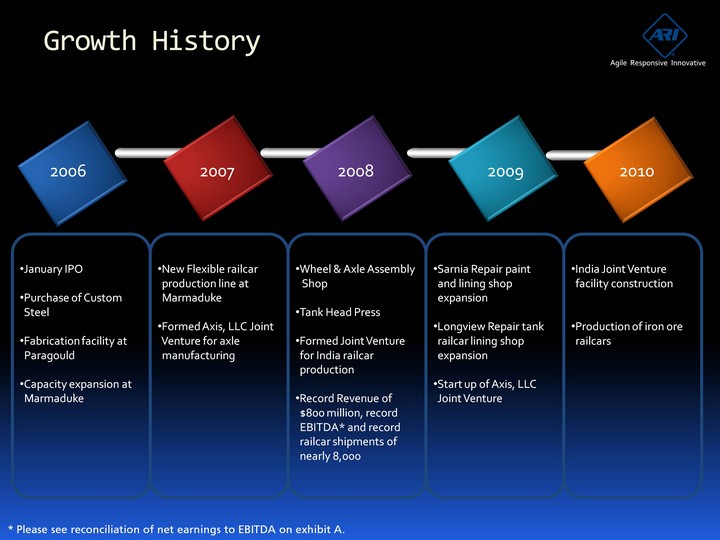

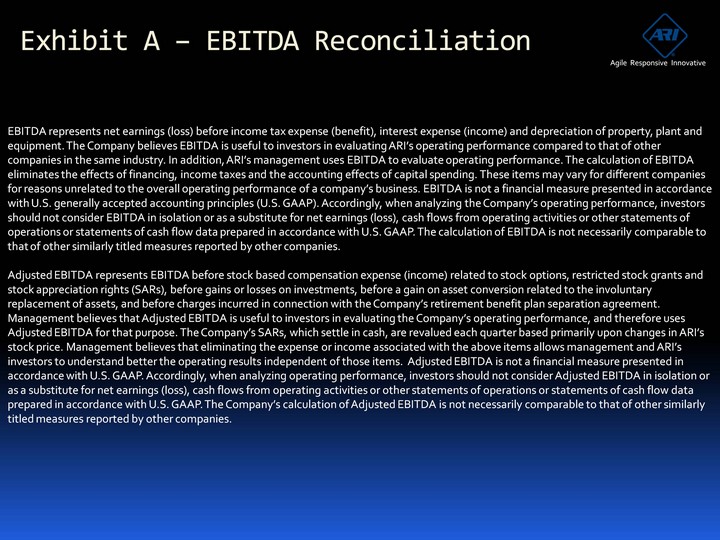

| 2005 2006 2007 2008 2009 2010 2011 Net earnings (loss) $ 14,768 $ 35,204 $ 37,264 $ 31,382 $ 15,458 $ (27,006) $ 4,336 Income tax expense (benefit) 9,356 20,752 22,104 18,403 6,568 (14,795) 3,866 Interest expense 4,846 1,372 17,027 20,299 20,909 21,275 20,291 Interest income (1,658) (1,504) (13,829) (7,835) (6,613) (3,519) (3,654) Depreciation 6,807 10,674 14,085 20,148 23,405 23,597 22,167 EBITDA $ 34,119 $ 66,498 $ 76,651 $ 82,397 $ 59,727 $ (448) $ 47,006 Expense related to stock option compensation $ - $ 8,116 $ 1,628 $ 109 $ - $ - $ - Expense (income) related to stock appreciation rights compensation - - 299 (47) 1,174 5,358 3,537 Gain on asset conversion, net - (4,323) - - - - - Retirement benefit plan expense 10,911 - - - - - - Other income on short-term investment activity - - - (3,657) (20,858) (379) - Adjusted EBITDA $ 45,030 $ 70,291 $ 78,578 $ 78,802 $ 40,043 $ 4,531 $ 50,453 Exhibit A - EBITDA Reconciliation Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Net (loss) earnings $ (7,023) $ (5,882) $ (6,252) $ (7,849) $ (5,329) $ 569 $ 4,026 $ 5,070 Income tax (benefit) expense (4,396) (3,683) (3,890) (2,826) (3,266) 425 2,357 4,350 Interest expense 5,321 5,319 5,316 5,319 5,335 5,330 4,478 5,148 Interest income (730) (769) (1,058) (962) (916) (944) (1,005) (789) Depreciation 5,915 5,986 5,876 5,820 5,766 5,688 5,418 5,295 EBITDA $ (913) $ 971 $ (8) $ (498) $ 1590 $ 11,068 $ 15,274 $ 19,074 Expense (Income) related to stock appreciation rights compensation 700 121 1,532 3,005 2,148 (189) (3,087) 4,665 Other income on short-term investment activity (81) (298) - - - - - - Adjusted EBITDA $ (294) $ 794 $ 1,524 $ 2,507 $ 3,738 $ 10,879 $ 12,187 $ 23,739 Annual Reconciliation Quarterly Reconciliation In Thousands, unaudited Agile Responsive Innovative |