2014 Second Quarter Conference Call

Speakers Scott Bonikowsky Senior Vice-President, Corporate Affairs & Investor Relations Marc Caira President & Chief Executive Officer Cynthia Devine Chief Financial Officer 2

Safe Harbor Statement Certain information in this presentation, particularly information regarding future performance, finances, and plans, expectations and objectives of management, and other information, constitutes forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We refer to all of these as forward-looking statements. Various factors including competition in the quick service segment of the food service industry, general economic conditions and others described as "risk factors" in the Company's 2013 Annual Report on Form 10-K filed on February 25, 2014, and our Quarterly Report on Form 10-Q filed on August 6, 2014 with the U.S. Securities and Exchange Commission and the Canadian Securities Administrators, could affect the Company's actual results and cause such results to differ materially from those expressed in, or implied by, forward-looking statements. As such, readers are cautioned not to place undue reliance on forward-looking statements contained in this presentation, which speak only as to management's expectations as of the date hereof. Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about: (i) prospects and execution risks concerning our growth strategy; (ii) the absence of an adverse event or condition that damages our strong brand position and reputation; (iii) the absence of a material increase in competition or in volume or type of competitive activity within the quick service restaurant segment of the food service industry; (iv) cost and availability of commodities; (v) the absence of an adverse event or condition that disrupts our distribution operations or impacts our supply chain; (vi) continuing positive working relationships with the majority of the Company’s restaurant owners; (vii) the absence of any material adverse effects arising as a result of litigation; (viii) there being no significant change in the Company’s ability to comply with current or future regulatory requirements; (ix) the ability to retain our senior management team or the inability to attract and retain new qualified personnel; (x) the Company’s ability to maintain investment grade credit ratings; (xi) the Company’s ability to obtain financing on favorable terms; and (xii) general worldwide economic conditions. We are presenting this information for the purpose of informing you of management's current expectations regarding these matters, and this information may not be appropriate for any other purpose. We assume no obligation to update or alter any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. Please review the Company's Safe Harbor Statement at www.timhortons.com/ca/en/corporate/safe-harbor.php. 3

Marc Caira President & Chief Executive Officer

Q2 Overview 5 Momentum in same-store sales growth Solid growth in operating performance and profitability Early stage execution of Strategic Roadmap

Delivering menu innovation 6 Desire for bold flavors Changing demographics Nutrition, health and wellness Fresh, quality ingredients Key trends/ drivers

Growing average cheque 7 Appealing Side Dishes Premium Products Increased Combo Penetration

New products introduced 8

Coffee leadership 9 Large-scale pilot in Quebec Single-serve platform through retail grocery channel

Implementing new technology 10 Improve speed of service Enhance guest experience Build loyalty with guests Leverage consumer insights

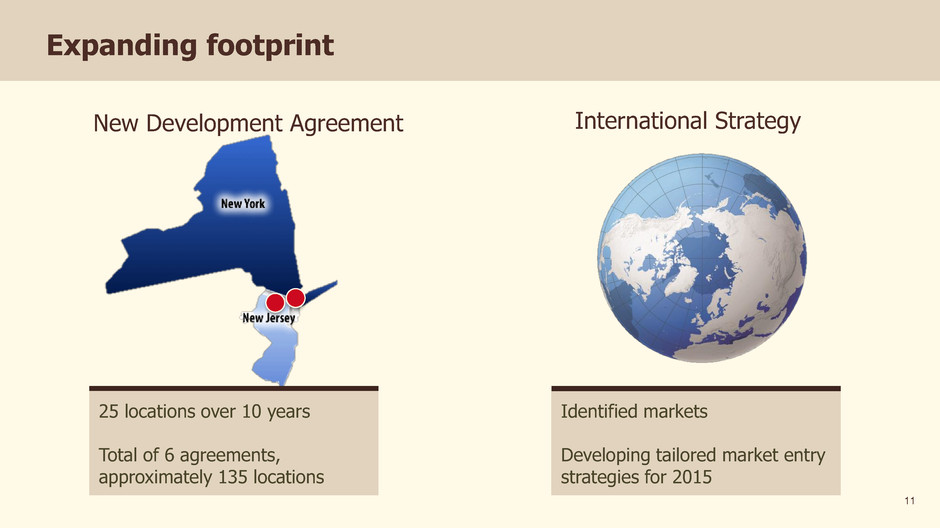

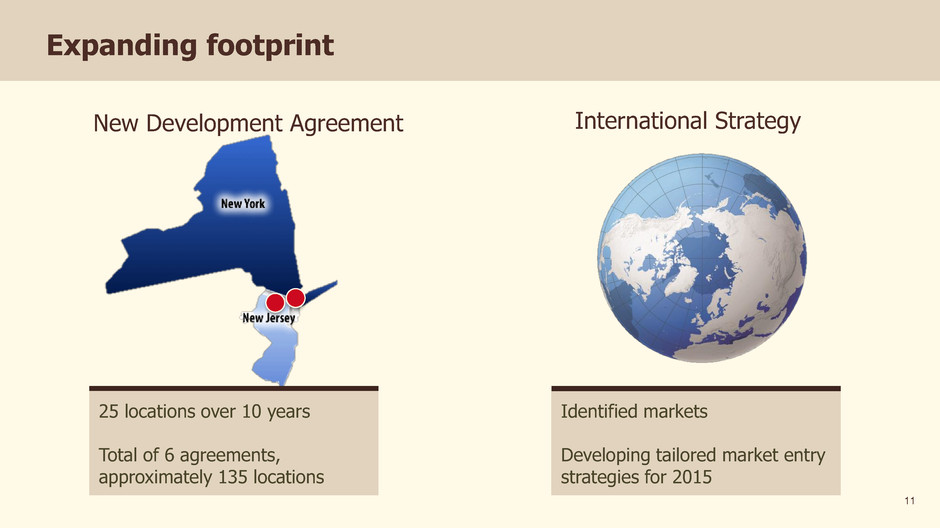

Expanding footprint 11 New Development Agreement International Strategy 25 locations over 10 years Total of 6 agreements, approximately 135 locations Identified markets Developing tailored market entry strategies for 2015

50th Anniversary Owner Convention 12

Cynthia Devine Chief Financial Officer

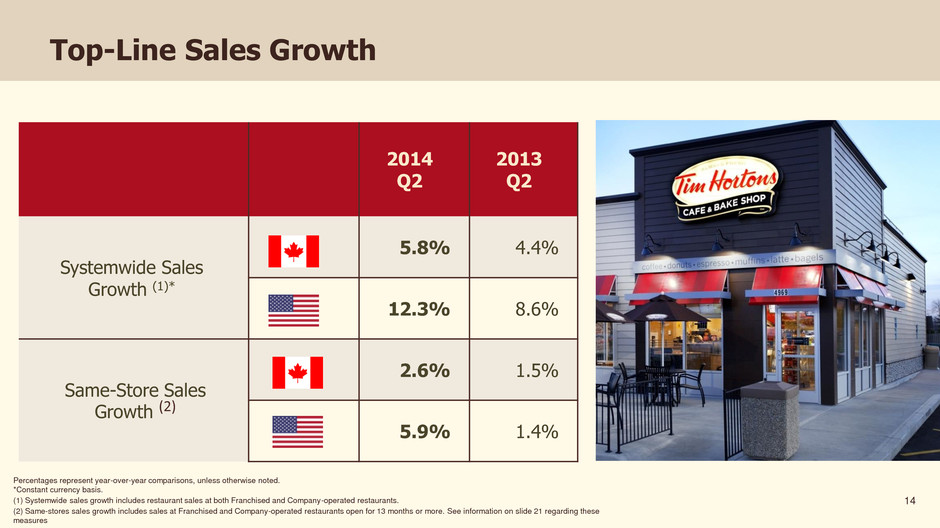

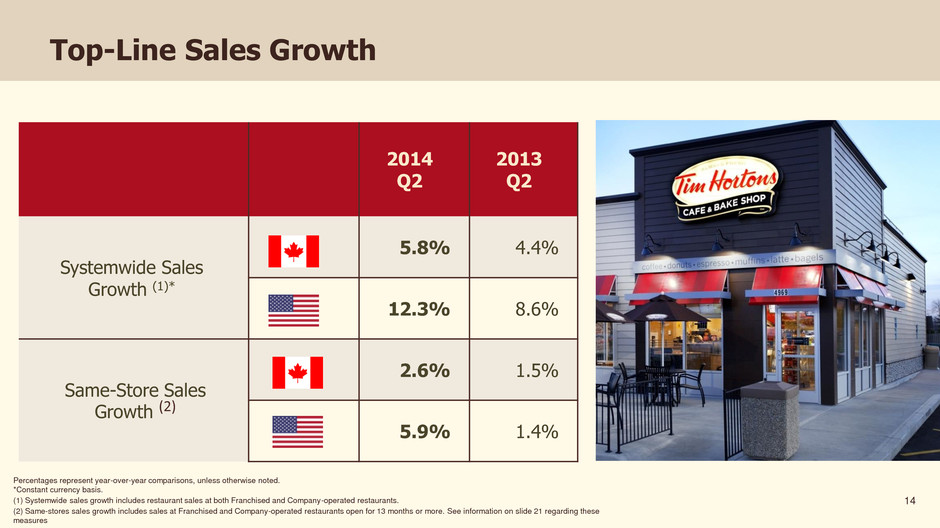

Top-Line Sales Growth 2014 Q2 2013 Q2 Systemwide Sales Growth (1)* 5.8% 4.4% 12.3% 8.6% Same-Store Sales Growth (2) 2.6% 1.5% 5.9% 1.4% Percentages represent year-over-year comparisons, unless otherwise noted. *Constant currency basis. (1) Systemwide sales growth includes restaurant sales at both Franchised and Company-operated restaurants. (2) Same-stores sales growth includes sales at Franchised and Company-operated restaurants open for 13 months or more. See information on slide 21 regarding these measures 14

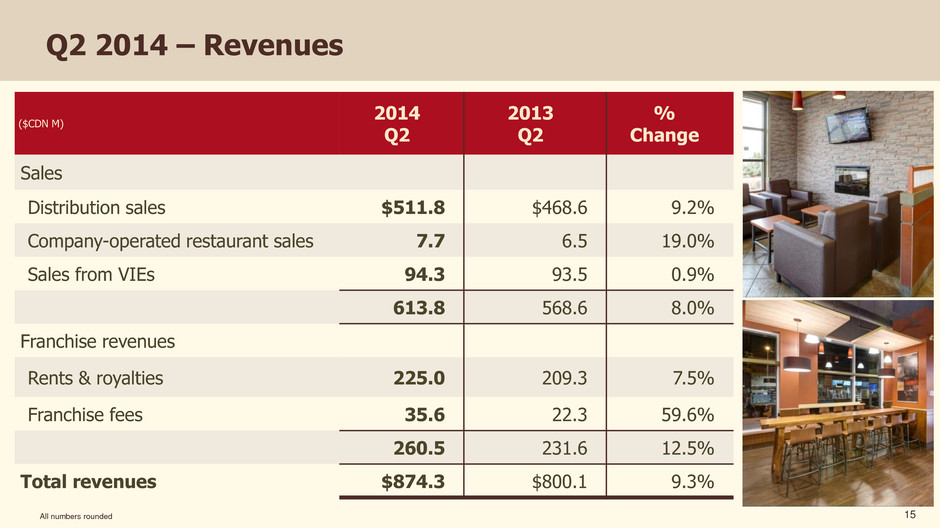

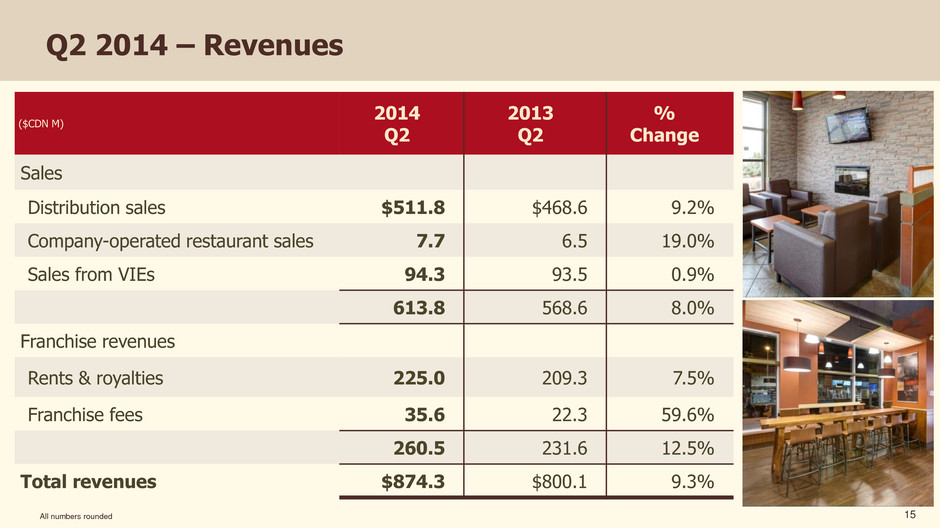

Q2 2014 – Revenues ($CDN M) 2014 Q2 2013 Q2 % Change Sales Distribution sales $511.8 $468.6 9.2% Company-operated restaurant sales 7.7 6.5 19.0% Sales from VIEs 94.3 93.5 0.9% 613.8 568.6 8.0% Franchise revenues Rents & royalties 225.0 209.3 7.5% Franchise fees 35.6 22.3 59.6% 260.5 231.6 12.5% Total revenues $874.3 $800.1 9.3% All numbers rounded 15

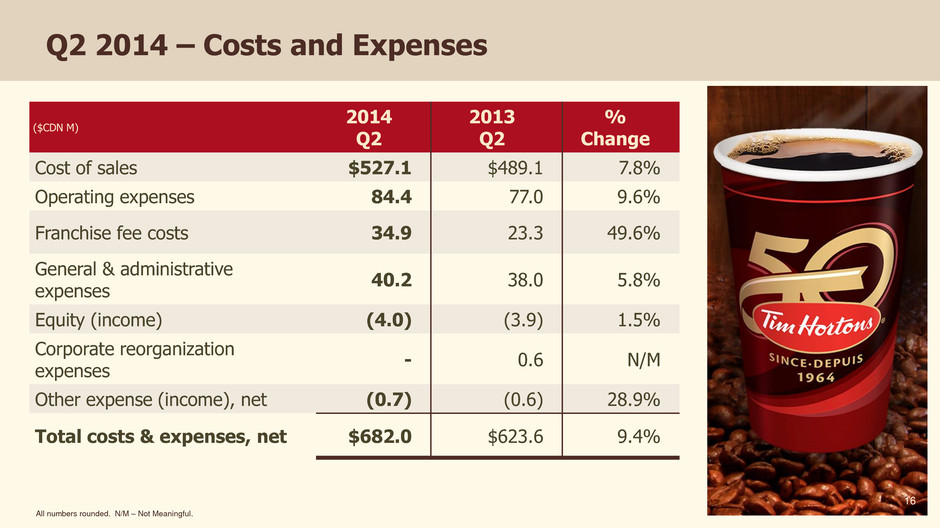

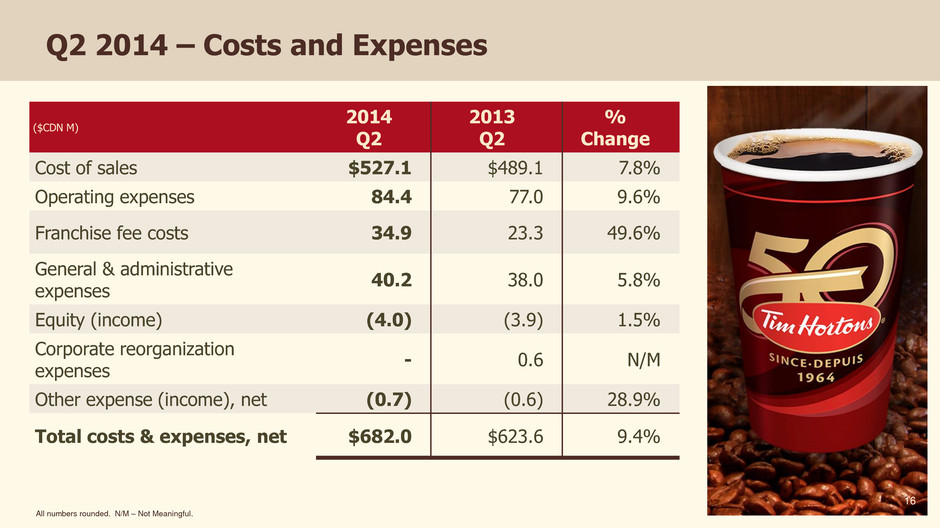

Q2 2014 – Costs and Expenses ($CDN M) 2014 Q2 2013 Q2 % Change Cost of sales $527.1 $489.1 7.8% Operating expenses 84.4 77.0 9.6% Franchise fee costs 34.9 23.3 49.6% General & administrative expenses 40.2 38.0 5.8% Equity (income) (4.0) (3.9) 1.5% Corporate reorganization expenses - 0.6 N/M Other expense (income), net (0.7) (0.6) 28.9% Total costs & expenses, net $682.0 $623.6 9.4% All numbers rounded. N/M – Not Meaningful. 16

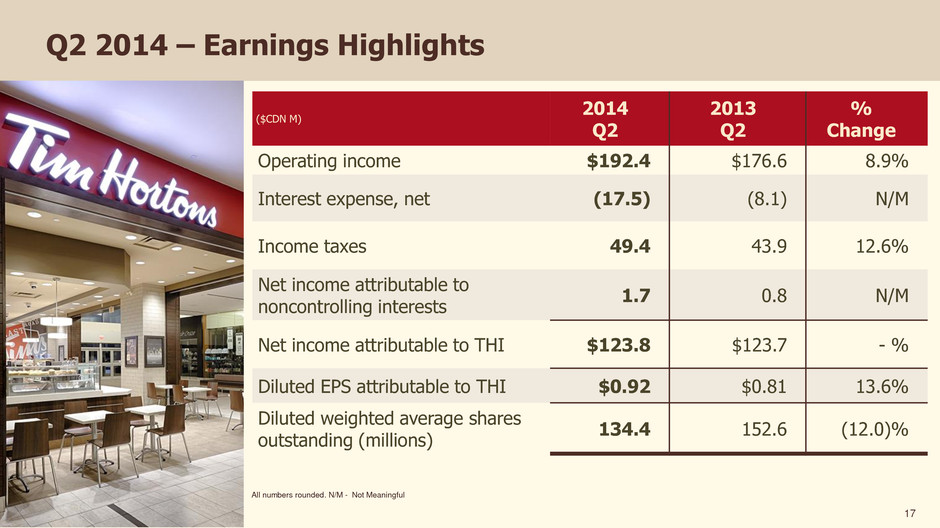

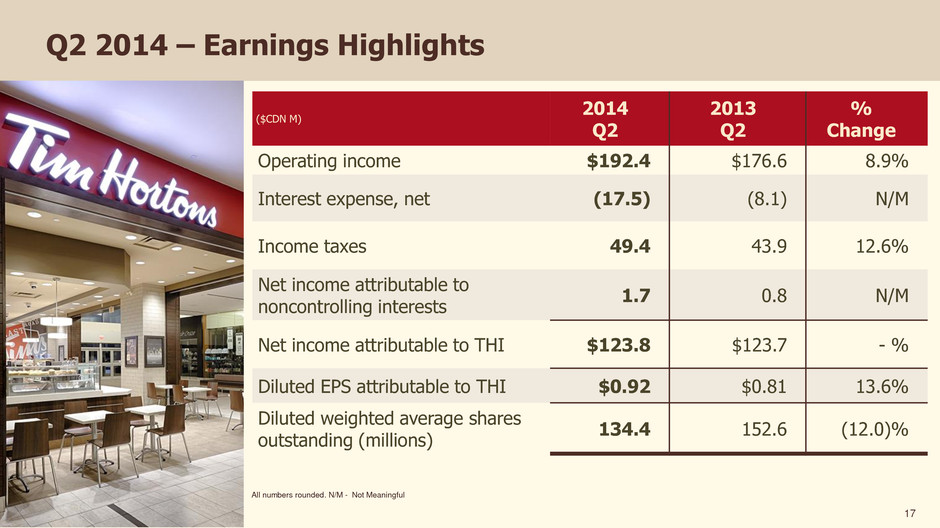

Q2 2014 – Earnings Highlights ($CDN M) 2014 Q2 2013 Q2 % Change Operating income $192.4 $176.6 8.9% Interest expense, net (17.5) (8.1) N/M Income taxes 49.4 43.9 12.6% Net income attributable to noncontrolling interests 1.7 0.8 N/M Net income attributable to THI $123.8 $123.7 - % Diluted EPS attributable to THI $0.92 $0.81 13.6% Diluted weighted average shares outstanding (millions) 134.4 152.6 (12.0)% All numbers rounded. N/M - Not Meaningful 17

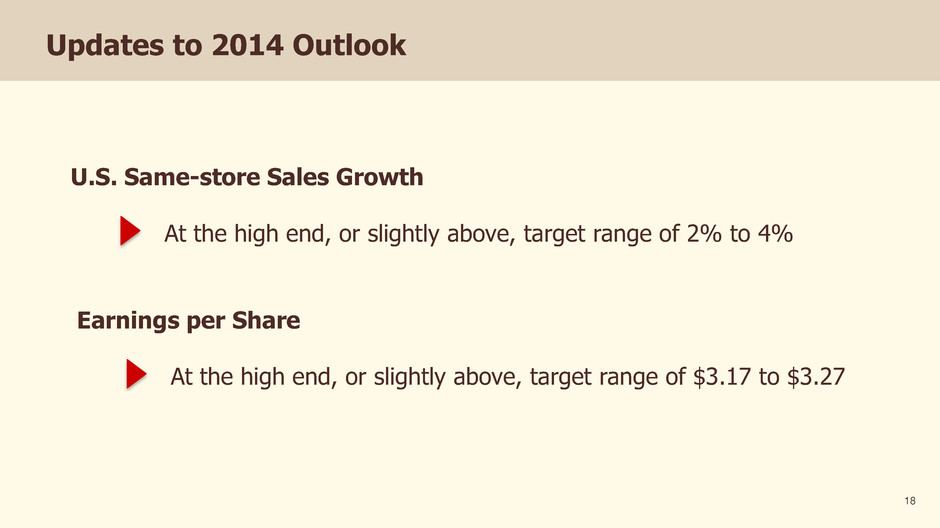

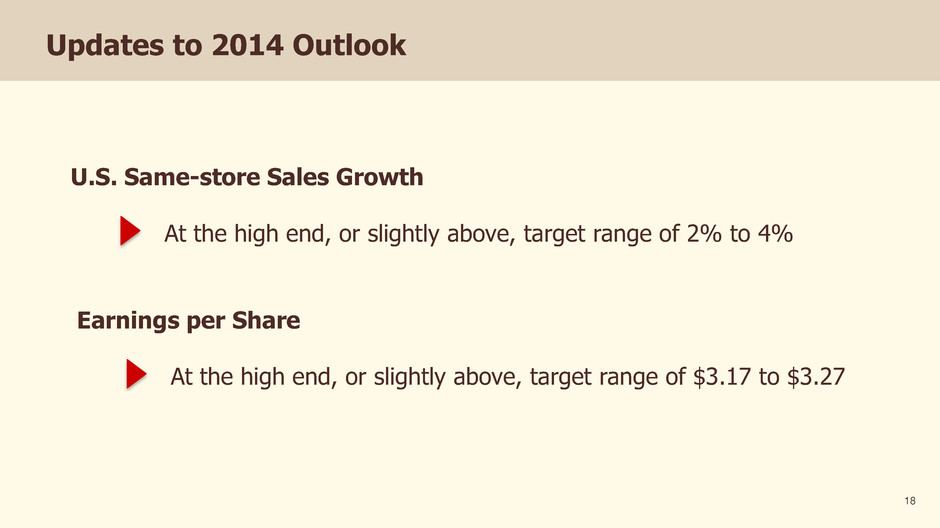

Updates to 2014 Outlook 18 U.S. Same-store Sales Growth At the high end, or slightly above, target range of 2% to 4% Earnings per Share At the high end, or slightly above, target range of $3.17 to $3.27

Q2 2014 – Segment Results ($CDN M) 2014 Q2 2013 Q2 % Change Canada $188.9 $174.8 8.1% U.S. $9.3 $2.6 N/M Corporate Services $(8.0) $(1.4) N/M All numbers rounded. N/M – Not Meaningful. 19

Appendix

Systemwide Sales Growth & Same-store Sales Total systemwide sales growth includes restaurant level sales at both Company-operated and franchised restaurants. Substantially all of our systemwide restaurants were franchised as at June 29, 2014. Systemwide sales growth is determined using a constant exchange rate where noted, to exclude the effects of foreign currency translation. U.S. dollar sales are converted to Canadian dollar amounts using the average exchange rate of the base year for the period covered. For the second quarter of 2014, systemwide sales on a constant currency basis increased 6.5% compared to the second quarter of 2013. Systemwide sales growth in Canadian dollars, including the effects of foreign currency translation, was 7.2% in the second quarter of 2014. Systemwide sales are important to understanding our business performance as they impact our franchise royalties and rental income, as well as our distribution income. Changes in systemwide sales are driven by changes in average same-store sales and changes in the number of systemwide restaurants, and are ultimately driven by consumer demand. We believe systemwide sales and same-store sales growth provide meaningful information to investors regarding the size of our system, the overall health and financial performance of the system, and the strength of our brand and restaurant owner base, which ultimately impacts our consolidated and segmented financial performance. Franchised restaurant sales are not generally included in our Condensed Consolidated Financial Statements (except for certain non-owned restaurants consolidated in accordance with applicable accounting rules). The amount of systemwide sales impacts our rental and royalties revenues, as well as distribution revenues. 21