2013 Third Quarter Conference Call

S p e a k e r s ( i n s e q u e n c e ) Scott Bonikowsky Vice Pres ident , Corporate, Publ ic & Government Affa i rs Marc Caira Pres ident & Chief Execut ive Off icer Cynthia Devine Chief F inanc ia l Off icer 2

Certain information in this presentation, particularly information regarding future economic performance, finances, and plans, expectations and objectives of management, and other information, constitutes forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. We refer to all of these as forward-looking statements. Various factors including competition in the quick service segment of the food service industry, general economic conditions and others described as “risk factors” in the Company’s 2012 Annual Report on Form 10-K filed February 21, 2013, and our Quarterly Report on Form 10- Q filed on November 7, 2013 with the U.S. Securities and Exchange Commission and Canadian Securities Administrators, could affect the Company’s actual results and cause such results to differ materially from those expressed in, or implied by, forward-looking statements. As such, readers are cautioned not to place undue reliance on forward-looking statements contained in this presentation, which speak only as to management’s expectations as of the date hereof. Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about: the absence of an adverse event or condition that damages our strong brand position and reputation; the absence of a material increase in competition or in volume or type of competitive activity within the quick service segment of the food service industry; our ability to obtain financing on favourable terms; our ability to maintain investment grade credit ratings; prospects and execution risks concerning our U.S. market strategy; general worldwide economic conditions; cost and availability of commodities; our ability to retain our senior management team or our inability to attract and retain qualified personnel; continuing positive working relationships with the majority of the Company’s restaurant owners; the absence of any material adverse effects arising as a result of litigation; and there being no significant change in the Company’s ability to comply with current or future regulatory requirements. We are presenting this information for the purpose of informing you of management’s current expectations regarding these matters, and this information may not be appropriate for any other purpose. We assume no obligation to update or alter any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. Please review the Company's Safe Harbor Statement at www.timhortons.com/en/about/safeharbor.html. Safe Harbor Statement 3

MARC CAIRA President & Chief Executive Officer

Q3 2013 Overview Progress in a challenging operating environment Improved same-store sales in Canada and the U.S. Growth in Operating Income and EPS 5

Creating the Ultimate Guest Experience More than 500 in Q3 Drive-thru enhancements — Fifth-car relocations — Double-order stations — Exterior menu boards Beverage-only express lines Targeting 300 renovations in Canada in 2013 Simplification initiatives 6

Menu Innovations Grilled Steak and Cheese Panini Extreme Italian sandwich K-Cup® compatible single-serve coffee Piloting new Dark Roast blend 7 All trademarks of the companies listed above are reserved by their respective owners

Strategic Planning Process: Emerging Themes Opportunities Include: Canada: Lead, defend and grow our position ̶ Simplification, menu innovation, technology, extending our reach, new customer occasions U.S.: Improve profitability in existing markets, within a reduced capital scenario ̶ Drive AUV growth, customer loyalty and unit economics International: Near-term focus on Middle East as we explore additional opportunities 8

CYNTHIA DEVINE Chief Financial Officer

Top-Line Sales Growth 10 2013 2012 Q3 Q3 Systemwide Sales Growth(1)* 4.7% 5.4% 10.8% 9.7% Same-Store Sales Growth(2) 1.7% 1.9% 3.0% 2.3% Percentages represent year-over-year comparisons, unless otherwise noted. *Constant currency basis. (1) Systemwide sales growth includes restaurant sales at both Franchised and Company-operated restaurants. (2) Same-stores sales growth includes sales at Franchised and Company-operated restaurants open for 13 months or more. See information on slide 19 regarding these measures.

Q3 2013 – Segment Results 2013 2012 % Q3 Q3 Change $179.6 $172.0 4.4% $2.7 $1.5 86.4% ($14.3) ($13.0) N/M U.S. CANADA Corporate Services All numbers rounded. N/M – Not Meaningful. Please note that we have reclassified our segments effective Q1 2013, numbers reflect reclassification. 11 Operating Income ($ in millions CDN)

Q3 2013 – Earnings Highlights 2013 2012 % Q3 Q3 Change Adjusted operating income* $169.8 $162.2 4.7% Operating income 168.8 153.7 9.9% Interest expense, net 8.5 7.7 9.5% Income taxes 45.4 39.0 16.5% Net income attributable to noncontrolling interests 1.1 1.3 (13.1%) Net income attributable to THI $113.9 $105.7 7.7% Diluted EPS attributable to THI $0.75 $0.68 10.7% Diluted weighted average shares outstanding (millions) 150,864 155,067 (2.7%) All numbers rounded. *Adjusted operating income is a non-GAAP measure, and excludes corporate reorganization expenses of $1.0 million in Q3 2013 and $8.6 million in Q3 2012. Please refer to slides 20 and 21 for the reconciliation to Operating Income, the closest GAAP measure and details of reconciling item. 12 ($ in millions CDN, except per share data)

Share Repurchase Activity Targeting $1 billion of share repurchases – August 2013 to August 2014 $128 million repurchased in Q3 2013 New debt financing to complete repurchases

New Debt Financing $400 million one-year revolving bank facility executed October 2013 Anticipate obtaining longer-term financing for a portion of the $900 million increase in Q4 2013 Comfortable with planned level of total debt Leveraging the strength of balance sheet Returning value to shareholders Preserving investment grade rating Providing strategic flexibility and access to capital to re-invest back into the business Addressing constraints of our cross border corporate structure

16 Q3 2013 – Revenues 2013 2012 % Q3 Q3 Change Sales Distribution sales $473.6 $475.2 (0.3%) Company-operated restaurant sales 6.1 7.9 (22.5%) Sales from VIEs 96.0 85.4 12.4% $575.8 $568.5 1.3% Franchise revenues Rents & royalties 212.1 201.6 5.2% Franchise fees 37.5 31.9 17.3% 249.6 233.5 6.9% Total revenues $825.4 $802.0 2.9% All numbers rounded. ($ in millions CDN)

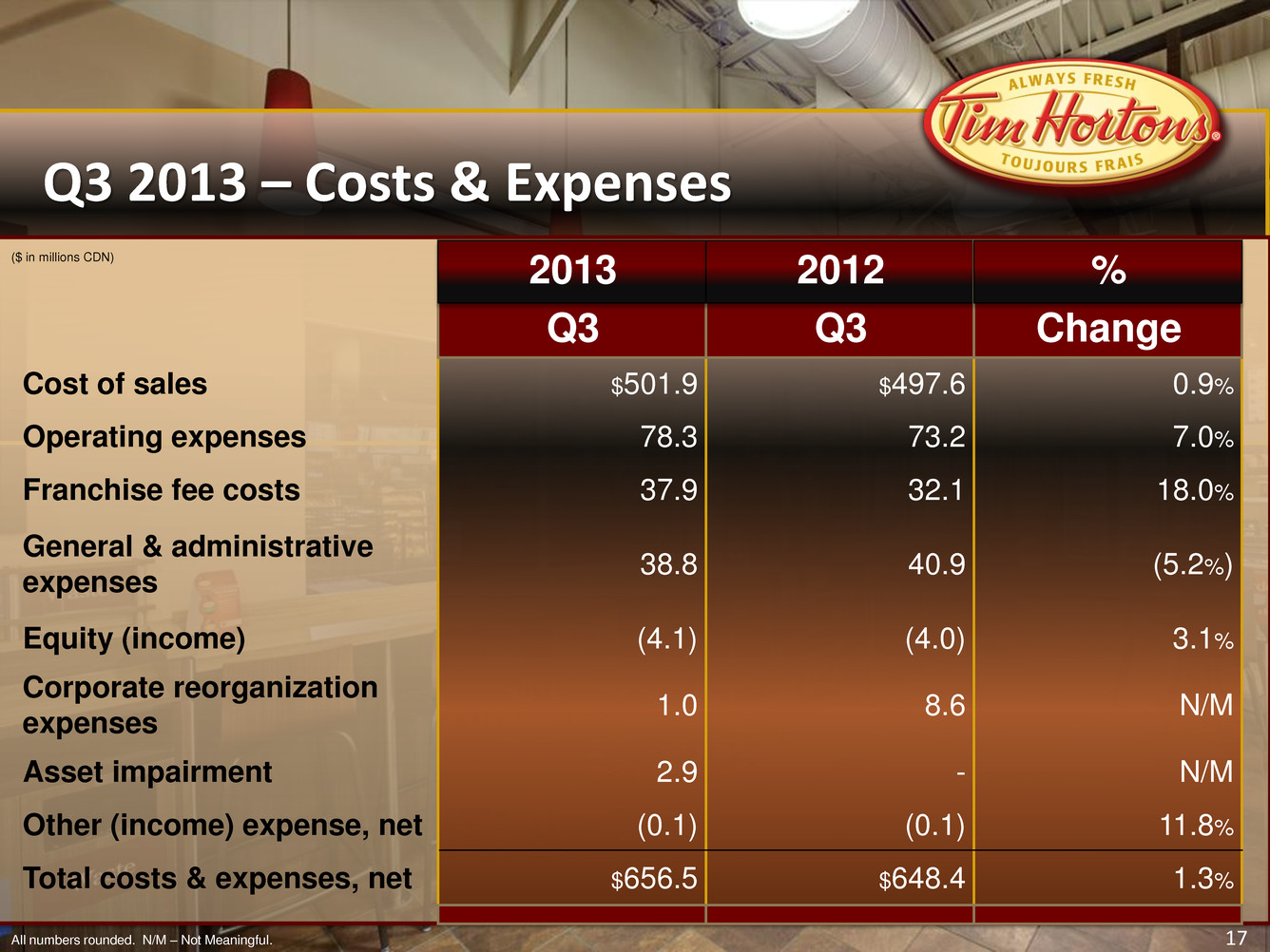

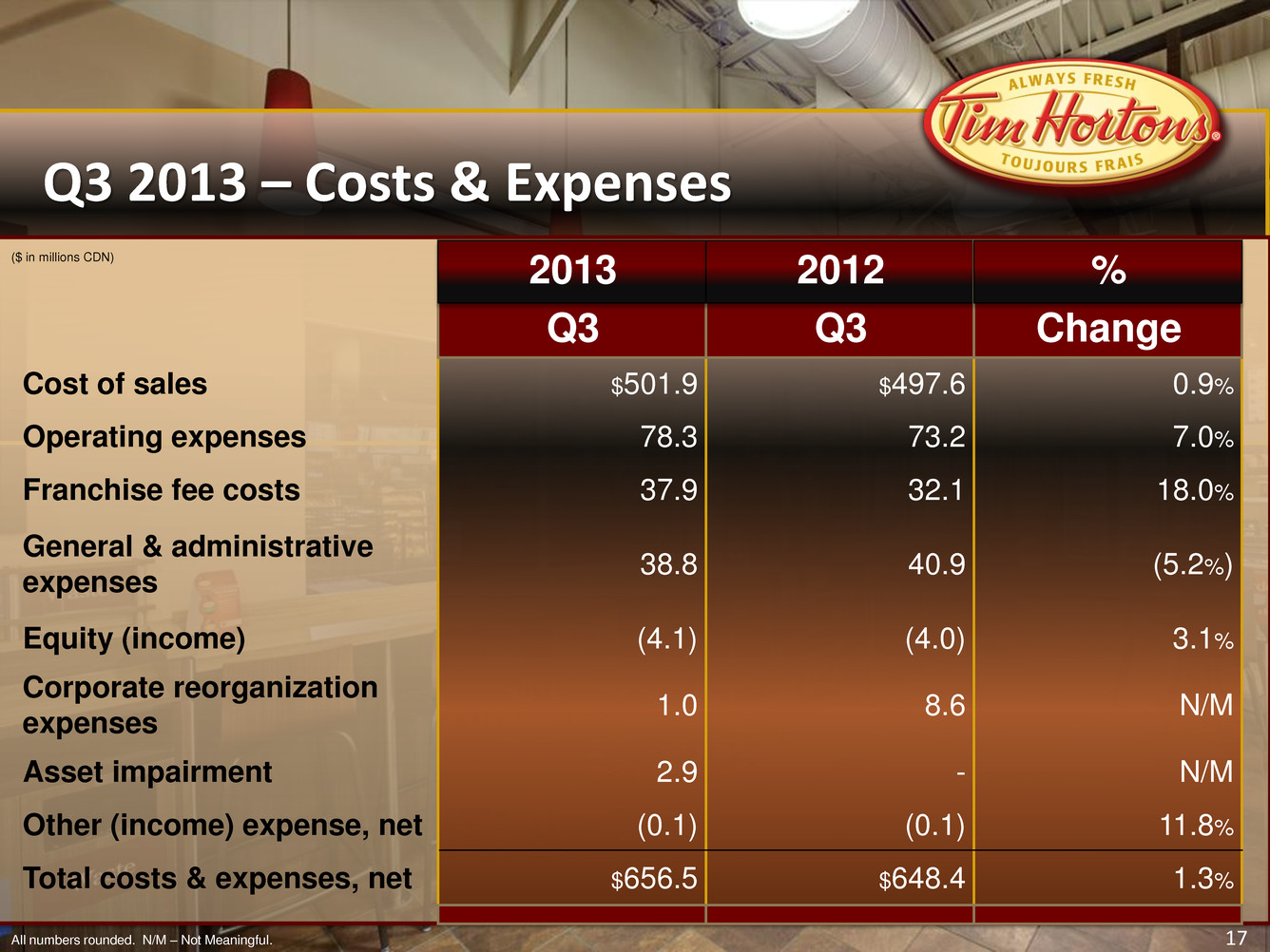

17 Q3 2013 – Costs & Expenses 2013 2012 % Q3 Q3 Change Cost of sales $501.9 $497.6 0.9% Operating expenses 78.3 73.2 7.0% Franchise fee costs 37.9 32.1 18.0% General & administrative expenses 38.8 40.9 (5.2%) Equity (income) (4.1) (4.0) 3.1% Corporate reorganization expenses 1.0 8.6 N/M Asset impairment 2.9 - N/M Other (income) expense, net (0.1) (0.1) 11.8% Total costs & expenses, net $656.5 $648.4 1.3% All numbers rounded. N/M – Not Meaningful. ($ in millions CDN)

Q3 2013 – Financial Review Cash Flow Q3 Cash Capex* $48.8 Q3 Depreciation and Amortization* $38.1 Balance Sheet Cash and cash equivalents $44.9 Restricted cash and cash equivalents $101.0 Total current assets $506.9 Total assets $2,265.8 Long-term debt** $409.6 Capital leases – long-term $115.4 All numbers rounded. *Includes amounts related to the Expanded Menu Board Program. **Includes $42.4 million long-term portion of Advertising Fund debt related to Expanded Menu Board Program. 18 ($ in millions CDN) ($ in millions CDN)

Total systemwide sales growth includes restaurant level sales at both Company-operated and Franchised restaurants. Approximately 99.6% of our systemwide restaurants were franchised as at September 29, 2013. Systemwide sales growth is determined using a constant exchange rate where noted, to exclude the effects of foreign currency translation. U.S. dollar sales are converted to Canadian dollar amounts using the average exchange rate of the base year for the period covered. For the third quarter of 2013, systemwide sales on a constant currency basis increased 5.3% compared to the third quarter of 2012. Systemwide sales are important to understanding our business performance as they impact our franchise royalties and rental income, as well as our distribution income. Changes in systemwide sales are driven by changes in average same-store sales and changes in the number of systemwide restaurants, and are ultimately driven by consumer demand. We believe systemwide sales and same-store sales growth provide meaningful information to investors regarding the size of our system, the overall health and financial performance of the system, and the strength of our brand and restaurant owner base, which ultimately impacts our consolidated and segmented financial performance. Franchised restaurant sales are not generally included in our Condensed Consolidated Financial Statements (except for certain non-owned restaurants consolidated in accordance with applicable accounting rules). The amount of systemwide sales impacts our rental and royalties revenues, as well as distribution revenues. Systemwide Sales Growth & Same-Store Sales 19

Adjusted operating income is a non-GAAP measure. Management uses adjusted operating income to assist in the evaluation of year-over-year performance, and believes that it will be helpful to investors as a measure of underlying operational growth rates. This non-GAAP measure is not intended to replace the presentation of our financial results in accordance with GAAP. The Company’s use of the term adjusted operating income may differ from similar measures reported by other companies. The reconciliation of operating income, a GAAP measure, to adjusted operating income, a non-GAAP measure, is set forth in the following slide. Information on Non-GAAP Measure: Adjusted Operating Income 20

21 Reconciliation of Adjusting Operating Income All numbers rounded. ($ in millions CDN) 2013 2012 Q3 Q3 Operating income $168.8 $153.7 Add: Corporate reorganization costs 1.0 8.6 Adjusted operating income $169.8 $162.2