CODI Investor Day Presentation December 2020

2 Welcome Elias Sabo

3 Today’s Presenters ELIAS SABO Founding Partner & CEO Responsible for directing CODI’s strategy Investment Committee Member Joined The Compass Group in 1998 as one of its founding partners Graduate of Rensselaer Polytechnic Institute RYAN FAULKINGHAM EVP & CFO Responsible for capital raising, accounting and reporting, financial controls, as well as risk assessment Investment Committee Member Joined The Compass Group in 2008 Graduate of Lehigh University and Fordham University PATRICK MACIARIELLO Chief Operating Officer Managing Partner Investment Committee Member Joined The Compass Group in 2005 Graduate of University of Notre Dame and Columbia Business School SHAWN NEVILLE President & CEO, BOA Technology Named CEO in June 2017 Seasoned executive with deep consumer/retail and technology experience at companies including Avery Dennison, Keds Corporation, Footaction USA, Reebok, Visa and Procter & Gamble Graduate of the University of Denver

4 Legal Disclaimer This presentation contains certain forward-looking statements within the meaning of the federal securities laws. These statements may be made a part of this presentation or by reference to other documents we file with the SEC. Some of the forward-looking statements can be identified by the use of forward-looking words. Statements that are not historical in nature, including the words “anticipate,” “may,” “estimate,” “should,” “seek,” “expect,” “plan,” “believe,” “intend,” and similar words, or the negatives of those words, are intended to identify forward-looking statements. Certain statements regarding the following particularly are forward-looking in nature: future financial performance, market forecasts or projections, projected capital expenditures; and our business strategy. All forward-looking statements are based on our management’s beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might cause such a difference include but are not limited to the risks set forth in “Risk Factors” included in our SEC filings. In addition, our discussion may include references to Adjusted EBITDA, EBITDA, cash flow, CAD or other non-GAAP measures. A reconciliation of the most directly comparable GAAP financial measures to such non-GAAP financial measures is included in our annual and quarterly reports in Forms 10-K and 10-Q filed with the SEC as well as the attached Appendix.

5 Today’s Agenda 1 CODI Prepared Remarks — Elias Sabo 2 Subsidiary Update — Pat Maciariello Disciplined Approach and Structural Advantage 3 BOA Technology Presentation — Shawn Neville Transforming CODI’s Portfolio 4 BOA Technology Q&A — Shawn Neville and Elias Sabo Competitive Advantages 5 CODI Financial Review — Ryan Faulkingham Investing in Tomorrow / ESG Initiatives 6 CODI Q&A — Elias Sabo, Ryan Faulkingham & Pat Maciariello 7 Closing Remarks — Elias Sabo

6 Prepared Remarks 6 Elias Sabo

7 CODI BY THE NUMBERS As of 9/30/2020 Provides access to a strategy typically reserved for private equity investors without the barriers to entry CODI is an experienced acquirer, manager and opportunistic divestor of established North American middle-market businesses; currently the portfolio is made up of 6 branded consumer and 4 niche industrial subsidiaries Compass Diversified (NYSE: CODI) Offers Shareholders a Unique Opportunity To Own a Diverse Group of Leading Middle-Market Businesses KEY DIFFERENTIATORS Long-term, Opportunistic Approach through Permanent Capital Base Value Creation Through Sector Expertise Superior Governance and Transparency 1998 FOUNDEDIPO in 2006 $6.4B+ AGGREGATE TRANSACTIONS21 Platforms & 27 Add-Ons $1.1B+ REALIZED GAINS SINCE IPO11 Divestitures To Date $2.5B ASSETS MANAGED10 Current Platforms ~$500M DRY POWDER Permanent Capital Base Pro forma for BOA Deal

8 Disciplined Approach and Structural Advantage in Action CODI’s permanent capital structure provides a competitive advantage throughout the entire lifecycle of an asset from sourcing to exit and through various economic cycles Our actions over the past two years demonstrate the effectiveness of this strategy: Generated tangible, sustained value for shareholders by selling two businesses opportunistically for sizeable gains Used proceeds to repay debt and strengthen balance sheet Permanent capital structure and strong balance sheet allowed CODI to move forward with the acquisitions of Marucci Sports and BOA Technology CODI IS POSITIONED TO DELIVER REGARDLESS OF ECONOMIC CLIMATE • If economic expansion — ten subsidiaries producing strong Cash Flow which on an annualized basis is expected to exceed distribution; poised to grow in economic expansion • If economic downturn — Cash Flow from existing subsidiaries expected to decline, however offset by $500mm in available capital to deploy into acquisitions at attractive prices

9 Transforming CODI’s Portfolio THE COMPOSITION OF CODI’S PORTFOLIO HAS CHANGED SIGNIFICANTLY OVER THE PAST TWO YEARS • Capitalized on market conditions in 2019 to divest two companies at strong valuations • Leveraged current market dislocation to acquire two best-in-class consumer businesses in 2020 AS A RESULT OF THESE STRATEGIC MOVES, THE CODI PORTFOLIO HAS: • Achieved a faster core growth rate • Added two highly aspirational, rapidly growing consumer businesses • Achieved a multiple arbitrage, netting roughly $100mm in added capital while retaining essentially the same cash flow to holdings ON A PRO FORMA BASIS, INCREASED BRANDED CONSUMER EBITDA CONCENTRATION TO OVER HALF THE PORTFOLIO • Branded consumer EBITDA growing YOY despite COVID

10 CODI Capital Allocation Clean Earth (LTM 6/30/19) Manitoba Harvest (FY 2018) Total Divested BOA (estimated FY 2019) Marucci (estimated FY 2019) BOA + Marucci (estimated FY 2019) EBITDA $42 $5 $47 $30 $14 $44 CapEx $11 $0 $11 $4 $1 $5 Cash Taxes $1 $0 $1 $5 $0 $5 Cash Flow to CODI1 $30 $5 $35 $21 $13 $34 Net sale/acq. proceeds $508 $203 $711 $400 $190 $590 1 Cash flow before CODI level expenses such as management fees, interest expense and corporate expense

11 Clear Alignment with Investors Benefits to Owning a Family of Uncorrelated Subsidiaries Permanent Capital is Strategic Capital Actively Manage Subsidiaries for the Long Term • Opportunistic in capital deployment • Enables long-term approach • “Eliminates” traditional PE investment horizon pressure • Lower cost of capital versus financing each company separately • Defensive positioning • Professionalization at scale • Diversity of subsidiaries provides consistency in earnings and cash flow Competitive Advantages — How We Win CODI’s core principles — which have differentiated our business for nearly 15 years — have never been more relevant or produced stronger results for shareholders 1 2 • Compensation structure aligns interest of shareholders and management team and allows for recruitment of top-level talent • Transparency / regular reporting • History of waiving management fees when appropriate • Significant and growing ownership of CODI shares by Manager partners and employees 3 4 • Business builders rather than asset traders • Permanent capital available to invest in businesses to drive long term value creation: • Build management teams • Invest in lasting infrastructure • Organic growth and add-on acquisitions

12 The Permanent Capital Advantage Certainty of financing and speed of closure Enables a conservative, low leverage approach Invest in businesses to drive long term value creation Ability to hold subsidiaries until divestiture optimizes outcome for shareholders Traditional private equity players are pressured to transact in a market characterized by rich valuations, abundant credit and fund life-related pressures With no pre-defined investment periods to drive our strategy, we can remain patient and disciplined in our approach to capital deployment and avoid the “moral hazard” faced by other private equity managers From sourcing to exit, this permanent capital approach allows our team to be opportunistic and patient in acquiring, actively managing and opportunistically divesting leading middle market businesses

13 Strategic Acquisitions Active Management Opportunistic Divestitures1 2 3 • Decentralized, regional business development efforts • Balance sheet provides certainty of financing and speed of closure • Permanent capital avoids “moral hazard” faced by private equity managers operating under a fixed fund life • Approach and model is attractive to management teams • Business builders rather than asset traders • Focus on a few core areas that we believe translate into the highest value creation for our shareholders, including: • Creating a culture of accountability; • Supporting our subsidiary management - enhancing talent and depth if needed; • Investing in infrastructure and systems; and • Enhancing strategic positioning through add-on acquisitions and growth capex. • Flexible model optimizes and prioritizes outcomes for all stakeholders • Strong industry relationships • Diverse range of exit strategies — have generated realized gains in excess of $1 billion CODI in Action — Active Management Permanent capital structure drives value at every stage of investment as CODI leverages its sector expertise and superior governance and transparency to build businesses for the long-term

14 Management Team Alignment Compared to both publicly-traded peers and market indices, CODI has consistently generated superior returns through its culture of transparency, alignment and accountability TOTAL RETURN FROM MAY 16, 2006 THROUGH DECEMBER 3, 2020 381.3% 259.4% 214.2% 46.9% CODI S&P 500 Russell 2000 XLF • Significant and growing ownership of CODI shares by partners and employees • Acquired approximately $4 million of stock using after-tax proceeds over the past 2 years • History of waiving management fees when appropriate • Approximately $20 million waived over the past 2 years • Compensation structure aligns interest of shareholders and management team and allows for recruitment of top-level talent • Added new MD of Business Development and hired 2 additional investment professionals • Best in class governance structure • Board remains majority independent and separated the roles of the Chairman and CEO

15 Diversity producing consistent cash flow and earnings Note: References to Adjusted EBITDA includes Pro Forma information for Marucci and BOA. SEPTEMBER 30, 2020 TTM REVENUES AND SUBSIDIARY PRO FORMA ADJUSTED EBITDA OF $1.6B AND $284M, RESPECTIVELY Subsidiary Pro Forma Adjusted EBITDA DIVERSIFIED CASH FLOWS FROM 10 SUBSIDIARIES • 4 niche industrial subsidiaries representing 42% of Revenues and 44% of Adjusted EBITDA • 6 branded consumer subsidiaries representing 58% of Revenues and 56% of Adjusted EBITDA DIVERSIFIED CUSTOMER BASE • 10 subsidiaries in diverse industry segments reduce customer concentration risk 6.1% 6.0% 4.1% 18.2% 10.8% 10.9% 9.8% 10.0% 4.1% 20.0% Ergobaby Liberty Pro Forma Marucci 5.11 Tactical Velocity Outdoor Pro Forma BOA Foam Fabricators Advanced Circuits Arnold Sterno

16 PILLARS OF OUR STRATEGY Commitment to ESG Our mission is to deliver superior investment results while mitigating risk and conducting our business in a socially responsible and ethical manner ESG is embedded in all aspects of our investment process from the original investment selection, to the subsequent value creation and eventual divestiture with a goal of continuous improvement Our long-term approach, deep expertise and commitment to sustainability are critical to ensuring we are a trusted partner to our subsidiary companies “Everlove” buyback and resale program benefits families and the planet by extending the use of Ergobaby carriers Going greener through its commitment to reducing the company’s carbon footprint Made recent investments in LEED-certified facility and sophisticated water reclamation system First industry player to introduce BioEPS®, a packaging solution that is 100% sustainable, recyclable, biodegradable and reusable Committed to sourcing timber from sustainable forests/establishing an end-of-life, recycling program INVESTING RESPONSIBLY ATTRACTING, RETAINING AND DEVELOPING THE BEST PROFESSIONALS ENGAGING WITH OUR LOCAL COMMUNITIES

17 Subsidiary Update Pat Maciariello

18 Subsidiary Snapshot ($ millions) Subsidiaries Year Acquired TTM 09/30/20(1) Revenue Adj. EBITDA Adj. EBITDA Margin 2006 $91 $28 31% 2012 $106 $12 11% 2018 $117 $27 23% 2014 $364 $57 16% Total Niche Industrial: $678 $124 18% 2020 $106 $31 29% 2010 $81 $17 21% 2010 $109 $17 16% 2020 $67 $12 18% 2017 $189 $31 16% 2016 $391 $52 13% Total Branded Consumer: $943 $160 17% Consolidated: $1,621 $284 18% 1. Revenue, Adj. EBITDA, Capex shown pro forma for acquisition of Marucci and BOA. 2. Subsidiary Adj. EBITDA does not include ~$14million of corporate expenses. See IR website at www.compassdiversified.com

19 ACQUIRED $454mm COMPETITIVE STRENGTHS • Disruptive, innovative and high-quality products • Large addressable market • Broad intellectual property position PURCHASE PRICE October 16, 2020 INDUSTRY Designer and marketer of dial-based closure systems that deliver performance fit across footwear, headwear and medical bracing products COMPASS VALUE ADDED Working with Management to penetrate new product categories and geographies, and drive new product development initiatives Minority cash investment: $61.5mm

20 Financial Review Ryan Faulkingham

21 Pro-Forma Balance Sheet — Summary Items (000,000’s) September 30, 2020 Summary of BOA Acquisition Pro-Forma September 30, 2020 Current Assets: Cash and cash equivalents $177 ($100) $77 Other current assets $624 — $624 Total current assets $801 (100) $701 Property, plant and equipment $155 — $155 Goodwill, intangibles and other assets $1,236 $460 $1,696 Total assets $2,192 $360 $2,552 Current Liabilities: Revolver — $300 $300 Other current liabilities $284 — $284 Total current liabilities $284 $300 $584 Senior Secured Notes $592 — $592 Other liabilities $125 — $125 Total liabilities $1,001 $300 $1,301 Stockholders’ Equity: Preferred equity (Series A, B and C) $304 — $304 Common Equity $1,009 — $1,009 Other Equity $(122) $60 $(62) Total stockholders’ equity $1,191 $60 $1,251 Total liabilities and stockholders’ equity $2,192 $360 $2,552 Pro Forma Subsidiary Adjusted EBITDA $253 $31 $284 Leverage Ratio 1.83 : 1.00 ~3.20 : 1.00

22 History of Successfully Deleveraging CODI has a demonstrated history of paying down its debt and is committed to staying conservatively levered 3.2x 3.0x 2.1x 1.8x 2.4x 2.9x 2.5x 2.6x 2.8x 3x 3.5x 3.5x 3.9x 3.9x 3.6x 1.9x 1.9x 1.4x 1.75x 1.9x 1.83 ~3.2x Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sept-20 Oct - 20 Reported Leverage at Quarter End Leverage at Time of Acquisition Decreased Leverage Estimated Divestitures Add-ons of HOCI, NII, Tula, Phoenix, & EWS Proceeds from $48MM FOXF Secondary Proceeds from $63MM FOXF Secondary $136MM FOXF Secondary $100MM Preferred Offering $100MM Preferred Offering $115MM Preferred Offering $88MM CODI Secondary 1.7x Acquisition Divestitures Ravin Add-on $72MM FOXF Secondary & $100MM CODI Secondary 3.7x 2.5x 3.0x 3.7x Acquisition

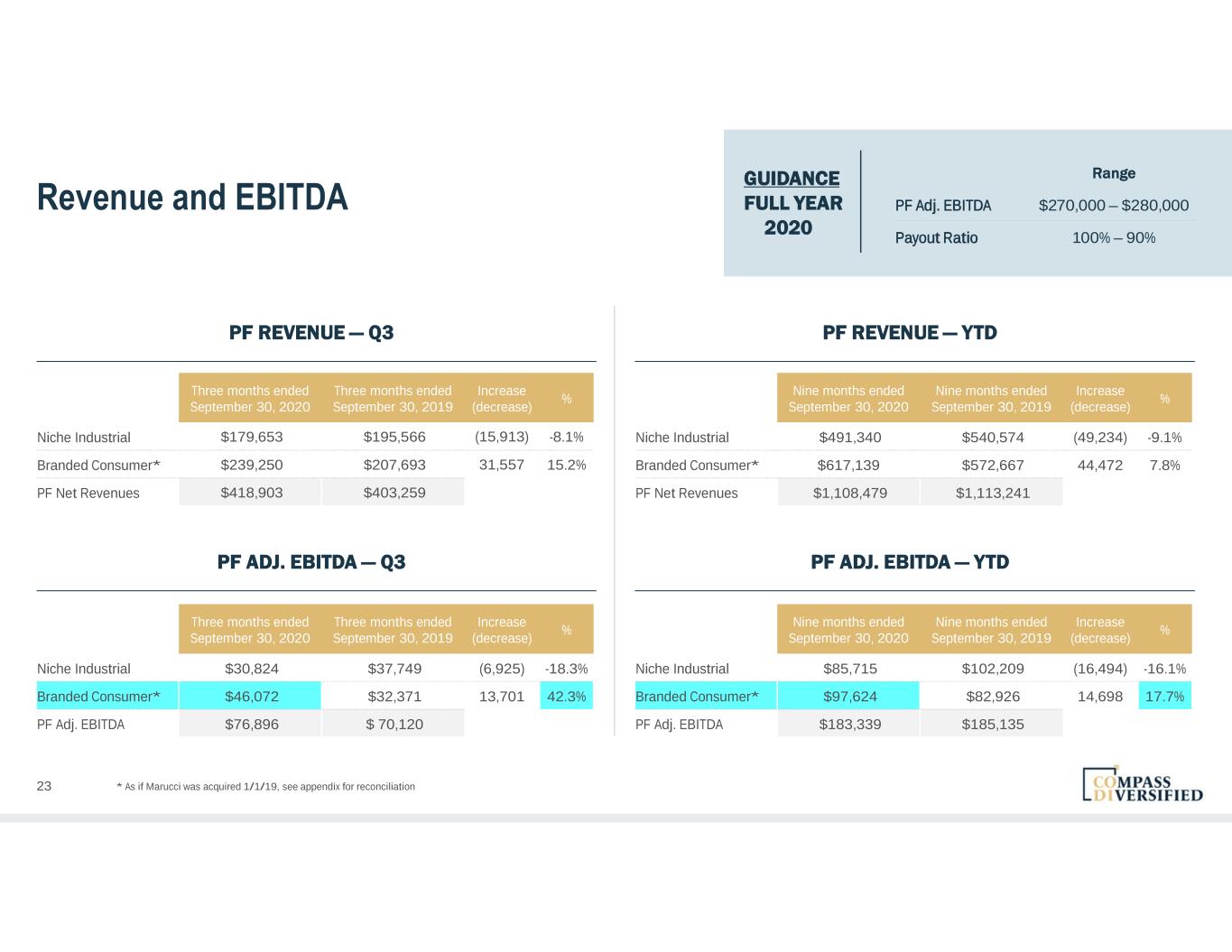

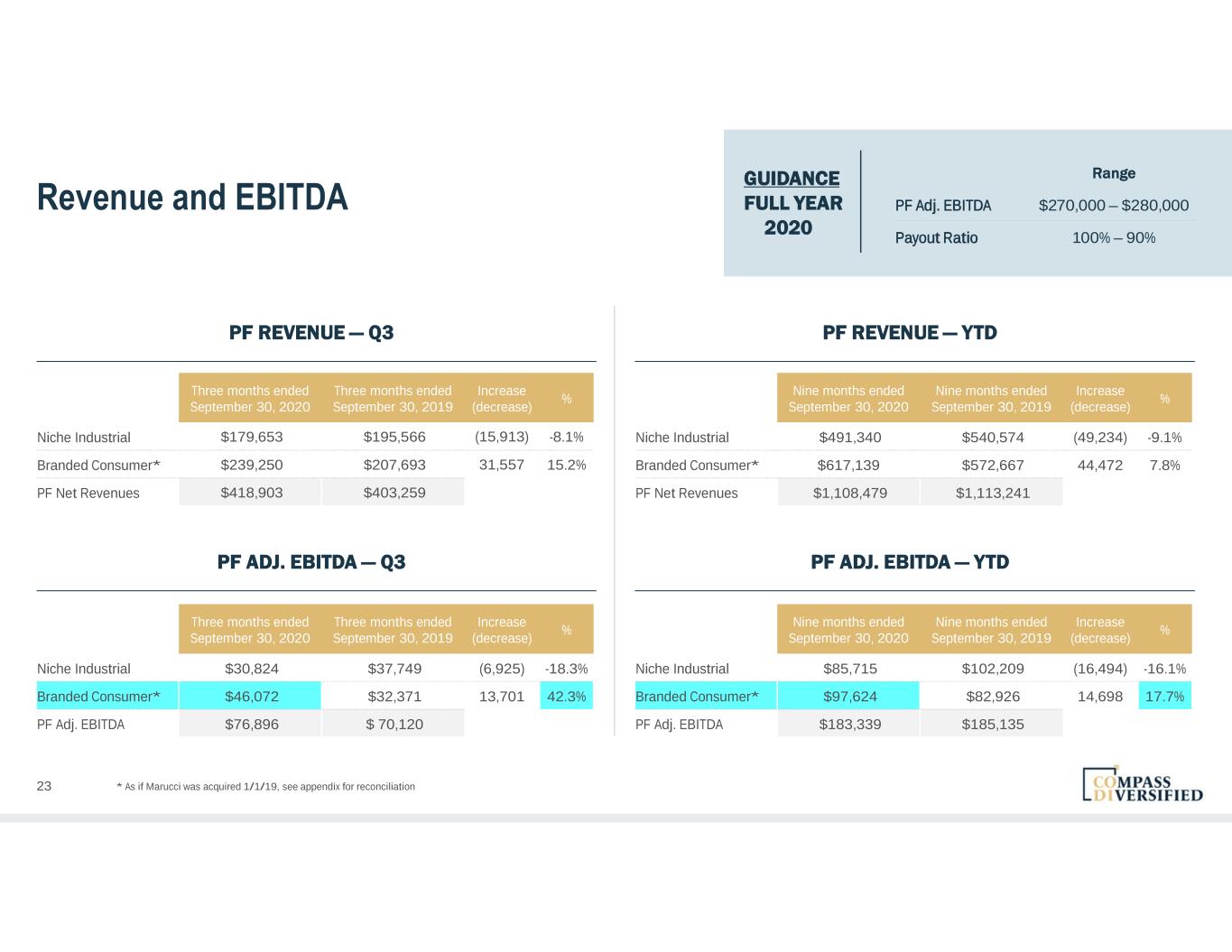

23 Revenue and EBITDA * As if Marucci was acquired 1/1/19, see appendix for reconciliation GUIDANCE FULL YEAR 2020 Range PF Adj. EBITDA $270,000 – $280,000 Payout Ratio 100% – 90% PF REVENUE — Q3 PF REVENUE — YTD PF ADJ. EBITDA — Q3 PF ADJ. EBITDA — YTD Three months ended September 30, 2020 Three months ended September 30, 2019 Increase (decrease) % Niche Industrial $30,824 $37,749 (6,925) -18.3% Branded Consumer* $46,072 $32,371 13,701 42.3% PF Adj. EBITDA $76,896 $ 70,120 Nine months ended September 30, 2020 Nine months ended September 30, 2019 Increase (decrease) % Niche Industrial $491,340 $540,574 (49,234) -9.1% Branded Consumer* $617,139 $572,667 44,472 7.8% PF Net Revenues $1,108,479 $1,113,241 Nine months ended September 30, 2020 Nine months ended September 30, 2019 Increase (decrease) % Niche Industrial $85,715 $102,209 (16,494) -16.1% Branded Consumer* $97,624 $82,926 14,698 17.7% PF Adj. EBITDA $183,339 $185,135 Three months ended September 30, 2020 Three months ended September 30, 2019 Increase (decrease) % Niche Industrial $179,653 $195,566 (15,913) -8.1% Branded Consumer* $239,250 $207,693 31,557 15.2% PF Net Revenues $418,903 $403,259

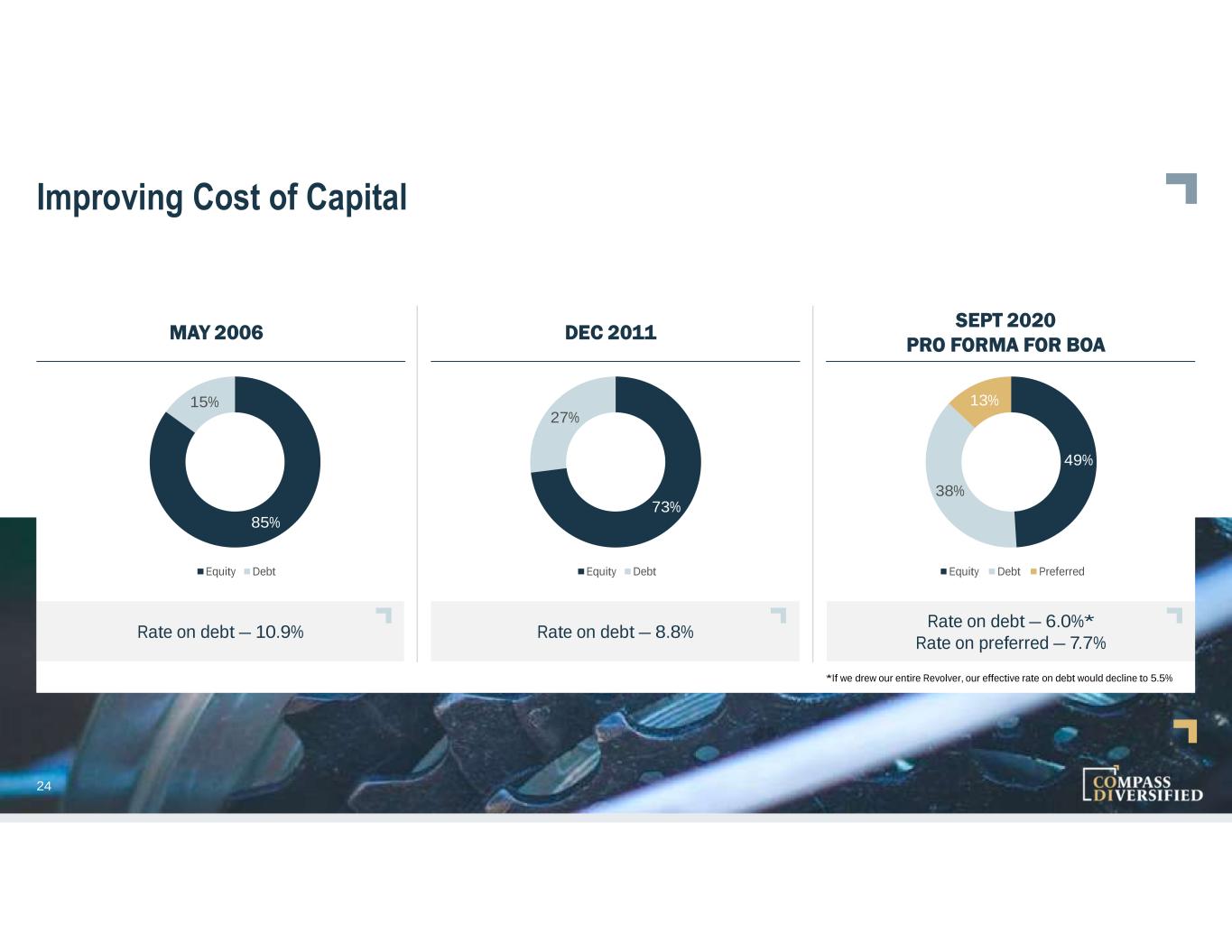

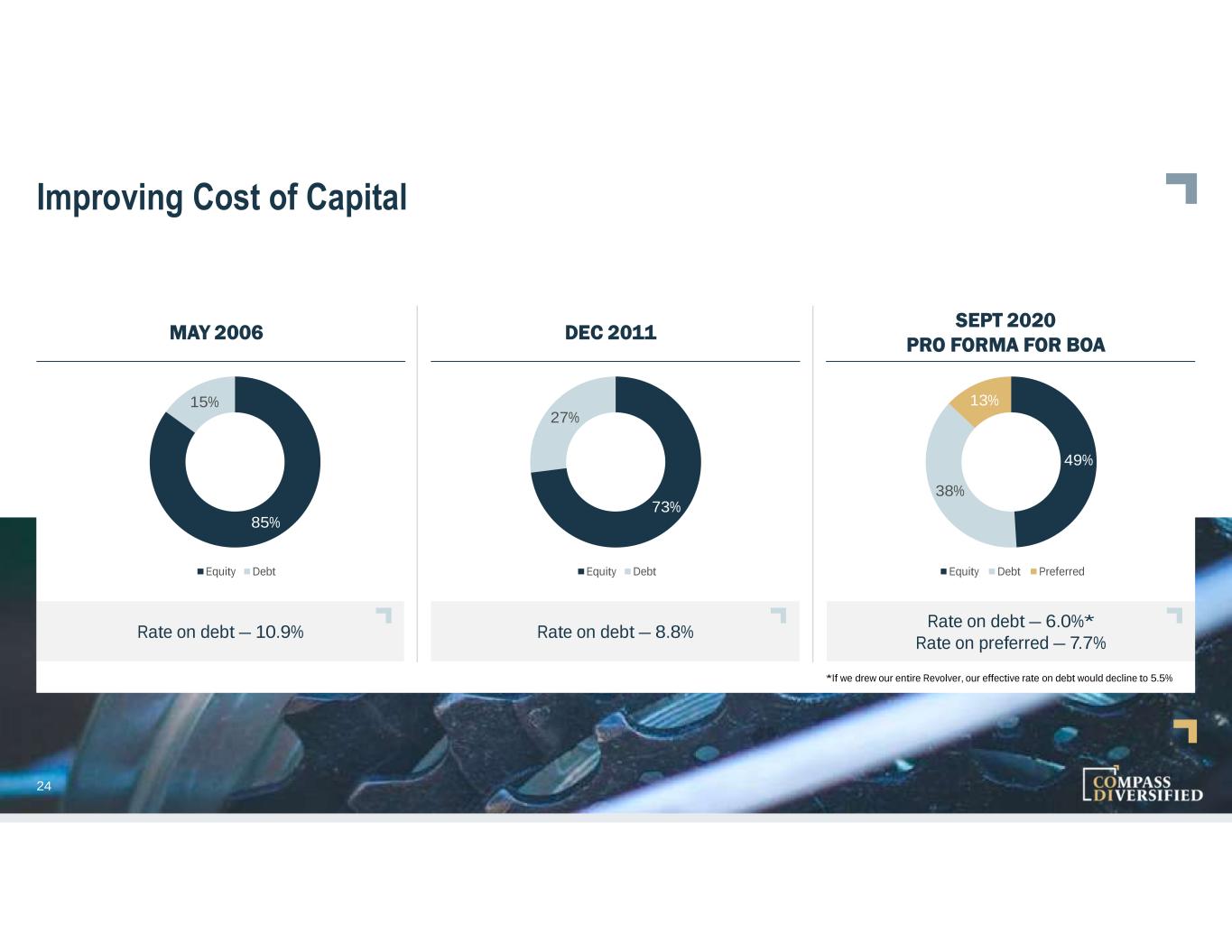

24 Improving Cost of Capital MAY 2006 DEC 2011 SEPT 2020 PRO FORMA FOR BOA Rate on debt — 6.0%* Rate on preferred — 7.7% Rate on debt — 8.8%Rate on debt — 10.9% 85% 15% Equity Debt 73% 27% Equity Debt 49% 38% 13% Equity Debt Preferred *If we drew our entire Revolver, our effective rate on debt would decline to 5.5%

25 Closing Remarks Elias Sabo

26 Strategy for 2021 and Beyond COMPELLING OPPORTUNITIES FOR CODI TO GENERATE LONG TERM SHAREHOLDER VALUE DURING MARKET DISLOCATIONS LIKE WE ARE CURRENTLY EXPERIENCING Executing on proven and disciplined acquisition strategy Improving the operating performance of our companies Opportunistically divesting Enhancing our commitment to ESG initiatives across our portfolio Our subsidiaries are leaders in their respective industries and are poised to gain additional market share in the months and years to come We are committed to taking a long-term perspective in building these businesses through strategic investments in people, processes and infrastructure Key differentiators have positioned us to not only weather the storm brought on by COVID-19, but also to proactively execute on our growth strategy: Capital allocation Unique permanent capital structure Active management style Diverse group of subsidiaries 3 4 1 2

Appendix

28 Current Subsidiaries

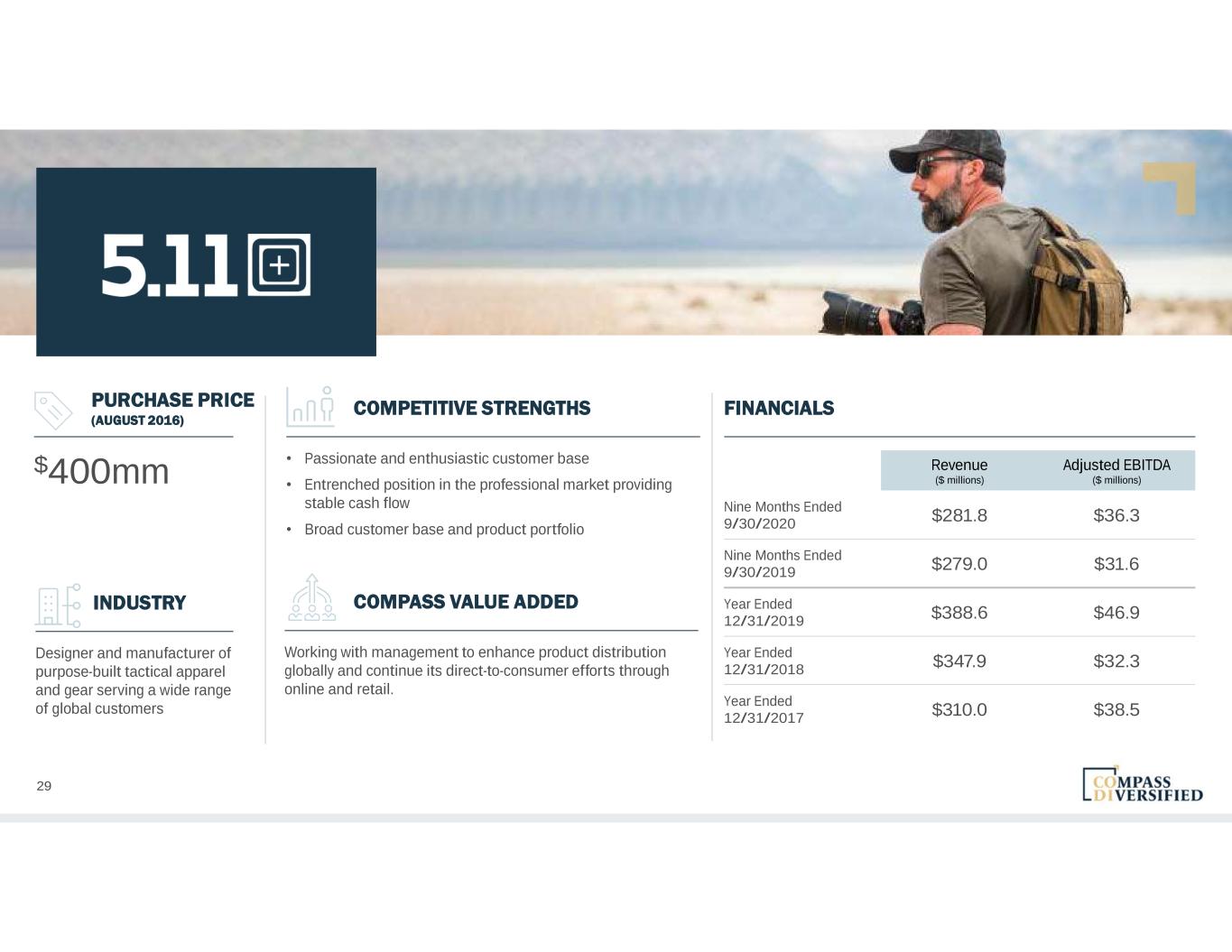

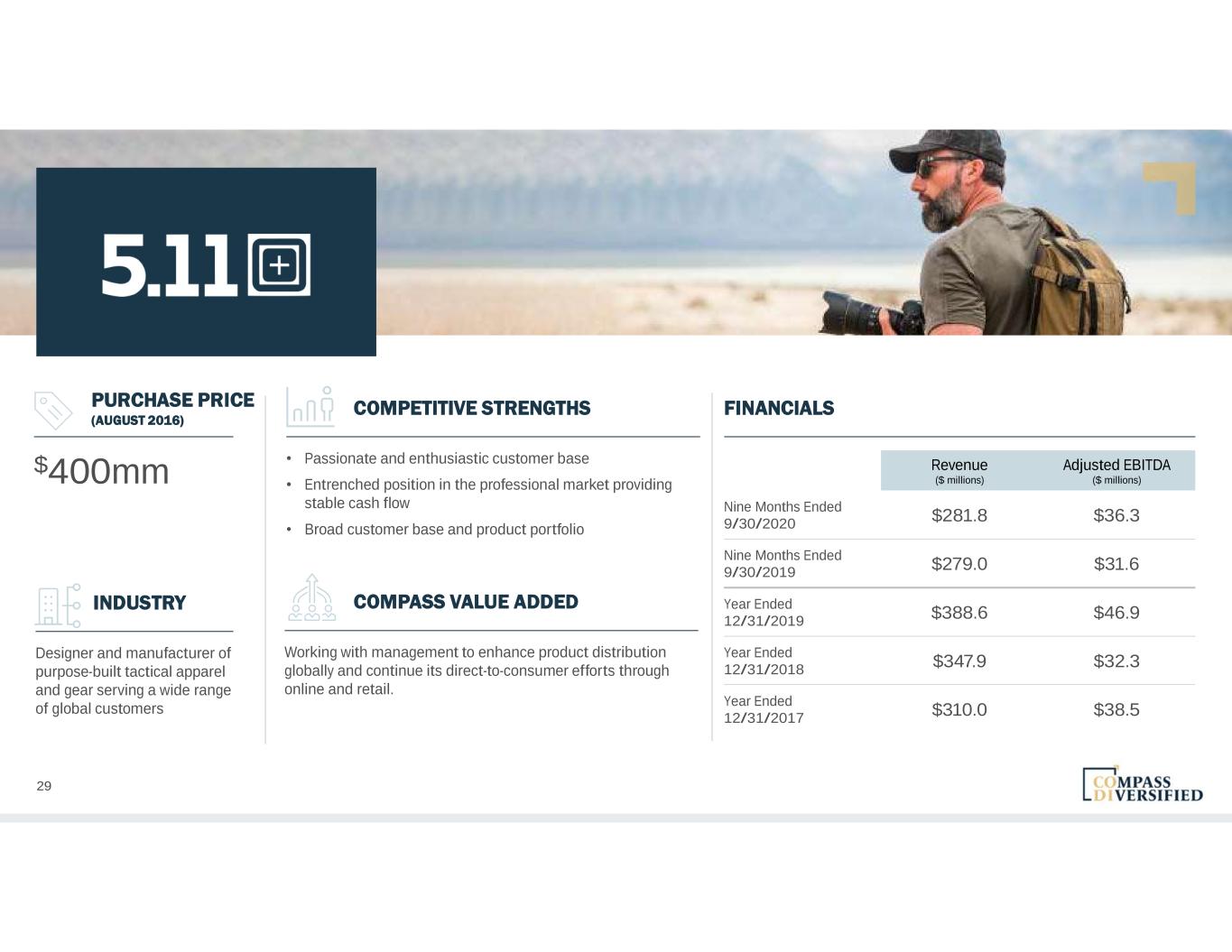

29 PURCHASE PRICE (AUGUST 2016) $400mm Revenue($ millions) Adjusted EBITDA($ millions) Nine Months Ended 9/30/2020 $281.8 $36.3 Nine Months Ended 9/30/2019 $279.0 $31.6 Year Ended 12/31/2019 $388.6 $46.9 Year Ended 12/31/2018 $347.9 $32.3 Year Ended 12/31/2017 $310.0 $38.5 FINANCIALSCOMPETITIVE STRENGTHS • Passionate and enthusiastic customer base • Entrenched position in the professional market providing stable cash flow • Broad customer base and product portfolio INDUSTRY Designer and manufacturer of purpose-built tactical apparel and gear serving a wide range of global customers COMPASS VALUE ADDED Working with management to enhance product distribution globally and continue its direct-to-consumer efforts through online and retail.

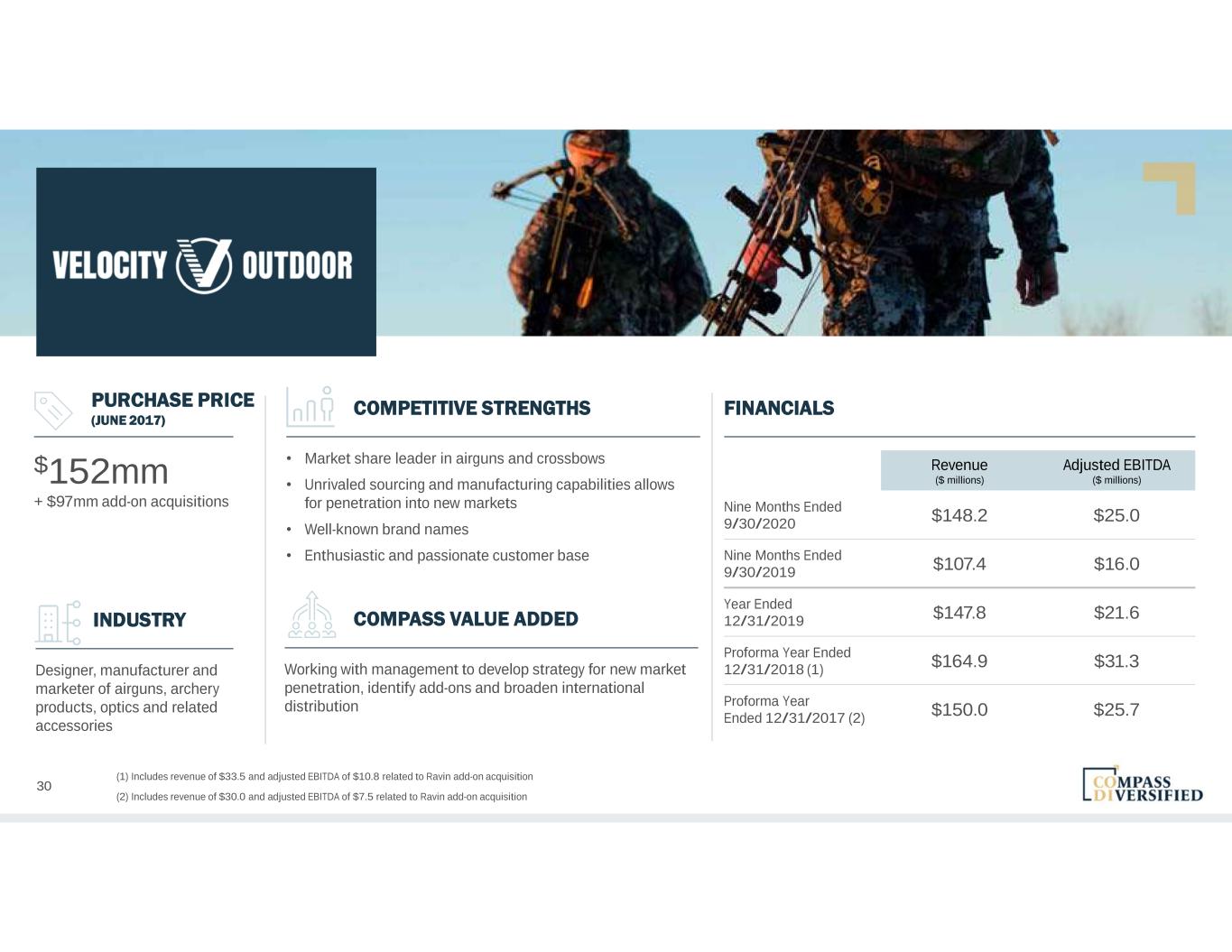

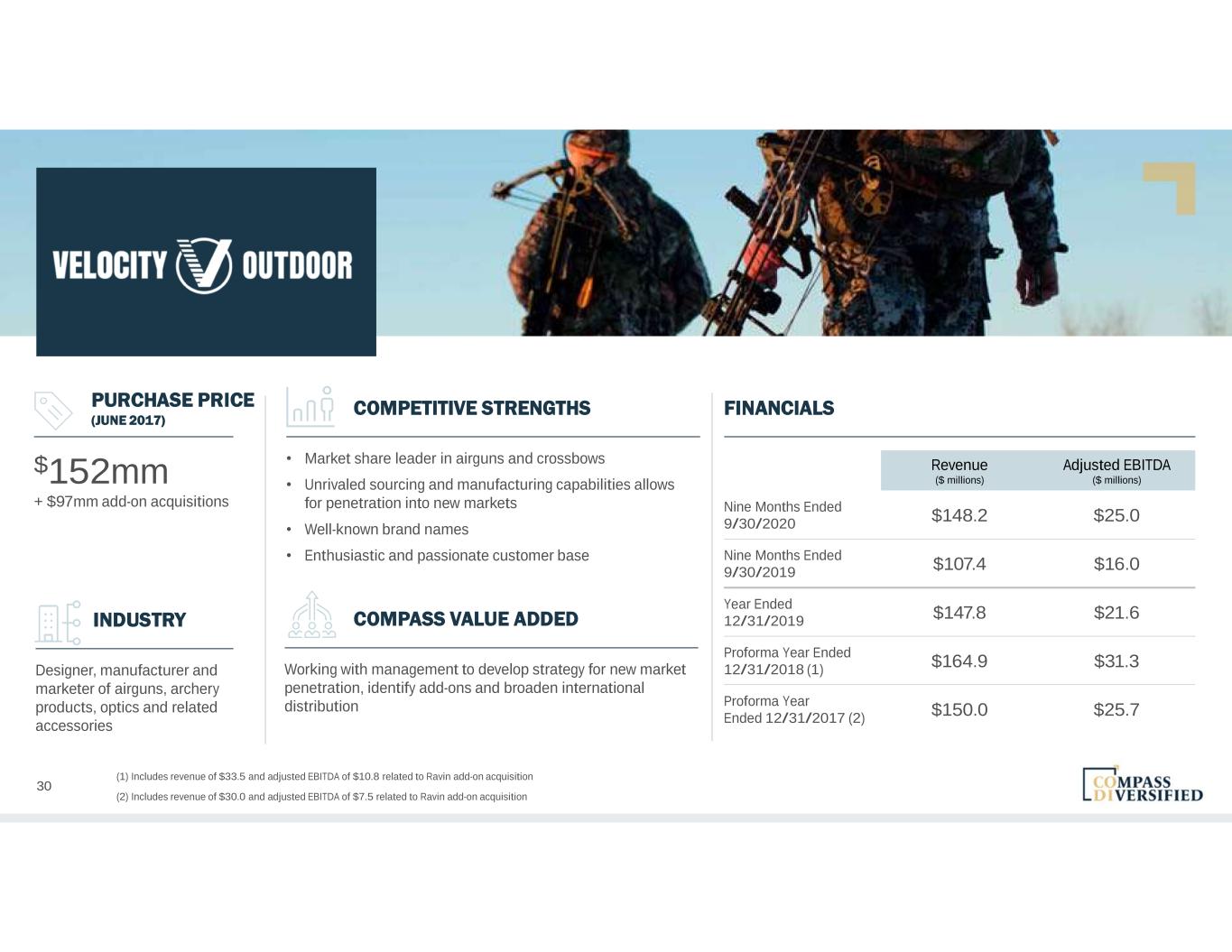

30 PURCHASE PRICE (JUNE 2017) $152mm + $97mm add-on acquisitions (1) Includes revenue of $33.5 and adjusted EBITDA of $10.8 related to Ravin add-on acquisition (2) Includes revenue of $30.0 and adjusted EBITDA of $7.5 related to Ravin add-on acquisition Revenue ($ millions) Adjusted EBITDA ($ millions) Nine Months Ended 9/30/2020 $148.2 $25.0 Nine Months Ended 9/30/2019 $107.4 $16.0 Year Ended 12/31/2019 $147.8 $21.6 Proforma Year Ended 12/31/2018 (1) $164.9 $31.3 Proforma Year Ended 12/31/2017 (2) $150.0 $25.7 FINANCIALSCOMPETITIVE STRENGTHS • Market share leader in airguns and crossbows • Unrivaled sourcing and manufacturing capabilities allows for penetration into new markets • Well-known brand names • Enthusiastic and passionate customer base INDUSTRY Designer, manufacturer and marketer of airguns, archery products, optics and related accessories COMPASS VALUE ADDED Working with management to develop strategy for new market penetration, identify add-ons and broaden international distribution

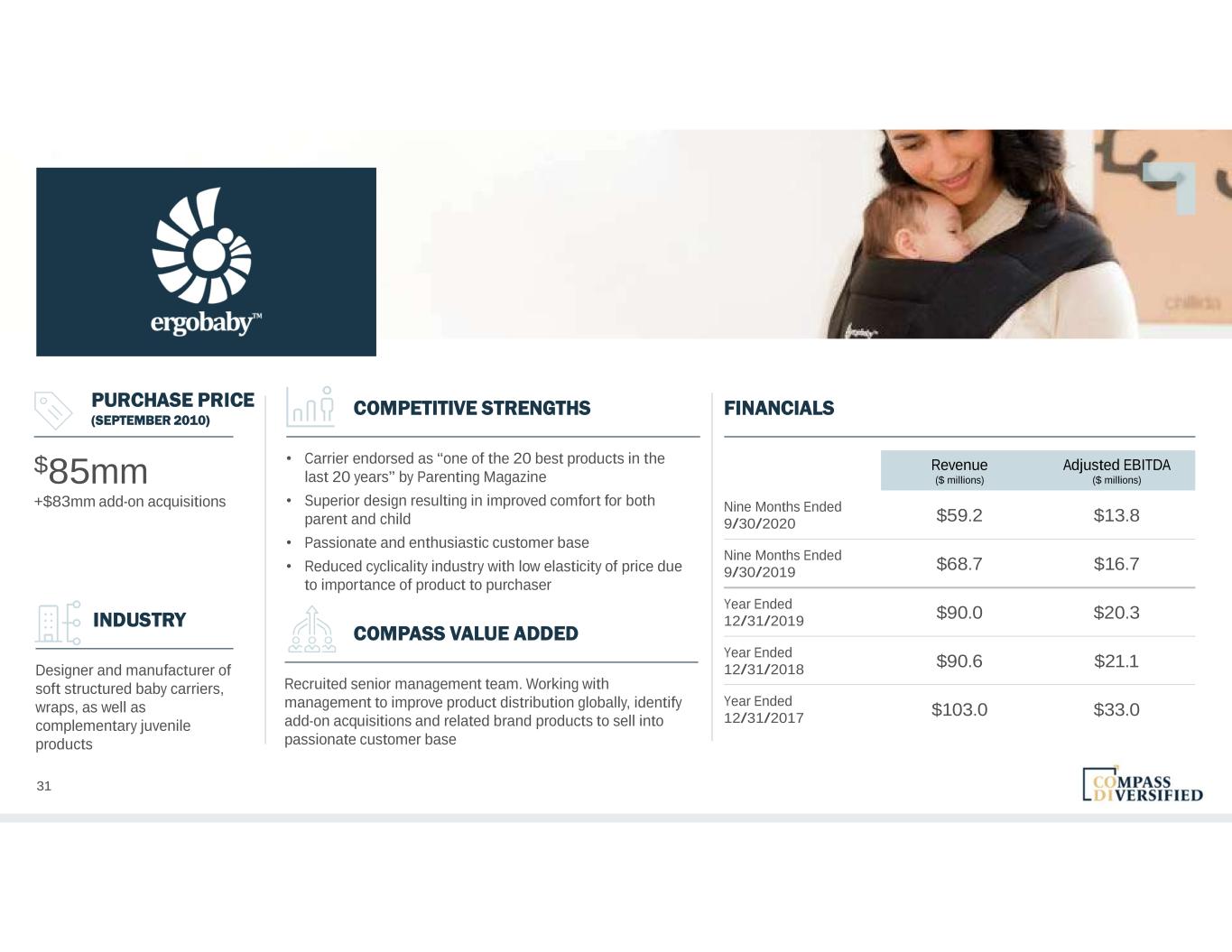

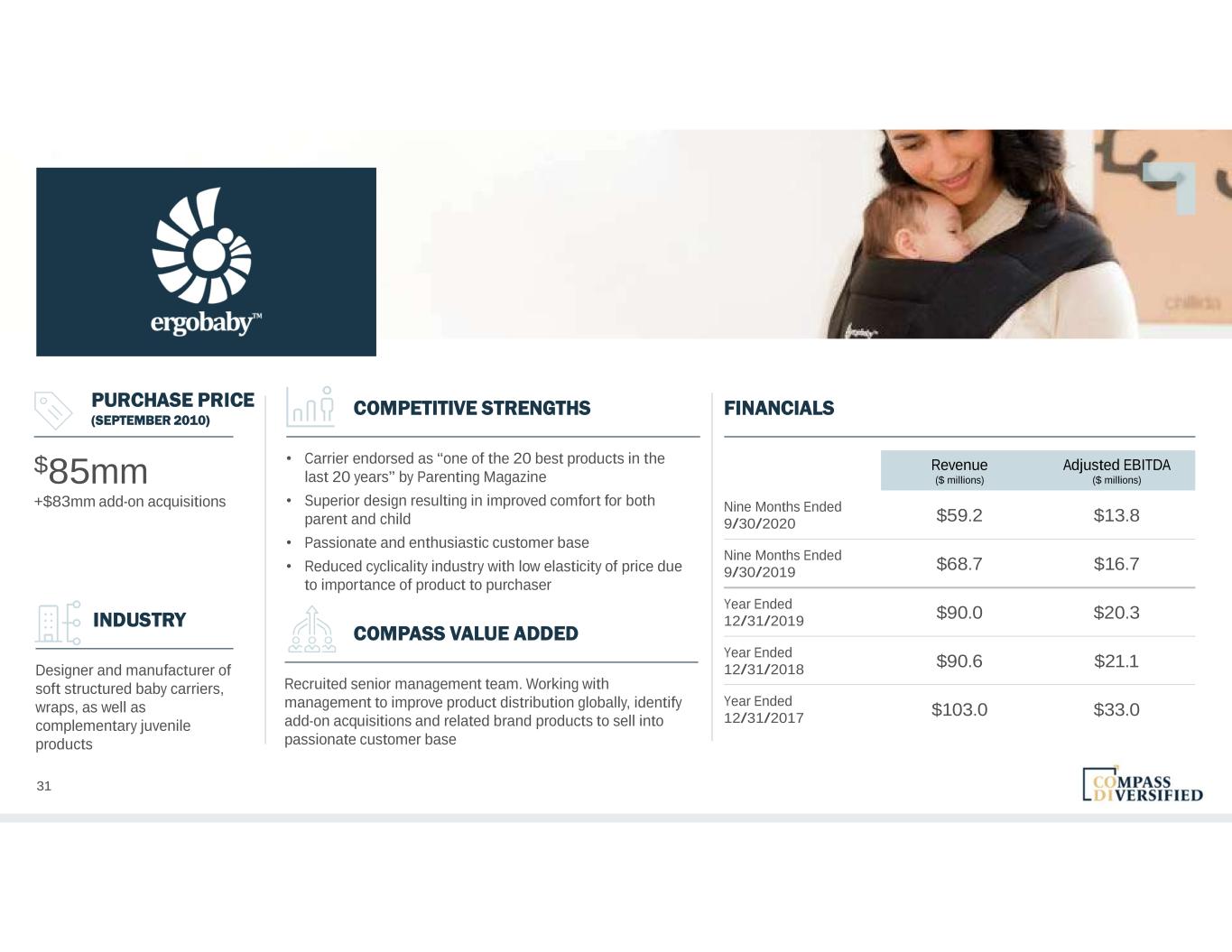

31 PURCHASE PRICE (SEPTEMBER 2010) $85mm +$83mm add-on acquisitions Revenue ($ millions) Adjusted EBITDA ($ millions) Nine Months Ended 9/30/2020 $59.2 $13.8 Nine Months Ended 9/30/2019 $68.7 $16.7 Year Ended 12/31/2019 $90.0 $20.3 Year Ended 12/31/2018 $90.6 $21.1 Year Ended 12/31/2017 $103.0 $33.0 FINANCIALSCOMPETITIVE STRENGTHS • Carrier endorsed as “one of the 20 best products in the last 20 years” by Parenting Magazine • Superior design resulting in improved comfort for both parent and child • Passionate and enthusiastic customer base • Reduced cyclicality industry with low elasticity of price due to importance of product to purchaser INDUSTRY Designer and manufacturer of soft structured baby carriers, wraps, as well as complementary juvenile products COMPASS VALUE ADDED Recruited senior management team. Working with management to improve product distribution globally, identify add-on acquisitions and related brand products to sell into passionate customer base

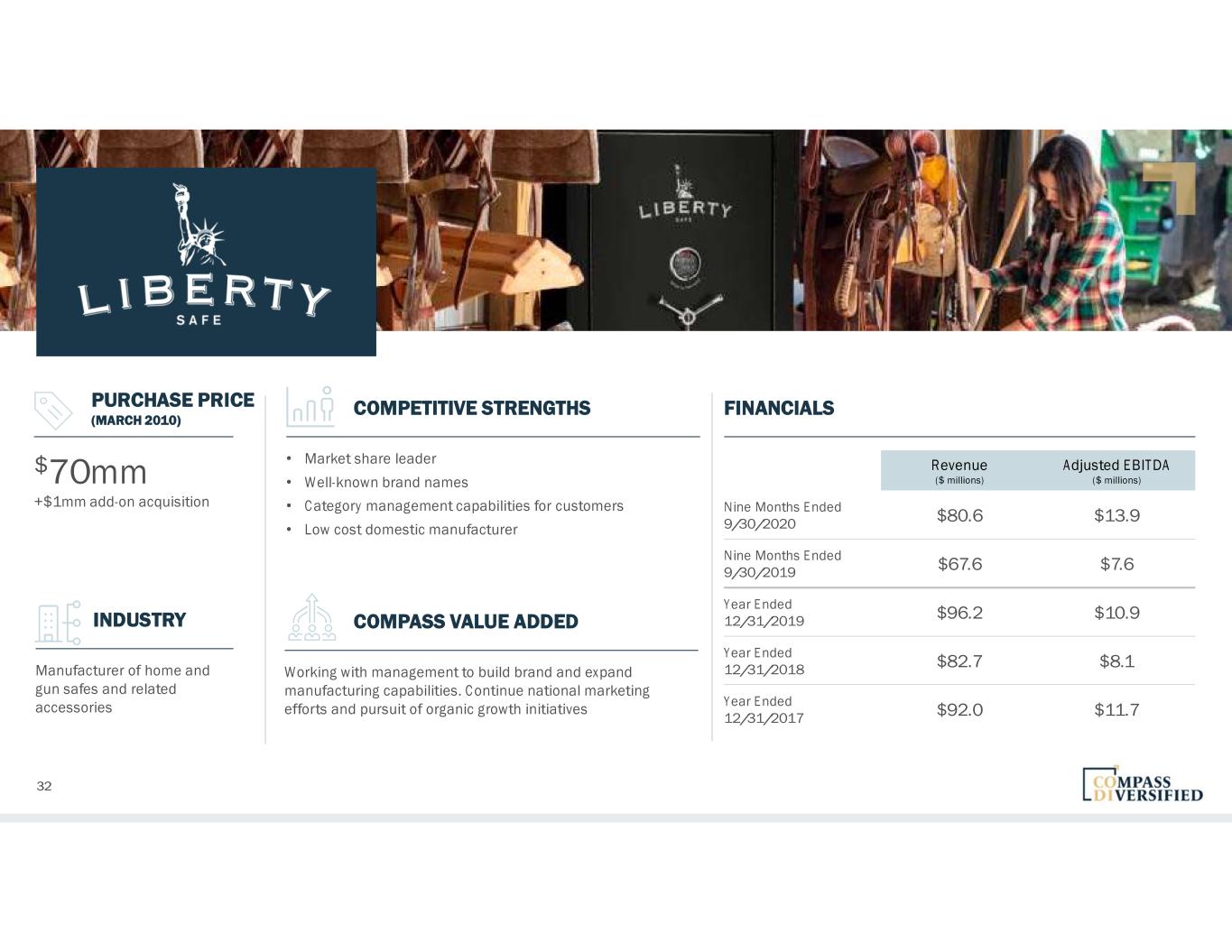

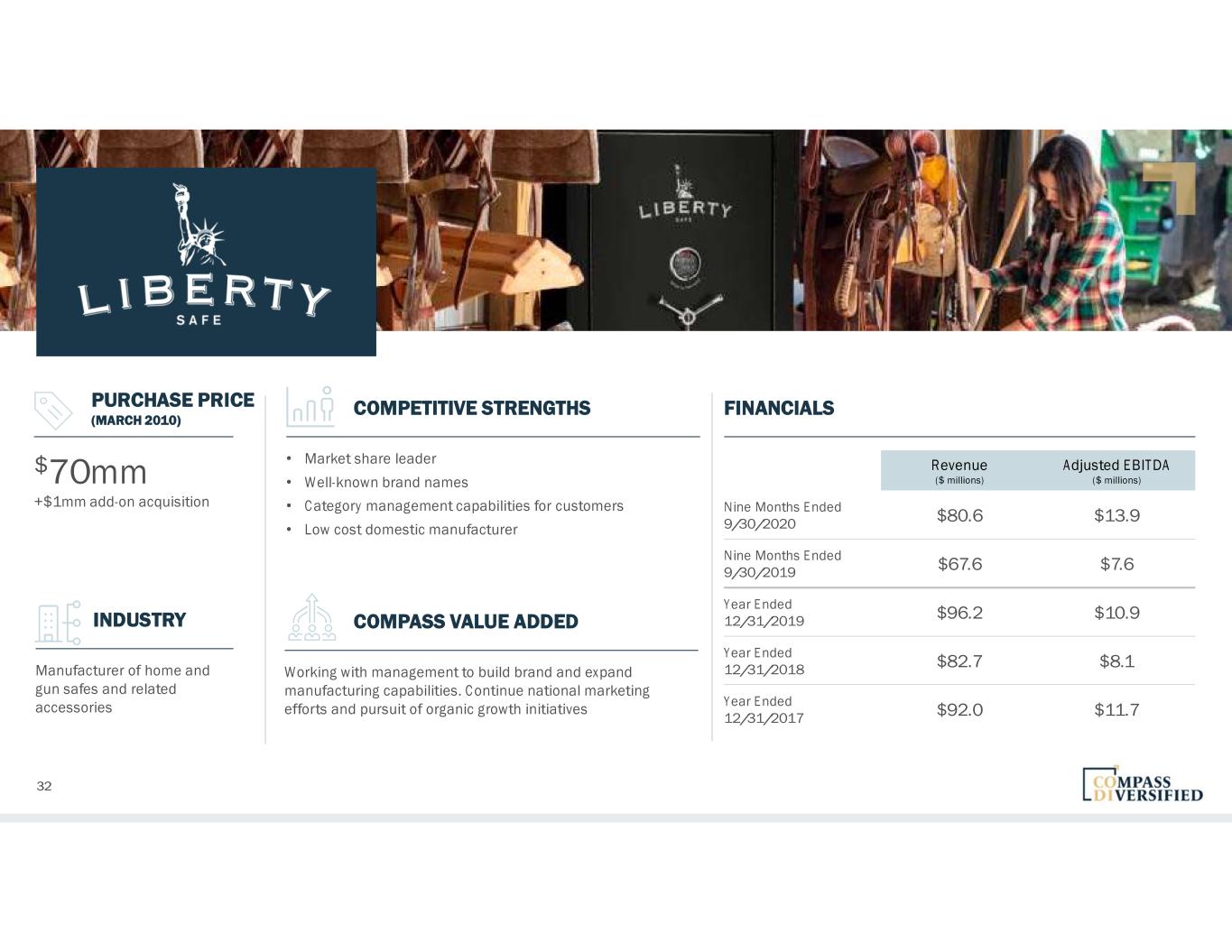

32 PURCHASE PRICE (MARCH 2010) $70mm +$1mm add-on acquisition Revenue ($ millions) Adjusted EBITDA ($ millions) Nine Months Ended 9/30/2020 $80.6 $13.9 Nine Months Ended 9/30/2019 $67.6 $7.6 Year Ended 12/31/2019 $96.2 $10.9 Year Ended 12/31/2018 $82.7 $8.1 Year Ended 12/31/2017 $92.0 $11.7 FINANCIALSCOMPETITIVE STRENGTHS • Market share leader • Well-known brand names • Category management capabilities for customers • Low cost domestic manufacturer INDUSTRY Manufacturer of home and gun safes and related accessories COMPASS VALUE ADDED Working with management to build brand and expand manufacturing capabilities. Continue national marketing efforts and pursuit of organic growth initiatives

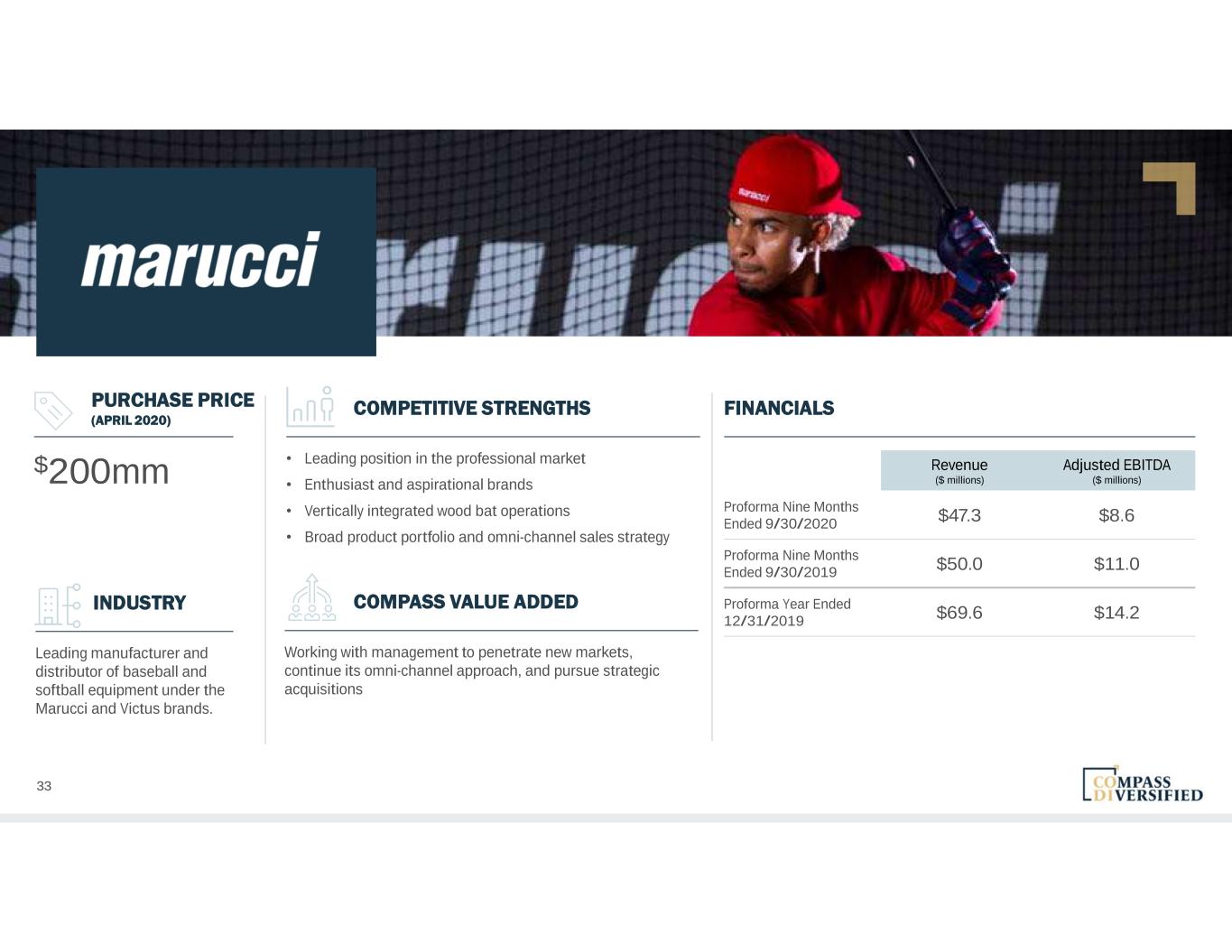

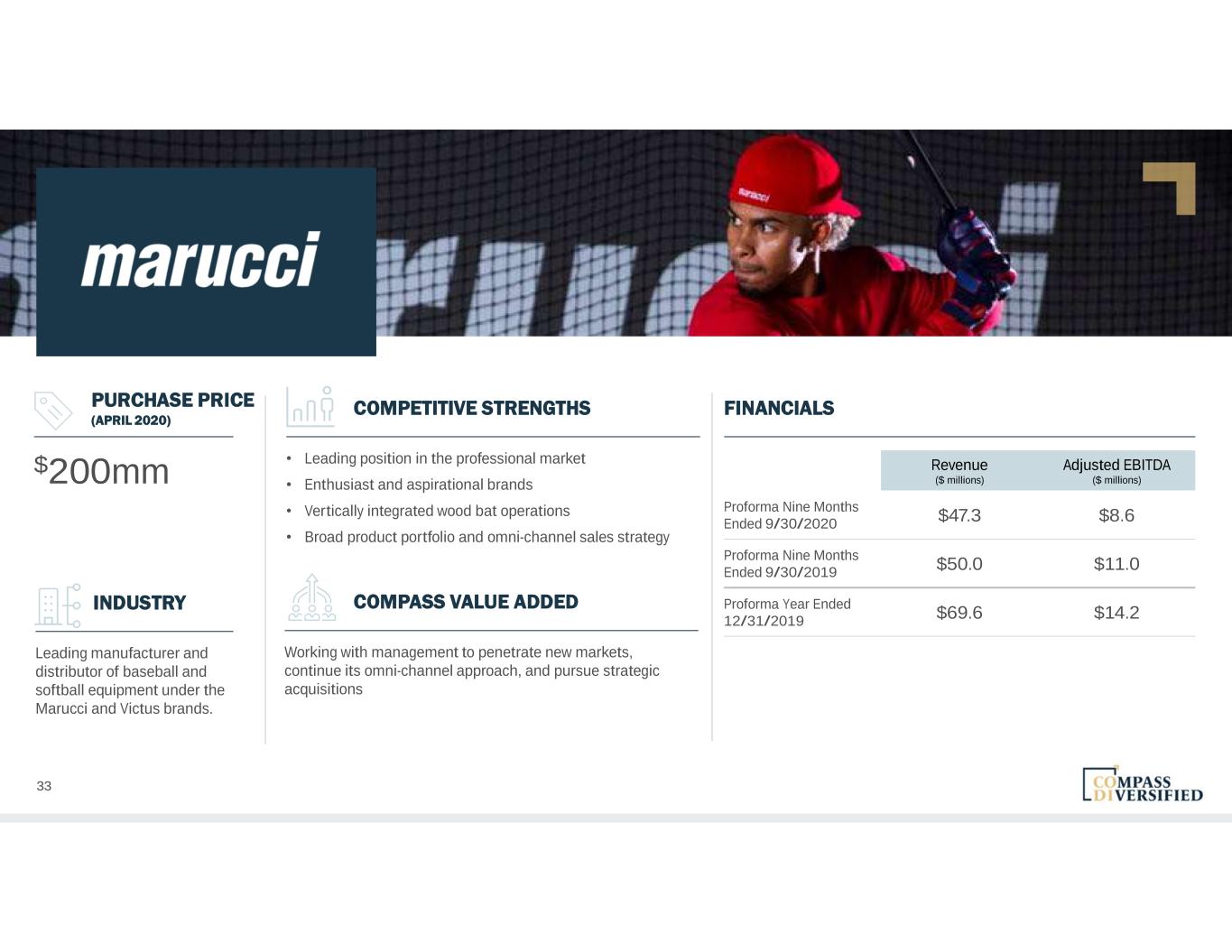

33 PURCHASE PRICE (APRIL 2020) $200mm Revenue ($ millions) Adjusted EBITDA ($ millions) Proforma Nine Months Ended 9/30/2020 $47.3 $8.6 Proforma Nine Months Ended 9/30/2019 $50.0 $11.0 Proforma Year Ended 12/31/2019 $69.6 $14.2 FINANCIALSCOMPETITIVE STRENGTHS • Leading position in the professional market • Enthusiast and aspirational brands • Vertically integrated wood bat operations • Broad product portfolio and omni-channel sales strategy INDUSTRY Leading manufacturer and distributor of baseball and softball equipment under the Marucci and Victus brands. COMPASS VALUE ADDED Working with management to penetrate new markets, continue its omni-channel approach, and pursue strategic acquisitions

34 PURCHASE PRICE (OCTOBER 2020) $454mm Revenue($ millions) Adjusted EBITDA($ millions) Proforma Nine Months Ended 9/30/2020 $77.2 $24.2 Proforma Nine Months Ended 9/30/2019 $77.8 $23.1 Proforma Year Ended 12/31/2019 $106.3 $29.9 FINANCIALSCOMPETITIVE STRENGTHS • Market leader with strong brand awareness in core categories • Diverse customer base with global end-market focus • Broad intellectual property position creates barriers to entry INDUSTRY Designer and marketer of dial-based closure systems that deliver performance fit across footwear, headwear and medical bracing products COMPASS VALUE ADDED Working with Management to penetrate new product categories and geographics, and drive new product development initiatives

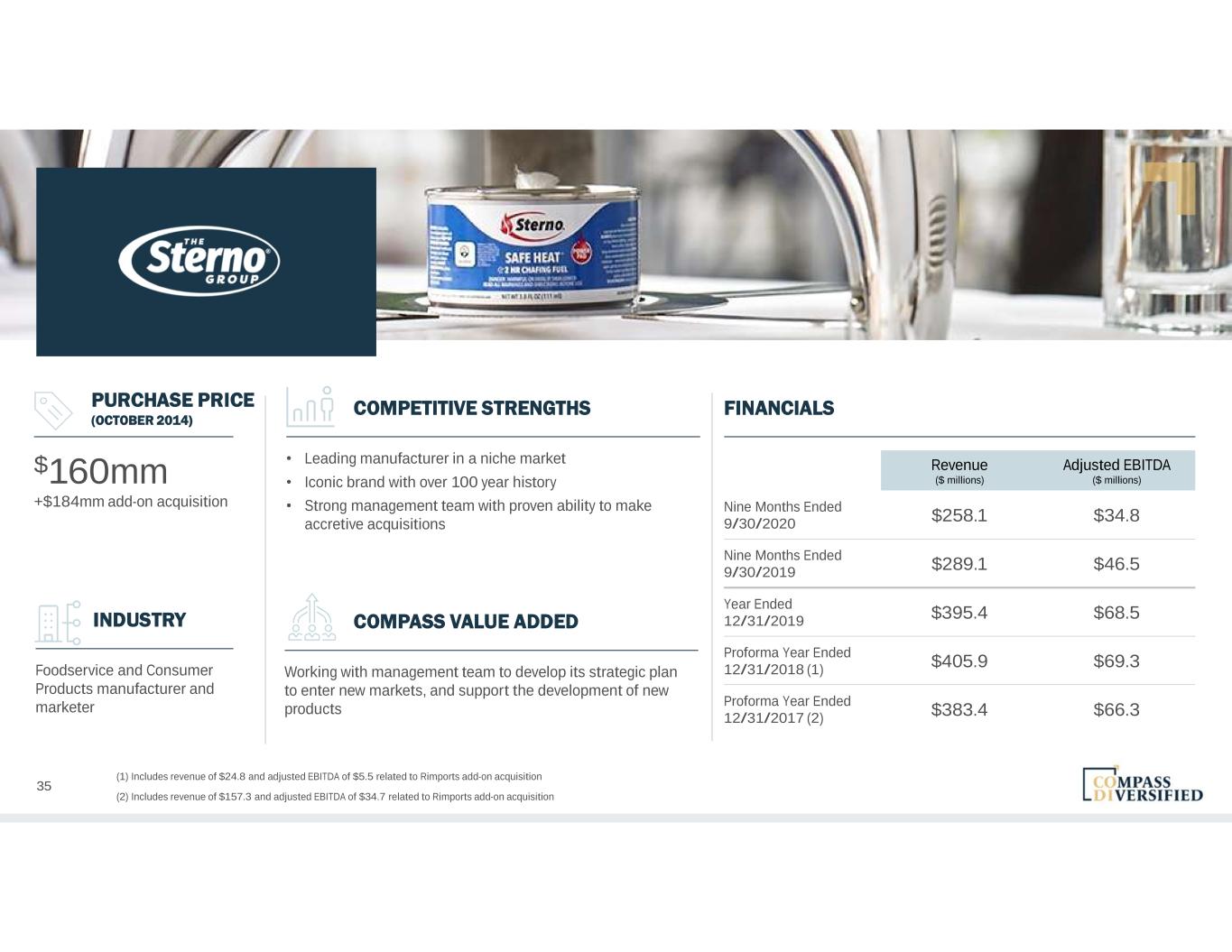

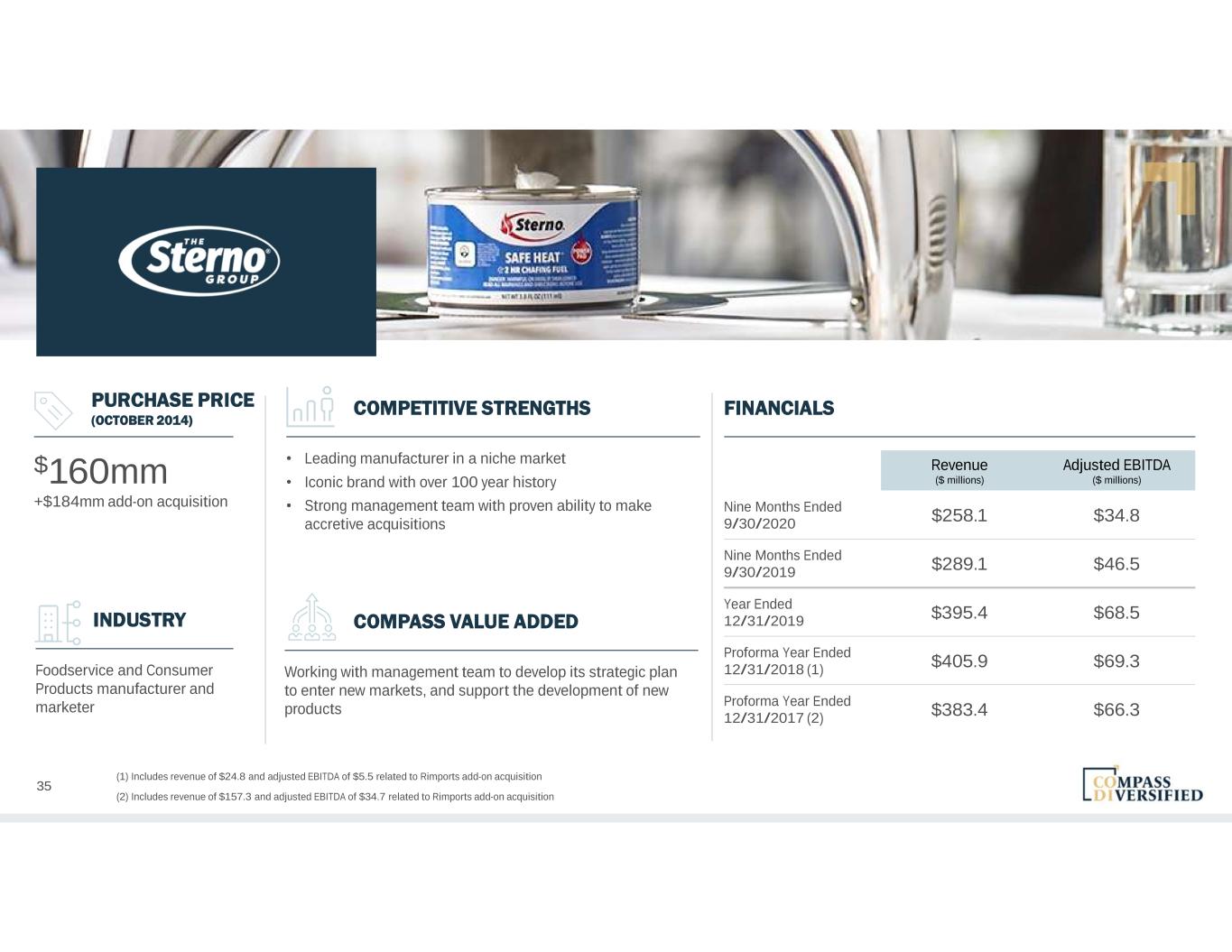

35 PURCHASE PRICE (OCTOBER 2014) $160mm +$184mm add-on acquisition Revenue ($ millions) Adjusted EBITDA ($ millions) Nine Months Ended 9/30/2020 $258.1 $34.8 Nine Months Ended 9/30/2019 $289.1 $46.5 Year Ended 12/31/2019 $395.4 $68.5 Proforma Year Ended 12/31/2018 (1) $405.9 $69.3 Proforma Year Ended 12/31/2017 (2) $383.4 $66.3 FINANCIALSCOMPETITIVE STRENGTHS • Leading manufacturer in a niche market • Iconic brand with over 100 year history • Strong management team with proven ability to make accretive acquisitions INDUSTRY Foodservice and Consumer Products manufacturer and marketer COMPASS VALUE ADDED Working with management team to develop its strategic plan to enter new markets, and support the development of new products (1) Includes revenue of $24.8 and adjusted EBITDA of $5.5 related to Rimports add-on acquisition (2) Includes revenue of $157.3 and adjusted EBITDA of $34.7 related to Rimports add-on acquisition

36 PURCHASE PRICE (FEBRUARY 2018) $248mm +$13mm add-on acquisition Revenue ($ millions) Adjusted EBITDA ($ millions) Nine Months Ended 9/30/2020 $89.3 $22.0 Nine Months Ended 9/30/2019 $93.6 $22.7 Year Ended 12/31/2019 $121.4 $28.5 Pro forma Year Ended 12/31/2018 $128.5 $29.4 Pro forma Year Ended 12/31/2017 $126.4 $29.0 FINANCIALSCOMPETITIVE STRENGTHS • A leader in molded foam protective packaging • National manufacturing footprint of 15 plants provides: • Ability to scale raw material purchases • Ability to service national customers • Long-tenured blue-chip customer relationships INDUSTRY Designer and manufacturer of custom molded protective foam solutions and OEM components made from expanded polystyrene COMPASS VALUE ADDED Working with management to develop its strategic plan and to pursue add-on acquisitions

37 PURCHASE PRICE (MARCH 2012) $129mm Revenue($ millions) Adjusted EBITDA($ millions) Nine Months Ended 9/30/2020 $76.4 $8.0 Nine Months Ended 9/30/2019 $90.4 $11.6 Year Ended 12/31/2019 $120.0 $15.4 Year Ended 12/31/2018 $117.9 $14.0 Year Ended 12/31/2017 $105.6 $10.3 FINANCIALSCOMPETITIVE STRENGTHS • Market share leader • Attractive and diverse end-markets • Engineering and product development capabilities • Stable blue chip customer base—2,000+ customers globally • Global manufacturing footprint INDUSTRY Engineered permanent magnet and magnetic assemblies, manufacturer of thin and ultra-thin alloy products in a variety of materials COMPASS VALUE ADDED Working with management to identify and consummate add- on acquisitions and build complementary quick turn assembly business

38 PURCHASE PRICE (MAY 2006) $81mm +$19mm add-on acquisition Revenue ($ millions) Adjusted EBITDA ($ millions) Nine Months Ended 9/30/2020 $67.4 $20.9 Nine Months Ended 9/30/2019 $67.4 $21.4 Year Ended 12/31/2019 $90.8 $28.9 Year Ended 12/31/2018 $92.5 $30.0 Year Ended 12/31/2017 $87.8 $27.2 FINANCIALSCOMPETITIVE STRENGTHS • Insulated from Asian manufacturing due to small, customized order size and requirements for rapid turnaround • Largest quick turn manufacturer in the US; approximately 300 unique daily orders received • Manufacturing scale produces high margins • Completed accretive acquisitions of Circuit Express and UCI • Diverse customer base — 10,000 current customers • Approximate 30% EBITDA margins INDUSTRY Quick-turn production printed circuit board (“PCB”) manufacturing COMPASS VALUE ADDED Working with management to identify and consummate add-on acquisitions and build complementary quick turn assembly business

39 Financials

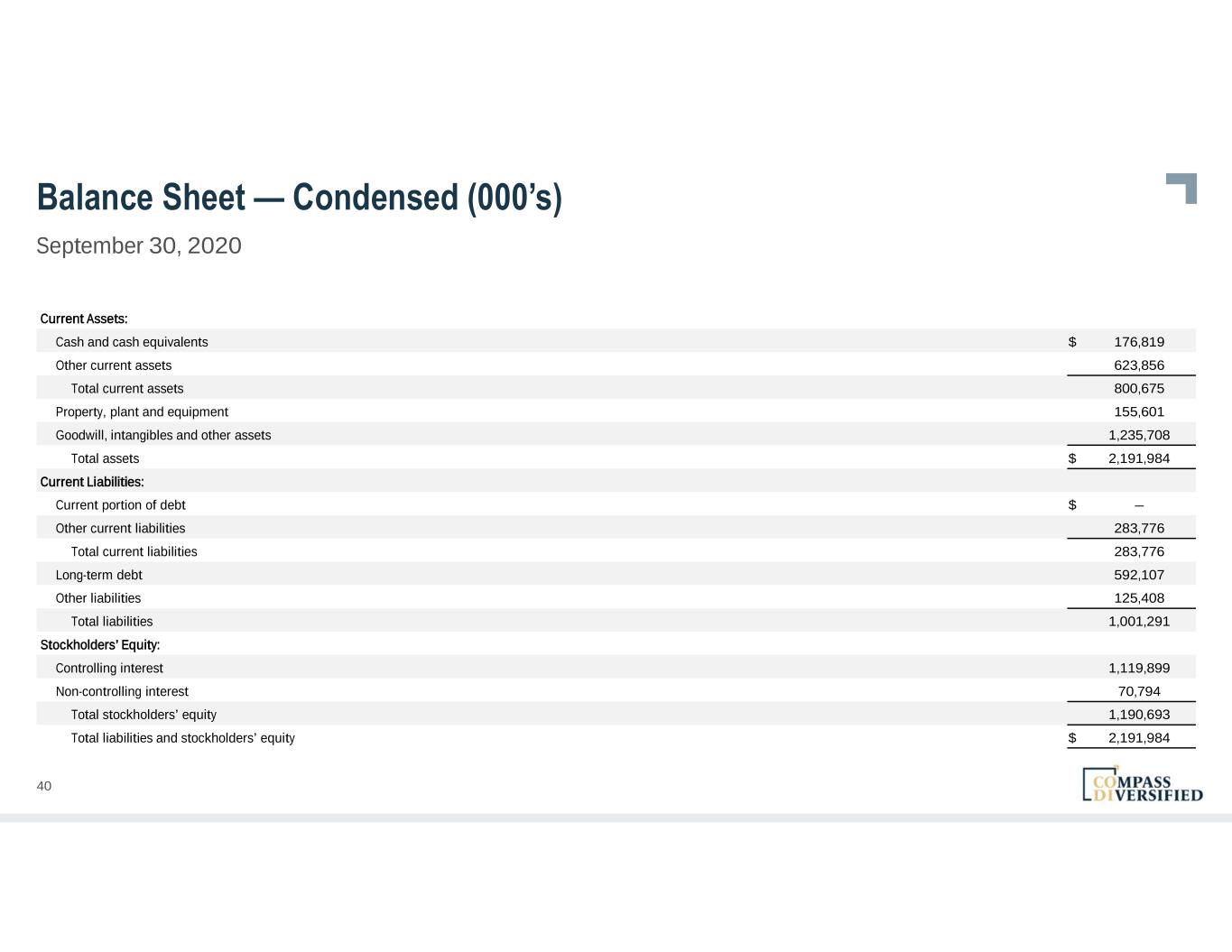

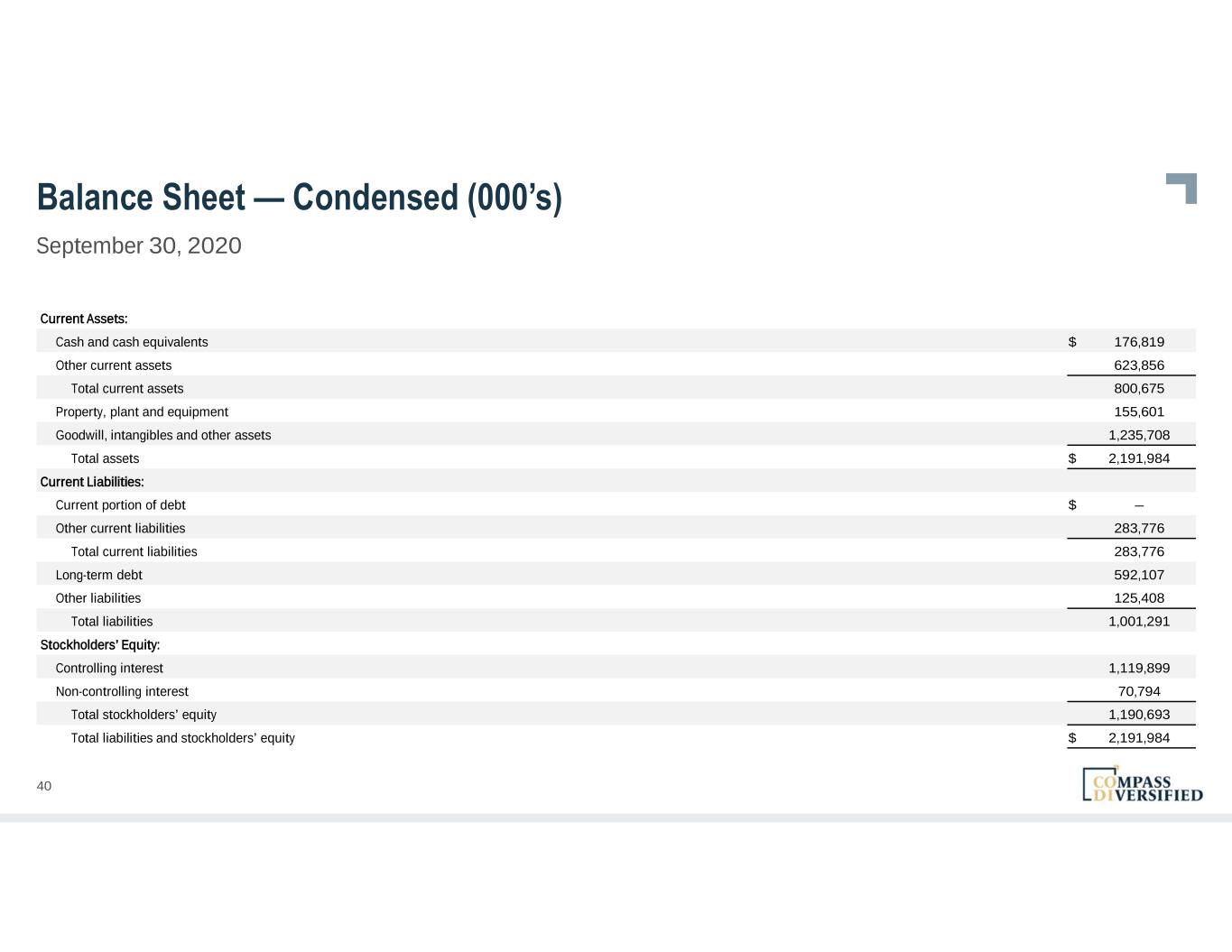

40 Balance Sheet — Condensed (000’s) September 30, 2020 Current Assets: Cash and cash equivalents $ 176,819 Other current assets 623,856 Total current assets 800,675 Property, plant and equipment 155,601 Goodwill, intangibles and other assets 1,235,708 Total assets $ 2,191,984 Current Liabilities: Current portion of debt $ — Other current liabilities 283,776 Total current liabilities 283,776 Long-term debt 592,107 Other liabilities 125,408 Total liabilities 1,001,291 Stockholders’ Equity: Controlling interest 1,119,899 Non-controlling interest 70,794 Total stockholders’ equity 1,190,693 Total liabilities and stockholders’ equity $ 2,191,984

41 Income Statement — Condensed (000’s) YTD September 30, 2020 Net Sales $ 1,085,979 Cost of Sales 695,304 Gross Profit $ 390,675 Operating Income $ 62,883 Interest expense, net (32,122) Other income (expense) (3,967) Provision (benefit) for income taxes 8,477 Income from discontinued operations, net of income tax — Net gain on sales of discontinued operations 100 Net Income $ 18,417 Noncontrolling interest 4,003 Net income attributable to Holdings $ 14,414

42 Cash Flow Statement — Condensed (000’s) YTD September 30, 2020 Net cash provided in operating activities $ 112,872 Net cash used in investing activities $ (236,502) Net cash provided by financing activities $ 200,395 Effect of foreign currency on cash $ (260) Net increase in cash and cash equivalents $ 76,505

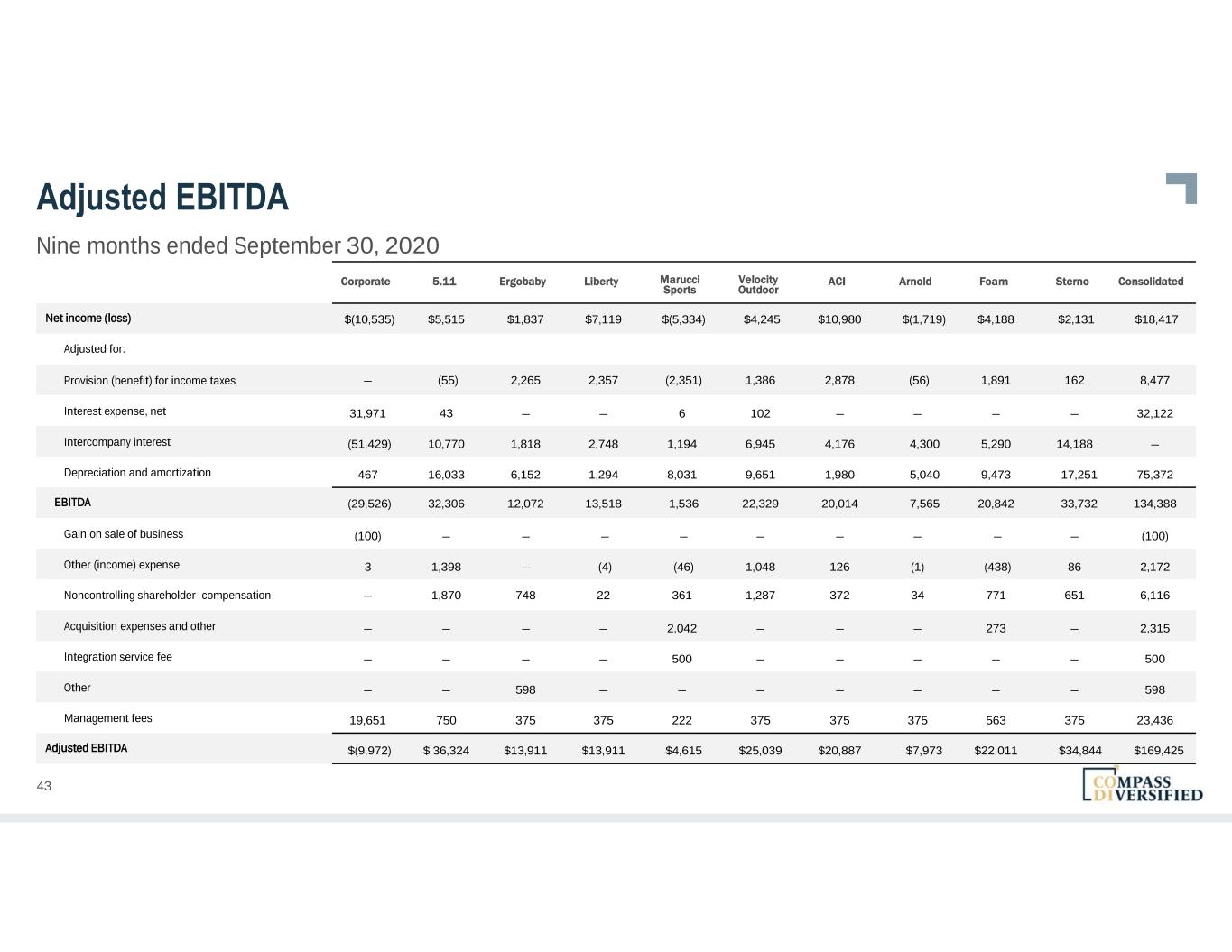

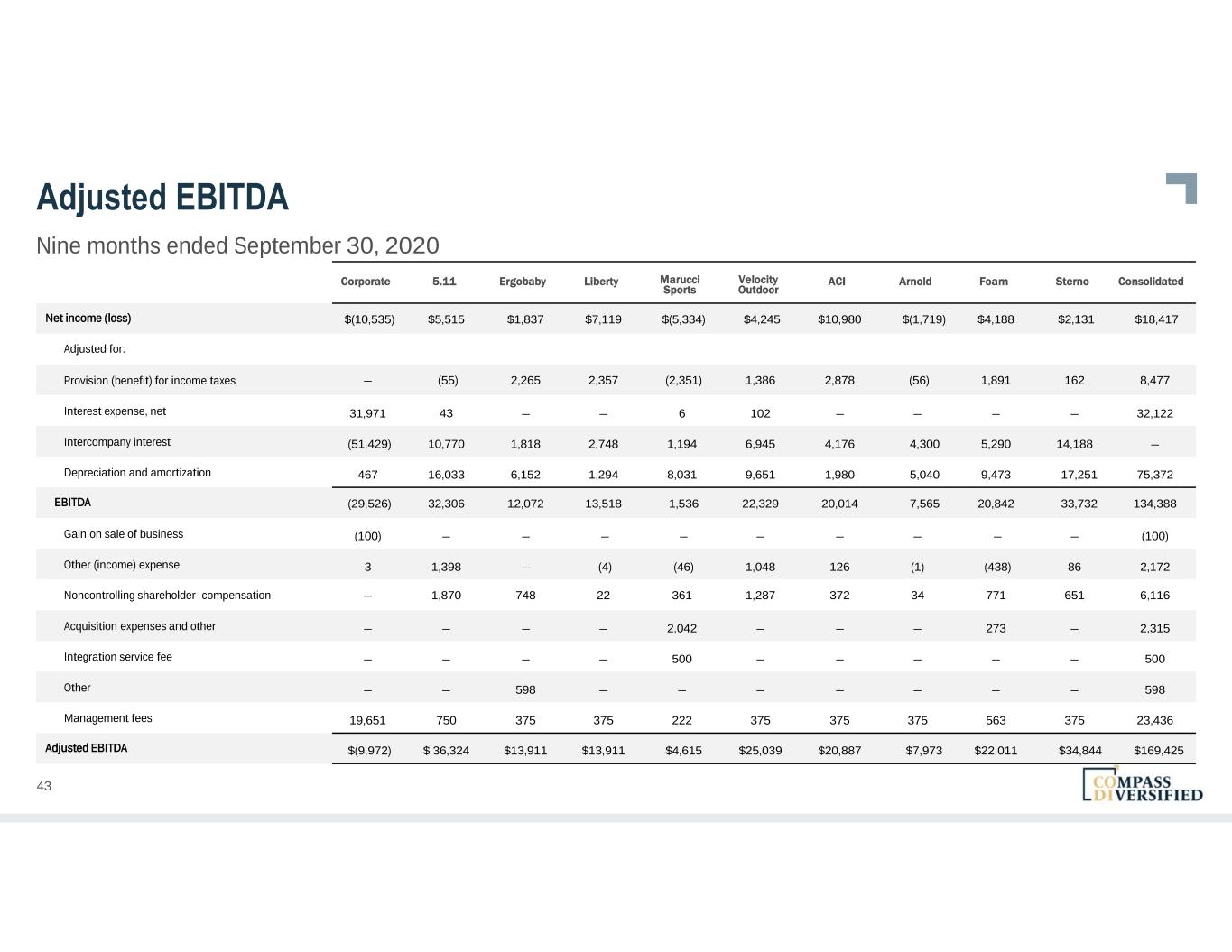

43 Adjusted EBITDA Nine months ended September 30, 2020 Corporate 5.11 Ergobaby Liberty Marucci Sports Velocity Outdoor ACI Arnold Foam Sterno Consolidated Net income (loss) $(10,535) $5,515 $1,837 $7,119 $(5,334) $4,245 $10,980 $(1,719) $4,188 $2,131 $18,417 Adjusted for: Provision (benefit) for income taxes — (55) 2,265 2,357 (2,351) 1,386 2,878 (56) 1,891 162 8,477 Interest expense, net 31,971 43 — — 6 102 — — — — 32,122 Intercompany interest (51,429) 10,770 1,818 2,748 1,194 6,945 4,176 4,300 5,290 14,188 — Depreciation and amortization 467 16,033 6,152 1,294 8,031 9,651 1,980 5,040 9,473 17,251 75,372 EBITDA (29,526) 32,306 12,072 13,518 1,536 22,329 20,014 7,565 20,842 33,732 134,388 Gain on sale of business (100) — — — — — — — — — (100) Other (income) expense 3 1,398 — (4) (46) 1,048 126 (1) (438) 86 2,172 Noncontrolling shareholder compensation — 1,870 748 22 361 1,287 372 34 771 651 6,116 Acquisition expenses and other — — — — 2,042 — — — 273 — 2,315 Integration service fee — — — — 500 — — — — — 500 Other — — 598 — — — — — — — 598 Management fees 19,651 750 375 375 222 375 375 375 563 375 23,436 Adjusted EBITDA $(9,972) $ 36,324 $13,911 $13,911 $4,615 $25,039 $20,887 $7,973 $22,011 $34,844 $169,425

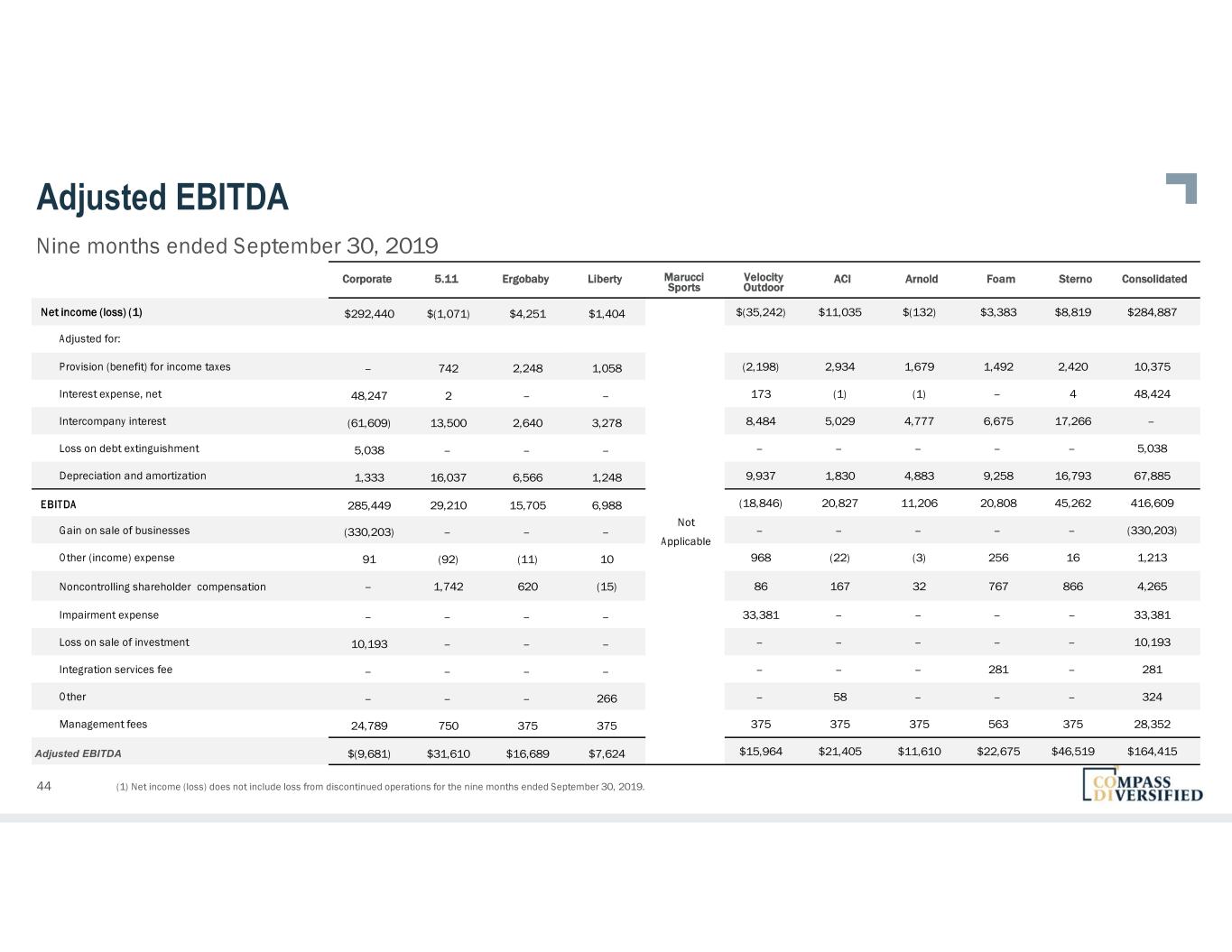

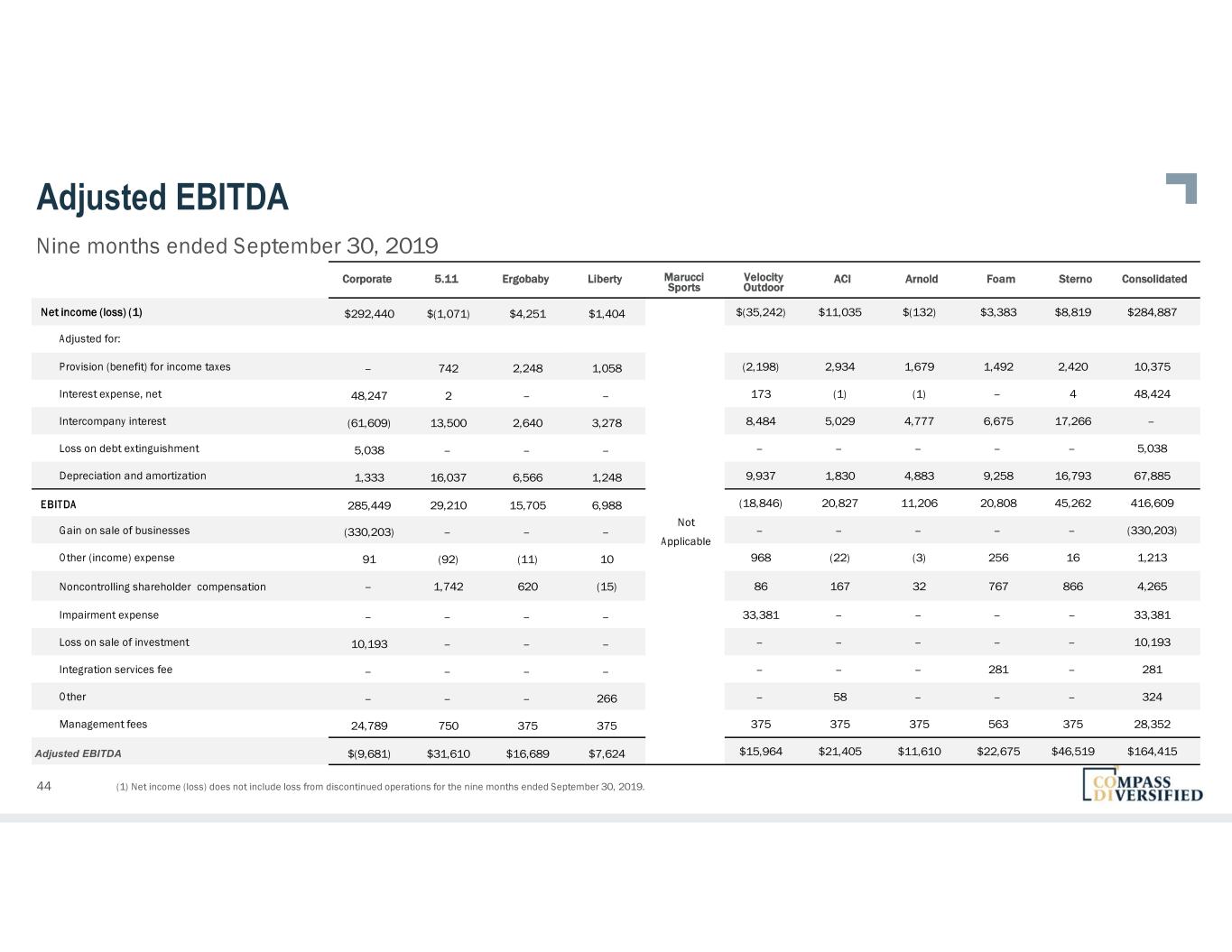

44 Adjusted EBITDA Nine months ended September 30, 2019 (1) Net income (loss) does not include loss from discontinued operations for the nine months ended September 30, 2019. Corporate 5.11 Ergobaby Liberty Marucci Sports Velocity Outdoor ACI Arnold Foam Sterno Consolidated Net income (loss) (1) $292,440 $(1,071) $4,251 $1,404 Not Applicable $(35,242) $11,035 $(132) $3,383 $8,819 $284,887 Adjusted for: Provision (benefit) for income taxes — 742 2,248 1,058 (2,198) 2,934 1,679 1,492 2,420 10,375 Interest expense, net 48,247 2 — — 173 (1) (1) — 4 48,424 Intercompany interest (61,609) 13,500 2,640 3,278 8,484 5,029 4,777 6,675 17,266 — Loss on debt extinguishment 5,038 — — — — — — — — 5,038 Depreciation and amortization 1,333 16,037 6,566 1,248 9,937 1,830 4,883 9,258 16,793 67,885 EBITDA 285,449 29,210 15,705 6,988 (18,846) 20,827 11,206 20,808 45,262 416,609 Gain on sale of businesses (330,203) — — — — — — — — (330,203) Other (income) expense 91 (92) (11) 10 968 (22) (3) 256 16 1,213 Noncontrolling shareholder compensation — 1,742 620 (15) 86 167 32 767 866 4,265 Impairment expense — — — — 33,381 — — — — 33,381 Loss on sale of investment 10,193 — — — — — — — — 10,193 Integration services fee — — — — — — — 281 — 281 Other — — — 266 — 58 — — — 324 Management fees 24,789 750 375 375 375 375 375 563 375 28,352 Adjusted EBITDA $(9,681) $31,610 $16,689 $7,624 $15,964 $21,405 $11,610 $22,675 $46,519 $164,415

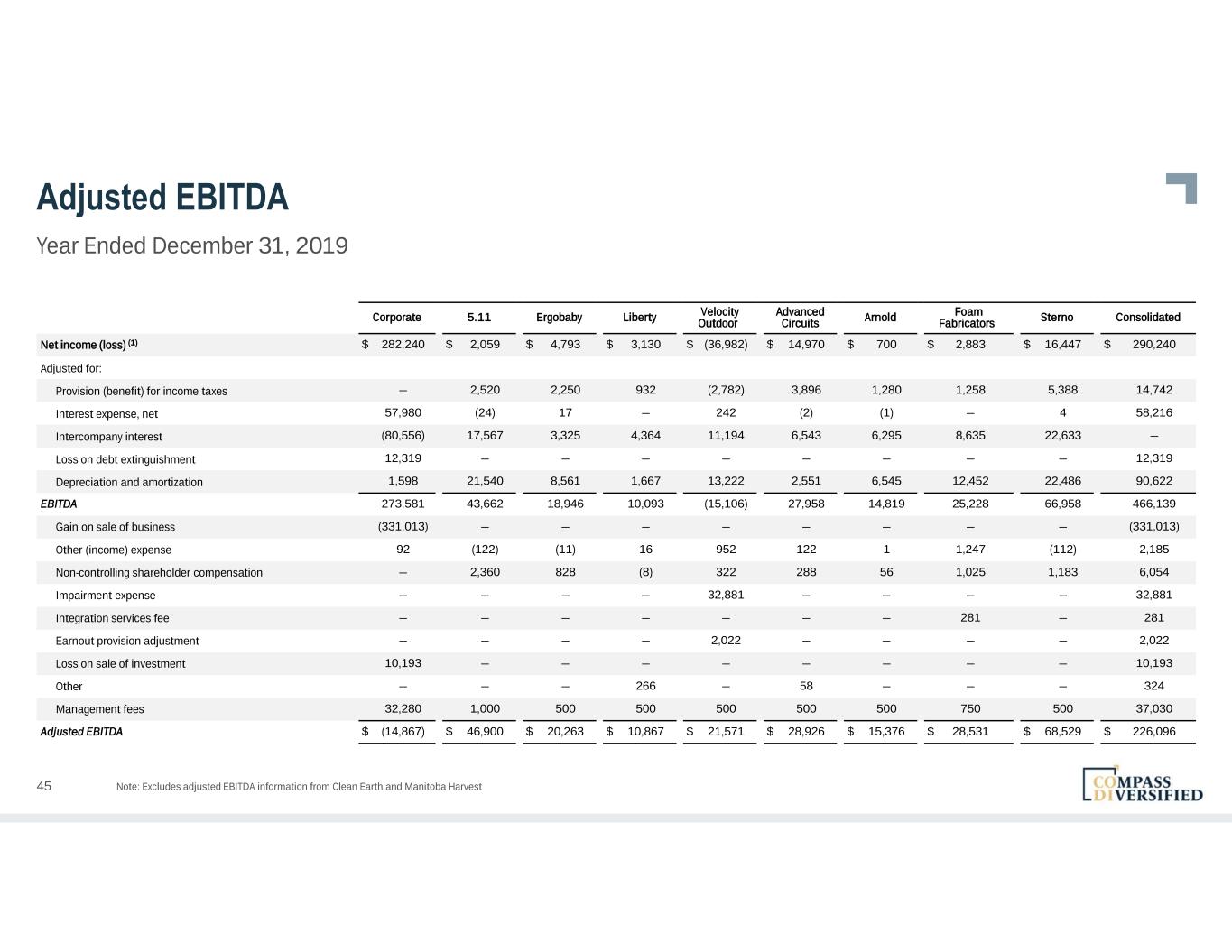

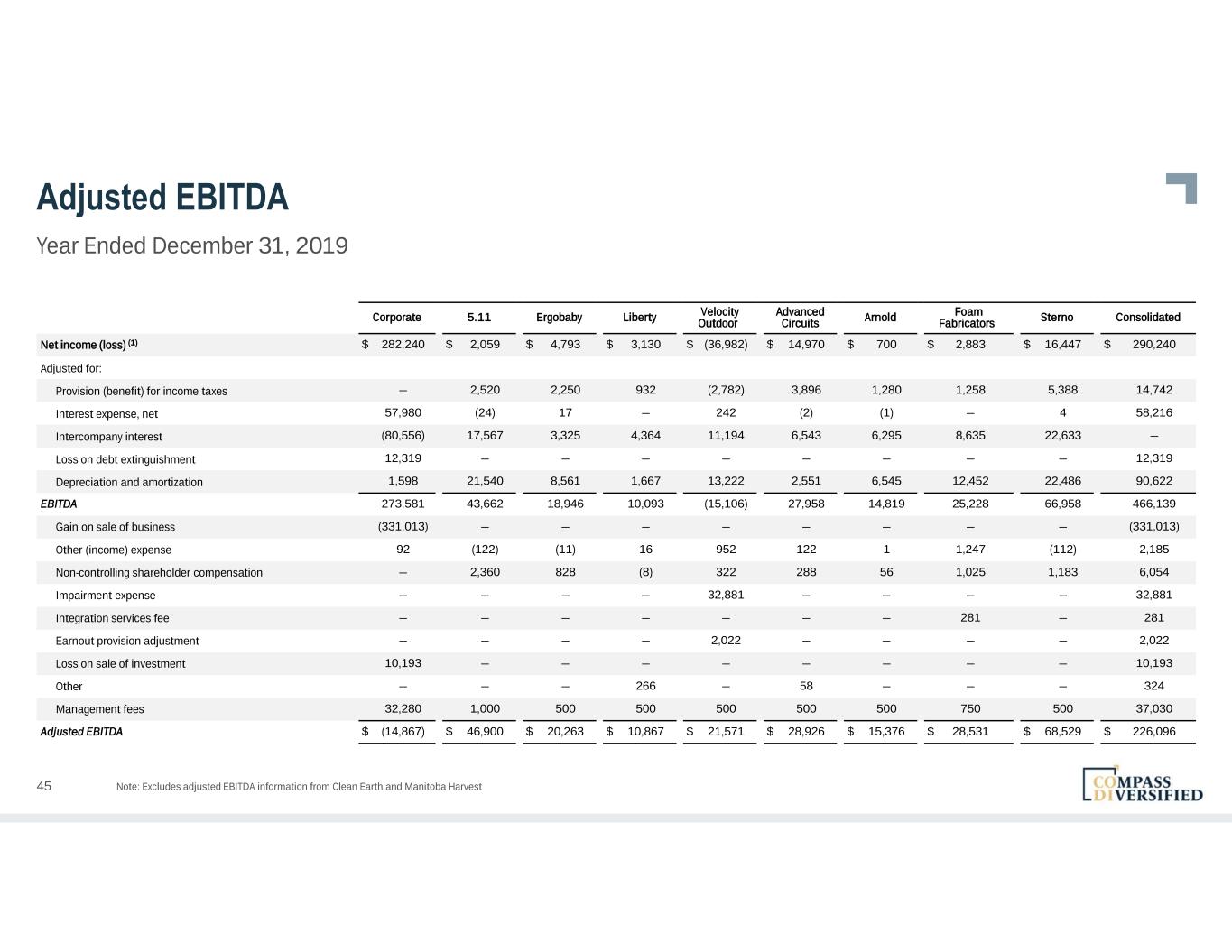

45 Adjusted EBITDA Year Ended December 31, 2019 Note: Excludes adjusted EBITDA information from Clean Earth and Manitoba Harvest Corporate 5.11 Ergobaby Liberty Velocity Outdoor Advanced Circuits Arnold Foam Fabricators Sterno Consolidated Net income (loss) (1) $ 282,240 $ 2,059 $ 4,793 $ 3,130 $ (36,982) $ 14,970 $ 700 $ 2,883 $ 16,447 $ 290,240 Adjusted for: Provision (benefit) for income taxes — 2,520 2,250 932 (2,782) 3,896 1,280 1,258 5,388 14,742 Interest expense, net 57,980 (24) 17 — 242 (2) (1) — 4 58,216 Intercompany interest (80,556) 17,567 3,325 4,364 11,194 6,543 6,295 8,635 22,633 — Loss on debt extinguishment 12,319 — — — — — — — — 12,319 Depreciation and amortization 1,598 21,540 8,561 1,667 13,222 2,551 6,545 12,452 22,486 90,622 EBITDA 273,581 43,662 18,946 10,093 (15,106) 27,958 14,819 25,228 66,958 466,139 Gain on sale of business (331,013) — — — — — — — — (331,013) Other (income) expense 92 (122) (11) 16 952 122 1 1,247 (112) 2,185 Non-controlling shareholder compensation — 2,360 828 (8) 322 288 56 1,025 1,183 6,054 Impairment expense — — — — 32,881 — — — — 32,881 Integration services fee — — — — — — — 281 — 281 Earnout provision adjustment — — — — 2,022 — — — — 2,022 Loss on sale of investment 10,193 — — — — — — — — 10,193 Other — — — 266 — 58 — — — 324 Management fees 32,280 1,000 500 500 500 500 500 750 500 37,030 Adjusted EBITDA $ (14,867) $ 46,900 $ 20,263 $ 10,867 $ 21,571 $ 28,926 $ 15,376 $ 28,531 $ 68,529 $ 226,096

46 Adjusted EBITDA Year Ended December 31, 2018 Note: Excludes adjusted EBITDA information from Clean Earth and Manitoba Harvest Corporate 5.11 Ergobaby Liberty Velocity Outdoor AdvancedCircuits Arnold Foam Sterno Consolidated Net income (loss) $ (35,018) $ (12,079) $ 4,937 $ 1,161 $ (4,458) $ 15,029 $ (740) $ 1,103 $ 12,451 $ (17,614) Adjusted for: Provision (benefit) for income taxes — (2,180) 1,634 409 (598) 3,736 1,731 1,152 4,582 10,466 Interest expense, net 54,994 14 1 — 281 (46) — — 1 55,245 Intercompany interest (78,708) 17,486 4,674 4,233 9,298 7,402 6,213 8,228 21,174 — Depreciation and amortization 2,739 21,898 8,523 1,620 12,352 3,310 6,384 10,973 27,385 95,184 EBITDA (55,993) 25,139 19,769 7,423 16,875 29,431 13,588 21,456 65,593 143,281 Gain on sale of business (1,258) — — — — — — — — (1,258) (Gain) loss on sale of fixed assets — (194) — 92 47 — 55 73 19 92 Non-controlling shareholder compensation — 2,183 869 45 1,009 23 (167) 848 1,901 6,711 Acquisition expenses 115 — — — 1,362 — 1,552 632 3,661 Integration services fee — — — — 750 — — 1,969 — 2,719 Earnout provision adjustment — — — — — — — — (4,800) (4,800) Inventory adjustment — 4,175 — — — — — — — 4,175 Loss on foreign currency transaction and other 4,083 — — — — — — — — 4,083 Management fees 38,786 1,000 500 500 500 500 500 658 500 43,444 Adjusted EBITDA $ (14,267) $ 32,303 $ 21,138 $ 8,060 $ 20,543 $ 29,954 $ 13,976 $ 26,556 $ 63,845 $ 202,108

47 Adjusted EBITDA Year Ended December 31, 2017 Note: Excludes adjusted EBITDA information from Clean Earth and Manitoba Harvest Corporate 5.11 Velocity Outdoor Ergobaby Liberty Advanced Circuits Arnold Sterno Consolidated Net income (loss) $ (22,790) $ (9,405) $ 7,634 $ 16,674 $ 4,861 $ 17,503 $ (10,740) $ 10,712 $ 14,449 Adjusted for: Provision (benefit) for income taxes — (12,492) (11,274) 917 531 (2,518) (2,337) 3,432 (23,741) Interest expense, net 27,047 53 167 — — (12) — — 27,255 Intercompany interest (49,193 14,521 4,590 5,990 4,029 8,171 6,996 4,896 — Depreciation and amortization 2,745 40,393 7,878 12,042 1,742 3,578 6,821 11,868 87,067 EBITDA (42,191) 33,070 8,995 35,623 11,163 26,722 740 30,908 105,030 Gain on sale of business (340) — — — — — — — (340 (Gain) loss on sale of fixed assets — (160) 43 — 46 (4) (7) 216 134 Non-controlling shareholder compensation — 2,301 508 698 17 23 191 740 4,478 Acquisition expenses — — 1,836 — — — — 214 2,050 Impairment expense — — — — — — 8,864 — 8,864 Loss on equity method investment 5,620) — — — — — — — 5,620 Adjustment to earnout provision — — — (3,780) — — — (956) (4,736) (Gain) loss on foreign currency transaction and other (3,137) — — — — — — — (3,137) — 2,333 750 — — — — — 3,083 Management fees 28,053 1,000 290 500 500 500 500 500 31,843 Adjusted EBITDA $ (11,995) $ 38,544 $ 12,422 $ 33,041 $ 11,726 $ 27,241 $ 10,288 $ 31,622 $ 152,889

48 CAD Reconciliation Year to Date Year to Date Year Ended Year Ended Year Ended Year Ended Year Ended (in thousands) 9/30/2020 9/30/2019 12/31/2019 12/31/2018 12/31/2017 12/31/2016 12/31/2015 Net Income $18,417 $301,788 $307,141 $(1,790) $33,612 $56,530 $165,770 Adjustment to reconcile net income to cash provided by operating activities: Depreciation and Amortization 73,578 78,413 100,462 120,575 110,051 87,405 63,072 Impairment expense — 33,381 32,881 — 17,325 25,204 9,165 (Gain) loss on sale of businesses (100) (330,203) (331,013) (1,258) (340) (2,308) (149,798) Amortization of debt issuance costs and original issue discount 1,656 3,022 3,773 4,483 5,007 3,565 2,883 Unrealized (gain) loss on interest rate hedges — 3,486 3,500 (2,251) (648) 1,539 5,662 Loss (gain) on equity method investment — — — — 5,620 (74,490) (4,533) Noncontrolling shareholder charges 6,116 6,204 7,993 8,975 7,027 4,382 3,737 Deferred taxes (3,352) (14,538) (12,876) (9,472) (59,429) (9,669) (3,131) Supplemental put expense — — — — — — — Other 6,150 8,747 17,994 1,440 3,940 730 34 Changes in operating assets and liabilities 10,407 (58,716) (45,293) (6,250) (40,394) 18,484 (8,313) Net cash provided by operating activities 112,872 31,584 84,562 114,452 81,771 111,372 84,548 Plus: Unused fee on revolving credit facility 1,148 1,393 1,851 1,630 2,856 1,947 1,612 Integration service fee 500 281 281 2,719 3,083 1,667 3,500 Other 2,315 11,152 13,174 14,607 2,467 5,866 4,587 Changes in operating assets and liabilities — 58,716 45,293 6,250 40,394 — 8,313 Less: Payments on interest rate swap — 675 675 1,783 3,964 4,303 2,007 Maintenance capital expenditures 10,366 14,760 22,005 27,246 20,270 20,363 18,194 Realized gain from foreign currency — — — — 3,315 1,327 — Changes in operating assets and liabilities 10,407 — — — — 18,484 — Preferred share distributions 17,633 11,344 15,125 12.179 2,457 — — Other 3,776 2,301 3,318 4,800 8,322 — — Estimated cash flow available for distribution and reinvestment $74,653 $74,046 $104,038 $93,650 $92,243 $76,375 $82,359

Thank you!