UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 29, 2013

| ¨ | TRANSITIONAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-32843

TIM HORTONS INC.

(Exact name of Registrant as specified in its charter)

| | |

| Canada | | 98-0641955 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| |

| 874 Sinclair Road, Oakville, ON, Canada | | L6K 2Y1 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code 905-845-6511

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Shares, without par value | | New York Stock Exchange |

| Associated Share Purchase Rights | | Toronto Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨.

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES x NO ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

| (Do not check if a smaller reporting company) | | | | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x.

The aggregate market value of the common shares held by non-affiliates of the Registrant computed by reference to the price at which such shares were last sold, as of June 28, 2013, was Cdn.$8,587,689,502 (US$8,172,497,059).

Number of common shares outstanding as of February 21, 2014: 138,165,308

DOCUMENTS INCORPORATED BY REFERENCE:

Exhibit index on pages 64-69.

EXPLANATORY NOTE

Tim Hortons Inc., a corporation incorporated under theCanada Business Corporations Act (the “Company”), qualifies as a foreign private issuer in the U.S. for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Although as a foreign private issuer the Company is no longer required to do so, the Company currently continues to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K with the Securities and Exchange Commission (“SEC”) instead of filing the reports available to foreign private issuers. The Company prepares and files a management proxy circular and related material under Canadian requirements. As the Company’s management proxy circular is not filed pursuant to Regulation 14A, the Company may not incorporate by reference information required by Part III of its Form 10-K from its management proxy circular.

The Company filed its Annual Report on Form 10-K for the fiscal year ended December 29, 2013 (“2013 Form 10-K”) on February 25, 2014. In reliance upon and as permitted by Instruction G(3) to Form 10-K, the Company is filing this Amendment No. 1 on Form 10-K/A in order to include in the 2013 Form 10-K the Part III information not previously included in the 2013 Form 10-K.

No attempt has been made in this Amendment No. 1 on Form 10-K/A to modify or update the other disclosures presented in the 2013 Form 10-K. This Amendment No. 1 on Form 10-K/A does not reflect events occurring after the filing of the 2013 Form 10-K. Accordingly, this Amendment No. 1 on Form 10-K/A should be read in conjunction with the 2013 Form 10-K and the Company’s other filings with the SEC.

In this Amendment No. 1 on Form 10-K/A, we also refer to Tim Hortons Inc. as “Tim Hortons,” “we,” “us,” “our,” “our corporation,” or “the corporation.” References to “GAAP” mean generally accepted accounting principles in the United States.

All references to our websites contained herein do not constitute incorporation by reference of information contained on such websites and such information should not be considered part of this document.

2

TIM HORTONS INC.

2013 FORM 10-K/A ANNUAL REPORT

TABLE OF CONTENTS

3

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance |

Directors of Registrant

| | |

Long Grove, Illinois, United States Age: 57 | | M. Shan Atkins Independent | Director since March 2007 Ms. Atkins has been a Managing Director of Chetrum Capital LLC, a private investment firm, since 2001. From 1996 to 2001, Ms. Atkins held various positions with Sears Roebuck & Co., a major retailer, being promoted to Executive Vice President in 1999. Prior to joining Sears, Ms. Atkins spent 14 years with Bain & Company, Inc., an international management consulting firm, as a leader in Bain’s consumer and retail practice. Ms. Atkins began her career as a public accountant at what is now PricewaterhouseCoopers LLP, a major accounting firm, and has designations as a C.A. (Ontario) and C.P.A. (Illinois). Ms. Atkins has served as a member of Queen’s School of Business International Advisory Board since the Spring of 2009. Ms. Atkins holds a Bachelor of Commerce degree from Queen’s University in Kingston, Ontario, as well as a Master of Business Administration from Harvard University. Key skills and experience General retail experience | Senior leadership experience | Public company board experience | Human resource and compensation expertise | Financial expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 99.17%FOR |

Human Resource and Compensation Committee | | 5 of 5 | | 100% | | |

Nominating and Corporate Governance Committee | | 4 of 4 | | 100% | | |

| |

| Securities held | | |

| DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

| 11,466 | | | 1,000 | | | $763,543 ($611,111 in prior year) | | Yes, 7X annual retainer (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

The Pep Boys-Manny, Moe & Jack (NYSE) SpartanNash Company (NASDAQ) | | Shoppers Drug Mart Corporation (2005-2012) (TSX) |

| | |

Calgary, Alberta Canada Age: 54 | | Sherri A. Brillon Independent | Audit Committee Financial Expert | Director since August 2013 Ms. Brillon is Executive Vice-President and Chief Financial Officer of Encana Corporation, a leading North American energy producer. In this role, Ms. Brillon directs the financial operations of the company and manages the availability of financial resources to enable the company to execute its strategy. Since joining one of Encana’s predecessor companies in 1985, her achievements have included key leadership roles in helping the company achieve some of its most significant milestones, including structuring the $22.5 billion merger that created Encana in 2002 and restructuring the organization into a core natural gas company in 2009. She has played a pivotal role in evaluating Encana’s investment opportunities and resource allocation and has been instrumental in assisting with corporate and operations planning, strategic planning and supply management. Ms. Brillon’s professional accomplishments include recognition as one of Canada’s Most Powerful Women: Top 100 Hall of Fame. She has also been recognized by the Women of Influence organization. Key skills and experience Senior leadership experience | Financial expertise | Risk assessment and mitigation expertise | New business development/M&A expertise | Governance/legal expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 1 of 1 | | 100% | | n/a(1) |

Audit Committee(1) | | n/a | | n/a | | |

| |

| Securities held | | |

| DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

| 919 | | | — | | | $56,289 | | Under the guidelines, Ms. Brillon has until August 2018 to meet the ownership threshold (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

| None | | None |

| (1) | Ms. Brillon was appointed to the Board on August 8, 2013 and was appointed to the Audit Committee on November 6, 2013. |

4

| | |

Toronto, Ontario, Canada Age: 60 | | Marc Caira Not independent | President and CEO since July 2, 2013 | Director since May 2013 Mr. Caira was appointed President & CEO of Tim Hortons effective July 2, 2013, and as a director of the Board effective May 9, 2013. Mr. Caira is responsible for the strategic direction and overall performance of Tim Hortons and its operations. Before his appointment as President and CEO, Mr. Caira was Global CEO of Nestlé Professional. He was also a member of the Executive Board of Nestlé SA, the world’s largest food and beverage company and a recognized leader in nutrition, health and wellness. Prior to being named Global CEO of Nestlé Professional in 2006, Mr. Caira had served, among other roles, as the President & CEO of Parmalat North America, as Chief Operating Officer of Parmalat Canada, and as President, Food Services and Nescafe Beverages for Nestlé Canada. Key skills and experience Senior leadership experience | Brand marketing expertise | Restaurant industry and operations expertise International expertise | Manufacturing expertise | Financial expertise | Human resource and compensation expertise | New business development/M&A expertise | General retail experience |

| | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 3 of 3 | | 100% | | 99.14%FOR(1) |

Executive Committee (not included for director attendance purposes) | | n/a | | n/a | | |

| |

| Securities held | | |

| DSUs | | Common shares | | Total value | | Meets share ownership guidelines |

| Mr. Caira receives compensation as President and CEO, not for his services as a director. See “Executive Compensation” beginning on page 14 of this circular for details | | Mr. Caira has until July 2018 to meet the CEO share ownership threshold (minimum 5X his base salary or $4,550,000) |

| |

| Other public company boards | | Other public company boards in last five years |

| None | | None |

| (1) | Our proxy circular for our 2013 annual shareholders meeting provided for nine nominees to the Board; however, one nominee, Mr. Ron Osborne, passed away suddenly and unexpectedly on April 9, 2013. In accordance with our By-laws, the Board subsequently nominated Mr. Caira as a substitute nominee to the Board in place of Mr. Osborne. |

| | |

Columbus, Ohio, United States Age: 66 | | Michael J. Endres Independent | Audit Committee Financial Expert | Director since April 2006 Mr. Endres is a Managing Principal of Stonehenge Financial Holdings, Inc. (Stonehenge), a private equity firm that he co-founded in 1999. Prior to co-founding Stonehenge, Mr. Endres was Vice Chairman of Banc One Capital Holdings Corporation and Chairman of Banc One Capital Partners. Mr. Endres currently serves as a member of the board of directors of Worthington Industries, Inc. and Huntington Bancshares, Inc. (Huntington)(1). Mr. Endres also served on the Board of Trustees of OhioHealth Corporation, a large non-profit health system with multiple hospitals and related healthcare facilities and services, located in Ohio, until June 2013. He holds a Bachelor of Science degree from Miami University in Oxford, Ohio. Key skills and experience Financial expertise | New business development/M&A expertise | Senior leadership experience | Public company board experience | Risk assessment and mitigation expertise |

| | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 99.20%FOR |

Audit Committee (Chair) | | 4 of 4 | | 100% | | |

Executive Committee (not included for director attendance purposes) | | n/a | | n/a | | |

| | | |

Securities held DSUs | | Common shares | | Total value | | Meets share ownership guidelines |

| 20,124 | | 52,884 | | $4,471,740 ($3,703,373 in prior year) | | Yes, 41X annual retainer (minimum 4X or $440,000) |

| | |

| Other public company boards | | | | Other public company boards in last five years |

Worthington Industries, Inc. (NYSE) Huntington Bancshares, Inc. (NASDAQ) | | None |

| (1) | Huntington, either directly, or indirectly through affiliates or subsidiaries, provides certain banking services to us in the U.S. The Board concluded that Mr. Endres’ independence is not affected by his service as a Huntington director because he is not involved in day-to-day activities of Huntington and does not have any direct responsibility with respect to arrangements between Huntington and us. Mr. Endres has agreed to recuse himself from participating in meetings of Huntington’s board of directors and our Board if it is reasonably likely that participating in the meeting would, or is reasonably likely to, present a conflict of interest. |

5

| | |

London, United Kingdom Age: 59 | | Moya M. Greene Independent | Director since February 2008 Ms. Greene has been Chief Executive Officer of the Royal Mail, the U.K. government postal service and FTSE 100 company listed on the London Stock Exchange, since July 2010, and prior thereto, was the President, Chief Executive Officer and a member of the Board of Directors of Canada Post Corporation, the Canadian postal authority, since May 2005. She was also Vice Chair of Purolator and served on its Nominating and Corporate Governance Committee and Compensation Committee. From 2003 to 2004, Ms. Greene was Senior Vice President, Operational Effectiveness, of Bombardier Inc., a leading manufacturer of rail transportation equipment and aircraft. From 2000 to 2003, she was Senior Vice President, Chief Administrative Officer, Retail Products, at Canadian Imperial Bank of Commerce, a leading North American financial institution, and from 1996 to 2000, Managing Director, Infrastructure Finance and Public Private Partnership for TD Securities Inc., a leading Canadian financial services firm. Ms. Greene also has an extensive public service background, having served most recently as Assistant Deputy Minister for Transport Canada, the Canadian federal transportation authority, from 1991 to 1996 and, from 1989 to 1991, as Director, General Policy, for Human Resources and Social Development, Canada. She is a graduate of Osgoode Hall Law School and was recognized in 2003 and in 2012 by the National Post as one of Canada’s Top 100 influential women and in 2004 by the Ivey School of Business/Women Executive Network as one of the Top 40 female corporate executives in Canada. Key skills and experience Senior leadership experience | Corporate Social Responsibility | Human resource and compensation | Government/regulatory expertise | International expertise | Financial expertise | Distribution, warehouse and logistics expertise | IT/technical expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 99.09%FOR |

Audit Committee | | 4 of 4 | | 100% | | |

Human Resource and Compensation Committee | | 5 of 5 | | 100% | | |

| |

| Securities held | | |

| DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

| 14,781 | | | — | | | $905,336 ($679,532 in prior year) | | Yes, 8X annual retainer (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

| None | | None |

6

| | |

Jordan, Ontario, Canada Age: 70 | | Paul D. House Not independent | Non-executive Chairman | Director since November 2005 Mr. House has served as our Chairman since March 1, 2008, and as our President and CEO from May 24, 2011 until July 2, 2013. Mr. House joined Tim Hortons as Vice President of Marketing in 1985 and occupied various senior management positions leading to his appointment in 1993 as Chief Operating Officer. He became President and Chief Operating Officer in 1995 and Chief Executive Officer in November 2005. In 2007, he was appointed Chairman of the Board. Mr. House served on the Board of Directors of Wendy’s International, Inc. from 1998 through February 1, 2007. He is a member of the Board of Directors of the Tim Horton Children’s Foundation and serves on the Board of Trustees of Brock University, as well as on the Advisory Board of the Brock University Business School. Mr. House joined Dairy Queen Canada in 1972 and held various management positions with that company including Vice President of Canadian Operations. Mr. House holds a Bachelor of Arts in Economics from McMaster University. Key skills and experience Franchised organization experience | Brand marketing expertise | Senior leadership experience | Real estate experience | General retail experience | Distribution, warehouse and logistics expertise | New business development/M&A expertise | Public company board experience | Restaurant industry and operations expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 96.66%FOR |

Executive Committee (not included for director attendance purposes) | | n/a | | n/a | | |

| |

| Securities held | | |

| DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

| 625 | | | 114,835 | | | $7,071,925 ($9,335,700 in prior year) | | Yes, 64X annual retainer (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

| None | | None |

| | |

Toronto, Ontario, Canada Age: 76 | | The Hon. Frank Iacobucci Independent | Lead Director since February 2007 | Director since February 2006 The Hon. Frank Iacobucci has been Counsel to Torys LLP, a major Canadian law firm, since July 2005. Mr. Iacobucci was the Chairman of Torstar Corporation, a newspaper and book publishing company, from July 2005 until May 2009. From September 2004 to June 2005, Mr. Iacobucci served as Interim President of the University of Toronto while the search for a new university president was being conducted. From 1991 to 2004, Mr. Iacobucci served as a Justice of the Supreme Court of Canada. Mr. Iacobucci is a Board Member of Costi Immigration Services, and is a member of the Advisory Committee of General Motors of Canada. From 2005 to 2012, Mr. Iacobucci served as Chair of the Higher Education Quality Council of Ontario. Mr. Iacobucci is a member of the Law Society of Upper Canada and holds academic degrees from Cambridge University and the University of British Columbia, and has been the recipient of numerous awards and honours from Canada, the United States, and Italy. In 2007, Mr. Iacobucci was made a Companion of the Order of Canada. Key skills and experience Governance/legal expertise | Public company board experience | Government/regulatory expertise | Senior leadership experience | Human resource and compensation expertise | Corporate Social Responsibility | Financial expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 98.81%FOR |

Human Resource and Compensation Committee | | 5 of 5 | | 100% | | |

Nominating and Corporate Governance Committee (Chair) | | 4 of 4 | | 100% | | |

Executive Committee (not included for director attendance purposes) | | n/a | | n/a | | |

| |

| Securities held | | |

| DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

| 29,266 | | | 6,663 | | | $2,200,651 ($1,857,069 in prior year) | | Yes, 20X annual retainer (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

| None | | Torstar Corporation (2003-2009) (TSX) |

7

| | |

Toronto, Ontario, Canada Age: 58 | | John A. Lederer Independent | Director since February 2007 Mr. Lederer currently serves as President and Chief Executive Officer, and as a director, of US Foods, a position he has held since September 2010(1). He served as Chairman of the Board and Chief Executive Officer of Duane Reade, a privately-held chain of retail pharmacies located primarily in the New York City area, from April 2008 to August 2010. Mr. Lederer served as President of Loblaw Companies Limited (Loblaw), Canada’s largest food distributor, from 2001 through September 2006 and also served as a director of Loblaw for much of this period, capping a 30-year career with Loblaw and its subsidiary companies during which he held a number of senior leadership positions. In these roles, he was responsible for the operation, performance, innovation and growth of national and regional banners, businesses and divisions. Mr. Lederer is a former director of the Food Marketing Institute. He holds a Bachelor of Arts degree from York University. Mr. Lederer has served as a member of the Board of Directors of the Tim Horton Children’s Foundation since May 2008. Key skills and experience Senior leadership experience | General retail experience | Franchised organization experience | Real estate experience | Brand marketing expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 99.00% FOR |

Human Resource and Compensation Committee | | 4 of 5(2) | | 80% | | |

Nominating and Corporate Governance Committee | | 3 of 4(2) | | 75% | | |

| | | |

Securities held DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

22,642 | | | 15,120 | | | $2,312,923 ($1,859,169 in prior year) | | Yes, 21X annual retainer (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

None | | None |

| (1) | US Foods is a food distribution enterprise which also supplies quick service restaurants in the U.S. Tim Hortons has no transactional or other business relationship with US Foods. The Board considered whether Mr. Lederer’s position would have an impact on his independence, from the perspective of a general competitive conflict, and concluded that his independence would not be affected by his relationship with US Foods. Mr. Lederer has agreed to recuse himself from participating in meetings of the US Foods board of directors and our Board if such participation would, or is reasonably likely to, present a conflict of interest. |

| (2) | Mr. Lederer missed two Committee meetings in 2013 for medical reasons. |

| | |

Caledon, Ontario, Canada Age: 69 | | David H. Lees Independent | Director since February 2006 Dr. Lees is the President and Chief Executive Officer of Cardinal Health in Canada, a major medical product manufacturer, distributor, and service provider, and the parent company of Source Medical Corporation and Cardinal Health’s other Canadian operations. From 1999 to 2006, Dr. Lees served as President and Chief Executive Officer of Source Medical. Dr. Lees was President, Chief Executive Officer and a director of Canada Bread Company, Limited/Corporate Foods Limited, a TSX-listed manufacturer and marketer of baked goods and other food products, from 1993 until 1999. From 1991 to 1995, Dr. Lees served as a director of Maple Leaf Foods Inc. Dr. Lees holds a Doctorate of Philosophy in Food Science from the University of Massachusetts, a Master of Science in Agriculture from Macdonald College, McGill University, and a Bachelor of Science (Agriculture) from Macdonald College. Key skills and experience Senior leadership experience | Manufacturing expertise | Distribution, warehouse and logistics expertise Public company board experience | Financial expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 99.21% FOR |

Audit Committee | | 4 of 4 | | 100% | | |

Nominating and Corporate Governance Committee | | 4 of 4 | | 100% | | |

| | | |

Securities held DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

22,533 | | | 6,680 | | | $1,789,296 ($1,405,798 in prior year) | | Yes, 16X annual retainer (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

None | | None |

8

| | |

Toronto, Ontario Canada Age: 58 | | Thomas V. Milroy Independent | Audit Committee Financial Expert | Director since August 2013 Mr. Milroy is Chief Executive Officer of BMO Capital Markets, and is responsible for all of BMO Financial Group’s businesses involving corporate, institutional and government clients in North America and globally(1). Prior to his current role, to which he was appointed in 2008, Mr. Milroy had senior roles in investment and corporate banking, and was responsible for the integration of Bank of Montreal’s corporate banking with the investment banking capabilities of Nesbitt Burns. He was subsequently also responsible for the integration of the corporate banking business of Harris Bank and Nesbitt Burns in the U.S. In 2001, Mr. Milroy was appointed Vice-Chair and Global Head of Investment and Corporate Banking, and in 2006 he was named Co-President of BMO Capital Markets. Previously, Mr. Milroy worked in the Mergers and Acquisition group of a U.S. investment banking firm in New York and Toronto. Prior to that, he practiced securities law as a partner in a Toronto-based law firm. Key skills and experience Senior leadership experience | Financial expertise | Governance/legal expertise | Public company board experience | New business development/M&A expertise |

| | | | | | | | | | | | |

| Board and Committees(2) | | Meeting attendance | | 2013 voting results |

Board | | 1 of 1 | | 100% | | n/a(2) |

Audit Committee | | n/a | | n/a | | |

| | | |

Securities held DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

919 | | | — | | | $56,289 | | Under the guidelines, Mr. Milroy has until August 2018 to meet the ownership threshold (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

None | | None |

| (1) | BMO Capital Markets is an affiliate of Bank of Montreal (BMO). Mr. Milroy is also Chair of BMO Nesbitt Burns Inc. The Board concluded that Mr. Milroy’s independence is not affected by his service with the BMO Financial Group. From time to time, Tim Hortons and its subsidiaries do business with BMO and its subsidiaries. For example, BMO Financial Group provides ordinary course banking and foreign exchange services to us at times, and Tim Hortons entered into a private share repurchase transaction to acquire our common shares from BMO (occurring prior to Mr. Milroy’s appointment to the Board), all of which were made in the ordinary course of business and were conducted on terms no less favourable than we could have obtained from an unrelated third party. Mr. Milroy, however, is not involved in BMO Financial Group’s business with Tim Hortons, and the determination of his compensation at BMO Financial Group is not affected by the existence or absence of any business relationship between us. Further, we have implemented various safeguards to address any potential independence concerns that might arise from entering into transactions with the BMO Financial Group. For example, the receipt of investment banking and other professional services from the BMO Financial Group is now prohibited, and the entering into of any non-ordinary course transactions with the BMO Financial Group is subject to the prior approval of our legal department. |

With respect to the share ownership position of BMO Asset Management, an affiliate of BMO Capital Markets, the Board was satisfied that confidentiality safeguards were in place between the investment banking and asset management departments of the BMO Financial Group, so that Mr. Milroy would have no control over any transactions involving Tim Hortons stock. Mr. Milroy has agreed to recuse himself from participating in meetings of the BMO Nesbitt Burns Inc. board of directors and our Board if participating in a meeting would, or is reasonably likely to, present a conflict of interest.

| (2) | Mr. Milroy was appointed to the Board on August 8, 2013 and was appointed to the Audit Committee on November 6, 2013. |

9

| | |

Burlingame, California, United States Age: 41 | | Christopher R. O’Neill Independent | Director since March 2014 Mr. O’Neill is the Managing Director of Google Canada, a role he has held since 2010(1). In this capacity, Mr. O’Neill oversees Google’s operations in Canada and is a member of Google’s Americas Management Group. From 2005 to 2010, Mr. O’Neill held a variety of executive-level roles at Google. Prior to joining Google, Mr. O’Neill was a product marketing director at HSBC, a large global financial organization, and a strategy consultant at Oliver Wyman, a leading global management consulting firm. Mr. O’Neill sits on the Board of the Canadian Marketing Association and is a Charter Member of the C100, a non-profit, member-driven organization dedicated to supporting Canadian technology entrepreneurship and investment. He is also a former Board Member of Shop.org, the National Retail Federation’s digital division. Mr. O’Neill holds a Bachelor of Arts (Economics) from Huron College, University of Western Ontario, and a Master of Business Administration from the Tuck School of Business at Dartmouth College. Key skills and experience IT/technical expertise | Brand marketing expertise | New business development/M&A expertise | Senior leadership experience | International expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | 2013 voting results |

Board(2) | | n/a | | n/a | | n/a(2) |

| | | |

Securities held DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

— | | | — | | | — | | Under the guidelines, Mr. O’Neill has until March 2019 to meet the ownership threshold (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

None | | None |

| (1) | The Board concluded that Mr. O’Neill’s independence is not affected by his service with Google Canada. From time to time, Tim Hortons and its subsidiaries do business with Google Canada and its affiliates (Google). For example, Tim Hortons, through its media agencies, purchases digital advertising from Google in the ordinary course of business, for insignificant amounts representing less than 0.1% of Google Inc.’s annual revenues. However, the determination of Mr. O’Neill’s compensation at Google is not affected by the existence or absence of any business relationship between us. Further, we have implemented various safeguards to address any potential independence concerns that might arise from entering into transactions with Google (for example, any non-ordinary course transactions with Google will be subject to prior approval). Mr. O’Neill has also agreed to recuse himself from participating in meetings of our Board if participating in a meeting would, or is reasonably likely to, present a conflict of interest. |

| (2) | Mr. O’Neill was appointed to the Board on March 11, 2014. |

| | |

Jupiter, Florida, United States Age: 64 | | Wayne C. Sales Independent | Director since April 2006 Mr. Sales was Chairman of the Board of Directors of SUPERVALU INC. (SUPERVALU), a grocery retailer and distributor, from June 2010 until March 2013, and has served as a director of SUPERVALU since 2006(1). From July 2012 until February 2013, he served as President and Chief Executive Officer of SUPERVALU. Previously, he served as President and Chief Executive Officer, and then as Vice-Chairman, of Canadian Tire Corporation Limited, a TSX-listed retail, financial services, and petroleum company. He served as Vice-Chairman of Canadian Tire until June 2007 following his tenure as President and Chief Executive Officer, a position that he held from 2000 to 2006. Prior to 2000, Mr. Sales held positions as Executive Vice President and Senior Vice President, Marketing at Canadian Tire Retail, a subsidiary of Canadian Tire. Mr. Sales is a graduate of Harvard Business School’s Advanced Management Program. Key skills and experience General retail experience | Senior leadership experience | Franchised organization experience | Brand marketing expertise | Human resource and compensation expertise | New business development/M&A expertise |

| | | | | | | | | | | | |

| Board and Committees | | Meeting attendance | | | | 2013 voting results |

Board | | 5 of 5 | | 100% | | 99.06% FOR |

Human Resource and Compensation Committee (Chair) | | 5 of 5 | | 100% | | |

Nominating and Corporate Governance Committee | | 4 of 4 | | 100% | | |

| | | |

Securities held DSUs | | Common shares | | | Total value | | Meets share ownership guidelines |

22,809 | | | 12,067 | | | $2,136,155 ($1,694,498 in prior year) | | Yes, 19X annual retainer (minimum 4X or $440,000) |

| |

| Other public company boards | | Other public company boards in last five years |

SUPERVALU INC. (NYSE) | | Discovery Air Inc. (2008-2012) (TSX) Georgia Gulf Corporation (2007-2012) (NYSE) |

| (1) | Tim Hortons has no transactional or other business relationship with SUPERVALU. The Board considered whether Mr. Sales’ position(s) with SUPERVALU would have an impact on his independence, from the perspective of a general competitive conflict, and concluded that Mr. Sales’ independence would not be affected by his relationship with SUPERVALU. Mr. Sales has agreed to recuse himself from participating in meetings of the SUPERVALU board of directors and our Board if participating in a meeting would, or is reasonably likely to, present a conflict of interest. |

10

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act does not apply because we are a foreign private issuer under U.S. securities laws. Our officers and directors are required to file reports of equity ownership and changes of ownership with the Canadian Securities Administrators and do not file such reports under the Exchange Act.

Code of Ethics (Standards of Business Practices)

The Company has adopted a Code of Ethics, which we have designated as ourStandards of Business Practices, that applies to all of our officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. TheStandards of Business Practices is available on the Company’s investor website atwww.timhortons-invest.com.

Audit Committee

The current members of the Audit Committee are Mr. Endres (Chair), Mses. Brillon and Greene, and Messrs. Lees and Milroy, each of whom is independent under our independence requirements (as described below under Item 13 – “Director Independence”), which incorporate the listing standards of the New York Stock Exchange (“NYSE”) and the rules of the Canadian Securities Administrators. The Board of Directors has determined that all current Audit Committee members are financially literate and that Messrs. Endres and Milroy, and Ms. Brillon, are “audit committee financial experts,” as such term is defined by applicable U.S. securities laws. The Audit Committee met four times during 2013. Executive sessions comprised only of the independent directors who were members of the Audit Committee were held at each of those meetings.

| Item 11. | Executive Compensation |

As a foreign private issuer in the United States, we are deemed to comply with this Item if we provide information required by Items 6.B and 6.E.2 of Form 20-F, with more detailed information provided if otherwise made publicly available or required to be disclosed in Canada. We have provided information required by Items 6.B and 6.E.2 of Form 20-F in our management proxy circular related to the Meeting (the “proxy circular”) and have filed it through the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”), the Canadian equivalent of the SEC’s Next-Generation EDGAR system, atwww.sedar.com. In addition, our proxy circular has been furnished to the SEC on Form 8-K. As a foreign private issuer in the U.S., we are not required to disclose executive compensation according to the requirements of Regulation S-K that apply to U.S. domestic issuers, and we are otherwise not required to adhere to the U.S. requirements relative to certain other proxy disclosures and requirements. Our executive compensation disclosure complies with Canadian requirements, which are, in most respects, substantially similar to the U.S. rules. We generally attempt to comply with the spirit of the U.S. proxy rules when possible and to the extent that they do not conflict, in whole or in part, with required Canadian corporate or securities requirements or disclosure.

All dollar amounts included in this Item 11 are in Canadian dollars, unless otherwise expressly stated to be in U.S. dollars.

11

Human Resource and Compensation Committee

The Human Resource and Compensation Committee is responsible for establishing our executive compensation policies and practices and administering compensation programs for our executive officers and any other officers that report directly to the CEO. It determines all elements of executive compensation, other than for the President and CEO, including any change of control or severance arrangements. The Board determines all aspects of the CEO’s compensation, including respective plans, programs and arrangements, based on its review and the Committee’s recommendation, in executive session, as required by the Committee charter.

The Committee met five times in 2013. It held an executive session at each meeting, consisting only of the Committee’s independent directors and without management present.

| | | | | | |

| Members | | Wayne C. Sales (Chair)

M. Shan Atkins Moya M. Greene | | The Hon. Frank Iacobucci John A. Lederer |

| |

| Independence | | 100% Each member meets our independence requirements and also satisfies the requirements of “non-employee directors” under Rule 16b-3 of the Exchange Act and of “outside directors” under Section 162(m) of the Internal Revenue Code |

| | |

| Collective qualifications of Human Resource and Compensation Committee members | | •

• • • | | human resources or compensation experience CEO experience member of a compensation committee of another public company governance, legal and oversight expertise |

| |

| Key responsibilities on an annual and ongoing basis | | Annual financial and business goals |

| | • | | together with the Board, reviews and approves the annual financial and business goals and objectives established by the CEO for executive officers, which are utilized for making executive compensation determinations |

| | • | | evaluates the performance of executive officers against these goals and objectives |

| | • | | establishes performance objectives, as well as the weightings and payout curves under the short-term incentive plan and long-term equity incentive plan |

| | • | | determines the type of award and approves grants under the equity compensation plans, subject to the Board’s approval of grants for the President and CEO |

| |

| | Compensation governance and best practices |

| | • | | monitors governance and best practice initiatives and trends in executive compensation |

| | • | | oversees all matters relating to shareholder advisory votes (‘say on pay’) |

| | • | | reports to the Board on director compensation at least once a year |

| | • | | reviewed and approved the CD&A in this circular |

| |

| | Succession planning |

| | • | | oversees the process for CEO succession planning, including any work to assist the Board in identifying and evaluating potential successors to the CEO |

| | • | | reviews the succession plans for each executive officer position |

| | • | | oversees development plans for the executive team members and their successors |

| | • | | initiates an external search for executive officer roles, as appropriate |

| |

| | Compliance review |

| | | • | | monitors compliance with our share ownership guidelines for directors and executives every year |

12

Pre-approval policy

The Human Resource and Compensation Committee pre-approves services and fees to be provided by an independent compensation consultant prior to any formal engagement, similar to the Audit Committee’s pre-approval policy for services and fees relating to the independent auditor. Prior to the beginning of the year, the independent consultant develops a project plan that sets out the services to be performed over the coming year and the estimated fees. The Committee approves the specific terms of the independent consultant’s engagement, and the project plan and related fees of the independent consultant, annually.

Report presented by the Human Resource and Compensation Committee

Wayne C. Sales (Chair)

M. Shan Atkins

Moya M. Greene

The Hon. Frank Iacobucci

John A. Lederer

13

| | | | |

Executive Compensation — Compensation Discussion and Analysis This Compensation Discussion and Analysis(CD&A) explains executive compensation at Tim Hortons and has been prepared by management, and reviewed and approved by the Human Resource and Compensation Committee. | | | | In this CD&A,executive means an executive officer of Tim Hortons andCommittee means the Human Resource and Compensation Committee unless we indicate otherwise. |

This CD&A includes information on executive pay for our Chief Executive Officer, former Chief Executive Officer, Chief Financial Officer and our three next most highly-compensated officers (ournamed executives) for 2013:

| | • | | Marc Caira, President and Chief Executive Officer(President and CEO) (as of July 2, 2013) |

| | • | | Paul D. House, Executive Chairman, President and CEO (until July 1, 2013) |

| | • | | Cynthia J. Devine, Chief Financial Officer(CFO) |

| | • | | David F. Clanachan, Chief Operating Officer(COO) |

| | • | | William A. Moir, Chief Brand and Marketing Officer(CMO) |

| | • | | Roland M. Walton, President, Tim Hortons Canada |

| | | | | | | | | | |

Marc Caira President and CEO (as of July 2, 2013) | |

Paul D. House Executive Chairman, President and CEO (until July 1, 2013) | |

Cynthia J. Devine Chief Financial Officer | |

David F. Clanachan Chief Operating Officer | |

William A. Moir Chief Brand and Marketing Officer | |

Roland M. Walton President, Tim Hortons Canada |

| | | | | |

| | | | | |

Mr. House stepped down as President and CEO on July 1, 2013 after serving on an interim basis since May 2011.

Mr. House has served in senior executive positions with us for more than 25 years and continues as Chairman of the Board.

14

| A. | Philosophy and Approach |

Tim Hortons is one of the largest publicly-traded restaurant chains in North America based on market capitalization, and the largest in Canada. We strive to deliver strong results and generate value for our shareholders.

Our compensation philosophy is based on two fundamental objectives:

| 1. | align the interests of our executives with those of our shareholders (pay for performance link) |

| 2. | attract and retain key talent required for us to deliver on our strategic plan |

Aligning the Interests of Executives and Shareholders

Pay for Performance

We believe in aligning executive pay with performance. That is why our compensation programs are designed to tie a substantial majority of total executive compensation to business performance over both the short- and long-term.

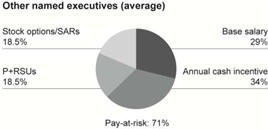

In 2013, over 70% of the compensation awarded to our named executives was contingent on performance and not guaranteed. The CEO has the highest proportion of pay-at-risk, with a heavier weighting on long-term equity compensation than the other named executives. Because a significant portion of compensation is at-risk, we evaluate our compensation programs annually to confirm they do not encourage excessive risk-taking.

Say on Pay

The Board believes that shareholders should have an opportunity to formally express their views on the compensation of the named executives. Accordingly, in 2013, we held our first ‘say on pay’ advisory vote, giving shareholders an opportunity to participate every year in a non-binding advisory vote on our approach to executive compensation.

Share Ownership

We require our executives (and other senior officers) to own Tim Hortons equity to further align their interests with those of our shareholders. The Committee reviews our share ownership guidelines periodically to verify that they are in line with the market practice of Canadian retail companies and certain peer companies in Canada and the U.S.

In February 2013, we increased the share ownership requirement for the President and CEO to five times base salary (from four times). In February 2014, we increased the requirement for the Executive Vice President level to two times base salary (from one time), and officers will now have five years instead of four years from their hire or promotion date to accumulate sufficient equity to meet the guidelines. We include common shares and vested, unexercised options in the calculation. We believe that these changes better align our share ownership guidelines with the market, strengthen alignment between the interests of our executives with those of our shareholders, and foster a longer-term focus.

The table below shows the ownership requirements by officer level.

| | | | |

Officer Level | | Share Ownership

Guideline | |

President and CEO | | | 5 x base salary | |

Other Named Executives | | | 3 x base salary | |

Executive Vice Presidents | | | 2 x base salary | |

Other Senior Executives | | | 1 x base salary | |

Vice Presidents | | | $80,000 | |

The Committee reviews compliance with the guidelines once a year, and an executive who does not comply may face disciplinary action. The guidelines do not apply to officers who are within five years of a planned retirement. Executives are not required to maintain their ownership levels after retirement.

15

The table below shows the equity ownership of each named executive as at December 31, 2013. The dollar values are based on a share price of $56.75, the average price of our common shares on the TSX in 2013. As of the end of 2013, all of the named executives (except for Mr. Caira) have met the requirement. Mr. Caira became President and CEO on July 2, 2013 and has five years to meet the guidelines. Mr. House meets our share ownership guidelines for directors (see page 7 for details).

| | | | | | | | | | | | | | | | | | | | |

Name | | Guideline | | | Value of Common

Shares Held ($) | | | Value of Vested

Unexercised Options

($) | | | Total

Value ($) | | | Ownership

(as a multiple of

base salary) | |

Marc Caira | | | 5x | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Cynthia J. Devine | | | 3x | | | | 5,189,810 | | | | 1,126,194 | | | | 6,316,004 | | | | 14.0 | |

David F. Clanachan | | | 3x | | | | 3,279,529 | | | | 674,741 | | | | 3,954,270 | | | | 8.8 | |

William A. Moir | | | 3x | | | | 6,376,550 | | | | 1,897,456 | | | | 8,274,006 | | | | 20.1 | |

Roland M. Walton | | | 3x | | | | 4,164,784 | | | | 2,000,996 | | | | 6,165,780 | | | | 15.0 | |

Attracting and Retaining Talent

Our strong brand, combined with our ability to offer a total compensation package that is fair and competitive within the markets in which we compete for talent, are key elements in our ability to attract and retain key talent.

Benchmarking

The Committee uses benchmarking data as a guideline every year to confirm that our executive compensation is consistent with our compensation philosophy, and that our compensation market position and compensation mix are competitive in the marketplace in which we compete for talent.

The comparator group used as a basis to establish 2013 compensation was developed from a compensation review conducted in 2010 by Meridian Compensation Partners Inc. (formerly Hewitt Associates), the Committee’s previous independent consultant. That comparator group consisted of companies that were similar to us in size, operating scope, geographical reach and various financial considerations. Due to a lack of Canadian food and beverage companies that are similar in size of revenues and number of employees, companies from a general industry group (including retail organizations that are subsidiaries of U.S. or global companies) were added to the comparator group. Both management and the Committee reviewed the comparator group for relevance.

The table below lists the Canadian comparator group that the Committee used as its primary market reference when making compensation decisions for our named executives for the past three years:

| | | | |

2013 Canadian Compensation Comparator Group |

| | |

Boston Pizza International Canada Bread Company Ltd. Canadian National Railway Company Canadian Tire Corporation Canfor Corporation Cara Operations Ltd. Cineplex Entertainment LP Finning International Inc. General Mills Canada Ltd. Home Depot Canada Inc. | | Hudson’s Bay Company Loblaw Companies Limited Lowe’s Companies Canada, ULC Maple Leaf Foods Inc. McDonald’s Restaurants of Canada Ltd. Molson Coors (Canada) Ltd. PepsiCo Foods Canada Priszm Brands Income Fund Quebecor Inc. Reitmans (Canada) Limited | | Rogers Communications Corp. Rogers Cable and Wireless Inc. RONA Inc. Sears Canada Inc. Shoppers Drug Mart Corp. Starbucks Coffee Canada TELUS Corporation Wal-Mart Canada Corp. Winners Merchants International LP |

The Committee also reviewed U.S. companies, primarily for operational roles, in light of our expanding U.S. presence and growing need to recruit senior executive talent in North America. The results of the Canadian comparator group and the U.S. comparator group listed below were averaged together to create a blended North American group, which was used by the Committee as a secondary point of reference.

16

| | | | |

2013 U.S. Compensation Comparator Group |

| | |

Abercrombie & Fitch Co. Ann Taylor, Inc. AutoZone, Inc. The Bon-Ton Stores, Inc. Brinker International, Inc. Burger King Corp. Campbell Soup Company Chipotle Mexican Grill, Inc. Chiquita Brands International, Inc. Darden Restaurants, Inc. Del Monte Foods Company | | Denny’s Corporation Dole Food Company, Inc. Dunkin’ Brands, Inc. Eddie Bauer LLC General Mills, Inc. H.J. Heinz Company The Hershey Company Hormel Foods Company Kellogg Company Krispy Kreme Doughnuts, Inc. McCormick & Company, Inc. | | McDonald’s Corporation Molson Coors Brewing Company Nestle USA OfficeMax Incorporated Panera Bread Papa John’s International Ross Stores, Inc. Sara Lee Corporation Starbucks Coffee Company Williams-Sonoma, Inc. Yum Brands, Inc. |

Note that the companies listed under the 2013 Canadian and the 2013 U.S. Compensation Comparator Groups were as at the time of the compensation study.

The Committee reviews the comparator group every few years and data on other peer companies from time to time as part of its analysis. Mercer (Canada) Limited (Mercer), the Committee’s current independent compensation consultant, assisted with the last review in 2012. The Committee reviewed the findings in 2012, but did not use the data as any proposed changes to executive compensation were deferred until 2013, after our corporate reorganization was complete and our new CEO was in place.

New in 2014

Beginning in 2014, we will benchmark our executive compensation against two new comparator groups developed from Mercer’s 2012 review to assess our market position and compensation mix and to measure our relative performance under the new performance share unit plan (see page 33 for details).

17

| B. | Compensation Governance and Oversight |

The Committee is directly responsible for determining the compensation of our executives and making recommendations to the Board regarding CEO compensation.

Management works closely with the Committee to refine our approach to executive compensation to meet our business needs, minimize risk, align with best practices to the extent they are appropriate for our business, and serve the interests of our shareholders.

The Committee’s main duties include:

| | • | | overseeing and administering compensation programs for our executives |

| | • | | determining all compensation elements for the executives, except the President and CEO (the Board makes all final compensation decisions relating to the CEO after considering the Committee’s recommendations) |

| | • | | making recommendations to the Board about the short-term incentive plan, long-term equity-based plans, and other benefits, plans, policies and executive compensation practices |

| | • | | determining appropriate comparator groups for benchmarking compensation levels |

| | • | | assessing performance against established goals and objectives for the short- and long-term incentive plans |

Qualified and Experienced Committee Members

All of the members of the Committee are independent directors. They all have direct and relevant experience in executive compensation and the necessary skills and expertise to make decisions about compensation policies and practices.

Specific Skills and Experience

| | |

| Wayne C. Sales (Chair) | | • director of SUPERVALU • CEO experience with major corporations in Canada (Canadian Tire Corporation) and the U.S. (SUPERVALU) • previous experience as a board chairman (SUPERVALU) and board vice-chairman (Canadian Tire Corporation) |

| |

| M. Shan Atkins | | • chair of the compensation committee of The Pep Boys—Manny, Moe and Jack • former member of the compensation and governance committee of Northwest Community Healthcare, and the compensation committee of Shoppers Drug Mart Corporation • holds C.A. and C.P.A. designations, has financial expertise, and senior executive and management consulting experience |

| |

| Moya M. Greene | | • served on the compensation committee of Purolator Inc. • CEO experience (Royal Mail (UK) and Canada Post) • human resources experience (Human Resources and Social Development, Canada) |

| |

| The Hon. Frank Iacobucci | | • previous experience as a board chairman (Torstar Corporation) and former chair of the salary and organization committee of Torstar Corporation • advisor to public companies and other organizations on ethics and other business matters • former Justice of the Supreme Court of Canada, esteemed lawyer and jurist and recipient of numerous awards in Canada and globally |

| |

| John A. Lederer | | • CEO experience (US Foods and Duane Reade) • former President of Loblaw Companies Limited • extensive senior executive experience |

Formal Review

The Committee reviews our executive compensation programs annually, and conducts a formal comprehensive review every two to three years.

In 2012, with the assistance of Mercer, the Committee undertook a comprehensive review of our short- and long-term incentive plans, including benchmarking and peer analysis, performance metrics and weightings and other plan features in the context of our business needs, long-term performance goals and industry practice. As part of this review, the Committee conducted a custom survey to look at the various kinds of short- and long-term incentive plans in the market.

The Committee’s final recommendations regarding changes to these plans were reviewed and approved by the Board in February 2014 (see page 33 for program changes that will be implemented in 2014 based on this review).

18

Independent Advice

The Committee can seek independent advice, which is paid for by the company. Mercer has served as the Committee’s independent compensation consultant since August 2011. Mercer has provided general executive compensation advice and other advisory services, including:

| | • | | market data, benchmarking and analysis |

| | • | | independent evaluation of proposals, data and analysis prepared by senior management |

| | • | | advice on executive compensation principles, trends and best practices |

Mercer receives instructions from the Committee chair and consults with senior management and our human resources department, as appropriate. While Mercer provides information and advice, the Committee is ultimately responsible for its own decisions and recommendations to the Board.

The Committee assesses Mercer’s independence every year and, in 2013, determined that Mercer was fully independent from Tim Hortons and management after reviewing, among other things:

| | • | | other services Mercer provided to us during the year |

| | • | | the fees we paid to Mercer, as a percentage of its total revenues |

| | • | | Mercer’s policies and procedures to prevent conflicts of interest |

| | • | | confirmation that there is no business or personal relationship between Mercer’s representatives and Committee members or our executives |

Mercer also conducts its own internal independence assessment every year and confirmed its independence in 2013 to the Committee chair.

Pre-Approving Services

The Committee has a policy for pre-approving services to be provided by Mercer and the corresponding fees, with the objective of confirming that these services would not impair Mercer’s independence.

From time to time, Mercer also provides services to us that are not related to the executive compensation advice provided to the Committee, and the nature of these services and the fees are reviewed as part of the annual independence assessment. Marsh Canada Limited (Marsh), an affiliate of Mercer, provides insurance brokerage services to us. Total fees for those other services represent an insignificant portion of Mercer’s total revenues.

The table below shows the total fees billed by Mercer and its affiliates for services provided to us in 2013 and 2012.

| | | | | | | | |

Fees | | 2013 | | | 2012 | |

Mercer—Executive compensation-related fees

(services and advice provided to the Committee) | | $ | 236,762 | | | $ | 190,775 | |

Mercer—All other fees

(includes consulting services related to pension and benefits and other surveys) | | $ | 213,111 | | | $ | 196,140 | |

Marsh (an affiliate of Mercer)—Insurance broker fees | | $ | 240,738 | | | $ | 239,032 | |

| | | | | | | | |

Total | | $ | 690,611 | | | $ | 625,947 | |

| | | | | | | | |

19

Managing Compensation Risk

Every year, or as circumstances require, the Committee considers whether our executive compensation programs create or incentivize inappropriate risk-taking by management. Our performance-based incentives represent a large portion of our executive compensation programs, so it is important that these incentives do not result in our executives taking actions that may conflict with our long-term interests.

In February 2014, the Committee concluded that our compensation structure, design and process are founded on strong principles that reduce the potential for inappropriate risk-taking, that our compensation programs are designed and administered with the appropriate balance of risk and reward in relation to our overall business strategies, and that our programs do not encourage executives to take excessive risks. The Committee has also instituted several policies and practices to mitigate compensation risk and limit the possibility of excessive risk-taking by management. The Committee considered the following key elements of our compensation programs when making these determinations.

Diligent Process

We have a formal annual budget review process that incorporates compensation planning. The Committee works with the Board and management and is focused on establishing annual performance objectives that support our business planning and achievement of strategic objectives, while also avoiding the risks of short-term decision-making.

Benchmarking enables us to verify that executive compensation is consistent with our compensation philosophy and is appropriate, based on our industry. We also monitor internal pay equity to confirm a proper balance of risk and reward between officer levels. Trends in executive compensation are considered periodically as well to evaluate our programs versus our peers.

As part of our risk management program, we stress test our compensation programs as appropriate, and test program design changes against historical results to assess the impact of those changes. In 2013, we tested different performance scenarios as part of the re-design of the short-term incentive plan to verify alignment with our intended results.

Careful Plan Design

Each incentive plan is carefully structured based on our business planning, market research and analysis, and independent advice from Mercer so that the plan design and corresponding targets and objectives are relevant and appropriate. We use qualitative and quantitative performance factors to set performance thresholds and determine payouts under the short- and long-term incentive plans. Furthermore, the vesting period associated with some of our long-term incentives means that a gain in the short-term would not be immediately realizable. We also cap payouts to limit the impact of extraordinary performance or large transactions. Additionally, executives do not receive accelerated vesting of their outstanding equity compensation awards when they retire.

Share Ownership Policies

Our share ownership guidelines require executives and other senior officers to hold a pre-established amount of Tim Hortons equity during the course of their employment. The share ownership guidelines were recently increased for the President and CEO and the Executive Vice President level to strengthen the alignment between the interests of our executives with those of our shareholders, and to foster a longer-term focus.

Trading and Anti-Hedging Policies

We have an insider and window trading policy that applies to our directors, executives, employees, members of our franchisee advisory board and other restaurant owners as may be applicable from time to time, to prohibit improper trading of our securities. Under this policy, insiders are restricted from trading (or advising anyone else to trade) Tim Hortons securities outside of pre-set window periods. Further, all insiders are required to pre-clear their intention to trade with a member of our securities practice group.

We have a separate policy governing automatic trading plans, as set out under Rule 10b5-1 under the Exchange Act and applicable provisions of Canadian securities laws, which establishes safeguards and required processes for the use of automatic trading plans by our directors, executives, employees and/or restaurant owners. We also strictly prohibit our directors, executives and employees from engaging in hedging or monetizing transactions involving Tim Hortons securities, including securities granted or vested to employees under our equity compensation programs.

20

Clawbacks

Since 2009, we have had a policy that allows us to recoup or “clawback” performance-based compensation if our consolidated financial statements need to be restated for any reason other than a change in accounting policy with retroactive effect. In such a case, our Board will review all performance-based compensation awarded to or earned by our senior executives (and certain other employees) for the fiscal periods materially affected by the restatement. If the Board determines that performance-based compensation was paid based on financial results that were subsequently corrected as part of a restatement, then it will seek recoupment from those who earned such compensation, regardless of intentional wrongdoing, if deemed appropriate.

Granting and Settling Equity Compensation

We have a policy that, among other things, sets out specific parameters for all grants and settlements of equity compensation awards, and hedging activities undertaken by us at the time we grant or settle the award. The policy is designed to mitigate the risk of the exercise price, settlement value or grant date value of any equity award (as well as any hedging transactions undertaken in connection with the awards) being subject to manipulation by a director, executive or other insider. The policy is intended to avoid determining equity award variables on a date when we are arguably in possession of material, undisclosed information that is not reflected in the market price of our common shares.

Use of Discretion

The Committee can use its discretion to make adjustments to minimize the positive or negative impact of extraordinary events or circumstances on corporate performance so that actual awards made to executives reflect our underlying operating performance. If warranted, the Committee also has the discretion not to award a payout. The Committee’s ability to review the amount of performance awards and the underlying factors driving the amount prior to us making the actual payment further mitigates our compensation risk.

21

| C. | Decision-Making Process |

Process for Setting Executive Pay

Management

The CEO typically provides insight and input to the Committee on all significant compensation decisions or recommendations that affect the named executives, other executives and Tim Hortons overall. The CEO’s input is critical in reviewing compensation for the other named executives because of his direct day-to-day involvement with them, putting him in the best position to assess their individual performance. He also shares his views on succession planning for the CEO role and positions that report directly to the CEO.

The Executive Vice-President, Human Resources and other members of senior management also analyze and provide input on compensation levels and mix, compensation policies, incentive plans and administration, tally sheets and other tools for setting compensation.

Human Resource and Compensation Committee

The Committee is responsible for benchmarking and determining executive compensation, including making recommendations to the Board with respect to CEO compensation and on material compensation matters.

| | | | |

The Committee sets target compensation for the other named executives for the coming year and determines the compensation elements. It establishes performance objectives and payout curves for the short- and long-term incentive plans, reviews executive performance against annual financial and other business goals and objectives, and makes compensation recommendations to the Board for review and approval. The Committee employs a number of tools when making compensation decisions: • It looks at internal equity to confirm that the differences between the CEO and other named executives as a group for base salary, short-term incentive targets and long-term incentive awards are appropriate • A tally sheet for each named executive sets out each element of target compensation for the coming year, and targeted and actual compensation received for the previous five years | | | | Key Elements and Tools Used in Decision Process • Prior year performance of each named executive • Corporate performance and objectives for the previous year • Analysis from the tally sheets, internal equity review and salary increases for other employees • Goals and objectives for the coming year • Macroeconomic and operating conditions |

|

• It also conducts an internal pay equity analysis of CEO compensation against the next highest paid officers at certain quick service restaurant peers for benchmarking purposes |

22

In addition to setting named executive compensation, the Committee makes decisions about other aspects of executive pay, including policy decisions, grants of incentive awards, recommendations to the Board on material changes to compensation programs or plans, and executive hires, among other things.

See the Committee’s report on page 12 for more information.

Board

The Board assesses CEO performance against his objectives and corporate performance, and reviews and approves all decisions relating to the CEO’s compensation. The Board also approves all material policy decisions on compensation plans, including short- and long-term incentive plans and executive benefits.

23

Base salary, a short-term cash incentive and long-term equity-based incentives make up total direct compensation for our executives. Together with the retirement benefits we offer, they form the most significant elements of our executive compensation program and are designed to satisfy the overall objectives of the program.

The table below describes the different components and the pay-at-risk profile for 2013 compensation. We implemented some changes to the components in 2013, as described below, based on the Committee’s compensation review and our business planning. More significant changes are planned for 2014, as described beginning on page 33.

| | | | |

| Component | | Purpose | | Key Features |

| | |

| Base salary | | • Stable source of annual income | | • Generally set at the 25th percentile in 2013, consistent with our philosophy of heavily weighting compensation towards performance-based compensation |

| | |

Short-term incentive (annual cash bonus) | | • Incentive award for achieving annual performance objective(s) | | • One-year performance period • Moderate pay-at-risk profile |

| | |

| Long-Term Incentives | | | | |

| | |

| Performance-conditioned restricted stock units (P+RSUs) | | • Incentive to create value over the long-term • Attract, motivate and retain key employees | | • Award level adjusted based on company performance (one-year performance period prior to grant) • Cliff vest (30 months after grant) • Moderate/high pay-at-risk profile |

| | |

| Stock options with tandem stock appreciation rights(Options/SARs) | | • Reward for increases in our share price over the longer term and directly aligns with shareholder interests • Attract and motivate key employees • Meaningful retention incentive | | • Seven-year term or performance period • One-third vests each year beginning on the first anniversary of the grant • High pay-at-risk profile |

Pay Mix

In 2013, we have generally targeted total compensation for each named executive at the 75th percentile of our 2013 compensation comparator group based on the Committee’s analysis and our strong relative performance and growth over the past several years. A substantial portion is at-risk pay, which is variable and based on performance. The amount the named executive actually receives (if any) can be significantly different from the grant value of the award.

The graphs below show the 2013 target pay mix for the CEO and other named executives:

New in 2014

The Committee revised our target pay positioning in early 2014 to reflect two new comparator groups and better align with market practice (see page 33 for details).

24

Plan Design and Performance Measures

| | | | |

Short-Term Incentive Our short-term incentive award is an annual cash bonus, and represents a substantial portion of executive compensation because of our pay for performance philosophy and the fact that our business tends to work on shorter performance cycles. The award is at-risk pay because the bonus is only paid if we achieve pre-determined performance objectives. The actual award may be above or below target, depending on the extent of achievement of the performance objective. The Committee took a stepped approach to revising the plan in early 2013 that consisted of making incremental changes for 2013 and establishing a set of principles to guide plan changes for 2014. The Committee deemed this appropriate in light of our new organizational structure, our goal of reinforcing functional accountability among the named executives, and the CEO search that was underway at the time. | | | | Guiding Principles • Plan changes will support our new organizational structure and reinforce functional and individual accountability • Business unit measures will form part of the performance metrics • Plan design will be flexible to allow top-line financial metrics and more corporate and business unit level operational or strategic objectives to be included in 2014 |

The first phase was implemented in 2013 and involved adjusting the weighting of EBIT, the performance objective we have used for many years, to support our new organizational structure and focus on business unit objectives.

Measuring Performance

The Committee retained EBIT as the only performance objective for 2013 because, at that time, the Committee considered that:

| | • | | EBIT is an important indicator of the financial health and performance of our business and each executive officer has the ability to make a meaningful contribution to EBIT |

| | • | | In 2013, EBIT was the corporate performance metric in the incentive plans for our other employees, so our collective interests were aligned to achieve the same goal. It is also a key performance measure used by other quick service restaurant companies, which allows us to compare relative performance using a similar measure |

Company performance for our named executives in 2013 was assessed on a weighted average of corporate and business unit results, to reinforce accountability for the health and growth of our Canadian and U.S. businesses. The table below shows the weightings for each named executive role.

| | | | |

Named Executive | | EBIT Weightings | | |

| CEO, CFO, COO, CMO | | Tim Hortons Inc. – 70%

Canada – 15% U.S. – 15% | | |

| | |

| President, Tim Hortons Canada | | Tim Hortons Inc. – 70%

Canada – 30% | | |

The Committee also established target, threshold and maximum performance objectives on a payout curve. Payouts range from 50% to 150% of the target award depending on our financial performance. No award is paid if we do not achieve threshold performance.

New in 2014

The short-term incentive plan will have new performance metrics and weightings that better align with our business priorities and support our long-term strategy (see page 34 for details).

25

Long-Term Incentives

Our 2013 long-term incentive awards are equity-based compensation designed to reward executives for appreciation in our share price over longer periods of time. These awards make up the largest part of the CEO’s total compensation, and represent a significant portion of total compensation for our other named executives.

Equity-based compensation is an effective way for us to achieve several goals:

| | • | | better align the level of compensation realized by executives with our financial and share performance |

| | • | | help executives build their share ownership and increasingly align the interests of our executives and shareholders |

| | • | | focus on executing longer-term strategic plans, which form part of our annual financial and non-financial goals and objectives |

| | • | | reward executives for performance that creates shareholder value |

We used two kinds of equity-based compensation awards in 2013, each representing 50% of the total dollar value of the target award:

| | • | | P+RSUs – the grant value is based on performance achieved over the prior year. Once granted, P+RSUs are forward-looking because they cliff vest in 30 months and are therefore effective in retaining management and motivating their performance through share price appreciation |

| | • | | Options/SARs – these align with shareholder interests because the value of options/SARs is directly related to our share price (they have no value if our share price does not increase) |

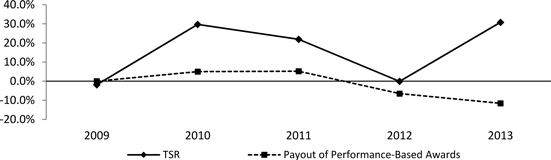

The Committee believes the equal mix and types of equity awarded enhance the link between pay and performance, better align the interests of executives and shareholders, and strengthen our ability to retain executive talent. This mix is also consistent with market practice among TSX 60 companies. The Committee does not take into account previous grants of P+RSUs and options/SARs when granting new awards.