships and harm our revenue and profitability. In addition, if our contract manufacturers and OEMs fail to perform adequate quality control and testing of their products, we could experience increased production costs for product repair and replacement, and our revenue, profitability and reputation would be harmed. Moreover, defects in products that are not discovered in the quality assurance process could damage customer relationships and result in product returns or product liability claims, each of which could have a material adverse

12

effect on our business, revenue, operating results, financial condition and reputation.

Design defects in our products could harm our reputation, revenue and profitability.

Any defect or deficiency in our products could reduce the functionality, effectiveness or marketability of such products. These defects or deficiencies could cause customers to cancel or delay their orders for products or could render the design of such products obsolete, either of which would reduce our revenue. In the event of any such defect or deficiency, we would be required to devote substantial financial and other resources for a significant period of time to develop new product designs. We cannot assure you that we would be successful in addressing any design defects in our products or in developing new product designs in a timely manner, if at all. Any of these events, individually or in the aggregate, could harm our business, revenue, operating results, financial condition and reputation.

Our business depends on the integrity of our intellectual property rights. If we fail to adequately protect our intellectual property, revenue, profitability, reputation or growth strategy could be adversely affected.

We attempt to protect our intellectual property and proprietary technology by generally entering into confidentiality or license agreements with our employees, consultants, vendors, strategic partners and customers as needed, and by generally limiting access to and distribution of our trade secrets, technology and proprietary information. We do not currently have any patents, but may seek patent protection in the future. There can be no assurance that if we apply for patent protection in the future, that patents will be issued with the desired scope, if at all. In addition, third parties may circumvent or design around our intellectual property rights, may misappropriate our proprietary technology, or may otherwise develop similar, duplicate or superior products. Further, the intellectual property laws and confidentiality and license agreements that we enter into may not adequately protect our intellectual property rights and effective intellectual property prote ction may be unavailable or limited in certain foreign countries in which we do business or may do business in the future.

The telecommunications and data communications industries are characterized by the existence of extensive patent portfolios and frequent intellectual property litigation. Prior to our acquisition of BAXL Technologies, it was the subject of claims that it was infringing third parties’ intellectual property rights, and we may receive such claims in the future. Any such claims, with or without merit, could be time consuming, result in costly litigation, divert management time and attention and other resources, cause product shipment delays or require us to enter into royalty or licensing agreements. Such royalty or licensing agreements, if required, may not be available on acceptable terms, if at all. In addition, any such litigation could result in us having to cease selling or using certain products or services, or to redesign such products or services. Further, we may in the future, initiate claims or litigation against third-parties for infringement of our intellectual property rights or to determine the scope and validity of our intellectual property rights or those of our competitors. Such litigation could result in substantial costs and diversion of resources. Any of the foregoing could have a material adverse effect upon our business, revenue, operating results, financial condition, reputation and growth strategy.

If we fail to provide our customers with adequate and timely customer support, our relationships with our customers could be damaged, which would harm our business, revenue, operating results, and financial condition.

Our ability to retain customers and to achieve our planned sales growth will depend in part on the quality of our customer support operations. Customers generally require significant support and training with respect to our products, particularly in the initial deployment and implementation stages. As our systems and products become more complex, we believe our ability to provide adequate customer support will become increasingly important to our success. We have limited experience with widespread deployment of our products to a diverse customer base, and cannot assure you that we will have adequate personnel to provide the levels of support that our customers may require during initial product deployment or on an ongoing basis. Failure to provide sufficient support to our customers could delay or prevent the successful deployment of our products. Failure to provide adequate support could also have a material adverse effect on our reputation and our relationships with our cu stomers; could prevent us from gaining new customers; and could have a material adverse effect on our business, revenue, operating results, and financial condition and could force us to curtail or abandon our current business plan.

13

If our products do not comply with complex government regulations, our product sales will suffer.

We and our customers are subject to varying degrees of federal, state and local as well as foreign governmental regulation. Our products must comply with various regulations and standards defined by the Federal Communications Commission, or FCC. The FCC has issued regulations that set installation and equipment standards for communications systems. Our products are also required to meet certain safety requirements. For example, Underwriters Laboratories must certify that certain of our products meet federal safety requirements relating to electrical appliances to be used inside the home. In addition, certain products must be Network Equipment Building Standard certified before our customers may deploy them. Any delay in or failure to obtain these approvals could harm our business, financial condition or results of operations. Outside of the United States, our products are subject to the regulatory requirements of each country in which our products are manufactured or s old. These requirements are likely to vary widely. If we do not obtain timely domestic or foreign regulatory approvals or certificates, we will not be able to sell our products where these regulations apply, which could prevent us from maintaining or growing our revenue or achieving profitability. In addition, regulation of our customers may adversely impact our business, operating results and financial condition. For example, FCC regulatory policies affecting the availability of data and Internet services and other terms on which telecommunications companies conduct their business may impede our entry into certain markets. In addition, the increasing demand for communications systems has exerted pressure on regulatory bodies worldwide to adopt new standards, generally following extensive investigation of competing technologies. The delays inherent in this governmental approval process may cause the cancellation, postponement or rescheduling of the installation of communications systems by our customer s, which in turn may harm our sales of products to these customers.

We rely on the availability of third-party licenses.

Many of our products are designed to include software or other intellectual property licensed from third parties. It may be necessary in the future to seek or renew licenses relating to various aspects of these products. There can be no assurance that the necessary licenses will be available on acceptable terms, if at all. The inability to obtain certain licenses or other rights or to obtain such licenses or rights on favorable terms, or the need to engage in litigation regarding these matters, could have a material adverse effect on our business, operating results, and financial condition. Moreover, the inclusion in our products of software or other intellectual property licensed from third parties on a nonexclusive basis could limit our ability to protect our proprietary rights in our products.

Our business may be affected by factors outside of our control.

Our ability to increase sales, and to profitably distribute and sell our products, is subject to a number of risks, including changes in our business relationships with our principal distributors, competitive risks such as the entrance of additional competitors into our markets, pricing and technological competition and risks associated with the development and marketing of new products in order to remain competitive.

We are dependent on our key personnel to manage our business effectively. If we are not able to retain our executive officers and other key employees, our business, financial condition and results of operations could be materially adversely affected.

Our future success depends to a significant degree on the skills, efforts and continued services of our executive officers and other key employees, including sales, marketing and support personnel who have critical industry experience and relationships. We have not entered into employment agreements with our executive officers and any of them may terminate his or her employment with us at any time on short notice. Accordingly, there can be no assurance that these employees will remain associated with us. The efforts of these persons will be critical to us as we continue to develop our business and technology. If we were to lose the services one or more of these key employees, we may experience difficulties in competing effectively, developing our technology and implementing our business strategies. Our future business plans may require additional expertise in areas such as wireless broadband applications, the Internet and telecommunications. Such activities may require the addition of new personnel and the development of additional expertise by existing management personnel. We face intense competition for such personnel from other companies, academic institutions, government entities and other organizations, and there can be no assurance that we will be successful in hiring or retaining qualified personnel. If we are unable to develop additional expertise or to hire and retain such qualified personnel, it could have a material adverse effect on our, business, financial condition and results of operations.

14

Certain sales of BAXL Technologies’ securities prior to our acquisition, may have been made in violation of the securities laws of certain States which could give the purchasers of such securities who resided in such states at the time of purchase the right to require BAXL Technologies to repurchase such securities and which may subject BAXL Technologies to enforcement actions by State securities regulators.

Certain sales of BAXL Technologies’ securities prior to our acquisition may have been made in violation of the securities laws of certain States. These violations could give the purchasers of such securities who resided in such states at the time of purchase the right to require the Company to repurchase such securities and which may subject the Company to enforcement actions by state securities regulators. The Company has consulted with its legal counsel and has made efforts to obtain waivers from stockholders who may be subject to this potential rescission and has obtained such waivers from several stockholders as part of this ongoing process. Further, management is not aware of any potential actions for rescission or other regulatory actions, since the transactions first occurred between August 2004 and October 2005. However, the process of obtaining waivers does not preclude State regulatory enforcement actions in the future. Management can n ot currently determine the potential impact of this matter at the time of these financial statements. In the event that the Company faced regulatory action or was required to repurchase such shares, the cost of such repurchases could result in our having to curtail and/or abandon our business operations, which could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Common Stock; Liquidity Risks

The price of our common stock may fluctuate significantly, which could lead to losses for stockholders.

The trading price of our common stock may fluctuate substantially. The price of the common stock that will prevail in the market after the sale of the shares of common stock by the selling stockholders may be higher or lower than the price you have paid, depending on many factors, some of which are beyond our control and may not be related to our operating performance. Any negative change in the public’s perception of the prospects of our company or companies in our market could also depress our stock price, regardless of our actual results. These fluctuations could cause you to lose part or all of your investment in our common stock. Those factors that could cause fluctuations include, but are not limited to, the following:

·

variations in operating results;

·

announcements of technological innovations, new products or product enhancements, strategic alliances or significant agreements by us or by competitors;

·

recruitment or departure of key personnel;

·

litigation, legislation, regulation or technological developments that adversely affect our business;

·

changes in the estimates of operating results or changes in recommendations by any securities analyst that elect to follow our common stock;

·

market conditions in our industry, the industries of our customers and the economy as a whole;

·

price and volume fluctuations in the overall stock market from time to time;

·

fluctuations in stock market prices and trading volumes of similar companies;

·

general economic conditions and trends;

·

major catastrophic events;

·

sales of large blocks of our common stock;

In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been brought against that company. Due to the potential volatility of our stock price, we may therefore be the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and resources from our business.

A limited public trading market may cause volatility in the price of our common stock.

Our common stock is quoted on the OTC Bulletin Board under the symbol BXLH. The quotation of our common stock on the OTC Bulletin Board does not assure that a meaningful, consistent and liquid trading market currently exists, and in recent years such market has experienced extreme price and volume fluctuations that have particularly affected the market prices of many smaller companies like us. Our common stock is thus subject to this volatility.

15

Sales of substantial amounts of common stock, or the perception that such sales might occur, could adversely affect prevailing market prices of our common stock and our stock price may decline substantially in a short time and our shareholders could suffer losses or be unable to liquidate their holdings. Our stock is thinly traded due to the limited number of shares available for trading on the market thus causing large swings in price.

We may not be able to achieve secondary trading of our stock in certain states because our common stock is not nationally traded.

Because our common stock is not listed for trading on a national securities exchange, it is subject to the securities laws of the various states and jurisdictions of the United States in addition to federal securities law. These regulations cover any primary offering we might attempt and all secondary trading by our stockholders. While we intend to take appropriate steps to register our common stock or qualify for exemptions for our common stock, in all of the states and jurisdictions of the United States, if we fail to do so, the investors in those jurisdictions where we have not taken such steps may not be allowed to purchase our stock or those who presently hold our stock may not be able to resell their shares without substantial effort and expense. These restrictions and potential costs could be significant burdens on our stockholders.

Material weaknesses have been identified in our internal control over financial reporting, which could have an adverse effect on our ability to report our results of operations and financial condition accurately and in a timely manner.

Our independent registered accounting firm informed our management that in connection with its audit of the financial statements of BAXL Technologies for its fiscal year ended December 31, 2006, it had identified a number of material weaknesses in its internal control over financial reporting. For a description of these material weaknesses, please see Item 9A(T) Controls and Procedures in this Form 10-K. Each of the material weaknesses results in more than a remote likelihood that a material misstatement of our annual or interim financial statements will not be prevented or detected. We are in the process of working to remedy the identified material weaknesses. There can be no assurance as to when all of the material weaknesses will be remedied. Until the remedial efforts are completed, management will continue to devote significant time and attention to these efforts, which may be to the detriment of our operations. We will continue to incur expenses associated with the add itional procedures and resources required to prepare our consolidated financial statements. Certain of the remedial actions will be ongoing and will result in the incurrence of additional costs even after the material weaknesses are remedied. As a result, our financial condition and results of operations may be negatively affected by the cost of these remediation measures. In addition, there exists the possibility that in working to remediate such weaknesses, our management may identify other material weaknesses.

We have not completed our assessment of our internal control over financial reporting as of the end of the period covered by this report.

We completed the acquisition of BAXL Technologies on August 29, 2007, and in connection with acquisition, the management of BAXL Technologies became our management. Since the acquisition was not completed until late in the third quarter of 2007, our management was not able to complete its assessment of our internal control over financial reporting by the end of 2007. Our management intends to work towards completing its assessment during 2008. As discussed above and in Item 9A(T) of this report on Form 10-K, certain material weaknesses have been identified in the internal control over financial reporting for our subsidiary, BAXL Technologies and in the course of our assessment of our internal control, our management may identify additional weaknesses. As a result, we expect to incur additional expenses and diversion of management’s time as a result of performing the system and process evaluation, testing and remediation required in order to comply with the m anagement certification and auditor attestation requirements.

Our executive officers, directors and principal stockholders control our business and may make decisions that are not in our best interests.

Our officers, directors and principal stockholders, and their affiliates, in the aggregate, beneficially own, as of March 14, 2008, 60.2% of the outstanding shares of our common stock on a fully diluted basis. As a result, such persons, acting together, have the ability to substantially influence all matters submitted to our stockholders for approval, including the election and removal of directors and any merger, consolidation or sale of all or substantially all of our

16

assets, and to control our management and affairs. Accordingly, such concentration of ownership may have the effect of delaying, deferring or preventing a change in discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our business, even if such a transaction would be beneficial to other stockholders.

Sales of additional equity securities may adversely affect the market price of our common stock and your rights in us may be reduced.

We expect to continue to incur product development and selling, general and administrative costs, and to satisfy our funding requirements, we will need to sell additional equity securities, which may be subject to registration rights. The sale or the proposed sale of substantial amounts of our common stock in the public markets may adversely affect the market price of our common stock and our stock price may decline substantially. Our stockholders may experience substantial dilution and a reduction in the price that they are able to obtain upon sale of their shares. Also, new equity securities issued may have greater rights, preferences or privileges than our existing common stock.

You may lose your investment in our common stock.

An investment in our common stock involves a high degree of risk. An investment in our common stock is suitable only for investors who can bear a loss of their entire investment.

We have no intention to pay dividends on our common stock.

For the foreseeable future, we intend to retain any remaining future earnings, if any, to finance our operations and we do not anticipate paying any cash dividends with respect to our common stock.

The issuance of preferred stock may have the effect of preventing a change of control and could dilute the voting power of our common stock and reduce the market price of our common stock.

Our authorized capital stock includes 10,000,000 shares of preferred stock, of which all 10,000,000 shares is blank check preferred stock. Our board of directors is authorized to designate such stock with preferences and relative, participating, optional or other special rights and qualifications, limitations or restrictions as they deem advisable without shareholder approval. The effect of designating and issuing shares of preferred stock upon the rights of our common stockholders cannot be stated until our board of directors determines the specific rights of such preferred stock. However, the effects might include, among other things, restricting dividends on the common stock, diluting the voting power of the common stock, reducing the market price of the common stock, or impairing the liquidation rights of the common stock, without further action by our shareholders. The designation and issuance of preferred stock could also have the effect of making it mo re difficult or time consuming for a third party to acquire a majority of our outstanding voting stock or otherwise effect a change of control. Shares of preferred stock may be sold to third parties that indicate that they would support our board of directors in opposing a hostile takeover bid. Our blank check preferred stock is not intended to be an anti-takeover measure, and we are not aware of any present third party plans to gain control of us. Although we may consider issuing preferred stock in the future for purposes of raising additional capital or in connection with acquisition transactions, it currently has no binding agreements or commitments with respect to the issuance of any shares of preferred stock.

Future sales of shares of our common stock pursuant to the exercise of options and warrants may decrease the market price of our common stock.

As of March 14, 2008, we had 14,721,150 shares of common stock outstanding, which does not include 3,270,575 shares issuable upon the exercise of warrants. If any of our stockholders either individually or in the aggregate cause a large number of securities to be sold in the public market, or if the market perceives that these holders intend to sell a large number of securities, such sales or anticipated sales could result in a substantial reduction in the trading price of shares of our common stock and could also impede our ability to raise future capital.

17

If securities analysts do not publish research or reports about our business or if they downgrade our stock, the price of our stock could decline.

The trading market for our common stock may be affected by research and reports that industry or financial analysts may in the future publish about us or our business. We have no control over such analysts. We are a relatively small company with no significant trading history and as such it is not likely that we will receive widespread, if any, analyst coverage. Furthermore, if one or more of the analysts who in the future elect to cover us downgrades our common stock, our stock price would likely decline rapidly. If one or more of these analysts cease coverage of us, we could lose visibility in the market, which in turn could cause our stock price to decline.

In the event that we fail to timely file any periodic report filings with the SEC, our common stock may be removed from the Over-The-Counter Bulletin Board (the “OTC Bulletin Board”).

Pursuant to OTC Bulletin Board rules relating to the timely filing of required reports with the SEC, any OTC Bulletin Board issuer required to file reports pursuant to Section 13 or 15(d) of the Exchange Act, must be current in its reporting obligations, subject to a 30 day grace period. Further, any OTC Bulletin Board issuer which fails to file a required annual or quarterly report by the due date of such report (not withstanding any extension granted to the issuer by the filing of a Form 12b-25), three (3) times during any twenty-four (24) month period is automatically removed from the OTC Bulletin Board. In the event an issuer is removed from the OTC Bulletin Board, such issuer would not be eligible to be return to the OTC Bulletin Board for a period of one-year, during which time any subsequent late filing would reset the one-year period of removal. If we are late in our filings three times in any twenty-four (24) month period and are re moved from the OTC Bulletin Board, the market value of our common stock could be reduced significantly and sales of shares of our common stock may be difficult.

The Common Stock may be subject to Penny Stock Rules, which could affect trading.