UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

þ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

¨ | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

| Alexza Pharmaceuticals, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| Not Applicable |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

| |

þ | | No fee required |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

ALEXZA PHARMACEUTICALS, INC.

2091 Stierlin Court

Mountain View, California 94043

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 6, 2012

Dear Stockholder:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Alexza Pharmaceuticals, Inc., a Delaware corporation (the “Company” or “Alexza”), will be held on June 6, 2012, at 2:00 p.m. local time at the offices of the Company, 2091 Stierlin Court, Mountain View, California 94043 for the following purposes:

1. To elect the eight nominees for director named herein, each to serve until the 2013 Annual Meeting of Stockholders and until his or her successor has been elected and qualified or until his or her earlier death, resignation or removal. The Company’s Board of Directors intends to present the following nominees for election as directors:

| | |

Thomas B. King | | J. Leighton Read, M.D. |

Hal V. Barron, M.D., F.A.C.C. | | Gordon Ringold, Ph.D. |

Andrew L. Busser | | Isaac Stein |

Deepika R. Pakianathan, Ph.D. | | Joseph L. Turner |

2. To approve a series of certificates of amendment to the Company’s Restated Certificate of Incorporation, as amended, to effect a reverse split of the Company’s outstanding common stock, pursuant to which any whole number of outstanding shares between, and including, three and ten would be combined into one share of common stock and to authorize the Company’s Board of Directors to select and file one such certificate of amendment.

3. To ratify the selection by the Audit and Ethics Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2012; and

4. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

These business items are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on April 20, 2012 as the record date for identifying those stockholders entitled to notice of, and to vote at, the annual meeting and any adjournment or postponement thereof. Only stockholders of record at the close of business on that day may vote at the annual meeting or any adjournment thereof. In accordance with Delaware law, for ten days prior to the annual meeting of stockholders, a list of stockholders will be available for inspection in the office of the Corporate Secretary, Alexza Pharmaceuticals, Inc., 2091 Stierlin Court, Mountain View, California 94043. The list of stockholders will also be available at the annual meeting.

By Order of the Board of Directors

Mark K. Oki

Vice President, Finance, Controller

and Secretary

Mountain View, California

[ ], 2012

Pursuant to the Internet proxy rules promulgated by the Securities and Exchange Commission, Alexza has elected to provide access to its proxy materials over the Internet. Accordingly, stockholders of record at the close of business on April 20, 2012 will receive a Notice of Internet Availability of Proxy Materials and may vote at the Annual Meeting and any adjournment or postponement thereof. Alexza expects to mail the Notice of Internet Availability of Proxy Materials on or about April 27, 2012.

All stockholders are cordially invited to attend the annual meeting in person. Whether or not you expect to attend the annual meeting, please vote, as instructed in the Notice of Internet Availability of Proxy Materials, via the Internet or the telephone, as promptly as possible in order to ensure your representation at the annual meeting. Alternatively, you may follow the procedures outlined in the Notice of Internet Availability of Proxy Materials to request a paper proxy card to submit your vote by mail. Even if you have voted by proxy, you may still vote in person if you attend the annual meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

ALEXZA PHARMACEUTICALS, INC.

2091 Stierlin Court

Mountain View, California 94043

PROXY STATEMENT

FOR THE 2012 ANNUAL MEETING OF STOCKHOLDERS

JUNE 6, 2012

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

What is the Notice of Internet Availability of Proxy Materials?

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to all stockholders entitled to vote at the annual meeting, we are furnishing the proxy materials to our stockholders over the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice of Internet Availability will instruct you as to how you may access and review the proxy materials and submit your vote via the Internet. If you received the Notice of Internet Availability by mail and would like to receive a printed copy of the proxy materials, please follow the instructions for requesting such materials included in the Notice of Internet Availability.

We intend to mail the Notice of Internet Availability on or about April 27, 2012 to all stockholders of record entitled to vote at the annual meeting. On the date of mailing of the Notice of Internet Availability, all stockholders and beneficial owners will have the ability to access all of our proxy materials on a website referred to in the Notice of Internet Availability. These proxy materials will be available free of charge.

Why am I being provided access to these materials?

We have provided you access to these proxy materials because the Board of Directors of Alexza Pharmaceuticals, Inc. (sometimes referred to as the “Company” or “Alexza”) is soliciting your proxy to vote at the 2012 Annual Meeting of Stockholders including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the annual meeting to vote your shares. Instead, you may simply vote, as instructed below and in the Notice of Internet Availability, via the Internet or the telephone. Alternatively, you may follow the procedures outlined in the Notice of Internet Availability to request a paper proxy card to submit your vote by mail.

How do I attend the annual meeting?

The meeting will be held on Wednesday, June 6, 2012, at 2:00 p.m. local time at the offices of the Company, 2091 Stierlin Court, Mountain View, California 94043. Directions to the annual meeting may be found at www.alexza.com. Information on how to vote in person at the annual meeting is discussed below.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 20, 2012 will be entitled to vote at the annual meeting. On April 20, 2012, there were [ ] shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 20, 2012 your shares were registered directly in your name with the Company’s transfer agent, Computershare then you are a stockholder of record. As a stockholder of record, you may vote in person at the

1

meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote, as instructed below and in the Notice of Internet Availability, via the Internet or the telephone, as promptly as possible to ensure your vote is counted. Alternatively, you may follow the procedures outlined in the Notice of Internet Availability to request a paper proxy card to submit your vote by mail.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 20, 2012 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice of Internet Availability is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote, as well as such other business as may properly come before the meeting or any adjournment thereof:

| | • | | Election of eight directors; |

| | • | | Approval of a series of certificates of amendment to the Company’s Restated Certificate of Incorporation, as amended, to effect a reverse split of the Company’s outstanding common stock, pursuant to which any whole number of outstanding shares between, and including, three and ten would be combined into one share of common stock and to authorize the Company’s Board of Directors to select and file one such certificate of amendment; and |

| | • | | Ratification of the selection by the Audit and Ethics Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm for the Company for its fiscal year ending December 31, 2012. |

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For all other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy on the Internet, vote by proxy over the telephone, or vote by proxy via the mail. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting and vote in person even if you have already voted by proxy.

| | • | | In Person: To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

2

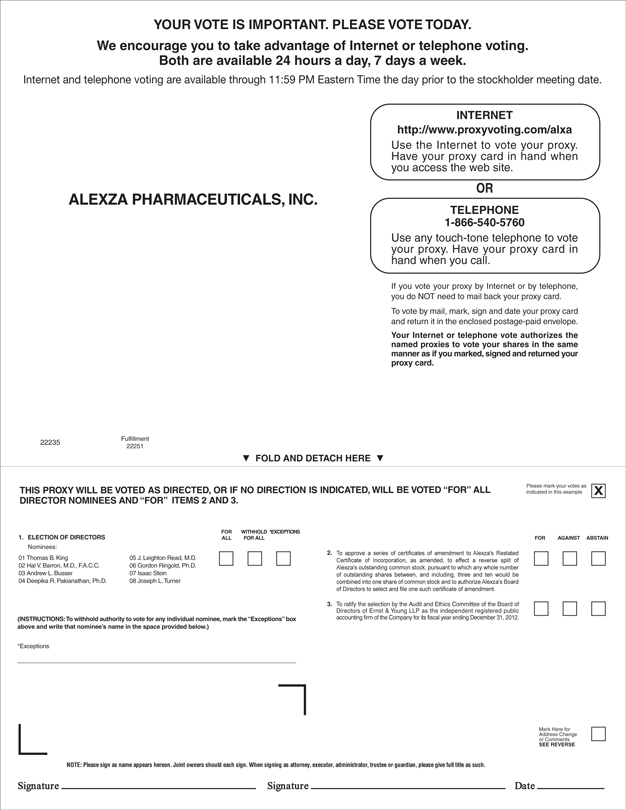

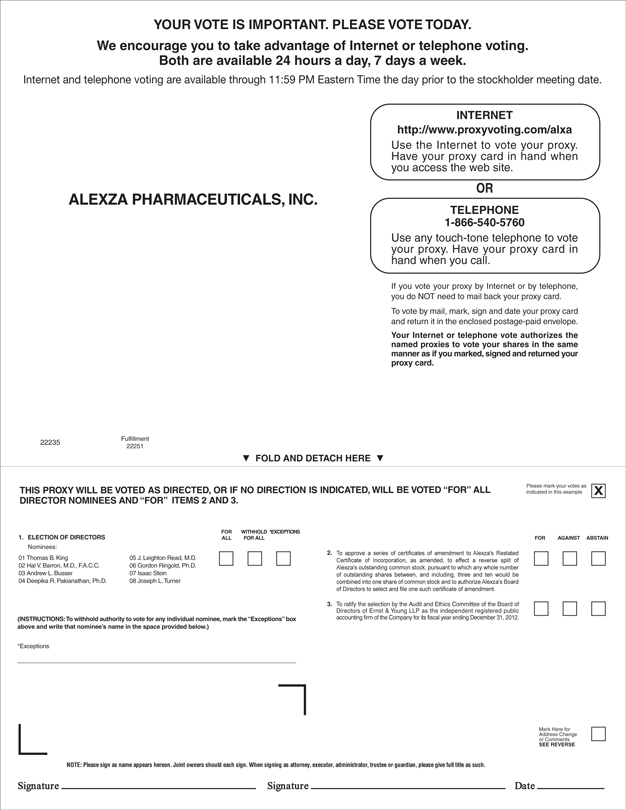

| | • | | Internet: To vote on the Internet, go to http://www.proxyvoting.com/alxa to complete an electronic proxy card. You will be asked to provide the control number from the Notice of Internet Availability. Your vote must be received by 11:59 p.m., Eastern time, on June 5, 2012 to be counted. |

| | • | | Telephone: To vote over the telephone, dial toll-free 1-866-540-5760 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the Notice of Internet Availability. Your vote must be received by 11:59 p.m. Eastern time, on June 5, 2012 to be counted. |

| | • | | Mail: To vote by mail, you must request a paper proxy card by following the instructions on the Notice of Internet Availability. Once you receive the paper proxy card, complete, sign and date the proxy card where indicated and return it promptly in the prepaid envelope that will be included with the paper proxy card. If we receive your signed proxy card before the annual meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice of Internet Availability containing voting instructions from that organization rather than from the Company. You may vote by proxy by following the instructions from your broker, bank or other agent included with the Notice of Internet Availability. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 20, 2012.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or in person at the annual meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposal Nos. 1 or 2 without your instructions, but may vote your shares on Proposal No. 3.

3

What if I submit a proxy via the Internet, by telephone or by mail but do not make specific choices?

If you submit a proxy via the Internet, by telephone or by mail without making voting selections, your shares will be voted “For” the election of all eight nominees for director and “For” for all other proposals. If any other matter is properly presented at the annual meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice of Internet Availability or set of proxy materials?

If you receive more than one Notice of Internet Availability or set of proxy materials, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or voting instruction card that you receive to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the annual meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| | • | | You may submit another properly completed proxy card with a later date. |

| | • | | You may grant a subsequent proxy by telephone or through the Internet. |

| | • | | You may send a timely written notice that you are revoking your proxy to the Company’s Corporate Secretary at 2091 Stierlin Court, Mountain View, CA 94043. |

| | • | | You may attend the annual meeting and vote in person. Simply attending the annual meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or Internet proxy is the one that will be counted.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 28, 2012, to Corporate Secretary, 2091 Stierlin Court, Mountain View, CA 94043. If you wish to submit a proposal (including a director nomination) at the meeting that is not to be included in next year’s proxy materials, you must do so not later than the close of business on March 8, 2013, nor earlier than the close of business on February 6, 2013.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes and, with respect to other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the vote total for each of Proposal Nos. 2 and 3, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal except Proposal No. 2. For Proposal No. 2, broker non-votes will have the same effect as “Against” votes.

4

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed to approve each proposal?

| | • | | For Proposal No. 1, the election of directors, the eight nominees receiving the most “For” votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes “For” or “Withheld” will affect the outcome. |

| | • | | To be approved, Proposal No. 2, the approval of a series of certificates of amendment to the Company’s Restated Certificate of Incorporation, as amended, to effect a reverse split of the Company’s outstanding common stock, pursuant to which any whole number of outstanding shares between, and including, three and ten would be combined into one share of common stock and to authorize the Company’s Board of Directors to select and file one such certificate of amendment, must receive “For” votes from the holders, either in person or by proxy, of a majority of the outstanding shares of common stock. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have the same effect as “Against” votes. |

| | • | | To be approved, Proposal No. 3, the ratification of Ernst & Young LLP as the independent registered public accounting firm for the Company for its fiscal year ending December 31, 2012, must receive “For” votes from the holders of a majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding a majority of the outstanding shares are present at the meeting in person or represented by proxy. On April 20, 2012, the record date, there were [ ] shares outstanding and entitled to vote. Thus, the holders of at least [ ] shares must be present in person or represented by proxy at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended report on Form 8-K to publish the final results.

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF ALEXZA SINCE THE DATE OF THIS PROXY STATEMENT.

5

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the annual meeting, stockholders will elect members of the Company’s Board of Directors (the “Board”) to hold office until the 2013 Annual Meeting of Stockholders and until their respective successors have been elected and qualified or until any such director’s earlier death, resignation or removal. There are eight nominees for election this year. Each such nominee is currently a director of the Company, and each such nominee was previously elected by the stockholders.

Directors are elected by a plurality (excess of votes cast over opposing nominees) of the votes present in person or represented by proxy and entitled to vote. If properly submitted, shares represented by proxy will be voted for the election of the eight nominees recommended by the Board unless the proxy is marked in such a manner as to withhold authority so to vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holders may determine. Each person nominated for election has agreed to serve if elected, and the Company has no reason to believe that any nominee will be unable to serve.

Director Nominees

The names of the nominees and certain information about them, including their ages as of April 20, 2012, are set forth below:

| | | | | | | | | | | | |

Name of Nominee | | Age | | | Position Held with Company | | Committees | | Director Since | |

Thomas B. King | | | 57 | | | Director, President and Chief Executive Officer | | Finance (Chair) | | | 2003 | |

Hal V. Barron, M.D., F.A.C.C. | | | 49 | | | Director | | Compensation | | | 2007 | |

Andrew L. Busser | | | 43 | | | Director | | Finance | | | 2009 | |

Deepika R. Pakianathan, Ph.D. | | | 47 | | | Director | | Compensation, Finance | | | 2004 | |

J. Leighton Read, M.D. | | | 61 | | | Director | | Audit and Ethics | | | 2004 | |

Gordon Ringold, Ph.D. | | | 61 | | | Director | | Compensation | | | 2001 | |

Isaac Stein | | | 65 | | | Director (Lead) | | Audit and Ethics, Corporate Governance and Nominating (Chair), Finance | | | 2001 | |

Joseph L. Turner | | | 60 | | | Director | | Audit and Ethics (Chair), Corporate Governance and Nominating | | | 2010 | |

Thomas B. Kinghas served as our President, Chief Executive Officer and a member of our Board since June 2003. From September 2002 to April 2003, Mr. King served as President, Chief Executive Officer and a member of the board of directors of Cognetix, Inc., a biopharmaceutical development company. From January 1994 to February 2001, Mr. King held various senior executive positions at Anesta Corporation, a publicly-traded pharmaceutical company, including President and Chief Executive Officer from January 1997 to October 2000, and was a member of the board of directors until it was acquired by Cephalon, Inc., a publicly-traded biopharmaceutical company. The Board believes that Mr. King’s position as the Company’s Chief Executive Officer and his prior experience as chief executive officer at similar companies, including a publicly-traded company, enables him to contribute to the Board his extensive knowledge of the Company and its industry and provide Board continuity. Mr. King received an M.B.A. from the University of Kansas and a B.A. in chemistry from McPherson College.

6

Hal V. Barron, M.D., F.A.C.C.has served as a member of our Board since December 2007. In April 2009, Dr. Barron became Executive Vice President of Genentech, Inc. and Chief Medical Officer of F. Hoffman-La Roche, Ltd., a pharmaceutical company, following La Roche, Ltd.’s acquisition of Genentech, Inc. Previously, starting in December 2003, Dr. Barron served as Senior Vice President of Development at Genentech, Inc. and as Chief Medical Officer since March 2004. Dr. Barron joined Genentech, Inc. in 1996 as a clinical scientist and in 2002 he was promoted to Vice President of Medical Affairs. Dr. Barron’s academic positions include Associate Adjunct Professor of Epidemiology and Biostatistics and Associate Clinical Professor of Medicine/Cardiology at the University of California, San Francisco. The Board believes that Dr. Barron’s experience as chief medical officer, vice president and clinical scientist of a large, publicly-traded pharmaceutical company gives him relevant industry experience, and his tenure with Genentech, Inc. in a variety of positions has provided him with the knowledge of the multiple stages of development of pharmaceutical companies and the challenges the Company will face at each stage. Dr. Barron received his B.S. in physics from Washington University in St. Louis, his M.D. from Yale University and completed his training in medicine and cardiology at the University of California, San Francisco.

Andrew L. Busserhas served as a member of our Board since September 2009. Mr. Busser is currently a Partner, Managing Member and Co-Founder of Symphony Capital LLC, an investment firm, and a Managing Member of Symphony. Prior to founding Symphony Capital LLC in 2002, Mr. Busser co-founded Wilkerson Partners LLC, a management consulting firm, in 2000. From 1997 to 2000, Mr. Busser served as a management consultant with The Wilkerson Group / IBM Healthcare Consulting. From 1993 to 1997, Mr. Busser was in sales and marketing management at The DuPont Merck Pharmaceutical Co., focusing on cardiovascular and neurology markets. The Board believes that Mr. Busser’s strong background in management consulting and the pharmaceutical industry offers a unique perspective to assist the Company. Mr. Busser received an A.B. in history from Colgate University.

Deepika R. Pakianathan, Ph.D.has served as a member of our Board since November 2004. Since 2001, Dr. Pakianathan has served as a managing member at Delphi Ventures, a venture capital firm focusing on healthcare investments. From 1998 to 2001, Dr. Pakianathan was a senior biotechnology banker at JPMorgan. Prior to joining JPMorgan, Dr. Pakianathan was a research analyst at Genesis Merchant Group, a private investment partnership, from 1997 to 1998 and a post-doctoral scientist at Genentech, Inc. from 1993 to 1997. Dr. Pakianathan is a director of various private healthcare companies. The Board believes that Dr. Pakianathan’s experience overseeing multiple healthcare companies as a director and prior work as a biotechnology investment banker provide knowledge related to the Company’s industry sector to aid in overseeing the business development and strategy of the Company. Dr. Pakianathan received a Ph.D. in immunology and an M.S. in biology from Wake Forest University, and an M.Sc. in biophysics and a B.Sc from the University of Bombay.

J. Leighton Read, M.D.has served as a member of our Board since November 2004. From 2001 until 2007, Dr. Read served as a Managing Member in four funds at Alloy Ventures, where he continues as a Venture Partner. Dr. Read founded Aviron, a biopharmaceutical company, and served as its Chairman and Chief Executive Officer until 1999 and as a director until its acquisition by MedImmune, LLC, in 2002. In 1989, Dr. Read co-founded Affymax NV, a biopharmaceutical company. Dr. Read is a member of the board of directors of various private companies. Dr. Read has received several awards for co-inventing the technology underlying the Affymetrix GeneChip. The Board believes that Dr. Read’s background in founding multiple biopharmaceutical companies brings experience to assist the Company in guiding it through the processes of drug development and commercialization. Dr. Read received an M.D. from the University of Texas Health Science Center at San Antonio and completed his training in internal medicine at Duke University and the Peter Bent Brigham Hospital, a B.S. in psychology and biology from Rice University.

Gordon Ringold, Ph.D.has served as a member of our Board since June 2001. Since March 2000, Dr. Ringold has served as Chairman and Chief Executive Officer of Alavita, Inc., a biotechnology company. From March 1995 to February 2000, Dr. Ringold served as Chief Executive Officer and Scientific Director of Affymax Research Institute where he managed the development of novel technologies to accelerate the pace of

7

drug discovery. Dr. Ringold is also a member of the board of directors of Maxygen, Inc., a publicly-traded biopharmaceutical company, and 3V Bio-Pharma, a privately-held biotechnology company, and was a member of the board of directors of Oxonica plc, a publicly-traded nanotechnology company, from 2005 to 2009. The Board believes that Dr. Ringold’s experience as both chief executive officer and director of multiple biotechnology and biopharmaceutical companies, as well as his work with technologies to advance drug discovery are important to the Company in its long-term goals to commercialize multiple products in connection with theStaccatosystem. Dr. Ringold received a Ph.D. in microbiology from University of California, San Francisco, in the laboratory of Dr. Harold Varmus before joining the Stanford University School of Medicine, Department of Pharmacology. Dr. Ringold also received a B.S. in biology from the University of California, Santa Cruz.

Isaac Steinhas served as a member of our Board since June 2001. Since November 1982, Mr. Stein has been President of Waverley Associates, Inc., a private investment firm. He is also the emeritus Chairman of the Board of Trustees of Stanford University and is the Chairman of the board of directors of Maxygen, Inc., a biopharmaceutical company. Mr. Stein is also a director of American Balanced Fund, Inc., International Growth and Income Fund, Inc., and The Income Fund of America, Inc. (part of the American Funds family of mutual funds). The Board believes that Mr. Stein’s tenure as a director of the Company provides continuity and experience that is important in his role as lead director. Mr. Stein also contributes relevant industry experience through his position as the chair of Maxygen’s board of directors and financial experience through his work with investment funds. Mr. Stein received an M.B.A. and J.D. from Stanford University and a B.A. in mathematical economics from Colgate University.

Joseph L. Turnerhas served as a member of our Board since July 2010. Mr. Turner currently serves on the Board of Directors and Audit Committee of QLT Inc., a publicly-traded pharmaceutical company, and serves on the Board of Directors and is the chair of the Audit Committee of Corcept Therapeutics, Inc., and Allos Therapeutics, Inc, both publicly-traded pharmaceutical companies, and Kythera Biopharmaceuticals, Inc., a privately-held pharmaceutical company. In 2008, Mr. Turner served as a director and member of the Audit Committee of SGX. Mr. Turner served as Chief Financial Officer at Myogen, Inc., a publicly-traded biopharmaceutical company, which he joined in 1999 and served until it was acquired by Gilead Sciences in 2006. Previously, Mr. Turner was Chief Financial Officer at Centaur Pharmaceuticals, Inc. and served as Chief Financial Officer and Vice President, Finance and Administration at Cortech, Inc. Since 2009, Mr. Turner has also served on the Board of Managers of Swarthmore College and in June 2010, he was appointed to its Finance Committee, Academic Affairs Committee and Student Affairs Committee. The Board believes that Mr. Turner’s background in finance and his experience in the biopharmaceutical industry make him well suited to aid the Company. Mr. Turner has an M.B.A. from the University of North Carolina at Chapel Hill, an M.A. in molecular biology from the University of Colorado, and a B.A. in chemistry from Swarthmore College.

Required Vote

The eight nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them will be elected as directors.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES LISTED ABOVE.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of the Board of Directors

As required under The Nasdaq Stock Market LLC (“Nasdaq”) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

8

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board has affirmatively determined that the following eight directors are or were (in the case of former directors) independent directors within the meaning of the applicable Nasdaq listing standards: Dr. Barron, Samuel D. Colella, Alan D. Frazier, Dr. Pakianathan, Dr. Read, Dr. Ringold, Mr. Stein, and Mr. Turner. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. Mr. Frazier did not stand for reelection in 2011 and Mr. Colella is not standing for reelection in 2012.

Board Leadership Structure

The Board has a lead independent director, Mr. Stein, who fulfills the duties and possesses the powers of the Board Chair when such position has not been appointed. In such capacity, Mr. Stein has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors and to set meeting agendas. Accordingly, the lead independent director has substantial ability to shape the work of the Board when fulfilling the duties of the Board Chair. The Company believes that separation of the positions of Board Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, the Company believes that having an independent Board Chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders. As a result, the Company believes that having an independent Board Chair enhances the effectiveness of the Board.

Role of the Board in Risk Oversight

One of the Board’s functions is informed oversight of the Company’s risk management processes. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, the Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. The Board’s Audit and Ethics Committee has the responsibility to consider and discuss the Company’s major financial risk exposures and the steps the Company’s management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit and Ethics Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of the Company’s internal audit function. The Board’s Corporate Governance and Nominating Committee monitors the effectiveness of the Company’s corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. The Board’s Compensation Committee assesses and monitors whether any of the Company’s compensation policies and programs has the potential to encourage excessive risk-taking. The Board’s Finance Committee monitors risks associated with, and has the authority to approve, any and all strategies, plans, policies and actions related to adjustment to the Company’s capital structure, financing arrangements, whether in the form of equity, debt or derivative securities. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible. The Board has delegated to the Board’s lead independent director the responsibility of coordinating between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues.

Meetings of the Board of Directors

The Board met 14 times during 2011. All directors, except Mr. Colella and Mr. Frazier, attended more than 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which they served during the portion of the fiscal year for which they were directors or committee members, respectively.

9

As required under applicable Nasdaq listing standards, in fiscal 2011, the Company’s independent directors met four (4) times in regularly scheduled executive sessions at which only independent directors were present. The lead independent director presided over such sessions.

Information Regarding Committees of the Board of Directors

Standing committees of the Board include an Audit and Ethics Committee, a Compensation Committee and a Corporate Governance and Nominating Committee. Below is a description of each of those committees. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit and Ethics Committee

The Audit and Ethics Committee represents the Board in discharging its responsibilities relating to the accounting, reporting, and financial practices of the Company, and has general responsibility for surveillance of internal controls and accounting and audit activities of the Company. Specifically, the Audit and Ethics Committee (i) is directly responsible for the appointment, compensation and oversight of the Company’s independent registered public accounting firm; (ii) reviews, prior to publication, the Company’s annual financial statements with management and the Company’s independent registered public accounting firm; (iii) reviews with the Company’s independent registered public accounting firm the scope, procedures and timing of the annual audits; (iv) reviews the Company’s accounting and financial reporting principles and practices; (v) reviews the adequacy and effectiveness of the Company’s internal accounting controls; (vi) reviews the scope of other auditing services to be performed by the independent registered public accounting firm; (vii) reviews the independence and effectiveness of the Company’s independent registered public accounting firm and their significant relationships with the Company; (viii) reviews the adequacy of the Company’s accounting and financial personnel resources; (ix) reviews the Audit and Ethics Committee charter on an annual basis; (x) reviews with management and the Company’s independent registered public accounting firm quarterly financial results, and the results of any significant matters identified as a result of the independent registered public accounting firm’s review procedures, prior to filing any Form 10-Q; (xi) reviews any other matters relative to the audit of the Company’s accounts and the preparation of its financial statements that the Audit and Ethics Committee deems appropriate; and (xii) reviews management’s efforts to monitor compliance with the Company’s code of conduct.

During 2011, the Company’s Audit and Ethics Committee met seven times. The Audit and Ethics Committee was comprised of Joseph L. Turner (Chair), J. Leighton Read, M.D. and Isaac Stein. The Audit and Ethics Committee is a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that Mr. Turner is an “audit committee financial expert” as defined under the Exchange Act. The Board has determined that all members of the Audit and Ethics Committee are “independent” as defined under the Exchange Act and the listing standards of Nasdaq.

The Board has adopted an Audit and Ethics Committee Charter, which is available on our website at www.alexza.com in the “Investor Relations — Corporate Governance” section.

10

Report of the Audit and Ethics Committee of the Board of Directors1

The Audit and Ethics Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the consolidated financial statements and the reporting process, including the system of internal controls.

The Audit and Ethics Committee has reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2011 with management of the Company. The Audit and Ethics Committee has discussed significant accounting policies applied by the Company in its consolidated financial statements, as well as alternative treatments. Management represented to the Audit and Ethics Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit and Ethics Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit and Ethics Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380),as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T.

In addition, the Audit and Ethics Committee has discussed with the independent registered public accounting firm the accountant’s independence from the Company and its management, including the matters in the written disclosures required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence. The Audit and Ethics Committee has received the letter from the independent registered public accounting firm required therein. The Audit and Ethics Committee has also considered whether the independent registered public accounting firm’s provision of non-audit services to the Company is compatible with the auditors’ independence.

The Audit and Ethics Committee has concluded that the independent registered public accounting firm is independent from the Company and its management.

The Audit and Ethics Committee reviewed and discussed Company policies with respect to risk assessment and risk management.

The Audit and Ethics Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit. The Audit and Ethics Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit and Ethics Committee recommended to the Board, and the Board has approved, inclusion of the audited consolidated financial statements of the Company in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011. The Board has also approved, subject to stockholder ratification, the Audit and Ethics Committee’s selection of the Company’s independent registered public accounting firm.

AUDIT AND ETHICS COMMITTEE

Joseph L. Turner (Chair)

J. Leighton Read, M.D.

Isaac Stein

1 The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of the Company’s filings under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

11

Compensation Committee

The Compensation Committee acts on behalf of the Board to oversee, review, and approve or recommend for adoption the Company’s compensation strategy, policies, plans and programs, including:

| | • | | establishment of corporate goals and objectives relevant to the compensation of the Company’s executive officers, the weighting of corporate and individual performance relating to compensation and evaluation of performance in light of these stated objectives; |

| | • | | review and approval or recommendation to the Board for approval of, the compensation and other terms of employment or service of the Company’s President and Chief Executive Officer and the other executive officers, including all forms of salary paid to executive officers of the Company and the grant of all forms of bonus and stock compensation, including retention incentives, provided to executive officers of the Company; and |

| | • | | administration of the Company’s equity compensation plans and other similar plans and programs. |

The Compensation Committee also reviews with management the Company’s Compensation Discussion and Analysis and considers whether to recommend that it be included in proxy statements and other filings.

The Compensation Committee is appointed by the Board and consists entirely of directors who are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code, “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act and “independent directors” for purposes of the Nasdaq listing standards. Our Compensation Committee is comprised of Samuel D. Colella (Chair) (who is resigning from the Board effective as of the date of the annual meeting), Hal Barron, M.D., F.A.C.C., Deepika R. Pakianathan, Ph.D. and Gordon Ringold, Ph.D. During 2011, the Company’s Compensation Committee met seven times.

The Compensation Committee reviews and recommends to our Board an executive officer compensation program intended to link compensation with our compensation philosophy. The Compensation Committee annually reviews our executive officers’ compensation to determine whether it provides adequate incentives. The Compensation Committee’s most recent review occurred in March 2012 when it approved the 2012 Bonus Plan (described below) and retention grants of restricted stock units to our executive officers and other employees. The Board has adopted a Compensation Committee Charter, which is available on our website at www.alexza.com in the “Investor Relations — Corporate Governance” section.

For more information about our Compensation Committee and our compensation program, see the section of this proxy statement entitled “Compensation Discussion and Analysis.”

Corporate Governance and Nominating Committee

Isaac Stein (Chair) and Samuel D. Colella (who is resigning from the Board effective as of the date of the annual meeting, and will be replaced on such day by Joseph L. Turner) are the current members of the Company’s Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee met one time in 2011. Other members of the Board are invited and often attend such meetings. The Board has determined that all members of the Corporate Governance and Nominating Committee are “independent” as defined under the Exchange Act and the listing standards of Nasdaq.

The Corporate Governance and Nominating Committee makes recommendations to the Board as to the appropriate size of the Board or any Board committee and reviews the qualifications of candidates for the Board (including those proposed by stockholders) and makes recommendations to the Board on potential Board members (whether created by vacancies or as part of the annual election cycle). The Corporate Governance and Nominating Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at the Company’s annual meeting of stockholders.

12

In evaluating the suitability of individuals for Board membership or continued Board membership, the Corporate Governance and Nominating Committee takes into account many factors, including whether the individual meets requirements for independence; the individual’s general understanding of the various disciplines relevant to the success of a publicly-traded pharmaceutical company; the individual’s understanding of the Company’s business; the individual’s professional expertise and educational background; and other factors that promote diversity of views and experience. The Corporate Governance and Nominating Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group of directors that can best achieve success for the Company and represent stockholder interests through the exercise of sound judgment, using its diversity of experience. While the Company does not have a written policy regarding Board diversity, it is one of a number of factors that the Corporate Governance and Nominating Committee takes into account in identifying nominees, and the committee believes it is important that the Board members represent diverse viewpoints, skill sets and backgrounds. In determining whether to recommend a director for re-election, the Corporate Governance and Nominating Committee also considers the director’s past attendance at meetings and participation in and contributions to the activities of the Board. The Corporate Governance and Nominating Committee has not established any specific minimum qualification standards for nominees to the Board, although from time to time the Corporate Governance and Nominating Committee may identify certain skills or attributes (e.g., financial experience or product commercialization experience) as being particularly desirable to help meet specific Board needs that have arisen.

In identifying potential candidates for Board membership, the Corporate Governance and Nominating Committee relies on suggestions and recommendations from the Board, stockholders, management and others. The Corporate Governance and Nominating Committee does not distinguish between nominees recommended by stockholders and other nominees.

From time to time, the Corporate Governance and Nominating Committee may also retain search firms to assist it in identifying potential candidates for director, gathering information about the background and experience of such candidates and acting as an intermediary with such candidates. Stockholders wishing to suggest candidates to the Corporate Governance and Nominating Committee for consideration as directors must timely submit a written notice to the Corporate Secretary of the Company, whose address is 2091 Stierlin Court, Mountain View, CA 94043. The Company’s Amended and Restated Bylaws, as amended (the “Bylaws”), set forth the procedures a stockholder must follow to nominate directors. For a stockholder to nominate a candidate for director at the 2013 Annual Meeting of Stockholders, notice of the nomination must be received by the Company not later than the close of business on March 8, 2013 and not earlier than the close of business on February 6, 2013. The notice must include all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, pursuant to Regulation 14A under the Exchange Act (including the consent of the nominee to be named in the proxy statement as a nominee and to serve as a director if elected). The Corporate Governance and Nominating Committee will consider any nominee properly presented by a stockholder, and will make a recommendation to the Board. After full consideration by the Board, the stockholder presenting the nomination will be notified of the Board’s conclusion. Copies of the Bylaws may be obtained by writing to the Corporate Secretary at the above address.

In addition, the Corporate Governance and Nominating Committee establishes procedures for the oversight and evaluation of the Board and management and considers conflicts of interest involving executive officers or Board members. Stockholders wishing to submit recommendations for our 2012 Annual Meeting should submit their proposals to the Corporate Governance and Nominating Committee, in care of our Corporate Secretary and in accordance with the time limitations, procedures and requirements described in the section entitled “Stockholder Proposals” below.

The Board has adopted a Corporate Governance and Nominating Committee Charter, which is available on our website at www.alexza.com in the “Investor Relations — Corporate Governance” section.

13

Stockholder Communications With the Board

Stockholders and other interested parties may contact any member (or all members) of the Board (including, without limitation, the non-management directors as a group), any Board committee or any Chair of any such committee by U.S. mail. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors by either name or title. Such correspondence should be sent c/o Corporate Secretary, Alexza Pharmaceuticals, Inc., 2091 Stierlin Court, Mountain View, CA 94043.

All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary for the sole purpose of determining whether the contents represent a message to the Company’s directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the communication is addressed.

Director Attendance at Annual Meeting

The Company encourages all directors to attend each annual meeting of stockholders. In furtherance of this policy and to maximize the attendance of directors at annual meetings, the Company generally schedules annual meetings of stockholders on the same day, and in the same location, as a regularly scheduled meeting of the Board. Andrew L. Busser, Deepika R. Pakianathan, Ph.D., Gordon Ringold, Ph.D., Isaac Stein and Joseph L. Turner of our Board attended the 2011 Annual Meeting of Stockholders.

Compensation Committee Interlocks and Insider Participation

For the fiscal year ended December 31, 2011, members of the Company’s Compensation Committee consisted of Samuel D. Colella (Chair), Hal Barron, M.D., F.A.C.C., Deepika R. Pakianathan, Ph.D. and Gordon Ringold, Ph.D., none of whom is currently, or has ever been at any time since the Company’s formation, one of the Company’s officers or employees. In addition, none of our executive officers has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Code of Conduct

The Company has adopted the Alexza Pharmaceuticals, Inc. Code of Business Conduct for Employees, Executive Officers and Directors (the “Code of Conduct”), which applies to all directors and employees, including executive officers, including, without limitation, the Company’s principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The Code of Conduct is filed as an exhibit on the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 and can be found on our website atwww.alexza.com.

14

PROPOSAL NO. 2

APPROVAL OF CERTIFICATES OF AMENDMENT TO THE COMPANY’S

RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

Introduction

The Board has adopted a resolution approving, and recommending to the Company’s stockholders for their approval, a series of proposed certificates of amendment to the Company’s Restated Certificate of Incorporation (as amended, the “Restated Certificate of Incorporation”) to effect a reverse split of the shares of the Company’s common stock at a ratio ranging from 3:1 to 10:1 (the “Reverse Stock Split”). The text of the forms of the proposed certificates of amendment to the Restated Certificate of Incorporation are annexed to this proxy statement as Annexes A-1 to A-8. Assuming the stockholders approve the proposal, the Board will have the sole discretion under Section 242(c) of the General Corporation Law of the State of Delaware (the “DGCL”), as it determines to be in the best interest of the Company and its stockholders, both to select the specific exchange ratio within the designated range of 3:1 to 10:1 and also to decide whether or not to proceed to effect a Reverse Stock Split or instead to abandon the proposed certificates of amendment altogether. If a certificate of amendment is filed with the Secretary of State of the State of Delaware, the certificate of amendment to the Restated Certificate of Incorporation will effect the Reverse Stock Split by reducing the outstanding number of shares of the Company’s common stock by the ratio to be determined by the Board, but will not increase the par value of the Company’s common stock, and will not change the number of authorized shares of the Company’s common stock. If the Board does not implement an approved Reverse Stock Split prior to the one-year anniversary of the annual meeting, the Board will seek stockholder approval before implementing any Reverse Stock Split after that time.

By approving this Proposal No. 2 and the Reverse Stock Split, stockholders will approve each of a series of certificates of amendment to the Restated Certificate of Incorporation pursuant to which any whole number of outstanding shares, between and including three and ten, would be combined into one share of the Company’s common stock, and authorize the Board to file only one such certificate of amendment, as determined by the Board in the manner described herein, and to abandon each certificate of amendment not selected by the Board. If approved, the Board may also elect not to effect any Reverse Stock Split and consequently not to file any certificate of amendment to the Restated Certificate of Incorporation. The Board believes that stockholder approval of the series of certificates of amendment granting the Board this discretion, rather than approval of a specified exchange ratio, provides the Board with maximum flexibility to react to then-current market conditions and, therefore, is in the best interests of the Company and its stockholders.

The Company’s Nasdaq Listing Compliance

The Company’s common stock is listed on the Nasdaq Global Market under the symbol “ALXA.” To maintain a listing on the Nasdaq Global Market, the Company must satisfy the applicable listing maintenance standards established by Nasdaq. Among other things, the Company is required to comply with the continued listing requirements of the Nasdaq Global Market (the “Nasdaq Global Requirements”). To comply with such requirements, the Company must substantially meet each of the following requirements:

1) a minimum bid price of at least $1.00 per share; and

2) at least 400 beneficial holders and holders of record of its common stock.

The Company must also meet one of the following three requirements:

1) (a) stockholders’ equity of at least $10 million, (b) at least 750,000 shares not held directly or indirectly by an officer, director or any person who is the beneficial owner of more than 10% of the total shares outstanding (“Publicly Held Shares”), (c) a market value of Publicly Held Shares of at least $10 million and (d) at least two registered and active dealers that, with respect to the Company’s common stock, hold

15

themselves out (by entering quotations in the service provided by Nasdaq that provides for the automated execution and reporting of transactions in Nasdaq securities) as being willing to buy and sell the Company’s common stock for their own account on a regular and continuous basis (“Market Makers”);

2) (a) a market value of the Company’s common stock of at least $50 million, (b) at least 1,100,000 Publicly Held Shares, (c) a market value of Publicly Held Shares of at least $15 million and (d) at least four registered and active Market Makers; or

3) (a) total assets and total revenue of at least $50 million each for the most recently completed fiscal year or two of the three most recently completed fiscal years, (b) at least 1,100,000 Publicly Held Shares, (c) a market value of Publicly Held Shares of at least $15 million and (d) at least four registered and active Market Makers.

Currently, the Company meets the Nasdaq Global Requirements, except the $1.00 minimum bid price. Assuming the stockholders approve this Proposal No. 2, the Board will determine whether to effect a Reverse Stock Split in the range of 3:1 to 10:1, at the ratio determined by the Board to be most likely sufficient to allow the Company to meet and maintain the $1.00 minimum bid price requirement.

Reasons for the Reverse Stock Split

On January 31, 2012, Nasdaq notified us that the bid price of our common stock had closed below the required $1.00 per share for 30 consecutive trading days, and, accordingly, that we did not comply with the applicable Nasdaq minimum bid price requirement. We have been provided 180 calendar days, or until July 30, 2012, to regain compliance with this requirement. To demonstrate compliance with the bid price requirement, we must maintain a bid price of greater than $1.00 for a minimum of 10 consecutive business days, although in certain circumstances Nasdaq may require a longer compliance period.

The Board has considered the potential harm to the Company of a delisting of the Company’s common stock and has determined that, if the Company’s common stock continues to trade below $1.00 per share, the consummation of the Reverse Stock Split is the best way to maintain liquidity by achieving compliance with the Nasdaq Global Requirements if the Company’s common stock continues to trade below $1.00 per share. Approval of this Proposal No. 2 will permit the Company to file one certificate of amendment to the Restated Certificate of Incorporation and the certificate of amendment filed thereby will contain the number of shares selected by the Board within the limits set forth in this proposal to be combined into one share of common stock.

The Board also believes that the current low per share market price of the Company’s common stock has had a negative effect on the marketability of the Company’s existing shares. The Board believes there are several reasons for this effect. First, certain institutional investors have internal policies preventing the purchase of low-priced stocks. Second, a variety of policies and practices of broker-dealers discourage individual brokers within those firms from dealing in low-priced stocks. Third, because the brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher priced stocks, the current share price of the Company’s common stock can result in individual stockholders paying transaction costs (commissions, markups or markdowns) that are a higher percentage of their total share value than would be the case if the share price of the common stock were substantially higher. This factor is also believed to limit the willingness of some institutions to purchase the common stock. The Board anticipates that a Reverse Stock Split will result in a higher bid price for the Company’s common stock, which may help to alleviate some of these problems. Additionally, there are very few shares of the Company’s common stock authorized under the Restated Certificate of Incorporation that are not already issued and outstanding or reserved for future issuance, which impairs the Company’s ability to raise capital through equity financings. Should the Company need additional sources of capital in the future to fund continuing operations, the Board believes that the Reverse Stock Split could facilitate such future financing.

16

If this Proposal No. 2 is approved by the holders of the Company’s common stock and the Board decides to implement the Reverse Stock Split, the Board will determine the ratio of the Reverse Stock Split, in the range of 3:1 to 10:1, as determined in the judgment of the Board to be most likely sufficient to allow the Company to achieve and maintain compliance with the minimum $1.00 per share requirement for listing on the Nasdaq Global Market for the longest period of time. By way of illustration, assuming a per share price of $0.60 immediately prior to the filing of the appropriate certificate of amendment to the Restated Certificate of Incorporation, the Board may determine that the Company should effect a 3:1 or 10:1 reverse stock split, with the goal of achieving a bid price of $1.80 or $6.00 per share, respectively. Please refer to the section entitled “Effects of the Reverse Stock Split” below for more detailed examples of the effects of the range of ratios.

The Company believes that maintaining listing on the Nasdaq Global Market will provide it with a market for its common stock that is more accessible than if the Company’s common stock were traded on the OTC Bulletin Board or in the “pink sheets” maintained by the OTC Markets Group, Inc. Such alternative markets are generally considered to be less efficient than, and not as broad as, the Nasdaq Global Market or the Nasdaq Capital Market. Among other factors, trading on the Nasdaq Global Market increases liquidity and may potentially minimize the spread between the “bid” and “asked” prices quoted by Market Makers. Further, a Nasdaq Global Market listing may enhance the Company’s access to capital, increase the Company’s flexibility in responding to anticipated capital requirements and facilitate the use of its common stock in any strategic or financing transactions that it may undertake. The Company believes that prospective investors will view an investment in the Company more favorably if its shares qualify for listing on the Nasdaq Global Market as compared with the OTC markets.

The Company expects that a Reverse Stock Split of its common stock will increase the market price of the common stock so that the Company is able to maintain compliance with the Nasdaq minimum bid price listing standard. However, the effect of a Reverse Stock Split on the market price of the common stock cannot be predicted with any certainty, and the history of similar stock split combinations for companies in like circumstances is varied. It is possible that the per share price of the common stock after the Reverse Stock Split will not rise in proportion to the reduction in the number of shares of the common stock outstanding resulting from the Reverse Stock Split, effectively reducing the Company’s market capitalization, and there can be no assurance that the market price per post-reverse split share will either exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time. The market price of the Company’s common stock may vary based on other factors that are unrelated to the number of shares outstanding, including the Company’s future performance.

In order to maintain the Company’s listing on the Nasdaq Global Market, the Company must maintain a minimum market value of listed securities of at least $50 million and a minimum market value of Publicly Held Shares of $15 million. As of April [ ], 2012, the Company’s market value of listed securities was $[ ] million and its market value of Publicly Held Shares was $[ ] million. Even if the Company meets the bid price requirement, if it its unable to comply with the other Nasdaq Global Requirements, Nasdaq may determine to delist the common stock from the Nasdaq Global Market. The Company may apply to transfer its common stock to the Nasdaq Capital Market if it will not meet the bid price requirement prior to the July 30, 2012 deadline and if it meets all other requirements for listing on the Nasdaq Capital Market other than the bid price requirement. If transferred, the Company would have an additional 180-day grace period to regain compliance with the bid price requirement. The Company must notify Nasdaq of its intention to cure the deficiency in this situation, and if Nasdaq determines that it does not appear possible for the Company to cure the bid price deficiency, Nasdaq may not afford the Company the additional 180-day grace period on the Nasdaq Capital Market. If Nasdaq makes a determination to delist the common stock, the delisting procedure will begin with a notification of delisting and may involve a hearing and the possibility of appeal. There is no assurance that at the end of this process the common stock would continue to be listed on the Nasdaq Global Market or, if transferred, the Nasdaq Capital Market.

17

The Board does not intend for this transaction to be the first step in a series of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Board Discretion to Implement the Reverse Stock Split

If the Board determines to effect the Reverse Stock Split, it will consider certain factors in selecting the specific exchange ratio, including prevailing market conditions, the trading price of the common stock and the steps that the Company will need to take in order to achieve compliance with the bid price requirement and other listing regulations of the Nasdaq Global Market. Based in part on the price of the common stock on the days leading up to the filing of the certificate of amendment to the Restated Certificate of Incorporation effecting the Reverse Stock Split, the Board will select the ratio that it believes will, in accordance with the Nasdaq Global Requirements, increase the trading price of the common stock sufficiently to maintain, at least in the short term, a minimum bid price of at least $1.00.

Notwithstanding approval of the Reverse Stock Split by the stockholders, the Board may, in its sole discretion, abandon all of the proposed certificates of amendment and determine prior to the effectiveness of any filing with the Secretary of State of the State of Delaware not to effect the Reverse Stock Split prior to the one year anniversary of this annual meeting of stockholders, as permitted under Section 242(c) of the DGCL. If the Board fails to implement any of the certificates of amendment prior to the one year anniversary of this annual meeting of stockholders, stockholder approval would again be required prior to implementing any Reverse Stock Split.

Consequences if Stockholder Approval for Proposal No. 2 Is Not Obtained

If stockholder approval for this Proposal No. 2 is not obtained, the Company will not be able to file a certificate of amendment to the Restated Certificate of Incorporation to effect the Reverse Stock Split. Unless the bid price for the common stock increases to greater than $1.00 for ten consecutive business days prior to July 30, 2012, then the Company will not meet the listing requirements for the Nasdaq Global Market. If compliance is not achieved by July 30, 2012, the Company will be eligible for another 180 day compliance period (until January 26, 2013) if the Company successfully applies to transfer its common stock to the Nasdaq Capital Market and meets the applicable market value of Publicly Held Shares requirement for continued listing and all other applicable requirements for initial listing on the Nasdaq Capital Market (except the bid price requirement) based on the Company’s most recent public filings and market information and notifies Nasdaq of its intent to cure this deficiency, unless it does not appear to Nasdaq that it is possible for the Company to cure the deficiency. No assurance can be given that the Company will be eligible for the additional 180-day compliance period or, if applicable, that the Company will regain compliance during any additional compliance period. If the Company is unable to qualify for the additional compliance period, or if it is unable to regain compliance during any such period, the common stock will likely be transferred to the OTC Bulletin Board or OTC Market.

If the Company fails to meet all applicable Nasdaq Global Requirements or, if transferred, requirements of the Nasdaq Capital Market, and Nasdaq determines to delist the common stock, the delisting could adversely affect the market liquidity of the common stock and the market price of the common stock could decrease. Delisting could also adversely affect the Company’s ability to obtain financing for the continuation of its operations and/or result in the loss of confidence by investors, suppliers, commercial partners and employees. In addition, the limited number of authorized shares of the Company’s common stock that are neither outstanding nor reserved for issuance could adversely affect the ability of the Company to raise capital through equity financings.

18

Effects of the Reverse Stock Split

The following table sets forth the number of shares of the Company’s common stock that would be outstanding immediately after the Reverse Stock Split at various exchange ratios, based on the [ ] shares of common stock outstanding as of April [ ], 2012. The table does not account for fractional shares that will be paid in cash.

| | | | |

Ratio of Reverse Stock Split | | Approximate Shares of

Common Stock

Outstanding

After Reverse Stock Split | |

None | | | [ | ] |

3:1 | | | [ | ] |

4:1 | | | [ | ] |

5:1 | | | [ | ] |

6:1 | | | [ | ] |

7:1 | | | [ | ] |