UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-21836

ONEFUND Trust

(Exact name of registrant as specified in charter)

200 2nd Ave. South #737

St. Petersburg, FL 33701

(Address of principal executive offices) (Zip code)

Michael G. Willis

200 2nd Ave. South #737

St. Petersburg, FL33701

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-808-600-5366

Date of fiscal year end: March 31

Date of reporting period: September 30, 2023

Item 1. Reports to Stockholders.

(a)

| Shareholder Letter | 1 |

| | |

| Investment Results | 3 |

| | |

| Portfolio Illustration | 4 |

| | |

| Schedule of Investments | 6 |

| | |

| Statement of Assets and Liabilities | 12 |

| | |

| Statement of Operations | 13 |

| | |

| Statements of Changes in Net Assets | 14 |

| | |

| Financial Highlights | 15 |

| | |

| Notes to Financial Statements | 16 |

| | |

| Liquidity Risk Management Program | 20 |

| | |

| Summary of Fund Expenses | 21 |

| | |

| Additional Information | 22 |

| | |

| Privacy Policy | 23 |

| ONEFUND S&P 500® Equal Weight Index | Shareholder Letter |

| September 30, 2023 (Unaudited) |

| | |

Dear Shareholders,

Discussion of the Fund:

The ONEFUND S&P 500® Equal Weight Index (the “Fund”) is a “no-load” index fund with no commissions and no 12b-1 fee. The Fund’s ticker symbol is INDEX. The Fund’s portfolio holds approximately 500 of the largest publicly traded companies on Wall Street, as selected by Standard & Poor’s. This puts INDEX in the “Large Cap Blend” category.

As of September 30, 2023, the Fund seeks to track the S&P 500® Equal Weight Index. The S&P 500® Equal Weight Index uses the same 500 constituents as the S&P 500® Market Cap Index. The primary difference is that the S&P 500® Equal Weight Index rebalances its holdings periodically so that, over time, they remain substantially equal*.

Discussion of Fund Performance:

During the six months ended September 30, 2023, INDEX returned -1.36% while the S&P 500® Equal Weight Index fell by -1.11%. The performance of the Fund relative to the S&P 500® Equal Weight Index showed tracking error due to our trading process, cash drag, our cash management process, expenses and trading costs of the Fund. Because the Fund equal weights its holdings over time, sharp price movements of individual holdings have the potential to materially affect the performance of the Fund. A historical chart of tracking error for INDEX is provided below.

| HISTORICAL TRACKING ERROR FOR INDEX |

| | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 Q3 |

| INDEX | 18.79% | -7.82% | 28.98% | 12.76% | 29.11% | -11.82% | 1.69% |

| S&P 500® EQUAL WIEIGHT INDEX | 18.90% | -7.64% | 29.24% | 12.83% | 29.63% | -11.45% | 1.79% |

| TRACKING ERROR | -0.11% | -0.18% | -0.26% | -0.07% | -0.52% | -0.37% | -0.10% |

During the six months ended September 30, 2023, the S&P 500® Index (Market Cap) grew by +5.18%. As noted above, as of September 30, 2023, the Fund seeks to track the S&P 500® Equal Weight Index, which is not the same as the S&P 500® Index (Market Cap). The better performance the market capitalization version of the S&P 500® Index to our Fund generally occurs when the largest 50 companies within the S&P 500 Index outperform the other 450 companies within the index. This is because the S&P 500® Index (Market Cap) overweight’s the top 50 companies within the index to approximately half of the index, whereas the Equal-Weight methodology seeks to hold all 500 companies equally over time. This data is provided for informational purposes only, and you should not regard the S&P 500® Index (Market Cap) as a benchmark for the Fund during the period of this report.*

| Semi-Annual Report | September 30, 2023 | 1 |

| ONEFUND S&P 500® Equal Weight Index | Shareholder Letter |

| | September 30, 2023 (Unaudited) |

| | |

During the 2nd quarter of 2023, First Republic Bank (FRC) was fair value priced to zero in the Fund’s portfolio because this bank failed before Standard & Poor’s removed it from the underlying index. Two other banks previously failed in Q1 of 2023 and had to be fair value priced to zero in the Fund. In the future, if there are additional abrupt bankruptcies in the banking industry, or other industries, this could affect the performance of the portfolio negatively.

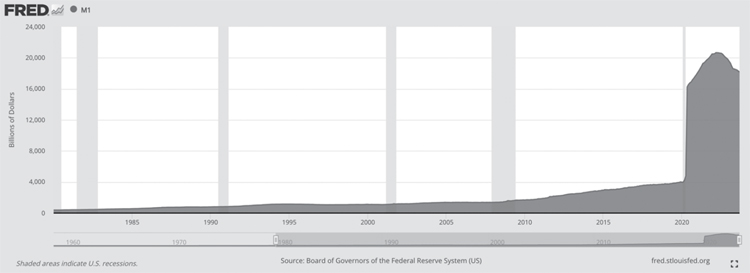

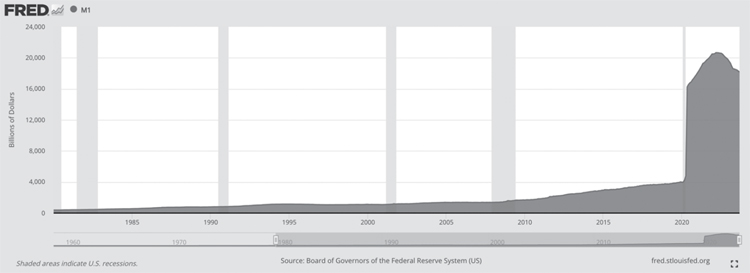

Because money supply is still at historically high levels (see chart on page 1), higher inflation than normal may continue to be a factor in 2023-24. Historically, the S&P 500® Index strategies have given investors the potential to keep up with inflation and grow their portfolios over time. We created INDEX to simplify investing for retail investors. With one simple purchase, you gain access to the potential growth of Americas’ 500 leading companies according to Standard & Poor’s.

Warm Regards,

Michael Willis

President, ONEFUND, LLC

The foregoing reflects the thoughts and opinions of ONEFUND, LLC, the adviser to the Fund, and is subject to change without notice. Investors cannot invest directly in an index. Subject to investment risks, including possible loss of principal amount invested.

| * | The S&P 500® Equal Weight Index is an equal weighted version of the S&P 500® Index. The S&P 500® Equal Weight Index includes the same constituents as the capitalization weighted S&P 500®, but each company in the S&P 500® Equal Weight Index is allocated a fixed weight - or 0.2% of the index total at each quarterly rebalance. It is a broad-based securities market index. Such indices are generally not actively managed and are not subject to fees and expenses typically associated with managed accounts or funds. You cannot invest directly in a broad-based securities index. |

The S&P 500® Market Cap Index: The headline market cap indices, the S&P 500®, the S&P MidCap 400® and the S&P SmallCap 600® are widely recognized as leading indicators of U.S. equity market performance. The S&P 500® is the world’s most-tracked index by assets under management.

Past performance is not indicative of future results, ordinary brokerage commissions apply, brokerage commissions will reduce returns.

| ONEFUND S&P 500® Equal Weight Index | Investment Results |

| September 30, 2023 (Unaudited) |

| | |

Average Annual Total Returns(a) (for the periods ended September 30, 2023)

| | Six Months | One Year | Five Year | Since Inception

(4/30/15) |

| ONEFUND S&P 500® Equal Weight Index | -1.36% | 13.25% | 7.71% | 8.77% |

| S&P 500® Equal Weight Index | -1.11% | 13.64% | 7.97% | 8.94% |

| | | | | |

| | | Expense Ratios (b) | |

| Gross | | 0.65% | |

| With Applicable Waivers | | 0.25% | |

| | | | | |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than actual performance data quoted. Fund performance current to the most recent month-end is available by calling (844) 464-6339 or by visiting https://onefund.io/fund/.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performances would have been lower. Total Returns for less than one year are not annualized. |

| (b) | The expense ratios are from the Fund’s prospectus dated July 28, 2023. ONEFUND, LLC (the “Adviser”) has contractually agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to not more than 0.25% of the Fund’s average daily net assets for No Load Class shares. This agreement is in effect through July 31, 2024. This agreement may not be terminated or modified by the Adviser prior to this date except with the approval of the Fund’s Board of Trustees. Additional information pertaining to the Fund’s expense ratios as of September 30, 2023, can be found in the financial highlights. |

You should consider the Fund’s investment objective, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objective, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month-end by calling (844) 464-6339.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

| Semi-Annual Report | September 30, 2023 | 3 |

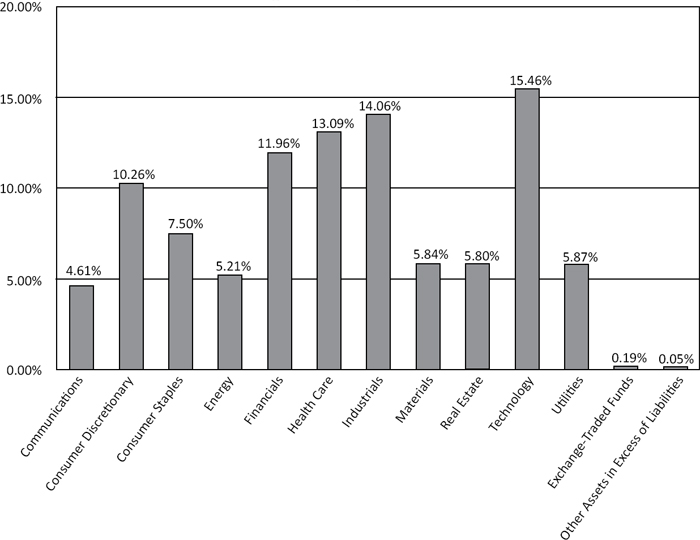

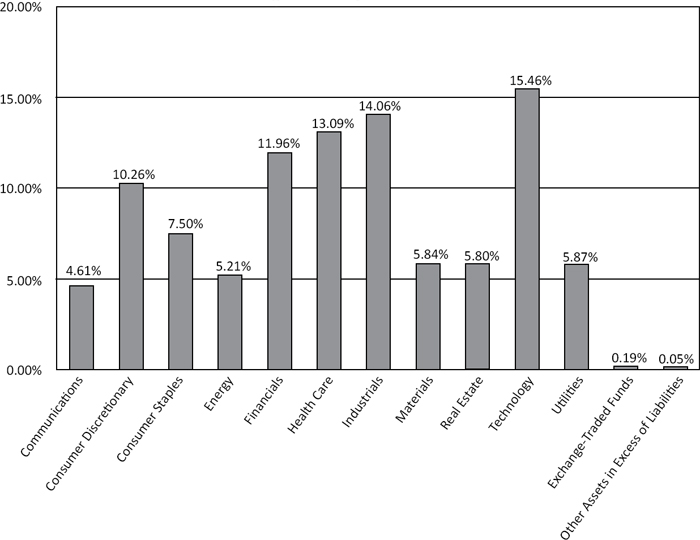

| ONEFUND S&P 500® Equal Weight Index | Portfolio Illustration |

| | September 30, 2023 (Unaudited) |

| | |

Sector Allocation*(as a % of Net Assets)*

ONEFUND S&P 500® Equal Weight Index

Holdings as of September 30, 2023(a)

| * | Holdings are subject to change and may not reflect the current or future position of the portfolio. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry subclassifications for reporting ease. Industries are shown as a percentage of net assets. |

| (a) | As a percentage of net assets. |

The S&P 500® Equal Weight Index (the “Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and their Third Party Licensors, and has been licensed for use by ONEFUND, LLC (the “Adviser”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); Third Party Licensor Trademarks are trademarks of the Third Party Licensor and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Adviser. It is not possible to invest directly in an index. The ONEFUND S&P 500® Equal Weight Index (the “Fund”) is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, any of their respective affiliates (collectively, “S&P Dow Jones Indices”) or their Third Party Licensors. Neither S&P Dow Jones Indices nor its Third Party Licensors make any representation or warranty, express or implied, to the owners of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly or the ability of the Index to track general market performance. Past performance of an index is not an indication or guarantee of future results. S&P Dow Jones Indices’ and its Third Party Licensors’ only relationship to the Adviser with respect to the Index is the licensing of the Index and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices and/or its licensors. The Index is determined, composed and calculated by S&P Dow Jones Indices or its Third Party Licensors without regard to the Adviser or the Fund. S&P Dow Jones Indices and its Third Party Licensors have no obligation to take the needs of the Adviser or the owners of the Fund into consideration in determining, composing or calculating the Index. Neither S&P Dow Jones Indices nor its Third Party Licensors are responsible for and have not participated in the determination of the prices, and amount of the Fund or the timing of the issuance or sale of the Fund or in the determination or calculation of the equation by which the Fund is to be converted into cash, surrendered or redeemed, as the case may be. S&P Dow Jones Indices and its Third Party Licensors have no obligation or liability in connection with the administration, marketing or trading of the Fund. There is no assurance that investment products based on the Index will accurately track index performance or provide positive

| ONEFUND S&P 500® Equal Weight Index | Portfolio Illustration |

| | September 30, 2023 (Unaudited) |

| | |

investment returns. S&P Dow Jones Indices LLC is not an investment or tax advisor. A tax advisor should be consulted to evaluate the impact of any tax-exempt securities on portfolios and the tax consequences of making any particular investment decision. Inclusion of a security within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it considered to be investment advice.

NEITHER S&P DOW JONES INDICES NOR ITS THIRD PARTY LICENSORS GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND ITS THIRD PARTY LICENSORS SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND ITS THIRD PARTY LICENSORS MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY ONEFUND, LLC, OWNERS OF THE FUND, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR ITS THIRD PARTY LICENSORS BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBLITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND ONEFUND, LLC, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

| Semi-Annual Report | September 30, 2023 | 5 |

| ONEFUND S&P 500® Equal Weight Index | Schedule of Investments |

| | September 30, 2023 (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 99.66% | | | | | | | | |

| Communications — 4.61% | | | | | | | | |

| Activision Blizzard, Inc. | | | 2,233 | | | $ | 209,077 | |

| Airbnb, Inc., Class A(a) | | | 1,411 | | | | 193,603 | |

| Alphabet, Inc., Class A(a) | | | 813 | | | | 106,389 | |

| Alphabet, Inc., Class C(a) | | | 691 | | | | 91,108 | |

| AT&T, Inc. | | | 14,284 | | | | 214,545 | |

| Booking Holdings, Inc.(a) | | | 65 | | | | 200,457 | |

| Charter Communications, Inc., Class A(a) | | | 487 | | | | 214,192 | |

| Comcast Corp., Class A | | | 4,568 | | | | 202,545 | |

| Electronic Arts, Inc. | | | 1,689 | | | | 203,356 | |

| Expedia Group, Inc.(a) | | | 1,873 | | | | 193,050 | |

| Fox Corp., Class A | | | 4,434 | | | | 138,341 | |

| Fox Corp., Class B | | | 2,306 | | | | 66,597 | |

| Interpublic Group of Companies, Inc. | | | 6,478 | | | | 185,659 | |

| Match Group, Inc.(a) | | | 4,669 | | | | 182,908 | |

| Meta Platforms, Inc., Class A(a) | | | 690 | | | | 207,146 | |

| Netflix, Inc.(a) | | | 465 | | | | 175,584 | |

| News Corp., Class A | | | 7,445 | | | | 149,346 | |

| News Corp., Class B | | | 2,257 | | | | 47,104 | |

| Omnicom Group, Inc. | | | 2,607 | | | | 194,170 | |

| Paramount Global, Class B | | | 15,058 | | | | 194,248 | |

| Take-Two Interactive Software, Inc.(a) | | | 1,441 | | | | 202,302 | |

| T-Mobile US, Inc.(a) | | | 1,494 | | | | 209,235 | |

| VeriSign, Inc.(a) | | | 996 | | | | 201,720 | |

| Verizon Communications, Inc. | | | 6,149 | | | | 199,289 | |

| Walt Disney Co. (The)(a) | | | 2,521 | | | | 204,327 | |

| Warner Bros. Discovery, Inc.(a) | | | 18,170 | | | | 197,326 | |

| | | | | | | | 4,583,624 | |

| Consumer Discretionary — 10.26% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 1,488 | | | | 189,155 | |

| Aptiv PLC(a) | | | 2,047 | | | | 201,814 | |

| AutoZone, Inc.(a) | | | 79 | | | | 200,659 | |

| Axon Enterprise, Inc.(a) | | | 958 | | | | 190,632 | |

| Bath & Body Works, Inc. | | | 5,635 | | | | 190,463 | |

| Best Buy Co., Inc. | | | 2,809 | | | | 195,141 | |

| BorgWarner, Inc. | | | 5,138 | | | | 207,421 | |

| Caesars Entertainment, Inc.(a) | | | 3,743 | | | | 173,488 | |

| CarMax, Inc.(a) | | | 2,534 | | | | 179,230 | |

| Carnival Corp.(a) | | | 13,444 | | | | 184,452 | |

| Chipotle Mexican Grill, Inc.(a) | | | 106 | | | | 194,174 | |

| Copart, Inc.(a) | | | 4,603 | | | | 198,343 | |

| D.R. Horton, Inc. | | | 1,753 | | | | 188,395 | |

| Darden Restaurants, Inc. | | | 1,376 | | | | 197,071 | |

| Domino’s Pizza, Inc. | | | 531 | | | | 201,137 | |

| eBay, Inc. | | | 4,736 | | | | 208,810 | |

| Etsy, Inc.(a) | | | 3,064 | | | | 197,873 | |

| Ford Motor Co. | | | 16,722 | | | | 207,687 | |

| General Motors Co. | | | 6,242 | | | | 205,799 | |

| Genuine Parts Co. | | | 1,371 | | | | 197,945 | |

| Hasbro, Inc. | | | 2,941 | | | | 194,518 | |

| Hilton Worldwide Holdings, Inc. | | | 1,335 | | | | 200,490 | |

| | | Shares | | | Fair Value | |

| Consumer Discretionary (Continued) | | | | | | | | |

| Home Depot, Inc. (The) | | | 626 | | | $ | 189,152 | |

| Las Vegas Sands Corp. | | | 4,209 | | | | 192,941 | |

| Lennar Corp., Class A | | | 1,733 | | | | 194,495 | |

| Live Nation Entertainment, Inc.(a) | | | 2,541 | | | | 211,004 | |

| LKQ Corp. | | | 4,076 | | | | 201,803 | |

| Lowe’s Companies, Inc. | | | 889 | | | | 184,770 | |

| Marriott International, Inc., Class A | | | 1,001 | | | | 196,757 | |

| Masco Corp. | | | 3,658 | | | | 195,520 | |

| McDonald’s Corp. | | | 737 | | | | 194,155 | |

| MGM Resorts International | | | 4,702 | | | | 172,846 | |

| Mohawk Industries, Inc.(a) | | | 2,186 | | | | 187,581 | |

| NIKE, Inc., Class B | | | 2,106 | | | | 201,376 | |

| Norwegian Cruise Lines Holdings Ltd.(a) | | | 12,619 | | | | 207,960 | |

| NVR, Inc.(a) | | | 33 | | | | 196,789 | |

| O’Reilly Automotive, Inc.(a) | | | 215 | | | | 195,405 | |

| Pool Corp. | | | 597 | | | | 212,592 | |

| PulteGroup, Inc. | | | 2,548 | | | | 188,679 | |

| Ralph Lauren Corp. | | | 1,759 | | | | 204,202 | |

| Ross Stores, Inc. | | | 1,723 | | | | 194,613 | |

| Royal Caribbean Cruises Ltd.(a) | | | 2,113 | | | | 194,692 | |

| Starbucks Corp. | | | 2,159 | | | | 197,052 | |

| Tapestry, Inc. | | | 6,450 | | | | 185,438 | |

| Tesla, Inc.(a) | | | 828 | | | | 207,182 | |

| TJX Companies, Inc. (The) | | | 2,249 | | | | 199,891 | |

| Tractor Supply Co. | | | 946 | | | | 192,085 | |

| Ulta Beauty, Inc.(a) | | | 497 | | | | 198,527 | |

| VF Corporation | | | 10,941 | | | | 193,327 | |

| Whirlpool Corp. | | | 1,507 | | | | 201,486 | |

| Wynn Resorts Ltd. | | | 2,172 | | | | 200,715 | |

| Yum! Brands, Inc. | | | 1,626 | | | | 203,152 | |

| | | | | | | | 10,200,884 | |

| Consumer Staples — 7.50% | | | | | | | | |

| Altria Group, Inc. | | | 4,666 | | | | 196,205 | |

| Archer-Daniels-Midland Co. | | | 2,610 | | | | 196,846 | |

| Brown-Forman Corp., Class B | | | 3,198 | | | | 184,493 | |

| Bunge Ltd. | | | 1,830 | | | | 198,098 | |

| Campbell Soup Co. | | | 4,876 | | | | 200,306 | |

| Church & Dwight Co., Inc. | | | 2,150 | | | | 197,005 | |

| Clorox Co. (The) | | | 1,330 | | | | 174,310 | |

| Coca-Cola Co. (The) | | | 3,526 | | | | 197,385 | |

| Colgate-Palmolive Co. | | | 2,810 | | | | 199,818 | |

| Conagra Brands, Inc. | | | 7,068 | | | | 193,805 | |

| Constellation Brands, Inc., Class A | | | 794 | | | | 199,556 | |

| Costco Wholesale Corp. | | | 373 | | | | 210,729 | |

| Dollar General Corp. | | | 1,617 | | | | 171,079 | |

| Dollar Tree, Inc.(a) | | | 1,773 | | | | 188,736 | |

| Estee Lauder Companies, Inc. (The), Class A | | | 1,336 | | | | 193,119 | |

| General Mills, Inc. | | | 3,109 | | | | 198,945 | |

| Hershey Co. (The) | | | 984 | | | | 196,879 | |

| Hormel Foods Corp. | | | 5,541 | | | | 210,724 | |

| See Notes to Financial Statements. |

| 6 | www.ONEFUND.io |

| ONEFUND S&P 500® Equal Weight Index | Schedule of Investments |

| | September 30, 2023 (Unaudited) |

| | | Shares | | | Fair Value | |

| Consumer Staples (Continued) | | | | | | | | |

| J.M. Smucker Co. (The) | | | 1,453 | | | $ | 178,588 | |

| Kellogg Co. | | | 3,462 | | | | 206,024 | |

| KENVUE INC | | | 9,657 | | | | 193,913 | |

| Keurig Dr Pepper, Inc. | | | 6,166 | | | | 194,661 | |

| Kimberly-Clark Corp. | | | 1,613 | | | | 194,931 | |

| Kraft Heinz Co. (The) | | | 6,240 | | | | 209,914 | |

| Kroger Co. (The) | | | 4,382 | | | | 196,095 | |

| Lamb Weston Holdings, Inc. | | | 2,090 | | | | 193,241 | |

| McCormick & Co., Inc., Non-Voting Shares | | | 2,549 | | | | 192,806 | |

| Molson Coors Brewing Co., Class B | | | 3,232 | | | | 205,522 | |

| Mondelez International, Inc., Class A | | | 2,946 | | | | 204,452 | |

| Monster Beverage Corp.(a) | | | 3,649 | | | | 193,215 | |

| PepsiCo, Inc. | | | 1,167 | | | | 197,736 | |

| Philip Morris International, Inc. | | | 2,196 | | | | 203,306 | |

| Procter & Gamble Co. (The) | | | 1,345 | | | | 196,182 | |

| Sysco Corp. | | | 2,940 | | | | 194,187 | |

| Target Corp. | | | 1,663 | | | | 183,878 | |

| Tyson Foods, Inc., Class A | | | 3,952 | | | | 199,536 | |

| Walgreens Boots Alliance, Inc. | | | 9,354 | | | | 208,033 | |

| Wal-Mart Stores, Inc. | | | 1,256 | | | | 200,872 | |

| | | | | | | | 7,455,130 | |

| Energy — 5.21% | | | | | | | | |

| APA Corp. | | | 4,647 | | | | 190,992 | |

| Baker Hughes Co. | | | 5,567 | | | | 196,626 | |

| Chevron Corp. | | | 1,230 | | | | 207,402 | |

| ConocoPhillips | | | 1,676 | | | | 200,785 | |

| Coterra Energy, Inc. | | | 7,294 | | | | 197,303 | |

| Devon Energy Corp. | | | 3,906 | | | | 186,316 | |

| Diamondback Energy, Inc. | | | 1,318 | | | | 204,132 | |

| Enphase Energy, Inc.(a) | | | 1,711 | | | | 205,576 | |

| EOG Resources, Inc. | | | 1,550 | | | | 196,478 | |

| EQT Corp. | | | 4,842 | | | | 196,488 | |

| Exxon Mobil Corp. | | | 1,779 | | | | 209,175 | |

| First Solar, Inc.(a) | | | 1,123 | | | | 181,466 | |

| Halliburton Co. | | | 4,983 | | | | 201,812 | |

| Hess Corp. | | | 1,281 | | | | 195,993 | |

| Kinder Morgan, Inc. | | | 12,243 | | | | 202,989 | |

| Marathon Oil Corp. | | | 7,532 | | | | 201,481 | |

| Marathon Petroleum Corp. | | | 1,324 | | | | 200,374 | |

| Occidental Petroleum Corp. | | | 3,151 | | | | 204,437 | |

| ONEOK, Inc. | | | 3,176 | | | | 201,454 | |

| Phillips 66 | | | 1,683 | | | | 202,212 | |

| Pioneer Natural Resources Co. | | | 861 | | | | 197,643 | |

| Schlumberger Ltd. | | | 3,418 | | | | 199,269 | |

| SolarEdge Technologies, Inc.(a) | | | 1,382 | | | | 178,983 | |

| Targa Resources Corp. | | | 2,410 | | | | 206,585 | |

| Valero Energy Corp. | | | 1,448 | | | | 205,196 | |

| Williams Companies, Inc. (The) | | | 6,082 | | | | 204,903 | |

| | | | | | | | 5,176,070 | |

| Financials — 11.96% | | | | | | | | |

| Aflac, Inc. | | | 2,749 | | | | 210,986 | |

| Allstate Corp. (The) | | | 1,937 | | | | 215,800 | |

| | | Shares | | | Fair Value | |

| Financials (Continued) | | | | | | | | |

| American Express Co. | | | 1,307 | | | $ | 194,991 | |

| American International Group, Inc. | | | 3,448 | | | | 208,949 | |

| Ameriprise Financial, Inc. | | | 596 | | | | 196,489 | |

| Aon PLC, Class A | | | 617 | | | | 200,044 | |

| Arch Capital Group Ltd.(a) | | | 2,662 | | | | 212,188 | |

| Arthur J. Gallagher & Co. | | | 901 | | | | 205,365 | |

| Assurant, Inc. | | | 1,487 | | | | 213,503 | |

| Bank of America Corp. | | | 7,253 | | | | 198,587 | |

| Bank of New York Mellon Corp. (The) | | | 4,593 | | | | 195,891 | |

| Berkshire Hathaway, Inc., Class B(a) | | | 566 | | | | 198,270 | |

| BlackRock, Inc. | | | 298 | | | | 192,654 | |

| Blackstone Group L.P. (The), Class A | | | 1,826 | | | | 195,638 | |

| Brown & Brown, Inc. | | | 2,813 | | | | 196,460 | |

| Capital One Financial Corp. | | | 2,059 | | | | 199,826 | |

| Cboe Global Markets, Inc. | | | 1,344 | | | | 209,946 | |

| Charles Schwab Corp. (The) | | | 3,467 | | | | 190,338 | |

| Chubb Ltd. | | | 1,005 | | | | 209,221 | |

| Cincinnati Financial Corp. | | | 1,959 | | | | 200,386 | |

| Citigroup, Inc. | | | 5,067 | | | | 208,406 | |

| Citizens Financial Group, Inc. | | | 7,515 | | | | 201,402 | |

| CME Group, Inc. | | | 1,003 | | | | 200,821 | |

| Comerica, Inc. | | | 4,402 | | | | 182,903 | |

| Discover Financial Services | | | 2,296 | | | | 198,902 | |

| Everest Re Group Ltd. | | | 555 | | | | 206,277 | |

| Fifth Third Bancorp | | | 7,788 | | | | 197,270 | |

| Franklin Resources, Inc. | | | 7,932 | | | | 194,969 | |

| Globe Life, Inc. | | | 1,884 | | | | 204,847 | |

| Goldman Sachs Group, Inc. (The) | | | 632 | | | | 204,496 | |

| Hartford Financial Services Group, Inc. (The) | | | 2,877 | | | | 204,008 | |

| Huntington Bancshares, Inc. | | | 18,922 | | | | 196,789 | |

| Intercontinental Exchange, Inc. | | | 1,789 | | | | 196,826 | |

| Invesco Ltd. | | | 13,313 | | | | 193,305 | |

| JPMorgan Chase & Co. | | | 1,430 | | | | 207,378 | |

| KeyCorp | | | 18,283 | | | | 196,725 | |

| Loews Corp. | | | 3,295 | | | | 208,606 | |

| M&T Bank Corp. | | | 1,689 | | | | 213,574 | |

| Marsh & McLennan Companies, Inc. | | | 1,056 | | | | 200,957 | |

| MetLife, Inc. | | | 3,249 | | | | 204,395 | |

| Morgan Stanley | | | 2,422 | | | | 197,805 | |

| Nasdaq, Inc. | | | 3,999 | | | | 194,311 | |

| Northern Trust Corp. | | | 2,693 | | | | 187,110 | |

| PNC Financial Services Group, Inc. (The) | | | 1,759 | | | | 215,953 | |

| Principal Financial Group, Inc. | | | 2,729 | | | | 196,679 | |

| Progressive Corp. (The) | | | 1,515 | | | | 211,040 | |

| Prudential Financial, Inc. | | | 2,163 | | | | 205,247 | |

| Raymond James Financial, Inc. | | | 1,934 | | | | 194,232 | |

| Regions Financial Corp. | | | 11,478 | | | | 197,422 | |

| State Street Corp. | | | 2,932 | | | | 196,327 | |

| Synchrony Financial | | | 6,576 | | | | 201,029 | |

| T. Rowe Price Group, Inc. | | | 1,883 | | | | 197,469 | |

| Travelers Companies, Inc. (The) | | | 1,286 | | | | 210,017 | |

| See Notes to Financial Statements. |

| Semi-Annual Report | September 30, 2023 | 7 |

| ONEFUND S&P 500® Equal Weight Index | Schedule of Investments |

| | September 30, 2023 (Unaudited) |

| | | Shares | | | Fair Value | |

| Financials (Continued) | | | | | | | | |

| Truist Financial Corp. | | | 6,907 | | | $ | 197,609 | |

| U.S. Bancorp | | | 5,696 | | | | 188,310 | |

| W.R. Berkley Corp. | | | 3,321 | | | | 210,850 | |

| Wells Fargo & Co. | | | 5,017 | | | | 204,995 | |

| Willis Towers Watson PLC | | | 1,014 | | | | 211,885 | |

| Zions Bancorporation | | | 5,890 | | | | 205,502 | |

| | | | | | | | 11,892,180 | |

| Health Care — 13.09% | | | | | | | | |

| Abbott Laboratories | | | 2,042 | | | | 197,768 | |

| AbbVie, Inc. | | | 1,380 | | | | 205,703 | |

| Agilent Technologies, Inc. | | | 1,804 | | | | 201,723 | |

| Align Technology, Inc.(a) | | | 619 | | | | 188,993 | |

| AmerisourceBergen Corp. | | | 1,157 | | | | 208,225 | |

| Amgen, Inc. | | | 793 | | | | 213,126 | |

| Baxter International, Inc. | | | 5,319 | | | | 200,739 | |

| Becton, Dickinson and Co. | | | 771 | | | | 199,327 | |

| Biogen, Inc.(a) | | | 794 | | | | 204,066 | |

| Bio-Rad Laboratories, Inc., Class A(a) | | | 575 | | | | 206,109 | |

| Bio-Techne Corp. | | | 2,864 | | | | 194,952 | |

| Boston Scientific Corp.(a) | | | 3,818 | | | | 201,590 | |

| Bristol-Myers Squibb Co. | | | 3,382 | | | | 196,291 | |

| Cardinal Health, Inc. | | | 2,317 | | | | 201,162 | |

| Catalent, Inc.(a) | | | 4,243 | | | | 193,184 | |

| Centene Corp.(a) | | | 3,145 | | | | 216,628 | |

| Charles River Laboratories International, Inc.(a) | | | 1,030 | | | | 201,859 | |

| Cigna Corp. | | | 731 | | | | 209,117 | |

| Cooper Companies, Inc. (The) | | | 588 | | | | 186,990 | |

| CVS Health Corp. | | | 3,124 | | | | 218,118 | |

| Danaher Corp. | | | 828 | | | | 205,427 | |

| DaVita, Inc.(a) | | | 2,153 | | | | 203,523 | |

| DENTSPLY SIRONA, Inc. | | | 5,714 | | | | 195,190 | |

| DexCom, Inc.(a) | | | 1,971 | | | | 183,894 | |

| Edwards LifeSciences Corp.(a) | | | 2,777 | | | | 192,391 | |

| Elevance Health, Inc. | | | 458 | | | | 199,422 | |

| Eli Lilly & Co. | | | 351 | | | | 188,533 | |

| GE HealthCare Technologies, Inc. | | | 3,169 | | | | 215,618 | |

| Gilead Sciences, Inc. | | | 2,706 | | | | 202,788 | |

| HCA Healthcare, Inc. | | | 752 | | | | 184,977 | |

| Henry Schein, Inc.(a) | | | 2,784 | | | | 206,712 | |

| Hologic, Inc.(a) | | | 2,848 | | | | 197,651 | |

| Humana, Inc. | | | 440 | | | | 214,069 | |

| IDEXX Laboratories, Inc.(a) | | | 442 | | | | 193,273 | |

| Illumina, Inc.(a) | | | 1,299 | | | | 178,327 | |

| Incyte Corp.(a) | | | 3,215 | | | | 185,731 | |

| Insulet Corp.(a) | | | 1,196 | | | | 190,750 | |

| Intuitive Surgical, Inc.(a) | | | 690 | | | | 201,680 | |

| IQVIA Holdings, Inc.(a) | | | 963 | | | | 189,470 | |

| Johnson & Johnson | | | 1,281 | | | | 199,516 | |

| Laboratory Corporation of America Holdings | | | 1,012 | | | | 203,463 | |

| McKesson Corp. | | | 489 | | | | 212,642 | |

| Medtronic PLC | | | 2,572 | | | | 201,542 | |

| | | Shares | | | Fair Value | |

| Health Care (Continued) | | | | | | | | |

| Merck & Co., Inc. | | | 1,886 | | | $ | 194,164 | |

| Mettler-Toledo International, Inc.(a) | | | 182 | | | | 201,669 | |

| Moderna, Inc.(a) | | | 1,911 | | | | 197,387 | |

| Molina Healthcare, Inc.(a) | | | 642 | | | | 210,505 | |

| Organon & Co. | | | 10,663 | | | | 185,110 | |

| PerkinElmer, Inc. | | | 1,925 | | | | 213,098 | |

| Pfizer, Inc. | | | 6,005 | | | | 199,186 | |

| Quest Diagnostics, Inc. | | | 1,619 | | | | 197,291 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 248 | | | | 204,094 | |

| ResMed, Inc. | | | 1,390 | | | | 205,539 | |

| STERIS PLC | | | 923 | | | | 202,525 | |

| Stryker Corp. | | | 710 | | | | 194,022 | |

| Teleflex, Inc. | | | 995 | | | | 195,428 | |

| Thermo Fisher Scientific, Inc. | | | 397 | | | | 200,949 | |

| UnitedHealth Group, Inc. | | | 428 | | | | 215,793 | |

| Universal Health Services, Inc., Class B | | | 1,564 | | | | 196,642 | |

| Vertex Pharmaceuticals, Inc.(a) | | | 600 | | | | 208,643 | |

| Viatris, Inc. | | | 20,345 | | | | 200,602 | |

| Waters Corp.(a) | | | 780 | | | | 213,884 | |

| West Pharmaceutical Services, Inc. | | | 523 | | | | 196,235 | |

| Zimmer Biomet Holdings, Inc. | | | 1,705 | | | | 191,335 | |

| Zoetis, Inc., Class A | | | 1,107 | | | | 192,596 | |

| | | | | | | | 13,008,956 | |

| Industrials — 14.06% | | | | | | | | |

| 3M Co. | | | 1,936 | | | | 181,248 | |

| A.O. Smith Corp. | | | 2,930 | | | | 193,761 | |

| Alaska Air Group, Inc.(a) | | | 5,167 | | | | 191,592 | |

| Allegion PLC | | | 1,903 | | | | 198,293 | |

| American Airlines Group, Inc.(a) | | | 14,713 | | | | 188,474 | |

| AMETEK, Inc. | | | 1,336 | | | | 197,407 | |

| Amphenol Corp., Class A | | | 2,395 | | | | 201,156 | |

| Boeing Co. (The)(a) | | | 974 | | | | 186,696 | |

| Carrier Global Corp. | | | 3,506 | | | | 193,531 | |

| Caterpillar, Inc. | | | 729 | | | | 199,017 | |

| CH Robinson Worldwide, Inc. | | | 2,383 | | | | 205,248 | |

| Cintas Corp. | | | 415 | | | | 199,619 | |

| CSX Corp. | | | 6,868 | | | | 211,191 | |

| Cummins, Inc. | | | 876 | | | | 200,131 | |

| Deere & Co. | | | 515 | | | | 194,351 | |

| Delta Air Lines, Inc. | | | 5,039 | | | | 186,443 | |

| Dover Corp. | | | 1,447 | | | | 201,871 | |

| Eaton Corp. PLC | | | 871 | | | | 185,767 | |

| Emerson Electric Co. | | | 2,079 | | | | 200,769 | |

| Expeditors International of Washington, Inc. | | | 1,793 | | | | 205,532 | |

| Fastenal Co. | | | 3,773 | | | | 206,157 | |

| FedEx Corp. | | | 812 | | | | 215,114 | |

| Fortive Corp. | | | 2,652 | | | | 196,672 | |

| Generac Holdings, Inc.(a) | | | 1,786 | | | | 194,603 | |

| General Dynamics Corp. | | | 944 | | | | 208,595 | |

| General Electric, Co. | | | 1,841 | | | | 203,523 | |

| See Notes to Financial Statements. |

| 8 | www.ONEFUND.io |

| ONEFUND S&P 500® Equal Weight Index | Schedule of Investments |

| | September 30, 2023 (Unaudited) |

| | | Shares | | | Fair Value | |

| Industrials (Continued) | | | | | | | | |

| Honeywell International, Inc. | | | 1,115 | | | $ | 205,985 | |

| Howmet Aerospace Inc. | | | 4,317 | | | | 199,661 | |

| Huntington Ingalls Industries, Inc. | | | 976 | | | | 199,670 | |

| IDEX Corp. | | | 952 | | | | 198,035 | |

| Illinois Tool Works, Inc. | | | 863 | | | | 198,758 | |

| Ingersoll Rand, Inc. | | | 2,963 | | | | 188,802 | |

| Jacobs Solutions, Inc. | | | 1,573 | | | | 214,714 | |

| JB Hunt Transport Services, Inc. | | | 1,114 | | | | 210,011 | |

| Johnson Controls International PLC | | | 3,587 | | | | 190,864 | |

| Keysight Technologies, Inc.(a) | | | 1,555 | | | | 205,742 | |

| L3 Harris Technologies, Inc. | | | 1,225 | | | | 213,297 | |

| Lockheed Martin Corp. | | | 486 | | | | 198,755 | |

| Nordson Corp. | | | 884 | | | | 197,282 | |

| Norfolk Southern Corp. | | | 1,051 | | | | 206,973 | |

| Northrop Grumman Corp. | | | 487 | | | | 214,372 | |

| Old Dominion Freight Line, Inc. | | | 488 | | | | 199,660 | |

| Otis Worldwide Corp. | | | 2,487 | | | | 199,731 | |

| PACCAR, Inc. | | | 2,434 | | | | 206,939 | |

| Parker-Hannifin Corp. | | | 503 | | | | 195,929 | |

| Pentair PLC | | | 3,021 | | | | 195,610 | |

| Quanta Services, Inc. | | | 996 | | | | 186,322 | |

| Raytheon Technologies Corp. | | | 2,464 | | | | 177,334 | |

| Republic Services, Inc. | | | 1,407 | | | | 200,512 | |

| Robert Half International, Inc. | | | 2,810 | | | | 205,917 | |

| Rockwell Automation, Inc. | | | 693 | | | | 198,108 | |

| Rollins, Inc. | | | 5,696 | | | | 212,631 | |

| Roper Technologies, Inc. | | | 418 | | | | 202,429 | |

| Snap-on, Inc. | | | 792 | | | | 202,008 | |

| Southwest Airlines Co. | | | 6,965 | | | | 188,543 | |

| Stanley Black & Decker, Inc. | | | 2,261 | | | | 188,974 | |

| TE Connectivity Ltd. | | | 1,609 | | | | 198,760 | |

| Teledyne Technologies, Inc.(a) | | | 501 | | | | 204,699 | |

| Textron, Inc. | | | 2,721 | | | | 212,619 | |

| Trane Technologies PLC | | | 999 | | | | 202,707 | |

| Transdigm Group, Inc.(a) | | | 236 | | | | 198,979 | |

| Trimble, Inc.(a) | | | 4,035 | | | | 217,325 | |

| Union Pacific Corp. | | | 971 | | | | 197,725 | |

| United Airlines Holdings, Inc.(a) | | | 4,336 | | | | 183,413 | |

| United Parcel Service, Inc., Class B | | | 1,277 | | | | 199,046 | |

| United Rentals, Inc. | | | 444 | | | | 197,389 | |

| W.W. Grainger, Inc. | | | 298 | | | | 206,168 | |

| Wabtec Corp. | | | 1,930 | | | | 205,101 | |

| Waste Management, Inc. | | | 1,315 | | | | 200,459 | |

| Xylem, Inc. | | | 2,160 | | | | 196,625 | |

| | | | | | | | 13,971,344 | |

| Materials — 5.84% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 689 | | | | 195,263 | |

| Albemarle Corp. | | | 1,115 | | | | 189,595 | |

| Amcor PLC | | | 22,236 | | | | 203,682 | |

| Avery Dennison Corp. | | | 1,136 | | | | 207,513 | |

| Ball Corp. | | | 3,949 | | | | 196,581 | |

| Celanese Corp. | | | 1,651 | | | | 207,234 | |

| CF Industries Holdings, Inc. | | | 2,456 | | | | 210,577 | |

| | | Shares | | | Fair Value | |

| Materials (Continued) | | | | | | | | |

| Corteva, Inc. | | | 4,149 | | | $ | 212,262 | |

| Dow, Inc. | | | 3,830 | | | | 197,475 | |

| DuPont de Nemours, Inc. | | | 2,728 | | | | 203,482 | |

| Eastman Chemical Co. | | | 2,586 | | | | 198,398 | |

| Ecolab, Inc. | | | 1,130 | | | | 191,422 | |

| FMC Corp. | | | 2,726 | | | | 182,560 | |

| Freeport-McMoRan, Inc. | | | 5,235 | | | | 195,213 | |

| International Flavors & Fragrances, Inc. | | | 2,993 | | | | 204,033 | |

| International Paper Co. | | | 5,940 | | | | 210,692 | |

| Linde PLC | | | 532 | | | | 198,090 | |

| LyondellBasell Industries N.V., Class A | | | 2,070 | | | | 196,029 | |

| Martin Marietta Materials, Inc. | | | 470 | | | | 192,926 | |

| Mosaic Co. (The) | | | 5,463 | | | | 194,483 | |

| Newmont Corp. | | | 5,311 | | | | 196,241 | |

| Nucor Corp. | | | 1,247 | | | | 194,968 | |

| Packaging Corporation of America | | | 1,403 | | | | 215,430 | |

| PPG Industries, Inc. | | | 1,516 | | | | 196,777 | |

| Sealed Air Corp. | | | 6,057 | | | | 199,033 | |

| Sherwin-Williams Co. (The) | | | 758 | | | | 193,328 | |

| Steel Dynamics, Inc. | | | 1,998 | | | | 214,226 | |

| Vulcan Materials Co. | | | 951 | | | | 192,121 | |

| WestRock Co. | | | 5,950 | | | | 213,010 | |

| | | | | | | | 5,802,644 | |

| Real Estate — 5.80% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 1,788 | | | | 178,979 | |

| American Tower Corp. | | | 1,137 | | | | 186,980 | |

| AvalonBay Communities, Inc. | | | 1,147 | | | | 196,986 | |

| Boston Properties, Inc. | | | 3,089 | | | | 183,734 | |

| Camden Property Trust | | | 1,997 | | | | 188,876 | |

| CBRE Group, Inc., Class A(a) | | | 2,413 | | | | 178,224 | |

| Crown Castle International Corp. | | | 2,073 | | | | 190,778 | |

| Digital Realty Trust, Inc. | | | 1,582 | | | | 191,454 | |

| Equinix, Inc. | | | 267 | | | | 193,911 | |

| Equity Residential | | | 3,283 | | | | 192,745 | |

| Essex Property Trust, Inc. | | | 913 | | | | 193,638 | |

| Extra Space Storage, Inc. | | | 1,627 | | | | 197,811 | |

| Federal Realty Investment Trust | | | 2,107 | | | | 190,957 | |

| Healthpeak Properties, Inc. | | | 10,274 | | | | 188,631 | |

| Host Hotels & Resorts, Inc. | | | 12,815 | | | | 205,936 | |

| Invitation Homes, Inc. | | | 6,071 | | | | 192,390 | |

| Iron Mountain, Inc. | | | 3,282 | | | | 195,115 | |

| Kimco Realty Corp. | | | 11,070 | | | | 194,721 | |

| Mid-America Apartment Communities, Inc. | | | 1,492 | | | | 191,946 | |

| Prologis, Inc. | | | 1,679 | | | | 188,401 | |

| Public Storage | | | 752 | | | | 198,167 | |

| Realty Income Corp. | | | 3,718 | | | | 185,677 | |

| Regency Centers Corp. | | | 3,210 | | | | 190,802 | |

| SBA Communications Corp., Class A | | | 948 | | | | 189,761 | |

| Simon Property Group, Inc. | | | 1,795 | | | | 193,914 | |

| UDR, Inc. | | | 5,320 | | | | 189,764 | |

| Ventas, Inc. | | | 4,853 | | | | 204,457 | |

| VICI Properties, Inc. | | | 6,595 | | | | 191,915 | |

| See Notes to Financial Statements. |

| Semi-Annual Report | September 30, 2023 | 9 |

| | |

| ONEFUND S&P 500® Equal Weight Index | Schedule of Investments |

| | September 30, 2023 (Unaudited) |

| | | Shares | | | Fair Value | |

| Real Estate (Continued) | | | | | | | | |

| Welltower, Inc. | | | 2,490 | | | $ | 203,981 | |

| Weyerhaeuser Co. | | | 6,408 | | | | 196,469 | |

| | | | | | | | 5,767,120 | |

| Technology — 15.46% | | | | | | | | |

| Accenture PLC, Class A | | | 632 | | | | 194,094 | |

| Adobe, Inc.(a) | | | 367 | | | | 187,133 | |

| Advanced Micro Devices, Inc.(a) | | | 1,939 | | | | 199,368 | |

| Akamai Technologies, Inc.(a) | | | 1,965 | | | | 209,350 | |

| Analog Devices, Inc. | | | 1,159 | | | | 202,929 | |

| ANSYS, Inc.(a) | | | 654 | | | | 194,598 | |

| Apple, Inc. | | | 1,154 | | | | 197,576 | |

| Applied Materials, Inc. | | | 1,394 | | | | 192,999 | |

| Arista Networks, Inc.(a) | | | 1,047 | | | | 192,575 | |

| Autodesk, Inc.(a) | | | 938 | | | | 194,082 | |

| Automatic Data Processing, Inc. | | | 825 | | | | 198,479 | |

| Broadcom, Inc. | | | 240 | | | | 199,339 | |

| Broadridge Financial Solutions, Inc. | | | 1,096 | | | | 196,239 | |

| Cadence Design Systems, Inc.(a) | | | 864 | | | | 202,435 | |

| CDW Corp. | | | 967 | | | | 195,102 | |

| Ceridian HCM Holding, Inc.(a) | | | 2,813 | | | | 190,862 | |

| Cisco Systems, Inc. | | | 3,630 | | | | 195,149 | |

| Cognizant Technology Solutions Corp., Class A | | | 2,883 | | | | 195,294 | |

| Corning, Inc. | | | 6,557 | | | | 199,792 | |

| CoStar Group, Inc.(a) | | | 2,491 | | | | 191,533 | |

| DXC Technology Co.(a) | | | 10,009 | | | | 208,487 | |

| EPAM Systems, Inc.(a) | | | 775 | | | | 198,160 | |

| Equifax, Inc. | | | 1,046 | | | | 191,606 | |

| F5, Inc.(a) | | | 1,281 | | | | 206,420 | |

| FactSet Research Systems, Inc. | | | 479 | | | | 209,449 | |

| Fair Isaac Corp.(a) | | | 229 | | | | 198,893 | |

| Fidelity National Information Services, Inc. | | | 3,717 | | | | 205,438 | |

| Fiserv, Inc.(a) | | | 1,692 | | | | 191,128 | |

| FleetCor Technologies, Inc.(a) | | | 757 | | | | 193,292 | |

| Fortinet, Inc.(a) | | | 3,210 | | | | 188,363 | |

| Garmin Ltd. | | | 2,001 | | | | 210,505 | |

| Gartner, Inc.(a) | | | 581 | | | | 199,637 | |

| Global Payments, Inc. | | | 1,634 | | | | 188,547 | |

| Hewlett Packard Enterprise Co. | | | 11,862 | | | | 206,043 | |

| HP, Inc. | | | 6,984 | | | | 179,489 | |

| Intel Corp. | | | 5,411 | | | | 192,361 | |

| International Business Machines Corp. | | | 1,393 | | | | 195,438 | |

| Intuit, Inc. | | | 374 | | | | 191,092 | |

| Jack Henry & Associates, Inc. | | | 1,359 | | | | 205,399 | |

| Juniper Networks, Inc. | | | 7,076 | | | | 196,642 | |

| KLA Corp. | | | 413 | | | | 189,427 | |

| Lam Research Corp. | | | 308 | | | | 193,045 | |

| Leidos Holdings, Inc. | | | 2,147 | | | | 197,868 | |

| MarketAxess Holdings, Inc. | | | 908 | | | | 193,985 | |

| MasterCard, Inc., Class A | | | 496 | | | | 196,371 | |

| Microchip Technology, Inc. | | | 2,611 | | | | 203,789 | |

| | | Shares | | | Fair Value | |

| Technology (Continued) | | | | | | | | |

| Micron Technology, Inc. | | | 2,931 | | | $ | 199,396 | |

| Microsoft Corp. | | | 615 | | | | 194,186 | |

| Monolithic Power Systems, Inc. | | | 411 | | | | 189,882 | |

| Moody’s Corp. | | | 605 | | | | 191,283 | |

| Motorola Solutions, Inc. | | | 728 | | | | 198,191 | |

| MSCI, Inc. | | | 385 | | | | 197,536 | |

| NetApp, Inc. | | | 2,601 | | | | 197,364 | |

| NortonLifeLock, Inc. | | | 10,289 | | | | 181,910 | |

| NVIDIA Corp. | | | 451 | | | | 196,180 | |

| NXP Semiconductors NV | | | 1,013 | | | | 202,519 | |

| ON Semiconductor Corp.(a) | | | 2,101 | | | | 195,288 | |

| Oracle Corp. | | | 1,628 | | | | 172,438 | |

| Palo Alto Networks, Inc.(a) | | | 827 | | | | 193,882 | |

| Paychex, Inc. | | | 1,706 | | | | 196,753 | |

| Paycom Software, Inc. | | | 723 | | | | 187,452 | |

| PayPal Holdings, Inc.(a) | | | 3,373 | | | | 197,186 | |

| PTC, Inc.(a) | | | 1,432 | | | | 202,886 | |

| Qorvo, Inc.(a) | | | 2,071 | | | | 197,718 | |

| Qualcomm, Inc. | | | 1,938 | | | | 215,235 | |

| S&P Global, Inc. | | | 526 | | | | 192,206 | |

| Salesforce, Inc.(a) | | | 915 | | | | 185,544 | |

| Seagate Technology PLC | | | 3,146 | | | | 207,479 | |

| ServiceNow, Inc.(a) | | | 343 | | | | 191,723 | |

| Skyworks Solutions, Inc. | | | 2,070 | | | | 204,081 | |

| Synopsys, Inc.(a) | | | 448 | | | | 205,619 | |

| Teradyne, Inc. | | | 2,063 | | | | 207,250 | |

| Texas Instruments, Inc. | | | 1,249 | | | | 198,603 | |

| Tyler Technologies, Inc.(a) | | | 524 | | | | 202,337 | |

| Verisk Analytics, Inc. | | | 842 | | | | 198,914 | |

| Visa, Inc., Class A | | | 832 | | | | 191,368 | |

| Western Digital Corp.(a) | | | 4,732 | | | | 215,920 | |

| Zebra Technologies Corp., Class A(a) | | | 802 | | | | 189,697 | |

| | | | | | | | 15,357,828 | |

| Utilities — 5.87% | | | | | | | | |

| AES Corp. | | | 11,910 | | | | 181,032 | |

| Alliant Energy Corp. | | | 4,054 | | | | 196,416 | |

| Ameren Corp. | | | 2,590 | | | | 193,810 | |

| American Electric Power Co., Inc. | | | 2,646 | | | | 199,032 | |

| American Water Works Co., Inc. | | | 1,493 | | | | 184,878 | |

| Atmos Energy Corp. | | | 1,801 | | | | 190,780 | |

| CenterPoint Energy, Inc. | | | 7,271 | | | | 195,226 | |

| CMS Energy Corp. | | | 3,675 | | | | 195,179 | |

| Consolidated Edison, Inc. | | | 2,305 | | | | 197,147 | |

| Constellation Energy Corp. | | | 1,893 | | | | 206,487 | |

| Dominion Energy, Inc. | | | 4,365 | | | | 194,985 | |

| DTE Energy Co. | | | 2,004 | | | | 198,957 | |

| Duke Energy Corp. | | | 2,260 | | | | 199,468 | |

| Edison International | | | 2,947 | | | | 186,516 | |

| Entergy Corp. | | | 2,159 | | | | 199,708 | |

| Evergy, Inc. | | | 3,813 | | | | 193,319 | |

| Eversource Energy | | | 3,313 | | | | 192,651 | |

| Exelon Corp. | | | 5,069 | | | | 191,558 | |

| FirstEnergy Corp. | | | 5,774 | | | | 197,355 | |

| See Notes to Financial Statements. |

| 10 | www.ONEFUND.io |

| ONEFUND S&P 500® Equal Weight Index | Schedule of Investments |

| | September 30, 2023 (Unaudited) |

| | | Shares | | | Fair Value | |

| Utilities (Continued) | | | | | | | | |

| NextEra Energy, Inc. | | | 3,078 | | | $ | 176,339 | |

| Nisource, Inc. | | | 7,626 | | | | 188,210 | |

| NRG Energy, Inc. | | | 5,206 | | | | 200,535 | |

| PG&E Corp.(a) | | | 12,128 | | | | 195,625 | |

| Pinnacle West Capital Corp. | | | 2,685 | | | | 197,831 | |

| PPL Corp. | | | 8,311 | | | | 195,807 | |

| Public Service Enterprise Group, Inc. | | | 3,384 | | | | 192,583 | |

| Sempra Energy | | | 2,887 | | | | 196,403 | |

| Southern Co. (The) | | | 3,028 | | | | 195,972 | |

| WEC Energy Group, Inc. | | | 2,429 | | | | 195,656 | |

| Xcel Energy, Inc. | | | 3,604 | | | | 206,220 | |

| | | | | | | | 5,835,685 | |

| | | | | | | | | |

| Total Common Stocks (Cost $78,786,042) | | | | | | | 99,051,465 | |

| | | Shares | | | Fair Value | |

| EXCHANGE-TRADED FUNDS — 0.19% | | | | | | | | |

| SPDR® S&P 500® ETF Trust | | | 440 | | | $ | 188,091 | |

| Total Exchange-Traded Funds (Cost $188,740) | | | | | | | 188,091 | |

| | | | | | | | | |

| Total Investments — 99.85% (Cost $78,974,782) | | | | | | | 99,239,556 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.15% | | | | | | | 153,595 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 99,393,151 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| See Notes to Financial Statements. |

| Semi-Annual Report | September 30, 2023 | 11 |

| ONEFUND S&P 500® Equal Weight Index | Statement of Assets and Liabilities |

| | September 30, 2023 (Unaudited) |

| ASSETS: | | | | |

| Investments in securities at fair value (cost $78,974,782) | | $ | 99,239,556 | |

| Cash and cash equivalents | | | 164,551 | |

| Receivable for fund shares sold | | | 34,368 | |

| Dividends receivable | | | 129,705 | |

| Tax reclaims receivable | | | 260 | |

| Receivable from Investment Adviser | | | 20,445 | |

| Prepaid expenses | | | 21,414 | |

| Total Assets | | | 99,610,299 | |

| LIABILITIES: | | | | |

| Payable for fund shares redeemed | | | 47,511 | |

| Payable for investments purchased | | | 154,155 | |

| Payable to Administrator | | | 10,830 | |

| Payable to trustees | | | 2,396 | |

| Other accrued expenses | | | 2,256 | |

| Total Liabilities | | | 217,148 | |

| NET ASSETS | | $ | 99,393,151 | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | | 82,330,335 | |

| Accumulated earnings | | | 17,062,816 | |

| NET ASSETS | | $ | 99,393,151 | |

| Shares of beneficial interest outstanding, without par value | | | 2,357,718 | |

| Net asset value, offering and redemption price per share(a) | | $ | 42.16 | |

| | | | | |

| (a) | The Fund charges a 0.25% redemption fee on shares redeemed within 30 calendar days of purchase. Shares are redeemed at the Net Asset Value if held longer than 30 calendar days. |

| See Notes to Financial Statements. |

| 12 | www.ONEFUND.io |

| ONEFUND S&P 500® Equal Weight Index | Statement of Operations |

| For the six months ended September 30, 2023 (Unaudited) |

| INVESTMENT INCOME: | | | | |

| Dividend and interest income (net of foreign taxes withheld of $493) | | $ | 1,005,984 | |

| Total investment income | | | 1,005,984 | |

| | | | | |

| EXPENSES: | | | | |

| Investment Adviser fees (Note 3) | | | 127,990 | |

| Fund accounting and administration fees | | | 55,004 | |

| Registration expenses | | | 24,638 | |

| Insurance expenses | | | 20,508 | |

| Transfer agent fees | | | 17,751 | |

| Chief compliance officer fees | | | 16,525 | |

| Legal fees | | | 13,620 | |

| Printing and postage expenses | | | 11,257 | |

| Audit and tax preparation fees | | | 10,181 | |

| Custodian fees | | | 7,901 | |

| Pricing | | | 5,686 | |

| Trustee fees and expenses | | | 512 | |

| Miscellaneous expenses | | | 9,008 | |

| Total expenses | | | 320,581 | |

| Fees waived/reimbursed by Investment Adviser (Note 3) | | | (192,950 | ) |

| Net operating expenses | | | 127,631 | |

| NET INVESTMENT INCOME: | | | 878,353 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMETNTS: | | | | |

| Net realized loss on investments | | | (874,909 | ) |

| Net change in unrealized loss on investments | | | (1,440,443 | ) |

| NET REALIZED AND CHANGE IN UNREALIZED LOSS ON INVESTMENTS | | | (2,315,352 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (1,436,999 | ) |

| | | | | |

| See Notes to Financial Statements. |

| Semi-Annual Report | September 30, 2023 | 13 |

| ONEFUND S&P 500® Equal Weight Index | Statements of Changes in Net Assets |

| | | For the | | | | |

| | | Six Months | | | For the | |

| | | Ended | | | Year | |

| | | September 30, | | | Ended | |

| | | 2023 | | | March 31, | |

| | | (Unaudited) | | | 2023 | |

| INCREASE (DECREASE) IN NET ASSETS DUE TO: | | | | | | | | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 878,353 | | | $ | 1,608,094 | |

| Net realized loss on investments | | | (874,909 | ) | | | (1,269,938 | ) |

| Net change in unrealized depreciation on investments | | | (1,440,443 | ) | | | (6,843,597 | ) |

| Net decrease in net assets resulting from operations | | | (1,436,999 | ) | | | (6,505,441 | ) |

| | | | | | | | | |

| Distributions to shareholders | | | | | | | | |

| From earnings | | | — | | | | (3,101,494 | ) |

| Total Distributions | | | — | | | | (3,101,494 | ) |

| | | | | | | | | |

| CAPITAL TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 10,162,773 | | | | 22,388,785 | |

| Reinvestment of distributions | | | — | | | | 3,060,343 | |

| Amount paid for shares redeemed | | | (10,782,689 | ) | | | (16,662,661 | ) |

| Proceeds from redemption fees(a) | | | 675 | | | | 2,628 | |

| Net increase (decrease) in net assets resulting from capital transactions | | | (619,241 | ) | | | 8,789,095 | |

| Total Decrease in Net Assets | | | (2,056,240 | ) | | | (817,840 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 101,449,391 | | | | 102,267,231 | |

| End of period | | $ | 99,393,151 | | | $ | 101,449,391 | |

| | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | |

| Shares sold | | | 232,895 | | | | 521,607 | |

| Shares issued in reinvestment of distributions | | | — | | | | 71,570 | |

| Shares redeemed | | | (248,856 | ) | | | (388,236 | ) |

| Net increase (decrease) in shares outstanding | | | (15,961 | ) | | | 204,941 | |

| | | | | | | | | |

| (a) | The Fund charges a 0.25% redemption fee on shares redeemed within 30 calendar days of purchase. Shares are redeemed at the Net Asset Value if held longer than 30 calendar days. |

| See Notes to Financial Statements. |

| 14 | www.ONEFUND.io |

| ONEFUND S&P 500® Equal Weight Index | Financial Highlights |

| (For a share outstanding during each period) |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | September 30, | | | For the Year | | | For the Year | | | For the Year | | | For the Year | | | For the Year | |

| | | 2023 | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | (Unaudited) | | | March 31, 2023 | | | March 31, 2022 | | | March 31, 2021 | | | March 31, 2020 | | | March 31, 2019 | |

| SELECTED PER SHARE DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 42.74 | | | $ | 47.16 | | | $ | 42.58 | | | $ | 25.34 | | | $ | 31.19 | | | $ | 30.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.37 | | | | 0.71 | | | | 0.63 | | | | 0.56 | | | | 0.60 | | | | 0.57 | |

| Net realized and unrealized gain (loss) on investments | | | (0.95 | ) | | | (3.78 | ) | | | 4.83 | | | | 17.25 | | | | (5.90 | ) | | | 1.42 | |

| Total from investment operations | | | (0.58 | ) | | | (3.07 | ) | | | 5.46 | | | | 17.81 | | | | (5.30 | ) | | | 1.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.50 | ) | | | (0.53 | ) | | | (0.58 | ) | | | (0.55 | ) | | | (0.49 | ) |

| Net realized gains | | | — | | | | (0.85 | ) | | | (0.35 | ) | | | — | | | | — | | | | (0.35 | ) |

| Total distributions | | | — | | | | (1.35 | ) | | | (0.88 | ) | | | (0.58 | ) | | | (0.55 | ) | | | (0.84 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | (b) | | | 0.01 | | | | — | (b) | | | — | (b) |

| Net asset value, end of period | | $ | 42.16 | | | $ | 42.74 | | | $ | 47.16 | | | $ | 42.58 | | | $ | 25.34 | | | $ | 31.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return(c) | | | (1.36 | )% (d) | | | (6.52 | )% | | | 12.83 | % | | | 70.67 | % | | | (17.44 | )% | | | 7.02 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 99,393 | | | $ | 101,449 | | | $ | 102,267 | | | $ | 70,202 | | | $ | 39,322 | | | $ | 39,258 | |

| Ratio of expenses to average net assets after expense waiver | | | 0.25 | % (e) | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

| Ratio of expenses to average net assets before expense waiver | | | 0.63 | % (e) | | | 0.65 | % | | | 0.66 | % | | | 0.86 | % | | | 1.12 | % | | | 1.34 | % |

| Ratio of net investment income to average net assets after expense waiver | | | 1.72 | % (e) | | | 1.66 | % | | | 1.37 | % | | | 1.61 | % | | | 1.87 | % | | | 1.85 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 24 | % (d) | | | 42 | % | | | 60 | % | | | 96 | % | | | 76 | % | | | 83 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated using the average shares method. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| See Notes to Financial Statements. |

| Semi-Annual Report | September 30, 2023 | 15 |

| ONEFUND S&P 500® Equal Weight Index | Notes to Financial Statements |

| | September 30, 2023 (Unaudited) |

The ONEFUND S&P 500® Equal Weight Index (formerly known as the Index Funds S&P 500® Equal Weight) (the “Fund”) is a separate series of ONEFUND TRUST (formerly known as Index Funds), an open-end management investment company that was organized as a trust under the laws of the State of Delaware on November 9, 2005 (the “Trust”). The Fund currently offers one class of shares: No Load Shares. The Fund is diversified, as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund seeks to achieve its investment objective by investing in a portfolio of assets whose performance, before fees and expenses, is expected to match approximately the performance of the S&P 500® Equal Weight Index (the “Index”). The Fund expects that its portfolio will consist primarily of securities of issuers included in the Index. The Index is designed to measure the performance of approximately 500 U.S. issuers chosen for market size, liquidity and industry grouping, among other factors.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

| | |

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in The United States of America (“GAAP”). The Fund is an investment company and accordingly follows the Investment Company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services-Investment Companies.”

Regulatory Update — Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – Effective January 24, 2023, the Securities and Exchange Commission (the “SEC”) adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. At this time, management is evaluating the impact of these amendments on the shareholder reports for the Fund.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Transactions — Investment security transactions are accounted for on trade date. Gains and losses on securities sold are determined on a specific identification basis.

Investment Income — Dividend income is recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Interest income, which includes amortization of premium and accretion of discount, is recorded on the accrual basis.

Investment Valuation — The Fund’s portfolio securities are valued as of the close of trading of the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern Time). Each security, excluding short-term investments, is valued at the last sale price reported by the principal security exchange on which the issue is traded. Money market funds, representing short-term investments, are valued at their daily net asset value. Securities that are traded on the Nasdaq Stock Market, Inc. are valued at the Nasdaq Official Closing Price or if no sale is reported, the mean between the bid and the ask. Securities which are traded over-the-counter are valued at the last sale price or, if no sale, at the mean between the bid and the ask. Securities for which quotations are not readily available are valued at fair value as determined by the Fund’s investment adviser, as the Valuation Designee appointed by the Board of Trustees (the “Board”), in accordance with procedures approved by the Board. The fair value of a security is the amount which the Fund might reasonably expect to receive upon a current sale. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the NYSE. As of March 31, 2023, there were no securities that were internally fair valued.

Fair Value Measurements — A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

| ONEFUND S&P 500® Equal Weight Index | Notes to Financial Statements |

| | September 30, 2023 (Unaudited) |

| | |

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 — | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 — | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 — | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the six months ended September 30, 2023 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund’s investments as of March 31, 2023:

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | | | | | |

| Common Stocks* | | $ | 99,051,465 | | | $ | — | | | $ | — | | | $ | 99,051,465 | |

| Exchange-Traded Funds | | | 188,091 | | | | — | | | | — | | | | 188,091 | |

| TOTAL | | $ | 99,239,556 | | | $ | — | | | $ | — | | | $ | 99,239,556 | |

| | | | | | | | | | | | | | | | | |

| * | See Schedule of Investments for sector classifications. |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

Cash and Cash Equivalents — Idle cash may be swept into various interest bearing overnight demand deposits and is classified as a cash equivalent on the Statement of Assets and Liabilities. The Fund maintains cash in bank deposit accounts which, at times, may exceed United States federally insured limit of $250,000. Amounts swept overnight are available on the next business day.

Expenses — The Fund bears expenses incurred specifically for the Fund and general Trust expenses.

Distributions to Shareholders — Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gains distributions are determined in accordance with income tax regulations, which may differ from GAAP. Distributions to shareholders are recorded on the ex-dividend date.

Fees on Redemptions — The Fund charges a redemption fee of 0.25% on redemptions of Fund’s shares occurring within 30 days following the issuance of such shares. The redemption fee is not a fee to finance sales or sales promotion expenses but is paid to the Fund to defray the costs of liquidating an investor and discourage short-term trading of the Fund’s shares. No redemption fee will be imposed on the redemption of shares representing dividends or capital gains distributions, or on amounts representing capital appreciation of shares.

Federal Income Taxes — As of and during the six months ended September 30, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes. Therefore, no provision is made by the Fund for federal income or excise taxes. The Fund intends to continue to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. By so qualifying, the Fund will not be subject to federal income taxes to the extent that it distributes substantially all of its taxable or tax-exempt income, if any, for its tax year ended March 31, 2023. In addition, by distributing in each calendar year substantially all of its net investment income, capital gains and certain other amounts, if any, the Fund will not be subject to a federal excise tax. Interest or penalties, if any, will be recorded in the Statement of Operations when incurred.

| Semi-Annual Report | September 30, 2023 | 17 |

| ONEFUND S&P 500® Equal Weight Index | Notes to Financial Statements |

| | September 30, 2023 (Unaudited) |

| 3. | ADVISORY FEES, ADMINISTRATION FEES AND OTHER AGREEMENTS |

| | |

Investment Advisory Agreement — ONEFUND, LLC (the “Adviser”) currently provides investment advisory services for individuals, trusts, estates and institutions. The Adviser commenced operations in 2004 and is registered as an investment adviser with the Securities and Exchange Commission. The Adviser is entitled to an investment advisory fee, computed daily and payable monthly, of 0.25% of the average daily net assets of the Fund. Mike Willis, an officer of the Trust is also an officer of the Adviser.

The Adviser has agreed to waive and/or reimburse fees or expenses in order to limit total annual fund operating expenses after fee waiver/expense reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 0.25% of the Fund’s average daily net assets for No Load Shares. The Adviser intends to reimburse fund expenses no less frequently than on a quarterly basis, but there have been and there may continue to be instances where the Adviser reimburses fund expenses on a less frequent basis. This agreement is in effect through July 31, 2024, and may not be terminated or modified by the Adviser prior to this date except with the approval of the Fund’s Board. Amounts previously waived or reimbursed by the Adviser under this agreement are not subject to subsequent recapture by the Adviser.

Fund Accounting and Administration Fees and Expenses — Ultimus Fund Solutions, LLC (“Ultimus” or the “Administrator”) provides administrative, fund accounting and other services to the Fund under a Master Services Agreement with the Trust (the “Master Services Agreement”). Under the Master Services Agreement, Ultimus is paid fees for its services and is reimbursed for certain out-of-pocket expenses. Administrator fees paid by the Fund for the six months ended September 30, 2023 are disclosed in the Statement of Operations.

Transfer Agent and Shareholder Services Agreement — Ultimus serves as transfer, dividend paying and shareholder servicing agent for the Fund (the “Transfer Agent”) under the Master Services Agreement. Transfer Agent fees paid by the Fund for the six months ended September 30, 2023 are disclosed in the Statement of Operations.

Compliance Services — Pine Advisors LLC (“PINE”) provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between PINE and the Trust. Under the terms of such agreement, PINE receives fees from the Fund, which are approved annually by the Board. Prior to June 29, 2023, Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provided a Chief Compliance Officer to the Trust, as well as related compliance services.

Distributor — The Fund has entered into a Distribution Agreement with Ultimus Fund Distributors, LLC (the “Distributor”) to provide distribution services to the Fund. The Distributor serves as underwriter/distributor of shares of the Fund. Distribution services fees are paid by the Adviser pursuant to the terms set forth in the Distribution Agreement.

| 4. | PURCHASES AND SALES OF INVESTMENT SECURITIES |

| | |

The aggregate cost of purchases and proceeds from sales of investment securities, excluding short-term securities, are shown below for the six months ended September 30, 2023.

| | | Cost of Investments | | | Proceeds from | |

| | | Purchased | | | Investments Sold | |

| ONEFUND S&P 500® Equal Weight Index | | $ | 24,330,983 | | | $ | 24,221,742 | |

Distributions are determined in accordance with federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end.

The tax character of distributions paid during the fiscal year ended March 31, 2023, were as follows:

| | | Ordinary Income | | | Long-Term

Capital Gains | |

| ONEFUND S&P 500® Equal Weight Index | | $ | 2,323,947 | | | $ | 777,547 | |

| ONEFUND S&P 500® Equal Weight Index | Notes to Financial Statements |

| | September 30, 2023 (Unaudited) |

| | |

As of September 30, 2023, net unrealized appreciation/(depreciation) of investments based on the federal tax cost were as follows:

| | | Gross Appreciation | | | Gross Depreciation | | | | | | Cost of Investments | |

| | | (excess of value over | | | (excess of tax cost | | | Net Unrealized | | | for Income Tax | |

| | | tax cost) | | | over value) | | | Appreciation | | | Purposes | |

| ONEFUND S&P 500® Equal Weight Index | | $ | 21,731,341 | | | | (4,341,886 | ) | | $ | 17,389,455 | | | $ | 81,850,101 | |

| | | | | | | | | | | | | | | | | |

The difference between book basis and tax basis is primarily attributable to wash sales.

At March 31, 2023, components of distributable earnings on a tax basis were as follows:

| | | ONEFUND S&P 500® | |

| | | Equal Weight Index | |

| Accumulated ordinary income | | $ | 823,963 | |

| Accumulated capital and other losses | | | (1,154,047 | ) |

| Net unrealized appreciation on investments | | | 18,829,899 | |

| Total | | $ | 18,499,815 | |

| | | | | |

Capital Losses — As of March 31, 2023, the Fund had short-term and long-term capital loss carryforwards of $466,593 and $687,454, respectively. These capital loss carryforwards may reduce the Fund’s taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code and thus may reduce the amount of the distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal tax pursuant to the Code. During the fiscal year ended March 31, 2023, the Fund did not utilize any capital loss carryforwards.

As of September 30 2023, the following entities owned beneficially 25% or greater of the Fund’s outstanding shares. The shares are held under omnibus accounts (whereby the transactions of two or more shareholders are combined and carried in the name of the origination broker rather than designated separately).

| ONEFUND S&P 500® Equal Weight Index | | Percentage |

| Charles Schwab & Co. | | 66% |

| 7. | COMMITMENTS AND CONTINGENCIES |

| | |

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects the risk of loss to be remote.

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure except as noted below.

Effective November 15, 2023, the Fund’s name will change from “ONEFUND S&P 500® Equal Weight Index” to the “ONEFUND S&P 500®” and the Fund’s underlying index will change from the “S&P 500® Equal Weight Index” to the “S&P 500® Index”.

| Semi-Annual Report | September 30, 2023 | 19 |

| Index Funds S&P 500® Equal Weight | Liquidity Risk Management Program |

| | September 30, 2023 (Unaudited) |

| | |