Exhibit 99.1

Tim Hortons

Q2 2013

Investor Update

SAFE HARBOR STATEMENT

Certain information in this presentation, particularly information regarding future economic performance, finances, and plans, expectations and objectives of management, and other information, constitutes forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We refer to all of these as forward-looking statements. Various factors including competition in the quick service segment of the food service industry, general economic conditions and others described as “risk factors” in the Company’s 2012 Annual Report on Form 10-K filed February 21st, 2013, and our Quarterly Report on Form 10-Q filed on August 8th, 2013 with the U.S. Securities and Exchange Commission and Canadian Securities Administrators, could affect the Company’s actual results and cause such results to differ materially from those expressed in forward-looking statements. As such, readers are cautioned not to place undue reliance on forward-looking statements contained in this presentation, which speak only as to management’s expectations as of the date hereof.

Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about: the absence of an adverse event or condition that damages our strong brand position and reputation; the absence of a material increase in competition or in volume or type of competitive activity within the quick service restaurant segment of the food service industry; ability to obtain financing on favourable terms; ability to maintain investment grade credit ratings; prospects and execution risks concerning the U.S. market strategy; general worldwide economic conditions; cost and availability of commodities; the ability to retain our senior management team or the inability to attract and retain new qualified personnel; continuing positive working relationships with the majority of the Company’s restaurant owners; the absence of any material adverse effects arising as a result of litigation; and there being no significant change in the Company’s ability to comply with current or future regulatory requirements.

We are presenting this information for the purpose of informing you of management’s current expectations regarding these matters, and this information may not be appropriate for any other purpose. We assume no obligation to update or alter any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. Please review the Company’s Safe Harbor Statement at www.timhortons.com/en/about/safeharbor.html.

2

Strong Business with Focused Strategy to Drive Shareholder Returns

Canadian market leadership position and unique business model supports strong, reliable cash flows

Significant opportunities in 3 distinct markets: Canada, U.S. and International

Strong track record of returning capital to shareholders with clear plans to continue

Taking actions to drive shareholder value and position Tim Hortons for sustainable long-term earnings growth

3

Q2 2013: Key Themes

New reality facing food services industry: low-growth, competitive environment

Building on our strengths and leadership position to drive top-line sales

A great business; focused on key opportunities and challenges

4

Recent Announcements Designed to Drive Shareholder Value

Board approved $900 million increase in debt

Plan to direct proceeds to repurchase $1 billion of shares within the next year

Accelerating initiative to partner with well-capitalized franchisees in the U.S. market

Two new directors add financial and strategic expertise to Board

Sherri Brillon, EVP & CFO, Encana Corp

Thomas Milroy, CEO, BMO Capital Markets

5

Tailored Growth Initiatives in Three Distinct Markets

Opportunities

Capitalize on leadership position

Re-imaging

Target underpenetrated geographies

Drive AUVs

Continue to approach critical mass in several markets

Aim to improve returns on capital

Strong partner and clear path to growth in GCC

Develop brand in new markets

Challenges

Address capacity

Economic headwinds resulting in an intensified competitive environment

Limited brand awareness

Leverage limited marketing resources

Competitive QSR market

Manage inherent risks

Identify suitable partners/markets

Initiatives

Continue to assert coffee leadership

Invest to refresh chain and improve throughput

Menu and technology innovation

Partner with well-capitalized franchisees

Increase density in existing markets

Improve unit economics

Master license model

Evaluate and enter new markets over time

Longer-term strategy to drive future growth under development

6

Canada: Building on Market Leadership

Leading share (42% of total QSR traffic)*

2 billion cups of coffee served annually*

Three quarters of brewed coffee sold in Canadian restaurants are poured at Tim Hortons*

#1 in morning meal, morning snack, afternoon snack and evening snack dayparts and strong #2 in lunch*

Investing in brand value and enhanced profitability:

Renovations to >300 restaurants

Drive-thru enhancements to >1,000 restaurants

Develop 160-180 new restaurants

Improving the guest experience Ongoing menu innovation

Opportunity to expand in Western Canada, Quebec and Ontario, including major urban markets

Canada growth objective: Leverage market leadership, target underpenetrated markets

* Source: Company information and NPD Crest (year ended May 2013). Market share data refers to share of traffic among quick service restaurants in Canada.

7

United States: Committed to Driving Market Success

Potential to significantly contribute to long-term earnings growth

Current footprint: 11 states with combined population of 70 million

Sales progression in certain markets mirroring that of many of our early-stage Canadian markets

But overall sales volumes in newer U.S. markets do not yet match our larger, more developed U.S. markets

We recognize the need to improve U.S. returns

Accelerating initiative to partner with well-capitalized franchisees

Expect to reduce capital deployed beginning in 2014

Continue focusing resources on increasing density of restaurants in our most developed markets

U.S. growth objective: Selectively grow footprint with less capital

8

Good Sales Progression as We Build Density in Core U.S. Markets

% Total Growth Rate: 2008 to 2012*

25%

42%

28%

31%

42%

62%

27%

44%

Buffalo

Columbus

Detroit

Rochester

Restaurant Count Systemwide Sales

*Based on standard restaurants

9

International: Seeding Future Growth

International expansion opportunities offer exciting longer-term possibilities

Roadmap to 220 restaurants in the Gulf Cooperation Council within 5 years

29 restaurants now opened under initial agreement for 120 restaurants Recently signed area development agreement for a further 100 restaurants in Saudi Arabia

Evaluating opportunities for expansion in additional international markets

International growth objective: Seed international presence to drive long-term growth

10

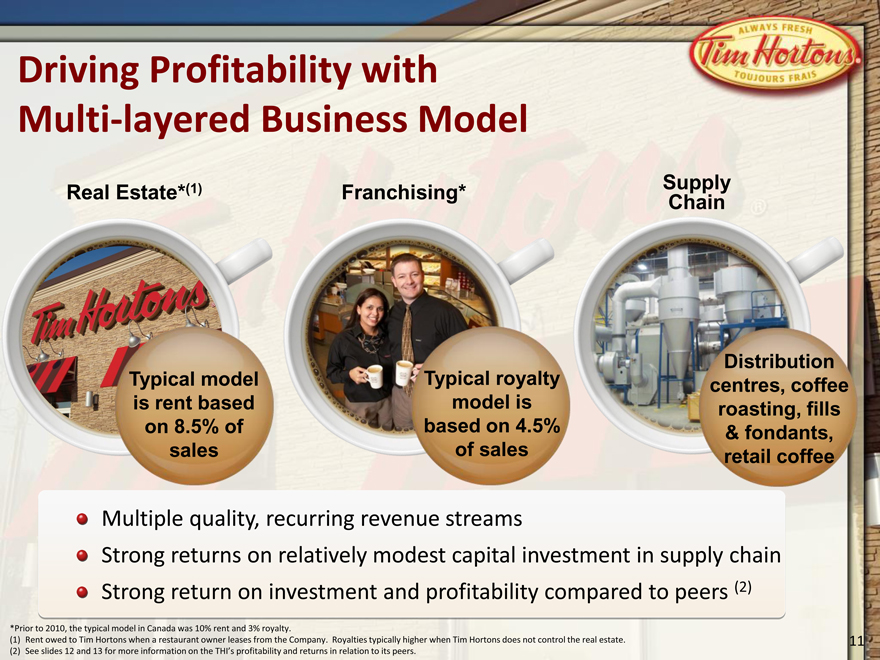

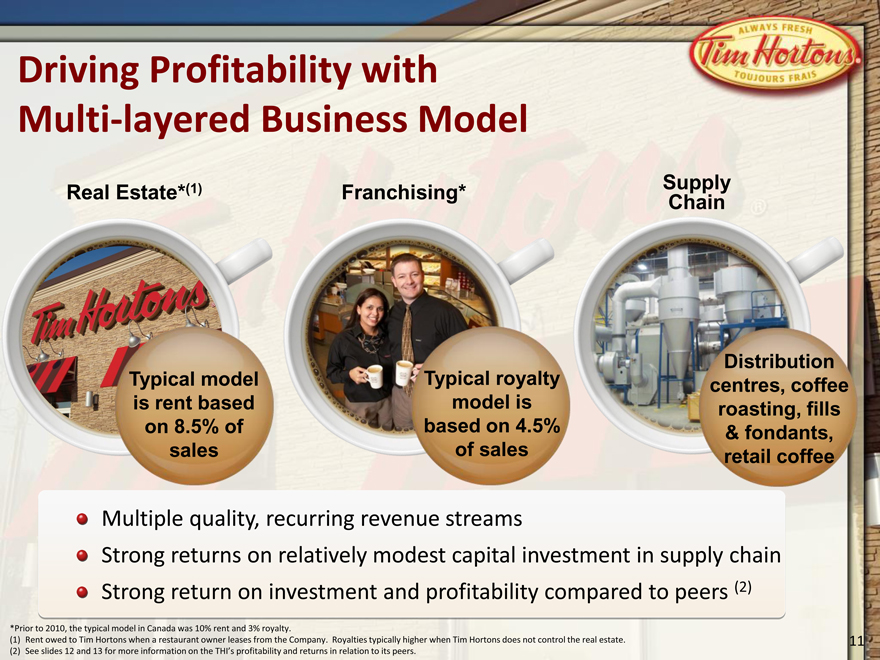

Driving Profitability with

Multi-layered Business Model

*Prior to 2010, the typical model in Canada was 10% rent and 3% royalty.

Rent owed to Tim Hortons when a restaurant owner leases from the Company. Royalties typically higher when Tim Hortons does not control the real estate.

See slides 12 and 13 for more information on the THI’s profitability and returns in relation to its peers.

Supply

Chain

Real Estate*(1)

Franchising*

Typical royalty

model is

based on 4.5%

of sales

Distribution

centres, coffee

roasting, fills

& fondants,

CPG

Multiple quality, recurring revenue streams

Strong returns on relatively modest capital investment in supply chain

Strong return on investment and profitability compared to peers (2)

Typical model

is rent based

on 8.5% of

sales

11

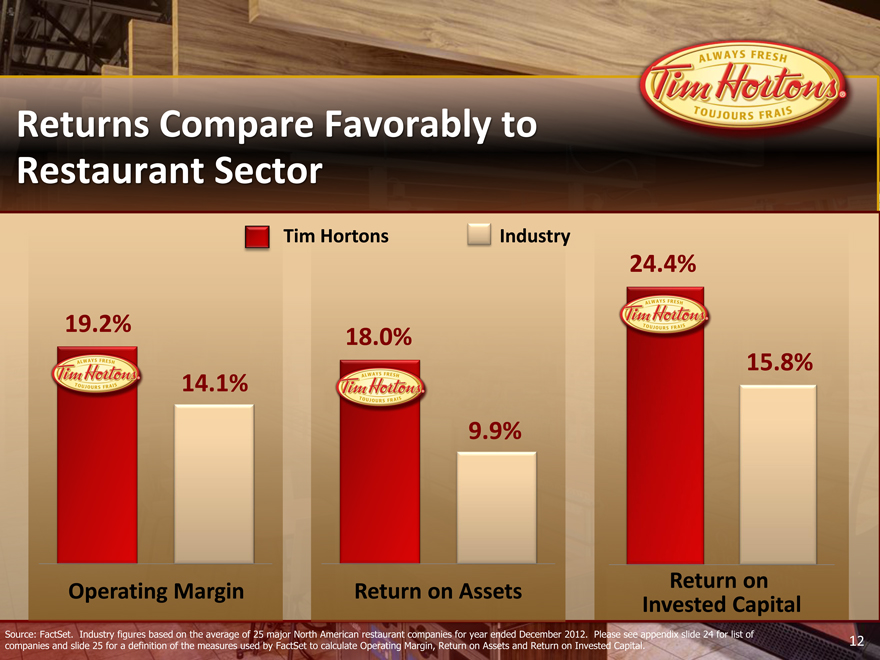

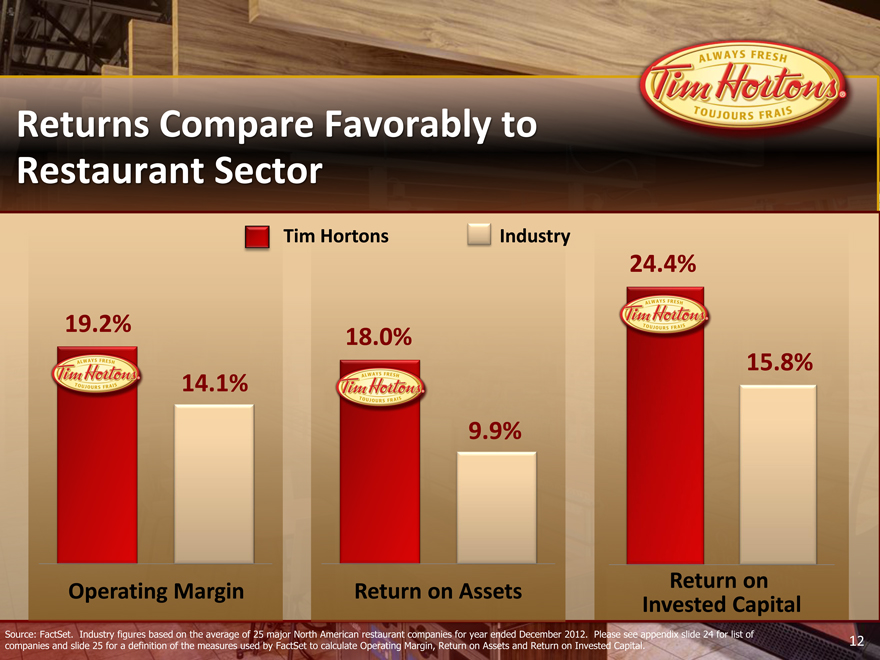

Returns Compare Favorably to

Restaurant Sector

Tim Hortons

(CHART)

(CHART)

Industry

(CHART)

Operating Margin

Return on Assets

Return on

Invested Capital

24.4%

15.8%

18.0%

9.9%

19.2%

14.1%

Source: FactSet. Industry figures based on the average of 25 major North American restaurant companies for year ended December 2012. Please see appendix slide 24 for list of

companies and slide 25 for a definition of the measures used by FactSet to calculate Operating Margin, Return on Assets and Return on Invested Capital.

12

Proven Business Model Drives

Strong Position Among QSR Peers

Profit Per Restaurant*

Casual

Fast Casual

Quick Service Restaurants

(In 000’s USD, unless otherwise noted)

C

*Profit per restaurant is calculated as operating income (adjusted for one-time items) divided by the total number of restaurants (defined as the average of the restaurant count at the start

and end of the fiscal year, as disclosed). All information sourced from each company’s audited financial statements for the most recently reported fiscal year.

13

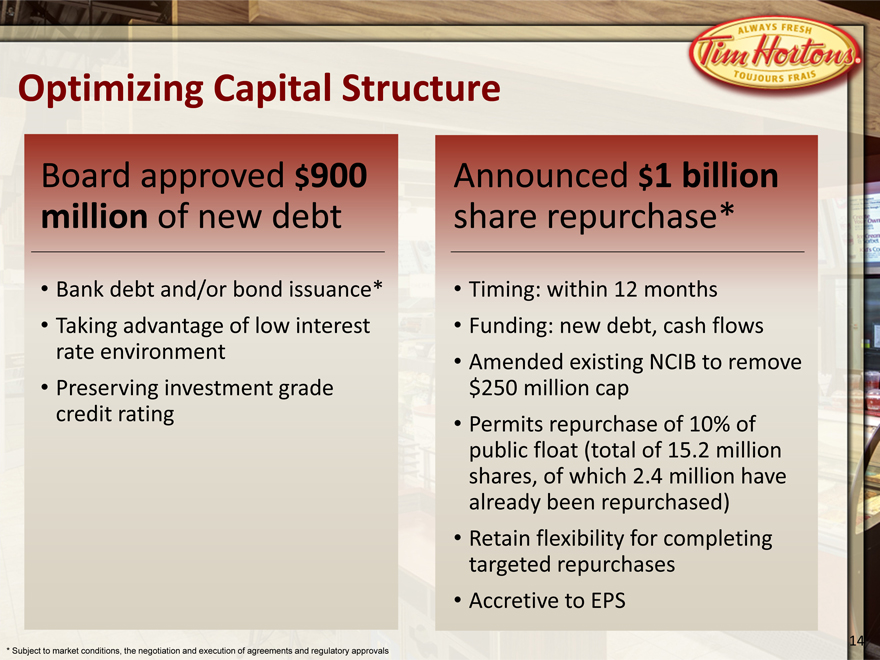

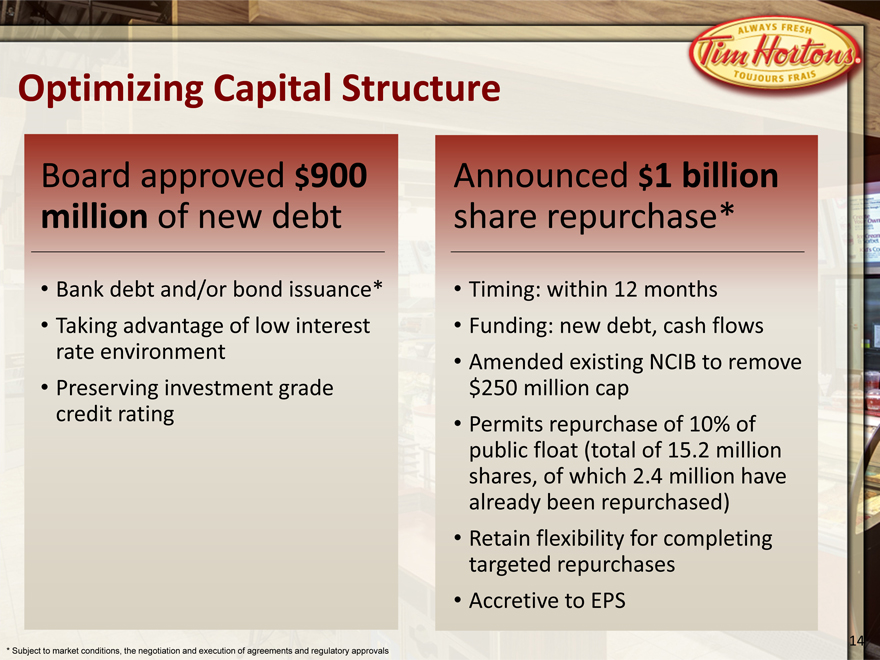

Optimizing Capital Structure

Board approved $900

million of new debt

Bank debt and/or bond issuance*

Taking advantage of low interest

rate environment

Preserving investment grade

credit rating

Announced $1 billion

share repurchase*

Timing: within 12 months

Funding: new debt, cash flows

Amended existing NCIB to remove

$250 million cap

Permits repurchase of 10% of

public float (total of 15.2 million

shares, of which 2.4 million have

already been repurchased)

Retain flexibility for completing

targeted repurchases

Accretive to EPS

* | | Subject to market conditions, the negotiation and execution of agreements and regulatory approvals |

14

Optimizing Capital Structure

Remaining consistent with our focus on building shareholder value

and our strong track record of returning capital to shareholders

Maintaining a structure that is aligned with the capital intensity of

our business

Business model requires investment in our system

Capital structure in line with restaurant company peers with similar

capital intensity, and with Canadian consumer companies

Preserving financial and strategic flexibility

Addressing the constraints arising within our corporate structure

15

Strong Track Record of

Returning Capital to Shareholders

Share repurchases

Dividends

~$1.7 billion

(does not include planned

$1 billion share repurchase)

~$0.6 billion

Cumulative Totals

Strong cash flows have historically supported return of ~$2.3 billion of capital

Reduced shares outstanding by 21.9% since IPO in 2006

Six consecutive dividend increases averaging 20.6% annually

Recently increased dividend payout ratio to 35%-40% range

$ millions

16

Summary: Taking Actions to Drive Value

and Position Tim Hortons for Sustainable Growth

New leadership in place; strategic

planning process underway

Announced plan to optimize

capital structure

Taking advantage of financial

strength and flexibility to return

capital to shareholders

Committed to driving improved

returns in U.S. business

Significant opportunities across all

business units

17

Appendix

18

Q2 2013 Overview

Progress in same-store sales

in Canada and the U.S.

Continuation of intensified

competitive environment

Positive contributions from

recently-introduced products

Growth in Adjusted Operating

Income* and EPS

Strong cash flow and balance

sheet

*Adjusted operating income is a non-GAAP measure, and excludes a $0.6 million charge for corporate reorganization expenses in Q2 2013. Please refer to slides 22 and 23 for the reconciliation and details of reconciling

item.

19

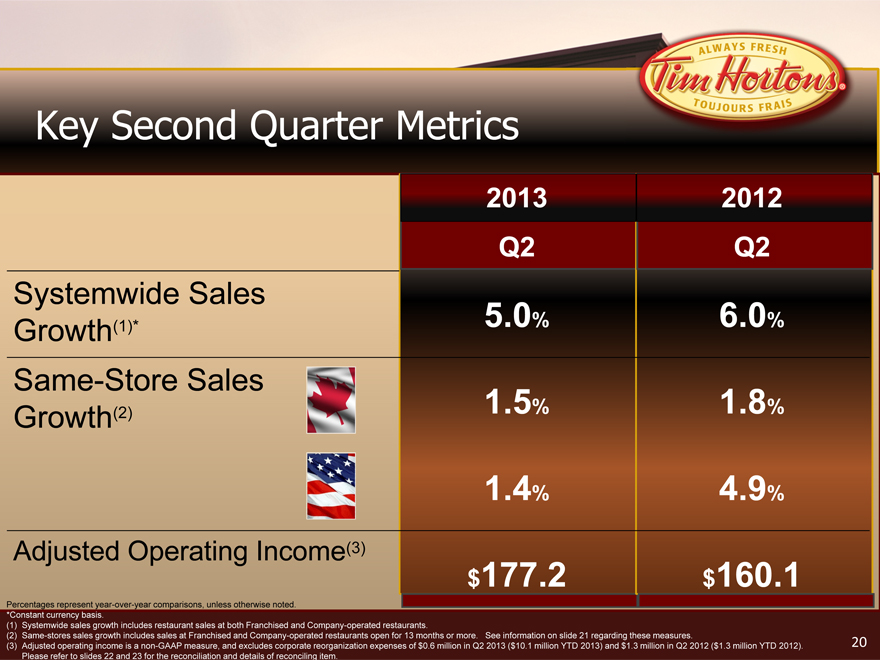

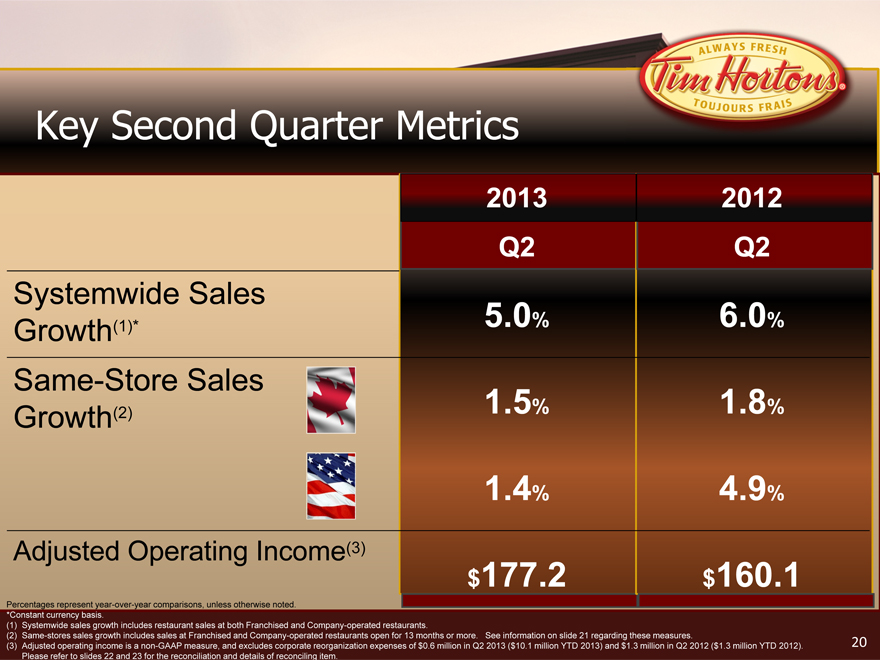

Key Second Quarter Metrics

2013 2012

Q2 Q2

Systemwide Sales Growth(1)* 5.0% 6.0%

Same-Store Sales Growth(2) 1.5% 1.8%

1.4% 4.9%

Adjusted Operating Income(3) $177.2 $160.1

Percentages represent year-over-year comparisons, unless otherwise noted.

*Constant currency basis.

Systemwide sales growth includes restaurant sales at both Franchised and Company-operated restaurants.

Same-stores sales growth includes sales at Franchised and Company-operated restaurants open for 13 months or more. See information on slide 21 regarding these measures.

Adjusted operating income is a non-GAAP measure, and excludes corporate reorganization expenses of $0.6 million in Q2 2013 ($10.1 million YTD 2013) and $1.3 million in Q2 2012 ($1.3 million YTD 2012).

Please refer to slides 22 and 23 for the reconciliation and details of reconciling item.

20

Total systemwide sales growth includes restaurant level sales at both Company and

Franchised restaurants. Approximately 99.5% of our systemwide restaurants were franchised

as at June 30th, 2013. Systemwide sales growth is determined using a constant exchange rate

where noted, to exclude the effects of foreign currency translation. U.S. dollar sales are

converted to Canadian dollar amounts using the average exchange rate of the base year for

the period covered. For the second quarter of 2013, systemwide sales on a constant

currency basis increased 5.0% compared to the second quarter of 2012. Systemwide sales

are important to understanding our business performance as they impact our franchise

royalties and rental income, as well as our distribution income. Changes in systemwide sales

are driven by changes in average same-store sales and changes in the number of systemwide

restaurants, and are ultimately driven by consumer demand.

We believe systemwide sales and same-store sales growth provide meaningful information

to investors regarding the size of our system, the overall health and financial performance of

the system, and the strength of our brand and restaurant owner base, which ultimately

impacts our consolidated and segmented financial performance. Franchised restaurant sales

are not generally included in our Condensed Consolidated Financial Statements (except for

certain non-owned restaurants consolidated in accordance with applicable accounting rules).

Systemwide Sales Growth

& Same-Store Sales

21

Adjusted operating income is a non-GAAP measure. See reconciliations for adjusting items to

calculate adjusted operating income. Management uses adjusted operating income to assist

in the evaluation of year-over-year performance, and believes that it will be helpful to

investors as a measure of underlying operational growth rates. This non-GAAP measure is

not intended to replace the presentation of our financial results in accordance with GAAP.

The Company’s use of the term adjusted operating income may differ from similar measures

reported by other companies. The reconciliation of operating income, a GAAP measure, to

adjusted operating income, a non-GAAP measure, is set forth in the following slide.

Information on Non-GAAP Measure:

Adjusted Operating Income

22

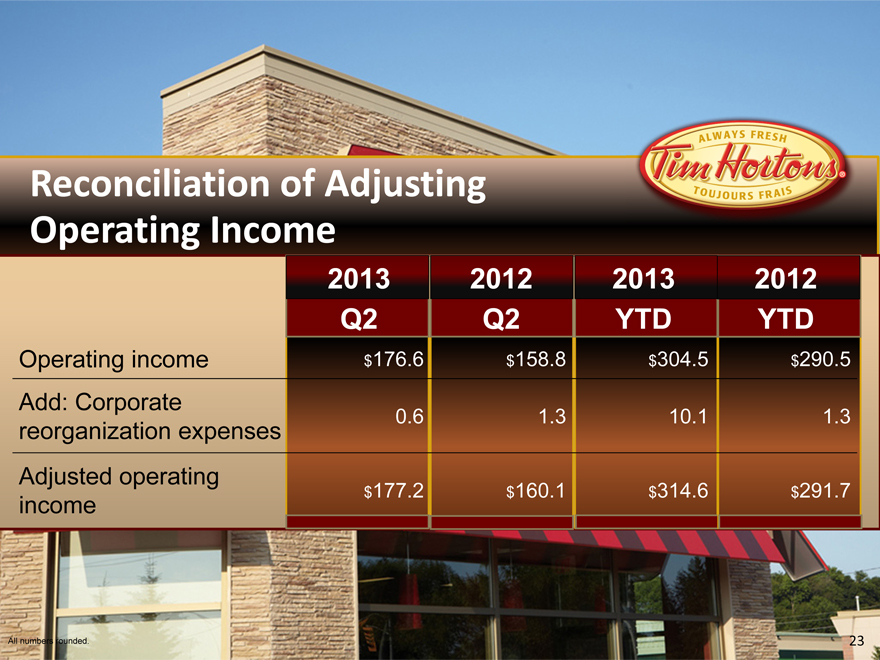

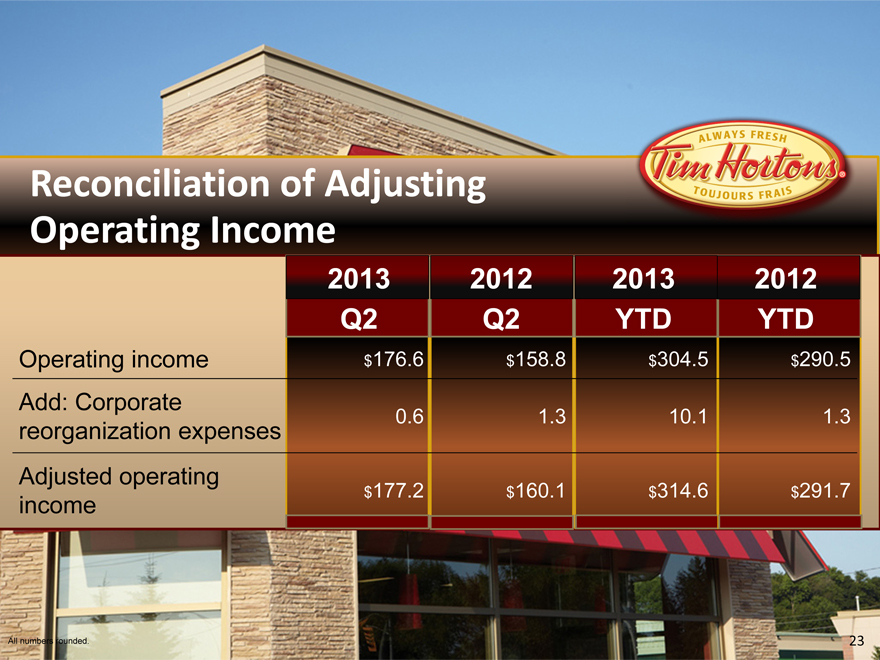

Reconciliation of Adjusting

Operating Income

All numbers rounded.

2013 2012 2013 2012

Q2 Q2 YTD YTD

Operating income $176.6 $158.8 $304.5 $290.5

Add: Corporate reorganization expenses 0.6 1.3 10.1 1.3

Adjusted operating income $177.2 $160.1 $314.6 $291.7

23

Restaurant Peer Group

McDonald’s Corp.

Starbucks Corp.

Yum! Brands Inc.

Chipotle Mexican Grill Inc.

Darden Restaurants Inc.

Burger King Worldwide Inc.

Panera Bread Co.

Dunkin’ Brands Group Inc.

Domino’s Pizza Inc.

Brinker International Inc.

The Wendy’s Co.

Cheesecake Factory Inc.

Cracker Barrel Old Country Store Inc.

Buffalo Wild Wings Inc.

Texas Roadhouse Inc

Jack in the Box Inc.

Papa John’s International Inc.

DineEquity Inc.

Bob Evans Farms Inc.

Krispy Kreme Doughnuts Inc.

AFC Enterprises Inc.

Red Robin Gourmet Burgers Inc.

Sonic Corp.

CEC Entertainment Inc.

Denny’s Corp.

Companies comprising peer group in analysis of operating margin, return

on assets, and return on invested capital

24

FactSet Metric Definitions

Operating Margin

Returns operating margin for the period and date(s) requested. This is calculated as Operating

Income divided by Net Sales or Revenue, multiplied by 100.

Return on Assets

Returns return on average assets for the period and date(s) requested in local currency by

default. This is calculated as Net Income divided by the two fiscal period average of Total

Assets.

Return on Invested Capital

Returns the return on average invested capital for the period and date(s) requested. This is

calculated as Net Income divided by the two fiscal period average of Total Invested Capital,

multiplied by 100.

Source: FactSet

25

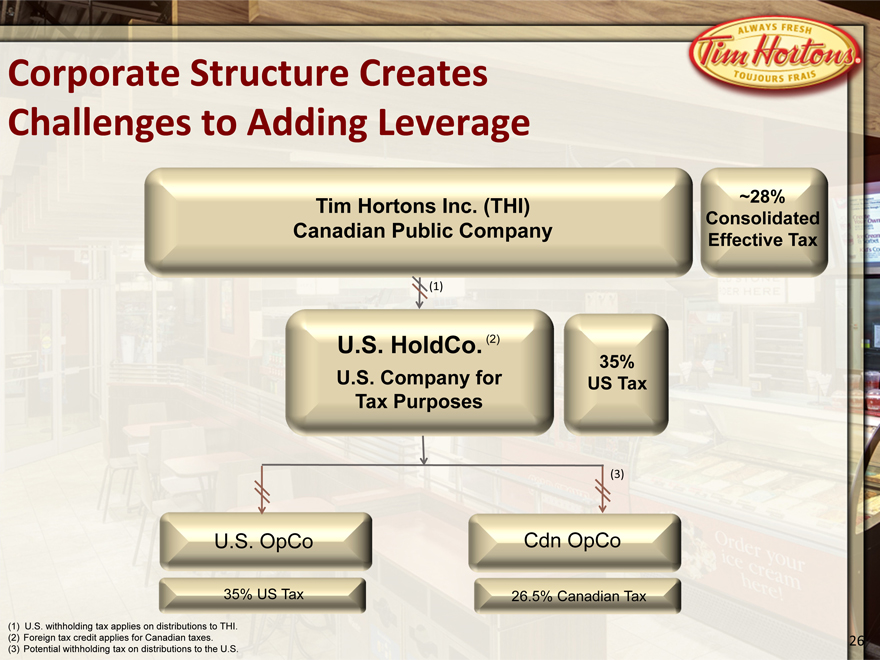

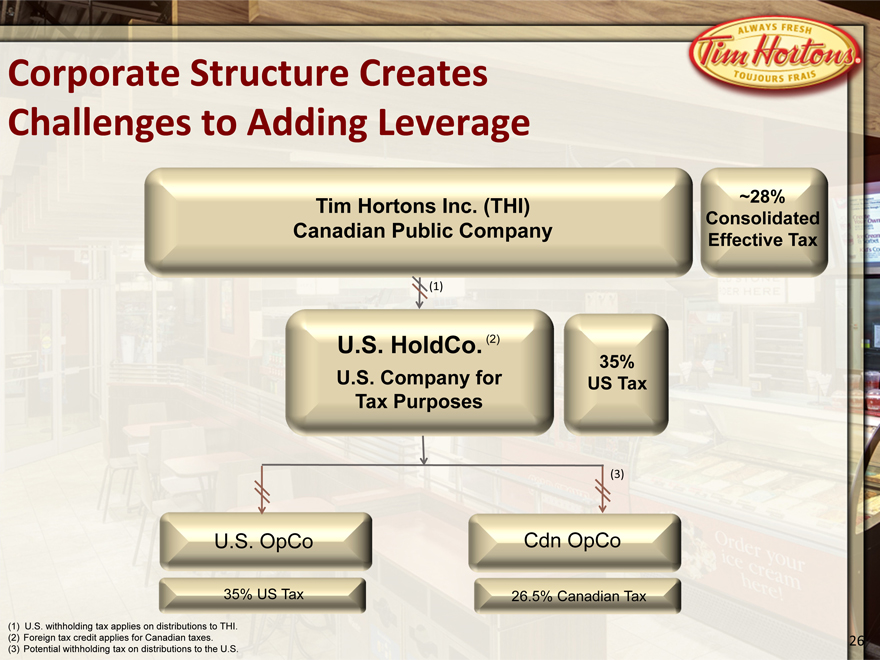

Corporate Structure Creates

Challenges to Adding Leverage

Tim Hortons Inc. (THI)

Canadian Public Company

U.S. OpCo

U.S. HoldCo. (2)

U.S. Company for

Tax Purposes

Cdn OpCo

35%

US Tax

~28%

Consolidated

Effective Tax

26.5% Canadian Tax

35% US Tax

(1) | | U.S. withholding tax applies on distributions to THI. |

Foreign tax credit applies for Canadian taxes.

Potential withholding tax on distributions to the U.S.

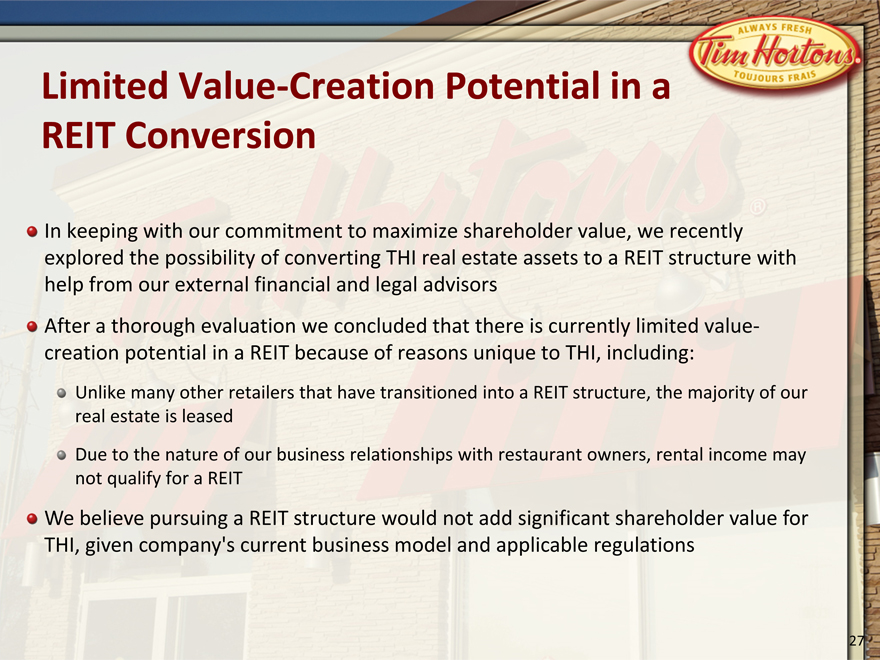

Limited Value-Creation Potential in a

REIT Conversion

26

In keeping with our commitment to maximize shareholder value, we recently

explored the possibility of converting THI real estate assets to a REIT structure with

help from our external financial and legal advisors

After a thorough evaluation we concluded that there is currently limited value-

creation potential in a REIT because of reasons unique to THI, including:

Unlike many other retailers that have transitioned into a REIT structure, the majority of our

real estate is leased

Due to the nature of our business relationships with restaurant owners, rental income may

not qualify for a REIT

We believe pursuing a REIT structure would not add significant shareholder value for

THI, given company’s current business model and applicable regulations

27