UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Alexza Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

ALEXZA PHARMACEUTICALS, INC.

2091 Stierlin Court

Mountain View, California 94043

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 7, 2009

Dear Stockholder:

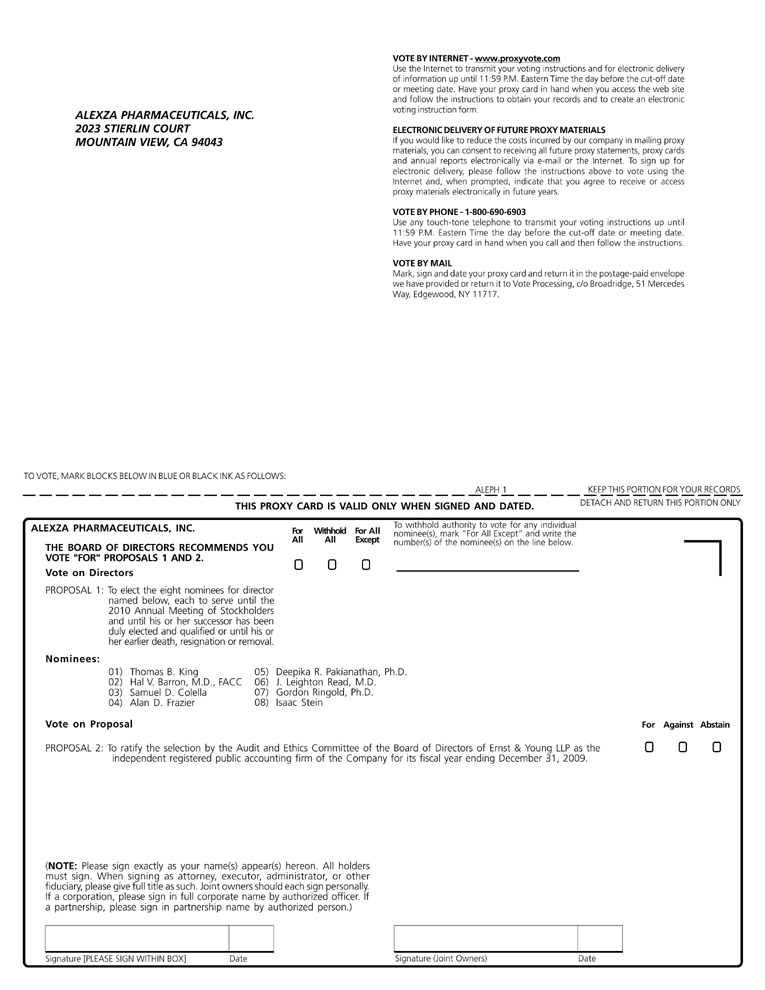

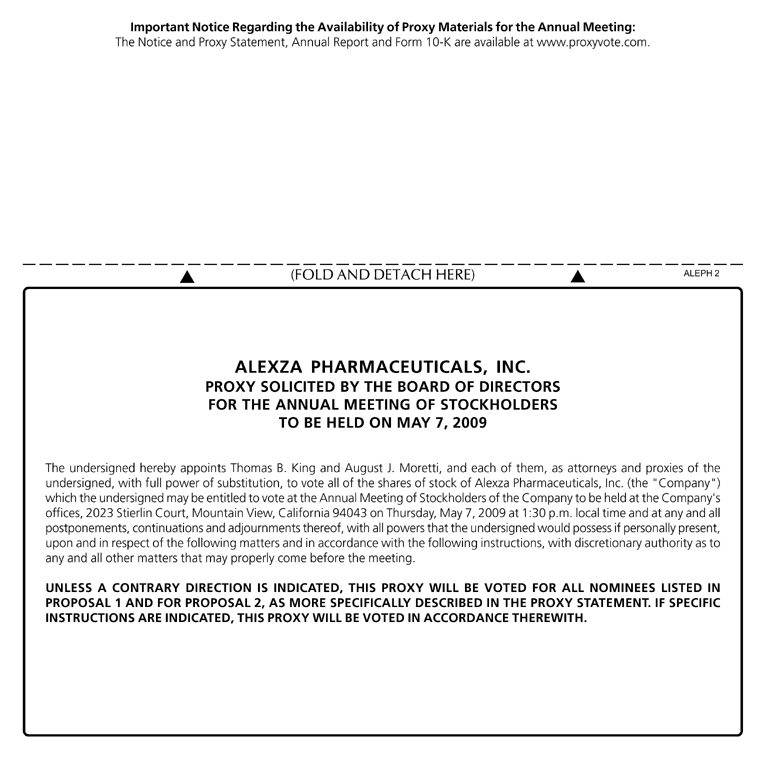

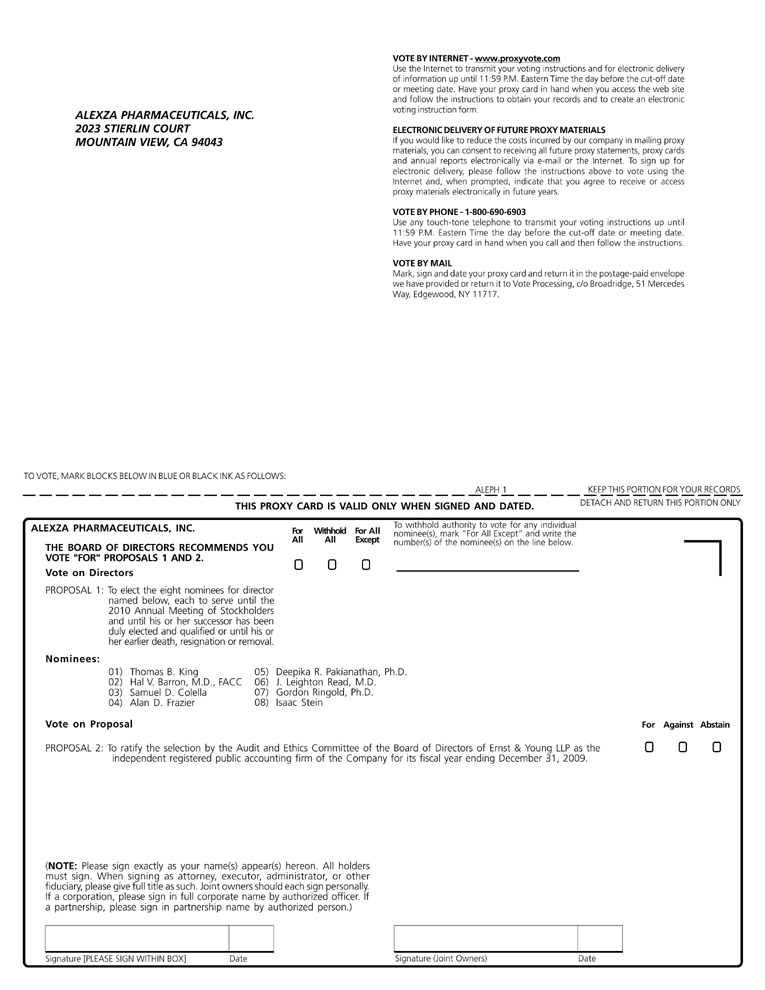

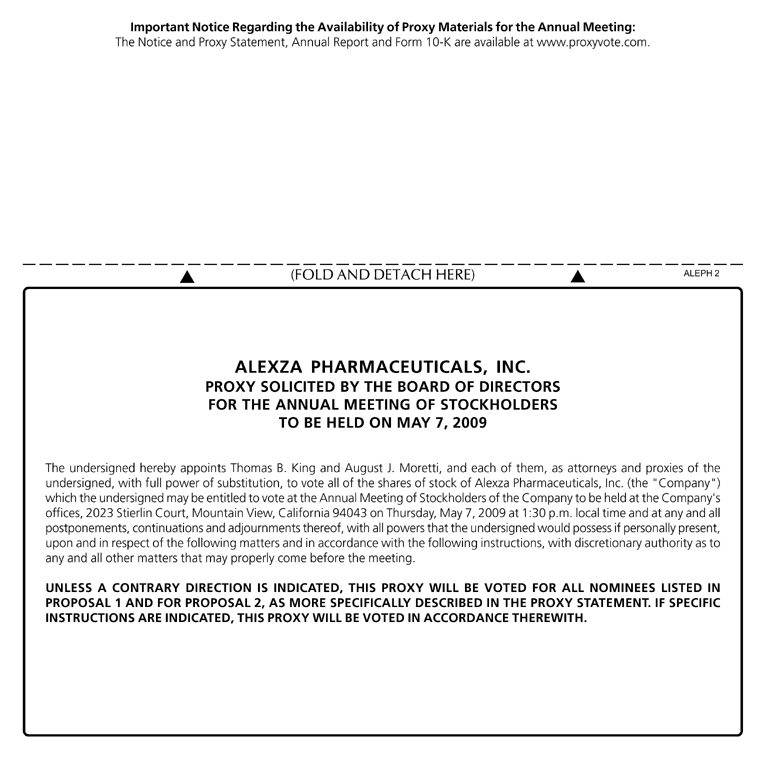

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Alexza Pharmaceuticals, Inc., a Delaware corporation (the “Company” or “Alexza”), will be held on Thursday, May 7, 2009, at 1:30 p.m. local time at the offices of the Company, 2023 Stierlin Court, Mountain View, California 94043 for the following purposes:

1. To elect the eight nominees for director named herein, each to serve until the 2010 Annual Meeting of Stockholders and until his or her successor has been elected and qualified or until his or her earlier death, resignation or removal. The Company’s Board of Directors intends to present the following nominees for election as directors:

| | | |

Thomas B. King

Hal V. Barron, M.D., FACC

Samuel D. Colella

Alan D. Frazier | | Deepika R. Pakianathan, Ph.D.

J. Leighton Read, M.D.

Gordon Ringold, Ph.D.

Isaac Stein |

2. To ratify the selection by the Audit and Ethics Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2009.

3. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

These business items are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 16, 2009 as the record date for identifying those stockholders entitled to notice of, and to vote at, the annual meeting and any adjournment or postponement thereof. Only stockholders of record at the close of business on that day may vote at the annual meeting or any adjournment thereof. In accordance with Delaware law, for ten days prior to the annual meeting of stockholders, a list of stockholders will be available for inspection in the office of the Corporate Secretary, Alexza Pharmaceuticals, Inc., 2091 Stierlin Court, Mountain View, California, 94043. The list of stockholders will also be available at the annual meeting.

By Order of the Board of Directors

August J. Moretti

Secretary

Mountain View, California

March 27, 2009

Pursuant to the Internet proxy rules promulgated by the Securities and Exchange Commission, Alexza has elected to provide access to its proxy materials over the Internet. Accordingly, stockholders of record at the close of business on March 16, 2009 will receive a Notice of Internet Availability of Proxy Materials and may vote at the Annual Meeting and any adjournment or postponement thereof. Alexza expects to mail the Notice of Internet Availability of Proxy Materials on or about March 27, 2009.

All stockholders are cordially invited to attend the annual meeting in person. Whether or not you expect to attend the annual meeting, please vote, as instructed in the Notice of Internet Availability of Proxy Materials, via the Internet or the telephone, as promptly as possible in order to ensure your representation at the annual meeting. Alternatively, you may follow the procedures outlined in the Notice of Internet Availability of Proxy Materials to request a paper proxy card to submit your vote by mail. Even if you have voted by proxy, you may still vote in person if you attend the annual meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

ALEXZA PHARMACEUTICALS, INC.

2091 Stierlin Court

Mountain View, California 94043

PROXY STATEMENT

FOR THE 2009 ANNUAL MEETING OF STOCKHOLDERS

May 7, 2009

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

What is the Notice of Internet Availability of Proxy Materials?

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to all stockholders entitled to vote at the annual meeting, we are furnishing the proxy materials to our stockholders over the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice of Internet Availability will instruct you as to how you may access and review the proxy materials and submit your vote via the Internet. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of the proxy materials, please follow the instructions for requesting such materials included in the Notice of Internet Availability.

We intend to mail the Notice of Internet Availability on or about March 27, 2009 to all stockholders of record entitled to vote at the annual meeting. On the date of mailing of the Notice of Internet Availability, all stockholders and beneficial owners will have the ability to access all of our proxy materials on a website referred to in the Notice of Internet Availability. These proxy materials will be available free of charge.

Why am I being provided access to these materials?

We have provided you access to these proxy materials because the Board of Directors of Alexza Pharmaceuticals, Inc. (sometimes referred to as the “Company” or “Alexza”) is soliciting your proxy to vote at the 2009 Annual Meeting of Stockholders including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the annual meeting to vote your shares. Instead, you may simply vote, as instructed below and in the Notice of Internet Availability of Proxy Materials, via the Internet or the telephone. Alternatively, you may follow the procedures outlined in the Notice of Internet Availability to request a paper proxy card to submit your vote by mail.

How do I attend the annual meeting?

The meeting will be held on Thursday, May 7, 2009, at 1:30 p.m. local time at the offices of the Company, 2023 Stierlin Court, Mountain View, California 94043.Directions to the annual meeting may be found atwww.alexza.com. Information on how to vote in person at the annual meeting is discussed below.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on March 16, 2009 will be entitled to vote at the annual meeting. On this record date, there were 32,973,951 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 16, 2009 your shares were registered directly in your name with the Company’s transfer agent, Mellon Investor Services, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote, as instructed below and in the Notice of Internet Availability, via the Internet or the telephone, as promptly as possible to ensure your vote is counted. Alternatively, you may follow the procedures outlined in the Notice of Internet Availability to request a paper proxy card to submit your vote by mail.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 16, 2009 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice of Internet Availability is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

| | |

| | • | Election of eight directors; and |

| |

| | • | Ratification of the selection by the Audit and Ethics Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm for the Company for its fiscal year ending December 31, 2009. |

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For the other matter to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy on the Internet, vote by proxy over the telephone, or vote by proxy via the mail. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting and vote in person even if you have already voted by proxy.

| | |

| | • | In Person: To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| |

| | • | Internet: To vote on the Internet, go towww.proxyvote.comto complete an electronic proxy card . You will be asked to provide the control number from the Notice of Internet Availability. Your vote must be received by 11:59 p.m. Eastern time, on May 6, 2009 to be counted. |

| |

| | • | Telephone: To vote over the telephone, dial toll-free1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the Notice of Internet Availability. Your vote must be received by 11:59 p.m. Eastern time, on May 6, 2009 to be counted. |

| |

| | • | Mail: To vote by mail, you must request a paper proxy card by following the instructions on the Notice of Internet Availability. Once you receive the paper proxy card, complete, sign and date the proxy card where indicated and return it promptly in the prepaid envelope that will be included with the paper proxy card. If we receive your signed proxy card before the annual meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice of Internet Availability and voting instructions from that organization rather than from the Company. You may vote by proxy by following the instructions from your broker, bank or other agent included with

2

the Notice of Internet Availability. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 16, 2009.

What if I submit a proxy via the Internet, by telephone or by mail but do not make specific choices?

If you submit a proxy via the Internet, by telephone or by mail without making voting selections, your shares will be voted “For” the election of all eight nominees for director and “For” ratification of the selection of Ernst & Young LLP. If any other matter is properly presented at the annual meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice of Internet Availability or set of proxy materials?

If you receive more than one Notice of Internet Availability or set of proxy materials, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or voting instruction card that you receive to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the annual meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| | |

| | • | You may submit another properly completed proxy card with a later date. |

| |

| | • | You may grant a subsequent proxy by telephone or through the Internet. |

| |

| | • | You may send a timely written notice that you are revoking your proxy to the Company’s Corporate Secretary at 2091 Stierlin Court, Mountain View, CA 94043. |

| |

| | • | You may attend the annual meeting and vote in person. Simply attending the annual meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or Internet proxy is the one that will be counted.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by November 24, 2009, to Corporate Secretary, 2091 Stierlin Court, Mountain View, CA 94043. If you wish to submit a

3

proposal that is not to be included in next year’s proxy materials or nominate a director, you must do so not later than the close of business on February 6, 2010 nor earlier than the close of business on January 7, 2010.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Withhold” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters.

How many votes are needed to approve each proposal?

| | |

| | • | For the election of directors, the eight nominees receiving the most “For” votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes “For” or “Withheld” will affect the outcome. |

| |

| | • | To be approved, Proposal No. 2, the ratification of Ernst & Young LLP as the independent registered public accounting firm for the Company for its fiscal year ending December 31, 2009, must receive “For” votes from the holders of a majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding a majority of the outstanding shares are present at the meeting in person or represented by proxy. On the record date, there were 32,973,951 outstanding and entitled to vote. Thus, the holders of at least 16,486,976 shares must be present in person or represented by proxy at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in the Company’s quarterly report onForm 10-Q for the second quarter of 2009.

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF ALEXZA SINCE THE DATE OF THIS PROXY STATEMENT.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting of Stockholders, stockholders will elect members of the Company’s Board of Directors (the “Board”) to hold office until the 2010 Annual Meeting of Stockholders and until their respective successors have been elected and qualified or until any such director’s earlier death, resignation or removal. There are eight nominees for election this year. Each such nominee is currently a director of the Company, and each such nominee was previously elected by the stockholders.

Directors are elected by a plurality (excess of votes cast over opposing nominees) of the votes present in person or represented by proxy and entitled to vote. If properly submitted, shares represented by proxy will be voted for the election of the eight nominees recommended by the Board unless the proxy is marked in such a manner as to withhold authority so to vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holders may determine. Each person nominated for election has agreed to serve if elected, and the Company has no reason to believe that any nominee will be unable to serve.

Current Directors and Nominees

The names of the nominees and certain information about them, including their ages as of March 16, 2009, are set forth below:

| | | | | | | | | |

| | | | | Position Held with

| | | | Director

|

Name of Nominee | | Age | | Company | | Committees | | Since |

| |

| Thomas B. King | | 54 | | Director, President and Chief Executive Officer | | | | 2003 |

| Hal V. Barron, M.D., FACC | | 46 | | Director | | Compensation | | 2007 |

| Samuel D. Colella | | 69 | | Director | | Compensation (Chair), Corporate Governance and Nominating | | 2002 |

| Alan D. Frazier | | 57 | | Director | | Audit and Ethics (Chair) | | 2002 |

| Deepika R. Pakianathan, Ph.D. | | 44 | | Director | | Compensation | | 2004 |

| J. Leighton Read, M.D. | | 58 | | Director | | Audit and Ethics | | 2004 |

| Gordon Ringold, Ph.D. | | 58 | | Director | | Compensation | | 2001 |

| Isaac Stein | | 62 | | Director (Lead) | | Audit and Ethics, Corporate Governance and Nominating (Chair) | | 2001 |

Thomas B. Kinghas served as our President, Chief Executive Officer and a member of our Board since June 2003. From September 2002 to April 2003, Mr. King served as President, Chief Executive Officer and a member of the board of directors of Cognetix, Inc., a biopharmaceutical development company. From January 1994 to February 2001, Mr. King held various senior executive positions, including President and Chief Executive Officer from January 1997 to October 2000, and was a member of the board of directors at Anesta Corporation, a publicly traded pharmaceutical company, until it was acquired by Cephalon, Inc., a publicly traded biopharmaceutical company. Mr. King is a member of the board of directors of Achaogen, Inc., a private biotechnology company. Mr. King received an M.B.A. from the University of Kansas and a B.A. in chemistry from McPherson College.

Hal V. Barron, M.D., FACChas served as a member of our Board since December 2007. Since December 2003, Dr. Barron has served as Senior Vice President of Development and as Chief Medical Officer since March 2004 at Genentech, Inc., a biotechnology company. Dr. Barron joined Genentech in 1996 as a clinical scientist and in 2002 he was promoted to Vice President of Medical Affairs. Dr. Barron’s academic positions include Associate Adjunct Professor of Epidemiology and Biostatistics and Associate Clinical Professor of Medicine/Cardiology at the University of California, San Francisco. Dr. Barron received his B.S. in physics from Washington University in

5

St. Louis, his M.D. from Yale University and completed his training in medicine and cardiology at the University of California San Francisco.

Samuel D. Colellahas served as a member of our Board since September 2002. In 1999, Mr. Colella co-founded Versant Ventures, a venture capital firm, and has served as a managing member since its formation. Prior to founding Versant Ventures, Mr. Colella has served as general partner of Institutional Venture Partners, a venture capital firm, since 1984. Mr. Colella is a member of the board of directors of Genomic Health, Inc., a publicly traded molecular diagnostics company, Jazz Pharmaceuticals, Inc., a publicly traded pharmaceutical medicine company, and various private companies. Mr. Colella received an M.B.A. from Stanford University and a B.S. in business and engineering from the University of Pittsburgh.

Alan D. Frazierhas served as a member of our Board since September 2002. In 1991, Mr. Frazier founded Frazier Healthcare Ventures, a venture capital firm, and has served as the managing principal since its inception. From 1983 to 1991, Mr. Frazier served as Executive Vice President, Chief Financial Officer and Treasurer of Immunex Corporation, a publicly traded biopharmaceutical company. From 1980 to 1983, Mr. Frazier was a principal in the audit department of Arthur Young & Company, which is now Ernst & Young LLP. Mr. Frazier is a member of the board of directors of Cadence Pharmaceuticals, Inc., a publicly traded pharmaceutical company, and various privately held biopharmaceutical companies. Mr. Frazier received a B.A. in economics from the University of Washington.

Deepika R. Pakianathan, Ph.D. has served as a member of our Board since November 2004. Since 2001, Dr. Pakianathan has served as a general partner at Delphi Ventures, a venture capital firm focusing on healthcare investments. From 1998 to 2001, Dr. Pakianathan was a senior biotechnology banker at JPMorgan. Prior to joining JP Morgan, Dr. Pakianathan was a research analyst at Genesis Merchant Group, a private investment partnership, from 1997 to 1998 and a post-doctoral scientist at Genentech, Inc. from 1993 to 1997. Dr. Pakianathan is a director of various private healthcare companies. Dr. Pakianathan received a Ph.D. in immunology and an M.S. in biology from Wake Forest University, and an M.Sc. in biophysics and a B.Sc from the University of Bombay.

J. Leighton Read, M.D. has served as a member of our Board since November 2004. Since 2001, Dr. Read has served as a general partner in three funds at Alloy Ventures, a venture capital firm. Dr. Read founded Aviron, a biopharmaceutical company, and served as its Chief Executive Officer until 1999. In 1989, Dr. Read co-founded Affymax NV, a biopharmaceutical company. Dr. Read is a member of the board of directors of various private companies. Dr. Read has received several awards for co-inventing the technology underlying the Affymetrix GeneChip. Dr. Read received an M.D. from the University of Texas Health Science Center at San Antonio and a B.S. in psychology and biology from Rice University.

Gordon Ringold, Ph.D. has served as a member of our Board since June 2001. Since March 2000, Dr. Ringold has served as Chairman and Chief Executive Officer of Alavita, Inc. From March 1995 to February 2000, Dr. Ringold served as Chief Executive Officer and Scientific Director of Affymax Research Institute where he managed the development of novel technologies to accelerate the pace of drug discovery. Dr. Ringold is also a member of the board of directors of Maxygen, Inc., a publicly traded biopharmaceutical company, and Oxonica plc, a publicly traded nanotechnology company. Dr. Ringold received a Ph.D. in microbiology from University of California, San Francisco in the laboratory of Dr. Harold Varmus before joining the Stanford University School of Medicine, Department of Pharmacology. Dr. Ringold also received a B.S. in biology from the University of California, Santa Cruz.

Isaac Steinhas served as a member of our Board since June 2001. Since November 1982, Mr. Stein has been President of Waverley Associates, Inc., a private investment firm. He is also the emeritus Chairman of the Board of Trustees of Stanford University and is the Chairman of the board of directors of Maxygen, Inc. Mr. Stein is also a director of American Balanced Fund, Inc., International Growth and Income Fund, Inc., and The Income Fund of America, Inc. (part of the American Funds family of mutual funds). Mr. Stein received an M.B.A. and J.D. from Stanford University and a B.A. in mathematical economics from Colgate University.

Our officers are appointed by and serve at the discretion of our Board. There are no family relationships between our directors and officers.

6

Required Vote

The eight nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them will be elected as directors.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES LISTED ABOVE.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of the Board of Directors

As required under the Nasdaq Global Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board has affirmatively determined that the following seven directors are independent directors within the meaning of the applicable Nasdaq listing standards: Dr. Barron, Mr. Colella, Mr. Frazier, Dr. Pakianathan, Dr. Read, Dr. Ringold, and Mr. Stein. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. Mr. King, the Company’s President and Chief Executive Officer, is not an independent director by virtue of his employment with the Company.

Meetings of the Board of Directors

The Board met five times during 2008 and acted by unanimous written consent three times. All directors attended more than 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which they served, held during the portion of the fiscal year for which they were directors or committee members, respectively.

As required under applicable Nasdaq listing standards, in fiscal 2008, the Company’s independent directors met five times in regularly scheduled executive sessions at which only independent directors were present. The Lead Director presided over such sessions.

Information Regarding Committees of the Board of Directors

Standing committees of the Board include an Audit and Ethics Committee, a Compensation Committee and a Corporate Governance and Nominating Committee. Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit and Ethics Committee

The Audit and Ethics Committee represents the Board in discharging its responsibilities relating to the accounting, reporting, and financial practices of the Company, and has general responsibility for surveillance of internal controls and accounting and audit activities of the Company. Specifically, the Audit and Ethics Committee (i) is directly responsible for the appointment, compensation and oversight of the Company’s independent registered public accounting firm; (ii) reviews, prior to publication, the Company’s annual financial statements with management and the Company’s independent registered public accounting firm; (iii) reviews with the Company’s independent registered public accounting firm the scope, procedures and timing of the annual audits;

7

(iv) reviews the Company’s accounting and financial reporting principles and practices; (v) reviews the adequacy and effectiveness of the Company’s internal accounting controls; (vi) reviews the scope of other auditing services to be performed by the independent registered public accounting firm; (vii) reviews the independence and effectiveness of the Company’s independent registered public accounting firm and their significant relationships with the Company; (viii) reviews the adequacy of the Company’s accounting and financial personnel resources; (ix) reviews the Audit and Ethics Committee charter on an annual basis; (x) reviews with management and the Company’s independent registered public accounting firm quarterly financial results, and the results of any significant matters identified as a result of the independent registered public accounting firm’s review procedures, prior to filing anyForm 10-Q; and (xi) reviews any other matters relative to the audit of the Company’s accounts and the preparation of its financial statements that the Audit and Ethics Committee deems appropriate.

During 2008, the Company’s Audit and Ethics Committee met four times. The Audit and Ethics Committee was comprised of Alan D. Frazier (Chair), J. Leighton Read, M.D. and Isaac Stein. The Audit and Ethics Committee is a separately designated standing audit committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Frazier joined the Audit and Ethics Committee and became its Chair upon its formation on September 20, 2002. The Board has determined that Mr. Frazier is an “audit committee financial expert” as defined under the Exchange Act. The Board has determined that all members of the Audit and Ethics Committee are “independent” as defined under the Exchange Act and the listing standards of Nasdaq.

The Board has adopted an Audit and Ethics Committee Charter, which is available on our website at www.alexza.com in the “Investor Relations — Corporate Governance” section.

Report of the Audit and Ethics Committee of the Board of Directors*

The Audit and Ethics Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the consolidated financial statements and the reporting process, including the system of internal controls.

The Audit and Ethics Committee has reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2008 with management of the Company. The Audit and Ethics Committee has discussed significant accounting policies applied by the Company in its consolidated financial statements, as well as alternative treatments. Management represented to the Audit and Ethics Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit and Ethics Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit and Ethics Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 114, The Auditor’s Communication with Those Charged with Governance,as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T.

In addition, the Audit and Ethics Committee has discussed with the independent registered public accounting firm the accountant’s independence from the Company and its management, including the matters in the written disclosures required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence. The Audit and Ethics Committee has received the letter from the independent registered public accounting firm required therein. The Audit and Ethics Committee has also considered whether the independent registered public accounting firm’s provision of non-audit services to the Company is compatible with the auditors’ independence.

The Audit and Ethics Committee has concluded that the independent registered public accounting firm is independent from the Company and its management.

* The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of the Company’s filings under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

8

The Audit and Ethics Committee reviewed and discussed Company policies with respect to risk assessment and risk management.

The Audit and Ethics Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit. The Audit and Ethics Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit and Ethics Committee recommended to the Board that, and the Board has approved, the audited consolidated financial statements be included in the Company’s Annual Report onForm 10-K for the year ended December 31, 2008. The Board has also approved, subject to stockholder ratification, the Audit and Ethics Committee’s selection of the Company’s independent registered public accounting firm.

AUDIT AND ETHICS COMMITTEE

Alan D. Frazier (Chair)

J. Leighton Read, M.D.

Isaac Stein

Compensation Committee

The Compensation Committee acts on behalf of the Board to review, recommend for adoption and oversee the Company’s compensation strategy, policies, plans and programs, including:

| | |

| | • | establishment of corporate goals and objectives relevant to the compensation of the Company’s executive officers, the weighting of corporate and individual performance relating to compensation and evaluation ofperformance in light of these stated objectives; |

| |

| | • | review and recommendation to the Board for approval of the compensation and other terms of employment or service of the Company’s President and Chief Executive Officer and the other executive officers including all forms of salary paid to executive officers of the Company and the grant of all forms of bonus and stock compensation provided to executive officers of the Company; and |

| |

| | • | administration ofthe Company’s equity compensation plans and other similar plans and programs. |

Commencing in 2007, the Compensation Committee also began to review with management the Company’s Compensation Discussion and Analysis and to consider whether to recommend that it be included inproxy statements and other filings.

The Compensation Committee is appointed by our Board and consists entirely of directors who are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code, “non-employee directors” for purposes ofRule 16b-3 under the Exchange Act and “independent directors” for purposes of the Nasdaq listing standards. Our Compensation Committee is comprised of Samuel D. Colella (Chair), Hal Barron, M.D., FACC., Deepika R. Pakianathan, Ph.D. and Gordon Ringold, Ph.D. During 2008, the Company’s Compensation Committee met four times.

The Compensation Committee reviews and recommends to our Board an executive officer compensation program intended to link compensation with our compensation philosophy. The Compensation Committee annually reviews our executive officers’ compensation to determine whether it provides adequate incentives. The Compensation Committee’s most recent review occurred in December 2008. The Board has adopted a Compensation Committee Charter, which is available on our website at www.alexza.com in the “Investor Relations — Corporate Governance” section.

For more information about our Compensation Committee and our compensation program, see the section of this proxy statement entitled “Compensation Discussion and Analysis.”

9

Corporate Governance and Nominating Committee

Isaac Stein (Chair) and Samuel D. Colella are the current members of the Company’s Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee met four times during 2008. Other members of the Board are invited and often attend such meetings. The Board has determined that all members of the Corporate Governance and Nominating Committee are “independent” as defined under the Exchange Act and the listing standards of Nasdaq.

The Corporate Governance and Nominating Committee makes recommendations to the Board as to the appropriate size of the Board or any Board committee and reviews the qualifications of candidates for the Board (including those proposed by stockholders) and makes recommendations to the Board on potential Board members (whether created by vacancies or as part of the annual election cycle). The Corporate Governance and Nominating Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at the Annual Meeting.

In evaluating the suitability of individuals for Board membership or continued Board membership, the Corporate Governance and Nominating Committee takes into account many factors, including whether the individual meets requirements for independence; the individual’s general understanding of the various disciplines relevant to the success of a publicly-traded pharmaceutical company; the individual’s understanding of the Company’s business; the individual’s professional expertise and educational background; and other factors that promote diversity of views and experience. The Corporate Governance and Nominating Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group of directors that can best achieve success for the Company and represent stockholder interests through the exercise of sound judgment, using its diversity of experience. In determining whether to recommend a director for re-election, the Corporate Governance and Nominating Committee also considers the director’s past attendance at meetings and participation in and contributions to the activities of the Board. The Corporate Governance and Nominating Committee has not established any specific minimum qualification standards for nominees to the Board, although from time to time the Corporate Governance and Nominating Committee may identify certain skills or attributes (e.g., financial experience or product commercialization experience) as being particularly desirable to help meet specific Board needs that have arisen.

In identifying potential candidates for Board membership, the Corporate Governance and Nominating Committee relies on suggestions and recommendations from the Board, stockholders, management and others. The Corporate Governance and Nominating Committee does not distinguish between nominees recommended by stockholders and other nominees.

From time to time, the Corporate Governance and Nominating Committee may also retain search firms to assist it in identifying potential candidates for director, gathering information about the background and experience of such candidates and acting as an intermediary with such candidates. Stockholders wishing to suggest candidates to the Corporate Governance and Nominating Committee for consideration as directors must timely submit a written notice to the Corporate Secretary of the Company, whose address is 2091 Stierlin Court, Mountain View, CA 94043. The Company’s Bylaws, as amended (the “Bylaws”), set forth the procedures a stockholder must follow to nominate directors. For a stockholder to nominate a candidate for director at the 2010 Annual Meeting of Stockholders, notice of the nomination must be received by the Company prior to February 6, 2010. The notice must include all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including the consent of the nominee to be named in the proxy statement as a nominee and to serve as a director if elected). The Corporate Governance and Nominating Committee will consider any nominee properly presented by a stockholder, and will make a recommendation to the Board. After full consideration by the Board, the stockholder presenting the nomination will be notified of the Board’s conclusion. Copies of the Company’s Bylaws may be obtained by writing to the Corporate Secretary at the above address.

In addition, the Corporate Governance and Nominating Committee establishes procedures for the oversight and evaluation of the Board and management and considers conflicts of interest involving executive officers or Board members. Stockholders wishing to submit recommendations for our 2010 Annual Meeting should submit their proposals to the Corporate Governance and Nominating Committee, in care of our Corporate Secretary in

10

accordance with the time limitations, procedures and requirements described in the Section entitled “Stockholder Proposals” below.

The Board has adopted a Corporate Governance and Nominating Committee Charter, which is available on our website at www.alexza.com in the “Investor Relations — Corporate Governance” section.

Stockholder Communications With the Board

Stockholders and other interested parties may contact any member (or all members) of the Board (including, without limitation, the non-management directors as a group), any Board committee or any Chair of any such committee by U.S. mail. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors by either name or title. Such correspondence should be sentc/o Corporate Secretary, Alexza Pharmaceuticals, Inc., 2091 Stierlin Court, Mountain View, CA 94043.

All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary for the sole purpose of determining whether the contents represent a message to the Company’s directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the communication is addressed.

Director Attendance at Annual Meeting

The Company encourages all directors to attend each annual meeting of stockholders. In furtherance of this policy and to maximize the attendance of directors at annual meetings, the Company generally schedules annual meetings of stockholders on the same day, and in the same location, as a regularly scheduled meeting of the Board. Drs. Barron, Read, and Ringold and Mr. Stein of our board of directors attended the 2008 Annual Meeting of Stockholders.

Compensation Committee Interlock and Insider Participation

For the fiscal year ended December 31, 2008, members of the Company’s Compensation Committee consisted of Samuel D. Colella (Chair), Hal Barron, M.D., FACC, Deepika R. Pakianathan, Ph.D. and Gordon Ringold, Ph.D., none of whom is currently, or has ever been at any time since the Company’s formation, one of the Company’s officers or employees. In addition, none of our executive officers has served as a member of the Board of Directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Code of Conduct

The Company has adopted the Alexza Pharmaceuticals, Inc. Code of Business Conduct for Employees, Executive Officers and Directors (the “Code of Conduct”), which applies to all directors and employees, including executive officers, including, without limitation, the Company’s principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The Code of Conduct is filed as an exhibit on the Company’s Annual Report onForm 10-K for the year ended December 31, 2008.

11

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit and Ethics Committee has selected Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009. The Company is submitting the Audit and Ethics Committee’s selection of independent registered public accounting firm for ratification by the stockholders at the 2009 Annual Meeting of Stockholders. Ernst & Young LLP has audited the Company’s consolidated financial statements since inception. The Company expects that representatives of Ernst & Young LLP will be present at the 2009 annual meeting, will have an opportunity to make a statement if they wish and will be available to respond to appropriate questions.

Required Vote

Neither the Company’s Bylaws nor any other governing document or law requires that the stockholders ratify the selection of Ernst &Young LLP as the Company’s independent registered public accounting firm. However, the Company is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the selection, the Audit and Ethics Committee will reconsider whether or not to retain Ernst & Young LLP. Even if the selection is ratified, the Audit and Ethics Committee in its discretion may change the appointment at any time during the year if the Audit and Ethics Committee determines that such a change would be in the best interests of the Company and its stockholders.

If a quorum is present and voting, the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting on the proposal will be required to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

Principal Accountant Fees and Services

In connection with the audit of the 2008 financial statements, the Company entered into an engagement agreement with Ernst & Young LLP which sets forth the terms by which Ernst & Young LLP will perform audit services for the Company. That agreement is subject to alternative dispute resolution procedures.

The following table presents aggregate fees billed for professional audit services rendered by Ernst & Young LLP for the audit of our annual consolidated financial statements for the years ended December 31, 2008 and December 31, 2007, and aggregate fees billed for other services rendered by Ernst & Young LLP during those periods.

| | | | | | | | | |

| | | 2008 | | | 2007 | |

| |

| Audit fees(1) | | $ | 642,289 | | | $ | 710,998 | |

| Tax fees(2) | | | 231,903 | | | | 39,375 | |

| All other fees(3) | | | 1,500 | | | | 1,325 | |

| | | | | | | | | |

| Total | | $ | 875,692 | | | $ | 751,698 | |

| | | | | | | | | |

| | |

| (1) | | Audit fees consisted of professional services rendered by Ernst & Young LLP for the integrated audits of our annual consolidated financial statements, including the audit of the consolidated financial statements for the years ended December 31, 2008 and 2007 and the audit of internal control over financial reporting as of December 31, 2008 and 2007. For the years ended December 31, 2008 and 2007, the audit fees also include review of unaudited interim consolidated financial statements included in our quarterly reports on Form10-Q, consultation regarding financial accounting and reporting standards billed as audit services, as well as assistance with and review of our Registration Statement filings onForm S-3 andForm S-8 filed with the SEC. |

12

| | |

| (2) | | For the year ended December 31, 2008, tax fees primarily included income tax return preparation fees and international tax planning fees. For the year ended December 31, 2007, tax fees primarily included income tax preparation fees. |

| |

| (3) | | Other fees consist of subscription fees paid for access to Ernst & Young’s Accounting & Auditing Research Tool and tax planning consultation. |

Pre-approval Policies and Procedures

Consistent with SEC policies regarding auditor independence, the Audit and Ethics Committee has responsibility for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In recognition of this responsibility, the Audit and Ethics Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm.

Prior to engagement of the independent registered public accounting firm for the next year’s audit, management will discuss with the Audit and Ethics Committee the services expected to be rendered by the independent registered public accounting firm during that year for each of four categories of services.

1. Audit servicesinclude audit work performed in the preparation of financial statements and internal control over financial reporting, as well as work that generally only the independent registered public accounting firm can reasonably be expected to provide, including consultation regarding the proper application of financial accountingand/or reporting standards.

2. Audit related servicesare for assurance and related services that are traditionally performed by the independent registered public accounting firm, including due diligence related to mergers and acquisitions and special procedures required to meet certain regulatory requirements.

3. Tax servicesinclude all services performed by the independent registered public accounting firm’s tax personnel, except those services specifically related to the audit of the financial statements, and includes fees in the areas of tax compliance, tax planning, tax advice and tax return preparation. The Company retains its independent registered public accounting firm for corporate income tax return preparation.

4. Other servicesinclude those associated with services not captured in the other categories. The Company generally does not request such services from the independent registered public accounting firm.

Prior to engagement, the Audit and Ethics Committee pre-approves all audit and permissible non-audit services to be provided by its independent registered public accounting firm.

The Audit and Ethics Committee pre-approved all audit related, tax and other services rendered in 2008 and did not rely on the waiver of pre-approval requirement provided by paragraph (C)(7)(i)(C) ofRule 2-01 ofRegulation S-X promulgated under the Exchange Act.

The Company discloses all approved non-audit engagements during a quarter in the appropriate quarterly report onForm 10-Q or Annual Report onForm 10-K.

13

EXECUTIVE OFFICERS

Our executive officers and key employees as of March 27, 2009, are as follows:

| | | | | | | |

Name | | Age | | Position |

| |

| Thomas B. King | | | 54 | | | President, Chief Executive Officer and Director |

| James V. Cassella, Ph.D. | | | 54 | | | Senior Vice President, Research and Development |

| August J. Moretti | | | 58 | | | Senior Vice President, Chief Financial Officer and Secretary |

| Michael J. Simms | | | 47 | | | Senior Vice President, Operations and Manufacturing |

| Anthony G. Tebbutt | | | 61 | | | Senior Vice President, Corporate Strategy & Business Development |

| Joseph L. Baker | | | 54 | | | Vice President, Commercial Manufacturing |

| Anthony Clarke, Ph.D. | | | 53 | | | Vice President, International Development Operations |

| Robert S. Fishman, M.D., F.C.C.P. | | | 47 | | | Vice President, Clinical Operations |

| Emily Lee Kelley, SPHR | | | 51 | | | Vice President, Human Resources |

| Christopher Kurtz | | | 42 | | | Vice President, Global Supply Chain and Sustainment Engineering |

| Peter D. Noymer, Ph.D. | | | 42 | | | Vice President, Product Research & Development |

| Carlos A. Parra | | | 56 | | | Vice President, Quality |

| Jeffrey S. Williams | | | 44 | | | Vice President, Technology Outlicensing |

Thomas B. King. See Mr. King’s biography in Proposal Number 1 — Election of Directors.

James V. Cassella, Ph.D. has served as our Senior Vice President, Research and Development since June 2004. From April 1989 to April 2004, Dr. Cassella held various management positions at Neurogen Corporation, a publicly traded biotechnology company, including Senior Vice President of Clinical Research and Development from January 2003 to June 2004. Prior to Neurogen, Dr. Cassella was Assistant Professor of Neuroscience at Oberlin College. Dr. Cassella received a Ph.D. in physiological psychology from Dartmouth College, completed a postdoctoral fellowship in the Department of Psychiatry at the Yale University School of Medicine and received a B.A. in psychology from the University of New Haven.

August J. Morettihas served as our Senior Vice President and Chief Financial Officer since February 2005 and as our Secretary since December 2005. From August 2004 to February 2005, Mr. Moretti was our part time Chief Financial Officer. From January 2001 to January 2005, Mr. Moretti served as Chief Financial Officer and General Counsel at Alavita, Inc. (formerly known as SurroMed, Inc.), a biotechnology company. From January 1982 to December 2000, Mr. Moretti was a member of Heller Ehrman White & McAuliffe LLP, an international law firm. Mr. Moretti received a J.D. from Harvard Law School and a B.A. in economics from Princeton University.

Michael J. Simmshas served as our Senior Vice President, Operations and Manufacturing since February 2008. From May 2007 to February 2008 Mr. Simms served as Senior Vice President, Manufacturing Operations and from June 2004 to May 2007 served as Vice President, Manufacturing of Nektar Therapeutics, a publicly traded biopharmaceutical company. From August 2002 to June 2004, Mr. Simms worked as an independent consultant to develop manufacturing strategies and business plans for various early stage and small commercial stage companies. Prior to this, Mr. Simms held executive level positions at various life science companies. Mr. Simms holds an M.B.A from Pepperdine University and a B.S. in Chemical Engineering from the University of Missouri-Rolla.

Anthony G. Tebbutthas served as our Senior Vice President, Corporate Strategy and Business Development since March 2007. Mr. Tebbutt’s employment with the Company will be ending on May 31, 2009. From September 1996 to October 2006, Mr. Tebbutt served as Senior Vice President and President at UCB, SA (Belgium), a pharmaceutical company, and from 1983 to 1995 Mr. Tebbut served in various Vice President positions in New Product Planning and Marketing for Syntex Laboratories, a publicly traded pharmaceutical company. Prior to

14

Syntex, Mr. Tebbutt was also Marketing Manager for Eli Lilly Canada, Inc. from 1974 to 1983. Mr. Tebbutt holds an M.B.A. from Stanford Graduate School of Business and a B.S. from Santa Clara University.

Joseph L. Bakerhas served as our Vice President, Commercial Manufacturing since June 2008 and as our Vice President, Commercial Manufacturing and Global Supply Chain from November 2006 to June 2008. From 1999 to 2006, Mr. Baker was General Manager for Watson Laboratories, Inc., a subsidiary of Watson Pharmaceuticals, Inc., a publicly traded specialty pharmaceutical company, where he was responsible for all activities for the Salt Lake City manufacturing facility. He was previously Director, Oral Product R&D and Director, Operations Technical Services for Theratech, Inc., a publicly traded medical device company, from 1995 to 1999. Prior to Watson Laboratories and Theratech, Mr. Baker held various management and technical positions with Lohmann Therapy Systems from 1993 to 1995 and Lederle Laboratories from 1974 to 1993. Mr. Baker holds an undergraduate degree in Natural Sciences, with a concentration in chemistry, from Thomas A. Edison College.

Anthony Clarke, Ph.D. has served as Alexza’s Vice President, International Development Operations since May 2008. From 2005 until he joined Alexza, Dr. Clarke was Vice President, Clinical Development for Amarin Corporation, a biopharmaceutical company, based in the United Kingdom. Previously, Dr. Clarke held positions as Director, Clinical Development and Independent Consultant for Curidium Medica plc, a medical diagnostic technology company, from 2004 to 2005, and before that he was Senior Director, Worldwide Pain Management / Clinical & Regulatory Affairs for Cephalon, Inc., a publicly traded biopharmaceutical company, from 2000 to 2004. Prior to Cephalon, Dr. Clarke held various regulatory and clinical positions with Anesta UK Ltd., a subsidiary of Anesta Corporation, a publicly traded pharmaceutical company, from 1999 to 2000 and Scherer DDS, a division of RP Scherer, a publicly traded drug delivery company, from 1994 to 1999. Dr. Clarke holds a Bachelors of Science in Pharmacology from University of Sunderland and a Ph.D. in Psychopharmacology from University of London.

Robert S. Fishman, M.D., F.C.C.P. has served as our Vice President, Clinical Development since May 2008, and served as our Vice President, Medical Affairs from September 2007 to May 2008. Prior to Alexza, Dr. Fishman served as Senior Vice President, Clinical Development for Anthera Pharmaceuticals, Inc., a privately held pharmaceutical company, from 2005 to 2007. Previously, he was Vice President, Scientific Affairs for Aerogen, Inc., a publicly traded specialty pharmaceutical company, where he served in various capacities from 1998 to 2005. Prior to Aerogen, Dr. Fishman was Director of Clinical Affairs for Heartport, Inc., a publicly traded medical device company, from 1995 to 1998. Dr. Fishman was Assistant Professor of Medicine, Pulmonary and Critical Care Medicine, at Stanford University School of Medicine from 1993 to 1995. He completed a fellowship in pulmonary and critical care medicine at Massachusetts General Hospital from 1989 to 1992. Dr. Fishman holds an M.D. from Stanford University School of Medicine and an A.B. in biology from Harvard University.

Emily Lee Kelley, SPHRhas served as our Vice President, Human Resources since October 2002. From October 2001 to October 2002, Ms. Kelley provided human resources consulting services to us and Versicor, Inc., a majority owned subsidiary of Sepracor Inc., a publicly traded pharmaceutical company. From 1995 to 2001, Ms. Kelley served as Vice President of Human Resources, Finance and Operations at Affymax Research Institute, a pharmaceutical company, and oversaw human resource matters for Maxygen, Inc., a publicly traded biotechnology company. Ms. Kelley received a B.S. in organizational behavior and industrial relations from the University of California, Berkeley.

Christopher Kurtzhas served as our Vice President, Global Supply Chain and Sustainment Engineering since June 2008. Mr. Kurtz was most recently Vice President of Research and Development and Director, Pharmaceutical Manufacturing and Development for Novo Nordisk Delivery Technologies, a pharmaceutical company, from June 2006 to May 2008. Prior to his tenure at Novo, he held positions as Senior Director, Process Engineering for ALZA Corporation, a division of Johnson and Johnson, a pharmaceutical and medical systems company, from January 2006 to June 2006. He was previously Director, Operations Engineering and Director Manufacturing Engineering for Nektar Therapeutics, a publicly traded biopharmaceutical company, from 2001 to 2006 and also held previous positions at PowderJect Pharmaceuticals, PLC, Monsanto, Inc., Hauser Chemical Research, and spent 6 years in the US Navy Submarine Force. Mr. Kurtz holds a Bachelor of Science degree in Chemical Engineering with a Chemistry Minor from University of Colorado at Boulder.

15

Peter D. Noymer, Ph.D. has served as our Vice President, Product Research and Development since January 2009. Dr. Noymer served as our Senior Director, Product Research & Development from January 2008 to January 2009 and as our Senior Director, Product Design & Development from August 2006 to January 2008. From September 1999 to July 2006, Dr. Noymer held various management positions at Aradigm Corporation, a publicly traded specialty pharmaceutical company, most recently Director, Systems Engineering. Prior to Aradigm, Dr. Noymer held an appointment as Visiting Assistant Professor at Carnegie Mellon University, as well as various engineering positions at General Electric, a publicly traded company. Dr. Noymer received M.S. and Ph.D. degrees in mechanical engineering from M.I.T., and a B.S. degree in mechanical & aerospace engineering from Princeton University.

Carlos A. Parrahas served as our Vice President, Quality since May 2008. From February 2007 to April 2008, Mr. Parra was Vice President, Operations and Quality and from June 2002 to February 2007 was Vice President, Quality at Telik, Inc., a publicly traded biopharmaceutical company. Prior to his tenure at Telik, he was Principal Partner at West Coast Associates, a consulting firm, from January 1996 to June 2002. Before founding West Coast Associates, his experience in Quality positions spanned 20 years with both small and large pharmaceutical and biotechnology companies including Somatogen, Syntex Research, Genentech, Abbott Laboratories and American Hospital Supply Corporation. Mr. Parra holds a B.S. in Microbiology with a minor in Engineering from University of Texas at El Paso.

Jeffrey S. Williamshas served as our Vice President, Technology Outlicensing since March 2009 and from May 2008 to March 2009 served as our President, Alexza Singapore Pte. Ltd. Mr. Williams served as the Chief Business Officer for CoNCERT Pharmaceuticals, Inc., a private biotechnology company, from December 2007 to May 2008 on a full-time basis and from May 2008 to August 2008 in a part-time capacity. Mr. Williams served as our Senior Vice President, Operations and Manufacturing from March 2007 to November 2007 and as our Senior Vice President, Corporate and Business Development from March 2004 to March 2007. From September 2001 to February 2004, Mr. Williams served as Vice President, Corporate Development at Scion Pharmaceuticals, Inc., a biopharmaceutical company. From March 2001 to August 2001, Mr. Williams served as Vice President, Corporate Development and Strategy at EmerGen, Inc., a biopharmaceutical company. From December 1996 to February 2001, Mr. Williams held various executive positions at Anesta Corporation, a publicly traded pharmaceutical company. Mr. Williams received an M.S. in management from the M.I.T. Sloan School of Management and a B.A. in economics from Brigham Young University.

Our officers are appointed by and serve at the discretion of our Board. There are no family relationships between our directors and officers.

16

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of February 28, 2009 by (i) each stockholder that is known by us to beneficially own more than 5% of the common stock, (ii) each of our named executive officers named in the Summary Compensation Table, (iii) each director and nominee for director and (iv) all executive officers and directors as a group.

Percentage of ownership is based upon 32,973,951 shares outstanding as of February 28, 2009. Beneficial ownership is calculated based upon SEC requirements. All shares of common stock subject to options, restricted stock units, or warrants currently exercisable or exercisable within 60 days after February 28, 2009 are deemed to be outstanding for the purpose of computing the percentage of ownership of the person holding such options, restricted stock units, or warrants, but are not deemed to be outstanding for computing the percentage of ownership of any other person. Unless otherwise indicated below, each stockholder named in the table has sole or shared voting and investment power with respect to all shares beneficially owned, subject to applicable community property laws. Unless otherwise indicated in the footnotes to the table, the address of each individual listed in the table isc/o Alexza Pharmaceuticals, Inc., 2091 Stierlin Court, Mountain View, CA 94043.

| | | | | | | | | | | | | |

| | | | | | Shares

| | | | |

| | | | | | Issuable

| | | | |

| | | | | | Pursuant

| | | | |

| | | | | | to Options

| | | | |

| | | | | | Exercisable

| | | Percentage

| |

| | | Number of

| | | Within 60

| | | of Shares

| |

| | | Shares

| | | Days of

| | | Beneficially

| |

Beneficial Owner | | Outstanding | | | February 28, 2009 | | | Owned(1) | |

| |

5% Stockholders | | | | | | | | | | | | |

| Zesiger Capital Group LLC(2) | | | 2,521,240 | | | | — | | | | 7.65 | % |

| Entities affiliated with Abingworth Bioventures(3) | | | 2,228,105 | | | | — | | | | 6.76 | % |

| Entities affiliated with Frazier Healthcare Ventures(4) | | | 2,183,127 | | | | — | | | | 6.62 | % |

| Entities affiliated with Versant Ventures(5) | | | 2,183,128 | | | | — | | | | 6.62 | % |

| Alejandro C. Zaffaroni, Ph.D.(6) | | | 2,110,033 | | | | — | | | | 6.40 | % |

| | | | | | | | | | | | | |

Named Executive Officers and Directors | | | | | | | | | | | | |

| Thomas B. King(7) | | | 123,475 | | | | 594,772 | | | | 2.14 | % |

| James V. Cassella | | | 9,504 | | | | 205,038 | | | | | * |

| August J. Moretti | | | 12,219 | | | | 197,484 | | | | | * |

| Anthony G. Tebbutt(8) | | | 3,983 | | | | 110,262 | | | | | * |

| Michael J. Simms | | | 3,709 | | | | 64,036 | | | | | * |

| Hal V. Barron, M.D., FACC | | | — | | | | 8,333 | | | | | * |

| Samuel D. Colella(5) | | | 2,183,128 | | | | 23,696 | | | | 6.69 | % |

| Alan D. Frazier(4) | | | 2,183,127 | | | | 23,696 | | | | 6.69 | % |

| Deepika R. Pakianathan, Ph.D.(9) | | | 990,678 | | | | 23,696 | | | | 3.07 | % |

| J. Leighton Read, M.D.(10) | | | 1,353,950 | | | | 23,696 | | | | 4.17 | % |

| Gordon Ringold, Ph.D.(11) | | | 107,555 | | | | 23,696 | | | | | * |

| Isaac Stein(12) | | | 117,653 | | | | 23,696 | | | | | * |

| All directors and executive officers as a group (12 persons)(13) | | | 7,088,981 | | | | 1,322,101 | | | | 24.52 | % |

| | |

| * | | Less than 1% of our outstanding common stock. |

| |

| (1) | | This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the SEC. |

| |

| (2) | | Based solely upon a Schedule 13G filed with the SEC on February 10, 2009. These shares represent the combined holdings by Zesiger Capital Group LLC acting as an investment adviser to its clients. Zesiger Capital Group LLC disclaims beneficial ownership of all of the shares held in discretionary accounts in which |

17

| | |

| | it manages. The address for the Zesiger Capital Group LLC is 320 Park Avenue, 30th Floor, New York, NY 10022. |

| |

| (3) | | Based solely upon a Schedule 13G filed with the SEC on February 13, 2009. Includes 1,444,529 shares held by Abingworth Bioventures IV LP, 12,383 shares held by Abingworth Bioventures IV Executives LP, 422,193 shares held by Abingworth Bioventures V LP and 349,000 shares held by Abingworth Bioequities Master Fund LTD. The address for the Abingworth Entities is Princess House, 38 Jermyn Street, London, England SW1Y 6DN. |

| |

| (4) | | Includes 583,931 shares held by Frazier Healthcare III, L.P., 1,586,752 shares held by Frazier Healthcare IV, L.P., 4,390 shares held by Frazier Affiliates III, L.P. and 8,054 shares held by Frazier Affiliates IV, L.P. Mr. Frazier is the president and controlling stockholder of Frazier and Company, Inc., the managing director of FHM III, LLC, which is the general partner of Frazier Healthcare III, L.P. and Frazier Affiliates III, L.P., and he shares voting and investment power over the shares held by these entities. He is also a managing member of FHM IV, LLC, which is the general partner of FHM IV, LP, which is the general partner of Frazier Healthcare IV, L.P. and Frazier Affiliates IV, L.P., and he shares voting and investment power over the shares held by those entities. He disclaims beneficial ownership of the shares held by these entities, except to the extent of his proportionate pecuniary interest therein. The address for all entities and individuals affiliated with Frazier Healthcare Ventures is Two Union Square, Suite 3200, 601 Union Street, Seattle, WA 98101. |

| |

| (5) | | Includes 2,153,442 shares held by Versant Venture Capital II, L.P., 10,440 shares held by Versant AffiliatesFund II-A, L.P. and 19,246 shares held by Versant Side Fund II, L.P. (together the “Versant Funds”). Mr. Colella is a managing member of Versant Ventures II, LLC, which is the general partner of each of the Versant Funds, and he shares voting and investment power over the shares held by these entities. He disclaims beneficial ownership of the shares held by these entities, except to the extent of his proportionate pecuniary interest therein. The address for all entities and individuals affiliated with Versant Ventures is 3000 Sand Hill Road, Building 4, Ste. 210, Menlo Park, CA 94025. |

| |

| (6) | | Based solely upon a Schedule 13G filed with the SEC on February 12, 2009. Includes 1,831,626 shares held by the Zaffaroni Revocable Trust u/t/d 1/24/86, of which Dr. Zaffaroni and his wife are trustees; 269,090 shares held by the Zaffaroni Partners, L.P., of which Dr. Zaffaroni is a general partner and limited partner, and an aggregate of 9,317 shares held by certain Alejandro Zaffaroni Retirement Trusts, of which Dr. Zaffaroni is trustee. Dr. Zaffaroni disclaims beneficial ownership of the shares held by these entities, except to the extent of his proportionate pecuniary interest therein. Dr. Zaffaroni’s address is 2600 El Camino Real, Suite 401, Palo Alto, CA 94306. |

| |

| (7) | | Includes 116,107 shares held by the Thomas and Beth King 2000 Family Trust, of which Mr. King and his spouse are trustees. |

| |

| (8) | | Mr. Tebbutt’s employment with Alexza will be ending on May 31, 2009. |

| |

| (9) | | Includes 979,880 shares held by Delphi Ventures VI, L.P. and 9,798 shares held by Delphi BioInvestments VI, L.P. (together, the “Delphi Funds”). Dr. Pakianathan is a managing member of Delphi Management Partners VI, LLC, which is the general partner of each of the Delphi Funds, and she shares voting and investment power over the shares held by these entities. She disclaims beneficial ownership of the shares held by these entities, except to the extent of her proportionate pecuniary interest therein. The address for all entities and individuals affiliated with Delphi Ventures is 3000 Sand Hill Road, Building 1, Ste. 135, Menlo Park, CA 94025. |

| |

| (10) | | Includes 35,594 shares held by Alloy Partners 2002, L.P. and 1,318,356 shares held by Alloy Ventures 2002, L.P. (together, the “Alloy Funds”). Dr. Read is a managing member of Alloy Ventures 2002, LLC, which is the general partner of each of the Alloy Funds, and he shares voting and investment power over the shares held by these entities. He disclaims beneficial ownership of the shares held by these entities, except to the extent of his proportionate pecuniary interest therein. The address for all entities and individuals affiliated with Alloy Ventures is 400 Hamilton Avenue, 4th Floor, Palo Alto, CA 94301. |

| |

| (11) | | Includes 9,276 shares held by the Gordon Ringold and Tanya Zurucki 1999 Reversible Trust, of which Dr. Ringold and his spouse are trustees and 7,000 shares held by the Vivian Robb Trust, of which Dr. Ringold is trustee. |

18

| | |

| (12) | | Includes 117,653 shares held by The Stein 1995 Revocable Trust, of which Mr. Stein and his spouse are trustees. |

| |

| (13) | | See notes (4), (5) and (7) and through (12). |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulation to furnish us with copies of all Section 16(a) forms that they file.